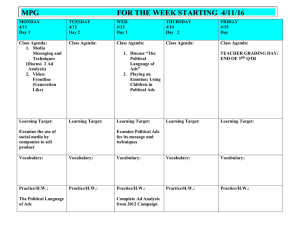

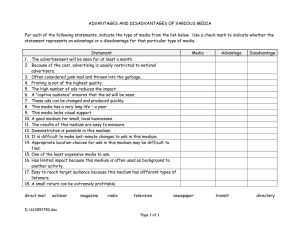

WORLD’S FIRST MOBILE OPERATOR MEDIA CHANNEL welcome CONFIDENTIAL For Internal Use only + Rate Card Assessment Methodology The purpose of the Rate Card Assessment (RCA) project is to establish the base retail Cost Per View (CPV) and Cost Per Click (CPC) based on the inputs collected from main Advertising Agencies in different comparable markets. Novelty Media has interacted with 4 media agencies – namely Carat (Dentsu), ArenaMedia (Havas), Globeone Digital and Publicis – in three markets to provide: • their point of view on the gross retail price SmartAd should be introduced (before bidding platform roll-out) and • an indication of the expected market position versus comparable established competitors (e.g. YouTube, Instagram, Viber, popular games and several local sites) both in terms of formats and profiling ability. Each Agency provided Novelty Media with their view on SmartAd’s differentiation factors, a recommended price range along with useful insights on market’s semantics. This document summarizes the outcomes of the extensive interactions Novelty Media had held, mainly via meetings and written communications. Further interactions with other two main agencies – namely MindShare (WPP) and PHD (Omnicom) – are in process in 2 countries. Two more programmatic advertising agencies will also be included in the evaluation. CONFIDENTIAL For Internal Use only Product Assessment Key Factors of the evaluation and positioning CONFIDENTIAL For Internal Use only 1 Innovation. The Media advertising industry is constantly seeking for new channels and formats. SmartAd represents an innovative product for Advertisers to consider. 2 Performance/Impact. All campaigns are measured on results. To assess the impact of the channel in full several KPIs should be taken into account (e.g. e2e conversion rates, average view time). SmartAd has demonstrated so far very high CTR (>4%) but further measurements by Digital Performance companies are required to establish its effectiveness rates. 3 Fraud free. Fraud is hugely impacting the digital market, both from an Advertiser’s and an End User’s perspective. SmartAd looks much less impacted by the most common issues. 4 Buffering. The impact of buffering delays translating in missed views and poor user experience is becoming more and more relevant in all markets. 5 Digital measurements. The non-clear traceability of in-call ads is an issue for SmartAd which is counter balanced by the fact that ads can be viewed without data network availability. 6 Sophistication. The predictable and recurrent manner of addressing users is a plus. Implementation of storytelling content can thus work extremely efficiently via SmartAd. 7 Branding, Product Introduction and Special Offers are the best-suited campaigns for SmartAd Recommendations What should be taken into account 1 2 3 4 Independent audit Click feature CPM vs. CPV Ads duration For major Advertisers, it will be mandatory to have an independent reporting tool integrated with SmartAd platform (e.g. Double Verify, Google Analytics). Digital performance is focusing on clicks. There should be a strict differentiation between the policies of CPV and CPC. A combined offering could work in some countries Despite for the product an impression will correspond to at least a partial view, strategically is most relevant to sell the product in CPV since better perceived by the market Short videos are definitively the new norm, but still majority of ads are in the range of 15-30secs videos. So the recommendation is not to charge for longer formats. 5 6 7 8 Sound Programmatic Its importance is gradually increasing making mandatory the introduction of HTML ads display and the display on-demand post-call ads Volume Discounts Introductory and test-only offers are the norm. Major brands and retailers are used to +30% volume discounts No of Ads?day SmartAd is considered as a push display media. 1-2 ads/hour is considered as non-intrusive. So in the majority of the markets we can go for 15-20 ads/day Some clients still require a sound-on feature, despite the market is definitively going in towards a sound disabled trend. CONFIDENTIAL For Internal Use only Price Recommendation Collected feedback Discount: +30% Discount: 20-30% 0,020 $0,008-0,012 $0,2-0,3 0,020 0,015 0,015 0,010 0,010 0,005 0,005 CPV CPC 0,020 • Base price to include also extended duration above 8secs 0,020 0,015 0,015 • Expected higher discount rates in the first year 0,010 0,010 0,005 0,005 $0,006-0,015 $0,25-0,4 CPV Price Range in the market CPC Price Range in the market Discount: 15-25% Discount: 25-30% 0,020 $0,008-0,014 $0,3-0,5 0,020 0,020 $0,005-0,015 $0,2-0,4 0,020 0,015 0,010 0,010 0,005 0,005 0,005 0,000 0,000 0,015 0,010 0,010 0,005 CPC • Provided that the effectiveness will be equal or better of the established media 0,015 0,015 0,000 CONFIDENTIAL CPV For Internal Use only $ $ $ $ 0,000 CPV Price Range in the market • Recommended to price 30% higher to match premium CPV values, but to incentivize adoption via consistent special deals and discounts 0,000 0,000 0,000 0,000 $ $ $ $ CPC • Base price to include most of the available segmentation • Recommended discounts to be granted in the form of extra views Price Range in the market Conclusions Recommended positioning Medium advertizing spending/capita markets Low advertizing spending/capita markets Recommended Cost Per View $0,012 $0,009 Recommended Cost Per Click $0,030 $0,020 25% 20% Volume discounts CONFIDENTIAL For Internal Use only