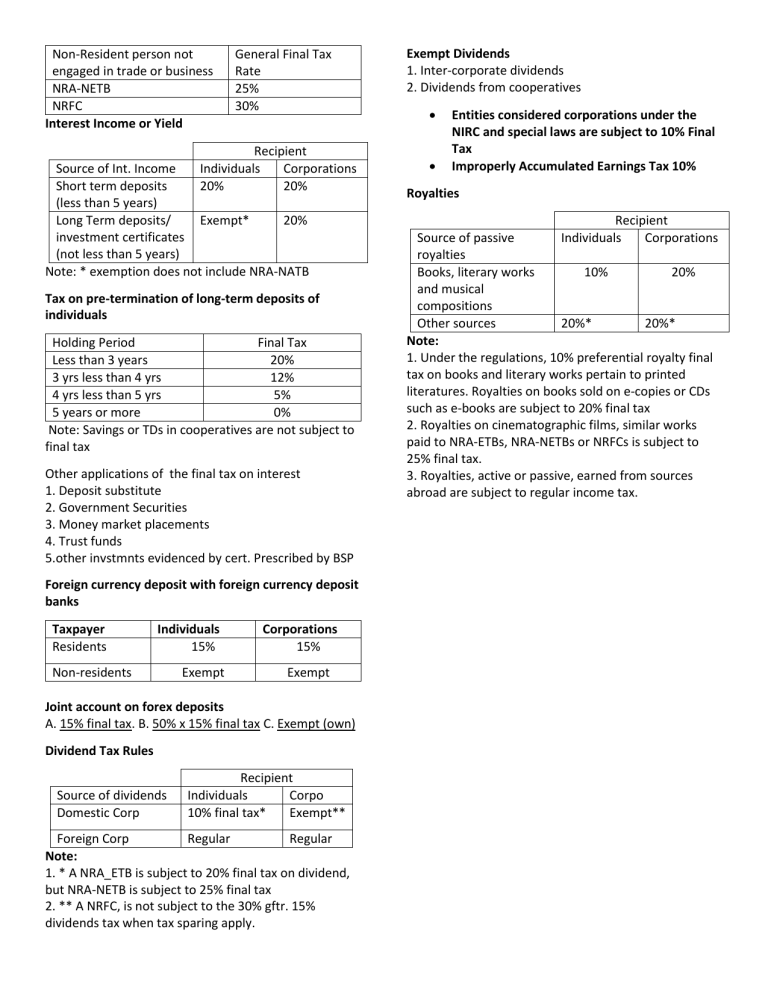

Non-Resident person not engaged in trade or business NRA-NETB NRFC Interest Income or Yield General Final Tax Rate 25% 30% Recipient Individuals Corporations 20% 20% Source of Int. Income Short term deposits (less than 5 years) Long Term deposits/ Exempt* 20% investment certificates (not less than 5 years) Note: * exemption does not include NRA-NATB Tax on pre-termination of long-term deposits of individuals Holding Period Final Tax Less than 3 years 20% 3 yrs less than 4 yrs 12% 4 yrs less than 5 yrs 5% 5 years or more 0% Note: Savings or TDs in cooperatives are not subject to final tax Other applications of the final tax on interest 1. Deposit substitute 2. Government Securities 3. Money market placements 4. Trust funds 5.other invstmnts evidenced by cert. Prescribed by BSP Foreign currency deposit with foreign currency deposit banks Taxpayer Residents Individuals 15% Non-residents Exempt Corporations 15% Exempt Joint account on forex deposits A. 15% final tax. B. 50% x 15% final tax C. Exempt (own) Dividend Tax Rules Source of dividends Domestic Corp Recipient Individuals Corpo 10% final tax* Exempt** Foreign Corp Regular Regular Note: 1. * A NRA_ETB is subject to 20% final tax on dividend, but NRA-NETB is subject to 25% final tax 2. ** A NRFC, is not subject to the 30% gftr. 15% dividends tax when tax sparing apply. Exempt Dividends 1. Inter-corporate dividends 2. Dividends from cooperatives Entities considered corporations under the NIRC and special laws are subject to 10% Final Tax Improperly Accumulated Earnings Tax 10% Royalties Recipient Individuals Corporations Source of passive royalties Books, literary works 10% 20% and musical compositions Other sources 20%* 20%* Note: 1. Under the regulations, 10% preferential royalty final tax on books and literary works pertain to printed literatures. Royalties on books sold on e-copies or CDs such as e-books are subject to 20% final tax 2. Royalties on cinematographic films, similar works paid to NRA-ETBs, NRA-NETBs or NRFCs is subject to 25% final tax. 3. Royalties, active or passive, earned from sources abroad are subject to regular income tax.