Climate Change Financial Impact Assessment Framework

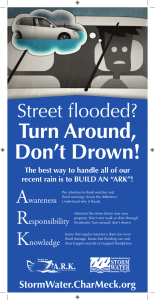

advertisement