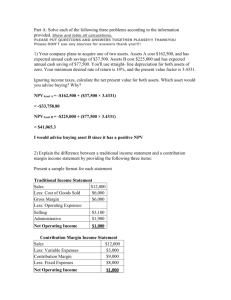

MANAGEMENT ACCOUNTING - Solutions Manual TABLE OF CONTENTS Chapter 1 MANAGEMENT ACCOUNTING: AN OVERVIEW 1-1 – 1-19 2 Management Accounting and the Business Environment 2-1 – 2-5 3 Understanding of Financial Statements 3-1 – 3-10 4 Financial Statements Analysis – I 4-1 – 4-9 5 Financial Statements Analysis – II 5-1 – 5-38 6 Cash Flow Analysis 6-1 – 6-18 7 Gross Profit Valuation Analysis and Earnings Per Share Determination 7-1 – 7-7 8 Cost Concepts and Classifications 8-1 – 8-17 9 Cost Behavior: Analysis and Use 9-1 – 9-30 10 Systems Design: Job-Order Costing and Process Costing 10-1 – 10-16 11 Systems Design: Activity-Based Costing and Management 11-1 – 11-15 12 Variable Costing 12-1 – 12-21 13 Cost-Volume-Profit Relationships 13-1 – 13-37 14 Responsibility Accounting and Transfer Pricing 14-1 – 14-26 15 Functional and Activity-Based Budgeting 15-1 – 15-22 16 Standard Costs and Operating Performance Measures 16-1 – 16-17 17 Application of Quantitative Techniques in Planning, Control and Decision Making - I 17-1 – 17-2 Application of Quantitative Techniques in Planning, Control and Decision Making – II 18-1 – 18-7 19 Relevant Costs for Decision Making 19-1 – 19-33 20 Capital Budgeting Decisions 20-1 – 20-16 21 Decentralized Operations and Segment Reporting 21-1 – 21-4 22 Business Planning 22-1 – 22-6 18 1-1 Chapter 1 Management Accounting: An Overview 23 Strategic Cost Management; Balanced Scorecard 23-1 – 23-4 24 Advanced Analysis and Appraisal of Performance: Financial and Nonfinancial 24-1 – 24-12 25 Managing Productivity and Marketing Effectiveness 25-1 – 25-19 26 Executive Performance Measures and Compensation 26-1 – 26-3 27 Managing Accounting in a Changing Environment 27-1 – 27-22 CHAPTER 1 MANAGEMENT ACCOUNTING: AN OVERVIEW I. Questions 1. Use of the word “need” in the quoted passage is pejorative. It implies an unlimited level of demand for information. However, rational managers apply a cost-benefit criterion to information and will only want accounting information if its benefits exceed its costs. Accounting information provides benefits by improving decision making and controlling behavior in organizations. In most organizations, accounting information is very prevalent which implies that its benefits exceed its costs. Hence, successful managers will find it in their self-interest to learn how to use accounting information in these organizations. Clearly, this statement is incurred in those firms where accounting information has very limited usefulness (e.g., if the accounting information is often wrong or is not produced in a timely fashion). In these organizations, managers do not find the accounting information to have benefits in excess of its costs, will not use it, do not need to know how to use it, and definitely do not need it. 2. a. Historical costs are of limited use in making planning decisions in a rapidly changing environment. With changing products, processes and prices, the historical costs are inadequate approximations of the opportunity costs of using resources. 1-2 Management Accounting: An Overview Chapter 1 Historical costs may, however, be useful for control purposes, as they provide information about the activities of managers and can be used as performance measures to evaluate managers. b. The purpose of accounting systems is to provide information for planning purposes and control. Although historical costs are not generally appropriate for planning purposes, additional measures are costly to make. An accounting system should include additional measures if the benefits of improved decision making are greater than the costs of the additional information. 3. Finance and economics textbooks traditionally state that the goal of a profit organization is to maximize shareholder wealth. Managers are frequently presumed to act in the best interest of the shareholder, although recent finance literature recognizes that appropriate incentives are necessary to align manager interests with shareholder interests. The goal, however, are not very clear as to how this is achieved. Most finance textbooks focus on financing decisions and not on the use of assets and dealing with customers. Marketing’s goal of satisfying customers recognizes that customers are the source of revenues for the organization, and therefore the means through which shareholder value is increased. However, customer satisfaction is only valuable insofar as it creates shareholder wealth. The further goal of marketing is to ensure that customer satisfaction is maximized without compromising the organization’s profitability. 4. Yes. Planning is really much more vital than control; that is, superior control is fruitless if faulty plans are being implemented. However, planning and control are so intertwined that it seems artificial to draw rigid lines of separation between them. 5. Yes. The controller has line authority over the personnel in his own department but is a staff executive with respect to the other departments. 6. Line authority is exerted downward over subordinates. Staff authority is the authority to advise but not command others; it is exercised laterally or upward. Functional authority is the right to command action laterally and downward with regard to a specific function or specialty. 7. Cost accounting is the controller’s primary means of implementing the 7point concept of modern controllership. Cost accounting is intertwined with all seven duties to some extent, but its major focus is on the first three. 1-3 Chapter 1 Management Accounting: An Overview 8. Bettina Company President VP, Production VP, Finance VP, Sales Controller Treasurer Assistant Controller Assistant Treasurer Special Studies Manager Cost Accounting Manager Tax Manager Internal Audit Manager Cost Systems Analyst Budget & Standard Cost Analyst Performance Analyst Cost Clerk Payroll Clerk Accounts Receivable Clerk Accounts Payable Clerk General Accounting Manager Billing Clerk System & EDP Manager General Ledger Bookkeeper 9. Management accountants contribute to strategic decisions by providing information about the sources of competitive advantage and by helping managers identify and build a company’s resources and capabilities. 10. In most organizations, management accountants perform multiple roles: problem solving (comparative analyses for decision making), scorekeeping (accumulating data and reporting reliable results), and attention directing (helping managers properly focus their attention). 11. Three guidelines that help management accountants increase their value to managers are (a) employ a cost-benefit approach, (b) recognize behavioral as well as technical considerations, and (c) identify different costs for different purposes. 12. Management accounting is an integral part of the controller’s function in an organization. In most organizations, the controller reports to the chief financial officer, who is a key member of the top management team. 1-4 Management Accounting: An Overview Chapter 1 13. Management accountants have ethical responsibilities that are related to competence, confidentiality, integrity, and objectivity. 14. By reporting and interpreting relevant data, the controller exerts a force or influence that impels management toward making better-informed decisions. The controller of one company described the job as “a business advisor to…help the team develop strategy and focus the team all the way through recommendations and implementation.” 15. Audience: Purpose: Timeliness: Restrictions: Type of Information: Nature of Information: Scope: Audience: Purpose: Timeliness: Restrictions: Type of Information: Financial Accounting External: shareholders, creditors, tax authorities Report on past performance to external parties; basis of contracts with owners and lenders Delayed; historical Regulated; rules driven by generally accepted accounting principles and government authorities Financial measurements only Objective, auditable, reliable, consistent, precise Highly aggregate; report on entire organization Managerial Accounting Internal: Workers, managers, executives Inform internal decisions made by employees and managers; feedback and control on operating performance Current, future oriented No regulations; systems and information determined by management to meet strategic and operational needs Financial, plus operational and physical measurements on processes, technologies, suppliers customers, and competitors 1-5 Chapter 1 Management Accounting: An Overview Nature of Information: Scope: More subjective and judgmental; valid, relevant, accurate Disaggregate; inform local decisions and actions 16. The competitive environment has changed dramatically. Companies encountered severe competition from overseas companies that offered high-quality products at low prices. Activity-based costing systems are introduced in many manufacturing and service organizations to overcome the inability of traditional cost systems to accurately assign overhead costs. Activity-based management is a viable approach for managers to make decisions based on ABC information. There has been improvement of operational control systems such that information is more current and provided more frequently. The nature of work has changed from controlling to informing. Firms are concerned about continuous improvement, employee empowerment and total quality. Nonfinancial information has become a critical feedback measure. Finally, the focus of many firms is on measuring and managing activities. 17. As measurements are made on operations and, especially, on individuals and groups, the behavior of the individuals and groups are affected. People will react to the measurements being made by focusing on the variables or behavior being measured. In addition, if managers attempt to introduce or redesign cost and performance measurement systems, people familiar with the previous system will resist. Management accountants must understand and anticipate the reactions of individuals to information and measurements. The design and introduction of new measurements and systems must be accompanied with an analysis of the likely reactions to the innovations. II. Exercises Exercise 1 a. b. c. d. (1) (3) (1) (2) Problem solving Attention-directing Problem solving Scorekeeping Exercise 2 1-6 Management Accounting: An Overview Chapter 1 a. b. c. d. (4) (3) (6) (5) Marketing Production Customer service Distribution Exercise 3 a. b. c. d. e. f. g. h. (4) (3) (5) (4) (5) (3) (1) (2) Marketing Production Distribution Marketing Distribution Production Research and development Design III. Problems Problem 1 (Problem Solving, Scorekeeping, and Attention Directing) Because the accountant’s duties are often not sharply defined, some of these answers might be challenged: 1. 2. 3. 4. 5. 6. 7. 8. Scorekeeping Attention directing Scorekeeping Problem solving Attention directing Attention directing Problem solving Scorekeeping (depending on the extent of the report) or attention getting 9. This question is intentionally vague. The give-and-take of the budgetary process usually encompasses all three functions, but it emphasizes scorekeeping the least. The main function is attention directing, but problem solving is also involved. 10. Problem solving Problem 2 (Management Accounting Information System) 1. Inputs: b, g, i, m 2. Processes: a, d, f, j 3. Outputs: e, k, n 1-7 Chapter 1 Management Accounting: An Overview 4. System objectives: c, h, l Problem 3 (Role of Management Accountants) Planning. The management accountant gains an understanding of the impact on the organization of planned transactions (i.e., analyzing strengths and weaknesses) and economic events, both strategic and tactical, and sets obtainable goals for the organization. The development of budgets is an example of planning. Controlling. The management accountant ensures the integrity of financial information, monitors performance against budgets and goals, and provides information internally for decision making. Comparing actual performance against budgeted performance and taking corrective action where necessary is an example of controlling. Internal auditing is another example. Evaluating Performance. The management accountant judges and analyzes the implication of various past and expected events, and then chooses the optimum course of action. The management accountant also translates data and communicates the conclusions. Graphical analysis (such as trend, bar charts, or regression) and reports comparing actual costs with budgeted costs are examples of evaluating performance. Ensuring Accountability of Resources. The management accountant implements a reporting system closely aligned to organizational goals that contribute to the measurement of the effective use of resources and safeguarding of assets. Internal reporting such as comparison of actual to budget is an example of accountability. External Reporting. The management accountant prepares reports in accordance with generally accepted accounting principles and then disseminates this information to shareholders, creditors, and regulatory tax agencies. An annual report or a credit application are examples of external reporting. Problem 4 (Line Versus Staff) Jamie Reyes is staff. She is in a support role – she prepares reports and helps explain and interpret them. Her role is to help the line managers more effectively carry out their responsibilities. Stephen Santos is a line manager. He has direct responsibility for producing a garden hose. Clearly, one of the basic objectives for the existence of a 1-8 Management Accounting: An Overview Chapter 1 manufacturing firm is to make a product. Thus, Stephen has direct responsibility for a basic objective and therefore holds a line position. Problem 5 (Professional Ethics and End-of-Year Games) Requirement 1 The possible motivations for the snack foods division wanting to play end-ofyear games include: (a) Management incentives. Yummy Foods may have a division bonus scheme based on one-year reported division earnings. Efforts to front-end revenue into the current year or transfer costs into the next year can increase this bonus. (b) Promotion opportunities and job security. Top management of Yummy Foods likely will view those division managers that deliver high reported earnings growth rates as being the best prospects for promotion. Division managers who deliver “unwelcome surprises” may be viewed as less capable. (c) Retain division autonomy. If top management of Yummy Foods adopts a “management by exception” approach, divisions that report sharp reductions in their earnings growth rates may attract a sizable increase in top management supervision. Requirement 2 The “Standards of Ethical Conduct…” require management accountants to: Refrain from either actively or passively subverting the attainment of the organization’s legitimate and ethical objectives, and Communicate unfavorable as well as favorable information and professional judgment or opinions. Several of the “end-of-year games” clearly are in conflict with these requirements and should be viewed as unacceptable by Tan: (a) The fiscal year-end should be closed on midnight of December 31. “Extending” the close falsely reports next year’s sales as this year’s sales. (b) Altering shipping dates is falsification of the accounting reports. (c) Advertisements run in December should be charged to the current year. The advertising agency is facilitating falsification of the accounting records. 1-9 Chapter 1 Management Accounting: An Overview The other “end-of-year games” occur in many organizations and may fall into the “gray” to “acceptable” area. However, much depends on the circumstances surrounding each one: (a) If the independent contractor does not do maintenance work in December, there is no transaction regarding maintenance to record. The responsibility for ensuring that packaging equipment is well maintained is that of the plant manager. The division controller probably can do little more than observe the absence of a December maintenance charge. (d) In many organizations, sales are heavily concentrated in the final weeks of the fiscal year-end. If the double bonus is approved by the division marketing manager, the division controller can do little more than observe the extra bonus paid in December. (e) If TV spots are reduced in December, the advertising cost in December will be reduced. There is no record falsification here. (g) Much depends on the means of “persuading” carriers to accept the merchandise. For example, if an under-the-table payment is involved, it is clearly unethical. If, however, the carrier receives no extra consideration and willingly agrees to accept the assignment, the transaction appears ethical. Each of the (a), (d), (e) and (g) “end-of-year games” may well disadvantage Yummy Foods in the long run. For example, lack of routine maintenance may lead to subsequent equipment failure. The divisional controller is well advised to raise such issues in meetings with the division president. However, if Yummy Foods has a rigid set of line/staff distinctions, the division president is the one who bears primary responsibility for justifying division actions to senior corporate officers. Requirement 3 If Tan believes that Ryan wants her to engage in unethical behavior, she should first directly raise her concerns with Ryan. If Ryan is unwilling to change his request, Tan should discuss her concerns with the Corporate Controller of Yummy Foods. Tan also may well ask for a transfer from the snack foods division if she perceives Ryan is unwilling to listen to pressure brought by the Corporate Controller, CFO, or even President of Yummy Foods. In the extreme, she may want to resign if the corporate culture of Yummy Foods is to reward division managers who play “end-of-year games” that Tan views as unethical and possibly illegal. Problem 6 1-10 Management Accounting: An Overview Chapter 1 James Torres has come up with a scheme that involves a combination of data falsification and smoothing! Not only has he made up the revenue numbers, but also he has had the gall to defer some of them to the next period. Making up such numbers is clearly illegal. Smoothing, in this example is also illegal because the numbers are fictitious. Problem 7 Clearly the vice-president will lose his or her job if you turn him or her in. Given that this is a major violation of the code of ethics and a violation patent law, the vice-president could go to jail. Your best course of action is to check your information and if the vice-president is definitely involved, go immediately to the VP’s superior (who is probably a senior VP or the company president). The organization’s attorneys will take over from there. Problem 8 One option is to do nothing and ignore what you saw, however, this may violate your own code of ethics and your ethical responsibilities under the organization’s code of ethics. Given that you want to do something, it is probably best to start by talking to employees in your organization whose job it is to deal with ethical issues. If no such employees exist or are available, you might start by using a decision model. This model incorporated the following steps: 1. 2. 3. 4. 5. 6. 7. Determine the Facts – What, Who, Where, How Define the Ethical Issue Identify Major Principles, Rule, Values Specify the Alternatives. Compare Values and Alternatives, See if Clear Decision Assess the Consequences. Make Your Decision. IV. Cases Case 1 (Financial vs. Managerial Accounting) Requirement (a) Other forward looking information desired in addition to the income statement information are 1. Disclosure of the components of financial performance, i.e., nature and source of revenues, various activities, transactions, and other relevant events affecting the company. 1-11 Chapter 1 Management Accounting: An Overview 2. Nature and function of the components of income and expenses Requirement (b) No. GAAP does not allow capitalization of employee training and advertising costs even if management feels that they increase the value of the company’s brand name. The reasons are uncertainty of the future benefits that may be derived therefrom and difficulty and reliability of their measurement. Requirement (c) Detailed information that managers would likely request are analysis of the significant increases in 1. 2. 3. 4. 5. Sales Cost of sales Payroll Stock and option based compensation Advertising and promotion. Requirement (d) Nonmonetary measures: 1. 2. 3. 4. 5. Change in number and profile of customers Share in the market Who, what and how many are the competitors Product lines offered by the entity vs. Product lines of competitors Sales promotion and advertising activities Requirement (e) 1. Competitors 2. Employees 3. Prospective creditors Case 2 (You get what you measure!) Requirement (a) Increase in sales to new customers to sales Too much emphasis on this ratio may lead the sales manager to spend more time developing business with new customers and disregard the needs of 1-12 Management Accounting: An Overview Chapter 1 existing customers. It is therefore possible to lose the business of several key accounts. Requirement (b) Decrease in cost of goods sold to sales This performance measure could create the following problems: 1. Purchasing goods with poor quality at lower cost and selling them for the same price. 2. Indiscriminately increasing selling price to widen the profit margin without regard to competitor’s current prices. 3. If the entity is manufacturing its own goods, managers could try to economize on costs, i.e., buying poorer quality of materials, employing unskilled workers, etc. thereby causing deterioration of the quality of the finished products. In all of the above situations, customer patronage could eventually be adversely affected. Requirement (c) Decrease in selling and administrative expense to sales Cost-cutting is generally advisable for as long as the quality of goods and services are not compromised. Likewise, certain cost-saving measures could demotivate sales people and other employees and could lead to counterproductive activities. Case 3 (The Roles of Managers and Management Accountants) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Managerial accounting, Financial accounting Planning Directing and motivating Feedback Decentralization Line Staff Controller Budgets Performance report Chief Financial Officer Precision; Nonmonetary data 1-13 Chapter 1 Management Accounting: An Overview Case 4 (Ethics in Business) If cashiers routinely short-changed customers whenever the opportunity presented itself, most of us would be careful to count our change before leaving the counter. Imagine what effect this would have on the line at your favorite fast-food restaurant. How would you like to wait in line while each and every customer laboriously counts out his or her change? Additionally, if you can’t trust the cashiers to give honest change, can you trust the cooks to take the time to follow health precautions such as washing their hands? If you can’t trust anyone at the restaurant would you even want to eat out? Generally, when we buy goods and services in the free market, we assume we are buying from people who have a certain level of ethical standards. If we could not trust people to maintain those standards, we would be reluctant to buy. The net result of widespread dishonesty would be a shrunken economy with a lower growth rate and fewer goods and services for sale at a lower overall level of quality. Case 5 (Ethics and the Manager) Requirement 1 Failure to report the obsolete nature of the inventory would violate the Standards of Ethical Conduct as follows: Competence Perform duties in accordance with relevant technical standards. Prepare complete reports using reliable information. By failing to write down the value of the obsolete inventory, Perez would not be preparing a complete report using reliable information. In addition, generally accepted accounting principles (GAAP) require the write-down of obsolete inventory. Integrity Avoid conflicts of interest. Refrain from activities that prejudice the ability to perform duties ethically. Refrain from subverting the legitimate goals of the organization. Refrain from discrediting the profession. 1-14 Management Accounting: An Overview Chapter 1 Members of the management team, of which Perez is a part, are responsible for both operations and recording the results of operations. Since the team will benefit from a bonus, increasing earnings by ignoring the obsolete inventory is clearly a conflict of interest. Perez would also be concealing unfavorable information and subverting the goals of the organization. Furthermore, such behavior is a discredit to the profession. Objectivity Communicate information fairly and objectively. Disclose all relevant information. Hiding the obsolete inventory impairs the objectivity and relevance of financial statements. Requirement 2 As discussed above, the ethical course of action would be for Perez to insist on writing down the obsolete inventory. This would not, however, be an easy thing to do. Apart from adversely affecting her own compensation, the ethical action may anger her colleagues and make her very unpopular. Taking the ethical action would require considerable courage and self-assurance. Case 6 (Preparing an Organization Chart) Requirement 1 See the organization chart on page 17. Requirement 2 Line positions would include the university president, academic vice-president, the deans of the four colleges, and the dean of the law school. In addition, the department heads (as well as the faculty) would be in line positions. The reason is that their positions are directly related to the basic purpose of the university, which is education. (Line positions are shaded on the organization chart.) All other positions on the organization chart are staff positions. The reason is that these positions are indirectly related to the educational process, and exist only to provide service or support to the line positions. Requirement 3 All positions would have need for accounting information of some type. For 1-15 Chapter 1 Management Accounting: An Overview example, the manager of central purchasing would need to know the level of current inventories and budgeted allowances in various areas before doing any purchasing; the vice president for admissions and records would need to know the status of scholarship funds as students are admitted to the university; the dean of the business college would need to know his/her budget allowances in various areas, as well as information on cost per student credit hour; and so forth. Case 7 (Ethics in Business) Requirement 1 No, Santos did not act in an ethical manner. In complying with the president’s instructions to omit liabilities from the company’s financial statements he was in direct violation of the IMA’s Standards of Ethical Conduct for Management Accountants. He violated both the “Integrity” and “Objectivity” guidelines on this code of ethical conduct. The fact that the president ordered the omission of the liabilities is immaterial. Requirement 2 No, Santos’ actions can’t be justified. In dealing with similar situations, the Securities and Exchange Commission (SEC) has consistently ruled that “… corporate officers…cannot escape culpability by asserting that they acted as ‘good soldiers’ and cannot rely upon the fact that the violative conduct may have been condoned or ordered by their corporate superiors.” (Quoted from: Gerald H. Lander, Michael T. Cronin, and Alan Reinstein, “In Defense of the Management Accountant,” Management Accounting, May, 1990, p. 55) Thus, Santos not only acted unethically, but he could be held legally liable if insolvency occurs and litigation is brought against the company by creditors or others. It is important that students understand this point early in the course, since it is widely assumed that “good soldiers” are justified by the fact that they are just following orders. In the case at hand, Santos should have resigned rather than become a party to the fraudulent misrepresentation of the company’s financial statements. 1-16 Case 6 Requirement 1 President Vice President, Auxiliary Services Manager, Central Purchasing Vice President, Admissions & Records Manager, University Press Dean, Business (Departments) Vice Academic Vice President Manager, University Bookstore Dean, Humanities (Departments) President, Financial Services (Controller) Manager, Computer Services Manager, Accounting & Finance Dean, Engineering & Quantitative Dean, Fine Arts (Departments) 1-17 Vice President, Physical Plant (Departments) Manager, Grounds & Custodial Services Dean, Law School Manager, Plant & Maintenance MANAGEMENT ACCOUNTING - Solutions Manual Case 8 (Ethics in Business) Requirement 1 Andres Romero has an ethical responsibility to take some action in the matter of PhilChem, Inc. and the dumping of toxic wastes. The Standards of Ethical Conduct for Management Accountants specifies that management accountants should not condone the commission of acts by their organization that violate the standards of ethical conduct. The specific standards that apply are as follows. • • • • Competence. Management accountants have a responsibility to perform their professional duties in accordance with relevant laws and regulations. Confidentiality. Management accountants must refrain from disclosing confidential information unless legally obligated to do so. However, Andres Romero may have a legal responsibility to take some action. Integrity. Management accountants have a responsibility to: - refrain from either actively or passively subverting the attainment of the organization’s legitimate and ethical objectives. - communicate favorable as well as unfavorable information and professional judgments or opinions. Objectivity. Management accountants must fully disclose all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports, comments, and recommendations. Requirement 2 The Standards of Ethical Conduct for Management Accountants indicates that the first alternative being considered by Andres Romero, seeking the advice of his boss, is appropriate. To resolve an ethical conflict, the first step is to discuss the problem with the immediate superior, unless it appears that this individual is involved in the conflict. In this case, it does not appear that Romero’s boss is involved. Communication of confidential information to anyone outside the company is inappropriate unless there is a legal obligation to do so, in which case Romero should contact the proper authorities. Contacting a member of the Board of Directors would be an inappropriate action at this time. Romero should report the conflict to successively higher levels within the organization and turn only to the Board of Directors if the problem is not resolved at lower levels. 8-18 Cost Concepts and Classifications Chapter 8 Requirement 3 Andres Romero should follow the established policies of the organization bearing on the resolution of such conflict. If these policies do not resolve the ethical conflict, Romero should report the problem to successively higher levels of management up to the Board of Directors until it is satisfactorily resolved. There is no requirement for Romero to inform his immediate superior of this action because the superior is involved in the conflict. If the conflict is not resolved after exhausting all courses of internal review, Romero may have no other recourse than to resign from the organization and submit an informative memorandum to an appropriate member of the organization. (CMA Unofficial Solution, adapted) V. Multiple Choice Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. D D D B D A B D D A 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. D D D A A A D A D D 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. B B A A B C B D B C 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. D C D B D B C B A A 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. A C D B C B A B C D CHAPTER 2 MANAGEMENT ACCOUNTING AND THE BUSINESS ENVIRONMENT I. Questions 8-19 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. B B A C D C C C A B Chapter 8 Cost Concepts and Classifications 1. Managerial accounting information often brings to the attention of managers important issues that need their managerial experience and skills. In many cases, managerial-accounting information will not answer the question or solve the problem, but rather make management aware that the issue or problem exists. In this sense, managerial accounting sometimes is said to serve an attention-directing role. 2. Non-value-added costs are the costs of activities that can be eliminated with no deterioration of product quality, performance, or perceived value. 3. Managers rely on many information systems in addition to managerialaccounting information. Examples of other information systems include economic analysis and forecasting, marketing research, legal research and analysis, and technical information provided by engineers and production specialists. 4. Becoming the low-cost producer in an industry requires a clear understanding by management of the costs incurred in its production process. Reports and analysis of these costs are a primary function of managerial accounting. 5. Some activities in the value chain of a manufacturer of cotton shirts are as follows: (a) Growing and harvesting cotton (b) Transporting raw materials (c) Designing shirts (d) Weaving cotton material (e) Manufacturing shirts (f) Transporting shirts to retailers (g) Advertising cotton shirts Some activities in the value chain of an airline are as follows: (a) (b) (c) (d) (e) (f) (g) (h) Making reservations and ticketing Designing the route network Scheduling Purchasing aircraft Maintaining aircraft Running airport operations, including handling baggage Serving food and beverages in flight Flying passengers and cargo 8-20 Cost Concepts and Classifications Chapter 8 6. Strategic cost management is the process of understanding and managing, to the organization’s advantage, the cost relationships among the activities in an organization’s value chain. 7. If customers who provide a company with the most profits are attracted, satisfied, and retained, profits will increase as a result. 8. A value chain is a sequence of business functions whose objective is to provide a product to a customer or provide an intermediate good or service in a larger value chain. These business functions include R&D, design, production, marketing, distribution, and customer service. An organization can become more effective by focusing on whether each link in the chain adds value from the customer’s perspective and furthers the organization’s objectives. 9. Cost: Quality: Organizations are under continuous pressure to reduce the cost of the products or services they sell to their customers. Customers are expecting higher levels of quality and are less tolerant of low quality than in the past. Time: Time has many components: the time taken to develop and bring new products to market; the speed at which an organization responds to customer requests; and the reliability with which promised delivery dates are met. Organizations are under pressure to complete activities faster and to meet promised delivery dates more reliably than in the past in order to increase customer satisfaction. Innovation: There is now heightened recognition that a continuing flow of innovative products or services is a prerequisite for the ongoing success of most organizations. 10. Managers make planning decisions and control decisions. Planning decisions include deciding on organization goals, predicting results under various alternative ways of achieving those goals, and then deciding how to attain the desired goals. Control decisions include taking actions to implement the planning decisions and deciding on performance evaluation and feedback that will help future decision making. 11. Four themes for managers to attain success are customer focus, valuechain and supply-chain analysis, key success factors, and continuous improvement and benchmarking. 8-21 Chapter 8 Cost Concepts and Classifications 12. Companies add value through R&D; design of products, services, or processes; production; marketing; distribution; and customer service. Managers in all business functions of the value chain are customers of management accounting information. 13. This phrase means that people will direct their attention to work primarily on those tasks that management monitors and measures. Employees may not pay as much attention (or no attention) to tasks that are not measured. Often management will reward people based on how well they perform relative to a specific measure. As an example, in a manufacturing organization, if people are measured and rewarded based on the number of outputs per hour, regardless of quality, employees will focus their attention on producing as many units of output as possible. A negative consequence is that the quality of output may suffer. 14. Some of these new measures are quality, speed to market, cycle time, flexibility, complexity and productivity. 15. Customer satisfaction is often thought to be a qualitative measure of performance as one cannot directly observe “satisfaction.” However, using attitude surveys and psychological measurements, customer satisfaction can be measured in quantitative terms. For instance, people who design surveys often employ attitude scales that ask questions in which customers respond on a 1 to 5 scale. These values can be summed and averaged to determine satisfaction scores. 16. Stakeholders Contribution Requirements Employees Effort, skills, information Rewards, interesting jobs, economic security, proper treatment Partners Goods, services, information Financial rewards commensurate with the risk taken Owners Capital Financial rewards Community Allows the organization to operate Conformance to laws, good corporate 8-22 Cost Concepts and Classifications Chapter 8 and does not oppose its operation citizenship and, perhaps, leadership 17. Competitive benchmarking is an organization’s search for, and implementation of, the best way to do something as practiced in other organizations. Continuous improvement is the relentless search to (1) document, understand, and improve the activities that the organization undertakes to meet its customers’ requirement, (2) eliminate processing activities that do not add product features that customers value, and (3) improve the performance of activities that increase customer value or satisfaction. 18. A value-added activity is an activity that, if eliminated, would reduce the product’s service to the customer in the long run. An activity that cannot be classified as value-added is a nonvalue-added activity: a. b. c. d. e. f. g. h. i. j. Value-added Nonvalue-added Nonvalue-added Value-added Nonvalue-added Nonvalue-added Value-added Value-added Nonvalue-added Value-added 19. Just-in-time means making a good or service only when the customer, internal or external, requires it. Just-in-time requires a product layout with a continuous flow (no delays) once production starts. It means that setup costs must be reduced substantially to eliminate the need to produce in batches, and it means that processing systems must be reliable. Just-intime production is based on the elimination of all nonvalue-added activities to reduce cost and time. It is an approach to improvement that is continuous and involves employee empowerment and involvement. 20. Managerial accounting is concerned with providing information to managers for use within the organization. Financial accounting is concerned with providing information to stockholders, creditors, and others outside of the organization. 8-23 Chapter 8 Cost Concepts and Classifications 21. A strategy is a game plan that enables a company to attract customers by distinguishing itself from competitors. The focal point of a company’s strategy should be its target customers. II. Multiple Choice Questions 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. B A D A D A C B D B 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. A B C D A A B C B A 31. B 32. C 33. C CHAPTER 3 UNDERSTANDING FINANCIAL STATEMENTS I. Questions 1. A financial statement is a means of communicating information about an enterprise in financial (i.e., peso) terms. It represents information that the accountant believes is a true and fair representation of the financial activity of the enterprise. 2. Every financial statement relates to time in one way or another. A statement of financial position, or balance sheet, represent a “picture” of the enterprise at a point in time (e.g., the end of a month or year). An income statement and a statement of cash flows, on the other hand, cover activity that took place over a period of time (e.g., a month or year). 3. a. Creditors are interested in financial statements to assist them in evaluating the ability of a business to repay its debts. No one wants 8-24 Cost Concepts and Classifications Chapter 8 to extend credit to a company that is unable to meet its obligations as they come due. b. Potential investors use financial statements in selecting among alternative investment opportunities. They are interested in investing in companies in which the value of their investment will increase as a result of future profitable operations. c. Labor unions are interested in financial statements because the financial position of a company and its profits are important factors in the company’s ability to pay higher wages and to employ more people. 4. Business transactions affect a company’s financial position, and as a result they change the statement of financial position or balance sheet. The other financial statements – the income statement and the statement of cash flows – are detailed expansions of certain aspects of the statement of financial position and help explain how the company’s position changed over time. 5. The cost principle indicates that many assets are included in the financial records, and therefore, in the statement of financial position, at their original cost to the reporting enterprise. This principle affects accounting for assets in several ways, one of which is that the amount of most assets is not adjusted periodically for changes in the market value of the assets. Instead, cost is retained as the basic method of accounting, regardless of changes in the market value of those assets. 6. The going concern assumption states that in the absence of evidence to the contrary (i.e., bankruptcy proceedings), an enterprise is expected to continue to operate in the foreseeable future. This means, for example, that it will continue to use the assets it has in its financial statements for the purpose for which they were acquired. 7. The three categories and the information included in each are: Operating activities – Cash provided by and used in revenue and expense transactions. Investing activities – Cash provided by and used as a result of investments in assets, such as machinery, equipment, land, and buildings. Financial activities – Cash provided by and used in debt and equity financing, such as borrowing and repaying loans, and investments from and dividends paid to the enterprise’s owners. 8-25 Chapter 8 Cost Concepts and Classifications 8. Adequate disclosure refers to the requirement that financial statements, including accompanying notes, must include information necessary for reasonably informed users of financial statements to understand the company’s financial activities. This requirement is often met, in part, by the addition of notes to the financial statements. Financial statement notes include both quantitative and qualitative information that is not included in the body of the financial statements. 9. A strong income statement is one that has significantly more pesos of revenue than expenses, resulting in net income that is a relatively high percentage of the revenue figure. A trend of relatively high income numbers over time signals a particularly strong income situation. 10. A strong statement of cash flows is one that shows significant amounts of cash generated from operating activities. This means that the enterprise is generating cash from its ongoing activities and is not required to rely on continuous debt and equity financing, or the sale of its major assets. 11. The purpose of classifications in financial statements is to develop useful subtotals, which help users analyze the statements. The most commonly used classifications are: In a balance sheet: current assets, plant and equipment, other assets, current liabilities, long-term liabilities and equity. In a multiple-step income statement: revenue, cost of goods sold, operating expenses, and nonoperating items. The operating expense section often includes subclassifications for selling expenses and for general and administrative expenses. In a statement of cash flows: operating activities, investing activities, and financing activities. 12. In classified financial statements, similar items are grouped together to produce subtotals which may assist users in their analyses. Comparative financial statements show financial statements for two or more time periods in side-by-side columns. Consolidated statements include not only the financial statement amounts for the company itself but also for any subsidiary companies that it owns. The financial statements of large corporations often possess all three of these characteristics. 13. In a multiple-step income statement, different categories of expenses are deducted from revenue in a series of steps, thus resulting in various subtotals, such as gross profit and operating income. In a single-step 8-26 Cost Concepts and Classifications Chapter 8 income statement, all expenses are combined and deducted from total revenue in a single step. Both formats result in the same amount of net income. II. Matching Type 1. 1. d 2. g 3. a 4. j 5. e 6. h 7. f 8. b 9. c 10. i 2. 1. d 2. a 3. i 4. g 5. m 6. c 7. h 8. n 9. f 10. k 11. b 12. j 13. e 14. l 3. a. F b. I c. F d. I e. I f. F g. F h. F I. j. I F k. F l. I III. Problems Problem 1 (Preparing a Balance Sheet – A Second Problem) Requirement (a) SM Farms Balance Sheet September 30, 2005 Assets Liabilities and Equity Liabilities: Cash P 16,710 Accounts receivable 22,365 Land Barns and sheds Citrus trees Livestock Notes payable P530,000 Accounts 550,000 78,300 76,650 payable 77,095 Property taxes payable 9,135 Wages payable 1,820 120,780 Total 8-27 liabilities P618,050 Chapter 8 Cost Concepts and Classifications Irrigation system Farm machinery 20,125 42,970 Fences & gates 33,570 Total Equity: Share capital 250,000 Retained earnings* 93,420 Total P961,470 P961,470 * Total assets, P961,470, minus total liabilities, P618,050, less share capital, P250,000. Requirement (b) The loss of an asset, Barns and Sheds, from a typhoon would cause a decrease in total assets. When total assets are decreased, the balance sheet total of liabilities and equity must also decrease. Since there is no change in liabilities as a result of the destruction of an asset, the decrease on the right-hand side of the balance sheet must be in the retained earnings account. The amount of the decrease in Barns and Sheds, in the equity, and in both balance sheet totals, is P23,800. Problem 2 (Preparing a Balance Sheet and Cash Flow Statement; Effects of Business Transactions) Requirement (a) The Tasty Bakery Balance Sheet August 1, 2005 Assets Liabilities and Equity Liabilities: Cash P 6,940 Accounts receivable 11,260 Supplies Notes P 7,000 Accounts payable 16,200 Salaries payable 8,900 Land Building 67,000 84,000 Total Equipment and fixtures 44,500 Equity: 8-28 payable 74,900 liabilities P100,000 Cost Concepts and Classifications Chapter 8 Share capital 80,000 Retained earnings 40,700 Total Total P220,700 P220,700 Requirement (b) The Tasty Bakery Balance Sheet August 3, 2005 Assets Liabilities and Equity Liabilities: Cash P 14,490 Accounts receivable 11,260 Supplies 8,250 Land Building Notes P payable 74,900 Accounts payable 7,200 payable 8,900 Salaries 67,000 84,000 Total Equipment and fixtures 51,700 liabilities P 91,000 Equity: Share capital 105,000 Retained earnings 40,700 Total Total P236,700 The Tasty Bakery Statement of Cash Flows For the Period August 1 - 3, 2005 8-29 P236,700 Chapter 8 Cost Concepts and Classifications Cash flows from operating activities: Cash payment of accounts payable Cash purchase of supplies Cash used in operating activities P(16,200 ) (1,250) P(17,450 ) Cash flows from investing activities: None Cash flows from financing activities: Sale of share capital Increase in cash Cash balance, August 1, 2005 Cash balance, August 3, 2005 P25,000 P 7,550 6,940 P14,490 Requirement (c) The Tasty Bakery is in a stronger financial position on August 3 than it was on August 1. On August 1, the highly liquid assets (cash and accounts receivable) total only P18,200, but the company has P25,100 in debts due in the near future (accounts payable plus salaries payable). On August 3, after additional infusion of cash from the sale of stock, the liquid assets total P25,750, and debts due in the near future amount to P16,100. Note to Instructor: The analysis of financial position strength in requirement (c) is based solely upon the balance sheets at August 1 and August 3. Hopefully, students will raise many legitimate issues regarding necessity of information about operations, rate at which cash flows into the business, etc. In this problem, the improvement in financial position results solely from the sale of share capital. 8-30 Cost Concepts and Classifications Chapter 8 Problem 3 (Preparing Financial Statements; Transactions) Effects of Business Requirement (a) The First Malt Shop Balance Sheet September 30, 2005 Assets Liabilities and Equity Liabilities: Cash Accounts receivable Supplies P 7,400 1,250 Notes payable* P 70,000 3,440 Accounts 55,000 Total payable 8,500 Land Building 45,500 liabilities P 78,500 Equity: Share Furniture & fixtures capital 50,000 Retained earnings 4,090 20,000 Total Total P132,590 P132,590 * Total assets, P132,590, less equity, P54,090, less accounts payable, P8,500, equals notes payable. Requirement (b) The First Malt Shop Balance Sheet October 6, 2005 Assets Liabilities and Equity Liabilities: Cash Accounts receivable Supplies P 29,400 1,250 4,440 8-31 Notes P payable 70,000 Accounts payable Chapter 8 Cost Concepts and Classifications 18,000 Land 55,000 Building 45,500 Total liabilities P 88,000 Equity: Share Furniture & fixtures capital 80,000 Retained earnings 5,590 38,000 Total Total P173,590 P173,590 The First Malt Shop Income Statement For the Period October 1-6, 2005 Revenues Expenses Net income P 5,500 (4,000) P 1,500 The First Malt Shop Statement of Cash Flows For the Period October 1-6, 2005 Cash flows from operating activities: Cash received from revenues Cash paid for expenses Cash paid for accounts payable Cash paid for supplies Cash used in operating activities 8-32 P5,500 (4,000 ) (8,500 ) (1,0 00) P(8,000) Cost Concepts and Classifications Chapter 8 Cash flows from investing activities: None Cash flows from financing activities: Cash received from sale of share capital P30,000 Increase in cash P 22,000 7,400 P29,400 Cash balance, October 1, 2005 Cash balance, October 6, 2005 Requirement (c) The First Malt Shop is in a stronger financial position on October 6 than on September 30. On September 30, the company had highly liquid assets (cash and accounts receivable) of P8,650, which barely exceeded the P8,500 in liabilities (accounts payable) due in the near future. On October 6, after the additional investment of cash by shareholders, the company’s cash alone exceeded its short-term obligations. Problem 4 (Preparing a Balance Sheet; Discussion of Accounting Principles) Requirement (1) Fil-Cinema Scripts Balance Sheet November 30, 2005 Assets Liabilities and Equity Liabilities: Cash Notes receivable Accounts receivable P 3,940 2,200 2,450 8-33 Notes P payable 73,500 Accounts payable Chapter 8 Cost Concepts and Classifications 32,700 Land 39,000 Building 54,320 Total liabilities P106,200 Equity: Share Office furniture* 12,825 Total Retained capital 5,000 earnings 3,535 Total P114,735 P114,735 * P8,850 + P6,500 – P2,525. Requirement (2) (1) The cash in Cruz’s personal savings account is not an asset of the business entity Fil-Cinema Scripts and should not appear in the balance sheet of the business. The money on deposit in the business bank account (P3,400) and in the company safe (P540) constitute cash owned by the business. Thus, the cash owned by the business at November 30 totals P3,940. (2) The years-old IOU does not qualify as a business asset for two reasons. First, it does not belong to the business entity. Second, it appears to be uncollectible. A receivable that cannot be collected is not viewed as an asset, as it represents no future economic benefit. (3) The total amount to be included in “Office furniture” for the rug is P9,400, the total cost, regardless of whether this amount was paid in cash. Consequently, “Office furniture” should be increased by P6,500. The P6,500 liability arising from the purchase of the rug came into existence prior to the balance sheet date and must be added to the “Notes payable” amount. (4) The computer is no longer owned by Hollywood Scripts and therefore cannot be included in the assets. To do so would cause an overstatement of both assets and equity. The “Office furniture” amount must be reduced by P2,525. (5) The P22,400 described as “Other assets” is not an asset, because there is no valid legal claim or any reasonable expectation of recovering the income taxes paid. Also, the payment of income taxes by Cruz was not a business transaction by Fil-Cinema Scripts. If a refund were obtained 8-34 Cost Concepts and Classifications Chapter 8 from the government, it would come to Cruz personally, not to the business entity. (6) The proper valuation for the land is its historical cost of P39,000, the amount established by the transaction in which the land was purchased. Although the land may have a current fair value in excess of its cost, the offer by the friend to buy the land if Cruz would move the building appears to be mere conversation rather than solid, verifiable evidence of the fair value of the land. The “cost principle,” although less than perfect, produces far more reliable financial statements than would result if owners could “pull figures out of the air” in recording asset values. (7) The accounts payable should be limited to the debts of the business, P32,700, and should not include Cruz’s personal liabilities. IV. Multiple Choice Questions 21. 22. 23. 24. 25. 26. D D D B A B 31. 32. 33. 34. 35. a. 27. 28. 29. 30. D C B C 17. 18. 19. 20. B C D A D A A B C C 21. 22. 23. 24. 25. 26. B C A B A D 31. 32. 33. 34. 35. 36. B D D D C A 27. 28. 29. 30. B B D C 37. A 38. C CHAPTER 4 FINANCIAL STATEMENTS ANALYSIS - I I. Questions 1. The objective of financial statements analysis is to determine the extent of a firm’s success in attaining its financial goals, namely: a. To earn maximum profit 8-35 Chapter 8 Cost Concepts and Classifications b. To maintain solvency c. To attain stability 2. Some of the indications of satisfactory short-term solvency or working capital position of a business firm are: 1. Favorable credit position 2. Satisfactory proportion of cash to the requirements of the current volume 3. Ability to pay current debts in the regular course of business 4. Ability to extend more credit to customers 5. Ability to replenish inventory promptly 3. These tests are: 1. Improvement in the financial position 2. Well-balanced financial structure between borrowed funds and equity 3. Effective employment of borrowed funds and equity 4. Ability to declare satisfactory amount of dividends to shareholders 5. Ability to withstand adverse business conditions 6. Ability to engage in research and development in an attempt to provide new products or improve old products, methods or processes 4. Some indicators of managerial efficiency are: 1. Ability to earn a reasonable return on its investment of borrowed funds and equity 2. Ability to control operating costs within reasonable limits 3. No overinvestment in fixed assets, receivables and inventories 5. The techniques used in Financial Statement Analysis are: I. Vertical analysis which shows the relationships of the items in the same year: also referred to as “static measure.” a. Financial ratios b. Common-size statements II. Horizontal analysis which shows the changes or tendencies of an item for 2 or more years; also referred to as “dynamic measure.” 8-36 Cost Concepts and Classifications Chapter 8 a. Comparative statements - showing changes in absolute amount and percentages b. Trend percentages III. Use of special reports or statements a. Statements of Changes in Financial Position b. Gross Profit / Net Income Variation Analysis 6. Refer to page 133 of the textbook. 7. Horizontal analysis involves the comparison of items on financial statements between years. Analysis of comparative financial statements or the increase/decrease method of analysis and trend percentages are the two techniques that may be applied under horizontal analysis. Vertical analysis involves the study of items on a single statement for a single year, such as the analysis of an income statement for some given year. Common-size statement and financial ratios are techniques used in vertical analysis. 8. Trends can indicate whether a situation is improving, remaining the same or deteriorating. They can also give insight to the probable future course of events in a firm. 9. Trend percentages represent the expression of several years’ financial data in percentage form in terms of a base year. 10. Refer to page 133 of the textbook. 11. Observation of trends is useful primarily in determining whether a situation is improving, worsening, or remaining constant. By comparing current data with similar data of prior periods we gain insight into the direction in which future results are likely to move. Some other standards of comparison include comparison with other similar companies, comparison with industry standards, and comparison with previous years’ information. By comparing analytical data for one company with some independent yardstick, the analyst hopes to determine how the position of the company in question compares with some standard of performance. 12. Trend percentages are used to show the increase or decrease in a financial statement amount over a period of years by comparing the amount in each 8-37 Chapter 8 Cost Concepts and Classifications year with the base-year amount. A component percentage is the percentage relationship between some financial amount and a total of which it is a part. Measuring the change in sales over a period of several years would call for use of trend percentages. The sales in the base year are assigned a weight of 100%. The percentage for each later year is computed by dividing that year’s sales by the sales in the base year. 13. Expenses (including the cost of goods sold) have been increasing at an even faster rate than net sales. Thus Premiere is apparently having difficulty in effectively controlling its expenses. 14. A corporate net income of P1 million would be unreasonably low for a large corporation, with, say, P100 million in sales, P50 million in assets, and P40 million in equity. A return of only P1 million for a company of this size would suggest that the owners could do much better by investing in insured bank savings accounts or in government bonds which would be virtually risk-free and would pay a higher return. On the other hand, a profit of P1 million would be unreasonably high for a corporation which had sales of only P5 million, assets of, say, P3 million, and equity of perhaps one-half million pesos. In other words, the net income of a corporation must be judged in relation to the scale of operations and the amount invested. II. True or False 1. True 2. False 3. True 4. True 5. False 6. False 7. True 8. False 9. True 10. True III. Problems Problem 1 (Percentage Changes) a. Accounts receivable decreased 16% (P24,000 decrease P150,000 = 16% decrease). b. Marketable securities decreased 100% (P250,000 decrease P250,000 = 100% decrease). c. A percentage change cannot be calculated because retained earnings showed a negative amount (a deficit) in the base year and a positive amount in the following year. 8-38 Cost Concepts and Classifications Chapter 8 d. A percentage change cannot be calculated because of the zero amount of notes receivable in 2005, the base year. e. Notes payable increased 7 ½% (P60,000 increase P800,000 = 7 ½% increase). f. Cash increased 3% (P2,400 increase P80,000 = 3% increase). g. Sales increased 10% (P90,000 increase P900,000 = 10% increase). Problem 2 (Computing and Interpreting Rates of Change) Requirement (a) Computation of percentage changes: 1. Net sales increased 10% (P200,000 increase P2,000,000 = 10% increase). 2. Total expenses increased 11% (P198,000 increase P1,800,000 = 11% increase). Requirement (b) 1. Total expenses grew faster than net sales. Net income cannot also have grown faster than net sales, or the sum of the parts would exceed the size of the whole. 2. Net income must represent a smaller percentage of net sales in 2006 than it did in 2005. Again, the reason is that the expenses have grown at a faster rate than net sales. Thus, total expenses represent a larger percentage of total sales in 2006 than in 2005, and net income must represent a smaller percentage. Problem 3 (Financial Statement Analysis using Comparative Statements or Increase-Decrease Method) Requirement 1 XYZ Corporation Balance Sheet As of December 31 Change Peso Assets Cash and equivalents Receivables 2005 2006 14,000 28,800 16,000 55,600 8-39 2,000 26,800 % 14.29% 93.06% Chapter 8 Cost Concepts and Classifications Inventories Prepayments and others Total current assets Property, plant & equipment - net of dep. Total assets Liabilities and Equity Notes payable to banks Accounts payable Accrued liabilities Income taxes payable Total current liabilities Share capital Retained earnings Total equity Total liabilities and equity 54,000 4,800 101,600 85,600 7,400 164,600 31,600 2,600 63,000 58.52% 54.17% 62.01% 30,200 131,800 73,400 238,000 43,200 106,200 143.05% 80.58% 10,000 31,600 4,200 5,800 51,600 44,600 35,600 80,200 131,800 54,000 55,400 6,800 7,000 123,200 44,600 70,200 114,800 238,000 44,000 23,800 2,600 1,200 71,600 0 34,600 34,600 106,200 440.00% 73.32% 61.90% 20.69% 138.76% 0.00% 97.19% 43.14% 80.58% XYZ Corporation Income Statement Years ended December 31 (P thousands) Change Peso Net sales Cost of goods sold Gross profit Selling, general and administrative expenses Income before income taxes Income taxes Net income % 2005 266,400 191,400 75,000 2006 424,000 314,600 109,400 157,600 123,200 34,400 59.16% 64.37% 45.87% 35,500 39,500 12,300 27,200 58,400 51,000 16,400 34,600 22,900 11,500 4,100 7,400 64.51% 29.11% 33.33% 27.21% while Current Liabilities increased by 138.76% while Current Liabilities increased by 138.76% while Accounts Receivable increased by 93.06% Requirement 2 Short-term financial position 1. Current increased by 62.01% Assets Unfavorable 2. Quick increased by 62.40% Assets Unfavorable 3. Net increased by 59.16% Sales Unfavorable 8-40 Cost Concepts and Classifications Chapter 8 4. Cost of Goods Sold Leverage 5. Total Assets 6. Total Liabilities Profitability 7. Net Sales 8. Net Sales increased by 64.37% while 10. Net Income increased by 58.52% Favorable increased by 80.58% while Total Liabilities increased by 138.76% while Total Equity increased by 43.14% while Cost of Goods Sold increased by 64.37% while Selling, General & increased by 64.51% Administrative Expenses while Net Income increased by 27.21% while Total Assets increased by 80.58% Unfavorable increased by 138.76% Unfavorable increased by 59.16% Unfavorable increased by 59.16% Unfavorable 9. Net Sales Inventories increased by 59.16% Unfavorable increased by 27.21% Unfavorable Problem 4 (Trend Percentages) Requirement (1) The trend percentages are: Sales Year 5 Year 4 Year 3 Year 2 Year 1 125.0 120.0 110.0 105.0 100.0 Cash Accounts receivable Inventory Total current assets 80.0 140.0 112.0 118.8 90.0 124.0 110.0 113.1 105.0 108.0 102.0 104.1 110.0 104.0 108.0 106.9 100.0 100.0 100.0 100.0 Current liabilities 130.0 106.0 108.0 110.0 100.0 Requirement (2) 8-41 Chapter 8 Cost Concepts and Classifications Sales: The sales are increasing at a steady rate, with a particularly strong gain in Year 4. Assets: Cash declined from Year 3 through Year 5. This may have been due to the growth in both inventories and accounts receivable. In particular, the accounts receivable grew far faster than sales in Year 5. The decline in cash may reflect delays in collecting receivables. This is a matter for management to investigate further. Liabilities: The current liabilities jumped up in Year 5. This was probably due to the buildup in accounts receivable in that the company doesn’t have the cash needed to pay bills as they come due. Problem 5 (Use of Trend Percentages) a. 1. An unfavorable tendency could be observed in Receivables in relation to Net Sales from 2003 – 2005 because receivables had been increasing at a much faster rate than Net Sales. This could indicate inefficiency in the collection of receivables or simply poor company credit policy. The situation however, improved in 2006 and 2007 when sales started to move up at a faster rate than accounts receivable. This would indicate improvement in the credit and collection policy or more cash sales were being generated. 2. Unfavorable tendency in inventory persisted from 2003 to 2007 because it had been going up at a much faster rate than Net Sales. If this continues, the company will end up with over-investment in inventory because the buying rate is faster than the selling price. 3. Favorable tendencies could be noted in Fixed Assets in relation to Net Sales because inspite of the minimal additions to fixed assets made by the company from 2003 through 2007, sales had been increasing at a very encouraging rate. 4. Net Income had likewise been increasing at a much faster rate than net sales. This is favorable because this would indicate that the company had been successfully controlling the increases in Cost of Sales and Operating Expenses. b. Review computations of the Trend Percentages. It will be noted that the Trend Percentages in Total Noncurrent Liabilities and Equity from 2005 8-42 Cost Concepts and Classifications Chapter 8 to 2007 were interchanged. interpretation is done. Correction should be made first before 1. The upward tendency in current assets had been accompanied by an upward trend in current liabilities. It could be noted that current assets had been moving up at a much faster rate than current liabilities. This is favorable because the margin of safety of the shortterm creditors is widened. 2. Favorable tendencies could also be observed in noncurrent assets which had been increasing and which increases had been accompanied by downward trend in noncurrent liabilities. This would mean better security on the part of creditors and stronger financial position. 3. There is an unfavorable tendency in Net Sales in relation to noncurrent assets. Sales had not been increasing at the same rate as the increases in fixed assets. This could indicate that more investments are made in noncurrent assets without considering whether or not they could sell the additional units of product they are producing. c. The unfavorable trend in net income could be attributed to the following tendencies: 1. Higher rates of increases in cost of sales as compared to sales. 2. Higher rates of increases in selling, general and administrative expenses in relation to net sales. 3. Higher rates of increases in other financial expenses than the rates of increases in net sales IV. Multiple Choice Questions 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. D A A B D C C A D C 36. A, C, D 37. B* 38. D 8-43 Chapter 8 Cost Concepts and Classifications * (P400,000 – P160,000) P160,000 = 150% CHAPTER 5 FINANCIAL STATEMENTS ANALYSIS - II I. Questions 1. By looking at trends, an analyst hopes to get some idea of whether a situation is improving, remaining the same, or deteriorating. Such analyses can provide insight into what is likely to happen in the future. Rather than looking at trends, an analyst may compare one company to another or to industry averages using common-size financial statements. 2. Ratios highlight relationships, movements, and trends that are very difficult to perceive looking at the raw underlying data standing alone. Also, ratios make financial data easier to grasp by putting the data into perspective. As to the limitation in the use of ratios, refer to page 129. 3. Price-earnings ratios are determined by how investors see a firm’s future prospects. Current reported earnings are generally considered to be useful only so far as they can assist investors in judging what will happen in the future. For this reason, two firms might have the same current earnings, but one might have a much higher price-earnings ratio if investors view it to have superior future prospects. In some cases, firms with very small current earnings enjoy very high price-earnings ratios. This is simply because investors view these firms as having very favorable prospects for earnings in future years. By definition, a stock with current earnings of P4 and a price-earnings ratio of 20 would be selling for P80 per share. 4. A manager’s financing responsibilities relate to the acquisition of assets for use in his or her company. The acquisition of assets can be financed in a number of ways, including through issue of ordinary shares, through issue of preference shares, through issue of long-term debt, through leasing, etc. A manager’s operating responsibilities relate to how these assets are used once they have been acquired. The return on total assets ratio is designed to measure how well a manager is discharging his or her 8-44 Cost Concepts and Classifications Chapter 8 operating responsibilities. It does this by looking at a company’s income before any consideration is given as to how the income will be distributed among capital resources, i.e., before interest deductions. 5. Financial leverage, as the term is used in business practice, means obtaining funds from investment sources that require a fixed annual rate of return, in the hope of enhancing the well-being of the ordinary shareholders. If the assets in which these funds are invested earn at a rate greater that the return required by the suppliers of the funds, then leverage is positive in the sense that the excess accrues to the benefit of the ordinary shareholders. If the return on assets is less than the return required by the suppliers of the funds, then leverage is negative in the sense that part of the earnings from the assets provided by the ordinary shareholders will have to go to make up the deficiency. 6. How a shareholder would feel would depend in large part on the stability of the firm and its industry. If the firm is in an industry that experiences wide fluctuations in earnings, then shareholders might be very pleased that no interest-paying debt exists in the firm’s capital structure. In hard times, interest payments might be very difficult to meet, or earnings might be so poor that negative leverage would result. 7. No, the stock is not necessarily overpriced. Book value represents the cumulative effects on the balance sheet of past activities evaluated using historical prices. The market value of the stock reflects investors’ beliefs about the company’s future earning prospects. For most companies market value exceeds book value because investors anticipate future growth in earnings. 8. A company in a rapidly growing technological industry probably would have many opportunities to invest its earnings at a high rate of return; thus, one would expect it to have a low dividend payout ratio. 9. It is more difficult to obtain positive financial leverage from preference shares than from long-term debt due to the fact that interest on long-term debt is tax deductible, whereas dividends paid on preference shares are not tax deductible. 10. The current ratio would probably be highest during January, when both current assets and current liabilities are at a minimum. During peak operating periods, current liabilities generally include short-term borrowings that are used to temporarily finance inventories and 8-45 Chapter 8 Cost Concepts and Classifications receivables. As the peak periods end, these short-term borrowings are paid off, thereby enhancing the current ratio. 11. A 2-to-1 current ratio might not be adequate for several reasons. First, the composition of the current assets may be heavily weighted toward slowturning inventory, or the inventory may consist of large amounts of obsolete goods. Second, the receivables may be large and of doubtful collectibility, or the receivables may be turning very slowly due to poor collection procedures. 12. Expenses (including the cost of goods sold) have been increasing at an even faster rate than net sales. Thus Sunday is apparently having difficulty in effectively controlling its expenses. 13. If the company’s earnings are very low, they may become almost insignificant in relation to stock price. While this means that the p/e ratio becomes very high, it does not necessarily mean that investors are optimistic. In fact, they may be valuing the company at its liquidation value rather than a value based upon expected future earnings. 14. From the viewpoint of the company’s shareholders, this situation represents a favorable use of leverage. It is probable that little interest, if any, is paid for the use of funds supplied by current creditors, and only 11% interest is being paid to long-term bondholders. Together these two sources supply 40% of the total assets. Since the firm earns an average return of 16% on all assets, the amount by which the return on 40% of the assets exceeds the fixed-interest requirements on liabilities will accrue to the residual equity holders – the ordinary shareholders – raising the return on equity. 15. The length of operating cycle of the two companies cannot be determined from the fact the one company’s current ratio is higher. The operating cycle depends on the relationships between receivables and sales, and between inventories and cost of goods sold. The company with the higher current ratio might have either small amounts of receivables and inventories, or large sales and cost of sales, either of which would tend to produce a relatively short operating cycle. 16. The investor is calculating the rate of return by dividing the dividend by the purchase price of the investment (P5 P50 = 10%). A more meaningful figure for rate of return on investment is determined by relating dividends to current market price, since the investor at the present time is faced with the alternative of selling the stock for P100 and 8-46 Cost Concepts and Classifications Chapter 8 investing the proceeds elsewhere or keeping the investment. A decision to retain the stock constitutes, in effect, a decision to continue to invest P100 in it, at a return of 5%. It is true that in a historical sense the investor is earning 10% on the original investment, but this is interesting history rather than useful decision-making information. 17. A corporate net income of P1 million would be unreasonably low for a large corporation, with, say, P100 million in sales, P50 million in assets, and P40 million in equity. A return of only P1 million for a company of this size would suggest that the owners could do much better by investing in insured bank savings accounts or in government bonds which would be virtually risk-free and would pay a higher return. On the other hand, a profit of P1 million would be unreasonably high for a corporation which had sales of only P5 million, assets of, say, P3 million, and equity of perhaps one-half million pesos. In other words, the net income of a corporation must be judged in relation to the scale of operations and the amount invested. II. True or False 1. True 2. True 3. True 4. False 5. True 6. True 7. True 8. True 9. False 10. False III. Problems Problem 1 (Common Size Income Statements) Common size income statements for 2005 and 2006: Sales................................................. Cost of goods sold............................. Gross profit....................................... Operating expenses........................... Net income........................................ 2006 100% 66 34% 28 6% 2005 100% 67 33% 29 4% The changes from 2005 to 2006 are all favorable. Sales increased and the gross profit per peso of sales also increased. These two factors led to a substantial increase in gross profit. Although operating expenses increased in peso amount, the operating expenses per peso of sales decreased from 29 cents to 28 cents. The combination of these three favorable factors caused net income to rise from 4 cents to 6 cents out of each peso of sales. 8-47 Chapter 8 Cost Concepts and Classifications Problem 2 (Measures of Liquidity) Requirement (a) Current assets: Cash Marketable securities Accounts receivable Inventory Unexpired insurance Total current assets Current liabilities: Notes payable Accounts payable Salaries payable Income taxes payable Unearned revenue Total current liabilities P 47,600 175,040 230,540 179,600 4,500 P637,280 P 70,000 125,430 7,570 14,600 10,000 P227,600 Requirement (b) The current ratio is 2.8 to 1. It is computed by dividing the current assets of P637,280 by the current liabilities of P227,600. The amount of working capital is P409,680, computed by subtracting the current liabilities of P227,600 from the current assets of P637,280. The company appears to be in a strong position as to short-run debt-paying ability. It has almost three pesos of current assets for each peso of current liabilities. Even if some losses should be sustained in the sale of the merchandise on hand or in the collection of the accounts receivable, it appears probable that the company would still be able to pay its debts as they fall due in the near future. Of course, additional information, such as the credit terms on the accounts receivable, would be helpful in a careful evaluation of the company’s current position. Problem 3 (Common-Size Income Statement) Requirement 1 2006 2005 Sales 100.0 % 100.0 % Less cost of goods sold........................................................................................................... 63.2 60.0 Gross margin.......................................................................................................................... 36.8 40.0 Selling expenses..................................................................................................................... 18.0 17.5 8-48 Cost Concepts and Classifications Chapter 8 Administrative expenses........................................................................................................ 13.6 14.6 Total expenses........................................................................................................................ 31.6 32.1 Net operating income............................................................................................................ 5.2 7.9 Interest expense..................................................................................................................... 1.4 1.0 Net income before taxes......................................................................................................... 3.8 % 6.9 % Requirement 2 The company’s major problem seems to be the increase in cost of goods sold, which increased from 60.0% of sales in 2005 to 63.2% of sales in 2006. This suggests that the company is not passing the increases in costs of its products on to its customers. As a result, cost of goods sold as a percentage of sales has increased and gross margin has decreased. Selling expenses and interest expense have both increased slightly during the year, which suggests that costs generally are going up in the company. The only exception is the administrative expenses, which have decreased from 14.6% of sales in 2005 to 13.6% of sales in 2006. This probably is a result of the company’s efforts to reduce administrative expenses during the year. Problem 4 (Comparing Operating Results with Average Performance in the Industry) Requirement (a) Ms. Freeze,Inc. 100% 49 51% Sales (net) Cost of goods sold Gross profit on sales Operating expenses: Selling General and administrative Total operating expenses Operating income Income taxes Net income 21% 17 38% 13% 6 7% Industry Average 100% 57 43% 16% 20 36% 7% 3 4% Requirement (b) Ms. Freeze’s operating results are significantly better than the average performance within the industry. As a percentage of sales revenue, Ms. Freeze’s operating income and net income after nearly twice the average for the industry. As a percentage of total assets, Ms. Freeze’s profits amount to an impressive 23% as compared to 14% for the industry. The key to Ms. Freeze’s success seems to be its ability to earn a relatively high rate of gross profit. Ms. Freeze’s exceptional gross profit rate (51%) probably results from a combination of factors, such as an ability to command 8-49 Chapter 8 Cost Concepts and Classifications a premium price for the company’s products and production efficiencies which lead to lower manufacturing costs. As a percentage of sales, Ms. Freeze’s selling expenses are five points higher than the industry average (21% compared to 16%). However, these higher expenses may explain Ms. Freeze’s ability to command a premium price for its products. Since the company’s gross profit rate exceeds the industry average by 8 percentage points, the higher-than-average selling costs may be part of a successful marketing strategy. The company’s general and administrative expenses are significantly lower than the industry average, which indicates that Ms. Freeze’s management is able to control expenses effectively. Problem 5 (Common-Size Statements) Requirement 1 The income statement in common-size form would be: Sales......................................................... Less cost of goods sold............................. Gross margin............................................ Less operating expenses............................ Net operating income................................ Less interest expense................................ Net income before taxes............................ Less income taxes (30%).......................... Net income............................................... 2006 100.0% 65.0 35.0 26.3 8.7 1.2 7.5 2.3 5.3% 2005 100.0% 60.0 40.0 30.4 9.6 1.6 8.0 2.4 5.6% The balance sheet in common-size form would be: 2006 Current assets: Cash .......................................................... Accounts receivable, net .......................................................... Inventory .......................................................... Prepaid expenses .......................................................... Total current assets 8-50 2.0% 2005 5.1% 15.0 10.1 30.1 15.2 1.0 1.3 48.1 31.6 Cost Concepts and Classifications Chapter 8 Plant and equipment................................. Total assets............................................... 51.9 100.0% 68.4 100.0% 25.1% 20.1 45.1 12.7% 25.3 38.0 15.0 19.0 Ordinary shares, P5 par 10.0 12.7 Retained earnings 29.8 30.4 54.9 62.0 100.0% 100.0% Liabilities: Current liabilities............................... Bonds payable, 12%........................... Total liabilities............................. Equity: Preference shares, 8%, P10 par Total equity Total liabilities and equity......................... Note: Columns do not total down in all cases due to rounding differences. Requirement 2 The company’s cost of goods sold has increased from 60 percent of sales in 2005 to 65 percent of sales in 2006. This appears to be the major reason the company’s profits showed so little increase between the two years. Some benefits were realized from the company’s cost-cutting efforts, as evidenced by the fact that operating expenses were only 26.3 percent of sales in 2006 as compared to 30.4 percent in 2005. Unfortunately, this reduction in operating expenses was not enough to offset the increase in cost of goods sold. As a result, the company’s net income declined from 5.6 percent of sales in 2005 to 5.3 percent of sales in 2006. Problem 6 (Solvency of Alabang Supermarket) Requirement (a) (Pesos in Millions) Current assets: Cash Receivables Merchandise inventories Prepaid expenses P 8-51 74.8 152.7 1,191.8 95.5 Chapter 8 Cost Concepts and Classifications Total current assets P1,514.8 Quick assets: Cash Receivables Total quick assets P 74.8 152.7 P 227.5 Requirement (b) (1) Current ratio: Current assets (Req. a) Current liabilities Current ratio (P1,514.8 P1,939.0) P1,514.8 P1,939.0 0.8 to 1 (2) Quick ratio: Quick assets (Req. a) Current liabilities Quick ratio (P227.5 P1,939.0) P 227.5 P1,939.0 0.1 to 1 (3) Working capital: Current assets (Req. a) Less: Current liabilities Working capital P1,514.8 P1,939.0 P(424.2) Requirement (c) No. It is difficult to draw conclusions from the above ratios. Alabang Supermarket’s current ratio and quick ratio are well below “safe” levels, according to traditional rules of thumb. On the other hand, some large companies with steady ash flows are able to operate successfully with current ratios lower than Alabang Supermarket’s. Requirement (d) Due to characteristics of the industry, supermarkets tend to have smaller amounts of current assets and quick assets than other types of merchandising companies. An inventory of food has a short shelf life. Therefore, the inventory of a supermarket usually represents only a few weeks’ sales. Other merchandising companies may stock inventories representing several months’ sales. Also, supermarkets sell primarily for cash. Thus, they have relatively few receivables. Although supermarkets may generate large amounts of cash, it is not profitable for them to hold assets in this form. Therefore, they are likely to reinvest their cash flows in business operations as quickly as possible. 8-52 Cost Concepts and Classifications Chapter 8 Requirement (e) In evaluating Alabang Supermarket’s liquidity, it would be useful to review the company’s financial position in prior years, statements of cash flows, and the financial ratios of other supermarket chains. One might also ascertain the company’s credit rating from an agency such as Dun & Bradstreet. Note to Instructor: Prior to the year in which the data for this problem was collected, Alabang Supermarket had reported a negative retained earnings balance in its balance sheet for several consecutive periods. The fact that Alabang Supermarket has only recently removed the deficit from its financial statements is also worrisome. Problem 7 (Balance Sheet Measures of Liquidity and Credit Risk) Requirement (a) (1) Quick assets: Cash Marketable securities (short-term) Accounts receivable Total quick assets P 47,524 55,926 23,553 P127,003 (2) Current assets: Cash Marketable securities (short-term) Accounts receivable Inventories Prepaid expenses Total current assets P 47,524 55,926 23,553 32,210 5,736 P164,949 (3) Current liabilities: Notes payable to banks (due within one year) Accounts payable Dividends payable Accrued liabilities (short-term) Income taxes payable Total current liabilities P 20,000 5,912 1,424 21,532 6,438 P 55,306 8-53 Chapter 8 Cost Concepts and Classifications Requirement (b) (1) Quick ratio: Quick assets (Req. a) Current liabilities (Req. a) Quick ratio (P127,003 P55,306) P127,003 P 55,306 2.3 to 1 (2) Current ratio: Current assets (Req. a) Current liabilities (Req. a) Current ratio (P164,949 P55,306) P164,949 P 55,306 3.0 to 1 (3) Working capital: Current assets (Req. a) Less: Current liabilities (Req. a) Working capital P164,949 55,306 P109,643 (4) Debt ratio: Total liabilities (given) Total assets (given) Debt ratio (P81,630 P353,816) P 81,630 P353,816 23.1% Requirement (c) (1) From the viewpoint of short-term creditors, Bonbon Sweets’ appear highly liquid. Its quick and current ratios are well above normal rules of thumb, and the company’s cash and marketable securities alone are almost twice its current liabilities. (2) Long-term creditors also have little to worry about. Not only is the company highly liquid, but creditors’ claims amount to only 23.1% of total assets. If Bonbon Sweets’ were to go out of business and liquidate its assets, it would have to raise only 23 cents from every peso of assets for creditors to emerge intact. (3) From the viewpoint of shareholders, Bonbon Sweets’ appears overly liquid. Current assets generally do not generate high rates of return. Thus, the company’s relatively large holdings of current assets dilutes its return on total assets. This should be of concern to shareholders. If Bonbon Sweets is unable to invest its highly liquid assets more productively in its business, shareholders probably would like to see the money distributed as dividends. 8-54 Cost Concepts and Classifications Chapter 8 Problem 8 (Selected Financial Measures for Short-term Creditors) Requirement 1 Current assets (P80,000 + P460,000 + P750,000 + P10,000).............................................................................................................. P1,300,000 Current liabilities (P1,300,000 ÷ 2.5)...................................................................... 520,000 Working capital....................................................................................................... P 780,000 Requirement 2 Acid-test ratio = Cash + Marketable securities + Accounts receivable Current liabilities Acid-test ratio Requirement 3 = P80,000 + P0 + P460,000 P520,000 = 1.04 to 1 (rounded) a. Working capital would not be affected: Current assets (P1,300,000 – P100,000)................................................................. P1,200,000 Current liabilities (P520,000 – P100,000)............................................................... 420,000 Working capital....................................................................................................... P 780,000 b. The current ratio would rise: Current ratio = Current rate = Current assets Current liabilities P1,200,000 P420,000 = 2.9 to 1 (rounded) Problem 9 (Selected Financial Ratios) 1. Gross margin percentage: Gross margin Sales P840,000 P2,100,000 = 2. Current ratio: Current assets Current liabilities = P490,000 P200,000 3. Acid-test ratio: 8-55 = 40% = 2.45 to 1 Chapter 8 Cost Concepts and Classifications Quick assets Current liabilities P181,000 P200,000 = = 0.91 to 1 (rounded) 4. Accounts receivable turnover: Sales Average accounts receivables = 365 days 14 times P2,100,000 P150,000 = 14 times = 26.1 days (rounded) 5. Inventory turnover: Cost of goods sold Average inventory = 365 days 4.5 times P1,260,000 P280,000 = 4.5 times = 81.1 days to turn (rounded) 6. Debt-to-equity ratio: Total liabilities Total equity P500,000 P800,000 = = 0.63 to 1 (rounded) 7. Times interest earned: Earnings before interest and income taxes Interest expense = 8. Book value per share: Equity Ordinary shares outstanding = P180,000 P30,000 P800,000 20,000 shares* = 6.0 times = P40 per share * P100,000 total par value ÷ P5 par value per share = 20,000 shares Problem 10 (Selected Financial Ratios for Ordinary Shareholders) 1. Earnings per share: Net income to ordinary shares Average ordinary shares outstanding 8-56 = P105,000 20,000 shares = P5.25 per share Cost Concepts and Classifications Chapter 8 2. Dividend payout ratio: Dividends paid per share Earnings per share 3. Dividend yield ratio: Dividends paid per share Market price per share 4. Price-earnings ratio: Market price per share Earnings per share = P3.15 P5.25 = 60% = P3.15 P63.00 = 5% = P63.00 P5.25 = 12.0 Problem 11 (Selected Financial Ratios for Ordinary Shareholders) 1. Return on total assets: Return on total assets = Net income + [Interest expense x (1 – Tax rate)] Average total assets = P105,000 + [P30,000 x (1 – 0.30)] ½ (P1,100,000 + P1,300,000) = P126,000 P1,200,000 = 10.5% 2. Return on ordinary shareholders’ equity: Return on ordinary shareholders’ equity = = = Net income – preference dividends Average ordinary shareholders’ equity P105,000 ½ (P725,000 + P800,000) P105,000 P762,500 = 13.8% (rounded) 3. Financial leverage was positive, since the rate of return to the ordinary shareholders (13.8%) was greater than the rate of return on total assets (10.5%). This positive leverage is traceable in part to the company’s current liabilities, which may carry no interest cost, and to the bonds 8-57 Chapter 8 Cost Concepts and Classifications payable, which have an after-tax interest cost of only 7%. 10% interest rate × (1 – 0.30) = 7% after-tax cost. Problem 12 (Selected Financial Measures for Short-Term Creditors) Requirement (1) Current assets (P80,000 + P460,000 + P750,000 + P10,000).................................... P1,300,000 Current liabilities (P1,300,000 ÷ 2.5)...................................................... 520,000 Working capital....................................................................................... P 780,000 Requirement (2) Acid-test ratio = Cash + Marketable securities + Accounts receivable + Short-term notes Current liabilities = P80,000 + P0 + P460,000 + P0 P520,000 = 1.04 (rounded) Requirement (3) a. Working capital would not be affected by a P100,000 payment on accounts payable: Current assets (P1,300,000 – P100,000)................................ P1,200,000 Current liabilities (P520,000 – P100,000).............................. 420,000 Working capital...................................................................... P 780,000 b. The current ratio would increase if the company makes a P100,000 payment on accounts payable: Current ratio = Current assets Current liabilities = P1,200,000 P420,000 8-58 = 2.9 (rounded) Cost Concepts and Classifications Chapter 8 Problem 13 (Effects of Transactions on Various Financial Ratios) 1. Decrease Sale of inventory at a profit will be reflected in an increase in retained earnings, which is part of shareholders’ equity. An increase in shareholders’ equity will result in a decrease in the ratio of assets provided by creditors as compared to assets provided by owners. 2. No effect Purchasing land for cash has no effect on earnings or on the number of ordinary shares outstanding. One asset is exchanged for another. 3. Increase A sale of inventory on account will increase the quick assets (cash, accounts receivable, marketable securities) but have no effect on the current liabilities. For this reason, the acidtest ratio will increase. 4. No effect Payments on account reduce cash and accounts payable by equal amounts; thus, the net amount of working capital is not affected. 5. Decrease When a customer pays a bill, the accounts receivable balance is reduced. This increases the accounts receivable turnover, which in turn decreases the average collection period. 6. Decrease Declaring a cash dividend will increase current liabilities, but have no effect on current assets. Therefore, the current ratio will decrease. 7. Increase Payment of a previously declared cash dividend will reduce both current assets and current liabilities by the same amount. An equal reduction in both current assets and current liabilities will always result in an increase in the current ratio, so long as the current assets exceed the current liabilities. 8. No effect Book value per share is not affected by the current market price of the company’s stock. 8-59 Chapter 8 Cost Concepts and Classifications 9. Decrease The dividend yield ratio is obtained by dividing the dividend per share by the market price per share. If the dividend per share remains unchanged and the market price goes up, then the yield will decrease. 10. Increase Selling property for a profit would increase net income and therefore the return on total assets would increase. 11. Increase A write-off of inventory will reduce the inventory balance, thereby increasing the turnover in relation to a given level of cost of goods sold. 12. Increase Since the company’s assets earn at a rate that is higher than the rate paid on the bonds, leverage is positive, increasing the return to the ordinary shareholders. 13. No effect Changes in the market price of a stock have no direct effect on the dividends paid or on the earnings per share and therefore have no effect on this ratio. 14. Decrease A decrease in net income would mean less income available to cover interest payments. Therefore, the times-interestearned ratio would decrease. 15. No effect Write-off of an uncollectible account against the Allowance for Bad Debts will have no effect on total current assets. For this reason, the current ratio will remain unchanged. 16. Decrease A purchase of inventory on account will increase current liabilities, but will not increase the quick assets (cash, accounts receivable, marketable securities). Therefore, the ratio of quick assets to current liabilities will decrease. 17. Increase The price-earnings ratio is obtained by dividing the market price per share by the earnings per share. If the earnings per share remains unchanged, and the market price goes up, then the price-earnings ratio will increase. 18. Decrease Payments to creditors will reduce the total liabilities of a company, thereby decreasing the ratio of total debt to total equity. Problem 14 (Interpretation of Financial Ratios) a. The market price is going down. The dividends paid per share over the three-year period are unchanged, but the dividend yield is going up. 8-60 Cost Concepts and Classifications Chapter 8 Therefore, the market price per share of stock must be decreasing. b. The earnings per share is increasing. Again, the dividends paid per share have remained constant. However, the dividend payout ratio is decreasing. In order for the dividend payout ratio to be decreasing, the earnings per share must be increasing. c. The price-earnings ratio is going down. If the market price of the stock is going down [see part (a) above], and the earnings per share are going up [see part (b) above], then the price-earnings ratio must be decreasing. d. In Year 1, leverage was negative because in that year the return on total assets exceeded the return on ordinary equity. In Year 2 and in Year 3, leverage was positive because in those years the return on ordinary equity exceeded the return on total assets employed. e. It is becoming more difficult for the company to pay its bills as they come due. Although the current ratio has improved over the three years, the acid-test ratio is down. Also note that the accounts receivable and inventory are both turning more slowly, indicating that an increasing portion of the current assets is being made up of those items, from which bills cannot be paid. f. Customers are paying their bills more slowly in Year 3 than in Year 1. This is evidenced by the decline in accounts receivable turnover. g. Accounts receivable is increasing. This is evidenced both by a slowdown in turnover and in an increase in total sales. h. The level of inventory undoubtedly is increasing. Notice that the inventory turnover is decreasing. Even if sales (and cost of goods sold) just remained constant, this would be evidence of a larger average inventory on hand. However, sales are not constant but rather are increasing. With sales increasing (and undoubtedly cost of goods sold also increasing), the average level of inventory must be increasing as well in order to service the larger volume of sales. IV. Cases Case 1 (Common-Size Statements and Financial Ratios for Creditors) Requirement 1 This Year 8-61 Last Year Chapter 8 Cost Concepts and Classifications a. Current assets Current liabilities Working capital P2,060,000 1,100,000 P 960,000 P1,470,000 600,000 P 870,000 b. Current assets (a) Current liabilities (b) Current ratio (a) ÷ (b) P2,060,000 P1,100,000 1.87 to 1 P1,470,000 P600,000 2.45 to 1 c. Quick assets (a) Current liabilities (b) Acid-test ratio (a) ÷ (b) P740,000 P1,100,000 0.67 to 1 P650,000 P600,000 1.08 to 1 d. Sales on account (a) Average receivables (b) Turnover of receivables (a) ÷ (b) P7,000,000 P525,000 13.3 times P6,000,000 P375,000 16.0 times Average age of receivables: 365 ÷ turnover 27.4 days 22.8 days e. Cost of goods sold (a) Average inventory (b) Inventory turnover (a) ÷ (b) P5,400,000 P1,050,000 5.1 times P4,800,000 P760,000 6.3 times 71.6 days P1,850,000 P2,150,000 0.86 to 1 57.9 days P1,350,000 P1,950,000 0.69 to 1 P630,000 P90,000 7.0 times P490,000 P90,000 5.4 times f. Turnover in days: 365 ÷ turnover Total liabilities (a) Equity (b) Debt-to-equity ratio (a) ÷ (b) g. Net income before interest and taxes (a) Interest expense (b) Times interest earned (a) ÷ (b) Requirement 2 a. METRO BUILDING SUPPLY Common-Size Balance Sheets Current assets: Cash Marketable securities Accounts receivable, net Inventory 8-62 This Year Last Year 2.3 % 0.0 16.3 32.5 6.1 % 1.5 12.1 24.2 Cost Concepts and Classifications Chapter 8 Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities: Current liabilities Bonds payable, 12% Total liabilities Equity: Preference shares, P50 par, 8% Ordinary shares, P10 par Retained earnings Total equity Total liabilities and equity 0.5 51.5 48.5 100.0 % 0.6 44.5 55.5 100.0 % 27.5 % 18.8 46.3 18.2 % 22.7 40.9 5.0 12.5 36.3 53.8 100.0 % 6.1 15.2 37.9 59.1 100.0 % Note: Columns do not total down in all cases due to rounding. b. METRO BUILDING SUPPLY Common-Size Income Statements This Year 100.0 % 77.1 22.9 13.9 9.0 1.3 7.7 3.1 4.6 % Sales Less cost of goods sold Gross margin Less operating expenses Net operating income Less interest expense Net income before taxes Less income taxes Net income Last Year 100.0 % 80.0 20.0 11.8 8.2 1.5 6.7 2.7 4.0 % Requirement 3 The following points can be made from the analytical work in parts (1) and (2) above: The company has improved its profit margin from last year. This is attributable to an increase in gross margin, which is offset somewhat by an increase in operating expenses. In both years the company’s net income as a percentage of sales equals or exceeds the industry average of 4%. 8-63 Chapter 8 Cost Concepts and Classifications Although the company’s working capital has increased, its current position actually has deteriorated significantly since last year. Both the current ratio and the acid-test ratio are well below the industry average, and both are trending downward. (This shows the importance of not just looking at the working capital in assessing the financial strength of a company.) Given the present trend, it soon will be impossible for the company to pay its bills as they come due. The drain on the cash account seems to be a result mostly of a large buildup in accounts receivable and inventory. This is evident both from the common-size balance sheet and from the financial ratios. Notice that the average age of the receivables has increased by 5 days since last year, and that it is now 9 days over the industry average. Many of the company’s customers are not taking their discounts, since the average collection period is 27 days and collection terms are 2/10, n/30. This suggests financial weakness on the part of these customers, or sales to customers who are poor credit risks. Perhaps the company has been too aggressive in expanding its sales. The inventory turned only 5 times this year as compared to over 6 times last year. It takes three weeks longer for the company to turn its inventory than the average for the industry (71 days as compared to 50 days for the industry). This suggests that inventory stocks are higher than they need to be. In the authors’ opinion, the loan should be approved on the condition that the company take immediate steps to get its accounts receivable and inventory back under control. This would mean more rigorous checks of creditworthiness before sales are made and perhaps paring out of slow paying customers. It would also mean a sharp reduction of inventory levels to a more manageable size. If these steps are taken, it appears that sufficient funds could be generated to repay the loan in a reasonable period of time. Case 2 (Financial Ratios for Ordinary Shareholders) Requirement 1 a. Net income Less preference dividends Net income remaining for ordinary (a) Average number of ordinary shares (b) 8-64 This Year P324,000 16,000 Last Year P240,000 16,000 P308,000 50,000 P224,000 50,000 Cost Concepts and Classifications Chapter 8 Earnings per share (a) ÷ (b) P6.16 P4.48 b. Ordinary dividend per share (a)* Market price per share (b) Dividend yield ratio (a) ÷ (b) P2.16 P45.00 4.8% P1.20 P36.00 3.33% *P108,000 ÷ 50,000 shares = P2.16; P60,000 ÷ 50,000 shares = P1.20 c. Ordinary dividend per share (a)............................................................................... P2.16 P1.20 Earnings per share (b)............................................................................................. P6.16 P4.48 Dividend payout ratio (a) ÷ (b)................................................................................ 35.1% 26.8% d. Market price per share (a)....................................................................................... P45.00 P36.00 Earnings per share (b)............................................................................................. P6.16 P4.48 Price-earnings ratio (a) ÷ (b)................................................................................... 7.3 8.0 Investors regard Metro Building Supply less favorably than other firms in the industry. This is evidenced by the fact that they are willing to pay only 7.3 times current earnings for a share of the company’s stock, as compared to 9 times current earnings for the average of all stocks in the industry. If investors were willing to pay 9 times current earnings for Metro Building Supply’s stock, then it would be selling for about P55 per share (9 × P6.16), rather than for only P45 per share. e. This Year Last Year Equity...................................................................................................................... P2,150,000 P1,950,000 Less preference shares............................................................................................. 200,000 200,000 Ordinary equity (a).................................................................................................. P1,950,000 P1,750,000 Number of ordinary shares (b)................................................................................. 50,000 50,000 Book value per share (a) ÷ (b)................................................................................. P39.00 P35.00 A market price in excess of book value does not mean that the price of a stock is too high. Market value is an indication of investors’ perceptions of future earnings and/or dividends, whereas book value is a result of already completed transactions and is geared to the past. Requirement 2 a. This Year Last Year Net income.............................................................................................................. P 324,000 P 240,000 Add after-tax cost of interest paid: [P90,000 × (1 – 0.40)]......................................................................................... 54,000 54,000 8-65 Chapter 8 Cost Concepts and Classifications Total (a)................................................................................................................... P 378,000 P 294,000 Average total assets (b)............................................................................................ P3,650,000 P3,000,000 Return on total assets (a) ÷ (b)................................................................................ 10.4% 9.8% b. This Year Last Year Net income.............................................................................................................. P 324,000 P 240,000 Less preference dividends........................................................................................ 16,000 16,000 Net income remaining for ordinary shareholders (a)................................................................................................... P 308,000 P 224,000 Average total equity*............................................................................................... P2,050,000 P1,868,000 Less average preference shares................................................................................ 200,000 200,000 Average ordinary equity (b)..................................................................................... P1,850,000 P1,668,000 *1/2(P2,150,000 + P1,950,000); 1/2(P1,950,000 + P1,786,000). Return on ordinary equity (a) ÷ (b) 16.6% 13.4% c. Financial leverage is positive in both years, since the return on ordinary equity is greater than the return on total assets. This positive financial leverage is due to three factors: the preference shares, which has a dividend of only 8%; the bonds, which have an after-tax interest cost of only 7.2% [12% interest rate × (1 – 0.40) = 7.2%]; and the accounts payable, which may bear no interest cost. Requirement 3 We would recommend keeping the stock. The stock’s downside risk seems small, since it is selling for only 7.3 times current earnings as compared to 9 times earnings for the average firm in the industry. In addition, its earnings are strong and trending upward, and its return on ordinary equity (16.6%) is extremely good. Its return on total assets (10.4%) compares favorably with that of the industry. The risk, of course, is whether the company can get its cash problem under control. Conceivably, the cash problem could worsen, leading to an eventual reduction in profits through inability to operate, a reduction in dividends, and a precipitous drop in the market price of the company’s stock. This does not seem likely, however, since the company can easily control its cash problem through more careful management of accounts receivable and inventory. If this problem is brought under control, the price of the stock could rise sharply over the next few years, making it an excellent investment. 8-66 Cost Concepts and Classifications Chapter 8 Case 3 (Comprehensive Ratio Analysis) Requirement 1 This Year Last Year a. Net income.............................................................................................................. P 280,000 P 168,000 Add after-tax cost of interest: P120,000 × (1 – 0.30)......................................................................................... 84,000 P100,000 × (1 – 0.30)......................................................................................... 70,000 Total (a)................................................................................................................... P 364,000 P 238,000 Average total assets (b)............................................................................................ P5,330,000 P4,640,000 Return on total assets (a) ÷ (b)................................................................................ 6.8% 5.1% b. Net income.............................................................................................................. P 280,000 P 168,000 Less preference dividends........................................................................................ 48,000 48,000 Net income remaining for ordinary (a)..................................................................... P 232,000 P 120,000 Average total equity................................................................................................. P3,120,000 P3,028,000 Less average preference shares................................................................................ 600,000 600,000 Average ordinary equity (b)..................................................................................... P2,520,000 P2,428,000 Return on ordinary equity (a) ÷ (b).......................................................................... 9.2% 4.9% c. Leverage is positive for this year, since the return on ordinary equity (9.2%) is greater than the return on total assets (6.8%). For last year, leverage is negative since the return on the ordinary equity (4.9%) is less than the return on total assets (5.1%). Requirement 2 This Year P 232,000 50,000 P4.64 Last Year P 120,000 50,000 P2.40 b. Ordinary dividend per share (a) Market price per share (b) Dividend yield ratio (a) ÷ (b) P1.44 P36.00 4.0% P0.72 P20.00 3.6% c. Ordinary dividend per share (a) P1.44 P0.72 a. Net income remaining for ordinary (a) Average number of ordinary shares (b) Earnings per share (a) ÷ (b) 8-67 Chapter 8 Cost Concepts and Classifications Earnings per share (b) Dividend payout ratio (a) ÷ (b) d. Market price per share (a) Earnings per share (b) Price-earnings ratio (a) ÷ (b) P4.64 31.0% P2.40 30.0% P36.00 P4.64 7.8 P20.00 P2.40 8.3 Notice from the data given in the problem that the average P/E ratio for companies in Helix’s industry is 10. Since Helix Company presently has a P/E ratio of only 7.8, investors appear to regard it less well than they do other companies in the industry. That is, investors are willing to pay only 7.8 times current earnings for a share of Helix Company’s stock, as compared to 10 times current earnings for a share of stock for the average company in the industry. e. Equity Less preference shares Ordinary equity (a) Number of ordinary shares (b) Book value per share (a) ÷ (b) P3,200,000 600,000 P2,600,000 P3,040,000 600,000 P2,440,000 50,000 P52.00 50,000 P48.80 Note that the book value of Helix Company’s stock is greater than the market value for both years. This does not necessarily indicate that the stock is selling at a bargain price. Market value is an indication of investors’ perceptions of future earnings and/or dividends, whereas book value is a result of already completed transactions and is geared to the past. f. Gross margin (a) Sales (b) Gross margin percentage (a) ÷ (b) P1,050,000 P5,250,000 20.0% P860,000 P4,160,000 20.7% This Year P2,600,000 1,300,000 P1,300,000 Last Year P1,980,000 920,000 P1,060,000 P2,600,000 P1,300,000 P1,980,000 P920,000 Requirement 3 a. Current assets Current liabilities Working capital b. Current assets (a) Current liabilities (b) 8-68 Cost Concepts and Classifications Chapter 8 Current ratio (a) ÷ (b) 2.0 to 1 2.15 to 1 c. Quick assets (a) Current liabilities (b) Acid-test ratio (a) ÷ (b) P1,220,000 P1,300,000 0.94 to 1 P1,120,000 P920,000 1.22 to 1 d. Sales on account (a) Average receivables (b) Accounts receivable turnover (a) ÷ (b) Average age of receivables, 365 ÷ turnover e. Cost of goods sold (a) Average inventory (b) Inventory turnover (a) ÷ (b) Number of days to turn inventory, 365 days ÷ turnover (rounded) P5,250,000 P750,000 7.0 times P4,160,000 P560,000 7.4 times 52 days P4,200,000 P1,050,000 4.0 times 49 days P3,300,000 P720,000 4.6 times 91 days 79 days f. P2,500,000 P3,200,000 0.78 to 1 P1,920,000 P3,040,000 0.63 to 1 P520,000 P120,000 4.3 times P340,000 P100,000 3.4 times Total liabilities (a) Equity (b) Debt-to-equity ratio (a) ÷ (b) g. Net income before interest and taxes (a) Interest expense (b) Times interest earned (a) ÷ (b) Requirement 4 As stated by Meri Ramos, both net income and sales are up from last year. The return on total assets has improved from 5.1% last year to 6.8% this year, and the return on ordinary equity is up to 9.2% from 4.9% the year before. But this appears to be the only bright spot in the company’s operating picture. Virtually all other ratios are below the industry average, and, more important, they are trending downward. The deterioration in the gross margin percentage, while not large, is worrisome. Sales and inventories have increased substantially, which should ordinarily result in an improvement in the gross margin percentage as fixed costs are spread over more units. However, the gross margin percentage has declined. Notice particularly that the average age of receivables has lengthened to 52 days—about three weeks over the industry average—and that the inventory turnover is 50% longer than the industry average. One wonders if the increase in sales was obtained at least in part by extending credit to high-risk customers. Also notice that the debt-to-equity ratio is rising rapidly. If the 8-69 Chapter 8 Cost Concepts and Classifications P1,000,000 loan is granted, the ratio will rise further to 1.09 to 1. In the author’s opinion, what the company needs is more equity—not more debt. Therefore, the loan should not be approved. The company should be encouraged to make another issue of ordinary stock in order to provide a broader equity base on which to operate. Case 4 (Statement Reconstruction Using Ratios) Bulacan Company Income Statement For the Year Ended December 31, 2005 Sales Less: Cost of Sales (4) Gross Profit Less: Expenses Net Income (1) P140,800 84,480 P 56,320 46,320 P 10,000 Bulacan Company Balance Sheet December 31, 2005 As s e t s Current Assets: Cash Accounts Receivable (5) Merchandise Inventory (3) Total Current Assets (2) Fixed Assets (8) Total Assets P 27,720 28,160 21,120 P 77,000 55,000 P132,000 Liabilities and Equity Current Liabilities: Accounts Payable (2) Equity: Share Capital (issued 20,000 shares) (6) Retained Earnings Total Liabilities and Equity 8-70 P 44,000 P40,000 48,000 88,000 P132,000 Cost Concepts and Classifications Chapter 8 Supporting Computations: (1) Earnings Per Share = Net Income Ordinary Shares Outstanding P0.50 = X 20,000 X (Net Income) = P10,000 (2) Current Assets Pxx Current Liabilities xx Working Capital P33,000 1.75 1 0.75 Current Liabilities (3) Current Ratio = P33,000 0.75 = P44,000 = Current Assets Current Liabilities X 44,000 1.27 = X (Current Assets) = P77,000 = Quick Assets Current Liabilities 1.27 = X 44,000 X (Current Assets) = P55,880 Quick Ratio Current Assets Quick Assets Inventory P77,000 55,800 P21,120 8-71 Cost of Sales Ave. Inventory Chapter 8 Cost Concepts and Classifications (4) Inventory turnover = 4 = X (Cost of Sales) X P21,120 P84,480 = (5) Average age of outstanding Accounts Receivable Quick Assets Current Liabilities = 365 5 = 73 days (Average age of receivables) Net Sales Average Receivables = 5 P140,800 X = 5 X (Receivables) = P28,160 Another Method: P140,800 365 = 73 days = P28,160 Accounts receivable (6) Earnings for the year as a percentage of Share Capital P10,000 = 25% Share Capital Share Capital = P40,000 Fixed Assets = Current Liabilities + Equity P77,000 + 0.625X = P44,000 + X 0.375X = P33,000 X (8) Fixed Assets to Equity = P88,000 Equity (7) Current Assets + Fixed Assets Equity X P140,800 = 8-72 0.625 Cost Concepts and Classifications Chapter 8 X (Fixed Assets) = 0.625 = P55,000 Case 5 (Ethics and the Manager) Requirement 1 The loan officer stipulated that the current ratio prior to obtaining the loan must be higher than 2.0, the acid-test ratio must be higher than 1.0, and the interest on the loan must be no more than four times net operating income. These ratios are computed below: Current ratio = Current assets Current liabilities Current rate = P290,000 P164,000 Acid-test ratio = = 1.8 (rounded) Cash + Marketable securities + Accounts receivable Current liabilities P70,000 + P0 + P50,000 Acid-test ratio = = 0.70 (rounded) P164,000 Net operating income P20,000 = P80,000 x 0.10 x (6/12) = 5.0 Interest on the loan The company would fail to qualify for the loan because both its current ratio and its acid-test ratio are too low. Requirement 2 By reclassifying the P45 thousand net book value of the old machine as inventory, the current ratio would improve, but there would be no effect on the acid-test ratio. This happens because inventory is considered to be a current asset but is not included in the numerator when computing the acid-test ratio. Current ratio = Current rate = Current assets Current liabilities P290,000 + P45,000 = 2.0 (rounded) P164,000 Acid-test ratio = Cash + Marketable securities + Current receivables Current liabilities Acid-test ratio = P70,000 + P0 + P50,000 P164,000 8-73 = 0.70 (rounded) Chapter 8 Cost Concepts and Classifications Even if this tactic had succeeded in qualifying the company for the loan, we strongly advise against it. Inventories are assets the company has acquired for the sole purpose of selling them to outsiders in the normal course of business. Used production equipment is not considered to be inventory—even if there is a clear intention to sell it in the near future. Since the loan officer would not expect used equipment to be included in inventories, doing so would be intentionally misleading. Nevertheless, the old equipment is an asset that could be turned into cash. If this were done, the company would immediately qualify for the loan since the P45 thousand in cash would be included in the numerator in both the current ratio and in the acid-test ratio. Current ratio = Current rate = Current assets Current liabilities P290,000 + P45,000 = 2.0 (rounded) P164,000 Acid-test ratio = Cash + Marketable securities + Current receivables Current liabilities Acid-test ratio = P70,000 + P0 + P50,000 + P45,000 P164,000 = 1.00 (rounded) However, other options may be available. After all, the old machine is being used to relieve bottlenecks in the plastic injection molding process and it would be desirable to keep this standby capacity. We would advise Rome to fully and honestly explain the situation to the loan officer. The loan officer might insist that the machine be sold before any loan is approved, but he might instead grant a waiver of the current ratio and acid-test ratio requirements on the basis that they could be satisfied by selling the old machine. Or he may approve the loan on the condition that the equipment is pledged as collateral. In that case, Rome would only have to sell the machine if he would otherwise be unable to pay back the loan. Case 6 (Financial Ratios for Ordinary Shareholders) [pesos in thousands] Requirement (1) Calculation of the gross margin percentage: Gross margin percentage = 8-74 = Gross margin Sales P23,000 P66,000 = 34.8% Cost Concepts and Classifications Chapter 8 Requirement (2) Calculation of the earnings per share: Earnings per share = = Net income – Preference dividends Average number of ordinary shares outstanding P1,980 – P60 600 shares = P3.20 per share Requirement (3) Calculation of the price-earnings ratio: Market price per share Price-earnings ratio = Earnings per share P26 P3.20 = = 8.1 Requirement (4) Calculation of the dividend payout ratio: Dividend payout ratio Dividends per share Earnings per share = P0.75 P3.20 = = 23.4% Requirement (5) Calculation of the dividend yield ratio: Dividend yield ratio = = Requirement (6) Calculation of the return on total assets: 8-75 Dividends per share Market price per share P0.75 P26.00 = 2.9% Chapter 8 Cost Concepts and Classifications Return on total assets = Net income + [Interest expense x (1 – Tax rate)] Average total assets = P1,980 + [P800 x (1 – 0.40)] (P65,810 + P68,480) / 2 = 3.7% Requirement (7) Calculation of the return on ordinary shareholders’ equity: Beginning balance, shareholders’ equity (a) Ending balance, shareholders’ equity (b) Average shareholders’ equity [(a) + (b)]/2 Average preference shares Average ordinary shareholders’ equity Return on ordinary shareholders’ equity Net income – Preference dividends Average ordinary shareholders’ equity = = P39,610 41,080 40,345 1,000 P39,345 P1,980 – P60 P39,345 = 4.9% Requirement (8) Calculation of the book value per share: Book value per share = Total shareholders’ equity – Preference shares Number of ordinary shares outstanding P41,080 – P1,000 = for Short-Term Creditors)= P66.80 per share Case 7 (Financial Ratios 600 shares Requirement (1) Calculation of working capital: Working capital Requirement (2) = Current assets – Current liabilities = P22,680 – P19,400 = P3,280 Calculation of the current ratio: Current ratio = = Current assets Current liabilities P22,680 = 1.17 P19,400 8-76 Cost Concepts and Classifications Chapter 8 Requirement (3) Calculation of the acid-test ratio: Cash + Marketable securities + Accounts receivable + Short-term notes Current liabilities Acid-test ratio = P1,080 + P0 + P9,000 + P0 P19,400 Acid-test ratio = = 0.52 Requirement (4) Calculation of accounts receivable turnover: Accounts receivable turnover Sales on account Average accounts receivable balance = P66,000 (P6,500 + P9,000) / 2 Acid-test ratio = = 8.5 Requirement (5) Calculation of the average collection period: Average collection period 365 days Accounts receivable turnover = 365 days 8.5 Acid-test ratio = = 42.9 days Requirement (6) Calculation of inventory turnover: Inventory turnover = Acid-test ratio = Cost of goods sold Average inventory balance P43,000 (P10,600 + P12,000) / 2 8-77 = 3.8 Chapter 8 Cost Concepts and Classifications Requirement (7) Calculation of the average sale period: Average sale period 365 days Inventory turnover = 365 days 3.8 Acid-test ratio = = 96.1 days Case 8 (Financial Ratios for Long-Term Creditors) Requirement (1) Calculation of the times interest earned ratio: Earnings before interest expense and income taxes Inventory expense P4,100 = 5.1 P800 Times interest earned = ratio Acid-test ratio = Requirement (2) Calculation of the debt-to-equity ratio: Debt-to-equity ratio = Acid-test ratio = Total liabilities Shareholders’ equity P27,400 P41,080 = 0.67 V. Multiple Choice Questions 41. 42. 43. 44. 45. 46. 47. 48. A C D B A D C D 39. 40. 41. 42. 43. 44. 45. 46. C A C B D B A C 34. 35. 36. 37. 38. 39. 40. 41. B D A C A C D A 41. 42. 43. 44. 45. 46. 47. 48. 8-78 C D C A A C A A 41. C Cost Concepts and Classifications Chapter 8 49. A 50. B 47. A 48. C 42. D 43. A 49. C 50. C CHAPTER 6 CASH FLOW ANALYSIS I. Questions 1. Purposes of the Statement of Cash Flows a. To predict future cash flows b. To evaluate management decisions c. To determine the ability to pay dividends to shareholders and interest and principal to creditors d. To show the relationship of net income to changes in the business’s cash. 2. Comparative balance sheets present the financial position of the enterprise at two points in time. The income statement for the period between the two balance sheets describes how the income-producing activities affected the financial position. Because cash flows from operating activities may differ substantially from net income, and because numerous other financing and investing activities have an impact on financial position, the statement of cash flows is necessary. The statement emphasizes changes in the cash balances that result from changes in assets, liabilities and equity accounts caused by operating, investing and financing activities. 3. The most important source of cash for many successful companies is from operating activities. A large positive operating cash flow is a good sign because it means funds have been internally generated with no fixed obligations or commitment to return such to anybody. 4. It is possible for cash to decrease during a year when income is high because cash may be used not only for operating activities but also for investing and financing activities. 8-79 Chapter 8 Cost Concepts and Classifications 5. Transactions involving accounts payable are not considered to be financing activities because such transactions are used to obtain goods and services rather than to obtain cash. Furthermore, purchases of goods and services relate to a company’s day-to-day operating activities. 6. The loss is added back to net income to avoid double counting since the entire proceeds from the sale (net book value minus loss on sale) will appear as a cash inflow from investing activities. 7. Three categories of transactions that may result in increases in cash are a. Operating activities b. Investing activities (e.g., sale of investments or other assets). c. Financing activities (e.g., borrowing or sale of shares). These activities are sources of cash when cash is increased as a result of the particular activity. 8. Three categories of transactions that may result in decreases in cash are a. Operating activities b. Investing activities (e.g., purchase of investments or other assets). c. Financing activities (e.g., repayment of debt or retirement of shares). These activities are uses of cash when cash is decreased as a result of the particular activity. 9. Noncash transactions do not provide or consume cash even though they may result in significant changes in financial position. Examples are the issuance of share capital for plant assets and the conversion of debt or preference shares into ordinary shares. Such transactions are not presented in the body of the statement of cash flows but rather disclosed in a separate schedule as financing or investing activities. 10. While net loss is usually associated with a decrease in cash, it may be a source of cash if noncash expenses are greater than the amount of the net loss. For example, if a net loss of P100,000 included amortization and depreciation of P125,000 and no noncash revenues existed, cash provided by operating activities would be P25,000, computed as follows: Net loss Add: Expenses not requiring cash – depreciation and amortization Net cash provided by operating activities 8-80 P(100,000) P 125,000 25,000 Cost Concepts and Classifications Chapter 8 11. The change in cash is the difference between cash at the beginning and end of the accounting period. The net amount of cash provided by or used in operating, investing and financing activities must equal this change in cash. For example, if cash increased by P150,000 during the year, total sources from operating, investing, and financing activities must exceed total uses by P150,000. Also, if cash decreased by P25,000 during the year, total uses of cash must exceed total sources by P25,000. 12. (a) The use of cash does not occur until the cash dividend is actually paid in the next period. The declaration of the dividend does affect financial position, however, and should be disclosed as a noncash financing activity in a separate schedule accompanying the statement of cash flows. (b) Because the dividend was declared and paid in the same accounting period, it appears in the statement of cash flows as a cash decrease in the financing activities category. 13. Disagree. The refunding of 10% debt by the 8% debt represents a significant financing activity, even though the net impact of the exchange on the balance sheet or on the amount of cash is not material. The issuance of 8% bonds and the retirement of 10% bonds should be reported as noncash financing transactions in a schedule accompanying the statement of cash flows. 14. The net income figure includes P150,000 as an expense. Only P112,500 of this amount resulted in a decrease in cash, because P37,500 represents an increase in the deferred income tax liability account. In determining cash provided by operating activities, the amount of income tax paid is P112,500 (direct method). Alternatively, under the indirect method, P37,500 must be added to net income to determine cash flows from operating activities. 15. The loss is omitted when listing expenses requiring cash payment (direct approach) or added back to net income (indirect approach) in determining cash provided by operating activities. This eliminates the impact of the transaction from cash provided by operating activities. Then, the proceeds from the sale are included as a source of cash in the investing activities category of the statement of cash flows. Any tax effects of the transaction are included in the tax expense figure and remain a part of cash flows from operating activities. 8-81 Chapter 8 Cost Concepts and Classifications 16. (1) Operating activities: Transactions that affect current assets, current liabilities, or net income. (2) Investing activities: Transactions that involve the acquisition or disposition of noncurrent assets. (3) Financing activities: Transactions (other than the payment of interest) involving borrowing from creditors, and any transactions (involving the owners of a company. 17. Interest is included as an operating activity since it is part of net income. Financing activities are narrowly defined to include only the principal amount borrowed or repaid. 18. Since the entire proceeds from a sale of an asset (including any gain) appear as a cash inflow from investing activities, the gain must be deducted from net income to avoid double counting. 19. The direct method reconstructs the income statement on a cash basis by restating revenues and expenses in terms of cash inflows and outflows. The indirect method starts with net income and adjusts it to a cash basis to determine the cash provided by operating activities. 20. An increase in the Accounts Receivable account must be deducted from net income under the indirect method because this is an increase in a noncash asset. 21. A decrease in the Accounts Payable account must be added to cost of goods sold under the direct method. The cost of goods sold is increased by the amount of the decrease in accounts payable. Because the cost of goods sold is increased, the net cash flow provided by operating activities is decreased. The effect of a decrease in a liability is a decrease in cash. 22. A sale of equipment for cash would be classified as an investing activity. Any transaction involving the acquisition or disposition of noncurrent assets is classified as an investing activity. II. Exercises Exercise 1 Net income...................................................................................................................... P84,000 Adjustments to convert net income to a cash basis: Depreciation charges for the year.............................................................................. P50,000 8-82 Cost Concepts and Classifications Chapter 8 Increase in accounts receivable.................................................................................. (60,000) Increase in inventory.................................................................................................. (77,000) Decrease in prepaid expenses.................................................................................... 2,000 Increase in accounts payable...................................................................................... 30,000 Decrease in accrued liabilities................................................................................... (4,000) Increase in deferred income taxes............................................................................. 6,000 (53,000) Net cash provided by operating activities...................................................................... P31,000 Exercise 2 Sales................................................................................................. P1,000,000 Adjustments to a cash basis: Less increase in accounts receivable.......................................... – 60,000 P940,000 Cost of goods sold............................................................................. 580,000 Adjustments to a cash basis: Plus increase in inventory.......................................................... + 77,000 Less increase in accounts payable............................................. – 30,000 627,000 Selling and administrative expenses.................................................. 300,000 Adjustments to a cash basis: Less decrease in prepaid expenses............................................. – 2,000 Plus decrease in accrued liabilities............................................ + 4,000 Less depreciation charges.......................................................... – 50,000 252,000 Income taxes..................................................................................... 36,000 Adjustments to a cash basis: Less increase in deferred income taxes...................................... – 6,000 30,000 Net cash provided by operating activities..........................................P 31,000 Note that the P31,000 agrees with the cash provided by operating activities figure under the indirect method in the previous exercise. Exercise 3 Item Amount Accounts Receivable......................................... P70,000 decrease Accrued Interest Receivable.............................. P6,000 increase Inventory.......................................................... P110,000 increase Prepaid Expenses.............................................. P3,000 decrease Accounts Payable............................................. P40,000 decrease Accrued Liabilities............................................ P9,000 increase Deferred Income Taxes Liability....................... P15,000 increase 8-83 Add X Deduct X X X X X X Chapter 8 Cost Concepts and Classifications Sale of equipment............................................. P8,000 gain Sale of long-term investments........................... P12,000 loss X X Exercise 4 Requirement (1) Net income................................................................................................. P75 Adjustments to convert net income to a cash basis: Depreciation charges.............................................................................. P40 Decrease in accounts receivable.............................................................. 10 Increase in inventory............................................................................... (30) Decrease in prepaid expenses................................................................. 5 Increase in accounts payable.................................................................. 20 Decrease in accrued liabilities................................................................. (10) Increase in taxes payable........................................................................ 10 Increase in deferred taxes....................................................................... 5 Loss on sale of long-term investments.................................................... 5 Gain on sale of land................................................................................ (40) 15 Net cash provided by operating activities................................................... P90 Requirement (2) Swan Company Statement of Cash Flows Operating activities: Net cash provided by operating activities (see above).......................................... P 90 Investing activities: Proceeds from sale of long-term investments........................................................ P 45 Proceeds from sale of land................................................................................... 70 Additions to long-term investments...................................................................... (20) Additions to plant & equipment........................................................................... (150) Net cash used for investing activities................................................................... (55) Financing activities: Decrease in bonds payable................................................................................... (20) Increase in ordinary shares................................................................................... 40 Cash dividends..................................................................................................... (35) Net cash used by financing activities.................................................................... (15) 8-84 Cost Concepts and Classifications Chapter 8 Net increase in cash (net cash flow)..................................................................... 20 Cash balance, beginning....................................................................................... 100 Cash balance, ending........................................................................................... P120 While not a requirement, a worksheet may be helpful. Change Assets (except cash and cash equivalents) Current assets: Accounts receivable................................................ –10 Inventory................................................................. +30 Prepaid expenses.................................................... –5 Noncurrent assets: Long-term investments............................................ –30 Plant and equipment............................................... +150 Land........................................................................ –30 Liabilities, Contra assets, and Shareholders’ Equity Contra assets: Accumulated depreciation....................................... Current liabilities: Accounts payable.................................................... Accrued liabilities.................................................... Taxes payable......................................................... Noncurrent liabilities: Bonds payable........................................................ Deferred income taxes............................................ Shareholders’ equity: Ordinary shares....................................................... Retained earnings: Net income......................................................... Dividends........................................................... Source Cash or Flow Adjust Use? Effect -ments Source +10 Use –30 Source +5 Source +30 – Use 150 Source +30 Adjuste d Effect Classification +10 –30 +5 Operating Operating Operating –50 –20 Investing –30 –150 0 Investing Investing +40 Source +40 +40 Operating +20 –10 +10 Source +20 Use –10 Source +10 +20 –10 +10 Operating Operating Operating –20 +5 Use –20 Source +5 –20 +5 Financing Operating +40 Source +40 +40 Financing +75 –35 Source +75 Use –35 +75 –35 Operating Financing +45 +5 +70 –40 +20 Investing Operating Investing Operating Additional entries Proceeds from sale of investments.............................. Loss on sale of investments......................................... Proceeds from sale of land........................................... Gain on sale of land..................................................... Total +20 +45 +5 +70 –40 0 Exercise 5 Sales........................................................................................... P600 Adjustments to a cash basis: 8-85 Chapter 8 Cost Concepts and Classifications Decrease in accounts receivable..........................................+10 Cost of goods sold......................................................................250 Adjustments to a cash basis: Increase in inventory...........................................................+30 Increase in accounts payable...............................................–20 Selling and administrative expenses............................................280 Adjustments to a cash basis: Decrease in prepaid expenses.............................................. –5 Decrease in accrued liabilities.............................................+10 Depreciation charges...........................................................–40 Income taxes............................................................................... 30 Adjustments to a cash basis: Increase in taxes payable....................................................–10 Increase in deferred taxes.................................................... –5 Net cash provided by operating activities................................... Exercise 6 P610 260 245 15 P 90 Requirements (1) and (2) Stephenie Company Statement of Cash Flows For the Year Ended December 31, 2008 Operating activities: Net income..............................................................................................P 56 Adjustments to convert net income to cash basis: Depreciation charges....................................................................... 25 Increase in accounts receivable........................................................ (80) Decrease in inventory...................................................................... 35 Increase in prepaid expenses............................................................ (2) Increase in accounts payable........................................................... 75 Decrease in accrued liabilities.......................................................... (10) Gain on sale of investments............................................................. (5) Loss on sale of equipment................................................................ 2 Increase in deferred income taxes.................................................... 8 48 Net cash provided by operating activities................................................ 104 Investing activities: Proceeds from sale of long-term investments........................................... 12 Proceeds from sale of equipment............................................................. 18 Additions to plant and equipment............................................................ (110) Net cash used for investing activities....................................................... (80) 8-86 Cost Concepts and Classifications Chapter 8 Financing activities: Increase in bonds payable........................................................................ 25 Decrease in ordinary shares..................................................................... (40) Cash dividends........................................................................................ (16) Net cash used for financing activities...................................................... (31) Net decrease in cash................................................................................ (7) Cash balance, January 1, 2008................................................................ 11 Cash balance, December 31, 2008..........................................................P 4 While not a requirement, a worksheet may be helpful. Sourc e or Use? Cash Flow Effec t Use Source Use –80 +35 –2 Use Source –80 +7 +15 Source +15 +75 –10 Source Use +25 +8 Adjuste d Effect Classification –80 +35 –2 Operating Operating Operating –30 –7 –110 0 Investing Investing +10 +25 Operating +75 –10 +75 –10 Operating Operating Source Source +25 +8 +25 +8 Financing Operating –40 Use –40 –40 Financing +56 –16 Source Use +56 –16 +56 –16 Operating Financing +18 +2 +12 –5 +18 +2 +12 –5 Investing Operating Investing Operating 0 –7 Change Assets (except cash and cash equivalents) Current assets: Accounts receivable................................................ +80 Inventory................................................................. –35 Prepaid expenses.................................................... +2 Noncurrent assets: Plant and equipment............................................... +80 Long-term investments............................................ –7 Liabilities, Contra assets, and Shareholders’ Equity Contra assets: Accumulated depreciation....................................... Current liabilities: Accounts payable.................................................... Accrued liabilities.................................................... Noncurrent liabilities: Bonds payable........................................................ Deferred income taxes............................................ Shareholders’ equity: Ordinary shares....................................................... Retained earnings: Net income......................................................... Dividends........................................................... Adjust ments Additional entries Proceeds from sale of equipment................................. Loss on sale of equipment............................................ Proceeds from sale of long-term investments............... Gain on sale of long-term investments......................... Total –7 8-87 Chapter 8 Cost Concepts and Classifications II. Problems Problem 1 Transaction Operating Investing Financing Short-term investment securities were purchased X ..................................... 2. Equipment was purchased X ..................................... 3. Accounts payable increased X ..................................... 4. Deferred taxes decreased X ..................................... 5. Long-term bonds were issued X ..................................... 6. Ordinary shares were sold X ..................................... 7. Interest was paid to long-term creditors X ..................................... 8. A long-term mortgage was entirely paid off X ..................................... 9. A cash dividend was declared and paid X ..................................... 10. Inventories decreased. . . X 11. Accounts receivable increased X ...................................... 12. Depreciation charges totaled P200,000 for the year X ...................................... Source Use 1. Problem 2 (Analysis of Cash Flow Transactions) 8-88 X X X X X X X X X X X X Cost Concepts and Classifications Chapter 8 Requirement (a) The eight items should be presented in the statement of cash flows as follows: 1. Net income is the basis for the calculation of cash flows from operating activities by starting with that number and adjusting for noncash revenue and expense transactions (indirect method) or by computing by the direct method the positive cash flows from revenues, less the negative cash flows from expenses. The cash flows from the transaction giving rise to the extraordinary loss is reclassified as an investing activity. 2. The acquisition of intangibles is a negative cash flow from investing activities. The amortization is a noncash expense in determining cash flows from operating activities. 3. The payment of a cash dividend is a negative cash flow that is presented in the financing activities section of the statement. 4. The purchase of treasury share is a negative cash flow in the financing activities section of the statement. 5. The depreciation expense recognized during the year is a noncash expense in determining cash flows from operating activities. 6. The conversion of convertible bonds into ordinary shares is a noncash financing activity that requires disclosure in a separate schedule. 7. The changes in plant asset accounts – land, equipment, and building – represent activities whose cash flow effects are presented in the investing activities section of the statement. 8. The increase in working capital also represents the change in cash because all other current assets and current liabilities remained constant. The net of all cash flows from operating, investing and financing activities must reconcile with the change in cash in the statement of cash flows. Requirement (b) 1. Net cash provided by operating activities Net income Noncash expense adjustments: Depreciation expense Amortization expense Reclassification of extraordinary loss P145,000 46,250 6,000 15,000 P212,250 2. Net cash used in investing activities Purchase of intangible assets Purchase of land 8-89 P (34,000) (130,000) Chapter 8 Cost Concepts and Classifications Purchase of equipment Purchase of building Sale of land (60,000) (100,000) 165,000 P(159,000) 3. Net cash used in financing activities Purchase of treasury shares Payment of dividends P(31,000) (12,500) P(43,500) Computations: Depreciation expense Change in accumulated depreciation account Accumulated depreciation on fully depreciated assets disposed Purchase of land Change in land account Cost of land sold in condemnation proceedings P35,000 11,250 P46,250 P (50,000) 180,000 P130,000 Problem 3 (Cash Flow from Operating Activities) Cash received from customers: Total revenues Less: Note receivable Cash disbursed for expenses: Total expenses (P173,000 + P4,200) Less: Income taxes deferred Depreciation Amortization Net cash provided by operating activities P185,000 (15,000) P177,200 (1,260) (25,000) (7,000) P170,000 (143,940) P 26,060 Problem 4 (Cash Flow from Operating Activities) Cash received from customers (1) Cash paid for expenses: Cost of goods sold Selling Salaries and wages (2) Interest (3) Miscellaneous operating P5,237,000 P3,150,000 246,000 394,400 65,200 5,000 8-90 Cost Concepts and Classifications Chapter 8 Incomes taxes (4) Net cash provided by operating activities Computations: 335,000 4,195,600 P1,041,400 1. Revenue from sales Less: Note receivable Land P5,432,000 (120,000) (75,000) P5,237,000 2. Salaries and wages expense Less: Increase in accrued salaries and wages (P45,600 – P40,000) P 400,000 3. Interest expense Less: Discount amortization P (5,600) P 394,400 P 4. Income tax expense Less: Deferred portion 72,000 (6,800) 65,200 P 445,000 (110,000) P 335,000 Problem 5 (Statement of Cash Flows Preparation – Indirect) Green Tea Company Statement of Cash Flows For the Year Ended December 31, 2005 Cash flows from operating activities Net income* Adjustments to reconcile net income to net cash flows provided by operating activities: Depreciation Amortization of intangibles Increase in current assets Increase in current liabilities Net cash provided by operating * Increase in retained earnings (P20,000 – P13,000) Dividends declared Net income 8-91 P8,500 1,000 1,000 (6,000 ) 3,000 P7,500 P7,000 1,500 P8,500 Chapter 8 Cost Concepts and Classifications activities Cash flows from financing activities Dividends paid Retirement of long-term liabilities (1,500 ) (1,000 ) Net cash used in financing activities Net increase in cash (2,500) P 5,000 10,000 P15,00 0 Cash, January 1, 2005 Cash, December 31, 2005 Problem 6 (Cash Flow Statement Preparation – Direct) Requirement (a) Hundred Acre Company Statement of Cash Flows For the Year Ended December 31, 2005 Cash flows from operating activities Cash received from customers Cash paid for expense Net cash provided by operating activities Cash flow from investing activities Sale of equipment Sale of investments Acquisition of equipment Net cash used in investing activities Cash flows from financing activities Sale of ordinary shares Payment of cash dividends Net cash used in financing activities 8-92 P74,00 0 67,000 P7,000 9,500 15,000 (53,000 ) (28,500) 40,000 (8,500 ) 31,500 Cost Concepts and Classifications Chapter 8 Net increase in cash P10,00 0 20,000 P30,00 0 Cash, January 1, 2005 Cash, December 31, 2005 Reconciliation of net income to net cash provided by operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Amortization expense Increase in accounts receivable Decrease in accrued expenses Net cash provided by operating activities P15,00 0 24,500* 1,000 (33,000) (500) P 7,000 Computations: Cash received from customers: Revenues Deduct: Increase in accounts receivable (P78,000 – P45,000) Cash paid for expenses: Expenses Add: Decrease in accrued expenses (P7,500 – P7,000) Deduct: Depreciation expense (P33,600 – P27,100 + P18,000) Amortization Cash from sale of equipment: Cost Deduct: Accumulated depreciation Cash received on sale at book value Cash paid to acquire equipment: * Net increase during 2005 (P33,600 – P27,100) Accumulated depreciation on assets sold Depreciation expense for 2005 8-93 P107,000 33,000 P 74,000 P 92,000 500 (24,500) (1,000) P 67,000 P 27,500 (18,000) P 9,500 P 6,500 18,000 P24,500 Chapter 8 Cost Concepts and Classifications Increase in property, plant and equipment (P118,100 – P92,600) Cost of machinery sold P 25,500 27,500 P 53,000 Cash received on sale of shares: Increase in ordinary shares amount (P100,000 – P75,000) Increase in additional paid-in capital account (P55,000 – P40,000) P 25,000 Cash dividends: Increase in retained earnings (P21,000 – P14,500) Net income (P107,000 – P92,000) P 15,000 P 40,000 6,500 (15,000) P 8,500 Requirement (b) The reconciliation of net income to net cash provided by or used in operating activities is required to be disclosed in order to show more clearly the relationship and emphasize the differences between the two. Users of financial statements are often not as aware of the accrual concepts, which determine net income, as are preparers of those statements. The reconciliation of net income to net cash flows from operating activities clearly demonstrates that the two are different and details those events and transactions that account for the difference. Problem 7 (Interpretation of Cash Flow Statement) Requirement (a) The two companies are similar in the following respects: 1. 2. 3. 4. Overall size. Industry in which they operate. Current ratio (2.4 to 1). Overall peso amounts of cash provided and used: Range, 2002-2005 Cash Cash Used Provided P125,000 – P115,000 – P168,000 P170,000 P135,000 – P125,000 – Ebony Company Ivory 8-94 Cost Concepts and Classifications Chapter 8 Company P160,000 P165,000 5. Net increase in working capital is identical for each year, 2002 – 2005. Requirement (b) The two companies are dissimilar in the makeup of the sources of cash, as indicated in the following analysis: Sources of Cash in Percentages 2002 Cash provided: Operations Long-term debt Share capital Asset disposition 2003 2004 Ebony Ivory Ebony Ivory Ebony I 80 8 -12 37 56 -7 77 -16 7 21 10 52 17 70 --30 ( 100 100 100 100 100 1 Ebony Company has relied much more heavily on operations to provide cash and to a very limited extent on debt and equity financing and asset disposition. On the other hand, Ivory Company has not been able to provide cash from operations and has been required to rely on the alternatives of debt and equity financing and asset disposition. Requirement (c) Ebony Company is in a considerably stronger position (as determined by the data given) and thus should be considered the better investment and credit risk. The following points are significant: 1. Ebony Company has provided 70%-80% of its cash via operating activities, supplementing with other means to maintain a current ratio at the industry average. Ebony has not had to rely consistently on any alternative source of funding. 2. Ivory Company has apparently been forced to rely continuously on debt financing except in 2005, perhaps because of the inability to obtain such financing. The year 2004 is particularly weak for Ivory, with operations resulting in a P60,000 reduction in cash. The ability 8-95 Chapter 8 Cost Concepts and Classifications of Ivory to sustain its present financial position (i.e., current ratio, etc.) is questionable in light of its history. III. Multiple Choice Questions 1. D 2. C 3. D 4. D 5. B 6. D 7. C 8. B 9. A 10. B 11. A 12. D CHAPTER 7 GROSS PROFIT VARIATION ANALYSIS AND EARNINGS PER SHARE DETERMINATION I. Problems Problem I The Dawn Mining Company Gross Profit Variation Analysis For 2006 Increase in Sales: Quantity Factor [(24,000) x P8] Price Factor (105,000 x P3) Quantity/Price Factor [(24,000) x P3] Less: Increase (decrease) in Cost of Sales: Quantity Factor [(24,000) x P9] Cost Factor [105,000 x (P.50)] Quantity/Cost Factor [(24,000) x (P.50)] Increase in Gross Profit P(192,000) 315,000 (72,000) P(216,000) (52,500) 12,000 P 51,000 (256,500) P 307,500 Problem II 1. Selling Price Factor Sales in 2006 Less: Sales in 2006 at 2005 prices (P210,000 105%) 8-96 P210,000 200,000 Cost Concepts and Classifications Chapter 8 Favorable P 10,000 2. Cost Factor Cost of Sales in 2006 Less: Cost of Sales in 2006 at 2005 costs Favorable P(12,000) 3. Quantity Factor Increase in Sales Sales in 2006 at 2005 prices Less: Sales in 2005 Favorable Less: Increase in Cost of Sales Cost of Sales in 2006 at 2005 costs (P132,000 x 133-1/3%) Less: Cost of Sales in 2005 Unfavorable Net favorable quantity factor Increase in Gross Profit P164,000 176,000 P200,000 150,000 P 50,000 P176,000 132,000 P 44,000 6,000* P 28,000 * This may also be obtained using the following presentation: Quantity Factor: Sales in 2006 at 2005 prices Less: Sales in 2005 Increase in Sales Multiplied by: Ave. Gross Profit rate in 2005 Net favorable variance P200,000 150,000 P 50,000 12% P 6,000 Problem III Requirement A: Tony Corporation Statement Accounting for Gross Profit Variation For 2006 Increase (Decrease) in Sales accounted for as follows: Price Factor Sales this year Less: Sales this year at last year’s prices Favorable (Unfavorable) 8-97 P210,210 269,500 P(59,290) Chapter 8 Cost Concepts and Classifications Quantity Factor Sales this year at last year’s prices (P210,210 78%) Less: Sales last year Favorable (Unfavorable) Net Increase (decrease) in sales P269,500 192,500 P 77,000 P 17,710 Increase (decrease) in Cost of Sales accounted for as follows: Cost Factor Cost of Sales this year Less: Cost of Sales this year at last year’s costs (Favorable) Unfavorable P 165,400 P 161,700 3,700 Quantity Factor Cost of Sales this year at last year’s costs (115,500 x 140%) Less: Cost of Sales last year (Favorable) Unfavorable P 161,700 115,500 P 46,200 Net increase (decrease) in Cost of Sales Net increase (decrease) in Gross Profit P 49,900 P (32,190) Gross Profit, this year Gross Profit, last year Increase (Decrease) in Gross Profit P 44,810 77,000 P(32,190) Requirement B: (1) Change in Quantity = (2) Change in Unit Costs = P 77,000 P192,500 P 3,700 P161,700 = 40% increase = 2.38% increase Problem IV Quantity Factor 1. Decrease in Sales due to decrease in the number of customers [(1,000) x 18 MCF x P2.50)] 8-98 P(45,000) Cost Concepts and Classifications Chapter 8 2. Increase in Sales due to increase in consumption rate per customer (26,000 x 2 MCF x P2.50) Net Increase 130,000 P 85,000 Price Factor 3. Decrease in Sales due to the decrease in rate per MCF [P(.05) x 520,000] Increase in operating revenues P 59,000 (26,000) Supporting Computations: Average Consumption: (a) 2006 = 520,000 26,000 = 20 MCF/customer 2005 = 486,000 27,000 = 18 MCF/customer Increase in Consumption per customer 2 MCF/customer (b) 27,000 - 26,000 = 1,000 decrease in number of customers (c) Price 2006 2005 Decrease in rate or price per MCF sold P2.45 2.50 P(.05) Problem V XYZ Corporation Gross Profit Variation Analysis For 2006 Price Factor Sales in 2006 Less: Sales in 2006 at 2005 prices A (25 x P10) B (75 x P20) Increase (decrease) in gross profit P 1,750 P 250 1,500 Cost Factor: Cost of sales in 2006 Less: Cost of sales in 2006 at 2005 costs: A (25 X P5) P 125 8-99 P 1,750 - P 875 Chapter 8 Cost Concepts and Classifications B (75 x P10) Increase (decrease) in gross profit 750 P Quantity Factor: Increase (decrease) in total quantity Multiplied by: Average gross profit per unit in 2005 (P750 100) 875 - P Increase (decrease) in gross profit P Sales Mix Factor: Average gross profit per unit in 2006 at 2005 prices Less: Average gross profit per unit in 2005 Increase (decrease) 7.50 - P8.75 * 7.50 P1.25 Multiplied by: Total quantity in 2006 Increase (decrease) in gross profit Increase in Gross Profit 100 P125.00 P125.00 * Sales in 2006 at 2005 prices Less: Cost of sales in 2006 at 2005 prices Gross profit in 2006 at 2005 prices P1,750 875 P 875 Average Gross Profit on 2006 at 2005 prices: P875 100 (volume in 2006) = P8.75 Problem VI (Computation of Weighted Average Number of Ordinary Shares) Date 1/1/2006 2/15/2006 4/1/2006 6/1/2006 9/1/2006 Number of Shares Adjustment for 25% stock As Unadjusted dividend Adjusted 16,000 4,000 20,000 3,200 800 4,000 (3,000) (750) (3,750) 1,400 350 1,750 6,400 1,600 8,000 8-100 Multiplier 12/12 10.5/12 9/12 7/12 4/12 Weighted Shares 20,000 3,500 (2,812) 1,020 2,667 Cost Concepts and Classifications Chapter 8 12/1/2006 Total 6,000 30,000 (6,000) - 30,000 - 24,375 Problem VII (Computation of Basic EPS and Diluted EPS) 1. Basic EPS P 90,000 100,000 = = 2. Diluted EPS = = P0.90 P90,000 + (10% x P500,000 x 65%) P500,000 100,000 + P1,000 x 100 P90,000 + P32,500 150,000 = P0.82 (rounded off) Problem VIII Requirements (1) and (2) Explanation Earnings Basic earnings and shares P122,000a Stock option share increment Tentative DEPS1 amounts P122,000 10% bond interest expense savings e 13,300d Increment in shares Tentative DEPS2 amounts P135,300 7.5% preference dividend savingse 28,500d Increment in shares P163,800 5.8% bonds 21,924 Diluted earnings and shares P185,724 a Shares 33,333b = P3.66 Basic 293c 33,626 = P3.63 DEPS1 4,400d 38,026 = P3.56 DEPS2 = Per Share 9,310d 47,336 = P3.46 DEPS3 6,264 53,600 = P3.465 Diluted P122,000 = P150,500 (net income) - P28,500 (preference dividends) Weighted average shares: b Weighted average shares 25,000 x 1.20 = 30,000 x 7/12 = 17,500 32,000 x 1.20 = 38,400 x 4/12 = 12,800 38,400 - 2,000 = 36,400 x 1/12 = 3,033 33,333 8-101 Chapter 8 Cost Concepts and Classifications c Increment due to stock options: Issued 4,000 Reacquired 4,000 x ( P33 + P5 ) P41 = (3,707) Increment in shares 293 Impact on diluted earnings per share and ranking: d Impact Ranking [(0.10 x P200,000) – P1,000] x 0.7 = 200 x 22 10% bonds: (0.058 x P540,000) x 0.7 540 x 11.6 5.8% bonds: (0.075 x P380,000) 3,800 x 2.45 7.5% preference: e P13,300 4,400 P3.02 5 = P21,924 6,264 P3.50 3 = P28,500 9,310 P3.06 2 Dilutive effect on diluted earnings per share: 10% bonds: P3.02 impact < P3.63 (DEPS 1), therefore dilutive 7.5% preference: P3.06 impact < P3.56 (DEPS2), therefore dilutive 5.8% bonds: P3.50 impact > P3.46 (DEPS3), therefore exclude from EPS Requirement 3 Fuego Company would report basic earnings per share of P3.66 and diluted earnings per share of P3.46 on its 2005 income statement. II. Multiple Choice Questions 1. 2. 3. 4. B B C D 5. 6. 7. 8. A B B B 9. A 10. A 11. D * 12. C 13. 14. 15. 16. A D C A 17. 18. 19. 20. A B C D 21. C 22. A 23. B * Supporting computation for no. 11: Diluted EPS for 12/31/2006 = = P3,500,000 + (P800,000 x 65%) 400,000 + 25,000 + 225,000 P4,020,000 or P6.18 650,000 8-102 Cost Concepts and Classifications Chapter 8 CHAPTER 8 COST CONCEPTS AND CLASSIFICATIONS I. Questions 1. The phrase “different costs for different purposes” refers to the fact that the word “cost” can have different meanings depending on the context in which it is used. Cost data that are classified and recorded in a particular way for one purpose may be inappropriate for another use. 2. Fixed costs remain constant in total across changes in activity, whereas variable costs change in proportion to the level of activity. 3. Examples of direct costs of the food and beverage department in a hotel include the money spent on the food and beverages served, the wages of table service personnel, and the costs of entertainment in the dining room and lounge. Examples of indirect costs of the food and beverage department include allocations of the costs of advertising for the entire hotel, of the costs of the grounds and maintenance department, and of the hotel general manager’s salary. 4. The cost of idle time is treated as manufacturing overhead because it is a normal cost of the manufacturing operation that should be spread out among all of the manufactured products. The alternative to this treatment would be to charge the cost of idle time to a particular job that happens to be in process when the idle time occurs. Idle time often results from a random event, such as a power outage. Charging the cost of the idle time resulting from such a random event to only the job that happened to be in process at the time would overstate the cost of that job. 5. a. Uncontrollable cost b. Controllable cost c. Uncontrollable cost 6. Product costs are costs that are associated with manufactured goods until the time period during which the products are sold, when the product costs become expenses. Period costs are expensed during the time period in which they are incurred. 8-103 Chapter 8 Cost Concepts and Classifications 7. The most important difference between a manufacturing firm and a service industry firm, with regard to the classification of costs, is that the goods produced by a manufacturing firm are inventoried, whereas the services produced by a service industry firm are consumed as they are produced. Thus, the costs incurred in manufacturing products are treated as product costs until the period during which the goods are sold. Most of the costs incurred in a service industry firm to produce services are operating expenses that are treated as period costs. 8. Product costs are also called inventoriable costs because they are assigned to manufactured goods that are inventoried until a later period, when the products are sold. The product costs remain in the finished goods inventory account until the time period when the goods are sold. 9. A sunk cost is a cost that was incurred in the past and cannot be altered by any current or future decision. A differential cost is the difference in a cost item under two decision alternatives. 10. a. b. c. d. Direct cost Direct cost Indirect cost Indirect cost 11. The two properties of a relevant cost are: 1. it differs between the decision options 2. it will be incurred in the future 12. The three types of product costs are: 1. direct materials – the materials used in manufacturing the product, which become a physical part of the finished product. 2. direct labor – the labor used in manufacturing the product. 3. factory overhead – the indirect costs for materials, labor, and facilities used to support the manufacturing process, but not used directly in manufacturing the product. 13. The three types of manufacturing inventories are: 1. materials inventory – the store of materials used in the manufacturing process or in providing the service. 8-104 Cost Concepts and Classifications Chapter 8 2. work in process inventory – accounts for all costs put into the manufacturing of products that are started but not complete at the financial statement date. 3. finished goods inventory – the cost of goods that are ready for sale. 14. Direct materials include the materials in the product and a reasonable allowance for scrap and defective units, while indirect materials are materials used in manufacturing that are not physically part of the finished product. 15. The income statement of a manufacturing company differs from the income statement of a merchandising company in the cost of goods sold section. A merchandising company sells finished goods that it has purchased from a supplier. These goods are listed as “purchases” in the cost of goods sold section. Since a manufacturing company produces its goods rather than buying them from a supplier, it lists “cost of goods manufactured” in place of “purchases.” Also, the manufacturing company identifies its inventory in this section as Finished Goods inventory, rather than as Merchandise Inventory. 16. Yes, costs such as salaries and depreciation can end up as part of assets on the balance sheet if these are manufacturing costs. Manufacturing costs are inventoried until the associated finished goods are sold. Thus, if some units are still in inventory, such costs may be part of either Work in Process inventory or Finished Goods inventory at the end of a period. 17. No. A variable cost is a cost that varies, in total, in direct proportion to changes in the level of activity. A variable cost is constant per unit of product. A fixed cost is fixed in total, but the average cost per unit changes with the level of activity. 18. Manufacturing overhead is an indirect cost since these costs cannot be easily and conveniently traced to particular units of products. 19. 20. Direct labor cost (34 hours P15 per hour).......................... Manufacturing overhead cost (6 hours P15 per hour)......... Total wages earned................................................................. P510 90 P600 Direct labor cost (45 hours P14 per hour)......................... Manufacturing overhead cost (5 hours P7 per hour)......... Total wages earned............................... P630 35 P665 8-105 Chapter 8 Cost Concepts and Classifications II. Exercises Exercise 1 (Schedule of Cost of Goods Manufactured and Sold; Income Statement) Requirement 1 Amazing Aluminum Company Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2005 Direct material: Raw-material inventory, January 1................... Add: Purchases of raw material....................... Raw material available for use......................... Deduct: Raw-material December Raw inventory, 31 material P 60,000 250,000 P310,00 0 70,00 0 used Direct labor............................................................ Manufacturing overhead: Indirect material P240,00 0 400,000 labor P 10,000 25,000 Depreciation on plant and equipment 100,000 Utilities ............................................................. ............................................................. Other ............................................................. ............................................................. Total manufacturing overhead 25,000 Indirect Total manufacturing costs....................................... Add: Work-in-process inventory, January 1........... Subtotal.................................................................. 8-106 30,00 0 190,000 P830,00 0 120,000 P950,00 Cost Concepts and Classifications Chapter 8 0 115,000 Deduct: Work-in-process inventory, December 1....................................................................... Cost of goods manufactured................................... P835,00 0 Requirement 2 Amazing Aluminum Company Schedule of Cost of Goods Sold For the Year Ended December 31, 2005 Finished goods inventory, January 1......................................... Add: Cost of goods manufactured............................................ Cost of goods available for sale................................................ Deduct: Finished goods inventory, December 31...................... Cost of goods sold.................................................................... P150,00 0 835,000 P985,00 0 165,000 P820,00 0 Requirement 3 Amazing Aluminum Company Income Statement For the Year Ended December 31, 2005 Sales revenue............................................................................ Less: Cost of goods sold.......................................................... Gross margin............................................................................ Selling and administrative expenses.......................................... Income before taxes.................................................................. Income tax expense................................................................... Net income .............................................................................. Exercise 2 8-107 P1,105,00 0 820,00 0 P 285,000 110,000 P 175,000 70,00 0 P 105,000 Chapter 8 Cost Concepts and Classifications a. b. c. d. e. f. g. h. i. j. k. l. m. n. o. p. q. r. s. t. Cost Item Transportation-in costs on materials purchased Assembly-line workers’ wages Property taxes on work in process inventories Salaries of top executives in the company Overtime premium for assembly workers Sales commissions Sales personnel office rental Production supervisory salaries Controller’s office supplies Cost Item Executive office heat and air conditioning Executive office security personnel Supplies used in assembly work Factory heat and air conditioning Power to operate factory equipment Depreciation on furniture for sales staff Varnish used for finishing product Marketing personnel health insurance Packaging materials for finished product Salary of the quality control manager who checks work on the assembly line Assembly-line workers’ dental insurance Fixed (F) Variable (V) Period (P) Product (R) V V R R V F V V F F F Fixed (F) Variable (V) F F V F V F V F V R P R P P R P Period (P) Product (R) P P R R R P R P R F F R R Exercise 3 (Cost Classifications; Manufacturer) 1. 2. 3. 4. 5. 6. 7. 8. 9. a, d, g, i a, d, g, j b, f b, d, g, k a, d, g, k a, d, g, j b, c, f b, d, g, k b, c and d*, e and f and g*, k* 8-108 Cost Concepts and Classifications Chapter 8 * The building is used for several purposes. 10. 11. 12. 13. 14. b, c, f b, c, h b, c, f b, c, e b, c and d†, e and f and g†, k† † The building that the furnace heats is used for several purposes. 15. b, d, g, k Exercise 4 (Economic Characteristics of Costs) 1. 2. 3. 4. 5. 6. marginal cost sunk cost average cost opportunity cost differential cost out-of-pocket cost Exercise 5 (Cost Classifications; Hotel) 1. 2. 3. 4. 5. 6. 7. 8. a, c, e, k b, d, e, k d, e, i d, e, i a, d, e, k a, d, e, k d, e, k b, d†, e, k † Unless the dishwasher has been used improperly. 9. h 10. a, d, e*, j * The hotel general manager may have some control over the total space allocated to the kitchen. 11. i 12. j 13. a, c, e 8-109 Chapter 8 Cost Concepts and Classifications 14. e, k Exercise 6 Pickup Truck Output 3,000 trucks P 29,640,000 39,200,000 4,500,000 13,660,000 P 87,000,000 6,000 trucks P 59,280,000 39,200,000 9,000,000 13,660,000 P121,140,000 9,000 trucks P 88,920,000 39,200,000 13,500,000 13,660,000 P155,280,000 Selling price per truck 46,000 40,100 35,900 Unit cost 29,000 20,190 17,253 Profit per truck 17,000 19,910 18,647 Variable production costs Fixed production costs Variable selling costs Fixed selling costs Total costs Exercise 7 (see next page) Exercise 8 1. The wages of employees who build the sailboats: direct labor cost. 2. The cost of advertising in the local newspapers: marketing and selling cost. 3. The cost of an aluminum mast installed in a sailboat: direct materials cost. 4. The wages of the assembly shop’s supervisor: manufacturing overhead cost. 5. Rent on the boathouse: a combination of manufacturing overhead, administrative, and marketing and selling cost. The rent would most likely be prorated on the basis of the amount of space occupied by manufacturing, administrative, and marketing operations. 6. The wages of the company’s bookkeeper: administrative cost. 7. Sales commissions paid to the company’s salespeople: marketing and selling cost. 8. Depreciation on power tools: manufacturing overhead cost. 8-110 Cost Concepts and Classifications Chapter 8 Exercise 7 Variable Cost 1. 2. 3. 4. Wood used in a table (P200 per table) Labor cost to assemble a table (P80 per table) Salary of the factory supervisor (P76,000 per year) Cost of electricity to produce tables (P4 per machinehour) Fixe d Cost Period (Selling and Administrative) Cost X Direct Material s Product Cost Direc t Labor Manufacturing Overhead Sunk Cost X X X X X X X 5. Depreciatio n of machines used to produce tables (P20,000 per year) X X 8-111 X* Opportunity Cost Chapter 8 Cost Concepts and Classifications 6. 7. Salary of the company president (P200,000 per year) Advertising expense (P500,000 per year) X X X X 8. 9. * 1 Commissio ns paid to salesperso ns (P60 per table sold) Rental income forgone on factory space X X X1 This is a sunk cost because the outlay for the equipment was made in a previous period. This is an opportunity cost because it represents the potential benefit that is lost or sacrificed as a result of using the factory space to produce tables. Opportunity cost is a special category of cost that is not ordinarily recorded in an organization’s accounting books. To avoid possible confusion with other costs, we will not attempt to classify this cost in any other way except as an opportunity cost. 8-112 Chapter 8 Cost Concepts and Classifications Exercise 9 1. 2. Cost The salary of the head chef The salary of the head chef 3. 4. 5. 6. Room cleaning supplies Flowers for the reception desk The wages of the doorman Room cleaning supplies 7. Fire insurance on the hotel building Towels used in the gym 8. Cost Object The hotel’s restaurant A particular restaurant customer A particular hotel guest A particular hotel guest A particular hotel guest The housecleaning department The hotel’s gym Direc t Cost X The hotel’s gym Indirec t Cost X X X X X X X Note: The room cleaning supplies would most likely be considered an indirect cost of a particular hotel guest because it would not be practical to keep track of exactly how much of each cleaning supply was used in the guest’s room. III. Problems Problem 1 The relevant costs for this decision are the differential costs. These are: Opportunity cost or lost wages (take home) [P1,500 x 70% x 12 months]........ P12,600 Tuition..................................................... 2,200 Books and supplies.................................. 300 Total differential costs....................... P15,100 Room and board, clothing, car, and incidentals are not relevant because these are presumed to be the same whether or not Francis goes to school. The possibility of part-time work, summer jobs, or scholarship assistance could be considered as reductions to the cost of school. If students are familiar with the time value of money, then they should recognize that the analysis calls for a comparison of the present value of the differential after-tax cash inflows with the present value of differential costs of getting the education (including the opportunity costs of lost income). Problem 2 Requirement (a) 8-113 Chapter 8 Cost Concepts and Classifications Only the differential outlay costs need be considered. The travel and other variable expenses of P22 per hour would be the relevant costs. Any amount received in excess would be a differential, positive return to Pat. Requirement (b) The opportunity cost of the hours given up would be considered in this situation. Unless Pat receives more than the P100 normal consulting rate, the contract would not be beneficial. Requirement (c) In this situation Pat would have to consider the present value of the contract and compare that to the present value of the existing consulting business. The final rate may be more or less than the normal P100 rate depending on the outcome of Pat’s analysis. Problem 3 Utilities for the bakery Paper used in packaging product Salaries and wages in the bakery Cookie ingredients Bakery labor and fringe benefits Bakery equipment maintenance Depreciation of bakery plant and equipment Uniforms Insurance for the bakery Boxes, bags, and cups used in the bakery Bakery overtime premiums Bakery idle time Total product costs in pesos 2,100 90 19,500 35,000 1,300 800 2,000 400 900 1,100 2,600 500 66,290 Problem 4 Administrative costs Rent for administration offices Advertising Office manager’s salary Total period costs in pesos Problem 5 8-114 1,000 17,200 1,900 13,000 33,100 Cost Concepts and Classifications Chapter 8 Requirement (a) Sunk costs not shown could include lost book value on traded assets, depreciation estimates for new investment, and interest costs on capital needed during facilities construction. Requirement (b) The client might be used to differential cost as a decision tool, and believes (correctly) that use of differential analyses has several advantages --- it is quicker, requires less data, and tends to give a better focus to the decision. The banker might suspect the client of hiding some material data in order to make the proposal more acceptable to the financing agency. Problem 6 Requirement (1) EH Corporation Schedule of Cost of Goods Manufactured For the Year Ended December 31 Direct materials: Raw materials, inventory, January 1 Add: Purchases of raw materials Raw materials available for use Deduct: Raw materials inventory, December 31 Raw materials used in production P 45,000 375,0 00 420,00 0 30,0 00 P 390,000 75,000 Direct labor Manufacturing overhead: Utilities, factory Depreciation, factory Insurance, factory Supplies, factory Indirect labor 18,000 81,000 20,000 7,500 150,00 0 43,5 Maintenance, factory 8-115 Chapter 8 Cost Concepts and Classifications 00 Total manufacturing overhead cost 320,0 00 785,000 90,00 0 875,000 50,00 0 P825,00 0 Total manufacturing cost Add: Work in process inventory, January 1 Deduct: Work in process inventory, December 31 Cost of goods manufactured Requirement (2) The cost of goods sold would be computed as follows: Finished goods inventory, January 1 P130,00 0 825,00 0 955,000 105,00 0 P850,00 0 Add: Cost of goods manufactured Goods available for sale Deduct: Finished goods inventory, December 31 Cost of goods sold Requirement (3) EH Corporation Income Statement For the Year Ended December 31 Sales P1,250,00 0 850,00 0 400,000 Cost of goods sold (above) Gross margin Selling and administrative expenses: Selling expenses P 70,000 135,0 00 Administrative expenses Net operating income 8-116 205,00 0 P Cost Concepts and Classifications Chapter 8 195,000 8-117 Chapter 8 Cost Concepts and Classifications Problem 7 Note to the Instructor: Some of the answers below are debatable. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. Variable or Cost Item Fixed Depreciation, executive jet............................................................................ F Costs of shipping finished goods to customers.............................................. V Wood used in manufacturing furniture.......................................................... V Sales manager’s salary.................................................................................. F Electricity used in manufacturing furniture................................................... V Secretary to the company president............................................................... F Aerosol attachment placed on a spray can produced by the company............ V Billing costs.................................................................................................. V Packing supplies for shipping products overseas........................................... V Sand used in manufacturing concrete............................................................ V Supervisor’s salary, factory........................................................................... F Executive life insurance................................................................................ F Sales commissions........................................................................................ V Fringe benefits, assembly line workers.......................................................... V Advertising costs........................................................................................... F Property taxes on finished goods warehouses................................................ F Lubricants for production equipment............................................................ V *Could be an administrative cost. **Could be an indirect cost. Selling Cost Administrative Cost X Manufacturing (Product) Cost Direct Indirect X X X X X X X* X X X X X X** X X X Cost Concepts and Classifications Chapter 8 Problem 8 Requirement (1) Variable Cost Name of the Cost Ling’s present salary of P400,000 per month........................................................................... Rent on the garage, P15,000 per month........................... Rent of production equipment, P50,000 per month........................................................................... Materials for producing flyswatters, at P30.00 each................................................................. X Labor cost of producing flyswatters, at P50.00 each................................................................. X Rent of room for a sales office, P7,500 per month........................................................................... Answering device attachment, P2,000 per month........................................................................... Interest lost on savings account, P100,000 per year........................................................................ Advertising cost, P40,000 per month............................... Sales commission, at P10.00 per flyswatter..................... X Legal and filing fees, P60,000......................................... Fixed Cost Direct Materials Product Cost Direct Mfg. Labor Overhead Period (Selling and Admin.) Cost Opportunity Cost Sunk Cost X X X X X X X X X X X X X X X X 8-119 MANAGEMENT ACCOUNTING - Solutions Manual Requirement (2) The P60,000 legal and filing fees are not a differential cost. These legal and filing fees have already been paid and are a sunk cost. Thus, the cost will not differ depending on whether Ling decides to produce flyswatters or to stay with the consulting firm. All other costs listed above are differential costs since they will be incurred only if Ling leaves the consulting firm and produces the flyswatters. Problem 9 Requirement (1) Ms. Rio’s first action was to direct that discretionary expenditures be delayed until the first of the new year. Providing that these “discretionary expenditures” can be delayed without hampering operations, this is a good business decision. By delaying expenditures, the company can keep its cash a bit longer and thereby earn a bit more interest. There is nothing unethical about such an action. The second action was to ask that the order for the parts be cancelled. Since the clerk’s order was a mistake, there is nothing unethical about this action either. The third action was to ask the accounting department to delay recognition of the delivery until the bill is paid in January. This action is dubious. Asking the accounting department to ignore transactions strikes at the heart of the integrity of the accounting system. If the accounting system cannot be trusted, it is very difficult to run a business or obtain funds from outsiders. However, in Ms. Rio’s defense, the purchase of the raw materials really shouldn’t be recorded as an expense. He has been placed in an extremely awkward position because the company’s accounting policy is flawed. Requirement (2) The company’s accounting policy with respect to raw materials is incorrect. Raw materials should be recorded as an asset when delivered rather than as an expense. If the correct accounting policy were followed, there would be no reason for Ms. Rio to ask the accounting department to delay recognition of the delivery of the raw materials. This flawed accounting policy creates incentives for managers to delay deliveries of raw materials until after the end of the fiscal year. This could lead to raw materials shortages and poor relations with suppliers who would like to record their sales before the end of the year. 13-120 Cost-Volume-Profit Relationships Chapter 13 The company’s “manage-by-the-numbers” approach does not foster ethical behavior—particularly when managers are told to “do anything so long as you hit the target profits for the year.” Such “no excuses” pressure from the top too often leads to unethical behavior when managers have difficulty meeting target profits. IV. Multiple Choice Questions 1. 2. 3. 4. 5. 6. B D B A C D 7. 8. 9. 10. 11. 12. C D C C A C 13. 14. 15. 16. 17. 18. D D† B† A† C† C 19. 20. 21. 22. 23. 24. A A* B B C C 25. 26. 27. 28. 29. 30. C B B A ** A B * Controllable costs are those costs that can be influenced by a specified manager within a given time period. ** The answer assumes absorption costing method is used. † Supporting Computations 14. P60 + P10 + P18 + P4 = P92 16. P60 + P10 + P18 + P32 = P120 15. P32 + P16 = P48 17. P4 + P16 = P20 CHAPTER 9 COST BEHAVIOR: ANALYSIS AND USE I. Questions 1. a. Variable cost: A variable cost is one that remains constant on a per unit basis, but which changes in total in direct relationship to changes in volume. b. Fixed cost: A fixed cost is one that remains constant in total amount, but which changes, if expressed on a per unit basis, inversely with changes in volume. c. Mixed cost: A mixed cost is a cost that contains both variable and fixed cost elements. 2. a. Unit fixed costs will decrease as volume increases. 13-121 Chapter 13 Cost-Volume-Profit Relationships b. Unit variable costs will remain constant as volume increases. c. Total fixed costs will remain constant as volume increases. d. Total variable costs will increase as volume increases. 3. a. Cost behavior: Cost behavior can be defined as the way in which costs change or respond to changes in some underlying activity, such as sales volume, production volume, or orders processed. b. Relevant range: The relevant range can be defined as that range of activity within which assumptions relative to variable and fixed cost behavior are valid. 4. Although the accountant recognizes that many costs are not linear in relationship to volume at some points, he concentrates on their behavior within narrow bands of activity known as the relevant range. The relevant range can be defined as that range of activity within which assumptions as relative to variable and fixed cost behavior are valid. Generally, within this range an assumption of strict linearity can be used with insignificant loss of accuracy. 5. The high-low method, the scattergraph method, and the least-squares regression method are used to analyze mixed costs. The least-squares regression method is generally considered to be most accurate, since it derives the fixed and variable elements of a mixed cost by means of statistical analysis. The scattergraph method derives these elements by visual inspection only, and the high-low method utilizes only two points in doing a cost analysis, making it the least accurate of the three methods. 6. The fixed cost element is represented by the point where the regression line intersects the vertical axis on the graph. The variable cost per unit is represented by the slope of the line. 7. The two assumptions are: 1. A linear cost function usually approximates cost behavior within the relevant range of the cost driver. 2. Changes in the total costs of a cost object are traceable to variations or changes in a single cost driver. 8. No. High correlation merely implies that the two variables move together in the data examined. Without economic plausibility for a relationship, it is less likely that a high level of correlation observed in one set of data will be found similarly in another set of data. 13-122 Cost-Volume-Profit Relationships Chapter 13 9. Refer to page 312 of the textbook. 10. The relevant range is the range of the cost driver in which a specific relationship between cost and cost driver is valid. This concept enables the use of linear cost functions when examining CVP relationships as long as the volume levels are within that relevant range. 11. A unit cost is computed by dividing some amount of total costs (the numerator) by the related number of units (the denominator). In many cases, the numerator will include a fixed cost that will not change despite changes in the denominator. It is erroneous in those cases to multiply the unit cost by activity or volume change to predict changes in total costs at different activity or volume levels. 12. Cost estimation is the process of developing a well-defined relationship between a cost object and its cost driver for the purpose of predicting the cost. The cost predictions are used in each of the management functions: Strategic Management: Cost estimation is used to predict costs of alternative activities, predict financial impacts of alternative strategic choices, and to predict the costs of alternative implementation strategies. Planning and Decision Making: Cost estimation is used to predict costs so that management can determine the desirability of alternative options and to budget expenditures, profits, and cash flows. Management and Operational Control: Cost estimation is used to develop cost standards, as a basis for evaluating performance. Product and Service Costing: Cost estimation is used to allocate costs to products and services or to charge users for jointly incurred costs. 13. The five methods of cost estimation are: a. Account Classification. Advantages: simplicity and ease of use. Disadvantages: subjectivity of method and some costs are a mix of both variable and fixed. b. Visual fit. The visual fit method is easy to use, and requires only that the data is graphed. Disadvantages are that the scale of the graph may limit ability to estimate costs accurately and in both graphical and tabular form, significant perceptual errors are common. c. High-Low. Because of the precision in the development of the equation, it provides a more consistent estimate than the visual fit and 13-123 Chapter 13 Cost-Volume-Profit Relationships is not difficult to use. Disadvantages: uses only two selected data points and is, therefore, subjective. d. Work Measurement. The advantage is accurate estimates through detailed study of the different operations in the product process, but like regression, it is more complex. e. Regression. Quantitative, objective measures of the precision and accuracy and reliability of the model are the advantages of this model; disadvantages are its complexity: the effort, expense, and expertise necessary to utilize this method. 14. Implementation problems with cost estimation include: a. cost estimates outside of the relevant range may not be reliable. b. sufficient and reliable data may not be available. c. cost drivers may not be matched to dependent variables properly in each observation. d. the length of the time period for each observation may be too long, so that the underlying relationship between the cost driver and the variable to be estimated is difficult to isolate from the numerous variables and events occurring in that period of time; alternatively the period may be too short, so that the data is likely to be affected by accounting errors in which transactions are not properly posted in the period in which they occurred. e. dependent variables and cost drivers may be affected by trend or seasonality. f. when extreme observations (outliers) are used the reliability of the results will be diminished. g. when there is a shift in the data, as, for example, a new product is introduced or when there is a work stoppage, the data will be unreliable for future estimates. 15. The dependent variable is the cost object of interest in the cost estimation. An important issue in selecting a dependent variable is the level of aggregation in the variable. For example, the company, plant, or department may all be possible levels of data for the cost object. The choice of aggregation level depends on the objectives for the cost estimation, data availability, reliability, and cost/benefit considerations. If a key objective is accuracy, then a detailed level of analysis is often preferred. The detail cost estimates can then be aggregated if desired. 13-124 Cost-Volume-Profit Relationships Chapter 13 16. Nonlinear cost relationships are cost relationships that are not adequately explained by a single linear relationship for the cost driver(s). In accounting data, a common type of nonlinear relationship is trend and seasonality. For a trend example, if sales increase by 8% each year, the plot of the data for sales with not be linear with the driver, the number of years. Similarly, sales which fluctuate according to a seasonal pattern will have a nonlinear behavior. A different type of nonlinearity is where the cost driver and the dependent variable have an inherently nonlinear relationship. For example, payroll costs as a dependent variable estimated by hours worked and wage rates is nonlinear, since the relationship is multiplicative and therefore not the additive linear model assumed in regression analysis. 17. The advantages of using regression analysis include that it: a. provides an estimation model with best fit (least squared error) to the data b. provides measures of goodness of fit and of the reliability of the model which can be used to assess the usefulness of the specific model, in contrast to the other estimation methods which provide no means of self-evaluation c. can incorporate multiple independent variables d. can be adapted to handle non-linear relationships in the data, including trends, shifts and other discontinuities, seasonality, etc. e. results in a model that is unique for a given set of data 18. High correlation exists when the changes in two variables occur together. It is a measure of the degree of association between the two variables. Because correlation is determined from a sample of values, there is no assurance that it measures or describes a cause and effect relationship between the variables. 19. An activity base is a measure of whatever causes the incurrence of a variable cost. Examples of activity bases include units produced, units sold, letters typed, beds in a hospital, meals served in a cafe, service calls made, etc. 20. (a) Variable cost: A variable cost remains constant on a per unit basis, but increases or decreases in total in direct relation to changes in activity. (b) Mixed cost: A mixed cost is a cost that contains both variable and fixed cost elements. 13-125 Chapter 13 Cost-Volume-Profit Relationships (c) Step-variable cost: A step-variable cost is a cost that is incurred in large chunks, and which increases or decreases only in response to fairly wide changes in activity. Mixed Cost Variable Cost Cost Step-Variable Cost Activity 21. The linear assumption is reasonably valid providing that the cost formula is used only within the relevant range. 22. A discretionary fixed cost has a fairly short planning horizon—usually a year. Such costs arise from annual decisions by management to spend on certain fixed cost items, such as advertising, research, and management development. A committed fixed cost has a long planning horizon— generally many years. Such costs relate to a company’s investment in facilities, equipment, and basic organization. Once such costs have been incurred, they are “locked in” for many years. 23. a. Committed b. Discretionary c. Discretionary d. Committed e. Committed f. Discretionary 24. The high-low method uses only two points to determine a cost formula. These two points are likely to be less than typical since they represent extremes of activity. 13-126 Cost-Volume-Profit Relationships Chapter 13 25. The term “least-squares regression” means that the sum of the squares of the deviations from the plotted points on a graph to the regression line is smaller than could be obtained from any other line that could be fitted to the data. 26. Ordinary single least-squares regression analysis is used when a variable cost is a function of only a single factor. If a cost is a function of more than one factor, multiple regression analysis should be used to analyze the behavior of the cost. II. Exercises Exercise 1 (Cost Classification) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. b f e i e h l a j k c or d g Exercise 2 (Cost Estimation; High-Low Method) Requirement (1) Cost equation using square fee as the cost driver: Variable costs: P4,700 – P2,800 4,050 – 2,375 = P1.134 Fixed costs: P4,700 = Fixed Cost + P1.134 x 4,050 Fixed Cost = P107 13-127 Chapter 13 Cost-Volume-Profit Relationships Equation One: Total Cost = P107 + P1.134 x square feet There are two choices for the High-Low points when using openings for the cost driver. At 11 openings there is a cost of P2,800 and at 10 openings there is a cost of P2,875. Cost equation using 11 openings as the cost driver: Variable costs: P4,700 – P2,800 19 – 11 = P237.50 Fixed costs: P4,700 = Fixed Cost + P237.50 x 19 Fixed Cost = P187.50 Equation Two: Total Cost = P187.50 + P237.50 x openings Cost equation using 10 openings as the cost driver: Variable costs: P4,700 – P2,875 19 – 10 = P202.78 Fixed costs: P4,700 = Fixed Cost + P202.78 x 19 Fixed Cost = P847.18 Equation Three: Total Cost = P847.18 + P202.78 x openings Predicted total cost for a 3,200 square foot house with 14 openings using equation one: P107 + P1.134 x 3,200 = P3,735.80 Predicted total cost for a 3,200 square foot house with 14 openings using equation two: 13-128 Cost-Volume-Profit Relationships Chapter 13 P187.50 + P237.50 x 14 = P3,512.50 Predicted total cost for a 3,200 square foot house with 14 openings using equation three: P847.18 + P202.78 x 14 = P3,686.10 There is no simple method to determine which prediction is best when using the High-Low method. In contrast, regression provides quantitative measures (R-squared, standard error, t-values,…) to help asses which regression equation is best. Predicted cost for a 2,400 square foot house with 8 openings, using equation one: P107 + P1.134 x 2,400 = P2,828.60 We cannot predict with equation 2 or equation 3 since 8 openings are outside the relevant range, the range for which the high-low equation was developed. Requirement 2 Figure 9-A shows that the relationship between costs and square feet is relatively linear without outliers, while Figure 9-B shows a similar result for the relationship between costs and number of openings. From this perspective, both variables are good cost drivers. Figure 9-A 13-129 Chapter 13 Cost-Volume-Profit Relationships Figure 9-B 13-130 Cost-Volume-Profit Relationships Chapter 13 Exercise 3 (Cost Estimation; Account Classification) Requirement 1 Fixed Costs: Rent Depreciation Insurance Advertising Utilities Mr. Black’s salary Total Variable Costs: Wages CD Expense Shopping Bags Total P10,250 400 750 650 1,250 18,500 P31,800 P17,800 66,750 180 P84,730 Variable Costs Per Unit = P84,730 / 8,900 = P95.20 13-131 Chapter 13 Cost-Volume-Profit Relationships Cost Function Equation: y = P31,800 + P95.20 x (CD’s sold) Requirement 2 New Sales = 8,900 x 1.25 = 11,125 units = round to 11,130 Total Costs = P31,800 + P95.20 x (11,130) = P137,760 Per Unit Total Costs = P137,760 / 11,130 = P123.80 Add P1 profit per disc: P123.80 + P10 = P133.80 Requirement 3 Adjusted New Sales = 8,900 x 11.50 = 10,240 units Revenue = P133.80 x (10,240) = P137,010 Total Cost = P31,800 + P95.20 x (10,240) = P129,280 Cost Per Disc = P129,280 / 10,240 = P126.30 Profit Per Disk = P133.80 – P126.30 = P7.50 Exercise 4 (Cost Estimation Using Graphs; Service) Requirement 1 13-132 Cost-Volume-Profit Relationships Chapter 13 Requirement 2 There seems to be a positive linear relationship for the data between P2,500 and P4,000 of advertising expense. Llanes’ analysis is correct within this relevant range but not outside of it. Notice that the relationship between advertising expense and sales changes at P4,000 of expense. Exercise 5 (Fixed and Variable Cost Behavior) Requirement (1) Fixed cost Variable cost Total cost Cost per cup of coffee served * Cups of Coffee Served in a Week 1,800 1,900 2,000 P11,000 P11,000 P11,000 4,680 4,940 5,200 P15,680 P15,940 P16,200 P8.71 P8.39 P8.10 * Total cost ÷ cups of coffee served in a week Requirement (2) The average cost of a cup of coffee declines as the number of cups of coffee served increases because the fixed cost is spread over more cups of coffee. 13-133 Chapter 13 Cost-Volume-Profit Relationships Exercise 6 (Scattergraph Analysis) Requirement (1) The completed scattergraph is presented below: 16,000 14,000 12,000 Total Cost 10,000 8,000 6,000 4,000 2,000 0 0 2,000 4,000 6,000 Units Processed 13-134 8,000 10,000 Cost-Volume-Profit Relationships Chapter 13 Requirement (2) (Students’ answers will vary considerably due to the inherent imprecision and subjectivity of the quick-and-dirty scattergraph method of estimating variable and fixed costs.) The approximate monthly fixed cost is P6,000—the point where the straight line intersects the cost axis. The variable cost per unit processed can be estimated as follows using the 8,000-unit level of activity, which falls on the straight line: Total cost at the 8,000-unit level of activity............................................. P14,000 Less fixed costs........................................................................................6,000 Variable costs at the 8,000-unit level of activity....................................... P 8,000 P8,000 ÷ 8,000 units = P1 per unit. Observe from the scattergraph that if the company used the high-low method to determine the slope of the line, the line would be too steep. This would result in underestimating the fixed cost and overestimating the variable cost per unit. Exercise 7 (High-Low Method) Requirement (1) Month Occupancy-Days High activity level (August).................... 3,608 Low activity level (October)................... 186 Change.................................................... 3,422 Electrical Costs P8,111 1,712 P6,399 Variable cost = Change in cost ÷ Change in activity = P6,399 ÷ 3,422 occupancy-days = P1.87 per occupancy-day Total cost (August)........................................................................................... P8,111 Variable cost element (P1.87 per occupancy-day × 3,608 occupancy-days).................................... 6,747 Fixed cost element............................................................................................ P1,364 Requirement (2) Electrical costs may reflect seasonal factors other than just the variation in 13-135 Chapter 13 Cost-Volume-Profit Relationships occupancy days. For example, common areas such as the reception area must be lighted for longer periods during the winter. This will result in seasonal effects on the fixed electrical costs. Additionally, fixed costs will be affected by how many days are in a month. In other words, costs like the costs of lighting common areas are variable with respect to the number of days in the month, but are fixed with respect to how many rooms are occupied during the month. Other, less systematic, factors may also affect electrical costs such as the frugality of individual guests. Some guests will turn off lights when they leave a room. Others will not. Exercise 8 (Least-Squares Regression) The least-squares regression estimates of fixed and variable costs can be computed using any of a variety of statistical and mathematical software packages or even by hand. Month January......................... February....................... March........................... April............................. May.............................. June.............................. July............................... August.......................... September..................... October......................... November..................... December...................... Intercept Rental Returns 2,310 2,453 2,641 2,874 3,540 4,861 5,432 5,268 4,628 3,720 2,106 2,495 Car Wash Costs P10,113 P12,691 P10,905 P12,949 P15,334 P21,455 P21,270 P19,930 P21,860 P18,383 P 9,830 P11,081 P2,29 6 Slope P3.74 RSQ 0.92 The intercept provides the estimate of the fixed cost element, P2,296 per month, and the slope provides the estimate of the variable cost element, P3.74 per rental return. Expressed as an equation, the relation between car wash costs and rental returns is 13-136 Cost-Volume-Profit Relationships Chapter 13 Y = P2,296 + P3.74X where X is the number of rental returns. Note that the R2 is 0.92, which is quite high, and indicates a strong linear relationship between car wash costs and rental returns. While not a requirement of the exercise, it is always a good to plot the data on a scattergraph. The scattergraph can help spot nonlinearities or other problems with the data. In this case, the regression line (shown below) is a reasonably good approximation to the relationship between car wash costs and rental returns. III. Problems Problem 1 Requirement (a) Miles 13-137 Total Annual Chapter 13 Cost-Volume-Profit Relationships High level of activity.......................... Low level of activity........................... Difference...................................... Driven 120,000 80,000 40,000 Cost* P13,920 10,880 P 3,040 * 120,000 miles x P0.116 = P13,920. 80,000 miles x P0.136 = P10,880. Variable cost per mile: Change in cost, P3,040 Change in activity,40,000 = P0.076 per mile. Fixed cost per year: Total cost at 120,000 miles.................................... P13,920 Less variable cost element: 120,000 x P0.076...... 9,120 Fixed cost per year............................................. P 4,800 Requirement (b) Y = P4,800 + P0.076X Requirement (c) Fixed cost..................................................................... P 4,800 Variable cost: 100,000 miles x P0.076........................ 7,600 Total annual cost.................................................... P12,400 Problem 2 Requirement 1 Cost of goods sold...................................................... Shipping expense........................................................ Advertising expense.................................................... Salaries and commissions........................................... Insurance expense....................................................... Depreciation expense.................................................. Variable Mixed Fixed Mixed Fixed Fixed Requirement 2 Analysis of the mixed expenses: High level of activity................ 13-138 Units 4,500 Shipping Expense P56,000 Salaries and Comm. Expense P143,000 Cost-Volume-Profit Relationships Chapter 13 Low level of activity................. Difference.......................... 3,000 1,500 44,000 P12,000 107,000 P 36,000 Variable cost element: Change in cost = Variable rate Change in activity Shipping expense: P12,000 = P8 per unit. 1,500 units P36,000 Salaries and comm. expense: 1,500 units = P24 per unit. Fixed cost element: Shipping Expense Cost at high level of activity................ Less variable cost element: 4,500 units x P8............................ 4,500 units x P24.......................... P56,000 Fixed cost element............................... P20,000 The cost elements are: Shipping expense: P20,000 + P8X. Salaries and Comm. Expense P143,000 36,000 108,000 P 35,000 P20,000 per month plus P8 per unit or Y = Salaries and comm. expense: P35,000 per month plus P24 per unit or Y = P35,000 + P24X. Requirement 3 LILY COMPANY Income Statement For the Month Ended June 30 Sales in units................................................... Sales revenues................................................. 13-139 4,500 P630,000 Chapter 13 Cost-Volume-Profit Relationships Less variable expenses: Cost of goods sold (@P56)......................... P252,000 Shipping expense (@P8)............................ 36,000 Salaries and commission expense (@P24)................................................... 108,000 396,000 Contribution margin........................................ 234,000 Less fixed expense: Shipping expense........................................ 20,000 Advertising................................................. 70,000 Salaries and commissions........................... 35,000 Insurance.................................................... 9,000 Depreciation............................................... 42,000 176,000 Net income...................................................... P 58,000 Problem 3 Requirement 1 Number of Leagues (X) 5 2 4 6 3 20 Year 2004 2005 2006 2007 2008 b a Total Cost (Y) P13,000 7,000 10,500 14,000 10,000 P54,500 = n (XY) - (X) (Y) n (X2) - (X)2 = 5 (235,000) - (20) (54,500) 5 (90) - (20)2 = 1,700 = (Y) - b(X) n = (54,500) - 1,700 (20) 5 = P4,100 XY P 65,000 14,000 42,000 84,000 30,000 P235,000 X2 25 4 16 36 9 90 Therefore, the variable cost per league is P1,700 and the fixed cost is P4,100 per year. 13-140 Cost-Volume-Profit Relationships Chapter 13 Requirement 2 Y = P4,100 + P1,700X Requirement 3 The expected value total would be: Fixed cost.............................................................. P 4,100 Variable cost (7 leagues x P1,700)......................... 11,900 Total cost.......................................................... P16,000 The problem with using the cost formula from (2) to derive this total cost figure is that an activity level of 7 sections lies outside the relevant range from which the cost formula was derived. [The relevant range is represented by a solid line on the graph in requirement 4 below.] Although an activity figure may lie outside the relevant range, managers will often use the cost formula anyway to compute expected total cost as we have done above. The reason is that the cost formula frequently is the only basis that the manager has to go on. Using the cost formula as the starting point should not present a problem so long as the manager is alert for any unusual problems that the higher activity level might bring about. Requirement 4 Y P16,000 P14,000 P12,000 P10,000 P8,000 P6,000 P4,000 P2,000 P- X 0 1 2 3 13-141 4 5 6 7 8 Chapter 13 Cost-Volume-Profit Relationships Problem 4 (Regression Analysis, Service Company) Requirement 1 Figure 9-C plots the relationship between labor-hours and overhead costs and shows the regression line. y = P48,271 + P3.93 X Economic plausibility. Labor-hours appears to be an economically plausible driver of overhead cost for a catering company. Overhead costs such as scheduling, hiring and training of workers, and managing the workforce are largely incurred to support labor. Goodness of fit. The vertical differences between actual and predicted costs are extremely small, indicating a very good fit. The good fit indicates a strong relationship between the labor-hour cost driver and overhead costs. Slope of regression line. The regression line has a reasonably steep slope from left to right. The positive slope indicates that, on average, overhead costs increase as labor-hours increase. Requirement 2 The regression analysis indicates that, within the relevant range of 2,500 to 7,500 labor-hours, the variable cost per person for a cocktail party equals: Food and beverages P15.00 Labor (0.5 hrs. x P10 per hour) 5.00 Variable overhead (0.5 hrs. x P3.93 per labor-hour) 1.97 Total variable cost per person P21.97 Requirement 3 To earn a positive contribution margin, the minimum bid for a 200-person cocktail party would be any amount greater than P4,394. This amount is calculated by multiplying the variable cost per person of P21.97 by the 200 people. At a price above the variable costs of P4,394, Bobby Gonzales will be earning a contribution margin toward coverage of his fixed costs. Of course, Bobby Gonzales will consider other factors in developing his bid including (a) an analysis of the competition – vigorous competition will limit Gonzales’ ability to obtain a higher price (b) a determination of whether or not 13-142 Cost-Volume-Profit Relationships Chapter 13 his bid will set a precedent for lower prices – overall, the prices Bobby Gonzales charges should generate enough contribution to cover fixed costs and earn a reasonable profit, and (c) a judgment of how representative past historical data (used in the regression analysis) is about future costs. Figure 9-C Regression Line of Labor-Hours on Overhead Costs for Bobby Gonzales’ Catering Company Problem 5 (Linear Cost Approximation) Requirement 1 Slope coefficient (b) = = Constant (a) Difference in cost Difference in labor-hours P529,000 – P400,000 7,000 – 4,000 = P43.00 = P529,000 – P43.00 (7,000) = P228,000 Cost function = P228,000 + P43.00 (professional labor-hours) 13-143 Chapter 13 Cost-Volume-Profit Relationships The linear cost function is plotted in Figure 9-D. No, the constant component of the cost function does not represent the fixed overhead cost of the ABS Group. The relevant range of professional laborhours is from 3,000 to 8,000. The constant component provides the best available starting point for a straight line that approximates how a cost behaves within the 3,000 to 8,000 relevant range. Requirement 2 A comparison at various levels of professional labor-hours follows. The linear cost function is based on formula of P228,000 per month plus P43.00 per professional labor-hours. Total overhead cost behavior: Month 1 Actual total overhead costs Linear approximati on Actual minus linear approximati on Professional labor-hours Month 2 P340,000 Month 3 P400,00 0 400,000 357,000 P(17,000 ) P 3,000 Month 4 P435,00 0 443,000 P477,00 0 486,000 0 P (8,000) P (9,000) 4,000 5,000 6,000 The data are shown in Figure 9-D. The linear cost function overstates costs by P8,000 at the 5,000-hour level and understates costs by P15,000 at the 8,000-hour level. Requirement 3 Contribution before deducting incremental overhead Incremental overhead Contribution after incremental overhead 13-144 Based on Actual Based on Linear Cost Function P38,00 0 35,000 P 3,000 P38,00 0 43,000 P (5,000) Month 5 P529,00 0 529,000 P 0 7,000 Cost-Volume-Profit Relationships Chapter 13 The total contribution margin actually forgone is P3,000. Figure 9-D Linear Cost Function Plot of Professional Labor-Hours on Total Overhead Costs for ABS Consulting Group Problem 6 (Cost Behavior) The variable cost per hour can be computed as follows: P20,000 / 5,000 hours = P4 per hour Therefore, the missing amounts are as follows: 5,000 13-145 Hours of Operating Time 6,000 7,000 8,000 Chapter 13 Cost-Volume-Profit Relationships Total costs: Variable costs (@ P4 per hour) Fixed costs Total costs P 20,000 P24,000 P28,000 P32,000 168,000 P188,000 168,000 P192,000 168,000 P196,000 168,000 P200,000 5,000 Cost hour: Hours of Operating Time 6,000 7,000 8,000 per Variable cost Fixed cost Total cost per hour P4.00 P4.00 P4.00 P4.00 33.60 28.00 24.00 21.00 P37.60 P32.00 P28.00 P25.00 Observe that the total variable costs increase in proportion to the number of hours of operating time, but that these costs remain constant at P4 if expressed on a per hour basis. In contrast, the total fixed costs do not change with changes in the level of activity. They remain constant at P168,000 within the relevant range. With increases in activity, however, the fixed cost per hour decreases, dropping from P33.60 per hour when the boats are operated 5,000 hours a period to only P21.00 per hour when the boats are operated 8,000 hours a period. Because of this troublesome aspect of fixed costs, they are most easily (and most safely) dealt with on a total basis, rather than on a unit basis, in cost analysis work. Problem 7 (High-Low Method) Requirement (1) 13-146 Cost-Volume-Profit Relationships Chapter 13 The first step in the high-low method is to identify the periods of the lowest and highest activity. Those periods are November (1,100 patients admitted) and June (1,900 patients admitted). The second step is to compute the variable cost per unit using those two data points: level Number of Patients Admitted 1,900 level 1,100 Month High activity (June) Low activity (November) Change Variable cost 800 = = Admitting Department Costs P15,20 0 12,800 P 2,400 Change in cost Change in activity P240,000 800 patients admitted = P3 per patient admitted The third step is to compute the fixed cost element by deducting the variable cost element from the total cost at either the high or low activity. In the computation below, the high point of activity is used: Fixed cost element = = = Total cost – Variable cost element P15,200 – (P3 per patient admitted x 1,900 patients admitted) P9,500 Requirement (2) The cost formula is Y = P9,500 + P3X. Problem 8 (Scattergraph Analysis; Selection of an Activity Base) 13-147 Chapter 13 Cost-Volume-Profit Relationships Requirement (1) The completed scattergraph for the number of units produced as the activity base is presented below: 5,000 4,500 Janitorial Labor Cost 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 0 20 40 60 80 100 120 140 Units Produced Requirement (2) The completed scattergraph for the number of workdays as the activity base is presented below: 13-148 Cost-Volume-Profit Relationships Chapter 13 Requirement (3) 5,000 4,500 Janitorial Labor Cost 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 0 2 4 6 8 10 12 14 16 18 20 22 24 Number of Janitorial Workdays The number of workdays should be used as the activity base rather than the 13-149 Chapter 13 Cost-Volume-Profit Relationships number of units produced. There are several reasons for this. First, the scattergraphs reveal that there is a much stronger relationship (i.e., higher correlation) between janitorial costs and number of workdays than between janitorial costs and number of units produced. Second, from the description of the janitorial costs, one would expect that variations in those costs have little to do with the number of units produced. Two janitors each work an eighthour shift—apparently irrespective of the number of units produced or how busy the company is. Variations in the janitorial labor costs apparently occur because of the number of workdays in the month and the number of days the janitors call in sick. Third, for planning purposes, the company is likely to be able to predict the number of working days in the month with much greater accuracy than the number of units that will be produced. Note that the scattergraph in part (1) seems to suggest that the janitorial labor costs are variable with respect to the number of units produced. This is false. Janitorial labor costs do vary, but the number of units produced isn’t the cause of the variation. However, since the number of units produced tends to go up and down with the number of workdays and since the janitorial labor costs are driven by the number of workdays, it appears on the scattergraph that the number of units drives the janitorial labor costs to some extent. Analysts must be careful not to fall into this trap of using the wrong measure of activity as the activity base just because it appears there is some relationship between cost and the measure of activity. Careful thought and analysis should go into the selection of the activity base. IV. Multiple Choice Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. A D B A B B C D C A 11. 11. 12. 13. 14. 15. 16. 17. 18. 19. C* C* C A D C D B C C 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. C D C A D B D B A D 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. D B A B A D B C B D 41. B 42. D 43. C * Supporting Computations: 11. (10,000 x 2) – (P3,000 x 2) – P5,000 = P9,000 12. [(P20 + P3 + P6) x 2,000 units] + (P10 x 1,000 units) = P68,000 13-150 Cost-Volume-Profit Relationships Chapter 13 CHAPTER 10 SYSTEMS DESIGN: JOB-ORDER COSTING AND PROCESS COSTING I. Questions 1. Job-order costing is used in those manufacturing situations where there are many different products produced each period. Each product or job is different from all others and requires separate costing. Process costing is used in those manufacturing situations where a single, homogeneous product, such as cement, bricks, or gasoline, is produced for long periods at a time. 2. The job cost sheet is used in accumulating all costs assignable to a particular job. These costs would include direct materials cost traceable to the job, and manufacturing overhead cost allocable to the job. When a job is completed, the job cost sheet is used to compute the cost per completed unit. The job cost sheet is then used as a control document for: (1) determining how many units have been sold and determining the cost of these units; and (2) determining how many units are still in inventory at the end of a period and determining the cost of these units on the balance sheet. 3. Many production costs cannot be traced directly to a particular product or job, but rather are incurred as a result of overall production activities. Therefore, in order to be assigned to products, such costs must be allocated to the products in some manner. Examples of such costs would include utilities, maintenance on machines, and depreciation of the factory building. These costs are indirect production costs. 4. A firm will not know its actual manufacturing overhead costs until after a period is over. Thus, if actual costs were used to cost products, it would be necessary either (1) to wait until the period was over to add overhead costs to jobs, or (2) to simply add overhead cost to jobs as the overhead cost was incurred day by day. If the manager waits until after the period is over to add overhead cost to jobs, then cost data will not be available 13-151 Chapter 13 Cost-Volume-Profit Relationships during the period. If the manager simply adds overhead cost to jobs as the overhead cost is incurred, then unit costs may fluctuate from month to month. This is because overhead cost tends to be incurred somewhat evenly from month to month (due to the presence of fixed costs), whereas production activity often fluctuates. For these reasons, most firms use predetermined overhead rates, based on estimates of overhead cost and production activity, to apply overhead cost to jobs. 5. An allocation base should act as a cost driver in the incurrence of the overhead cost; that is, the base should cause the overhead cost. If the allocation base does not really cause the overhead, then costs will be incorrectly attributed to products and jobs and their costs will be distorted. 6. A process costing system is appropriate in those situations where a homogeneous product is produced on a continuous basis. 7. In a process costing system, costs are accumulated by department. 8. First, the activity performed in a department must be performed uniformly on all units moving through it. Second, the output of the department must be homogeneous. 9. The reason cost accumulation is simpler is that costs only need to be identified by department - not by separate job. Usually there will be only a few departments in a company, whereas there can be hundreds or even thousands of jobs in a job-order costing system. 10. A quantity schedule shows the physical flow of units through a department during a period. It serves several purposes. First, it provides the manager with information relative to activity in his or her department and also shows the manager the stage of completion of any in-process units. Second, it serves as an essential guide in computing the equivalent units and in preparing the other parts of the production report. 11. By definition, manufacturing overhead consists of costs that cannot be practically traced to products or jobs. Therefore, if these costs are to be assigned to products or jobs, they must be allocated rather than traced. 12. Assigning manufacturing overhead costs to jobs does not ensure a profit. The units produced may not be sold and if they are sold, they may not be sold at prices sufficient to cover all costs. It is a myth that assigning costs to products or jobs ensures that those costs will be recovered. Costs are recovered only by selling to customers—not by allocating costs. 13. (a) Job-order costing and process costing have the same basic purposes— to assign materials, labor, and overhead cost to products and to provide a mechanism for computing unit product costs. 13-152 Cost-Volume-Profit Relationships Chapter 13 (b) Both systems use the same basic manufacturing accounts. (c) Costs flow through the accounts in basically the same way in both systems. 14. The company will want to distinguish between the costs of the metals used to make the medallions, but the medals are otherwise identical and go through the same production processes. Thus, operation costing is ideally suited for the company’s needs. II. Exercises Exercise 1 (Process Costing and Job Order Costing) b. c. d. e. a. Job-order costing Process costing Process costing * Job-order costing Job-order costing g. h. i. j. f. Process costing Process costing Job-order costing Job-order costing Job-order costing * Some of the listed companies might use either a process costing or a joborder costing system, depending on how operations are carried out and how homogeneous the final product is. For example, a plywood manufacturer might use job-order costing if plywoods are constructed of different woods or come in markedly different sizes. Exercise 2 (Applying Overhead with Various Bases) Requirement 1 Predetermined overhead rates: Company X: Predetermined overhead rate = = Estimated total manufacturing overhead cost Estimated total amount of the allocation base P432,000 60,000 DLHs = P7.20 per DLH Company Y: Predetermined overhead rate = = Estimated total manufacturing overhead cost Estimated total amount of the allocation base P270,000 90,000 DLHs 13-153 = P3.00 per MH Chapter 13 Cost-Volume-Profit Relationships Company Z: Predetermined overhead rate = Estimated total manufacturing overhead cost Estimated total amount of the allocation base = P384,000 P240,000 materials cost Requirement 2 = 160% of materials cost Actual overhead costs incurred......................................... Overhead cost applied to Work in Process:........................ 58,000* actual hours × P7.20 per hour....................... Underapplied overhead cost.............................................. P420,000 P 417,600 2,400 * 7,000 hours + 30,000 hours + 21,000 hours = 58,000 hours Exercise 3 (Departmental Overhead Rates) Requirement 1 Milling Department: Predetermined overhead rate = Estimated total manufacturing overhead cost Estimated total amount of the allocation base = P510,000 60,000 machine-hours = P8.50 per machine-hour Assembly Department: Predetermined overhead rate = Estimated total manufacturing overhead cost Estimated total amount of the allocation base = P800,000 P640,000 direct labor cost = 125% of direct labor cost Requirement 2 Milling Department: 90 MHs × P8.50 per MH Assembly Department: P160 × 125% Total overhead cost applied Requirement 3 13-154 Overhead Applied P765 200 P965 Cost-Volume-Profit Relationships Chapter 13 Yes; if some jobs required a large amount of machine time and little labor cost, they would be charged substantially less overhead cost if a plantwide rate based on direct labor cost were being used. It appears, for example, that this would be true of job 123 which required considerable machine time to complete, but required only a small amount of labor cost. Exercise 4 (Process Costing Journal Entries) Work in Process—Mixing....................................................................................... 330,000 Raw Materials Inventory................................................................................. 330,000 Work in Process—Mixing....................................................................................... 260,000 Work in Process—Baking........................................................................................ 120,000 Wages Payable................................................................................................. 380,000 Work in Process—Mixing....................................................................................... 190,000 Work in Process—Baking........................................................................................ 90,000 Manufacturing Overhead................................................................................. 280,000 Work in Process—Baking........................................................................................ 760,000 Work in Process—Mixing................................................................................ 760,000 Finished Goods........................................................................................................ 980,000 Work in Process—Baking................................................................................ 980,000 Exercise 5 (Quantity Schedule, Equivalent Units, and Cost per Equivalent Unit – Weighted Average Method) Requirement 1 Weighted-Average Method Quantity Schedule Gallons to be accounted for: Work in process, May 1 (materials 80% complete, labor and overhead 75% complete) Started into production Total gallons accounted for 80,000 760,000 840,000 Equivalent Units Materials Labor Overhead Gallons accounted for as follows: 13-155 Chapter 13 Cost-Volume-Profit Relationships Transferred to the next department.............. Work in process, May 31 (materials 60% complete, labor and overhead 20% complete)................................................ Total gallons accounted for............................... 790,000 790,000 790,000 790,000 50,000 840,000 30,000 820,000 10,000 800,000 10,000 800,000 Requirement 2 Total Costs Materials Cost to be accounted for: Work in process, May 1............................................... P 146,600 P 68,600 Cost added during the month....................................... 1,869,200 907,200 Total cost to be accounted for (a)...................................... P2,015,800 P975,800 Equivalent units (b)........................................................... — 820,000 Cost per equivalent unit (a) ÷ (b)...................................... P1.19 Labor P 30,000 370,000 P400,000 800,000 + P0.50 Overhead P 48,000 592,000 P640,000 800,000 + P0.80 Whole Unit = P2.49 Exercise 6 (Quantity Schedule, Equivalent Units, and Cost per Equivalent Unit – FIFO Method) Requirement 1 FIFO Method Quantity Schedule Gallons to be accounted for: Work in process, May 1 (materials 80% complete, labor and overhead 75% complete) Started into production Total gallons accounted for 80,000 760,000 840,000 Equivalent Units Materials Labor Overhead Gallons accounted for as follows: Transferred to the next department: From the beginning inventory................. 80,000 Started and completed this month**...... 710,000 Work in process, May 31 (materials 60% complete, labor and overhead 20% complete)................................................ 50,000 Total gallons accounted for............................... 840,000 16,000* 710,000 20,000* 710,000 20,000* 710,000 30,000 756,000 10,000 740,000 10,000 740,000 * Work required to complete the beginning inventory. ** 760,000 gallons started – 50,000 gallons in ending work in process = 710,000 gallons started and completed. Requirement 2 13-156 Cost-Volume-Profit Relationships Chapter 13 Total Costs Materials Cost to be accounted for: Work in process, May 31............................................. P 146,600 Cost added during the month (a).................................. 1,869,200 P907,200 Total cost to be accounted for............................................ P2,015,800 Equivalent units (b)........................................................... 756,000 Cost per equivalent unit (a) ÷ (b)...................................... P1.20 Labor P370,000 + 740,000 P0.50 Overhead Whole Unit P592,000 + 740,000 P0.80 = P2.50 Exercise 7 Requirement (1) The direct materials and direct labor costs listed in the exercise would have been recorded on four different documents: the materials requisition form for Job KC123, the time ticket for Kristine, the time ticket for Clarisse, and the job cost sheet for Job KC123. Requirement (2) The costs for Job KC123 would have been recorded as follows: Materials requisition form: Quantity Blanks 40 Nibs 960 Unit Cost P80.00 P6.00 Total Cost P3,200 5,760 P8,960 Time ticket for Kristine Started 9:00 AM Ended 12:15 PM Time Completed 3.25 Rate P120.00 Amount P390.00 Job Number KC123 Time Completed 2.25 Rate P140.00 Amount P315.00 Job Number KC123 Time ticket for Clarisse Started 2:15 PM Ended 4:30 PM Job Cost Sheet for Job KC123 Direct materials............... P8,960.00 Direct labor: Kristine..................... 390.00 Clarisse..................... 315.00 13-157 Chapter 13 Cost-Volume-Profit Relationships P9,665.00 Exercise 8 The predetermined overhead rate is computed as follows: Estimated total manufacturing overhead......................................P586,000 ÷ Estimated total direct labor hours (DLHs)................................ 40,000 DLHs = Predetermined overhead rate..................................................... P14.65 per DLH Exercise 9 Weighted-Average Method Materials Work in process, May 1................................. P 14,550 Cost added during May.................................88,350 Total cost (a).................................................. P102,900 Equivalent units of production (b)............................................ 1,200 Cost per equivalent unit (a) ÷ (b).....................................................P85.75 Labor P23,620 14,330 P37,950 Overhead P118,100 71,650 P189,750 1,100 1,100 P34.50 P172.50 Total P292.75 Exercise 10 FIFO Method Materials Conversion To complete beginning work in process: Materials: 400 units x (100% – 75%)............................................................. 100 Conversion: 400 units x (100% – 25%).......................................................... 300 Units started and completed during the period (42,600 units started – 500 units in ending inventory)......................................................................................................... 42,100 42,100 Ending work in process Materials: 500 units x 80% complete.............................................................. 400 Conversion: 500 units x 30% complete........................................................... 150 Equivalent units of production............................................................................... 42,600 42,550 III. Problems Problem 1 13-158 Cost-Volume-Profit Relationships Chapter 13 Requirement 1 a. Raw Materials Inventory.............................................. 210,000 Accounts Payable..................................................... 210,000 b. Work in Process........................................................... 178,000 Manufacturing Overhead............................................. 12,000 Raw Materials Inventory.......................................... 190,000 c. Work in Process........................................................... 90,000 Manufacturing Overhead............................................. 110,000 Salaries and Wages Payable..................................... 200,000 d. Manufacturing Overhead............................................. 40,000 Accumulated Depreciation....................................... 40,000 e. Manufacturing Overhead............................................. 70,000 Accounts Payable..................................................... 70,000 f. Work in Process........................................................... 240,000 Manufacturing Overhead.......................................... 240,000 30,000 MH x P8 per MH = P240,000. g. Finished Goods............................................................ 520,000 Work in Process....................................................... 520,000 h. Cost of Goods Sold...................................................... 480,000 Finished Goods......................................................... 480,000 Accounts Receivable.................................................... 600,000 Sales......................................................................... 600,000 P480,000 × 1.25 = P600,000 Requirement 2 Manufacturing Overhead (b) 12,000 240,000(f) (c) 110,000 (d) 40,000 Work in Process Bal. 42,000 510,000(g) (b) 178,000 (c) 90,000 13-159 Chapter 13 Cost-Volume-Profit Relationships (e) 70,000 (f) 240,000 8,000 (Overapplied overhea d) Bal. 30,000 Problem 2 Requirement 1 The costing problem does, indeed, lie with manufacturing overhead cost, as suggested. Since manufacturing overhead is mostly fixed, the cost per unit increases as the level of production decreases. The problem can be solved by use of predetermined overhead rates, which should be based on expected activity for the entire year. Many students will use units of product in computing the predetermined overhead rate, as follows: Estimated manufacturing overhead cost, P840,000 = P4.20 per unit. Estimated units to be produced, 200,000 The predetermined overhead rate could also be set on the basis of either direct labor cost or direct materials cost. The computations are: Estimated manufacturing overhead cost, P840,000 = 350% of direct Estimated direct labor cost, P240,000 labor cost Estimated manufacturing overhead cost, P840,000 140% of direct Estimated direct materials cost, P600,000 = materials cost Requirement 2 Using a predetermined overhead rate, the unit costs would be: Direct materials................... Direct labor......................... Manufacturing overhead: Applied at P4.20 per units; 350% of direct labor cost, or 140% of First P240,000 96,000 13-160 Quarter Second Third P120,000 P 60,000 48,000 24,000 Fourth P180,000 72,000 Cost-Volume-Profit Relationships Chapter 13 direct materials cost Total cost....................... Number of units produced........................... Estimated cost per unit........ 336,000 168,000 84,000 252,000 P672,000 P336,000 P168,000 P504,000 80,000 P8.40 40,000 P8.40 20,000 P8.40 60,000 P8.40 Problem 3 Weighted-Average Method Pounds to be accounted for: Work in process, May 1 (all materials, 55% labor and overhead added last month).......... Started into production during May................................................ Total pounds............................. Quantity Schedule 30,000 480,000 510,000 Equivalent Units Labor & Materials Overhead Pounds accounted for as follows: Transferred to Department 2............ Work in process, May 31 (all materials, 90% labor and overhead added this month).......... Total pounds............................. 490,000* 490,000 490,000 20,000 510,000 20,000 510,000 18,000 508,000 * 30,000 + 480,000 - 20,000 = 490,000. Problem 4 (Weighted-Average Method; Interpreting a Production Report) Requirement 1 Weighted-Average Method The equivalent units for the month would be: Units accounted for as follows: Transferred to next department.... Work in process, April 30 (75% materials, 60% 13-161 Quantity Schedule Equivalent Units Materials Conversion 190,000 190,000 190,000 Chapter 13 Cost-Volume-Profit Relationships conversion cost added this month)...................................... Total units and equivalent units of production............................ 40,000 30,000 24,000 230,000 220,000 214,000 Whole Unit Requirement 2 Work in process, April 1... Total Cost Materials Conversion P 98,000 P 67,800 P 30,200 827,00 579,00 248,00 0 0 0 P925,000 P646,800 P278,200 – 220,000 214,000 – P2.94 + = P P 1 4 . . 3 2 0 4 Cost added during the month Total cost (a).................. Equivalent units of production (b) Cost per EU (a) (b)....... Requirement 3 Total units transferred....................................................... Less units in the beginning inventory................................. Units started and completed during April.......................... 190,000 30,000 160,000 Requirement 4 No, the manager should not be rewarded for good cost control. The reason for the Mixing Department’s low unit cost for April is traceable to the fact that costs of the prior month have been averaged in with April’s costs in computing the lower, P2.94 per unit figure. This is a major criticism of the weightedaverage method in that the figures computed for product costing purposes 13-162 Cost-Volume-Profit Relationships Chapter 13 can’t be used to evaluate cost control or measure performance for the current period. Problem 5 (Preparation of Production Report from Analysis of Work in Process T-account – Weighted-Average Method) Requirement 1 Weighted-Average Method Quantity Schedule and Equivalent Units Quantity Schedule Pounds to be accounted for: Work in process, May 1 (materials all complete, labor and overhead 4/5 complete)...... Started into production................ Total pounds to be accounted for...... 35,000 280,000 315,000 Equivalent Units (EU) Labor & Materials Overhead Pounds accounted for as follows: Transferred to Blending*............. Work in process, May 31 (materials all complete, labor and overhead 2/3 complete)...... Total pounds accounted for.............. 270,000 270,000 270,000 45,000 315,000 45,000 315,000 30,000 300,000 Labor & Whole * 35,000 + 280,000 – 45,000 = 270,000. Cost per Equivalent Unit Total Materials Ov er he ad Cost to be accounted for: Work in process, May 1. . . P 63,700 13-163 P 43,400 P 20,300 Unit Chapter 13 Cost-Volume-Profit Relationships Cost added during the month 587,30 397,60 189,70 0 0 0 P651,000 P441,000 P210,000 315,000 300,000 P1.40 + = P P 0 2 . . 7 1 0 0 Total cost to be accounted for (a) Equivalent units (b)......... Cost per equivalent unit (a) (b) Cost Reconciliation Total Cost Cost accounted for as follows: Transferred to Blending: 270,000 pounds x P2.10 per pound.............................. Work in process, May 31: Materials, at P1.40 per EU...... Labor and overhead, at P0.70 per EU................................... Total work in process, May 31.... Total costs accounted for.................. Equivalent Units (EU) Materials Conversion P567,000 270,000 63,000 45,000 21,000 84,000 P651,000 270,000 30,000 Requirement 2 In computing unit costs, the weighted-average method mixes costs of the prior period with current period costs. Thus, under the weighted-average method, unit costs are influenced to some extent by what happened in a prior period. This problem becomes particularly significant when attempting to measure performance in the current period. Good (or bad) cost control in the current 13-164 Cost-Volume-Profit Relationships Chapter 13 period might be concealed to some degree by the costs that have been brought forward in the beginning inventory. IV. Multiple Choice Questions 1. 2. 3. 4. 5. D D D C D 6. 7. 8. 9. 10. D A C C B 11. 12. 13. 14. 15. A D B D C 16. 17. 18. 19. 20. A D A C D CHAPTER 11 SYSTEMS DESIGN: ACTIVITY-BASED COSTING AND MANAGEMENT I. Questions 1. The three levels available are: Level 1, in which a company uses a plantwide overhead rate; Level 2, in which a company uses departmental overhead rates; and Level 3, in which a company uses activity-based costing. 2. New approaches to costing are needed because events of the last few decades have made drastic changes in many organizations. Automation has greatly decreased the amount of direct labor required to manufacture products; product diversity has increased in that companies are manufacturing a wider range of products and these products differ substantially in volume, lot size, and complexity of design; and total overhead cost has increased to the point in some companies that a correlation no longer exists between it and direct labor. 3. The departmental approach to assigning overhead cost to products relies solely on volume as an assignment base. Where diversity exists between products (that is, where products differ in terms of number of units produced, lot size, or complexity of production), volume alone is not adequate for overhead costing. Overhead costing based on volume will 13-165 Chapter 13 Cost-Volume-Profit Relationships systematically overcost high-volume products and undercost low-volume products. 4. Process value analysis (PVA) is a systematic approach to gaining an understanding of the steps associated with a product or service. It identifies all resource-consuming activities involved in the production process and labels these activities as being either value-added or nonvalue-added. Thus, it is the beginning point in designing an activity-based costing system since management must know what activities are involved with each product before activity centers can be designated and cost drivers established. Also, PVA helps management to eliminate any nonvalue-added activities and thereby streamline operations and minimize costs. 5. The four general levels of activities are: 1. Unit-level activities, which are performed each time a unit is produced. 2. Batch-level activities, which are performed each time a batch of goods is handled or processed. 3. Product-level activities, which are performed as needed to support specific products. 4. Facility-level activities, which simply sustain a facility’s general manufacturing process. 6. First, activity-based costing increases the number of cost pools used to accumulate overhead costs. Second, it changes the base used to assign overhead costs to products. And third, it changes a manager’s perception of many overhead costs in that costs that were formerly thought to be indirect (such as depreciation or machine setup) are identified with specific activities and thereby are recognized as being traceable to individual products. 7. The two chief limitations are: First, the portion of overhead costs that relate to facility-level activities are still usually allocated to products on some arbitrary basis, such as machine-hours or direct labor-hours. Critics of activity-based costing argue that facility-level activities account for the bulk of all overhead costs in some companies. Second, high measurement costs are involved in operating an activity-based costing system. That is, the system requires the tracking of large amounts of detail and the completion of many separate computations in order to determine the cost of a unit or product. 13-166 Cost-Volume-Profit Relationships Chapter 13 8. Yes, activity-based costing can be used in service organizations. It has been successfully implemented, for example, in railroads, hospitals, banks and data service companies. 9. A resource driver is a measure of the quality of resources consumed by an activity. 10. An activity driver is a measure of frequency and intensity of demands placed on activities by cost objects. 11. Two-stage allocation is a procedure that first assigns a firm’s resource costs, namely factory overhead cost, to cost pools, and then to cost objects. 12. Two major advantages of ABM are: a. ABM measures the effectiveness of the key business processes and activities, and identifies how they can be improved to reduce costs and improve the customer value. b. ABM improves the management focus by allocating resources to key value-added activities, key customers, key products, and continuous improvement methods to maintain the firm’s competitive advantage. 13. When direct labor is used as an allocation base for overhead, it is implicitly assumed that overhead cost is directly proportional to direct labor. When cost systems were originally developed in the 1800s, this assumption may have been reasonably accurate. However, direct labor has declined in importance over the years while overhead has been increasing. This suggests that there is no longer a direct link between the level of direct labor and overhead. Indeed, when a company automates, direct labor is replaced by machines; a decrease in direct labor is accompanied by an increase in overhead. This violates the assumption that overhead cost is directly proportional to direct labor. Overhead cost appears to be driven by factors such as product diversity and complexity as well as by volume, for which direct labor has served as a convenient measure. 14. Employees may resist activity-based costing because it changes the “rules of the game.” ABC changes some of the key measures, such as product costs, used in making decisions and may affect how individuals are evaluated. Without top management support, employees may have little interest in making these changes. In addition, if top managers continue to make decisions based on the numbers generated by the traditional costing system, subordinates will quickly conclude that the activity-based costing system can be ignored. 13-167 Chapter 13 Cost-Volume-Profit Relationships 15. Unit-level activities are performed for each unit that is produced. Batchlevel activities are performed for each batch regardless of how many units are in the batch. Product-level activities must be carried out to support a product regardless of how many batches are run or units produced. Customer-level activities must be carried out to support customers regardless of what products or services they buy. Organization-sustaining activities are carried out regardless of the company’s precise product mix or mix of customers. 16. Organization-sustaining costs, customer-level costs, and the costs of idle capacity should not be assigned to products. These costs represent resources that are not consumed by the products. II. True or False 1. True 2. True 3. False 4. True 5. False 6. False 7. True 8. True III. Exercises Exercise 1 Activity Activity Classification Examples of Traceable Costs Labor cost; depreciation Examples of Cost Drivers a. Materials are moved from the receiving dock to product flow lines by a materialhandling crew Batch-level b. Direct labor workers assemble various products Unit-level Direct labor cost; indirect labor cost; labor benefits Direct laborhours c. Ongoing training is provided to all employees in the company Facility-level* Space cost; training costs; administration costs Hours of training time; number trained d. A product is designed by a specialized design team Product-level Space cost; supplies used; depreciation of design equipment Hours of design time; number of engineering change orders of equipment; space cost 13-168 Number of receipts; pounds handled Cost-Volume-Profit Relationships Chapter 13 e. Equipment setups are performed on a regular basis Batch-level Labor cost; supplies used; depreciation of equipment Number of setups; hours or setup time f. Numerical control (NC) machines are used to cut and shape materials Unit-level Power; supplies used; maintenance; depreciation Machinehours; number of units * Personnel administration and training costs might be traceable in part to the facility-level and in part to other activity centers at the unit-level, productlevel, and batch-level. Exercise 2 1. 2. 3. 4. 5. plantwide overhead rate volume two stage, stage, stage Process value analysis Unit-level 6. 7. 8. 9. 10. Batch-level Product-level Facility-level high-volume, low-volume, low-volume activity centers Exercise 3 a. b. c. d. e. f. g. h. Various individuals manage the parts inventories. A clerk in the factory issues purchase orders for a job. The personnel department trains new production workers. The factory’s general manager meets with other department heads such as marketing to coordinate plans. Direct labor workers assemble products. Engineers design new products. The materials storekeeper issues raw materials to be used in jobs. The maintenance department performs periodic preventative maintenance on general-use equipment. Product-level Batch-level Organizationsustaining Organizationsustaining Unit-level Product-level Batch-level Organizationsustaining Note: Some of these classifications are debatable and may depend on the specific circumstances found in particular companies. 13-169 Chapter 13 Cost-Volume-Profit Relationships Exercise 4 Sales (P1,650 per standard model glider × 10 standard model gliders + P2,300 per custom designed glider × 2 custom designed gliders)...................................................................................... P21,100 Costs: Direct materials (P462 per standard model glider × 10 standard model gliders + P576 per custom designed glider × 2 custom designed gliders)................................................. P5,772 Direct labor (P19 per direct labor-hour × 28.5 direct labor-hours per standard model glider × 10 standard model gliders + P19 per direct labor-hour × 32 direct labor-hours per custom designed glider × 2 custom designed gliders).............................................................................................. 6,631 Supporting manufacturing (P18 per direct labor-hour × 28.5 direct labor-hours per standard model glider × 10 standard model gliders + P18 per direct laborhour × 32 direct labor-hours per custom designed glider × 2 custom designed gliders)................................................................. 6,282 Order processing (P192 per order × 3 orders)..................................................... 576 Custom designing (P261 per custom design × 2 custom designs)............................................................................................................ 522 Customer service (P426 per customer × 1 customer)....................................................................................................... 426 20,209 Customer margin...................................................................................................... P 891 Exercise 5 Requirement 1 The predetermined overhead rate is computed as follows: Predetermined overhead rate = P290,000 50,000 DLHs = P5.80 per DLH The unit product costs under the company’s traditional costing system are computed as follows: Special Regular Direct materials................................................................................................................ P60.00 P45.00 Direct labor...................................................................................................................... 9.60 7.20 Manufacturing overhead (0.8 DLH × P5.80 per DLH; 0.6 DLH × P5.80 per DLH)........................................................................................ 4.64 3.48 Unit product cost.............................................................................................................. P74.24 P55.68 Requirement 2 13-170 Cost-Volume-Profit Relationships Chapter 13 The activity rates are computed as follows: (a) Estimated Overhead Activities Cost Supporting direct labor............................... P150,000 Batch setups............................................... P60,000 Safety testing.............................................. P80,000 (b) Total Expected Activity 50,000 DLHs 250 setups 100 tests (a) ÷ (b) Activity Rate P3 per DLH P240 per setup P800 per test Manufacturing overhead is assigned to the two products as follows: Special Product: (a) Activity Cost Pool Activity Rate Supporting direct labor.......................................................... P3 per DLH Batch setups.......................................................................... P240 per setup Safety testing......................................................................... P800 per test Total Regular (b) Activity 8,000 DLHs 200 setups 80 tests (a) × (b) ABC Cost P24,000 48,000 64,000 P136,000 (b) Activity 42,000 DLHs 50 setups 20 tests (a) × (b) ABC Cost P126,000 12,000 16,000 P154,000 Product: (a) Activity Cost Pool Activity Rate Supporting direct labor.......................................................... P3 per DLH Batch setups.......................................................................... P240 per setup Safety testing......................................................................... P800 per test Total Activity-based costing unit product costs are computed as follows: Special Direct materials................................................................................................... P60.00 Direct labor......................................................................................................... 9.60 Manufacturing overhead (P136,000 ÷ 10,000 units; P154,000 ÷ 70,000 units).................................................................................................. 13.60 Unit product cost................................................................................................. P83.20 Regular P45.00 7.20 2.20 P54.40 IV. Problems Problem 1 Cost Systems Traditional cost system Pool Rate 350% 13-171 Cost Driver Consumption P10,000 Cost Assignment P35,000 Chapter 13 Cost-Volume-Profit Relationships ABC system Labor Machining Setup Production order Material handling Parts administration 10% P25/hour P10/hour P100/order P20/requisition P40/part P10,000 800 hours 100 hours 12 orders 5 requisitions 18 parts P 1,000 20,000 1,000 1,200 100 720 P24,020 Problem 2 Requirement 1 (a) Total overhead = P200,000 + P32,000 + P100,000 + P120,000 = P452,000 Overhead rate = P452,000 / 50,000 direct labor hours = P9.04 per direct labor hour Overhead assigned to proposed job = P9.04 x 1,000 direct labor hours = P9,040 (b) Total cost of proposed job: Direct materials Direct labor 10,000 Overhead applied Total cost P 6,000 9,040 P25,040 (c) Company’s bid = Full manufacturing cost x 120% = P25,040 x 120% = P30,048 Requirement 2 (a) Maintenance : P200,000 / 20,000 Materials handling: P32,000 / 1,600 = Setups: P100,000 / 2,500 = Inspection: P120,000 / 4,000 = = P10 per machine hour P20 per move P40 per setup P30 per inspection Overhead assigned to proposed job: Maintenance (P10 x 500) P5,000 13-172 Cost-Volume-Profit Relationships Chapter 13 Material handling (P20 x 12) Setups (P40 x 2) Inspection (P30 x 10) Total overhead assigned to job 240 80 300 P5,620 (b) Total cost of proposed project: Direct materials Direct labor 10,000 Overhead applied Total cost P 6,000 5,620 P21,620 (c) Company’s bid = Full manufacturing cost x 120% = P21,620 x 120% = P25,944 The bid price of P25,944 was determined as follows: Direct materials Direct labor Overhead assigned: Maintenance (P10 x 500) Material handling (P20 x 12) Setups (P40 x 2) Inspections (P30 x 10) Total overhead assigned to job Total cost Markup Bid price P6,000 10,000 P5,000 240 80 300 5,620 P21,620 120% P25,944 Problem 3 (Activity-Based Costing) Requirement 1 The first-stage allocation of costs to the activity cost pools appears below: Assemblin g Units Manufacturing overhead Selling and administrative P250,000 30,000 Activity Cost Pools Processing Supporting Orders Customers Other P175,000 135,000 13-173 P25,000 75,000 P50,000 60,000 Total P500,000 300,000 Chapter 13 Cost-Volume-Profit Relationships overhead Total cost P280,000 P310,000 P100,000 P110,000 P800,000 Requirement 2 The activity rates for the cost pools are: (a) Total Cost P280,000 P310,000 P100,000 Assembling units Processing orders Supporting customers (b) Total Activity 1,000 units 250 orders 100 customers (a) (b) Activity Rate P280 per unit P1,240 per order P1,000 per customer Requirement 3 The overhead cost attributable to Lucky Sale would be computed as follows: (a) Activity Rate P280 per unit P1,240 per order P1,000 per customer Activity Cost Pools Assembling units Processing orders Supporting customers (b) Activity 80 units 4 orders 1 customer (a) x (b) ABC Cost P22,400 P4,960 P1,000 Requirement 4 The customer margin can be computed as follows: Sales (P595 per unit x 80 units) Costs: Direct materials (P180 per unit x 80 units) Direct labor (P50 per unit x 80 units) Unit-related overhead (above) Order-related overhead (above) Customer-related overhead (above) Customer margin P47,600 P14,400 4,000 22,400 4,960 1,000 P 46,760 840 Problem 4 (Activity-Based Costing as an Alternative to Traditional Product Costing) Requirement 1 a. When direct labor-hours are used to apply overhead cost to products, the company’s predetermined overhead rate would be: Predetermined overhead rate = = Manufacturing overhead cost Direct labor hours 13-174 P1,480,000 20,000 DLHs = P74 per DLH Cost-Volume-Profit Relationships Chapter 13 b. Model HY5 AS2 Direct materials...................................................................... P35.00 P25.00 Direct labor: P20 per hour × 0.2 DLH, 0.4 DLH.................................... 4.00 8.00 Manufacturing overhead: P74 per hour × 0.2 DLH, 0.4 DLH.................................... 14.80 29.60 Total unit product cost............................................................ P53.80 P62.60 Requirement 2 a. Predetermined overhead rates for the activity cost pools: (a) Estimated Activity Cost Pool Total Cost Machine setups.................P180,000 Special milling..................P300,000 General factory................. P1,000,000 (b) Estimated Total Activity 250 setups 1,000 MHs 20,000 DLHs (a) ÷ (b) Activity Rate P720 per setup P300 per MH P50 per DLH The overhead applied to each product can be determined as follows: Model HY5 (a) Predetermined Activity Cost Pool Overhead Rate Machine setups.................................................................................... P720 per setup Special milling..................................................................................... P300 per MH General factory.................................................................................... P50 per DLH Total manufacturing overhead cost (a)................................................ Number of units produced (b)............................................................. Overhead cost per unit (a) ÷ (b).......................................................... (b) Activity 150 setups 1,000 MHs 4,000 DLHs (a) × (b) Overhead Applied P108,000 300,000 200,000 P608,000 20,000 P30.40 Model AS2 (a) Predetermined Activity Cost Pool Overhead Rate Machine setups.................................................................................... P720 per setup 13-175 (b) Activity 100 setups (a) × (b) Overhead Applied P 72,000 Chapter 13 Cost-Volume-Profit Relationships Special milling..................................................................................... P300 per MH 0 MHs General factory.................................................................................... P50 per DLH 16,000 DLHs Total manufacturing overhead cost (a)................................................ Number of units produced (b)............................................................. Overhead cost per unit (a) ÷ (b).......................................................... 0 800,000 P872,000 40,000 P21.80 b. The unit product cost of each model under activitybased costing would be computed as follows: Model HY5 AS2 Direct materials........................................................................................................ P35.00 P25.00 Direct labor (P20 per DLH × 0.2 DLH; P20 per DLH × 04.DLH)........................... 4.00 8.00 Manufacturing overhead (above).............................................................................. 30.40 21.80 Total unit product cost.............................................................................................. P69.40 P54.80 Comparing these unit cost figures with the unit costs in Part 1(b), we find that the unit product cost for Model HY5 has increased from P53.80 to P69.40, and the unit product cost for Model AS2 has decreased from P62.60 to P54.80. Requirement 3 It is especially important to note that, even under activity-based costing, 68% of the company’s overhead costs continue to be applied to products on the basis of direct labor-hours: Machine setups (number of setups)............................P 180,000 Special milling (machine-hours)................................. 300,000 General factory (direct labor-hours)........................... 1,000,000 Total overhead cost.....................................................P1,480,000 12% 20 68 100% Thus, the shift in overhead cost from the high-volume product (Model AS2) to the low-volume product (Model HY5) occurred as a result of reassigning only 32% of the company’s overhead costs. The increase in unit product cost for Model HY5 can be explained as follows: First, where possible, overhead costs have been traced to the products rather than being lumped together and spread uniformly over production. Therefore, the special milling costs, which are traceable to Model HY5, have all been assigned to Model HY5 and none assigned to Model AS2 under the activity13-176 Cost-Volume-Profit Relationships Chapter 13 based costing approach. It is common in industry to have some products that require special handling or special milling of some type. This is especially true in modern factories that produce a variety of products. Activity-based costing provides a vehicle for assigning these costs to the appropriate products. Second, the costs associated with the batch-level activity (machine setups) have also been assigned to the specific products to which they relate. These costs have been assigned according to the number of setups completed for each product. However, since a batch-level activity is involved, another factor affecting unit costs comes into play. That factor is batch size. Some products are produced in large batches and some are produced in small batches. The smaller the batch, the higher the cost per unit of the batch activity. In the case at hand, the data can be analyzed as shown below. Model HY5: Cost to complete one setup [see 2(a)]......................................... P720 Number of units processed per setup (20,000 units ÷ 150 setups)...................................................133.33 Setup cost per unit (a) ÷ (b)....................................................... P5.40 Model AS2: Cost to complete one setup (above)............................................ P720 Number of units processed per setup (40,000 units ÷ 100 setups)................................................... 400 Setup cost per unit (a) ÷ (b)....................................................... P1.80 (a) (b) (a) (b) Thus, the cost per unit for setups is three times as great for Model HY5, the low-volume product, as it is for Model AS2, the high-volume product. Such differences in cost are obscured when direct labor-hours (or any other volume measure) is used as the basis for applying overhead cost to products. In sum, overhead cost has shifted from the high-volume product to the lowvolume product as a result of more appropriately assigning some costs to the products on the basis of the activities involved, rather than on the basis of direct labor-hours. V. Multiple Choice Questions 1. 2. 3. 4. A D C B 11. 12. 13. 14. B D C A 21. 21. 22. 23. D A B A 13-177 Chapter 13 Cost-Volume-Profit Relationships 5. 6. 7. 8. 9. 10. A D A B D C 15. 16. 17. 18. 19. 20. C D D C B A 24. 25. 26. 27. 28. 29. B D B C A C CHAPTER 12 VARIABLE COSTING I. Questions 1. The variable costing technique does not consider fixed costs as unimportant or irrelevant, but it maintains that the distinction between behaviors of different costs is crucial for certain decisions. 2. The central issue in variable costing is what is the proper timing for release of fixed manufacturing overhead as expense: at the time of incurrence, or at the time the finished units to which the fixed overhead relates are sold. 3. Direct costing would be more accurately called variable or marginal costing because in substance it is the inventory costing method which applies only variable production costs to product; fixed factory overhead is not assigned to product. 4. Marketing and administrative costs are treated as period costs under both variable costing and absorption costing methods of product costing. 5. Under absorption costing, as a company manufactures units of product, the fixed manufacturing overhead costs of the period are added to the units, along with direct materials, direct labor, and variable manufacturing overhead. If some of these units are not sold by the end of the period, then they are carried into the next period as inventory. The fixed manufacturing overhead cost attached to the units in ending inventory follow the units into the next period as part of their inventory cost. When the units carried over as inventory are finally sold, the fixed manufacturing overhead cost that has been carried over with the units is included as part of that period’s cost of goods sold. 13-178 Cost-Volume-Profit Relationships Chapter 13 6. Many accountants and managers believe absorption costing does a better job of matching costs with revenues than variable costing. They argue that all manufacturing costs must be assigned to products to properly match the costs of producing units of product with the revenues from the units when they are sold. They believe that the fixed costs of depreciation, taxes, insurance, supervisory salaries, and so on, are just as essential to manufacturing products as are the variable costs. 7. If fixed manufacturing overhead cost is released from inventory, then inventory levels must have decreased and therefore production must have been less than sales. 8. Under absorption costing it is possible to increase net operating income without increasing sales by increasing the level of production. If production exceeds sales, units of product are added to inventory. These units carry a portion of the current period’s fixed manufacturing overhead costs into the inventory account, thereby reducing the current period’s reported expenses and causing net operating income to rise. 9. Generally speaking, variable costing cannot be used externally for financial reporting purposes nor can it be used for tax purposes. 10. If production exceeds sales, absorption costing will show higher net operating income than variable costing. The reason is that inventories will increase and therefore part of the fixed manufacturing overhead cost of the current period will be deferred in inventory to the next period under absorption costing. By contrast, all of the fixed manufacturing overhead cost of the current period will be charged immediately against revenues as a period cost under variable costing. 11. Absorption and variable costing differ in how they handle fixed manufacturing overhead. Under absorption costing, fixed manufacturing overhead is treated as a product cost and hence is an asset until products are sold. Under variable costing, fixed manufacturing overhead is treated as a period cost and is expensed on the current period’s income statement. 12. Advocates of variable costing argue that fixed manufacturing costs are not really the cost of any particular unit of product. If a unit is made or not, the total fixed manufacturing costs will be exactly the same. Therefore, how can one say that these costs are part of the costs of the products? These costs are incurred to have the capacity to make products during a particular period and should be charged against that period as period costs according to the matching principle. 13-179 Chapter 13 Cost-Volume-Profit Relationships II. Exercises Exercise 1 (Variable and Absorption Costing Unit Product Costs and Income Statements) Requirement 1 a. The unit product cost under absorption costing would be: Direct materials.......................................................................... Direct labor................................................................................. Variable manufacturing overhead................................................ Total variable manufacturing costs............................................. Fixed manufacturing overhead (P160,000 ÷ 20,000 units).......... Unit product cost........................................................................ P18 7 2 27 8 P35 b. The absorption costing income statement: Sales (16,000 units × P50 per unit)........................ Less cost of goods sold: Beginning inventory........................................... Add cost of goods manufactured (20,000 units × P35 per unit)......................... Goods available for sale..................................... Less ending inventory (4,000 units × P35 per unit)........................... Gross margin.......................................................... Less selling and administrative expenses................ Net operating income............................................. P800,000 P 0 700,000 700,000 140,000 560,000 240,000 190,000* P 50,000 *(16,000 units × P5 per unit) + P110,000 = P190,000. Requirement 2 a. The unit product cost under variable costing would be: Direct materials............................................................................... Direct labor..................................................................................... Variable manufacturing overhead..................................................... Unit product cost............................................................................. b. The variable costing income statement: 13-180 P18 7 2 P27 Cost-Volume-Profit Relationships Chapter 13 Sales (16,000 units × P50 per unit)...................... Less variable expenses: Variable cost of goods sold: Beginning inventory...................................... Add variable manufacturing costs (20,000 units × P27 per unit).................... Goods available for sale................................ Less ending inventory (4,000 units × P27 per unit)...................... Variable cost of goods sold............................... Variable selling expense (16,000 units × P5 per unit).......................... Contribution margin............................................. Less fixed expenses: Fixed manufacturing overhead.......................... Fixed selling and administrative........................ Net operating income............................................ P800,000 P 0 540,000 540,000 108,000 432,000 * 80,000 160,000 110,000 512,000 288,000 270,000 P 18,000 * The variable cost of goods sold could be computed more simply as: 16,000 units × P27 per unit = P432,000. Exercise 2 (Variable and Absorption Costing Unit Product Costs) Requirement 1 Sales (40,000 units × P33.75 per unit).................................... P1,350,000 Less variable expenses: Variable cost of goods sold (40,000 units × P16 per unit*)......................................... P640,000 Variable selling and administrative expenses (40,000 units × P3 per unit)............................................. 120,000 760,000 Contribution margin................................................................ 590,000 Less fixed expenses: Fixed manufacturing overhead............................................. 250,000 Fixed selling and administrative expenses............................ 300,000 550,000 Net operating income............................................................... P 40,000 *Direct materials....................................................................................................... P10 Direct labor............................................................................................................. 4 Variable manufacturing overhead............................................................................. 2 Total variable manufacturing cost............................................................................ P16 Requirement 2 13-181 Chapter 13 Cost-Volume-Profit Relationships The difference in net operating income can be explained by the P50,000 in fixed manufacturing overhead deferred in inventory under the absorption costing method: Variable costing net operating income.......................................... Add: Fixed manufacturing overhead cost deferred in inventory under absorption costing: 10,000 units × P5 per unit in fixed manufacturing overhead cost............................................ Absorption costing net operating income...................................... P40,000 50,000 P90,000 Exercise 3 (Variable Costing Unit Product Cost and Income Statement; Break-even) Requirement 1 Under variable costing, only the variable manufacturing costs are included in product costs. Direct materials............................................................................ Direct labor.................................................................................. Variable manufacturing overhead................................................. Unit product cost.......................................................................... P 600 300 100 P1,000 Note that selling and administrative expenses are not treated as product costs; that is, they are not included in the costs that are inventoried. These expenses are always treated as period costs and are charged against the current period’s revenue. Requirement 2 The variable costing income statement appears below: Sales....................................................................... P18,000,000 Less variable expenses: Variable cost of goods sold: Beginning inventory....................................... P 0 Add variable manufacturing costs (10,000 units × P1,000 per unit)................. 10,000,000 Goods available for sale................................. 10,000,000 Less ending inventory (1,000 units × P1,000 1,000,000 13-182 Cost-Volume-Profit Relationships Chapter 13 per unit)................................................... Variable cost of goods sold*................................ Variable selling and administrative (9,000 units × P200 per unit)..................................................... Contribution margin................................................ Less fixed expenses: Fixed manufacturing overhead................................ Fixed selling and administrative.............................. Net operating loss.................................................... 9,000,000 1,800,000 10,800,000 7,200,000 3,000,000 4,500,000 7,500,000 P (300,000) * The variable cost of goods sold could be computed more simply as: 9,000 units sold × P1,000 per unit = P9,000,000. Requirement 3 The break-even point in units sold can be computed using the contribution margin per unit as follows: Selling price per unit................................................................................................ P2,000 Variable cost per unit............................................................................................... 1,200 Contribution margin per unit................................................................................... P 800 Fixed expenses Unit contribution margin Exercise 4 (Absorption Break-even unit Costing sales Unit = Product Cost and Income Statement) Requirement 1 = P7,500,000 P800 per unit = 9,375 units Under absorption costing, all manufacturing costs (variable and fixed) are included in product costs. Direct materials................................................................. Direct labor....................................................................... Variable manufacturing overhead...................................... Fixed manufacturing overhead (P3,000,000 ÷ 10,000 units).......................................... Unit product cost............................................................... P 600 300 100 300 P1,300 Requirement 2 The absorption costing income statement appears below: Sales (9,000 units × P2,000 per unit)................................... 13-183 P18,000,000 Chapter 13 Cost-Volume-Profit Relationships Cost of goods sold: Beginning inventory......................................................... P 0 Add cost of goods manufactured (10,000 units × P1,300 per unit).................................. 13,000,000 Goods available for sale................................................... 13,000,000 Less ending inventory (1,000 units × P1,300 per unit).................................... 1,300,000 Gross margin........................................................................ Selling and administrative expenses: Variable selling and administrative (9,000 units × P200 per unit)........................................................... 1,800,000 Fixed selling and administrative....................................... 4,500,000 Net operating income........................................................... 11,700,000 6,300,000 P 6,300,000 0 Note: The company apparently has exactly zero net operating income even though its sales are below the break-even point computed in Exercise 3. This occurs because P300,000 of fixed manufacturing overhead has been deferred in inventory and does not appear on the income statement prepared using absorption costing. Exercise 5 (Variable Costing Income Statement; Explanation of Difference in Net Operating Income) Requirement 1 2,000 units × P60 per unit fixed manufacturing overhead = P120,000 Requirement 2 The variable costing income statement appears below: Sales.............................................................................. P4,000,000 Variable expenses: Variable cost of goods sold: Beginning inventory............................................... P 0 Add variable manufacturing costs (10,000 units × P310 per unit)........................3,100,000 Goods available for sale.........................................3,100,000 Less ending inventory (2,000 units × P310 per unit)............................. 620,000 Variable cost of goods sold*.......................................2,480,000 13-184 Cost-Volume-Profit Relationships Chapter 13 Variable selling and administrative (8,000 units × P20 per unit)................................... 160,000 2,640,000 Contribution margin....................................................... 1,360,000 Fixed expenses: Fixed manufacturing overhead................................... 600,000 Fixed selling and administrative................................. 400,000 1,000,000 Net operating income..................................................... P 360,000 * The variable cost of goods sold could be computed more simply as: 8,000 units sold × P310 per unit = P2,480,000. The difference in net operating income between variable and absorption costing can be explained by the deferral of fixed manufacturing overhead cost in inventory that has taken place under the absorption costing approach. Note from part (1) that P120,000 of fixed manufacturing overhead cost has been deferred in inventory to the next period. Thus, net operating income under the absorption costing approach is P120,000 higher than it is under variable costing. Exercise 6 (Evaluating Absorption and Variable Costing as Alternative Costing Methods) Requirement 1 a. By assumption, the unit selling price, unit variable costs, and total fixed costs are constant from year to year. Consequently, variable costing net operating income will vary with sales. If sales increase, variable costing net operating income will increase. If sales decrease, variable costing net operating income will decrease. If sales are constant, variable costing net operating income will be constant. Because variable costing net operating income was P16,847 each year, unit sales must have been the same in each year. The same is not true of absorption costing net operating income. Sales and absorption costing net operating income do not necessarily move in the same direction because changes in inventories also affect absorption costing net operating income. b. When variable costing net operating income exceeds absorption costing net operating income, sales exceeds production. Inventories shrink and fixed manufacturing overhead costs are released from inventories. In contrast, when variable costing net operating income is less than absorption costing net operating income, production exceeds sales. Inventories grow and fixed manufacturing overhead costs are deferred in 13-185 Chapter 13 Cost-Volume-Profit Relationships inventories. The year-by-year effects are shown below. Year 1 Variable costing NOI = Absorption costing NOI Production = Sales Inventories remain the same Year 2 Variable costing NOI < Absorption costing NOI Production > Sales Year 3 Variable costing NOI > Absorption costing NOI Production < Sales Inventories grow Inventories shrink Requirement 2 a. As discussed in part (1 a) above, unit sales and variable costing net operating income move in the same direction when unit selling prices and the cost structure are constant. Because variable costing net operating income declined, unit sales must have also declined. This is true even though the absorption costing net operating income increased. How can that be? By manipulating production (and inventories) it may be possible to maintain or increase the level of absorption costing net operating income even though unit sales decline. However, eventually inventories will grow to be so large that they cannot be ignored. b. As stated in part (1 b) above, when variable costing net operating income is less than absorption costing net operating income, production exceeds sales. Inventories grow and fixed manufacturing overhead costs are deferred in inventories. The year-by-year effects are shown below. Year 1 Variable costing NOI = Absorption costing NOI Production = Sales Inventories remain the same Year 2 Variable costing NOI < Absorption costing NOI Production > Sales Year 3 Variable costing NOI < Absorption costing NOI Production > Sales Inventories grow Inventories grow Requirement 3 Variable costing appears to provide a much better picture of economic reality than absorption costing in the examples above. In the first case, absorption costing net operating income fluctuates wildly even though unit sales are the same each year and unit selling prices, unit variable costs, and total fixed costs remain the same. In the second case, absorption costing net operating income increases from year to year even though unit sales decline. Absorption 13-186 Cost-Volume-Profit Relationships Chapter 13 costing is much more subject to manipulation than variable costing. Simply by changing production levels (and thereby deferring or releasing costs from inventory) absorption costing net operating income can be manipulated upward or downward. Note: This exercise is based on the following data: Common data: Annual fixed manufacturing costs............................... Contribution margin per unit...................................... Annual fixed SGA costs............................................... P153,153 P35,000 P180,000 Part 1: Year 1 Beginning inventory............................................................. 1 Production............................................................................. 10 Sales...................................................................................... 10 Ending................................................................................... 1 Year 2 1 11 10 2 Year 3 2 9 10 1 Variable costing net operating income.................................P16,84 7 P16,84 7 P16,84 7 Fixed manufacturing overhead in beginning P15,31 inventory*...................................................................... 5 Fixed manufacturing overhead in ending inventory............P15,31 5 Absorption costing net operating income............................P16,84 7 P15,31 5 P27,84 6 P29,37 8 P27,84 6 P17,01 7 P6,018 * Fixed manufacturing overhead in beginning inventory is assumed in both parts 1 and 2 for Year 1. A FIFO inventory flow assumption is used. Part 2: Year 1 Beginning inventory................................................... 1 Production.................................................................. 10 Sales........................................................................... 10 Ending........................................................................ 1 Year 2 1 12 9 4 4 20 8 16 Variable costing net operating income (loss)............ P16,847 (P18,153 ) (P53,153) Fixed manufacturing overhead in beginning inventory*...........................................................P15,315 P15,315 P51,051 13-187 Year 3 Chapter 13 Cost-Volume-Profit Relationships Fixed manufacturing overhead in ending inventory.............................................................P15,315 Absorption costing net operating income.................P16,847 P51,051 P17,583 P122,522 P18,318 * Fixed manufacturing overhead in beginning inventory is assumed in both parts 1 and 2 for Year 1. A FIFO inventory flow assumption is used. III. Problems Problem 1 Requirement 1: Variable Costing Method Romero Parts, Inc. Income Statement - Manufacturing For the Year Ended December 31, 2005 Sales Less: Variable Cost of Sales Inventory, Jan. 1 Current Production Total Available for Sale Inventory, Dec. 31 Contribution Margin Less Fixed Costs and Expenses Net Income P20,700,000 P1,155,000 7,700,000 P8,855,000 805,000 8,050,000 P12,650,000 6,000,000 P 6,650,000 Requirement 2: Absorption Costing Method Romero Parts, Inc. Income Statement - Manufacturing For the Year Ending December 31, 2006 Sales Less Cost of goods sold: Inventory, Jan. 1 Current Production Total Available for Sale Inventory, Dec. 31 Cost of Sales - Standard Favorable Capacity Variance Income from Manufacturing 13-188 P26,100,000 P 1,380,000 16,100,000 P17,480,000 747,500 P16,732,500 900,000 15,832,500 P10,267,500 Cost-Volume-Profit Relationships Chapter 13 Requirement 3: Variable Costing Method Romero Parts, Inc. Income Statement - Manufacturing For the Year Ending December 31, 2006 Sales Less Variable Cost of Sales: Inventory, Jan. 1 Production Total Available for Sale Inventory, Dec. 31 Contribution Margin - Manufacturing Less Fixed Cost Income from Manufacturing P26,100,000 P 805,000 9,800,000 P10,605,000 455,000 10,150,000 P15,950,000 5,400,000 P10,550,000 Reconciliation Net Income, absorption costing Add Fixed Factory Overhead Inventory, 1/1 Total Less Fixed Factory Overhead Inventory, 12/31 Net Income, direct costing P10,267,500 575,000 P10,842,500 292,500 P10,550,000 Problem 2 Requirement 1 Honey Company Income Statement - Direct Costing For the Year Ended December 31, 2005 Sales Less Variable Cost of Sales: Finished Goods Inventory, 1/1 Current Production Total Available for Sale Finished Goods Inventory, 12/31 Variable Cost of Sale - Standard Unfavorable Variance 13-189 P280,000 P 4,000 120,000 P124,000 12,000 P112,000 5,000 117,000 Chapter 13 Cost-Volume-Profit Relationships Contribution Margin - Manufacturing Less Variable Marketing Expenses Contribution Margin - Final Less Fixed Costs and Expenses: Fixed Factory Overhead Fixed Marketing and Administrative Expenses Net Income P163,000 28,000 P135,000 P 54,000 20,000 74,000 P 61,000 Requirement 2 Honey Company Income Statement - Absorption Costing For the Year Ended December 31, 2005 Sales P280,000 Less: Cost of Sales Finished goods inventory, Jan. 1 (1,000 x P5.50) Current production costs Variable (30,000 x P4.00) P120,000 Fixed (30,000 x P1.50) 45,000 Less: Finished goods inventory, Dec. 31 (3,000 x P5.50) Cost of Sales - at Standard Add (Deduct) Variance Unfavorable variable manufacturing costs variances Underapplied fixed factory overhead (6,000 x P1.50) Cost of Sales - Actual Gross Profit Less: Selling and administrative expenses Variable Fixed Net Income Problem 3 (Variable Costing Income Statement; Reconciliation) Requirement 1 13-190 P 5,500 165,000 P170,500 16,500 P154,000 5,000 9,000 P168,000 P112,000 28,000 20,000 P 48,000 P 64,000 Cost-Volume-Profit Relationships Chapter 13 The unit product cost under the variable costing approach would be computed as follows: Direct materials....................................................................................................... P 8 Direct labor............................................................................................................. 10 Variable manufacturing overhead............................................................................. 2 Unit product cost..................................................................................................... P20 With this figure, the variable costing income statements can be prepared: Year 1 Year 2 Sales........................................................................................................................ P1,000,000 P1,500,000 Less variable expenses: Variable cost of goods sold @ P20 per unit.......................................................... 400,000 600,000 Variable selling and administrative @ P3 per unit................................................................................................... 60,000 90,000 Total variable expenses............................................................................................ 460,000 690,000 Contribution margin................................................................................................ 540,000 810,000 Less fixed expenses: Fixed manufacturing overhead............................................................................. 350,000 350,000 Fixed selling and administrative........................................................................... 250,000 250,000 Total fixed expenses................................................................................................ 600,000 600,000 Net operating income (loss)..................................................................................... P (60,000) P 210,000 Requirement 2 Variable costing net operating income (loss)................. P (60,000) P 210,000 Add: Fixed manufacturing overhead cost deferred in inventory under absorption costing (5,000 units × P14 per unit)................................................ 70,000 Deduct: Fixed manufacturing overhead cost released from inventory under absorption costing (5,000 units × P14 per unit)........................ (70,000) Absorption costing net operating income...................... P 10,000 P 140,000 Problem 4 (Prepare and Interpret Statements; Changes in Both Sales and Production; JIT) Requirement 1 Year 1 P1,000,000 Sales Less variable expenses: 13-191 Year 2 Year 3 P 800,000 P1,000,000 Chapter 13 Cost-Volume-Profit Relationships Variable cost of goods sold @ P4 per unit Variable selling and administrative @ P2 per unit Total variable expenses Contribution margin Less fixed expenses: Fixed manufacturing overhead Fixed selling and administrative Total fixed expenses Net operating income (loss) 200,000 160,000 200,000 100,000 300,000 700,000 80,000 240,000 560,000 100,000 300,000 700,000 600,000 70,000 670,000 P 30,000 600,000 600,000 70,000 70,000 670,000 670,000 P(110,000) P 30,000 Requirement 2 a. Year 1 P 4 Variable manufacturing cost Fixed manufacturing cost: P600,000 ÷ 50,000 units P600,000 ÷ 60,000 units P600,000 ÷ 40,000 units Unit product cost Year 2 P 4 Year 3 P 4 12 10 P16 P14 15 P19 b. Variable costing net operating income (loss) Add (Deduct): Fixed manufacturing overhead cost deferred in inventory from Year 2 to Year 3 under absorption costing (20,000 units × P10 per unit) Add: Fixed manufacturing overhead cost deferred in inventory from Year 3 to the future under absorption costing (10,000 units × P15 per unit) P30,000 P(110,000) 200,000 P 30,000 (200,000) 150,000 Absorption costing net operating income (loss) P30,000 P 90,000 P(20,000) Requirement 3 Production went up sharply in Year 2 thereby reducing the unit product cost, as shown in (2a). This reduction in cost, combined with the large amount of 13-192 Cost-Volume-Profit Relationships Chapter 13 fixed manufacturing overhead cost deferred in inventory for the year, more than offset the loss of revenue. The net result is that the company’s net operating income rose even though sales were down. Requirement 4 The fixed manufacturing overhead cost deferred in inventory from Year 2 was charged against Year 3 operations, as shown in the reconciliation in (2b). This added charge against Year 3 operations was offset somewhat by the fact that part of Year 3’s fixed manufacturing overhead costs was deferred in inventory to future years [again see (2b)]. Overall, the added costs charged against Year 3 were greater than the costs deferred to future years, so the company reported less income for the year even though the same number of units was sold as in Year 1. Requirement 5 a. Several things would have been different if the company had been using JIT inventory methods. First, in each year production would have been geared to sales so that little or no inventory of finished goods would have been built up in either Year 2 or Year 3. Second, unit product costs probably would have been the same in all three years, since these costs would have been established on the basis of expected sales (50,000 units) for each year. Third, since only 40,000 units were sold in Year 2, the company would have produced only that number of units and therefore would have had some underapplied overhead cost for the year. (See the discussion on underapplied overhead in the following paragraph.) b. If JIT had been in use, the net operating income under absorption costing would have been the same as under variable costing in all three years. The reason is that with production geared to sales, there would have been no ending inventory on hand, and therefore there would have been no fixed manufacturing overhead costs deferred in inventory to other years. Assuming that the company expected to sell 50,000 units in each year and that unit product costs were set on the basis of that level of expected activity, the income statements under absorption costing would have appeared as follows: Year 1 P1,000,000 Sales Less cost of goods sold: 13-193 Year 2 Year 3 P 800,000 P1,000,000 Chapter 13 Cost-Volume-Profit Relationships Cost of goods manufactured @ P16 per unit Add underapplied overhead Cost of goods sold Gross margin Selling and administrative expenses Net operating income (loss) 800,000 800,000 200,000 170,000 P 30,000 640,000 * 120,000 ** 760,000 40,000 150,000 P(110,000) P 800,000 800,000 200,000 170,000 30,000 * 40,000 units × P16 per unit = P640,000. ** 10,000 units not produced × P12 per unit fixed manufacturing overhead cost = P120,000 fixed manufacturing overhead cost not applied to products. Problem 5 (Contrasting Variable and Absorption Costing) Requirement 1 (a) Under absorption costing, all manufacturing costs, variable and fixed, are included in unit product costs: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead (P120,000 10,000 units) (P120,000 6,000 units) Unit product cost Year 1 P11 6 3 Year 2 P11 6 3 12 20 P40 P32 Requirement 1 (b) The absorption costing income statements follow: Year 1 Sales (8,000 units x P50 per unit) Cost of goods sold: Beginning inventory Year 2 P400,00 0 P 0 P400,00 0 P 64,000 13-194 Cost-Volume-Profit Relationships Chapter 13 Add cost of goods manufactur ed (10,000 units x P32 per unit; 6,000 units x P40 per unit) Goods available for sale Less ending inventory (2,000 units x P32 per unit; 0 units x P40 per unit) Gross margin Selling and administrativ e expenses (8,000 units x P4 per unit + P70,000) Net operating income 320,0 00 240,00 0 320,00 0 304,00 0 64,00 0 256,00 0 144,000 102,00 0 P 42,000 Requirement 2 (a) 13-195 0 304,00 0 96,000 102,00 0 P (6,000) Chapter 13 Cost-Volume-Profit Relationships Under variable costing, only the variable manufacturing costs are included in unit product costs: Year 1 P11 6 3 P20 Direct materials Direct labor Variable manufacturing overhead Unit product cost Year 2 P11 6 3 P20 Requirement 2 (b) The variable costing income statements follow. Notice that the variable cost of goods sold is computed in a simpler, more direct manner than in the examples provided earlier. On a variable costing income statement, this simple approach or the more complex approach illustrated earlier is acceptable for computing the cost of goods sold. Year 1 Sales (8,000 units x P50 per unit) Variable expenses: Variable cost of goods sold (8,000 units x P20 per unit) Variable selling and administrati ve (8,000 units x P4 per unit) Year 2 P400,00 0 P160,00 0 32,00 0 13-196 P400,00 0 P160,00 0 192,00 0 32,00 0 192,00 0 Cost-Volume-Profit Relationships Chapter 13 Contribution margin Fixed expenses: Fixed manufacturin g overhead Fixed selling and administrati ve expenses Net operating income 208,000 120,000 70,00 0 208,000 120,000 190,00 0 P 18,000 70,00 0 190,00 0 P 18,000 Requirement 3 The reconciliation of the variable and absorption costing net operating incomes follows: Variable costing net operating income Add fixed manufacturing overhead costs deferred in inventory under absorption costing (2,000 units x P12 per unit) Deduct fixed manufacturing overhead costs released from inventory under absorption costing (2,000 units x P12 per unit) Absorption costing net operating income Year 1 P18,000 Year 2 P18,000 24,000 P42,000 (24,000) P(6,000) Problem 6 (Variable Costing Income Statement; Reconciliation) Requirement 1 Sales (40,000 units × P33.75 per unit).......................................... P1,350,000 Variable expenses: Variable cost of goods sold (40,000 units × P16 per unit*)............................................... P640,000 13-197 Chapter 13 Cost-Volume-Profit Relationships Variable selling and administrative expenses (40,000 units × P3 per unit)................................................... 120,000 Contribution margin...................................................................... 760,000 590,000 Fixed expenses: Fixed manufacturing overhead................................................... 250,000 Fixed selling and administrative expenses.................................. 300,000 550,000 Net operating income..................................................................... P 40,000 * Direct materials........................................................ Direct labor.............................................................. Variable manufacturing overhead.............................. Total variable manufacturing cost............................. P10 4 2 P16 Requirement 2 The difference in net operating income can be explained by the P50,000 in fixed manufacturing overhead deferred in inventory under the absorption costing method: Variable costing net operating income.................................................................. P40,000 Add: Fixed manufacturing overhead cost deferred in inventory under absorption costing: 10,000 units × P5 per unit in fixed manufacturing overhead cost............................................................................ 50,000 Absorption costing net operating income.............................................................. P90,000 IV. Multiple Choice Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. D B B B B C A B A A 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. B A C D B A C C B C 13-198 Cost-Volume-Profit Relationships Chapter 13 CHAPTER 13 COST-VOLUME-PROFIT RELATIONSHIPS I. Questions 1. The total “contribution margin” is the excess of total revenue over total variable costs. The unit contribution margin is the excess of the unit price over the unit variable costs. 2. Total contribution margin: Selling price - manufacturing variable costs expensed - nonmanufacturing variable costs expensed = Total contribution margin. Gross margin: Selling price - variable manufacturing costs expensed - fixed manufacturing costs expensed = Gross margin. 3. A company operating at “break-even” is probably not covering costs which are not recorded in the accounting records. An example of such a cost is the opportunity cost of owner-invested capital. In some small businesses, owner-managers may not take a salary as large as the opportunity cost of forgone alternative employment. Hence, the opportunity cost of owner labor may be excluded. 4. In the short-run, without considering asset replacement, net operating cash flows would be expected to exceed net income, because the latter includes depreciation expense, while the former does not. Thus, the cash basis break-even would be lower than the accrual break-even if asset replacement is ignored. However, if asset replacement costs are taken into account, (i.e., on a “cradle to grave” basis), the long-run net cash flows equal long-run accrual net income, and the long-run break-even points are the same. 5. Both unit price and unit variable costs are expressed on a per product basis, as: = (P1 - V1) X1 + (P2 - V2) X2 + + (Pn - Vn) Xn - F, for all products 1 to n where: P = = operating profit, average unit selling price, 13-199 Chapter 13 Cost-Volume-Profit Relationships V = X = F = average unit variable cost, quantity of units, total fixed costs for the period. 6. If the relative proportions of products (i.e., the product “mix”) is not held constant, products may be substituted for each other. Thus, there may be almost an infinite number of ways to achieve a target operating profit. As shown from the multiple product profit equation, there are several unknowns for one equation: = (P1 - V1) X1 + (P2 - V2) X2 + + (Pn - Vn) Xn - F, for all products 1 to n. 7. A constant product mix is assumed to simplify the analysis. Otherwise, there may be no unique solution. 8. Operating leverage measures the impact on net operating income of a given percentage change in sales. The degree of operating leverage at a given level of sales is computed by dividing the contribution margin at that level of sales by the net operating income. 9. Three approaches to break-even analysis are (a) the equation method, (b) the contribution margin method, and (c) the graphical method. In the equation method, the equation is: Sales = Variable expenses + Fixed expenses + Profits, where profits are zero at the break-even point. The equation is solved to determine the break-even point in units or peso sales. 10. The margin of safety is the excess of budgeted (or actual) sales over the break-even volume of sales. It states the amount by which sales can drop before losses begin to be incurred. 11. The sales mix is the relative proportions in which a company’s products are sold. The usual assumption in cost-volume-profit analysis is that the sales mix will not change. 12. A higher break-even point and a lower net operating income could result if the sales mix shifted from high contribution margin products to low contribution margin products. Such a shift would cause the average contribution margin ratio in the company to decline, resulting in less total contribution margin for a given amount of sales. Thus, net operating income would decline. With a lower contribution margin ratio, the breakeven point would be higher since it would require more sales to cover the same amount of fixed costs. 13. The contribution margin (CM) ratio is the ratio of the total contribution margin to total sales revenue. It can be used in a variety of ways. For example, the change in total contribution margin from a given change in 13-200 Cost-Volume-Profit Relationships Chapter 13 total sales revenue can be estimated by multiplying the change in total sales revenue by the CM ratio. If fixed costs do not change, then a peso increase in contribution margin will result in a peso increase in net operating income. The CM ratio can also be used in break-even analysis. Therefore, knowledge of a product’s CM ratio is extremely helpful in forecasting contribution margin and net operating income. 14. Incremental analysis focuses on the changes in revenues and costs that will result from a particular action. 15. All other things equal, Company B, with its higher fixed costs and lower variable costs, will have a higher contribution margin ratio than Company A. Therefore, it will tend to realize a larger increase in contribution margin and in profits when sales increase. 16. (a) If the selling price decreased, then the total revenue line would rise less steeply, and the break-even point would occur at a higher unit volume. (b) If the fixed cost increased, then both the fixed cost line and the total cost line would shift upward and the break-even point would occur at a higher unit volume. (c) If the variable cost increased, then the total cost line would rise more steeply and the break-even point would occur at a higher unit volume. II. Exercises Exercise 1 (Using a Contribution Format Income Statement) Requirement 1 Total Per Unit Sales (30,000 units × 1.15 = 34,500 units).............................................................. P172,500 P5.00 Less variable expenses............................................................................................. 103,500 3.00 Contribution margin................................................................................................ 69,000 P2.00 Less fixed expenses................................................................................................. 50,000 Net operating income............................................................................................... P 19,000 Requirement 2 Sales (30,000 units × 1.20 = 36,000 units).............................................................. P162,000 P4.50 Less variable expenses............................................................................................. 108,000 3.00 Contribution margin................................................................................................ 54,000 P1.50 Less fixed expenses................................................................................................. 50,000 Net operating income............................................................................................... P 4,000 13-201 Chapter 13 Cost-Volume-Profit Relationships Requirement 3 Sales (30,000 units × 0.95 = 28,500 units).............................................................. P156,750 P5.50 Less variable expenses............................................................................................. 85,500 3.00 Contribution margin................................................................................................ 71,250 P2.50 Less fixed expenses (P50,000 + P10,000)............................................................... 60,000 Net operating income............................................................................................... P 11,250 Requirement 4 Sales (30,000 units × 0.90 = 27,000 units).............................................................. P151,200 P5.60 Less variable expenses............................................................................................. 86,400 3.20 Contribution margin................................................................................................ 64,800 P2.40 Less fixed expenses................................................................................................. 50,000 Net operating income............................................................................................... P 14,800 Exercise 2 (Break-even Analysis and CVP Graphing) Requirement 1 The contribution margin per person would be: Price per ticket......................................................................................................... P30 Less variable expenses: Dinner.................................................................................................................. P7 Favors and program............................................................................................. 3 10 Contribution margin per person............................................................................... P20 The fixed expenses of the Extravaganza total P8,000; therefore, the breakeven point would be computed as follows: Sales = Variable expenses + Fixed expense + Profits P30Q P20Q Q Q = = = = P10Q + P8,000 + P0 P8,000 P8,000 ÷ P20 per person 400 persons; or, at P30 per person, P12,000 Alternative solution: 13-202 Cost-Volume-Profit Relationships Chapter 13 Break-even point in unit sales = Fixed expenses Unit contribution margin = P8,000 P20 per person = 400 persons or, at P30 per person, P12,000. Requirement 2 Variable cost per person (P7 + P3).......................................................................... P10 Fixed cost per person (P8,000 ÷ 250 persons)......................................................... 32 Ticket price per person to break even....................................................................... P42 Requirement 3 Cost-volume-profit graph: 13-203 Chapter 13 Cost-Volume-Profit Relationships Total Sales Break-even point: 400 persons, or P12,000 in sales Total Expenses Fixed Expenses Exercise 3 (Break-even and Target Profit Analysis) Requirement 1 Sales P900Q P270Q Q Q = = = = = Variable expenses + Fixed expenses + Profits P630Q + P1,350,000 + P0 P1,350,000 P1,350,000 ÷ P270 per lantern 5,000 lanterns, or at P900 per lantern, P4,500,000 in sales Alternative solution: Break-even point in unit sales = Fixed expenses Unit contribution margin = P1,350,000 P270 per lantern = 5,000 lanterns 13-204 Cost-Volume-Profit Relationships Chapter 13 or at P900 per lantern, P4,500,000 in sales Requirement 2 An increase in the variable expenses as a percentage of the selling price would result in a higher break-even point. The reason is that if variable expenses increase as a percentage of sales, then the contribution margin will decrease as a percentage of sales. A lower CM ratio would mean that more lanterns would have to be sold to generate enough contribution margin to cover the fixed costs. Requirement 3 Present: Proposed: 8,000 Lanterns 10,000 Lanterns* Total Per Unit Total Per Unit P7,200,000 P900 P8,100,000 P810 ** 5,040,000 630 6,300,000 630 2,160,000 P270 1,800,000 P180 1,350,000 1,350,000 P 810,000 P 450,000 Sales Less variable expenses Contribution margin Less fixed expenses Net operating income * 8,000 lanterns × 1.25 = 10,000 lanterns ** P900 per lantern × 0.9 = P810 per lantern As shown above, a 25% increase in volume is not enough to offset a 10% reduction in the selling price; thus, net operating income decreases. Requirement 4 Sales P810Q P180Q Q Q = = = = = Variable expenses + Fixed expenses + Profits P630Q + P1,350,000 + P720,000 P2,070,000 P2,070,000 ÷ P180 per lantern 11,500 lanterns Alternative solution: Unit sales to attain target profit = = = Fixed expenses + Target profit Unit contribution margin P1,350,000 + P720,000 P180 per lantern 11,500 lanterns 13-205 Chapter 13 Cost-Volume-Profit Relationships Exercise 4 (Operating Leverage) Requirement 1 Sales (30,000 doors)................................................................................................ P18,000,000 P600 Less variable expenses............................................................................................. 12,600,000 420 Contribution margin................................................................................................ 5,400,000 P180 Less fixed expenses................................................................................................. 4,500,000 Net operating income............................................................................................... P 900,000 Degree of operating leverage = Contribution margin Net operating income = P5,400,000 P900,000 = 6 Requirement 2 a. Sales of 37,500 doors represents an increase of 7,500 doors, or 25%, over present sales of 30,000 doors. Since the degree of operating leverage is 6, net operating income should increase by 6 times as much, or by 150% (6 × 25%). b. Expected total peso net operating income for the next year is: Present net operating income................................................................................... P 900,000 Expected increase in net operating income next year (150% × P900,000)............................................................................................. 1,350,000 Total expected net operating income........................................................................ P2,250,000 Exercise 5 (Multiproduct Break-even Analysis) Requirement 1 Sales Less variable expenses Contribution margin Less fixed expenses Net operating income Model E700 Model J1500 Total Company Amount % Amount % Amount % P700,000 100 P300,000 100 P1,000,000 100 280,000 P420,000 40 90,000 60 P210,000 13-206 30 70 370,000 630,000 598,500 P 31,500 37 63 * Cost-Volume-Profit Relationships Chapter 13 * 630,000 ÷ P1,000,000 = 63%. Requirement 2 The break-even point for the company as a whole would be: Break-even point Fixed expenses = in total peso sales Overall CM ratio P598,500 = 0.63 = P950,000 in sales Requirement 3 The additional contribution margin from the additional sales can be computed as follows: P50,000 × 63% CM ratio = P31,500 Assuming no change in fixed expenses, all of this additional contribution margin should drop to the bottom line as increased net operating income. This answer assumes no change in selling prices, variable costs per unit, fixed expenses, or sales mix. Exercise 6 (Break-even Analysis; Target Profit; Margin of Safety) Requirement 1 Sales P40Q P12Q Q Q = = = = = Variable expenses + Fixed expenses + Profits P28Q + P150,000 + P0 P150,000 P150,000 ÷ P12 per unit 12,500 units, or at P40 per unit, P500,000 Alternatively: Break-even point in unit sales = Fixed expenses Unit contribution margin = P150,000 P12 per unit = 12,500 units 13-207 Chapter 13 Cost-Volume-Profit Relationships or, at P40 per unit, P500,000. Requirement 2 The contribution margin at the break-even point is P150,000 since at that point it must equal the fixed expenses. Requirement 3 Unit sales to attain target profit = Fixed expenses + Target profit Unit contribution margin = P150,000 + P18,000 P12 per unit = 14,000 units Total Unit Sales (14,000 units × P40 per unit)......................................................................... P560,000 P40 Less variable expenses (14,000 units × P28 per unit)............................................................................... 392,000 28 Contribution margin (14,000 units × P12 per unit)............................................................................... 168,000 P12 Less fixed expenses................................................................................................. 150,000 Net operating income............................................................................................... P 18,000 Requirement 4 Margin of safety in peso terms: Margin of safety in pesos = Total sales – Break-even sales = P600,000 P500,000 – Margin of safety in percentage terms: Margin of safety percentage = = Margin of safety in pesos Total sales P100,000 P600,000 = 16.7% (rounded) 13-208 = P100,000 Cost-Volume-Profit Relationships Chapter 13 Requirement 5 The CM ratio is 30%. Expected total contribution margin: P680,000 × 30%............................................. P204,000 Present total contribution margin: P600,000 × 30%................................................ 180,000 Increased contribution margin.................................................................................. P 24,000 Alternative solution: P80,000 incremental sales × 30% CM ratio = P24,000 Since in this case the company’s fixed expenses will not change, monthly net operating income will increase by the amount of the increased contribution margin, P24,000. Exercise 7 (Changes in Variable Costs, Fixed Costs, Selling Price, and Volume) Requirement (1) The following table shows the effect of the proposed change in monthly advertising budget: Sales With Additional Current Advertising Sales Budget Difference Sales.............................................. P225,000 P240,000 P15,000 Variable expenses.......................... 135,000 144,000 9,000 Contribution margin...................... 90,000 96,000 6,000 Fixed expenses.............................. 75,000 83,000 8,000 Net operating income..................... P 15,000 P 13,000 P(2,000) Assuming that there are no other important factors to be considered, the increase in the advertising budget should not be approved since it would lead to a decrease in net operating income of P2,000. Alternative Solution 1 Expected total contribution margin: 13-209 P96,000 Chapter 13 Cost-Volume-Profit Relationships P240,000 × 40% CM ratio........................................... Present total contribution margin: P225,000 × 40% CM ratio........................................... Incremental contribution margin....................................... Change in fixed expenses: Less incremental advertising expense............................ Change in net operating income........................................ 90,000 6,000 8,000 P(2,000) Alternative Solution 2 Incremental contribution margin: P15,000 × 40% CM ratio............................................ Less incremental advertising expense................................ Change in net operating income........................................ P 6,000 8,000 P(2,000) Requirement (2) The P3 increase in variable costs will cause the unit contribution margin to decrease from P30 to P27 with the following impact on net operating income: Expected total contribution margin with the higher-quality components: 3,450 units × P27 per unit................................................................P93,150 Present total contribution margin: 3,000 units × P30 per unit................................................................ 90,000 Change in total contribution margin.....................................................P 3,150 Assuming no change in fixed costs and all other factors remain the same, the higher-quality components should be used. Exercise 8 (Compute the Margin of Safety) Requirement (1) To compute the margin of safety, we must first compute the break-even unit sales. Sales P25Q P10Q Q Q = Variable expenses + Fixed expenses + Profits = P15Q + P8,500 + P0 = P8,500 = P8,500 ÷ P10 per unit = 850 units 13-210 Cost-Volume-Profit Relationships Chapter 13 Sales (at the budgeted volume of 1,000 units)................................... P25,000 Break-even sales (at 850 units)......................................................... 21,250 Margin of safety (in pesos)............................................................... P 3,750 Requirement (2) The margin of safety as a percentage of sales is as follows: Margin of safety (in pesos)...................................................... P3,750 ÷ Sales.................................................................................... P25,000 Margin of safety as a percentage of sales................................ 15.0% Exercise 9 (Compute and Use the Degree of Operating Leverage) Requirement (1) The company’s degree of operating leverage would be computed as follows: Contribution margin................................... ÷ Net operating income.............................. Degree of operating leverage...................... P36,000 P12,000 3.0 Requirement (2) A 10% increase in sales should result in a 30% increase in net operating income, computed as follows: Degree of operating leverage......................................................................... 3.0 × Percent increase in sales............................................................................. 10% Estimated percent increase in net operating income....................................... 30% Requirement (3) The new income statement reflecting the change in sales would be: Sales.............................................. Variable expenses.......................... Contribution margin...................... Fixed expenses.............................. Net operating income..................... Amount P132,000 92,400 39,600 24,000 P 15,600 Percent of Sales 100% 70% 30% Net operating income reflecting change in sales.......................................... P15,600 13-211 Chapter 13 Cost-Volume-Profit Relationships Original net operating income..................................................................... P12,000 Percent change in net operating income......................................................30% Exercise 10 (Compute the Break-Even Point for a Multiproduct Company) Requirement (1) The overall contribution margin ratio can be computed as follows: Overall CM ratio Total contribution margin Total sales = P120,000 P150,000 = Requirement (2) = 80% The overall break-even point in sales pesos can be computed as follows: Overall break-even Total fixed expenses = Overall CM ratio P90,000 80% = = P112,500 Requirement (3) To construct the required income statement, we must first determine the relative sales mix for the two products: Original peso sales........................ Percent of total.............................. Sales at break-even........................ Sales.............................................. Variable expenses*........................ Contribution margin...................... Fixed expenses.............................. Net operating income..................... Ping P100,000 67% P75,000 Pong P50,000 33% P37,500 Total P150,000 100% P112,500 Ping P75,000 18,750 P56,250 Pong P37,500 3,750 P33,750 Total P112,500 22,500 90,000 90,000 P 0 13-212 Cost-Volume-Profit Relationships Chapter 13 *Ping variable expenses: (P75,000/P100,000) × P25,000 = P18,750 Pong variable expenses: (P37,500/P50,000) × P5,000 = P3,750 Exercise 11 (Break-Even and Target Profit Analysis) Requirement (1) Variable expenses: P60 × (100% – 40%) = P36. Requirement (2) Selling price............................................... Variable expenses....................................... Contribution margin................................... P60 36 P24 100% 60% 40% Let Q = Break-even point in units. Sales P60Q P24Q Q Q = = = = = Variable expenses + Fixed expenses + Profits P36Q + P360,000 + P0 P360,000 P360,000 ÷ P24 per unit 15,000 units In sales pesos: 15,000 units × P60 per unit = P900,000 Alternative solution: Let X X 0.40X X X = = = = = Break-even point in sales pesos. 0.60X + P360,000 + P0 P360,000 P360,000 ÷ 0.40 P900,000 In units: P900,000 ÷ P60 per unit = 15,000 units P60Q = P36Q + P360,000 + P90,000 P24Q = P450,000 Q = P450,000 ÷ P24 per unit Q = 18,750 units In sales pesos: 18,750 units × P60 per unit = P1,125,000 Alternative solution: X = 0.60X + P360,000 + P90,000 0.40X = P450,000 13-213 Chapter 13 Cost-Volume-Profit Relationships X = P450,000 ÷ 0.40 X = P1,125,000 In units: P1,125,000 ÷ P60 per unit = 18,750 units c. The company’s new cost/revenue relationships will be: Selling price.................................................................. Variable expenses (P36 – P3)........................................ Contribution margin...................................................... P60Q P27Q Q Q = = = = P60 33 P27 P33Q + P360,000 + P0 P360,000 P360,000 ÷ P27 per unit 13,333 units (rounded). In sales pesos: 13,333 units × P60 per unit = P800,000 (rounded) Alternative solution: X 0.45X X X = = = = 0.55X + P360,000 + P0 P360,000 P360,000 ÷ 0.45 P800,000 In units: P800,000 ÷ P60 per unit = 13,333 units (rounded) Requirement (3) a. Break-even point in unit sales = Fixed expenses Unit contribution margin = P360,000 P24 per unit = 15,000 units In sales pesos: 15,000 units × P60 per unit = P900,000 Alternative solution: Break-even point in sales pesos = Fixed expenses CM ratio = P360,000 0.40 = P900,000 In units: P900,000 ÷ P60 per unit = 15,000 units 13-214 100% 55% 45% Cost-Volume-Profit Relationships Chapter 13 b. Unit sales to attain target profit = Fixed expenses + Target profit Unit contribution margin = (P360,000 + P90,000) P24 per unit = 18,750 units In sales pesos: 18,750 units × P60 per unit = P1,125,000 Alternative solution: Peso sales to attain target profit = Fixed expenses + Target profit CM ratio = (P360,000 + P90,000) 0.40 = P1,125,000 In units: P1,125,000 ÷ P60 per unit = 18,750 units c. Break-even point in unit sales = Fixed expenses Unit contribution margin = P360,000 P27 per unit = 13,333 units (rounded) In sales pesos: 13,333 units × P60 per unit = P800,000 (rounded) Alternative solution: Break-even point in sales pesos = Fixed expenses CM ratio = P360,000 0.45 = P800,000 In units: P800,000 ÷ P60 per unit = 13,333 (rounded) 13-215 Chapter 13 Cost-Volume-Profit Relationships Exercise 12 (Operating Leverage) Requirement (1) Sales (30,000 doors)............................... P1,800,000 Variable expenses.................................... 1,260,000 Contribution margin................................ 540,000 Fixed expenses........................................ 450,000 Net operating income.............................. P 90,000 Degree of operating Contribution margin = leverage Net operating income P60 42 P18 = P540,000 P90,000 = 6 Requirement (2) a. Sales of 37,500 doors represents an increase of 7,500 doors, or 25%, over present sales of 30,000 doors. Since the degree of operating leverage is 6, net operating income should increase by 6 times as much, or by 150% (6 × 25%). b. Expected total peso net operating income for the next year is: Present net operating income................................................................ P 90,000 Expected increase in net operating income next year (150% × P90,000)........................................................................................ 135,000 Total expected net operating income..................................................... P225,000 III. Problems Problem 1 (CVP Relationships) Requirement 1 CM ratio Variable expense ratio = Contribution margin Selling price = P15 P60 = Variable expense Selling price = P45 P60 Requirement 2 Sales = Variable expenses + Fixed expenses + Profits P60Q = P45Q + P240,000 + P0 13-216 = 25% = 75% Cost-Volume-Profit Relationships Chapter 13 P15Q = P240,000 Q = P240,000 ÷ P15 per unit Q = 16,000 units, or at P60 per unit, P960,000 Alternative solution: X 0.25X X X = = = = 0.75X + P240,000 + P0 P240,000 P240,000 ÷ 0.25 P960,000; or at P60 per unit, 16,000 units Requirement 3 Increase in sales................................................... Multiply by the CM ratio..................................... Expected increase in contribution margin............. P400,000 x 25% P100,000 Since the fixed expenses are not expected to change, net operating income will increase by the entire P100,000 increase in contribution margin computed above. Requirement 4 Sales P60Q P15Q Q Q = = = = = Variable expenses + Fixed expenses + Profits P45Q + P240,000 + P90,000 P330,000 P330,000 ÷ P15 per unit 22,000 units Contribution margin method: Fixed expenses + Target profit Contribution margin per unit = P240,000 + P90,000 P15 per unit = 22,000 units Requirement 5 Margin of safety in pesos Margin of safety = percentage = Total sales – Break-even sales = P1,200,000 – P960,000 Margin of safety in pesos Total sales 13-217 = P240,000 P240,000 = P1,200,000 = 20% Chapter 13 Cost-Volume-Profit Relationships Requirement 6 a. b. Degree of operating leverage = Contribution margin = P300,000 P60,000 Net operating income Expected increase in sales........................................... Degree of operating leverage...................................... Expected increase in net operating income.................. = 5 8% x 5 40% c. If sales increase by 8%, then 21,600 units (20,000 x 1.08 = 21,600) will be sold next year. The new income statement will be as follows: Sales (21,600 units)............... Less variable expenses........... Contribution margin.............. Less fixed expenses................ Net operating income............. Total P1,296,000 972,000 324,000 240,000 P 84,000 Per Unit P60 45 P15 Percent of Sales 100% 75% 25% Thus, the P84,000 expected net operating income for next year represents a 40% increase over the P60,000 net operating income earned during the current year: P24,000 P60,000 P84,000 – P60,000 = P60,000 = 40% increase Note from the income statement above that the increase in sales from 20,000 to 21,600 units has resulted in increases in both total sales and total variable expenses. It is a common error to overlook the increase in variable expense when preparing a projected income statement. Requirement 7 a. A 20% increase in sales would result in 24,000 units being sold next year: 20,000 units x 1.20 = 24,000 units. Total 13-218 Per Unit Percent of Sales Cost-Volume-Profit Relationships Chapter 13 Sales (24,000 units)............... Less variable expenses........... Contribution margin.............. Less fixed expenses................ Net operating income............. P1,440,000 1,152,000 288,000 210,000† P 78,000 P60 48* P12 100% 80% 20% * P45 + P3 = P48; P48 P60 = 80%. † P240,000 – P30,000 = P210,000. Note that the change in per unit variable expenses results in a change in both the per unit contribution margin and the CM ratio. b. Break-even point in unit sales = = Fixed expenses Contribution margin per unit P210,000 P12 per unit 17,500 units be made. The changes will Break-even Fixedshould expenses c. Yes, based on these point data = the changes = in peso sales CM ratiofrom the present P60,000 to increase the company’s net operating income P78,000 per year. Although the changes will also result in a higher breakP210,000 even point (17,500 units as =compared to 0.20 the present 16,000 units), the company’s margin of safety will actually be wider than before: = P1,050,000 Margin of safety in pesos = Total sales – Break-even sales = P1,440,000 – P1,050,000 = P390,000 As shown in requirement (5) above, the company’s present margin of safety is only P240,000. Thus, several benefits will result from the proposed changes. Problem 2 (Basics of CVP Analysis; Cost Structure) Requirement 1 The CM ratio is 30%. Total P270,000 189,000 P 81,000 Sales (13,500 units) Less variable expenses Contribution margin 13-219 Per Unit P20 14 P 6 Percentage 100 % 70 30 % Chapter 13 Cost-Volume-Profit Relationships The break-even point is: Sales P20Q P 6Q Q Q = = = = = Variable expenses + Fixed expenses + Profits P14Q + P90,000 + P0 P90,000 P90,000 ÷ P6 per unit 15,000 units 15,000 units × P20 per unit = P300,000 in sales Alternative solution: Break-even point in unit sales = = Break-even point in sales pesos = = = Requirement 2 = Fixed expenses Contribution margin per unit P90,000 P6 per unit 15,000 units Fixed expenses CM ratio P90,000 0.30 P300,000 in sales Incremental contribution margin: P70,000 increased sales × 30% CM ratio............................................................ P21,000 Less increased fixed costs: Increased advertising cost.................................................................................... 8,000 Increase in monthly net operating income................................................................ P13,000 Since the company presently has a loss of P9,000 per month, if the changes are adopted, the loss will turn into a profit of P4,000 per month. Requirement 3 13-220 Cost-Volume-Profit Relationships Chapter 13 Sales (27,000 units × P18 per unit*)........................................................................ P486,000 Less variable expenses (27,000 units × P14 per unit)............................................................................... 378,000 Contribution margin................................................................................................ 108,000 Less fixed expenses (P90,000 + P35,000)............................................................... 125,000 Net operating loss.................................................................................................... P(17,000) *P20 – (P20 × 0.10) = P18 Requirement 4 Sales P 20Q P5.40Q Q Q = = = = = Variable expenses + Fixed expenses + Profits P14.60Q* + P90,000 + P4,500 P94,500 P94,500 ÷ P5.40 per unit 17,500 units * P14.00 + P0.60 = P14.60. Alternative solution: Unit sales to attain target profit = = = Fixed expenses + Target profit CM per unit P90,000 + P4,500 P5.40 per unit** 17,500 units ** P6.00 – P0.60 = P5.40. Requirement 5 a. The new CM ratio would be: Per Unit P20 7 P13 Sales Less variable expenses Contribution margin 13-221 Percentage 100 % 35 65 % Chapter 13 Cost-Volume-Profit Relationships The new break-even point would be: Break-even point in unit sales Break-even point in sales pesos = Fixed expenses Contribution margin per unit = P208,000 P13 per unit = 16,000 units = Fixed expenses CM ratio = P208,000 0.65 = P320,000 in sales b. Comparative income statements follow: Sales (20,000 units) Less variable expenses Contribution margin Less fixed expenses Net operating income Not Automated Automated Total Per Unit % Total Per Unit P400,000 P20 100 P400,000 P20 280,000 14 70 140,000 7 120,000 P 6 30 260,000 P13 90,000 208,000 P 30,000 P 52,000 % 100 35 65 c. Whether or not one would recommend that the company automate its operations depends on how much risk he or she is willing to take, and depends heavily on prospects for future sales. The proposed changes would increase the company’s fixed costs and its break-even point. However, the changes would also increase the company’s CM ratio (from 30% to 65%). The higher CM ratio means that once the break-even point is reached, profits will increase more rapidly than at present. If 20,000 units are sold next month, for example, the higher CM ratio will generate P22,000 more in profits than if no changes are made. The greatest risk of automating is that future sales may drop back down to present levels (only 13,500 units per month), and as a result, losses will be even larger than at present due to the company’s greater fixed costs. (Note the problem states that sales are erratic from month to month.) In sum, the proposed changes will help the company if sales continue to 13-222 Cost-Volume-Profit Relationships Chapter 13 trend upward in future months; the changes will hurt the company if sales drop back down to or near present levels. Note to the Instructor: Although it is not asked for in the problem, if time permits you may want to compute the point of indifference between the two alternatives in terms of units sold; i.e., the point where profits will be the same under either alternative. At this point, total revenue will be the same; hence, we include only costs in our equation: Let Q P14Q + P90,000 P7Q Q Q = = = = = Point of indifference in units sold P7Q + P208,000 P118,000 P118,000 ÷ P7 per unit 16,857 units (rounded) If more than 16,857 units are sold, the proposed plan will yield the greatest profit; if less than 16,857 units are sold, the present plan will yield the greatest profit (or the least loss). Problem 3 (Sales Mix; Multiproduct Break-even Analysis) Requirement 1 Percentage of total sales Sales Less variable expenses Contribution margin Less fixed expenses Net operating income (loss) Products Sinks Mirrors Vanities Total 32% 40% 28% 100% P160,000 100 % P200,000 100 % P140,000 100 % P500,000 100% 48,000 30 160,000 80 77,000 55 285,000 57 P112,000 70 % P 40,000 20 % P 63,000 45 % 215,000 43%* 223,600 P ( 8,600) * P215,000 ÷ P500,000 = 43%. Requirement 2 Break-even sales: Break-even point in total peso sales = Fixed expenses CM ratio 13-223 = = P223,600 0.43 P520,000 in sales Chapter 13 Cost-Volume-Profit Relationships Requirement 3 Memo to the president: Although the company met its sales budget of P500,000 for the month, the mix of products sold changed substantially from that budgeted. This is the reason the budgeted net operating income was not met, and the reason the break-even sales were greater than budgeted. The company’s sales mix was planned at 48% Sinks, 20% Mirrors, and 32% Vanities. The actual sales mix was 32% Sinks, 40% Mirrors, and 28% Vanities. As shown by these data, sales shifted away from Sinks, which provides our greatest contribution per peso of sales, and shifted strongly toward Mirrors, which provides our least contribution per peso of sales. Consequently, although the company met its budgeted level of sales, these sales provided considerably less contribution margin than we had planned, with a resulting decrease in net operating income. Notice from the attached statements that the company’s overall CM ratio was only 43%, as compared to a planned CM ratio of 52%. This also explains why the break-even point was higher than planned. With less average contribution margin per peso of sales, a greater level of sales had to be achieved to provide sufficient contribution margin to cover fixed costs. Problem 4 (Basic CVP Analysis) Requirement 1 The CM ratio is 60%: Selling price Less variable expenses Contribution margin Requirement 2 Break-even point in total sales pesos Requirement 3 P150 60 P 90 = Fixed expenses CM ratio = P1,800,000 0.60 = P3,000,000 in sales 13-224 100% 40 60% Cost-Volume-Profit Relationships Chapter 13 P450,000 increased sales × 60% CM ratio = P270,000 increased contribution margin. Since fixed costs will not change, net operating income should also increase by P270,000. Requirement 4 a. Degree of operating leverage = Contribution margin = P2,160,000 = 6 P360,000 Net operating income b. 6 × 15% = 90% increase in net operating income. Requirement 5 Sales Less variable expenses Contribution margin Less fixed expenses Net operating income Last Year: 28,000 units Total Per Unit P4,200,000 P150.00 Proposed: 42,000 units* Total Per Unit P5,670,000 P135.00** 1,680,000 2,520,000 1,800,000 P 720,000 2,520,000 3,150,000 2,500,000 P 650,000 60.00 P 90.00 60.00 P 75.00 * 28,000 units × 1.5 = 42,000 units ** P150 per unit × 0.90 = P135.00 per unit No, the changes should not be made. Requirement 6 Expected total contribution margin: 28,000 units × 200% × P70 per unit*.................................................................. P3,920,000 Present total contribution margin: 28,000 units × P90 per unit................................................................................. 2,520,000 Incremental contribution margin, and the amount by which advertising can be increased with net operating income remaining unchanged........................................................................................... P1,400,000 * P150 – (P60 + P20) = P70 Problem 5 (Break-Even and Target Profit Analysis) Requirement 1 The contribution margin per patch would be: 13-225 Chapter 13 Cost-Volume-Profit Relationships Selling price............................................................................................................. P30 Less variable expenses: Purchase cost of the patches................................................................................ P15 Commissions to the student salespersons............................................................. 6 21 Contribution margin................................................................................................ P 9 Since there are no fixed costs, the number of unit sales needed to yield the desired P7,200 in profits can be obtained by dividing the target profit by the unit contribution margin: P7,200 Target profit = P9 per patch = 800 patches Unit contribution margin 800 patches x P30 per patch = P24,000 in total sales Requirement 2 Since an order has been placed, there is now a “fixed” cost associated with the purchase price of the patches (i.e., the patches can’t be returned). For example, an order of 200 patches requires a “fixed” cost (investment) of P3,000 (200 patches × P15 per patch = P3,000). The variable costs drop to only P6 per patch, and the new contribution margin per patch becomes: Selling price............................................................................................................. P30 Less variable expenses (commissions only)............................................................. 6 Contribution margin................................................................................................ P24 Since the “fixed” cost of P3,000 must be recovered before Ms. Morales shows any profit, the break-even computation would be: Break-even point = in unit sales Fixed expenses Unit contribution margin P3,000 = P24 per patch = 125 patches 125 patches x P30 per patch = P3,750 in total sales If a quantity other than 200 patches were ordered, the answer would change accordingly. Problem 6 13-226 Cost-Volume-Profit Relationships Chapter 13 Requirement 1: Break-even chart TR 600,000 500,000 TC 400,000 (P) 300,000 Break-even point 200,000 FC 100,000 5,000 10,000 15,000 20,000 25,000 30,000 (units) Requirement 2: Profit-volume graph 13-227 250,000 Chapter 13 Cost-Volume-Profit Relationships P 200,000 R O F 150,000 I T 100,000 50,000 Break-even point 0 5,000 10,000 15,000 20,000 25,000 30,000 50,000 100,000 L O S S 150,000 200,000 250,000 Problem 7 (Sales Mix; Break-Even Analysis; Margin of Safety) Requirement (1) Hun Pesos % Sales............................................... P80,000 100 Variable expenses.......................... 48,000 60 Contribution margin...................... P32,000 40 Fixed expenses............................... Net operating income.................... 13-228 Yun P % P48,000 100 9,600 20 P38,400 80 Total Euros % P128,000 100 57,600 45 70,400 55 66,000 P 4,400 Cost-Volume-Profit Relationships Chapter 13 b. Break-even sales = = Margin of safety = in pesos Fixed expenses ÷ CM ratio P66,000 ÷ 0.55 = P120,000 Actual sales – Break-even sales = P128,000 – P120,000 = P8,000 Margin of safety in pesos Actual sales Margin of safety = percentage Requirement (2) Sales Variable expenses Contribution margin Fixed expenses Net operating income = P8,000 P128,000 = 6.25% Hun Pesos % P80,000 100 48,000 60 P32,000 40 b. Break-even sales = = Margin of safety = in pesos Yun Pesos % P48,000 100 9,600 20 P38,400 80 HY143 Pesos % P32,000 100 2,4000 75 P 8,000 25 Total Pesos % P160,000 100 81,600 51 78,400 49 66,000 P 12,400 Fixed expenses ÷ CM ratio P66,000 ÷ 0.49 = P134,700 (rounded) Actual sales – Break-even sales = P160,000 – P134,700 = P25,300 Margin of safety in pesos Actual sales Margin of safety = percentage = P25,300 P160,000 = 15.81% 13-229 Chapter 13 Cost-Volume-Profit Relationships Requirement (3) The reason for the increase in the break-even point can be traced to the decrease in the company’s average contribution margin ratio when the third product is added. Note from the income statements above that this ratio drops from 55% to 49% with the addition of the third product. This product, called HY143, has a CM ratio of only 25%, which causes the average contribution margin ratio to fall. This problem shows the somewhat tenuous nature of break-even analysis when more than one product is involved. The manager must be very careful of his or her assumptions regarding sales mix when making decisions such as adding or deleting products. It should be pointed out to the president that even though the break-even point is higher with the addition of the third product, the company’s margin of safety is also greater. Notice that the margin of safety increases from P8,000 to P25,300 or from 6.25% to 15.81%. Thus, the addition of the new product shifts the company much further from its break-even point, even though the break-even point is higher. 13-230 Cost-Volume-Profit Relationships Chapter 13 Problem 8 (Break-Even Analysis with Step Fixed Costs) Requirement (1) The total annual fixed cost of the Pediatric Ward can be computed as follows: Annual Patient-Days 10,000-12,000 12,001-13,750 13,751-16,500 16,501-18,250 18,251-20,750 20,751-23,000 Aides @ P360,000 P2,520,000 P2,880,000 P3,240,000 P3,600,000 P3,600,000 P3,960,000 Nurses @ P580,000 P8,700,000 P8,700,000 P9,280,000 P9,280,000 P9,860,000 P10,440,000 Supervising Nurses @ P760,000 P2,280,000 P2,280,000 P3,040,000 P3,040,000 P3,800,000 P3,800,000 Total Personnel Other Fixed Cost P13,500,000 P13,860,000 P15,560,000 P15,920,000 P17,260,000 P18,200,000 P27,400,000 P27,400,000 P27,400,000 P27,400,000 P27,400,000 P27,400,000 Total Fixed Cost P40,900,000 P41,260,000 P42,960,000 P43,320,000 P44,660,000 P45,600,000 Requirement (2) The “break-even” can be computed for each range of activity by dividing the total fixed cost for that range of activity by the contribution margin per patient-day, which is P3,000 (=P4,800 revenue − P1,800 variable cost). Annual (a) Patient-Days Total Fixed Cost 10,000-12,000 P40,900,000 12,001-13,750 P41,260,000 13,751-16,500 P42,960,000 16,501-18,250 P43,320,000 18,251-20,750 P44,660,000 20,751-23,000 P45,600,000 (b) Contribution Margin P3,000 P3,000 P3,000 P3,000 P3,000 P3,000 “Break-Even” (a) ÷ (b) 13,633 13,753 14,320 14,440 14,887 15,200 Within Relevant Range? No No Yes No No No While a “break-even” can be computed for each range of activity (i.e., relevant range), all but one of these break-evens is bogus. For example, within the range of 10,000 to 12,000 patient-days, the computed break-even is 13,633 (rounded) patient-days. However, this level of activity is outside this relevant range. To serve 13,633 patient-days, the fixed costs would have to be increased from P40,900,000 to P41,260,000 by 13-231 Chapter 13 Cost-Volume-Profit Relationships adding one more aide. The only “break-even” that occurs within its own relevant range is 14,320. This is the only legitimate break-even. Requirement (3) The level of activity required to earn a profit of P7,200,000 can be computed as follows: Annual Patient-Days Total Fixed Cost Target Profit 10,000-12,000 P40,900,000 P7,200,000 12,001-13,750 P41,260,000 P7,200,000 13,751-16,500 P42,960,000 P7,200,000 16,501-18,250 P43,320,000 P7,200,000 18,251-20,750 P44,660,000 P7,200,000 20,751-23,000 P45,600,000 P7,200,000 (a) Total Fixed Cost + Target Profit P48,100,000 P48,460,000 P50,160,000 P50,520,000 P51,860,000 P52,800,000 (b) Contribution Margin P3,000 P3,000 P3,000 P3,000 P3,000 P3,000 In this case, the only solution that is within the appropriate relevant range is 16,840 patient-days. 13-232 Activity to Attain Target Profit (a) ÷ (b) 16,033 16,153 16,720 16,840 17,287 17,600 Within Relevant Range? No No No Yes No No MANAGEMENT ACCOUNTING - Solutions Manual IV. Multiple Choice Questions 1. 2. 3. 4. 5. B B B C C 6. 7. 8. 9. 10. B D B A D 11. 12. 13. 14. 15. B A A C D 16. 17. 18. 19. 20. D D D C D 21. 22. 23. 24. 25. A D C B C 26. 27. 28. 29. 30. A B C B A CHAPTER 14 RESPONSIBILITY ACCOUNTING AND TRANSFER PRICING I. Questions 1. Cost centers are evaluated by means of performance reports. Profit centers are evaluated by means of contribution income statements (including cost center performance reports), in terms of meeting sales and cost objectives. Investment centers are evaluated by means of the rate of return which they are able to generate on invested assets. 2. Overall profitability can be improved (1) by increasing sales, (2) by reducing expenses, or (3) by reducing assets. 3. ROI may lead to dysfunctional decisions in that divisional managers may reject otherwise profitable investment opportunities simply because they would reduce the division’s overall ROI figure. The residual income approach overcomes this problem by establishing a minimum rate of return which the company wants to earn on its operating assets, thereby motivating the manager to accept all investment opportunities promising a return in excess of this minimum figure. 4. A cost center manager has control over cost, but not revenue or investment funds. A profit center manager, by contrast, has control over both cost and revenue. An investment center manager has control over cost and revenue and investment funds. 5. The term transfer price means the price charged for a transfer of goods or services between units of the same organization, such as two departments 18-233 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II or divisions. purposes. Transfer prices are needed for performance evaluation 6. The use of market price for transfer purposes will create the actual conditions under which the transferring and receiving units would be operating if they were completely separate, autonomous companies. It is generally felt that the creation of such conditions provides managerial incentive, and leads to greater overall efficiency in operations. 7. Negotiated transfer prices should be used (1) when the volume involved is large enough to justify quantity discounts, (2) when selling and/or administrative expenses are less on intracompany sales, (3) when idle capacity exists, and (4) when no clear-cut market price exists (such as a sister division being the only supplier of a good or service). 8. Suboptimization can result if transfer prices are set in a way that benefits a particular division, but works to the disadvantage of the company as a whole. An example would be a transfer between divisions when no transfers should be made (e.g., where a better overall contribution margin could be generated by selling at an intermediate stage, rather than transferring to the next division). Suboptimization can also result if transfer pricing is so inflexible that one division buys from the outside when there is substantial idle capacity to produce the item internally. If divisional managers are given full autonomy in setting, accepting, and rejecting transfer prices, then either of these situations can be created, through selfishness, desire to “look good”, pettiness, or bickering. II. Exercises Exercise 1 (Evaluation of a Profit Center) No. Although Department 3 does not cover all of the cost allocated to it. It contributes P21,000 to the total operations over and above its direct costs. Without Department 3, the company would earn P21,000 less as compared with the original over-all income of P47,000. Revenue Direct cost of department Contribution of the department Allocated cost Net income Department 1 2 4 Total P132,000 P168,000 P98,000 P398,000 82,000 108,000 61,000 251,000 P 50,000 18-234 P 60,000 P37,000 P147,000 121,000 P 26,000 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 With the discontinuance of Department 3, the revenue and direct cost of the department are eliminated, but there is no reduction in the total allocated cost. Exercise 2 (Evaluation of an Investment Center) Requirement 1 ROI P400,000 P100,000 25% Operating assets Operating income ROI (P100,000 P400,000) Minimum required income (16% x P400,000) RI (P100,000 - P64,000) RI P400,000 P100,000 P64,000 P36,000 Requirement 2 The manager of the Cling Division would not accept this project under the ROI approach since the division is already earning 25%. Accepting this project would reduce the present divisional performance, as shown below: Operating assets Operating income ROI Present P400,000 P100,000 25% New Project P60,000 P12,000* 20% Overall P460,000 P112,000 24.35% * P60,000 x 20% = P12,000 Under the RI approach, on the other hand, the manager would accept this project since the new project provides a higher return than the minimum required rate of return (20 percent vs. 16 percent). The new project would increase the overall divisional residual income, as shown below: Operating assets Operating income Minimum required return at 16% RI Present P400,000 P100,000 New Project P60,000 P12,000 Overall P460,000 P112,000 64,000 P 36,000 9,600* P 2,400 73,600 P 38,400 * P60,000 x 16% = P9,600 18-235 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Exercise 3 (ROI, Comparison of Three Divisions) Requirement 1 ROI: Division X Division Y Division Z P10,000 P12,600 P 28,800 = 25% = 18% = 16% P40,000 P70,000 P180,000 Requirement 2 Division X would reject this investment opportunity since the addition would lower the present divisional ROI. Divisions Y and Z would accept it because they would look better in terms of their divisional ROI. Exercise 4 (ROI, RI, Comparisons of Two Divisions) Requirement 1 Net Operating income X Sales Division A : Division B : Sales Average Operating Assets P630,000 P9,000,000 X P9,000,000 P3,000,000 X 7% 3 P1,800,000 X P20,000,000 9% X = ROI = ROI = 21% P20,000,000 P10,000,000 = ROI 2 = 18% Requirement 2 Average operating assets (a).......... Net operating income.................... Minimum required return on average operating assets - 16% x (a)..... Residual income............................ 18-236 Division A P3,000,000 P 630,000 Division B P10,000,000 P 1,800,000 480,000 P 150,000 P 1,600,000 200,000 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Requirement 3 No, Division B is simply larger than Division A and for this reason one would expect that it would have a greater amount of residual income. As stated in the text, residual income can’t be used to compare the performance of divisions of different sizes. Larger divisions will almost always look better, not necessarily because of better management but because of the larger peso figures involved. In fact, in the case above, Division B does not appear to be as well managed as Division A. Note from Part (2) that Division B has only an 18 percent ROI as compared to 21 percent for Division A. Exercise 5 (Evaluation of a Cost Center) (1) Controllable Costs by supervisor of Department 10 are as follows: a. Supplies, Department 10 b. Repairs and Maintenance, Department 10 c. Labor Cost, Department 10 (2) Direct Costs of Department 10 are a. Salary, supervisor of Department 10 b. Supplies, Department 10 c. Repairs and Maintenance, Department 10 d. Labor Cost, Department 10 (3) Costs allocated to Factory Department are: a. Factory, heat and light b. Depreciation, factory c. Factory insurance d. Salary of factory superintendent (4) Costs which do not pertain to factory operations are: a. Sales salaries and commissions b. General office salaries Exercise 6 (Evaluating New Investments Using Return on Investment (ROI) and Residual Income) Requirement 1 18-237 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Computation of ROI Division A: ROI = P300,000 P6,000,000 x P6,000,000 P1,500,000 = 5% x 4 = 20% P900,000 P10,000,000 x P10,000,000 P5,000,000 = 9% x 2 = 18% P180,000 P8,000,000 x P8,000,000 P2,000,000 = 2.25% x 4 = 9% Division B: ROI = Division C: ROI = Requirement 2 Average operating assets Required rate of return Required operating income Actual operating income Required operating income (above) Residual income Division A P1,500,000 × 15% P 225,000 P 300,000 225,000 P 75,000 Division B P5,000,000 × 18% P 900,000 P 900,000 900,000 P 0 Division C P2,000,000 × 12% P 240,000 P 180,000 240,000 P (60,000) Division A 20% Division B 18% Division C 9% Reject Reject Accept 15% 18% 12% Accept Reject Accept Requirement 3 a. and b. Return on investment (ROI) Therefore, if the division is presented with an investment opportunity yielding 17%, it probably would Minimum required return for computing residual income Therefore, if the division is presented with an investment opportunity yielding 17%, it probably would 18-238 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 If performance is being measured by ROI, both Division A and Division B probably would reject the 17% investment opportunity. The reason is that these companies are presently earning a return greater than 17%; thus, the new investment would reduce the overall rate of return and place the divisional managers in a less favorable light. Division C probably would accept the 17% investment opportunity, since its acceptance would increase the Division’s overall rate of return. If performance is being measured by residual income, both Division A and Division C probably would accept the 17% investment opportunity. The 17% rate of return promised by the new investment is greater than their required rates of return of 15% and 12%, respectively, and would therefore add to the total amount of their residual income. Division B would reject the opportunity, since the 17% return on the new investment is less than B’s 18% required rate of return. Exercise 7 (Transfer Pricing from Viewpoint of the Entire Company) Requirement 1 Sales Less expenses: Added by the division Transfer price paid Total expenses Net operating income 1 2 3 Division A P3,500,000 1 2,600,000 — 2,600,000 P 900,000 Division B P2,400,000 1,200,000 700,000 1,900,000 P 500,000 2 Total Company P5,200,000 3 3,800,000 — 3,800,000 P1,400,000 20,000 units × P175 per unit = P3,500,000. 4,000 units × P600 per unit = P2,400,000. Division A outside sales (16,000 units × P175 per unit)....................................................... P2,800,000 Division B outside sales (4,000 units × P600 per unit)........................................................ 2,400,000 Total outside sales.................................................................................................................. P5,200,000 Observe that the P700,000 in intracompany sales has been eliminated. Requirement 2 Division A should transfer the 1,000 additional units to Division B. Note that Division B’s processing adds P425 to each unit’s selling price (B’s P600 selling price, less A’s P175 selling price = P425 increase), but it adds only P300 in cost. Therefore, each tube transferred to Division B ultimately yields P125 more in contribution margin (P425 – P300 = P125) to the company than can be obtained from selling to outside customers. Thus, the company as a whole will be better off if Division A transfers the 1,000 additional tubes to Division B. 18-239 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Exercise 8 (Transfer Pricing Situations) Requirement 1 The lowest acceptable transfer price from the perspective of the selling division is given by the following formula: Total contribution margin on lost sales Variable cost + Transfer price Number of units transferred per unit . There is no idle capacity, so each of the 20,000 units transferred from Division X to Division Y reduces sales to outsiders by one unit. The contribution margin per unit on outside sales is P20 (= P50 – P30). P20 x 20,000 Transfer price (P30 – P2) + 20,000 Transfer price = P28 + P20 = P48 The buying division, Division Y, can purchase a similar unit from an outside supplier for P47. Therefore, Division Y would be unwilling to pay more than P47 per unit. Transfer price Cost of buying from outside supplier = P47 The requirements of the two divisions are incompatible and no transfer will take place. Requirement 2 In this case, Division X has enough idle capacity to satisfy Division Y’s demand. Therefore, there are no lost sales and the lowest acceptable price as far as the selling division is concerned is the variable cost of P20 per unit. P20 + P0 20,000 = P20 The buying division, Division Y, can purchase a similar unit from an outside supplier for P34. Therefore, Division Y would be unwilling to pay more than P34 per unit. Transfer price Transfer price Cost of buying from outside supplier = P34 18-240 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 In this case, the requirements of the two divisions are compatible and a transfer will hopefully take place at a transfer price within the range: P20 Transfer price P34 Exercise 9 (Transfer Pricing: Decision Making) Requirement 1 Division A’s purchase decision from the overall firm perspective: Purchase costs from outside 10,000 x P150 = P1,500,000 Less: Savings of Divisions B’s variable costs 10,000 x P140 = 1,400,000 Net Cost (Benefit) for A to buy outside P 100,000 Assuming Division B has no outside sales, Division A should buy inside from Division B for the benefit of the entire firm. Requirement 2 As above, but in addition, if Division A buys outside, Division B saves an additional P200,000. Purchase costs from outside Less: Savings in variable costs Less: Savings of B material assignment Net Cost (Benefit) for A to buy outside 10,000 x P150 = P1,500,000 10,000 x P140 = 1,400,000 200,000 P (100,000) The additional savings in Division B means that now Division A should buy outside. Requirement 3 Assuming the outside price drops from P150 to P130: Purchase costs from outside Less: Savings in variable costs Net Cost (Benefit) for A to buy outside 18-241 10,000 x P130 = P1,300,000 10,000 x P140 = 1,400,000 P (100,000) Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Division A should buy outside. Exercise 10 (Compute the Return on Investment (ROI)) Requirement (1) Net operating income Sales Margin = = P5,400,000 P18,000,000 = 30% Requirement (2) Sales Average operating assets Turnover = = P18,000,000 P36,000,000 = 0.5 Requirement (3) ROI = Margin x Turnover = 30% x 0.5 = 15% Exercise 11 (Residual Income) Average operating assets (a).............................................. Net operating income........................................................ Minimum required return: 16% × (a)................................ Residual income................................................................ III. Problems Problem 1 (Evaluation of Profit Centers) Requirement (a) Jadlow Manufacturing Corporation Income Statement 18-242 P2,200,000 P400,000 352,000 P 48,000 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 For the Year Ended December 31, 2005 Sales Less: Variable Costs Contribution Margin Less: Controllable fixed expenses Contribution to the recovery of non-controllable fixed expenses Total P5,100,000 3,330,000 P1,770,000 Product S P2,700,000 1,890,000 P 810,000 Product T P2,400,000 1,440,000 P 960,000 501,000 66,000 435,000 P1,269,000 P 744,000 P 525,000 Requirement (b) The complaint of the manager of Product T is justified on the ground that his product line shows a positive contribution margin and therefore, contributes to the recovery of non-controllable fixed expenses. This observation is, of course, made under the assumption that the preceding year’s figures (which are not given) were less favorable than the current year. Problem 2 (Evaluation of Profit Centers) Requirement 1 Incremental sales Less: Incremental costs Net income A P71,000 42,000 P29,000 Product B P46,000 15,000 P31,000 C P117,000 96,000 P 21,000 Product B seems to offer the best profit potential. Requirement 2 The sunk costs are: Depreciation of equipment Operating cost of the equipment Total Requirement 3 18-243 P 6,400 4,600 P11,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Opportunity cost of selling Product B is From Product A From Product C Total P29,000 21,000 P50,000 Problem 3 (Evaluation of Performance) Ranjie Tool Company Performance Report For the Year 2005 Budgeted Labor Hours Actual Labor Hours 4,000 4,200 Budget Based on 4,200 Hours Variance U (F) P 3,600 7,400 5,300 P16,300 P 3,360 7,560 5,040 P15,960 P240 (160) 260 P340 P 1,600 2,200 6,000 5,400 1,200 P16,400 P32,700 P 1,600 2,200 6,000 5,400 1,200 P16,400 P32,360 - Actual 4,200 Hours Cost-Volume Formula Variable Overhead Costs: Utilities P0.80 per hour Supplies 1.80 Indirect labor 1.20 Total P3.80 Fixed Overhead Costs: Utilities Supplies Depreciation Indirect labor Insurance Total Total Factory Overhead Costs Problem 4 (Evaluation of Performance) Requirement 1 Performance Report for the Production Manager Controllable costs: Direct material Direct labor Supplies Maintenance Total Actual Cost Flexible Budget Cost Variance (U) or (F) P24,000 48,000 4,000 3,000 P79,000 P20,000 50,000 6,000 4,000 P80,000 P4,000 (U) 2,000 (F) 2,000 (F) 1,000 (F) P1,000 (F) 18-244 P340 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 The cost of raw materials rose significantly, possibly because of (1) deficient machinery due to the cutback in maintenance expenditures and/or (2) to the lower labor cost, possibly due to the use of less-skilled workers. Supplies decreased, indicating possible inadequacies for next period’s production run. Requirement 2 Performance Report for the Vice President Actual Cost Flexible Budget Cost Variance (U) or (F) Controllable costs: Marketing division P104,000 P102,000 P2,000 (U) Production division 79,000 80,000 1,000 (F) Personnel division 72,000 76,000 4,000 (F) Other costs 68,800 70,000 1,200 (F) Total P323,800 P328,000 P4,200 (F) The marketing division is behind its cost allotment. The personnel division came in somewhat under its budgeted costs. Perhaps there has been a cutback in hiring, indicating possible reduction in future production. Problem 5 (Target Sales Price; Return on Investment) Requirement 1 Return on investment = Operating income / Investment 20% = X / P800,000 Target Operating Income = P160,000 Target revenues, calculated as follows: Fixed overhead Variable costs Desired operating income Revenues 1,500,000 x P300 The selling price per units is P540 = P810,000 / 1,500 Requirement 2 Data are in thousands. 18-245 P200,000 450,000 160,000 P810,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Units Revenues 1,500 P810 2,000 P1,080 1,000 P540 450 200 650 600 200 800 300 200 500 P160 20% P280 35% P 40 5% = P160 / P800 = P280 / P800 = P40 / P800 Variable costs Fixed costs Total costs Operating income Return on investment Note how the change in income follows the change in revenues, as predicted by operating leverage. Operating leverage multiplied times the percentage change in sales gives the percentage change in income. Thus, the greater the operating leverage ratio, the larger the effect on income and ROI of a given percentage change in sales. This exercise provides an opportunity to review the relationship between volume and profit. See the illustration below: Operating leverage = contribution margin / operating income = (P810 – P450) / P160 = 2.25 % change in income = = operating leverage x % change in revenues 2.25 x 33.33% = 75% % change in income If volume goes to 2,000 units: (P280 – P160) / P160 = 75% If volume goes to 1,000 units: (P160 – P40) / P160 = 75% % change in ROI If volume goes to 2,000 units: (35% - 20%) / 20% = 75% If volume goes to 1,000 units: (20% - 5%) / 20% = 75% Problem 6 (Contrasting Return on Investment (ROI) and Residual Income) Requirement 1 ROI computations: Net operating income Sales 18-246 Sales Average operating assets Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 ROI x = Pasig: P630,000 P9,000,000 x P9,000,000 P3,000,000 = 7% x 3 = 21% Quezon: P1,800,000 P20,000,000 x P20,000,000 P10,000,000 = 9% x 2 = 18% Requirement 2 Average operating assets (a) Net operating income Minimum required return on average operating assets—16% × (a) Residual income Pasig P3,000,000 P 630,000 Quezon P10,000,000 P 1,800,000 480,000 P 150,000 P 1,600,000 P 200,000 Requirement 3 No, the Quezon Division is simply larger than the Pasig Division and for this reason one would expect that it would have a greater amount of residual income. Residual income can’t be used to compare the performance of divisions of different sizes. Larger divisions will almost always look better, not necessarily because of better management but because of the larger peso figures involved. In fact, in the case above, Quezon does not appear to be as well managed as Pasig. Note from Part (1) that Quezon has only an 18% ROI as compared to 21% for Pasig. Problem 7 (Transfer Pricing) Requirement 1 Since the Valve Division has idle capacity, it does not have to give up any outside sales to take on the Pump Division’s business. Applying the formula 18-247 Transfer price Variable cost + per unit Total contribution margin on lost sales Number of units transferred Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II for the lowest acceptable transfer price from the viewpoint of the selling division, we get: P16 + P0 10,000 = P16 The Pump Division would be unwilling to pay more than P29, the price it is currently paying an outside supplier for its valves. Therefore, the transfer price must fall within the range: Transfer price P16 Transfer price P29 Requirement 2 Since the Valve Division is selling all of the valves that it can produce on the outside market, it would have to give up some of these outside sales to take on the Pump Division’s business. Thus, the Valve Division has an opportunity cost, which is the total contribution margin on lost sales: Variable cost + per unit Transfer price P16 + Transfer price Total contribution margin on lost sales Number of units transferred (P30 – P16) x 10,000 10,000 = P16 + P14 = P30 Since the Pump Division can purchase valves from an outside supplier at only P29 per unit, no transfers will be made between the two divisions. Requirement 3 Applying the formula for the lowest acceptable price from the viewpoint of the selling division, we get: Transfer price Variable cost + per unit Transfer price Total contribution margin on lost sales Number of units transferred (P16 – P3) + 18-248 = P27 P13 (P30 – P16) x 10,000 10,000 + P14 = Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 In this case, the transfer price must fall within the range: P27 Transfer price P29 Problem 8 (Transfer Pricing) To produce the 20,000 special valves, the Valve Division will have to give up sales of 30,000 regular valves to outside customers. Applying the formula for the lowest acceptable price from the viewpoint of the selling division, we get: Transfer price Variable cost + per unit Transfer price P20 + Total contribution margin on lost sales Number of units transferred (P30 – P16) x 30,000 20,000 = P20 + P21 = P41 Problem 9 (Effects of Changes in Sales, Expenses, and Assets in ROI) 1. Margin = = 2. Turnover = = Net operating income Sales P800,000 P8,000,000 = 10% Sales Average operating assets P8,000,000 P3,200,000 3. 18-249 = 2.5 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II ROI = Margin x Turnover = 10% x 2.5 = 25% Problem 10 (Transfer Pricing Basics) Requirement (1) a. The lowest acceptable transfer price from the perspective of the selling division, the Electrical Division, is given by the following formula: Transfer price = Variable cost per unit + Total contribution margin on lost sales Number of units transferred Because there is enough idle capacity to fill the entire order from the Motor Division, there are no lost outside sales. And because the variable cost per unit is P21, the lowest acceptable transfer price as far as the selling division is concerned is also P21. Transfer price = P21 + P0 10,000 = P21 b. The Motor Division can buy a similar transformer from an outside supplier for P38. Therefore, the Motor Division would be unwilling to pay more than P38 per transformer. Transfer price: Cost from buying from outside supplier = P38 c. Combining the requirements of both the selling division and the buying division, the acceptable range of transfer prices in this situation is: P21 : Transfer price : P38 Assuming that the managers understand their own businesses and that they are cooperative, they should be able to agree on a transfer price within this range and the transfer should take place. d. From the standpoint of the entire company, the transfer should take place. The cost of the transformers transferred is only P21 and the company saves the P38 cost of the transformers purchased from the outside supplier. Requirement (2) 18-250 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 a. Each of the 10,000 units transferred to the Motor Division must displace a sale to an outsider at a price of P40. Therefore, the selling division would demand a transfer price of at least P40. This can also be computed using the formula for the lowest acceptable transfer price as follows: (P40 – P21) x 10,000 Transfer price = P21 + 10,000 = P21 + (P40 – P21) = P40 b. As before, the Motor Division would be unwilling to pay more than P38 per transformer. c. The requirements of the selling and buying divisions in this instance are incompatible. The selling division must have a price of at least P40 whereas the buying division will not pay more than P38. An agreement to transfer the transformers is extremely unlikely. d. From the standpoint of the entire company, the transfer should not take place. By transferring a transformer internally, the company gives up revenue of P40 and saves P38, for a loss of P2. Problem 11 (Transfer Pricing with an Outside Market) Requirement (1) The lowest acceptable transfer price from the perspective of the selling division is given by the following formula: Total contribution margin Variable cost + on lost sales Transfer price = per unit Number of units transferred The Tuner Division has no idle capacity, so transfers from the Tuner Division to the Assembly Division would cut directly into normal sales of tuners to outsiders. The costs are the same whether a tuner is transferred internally or sold to outsiders, so the only relevant cost is the lost revenue of P200 per tuner that could be sold to outsiders. This is confirmed below: Transfer price = P110 + (P200 – P110) x 30,000 30,000 = P110 + (P200 – P110) = P200 Therefore, the Tuner Division will refuse to transfer at a price less than P200 per tuner. 18-251 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II The Assembly Division can buy tuners from an outside supplier for P200, less a 10% quantity discount of P20, or P180 per tuner. Therefore, the Division would be unwilling to pay more than P180 per tuner. Transfer price : Cost of buying from outside supplier = P180 The requirements of the two divisions are incompatible. The Assembly Division won’t pay more than P180 and the Tuner Division will not accept less than P200. Thus, there can be no mutually agreeable transfer price and no transfer will take place. Requirement (2) The price being paid to the outside supplier, net of the quantity discount, is only P180. If the Tuner Division meets this price, then profits in the Tuner Division and in the company as a whole will drop by P600,000 per year: Lost revenue per tuner....................................................... Outside supplier’s price..................................................... Loss in contribution margin per tuner................................ Number of tuners per year................................................. Total loss in profits............................................................ P200 P180 P20 × 30,000 P600,000 Profits in the Assembly Division will remain unchanged, since it will be paying the same price internally as it is now paying externally. Requirement (3) The Tuner Division has idle capacity, so transfers from the Tuner Division to the Assembly Division do not cut into normal sales of tuners to outsiders. In this case, the minimum price as far as the Assembly Division is concerned is the variable cost per tuner of P11. This is confirmed in the following calculation: P0 Transfer price = P110 + = P110 30,000 The Assembly Division can buy tuners from an outside supplier for P180 each and would be unwilling to pay more than that in an internal transfer. If the managers understand their own businesses and are cooperative, they should agree to a transfer and should settle on a transfer price within the range: P110 : Transfer price : P180 18-252 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Requirement (4) Yes, P160 is a bona fide outside price. Even though P160 is less than the Tuner Division’s P170 “full cost” per unit, it is within the range given in Part 3 and therefore will provide some contribution to the Tuner Division. If the Tuner Division does not meet the P160 price, it will lose P1,500,000 in potential profits: Price per tuner.................................................. P160 Variable costs................................................... 110 Contribution margin per tuner.......................... P 50 30,000 tuners × P50 per tuner = P1,500,000 potential increased profits This P1,500,000 in potential profits applies to the Tuner Division and to the company as a whole. Requirement (5) No, the Assembly Division should probably be free to go outside and get the best price it can. Even though this would result in lower profits for the company as a whole, the buying division should probably not be forced to purchase inside if better prices are available outside. Requirement (6) The Tuner Division will have an increase in profits: Selling price...................................................... P200 Variable costs................................................... 110 Contribution margin per tuner.......................... P 90 30,000 tuners × P90 per tuner = P2,700,000 increased profits 18-253 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II The Assembly Division will have a decrease in profits: Inside purchase price........................................ P200 Outside purchase price..................................... 160 Increased cost per tuner.................................... P 40 30,000 tuners × P40 per tuner = P1,200,000 decreased profits The company as a whole will have an increase in profits: Increased contribution margin in the Tuner Division............................................ P 90 Decreased contribution margin in the Assembly Division..................................... 40 Increased contribution margin per tuner............................................................... P 50 30,000 tuners × P50 per tuner = P1,500,000 increased profits So long as the selling division has idle capacity and the transfer price is greater than the selling division’s variable costs, profits in the company as a whole will increase if internal transfers are made. However, there is a question of fairness as to how these profits should be split between the selling and buying divisions. The inflexibility of management in this situation damages the profits of the Assembly Division and greatly enhances the profits of the Tuner Division. Problem 12 (Transfer Pricing; Divisional Performance) Requirement (1) The Electronics Division is presently operating at capacity; therefore, any sales of the KK8 circuit board to the Clock Division will require that the Electronics Division give up an equal number of sales to outside customers. Using the transfer pricing formula, we get a minimum transfer price of: Transfer price = Variable cost per unit + Total contribution margin on lost sales Number of units transferred Transfer price = P82.50 + (P125.00 – P82.50) Transfer price = P82.50 + P42.50 Transfer price = P125.00 Thus, the Electronics Division should not supply the circuit board to the Clock 18-254 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Division for P90 each. The Electronics Division must give up revenues of P125.00 on each circuit board that it sells internally. Since management performance in the Electronics Division is measured by ROI and dollar profits, selling the circuit boards to the Clock Division for P9 would adversely affect these performance measurements. Requirement (2) The key is to realize that the P100 in fixed overhead and administrative costs contained in the Clock Division’s P697.50 cost per timing device is not relevant. There is no indication that winning this contract would actually affect any of the fixed costs. If these costs would be incurred regardless of whether or not the Clock Division gets the oven timing device contract, they should be ignored when determining the effects of the contract on the company’s profits. Another key is that the variable cost of the Electronics Division is not relevant either. Whether the circuit boards are used in the timing devices or sold to outsiders, the production costs of the circuit boards would be the same. The only difference between the two alternatives is the revenue on outside sales that is given up when the circuit boards are transferred within the company. Selling price of the timing devices................................................................. P700.00 Less: The cost of the circuit boards used in the timing devices (i.e. the lost revenue from sale of circuit boards to outsiders)............................................................................................... P125.00 Variable costs of the Clock Division excluding the circuit board (P300.00 + P207.50)................................................................... 507.50 632.50 Net positive effect on the company’s profit.................................................... P 67.50 Therefore, the company as a whole would be better off by P67.50 for each timing device that is sold to the oven manufacturer. Requirement (3) As shown in part (1) above, the Electronics Division would insist on a transfer price of at least P125.00 for the circuit board. Would the Clock Division make any money at this price? Again, the fixed costs are not relevant in this decision since they would not be affected. Once this is realized, it is evident that the Clock Division would be ahead by P67.50 per timing device if it accepts the P125.00 transfer price. Selling price of the timing devices................................................................ P700.00 18-255 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Less: Purchased parts (from outside vendors).................................................... P300.00 Circuit board KK8 (assumed transfer price)............................................. 125.00 Other variable costs................................................................................. 207.50 632.50 Clock Division contribution margin............................................................. P 67.50 In fact, since the contribution margin is P62.50, any transfer price within the range of P125.00 to P192.50 (= P125.00 + P67.50) will improve the profits of both divisions. So yes, the managers should be able to agree on a transfer price. Requirement (4) It is in the best interests of the company and of the divisions to come to an agreement concerning the transfer price. As demonstrated in part (3) above, any transfer price within the range P125.00 to P192.50 would improve the profits of both divisions. What happens if the two managers do not come to an agreement? In this case, top management knows that there should be a transfer and could step in and force a transfer at some price within the acceptable range. However, such an action, if done on a frequent basis, would undermine the autonomy of the managers and turn decentralization into a sham. Our advice to top management would be to ask the two managers to meet to discuss the transfer pricing decision. Top management should not dictate a course of action or what is to happen in the meeting, but should carefully observe what happens in the meeting. If there is no agreement, it is important to know why. There are at least three possible reasons. First, the managers may have better information than the top managers and refuse to transfer for very good reasons. Second, the managers may be uncooperative and unwilling to deal with each other even if it results in lower profits for the company and for themselves. Third, the managers may not be able to correctly analyze the situation and may not understand what is actually in their own best interests. For example, the manager of the Clock Division may believe that the fixed overhead and administrative cost of P100 per timing device really does have to be covered in order to avoid a loss. If the refusal to come to an agreement is the result of uncooperative attitudes or an inability to correctly analyze the situation, top management can take some positive steps that are completely consistent with decentralization. If the problem is uncooperative attitudes, there are many training companies that would be happy to put on a short course in team building for the company. If the problem is that the managers are unable to correctly analyze the 18-256 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 alternatives, they can be sent to executive training courses that emphasize economics and managerial accounting. IV. Multiple Choice Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. C D A A C A D A C A 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. E D C C B C B A B A 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. C B A D B A A B D A 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. B D D D C D B D B D CHAPTER 15 FUNCTIONAL AND ACTIVITY-BASED BUDGETING I. Questions 1. No. Planning and control are different, although related, concepts. Planning involves developing objectives and formulating steps to achieve those objectives. Control, by contrast, involves the means by which management ensures that the objectives set down at the planning stage are attained. 2. Budgets have a dual purpose, for planning and for following up the implementation of the plan. The great benefits from budgeting lie in the quick investigation of deviations and in the subsequent corrective action. Budgets should not be prepared in the first place if they are ignored, buried in files, or improperly interpreted. 3. Two major features of a budgetary program are (1) the accounting techniques which developed it and (2) the human factors which administer it. The human factors are far more important. The success of a budgetary system depends upon its acceptance by the company members who are affected by the budget. Without a thoroughly educated and 18-257 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II cooperative management group at all levels of responsibility, budgets are a drain on the funds of the business and are a hindrance instead of help to efficient operations. 4. Manufacturing overhead costs are budgeted at normal operating capacity, and the costs are applied to the products using a predetermined rate. The predetermined rate is computed by dividing a factor that can be identified with both the products and the overhead into the overhead budgeted at the normal operating capacity. Budgets may also be used in costing products in a standard cost accounting system. 5. The production division operates to produce the products that are sold. Production and sales must be coordinated. Products must be manufactured so that they will be available to meet sales delivery dates. Activity of the production division will depend upon the sales that can be made. Also, the sales division is limited by the capabilities of the production department in manufacturing products. Successful operations depend upon a coordination of sales and production. 6. Labor hour required for production can be translated into labor pesos by multiplying the number of hours budgeted by the appropriate labor rates. The rates to be used will depend upon the rates established for job classifications and the policy with respect to premium pay for overtime or shift differences. 7. A long-range plan for the acquisition of plant assets is broken down and entered in the current budget as the plan unfolds. The portion of the plan which is to be executed in the next year is included in the budget for that year. 8. A budget period is not limited to any particular unit of time. At a minimum, a budget should cover at least one operating cycle. For example, a budget should not cover a period when purchasing activity is high and omit the period when sales volume and cash collection are relatively high. The budget period should encompass the entire cycle extending from the purchasing operation to the subsequent sale of the products and the realization of the sales in cash. Ordinarily, a budget of operations is prepared for a year which in turn is divided into quarters and months. Long-term budgets, such as budgets for projects or capital investments, may extend five to ten years or more into the future. 9. A rolling budget or a progressive budget or sometimes called continuous budget, is a budget which is prepared throughout the year. As one month elapses, a budget is prepared for one more month in the future. At any one time for example, the company will have a budget for one year into 18-258 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 the future, when July of one year is over, a budget for the following July will be added at the other end of the budget. This process of adding a new month as a month expires is continuous. 10. Variances that are revealed by a comparison of actual results with a budget are investigated if it appears that an investigation is warranted. The investigation may show that stricter control measures are needed or that some weaknesses in the operation should be corrected. It may also reveal that the budget plan should be revised. The comparison is one step in the control and direction of business operations. 11. A comparison of actual results with a budget can contribute information that can be applied in the preparation of better budgets in the future. Subsequent investigation of variances provides management with a better knowledge of operations. This knowledge can be applied in the preparation of more realistic budgets for subsequent fiscal periods. 12. A self-imposed budget is one in which persons with responsibility over cost control prepare their own budgets, i.e., the budget is not imposed from above. The major advantages are: (1) the views and judgments of persons from all levels of an organization are represented in the final budget document; (2) budget estimates generally are more accurate and reliable, since they are prepared by those who are closest to the problems; (3) managers generally are more motivated to meet budgets which they have participated in setting; (4) self-imposed budgets reduce the amount of upward “blaming” resulting from inability to meet budget goals. One caution must be exercised in the use of self-imposed budgets. The budgets prepared by lower-level managers should be carefully reviewed to prevent too much slack. 13. No, although this is clearly one of the purposes of the cash budget. The principal purpose is to provide information on probable cash needs during the budget period, so that bank loans and other sources of financing can be anticipated and arranged well in advance of the actual time of need. 14. Zero-based budgeting requires that managers start at zero levels every year and justify all costs as if all programs were being proposed for the first time. In traditional budgeting, by contrast, budget data are usually generated on an incremental basis, with last year’s budget being the starting point. 15. A budget is a detailed quantitative plan for the acquisition and use of financial and other resources over a given time period. Budgetary control involves the use of budgets to control the actual activities of a firm. 18-259 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II 16. 1. Budgets communicate management’s plans throughout the organization. 2. Budgets force managers to think about and plan for the future. 3. The budgeting process provides a means of allocating resources to those parts of the organization where they can be used most effectively. 4. The budgeting process can uncover potential bottlenecks before they occur. 5. Budgets coordinate the activities of the entire organization by integrating the plans of its various parts. Budgeting helps to ensure that everyone in the organization is pulling in the same direction. 6. Budgets define goals and objectives that can serve as benchmarks for evaluating subsequent performance. 17. A master budget represents a summary of all of management’s plans and goals for the future, and outlines the way in which these plans are to be accomplished. The master budget is composed of a number of smaller, specific budgets encompassing sales, production, raw materials, direct labor, manufacturing overhead, selling and administrative expenses, and inventories. The master budget generally also contains a budgeted income statement, budgeted balance sheet, and cash budget. 18. The flow of budgeting information moves in two directions—upward and downward. The initial flow should be from the bottom of the organization upward. Each person having responsibility over revenues or costs should prepare the budget data against which his or her subsequent performance will be measured. As the budget data are communicated upward, higherlevel managers should review the budgets for consistency with the overall goals of the organization and the plans of other units in the organization. Any issues should be resolved in discussions between the individuals who prepared the budgets and their managers. All levels of an organization should participate in the budgeting process— not just top management or the accounting department. Generally, the lower levels will be more familiar with detailed, day-to-day operating data, and for this reason will have primary responsibility for developing the specifics in the budget. Top levels of management should have a better perspective concerning the company’s strategy. 19. Budgeting can assist a company forecast its workforce staffing needs through direct labor and other budgets. By careful planning through the budget process, a company can often smooth out its activities and avoid erratic hiring and laying off employees. 18-260 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 II. Matching Type 1. 2. 3. 4. 5. C H E F I 6. 7. 8. 9. 10. A B J D G III. Exercises Exercises 1 (Schedule of Expected Cash Collections) Requirement 1 July May sales: P430,000 × 10% June sales: P540,000 × 70%, 10% July sales: P600,000 × 20%, 70%, 10% August sales: P900,000 × 20%, 70% September sales: P500,000 × 20% Total cash collections August September P 43,000 Total P 43,000 378,000 P54,000 432,000 120,000 420,000 P 60,000 600,000 180,000 630,000 810,000 100,000 P654,000 P790,000 100,000 P1,985,000 P541,000 Notice that even though sales peak in August, cash collections peak in September. This occurs because the bulk of the company’s customers pay in the month following sale. The lag in collections that this creates is even more pronounced in some companies. Indeed, it is not unusual for a company to have the least cash available in the months when sales are greatest. Requirement 2 Accounts receivable at September 30: From August sales: P900,000 × 10%...................................................................... P 90,000 From September sales: P500,000 × (70% + 10%)................................................... 400,000 Total accounts receivable......................................................................................... P490,000 18-261 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Exercise 2 (Production Budget) July 30,000 4,500 34,500 3,000 31,500 Budgeted sales in units Add desired ending inventory* Total needs Less beginning inventory Required production August 45,000 6,000 51,000 4,500 46,500 Septembe r 60,000 5,000 65,000 6,000 59,000 Quarter 135,000 5,000 140,000 3,000 137,000 * 10% of the following month’s sales Exercise 3 (Materials Purchase Budget) First 60,000 × 3 180,000 Required production of calculators Number of chips per calculator Total production needs—chips Production needs—chips Add desired ending inventory— chips Total needs—chips Less beginning inventory—chips Required purchases—chips Cost of purchases at P2 per chip Quarter – Year 2 Second Third 90,000 150,000 × 3 × 3 270,000 450,000 First 180,000 Second 270,000 Year 2 Third 450,000 54,000 234,000 36,000 198,000 P396,000 90,000 360,000 54,000 306,000 P612,000 60,000 510,000 90,000 420,000 P840,000 Fourth 100,000 × 3 300,000 Fourth 300,000 Year 3 First 80,000 × 3 240,000 Year 1,200,000 48,000 48,000 348,000 1,248,000 60,000 36,000 288,000 1,212,000 P576,000 P2,424,000 Exercise 4 (Direct Labor Budget) Requirement 1 Assuming that the direct labor workforce is adjusted each quarter, the direct labor budget would be: Units to be produced 1st 2nd 3rd 4th Quarter Quarter Quarter Quarter 5,000 4,400 4,500 4,900 18-262 Year 18,800 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Direct labor time per unit (hours) × 0.40 × 0.40 × 0.40 × 0.40 × 0.40 Total direct labor hours needed 2,000 1,760 1,800 1,960 7,520 Direct labor cost per hour × P11.00 × P11.00 × P11.00 × P11.00 × P11.00 Total direct labor cost P 22,000 P 19,360 P 19,800 P 21,560 P 82,720 Requirement 2 Assuming that the direct labor workforce is not adjusted each quarter and that overtime wages are paid, the direct labor budget would be: Units to be produced Direct labor time per unit (hours) Total direct labor hours needed Regular hours paid Overtime hours paid Wages for regular hours (@ P11.00 per hour) Overtime wages (@ P11.00 per hour × 1.5) Total direct labor cost 1st 2nd 3rd 4th Quarter Quarter Quarter Quarter 5,000 4,400 4,500 4,900 Year 18,800 × 0.40 × 0.40 × 0.40 × 0.40 × 0.40 2,000 1,800 200 1,760 1,800 - 1,800 1,800 - 1,960 1,800 160 7,520 7,200 360 P19,800 P19,800 P19,800 P19,800 P79,200 3,300 P23,100 P19,800 P19,800 2,640 P22,440 5,940 P85,140 Exercise 5 (Manufacturing Overhead Budget) Requirement 1 Kiko Corporation Manufacturing Overhead Budget Budgeted direct labor-hours Variable overhead rate Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Less depreciation Cash disbursements for manufacturing overhead 1st Quarter 5,000 x P1.75 P 8,750 35,000 43,750 15,000 2nd Quarter 4,800 x P1.75 P 8,400 35,000 43,400 15,000 3rd Quarter 5,200 x P1.75 P 9,100 35,000 44,100 15,000 4th Quarter 5,400 x P1.75 P 9,450 35,000 44,450 15,000 Year 20,400 x P1.75 P 35,700 140,000 175,700 60,000 P28,750 P28,400 P29,100 P29,450 P115,700 Requirement 2 Total budgeted manufacturing overhead for the year (a) Total budgeted direct labor-hours for the year (b) 18-263 P175,700 20,400 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Predetermined overhead rate for the year (a) ÷ (b) P 8.61 Exercise 6 (Selling and Administrative Budget) Helene Company Selling and Administrative Expense Budget Budgeted unit sales Variable selling and administrative expense per unit Variable expense Fixed selling and administrative expenses: Advertising Executive salaries Insurance Property taxes Depreciation Total fixed selling and administrative expenses Total selling and administrative expenses Less depreciation Cash disbursements for selling and administrative expenses 1st Quarter 12,000 2nd Quarter 14,000 3rd Quarter 11,000 4th Quarter 10,000 Year 47,000 x P2.75 P33,000 x P2.75 P 38,500 x P2.75 P 30,250 x P2.75 P 27,500 x P2.75 P129,250 12,000 40,000 12,000 40,000 6,000 12,000 40,000 12,000 40,000 6,000 16,000 16,000 6,000 16,000 16,000 48,000 160,000 12,000 6,000 64,000 68,000 74,000 74,000 74,000 290,000 101,000 16,000 112,500 16,000 104,250 16,000 101,500 16,000 419,250 64,000 P 85,000 P 96,500 P 88,250 P 85,500 P355,250 Exercise 7 (Cash Budget Analysis) Cash balance, beginning Add collections from customers Total cash available Less disbursements: Purchase of inventory Operating expenses Equipment purchases Dividends Total disbursements Excess (deficiency) of cash available over disbursements Quarter (000 omitted) 1 2 3 4 P 9 * P 5 P 5 P 5 76 85 * 90 95 125 * 130 40 * 36 10 * 2 * 88 58 42 8 2 110 * 36 * 54 * * 8 * * 2 * * 100 (3)* 18-264 (15) 30 * 100 105 32 * 48 10 2 * 92 13 Year P 9 391 * 400 166 180 * 36 * 8 390 10 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Financing: Borrowings Repayments (including interest) Total financing Cash balance, ending 8 0 8 P5 20 * 0 20 P 5 — — 28 (25) (25) P 5 (7)* (7) P 6 (32) (4) P 6 *Given. IV. Problems Problem 1 (Schedule of Expected Cash Collections and Disbursements) Requirement 1 September cash sales............................................................................................... P 7,400 September collections on account: July sales: P20,000 × 18%................................................................................... 3,600 August sales: P30,000 × 70%.............................................................................. 21,000 September sales: P40,000 × 10%......................................................................... 4,000 Total cash collections............................................................................................... P36,000 Requirement 2 Payments to suppliers: August purchases (accounts payable).................................................................. P16,000 September purchases: P25,000 × 20%................................................................. 5,000 Total cash payments................................................................................................ P21,000 Requirement 3 COOKIE PRODUCTS Cash Budget For the Month of September Cash balance, September 1...................................................................................... P 9,000 Add cash receipts: Collections from customers.................................................................................. 36,000 Total cash available before current financing........................................................... 45,000 Less disbursements: Payments to suppliers for inventory..................................................................... P21,000 18-265 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Selling and administrative expenses..................................................................... 9,000 * Equipment purchases........................................................................................... 18,000 Dividends paid..................................................................................................... 3,000 Total disbursements................................................................................................. 51,000 Excess (deficiency) of cash available over disbursements...................................................................................................... (6,000) Financing: Borrowings.......................................................................................................... 11,000 Repayments......................................................................................................... 0 Interest................................................................................................................. 0 Total financing......................................................................................................... 11,000 Cash balance, September 30.................................................................................... P 5,000 * P13,000 – P4,000 = P9,000. Problem 2 (Production and Purchases Budget) Requirement 1 Production budget: Budgeted sales (units) Add desired ending inventory Total needs Less beginning inventory Required production July 40,000 20,000 60,000 17,000 43,000 August 50,000 26,000 76,000 20,000 56,000 Septembe r 70,000 15,500 85,500 26,000 59,500 October 35,000 11,000 46,000 15,500 30,500 Requirement 2 During July and August the company is building inventories in anticipation of peak sales in September. Therefore, production exceeds sales during these months. In September and October inventories are being reduced in anticipation of a decrease in sales during the last months of the year. Therefore, production is less than sales during these months to cut back on inventory levels. Requirement 3 Raw materials purchases budget: 18-266 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Septembe Third July August r Quarter Required production (units) 43,000 56,000 59,500 158,500 Material P214 needed per unit × 3 lbs. × 3 lbs. × 3 lbs. × 3 lbs. Production needs (lbs.) 129,000 168,000 178,500 475,500 Add desired ending inventory (lbs.) 84,000 89,250 45,750 * 45,750 Total Material P214 needs 213,000 257,250 224,250 521,250 Less beginning inventory (lbs.) 64,500 84,000 89,250 64,500 Material P214 purchases (lbs.) 148,500 173,250 135,000 456,750 * 30,500 units (October production) × 3 lbs. per unit= 91,500 lbs.; 91,500 lbs. × 0.5 = 45,750 lbs. As shown in requirement (1), production is greatest in September. However, as shown in the raw material purchases budget, the purchases of materials is greatest a month earlier because materials must be on hand to support the heavy production scheduled for September. Problem 3 (Cash Budget; Income Statement; Balance Sheet) Requirement 1 Schedule of cash receipts: Cash sales—June..................................................................................................... P 60,000 Collections on accounts receivable: May 31 balance................................................................................................... 72,000 June (50% × 190,000)......................................................................................... 95,000 Total cash receipts................................................................................................... P227,000 Schedule of cash payments for purchases: May 31 accounts payable balance........................................................................... P 90,000 June purchases (40% × 200,000)............................................................................. 80,000 Total cash payments................................................................................................ P170,000 PICTURE THIS, INC. Cash Budget For the Month of June Cash balance, beginning.......................................................................................... P 8,000 Add receipts from customers (above)....................................................................... 227,000 18-267 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Total cash available................................................................................................. 235,000 Less disbursements: Purchase of inventory (above).............................................................................. 170,000 Operating expenses.............................................................................................. 51,000 Purchases of equipment....................................................................................... 9,000 Total cash disbursements......................................................................................... 230,000 Excess of receipts over disbursements..................................................................... 5,000 Financing: Borrowings—note................................................................................................ 18,000 Repayments—note............................................................................................... (15,000) Interest................................................................................................................. (500) Total financing......................................................................................................... 2,500 Cash balance, ending............................................................................................... P 7,500 Requirement 2 PICTURE THIS, INC. Budgeted Income Statement For the Month of June Sales........................................................................................................................ P250,000 Cost of goods sold: Beginning inventory............................................................................................. P 30,000 Add purchases..................................................................................................... 200,000 Goods available for sale....................................................................................... 230,000 Ending inventory.................................................................................................. 40,000 Cost of goods sold............................................................................................... 190,000 Gross margin........................................................................................................... 60,000 Operating expenses (P51,000 + P2,000).................................................................. 53,000 Net operating income............................................................................................... 7,000 Interest expense....................................................................................................... 500 Net income.............................................................................................................. P 6,500 Requirement 3 PICTURE THIS, INC. Budgeted Balance Sheet June 30 Assets Cash........................................................................................................................ P 7,500 Accounts receivable (50% × 190,000)..................................................................... 95,000 Inventory................................................................................................................. 40,000 18-268 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Buildings and equipment, net of depreciation (P500,000 + P9,000 – P2,000)............................................................................ 507,000 Total assets.............................................................................................................. P649,500 Liabilities and Equity Accounts payable (60% × 200,000)........................................................................ P120,000 Note payable............................................................................................................ 18,000 Share capital............................................................................................................ 420,000 Retained earnings (P85,000 + P6,500).................................................................... 91,500 Total liabilities and equity........................................................................................ P649,500 Problem 4 (Sales, Production and Materials Purchases Budget) Requirement 1 Nikko Manufacturing Company Sales Budget For the year ending December 31, 2005 Units 16,000 20,000 22,000 22,000 80,000 First quarter Second quarter Third quarter Fourth quarter Total Amount P 480,000 600,000 660,000 660,000 P2,400,000 Requirement 2 Nikko Manufacturing Company Statement of Production Required For 2005 Units to be sold Add: Desired ending inventory (20%) Total units required Less: Beginning inventory Units to be produced 1st 16,000 4,000 20,000 3,000 17,000 18-269 Quarter 2nd 3rd 20,000 22,000 4,400 4,400 24,400 26,400 4,000 4,400 20,400 22,000 4th 22,000 5,000 27,000 4,400 22,600 Total 80,000 5,000 85,000 3,000 82,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Requirement 3 Nikko Manufacturing Company Statement of Raw Materials Purchase Requirements For 2005 Units required for production Add: Desired ending inventory Total units Less: Beginning inventory Raw Materials to be Purchased 1st 51,000 12,240 63,240 12,500 50,740 Quarter 2nd 3rd 61,200 66,000 13,200 13,560 74,400 79,560 12,240 13,200 62,160 66,360 4th Total 67,800 246,000 15,000 15,000 82,800 261,000 13,560 12,500 69,240 248,500 Problem 5 (Schedule of Expected Cash Collections; Cash Budget) Requirement 1 Schedule of expected cash collections: From accounts receivable From April sales: 20% × 200,000 75% × 200,000 4% × 200,000 From May sales: 20% × 300,000 75% × 300,000 From June sales: 20% × 250,000 Total cash collections April P141,000 Month May P 7,200 June 40,000 Quarter P148,200 P 8,000 40,000 150,000 8,000 225,000 60,000 225,000 50,000 P181,000 P217,200 P283,000 50,000 P681,200 Month May June P 27,000 P 20,200 Quarter P 26,000 150,000 60,000 Requirement 2 Cash budget: Cash balance, beginning Add receipts: April P 26,000 18-270 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Collections from customers Total available Less disbursements: Merchandise purchases Payroll Lease payments Advertising Equipment purchases Total disbursements Excess (deficiency) of receipts over disbursements Financing: Borrowings Repayments Interest Total financing Cash balance, ending 181,000 207,000 217,200 244,200 283,000 303,200 681,200 707,200 108,000 9,000 15,000 70,000 8,000 210,000 120,000 9,000 15,000 80,000 — 224,000 180,000 8,000 15,000 60,000 — 263,000 408,000 26,000 45,000 210,000 8,000 697,000 (3,000) 20,200 40,200 10,200 — — — (30,000) — (1,200) — (31,200) P 20,200 P 9,000 30,000 (30,000) (1,200) (1,200) P 9,000 30,000 — — 30,000 P 27,000 Requirement 3 If the company needs a minimum cash balance of P20,000 to start each month, the loan cannot be repaid in full by June 30. If the loan is repaid in full, the cash balance will drop to only P9,000 on June 30, as shown above. Some portion of the loan balance will have to be carried over to July, at which time the cash inflow should be sufficient to complete repayment. Problem 6 (Flexible Budget) Summer Machine Company Flexible Overhead Budget Department 1 Machine Hours Variable Overhead Fixed Overhead Total 100% 200,000 P1,300,000 300,000 P1,600,000 90% 180,000 P1,170,000 300,000 P1,470,000 18-271 Capacity 80% 160,000 P1,040,000 300,000 P1,340,000 70% 140,000 P 910,000 300,000 P1,210,000 60% 120,000 P 780,000 300,000 P1,080,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Manufacturing Overhead rate per machine hour P8.00 Summer Machine Company Flexible Overhead Budget Department 2 Direct Labor Hours Machine Hours Variable Overhead Fixed Overhead Total 100% 200,000 400,000 P1,400,000 500,000 P1,900,000 90% 180,000 360,000 P1,260,000 500,000 P1,760,000 Manufacturing Overhead rate per machine hour Capacity 80% 160,000 320,000 P1,120,000 500,000 P1,620,000 70% 140,000 280,000 P 980,000 500,000 P1,480,000 60% 120,000 240,000 P 840,000 500,000 P1,340,000 P4.75 Problem 7 (Cash Budget with Supporting Schedules) 1. Collections on sales: July August Sept. Quarter Cash sales..................................................... P 8,000 P14,000 P10,000 P 32,000 Credit sales: May: P30,000 × 80% × 20%..................... 4,800 4,800 June: P36,000 × 80% × 70%, 20%....................................................... 20,160 5,760 25,920 July: P40,000 × 80% × 10%, 70%, 20%.............................................. 3,200 22,400 6,400 32,000 Aug.: P70,000 × 80% × 10%, 70%....................................................... 5,600 39,200 44,800 Sept.: P50,000 × 80% × 10%.................... 4,000 4,000 Total cash collections.................................... P36,160 P47,760 P59,600 P143,520 2. a. Merchandise purchases budget: July August Sept. Oct. Budgeted cost of goods sold.......................... P24,000 P42,000 P30,000 P27,000 Add desired ending inventory*....................... 31,500 22,500 20,250 Total needs.................................................... 55,500 64,500 50,250 Less beginning inventory............................... 18,000 31,500 22,500 Required inventory purchases........................ P37,500 P33,000 P27,750 18-272 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 *75% of the next month’s budgeted cost of goods sold. b. Schedule of expected cash disbursements for merchandise purchases: Quarte July August Sept. r Accounts payable, June 30............................ P11,700 P11,700 July purchases...............................................18,750 P18,750 37,500 August purchases.......................................... 16,500 P16,500 33,000 September purchases..................................... 13,875 13,875 Total cash disbursements............................... P30,450 P35,250 P30,375 P96,075 3. Ju Products, Inc. Cash Budget For the Quarter Ended September 30 July P Cash balance, beginning.............................8,000 Add collections from sales.......................... 36,160 Total cash available................................ 44,160 Less disbursements: For inventory purchases......................... 30,450 For selling expenses...............................7,200 For administrative expenses...................3,600 For land..................................................4,500 For dividends.......................................... 0 Total disbursements.................................... 45,750 Excess (deficiency) of cash available over disbursements.................................(1,590) Financing: Borrowings............................................. 10,000 Repayment............................................. 0 Interest................................................... 0 Total financing........................................... 10,000 18-273 August Sept. P P 8,410 8,020 47,760 59,600 56,170 67,620 Quarter P 8,000 143,520 151,520 35,250 30,375 11,700 8,500 5,200 4,100 0 0 0 1,000 52,150 43,975 96,075 27,400 12,900 4,500 1,000 141,875 4,020 23,645 9,645 4,000 0 (14,000) 0 (380) 4,000 (14,380) 14,000 (14,000) (380) (380) Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II P Cash balance, ending..................................8,410 * P10,000 × 1% × 3 = P4,000 × 1% × 2 = P 8,020 P 9,265 P 9,265 P300 80 P380 V. Multiple Choice Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. B B C E C C D C A D 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. C B C B D C A B E B 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. C C D C C C D A C D Supporting computations: Questions 16 to 20: January Cost of sales P1,400,000 Add: Desired Minimum Inventory 492,000 Total 1,892,000 Less: Beginning Inventory (1,400,000 x 0.3) (17) 420,000 Gross Purchases (16) 1,472,000 Less: Cash discount 14,720 Net cost of purchases P1,457,280 Payments of Purchases 60% - month of purchase 40% - following month Total (19) 18-274 P874,368 (18) February P1,640,000 456,000 2,096,000 492,000 1,604,000 16,040 P1,587,960 P 952,776 582,912 P1,535,688 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Gross Current month’s sales (with discount) 35% Current month’s sales (without discount) 15% Previous month’s sales (with discount) 4.5% Previous month’s sales (without discount) 40.5% February Cash Discount Net P595,000 P11,900 P583,100 255,000 0 255,000 67,500 1,350 66,150 607,500 P1,525,000 607,500 P13,250 (20)Total Collections in February Add: Cash sales Total P1,511,750 P1,511,750 350,000 P1,861,750 (21)Estimated cash receipts Collections from customers Proceeds from issuance of common stock Proceeds from short-term borrowing Total Less: Estimated cash disbursements For cost and expenses For income taxes Purchase of fixed asset Payment on short-term borrowings Total Cash balance, Dec. 31 (22)Net income P120,000 Add: Depreciation 65,000 Working capital provided from operations Add: Increase in income taxes payable P 80,000 Increase in provision for doubtful accounts receivable 45,000 Total Less: Increase in accounts receivable P 35,000 Decrease in accounts payable 25,000 Increase in cash 18-275 P1,350,000 500,000 100,000 P1,950,000 P1,200,000 90,000 400,000 50,000 1,740,000 P 210,000 P185,000 125,000 P310,000 60,000 P250,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II (23)Cash Receipts for February 2005 From February sales (60% x 110,000) From January sales Total P 66,000 38,000 P104,000 (24)Pro-forma Income Statement, February 2005 Sales Cost of sales (75%) Gross profit P110,000 82,500 P 27,500 Less: Operating expenses Depreciation Bad debts Net operating income 16,500 5,000 2,200 23,700 P 3,800 (25)Accounts Payable on February 28, 2005 will be the unpaid purchases in February - (75% x P120,000) = P90,000. Questions 26 to 29: Net sales Less: Cost of sales Finished goods inventory, Jan. 1 Add: Cost of goods manufactured (Sch. I) Total available for sale Less: Finished goods inventory, Dec. 31 Gross Profit Less: Operating and financial expenses Selling Administrative Finance Net income before taxes * P2,000,000 P 350,000 1,350,000 * P1,700,000 400,000 1,300,000 (26) P 700,000 P 300,000 180,000 20,000 500,000 P 200,000 Determined by working back from net income to sales. Schedule I Raw materials used Raw materials inventory, Jan. 1 Add: Purchases Total available 18-276 P 250,000 491,000 (29) 741,000 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Less: Raw materials inventory, Dec. 31 Raw materials used Direct labor Manufacturing overhead Total Manufacturing Cost Add: Work-in-process inventory, Jan. 1 Total P1,670,000 Less: Work-in-process inventory, Dec. 31 Cost of goods manufactured 300,000 P 441,000 588,000 441,000 (28) P1,470,000 (27) 200,000 320,000 P1,350,000 (30)Variable factory overhead P150,000 48,000 P3.125 Fixed factory overhead P240,000 48,000 5.000 Total factory overhead P8.125 CHAPTER 16 STANDARD COSTS AND OPERATING PERFORMANCE MEASURES I. Questions 1. Standard costs are superior to past data for comparison with actual costs because they ask the question “Is present performance better than the past?”. 2. No. Cost control and cost reduction are not the same, but cost reduction does affect the standards which are used as basis for cost control. Cost reduction means finding ways to achieve a given result through improved design, better methods, new layouts and so forth. Cost reduction results 18-277 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II in setting new standards. On the other hand, cost control is a process of maintaining performance at or as new existing standards as is possible. 3. Managerial judgment is the basis for deciding whether a given variance is large enough to warrant investigation. For some items, a small amount of variance may spark scrutiny. For some items, 5%, 10% or 25% variances from standard may call for follow-up. Management may also derive the standard deviation based on past cost data. 4. The techniques for overhead control differ because 1) The size of individual overhead costs usually does not justify elaborate individual control systems; 2) The behavior of individual overhead item is either impossible or difficult to trace to specific lots or operations; and 3) Various overhead items are the responsibility of different people. 5. In the year-to-year planning of fixed costs, managers must consider: 1) the projected maximum and minimum levels of activity, 2) prices of cost factors, and 3) changes in facilities and organization. 6. Four criteria for selecting a volume base are: 1) 2) 3) 4) Cause of cost variability. Adequacy of control over the base. Independence of activity unit. Ease of understanding. 7. Non-volume factors which cause costs to vary are: 1) Changes in plant and equipment. 2) Changes in products made, materials used, or methods of manufacturing. 3) Changes in prices paid for cost factors. 4) Changes in managerial policy toward costs. 5) Lag between cost incurrence and measurement of volume. 8. A budget is usually expressed in terms of total pesos, whereas a standard is expressed on a per unit basis. A standard might be viewed as the budgeted cost for one unit. 18-278 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 9. Under management by exception, managers focus their attention on operating results that deviate from expectations. It is assumed that results that meet expectations do not require investigation. 10. Separating an overall variance into a price variance and a quantity variance provides more information. Moreover, prices and quantities are usually the responsibilities of different managers. 11. The materials price variance is usually the responsibility of the purchasing manager. The materials quantity variance is usually the responsibility of the production managers and supervisors. The labor efficiency variance generally is also the responsibility of the production managers and supervisors. 12. If used as punitive tools, standards can breed resentment in an organization and undermine morale. Standards must never be used as an excuse to conduct witch-hunts, or as a means of finding someone to blame for problems. 13. Several factors other than the contractual rate paid to workers can cause a labor rate variance. For example, skilled workers with high hourly rates of pay can be given duties that require little skill and that call for low hourly rates of pay, resulting in an unfavorable rate variance. Or unskilled or untrained workers can be assigned to tasks that should be filled by more skilled workers with higher rates of pay, resulting in a favorable rate variance. Unfavorable rate variances can also arise from overtime work at premium rates. 14. Poor quality materials can unfavorably affect the labor efficiency variance. If the materials create production problems, a result could be excessive labor time and therefore an unfavorable labor efficiency variance. Poor quality materials would not ordinarily affect the labor rate variance. 15. If labor is a fixed cost and standards are tight, then the only way to generate favorable labor efficiency variances is for every workstation to produce at capacity. However, the output of the entire system is limited by the capacity of the bottleneck. If workstations before the bottleneck in the production process produce at capacity, the bottleneck will be unable to process all of the work in process. In general, if every workstation is attempting to produce at capacity, then work in process inventory will build up in front of the workstations with the least capacity. 16. A quantity standard indicates how much of an input should be used to make a unit of output. A price standard indicates how much the input should cost. 18-279 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II 17. Chronic inability to meet a standard is likely to be demoralizing and may result in decreased productivity. 18. A variance is the difference between what was planned or expected and what was actually accomplished. A standard cost system has at least two types of variances. A price variance focuses on the difference between the standard price and the actual price of an input. A quantity variance is concerned with the difference between the standard quantity of the input allowed for the actual output and the actual amount of the input used. II. Matching Type 1. E 2. G 3. C 4. H 5. A 6. D 7. J 8. B 9. I 10. F III. Exercises Exercise 1 (Setting Standards; Preparing a Standard Cost Card) Requirement 1 Cost per 2 kilogram container.................................................................................. P6,000.00 Less: 2% cash discount............................................................................................ 120.00 Net cost................................................................................................................... P5,880.00 Add freight cost per 2 kilogram container (P1,000 ÷ 10 containers)..................................................................................... 100.00 Total cost per 2 kilogram container (a).................................................................... P5,980.00 Number of grams per container (2 kilograms × 1000 grams per kilogram) (b)...................................................... 2,000 Standard cost per gram purchased (a) ÷ (b)............................................................. P 2.99 Requirement 2 Beta ML12 required per capsule as per bill of materials.......................................... 6.00 grams Add allowance for material rejected as unsuitable (6 grams ÷ 0.96 = 6.25 grams; 6.25 grams – 6.00 grams = 0.25 grams).............................................................. 0.25 grams Total........................................................................................................................ 6.25 grams Add allowance for rejected capsules (6.25 grams ÷ 25 capsules).................................................................................. 0.25 grams Standard quantity of Beta ML12 per salable capsule............................................... 6.50 grams 18-280 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Requirement 3 Item Beta ML12 Standard Quantity per Capsule 6.50 grams Standard Price per Gram P2.99 Standard Cost per Capsule P19.435 Exercise 2 (Material Variances) Requirement 1 Number of chopping blocks..................................................................................... 4,000 Number of board feet per chopping block................................................................ × 2.5 Standard board feet allowed.................................................................................... 10,000 Standard cost per board foot.................................................................................... × P1.80 Total standard cost................................................................................................... P18,000 Actual cost incurred................................................................................................. P18,700 Standard cost above................................................................................................. 18,000 Total variance—unfavorable.................................................................................... P 700 Requirement 2 Actual Quantity of Inputs, at Actual Price (AQ × AP) P18,700 Actual Quantity of Inputs, at Standard Price (AQ × SP) 11,000 board feet × P1.80 per board foot = P19,800 Price Variance, P1,100 F Standard Quantity Allowed for Output, at Standard Price (SQ × SP) 10,000 board feet × P1.80 per board foot = P18,000 Quantity Variance, P1,800 U Total Variance, P700 U Alternatively: Materials Price Variance = AQ (AP – SP) 11,000 board feet (P1.70 per board foot* – P1.80 per board foot) = P1,100 F * P18,700 ÷ 11,000 board feet = P1.70 per board foot. Materials Quantity Variance = SP (AQ – SQ) 18-281 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II P1.80 per board foot (11,000 board feet – 10,000 board feet) = P1,800 U Exercise 3 (Labor and Variable Overhead Variances) Requirement 1 Number of units manufactured................................................................................ 20,000 Standard labor time per unit.................................................................................... × 0.4* Total standard hours of labor time allowed.............................................................. 8,000 Standard direct labor rate per hour.......................................................................... × P6 Total standard direct labor cost................................................................................ P48,000 *24 minutes ÷ 60 minutes per hour = 0.4 hour Actual direct labor cost............................................................................................ P49,300 Standard direct labor cost........................................................................................ 48,000 Total variance—unfavorable.................................................................................... P 1,300 Requirement 2 Actual Hours of Input, at the Actual Rate (AH × AR) P49,300 Actual Hour of Input, at Standard Rate (AH × SR) 8,500 hours × P6 per hour Standard Hours Allowed for Output, at the Standard Rate (SH × SR) 8,000 hours* × P6 per hour = P51,000 = P48,000 Rate Variance, P1,700 F Efficiency Variance, P3,000 U Total Variance, P1,300 U *20,000 units × 0.4 hour per unit = 8,000 hours Alternative Solution: Labor Rate Variance = AH (AR – SR) 8,500 hours (P5.80 per hour* – P6.00 per hour) = P1,700 F *P49,300 ÷ 8,500 hours = P5.80 per hour Labor Efficiency Variance = SR (AH – SH) P6 per hour (8,500 hours – 8,000 hours) = P3,000 U 18-282 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Requirement 3 Actual Hours of Input, at the Actual Rate (AH × AR) P39,100 Actual Hour of Input, at Standard Rate (AH × SR) 8,500 hours × P4 per hour Standard Hours Allowed for Output, at the Standard Rate (SH × SR) 8,000 hours × P4 per hour = P34,000 = P32,000 Spending Variance, P5,100 U Efficiency Variance, P2,000 U Total Variance, P7,100 U Alternative Solution: Variable Overhead Spending Variance = AH (AR – SR) 8,500 hours (P4.60 per hour* – P4.00 per hour) = P5,100 U *P39,100 ÷ 8,500 hours = P4.60 per hour Variable Overhead Efficiency Variance = SR (AH – SH) P4 per hour (8,500 hours – 8,000 hours) = P2,000 U Exercise 4 (Working Backwards from Labor Variances) Requirement 1 If the total variance is P330 unfavorable, and if the rate variance is P150 favorable, then the efficiency variance must be P480 unfavorable, since the rate and efficiency variances taken together always equal the total variance. Knowing that the efficiency variance is P480 unfavorable, one approach to the solution would be: Efficiency Variance = SR (AH – SH) P6 per hour (AH – 420 hours*) = P480 U P6 per hour × AH – P2,520 = P480** P6 per hour × AH = P3,000 AH = 500 hours * 168 batches × 2.5 hours per batch = 420 hours ** When used with the formula, unfavorable variances are positive and favorable variances are negative. Requirement 2 18-283 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Knowing that 500 hours of labor time were used during the week, the actual rate of pay per hour can be computed as follows: Rate Variance = AH (AR – SR) 500 hours (AR – P6 per hour) = P150 F 500 hours × AR – P3,000 = –P150* 500 hours × AR = P2,850 AR = P5.70 per hour * When used with the formula, unfavorable variances are positive and favorable variances are negative. Exercise 5 (Direct Labor Variances) 1. Number of meals prepared................................................... Standard direct labor-hours per meal................................... Total direct labor-hours allowed........................................... Standard direct labor cost per hour...................................... Total standard direct labor cost............................................ 6,000 × 0.20 1,200 × P9.50 P11,400 Actual cost incurred............................................................. Total standard direct labor cost (above)............................... Total direct labor variance................................................... P11,500 11,400 P 100 Unfavorable 2. Actual Hours of Input, at the Actual Rate (AH×AR) 1,150 hours × P10.00 per hour = P11,500 Actual Hours of Input, at the Standard Rate (AH×SR) 1,150 hours × P9.50 per hour = P10,925 Rate Variance, P575 U Standard Hours Allowed for Output, at the Standard Rate (SH×SR) 1,200 hours × P9.50 per hour = P11,400 Efficiency Variance, P475 F Total Variance, P100 U Alternatively, the variances can be computed using the formulas: Labor rate variance = AH(AR – SR) = 1,150 hours (P10.00 per hour – P9.50 per hour) = P575 U 18-284 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Labor efficiency variance = SR(AH – SH) = P9.50 per hour (1,150 hours – 1,200 hours) = P475 F Exercise 6 (Variable Overhead Variances) 1. Number of items shipped.................................................................. Standard direct labor-hours per item................................................. Total direct labor-hours allowed....................................................... Standard variable overhead cost per hour......................................... Total standard variable overhead cost............................................... 140,000 × 0.04 5,600 × P2.80 P15,680 Actual variable overhead cost incurred............................................. Total standard variable overhead cost (above).................................. Total variable overhead variance....................................................... P15,950 15,680 P 270 Unfavorable 2. Actual Hours of Input, at the Actual Rate (AH×AR) 5,800 hours × P2.75 per hour* = P15,950 Actual Hours of Input, at the Standard Rate (AH×SR) 5,800 hours × P2.80 per hour = P16,240 Variable overhead spending variance, P290 F Standard Hours Allowed for Output, at the Standard Rate (SH×SR) 5,600 hours × P2.80 per hour = P15,680 Variable overhead efficiency variance, P560 U Total variance, P270 U *P15,950÷ 5,800 hours =P2.75 per hour Alternatively, the variances can be computed using the formulas: Variable overhead spending variance: AH(AR – SR) = 5,800 hours (P2.75 per hour – P2.80 per hour) = P290 F Variable overhead efficiency variance: SR(AH – SH) = P2.80 per hour (5,800 hours – 5,600 hours) 18-285 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II = P560 U IV. Problems Problem 1 (Comprehensive Variance Analysis) Requirement 1 a. Actual Quantity of Inputs, at the Actual Price (AQ × AP) 25,000 pounds x P2.95 per pound Actual Quantity of Inputs, at Standard Price (AQ × SP) 25,000 pounds x P2.50 per pound Standard Quantity Allowed for Output, at the Standard Price (SQ × SP) 20,000 pounds* x P2.50 per pound = P73,750 = P62,500 = P50,000 Price Variance, P11,250 U 19,800 pounds x P2.50 per pound = P49,500 Quantity Variance, P500 F * 5,000 metal molds × 4.0 pounds per metal mold = 20,000 pounds Alternatively: Materials Price Variance = AQ (AP – SP) 25,000 pounds (P2.95 per pound – P2.50 per pound) = P11,250 U Materials Quantity Variance = SP (AQ – SQ) P2.50 per pound (19,800 pounds – 20,000 pounds) = P500 F b. Actual Hours of Input, at the Actual Rate (AH × AR) 3,600 hours x P8.70 per hour Actual Hours of Input, at the Standard Rate (AH × SR) 3,600 hours x P9.00 per hour Standard Hours Allowed for Output, at the Standard Rate (SH × SR) 3,000 hours* x P9.00 per hour = P31,320 = P32,400 = P27,000 Rate Variance, P1,080 F Efficiency Variance, P5,400 U Total Variance, P4,320 U 18-286 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 * 5,000 metal molds × 0.6 hour per metal mold = 3,000 hours Alternatively: Labor Rate Variance = AH (AR – SR) 3,600 hours (P8.70 per hour – P9.00 per hour) = P1,080 F Labor Efficiency Variance = SR (AH – SH) P9.00 per hour (3,600 hours – 3,000 hours) = P5,400 U c. Actual Hours of Input, at the Actual Rate (AH × AR) P4,320 Actual Hours of Input, at the Standard Rate (AH × SR) 1,800 hours × P2 per hour Standard Hours Allowed for Output, at the Standard Rate (SH × SR) 1,500 hours* × P2 per hour = P3,600 = P3,000 Spending Variance, P720 U Efficiency Variance, P600 U Total Variance, P1,320 U *5,000 metal molds × 0.3 hours per metal mold = 1,500 hours Alternatively: Variable Overhead Spending Variance = AH (AR – SR) 1,800 hours (P2.40 per hour* – P2.00 per hour) = P720 U * P4,320 ÷ 1,800 hours = P2.40 per hour Variable Overhead Efficiency Variance = SR (AH – SH) P2.00 per hour (1,800 hours – 1,500 hours) = P600 U Requirement 2 Summary of variances: Material price variance............................................................................................ P11,250 U Material quantity variance....................................................................................... 500 F Labor rate variance.................................................................................................. 1,080 F Labor efficiency variance........................................................................................ 5,400 U Variable overhead spending variance....................................................................... 720 U Variable overhead efficiency variance...................................................................... 600 U Net variance............................................................................................................ P16,390 U 18-287 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II The net unfavorable variance of P16,390 for the month caused the plant’s variable cost of goods sold to increase from the budgeted level of P80,000 to P96,390: Budgeted cost of goods sold at P16 per metal mold................................................. P80,000 Add the net unfavorable variance (as above)........................................................... 16,390 Actual cost of goods sold......................................................................................... P96,390 This P16,390 net unfavorable variance also accounts for the difference between the budgeted net operating income and the actual net loss for the month. Budgeted net operating income................................................................................ P15,000 Deduct the net unfavorable variance added to cost of goods sold for the month....................................................................................................... 16,390 Net operating loss.................................................................................................... P(1,390) Requirement 3 The two most significant variances are the materials price variance and the labor efficiency variance. Possible causes of the variances include: Materials Price Variance: Outdated standards, uneconomical quantity purchased, higher quality materials, highcost method of transport. Labor Efficiency Variance: Poorly trained workers, poor quality materials, faulty equipment, work interruptions, inaccurate standards, insufficient demand. Problem 2 1. 1,000 units 2. 25,000 lbs. 3. P2.01 per lb. 4. 14,900 lbs. 5. 3,100 hours 6. P3.98 per hour Problem 3 Material mix variance: Actual quantity x Standard price 18-288 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Material A (8,000 x P0.30) P2,400 Material B (2,400 x P0.20) 480 Material C (2,800 x P0.425) 1,190 Less: Total actual input x Average Standard price (13,200 x 0.30*) Unfavorable Mix Variance P 720 * Average Standard price = 2,400 = P4,070 3,960 P 110 P0.30 Material yield variance: Total actual input at Average Standard price Less: Total actual output at Standard raw material cost (10,000 x 0.36**) Unfavorable yield variance ** Standard Material Cost = P 720 2,000 = P3,960 3,600 P 360 P0.36 Problem 4 (Comprehensive Variance Analysis; Journal Entries) Requirement 1 a. Actual Quantity of Inputs, at Actual Price (AQ × AP) 21,120 yards x P3.35 per yard = P70,752 Actual Quantity of Inputs, at Standard Price (AQ × SP) 21,120 yards x P3.60 per yard = P76,032 Price Variance, P5,280 F Standard Quantity Allowed for Output, at Standard Price (SQ × SP) 19,200 yards* x P3.60 per yard = P69,120 Quantity Variance, P6,912 U Total Variance, P1,632 U * 4,800 units × 4.0 yards per unit = 19,200 yards Alternatively: Materials Price Variance = AQ (AP – SP) 21,120 yards (P3.35 per yard – P3.60 per yard) = P5,280 F Materials Quantity Variance = SP (AQ – SQ) P3.60 per yard (21,120 yards – 19,200 yards) = P6,912 U 18-289 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Raw Materials (21,120 yards @ P3.60 per yard).................................................... 76,032 Materials Price Variance (21,120 yards @ P0.25 per yard F)............................................................. 5,280 Accounts Payable (21,120 yards @ P3.35 per yard)................................................................. 70,752 Work in Process (19,200 yards @ P3.60 per yard).................................................................................................................... 69,120 Materials Quantity Variance (1,920 yards U @ P3.60 per yard)....................................................................... 6,912 Raw Materials (21,120 yards @ P3.60 per yard)............................................................................................................ 76,032 Requirement 2 a. Actual Hours of Input, at the Actual Rate (AH × AR) 6,720 hours* x P4.85 per hour = P32,592 Actual Hours of Input, at the Standard Rate (AH × SR) 6,720 hours x P4.50 per hour = P30,240 Rate Variance, P2,352 U Standard Hours Allowed for Output, at the Standard Rate (SH × SR) 7,680 hours** x P4.50 per hour = P34,560 Efficiency Variance, P4,320 F Total Variance, P1,968 F * 4,800 units × 1.4 hours per unit = 6,720 hours ** 4,800 units × 1.6 hours per unit = 7,680 hours Alternatively: Labor Rate Variance = AH (AR – SR) 6,720 hours (P4.85 per hour – P4.50 per hour) = P2,352 U Labor Efficiency Variance = SR (AH – SH) P4.50 per hour (6,720 hours – 7,680 hours) = P4,320 F Work in Process (7,680 hours @ P4.50 per hour).................................................... 34,560 Labor Rate Variance (6,720 hours @ P0.35 per hour U)...................................................................... 2,352 Labor Efficiency Variance (960 hours F @ P4.50 per hour).................................................................. 4,320 18-290 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Wages Payable (6,720 hours @ P4.85 per hour)............................................................................................................ 32,592 Requirement 3 Actual Hours of Input, at the Actual Rate (AH × AR) 6,720 hours x P2.15 per hour Actual Hours of Input, at the Standard Rate (AH × SR) 6,720 hours x P1.80 per hour Standard Hours Allowed for Output, at the Standard Rate (SH × SR) 7,680 hours x P1.80 per hour P14,448 = P12,096 = P13,824 Spending Variance, P2,352 U Efficiency Variance, P1,728 F Total Variance, P624 U Alternatively: Variable Overhead Spending Variance = AH (AR – SR) 6,720 hours (P2.15 per hour – P1.80 per hour) = P2,352 U Variable Overhead Efficiency Variance = SR (AH – SH) P1.80 per hour (6,720 hours – 7,680 hours) = P1,728 F Requirement 4 No. This total variance is made up of several quite large individual variances, some of which may warrant investigation. A summary of variances is shown on the next page. Materials: Price variance Quantity variance Labor: Rate variance Efficiency variance Variable overhead: Spending variance Efficiency variance Net unfavorable variance P5,280 F 6,912 U P1,632 U 2,352 U 4,320 F 1,968 F 2,352 U 1,728 F Requirement 5 18-291 624 U P 288 U Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II The variances have many possible causes. Some of the more likely causes include: Materials variances: Favorable price variance: Fortunate buy, inaccurate standards, inferior quality materials, unusual discount due to quantity purchased, drop in market price. Unfavorable quantity variance: Carelessness, poorly adjusted machines, unskilled workers, inferior quality materials, inaccurate standards. Labor variances: Unfavorable rate variance: Use of highly skilled workers, change in wage rates, inaccurate standards, overtime. Favorable efficiency variance: Use of highly skilled workers, high quality materials, new equipment, inaccurate standards. Variable overhead variances: Unfavorable spending variance: Increase in costs, inaccurate standards, waste, theft, spillage, purchases in uneconomical lots. Favorable efficiency variance: Same as for labor efficiency variance. V. Multiple Choice Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. C C A B A B C C B B 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. B A B C A D D A D B 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. A C C C C D E B B A CHAPTER 17 18-292 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. A B B D B B C D D A 41. 42. 43. 44. 45. B C D A B Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 APPLICATION OF QUANTITATIVE TECHNIQUES IN PLANNING, CONTROL AND DECISION MAKING - I I. Questions 1. a. Decision tree analysis provides a systematic framework for analyzing a sequence of interrelated decisions which may be made over time. Decision making is formulated in terms of the consequence of acts, events and consequences because it is believed that present decisions affect future profitability. The study and understanding of alternative scenarios is encouraged with the use of decision tree analysis. b. Advantages of Decision Tree Analysis 1. Clarifies the choices, risks, and monetary gains involved in an investment problem. 2. Presents the relevant information more clearly. 3. Combines action choices with different possible events or results of action which are partially affected by chance or other uncontrollable circumstances. 4. Encourages the focus on the relationship between current and future decisions. 5. Utilizes such analytical techniques as present value and discounted cash flow. 6. Considers various alternatives with greater ease. Weaknesses of Decision Tree Analysis 1. Not all events that can happen can be/are identified. 2. Not all the decisions that must be made on a subject under analysis are listed because choices are usually not restricted to two or three. 3. If a large number of choices is involved, decision tree analysis by hand becomes complicated. 4. Uncertain alternatives are generally treated as if they were discrete, well-defined possibilities. 2. Refer to page 665 of the textbook. II. Multiple Choice Questions 6. 7. 8. 9. A A B B 6. 7. 8. 9. C B D A 31. 32. 33. 34. B D C B 18-293 41. 42. 43. 44. B C D D 46. 47. 48. 49. B D B B Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II 10. B 10. D 35. A 45. A 50. D CHAPTER 18 APPLICATION OF QUANTITATIVE TECHNIQUES IN PLANNING, CONTROL AND DECISION MAKING - II I. Questions 1. PERT is superior to Gantt Charts in complex projects because: a. PERT charts are flexible and can reflect slippage or changes in plans, but Gantt charts simply plot a bar chart against a calendar scale. b. PERT charts reflect interdependencies among activities; Gantt charts do not. c. PERT charts reflect uncertainties or tolerances in the time estimates for various activities; Gantt charts do not. 2. The use of PERT provides a structured foundation for planning complex projects in sufficient detail to facilitate effective control. A workable sequence of events that comprise the project are first identified. Each key event should represent a task; then the interdependent relationships between the events are structured. After the network of events is constructed, cost and time parameters are established for each package. Staffing plans are reviewed and analyzed. The “critical path” computation identifies sequence of key events with total time equal to the time allotted for the project’s completion. Jobs which are not on the critical path can be slowed down and the slack resources available on these activities reallocated to activities on the critical path. Use of PERT permits sufficient scheduling of effort by functional areas and by geographic location. It also allows for restructuring scheduling efforts and redeployment of workers as necessary to compensate for delays or bottlenecks. The probability of completing this complex project on time and within the allotted budget is increased. 18-294 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 3. Time slippage in noncritical activities may not warrant extensive managerial analysis because of available slack, but activity cost usually increases with time and should be monitored. 4. The critical path is the network path with the longest cumulative expected activity time. It is critical because a slowdown along this path delays the entire project. 5. Crashing the network means finding the minimum cost for completing the project in minimum time in order to achieve an optimum tradeoff between cost and time. The differential crash cost of an activity is the additional cost of that activity for each period of time saved. 6. Slack is the amount of time an event can be delayed without affecting the project’s completion date. Slack can be utilized by management as a buffer against bottlenecks that may occur on the critical path. 7. Unit gross margin are typically computed with an allocation of fixed costs. Total fixed costs generally will not change with a change in volume within the relevant range. Unitizing the fixed costs results in treating them as though they are variable costs when, in fact, they are not. Moreover, when multiple products are manufactured, the relative contribution becomes the criterion for selecting the optimal product mix. Fixed costs allocations can distort the relative contributions and result in a suboptimal decision. 8. This approach will maximize profits only if there are no constraints on production or sales, or if both products use all scarce resources at an equal rate. Otherwise management would want to maximize the contribution per unit of scarce resource. 9. The opportunity cost of a constraint is the cost of not having additional availability of the constrained resources. This is also called a shadow price. 10. The feasible production region is the area which contains all possible combinations of production outputs. It is bounded by the constraints imposed on production possibilities. The production schedule which management chooses must come from the feasible production region. 11. The accountant usually supplies the contribution margin data that is used in formulating a profit-maximizing objective function. In addition, the accountant participates in the analysis of linear programming outputs by assessing the costs of additional capacity or of changes in product mix. 12. a. Hourly fee for inventory audit b. Salary of purchasing supervisor 18-295 (C) (N) Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II c. d. e. f. g. h. i. j. Costs to audit purchase orders and invoices (P) Taxes on inventory (C) Stockout costs (P) Storage costs charged per unit in inventory (C) Fire insurance on inventory (C) Fire insurance on warehouse (N) Obsolescence costs on inventory (C) Shipping costs per shipment (P) 13. Although the inventory models are developed by operations researchers, statisticians and computer specialists, their areas of expertise do not extend to the evaluation of the differential costs for the inventory models. Generally, discussions of inventory models take the costs as given. It is the role of the accountant to determine which costs are appropriate for inclusion in an inventory model. 14. Cost of capital represents the interest expense on funds if they were borrowed or opportunity cost if funds were provided internally or by owners. It is included as carrying cost of inventory because funds are tied up in inventory. 15. Costs that vary with the average number of units in inventory: Inventory insurance Inventory tax Total P 2.80 2.05 (P102.25 x 2%) P 4.85 Costs that vary with the number of units purchased: Purchase price Insurance on shipment Total P102.25 1.50 P103.75 Total carrying cost = (25% x P103.75) cost of capital + P4.85 = P25.94 + P4.85 = P30.79 Order costs: Shipping permit Costs to arrange for the shipment Unloading Stockout costs Total II. Problems 18-296 P201.65 21.45 80.20 122.00 P425.30 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Problem 1 (Solution is found on the next page.) Problem 2 Requirement (a) The critical path through each of the three alternative paths calculated as the longest is 0 - 1 - 6- 7- 8. 0-1-2-5-8 0-1-3-4-7-8 0-1-6-7-8 ________ 2 + 8 + 10 + 14 2+8+7+5+3 2 + 26 + 9 + 3 = = = 34 25 40* * critical Requirement (b) 40 - 3 - 5 = 32 Requirement (c) If path 4 - 7 has an unfavorable time variance of 10, this means it takes a total time of 15 to finish this activity rather than 5. This gives the path 0 - 1 - 3 - 4 - 7 - 8 a total time of 35, but since this is less than the critical path of 40, it has no effect. Requirement (d) The earliest time for reaching event 5 via 0 - 1 - 2 - 5 is 20, the sum of the expected times. Problem 3 No, they didn’t make a right decision, since they included fixed costs which do not differ in the short run. If they had used contribution margin instead of gross margin, they would have had P5 for G1 and P6.50 for G2, therefore they would have decided to produce G2 exclusively. 18-297 Application of Quantitative Techniques in Planning, Control and Decision Making – II Chapter 18 Problem 1 Requirement (a) TASKS 1 2 Order 1 Ma X X X X chi nin g 3 4 5 6 7 8 9 10 11 Order 3 Order 1 X X 12 13 14 15 16 Order 4 Order 3 17 18 19 20 21 22 23 24 25 26 27 28 Order 2 X ___________ X Dead Time Requirement (b) 28 days are required for the four orders. 18-298 X X Order 4 Order 2 Chapter 1 Management Accounting: An Overview Problem 4 Order costs P Carrying costs S = Insurance + Other order costs = P860 + = Out-of-pocket costs + Cost of capital on inventory = P65 + 20% x P222 P18 = P878 = P119.40 a. Carrying costs: QS 2 = Order costs: AP = Q 250 x P109.40 2 = 1,500 x P878 250 = P13,675.00 P 5,268.00 P18,943.00 Total b. Economic order quantity: Q* = 2 x 1,500 x P878 P109.40 = 24,077 = 155 units Carrying costs: QS 2 = 155 x P109.40 2 = Order costs: AP = Q 1,500 x P878 155 = P 8,478.50 P 8,496.77 P16,975.27 Total Problem 5 It is necessary to evaluate the annual carrying costs and expected stockout costs at each safety-stock level. The carrying cost will be P24.40 for each 18-299 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II unit in safety stock. With the given order size, there are 15 orders placed a year (i.e., 39,000/2,600 = 15). Based on these computations, we prepare the following schedule: Safety Stock 0 150 175 250 Carrying Costs of Safety Stock 0 150 x P24.40 = P3,660 175 x P24.40 = P4,270 250 x P24.40 = P6,100 b Expected Stockout Costs 0.50 x 15a x P1,650 = P12,375 0.20 x 15a x P1,650 = P 4,950 0.05 x 15a x P1,650 = P 1,273.5 0.01 x 15a x P1,650 = P 247.5 Total Costs P12,375 8,610 5,507.5 (optional) 6,347.5 Additional computations: a b 15 is the number of orders per year. It should be evident that at this level the carrying costs alone exceed the total costs at a safety stock of 175 units. Therefore, it is not possible for this or any safety-stock level larger than 250 to be less costly than 175 units. Indeed, given a total cost at 175 units of P5,507.5, stockout costs would have to occur with probability zero for any safety stock greater than 225.72 units (i.e., P5,507.5 / P24.40 = P225.72). III. Multiple Choice Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. C B D B D C A A A C 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. D C A A A C C D C D 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. D C C D D B D E B A 31. 32. 33. 34. 35. 36. 37. 38. C D A C D C D D CHAPTER 19 RELEVANT COSTS FOR DECISION MAKING I. Questions 18-300 Management Accounting: An Overview Chapter 1 1. Quantitative factors are those which may more easily be reduced in terms of pesos such as projected costs of materials, labor and overhead. Qualitative factors are those whose measurement in pesos is difficult and imprecise; yet a qualitative factor may be easily given more weight than the measurable cost savings. It can be seen that the accountant’s role in making decisions deals with the quantitative factors. 2. Relevant costs are expected future costs that will differ between alternatives. In view of the definition of relevant costs, historical costs are always irrelevant because they are not future costs. They may be helpful in predicting relevant costs but they are always irrelevant costs per se. 3. The differential costs in any given situation is commonly defined as the change in total cost under each alternative. It is not relevant cost, but it is the algebraic difference between the relevant costs for the alternatives under consideration. 4. Analysis: Future costs: New Truck Less: Proceeds from disposal, net Replace P10,200 Rebuild 1,000 P 9,200 Advantage of rebuilding P8,500 P700 The original cost of the old truck is irrelevant but its disposal value is relevant. It is recommended that the truck should be rebuilt because it will involve lesser cash outlay. 5. No. Variable costs are relevant costs only if they differ in total between the alternatives under consideration. 6. Only those costs that would be avoided as a result of dropping the product line are relevant in the decision. Costs that will not differ regardless of whether the product line is retained or discontinued are irrelevant. 7. Not necessarily. An apparent loss may be the result of allocated common costs or of sunk costs that cannot be avoided if the product line is dropped. A product line should be discontinued only if the contribution margin that will be lost as a result of dropping the line is less than the fixed costs that would be avoided. Even in that situation the product line may be retained if its presence promotes the sale of other products. 18-301 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II 8. Allocations of common fixed costs can make a product line (or other segment) appear to be unprofitable, whereas in fact it may be profitable. 9. In cost-plus pricing, prices are set by applying a markup percentage to a product’s cost. 10. The price elasticity of demand measures the degree to which a change in price affects unit sales. The unit sales of a product with inelastic demand are relatively insensitive to the price charged for the product. In contrast, the unit sales of a product with elastic demand are sensitive to the price charged for the product. 11. The profit-maximizing price should depend only on the variable (marginal) cost per unit and on the price elasticity of demand. Fixed costs do not enter into the pricing decision at all. Fixed costs are relevant in a decision of whether to offer a product or service, but are not relevant in deciding what to charge for the product or service. Because price affects unit sales, total variable costs are affected by the pricing decision and therefore are relevant. 12. The markup over variable cost depends on the price elasticity of demand. A product whose demand is elastic should have a lower markup over cost than a product whose demand is inelastic. If demand for a product is inelastic, the price can be increased without cutting as drastically into unit sales. II. Exercises Exercise 1 (Identifying Relevant Costs) Case 1 a. b. c. d. Item Relevant Sales revenue................................... X Direct materials............................... X Direct labor...................................... X Variable manufacturing overhead.......................................... e. Case 2 Not Relevant X X X 18-302 Not Relevant X X Book value – Model E7000 Relevant X X Management Accounting: An Overview Chapter 1 machine........................................... f. Disposal value – Model E7000 machine........................................... g. X Depreciation – Model E7000 machine........................................... h. X X Market value – Model F5000 machine (cost)................................. i. X Fixed manufacturing X overhead.......................................... j. Variable selling expense.................. k. Fixed selling expense...................... l. General administrative overhead.......................................... X X X X X X X X X Exercise 2 (Identification of Relevant Costs) Requirement 1 Fixed cost per mile (P3,500* ÷ 10,000 miles).......................................................... P0.35 Variable operating cost per mile............................................................................... 0.08 Average cost per mile............................................................................................... P0.43 * Depreciation............................................................................................................ P2,000 Insurance................................................................................................................. 960 Garage rent............................................................................................................. 480 Automobile tax and license..................................................................................... 60 Total........................................................................................................................ P3,500 Requirement 2 The variable operating costs would be relevant in this situation. The depreciation would not be relevant since it relates to a sunk cost. However, 18-303 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II any decrease in the resale value of the car due to its use would be relevant. The automobile tax and license costs would be incurred whether Ingrid decides to drive her own car or rent a car for the trip during summer break and are therefore irrelevant. It is unlikely that her insurance costs would increase as a result of the trip, so they are irrelevant as well. The garage rent is relevant only if she could avoid paying part of it if she drives her own car. Requirement 3 When figuring the incremental cost of the more expensive car, the relevant costs would be the purchase price of the new car (net of the resale value of the old car) and the increases in the fixed costs of insurance and automobile tax and license. The original purchase price of the old car is a sunk cost and is therefore irrelevant. The variable operating costs would be the same and therefore are irrelevant. (Students are inclined to think that variable costs are always relevant and fixed costs are always irrelevant in decisions. This requirement helps to dispel that notion.) Exercise 3 (Make or Buy a Component) Requirement 1 Cost of purchasing Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead, traceable1 Per Unit Differential Costs 15,000 units Make Buy Make Buy P200 P3,000,000 P 60 P 900,000 80 1,200,000 10 150,000 20 Fixed manufacturing overhead, common Total costs Difference in favor of continuing to make the parts 1 0 P170 P30 300,000 0 0 0 P200 P2,550,000 P3,000,000 P450,000 Only the supervisory salaries can be avoided if the parts are purchased. The remaining book value of the special equipment is a sunk cost; hence, the P3 per unit depreciation expense is not relevant to this decision. Based on these data, the company should reject the offer and should continue to produce the parts internally. 18-304 Management Accounting: An Overview Chapter 1 Requirement 2 Make Buy Cost of purchasing (part 1)................................................................................................... P3,000,000 Cost of making (part 1)........................................................................................................ P2,550,000 Opportunity cost—segment margin forgone on a potential new product line................................................................................................ 650,000 Total cost............................................................................................................................... P3,200,000 P3,000,000 Difference in favor of purchasing from the outside supplier.............................................................................................................................. P200,000 Thus, the company should accept the offer and purchase the parts from the outside supplier. Exercise 4 (Evaluating Special Order) Only the incremental costs and benefits are relevant. In particular, only the variable manufacturing overhead and the cost of the special tool are relevant overhead costs in this situation. The other manufacturing overhead costs are fixed and are not affected by the decision. Per Unit P3,499.50 Total 10 bracelets P34,995.00 Incremental revenue Incremental costs: Variable costs: Direct materials 1,430.00 14,300.00 Direct labor 860.00 8,600.00 Variable manufacturing overhead 70.00 700.00 Special filigree 60.00 600.00 Total variable cost P2,420.00 24,200.00 Fixed costs: Purchase of special tool 4,650.00 Total incremental cost 28.850.00 Incremental net operating income P 6.145.00 Even though the price for the special order is below the company’s regular price for such an item, the special order would add to the company’s net operating income and should be accepted. This conclusion would not necessarily follow if the special order affected the regular selling price of bracelets or if it required the use of a constrained resource. Exercise 5 (Utilization of a Constrained Resource) 18-305 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Requirement 1 (1) (2) (3) (4) X Y Z Contribution margin per unit................................................................................................ P18 P36 P20 Direct labor cost per unit....................................................................................................... P12 P32 P16 Direct labor rate per hour...................................................................................................... 8 8 8 Direct labor-hours required per unit (2) ÷ (3)....................................................................... 1.5 4.0 2.0 Contribution margin per direct labor-hour (1) ÷ (4)............................................................. P12 P 9 P10 Requirement 2 The company should concentrate its labor time on producing product X: Contribution margin per direct labor-hour X P12 × 3,000 P36,000 Direct labor-hours available Total contribution margin Y P9 × 3,000 P27,000 Z P10 × 3,000 P30,000 Although product X has the lowest contribution margin per unit and the second lowest contribution margin ratio, it has the highest contribution margin per direct labor-hour. Since labor time seems to be the company’s constraint, this measure should guide management in its production decisions. Requirement 3 The amount Jaycee Company should be willing to pay in overtime wages for additional direct labor time depends on how the time would be used. If there are unfilled orders for all of the products, Jaycee would presumably use the additional time to make more of product X. Each hour of direct labor time generates P12 of contribution margin over and above the usual direct labor cost. Therefore, Jaycee should be willing to pay up to P20 per hour (the P8 usual wage plus the contribution margin per hour of P12) for additional labor time, but would of course prefer to pay far less. The upper limit of P20 per direct labor hour signals to managers how valuable additional labor hours are to the company. If all the demand for product X has been satisfied, Jaycee Company would then use any additional direct labor-hours to manufacture product Z. In that case, the company should be willing to pay up to P18 per hour (the P8 usual wage plus the P10 contribution margin per hour for product Z) to manufacture more product Z. 18-306 Management Accounting: An Overview Chapter 1 Likewise, if all the demand for both products X and Z has been satisfied, additional labor hours would be used to make product Y. In that case, the company should be willing to pay up to P17 per hour to manufacture more product Y. Exercise 6 (Sell or Process Further) Sales value after further processing Sales value at split-off point Incremental revenue Cost of further processing Incremental profit (loss) Product A P80,000 50,000 30,000 35,000 P(5,000) Product B P150,000 90,000 60,000 40,000 20,000 Product C P75,000 60,000 15,000 12,000 3,000 Products B and C should be processed further, but not Product A. Exercise 7 (Identification of Relevant Costs) Requirement 1 The relevant costs of a fishing trip would be: Fuel and upkeep on boat per trip............................. Junk food consumed during trip*............................. Snagged fishing lures............................................... Total........................................................................ P25 8 7 P40 * The junk food consumed during the trip may not be completely relevant. Even if Shin were not going on the trip, he would still have to eat. The amount by which the cost of the junk food exceeds the cost of the food he would otherwise consume would be the relevant amount. The other costs are sunk at the point at which the decision is made to go on another fishing trip. Requirement 2 If he fishes for the same amount of time as he did on his last trip, all of his costs are likely to be about the same as they were on his last trip. Therefore, it really doesn’t cost him anything to catch the last fish. The costs are really incurred in order to be able to catch fish and would be the same whether one, 18-307 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II two, three, or a dozen fish were actually caught. Fishing, not catching fish, costs money. All of the costs are basically fixed with respect to how many fish are actually caught during any one fishing trip, except possibly the cost of snagged lures. Requirement 3 In a decision of whether to give up fishing altogether, nearly all of the costs listed by Shin’s wife are relevant. If he did not fish, he would not need to pay for boat moorage, new fishing gear, a fishing license, fuel and upkeep, junk food, or snagged lures. In addition, he would be able to sell his boat, the proceeds of which would be considered relevant in this decision. The original cost of the boat, which is a sunk cost, would not be relevant. These three requirements illustrate the slippery nature of costs. A cost that is relevant in one situation can be irrelevant in the next. None of the costs are relevant when we compute the cost of catching a particular fish; some of them are relevant when we compute the cost of a fishing trip; and nearly all of them are relevant when we consider the cost of not giving up fishing. What is even more confusing is that CG is correct; the average cost of a salmon is P167, even though the cost of actually catching any one fish is essentially zero. It may not make sense from an economic standpoint to have salmon fishing as a hobby, but as long as Shin is out in the boat fishing, he might as well catch as many fish as he can. Exercise 8 (Dropping or Retaining a Segment) Requirement 1 No, the housekeeping program should not be discontinued. It is actually generating a positive program segment margin and is, of course, providing a valuable service to seniors. Computations to support this conclusion follow: Contribution margin lost if the housekeeping program is dropped............................................................................................ P(80,000) Fixed costs that can be avoided: Liability insurance............................................................................... P15,000 Program administrator’s salary........................................................... 37,000 52,000 Decrease in net operating income for the organization as a whole........................................................................................... P(28,000) 18-308 Management Accounting: An Overview Chapter 1 Depreciation on the van is a sunk cost and the van has no salvage value since it would be donated to another organization. The general administrative overhead is allocated and none of it would be avoided if the program were dropped; thus it is not relevant to the decision. The same result can be obtained with the alternative analysis below: Current Total Revenues...................................................................... P900,000 Variable expenses......................................................... 490,000 Contribution margin.................................................... 410,000 Fixed expenses: Depreciation*.......................................................... 68,000 Liability insurance................................................... 42,000 Program administrators’ salaries............................ 115,000 General administrative overhead............................ 180,000 Total fixed expenses..................................................... 405,000 Net operating income (loss)......................................... P 5,000 Difference: Total If Net Operating HouseIncome keeping Is Increase or Dropped (Decrease) P660,000 P(240,000) 330,000 160,000 330,000 (80,000) 68,000 27,000 78,000 180,000 353,000 P(23,000) 0 15,000 37,000 0 52,000 P (28,000) *Includes pro-rated loss on disposal of the van if it is donated to a charity. Requirement 2 To give the administrator of the entire organization a clearer picture of the financial viability of each of the organization’s programs, the general administrative overhead should not be allocated. It is a common cost that should be deducted from the total program segment margin. Fol lowing the format for a segmented income statement, a better income statement would be: Total Revenues........................................................ P900,000 Variable expenses.......................................... 490,000 Contribution margin...................................... 410,000 Traceable fixed expenses: Depreciation.............................................. 68,000 Liability insurance.................................... 42,000 Program administrators’ salaries.................................................. 115,000 18-309 Home Nursing P260,000 120,000 140,000 Meals on Wheels P400,000 210,000 190,000 Housekeeping P240,000 160,000 80,000 8,000 20,000 40,000 7,000 20,000 15,000 40,000 38,000 37,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Total traceable fixed expenses....................... 225,000 Program segment margins............................ 185,000 General administrative overhead.................. 180,000 Net operating income (loss).......................... P 5,000 68,000 P 72,000 85,000 P105,000 P 72,000 8,000 Exercise 9 (Special Order) Requirement 1 Monthly profits would be increased by P9,000: Total for Per 2,000 Unit Units Incremental revenue......................................................................... P12.00 P24,000 Incremental costs: Variable costs: Direct materials........................................................................ 2.50 5,000 Direct labor.............................................................................. 3.00 6,000 Variable manufacturing overhead............................................. 0.50 1,000 Variable selling and administrative........................................... 1.50 3,000 Total variable cost........................................................................ P 7.50 15,000 Fixed costs: None affected by the special order............................................ Total incremental cost...................................................................... Incremental net operating income..................................................... 0 15,000 P 9,000 Requirement 2 The relevant cost is P1.50 (the variable selling and administrative costs). All other variable costs are sunk, since the units have already been produced. The fixed costs would not be relevant, since they would not be affected by the sale of leftover units. Exercise 10 (Make or Buy a Component) The costs that are relevant in a make-or-buy decision are those costs that can be avoided as a result of purchasing from the outside. The analysis for this exercise is: Per Unit 18-310 20,000 Units Management Accounting: An Overview Chapter 1 Differential Costs Make Buy Cost of purchasing....................................................... P23.50 Cost of making: Direct materials....................................................... P 4.80 Direct labor.............................................................. 7.00 Variable manufacturing overhead........................... 3.20 Fixed manufacturing overhead................................ 4.00 * Total cost.................................................................. P19.00 P23.50 Make Buy P470,000 P 96,000 140,000 64,000 80,000 P380,000 P470,000 * The remaining P6 of fixed manufacturing overhead cost would not be relevant, since it will continue regardless of whether the company makes or buys the parts. The P150,000 rental value of the space being used to produce part R-3 represents an opportunity cost of continuing to produce the part internally. Thus, the completed analysis would be: Make Buy Total cost, as above.......................................................................................... P380,000 P470,000 Rental value of the space (opportunity cost)................................................... 150,000 Total cost, including opportunity cost............................................................. P530,000 P470,000 Net advantage in favor of buying.................................................................... P60,000 Profits would increase by P60,000 if the outside supplier’s offer is accepted. Exercise 11 (The Economists’ Approach to Pricing) Requirement (1) Cecile makes more money selling the ice cream cones at the lower price, as shown below: P17.90 Price P13.90 Price Unit sales........................................................ 860 1,340 Sales...............................................................P15,394.00 Cost of goods sold @ P4.10............................ 3,526.00 Contribution margin........................................ 11,868.00 Fixed expenses................................................ 425.00 Net operating income...................................... P11,443.00 18-311 P18,626.00 5,494.00 13,132.00 425.00 P12,707.00 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Requirement (2) The price elasticity of demand is computed as follows: d In(1 + % change in quantity sold) In(1 + % change in price) = In(1 + 1,340 – 860 ) 860 In(1 + 13.90 – 17.90 ) 17.90 = = In(1 + 0.55814) In(1 – 0.22346) = In(1.55814) In(0.77654) = 0.44349 –0.25291 = –1.75 Requirement (3) The profit-maximizing price can be estimated using the following formulas: Profit-maximizing markup on variable cost = = Profit-maximizing price = –1 1 + d –1 1 + (–1.75) 1 + = 1.333 Profit-maximizing markup on variable cost x Variable cost per unit = (1 + 1.3333) x P4.10 = P9.60 This price is much lower than the prices Cecile has been charging in the past. Rather than immediately dropping the price to P9.60, it would be prudent to 18-312 Management Accounting: An Overview Chapter 1 drop the price a bit and see what happens to unit sales and to profits. The formula assumes that the price elasticity is constant, which may not be the case. Exercise 12 (Target Costing) Sales (50,000 batteries × P65 per battery).....................................P3,250,000 Less desired profit (20% × P2,500,000)........................................ 500,000 Target cost for 50,000 batteries.....................................................P2,750,000 Target cost per battery = (P2,750,000 ÷ 50,000 batteries) = P55 per battery Exercise 13 (Pricing a New Product) The selling price of the new amaretto cappuccino product should at least cover its variable cost and its opportunity cost. The variable cost of the new product is P4.60 and its opportunity cost can be computed by multiplying the opportunity cost of P34 per minute of order filling time by the amount of time required to fill an order for the new product: Selling price of the new product Variable cost of the new product + Opportunity cost per unit of the x constrained resource Amounts of the constrained resource required by a unit of the new product Selling price of the new product P4.60 + P34 per minute + Selling price of the new product P4.60 + P34 per minute + 0.75 minute Selling price of the new product P4.60 + P25.50 = 18-313 45 seconds 60 seconds per minute P30.10 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Hence, the selling price of the new product should at least cover both its variable cost of P4.60 and its opportunity cost of P25.50, for a total of P30.10. III. Problems Problem 1 (Accept or Reject an Order) Selling price per unit Less Variable costs/unit: Materials Labor Factory overhead (25%) Contribution margin/unit Multiplied by number of units to be sold Total contribution margin Product A P1.20 Product B P1.40 0.50 0.20 0.10 0.80 P0.40 21,000 units P8,400 0.70 0.24 0.14 1.08 P0.32 30,000 units P9,600 Product B should be accepted because its total contribution margin is higher than that of Product A. Problem 2 (Eliminate or Retain a Product Line) Requirement 1 No, production and sale of the round trampolines should not be discontinued. Computations to support this answer follow: Contribution margin lost if the round trampolines are discontinued............................................. Less fixed costs that can be avoided: Advertising – traceable.................................. Line supervisors’ salaries............................... Decrease in net operating income for the company as a whole....................................... P(80,000) P41,000 6,000 47,000 P(33,000) The depreciation of the special equipment represents a sunk cost, and therefore it is not relevant to the decision. The general factory overhead is allocated and will presumably continue regardless of whether or not the round trampolines are discontinued; thus, it is not relevant. 18-314 Management Accounting: An Overview Chapter 1 Requirement 2 If management wants a clear picture of the profitability of the segments, the general factory overhead should not be allocated. It is a common cost and therefore should be deducted from the total product-line segment margin. A more useful income statement format would be as follows: Trampoline Round Rectangular P140,000 P500,000 60,000 200,000 80,000 300,000 Total Sales...................................... P1,000,000 Less variable expenses.......... 410,000 Contribution margin............. 590,000 Less fixed expenses: Advertising – traceable..... 216,000 Depreciation of special equipment...................... 95,000 Line supervisors’ salaries........................... 19,000 Total traceable fixed expenses............................ 330,000 Product-line segment margin............................... 260,000 Less common fixed expenses............................ 200,000 Net operating income (loss).................................. P 60,000 Octagonal P360,000 150,000 210,000 41,000 110,000 65,000 20,000 40,000 35,000 6,000 7,000 6,000 67,000 157,000 106,000 P 13,000 P143,000 P104,000 Problem 3 (Product Mix) Requirement 1 Selling price per unit Variable cost per unit Contribution margin / unit Divided by no. of hours required for each unit Contribution per hour Product ranking: 1. D 2. B Product Line B C P25 P10 10 5 P15 P 5 A P30 25 P5 5 hrs. P1 3. C 18-315 10 hrs. P1.5 4. A 4 hrs. P1.25 D P8 4 P4 1 hr. P4 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Based on the above analysis, first priority should be given to Product D. The company should use 4,000 out of the available 96,000 hrs. to produce 4,000 units of product D. The remaining 92,000 hrs. should be used to produce 9,200 units of Product B. Hence, the best product combination is 4,000 units of Product D and 9,200 units of Product B. Requirement 2 If there were no market limitations on any of the products, the company should use all the available 96,000 hours in producing 96,000 units of product D only. The difference in profit between the two alternatives is computed as follows: Contribution margin of combination (1) Product D (4,000 x P 4.00) Product B (9,200 x P15.00) Total contribution margin of D and B Less contribution margin of D only (96,000 x P4) Difference, excess over profit in combination (1) Problem 4 (Accept or Reject a Special Order) P 16,000 138,000 P154,000 384,000 P230,000 Requirement 1 The company should accept the special order of 4,000 @ P10 each because this selling price is still higher than the additional variable cost to be incurred. Whether or not variable marketing expenses will be incurred, the decision is still to accept the order. Supporting computations: (a) Assume no additional variable marketing cost will be incurred. Selling price per unit Less variable manufacturing costs: Direct materials Direct labor Variable overhead Contribution margin/unit Multiplied by number of units of order Total increase in profit P10.00 P5.00 3.00 0.75 8.75 P 1.25 4,000 units P5,000 (b) Assume additional variable marketing cost will be incurred. Selling price per unit P10.00 18-316 Management Accounting: An Overview Chapter 1 Less variable costs (P8.75 + P0.25) Contribution margin / unit Multiplied by number of units of order Total increase in contribution margin 9.00 P 1.00 4,000 units P4,000 Requirement 2 P8.75, the total variable manufacturing cost. Requirement 3 Direct materials Direct labor Variable factory overhead Total cost of inventory under direct costing P5.00 3.00 0.75 P8.75 Requirement 4 Present contribution margin [10,000 units x (P15 - P9)] Less proposed contribution margin [(P14 - P9) x 11,000 units] Decrease in contribution margin P60,000 55,000 P 5,000 The company should not reduce the selling price from P15 to P14 even if volume will go up because total contribution margin will decrease. Problem 5 (CVP Analysis used for Decision Making) Requirement (a) Units sold per month 4,000 5,000 6,000 No. of months 6 15 9 30 Probability 20% 50% 30% 100% Requirement (b) Sales (4,000 x P40) Less variable costs Production cost @ P25 Purchase cost @ P45 4,000 units P160,000 Production 5,000 units P160,000 6,000 units P160,000 100,000 - 125,000 - 150,000 - 18-317 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Total Contribution margin P100,000 P 60,000 P125,000 P 35,000 P150,000 P 10,000 Sales (5,000 x P40) Less variable costs Production cost @ P25 Purchase cost @ P45 P200,000 P200,000 P200,000 100,000 45,000 125,000 - 150,000 - Total Contribution margin P145,000 P 55,000 P125,000 P 75,000 P150,000 P 50,000 Sales (6,000 x P40) Less variable costs Production cost @ P25 Purchase cost @ P45 Total Contribution margin P240,000 P240,000 P240,000 100,000 90,000 P190,000 P 50,000 125,000 45,000 P170,000 P 70,000 150,000 0 P150,000 P 90,000 Requirement (c) Sales Order Contribution Margin 4,000 P35,000 5,000 75,000 6,000 70,000 Average Contribution Margin Probability 0.20 0.50 0.30 Expected Value P 7,000 37,500 21,000 P65,500 Problem 6 (Pricing) Requirement A: Sales Less Variable cost Contribution margin Less Fixed cost Net income (loss) 2005 P 100,000 130,000 (P 30,000) 40,000 (P 70,000) 18-318 2006 P 400,000 520,000 (P120,000) 40,000 (P160,000) Operating Result at Full Capacity P 480,000 624,000 (P144,000) 40,000 (P184,000) Management Accounting: An Overview Chapter 1 The company had been operating at a loss because the product had been selling with a negative contribution margin. Hence, the more units are sold, the higher the loss will be. Requirement B: P60.14 Requirement C: P74.29 Requirement D: P56.58 Problem 7 (Make or Buy) Cost of Making Outside purchase Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead* Total cost Cost of Buying P90,000 P15,000 30,000 10,000 15,000 P70,000 P90,000 * 1/3 x P45,000 = P15,000 Therefore, the annual advantage to make the parts is P20,000. Problem 8 (Close or Retain a Store) Requirement 1 The simplest approach to the solution is: Gross margin lost if the store is closed............................................. Less costs that can be avoided: Direct advertising..........................................................................P36,000 Sales salaries................................................................................. 45,000 Delivery salaries............................................................................ 7,000 Store rent....................................................................................... 65,000 Store management salaries (new employee would not be hired to fill vacant position at another store)........................... 15,000 General office salaries................................................................... 8,000 Utilities.......................................................................................... 27,200 Insurance on inventories (2/3 × P9,000)...................................... 6,000 Employment taxes*....................................................................... 9,000 18-319 P(228,000) 218,200 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Decrease in company net operating income if the Ortigas Store is closed................................................................................ P( 9,800) *Salaries avoided by closing the store: Sales salaries.......................................................................................................... P45,000 Delivery salaries.................................................................................................... 7,000 Store management salaries....................................................................................15,000 General office salaries........................................................................................... 8,000 Total salaries..........................................................................................................75,000 Employment tax rate..............................................................................................× 12% Employment taxes avoided.................................................................................... P 9,000 Requirement 2 The Ortigas Store should not be closed. If the store is closed, overall company net operating income will decrease by P9,800 per quarter. Requirement 3 The Ortigas Store should be closed if P200,000 of its sales are picked up by the Makati Store. The net effect of the closure will be an increase in overall company net operating income by P76,200 per quarter: Gross margin lost if the Ortigas Store is closed....................................................................... P(228,000) Gross margin gained at the Makati Store: P200,000 × 43%................................................................................................................... 86,000 Net loss in gross margin........................................................................................................... (142,000) Costs that can be avoided if the Ortigas Store is closed (part 1).............................................. 218,200 Net advantage of closing the Ortigas Store.............................................................................. P 76,200 Problem 9 (Shutting Down or Continuing to Operate a Plant) Requirement 1 Product KK-8 yields a contribution margin of P14 per gallon (P35 – P21 = P14). If the plant closes, this contribution margin will be lost on the 22,000 gallons (11,000 gallons per month × 2 = 22,000 gallons) that could have been sold during the two-month period. However, the company will be able to avoid certain fixed costs as a result of closing down. The analysis is: Contribution margin lost by closing the plant for two months (P14 per gallon × 22,000 gallons).................................................P(308,000) Costs avoided by closing the plant for two months: Fixed manufacturing overhead cost (P60,000 × 2 months = P120,000).......................................................... P120,000 18-320 Management Accounting: An Overview Chapter 1 Fixed selling costs (P310,000 × 10% × 2 months)............................................................... 62,000 182,000 Net disadvantage of closing, before start-up costs.......................................... (126,000) Add start-up costs............................................................................................ (14,000) Disadvantage of closing the plant...................................................................P(140,000) No, the company should not close the plant; it should continue to operate at the reduced level of 11,000 gallons produced and sold each month. Closing will result in a P140,000 greater loss over the two-month period than if the company continues to operate. Additional factors are the potential loss of goodwill among the customers who need the 11,000 gallons of KK-8 each month and the adverse effect on employee morale. By closing down, the needs of customers will not be met (no inventories are on hand), and their business may be permanently lost to another supplier. Alternative Solution: Plant Kept Open Plant Closed Sales (11,000 gallons × P35 per gallon × 2)............................ P 770,000 P 0 Less variable expenses (11,000 gallons × P21 per gallon × 2).............................................. 462,000 0 Contribution margin................................................................. 308,000 0 Less fixed costs: Fixed manufacturing overhead cost (P230,000 × 2; P170,000 × 2)................................................................ 460,000 340,000 Fixed selling cost (P310,000 × 2; P310,000 × 90% × 2)......................................................................... 620,000 558,000 Total fixed cost......................................................................... 1,080,000 898,000 Net operating loss before start-up costs................................... (772,000) (898,000) Start-up costs........................................................................... (14,000) Net operating loss.................................................................... P (772,000) P(912,000) Difference— Net Operating Income Increase (Decrease) P(770,000) 462,000 (308,000) 120,000 62,000 182,000 (126,000) (14,000) P(140,000) Requirement 2 Ignoring the additional factors cited in part (1) above, Kristin Company should be indifferent between closing down or continuing to operate if the level of sales drops to 12,000 gallons (6,000 gallons per month) over the two-month period. The computations are: Cost avoided by closing the plant for two months (see above)............................... P182,000 Less start-up costs.................................................................................................... 14,000 Net avoidable costs.................................................................................................. P168,000 18-321 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Net avoidable costs Contribution margin per gallon P168,000 P14 per gallon = = 12,000 gallons Verification: Operate at 12,000 Close for Gallons for Two Two Months Months Sales (12,000 gallons × P35 per gallon)............................................... P 420,000 P 0 Less variable expenses (12,000 gallons × P21 per gallon)................... 252,000 0 Contribution margin.............................................................................. 168,000 0 Less fixed expenses: Manufacturing overhead (P230,000 and P170,000 × 2 months)......................................................................................... 460,000 340,000 Selling (P310,000 and P279,000 × 2 months)................................. 620,000 558,000 Total fixed expenses.............................................................................. 1,080,000 898,000 Start-up costs......................................................................................... 0 14,000 Total costs.............................................................................................. 1,080,000 912,000 Net operating loss.................................................................................. P (912,000) P(912,000) Problem 10 (The Economists’ Approach to Pricing) Requirement (1) The postal service makes more money selling the souvenir sheets at the lower price, as shown below: Unit sales................................................... P500 Price 50,000 P600 Price 40,000 Sales.......................................................... Cost of goods sold @ P60 per unit............ Contribution margin.................................. P25,000,000 3,000,000 P22,000,000 P24,000,000 2,400,000 P21,600,000 Requirement (2) The price elasticity of demand, as defined in the text, is computed as follows: d = In(1 + % change in quantity sold) In(1 + % change in price) 18-322 Management Accounting: An Overview Chapter 1 40,000 – 50,000 ) 50,000 600.00 – 500.00 In(1 + ) 500.00 In(1 – 0.2000) In(1 + 0.2000) In(1 + = = = = = In(0.8000) In(1.2000) –0.2231 0.1823 –1.2239 Requirement (3) The profit-maximizing price can be estimated using the following formulas: Profit-maximizing markup on variable cost Profit-maximizing price –1 1 + d = = –1 = 1 + (–1.2239) = 1 + 4.4663 Profit-maximizing markup on variable cost x = (1 + 4.4663) x P60 = P328 This price is much lower than the price the postal service has been charging in the past. Rather than immediately dropping the price to P328, it would be prudent for the postal service to drop the price a bit and observe what happens to unit sales and to profits. The formula assumes that the price elasticity of demand is constant, which may not be true. The critical assumption in the calculation of the profit-maximizing price is that the percentage increase (decrease) in quantity sold is al ways the same for a given percentage decrease (increase) in price. If this is true, we can estimate the demand schedule for souvenir sheets as follows: Price* Quantity Sold§ 18-323 Variable cost per unit Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II P600 P500 P417 P348 P290 P242 P202 P168 P140 P117 40,000 50,000 62,500 78,125 97,656 122,070 152,588 190,735 238,419 298,024 * The price in each cell in the table is computed by taking 5/6 of the price just above it in the table. For example, P500 is 5/6 of P600 and P417 is 5/6 of P500. § The quantity sold in each cell of the table is computed by multiplying the quantity sold just above it in the table by 50,000/40,000. For example, 62,500 is computed by multiplying 50,000 by the fraction 50,000/40,000. The profit at each price in the above demand schedule can be computed as follows: Price (a) P600 P500 P417 P348 P290 P242 P202 P168 P140 P117 Quantity Sold (b) 40,000 50,000 62,500 78,125 97,656 122,070 152,588 190,735 238,419 298,024 Sales (a) × (b) P24,000,000 P250,00,000 P26,062,500 P27,187,500 P28,320,200 P29,540,900 P30,822,800 P32,043,500 P33,378,700 P34,868,800 18-324 Cost of Sales P60 × (b) P2,400,000 P3,000,000 P3,750,000 P4,687,500 P5,859,400 P7,324,200 P9,155,300 P11,444,100 P14,305,100 P17,881,400 Contribution Margin P21,600,000 P22,000,000 P22,312,500 P22,500,000 P22,460,800 P22,216,700 P21,667,500 P20,599,400 P19,073,600 P16,987,400 Management Accounting: An Overview Chapter 1 The contribution margin is plotted below as a function of the selling price: 23,000,000 Contribution Margin 22,000,000 21,000,000 20,000,000 19,000,000 18,000,000 17,000,000 100.00 200.00 300.00 400.00 500.00 600.00 Selling Price The plot confirms that the profit-maximizing price is about P328. Requirement (4) If the postal service wants to maximize the contribution margin and profit from sales of souvenir sheets, the new price should be: Profit-maximizing price = 5.4663 × P70 = P383 Note that a P100 increase in cost has led to a P55 (P383 – P328) increase in the profit-maximizing price. This is because the profit-maximizing price is computed by multiplying the variable cost by 5.4663. Since the variable cost has increased by P100, the profit-maximizing price has increased by P100 × 5.4663, or P55. Some people may object to such a large increase in price as “unfair” and some 18-325 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II may even suggest that only the P10 increase in cost should be passed on to the consumer. The enduring popularity of full-cost pricing may be explained to some degree by the notion that prices should be “fair” rather than calculated to maximize profits. Problem 11 (Ranking Alternatives and Managing with a Constraint) Requirement (1) This problem can be solved by first computing the profitability index of each customer and then ranking the customers based on that profitability index: Ji Eun’s Time Required (B) 4 4 5 3 5 8 3 4 6 6 Incremental Profit Customer (A) Lalaine........................... P1,400 Emily............................. 1,240 Anna.............................. 1,600 Catherine....................... 960 Gee Ann......................... 1,900 Lily 2,880 Lourdes......................... 930 Ma. Cecilia..................... 1,360 Sheila Raya.................... 2,340 Jane.............................. 2,040 Customer Sheila Raya...... Gee Ann........... Lily Lalaine............. Jane Ma. Cecilia...... Anna................ Profitability Index P390 P380 P360 P350 P340 P340 P320 Ji Eun’s Time Required 6 5 8 4 6 4 5 18-326 Profitability Index (A) ÷ (B) P350 P310 P320 P320 P380 P360 P310 P340 P390 P340 Cumulative Amount of Ji Eun’s Time Required 6 11 19 23 29 27 38 Management Accounting: An Overview Chapter 1 Catherine.......... P320 3 41 Emily............... P310 4 45 Lourdes............ P310 3 48 Given that Ji Eun should not be asked to work more than 33 hours, the four customers below the line in the above table should be told that their reservations have to be cancelled. Requirement (2) The total profit on wedding cakes for the weekend after canceling the four reservations would be: Sheila Raya...... Gee Ann............ Lily Lalaine.............. Jane Ma. Cecilia....... Total................. P 2,34 0 1,900 2,880 1,400 2,040 1,360 P11,92 0 Notes: ● Both Ji Eun’s time and the cakes would have to be very carefully scheduled to make sure that all cakes are completed on time. We have assumed that the 33 hours of Ji Eun’s time that are available for cake decorating do not include hours that have been set aside as a buffer to provide protection from inevitable disruptions in the schedule. ● If the cumulative amount of Ji Eun’s time required did not exactly consume the total amount of time available, some adjustment might be required in which reservations are cancelled to ensure that the most profitable plan is selected. Requirement (3) To avoid disappointing customers, reservations should probably not be accepted for any particular weekend after 33 hours of Ji Eun’s time have been committed for that weekend’s cakes. To ensure that only the most profitable cake reservations are accepted, a reservation for any cake with a profitability index of less than P340 should probably not be accepted. This was the cutoff 18-327 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II point for the cakes in the first weekend in June. This cutoff may need to be adjusted upward or downward over time—the cakes that were reserved for the first weekend in June may not be representative of the cakes that would be reserved for other weekends. If too many reservations are turned down and Ji Eun’s time is not fully utilized, then the cutoff should be adjusted downward. If too few reservations are turned down and Ji Eun’s time is once again overbooked or profitable cake orders are turned away, then the cutoff should be adjusted upward. Requirement (4) Ms. Hye Young should consider changing the way prices are set so that they include a charge for Ji Eun’s time. On average, the prices may be the same, but they should be based not only on the size of the cakes, but also on the amount of cake decorating that the customer desires. The charge for Ji Eun’s time should be her hourly rate of pay (including any fringe benefits) plus the opportunity cost of at least P340 per hour. Because Ji Eun will not be working more than 33 hours per week, if another cake reservation is accepted, some other cake reservation will have to be cancelled. Ms. Hye Young would have to give up at least P34 profit per hour to accept another cake reservation. Requirement (5) Making Ji Eun happy involves not asking her to work more than 33 hours per week decorating cakes. Making customers happy involves not canceling their reservations, not raising prices, and providing top quality wedding cakes. Ms. Hye Young can accomplish both of these objectives and increase her profits by clever management of the constraint—Ji Eun’s time. The possibilities include: Ms. Hye Young should make sure that none of Ji Eun’s time is wasted on unnecessary tasks. For example, Ji Eun should not be asked to cream butter by hand for frostings if a machine could do the job as well with less labor time. Ms. Hye Young should make sure that none of Ji Eun’s time is wasted on tasks that can be done by other persons. For example, an assistant can be assigned to prepare frosting and to clean up, relieving Ji Eun of those tasks. As long as the cost of the assistant’s time is less than P34 per hour, the result will be higher profits and more pleased customers. Ms. Hye Young should consider assigning an apprentice to Ji Eun. The apprentice could relieve Ji Eun of some of her workload while learning the skills to eventually expand the company’s cake decorating capacity. Ms. Hye Young might consider subcontracting some of the less demanding 18-328 Management Accounting: An Overview Chapter 1 cake decorating to another baker. This would be profitable as long as the charge is less than P340 per hour. IV. Multiple Choice Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. C C B B A B C B A B 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. D A D A D C A C B C 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. D A D E B D D C A A 31. 32. 33. 34. 35. A D C A C Supporting computations for nos. 16 - 29: 16. Sales [(100,000 x 90%) x (P5.00 x 120%)] Less: Variable costs (P300,000 x 90%) Contribution margin Less: Fixed costs Operating income P540,000 270,000 P270,000 150,000 P120,000 17. Direct materials Direct labor Overhead Selling cost Minimum selling price per unit 18. Relevant cost to make (10,000 x P24) Purchase cost Less: Savings in manufacturing cost Avoidable fixed overhead Net purchase price Difference in favor of “buy” alternative P 4 5 2 3 P14 P240,000 P300,000 P45,000 50,000 95,000 P205,000 P 35,000 19. Increase in sales (60,000 x P3) P180,000 Less: Increase in variable cost (60,000 x P2.50) 150,000 Net increase in income P 30,000 20. R S T Sales (10,000 x P20) P200,000 P200,000 P200,000 Less: Variable costs 18-329 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II R (P12 x 10,000) S (P 8 x 10,000) T (P 4 x 10,000) 120,000 80,000 40,000 Contribution margin 21. Sales (P16 x 15,000) Less: Variable costs R (P12 x 15,000) S (P 8 x 15,000) T (P 4 x 15,000) P 80,000 P120,000 P160,000 R P240,000 S P240,000 T P240,000 180,000 120,000 60,000 Contribution margin Less: Fixed costs Operating income P 60,000 40,000 P 20,000 P120,000 80,000 P 40,000 22. Old operating income: Contribution margin Less: Fixed cost P180,000 120,000 P 60,000 P80,000 40,000 P40,000 20,000 P20,000 New operating income Difference - decrease 23. Sales Less: Variable costs Direct materials Direct labor Factory overhead Marketing expenses Administrative expenses Contribution margin Less: Fixed costs Factory overhead Marketing expenses Administrative expenses Increase in fixed costs Profit 24. Sales Less: Variable costs P1,200,000 P300,000 400,000 80,000 70,000 50,000 P 50,000 30,000 20,000 10,000 900,000 P 300,000 110,000 P 190,000 P1,200,000 18-330 Management Accounting: An Overview Chapter 1 Direct materials Direct labor Factory overhead Marketing expenses Administrative expenses Contribution margin Less: Fixed costs Factory overhead Marketing expenses Administrative expenses Decrease in fixed costs (P25,000 4) Profit P275,000 375,000 80,000 70,000 50,000 P 50,000 30,000 20,000 (6,250) 25. Direct materials (P2 x 5,000) Direct labor (P8 x 5,000) Variable overhead (P4 x 5,000) Total variable costs Add: Avoidable fixed overhead Total 26. Avoidable fixed overhead Direct materials Direct labor Variable overhead Total Multiplied by: Number of units to be produced Total relevant costs to make the part 27. Purchase cost (P1.25 x 10,000) Variable costs to make Savings of making the blade 28. Selling price per unit Less: Variable costs of goods sold per unit ([P320,000 - P80,000] 20,000 units) Contribution margin per unit Multiplied by units to be sold under Special Order Increase in operating income 29. Budgeted operating income: Contribution margin (P2,000,000 x 30%) Less fixed costs 18-331 850,000 P 350,000 93,750 P 256,250 P10,000 40,000 20,000 P70,000 10,000 P80,000 P 4 4 16 18 P42 20,000 P840,000 P12,500 10,000 P 2,500 P17 12 P 5 2,000 P10,000 P600,000 400,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Net operating income Operating income under the proposal: Sales P2,000,000 Less Variable costs ([70% x P2,000,000] x 80%) 1,120,000 Contribution margin P 880,000 Less fixed costs 520,000 Increase in budgeted operating profit P200,000 360,000 P160,000 CHAPTER 20 CAPITAL BUDGETING DECISIONS I. Questions 1. A capital investment involves a current commitment of funds with the expectation of generating a satisfactory return on these funds over a relatively extended period of time in the future. 2. Cost of capital is the weighted minimum desired average rate that a company must pay for long-term capital while discounted rate of return is the maximum rate of interest that could be paid for the capital employed over the life of an investment without loss on the project. 3. The basic principles in capital budgeting are: 1. Capital investment models are focused on the future cash inflows and outflows - rather than on net income. 2. Investment proposals should be evaluated according to their differential effects on the company’s cash flows as a whole. 3. Financing costs associated with the project are excluded in the analysis of incremental cash flows in order to avoid the “doublecounting” of the cost of money. 4. The concept of the time value of money recognizes that a peso of present return is worth more than a peso of future return. 5. Choose the investments that will maximize the total net present value of the projects subject to the capital availability constraint. 4. The major classifications as to purpose are: 18-332 Management Accounting: An Overview Chapter 1 1. Replacement projects - those involving replacements of worn-out assets to avoid disruption of normal operations, or to improve efficiency. 2. Product or process improvement - projects that aim to produce additional revenue or to realize cost savings. 3. Expansion - projects that enhance long-term returns due to increased profitable volume. 5. Greater amounts of capital may be used in projects whose combined returns will exceed any alternate combination of total investment. 6. No. This implies that any equity funds are cost free and this is a dangerous position because it ignores the opportunity cost or alternative earnings that could be had from the fund. 7. Yes, if there are alternative earnings foregone by stockholders. 8. Capital budgeting screening decisions concern whether a proposed investment project passes a preset hurdle, such as a 15% rate of return. Capital budgeting preference decisions are concerned with choosing from among two or more alternative investment projects, each of which has passed the hurdle. 9. The “time value of money” refers to the fact that a peso received today is more valuable than a peso received in the future. A peso received today can be invested to yield more than a peso in the future. 10. Discounting is the process of computing the present value of a future cash flow. Discounting gives recognition to the time value of money and makes it possible to meaningfully add together cash flows that occur at different times. 11. Accounting net income is based on accruals rather than on cash flows. Both the net present value and internal rate of return methods focus on cash flows. 12. One simplifying assumption is that all cash flows occur at the end of a period. Another is that all cash flows generated by an investment project are immediately reinvested at a rate of return equal to the discount rate. 13. No. The cost of capital is not simply the interest paid on long-term debt. The cost of capital is a weighted average of the individual costs of all sources of financing, both debt and equity. 18-333 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II 14. The internal rate of return is the rate of return on an investment project over its life. It is computed by finding that discount rate that results in a zero net present value for the project. 15. The project profitability index is computed by dividing the net present value of the cash flows from an investment project by the investment required. The index measures the profit (in terms of net present value) provided by each peso of investment in a project. The higher the project profitability index, the more desirable is the investment project. 16. Neither the payback method nor the simple rate of return method considers the time value of money. Under both methods, a peso received in the future is weighed the same as a peso received today. Furthermore, the payback method ignores all cash flows that occur after the initial investment has been recovered. II. Matching Type 1. 2. 3. 4. 5. A C F B I 6. 7. 8. 9. 10. H D G J E III. Exercises Exercise 1 (Simple Rate of Return Method) The annual incremental net operating income is determined by comparing the operating cost of the old machine to the operating cost of the new machine and the depreciation that would be taken on the new machine: Operating cost of old machine...................................................... Less operating cost of new machine............................................. Less annual depreciation on the new machine (P80,000 ÷ 10 years).................................................................................. Annual incremental net operating income..................................... P33,000 10,000 Cost of the new machine.............................................................. Less scrap value of old machine................................................... Initial investment.......................................................................... P80,000 5,000 P75,000 Simple rate of return = Annual incremental net operating income Initial investment = P15,000 18-334 = P75,000 20% 8,000 P15,000 Management Accounting: An Overview Chapter 1 Exercise 2 (Basic Present Value Concepts) 1. a. P400,000 × 0.794 = P317,600. b. P400,000 × 0.712 = P284,800. 2. a. P5,000 × 4.355 = P21,775. b. P5,000 × 3.685 = P18,425. 3. The factor for 10% for 20 years is 8.514. Thus, the present value of Tom’s winnings would be: P50,000 × 8.514 = P425,700. Whether or not Tom really won a million pesos depends on your point of view. She will receive a million pesos over the next 20 years; however, in terms of its value right now she won much less than a million pesos as shown by the present value computation above. Exercise 3 (After-Tax Costs) a. Management consulting fee.............................. Multiply by 1 – 0.30........................................ After-tax cost................................................... P100,000 × 0.70 P 70,000 b. Increased revenues........................................... Multiply by 1 – 0.30........................................ After-tax cash flow (benefit)............................ P40,000 × 0.70 P28,000 c. The depreciation deduction is P210,000 ÷ 7 years = P30,000 per year, which has the effect of reducing taxes by 30% of that amount, or P9,000 per year. Exercise 4 (Basic Net Present Value Analysis) Year(s) Purchase of the stock..................... Now Annual dividends*......................... 1-4 Sale of the stock............................4 Amount of Cash Flows P(18,000) P720 P22,500 18-335 12% Present Value Factor of Cash Flows 1.000 P(18,000) 3.037 2,187 0.636 14,310 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Net present value........................... *900 shares × P0.80 per share per year = P720 per year. P( 1,503) No, Ms. Cruz did not earn a 12% return on the share. The negative net present value indicates that the rate of return on the investment is less than the discount rate of 12%. Exercise 5 (Internal Rate of Return and Net Present Value) 1. Factor of the internal = rate of return Required investment Annual cash inflow P136,700 = anP25,000 = return 5.468of 16%. A factor of 5.468 represents internal rate of 2. Item Year(s) Initial investment........................... Now Net annual cash inflows................ 1-14 Net present value........................... Amount of 16% Present Value Cash Flows Factor of Cash Flows P(136,700) 1.000 P(136,700) P25,000 5.468 136,700 P 0 The reason for the zero net present value is that 16% (the discount rate) represents the machine’s internal rate of return. The internal rate of return is the rate that causes the present value of a project’s cash inflows to just equal the present value of the investment required. 3. Factor of the internal = rate of return Required investment Annual cash inflow P136,700 The 6.835 factor is closest to 6.982, the factor for the 11% rate of return. = the 6.835is 11%. P20,000 Thus, to the nearest whole percent, internal rate =of return Exercise 6 (Basic Net Present Value and Internal Rate of Return Analysis) 1. Item Year(s) Amount of Cash Flows 18-336 15% Present Value of Factor Cash Flows Management Accounting: An Overview Chapter 1 Initial investment..................... Now Annual cash inflows................1-4 Net present value.................... P(40,350) P15,000 1.000 2.855 P(40,350) 42,825 P 2,475 Yes, this is an acceptable investment. Its net present value is positive, which indicates that its rate of return exceeds the minimum 15% rate of return required by the company. 2. Factor of the internal = rate of return = Investment required Net annual cash inflow P111,500 P20,000 = 5.575 A factor of 5.575 represents an internal rate of return of 16%. 3. Factor of the internal = rate of return Investment required Net annual cash inflow P14,125 A factor of 5.650 represents internal rate =of 5.650 return of 12%. The = an P2,500 company did not make a wise investment because the return promised by the machine is less than the required rate of return IV. Problems Problem 1 (Equipment Replacement Sensitivity Analysis) Requirement 1 Total Present Value A. B. New Situation: Recurring cash operating costs (P26,500 x 2.69) Cost of new equipment Disposal value of old equipment now Present value of net cash outflows Present Situation: Recurring cash operating costs (P45,000 x 2.69) Disposal value of old equipment four years hence (P2,600 x 0.516) Present value of net cash inflows 18-337 P 71,285 44,000 (5,000) P110,285 P121,050 (1,342) P119,708 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Difference in favor of replacement P 9,423 Requirement 2 Payback period for the new equipment = = P44,000 – P5,000 P18,500 2.1 years Requirement 3 Let X = annual cash savings Let O = net present value X (2.69) + P5,000 - P44,000 - P1,342 = O 2.69X = P40,342 X = P14,997 If the annual cash savings decrease from P18,850 to P14,997 or by P3,503, the point of indifference will be reached. Another alternative way to get the same answer would be to divide the net present value of P9,423 by 2.690. Problem 2 Annual cash expenses of the manual bookkeeping machine system, P9,800 x 12 Annual cash expenses of computerized data processing Annual cash savings before taxes Annual cash savings (a) Depreciation Inflow before tax Income tax (50%) (b) Cash inflow after tax (a - b) Year 1 Year 2 Year 3 Year 3 Salvage P117,600 53,600 P 64,000 Year 1 P64,000 20,000 P44,000 22,000 P42,000 Year 2 P64,000 16,000 P48,000 24,000 P40,000 Year 3 P64,000 12,800 P51,200 25,600 P38,400 After Tax Cash Inflows P42,000 40,000 38,400 20,000 PV Factor x 0.909 x 0.826 x 0.750 x 0.750 PV P 38,178 33,040 28,800 15,000 18-338 Management Accounting: An Overview Chapter 1 Year 3 Tax loss 15,600* x 0.750 Investment (I) Net present value (NPV) _________________ * 11,700 P126,718 100,000 P 26,718 The P15,600 tax benefit of the loss on the disposal of the computer at the end of year 3 is computed as follows: Estimated salvage value Estimated book value: Historical cost Accumulated depreciation Estimated loss P 20,000 P100,000 48,800 Tax rate Tax effect of estimated loss 51,200 P(31,200) 50% P(15,600) Since the net present value is positive, the computer should be purchased replacing the manual bookkeeping system. Problem 3 Requirement 1 (a) Purchase price of new equipment Disposal of existing equipment: Selling price Book value Loss on disposal Tax rate Tax benefit of loss on disposal Required investment (I) P(300,000) P 0 60,000 P60,000 0.4 (b) Increased cash flows resulting from change in contribution margin: Using new equipment [18,000 (P20 - P7)] * Using existing equipment [11,000 (P20 - P9)] Increased cash flows Less: Taxes (0.40 x P113,000) Increased cash flows after taxes Depreciation tax shield: Depreciation on new equipment (P300,000 5) P60,000 18-339 24,000 P(276,000) P234,000 121,000 113,000 45,200 P 67,800 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Depreciation on existing equipment (P60,000 5) 12,000 Increased depreciation charge P48,000 Tax rate 0.40 Depreciation tax shield Recurring annual cash flows _________________ * 19,200 P 87,000 The new equipment is capable of producing 20,000 units, but ETC Products can sell only 18,000 units annually. The sales manager made several errors in his calculations of required investment and annual cash flows. The errors are as follows: Required investment: - The cost of the market research study (P44,000) is a sunk cost because it was incurred last year and will not change regardless of whether the investment is made or not. - The loss on the disposal of the existing equipment does not result in an actual cash cost as shown by the sales manager. The loss on disposal results in a reduction of taxes, which reduces the cost of the new equipment. Annual cash flows: - The sales manager considered only the depreciation on the new equipment rather than just the additional depreciation which would result from the acquisition of the new equipment. - The sales manager also failed to consider that the depreciation is a noncash expenditure which provides a tax shield. - The sales manager’s use of the discount rate (i.e., cost of capital) was incorrect. The discount rate should be used to reduce the value of future cash flows to their current equivalent at time period zero. Requirement 2 Present value of future cash flows (P87,000 x 3.36) Required investment (I) Net present value Problem 4 Requirement 1: P(507,000) Requirement 2: P(466,200) Requirement 3: P(23,400) 18-340 P292,320 276,000 P 16,320 Management Accounting: An Overview Chapter 1 Problem 5 1. The net annual cost savings is computed as follows: Reduction in labor costs........................................................................ P240,000 Reduction in material costs....................................................................96,000 Total cost reductions.............................................................................. 336,000 Less increased maintenance costs (P4,250 × 12)...................................51,000 Net annual cost savings......................................................................... P285,000 2. Using this cost savings figure, and other data provided in the text, the net present value analysis is: Year(s) Cost of the machine..................................... Now Installation and software.............................. Now Salvage of the old machine.......................... Now Annual cost savings..................................... 1-10 Overhaul required........................................ 6 Salvage of the new machine........................ 10 Net present value......................................... Amount of 18% Cash Flows Factor P(900,000) 1.000 P(650,000) 1.000 P70,000 1.000 P285,000 4.494 P(90,000) 0.370 P210,000 0.191 Present Value of Cash Flows P (900,000) (650,000) 70,000 1,280,790 (33,300) 40,110 P (192,400) No, the etching machine should not be purchased. It has a negative net present value at an 18% discount rate. 3. The intangible benefits would have to be worth at least P42,813 per year as shown below: Required increase in net present value P192,400 = Factor for 10 years 4.494 = P42,813 Thus, the new etching machine should be purchased if management believes that the intangible benefits are worth at least P42,813 per year to the company. Problem 6 Items and Computations Year(s) (1) Amount 18-341 (2) Tax Effect (1) × (2) After-Tax Cash 12% Factor Present Value of Cash Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Investment in new trucks.......................................... Now P(450,000) Salvage from sale of the old trucks.......................... Now P30,000 1 – 0.30 Net annual cash receipts.......................................... 1-8 P108,000 1 – 0.30 Depreciation deductions*.......................................... 1-8 P56,250 0.30 Overhaul of motors................................................... 5 P(45,000) 1 – 0.30 Salvage from the new trucks.................................... 8 P20,000 1 – 0.30 Net present value..................................................... Flows P(450,000) P21,000 P75,600 P16,875 P(31,500) P14,000 1.000 1.000 4.968 4.968 0.567 0.404 Flows P(450,000) 21,000 375,581 83,835 (17,861) 5,656 P 18,211 * P450,000 ÷ 8 years = P56,250 per year Since the project has a positive net present value, the contract should be accepted. Problem 7 1. Factor of the internal = rate of return Required investment Annual cash inflow P142,950 P37,500 = = 3.812 A factor of 3.812 equals an 18% rate of return. Verification of the 18% rate of return: Amount of Cash Item Year(s) Flows Investment in equipment.......................... Now P(142,950) Annual cash inflows................................ 1-7 P37,500 Net present value.................................... 2. Factor of the internal = rate of return 18% Factor 1.000 3.812 Present Value of Cash Flows P(142,950) 142,950 P 0 Required investment Annual cash inflow We know that the investment is P142,950, and we can determine the factor for an internal rate of return of 14% by looking at the PV table along the 7-period line. This factor is 4.288. Using these figures in the formula, we get: P142,950 Annual cash inflow = 4.288 Therefore, the annual cash inflow would have to be: P142,950 ÷ 4.288 = P33,337. 18-342 Management Accounting: An Overview Chapter 1 3. a. 5-year life for the equipment: The factor for the internal rate of return would still be 3.812 [as computed in (1) above]. Reading along the 5-period line of the PV table, a factor of 3.812 is closest to 3.791, the factor for 10%. Thus, to the nearest whole percent, the internal rate of return is 10%. b. 9-year life for the equipment: The factor of the internal rate of return would again be 3.812. From the PV table, reading along the 9-period line, a factor of 3.812 is closest to 3.786, the factor for 22%. Thus, to the nearest whole percent, the internal rate of return is 22%. The 10% return in part (a) is less than the 14% minimum return that Dr. Blue wants to earn on the project. Of equal or even greater importance, the following diagram should be pointed out to Dr. Blue: As this illustration shows, a decrease in years has a much greater impact on the rate of return than an increase in years. This is because of the time value of money; added cash inflows far into the future do little to enhance the rate of return, but loss of cash inflows in the near term can do much to reduce it. Therefore, Dr. Blue should be very concerned about any potential decrease in the life of the equipment, while at the same time realizing that any increase in the life of the equipment will do little to enhance her rate of return. 4. a. The expected annual cash inflow would be: P37,500 x 120% = P45,000 P142,950 P45,000 = 3.177 18-343 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Reading along the 7-period line of the PV table, a factor of 3.177 is closest to 3.161, the factor for 25%, and is between that factor and the factor for 24%. Thus, to the nearest whole percent, the internal rate of return is 25%. b. The expected annual cash inflow would be: P37,500 x 80% = P30,000 P142,950 P30,000 = 4.765 Reading along the 7-period line of the PV table, a factor of 4.765 is closest to 4.712, the factor for 11%. Thus, to the nearest whole percent, the internal rate of return is 11%. Unlike changes in time, increases and decreases in cash flows at a given point in time have basically the same impact on the rate of return, as shown below: 5. Since the cash flows are not even over the five-year period (there is an extra P61,375 cash inflow from sale of the equipment at the end of the fifth year), some other method must be used to compute the internal rate of return. Using trial-and-error or more sophisticated methods, it turns out that the actual internal rate of return will be 12%: Item Year(s) Investment in the equipment............................ Now Annual cash inflow........................................... 1-5 Sale of the equipment....................................... 5 Net present value.............................................. 18-344 Amount of Cash 12% Flows Factor P(142,950) 1.000 P30,000 3.605 P61,375 0.567 Present Value of Cash Flows P(142,950) 108,150 34,800 P 0 Management Accounting: An Overview Chapter 1 Problem 8 1. The income statement would be: Sales revenue............................................................. Less commissions (40% × P200,000)........................ Contribution margin................................................... Less fixed expenses: Maintenance........................................................... P50,000 Insurance................................................................ 10,000 Depreciation*......................................................... 36,000 Total fixed expenses................................................... Net operating income................................................. P200,000 80,000 120,000 96,000 P 24,000 *P180,000 ÷ 5 years = P36,000 per year 2. The initial investment in the simple rate of return calculations is net of the salvage value of the old equipment as shown below: Simple rate of return = Annual incremental net operating income Initial investment P24,000 Yes, the games=would be P24,000 purchased. The return exceeds the 14% =threshold = 16% set P180,000 – P30,000 P150,000 by the company. 3. The payback period would be: Payback period = Investment required Net annual cash inflow P180,000 – P30,000 P150,000 = = 2.5 years P60,000* P60,000 *Net annual cash inflow = Net operating income + Depreciation = P24,000 + P36,000 = P60,000. = Yes, the games would be purchased. The payback period is less than the 3 years. IV. Multiple Choice Questions 1. D 11. D 21. C 18-345 31. D Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II 2. 3. 4. 5. 6. 7. 8. 9. 10. C B B A C D B B A 12. 13. 14. 15. 16. 17. 18. 19. 20. D D C C D D B A A 22. 23. 24. 25. 26. 27. 28. 29. 30. B C D C C D B D A 32. 33. 34. 35. 36. 37. 38. 39. 40. C C D D B B B D B CHAPTER 21 I. DECENTRALIZED OPERATIONS AND SEGMENT REPORTING Questions 1. Decentralization means that decision making in an organization isn’t confined to a few top executives, but rather is spread throughout the organization with managers at various levels making key operating decisions relating to their sphere of responsibility. 2. The benefits include: (1) a spreading of decision-making responsibility among managers, thereby relieving top management from day-to-day problem solving and allowing them to focus their time on long-range planning; (2) training in decision making for lower-level managers, thereby preparing them to assume greater responsibility; (3) greater job satisfaction and greater incentive for lower-level managers; (4) better decisions, since decisions are made at the level where the problem is best understood; and (5) a more effective basis for measuring managerial performance through the creation of profit and investment centers. 3. The three business practices are (a) omission of some costs in the assignment process, (b) the use of inappropriate allocation methods, and (c) allocation of common costs to segments. 4. The contribution margin represents the portion of sales revenue remaining after deducting variable expenses. The segment margin represents the margin still remaining after deducting traceable fixed expenses from the contribution margin. Generally speaking, the contribution margin is most useful as a planning tool in the short run, 18-346 Management Accounting: An Overview Chapter 1 when fixed costs don’t change. The segment margin is most useful as a planning tool in the long run, when fixed costs will be changing, and as a tool for evaluating long-run segment performance. One concept is no more useful to management than the other; the two concepts simply relate to different planning horizons. 5. A segment is any part or activity of an organization about which a manager seeks cost, revenue, or profit data. Examples of segments include departments, operations, sales territories, divisions, product lines, and so forth. 6. Under the contribution approach, costs are assigned to a segment if and only if the costs are traceable to the segment (i.e., could be avoided if the segment were eliminated). Common costs are not allocated to segments under the contribution approach. 7. A traceable cost of a segment is a cost that arises specifically because of the existence of that segment. If the segment were eliminated, the cost would disappear. A common cost, by contrast, is a cost that supports more than one segment, but is not traceable in whole or in part to any one of the segments. If the departments of a company are treated as segments, then examples of the traceable costs of a department would include the salary of the department’s supervisor, depreciation of machines used exclusively by the department, and the costs of supplies used by the department. Examples of common costs would include the salary of the general counsel of the entire company, the lease cost of the headquarters building, corporate image advertising, and periodic depreciation of machines shared by several departments. II. Problems Problem 1 (Working with a Segmented Income Statement) Requirement 1 P75,000 × 40% CM ratio = P30,000 increased contribution margin in Cebu. Since the fixed costs in the office and in the company as a whole will not change, the entire P30,000 would result in increased net operating income for the company. It is incorrect to multiply the P75,000 increase in sales by Cebu’s 25% segment margin ratio. This approach assumes that the segment’s traceable fixed expenses increase in proportion to sales, but if they did, they would not be fixed. 18-347 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Requirement 2 a. The segmented income statement follows: Segments Total Company Manila Cebu Amount % Amount % Amount % Sales............................................. P800,000 100.0% P200,000 100% P600,000 100% Less variable expenses................. 420,000 52.5 60,000 30 360,000 60 Contribution margin.................... 380,000 47.5 140,000 70 240,000 40 Less traceable fixed expenses.................................... 168,000 21.0 78,000 39 90,000 15 Office segment margin................ 212,000 26.5 P 62,000 31% P150,000 25% Less common fixed expenses not traceable to segments................................... 120,000 15.0 Net operating income.................. P 92,000 11.5% b. The segment margin ratio rises and falls as sales rise and fall due to the presence of fixed costs. The fixed expenses are spread over a larger base as sales increase. In contrast to the segment ratio, the contribution margin ratio is a stable figure so long as there is no change in either the variable expenses or the selling price of a unit of service. Problem 2 (Segmented Income Statement) Requirement 1 Sales Less variable expenses Contribution margin Less traceable fixed expenses Geographic market segment margin Less common fixed expenses not traceable to geographic markets* Total Company Amount % P1,500,000 100.0 588,000 39.2 912,000 60.8 770,000 51.3 142,000 9.5 175,000 11.7 18-348 East Amount % P400,000 100 208,000 52 192,000 48 240,000 60 Geographic Market Central West Amount % Amount P600,000 100 P500,000 180,000 30 200,000 420,000 70 300,000 330,000 55 200,000 P(48,000) (12) P 90,000 15 P100,000 % 100 40 60 40 20 Management Accounting: An Overview Chapter 1 Net operating income (loss) P (33,000) (2.2) * P945,000 – P770,000 = P175,000. Requirement 2 Incremental sales (P600,000 × 15%)....................................................................... P90,000 Contribution margin ratio........................................................................................ × 70% Incremental contribution margin.............................................................................. 63,000 Less incremental advertising expense....................................................................... 25,000 Incremental net operating income............................................................................ P38,000 Yes, the advertising program should be initiated. Problem 3 (Basic Segmented Income Statement) Total Sales*............................................................................ P750,000 Variable expenses**....................................................... 435,000 Contribution margin....................................................... 315,000 Traceable fixed expenses............................................... 183,000 Product line segment margin.......................................... 132,000 Common fixed expenses not traceable to products..................................................................... 105,000 Net operating income..................................................... P 27,000 * CD: 37,500 packs × P8.00 per pack = P300,000; DVD: 18,000 packs × P25.00 per pack= P450,000. ** CD: 37,500 packs × P3.20 per pack = P120,000; DVD: 18,000 packs × P17.50 per pack= P315,000. III. Multiple Choice Questions 1. 2. 3. 4. 5. B C B B B 6. 7. 8. 9. 10. A C B D C 11. A 12. B CHAPTER 22 18-349 CD P300,000 120,000 180,000 138,000 P 42,000 DVD P450,000 315,000 135,000 45,000 P 90,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II BUSINESS PLANNING I. Questions 1. Strategy, plans, and budgets are interrelated and affect one another. Strategy describes how an organization matches its own capabilities with the opportunities in the marketplace to accomplish its overall objectives. Strategy analysis underlies both long-run and short-run planning. In turn, these plans lead to the formulation of budgets. Budgets provide feedback to managers about the likely effects of their strategic plans. Managers use this feedback to revise their strategic plans. 2. Budgeted performance is better than past performance for judging managers. Why? Mainly because the inefficiencies included in past results can be detected and eliminated in budgeting. Also, new opportunities in the future, which did not exist in the past, may be ignored if past performance is used. 3. A company that shares its own internal budget information with other companies can gain multiple benefits. One benefit is better coordination with suppliers, which can reduce the likelihood of supply shortages. Better coordination with customers can result in increased sales as demand by customers is less likely to exceed supply. Better coordination across the whole supply chain can also help a company reduce inventories and thus reduce the costs of holding inventories. 4. The sales forecast is typically the cornerstone for budgeting, because production (and, hence, costs) and inventory levels generally depend on the forecasted level of sales. 5. Sensitivity analysis adds an extra dimension to budgeting. It enables managers to examine how budgeted amounts change with changes in the underlying assumptions. This assists managers to monitor those assumptions that are most critical to a company attaining its budget or make timely adjustments to plans when appropriate. 6. Factors reducing the effectiveness of budgeting of companies include: 1. Lack of a well-defined strategy, 2. Lack of a clear linkage of strategy to operational plans, 3. Lack of individual accountability for results, and 18-350 Management Accounting: An Overview Chapter 1 4. Lack of meaningful performance measures. II. Problems Problem 1 (Budgeted Income Statement) Globalcom Company Budgeted Income Statement for 2006 (in thousands) Net sales P6,996 Equipment (P6,000 x 1.06 x 1.10) 1,908 Maintenance contracts (P1,800 x 1.06) Total net sales Cost of goods sold (P4,600 x 1.03 x 1.06) Gross margin Operating costs: Marketing costs (P600 + P250) 850 Distribution costs (P150 x 1.06) 159 Customer maintenance costs (P1,000 + P130) 1,130 Administrative costs 900 Total operating costs Operating income P8,904 5,022 3,882 3,039 P 843 Problem 2 (Comprehensive Operating Budget) Requirement 1 Schedule 1: Revenue Budget For the Year Ended December 31, 2006 Skateboards Total Units 1,000 Selling Price P450 Total Revenues P450,000 Requirement 2 Schedule 2: Production Budget (in Units) for the Year Ended December 31, 2006 Skateboards 18-351 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Budgeted unit sales (Schedule 1) Add target ending finished goods inventory Total requirements Deduct beginning finished goods inventory Units to be produced 1,000 200 1,200 100 1,100 Requirement 3 Schedule 3A: Direct Materials Usage Budget For the Year Ended December 31, 2006 Wood Physical Budget To be used in production (Wood: 1,100 x 5.00 b.f. Fiberglass: 1,100 x 6.00 yards) Fiberglass Total 5,500 6,600 5,500 Cost Budget Available from beginning inventory (Wood: 2,000 b.f. x P28.00 Fiberglass: 1,000 b.f. x 4.80) To be used from purchases this period (Wood: (5,500 – 2,000) x P30.00 Fiberglass: (6,600 – 1,000) x P5.00) Total cost of direct materials to be used 6,600 56,000 4,800 105,000 28,000 P161,000 P32,800 P193,800 Schedule 3B: Direct Materials Purchases Budget For the Year Ended December 31, 2006 Wood Physical Budget Production usage (from Schedule 3A) Add target ending inventory Total requirements Deduct beginning inventory Purchases Cost Budget (Wood: 5,000 x P30.00 Fiberglass: 7,600 x P5.00) 5,500 1,500 7,000 2,000 5,000 Total 6,600 2,000 8,600 1,000 7,600 P150,000 P38,000 P150,000 Requirement 4 Schedule 4: Direct Manufacturing Labor Budget For the Year Ended December 31, 2006 18-352 Fiberglass P38,000 P188,000 Management Accounting: An Overview Chapter 1 Labor Category Manufacturing labor Cost Driver Units 1,100 DML Hours per Driver Unit 5.00 Total Hours 5,500 Wage Rate P25.00 Total P137,500 Requirement 5 Schedule 5: Manufacturing Overhead Budget For the Year Ended December 31, 2006 At Budgeted Levels of 5,500 Direct Manufacturing Labor-Hours Variable manufacturing overhead costs (P7.00 x 5,500) Fixed manufacturing overhead costs Total manufacturing overhead costs P 38,500 66,000 P104,500 Requirement 6 Budgeted manufacturing overhead rate: P104,500 5,500 = P19.00 per hour Requirement 7 Budgeted manufacturing overhead cost per output unit: P104,500 = 1,100 = P95.00 per output unit Requirement 8 Schedule 6A: Computation of Unit Manufacturing Finished Goods in 2006 Cost per Unit of Inputa Direct materials Wood Fiberglass Direct manufacturing labor Total manufacturing overhead P30.00 5.00 25.00 18-353 Inputsb 5.00 6.00 5.00 Costs of Total P150.00 30.00 125.00 95.00 P400.00 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II a b cost is per board foot, yard or per hour inputs is the amount of input per board Requirement 9 Schedule 6B: Ending Inventory Budget December 31, 2006 Units Direct materials Wood Fiberglass Finished goods Skateboards Total Ending Inventory Cost per Unit Total 1,500 2,000 P 30.00 5.00 P 45,000 10,000 200 400.00 80,000 P135,000 Requirement 10 Schedule 7: Cost of Goods Sold Budget for the year Ended December 31, 2006 From Schedule Beginning finished goods inventory, January 1, 2006 Direct materials used Direct manufacturing labor Manufacturing overhead Cost of goods manufactured Cost of goods available for sale Deduct ending finished goods inventory, December 31, 2006 Cost of goods sold Given 3A 4 5 Total P 37,480 P193,800 137,500 104,500 435,800 473,280 6B 80,000 P393,280 Requirement 11 Budgeted Income Statement for Pacific for the Year Ended December 31, 2006 Revenues Costs Schedule 1 18-354 P450,000 Management Accounting: An Overview Chapter 1 Cost of goods sold Gross margin Operating costs Marketing costs (P250 x 30) Other costs Operating income Schedule 7 393,280 56,720 P 7,500 30,000 37,500 P 19,220 III. Multiple Choice Questions 6. 7. 8. 9. 10. A B C D D 11. 12. 13. 14. 15. A B D A C 11. 12. 13. 14. 15. D D B C A CHAPTER 23 STRATEGIC COST MANAGEMENT; BALANCED SCORECARD I. Questions 1. Strategy Weakness Cost leadership The tendency to cut costs in a way that undermines demand for the product or service. Differentiation The firm’s tendency to undermine its strength by attempting to lower costs or by lacking a continual and aggressive marketing plan to reinforce the perceived difference. Focus The market niche may suddenly disappear due to technological change in the industry or change in consumer tastes. 18-355 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II 2. The balanced scorecard is an accounting report that includes the firm’s critical success factors in four areas: customer satisfaction, financial performance, internal business processes, and innovation and learning (human resources). The primary objective of the balanced scorecard is to serve as an action plan, a basis for implementing the strategy expressed in the critical success factors. 3. The balanced scorecard is important to integrate both financial and nonfinancial information into management reports. Financial measures reflect only a partial- and short-term measure of the firm’s progress. Without strategic non-financial information, the firm is likely to stray from its competitive course and to make strategically wrong product decisions – to choose the wrong products, the wrong customers. The balanced scorecard provides a basis for a more complete analysis than is possible with financial data alone. 4. An analyst can incorporate other factors such as the growth in the overall market and reductions in selling prices resulting from productivity gains into a strategic analysis of operating income. To do so, the analyst attributes the sources of operating income changes to the particular factors of interests. For example, the analyst will combine the operating income effects of strategic price reductions and any resulting growth with the productivity component to evaluate a company’s cost leadership strategy. 5. A company’s balanced scorecard should be derived from and support its strategy. Since different companies have different strategies, their balanced scorecards should be different. 6. The difference between the delivery cycle time and the throughput time is the waiting period between when an order is received and when production on the order is started. The throughput time is made up of process time, inspection time, move time, and queue time. These four elements can be classified between value-added time (process time) and non-value-added time (inspection time, move time, and queue time). 7. The balanced scorecard is constructed to support the company’s strategy, which is a theory about what actions will further the company’s goals. Assuming that the company has financial goals, measures of financial performance must be included in the balanced scorecard as a check on the reality of the theory. If the internal business processes improve, but the financial outcomes do not improve, the theory may be flawed and the strategy should be changed. 8. If a company has an MCE of less than 1, it means the production process includes non-value-added time. An MCE of 0.40, for example, would 18-356 Management Accounting: An Overview Chapter 1 mean that 40% of the throughput time consists of actual processing, and that the other 60% consists of moving, inspection, and other non-valueadded activities. II. Problem (Measures of Internal Business Process Performance) Requirement 1 a, b, and c Month 1 Throughput time in days: Process time................................................... 0.6 Inspection time............................................... 0.7 Move time...................................................... 0.5 Queue time..................................................... 3.6 Total throughput time..................................... 5.4 2 3 4 0.5 0.7 0.5 3.6 5.3 0.5 0.4 0.4 2.6 3.9 0.4 0.3 0.5 1.7 2.9 12.8% 13.8% 5.3 3.9 9.2 4.7 2.9 7.6 Manufacturing cycle efficiency (MCE): 11.1% 9.4% Process time Throughput time................................................................ Delivery cycle time in days: Wait time........................................................ 9.6 8.7 Total throughput time..................................... 5.4 5.3 Total delivery cycle time................................. 15.0 14.0 Requirement 2 The general trend is favorable in all of the performance measures except for total sales. On-time delivery is up, process time is down, inspection time is down, move time is basically unchanged, queue time is down, manufacturing cycle efficiency is up, and the delivery time is down. Even though the company has improved its operations, it has not yet increased its sales. This may have happened because management attention has been focused on the factory – working to improve operations. However, it may be time now to exploit these improvements to go after more sales – perhaps by increased product promotion and better marketing strategies. It will ultimately be necessary to increase sales so as to translate the operational improvements into more profits. Requirement 3 18-357 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II a and b Month Throughput time in days: Process time................................................... Inspection time............................................... Move time...................................................... Queue time..................................................... Total throughput time..................................... Manufacturing cycle efficiency (MCE): Process time Throughput time.................. 5 6 0.4 0.3 0.5 0.4 1.2 0.9 33.3% 44.4% 0.5 As a company pares away non-value-added activities, the manufacturing cycle efficiency improves. The goal, of course, is to have an efficiency of 100%. This will be achieved when all non-value-added activities have been eliminated and process time equals throughput time. III. Multiple Choice Questions 11. 12. 13. 14. 15. D D C A A 16. 17. 18. 19. 20. C D C D A CHAPTER 24 ADVANCED ANALYSIS AND APPRAISAL OF PERFORMANCE: FINANCIAL AND NONFINANCIAL I. Questions 18-358 Management Accounting: An Overview Chapter 1 1. Return on investment (ROI) is the ratio of profit to amount invested for the business unit. 2. The measurement issues for ROI are: a. The effect of accounting policies, which affect the determination of net income. b. Other measurement issues for income, which include the handling of non-recurring items in the income statement, differences in the effect of income taxes across units, differential effect of foreign currency exchange, and the effect of cost allocation when two or more units share a facility or cost. c. Measuring investment: which assets to include. d. Measuring investment: allocating the cost of shared assets. 3. The advantages of return on investment are: a. It is intuitive and easily understood. b. It provides a useful basis for comparison among SBUs. c. It is widely used. The limitations of return on investment are: a. It has an excessive short-term focus. b. Investment planning uses discounted cash flow analysis while managers are evaluated on ROI. c. It contains a disincentive for new investment by the most profitable units. 4. The key advantage of residual income is that it deals effectively with the limitation of ROI, that is ROI has a disincentive for the managers of the most profitable units to make new investments. With residual income, no matter how profitable the unit, there is still an incentive for new profitable investment. In contrast, a key limitation is that since residual income is not a percentage, it suffers the same problem of profit SBUs in that it is not useful for comparing units of significantly difference sizes. It favors larger units that would be expected to have larger residual incomes, even with relatively poor performance. Moreover, relatively small changes in the desired minimum rate of return can dramatically affect the residual income for different size units. And, in contrast to ROI, some managers do not find residual income to be as intuitive and as easily understood. 5. Economic value added (EVA) is a business unit’s income after taxes and after deducting the cost of capital. The idea is very similar to what we have explained as residual income. The objectives of the measures are the same – to effectively motivate investment SBU managers and to properly measure their performance. In contrast to residual income, EVA uses the 18-359 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II firm’s cost of capital instead of a desired rate of return. For many firms the desired rate of return and the cost of capital will be nearly the same, with small differences due to adjustments for risk and for strategic goals such as the desired growth rate for the firm. Also, while residual income is intended to deal with the undesirable effects of ROI, EVA is used to focus managers’ attention on creating value for shareholders, by earning profits greater than the firm’s cost of capital. 6. Examples of financial and nonfinancial measures of performance are: Financial: Nonfinancial: ROI, residual income, and return on sales. Manufacturing lead time, on-time performance, number of new product launches, and number of new patents filed. 7. The six steps in designing an accounting-based performance measure are: a. Choose performance measures that align with top management’s financial goal(s). b. Choose the time horizon of each performance measure in Step 1. c. Choose a definition of the components in each performance measure in Step 1. d. Choose a measurement alternative for each performance measure in Step 1. e. Choose a target level of performance. f. Choose the timing of feedback. 8. Yes. Residual income (RI) is not identical to return on investment (ROI). ROI is a percentage with investment as the denominator of the computation. RI is an absolute amount in which investment is used to calculate an imputed interest charge. 9. Economic value added (EVA) is a specific type of residual income measure that is calculated as follows: Economic value added = (EVA) After tax operating income Weighted Average Cost x of Capital Total Assets minus Current Liabilities 10. Definitions of investment used in practice when computing ROI are: a. Total assets available. b. Total assets employed. c. Working capital (current assets minus current liabilities) plus other assets. d. Equity. 18-360 Management Accounting: An Overview Chapter 1 11. Present value is the asset measure based on DCF estimates. Current cost is the cost of purchasing an asset today identical to the one currently held if identical assets can currently be purchased; it is the cost of purchasing the services provided by that asset if identical assets cannot currently be purchased. Historical-cost-based measures of ROI compute the asset base as the original purchase cost of an asset minus any accumulated depreciation. Some commentators argue that present value is future-oriented and current cost is oriented to current prices, while historical cost is pastoriented. 12. Special problems arise when evaluating the performance of divisions in multinational companies because a. The economic, legal, political, social, and cultural environments differ significantly across countries. b. Governments in some countries may impose controls and limit selling prices of products. c. Availability of materials and skilled labor, as well as costs of materials, labor, and infrastructure may differ significantly across countries. d. Divisions operating in different countries keep score of their performance in different currencies. 13. a. Consider each activity and the organization itself from the customer’s perspective, b. Evaluate each activity using customer-validated measures of performance, c. Consider all facets of activity performance that affect customers and are comprehensive, and d. Provide feedback to help organization members identify problems and opportunities for improvement. II. Exercises Exercise 1 (ROI and Residual Income) Requirement 1 A quick inspection of the data shows mortgage loans with a higher ROI to be more successful. But see requirement 2 below. Requirement 2 18-361 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Division A (Mortgage Loans) Total Assets Operating Income Return on Investment Residual Income: (a) * at 11% (b) ** at 15% (c) ***at 17% P2,000 400 25% P180 100 60 * P400 – (P2,000 x 0.11) = P180 ** P400 – (P2,000 x 0.15) = P100 *** P400 – (P2,000 x 0.17) = P 60 Division B (Consumer Loans) P10,000 1,500 15% P400 0 (200) P1,500 – (P10,000 x 0.11) = P 400 P1,500 – (P10,000 x 0.15) = P 0 P1,500 – (P10,000 x 0.17) = P(200) There is no simple answer to which is more successful in terms of residual income. Division B is more successful at low rates, while A is more successful at high rates. This reflects an important limitation of residual income; larger divisions (Division B in this case) are favored when the desired return used to determine residual income is relatively low. Exercise 2 (Return on Investment; Comparisons of Three Companies) Sales Income Investment (assets) Return on sales Asset turnover Return on investment Companies in the Same Industry A B C P1,500,000 P 750,000 P3,750,000 200,000 75,000 18,750 500,000 7,500,000 2,500,000 13% 10% 0.5% 3 0.1 1.5 40% 1% 0.75% Exercise 3 (ROI, RI, ROS, Management Incentives) 18-362 Management Accounting: An Overview Chapter 1 Requirement 1 If Magic Industries uses return on investment to measure the Jump-Start Division’s (JSD’s) performance, Tan may be reluctant to invest in the new plant because, as shown below, return on investment for the plant of 19.2% is lower than JSD’s current ROI of 24%. Operating income for new plant New investment Return on investment for new plant P480,000 P2,500,000 19.2% Investing in the new plant would lower JSD’s ROI and, hence, limit Tan’s bonus. Requirement 2 The residual income computation for the new plant is as follows: Residual income = Income - (Imputed interest x Investment) Investment Operating income for new plant Charge for funds (Investment, P2,500,000 x 15%) Residual income P2,500,000 P 480,000 375,000 P 105,000 Investing in the new plant would add P105,000 to JSD’s residual income. Consequently, if Magic Industries could be persuaded to use residual income to measure performance, Tan would be more willing to invest in the new plant. Requirement 3 Return on Sales (ROS) = Operating income Sales = 480,000 2,400,000 = 20% If Magic Industries uses ROS to determine Tan’s bonus, Tan will be more willing to invest in the new plant because ROS for the new plant of 20% exceeds the current ROS of 19%. The advantages of using ROS are (a) that it is simpler to calculate and (b) that it avoids the negative short-run effects of ROI measures that may induce Tan to not make the investment in the new plant. Tan may favor ROS because she believes that eventually increases in ROS will increase ROI and RI. 18-363 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II The main disadvantage of using ROS is that it ignores the amount of investment needed to earn a return. For example, ROS may be high but not high enough to justify the level of investment needed to earn the required return on an investment. III. Problems Problem 1 (RI, EVA) Requirement 1 Total assets Current liabilities Investment (Total assets – current liabilities) Required return (12% x Investment) Operating income before tax Residual income (Operating income before tax – required return) Truck Rental Division P650,000 120,000 Transportation Division P950,000 200,000 530,000 750,000 63,600 90,000 75,000 160,000 11,400 70,000 Requirement 2 After-tax cost of debt financing = (1 – 0.4) x 10% = 6% After-tax cost of equity financing = 15% Weighted average = cost of capital P900,000 x 6% + 600,000 x 15% P900,000 + 600,000 Required return for EVA 9.6% x Investment (9.6% x P530,000; 9.6% x P750,000) P50,880 18-364 = 9.6% P72,000 Management Accounting: An Overview Chapter 1 Operating income after tax 0.6 x operating income before tax EVA (Operating income after tax – required return) 45,000 96,000 (5,880) 24,000 Requirement 3 Both the residual income and the EVA calculations indicate that the Transportation Division is performing better than the Truck Rental Division. The Transportation Division has a higher residual income (P70,000 versus P11,400) and a higher EVA [P24,000 versus P(5,880)]. The negative EVA for the Truck Rental Division indicates that, on an after-tax basis, the division is destroying value – the after-tax economic return from the Truck Rental Division’s assets is less than the required return. If EVA continues to be negative, Lighthouse may have to consider shutting down the Truck Rental Division. Problem 2 (ROI, RI, Measurement of Assets) The method for computing profitability preferred by each manager follows: Manager of S P F Method Chosen Residual income based on net book value Residual income based on gross book value ROI based on either gross or net book value Supporting Calculations: Division S P F Return on Investment Calculations Operating Income Operating Income Gross Book Value Net Book Value* P94,700 P800,000 = 11.84% (3) P94,700 P370,000 = 25.59% (3) P91,700 P760,000 = 12.07% (2) P91,700 P350,000 = 26.20% (2) P61,400 P500,000 = 12.28% (1) P61,400 P220,000 = 27.91% (1) Division S P Residual Income Calculations Operating Income – 10% Gross BV Operating Income – 10% Net BV* P94,700 – P80,000 = P14,700 (2) P94,700 – P37,000 = P57,700 (1) P91,700 – P76,000 = P15,700 (1) P91,700 – P35,000 = P56,700 (2) 18-365 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II F P61,400 – P50,000 = P11,400 (3) P61,400 – P22,000 = P39,400 (3) * Net book value is gross book value minus accumulated depreciation. The biggest weakness of ROI is the tendency to reject projects that will lower historical ROI even though the prospective ROI exceeds the required ROI. RI achieves goal congruence because subunits will make investments as long as they earn a rate in excess of the required return for investments. The biggest weakness of residual income is it favors larger divisions in ranking performance. The greater the amount of the investment (the size of the division), the more likely that larger divisions will be favored assuming that income grows proportionately. Problem 3 (Multinational Performance Measurement, ROI, RI) Requirement 1 (a) Phil. Division’s ROI in 2005 = Operating income Total assets = Operating income P8,000,000 = 15% Hence, operating income = 15% x P8,000,000 = P1,200,000. (b) Swedish Division’s ROI in 2005 in kronas = 9,180,000 kronas 60,000,000 kronas = 15.3% Requirement 2 Convert total assets into pesos at December 31, 2004 exchange rate, the rate prevailing when the assets were acquired (8 kronas = P1) 24,000,000 kronas = 60,000,000 kronas = 8 kronas per peso P7,500,000 Convert operating income into pesos at the average exchange rate prevailing when during 2005 when operating income was earned equal to 9,180,000 kronas 8.5 kronas per peso = P1,080,000 Comparable ROI for Swedish Division = 18-366 P1,080,000 P7,500,000 = 14.4% Management Accounting: An Overview Chapter 1 The Swedish Division’s ROI calculated in kronas is helped by the inflation that occurs in Sweden in 2005. Inflation boosts the division’s operating income. Since the assets are acquired at the start of the year on 1-1-2005, the asset values are not increased by the inflation that occurs during the year. The net effect of inflation on ROI calculated in kronas is to use an inflated value for the numerator relative to the denominator. Adjusting for inflationary and currency differences negates the effects of any differences in inflation rates between the two countries on the calculation of ROI. After these adjustments, the Phil. Division shows a higher ROI than the Swedish Division. Requirement 3 Phil. Division’s RI in 2005 = = P1,200,000 – 12% x P8,000,000 P1,200,000 – P960,000 = P240,000 Swedish Division’s RI in 2005 (in Phil. pesos) is P1,080,000 – 12% x P7,500,000 = P1,080,000 – P900,000 = P180,000. The Phil. Division’s RI also exceeds the Swedish Division’s RI in 2005 by P60,000 (P240,000 – P180,000). Problem 4 (ROI Performance Measures Based on Historical Cost and Current Cost) Requirement 1 ROI using historical cost measures: Luzon Division P130,000 P340,000 = 38.24% Visayas Division P220,000 P1,150,000 = 19.13% Mindanao Division P380,000 P1,620,000 = 23.46% The Luzon Division appears to be considerably more efficient than the Visayas and Mindanao Divisions. 18-367 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Requirement 2 The gross book values (i.e., the original costs of the plants) under historical cost are calculated as the useful life of each plant (12) x the annual depreciation: Luzon Visayas Mindanao 12 x P 70,000 12 x P100,000 12 x P120,000 = = = P 840,000 P1,200,000 P1,440,000 Step 1: Restate long-term assets from gross book value at historical costs to gross book value at current cost as of the end of 2005. Gross book value of long-term assets at historical cost x Construction cost index in 2005 Construction cost index in year of construction Luzon P 840,000 x (170 100) = P1,428,000 Visayas P1,200,000 x (170 136) = P1,500,000 Mindanao P1,440,000 x (170 160) = P1,530,000 Step 2: Derive net book value of long-term assets at current cost as of the end of 2005. (Estimated useful life of each plant is 12 years). Gross book value of long-term assets at current cost at the end of 2005 Luzon Visayas Mindanao x Estimated useful life remaining Estimated total useful life P1,428,000 x (2 12) P1,500,000 x (9 12) P1,530,000 x (11 12) = = = P 238,000 P1,125,000 P1,402,500 Step 3: Compute current cost of total assets at the end of 2005. (Assume current assets of each plant are expressed in 2005 pesos.) Current assets at the end Net book value of long-term assets at + current cost at the end of 2005 (Step 2) of 2005 (given) Luzon P200,000 + P238,000 = P 438,000 Visayas P250,000 + P1,125,000 = P1,375,000 Mindanao P300,000 + P1,402,500 = P1,702,500 Step 4: Compute current-cost depreciation expense in 2005 pesos. 18-368 Management Accounting: An Overview Chapter 1 Gross book value of long-term assets at current cost at the end of 2005 (from Step 1) x (1 12) P1,428,000 x (1 12) P1,500,000 x (1 12) P1,530,000 x (1 12) Luzon Visayas Mindanao = = = P119,000 P125,000 P127,500 Step 5: Compute 2005 operating income using 2005 current-cost depreciation. Historical-cost operating income Luzon Visayas Mindanao – Current-cost depreciation – in 2005 pesos (Step 4) P130,000 – (P119,000 – P70,000) P220,000 – (P125,000 – P100,000) P380,000 – (P127,500 – P120,000) Historical-cost depreciation = = = P 81,000 P195,000 P372,500 Step 6: Compute ROI using current-cost estimate for long-term assets and depreciation. Operating income for 2005 using 2005 current cost depreciation (Step 5) Current cost of total assets at the end of 2005 (Step 3) Luzon Visayas Mindanao Luzon Visayas Mindanao P 81,000 P 438,000 P195,000 P1,375,000 P372,500 P1,702,500 ROI: Historical Cost 38.24% 19.13% 23.46% = = = 18.49% 14.18% 21.88% ROI: Current Cost 18.49% 14.18% 21.88% Use of current cost results in the Mindanao Division appearing to be the most efficient. The Luzon ROI is reduced substantially when the ten-year-old plant is restated for the 70% increase in construction costs over the 1995 to 2005 period. Requirement 3 Use of current costs increases the comparability of ROI measures across divisions’ operating plants built at different construction cost price levels. Use 18-369 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II of current cost also will increase the willingness of managers, evaluated on the basis of ROI, to move from divisions with assets purchased many years ago to division with assets purchased in recent years. IV. Multiple Choice Questions 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. A B C C D B A C B A 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. B D C A C C A C B A 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. C D C A C D A C D D 31. 32. 33. 34. 35. 36. 37. A A B A C B D CHAPTER 25 MANAGING PRODUCTIVITY AND MARKETING EFFECTIVENESS I. Questions 1. Productivity is the relationship between the output and the input resources required for generating the output. 2. A critical success factor for a firm that competes as a cost leader is to be the low cost provider. A low cost provider needs to perform the required tasks for the same output with fewer resources than its competitors. 3. Among criteria that often are used in assessing productivity and their advantages and disadvantages are: Using a prior year’s productivity as the criterion Advantages: Data readily available Facilitates monitoring of continuous improvements 18-370 Management Accounting: An Overview Chapter 1 Disadvantages: Difficult to assess adequacy of productivity improvements Hard to compare productivity improvements between the years Using the best performance as the criterion Advantages: Provides as the benchmark the utmost performance Motivates people to strive for the maximum potential Disadvantages: The standard can be too high for the operation and frustrating to workers Data may be difficult to obtain The criteria on which the operation is based may not be comparable 4. An operational productivity is the ratio of the output to the number of units of an input resource. A financial productivity measures the relationship between the output and the cost of one or more of the input resources. 5. A partial productivity is a productivity measure that focuses only on the relationship between the amount of one of the input resources and the output attained. A total productivity measures the relationship between the output and the total input costs of all the required input resources for the output. 6. Manufacturing personnel often prefer operational productivity measures over financial productivity measures because all the input data for computing operational productivity measures are either results of their activities or resources consumed for these activities. Financial productivity measures use costs of resources that often are results of activities by personnel outside of manufacturing functions. 7. Measurements of marketing effectiveness include market share, sales price, sales mix, and sales quantity variances. 8. Sales quantity variance is a component of sales volume variance. A sales volume variance can be the result of both sales mix and sales quantity variances. 9. A market size variance measures the effect on the contribution margin and operating income of a firm because of changes in the total market size for 18-371 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II all firms in the same industry or product segment. A market share variance examines the effect on the contribution margin and operating income of a firm because of deviations of the firm’s actual market shares from its budgeted market shares. 10. a. No. A multi-product firm can still have an unfavorable sales volume variance even if it sells more than the budgeted units of sales. The unfavorable sales volume variance is a result of selling more of less profitable products and less of more profitable products. b. A favorable sales quantity variance reflects the marketing manager’s excellent performances only if there is no adverse change in selling prices, sales mix, or market size. A favorable sales quantity variance is hardly favorable to the firm if the firm has lowered its selling prices or sold more of low-priced, low-margin and less of high-priced, highmargin products. Increases in the total market size in which the firm operates often also leads to a favorable sales quantity variance. A favorable sales quantity variance in an expanding total market may not be favorable to the firm strategically if the firm also has an unfavorable market share variance. A firm can have a favorable market size variance and an unfavorable market share variance if the proportional increase of the firm’s total sales is less than those of the total market. c. Yes. The Wall Street Journal reported on April 14, 1994 (p. B4) that Colgate-Palmolive had slashed marketing spending to reach its ambitious target of 15 percent annual earnings growth. The firm, for example, spent P88.8 million on advertising in 1993, compared with P97.5 million in 1992. The firm met the goal of a 15 percent increase in per share earnings and its CEO, Mr. Mark, expected the company to announce a similar increase for first quarter earnings soon. The market share of the firm, however, have decreased in all categories. 11. The sales volume variance is the sum of sales quantity and sales mix variances. The sales quantity variance is the sum of market size and market share variances. II. Problems Problem 1 (Operational and Financial Partial Productivity) Requirement 1 Star Company 18-372 Management Accounting: An Overview Chapter 1 Comparative Income Statement For the years 2005 and 2006 2005 Sales 2006 15,000 x P40 P600,00 18,000 x P40 P720,000 = 0 = 12,000 x P 8 P 12,600 x P10 = 96,000 = Labor 6,000 x P20 = 120,000 5,000 x P25 = 125,000 Power 1,000 x P 2 2,00 2,000 x P 2 4,00 = 0 = 0 Variable cost of sales: Materials Total variable costs of P218,00 sales P126,000 P255,000 0 Contribution margin P382,00 P465,000 0 Change in profits from 2005: P465,000 – P382,000 = P83,000 increase Requirement 2 Operational Partial Productivity DM DL Power 2006 2005 18,000 / 12,600 = 1.4286 18,000 / 5,000 = 3.6 18,000 / 2,000 = 9 15,000 / 12,000 = 1.25 15,000 / 6,000 = 2.5 15,000 / 1,000 = 15 Requirement 3 Total cost of production factors 2006 DM 2005 12,600 x P10 = P126,000 12,000 x P 8 P 96,000 18-373 = Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II DL Power 5,000 x P25 = P125,000 6,000 x P20 = P120,000 2,000 x P 2 = P 4,000 1,000 x P 2 = P 2,000 Financial Partial Productivity DM DL Power 2006 2005 18,000 / 126,000 = 0.1429 18,000 / 125,000 = 0.144 18,000 / 4,000 = 4.5 15,000 / 96,000 = 0.15625 15,000 / 120,000 = 0.125 15,000 / 2,000 = 7.5 Requirement 4 Both direct materials and direct labor operation partial productivity improved from 2005 to 2006. In 2006 the firm was able to manufacture more output units for each unit of materials placed into production and for each hour spent on production. The operational productivity of power in 2006 deteriorated from 2005. It is likely that the firm used more equipment in production in 2006 that reduced consumption of materials and production hours. The financial partial productivity for both direct materials and power deteriorated from 2005 to 2006. Increases in direct materials costs were more than the improvements in operational partial productivity for direct materials. Like the operational partial productivity, the financial partial productivity for direct labor also improved. The extent of improvements, however, is much lower in financial partial productivity. The direct labor operational partial productivity improved 44 percent in 2006 over those of 2005. The financial partial productivity, however, improved only 15.2 percent between the two years. The decrease in financial partial productivity is likely a result of increases in direct labor wages. Requirement 5 Operating Data for Decomposing Financial Productivity Measure 2006 Output, 2006 Output 2006 Output 2005 Output 18-374 Management Accounting: An Overview Chapter 1 1/2006 Productivity 2006 Input cost 1/2005 Productivity 2006 Input cost 1/2005 Productivity 2005 Input cost 1/2005 Productivity 2005 Input cost (1) Output (unit): 18,000 18,000 18,000 15,000 (2) 1/Productivity DM: 12,000/15,0 12,000/15,0 12,000/15,0 12,600/18,0 00 00 00 00 = 0.7 = 0.8 = 0.8 = 0.8 DL: 6,000/15,00 6,000/15,00 6,000/15,00 5,000/18,00 0 0 0 0 = 0.2778 = 0.4 = 0.4 = 0.4 Power: 1,000/15,00 1,000/15,00 1,000/15,00 2,000/18,00 0 0 0 0 = 0.1111 = 0.0667 = 0.0667 = 0.0667 (3) Cost per unit of input DM: P10 P10 DL: P25 P25 Power: P 2 P 2 P 8 P20 P 2 P 8 P20 P 2 (4) Output x (1/Productivity) x Input cost DM: 18,000 x 0.7 x 10 18,000 x 0.8 x 10 18,000 x 0.8 x 8 15,000 x 0.8 x 8 = P126,000 = P144,000 = P115,200 = P96,000 DL: 18,000 x 0.2778 x 18,000 x 0.4 x 25 18,000 x 0.4 x 20 15,000 x 0.4 x 20 25 = P180,000 = P144,000 = P120,000 = P125,010 Power: 18,000 x 0.1111 18,000 x 0.0667 x 18,000 x 0.0667 x 2 15,000 x 0.0667 x 2 18-375 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II x 2 = P4,000 2 = P2,401 = P2,001 P326,401 P261,601 P218,001 18,000 / 144,000 = 0.125 18,000 / 180,000 = 0.1 18,000 / 2,401 = 7.4969 18,000 / 115,200 = 0.15625 18,000 / 144,000 = 0.125 18,000 / 2,401 = 7.4969 15,000 / 96,000 = 0.15625 15,000 / 120,000 = 0.125 15,000 / 2,001 = 7.4963 = P2,401 Total P255,010 Decompositi on DM: 18,000 / 126,000 = 0.1429 DL: 18,000 / 125,010 = 0.1440 Power: 18,000 / 4,000 = 4.5 Productivity change Input price change Output change DM: 0.1429 – 0.125 = 0.0179 F DL: 0.144 – 0.1 = 0.044 F Power: 4.5 – 7.4969 0.125 – 0.15625 = 0.03125 U 0.15625 – 0.15625 =0 0.125 – 0.125 =0 7.4969 – 7.4963 = 0.0006 0.1 – 0.125 = 0.025 U 7.4969 – 7.4969 =0 18-376 Management Accounting: An Overview Chapter 1 = 2.9969 U Summary Result (rounding) of Change as % of 2005 Productivity Productivity Input Price DM: DL: Productivity Input Price Change Change Change 0.0179 F 0.03125 0.01335 11.46% U U F 0.025 0.019 35.2% U F F 0 2.9969 39.98% U U 0.044 F Power: Total 2.9969 U Change Total Change 20% U Change 8.54% U 20% U 15.2% F 0 39.98% U Requirement 6 Productivity for both direct materials and direct labor improved in 2006. The percentages of improvements in productivity are 11.46 and 35.2 for direct materials and direct labor, respectively, of the 2005 productivity. However, cost increases in direct materials and direct labor reduced the gains in productivity on these two manufacturing factors Problem 2 (Direct Labor Rate and Efficiency Variances, Productivity Measures, and Standard Costs) Requirement 1 Assembly Department Direct Labor Variances 2005: Total actual direct labor hours: Total standard direct labor hours: P30 x 500,000 = P15,000,000 25 x 20,000 = 500,000 24 x 20,000 = 480,000 P28 x 500,000 = P14,000,000 18-377 P28 x 480,000 = P13,440,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Rate variance = P1,000,000 U Efficiency variance = P560,000 U 2006: Total actual direct labor hours: Total standard direct labor hours: P36 x 400,000 = P14,400,000 20 x 20,000 = 400,000 21 x 20,000 = 420,000 P35 x 400,000 = P14,000,000 Rate variance = P400,000 U P35 x 420,000 = P14,700,000 Efficiency variance = P700,000 F Testing Department Direct Labor Variances 2005: Total actual direct labor hours: Total standard direct labor hours: P20 x 240,000 = P4,800,000 12 x 20,000 = 240,000 14 x 20,000 = 280,000 P21 x 240,000 = P5,040,000 Rate variance = P240,000 F Efficiency variance = P840,000 F 2006: Total actual direct labor hours: Total standard direct labor hours: P24 x 200,000 = P4,800,000 P21 x 280,000 = P5,880,000 10 x 20,000 = 200,000 11 x 20,000 = 220,000 P25 x 200,000 = P5,000,000 Rate variance P25 x 220,000 = P5,500,000 Efficiency variance 18-378 Management Accounting: An Overview Chapter 1 = P200,000 F = P500,000 F Recap: Assembly Testing Department Department 2005 2006 2005 2006 Rate P1,000,000 P400,00 P240,00 P200,00 variance U 0U 0F 0F Efficiency P560,00 P700,00 P840,00 P500,00 variance 0U 0F 0F 0F Requirement 2 Assembly Department Operational Partial Productivity 2005: 2006: 20,000 / 500,000 = 0.04 20,000 / 400,000 = 0.05 Testing Department Operational Partial Productivity 2005: 2006: 20,000 / 240,000 = 0.0833 20,000 / 200,000 = 0.1 Requirement 3 Assembly Department Financial Partial Productivity 2005: 2006: 20,000 / P15,000,000 = 0.001333 20,000 / P14,400,000 = 0.001389 Testing Department Financial Partial Productivity 2005: 20,000 / P4,800,000 = 0.004167 2006: 20,000 / P4,800,000 = 0.004167 Requirement 4 Operational partial productivity Assembly 2005 0.04 2006 0.05 18-379 Change 0.01 F 25% F Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Testing 0.083 3 0.1 0.0167 F 20% F Financial partial productivity 2005 2006 Assembly 0.001333 0.001389 Testing 0.004167 0.004167 Change 0.00005 4.2% 6 F F -0-0- Operational partial productivity improved in both departments from 2005 to 2006. The financial partial productivity in the Assembly also improved while the Testing remains unchanged. Requirement 5 The standards in a standard costing system often are determined independently and incorporate changes in operating factors. The standard for the operation of a year may change because of changes in, for example, technology, quality of materials, experience of production workers, designs, or processes. Productivity measures use as the criterion the productivity of a prior year without adjusting for changes occurred or the expected changes for the current year. As a result, assessments of productivity may depict an entirely different picture than those of variance analyses in a standard costing system. Problem 3 (Sales Variance) Requirement 1 Selling price variances (in 000) Flexible budget sales: Master Budget for 2005 Total Sales Premium P36,000 Units 240 = 18-380 Budgeted Total Units Flexible Selling Price Sold in Budget Per Unit 2005 Sales P150 x 180 = P27,000 Management Accounting: An Overview Chapter 1 Regular P43,200 360 = P120 x Premium 540 = P64,800 Regular Selling Actual Barrels Sales Selling Flexible Price Budget Variance 180 180 P28,800 P27,000 P1,800 F Actual Flexible Price Budget Variance 540 540 P62,100 P64,800 P2,700 U Total selling price variance of the firm = P1,800 F + P2,700 U = P900 U Requirement 2 Sales volume variances for the period for each of the products and for the firm Flexible budget variable expenses: Master Budget for 2005 Total Budgeted Total Flexible Variable Units Budget Variable Number of Expenses Sold in Variable Expenses Units Per Unit 2005 Expenses Premium P21,600 240 = P90 x 180 = P16,200 Regular P27,000 360 = P75 x 540 = P40,500 Premium Regular Sales Barrels Sales Sales Flexible Master Volume Flexible Master Volume Budget Budget Variance Budget Budget Variance 180 180 540 360 P27,000 P36,000 P64,800 P43,200 16,200 21,600 40,500 27,000 P10,800 P14,400 P24,300 P16,200 Variable expenses Contribution margin P3,600 18-381 P8,100 F Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II U Fixed expenses 10,000 10,000 5,000 5,000 – – Operating income P 800 P 4,400 P3,600 P19,300 P11,200 P8,100 F U Total sales volume variance of the firm = P3,600 U + P8,100 F = P4,500 F Requirement 3 Sales quantity variances for the firm and for each of the products. (See next page.) Requirement 4 Sales mix variances for the period for each of the products and for the firm (000 omitted). Calculation for sales mixes: Budgeted Actual Total Sales Sales Total Sales Sales in Units Mix in Units Mix Premium 240 0.40 180 0.25 Regular 360 0.60 540 0.75 600 1.00 720 1.00 Flexible Budget Master Budget Total actual units of all products Total actual units Total budgeted units of sold x Actual sales mix x of all products sold sales for all products x Standard contribution margin x Budgeted sales Budgeted sales mix x per unit mix x Standard Standard contribution contribution margin margin per unit per unit 18-382 Management Accounting: An Overview Chapter 1 Premium 720 x 0.25 x P60 = 720 x 0.40 x P60 = P10,800 P17,280 600 x 0.40 x P60 = P14,400 Sales mix variance Sales quantity variance = P6,480 U = P2,880 F Sales volume variance = P10,800 – P14,400 = P3,600 U To verify: Sales volume variance = Sales mix variance = P6,480 U = P3,600 U + Sales quantity variance + P2,880 F Regular 720 x 0.75 x P45 = 720 x 0.60 x P45 = P24,300 P19,440 600 x 0.60 x P45 = P16,200 Sales mix variance Sales quantity variance = P4,860 F = P3,240 F Sales volume variance = P24,300 – P16,200 = P8,100 F 18-383 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II To verify: Sales volume variance = Sales mix variance = P4,860 F = P8,100 F + Sales quantity variance + P3,240 F Total Sales mix variance = P6,480 U + P4,860 F = P1,620 U Sales quantity variance = P2,880 U + P3,240 F = P6,120 F Requirement 5 Verification Sales mix variance + Sales quantity variance = Sales volume variance Premium P6,480 U P2,880 F P3,600 U Regular P4,860 F P3,240 F P8,100 F Total P1,620 U P6,120 F P4,500 F Requirement 6 Market size variances. (See below.) Requirement 7 Market share variances (000 omitted. See below.) Weighted average budgeted contribution margin per unit Master budget total contribution margin P30,600 Master budget total sales units 600 Weighted-average budgeted contribution margin per unit P 51 Calculation for market shares: 18-384 Management Accounting: An Overview Chapter 1 Budgeted:Total sales in units 600 Total sales of the industry 1,500 = 0.40 Actual: Total sales in units 720 Total sales of the industry 1,600 = 0.45 Calculation for variances: Actual total Actual total market size x market x Actual market Budgeted share x market share Average x Average budgeted budgeted contribution contribution margin per margin per unit unit 1,600 x 0.45 x 1,600 x 0.40 x P51 P51 = P36,720 = P32,640 Market share variance = P4,080 F Budgeted total market size x Budgeted market share x Average budgeted contribution margin per unit 1,500 x 0.40 x P51 = P30,600 Market size variance = P2,040 F Sales quantity variance = P4,080 F + P2,040 F = P6,120 F Requirement 8 The sum of market size variance and market share variance and verification that this total equals the sales quantity variance. 18-385 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Total market size variance Total + market variance P2,040 F share Total quantity variance = P4,080 F P6,120 F Problem 4 (Productivity and Ethics) Requirement 1 The operational partial productivity deteriorates slightly from 0.0051 in 2005 (500/99,000) to 0.005 in 2006 (560/112,000). Manipulating accounting numbers in order to show a desirable result is an unethical behavior regardless the intention. Requirement 2 Tan should not follow the order without following a consistent accounting method. If the firm believes that certain cost items should be reclassified as indirect costs, the same procedure should be followed for all years. Tan should then go back and revise operating results of previous years. Problem 5 (Small Business Market Size and Share Variances) Requirement 1 Empress ’ Designs WS 50 DH 25 Budget Industr y 500 200 Share 10.0 % 12.5 % Empress ’ Designs 45 35 Actual Industr y 425 150 Requirement 2 Weighted Average Budgeted Contribution Margin Per Unit: (50 welcome signs x P2) + (25 doghouses x P5.20) / 75 = P3.07 18-386 Share 45/42 5 35/15 0 Management Accounting: An Overview Chapter 1 Market Share Variance Welcome Signs: (45/425 – 0.1) x 425 x P3.07 = P7.68 F Doghouses: (35/150 – 25/200) x 150 x P3.07 = P49.89 F Requirement 3 Market Size Variance Welcome Signs: (45 – 500) x 50/500 x P3.07 = P23.03 U Doghouses: (150 – 200) x 25/200 x P3.07 = P19.19 U Requirement 4 Among possible reasons are quality changes, pricing changes, less producers due to seasonal variations, and market no longer there. Requirement 5 Among alternatives are improving costs through adopting activity based costing, making different signs, using less expensive wood, finding competitive advantage. III. Multiple Choice Questions 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. A C B D A C C B C D 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. A B A B C D B C A D 31. 32. 33. 34. A D C D Supporting Computations: Operational partial productivity 2005 Output Input 2006 Partial 18-387 Output Input Partial Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Resource Used X-45 60,000 75,000 = Resource Productivity Used 64,000 0.8 Productivity 89,600 = 0.7143 10,847 = 5.9002 (1) Direct labor 60,000 10,000 = 64,000 6.0 (2) Financial partial productivity X-45 2005 2006 Cost of Cost of Input Input Units of Resource Partial Units of Resource Partial Output Used Productivity Output Used Productivity 60,000 P540,000= 0.1111 64,000 P609,280= 0.1050 (3) Direct labor 60,000 300,000 = 0.2 64,000 P347,104= 0.1844 (4) Total productivity in units 2005 60,000 2006 64,000 (a)Total units manufactured (b) Total variable manufacturing costs P840,000 P956,384 incurred (c)Total productivity (a) 0.071429 0.066919 (b) (5) (d) Decrease in 0.071429 – 0.00451 productivity 0.066919 = (6) Total productivity in sales pesos 2005 P1,500,000 (a)Total sales 18-388 2006 P1,600,00 0 Management Accounting: An Overview Chapter 1 (b) Total variable manufacturing costs P840,000 P956,384 incurred (c)Total productivity (a) P1.7857 P1.6730 (b) (5) (d) Decrease in P1.7857 – P0.1127 (6) productivity P1.6730 = (7) Operational partial productivity: Operational Partial Productivity = Actual Production Actual Input = 9,500 8,950 (8) Financial partial productivity: (1) Output (2) Direct materials: Quantity Unit cost Total direct materials cost (3) DM financial partial productivity (1) (2) (4) Direct labor: Hour spent Hourly wage Total direct labor cost (5) DL financial partial productivity (1) (4) 2005 400,000 2006 486,000 160 x P3,375 P540,000 180 x P3,125 P562,500 0.7407 0.864 10,000 x P26 P260,000 13,500 x P25 P337,500 1.5385 1.44 (9) Total productivity: 2005 18-389 2006 = 1.06 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II (1) Output Total cost: Direct materials cost Direct labor cost (2) Total cost (3) Total productivity (1) (2) 400,000 486,000 P540,000 260,000 P800,000 0.5 P562,500 337,500 P900,000 0.54 Market Share Actual Budget 1. 2. 3. Firm 100,000 90,000 / / Total Market 2,000,000 = 1,500,000 = Market Share 5% 6% Market size variance: (2,000,000 – 1,500,000) x 0.06 x P8 = P240,000 F (10) Market share variance: (5% - 6%) x 2,000,000 x P8 = P160,000 U (11) Sales quantity variance: (100,000 – 90,000) x P8 = P 80,000 F (12) (13) Budgeted sales unit Budgeted contribution margin per unit Budgeted total contribution margin Budgeted average contribution margin per unit (14) Actual units sold Product A Product B 30,000 60,000 x P4.00 x P10.00 P120,00 0 P600,00 0 Total 90,000 P720,00 0 P8.00 Product A 35,000 18-390 Product B 65,000 Total Management Accounting: An Overview Chapter 1 Budgets sales unit Differences in sales units Budgeted contribution margin per unit Sales volume contribution margin variance – 30,000 – 60,000 5,000 x P4.00 5,000 x P10.00 P20,000 P50,000 P70,000 F F F Sales mixes: Budgeted Unit Product A Product B TOTAL 30,000 60,000 90,000 Actual % 1/3 2/3 100 Unit 35,000 65,000 100,000 % 35 65 100 (15)Sales mix contribution margin variance: Product A: (0.35 – 1/3) x 100,000 x P4 = Product B: (0.65 – 2/3) x 100,000 x P10 = Total sales mix contribution margin variance P 6,667 F 16,667 U P10,000 U (16)Sales quantity contribution margin variance: Product A: (100,000 – 90,000) x 1/3 x P4 = Product B: (100,000 – 90,000) x 2/3 x P10 = Total sales quantity contribution margin variance P13,333 F 66,667 F P80,000 F (17)Weighted average budget contribution margin per unit: P8.00 (calculated in no. 13) Market size contribution margin variance: (2,000,000 – 1,500,000) x 90,000 / 1,500,000 x P8 = P240,000 F 18-391 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II (18)Market share contribution margin variance: (100,000 / 2,000,000 – 90,000 / 1,500,000) x 2,000,000 x P8 = P160,000 U (19)Flexible budget contribution margin variance: Flexible Budget Total Contribution margin Actual Operating Contribution Flexible Budget Margin Variance Result Product A Product B TOTAL 35,000 x P3 = 35,000 x P4 = P105,000 P140,000 65,000 x P12 = 65,000 x P10 = P780,000 P650,000 P885,000 P790,000 P 35,000 U P130,000 F P 95,000 F (20)Total contribution margin price variance (given) P50,000 F Sales price variance: Product A: (P12 – P10) x 35,000 = P70,000 F Product B: (P24 – P25) x 65,000 = P65,000 U Total sales price variance – 5,000 F Total variable cost price variance P45,000 F (21)Total flexible budget contribution margin variance Total contribution margin price variance (given) Total variance cost efficiency variance (22)Sales mix ratio: R66 R100 TOTAL Actual Quantit Ratio y 1,000 0.50 1,000 0.50 2,000 1.00 P95,000 F 50,000 F P45,000 F Budget Quantit Ratio y 1,200 0.75 400 0.25 1,600 1.00 R66 sales quantity variance: (2,000 – 1,600) x 0.75 x P10 = P3,000 F (23)R100 sales mix variance: (0.5 – 0.25) x 2,000 x P70 = P35,000 F 18-392 Management Accounting: An Overview Chapter 1 (24)Total sales volume variance: R66: R100: Total (1,000 – 1,200) x P10 = (1,000 – 400) x P70 = P 2,000 U 42,000 F P40,000 F CHAPTER 26 EXECUTIVE PERFORMANCE MEASURES AND COMPENSATION I. Questions 1. Incentive compensation is a monetary reward that is based on measured performance. Organizations where employees have been given the responsibility to make decisions are best suited for incentive compensation systems. 2. The four guidelines are: fairness, participation, basic wage level, and independent wage policy. Fairness deals with the ratio of salaries of the highest paid to lowest paid employees. Participation states that all employees should be included in a compensation plan. Although, they do not need to be included in the same one. Basic wage level states that a market wage should be paid, and incentive compensation should not be used to adjust the market wage downward. Independent wage policy states that the incentive compensation system for the most senior levels of the organization should be set by a group that is independent of senior management. 3. a. based on salary – easy to administer, likely to be considered fair, and, to the extent that salary reflects the relative ability to contribute to results, is based on contribution; 18-393 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II based on equal share – easy to administer, likely to be considered fair, and reflects how people often divide up rewards when left to their own devices; based on position – same as based on salary; based on individual performance – ties reward most closely to performance and likely to have the highest motivational impact. b. based on salary – may convince lower level employees that they have little to contribute, does not necessarily reflect contributions; based on equal share – may have little motivational effect, may lead to feeling of inequity if some people contribute nothing; based on position – same as based on salary; based on individual performance – may be difficult and costly to administer, may lead to arguments about interpreting the performance measure. 4. A cash bonus is a cash reward tied to measured performance. A cash bonus is a bonus that is best related to activities oriented to short-run performance that should be rewarded immediately to provide a reinforcement effect. Cash bonuses are best tied to measures of achieved operating performance such as quality improvement, sales increases, and success at short-run cost control. Profit-sharing is a cash bonus incentive compensation plan where the total of all cash bonuses paid to all employees is determined by a formula involving the organization’s, or an organization unit’s, reported profit. Profit-sharing is used to focus organization members on team activities to improve the organization’s short-term performance. Gain-sharing is a cash bonus incentive compensation plan where the total of all cash bonuses paid to all employees is determined by a formula involving cost performance (on materials or labor that the group is deemed able to control) relative to some standard. Gain sharing is best used when there is a visible and agreed performance standard and the employees can work as a group to improve performance relative to that standard. A stock option plan is a process where employees, deemed to be able to affect the value of an organization’s shares, are given the option to purchase those shares at a specified price which is usually higher than the share price at the time the option is issued. Stock options are best used to focus attention of senior people, who can affect the organization’s longrun performance by their decisions, on long-run performance. 18-394 Management Accounting: An Overview Chapter 1 II. Problems Problem 1 Requirement (a) P20,000,000 – (0.18 x P60,000,000) = P9,200,000 P9,200,000 x 0.20 = P1,840,000 Therefore, P2,000,000 would be larger. Requirement (b) P50,000 / P12,000,000 x P2,000,000 = P8,333.33 Problem 2 Requirement (a) P30,000,000 – (0.18 x P72,000,000) = P17,040,000 P17,040,000 x 0.25 = P4,260,000 Therefore, P4,260,000 would be larger. Requirement (b) P40,000 / P10,000,000 x P4,260,000 = P17,040 III. Multiple Choice Questions 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. C A D C B D D A D B 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. C B D B A D C B B B 35. 36. 37. 38. 18-395 C D B D Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II CHAPTER 27 MANAGING ACCOUNTING IN A CHANGING ENVIRONMENT I. Questions 1. The American Heritage Dictionary defines quality as “1. a characteristic or attribute of something; property; a feature. 2. the natural or essential character of something. 3. excellence; superiority.” Quality for a product or service can be defined as a “product or service that conforms with a design which meets or exceeds the expectations of customers at a price they are willing to pay.” 2. Procter & Gamble defines TQM as “the unyielding and continually improving effort by everyone in an organization to understand, meet, and exceed the expectations of customers.” Typical characteristics of TQM include focusing on satisfying customers, striving for continuous improvement, and involving the entire workforce. TQM is a continual effort and never completes. Global competition, new technology, and ever-changing customer expectations make TQM a continual effort for a successful firm. 3. The core principles of TQM include (1) focusing on satisfying the customer, (2) striving for continuous improvement, and (3) involving the entire work force. 4. Continuous improvement (Kaizen) in total quality management is the belief that quality is not a destination; rather, it is a way of life and firms need to continuously strive for better products with lower costs. In today’s global competition, where firms are forever trying to outperform the competition and customers present ever-changing expectations, a firm can never reach the ideal quality standard and needs to continuously improve quality and reduce costs to remain competitive. 18-396 Management Accounting: An Overview Chapter 1 5. The Institute of Management Accountants (IMA) believes an effective implementation of total quality management will take between three and five years and involves the following tasks: Year 1 Create a quality council and staff Conduct executive quality training programs Conduct quality audits Prepare gap analysis Develop strategic quality improvement plans Year 2 Conduct employee communication and training programs Establish quality teams Create measurement systems and set goals Year 3 Revise compensation / appraisal / recognition systems Launch external initiatives with suppliers Review and revise 6. Reward and recognition are the best means of reinforcing the emphasis on TQM. Moreover, proper reward and recognition structures can be very powerful stimuli to promote TQM. Efforts and progress will most likely be short-lived if no change is made to the compensation / appraisal / recognition systems to make them in line with the objectives of the firm’s TQM. 7. The purposes of conducting a quality audit are to identify strengths and weaknesses in quality practices and levels of a firm’s quality and to help the firm identify the target areas for quality improvements. 8. A gap analysis is a type of benchmarking that includes analyzing the differences in practices between the firm and the best-in-class. The objective of gap analyses is to identify strengths, weaknesses, and target areas for quality improvement. 9. Some examples of costs associated with cost of quality categories are: Prevention costs: Training costs such as instructors’ fees, purchase of training equipment, tuition for external training, training wages and salaries; salaries for quality planning and executions, cost of preventive equipment, printing and promotion costs for quality programs, awards for quality. 18-397 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Appraisal costs: Costs of raw materials, work-in-process, and finished goods inspections. Internal failure costs: Scrap, rework, loss due to downgrades, reinspection costs, and loss due to work interruptions. External failure costs: Sales returns and allowance due to quality deficiency, warranty cost, and canceled sales orders due to quality deficiency. 10. Prevention costs rise during the early years of implementing TQM as the firm engages in education to prepare its employees and in the planning and promotion of the quality program. Appraisal costs will also likely rise during the early years of TQM, because the firm needs to ensure that quality is actually being achieved. The increase in appraisal cost, however, is most likely to occur at a slower pace than those of the prevention costs because at the beginning of a TQM program there will be substantial increases in quality training and in promotion to raise awareness on the importance of quality. The firm may see some decreases in internal and external failure costs in the early years of implementing a TQM. However, these two costs most likely will remain at about the same level as before during the first several years of TQM. Many firms may actually see internal failure cost rise, because of the higher standard demanded by the TQM or the higher level of employees’ awareness on the critical importance of perfection in every step of the process. As the firm makes progress in TQM, both internal failure and external failure costs should decrease. 11. Costs of conformance are costs incurred to ensure that products or services meet quality standards and include prevention costs and appraisal costs. Internal and external failure costs are costs of non-conformance. They are costs incurred or opportunity costs because of rejection of products or services. 12. Better prevention of poor quality often reduces all other costs of quality. With fewer problems in quality, appraisal is needed because the products are made right the first time. Fewer defective units also reduce internal and external failure costs as the occasion for repairs, rework, and recalls decrease. It is easier to design and build quality in than try to inspect or repair quality in. Theoretically, if prevention efforts are completely successful, there will be no need to incur appraisal costs and there will be no internal failure or external failure costs. In practice, appraisal costs usually do not 18-398 Management Accounting: An Overview Chapter 1 decrease, partly because management needs to ensure that quality is there as expected. Nonconformance costs, however, decrease at a much faster pace than prevention costs increase. 13. The role of management accountants in total quality management includes gathering all relevant quality information, participating actively in all phases of the quality program, and reviewing and disseminating quality cost reports. 14. To meet the challenges of total quality management, management accountants need to have a clear understanding of TQM methodology. They must be able to design, create, or modify information systems that measure and monitor quality and evaluate progress toward total quality as expected of each organizational unit and the total enterprise. 15. Just-in-time (JIT) purchasing is the purchase of goods or materials such that a delivery immediately precedes demand or use. Benefits include lower inventory holdings (reduced warehouse space required and less money tied up in inventory) and less risk of inventory obsolescence and spoilage. 16. The sequence of activities involved in placing a purchase order can be facilitated by use of the Internet. A company can streamline the procurement process for its customers – e.g., having online a complete price list, information about expected shipment dates, and a service order capability that is available 24 hours a day with email or fax confirmation. 17. Just-in-time (JIT) production is a “demand-pull” manufacturing system that has the following features: Organize production in manufacturing cells, Hire and retain workers who are multiskilled, Aggressively pursue total quality management (TQM) to eliminate defects, Place emphasis on reducing both setup time and manufacturing lead time, and Carefully select suppliers who are capable of delivering quality materials in a timely manner. 18. Reengineering is the fundamental rethinking and redesign of business processes to achieve improvements in critical measures of performance such as cost, quality, service, speed, and customer satisfaction. 19. The three main measures used in the theory of constraints are: a. Throughput contribution equal to sales revenue minus direct materials costs. 18-399 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II b. Investments (inventory) equal to the sum of materials costs of direct materials inventory, work-in-process inventory and finished goods inventory, research and development costs, and costs of equipment and buildings. c. Other operating costs equal to all operating costs (other than direct materials) incurred to earn throughput contribution. 20. The four key steps in managing bottleneck resources are: Step 1: Recognize that the bottleneck operation determines throughput contribution. Step 2: Search for, and find the bottleneck. Step 3: Keep the bottleneck busy, and subordinate all nonbottleneck operations to the bottleneck operation. Step 4: Increase bottleneck efficiency and capacity. 21. (a) Product warranty costs should be lower because a world-class manufacturer (WCM) will make fewer defectives. (b) Salaries of quality control inspectors should be lower because a WCM will have its workers inspect as they go, rather than having separate inspections. Nor will a WCM inspect incoming materials and components because it will deal only with vendors whose quality has been demonstrated. (c) Amounts paid to vendors for parts and components should be higher because a WCM will not search out the lowest prices, but will seek high-quality components delivered when needed. (d) Wages rates for direct laborers should be higher because a WCM’s workers will multiskilled and should therefore command premium wages. (e) Total supervisory salaries should be lower because a WCM’s workers will not need as much supervision. (f) Warehousing costs should be lower because a WCM will produce as needed and so will not require storage space for materials or finished product. 22. At the final assembly stage in a JIT system, a signal is sent to the preceding workstation as to the exact parts and materials that will be needed over the next few hours for the final assembly of products. Only those parts and materials are provided. The same signal is sent back through each preceding workstation so that a smooth flow of parts and materials is maintained with no buildup of inventories at any point. Thus, all workstations respond to the “pull” exerted by the final assembly stage. 18-400 Management Accounting: An Overview Chapter 1 The “pull” approach just described can be contrasted to the “push” approach used in conventional systems. In a conventional system, inventories of parts and materials are built up—often simply to keep everyone busy. These semi-completed parts and materials are “pushed” forward to the next workstation whether or not there is actually any customer demand for the products they will become part of. The result is large stockpiles of work in process inventories. 23. A number of benefits accrue from reduced setup time. First, reduced setup time allows a company to produce in smaller batches, which in turn reduces the level of inventories. Second, reduced setup time allows a company to spend more time producing goods and less time getting ready to produce. Third, the ability to rapidly change from making one product to making another allows the company to respond more quickly to customers. Finally, smaller batches make it easier to spot manufacturing problems before they result in a large number of defective units. II. Exercises Exercise 1 (Quality Cost Classification) Inter Exter nal nal Preven Apprai Failur Failur tion sal e e a. Warranty repairs b. Scrap c. Allowance granted due to blemish x x x d. Contribution margins of lost sales e. Tuition for quality courses f. Raw materials 18-401 x x x Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II inspections g. Work-inprocess inspection h. Shipping cost for replacements i. Recalls j. Attorney’s fee for unsuccessful defense of complaints about quality k. Inspection of reworks l. Overtime caused by reworking m. Machine maintenance n. Tuning of testing equipment x x x x x x x x Exercise 2 (Cost of Quality Report) Requirements 1 & 2 Bali Company Cost of Quality Report For 2005 and 2006 Cost of Quality Category 2006 Peso 2005 % Peso % Prevention costs: Quality manual Product design P 40,000 P 50,000 300,000 P 340,000 Appraisal costs: 18-402 5.67 270,000 P320,000 5.33 Management Accounting: An Overview Chapter 1 Testing P 80,000 80,000 1.33 P 60,000 60,000 1.00 425,000 7.08 Internal failure costs: Rework Retesting P200,000 P250,000 50,000 90,000 Disposal of defective units 90,000 340,000 5.67 85,000 External failure costs: Product recalls Field service P360,000 230,000 Total cost of quality P500,000 590,000 9.83 P1,350,000 22.50 350,000 850,000 14.17 P1,655,000 27.58 a. There were slight increases in both prevention and appraisal costs from 2005 to 2006. Each of these two cost of quality increased by approximately 0.33 percent of the total sales. These two costs increased by P40,000 over the two years. b. Both internal failure costs and external failure costs decreased substantially in 2006 as compared to those in 2005. The firm experienced a 1.41 percent decrease in internal failure and a 4.34 percent decrease in external failure costs with the total savings of P345,000. The savings was 863 percent of the increases in prevention and appraisal costs. Requirement 3 Among nonfinancial measures the firm may want to monitor are: The number of defects or the processes yield (ratio of good output to total output) The percentage of defective units shipped to customers to total units of products shipped The number of customer complaints Difference between delivery date requested by the customer On-time delivery percentage (total units shipped on or before the scheduled date to the total units shipped) Surveys of customer satisfaction It should be noted that nonfinancial measures by themselves often have limited meaning. Nonfinancial measures are more informative when trends of the same measure over time are examined. 18-403 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Exercise 3 (Cost of Quality Category) Requirement 1 Costs of Quality Rework Recalls Reengineering efforts Repair Replacements Retesting Supervision Scrap Training Testing of incoming materials Inspection of work in process Downtime Product liability insurance Quality audits Continuous improvement Warranty repairs Prevent ion Apprais al P 9,000 Internal Externa Failure l Failure P 6,000 P15,000 12,000 P18,000 15,000 5,000 12,000 9,000 7,000 18,000 5,000 1,000 18-404 10,000 9,000 15,00 0 Management Accounting: An Overview Chapter 1 Requirement 2 Total spent by category P25,000 P48,000 P42,000 P51,000 Requirement 3 The company is currently spending the least on preventive costs. They should concentrate their efforts on preventive costs because they prevent poor quality products from being manufactured. By increasing amount spent on prevention, they could reduce spending on the other cost of quality categories. Exercise 4 (Cost of Quality Analysis, Nonfinancial Quality Measures) Requirements 1 and 2 Revenues Costs of Quality Prevention costs Design engineering Preventive maintenance Training Supplier 2006 P12,500,000 Percent age of Revenu es (2) = (1) Cost P12,500 (1) ,000 2005 P10,000,000 Percent age of Revenu es (4) = (3) Cost P10,000 (3) ,000 P240,0 00 P100,0 00 90,000 120,00 0 50,0 35,000 18-405 45,000 20,0 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II evaluation Total prevention costs Appraisal costs Line inspection Product-testing equipment Incoming materials inspection Product-testing labor Total appraisal costs Internal failure costs Scrap Rework Breakdown maintenance Total internal failure costs 00 00 500,0 00 200,0 00 4.0% 85,000 110,00 0 50,000 50,000 40,000 75,0 00 250,0 00 20,000 220,0 00 400,0 00 2.0% 200,00 0 135,00 0 40,0 00 250,00 0 160,00 0 90,0 00 375,0 00 500,0 00 External failure costs 18-406 3.0% 2.0% 4.0% 5.0% Management Accounting: An Overview Chapter 1 Returned goods Customer support Product liability claims Warranty repair Total costs of quality 145,00 0 60,000 30,000 100,00 0 200 ,000 475 ,000 P1,600, 000 40,000 200,00 0 300 ,000 600 3.8% ,000 P1,700, 12.8% 000 6.0% 17.0% Between 2005 and 2006, Gabriel’s costs of quality have declined from 17% of sales to 12.8% of sales. The analysis of individual costs of quality categories indicates that Gabriel began allocating more resources to prevention activities – design engineering, preventive maintenance, training and supplier evaluations in 2006 relative to 2005. As a result, appraisal costs declined from 4% of sales to 2%, costs of internal failure fell from 5% of sales to 3%, and external failure costs decreased from 6% of sales to 3.8%. The one concern here is that, although external failure costs have decreased, the cost of returned goods has increased. Gabriel’s management should investigate the reasons for this and initiate corrective action. Requirement 3 Examples of nonfinancial quality measures that Gabriel Corporation could monitor are: a. Number of defective grinders shipped to customers as a percentage of total units of grinders shipped. b. Ratio of good output to total output at each production process. c. Employee turnover. Exercise 5 (Costs of Quality Analysis, Nonfinancial Quality Measures) Requirements 1 and 2 18-407 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Revenues, Costs of Quality and Costs of Quality as a Percentage of Revenues for Victoria Revenues = P2,000 x 10,000 units = P20,000,000 Costs of Quality Prevention costs Design engineering (P75 x 6,000 hours) Appraisal costs Testing and inspection (P40 x 1 hour x 10,000 units) Internal failure costs Rework (P500 x 5% x 10,000 units) External failure costs Repair (P600 x 4% x 10,000 units) Total costs of quality Costs (1) Percentage of Revenues (2) = (1) P20,000,000 P 450,000 2.25% 400,000 2.00% 250,000 1.25% 240,000 1.20% P1,340,000 6.70% Revenues, Costs of Quality and Costs of Quality as a Percentage of Revenues for Vancouver 18-408 Management Accounting: An Overview Chapter 1 Revenues = P1,500 x 5,000 units = P7,500,000 Costs of Quality Prevention costs Design engineering (P75 x 1,000 hours) Appraisal costs Testing and inspection (P40 x 0.5 x 5,000 units) Internal failure costs Rework (P400 x 10% x 5,000 units) External failure costs Repair (P450 x 8% x 5,000 units) Estimated forgone contribution margin on lost sales [(P1,500 – P800) x 300] Total external failure costs Total costs of quality Costs (1) Percentage of Revenues (2) = (1) P7,500,000 P 75,000 1.00% 100,000 1.33% 200,000 2.67% 180,000 2.40% 210,000 2.80% 390,000 5.20% P765,000 10.20% Costs of quality as a percentage of sales are significantly different for Vancouver (10.20%) compared with Victoria (6.70%). Canada spends very little on prevention and appraisal activities for Vancouver, and incurs high costs of internal and external failures. Canada follows a different strategy with respect to Victoria, spending a greater percentage of sales on prevention and appraisal activities. The result: fewer internal and external failure costs and lower overall costs of quality as a percentage of sales compared with Vancouver. 18-409 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Requirement 3 Examples of nonfinancial quality measures that Canada Industries could monitor as part of a total quality-control effort are: a. b. c. d. Outgoing quality yield for each product Returned refrigerator percentage for each product On-time delivery Employee turnover III. Problems Problem 1 (Quality Improvement, Relevant Cost Analysis) Requirement 1 Cost of new equipment and installation Training Total additional cost of the new process P12,000,000 3,000,000 P15,000,000 Requirement 2 Quality cost if no change is made: Rework 3,000 x 40% x P2,000 = Repair 3,000 x 15% x P2,500 = Appraisal Inspection 3,000 x P50 = Lost contribution: Contribution margin per unit P12,000 x 85% - P2,500 = P7,700 Lost sales 3,000 0.8 – 3,000 = x 750 Total current cost of quality P 2,400,000 1,125,000 600,000 150,000 5,775,000 P10,050,000 Quality cost with the new process: Warranty repair 3,000 0.8 x 5% x P1,000 = – 187,500 Savings from the new process each year P 9,862,500 Years effective x 3 Total P29,587,500 Appraisal and inspection cost in Year 1 18-410 – 750,000 Management Accounting: An Overview Chapter 1 Total savings over 3 years P28,837,500 Requirement 3 Yes. The cost of the new process is P15,000,000 and the expected benefits is P28,837,500 over three years. The firm can expect to earn a return of over 90%. Requirement 4 The following factors should be considered before making the final decision: a. Accuracy of cost estimates including Contribution margin per unit Costs of current repair and rework Cost of repair with the new process Cost of the new process b. Reliability of estimations of Rates of rework and repair Lost sales Amount of time before the current product become obsolete c. Reaction of competitors Requirement 5 The member of the board would be right if we ignore the financial payoff of the new process and if the firm is going to be in business for only three years. Having high quality products, especially for a high-end product such as the one the firm is selling, is crucial for a long term success. Problem 2 (Preparing a Cost of Quality Report) The Adoracion Company Comparative Costs of Quality Report Costs Categories 2005 Prevention 18-411 2006 Increase (Decrease ) Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II costs: Training Product design Total prevention Appraisal costs: Testing Calibration Total appraisal Internal failure costs: Rework Retesting Total internal failure External failure costs: Warranty repairs Product recalls P 75,000 150,00 0 225,000 P 100,000 175,00 0 275,000 P 25,000 25,0 00 50,000 50,000 75,00 0 125,000 150,000 100,00 0 250,000 100,000 25,0 00 125,000 325,000 250,00 0 575,000 100,000 200,00 0 300,000 (225,000) (50,00 0) (275,000) 150,000 75,000 (75,000) 400,000 200,000 (200,000) 18-412 Management Accounting: An Overview Chapter 1 Product liability Total external failure Total costs of quality 125,00 0 675,00 0 75,00 0 350,00 0 (50,00 0) (325,00 0) P1,600,00 0 P1,175,00 0 P (425,000) Problem 3 (JIT Production, Relevant Benefits, Relevant Costs) Requirement 1 Relevant Items Annual tooling costs Required return on investment 12% per year x P900,000 of average inventory per year 12% per year x P200,000 of average inventory per year Insurance, space, materials handling, and setup costs Rework costs Incremental revenues from higher selling prices Total net incremental costs Annual difference in favor of JIT production a P200,000 (1 – 0.30) = P140,000 b P350,000 (1 – 0.20) = P280,000 c P3 x 30,000 units = P90,000 18-413 Incremental Costs under Current Production System – Incremental Costs under JIT Production System P150,000 P108,000 24,000 200,000 350,000 140,000a 280,000b – P658,000 (90,000)c P504,000 P154,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Requirement 2 Other nonfinancial and qualitative factors that Francisco should consider in deciding whether it should implement a JIT system include: a. The possibility of developing and implementing a detailed system for integrating the sequential operations of the manufacturing process. Direct materials must arrive when needed for each subassembly so that the production process functions smoothly. b. The ability to design products that use standardized parts and reduce manufacturing time. c. The ease of obtaining reliable vendors who can deliver quality direct materials on time with minimum lead time. d. Willingness of suppliers to deliver smaller and more frequent orders. e. The confidence of being able to deliver quality products on time. Failure to do so would result in customer dissatisfaction. f. The skill levels of workers to perform multiple tasks such as minor repairs, maintenance, quality testing and inspection. Problem 4 (JIT Purchasing, Relevant Benefits, Relevant Costs) Requirement 1 Incremental Costs under Current Purchasing System Required return on investment 20% per year x P600,000 of average inventory per year 20% per year x P0 of inventory per year Annual insurance costs Warehouse rent Overtime costs 18-414 Incremental Costs under JIT Purchasing Policy P120,000 P 14,000 60,000 0 0 (13,500)a Management Accounting: An Overview Chapter 1 No overtime Overtime premium Stockout costs No stockouts P6.50b contribution margin per unit x 20,000 units Total incremental costs Difference in favor of JIT purchasing a b 0 40,000 0 130,000 P156,500 P194,000 P37,500 P(13,500) = Warehouse rental revenues, [(75% x 12,000) x P1.50]. Calculation of unit contribution margin Selling price (P10,800,000 900,000 units) P12.00 Variable costs per unit: Variable manufacturing costs per unit (P4,050,000 900,000 units) P4.50 Variable marketing and distribution costs per unit (P900,000 900,000 units) 1.00 Total variable costs per unit 5.50 Contribution margin per unit P6.50 Note that the incremental costs of P40,000 for overtime premiums to make the additional 15,000 units are less than the contribution margin from losing these sales equal to P97,500 (P6.50 x 15,000). Josefina would rather incur overtime than lose 15,000 units of sales. Problem 5 (Theory of Constraints, Throughput Contribution, Relevant Costs) Requirement 1 Finishing is a bottleneck operation. Hence, producing 1,000 more units will generate additional throughput contribution and operating income. Increase in throughput contribution (P72 – P32) x 1,000 Incremental costs of the jigs and tools Net benefit of investing in jigs and tools 18-415 P40,000 30,000 P10,000 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Zashi should invest in the modern jigs and tools because the benefit of higher throughput contribution of P40,000 exceeds the cost of P30,000. Requirement 2 The Machining Department has excess capacity and is not a bottleneck operation. Increasing its capacity further will not increase throughput contribution. There is, therefore, no benefit from spending P5,000 to increase the Machining Department’s capacity by 10,000 units. Zashi should not implement the change to do setups faster. Problem 6 (Theory of Constraints, Throughput Contribution, Relevant Costs) Requirement 1 Finishing is a bottleneck operation. Hence, getting an outside contractor to produce 12,000 units will increase throughput contribution. Increase in throughput contribution (P72 – P32) x 12,000 Incremental contracting costs P10 x 12,000 Net benefit of contracting 12,000 units of finishing P480,000 120,000 P360,000 Zashi should contract with an outside contractor to do 12,000 units of finishing at P10 per unit because the benefit of higher throughput contribution of P480,000 exceeds the cost of P120,000. The fact that the costs of P10 are double Zashi’s finishing cost of P5 per unit are irrelevant. Requirement 2 Operating costs in the Machining Department of P640,00, or P8 per unit, are fixed costs. Zashi will not save any of these costs by subcontracting machining of 4,000 units to Rainee Corporation. Total costs will be greater by P16,000 (P4 per unit x 4,000 units) under the subcontracting alternative. Machining more filing cabinets will not increase throughput contribution, which is constrained by the finishing capacity. Zashi should not accept Rainee’s offer. The fact that Rainee’s costs of machining per unit are half of what it costs Zashi in-house is irrelevant. Problem 7 (Theory of Constraints, Throughput Contribution, Quality) Requirement 1 18-416 Management Accounting: An Overview Chapter 1 Cost of defective unit at machining operation which is not a bottleneck operation is the loss in direct materials (variable costs) of P32 per unit. Producing 2,000 units of defectives does not result in loss of throughput contribution. Despite the defective production, machining can produce and transfer 80,000 units to finishing. Therefore, cost of 2,000 defective units at the machining operation is P32 x 2,000 = P64,000. Requirement 2 A defective unit produced at the bottleneck finishing operation costs Zashi materials costs plus the opportunity cost of lost throughput contribution. Bottleneck capacity not wasted in producing defective units could be used to generate additional sales and throughput contribution. Cost of 2,000 defective units at the finishing operation is: Lost of direct materials P32 x 2,000 Forgone throughput contribution (P72 – P32) x 2,000 Total cost of 2,000 defective units P 64,000 80,000 P144,000 Alternatively, the cost of 2,000 defective units at the finishing operation can be calculated as the lost revenue of P72 x 2,000 = P144,000. This line of reasoning takes the position that direct materials costs of P32 x 2,000 = P64,000 and all fixed operating costs in the machining and finishing operations would be incurred anyway whether a defective or good unit is produced. The cost of producing a defective unit is the revenue lost of P144,000. Problem 8 Requirement (a) The following table reclassified the cost-of-quality expenses: 18-417 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II Anthony Foods Quality Costs 2005-2006 (Millions) 2005 Q1 Quality assurance administration Training Process engineering Prevention Inspection Testing Appraisal Rework Scrap Internal failure Returns Customer complaint dept. Lost sales External failure Total costs Q2 2006 Q3 Q4 Q1 Q2 Q3 Q4 P 6.20 P 6.52 P 6.86 P 7.19 P 7.93 P 8.74 P 9.61 P10.53 13.10 14.39 15.90 17.46 21.12 25.50 30.37 36.35 2.20 21.50 1.40 1.60 3.00 15.80 17.60 33.40 26.90 2.46 23.37 1.56 1.72 3.28 12.65 14.48 27.13 21.09 2.76 25.52 1.75 1.85 3.60 10.03 11.92 21.95 16.35 3.11 27.76 1.95 1.99 3.94 8.49 10.32 18.81 13.53 3.87 32.92 2.39 2.29 4.68 7.25 8.92 16.17 11.32 4.86 39.10 2.96 2.62 5.58 6.16 7.72 13.88 9.50 6.13 46.11 3.63 3.01 6.64 5.56 7.00 12.56 8.43 7.58 54.46 4.46 3.45 7.91 5.00 6.34 11.34 7.52 3.90 3.45 3.03 2.76 2.50 2.27 2.14 2.01 49.20 40.31 33.11 28.42 24.45 21.08 19.20 17.44 80.00 64.85 52.49 44.71 38.27 32.85 29.77 26.97 P137.90 P118.63 P103.56 P95.22 P92.04 P91.41 P95.08 P100.68 Requirement (b) From the preceding data we see that prevention and appraisal costs are increasing while internal and external failure costs have been decreasing. The following graph plots three series: prevention and appraisal costs, failure costs, and total quality costs. 140 120 100 80 60 40 20 18-418 0 Q1 Q2 Q3 2005 Q4 Q1 Quarters Q2 Q3 2006 Q4 Management Accounting: An Overview Chapter 1 Appraisal and prevention costs Failure costs Total quality costs A preliminary conclusion from the graph is that Anthony Foods is probably now spending too much on trying to improve quality. Assuming that the underlying production processes have not changed over time, quality costs were minimized in the second quarter of 2006. Since then, the additional money spent on appraisal and prevention has yielded smaller internal- and external-failure costs savings. Problem 9 (Applying TQM in Manufacturing versus Administration) The ability of TQM to deliver cost savings and performance enhancements depends directly on how easy it is to measure and observe the output of the process. If a TQM team’s output is easy to measure, it is easier to hold the team members responsible for improving quality. If quality improvements are difficult to observe, then holding team members responsible imposes more risk on them. It is easier for them to argue that they didn’t achieve their goals because they were hard to observe. If the benefits from TQM are lower because it is more difficult to observe the TQM output, less will be invested in such activities. Measuring quality improvements in a manufactured process tends to be easier than a service. Engineering standards can be set for a manufactured good and conformance to the standards can be relatively easy to measure. But the output of many administrative departments is multidimensional and often hard to observe. Manufacturing involves repetitive processes with few exceptions. Administrative functions often involve handling numerous exceptions. It is 18-419 Chapter 18 Application of Quantitative Techniques in Planning, Control and Decision Making II likely to be easier to observe quality improvements in a television set than it is in a human resources department or a legal department. IV. Multiple Choice Questions 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. C B C D D A C C D D 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. C A C B C D D D A A 18-420