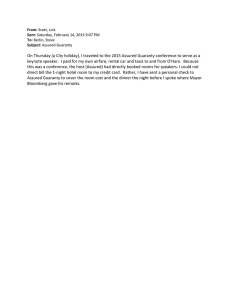

MyProtector-Legacy Protection and an inheritance that endures Do the #1 thing today that’ll leave a positive impact on your family for generations to come – create a legacy. Providing for your loved ones and building your wealth bring countless rewards. But perhaps the greatest fulfillment comes from giving them the very best in life – even when you’re not around. A legacy of financial security is one of the most precious heirlooms you can pass down. It can open the door for your child’s education in a prestigious university, pave the way for their entrepreneurial aspirations or enable them to maintain their current lifestyle. And it could inspire them to raise their own family with the same resilience you’ve given them. So, where do you start building your legacy – especially in today’s dynamic environment and amid market volatility? Life insurance offers the financial assurance that every lasting legacy should have. % of Singaporeans acknowledge that it’s important for them to leave money or an inheritance. Source: Aviva Consumer Attitudes Survey, June 2018 Have you ever had similar thoughts? “I know life insurance will give me the assurance that my dependants’ quality of life won’t be diluted should the unforeseen happen...” “... and it’s a way to leave behind a meaningful gift for them” “... but I don’t want to pay premiums for my whole life in order to get a longer protection term cover...” “... and I worry that I won’t be able to leave an inheritance for my loved ones if I outlive the policy!” At Aviva, we strive to make it possible for everyone to give their loved ones financial security that endures. That’s why we’ve created a plan that offers high protection over a long coverage term and lets you pay premiums for a limited period, so it can be financed during your working years. This way, you can continue to enjoy protection even when you’ve stopped paying premiums. Introducing MyProtector-Legacy Decided to start a legacy for your loved ones? Now you can make it happen easily. MyProtector-Legacy is a dual-purpose plan that gives you high coverage for unexpected events in life like Death and Terminal Illness while enabling you to leave a meaningful legacy. Designed to give coverage up to age 99 (Age Next Birthday), it’s the plan that gives a lifetime of protection but without life-long premium payments. You can safeguard the financial future of your loved ones with a lump-sum payout in the event of Death or upon diagnosis of a Terminal Illness. And should you outlive your policy, you’ll be rewarded with the full Sum Assured1 at age 99 (ANB) that you can distribute as you wish. It’s your answer to preserving your family’s well-being and financial security for a long time to come. Key Benefits: Coverage up to age 99 ANB – it pays a lump sum in the event of Death or upon diagnosis of a Terminal Illness2 during the policy term Limited premium payment term – you can choose to pay premiums up to age 65 (ANB) or 75 (ANB) Longevity Reward1 – you’ll receive 100% of your Sum Assured at the end of your policy term Increase coverage at key life events – the Guaranteed Issuance Option (GIO)3 gives you the flexibility to increase the coverage amount of your Basic Policy when you reach key milestones in life such as a new addition to the family Guaranteed Convertibility Option (GCO)4 – allows you to convert the Basic Policy into a new Endowment or Whole Life Policy without further medical underwriting In addition... MyProtector-Legacy also gives you these other benefits: Interim Accidental Death Benefit5 Money-back for financial needs with Surrender Benefit6 – flexibility to surrender your policy from 3rd policy year and receive a percentage of the Total Premiums Paid7 No nationality loading Coverage and Premium available in 6 currencies – SGD, USD, GBP, EUR, AUD and HKD Choice of riders to enhance your protection – complement your plan with optional riders8 for an additional layer of assurance: • TPD Advance Cover Plus II9 • CI Advance Cover Plus II9 • MultiPay Critical Illness Cover III • Early Critical Illness Cover • Critical Illness Premium Waiver • Payer Critical Illness Premium Waiver • Payer Premium Waiver Benefit How MyProtector-Legacy works Illustration 1: Christy is a working mum aged 40 (ANB) and a non-smoker. She worries that should unforeseen Critical Illness or death happen to her, the family would struggle with their monthly expenses. She also wants to be able to leave her kids an inheritance. Christy buys MyProtector-Legacy with a Sum Assured of S$1,000,000 which gives her protection against Death and Terminal Illness till she’s 99 (ANB). She chooses to pay premiums till she’s 75 (ANB) while she’s still working. She also adds on two riders: TPD Advance Cover Plus II with S$1,000,000 Sum Assured and CI Advance Cover Plus II with S$300,000 Sum Assured. At 58 (ANB), Christy is diagnosed with stage 3 breast cancer. She receives a S$300,000 lump-sum payout and the CI Advance Cover Plus II terminates. Her policy continues with a Sum Assured of S$700,000 and her premiums are reduced. Sum Assured When her policy expires at age 99 (ANB), she receives a Longevity Reward of S$700,000. Christy buys MyProtector-Legacy with S$1,000,000 Sum Assured plus riders She’s diagnosed with stage 3 breast cancer and receives a lump sum of S$300,000 New Sum Assured: S$700,000 S$1m Her policy term ends and she receives a Longevity Reward of S$700,000 S$700k Christy enjoys coverage till policy expiry at 99 (ANB) 40 (40 - 58 ANB) Monthly premium: S$807.65 58 (59 - 75 ANB) Monthly premium: S$539.25 Start of coverage term Sum Assured : S$1,000,000 Total premiums paid : S$287,681* 75 99 She stops paying premiums but continues to be covered Age Next Birthday (ANB) CI Advance Cover Plus II payout : S$300,000 Longevity Reward payout : S$700,000 * Amount is rounded up to the nearest dollar. Illustration 2: Frank, aged 40 (ANB), a non-smoker, is a businessman and father of three children. Frank considers his kids and the business that he’s grown from a one-man show to a successful enterprise with 25 employees his greatest pride. His business is the main source of income for his family and he wants to ensure that no matter what happens to him, it can continue to run smoothly and give his family financial support. Frank purchases MyProtector-Legacy, which gives him high life protection with a Sum Assured of S$1,000,000 and he opts to pay premiums till he’s 75 (ANB). Sum Assured At the age of 85 (ANB), Frank passes on. His family receives a lump-sum payout of S$1,000,000, which they can use to continue running the family business while supporting their lifestyle. Frank buys MyProtector-Legacy with S$1,000,000 Sum Assured When he dies at 85 (ANB), his family receives a lump sum of S$1,000,000 S$1m Frank enjoys coverage of S$1,000,000 Sum Assured during his policy term 40 Frank pays monthly premiums of S$679.45 till 75 (ANB) Start of coverage term Sum Assured : S$1,000,000 Total premiums paid : S$285,369 75 85 He stops paying premiums but continues to be covered Age Next Birthday (ANB) Death Benefit payout : S$1,000,000 Application is simple! 1. Choose your Sum Assured amount. 2. Decide if you want to pay premiums until 65 ANB or 75 ANB. 3. Consider eligible riders to enhance your protection. For more information about MyProtector-Legacy, visit www.aviva.com.sg or speak to your financial adviser representative today. Footnotes: 1. If the policyholder holds the policy until policy expiry (the Policy Anniversary immediately following age 99 at next birthday of the Life Assured), he/she will receive 100% of the Sum Assured of Death Benefit less any amount owed to Aviva Ltd. Where Aviva Ltd has already paid a part of the Death Benefit in respect of a prior claim under this Policy, only the remaining portion of the Death Benefit less any amount owed to Aviva Ltd will be payable. 2. Terminal Illness means the conclusive diagnosis of an illness that is expected to result in the death of the Life Assured within twelve (12) months from the date of diagnosis. The Terminal Illness must be diagnosed by a specialist and Aviva Ltd’s appointed Registered Medical Practitioner must confirm the diagnosis. Aviva Ltd will pay the Terminal Illness Benefit as an advancement of the Death Benefit, less any amount owed to Aviva Ltd in one lump sum. 3. The policyholder may opt for this option at each of the following key life events without providing evidence of insurability: a) the Life Assured marries or divorces (i.e. change of marital status); b) the Life Assured becomes a parent by having a newborn child, or legally adopts a child (i.e. adding a new child member to the immediate family); c) the Life Assured graduates from tertiary education; or d) the Life Assured purchases a property. This option allows the policyholder to increase the Sum Assured of the basic Policy by up to 50% of MyProtector-Legacy Sum Assured, or up to S$500,000 per life (or its equivalent in other currencies), whichever is lower. The limits set are irrespective of the number of policies the Life Assured may have. This option is extended to standard life only. Please refer to the Product Summary for more details. 4. The policyholder can fully or partially convert the basic Policy to a new endowment or whole life policy available at the point of conversion, without further evidence of insurability as long as the following conditions are met: a) The Policy is in force when this feature is exercised; b) The Life Assured is at age 65 at next birthday or younger when the Guaranteed Convertibility Option is exercised; c) For full conversion, the Life Assured will be insured for the same Sum Assured or less on the new Policy, subject to the Sum Assured limit of the new Policy; or d) For partial conversion, the Life Assured is insured for a Sum Assured equal to or less than the amount of Sum Assured converted, subject to the Sum Assured limit of the new Policy. The original Policy will continue with a reduced Sum Assured, subject to the Sum Assured limit of the original Policy; Footnotes: e) f) The maximum Death Benefit payable under the new Policy must not exceed: (i) the Death Benefit payable under the original Policy if it is a full conversion; or (ii) the Death Benefit payable for the amount of Sum Assured converted if it is a partial conversion; and No claims on this Policy have been admitted. The terms and conditions above are not exhaustive. Please refer to the Product Summary for details. 5. Aviva Ltd will insure the Life Assured against Accidental Death during the period starting from the date the application is signed to the earliest of the following: a) the Policy issue date; b) 90 days from the date the Application is signed; c) 30 days from the date the Application is accepted by Aviva Ltd on substandard terms, unless the Life Assured accepts the terms; d) the date the Application is withdrawn; e) the date the Application is rejected or postponed by Aviva Ltd; or f) the Accidental Death of the proposed Life Assured. Provided that his/her age next birthday is less than 60 years on the date of the application and he/she complies with the duty of disclosure as set out in the Application Form. The Interim Cover Benefit per life by Aviva Ltd under the Interim Cover is limited to the lower of: (i) Five Hundred Thousand Singapore dollars (S$500,000) (or its equivalent in other currencies); or (ii) the proposed Sum Assured for Death Benefit. Please refer to the Product Summary for details, including the list of exclusions. 6. The Policy will acquire a Surrender Benefit after it has been in force for at least 2 years as long as the premiums are paid up-to-date. The Surrender Benefit from: a) the start of the 3rd Policy Year until the end of the premium payment term is equal to 30% of the Total Premiums Paid for the Basic Benefit less any amount owed to Aviva Ltd; or b) the end of the premium payment term onwards is equal to 50% of the Total Premiums Paid for the Basic Benefit less any amount owed to Aviva Ltd. The policyholder also has the option to partially surrender the Policy by reducing the Sum Assured, which is subjected to the minimum Sum Assured of the Policy. Upon partial surrender of the Basic Benefit, the Surrender Benefit (if any) will be refunded proportionately depending on the amount of the Sum Assured reduced. Please refer to the Product Summary for more details. Footnotes: 7. Total Premiums Paid refers to the Instalment Premiums the policyholder has paid for the Basic Benefits, from the Policy Effective Date up to the Premium Cessation Date, the date Aviva Ltd processes the application to partially surrender the Policy or the date of termination of the Policy, whichever is later, without interest and excluding Premiums paid for all Supplementary Benefits (if any) attached to this Policy (as the case may be). Please refer to the Product Summary for more details. 8. For details on riders, please refer to the respective Product Summaries. 9. Premium payment term and policy term of TPD Advance Cover Plus II and CI Advance Cover Plus II will follow the basic plan when it is attached to MyProtector-Legacy. It includes the Guaranteed Issuance Option and Guaranteed Convertibility Option. These options allow the policyholder to enjoy the benefits without further evidence of insurability. Please refer to the respective Product Summaries for more details. Important Notes: The policy is underwritten by Aviva Ltd. This brochure is published for general information only and does not have regard to the specific investment objectives, financial situation and needs of any particular person. A copy of the Product Summary may be obtained from Aviva Ltd and the participating distributors’ offices. You should read the Product Summary before deciding whether to purchase the policy. You may wish to seek advice from a financial adviser representative before making a commitment to purchase the product. In the event that you choose not to seek advice from a financial adviser representative, you should consider whether the product in question is suitable for you. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. This is not a contract of insurance. Full details of the standard terms and conditions of this plan can be found in the relevant policy contract. Information is correct as at 15 January 2019. This advertisement has not been reviewed by the Monetary Authority of Singapore. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Aviva Ltd or visit the General Insurance Association, Life Insurance Association or SDIC websites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg). AV-MyProtector-Legacy_A5_v1.0_COMP/2019/01/PPM/002 Aviva Ltd 4 Shenton Way, #01-01, SGX Centre 2 Singapore 068807 Tel: (65) 6827 9933 Website: www.aviva.com.sg Company Reg. No.: 196900499K GST Reg. No.: MR-8500166-8