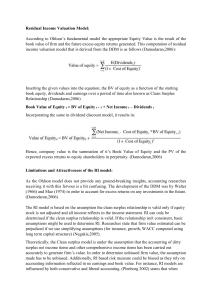

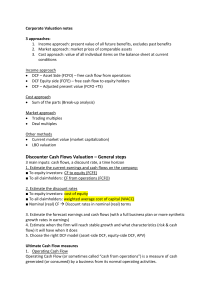

Corporate Finance Professional Certificate MOOC Course 2, The Free Cash Flow Method for Firm Valuation Module 1 Notes, Enterprise Discounted Cash Flow (DCF) Model Book Values of Assets The values of all assets owned at their historical cost minus accumulated depreciation.. Perpetuity Formula !" = PV = Present Value C = Cash Flow r = Rate % & Market Value The amount for which something can be sold on the market- based on future cash flows Liquidation The selling off of assets, especially when the book value of assets is higher than the market value of the firm Cash flow to equity method An approach to equity valuation based on computing cash flows that equity holders receive each period, after all payments to debt holders have been considered, and then discounting these cash flows Enterprise Discounted Cash Flow (DCF) Model An alternative approach to firm valuation which starts by first computing the value of the assets of the firm – not the value of equity – by discounting the free cash flows. To find the value of equity we subtract the value of debt from the asset value. Free Cash Flows (FCF) Cash flows which the operating assets of a firm generate. Operating Assets Assets that a firm uses for its core businesses. Value of Equity " '()*+, = " -.. 0112+1 + " 456 − -.. 0112+1 − "(92:+) V = Value Op. Assets = Operating Assets Non-Op. Assets = Non-Operating Assets

![FORM 0-12 [See rule of Schedule III]](http://s2.studylib.net/store/data/016947431_1-7cec8d25909fd4c03ae79ab6cc412f8e-300x300.png)