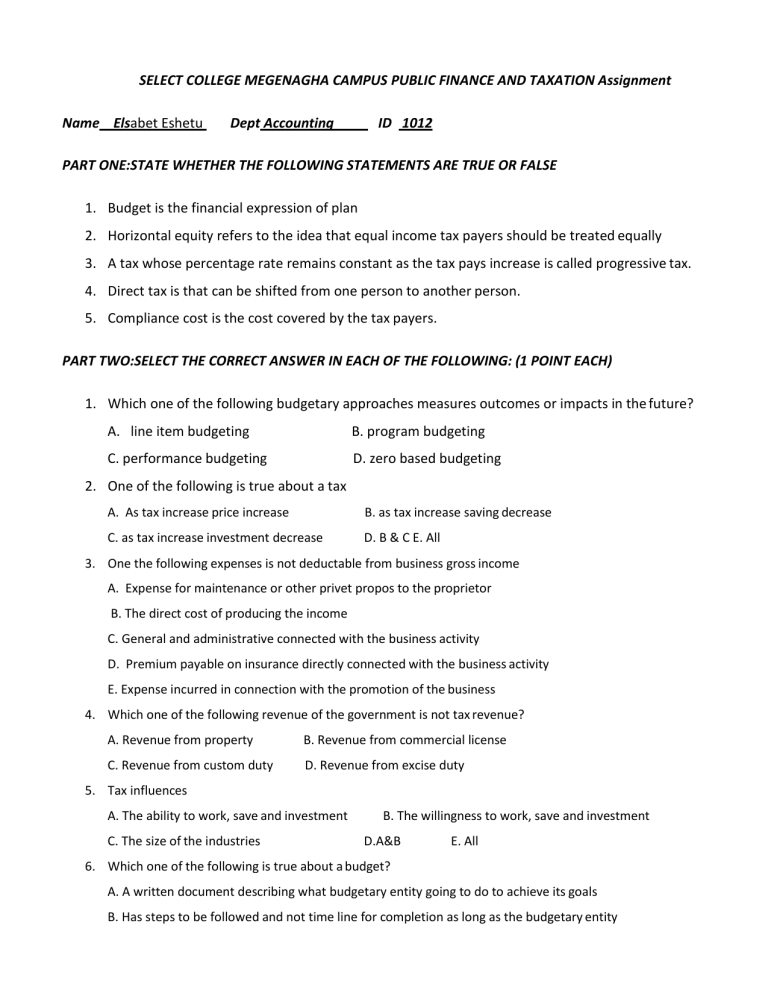

SELECT COLLEGE MEGENAGHA CAMPUS PUBLIC FINANCE AND TAXATION Assignment Name Elsabet Eshetu Dept Accounting ID 1012 PART ONE:STATE WHETHER THE FOLLOWING STATEMENTS ARE TRUE OR FALSE 1. Budget is the financial expression of plan 2. Horizontal equity refers to the idea that equal income tax payers should be treated equally 3. A tax whose percentage rate remains constant as the tax pays increase is called progressive tax. 4. Direct tax is that can be shifted from one person to another person. 5. Compliance cost is the cost covered by the tax payers. PART TWO:SELECT THE CORRECT ANSWER IN EACH OF THE FOLLOWING: (1 POINT EACH) 1. Which one of the following budgetary approaches measures outcomes or impacts in the future? A. line item budgeting B. program budgeting C. performance budgeting D. zero based budgeting 2. One of the following is true about a tax A. As tax increase price increase B. as tax increase saving decrease C. as tax increase investment decrease D. B & C E. All 3. One the following expenses is not deductable from business gross income A. Expense for maintenance or other privet propos to the proprietor B. The direct cost of producing the income C. General and administrative connected with the business activity D. Premium payable on insurance directly connected with the business activity E. Expense incurred in connection with the promotion of the business 4. Which one of the following revenue of the government is not tax revenue? A. Revenue from property B. Revenue from commercial license C. Revenue from custom duty D. Revenue from excise duty 5. Tax influences A. The ability to work, save and investment C. The size of the industries B. The willingness to work, save and investment D.A&B E. All 6. Which one of the following is true about a budget? A. A written document describing what budgetary entity going to do to achieve its goals B. Has steps to be followed and not time line for completion as long as the budgetary entity C. Only a revenue component in public finance D. All E. none 7. Which one of the following bases of accounting is used in the federal government of Ethiopia accounting system? A. Accrual bases B. Modified accrual bases C. Modified cash bases D. Cash bases E. Single entry system 8. One of the following true about excise tax in Ethiopia? A. Excise tax is imposed to reduce the consumption of hazardous goods B. Excise tax is imposed to collect revenue from basic goods that are demand inelastic C. Excise tax is imposed to collect revenue from luxurious goods D. Excise tax is imposed to discourage the consumption of goods that case social problems E. All of the above 9. Which one of the following tax base is concurrently owned by the central government and the regional governments? A. Tax collected income from air, train and marine transport activities B. Profit tax, royalty and large scale mining activities C. tax income from inland water transportation D. agricultural income tax from farmers E. tax collected from importation and exportation of goods 10. From the tax structure in Ethiopia which tax is categorize in schedule D? A. Employment income tax B. Rental income tax C. Business income tax D. Income from casual rent of property E. B & D 11. Which one of the following sentence is true about tax A. Tax is compulsory contribution B. Benefit is not a basic condition for the amount paid in the form of tax C. Government is the only authorized body to levy and collect tax D. Tax is not only on income but also on properties and commodities E. All of the above 12. Which one is the correct order of the budget cycle? A. Preparation B. Approval approval preparation execution execution C. Execution approval preparation D. Execution preparation approval 13. A tax for which the fraction of income used to pay it decrease as income increase A. Progressive B. Regressive C. Proportional D. all 14. Suppose mister X income is 20,000, mister Y income is 30,000 and mister Z income is 40,000. Tax payable mister is X 600, Tax payable mister is y 500 and Tax payable mister Z is 400. This tax system shows A. Proportional C. Regressive B. Progressive D.A & B E.A & C 15. If the income tax structure were changed from progressive tax to proportional tax this change would be most likely . A. Improve equity but leave tax revenue the same B. Increase the amount of tax collected but reduce equity C. Reduce both the tax base and the amount of tax collected D. All Answer sheet True or False 1.True 2.True 3. False 4. False 5.True Multiple choice 1.C 2.D 3.D 4.B 5.E 6. A 7. A 8.E 9.D 10.D 11.E 12. A 13.B 14.C 15.C