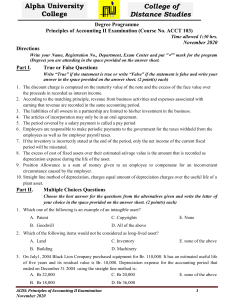

Alpha University College College of Distance Studies Degree Programme Principles of Accounting II Examination (Course No. ACCT 103) Time allowed 1:30 hrs. November 2020 Directions Write your Name, Registration No., Department, Exam Center and put "" mark for the program (Degree) you are attending in the space provided on the answer sheet. Part I. True or False Questions Write “True” if the statement is true or write “False” if the statement is false and write your answer in the space provided on the answer sheet. (2 point(s) each) 1. The discount charge is computed on the maturity value of the note and the excess of the face value over the proceeds in recorded as interest income. 2. According to the matching principle, revenue from business activities and expenses associated with earning that revenue are recorded in the same accounting period. 3. The liabilities of all owners in a partnership are limited to his/her investment in the business. 4. The articles of incorporation may only be in an oral agreement. 5. The period covered by a salary payment is called a pay period 6. Employers are responsible to make periodic payments to the government for the taxes withheld from the employees as well as for employer payroll taxes. 7. If the inventory is incorrectly stated at the end of the period, only the net income of the current fiscal period will be misstated. 8. The excess of cost of fixed assets over their estimated salvage value is the amount that is recorded as depreciation expense during the life of the asset. 9. Position Allowance is a sum of money given to an employee to compensate for an inconvenient circumstance caused by the employer. 10. Straight line method of depreciation, charges equal amount of depreciation charges over the useful life of a plant asset. Part II. Multiple Choices Questions Choose the best answer for the questions from the alternatives given and write the letter of your choice in the space provided on the answer sheet. (2 point(s) each) 1. Which one of the following is an example of an intangible asset? A. Patent C. Copyrights B. Goodwill D. All of the above E. None 2. Which of the following items would not be considered as long-lived asset? A. Land C. Inventory B. Building D. Machinery E. none of the above 3. On July1, 2004 Black Lion Company purchased equipment for Br. 110,000. It has an estimated useful life of five years and its residual value is Br. 10,000. Depreciation expense for the accounting period that ended on December 31 2004 using the straight line method is: A. Br 22,000 C. Br 20,000 E. none of the above B. Br 18,000 ACDS: Principles of Accounting II Examination November 2020 D. Br 36,000 1 Alpha University College College of Distance Studies 4. Care Company purchased a vehicle for Br 27,000 and estimated its useful life to be 8 years and its salvage value to be Br 3,000. After 6 years of straight-line depreciation, Care decided to do a major overhaul (major repair) at a cost of Br 10,000 which are expected to extend the remaining life of the vehicle to 5 years instead of 2 years. The new estimated salvage value is Br 2,000. Depreciation expense in year 7 equals: A. Br 2,400 C. Br 3,800 E. none B. Br 2,500 D Br 3,400 5. Which of the following methods is the accelerated method of depreciation expense? A. Straight-line method C. Sum-of-the years digits B. Double-declining method D. Unit of production E. B and C 6. Which of the following earnings of an employee is taxable? A. Basic salary C. Housing allowance B. Overtime earning D. All of the above E. None 7. Total amount earned by all employees for a pay period is called: A. Gross earrings C. Salary Expense B. Withholding D. Deductione none 8. In a payroll register, the net pay represents: A. Total earnings D. Total earnings less taxes withheld B. Total earnings less total deduction E. None of the above C. Departmental earnings 9. A business form used to record payroll information is called: A. Payroll register C. Employee earnings record E. none B. Check stub D. Memorandum 10. In bi-weekly payroll system employees are paid. A. Once a week C. Twice a month B. Twice each week D. Every two weeks 11. A sole proprietorship is a business where all of the following are true except that: A. The owner has complete control over decision making B. Profits are only taxed once as the proprietors income C. The proprietor is liable for losses to the extent of his or her personal asset D. The proprietor can sell stock to increase its capital E. None 12. A_________ partner is the owner who has unlimited liability. A. Senior partner C. Silent partner E. None B. General partner . D. Limited partner 13. X and Y agree to form a partnership. X is to contribute Br 50,000 in assets and to devote one-half time to the partnership. Y is to contribute Br 20,000 and to devote fulltime to the partnership. How will X and Y share in the division of net income or net loss? A. 5:2 C. 1:1 B. 1:2 D. None ACDS: Principles of Accounting II Examination November 2020 2 Alpha University College College of Distance Studies 14. X and Y invests Br 100,000 and Br 50,000 respectively in a partnership and agree to a division of net income that provides for an allowance interest at 10% on original investments, salary allowances of Br. 12,000 and Br 24,000 for a year respectively with remainder divided equally. What would be X’s share of periodic net income of Br 45,000? A. Br 22,500 C. Br 19,000 E. none B. Br 22,000 D. Br 10,000 15. GARA Company purchased machinery for Br 200,000 and estimated a salvage value of Br 10,000 at the end of its four year useful life. What is the constant percentage to be applied against book value each year if double declining balance method is used? A. 12.5 % C. 40% E. 50% B. 20% Part III. D. 25% Matching Questions Match the items listed under column "A" with appropriate answer listed under column "B" and write the letter of your choice in the space provided on the answer sheet. (1 point(s) each) 1. Column “A" Common stocks 2. Payroll deductions 3. Basic salary 4. Partnership 5. Current Liabilities 6. Par value 7. Overtime earnings 8. Dissolution 9. Authorized shares 10. Promissory note Part IV. 1. 2. 3. 4. 5. Column “B" A. It is an arbitrary monetary figure assigned to a share of stock by a corporation. B. It refers to payment for work performed by an employee beyond the regular working hours. C. These are basic class of stock ownership with right to vote. D. It is a written promise to pay a specific dollar amount on demand or at a specific time, usually with interest. E. Number of shares a corporation is allowed to issue. F. It refers to monthly remuneration of an employee for carrying out the normal work of employment. G. It is an association of two or more persons to carry a business for profit as co-owners. H. It arises from any change in the members of the partnership. I. Obligations expected to be paid using current assets or by creating other liabilities. J. Subtractions made from the total earning of an employee. Filling in the Blank Questions Fill in the blanks with the most appropriate answer and write it in the space provided on the answer sheet. (2 point(s) each) An inventory valuing systems that uses accounting records that continuously disclose the amount of inventory is called __________________. ________________is a financial statement that is used to report the net income or net loss of a business for the period. ________________are amount owned by a business. ________________ are entries made at the end of a period to bring accounts up to date. A note that the maker refused to pay, or is unable to pay, when it is due is called_________. ACDS: Principles of Accounting II Examination November 2020 3 Alpha University College College of Distance Studies Answer Sheet Degree Program Principles of Accounting II Examination (Course No. ACCT 103) November 2020 Please Fill in the Necessary Information Here Name:_________ ____________________ Registration No.: ____________________ Program: Degree , Diploma 10+1 , 10+2 , 10+3 , Level-3 , Level-4 Department: __________________ Exam Center: ________________ Date __ __/___ __/__ __ __ __ Part I True or False Questions’ Answers (2 point(s) each) 1. ______ 3. ______ 5. ______ 7. ______ 9. ______ 2. ______ 4. ______ 6. ______ 8. ______ 10. ______ Part II Multiple Choice Questions’ Answers (2 point(s) each) 1. _____ 4. _____ 7. _____ 10. _____ 13. _____ 2. _____ 5. _____ 8. _____ 11. _____ 14. _____ 3. _____ 6. _____ 9. _____ 12. _____ 15. _____ Part III. Matching Questions’ Answers (1 point(s) each) 1. _____ 3. _____ 5. _____ 7. _____ 9. _____ 2. _____ 4. ______ 6. ______ 8. _____ 10. _____ Part IV Filling in the Blanks Questions’ Answers (2 point(s) each) 1. ______________________________ 2. ______________________________ 3. ______________________________ 4. ______________________________ 5. ______________________________ ACDS: Principles of Accounting II Examination November 2020 4