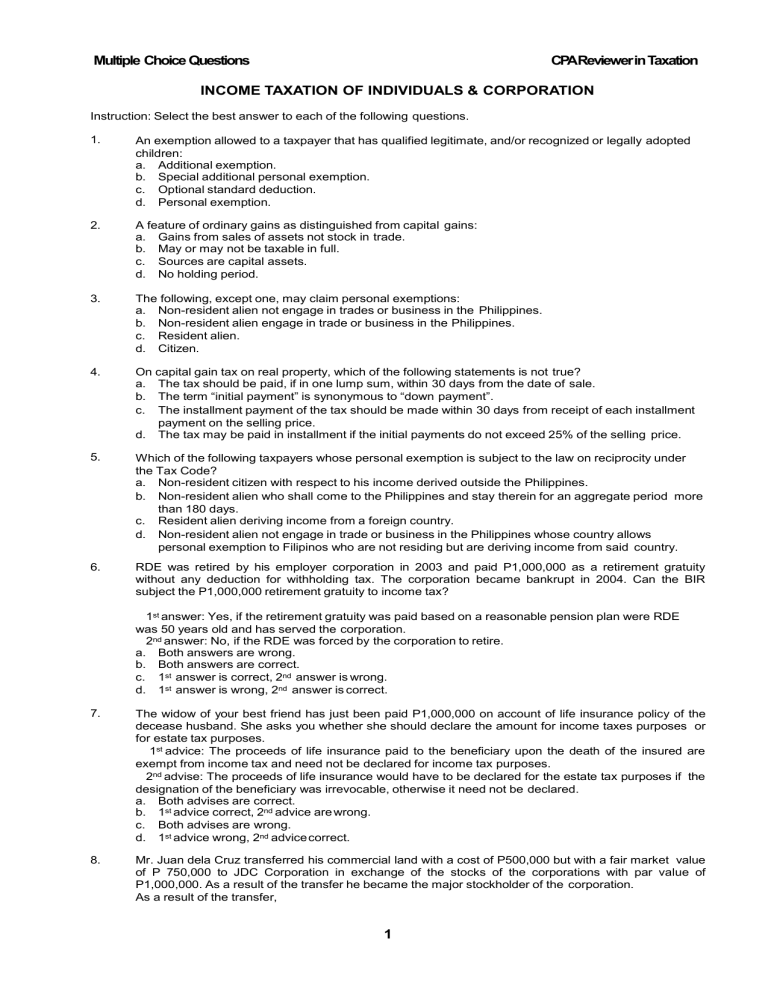

Multiple Choice Questions CPAReviewer inTaxation INCOME TAXATION OF INDIVIDUALS & CORPORATION Instruction: Select the best answer to each of the following questions. 1. An exemption allowed to a taxpayer that has qualified legitimate, and/or recognized or legally adopted children: a. Additional exemption. b. Special additional personal exemption. c. Optional standard deduction. d. Personal exemption. 2. A feature of ordinary gains as distinguished from capital gains: a. Gains from sales of assets not stock in trade. b. May or may not be taxable in full. c. Sources are capital assets. d. No holding period. 3. The following, except one, may claim personal exemptions: a. Non-resident alien not engage in trades or business in the Philippines. b. Non-resident alien engage in trade or business in the Philippines. c. Resident alien. d. Citizen. 4. On capital gain tax on real property, which of the following statements is not true? a. The tax should be paid, if in one lump sum, within 30 days from the date of sale. b. The term “initial payment” is synonymous to “down payment”. c. The installment payment of the tax should be made within 30 days from receipt of each installment payment on the selling price. d. The tax may be paid in installment if the initial payments do not exceed 25% of the selling price. 5. Which of the following taxpayers whose personal exemption is subject to the law on reciprocity under the Tax Code? a. Non-resident citizen with respect to his income derived outside the Philippines. b. Non-resident alien who shall come to the Philippines and stay therein for an aggregate period more than 180 days. c. Resident alien deriving income from a foreign country. d. Non-resident alien not engage in trade or business in the Philippines whose country allows personal exemption to Filipinos who are not residing but are deriving income from said country. 6. RDE was retired by his employer corporation in 2003 and paid P1,000,000 as a retirement gratuity without any deduction for withholding tax. The corporation became bankrupt in 2004. Can the BIR subject the P1,000,000 retirement gratuity to income tax? 1st answer: Yes, if the retirement gratuity was paid based on a reasonable pension plan were RDE was 50 years old and has served the corporation. 2nd answer: No, if the RDE was forced by the corporation to retire. a. Both answers are wrong. b. Both answers are correct. c. 1st answer is correct, 2nd answer is wrong. d. 1st answer is wrong, 2nd answer is correct. 7. The widow of your best friend has just been paid P1,000,000 on account of life insurance policy of the decease husband. She asks you whether she should declare the amount for income taxes purposes or for estate tax purposes. 1st advice: The proceeds of life insurance paid to the beneficiary upon the death of the insured are exempt from income tax and need not be declared for income tax purposes. 2nd advise: The proceeds of life insurance would have to be declared for the estate tax purposes if the designation of the beneficiary was irrevocable, otherwise it need not be declared. a. Both advises are correct. b. 1st advice correct, 2nd advice are wrong. c. Both advises are wrong. d. 1st advice wrong, 2nd advicecorrect. 8. Mr. Juan dela Cruz transferred his commercial land with a cost of P500,000 but with a fair market value of P 750,000 to JDC Corporation in exchange of the stocks of the corporations with par value of P1,000,000. As a result of the transfer he became the major stockholder of the corporation. As a result of the transfer, 1 Multiple Choice Questions CPAReviewer inTaxation a. The recognized gain is the difference between the fair market value of the shares of stocks and the cost of the land. b. The recognized gain is the difference between the par value of the stock and the fair market value of the land. c. No recognized gain because the land was in exchange or purely stocks and Mr. dela Cruz became the majority stockholders. d. No recognized gain because the land was in exchange of stocks of the corporation. 9. Gross income is reported partially in each taxable year in proportion to collections made in such period as it bears to the total contract price refers to: a. Crop year basis method. b. Percentage of completion basis method. c. Accrual method. d. Installment sales method. 10. “Schedular system of income taxation” means: a. All types of income are added together to arrive at gross income. b. Separate graduated rates are imposed on different types of income. c. Capital gains are excluded in determining gross income. d. Compensation income and business professional income are added together in arriving at gross income. 11. It is important to know the source of income for tax purposes (i.e., from within or without the Philippines) because: a. Some individual and corporate taxpayers are taxed on their worldwide income while others are taxable only upon income from sources within the Philippines. b. The Philippines imposes income tax only on income from sources within. c. Some individual taxpayers are citizens while others are aliens. d. Export sales are not subject to income tax. 12. In cases of deduction and exemption on income tax return doubts shall be resolved: a. Strictly against the taxpayer. b. Strictly against the government. c. Liberally in favor of the taxpayer. d. Liberally in favor of the employer. 13. The term “capital assets” includes: a. Stock in trade or other property included in the taxpayer’s inventory. b. Real property not used in the trade or business of taxpayer. c. Property primarily for sale to customers in the ordinary course of his trade or business. d. Property used in the trade or business of the taxpayer and subject to the depreciation. 14. Lots being rented when subsequently sold are classified as: a. Capital assets. b. Liquid assets. c. Ordinary assets. d. Fixed assets. 15. The following are examples of corporate expenses deductible from gross income, except one: a. Representation expenses designed to promote business. b. Contributions to drum up business, like contributions of soft drinks to barrio fiestas. c. Expenses paid to an advertising firm in order to create a favorable image for the corporation. d. Premiums on life insurance covering the life of an employee if the beneficiary is his heirs. 16. ABC Corporation took two key men insurance on the life of its President, Mr. X. In one policy, the beneficiary is the corporation to compensate it for its expected loss in case of death of its president. The other policy designates Mr. X’s wife as its irrevocable beneficiary. Question 1 – Are the insurance premium paid by X corporation in both policies deductible? Question 2 – Will the insurance proceeds be treated as income subject to tax by the corporation and by the wife? a. b. c. d. Yes to 1st and No to 2nd questions. Yes to both questions. No to 1st question and Yes to 2nd question. No to both questions. 2 Multiple Choice Questions CPAReviewer inTaxation 17. Who among the following is a non-resident alien? a. An alien who comes to the Philippines for a definite purpose which in its nature may be promptly accomplished. b. An alien who comes to the Philippines for a definite purpose which in its nature would require an extended stay. c. An alien who has acquired residence in the Philippines. d. An alien who lives in the Philippines with no definite intention as to his stay. 18. An exemption provided by the law to take care of personal, living and family expenses of the taxpayer and the amount of which is determined according to the status of the taxpayer are: a. Optional standard deduction. b. Personal exemption. c. Additional exemption. d. Special additional personal exemption. 19. The personal exemption of the non-resident alien engaged in trade or business in the Philippines is equal to that allowed by: a. The income tax law of his country to a citizen of the Philippines not residing there. b. The income tax law of his country to a citizen of the Philippines not residing there or the amount provided by the NIRC to a citizen or resident, whichever is lower. c. The National Internal Revenue Code to a citizen or resident. d. The income tax law of his country allows to a citizen of the Philippines not residing there or the amount provided by the NIRC to a citizen or resident alien whichever is higher. 20. If an individual performs services for a creditor who in consideration thereof cancels the debt, the cancellation of indebtedness may amount: a. To a gift. b. To a capital contribution. c. To a donation inter vivos. d. To a payment of income. 21. Statement 1. A non-resident citizen is taxable on his income from within the Philippines. Statement 2. A non-resident citizen is not taxable on his income from outside the Philippines. Statement 3. A non-resident citizen is taxable on his income from within and outside the Philippines. a. True, true, true. b. False, false, false. c. True, true, false. d. False, false, true. 22. The following are the general principles of income taxation: a. A citizen of the Philippines residing therein is taxable on all income derived from sources within and without the Philippines. b. A nonresident citizen is taxable on income derived from sources within the Philippines. c. An individual citizen of the Philippines who is working and deriving income from abroad as an overseas contract worker is taxable only on income from sources within the Philippines. d. An alien individual, whether a resident or not of the Philippines, is taxable only on income derived from sources within the Philippines. e. A domestic corporation is taxable on all income derived from sources within and outside the Philippines. f. A foreign corporation, whether engaged or not in business in the Philippines, is taxable only on income derived from sources within the Philippines. a. b. c. d. 23. All the statements are true. All the statements are false. One of the statements is false. Some of the statements are false. A citizen of the Philippines was a non-resident citizen in 2003. On May 15, 2004, he arrived in the Philippines to reside permanently in the Philippines. His income for the year was: A – From January 1, 2004 to May 14, 2004. B – From May 15, 2004 to December 31, 2004. Which of the following is wrong? a. He is considered a resident citizen on his “B” income. b. He is considered a non-resident citizen on his “A” income. c. He is considered a resident citizen on his “A” and “B” income. d. He is not taxable on his “A” income. 3 Multiple Choice Questions CPAReviewer inTaxation 24. Statement 1. If a taxpayer marries or has dependents during the year, or dies during the year, or his spouse dies during the year, he/his estate may claim personal exemption in full for such year. Statement 2. If a dependent child dies within the year, or becomes twenty-one years old within the year, the taxpayer may still claim additional exemption. a. First statement is correct while second statement is wrong. b. First statement is wrong while second statement is correct. c. Both statements are wrong. d. Both statements are correct. 25. Statement 1. An illegitimate child dependent upon the taxpayer is a unit of additional exemption. Statement 2. A dependent who marries within the year or who becomes gainfully employed during the year is still a dependent with additional exemption for the year. a. True, true. b. True, false. c. False, false. d. False, true. 26. Which of the following is not an income tax on corporation? a. Normal tax. b. Minimum corporate income tax. c. Gross income tax. d. Stock transaction tax. 27. The normal tax of an ordinary corporation effective January 1, 2000 is: a. 34%. b. 33%. c. 32%. d. 30%. 28. The minimum corporate income tax of a domestic or resident trading or manufacturing corporation is: a. 2% of gross income. b. 5% of gross sales. c. 15% of gross income. d. 15% of gross sales. 29. The minimum corporate income tax of a domestic or resident service corporation is: a. 2% of gross receipts. b. 2% of gross income. c. 15% of gross receipts. d. 15% of gross income. 30. One of the following statements is correct. Which is it? The minimum corporate income tax of a corporation is computed: a. In the quarterly and annual returns of the corporation. b. In the annual income tax return only of the corporation. c. In the quarterly returns only of the corporation. d. In all the taxable years of operations of the corporation. 31. One of the following is wrong. Which is it? The gross income tax on corporation is: a. Applicable to domestic corporations. b. Not applicable to resident corporation. c. Applicable to non-resident corporation. d. May begin only beginning 2000. 32. Which statement is wrong? The gross income tax: a. Is optional to a qualified corporation. b. Available only if the ratio of cost of sales does not exceed fifty-five per cent of gross sales or receipts from all sources. c. The choice shall be irrevocable for three consecutive years that the corporation is qualified under the scheme. d. Is always computed to compare with the normal income tax and minimum corporate income tax. 33. Which statement is wrong? The gross income tax of the corporation is: a. 15% of gross income. b. 15% of gross sales. c. 15% of gross profit from sales. d. 15% of gross receipts. 4 Multiple Choice Questions CPAReviewer inTaxation 34. One of the following statements is wrong. Identify. The improperly accumulated earnings tax imposed on corporations: a. Is calculated to force corporations to pay out dividends. b. Is computed on improperly accumulated income over several years. c. Is based on the net income per books after income tax. d. Is based on a statutory formula for improperly accumulated income. 35. All, except one, of the following, are not subject to the improperly accumulated earnings tax. Which is the exception?: a. Publicly-held corporations. b. Banks and other nonbank financial intermediaries. c. Insurance companies. d. Service enterprises. 36. The following, except one, give rise to the presumption that a corporation is improperly accumulating profits. Identify the exception: a. The corporation is a mere holding company. b. The corporation is an investment company. c. The corporation permits its profits to accumulate beyond the reasonable needs of the business. d. The corporation is a service enterprise. 37. Which of the following is not treated as a corporation? a. General partnership in trade. b. General professional partnership. c. Mutual fund company. d. Regional operating headquarters of multi national company. 38. Which of the following statements is wrong? a. A general partnership in trade is not taxable as a corporation. b. A joint venture for undertaking construction projects is not taxable as a corporation. c. A consortium for energy operations pursuant to an operating consortium agreement under a service contract with the government is not taxable as a corporation. d. A co-ownership where the activities of the co-owners are limited to the preservation of property and collection of income from the property is not taxable as a corporation. 39. As a general rule, proceeds of insurance are not taxable because they only constitute a return of capital (of what was lost). Which is the exception? a. Proceeds of life insurance. b. Proceeds of accident or health insurance. c. Proceeds of property insurance. d. Proceeds of crop insurance. 40. Which of the following is taxable? a. Separation pay received by a 50-year old employee due to the retrenchment program of the employer. b. Retirement pay received from a benefit plan registered with the Bureau of Internal Revenue where at the time the employee retired he was 55 years of age, retiring from employment for the first time in his life, and was employed with the employer from whom retiring for 6 years prior to retirement. c. Social security benefit received by a balikbayan from employer abroad at the age of 35. d. SSS and GSIS benefit. 41. Which of the following is taxable? a. Agricultural land inherited. b. Cash received as gift. c. Philippine Charity Sweepstakes winnings. d. Interest on government bonds. 42. Which of the following is taxable? a. Prize won in as essay contest. b. The Nobel prize. c. Prize won as member mythical team in the PBA. d. Award for being a model employee. 43. Which of the following items that reduce salaries of employees is not an exclusions from gross income? a. GSIS or SSS contributions. b. Pagibig contributions. c. Labor union dues. d. IOU’s. 5 Multiple Choice Questions CPAReviewer inTaxation 44. Which of the following is taxable? a. Interest on long-term deposit on banks of individuals. b. Gain on sale of 10-year bond. c. Prize exceeding P10,000. d. Lotto winning. 45. Which of the following is not gross compensation income? a. Salary of P20,000 of an employee. b. Bonus of P20,000 of an employee. c. Salaries of P20,000 of a partner of a general partnership in trade. d. Honorarium of P20,000 of an employee who is a member of the board of directors of a corporation. 46. Which of the following tax refunds constitutes income? a. Refund of Philippine income tax. b. Refund of estate tax. c. Refund of donor’s tax. d. Refund of percentage tax. 47. Statement 1. Only business expenses may be deducted from the gross income of taxpayers. Statement 2. Itemized deductions from gross income should be duly supported by vouchers or receipts. a. First statement is true while second statement is false. b. First statement is false while second statement is true. c. Both statements are true. d. Both statements are false. 48. 49. 50. 51. 52. Statement 1. Interest paid or incurred in the acquisition of fixed assets may be capitalized to the asset account. Statement 2. An individual on the cash basis of accounting shall deduct interest paid in advance in the year that the principal is paid. a. Statement 1 is correct while statement 2 is wrong. b. Statement 1 is wrong while statement 2 is correct. c. Both statements are correct. d. Both statements are wrong. One of the following is not correct for deductibility of losses from gross income: a. It must arise from fire, storm, or other casualty, robbery, theft, or embezzlement. b. It must not be compensated by insurance or any form of indemnity. c. A declaration of loss by casualty should be filed with the Bureau of Internal Revenue. d. It is of property owned by the taxpayer, whether used in business or not. Statement 1. In a total loss due to casualty, the measure of loss is the book value of the asset reduced by any form of indemnity. Statement 2. In a partial loss due to casualty, the measure of loss is the cost of the property, or the cost to restore the property to its normal operating condition, whichever is lower, reduced by any form of indemnity. Statement 3. In a wash sale, loss is not deductible. Statement 4. In a merger or consolidation, or transfer to a controlled corporation, loss is not deductible. a. True, true, true, true. b. False, false, false, false. c. True, false, true, false. d. False, true, false, true. Statement 1. A net operating loss is the excess of allowable deductions over the gross income from business for a taxable year. Statement 2. A net operating loss which had not previously been deducted from gross income shall be carried over as a deduction only in the next year immediately following the year of such loss. a. True, true. b. False, false. c. True, false. d. False, true. Statement 1. Bad debt is an expense in the books of account when a provision is made for it. Statement 2. Bad debt is a deduction from the gross income when the account is written off. a. The first statement is true while the second statement is false. b. The first statement is false while the second statement is true. c. Both statements are true. d. Both statements are false. 6 Multiple Choice Questions CPAReviewer inTaxation 53. Statement 1. The cost of leasehold improvements shall be deductible by the lessee by spreading the cost of the improvements over the life of the improvements or remaining term of the lease, whichever period is shorter. Statement 2. Deprecation expense can be a deduction for both tangible and intangible property with limited useful life. a. True, true. b. False, false. c. True, false. d. False, true. 54. Statement 1. Contributions by the employer to a pension trust for past service cost is deductible in full in year that the employer made the contributions, if he is on the cash basis of accounting. Statement 2. Contributions or donations given directly to individuals cannot be deducted from gross income. a. True, true. b. False, false. c. True, false. d. False, true. 55. Which statement is not correct? a. The deduction of an individual for contribution subject to limitation should not exceed ten percent (10%) of his taxable income from business, trade or profession before deduction for contributions. b. The deduction of a corporation for contributions subject to limitation should not exceed five percent (5%) of its taxable income from business or trade before deduction for contributions. c. Contributions to media in its fund drive for the relief of the calamity victims are deductible from gross income. d. Contributions of canned goods to student organizations during the Christmas season for distribution to Muntinglupa inmates are deductible from gross income. 56. Which statement is wrong/ research and development costs: a. When related to the acquisition and/or improvement of land and building, must be capitalized. b. If not related to land and building, may be treated as an outright deduction. c. If not related to land and building, may be treated as a deferred expense which may be amortized. d. Cannot be deducted because it has unlimited life. 57. Which statement is wrong? The deduction for premiums on hospitalization and health insurance is: a. Not to exceed P2,400 a year per family. b. Not to exceed P200 per month. c. Not allowed if the family income exceeds P250,000. d. In the case of married persons, can be claimed by either spouse. 58. Which statement is wrong? Deduction for premiums on hospitalization and health insurance is: a. Allowed a citizen with a gross compensation only. b. Allowed a citizen with business or professional income only. c. Allowed a citizen with mixed income. d. Only if the taxpayer is taking itemized deduction from gross income. 59. The Optional Standard Deduction is ten percent (10%) of the gross income. Choose the correct and best answer: For purposes of the Optional Standard Deduction of an individual (other than nonresident alien) gross income means: a. If a trading concern, gross profit from sales. b. If a service concern, gross receipts lee direct cost of services. c. Means gross profit from sales, or gross receipts or revenues less direct cost of services, plus all other items of gross income. d. Includes the net capital gain of an individual. 60. Which statement is wrong? The rule that capital losses are deductible only to the extent of capital gains is applicable: a. To a corporation. b. To an individual. c. To the individual taking the Optional Standard Deduction. d. To the individual taking the itemized deduction from gross income. 61. Which statement is wrong? The fringe benefit tax is: a. Imposed on the employer. b. Imposed on the employee. c. Withheld at source. d. Deductible by the employer. 7 Multiple Choice Questions CPAReviewer inTaxation 62. Which statement is wrong? The amount on which the fringe benefit tax rate is applied is: a. The monetary value of the fringe benefit. b. The grossed-up monetary value of the fringe benefit. c. The amount deductible by the employer from his/its gross income. d. Reflected in the books of accounts in the two account of fringe benefits expense and fringe benefit tax expense. 63. Which of the following fringe benefit is not subject to the fringe benefits tax? a. Contributions of the employer for the benefit of the employee to retirement, insurance and hospitalization benefit plans. b. Housing. c. Expense account. d. Vehicle of any kind. 64. 65. 66. Statement 1. A fringe benefit which is subject to the fringe benefit tax is taxable income of the employee. Statement 2. A fringe benefit which is not subject to the fringe benefit tax is taxable income of the employee. a. First statement is true while second statement is false. b. First statement is false while second statement is true. c. Both statements are true. d. Both statements are false. Statement 1. The fringe benefit tax is deductible from the gross income of the employer. Statement 2. The fringe benefit tax is withheld by the employer. a. The first statement is true while second statement is false. b. The first statement is false while second statement is true. c. Both statements are true. d. Both statements are false. Statement 1: A corporation cannot deduct a loss arising from a sale between the corporation and the controlling individual stockholders. Statement 2: A corporation cannot deduct a loss arising from a sale between the corporation and the controlling parent corporation. a. First statement is correct, but the second statement is wrong. b. First statement is wrong, but the second statement is correct. c. Both statements are correct. d. Both statements are wrong. 67. The family of an individual shall include his brothers and sisters, whether by whole or half blood, spouse, ancestors and lineal descendants. In which of the following does the concept not apply? a. Non-deductible loss from sales or exchange of property between members of the family. b. Non-deductible bad debts on transaction between members of the family. c. Non-deductible interest expense between members of the family. d. Deductible premiums on hospitalization and health insurance of the family. 68. Which of the following losses is deductible? a. Loss on wash sale. b. Loss on merger. c. Loss on a transfer of property to a corporation solely stock resulting in control. d. Loss on a transfer of property to a controlled corporation solely for stock. 69. Which interest expense can be deducted from gross income? a. Interest expense on money borrowed to buy government bonds. b. Interest expense on money borrowed to finance petroleum operations. c. Interest expense between a corporation and the controlling individual. d. None of the above. 70. Which statement is wrong? The net operating loss carry-over (NOLCO) is: a. Available to a domestic corporation. b. Available to a registered general partnership in business in the Philippines. c. Available to an individual in business in the Philippines. d. Not available to a general professional partnership in the Philippines. 71. Which statement wrong? Research and development cost: a. On land and building acquired for research and development purposes is not deductible as research and development cost. b. May be claimed as an outright deduction from gross income. c. May be treated as a deferred expense to be amortized over the period which will benefit from the expenditure. d. May be treated as a deferred expense to be amortized over a period of not less than sixty months from the date benefit from expenditure is derived. 8 Multiple Choice Questions CPAReviewer inTaxation 72. Which of the following statements is wrong? a. A deduction for bad debt is not available when a provision for it is made. b. A deduction for bad debt is available only when a write off is made. c. There is no deduction for bad debt when there is a surety for the debtor against whom collection may be enforced. d. A deduction for uncollectible account is available to a taxpayer whether he is on the cash or accrual method of accounting. 73. Which statement is wrong? Contributions made by an employer to a pension trust: a. For lump sum payment to cover past service cost, is allowable as deduction beginning with the year the payment was made. b. For lump sum payment to cover past service cost is allowable as deduction amortized for period of ten years. c. For a lump sum payment to cover past service cost, may be amortized over a period of more than, but not less than ten years. d. For present service cost, is deductible in the year that payment is made. 74. Which statement is not correct? Deduction for depletion: a. Is allowed on wasting assets only. b. For foreign corporations engaged in doing business in the Philippines is allowed only if the mine is located in the Philippines. c. For domestic corporations, shall be allowed only if the mine is located in the Philippines. d. Is separate from deduction for depreciation of building in the mine site. 75. For an individual on the cash basis of accounting, prepaid interest on an indebtedness is deductible: a. In the year that the interest is prepaid. b. In the year that the principal is paid. c. For the portion expired corresponding to the current accounting period. d. None of the above. 76. Income which is constructively received is already taxable income is a rule under this method of accounting: a. Cash method. b. Accrual method. c. Installment method. d. Deferred payment method. 77. Which statement is wrong? a. Income from a general professional partnership is constructively received by a partner when his share in the net income is credited to his capital account. b. Income from a taxable partnership is constructively received by a partner in the same taxable year that the partnership determined its net income after tax. c. Any distribution of dividends made to shareholders of a corporation shall be deemed to have been made from the most recently accumulated earnings or surplus. d. Accumulated profits of any year distributed to shareholder of a corporation shall be considered dividend subject to final tax on the distributee in the year received. 78. Which is wrong? Deferred recognition of income is allowed in: a. Installment sales where the initial payments do not exceed twenty-five percent of the selling price. b. Installment sales where the initial payments exceed twenty-five percent of the selling price. c. Long-term contracts. d. Advance rental received. 79. One of the following statements is wrong. Identify: a. The base stock method of valuing inventory is not recognized for income tax purposes. b. Second hand and odd or broken lots goods in the inventory should be valued at cost or market, whichever is lower. c. The Commissioner of Internal Revenue may prohibit the method of inventory valuation used in the books even if such method used conforms to accounting rules. d. The Commissioner of Internal Revenue may determine the taxable income of a taxpayer by using standards developed from other taxpayers. 80. The taxpayer is not a dealer of personal property regularly selling on installment. Installment method of reporting income is available to him on a sale of property if the initial payments on the sale: a. Exceed 25% of the selling price. b. Do not exceed 25% of the selling price. c. Regardless of the ratio of initial payments to the selling price. d. Do not exceed 25% of the contract price. 9 Multiple Choice Questions CPAReviewer inTaxation 81. Deferred payment method of reporting income on an installment sale is available to a taxpayer if, there being a requirement of the law on the ratio of initial payments to the selling price, the initial payments on the sale: a. Exceed 25% of the selling price. b. Do not exceed 25% of the selling price. c. Regardless of the ratio of initial payments to the selling price. d. Do not exceed 25% of the contract price. 82. Which is wrong? The net worth-expenditure method of investigation which is used by the Bureau of Internal Revenue to determine taxable income that was fraudulently concealed by an individual is based on: a. The statutory authority of the Commissioner of Internal Revenue to promulgate rules and regulations. b. The statutory authority of the Commissioner of the Internal Revenue to determine the taxable income of a taxpayer from the best evidence obtainable. c. The statutory authority of the Commissioner of Internal Revenue to have the income of a taxpayer computed under such method as in his opinion clearly reflects the income. d. All of the above. 83. Under the net worth-expenditure method of investigation, unexplained increase in net worth is attribute to undeclared income. Statement 1. The finding of the Bureau of Internal Revenue of undeclared income is presumed correct, unless the taxpayer proves otherwise. Statement 2. The underdeclaration of income is presumed to be fraudulent and the assessment of the tax by the Bureau of Internal Revenue will imposed a surcharge of fifty percent. a. The first statement is true, the second statement is false. b. The first statement is false, the second statement is true. c. Both statements are true. d. Both statements are false. 84. Which method of inventory valuation is not recognized for income tax purposes? a. Cost. b. Cost or market, whichever is lower. c. Farm price method. d. Base stock method. 85. Statement 1. The Commissioner of Internal Revenue can, if he makes a finding that the nature of stock on hand (e.g., scarcity, liquidity, marketability or price movements) is such that inventory gains should be considered realized for tax purposes, require a change in the inventory valuation method of a taxpayer. Statement 2. The accrual method of accounting is required of trading, manufacturing and service enterprises. a. First statement is correct, second statement is wrong. b. First statement is wrong, second statement is correct. c. Both statements are correct. d. Both statements are wrong. 86. If a general professional partnership is on the accrual method of accounting, and a partner, on his own transactions, is on the cash method of accounting, in the partner’s determination of his taxable income for a year: a. He can consolidate his share in the net income of the partnership, determined by the partnership under the accrual method, with his own income determined under the cash method. b. He must convert his income from the partnership into cash method before consolidating it with his own income on the cash method. c. He must convert his own income into accrual method before consolidating it with his own income from the partnership under the accrual method. d. He does not have to report his income from the partnership because the partnership is exempt from income tax. 87. An individual making a casual sales or disposition of property involving deferred payment, not in the course of trade or business, must report his income: a. On the cash method. b. On the accrual method. c. On the installment method. d. Any of the above. 10 Multiple Choice Questions CPAReviewer inTaxation 88. Statement 1. Where different enterprises or corporation are owned by the same taxpayer, the Commissioner of Internal Revenue may make an allocation of income and expenses among them so as to clearly reflect the income of each enterprise or corporations. Statement 2. In the interest of determining the correct taxable income, it is legal for the Commissioner of Internal revenue to determine the revenue and gross income of a taxpayer based on industry standards developed by the Bureau of Internal Revenue from an industry study. a. Both statements are correct. b. Both statements are wrong. c. First statement is correct, but second statement is wrong. d. First statement is wrong, but second statement is correct. 89. Which statement is wrong? When a taxpayer controls a manufacturing corporation and a marketing corporation, sales made by the manufacturing corporation to the marketing corporation, as recorded, in the books of account, may be considered by the Bureau of Internal Revenue as not reflective of correct selling price. a. Under the rule of “piercing the veil of corporate fiction”. b. Under the provision of the National Internal Revenue Code which authorizes the Commissioner of Internal Revenue to allocate revenues and expenses of corporations controlled by the same interests, so as to clearly reflect the income of the taxpayers. c. Under the provision of the National Internal Revenue Code which authorizes the Commissioner of Internal revenue to determine the correct taxable income from the best evidence obtainable. d. Cannot be done by the Bureau of Internal revenue. 90. Which is correct? When it takes more than one year from the time of planting to the time of harvesting and selling, income may be reported under the crop year method, under which, deductions for expenses shall be allowed in the year that the income from the crop is realized. a. This is an accounting period of more than twelve months. b. This is still an accounting period of twelve months. c. There are two accounting periods, one, a one-year period, and the other, a less-than-one-year accounting period. d. There is no definite accounting period. 91. Statement 1. There can be an accounting period of less than twelve months. Statement 2. There cannot be an accounting period of more than twelve months. a. Both statements are correct. b. Both statements are wrong. c. The first statement is correct, while the second statement is wrong. d. The first statement is wrong, while the second statement is correct. 92. Statement 1. A change in the method of accounting requires a prior approval of the Commissioner of Internal Revenue. Statement 2. A change in accounting period does not require prior approval of the Commissioner of Internal Revenue as long as the necessary income tax returns for the different accounting periods (old, interim and new) are filed. a. Both statements are correct. b. Both statements are wrong. c. First statement is correct, while second statement is wrong. d. First statement is wrong, wile second statement is correct. 93. Which statement is wrong? In income tax allocation: a. Permanent difference is an item of revenue in the books of accounts but which is not a taxable income. b. Permanent difference is an item of taxable income which is not revenue in the books of accounts. c. Timing difference is an item of revenue in the books of accounts in one accounting period but which is taxable income in another accounting period. d. Timing difference is an item of expense in one accounting period and is not a deduction for income tax purposes. 94. One of the following is correct: a. Income from long-term contracts may be reported on the completed contracts method of accounting. b. Income from long-term contracts must be reported only on the percentage of completion method of accounting. c. Income from deferred payment sales may not be reported on the accrual method. d. Where in a deferred payment sales the initial payments exceed twenty-five percent of he selling price, the income from the sales must be reported on the accrual method. 11 Multiple Choice Questions CPAReviewer inTaxation 95. Which income from sources partly within and partly outside the Philippines is allocated on the time basis? a. Income of an international shipping corporation with vessels touching Philippine ports. b. Income of a telegraph company with transmission from the Philippines to points abroad. c. Income from goods produced in whole or in part in the Philippines and sold in a foreign country, or vice-versa. d. Income from personal services performed in part in the Philippines and in part abroad. 96. Who of the following need not file income tax return? a. A taxable corporation, if with a net loss. b. A taxable partnership, if with a net loss. c. A general professional partnership, with a net income or net loss. d. An employee with a gross compensation income of P48,500 when the withholding tax by an employee was correct. 97. The income tax return of a parent includes the income of an unmarried child: a. If the child is minor and the income was derived from property inherited by the child, where the estate tax was paid. b. If the child is minor and the income was derived from property received as gift from a living parent, where the donor’s tax was not paid. c. If the child was minor and the income was derived from property received as gift from the living parent, where the donor’s tax was paid. d. If the child is minor and the income was derived from his labor. 98. Statement 1: The income tax return of husband and wife may be signed by one of the spouses only designated by them as the income tax return filer. Statement 2: The income tax return of husband and wife must be signed by both spouses. a. Both statements are correct. b. Both statements are wrong. c. Statement 1 is correct, but Statement 2 is wrong. d. Statement 1 is wrong, but Statement 2 is correct. 99. Which statement is wrong: a. The income tax return of a receiver of a corporation is the income tax return of the corporation. b. The income tax of a minor, unmarried child, from personal services, filed by the guardian of the child, is an income tax return of the child. c. The income tax return of a person under disability, from services, or from property, filed by the guardian, is an income tax return of the child. d. The income tax return by an agent or authorized representative of the taxpayer, as indicated in the return, is under the sole responsibility of the agent or authorized representative. 100. A corporation which is included in exempt corporation under Section 30 of the National Internal Revenue Code. (e.g., organized and operated for charitable purposes) which did not file its article of incorporation and by-laws with the Bureau of Internal Revenue: a. Is required to file an income tax return and paid the income tax. b. Is required to file an income tax return although not required to pay the income tax. c. Needs to file only an information return and will not be required to pay the income tax. d. Needs to file an information return and pay the income tax. 101. A general professional partnership is exempt from income tax, but is required to file an income tax return: a. For statistical purposes. b. Because the net income of the partnership will be traced into the income tax return of the partners. c. Because all income earners are required to file income tax return. d. None of the above. 102. When an individual taxpayer is under temporary disability: a. Income tax return is required to be filed for him by his guardian. b. No income tax return is required of him. c. Income tax return for the period when he was under disability shall be required only when becomes able. d. None of the above statements are correct. 103. Statement 1. A corporation with an annual income tax paid or payable of at least P1,000,000 for the preceding taxable year is a large taxpayer. Statement 2. When a corporation is dissolve and is under receivership, the corporation is still the taxpayer until the close of the liquidation. a. First statement is correct, while second statement is wrong. b. First statement is wrong, while second statement is correct. c. Both statements are correct. d. Both statements ate wrong. 12 Multiple Choice Questions CPAReviewer inTaxation 104. Which statement is wrong? When an individual, notwithstanding withholding income tax during the year on his compensation income, is required to file an income tax return at the end of the year, he: a. May pay the income tax into two installments if the income tax on his taxable income for the year, before credit for withholding income tax, exceeds P2,000. b. May pay the income tax into two installments if the income tax on his taxable income for the year, after credit for withholding income tax exceeds P2,000. c. May credit the income tax withheld against the first installment tax due. d. May still pay the income tax in one lump sum even if it exceeds P2,000 and credit the withholding income tax against it. 105. Which of the following withholding income tax should be remitted to the Bureau of Internal Revenue as a final tax? a. Withholding income tax and compensation income. b. Withholding income tax on certain passive income. c. Withholding income tax under the Expanded Withholding Tax System. d. All of the above. 106. Dividend received from a foreign corporation shall be subject to withholding income tax if: a. In all cases where the foreign corporation had business in the Philippines. b. In all cases where the foreign corporation engaged in business in the Philippines had more than fifty percent of its world gross income for the three-year period preceding the declaration of dividend derived from Philippine sources. c. In all cases where the foreign corporation engaged in business in the Philippines had more than eighty-five percent of its world gross income for the three-year preceding the declaration of dividend derived from Philippine sources. d. None of the above. 104. Which is not a creditable withholding income tax? a. Expanded withholding income tax. b. Withholding income tax on passive income on passive income.] c. Withholding income tax at source. d. None of the above. 105. One of the following statements is correct. A choice by an individual of the Optional Standard Deductions means that: a. His income tax return need not be accompanied by financial statements. b. He need not keep books of accounts. c. He need not have records of gross income. d. His choice can still be changed by filing an amended return. 106. Which of the following is a taxpayer required to file an income tax return? a. An estate which is under administration. b. A trust where the fiduciary must accumulate the income of the trust. c. A trust where the fiduciary may accumulate or distribute the income of the trust, at his discretion. d. All of the above. 107. Which is correct? The income tax return shall be accompanied by the following: a. Statement of Net Worth and Operations, if the gross receipts from business or profession do not exceed P50,000 in any one quarter. b. Balance Sheet and Income Statement, if the gross receipts from business or profession exceed P50,000, but do not exceed P150,000 in any one quarter. c. Balance Sheet and Income Statement certified by an independent Certified Public Accountant if the gross receipts from business or profession exceed P150,000 in any one quarter. d. All of the above. 108. Statement 1. A donation on which the donor’s tax was not paid is not a valid donation. Statement 2. Title to the donated real property cannot be transferred to the donee in the Register Deeds unless the donor’s tax on the donation had been paid. a. Both statements are correct. b. Both statements are wrong. c. The first statement is correct while the second statement is wrong. d. The first statement is wrong while the second statement is correct. 112. One of the following is not an excise tax in the Tax Code. a. Value-added tax. b. Community tax. c. Income tax. d. Percentage tax. 13 Multiple Choice Questions CPAReviewer inTaxation 113. One of the following statements is wrong: books of accounts are required to be kept, as follows: a. Where the quarterly gross sales, earnings, receipts or output do not exceed P50,000, a simplified set of bookkeeping records. b. Where the quarterly gross sales, earnings, receipts or output exceed P50,000 journal and ledger, or their equivalent. c. Where the gross quarterly sales, earnings or output exceed P150,000, the books shall be examined and audited by independent Certified Public Accountants. d. May be in language other than native, English or Spanish as long as it is in the language of the taxpayer. 114. Statement 1; Books of accounts shall be preserved for a period beginning from the last entry in such books until the expiration of the period of assessment (on transactions recorded there) that may be made by the Bureau of Internal Revenue. Statement 2: In the case of the taxpayers whose gross sales, earnings or receipts in any quarter exceed P150,000, the books of account should be audited and examined by independent Certified Public Accountants and their income tax returns accompanied with certified financial statements. a. Both answers are correct. b. Both answers are wrong. c. First statement is correct but second statement is wrong. d. First statement is wrong but second statement is correct. 115. Mr. Araki, a non-resident alien stockholder, received a dividend income of P300,000 in 2004 from a foreign corporation doing business in the Philippines. The gross income of the foreign corporation within and without the Philippines for three years preceding 2004 are as follows: Sources of Income From within the Philippines From without the Philippines 2001 P16,000,000 18,000,000 2002 P12,000,000 14,000,000 2003 P14,000,000 16,000,000 How much of the dividend income received by Mr. Araki is considered income from sources within the Philippines? a. Zero. b. P150,000. c. P270,000. d. Answer not given. 116. The following information are from the records of the Central Plain University, Inc., a private educational institution, for the fiscal year ended May, 31, 2003: Income: Miscellaneous fees P 362,600 Tuition fees 2,843,100 Income from rents 60,000 Net income, school canteen 36,200 Net income, book store 24,800 Dividends 15,000 Interest on time deposits 45,000 Expenses: Payroll and administrative salary 1,452,450 Other operating expenses 762,330 Interest on P750,000 bank loan 82,100 Depreciation, new six-room building 37,500 In the first month of the fiscal year, the school secured a loan from a bank in the amount of P750,000. The proceeds of the loan were spent in the construction of a new six-room building. How much is the income tax due from the Central Plain University, Inc. for the fiscal year ended May 31, 2003? a. P101,935. b. P 26,935. c. P105,685. d. P30,685. 117. The West Central College, Inc. is a private educational institution recognized by the Government. It submitted the following data for the fiscal year ending April 30, 2004: Tuition fees P 9,500,000 Miscellaneous fees 1,200,000 Cash dividends from domestic corporation 80,000 Income from book store 350,000 Interests on bank deposit 70,000 Income of school canteen 180,000 14 Multiple Choice Questions CPAReviewer inTaxation Salary, allowances and bonus Other operating expenses Other expenditures for improvement of school facilities: Construction of additional classrooms Furniture and equipment of library 6,400,000 2,600,000 1,300,000 400,000 The income tax due for the fiscal year ending April 30, 2004: a. P223,000. b. P61,000. c. P780,000. d. P53,000. 118. The Central Luzon University, Inc. is a private educational institution recognized by the Government. The following are financial data for its fiscal year ending April 30, 2004: Tuition fees P12,800,000 Miscellaneous fees 2,100,000 Interest on bank deposits 15,000 Rent income from school canteen 120,000 Salary and bonus, all personnel 8,500,000 Other operating expenses 3,750,000 Construction of classroom building 2,150,000 Repayment of loan 500,000 Quarterly (three quarters) income tax paid 36,000 The income tax still payable by the Central Luzon University, Inc. for the year ended April 30, 2004: a. P62,000. b. P241,000. c. P27,580. d. P26,000. 119. Mrs. Evangelista owns a parcel of land worth P500,000 which she inherited from her father in 2003 when it was worth P300,000. Her father purchased it in 1990 for P100,000. If Mrs. Evangelista transfer this parcel of land to her wholly owned corporation in exchange for shares of stocks of said corporation worth P450,000, Mrs. Evangelista’s taxable gain is: a. Zero. b. P50,000. c. P150,000. d. Answer not given. 120. Mr. Santiago purchased a life annuity for P100,000 which will pay him P10,000 a year. The life expectancy of Mr. Santiago is 12 years. Which of the following will Mr. Santiago be able to exclude from his gross income? a. P100,000. b. P10,000. c. P20,000. d. Answer not given. 121. A store building was constructed on January 2, 1999 with a cost of P570,000. Its estimated useful life is 16 years with scrap value of P70,000 after 16 years. In January, 2004 replacement of some worn- out parts of the building costing P50,000 was spent. After the repairs, the building was appraised with a fair market value of P770,000. The allowable deduction for depreciation for the year 2004 is: a. P35,794.45. b. P43,750.00. c. P49,431.82. d. Answer not given. Mr. Monte was injured in a vehicular accident in 2001. He incurred and paid medical expenses of P20,000 and legal fees of P10,000 during the year. In 2004, he received P70,000 as settlement from the insurance company which insured the car owned by the other party involved in the accident. From the above payments and transactions, the amount of taxable income to Mr. Monte in 2004: a. Zero. b. P40,000. c. P70,000. d. Answer notgiven. 122. 15 Multiple Choice Questions 123. CPAReviewer inTaxation On different dates as listed below, Mr. Santos purchased common stock of ABC Corporation. On May 31, 2004, he received a 50% stock dividend. Lot No. 1 2 3 4 Date Purchased Oct. 15, 2003 Jan. 15, 2004 Mar. 15, 2004 May. 15,2004 No. of Shares 400 300 200 100 Cost Per Share P 100.00 120.00 140.00 150.00 Total Cost P40,000.00 36,000.00 28,000.00 15,000.00 On June 30, 2004, Mr. Santos sold 1,400 shares at P100.00 per share. Using the first-in-first-out method, the gain or (loss) of Mr. Santos is: a. P31,000. b. P(26,600). c. P28,938. d. Answer not given. 124. Mr. Rivera leased his land to Mr. Gomez. The terms of the contract of lease is for fifteen (15) years and the rental fee is P36,000 a year. The contract provides that Mr. Gomez, the lessee, will construct a building and at the end of the term of the contract, the building will be owned by Mr. Rivera, the lessor. The building was constructed at a cost of P600,000 and has a useful life of 30 years. Assuming Mr. Rivera will spread his income over the term of the contract of lease, for income tax purposes, his yearly income is: a. P40,000. b. P56,000. c. P76,000. d. P20,000. 125. Mr. Pascual bought a 200 square meter land at a cost of P500,000. He leased the land to Mr. Franco at an annual rental of P40,000. The term of the contract of lease is 15 years. The contract of lease provides that Mr. Franco will construct a building which will belong to the lessor at the end of the term of the lease or at the termination of the lease, the building was constructed at a total cost of P400,000 and has an estimated useful life of 20 years which is the basis of a straight-line method of depreciation. Assuming that Mr. Pascual will spread his income over the term of the contract of lease, the annual income of Mr. Pascual is: a. P46,666.66. b. P26,666.66. c. P66,666.66. d. P40,000. Assuming the contract of lease was terminated after the tenth (10th) year or at the beginning of the eleventh (11th) year due to the fault of the lessee, the income of Mr. A Pascual in the eleventh (11th) year is; a. P173,333.34. b. P200,000. c. P133,333.34. d. P400,000. 126. Mr. B, married, is a citizen and resident of the Philippines. He had the following data on income and expenses: Salaries, net of P7,000 SSS, Philhealth, Pagibig contributions, and labor union dues Thirteen month pay Allowances Gain on sale of asset P88,000 8,000 16,000 10,000 The income tax withheld on compensation income: a. P11,015. b. P8,900. c. P7,975. d. P9,875. 127. In question 126, if the income tax was withheld correctly by the employer, income tax still due at the end of the year is: a. P2,640. b. P14,203. c. P2,000. d. P1,900. 16 Multiple Choice Questions 128. CPAReviewer inTaxation Mr. Richard Conception, a citizen and resident of the Philippines, married to Mrs. Dawn SeseConception, with the mother of Mrs. Conception living with the spouses, had the following data for 2004: Mr. Gross income from business P220,000 Gross income from profession, net income of a 10% withholding tax Rent income from land and building Dividend from domestic corporation Interest on notes receivable 2,000 Interest on Philippine currency bank deposit 3,000 Capital gain on sale directly to buyer at P280,000 of shares of domestic corporation 80,000 Capital gain on sale directly to buyer at P2,000,000 of land in the Philippines Interest on government bonds Capital loss thru the Philippine Stock exchange at P60,000 of shares of domestic corporation Income tax withheld on rent at 5% Income tax withheld on professional fees at 10% Expenses, business/profession 150,000 Mrs. Mr. & Mrs. P180,000 P48,000 10,000 1,000 2,000 8,000 300,000 5,000 5,000 2,400 20,000 120,000 10,000 The capital gain taxes paid within the year; a. P 8,150. b. P108,000. c. P124,000. d. P108,150. 129. In Question 128, the final tax paid on passive income within the year: a. P2,500. b. P2,600. c. P3,200. d. P4,600. 130. In Question 128, the taxable income before personal exemption of Mr. Concepcion: a. P54,000. b. P73,000. c. P91,000. d. P92,000. 131. In Question 128, the taxable income after personal exemption of Mr. Concepcion is: a. P59,000. b. P91,000. c. P75,000. d. P73,000. 132. In Question 128, the taxable income before personal exemption of Mrs. Concepcion: a. P68,000. b. P63,000. c. P105,000. d. P100,000. 133. In Question 128, the taxable income after personal exemption of Mrs. Concepcion: a. P73,000. b. P82,000. c. P68,000. d. P80,000. 134. Mr. A married, had the following data for a taxable year: Gross income, Philippines P380,600.28 Gross income, United States 255,304.65 194,269.03 Expenses, Philippines 193,248.39 Expenses, United States 17 Multiple Choice Questions CPAReviewer inTaxation If the taxpayer is a resident citizen of the Philippines who is married, his taxable income is: a. P216,387. b. P216,387.51. c. P154,331.25. d. P154,331. 135. If in Question 134, the taxpayer was a citizen of the Philippines with residence in the United States who is married, the taxable income is: a. P216,387. b. P216,387.51. c. P154.331.25. d. P154,331. 136. If in Question 134, the taxpayer was a non-resident alien engaged in business in the Philippines who is married and the law of his country allows full reciprocity on personal exemption, the taxable income is: a. P216,387. b. P216,387.51. c. P154,331.25. d. P154,331. 137. If in Question 134, the taxpayer was a non-resident alien not engaged in business in the Philippines who is married, the taxable income is: a. P186,331.25. b. P380,600.28. c. P154,335.25. d. P380,600. 138. A corporation, in its first year of operations, had the following data: Gross income Expenses Philippines P400,000 200,000 Foreign P300,000 200,000 The taxable income, if domestic corporation and the data are on business, is: a. P200,000. b. P300,000. c. P100,000. d. P400,000. 139. If in Question 138, the taxpayer is a resident corporation, and the data are on business, the taxable income: a. P200,000. b. P300,000. c. P100,000. d. P400,000. 140. If in Question 138, the taxpayer is a non-resident corporation, and the income and expenses are on isolated transaction, the taxable income is: a. P200,000. b. P300,000. c. P100,000. d. P400,000. 141. A domestic corporation, in its fifth year of operations in 2002, had the following data: P2,000,000 1,000,000 950,000 Sales Cost of sales Business expenses The income tax of the corporation is: a. P17,000. b. P20,000. c. P1,000. d. P340,000. 18 Multiple Choice Questions 142. CPAReviewer inTaxation In 2002, a domestic corporation was in its sixth year of operations. The following data are for the years 2001 and 2002: 2001 2002 Gross profit from sales P600,000 P700,000 Business expenses 580,000 650,000 The income tax for 2001 is: a. P12,000. b. P6,800. c. P4,000. d. P20,400. 143. In Question 142, the income tax due fro 2002 is: a. P10,400. b. P16,500. c. P11,300. d. P17,000. 144. In year 2002, a domestic corporation had the following data: Sales Cost of sales Business expenses P4,000,000 1,500,000 1,000,000 The gross income tax of the corporation is: a. P375,000. b. P480,000. c. P600,000. d. P125,000. 145. D. Co. is a domestic corporation with the following data for 2002 (first year of operations): Gross profit from sales Dividend from domestic corporation Capital gain on sale of land in the Philippines held for two years (sold at P1,000,000) Capital gains on sale of shares of domestic corporation held for two months (direct sale to buyer) Business expenses Capital loss on bonds of domestic corporation held for 6 months P2,000,000 20,000 200,000 120,000 1,100,000 30,000 The total capital gains taxes for the year: a. P64,000. b. P54,000. c. P67,000. d. P0. 146. In Question 145, the normal tax of the corporation at the end of the year: a. P327,000. b. P1,070,000. c. P288,000. d. P900,000. 147. Selected cumulative balances were taken from the records of ABC Co., Inc., a domestic corporation, of its fourth year of operations in 2002, which had an income tax refundable of P10,000 for a preceding year for which there is a certificate of tax credit: 1stQ 2ndQ 3rdQ Year 800,000 1,600,000 2,400,000 3,100,000 Gross profit from sales Capital gain on sale directly to buyer of shares of domestic corporation 50,000 50,000 50,000 100,000 Dividend from domestic corporation 10,000 10,000 20,000 20,000 Interest on Philippine currency bank deposit 5,000 10,000 15,000 20,000 Business expense 600,000 1,200,000 1,700,000 2,100,000 Income tax withheld 15,000 35,000 65,000 115,000 The income tax due at the end of the first quarter: a. P39,000. b. P45,000. c. P55,000. d. P60,000. 19 Multiple Choice Questions CPAReviewer inTaxation 148. In Question 147, the income tax due at the end of the second quarter: a. P50,000. b. P70,000. c. P140,000. d. P44,000. 149. In Question 147, the income tax due at end of the third quarter:] a. P66,000. b. P50,000. c. P75,000. d. P140,000. 150. In Question 147, the income tax due (or refundable) at the end of the year: a. P245,000. b. P350,000. c. (P10,000). d. P46,000. 151. A domestic corporation had the following data for 2002, the accumulated earnings for which year the Bureau of Internal Revenue considered to be improper: Sales P6,000,000 Cost of sales 2,000,000 Business expense 1,000,000 Interest on Philippine currency bank deposit 50,000 Capital gain on sale directly to buyer of shares of domestic 120,000 corporation Dividend income from domestic corporation 60,000 Dividend declared and paid during the year 500,000 The improperly accumulated earnings tax is: a. P175,300. b. P221,000. c. P171,000. d. P323,000. 152. AB is a general professional partnership, with A, married, and B, single, participating equally in the income and expenses. The following are data for the partnership and the partners in a calendar year: Gross income Expenses AB P600,000 350,000 A P150,000 70,000 B P200,000 120,000 The gross income of A from the partnership is: a. P300,000. b. P125,000. c. P600,000. d. None. 153. In Question 152, the taxable income of A is: a. P80,000. b. P205,000. c. P173,000. d. Some other amount. 154. The YZ & Co. is a general partnership in trade, in its fifth year of operations. In one calendar year it had a gross profit from sales and business expenses of P2,000,000 and P1,000,000, respectively. Y and Z share equally in the profits and losses of the partnership. The income tax of the partnership is: a. P40,000. b. P320,000. c. P640,000. d. P0. 20 Multiple Choice Questions CPAReviewer inTaxation 155. The income tax of Mr. Y as a consequence of being a partner in the YZ Partnership is: a. P0. b. P68,000. c. P77,000. d. P32,000. 156. Thirteenth month pay Christmas bonus Productivity incentives pay P25,000 5,000 8,000 The taxable compensation income is: a. P38,000. b. P13,000. c. P8,000. d. P1,000. 157. Mr. A was insured under an endowment policy with a value of P500,000. Total premiums paid by him during the term of premiums payments on the policy was P490,000, from which there was a return of P40,000. At the maturity of the policy, Mr. A received P500,000. The income of Mr. A under the policy is: a. Zero. b. P500,000. c. P10,000. d. P50,000. 158. A is an employee in a firm that gives benefits to its rank-and-file employees. He received the following in a year: Salaries, net of SSS, Philhealth, and Pagibig contributions, and of labor union dues, P360,000; Thirteenth month pay, 30,000; Productivity incentives pay, 30,000; Mid-year bonus, 15,000; Christmas bonus, 30,000; Rice subsidy, 20,000. The compensation income of A subject to income tax is: a. P590,500. b. P443,000. c. P473,000. d. P290,500. 159. Received by the taxpayer under policies: Proceeds of life insurance (as beneficiary of mother) Proceeds of life insurance (as beneficiary of father) Insurance purchased from the father at cost to taxpayer of Additional premiums paid by the taxpayer to continue the policy Amount received upon the death of the father Proceed of endowment policy, upon maturity, with premium payments made of P800,000 Proceeds of comprehensive car insurance Crop insurance, from crop destroyed by typhoon P400,000 600,000 200,000 50,000 500,000 1,000,000 100,000 50,000 The income from the amounts received is: a. P2,300,000. b. P500,000. c. P600,000. d. P50,000. 160. P1,000,000 50 years 40 years Cost of leasehold improvement Estimated useful life of improvements Remaining term of the lease Income from the improvements, if reported in one lump sum: a. P1,000,000. b. P800,000. c. P200,000. d. 100,000. 161. In Question 160, if the income from the improvements is reported annually, the annual income is: a. P 5,000. b. P 4,000. c. P200,000. d. P20,000. 21 Multiple Choice Questions CPAReviewer inTaxation 162. In Question 160, if the income from the improvements was reported annually, and at the beginning of the twenty-first year of the improvements, when the fair market value thereof was P250,000, the lessor took possession of the improvements, his income in Year 21 is: a. P250,000. b. P100,000. c. P150,000. d. P50,000. 163. In Question 160, if the income was reported annually, and the leasehold improvements were destroyed by fire before the end of Year 10, when the fair market value was P800,000 and insurance recovery for the lessor was P40,000 only, the deductible loss of the lessor is: a. P5,000. b. P800,000. c. P700,000. d. P45,000. 164. Recovery of bad debt written off by a taxpayer: No.1: P20,000 from accounts written off in a year which had a net income of P200,000 before writeoff (write-off for the year was P20,000). No. 2: P5,000 from accounts written off in a year which had a net loss before write-off of P36,000 (write-off for the year was P5,000). No. 3: P10,000 from accounts written off in a year which had a net loss income of P8,000 before write off and a write off for P12,000. The income from the bad debt recovery is: a. P35,000. b. P20,000. c. P26,000. d. P30,000. 165. Mr. Joey Baretto, a citizen and resident of the Philippines, sold to Martin Manzano on July 1, 1998 a piece of land held as capital asset in the Philippines at a selling price of P5,000,000. The land had a cost of P2,500,000 and at the time of the sale had a fair market value of P6,000,000 and a mortgage of P2,000,000, which mortgage was assumed by Mr. Manzano. The sale called for a payment of P300,000 on the date of sale and P200,000 on December 1, 1998. the balance shall be paid in installments of P500,000 each on December 1, 1999, December 1, 200, December 1, 2001, December 1, 2002 and December I, 2003. Mr. Baretto will pay the tax on the transaction in installments, if qualified The “initial payments” was: a. P300,000. b. P500,000. c. P700,000. d. None of the above. 166. In Question 165, the contract price was: a. P3,000,000. b. P2,000,000. c. P2,500,000. d. None of the above. 167. In Question 165, the tax paid on the payment received on July 1, 1998 was: a. P20,000. b. P50,000. c. P30,000. d. P36,000. 168. Selling price of land in the Philippines held as capital asset Fair market value of the land at the time of sale Cost of land Payments on the selling price: Assumption by the buyer of a mortgage on the property Cash in the year of sale Cash in the succeeding year The capital gain tax in the year of sale (installment, if qualified): a. P17,647.05. b. P53,333.33. c. P44,444.44. d. P100,000.00. 22 P1,700,000 2,000,000 800,000 900,000 300,000 500,000 Multiple Choice Questions 169. CPAReviewer inTaxation The taxpayer is a domestic corporation and the taxable year is 2003. it sold a piece of land and building abroad held as capital asset at a selling price of P5,000,000 with payment in one lump sum. The capital gain tax: a. P0. b. P250,000. c. P300,000. d. None of theabove. 170. A citizen of the Philippines sold his principal residence in the Philippines at a selling price equal to its fair market value of P4,000,000. The basis or cost of the property was P2,500,000. If the entire proceeds of the sale is immediately invested in acquiring a net principal residence, the capital gain tax is: a. P240,000. b. P200,000. c. P0. d. Some other amount. 171. In Question 170, how much is the basis of the new principal residence? a. P0. b. P249,000. c. P2,500,000. d. Some other amount. 172. In Question 170, if only P3,000,000 out of P4,000,000 was utilized in acquiring a new principal residence, the capital gain tax is: a. P60,000. b. P240,000. c. P180,000. d. Some other amount. 173. Calendar year 2002 Taxpayer is a citizen of the Philippines who is single: Capital gain on sale of bonds held for 20 months Capital gain on direct sale to buyer of shares of domestic corporation held for 6 months Capital loss on sale of family car held for 11 months Capital loss on sale of land in the Philippines held for 3 years Net capital loss in 2001 (net taxable income of the year was P10,000) P50,000 120,000 80,000 60,000 20,000 Total capital gains to consider at the end of the year: a. P145,000. b. P25,000. c. P120,000. d. P130,000. 174. In Question 173, the net capital loss carry-over from 2001 would have been: a. P40,000. b. P55,000. c. P10,000. d. P0. 175. Calendar year 2002: Taxpayer is a citizen of the Philippines who is single Capital gain on sale of bonds held for 2 months Capital gain on sale directly to buyer of shares of domestic corporation held for 16 months Capital loss on sale of family car held for 5 years Capital loss on sale of land in the Philippines held for 3 years on a selling price of P800,000 Net capital loss in 2001 (net taxable income of the year was P30,000) The net capital gain in 2002 was: a. P50,000. b. P5,000. c. None. d. Some other amount. 2 3 P45,000 120,000 80,000 60,000 20,000 Multiple Choice Questions CPAReviewer inTaxation 176. In Question 175, the net capital loss carry over to 2002 was: a. P5,000. b. P20,000. c. P30,000. d. Some other amount. 177. Capital stock issued and outstanding of domestic corporation – Common only Stock owned: Acquisition No. 1: 100 shares acquired at P120 per share; Acquisition No. 2: 50 shares acquired at P130 per share. Stock dividend received: (Acquisition No. 3) – 20%; Shares sold directly to a buyer – 110 shares at P110 per share. If costing is under the FIFO method, the capital gain tax is: a. P118. b. P55. c. P160. d. P110. 178. In Question 177, if costing is under the moving average method, the capital gain tax is: a. P35.75. b. P121.67. c. P39.72. d. P68.60. 179. Property held by an individual as capital asset (not real property or shares of stock) was sold in 2001. Data on the property follow: Selling price P60,000 Cost 10,000 Payment in 2002 15,000 45,000 Payment in 2003 2 years Holding period Capital gain on installment (if opted to) in 2002? a. P6,250. b. P12,500. c. P25,000. d. P25,500. 180. In Question 179, capital gain in installment (if opted) in 2003? a. P50,000. b. P25,000. c. P18,750. d. P37,500. 181. In 2002, a taxpayer borrowed money from Bank A, that gave him an interest expense of P8,000. He deposited the money with Bank B, and he had an interest income of P10,000. The deductible interest expense is: a. P8,000. b. P3,900. c. P4,200. d. None of those mentioned. 182. A domestic corporation had: Year 1998 1999 2000 2001 2002 Gross profit from business P600,000 500,000 900,000 850,000 920,000 The taxable income in 2001: a. P50,000. b. P0. c. Loss – (P20,000). d. Some other amount. 24 Business Expenses P700,000 470,000 850,000 900,000 620,000 Multiple Choice Questions CPAReviewer inTaxation 183. In Question 182, the taxable income in 2002 is: a. P250,000. b. P0. c. P300,000. d. Some otheramount. 184. A taxpayer, a resident citizen who is married, with six qualified dependent children, had a gross compensation income of P180,000, net of exclusions from gross compensation income, premium payments on health insurance for the family of P4,000, and expenses related to his employment of P70,000. The taxable income is: a. P113,600. b. P116,000. c. P177,600. d. Some other amount. 185. The taxpayer is a resident citizen who is married, with gross income from business of P500,000, business expenses with supporting receipts of P40,000 and premiums on health insurance of P3,000. If choosing the itemized deductions from gross income, the taxable income is: a. P460,000. b. P428,000. c. P418,000. d. Some other amount. 186. In Question 185, if the taxpayer chose the Optional Standard Deduction, the taxable income is: a. P460,000. b. P450,000. c. P418,000. d. Some other amount. 187. A citizen who is married, had the following data in 2000: Gross revenues from services Capital gain on sale of asset held for 2 years Dividend from resident corporation Direct costs of the services Capital loss on sale of asset held for 6 months P400,000 10,000 15,000 100,000 5,000 If choosing the Optional Standard Deduction, the taxable income is: a. P288,000. b. P256,000. c. P246,000. d. Some other amount. 188. In 2002, an employer gave the following fringe benefits, in cash and in kind, to its employees: To management level employees To rank-and-file employees P2,040,000 5,000,000 The fringe benefit tax is: a. P960,000. b. P652,000. c. P680,000. d. Some other amount. 189. In Question 188, the deduction from the gross income of the employer for Fringe Benefit Expense is: a. P3,000,000. b. P2,040,000. c. P8,000,000. d. P7,040,000. 190. Journal entry: (Debit) Fringe benefit expense (Debit) Fringe benefit tax expense (Credit) Cash (Credit) Fringe benefit tax payable 25 P389,000 136,000 P389,000 136,000 Multiple Choice Questions CPAReviewer inTaxation Means that the grossed-up monetary value of the fringe benefits to supervisory personnel had a gross monetary value of: a. P425,000. b. P289,000. c. P186,000. d. P389,000. 191. In Question 190, the monetary value of the fringe benefit to the rank-and-file employees is: a. P425,000. b. P100,000. c. P289,000. d. P389,000. 192. A management employee borrowed from his employer (advances against salaries) P120,000, payable from his salaries at P5,000 every payday (fifteen days). Since check-off was to be made against salaries, there was no interest charged to the loan. The fringe benefit tax is: a. P0. b. P14,400.22. c. P6,776.47. d. P21,178.49. 193. Included in the compensation package of an executive was the free use of the company’s residential condominium unit in in the Makati Philippines. Data on the condominium unit follow: Fair market value RealCity, Property Declaration P1,000,000 Zonal value 2,000,000 Fair market value 2,500,000 The monthly gross monetary value of the fringe benefit is: a. P1,500,000. b. P2,000,000. c. P6,127.45. d. P4,166.67. 194. In Question 193, how much is the fringe benefit tax? a. P326,400. b. P705,832.35. c. P1960.78. d. P945,176.47. 195. A corporation bought a piece of land with a building at a cost of P4,000,000 for the land and P1,000,000 for the building. It was not the intention of the corporation to use the building but to have it razed to make the land available for the construction of its offices. Upon razing the old building at a cost of P200,000, the corporation shall have a deductible loss of: a. P0. b. P1,000,000. c. 1,200,000. d. P200,000. 196. A Co. had investments in shares of stock of B Co. that it acquired at a cost of P20,000. It also had investment in shares of stock of C Co. That it acquired at a cost of P40,000. The value of the shares of stock of B Co. had decreased to P15,000, while the share of stock of C Co. are now worthless, and has to be written off. The deductible loss is: a. P45,000. b. P40,000. c. P60,000. d. P0. 197. Contributions and donations were made by a taxpayer, as follows: To the Quiapo Catholic Church P15,000 To the Society for the Blind, Inc., Philippines 10,000 To beggars in the streets 5,000 To the Sistine Chapel in Rome 20,000 26 Multiple Choice Questions CPAReviewer inTaxation The actual contributions to be compared with the 5%/10% limitation is: a. P50,000. b. P25,000. c. P45,000. d. P20,000. 198. Husband and wife, with five qualified dependent children, (with husband claiming the additional exemptions) had the following data for 2002: Wife: Salaries Thirteenth month pay Premiums on health insurance paid Husband: Sales Dividend from domestic corporation Dividend from resident corporation Interest on Philippine currency bank deposit Royalty from patented invention Royalty from books Capital gains on assets held for not more than 12 months: On sale directly to buyer of shares of domestic corporation On sale directly to buyer on bond of domestic corporation On sale thru the Philippine Stock Exchange of shares of domestic corporation On sale thru a real estate broker of land in the Philippines (fair market value-P2,800,000, selling price-P3,000,000) On sale of vacation house and lot in Malaysia Cost of sales Capital loss on asset held for more than 12 months: On sale directly to buyer of land in Indonesia On sale of family car On sale directly to buyer of bonds of domestic corporation Contributions to churches Business expenses The income tax withheld on the compensation income is: a. P20,400. b. P24,500. c. P32,650. d. P35,400. 199. In Question 198, the final tax on passive income is: a. P35,000. b. P39,200. c. P20,000. d. P37,000. 200. In Question 198, the capital gain tax on real property: a. P150,000. b. P180,000. c. P100,000. d. P120,000. 201. In Question 198, the capital gain tax on shares of stock: a. P8,500. b. P17,000. c. P13,500. d. P27,000. 202. In Question 198, the net capital gain (loss) at the end of the year: a. P105,000. b. P(135,000). c. P52,500. d. P40,500. 27 P180,000 15,000 5,000 2,000,000 20,000 15,000 100,000 60,000 30,000 135,000 40,000 60,000 500,000 200,000 980,000 250,000 100,000 25,000 5,000 500,000 Multiple Choice Questions CPAReviewer inTaxation 203. In Question 198, the income tax due at the end of the year from the husband and wife: a. P155,790. b. P130,920. c. P163,245. d. P145,364. 204. The year is 2002. a domestic corporation in its sixth year of operations had a gross profit from sales of P2,500,000, and net income per books of P700,000 after considering: Dividend income: From domestic corporation From resident corporation Interest income: From trade notes receivable From Philippine currency bank deposits Capital gain on sale at P4,000,000 of land in the Philippines held for ten years Capital gain on sale of bonds with maturity of 10years Capital gain on sale of shares of stock of a domestic corporation held for eight months, sold directly to buyer Income from trust indenture with the Equitable PCIBank Bad debts (direct writ-off) Salaries and wages Taxes and licenses (including income tax on interest income and on capital gain of P243,000) Utilities expense Losses Depreciation Pension trust Income tax (three quarterly income taxes) Capital loss on sale of bonds of a domestic corporation held for two years Dividend declared and paid P 20,000 15,000 5,000 8,000 100,000 6,000 12,000 4,000 18,000 100,000 260,000 75,000 90,000 40,000 16,000 80,200 5,500 200,000 The income tax due from the corporation: a. P200,984. b. P50,000. c. P298,758. d. P0. 205. In Question 204, if the accumulation of profits in 2002 is adjudged to be improper, the improperly accumulated earnings tax (IAET) is: a. P72,328.32. b. P50,364.86. c. P37,944.56. d. P29,901.60. 206. Mr. A sold property which had a cost to him of P110,000 for a selling price of P200,000. The sale was on July I, 2002, and under the terms of the sale, the buyer was to assume a mortgage of P50,000 on the property, pay P50,000 on the date of sale and P50,000 every July 1 thereafter. The income in 2002 reported under the installment method was: a. P22,450. b. P30,000. c. P90,000. d. None of the above. 207. Cielo Co. sold a piece of land (ordinary asset) which had a cost to it of P1,000,000 for a selling price of P4,000,000. The sale called for an assumption by the buyer of the mortgage on the land of P1,500,000, cash of P500,000 on the date of sale and installment payment of 500,000 every year thereafter. The income to report in the year of sale under the installment method of reporting income is: a. P500,000. b. P750,000. c. P375,000. d. P1,000,000. 28 Multiple Choice Questions 208. CPAReviewer inTaxation Del Mundo Co. sold a piece of land (ordinary asset) which had a cost of P2,000,000 for P4,000,000 on December 1, 2000. The sale called for a payment on date of sale of P1,500,000, and the balance, evidenced by a mortgage note for P2,500,000, payable at P1,500,000 on December 1, 2001 and P1,000,000 on December 1, 2002. The note had a fair market value at the time of execution equal to eighty-five percent of its face value. a. b. c. d. The income in 2000 under the deferred payment method of reporting income: P3,000,000. P1,625,000. P1,500,000. P2,000,000. 209. In Question 208, the income in 2001 when P1,500,000 is collected: a. P0. b. P235,000. c. P225,000. d. P1,500,000. 210. The taxpayer is a resident citizen who is married with two qualified dependent children. For 2002 which is under investigation, he had the following data: Net worth, beginning of the year Net worth, end of the year Interest received on long-term investment in banks Dividend on shares of stock of domestic corporation Rent income per books (out of an advance rental of P60,000) Income tax paid for 2001 Income tax shown on the return for 2002 Interest paid on money borrowed for use in acquiring long-term investment Personal, living and family expenses Cost to repair residential house partially destroyed by fire Premiums on family health and hospitalization insurance Capital gain on bonds of a domestic corporation held for 8 months Capital loss on bonds of a domestic corporation held for 18 months P400,000 600,000 2,000 5,000 10,000 60,000 29,000 1,000 100,000 30,000 77,400 30,000 70,000 The taxable income per investigation: a. P327,000. b. P466,000. c. P356,000. d. P283,000. 211. Mr. A is not a dealer in securities. In 2002, he had the following transactions of common shares of stock of Z Co., a domestic corporation: Purchase on January 5, of 100 shares Sale of June 18, of the shares purchased on January 5 Purchase on June 22, of 60 shares Sale on October 5, of the shares purchased on June 22 P7,000 6,000 6,500 8,000 The loss not recognized on the sale of June 18: a. P1,000. b. P600. c. P0. d. Some other amount. 212. In Problem 211, the basis of the shares purchased on June 22, 2000 is: a. P600. b. P7,100. c. P6,500. d. Some other amount. 213. In Problem 211, the gain on the sale of October 5, 2000 is: a. P900. b. P1,500. c. P0. d. Some other amount. 29 Multiple Choice Questions 214. CPAReviewer inTaxation Anson Co. was merged into Bono Co., and only Bono Co. continues to exist. Mr. Arnold Custodio, a stockholder of Anson Co. was asked to surrender his 100 shares of Anson Co. that he acquired for P100,000 and received under the merger 100 shares of Bono Co. with a fair market value of P130,000 and cash of 30,000. The gain to Mr. Arnold Custodio on the merger is: a. P60,000. b. P30,000. c. P0. d. Some other amount. 215. In Question 214, the basis to Mr. Arnold Custodio of the shares of Bono Co. received is: a. P100,000. b. P130,000. c. P70,000. d. Some other amount. 216. M CO., a domestic corporation, had the following data for 2000: Taxable income, Philippines Taxable income, X Foreign Country Taxable income, Y Foreign Country Income tax paid to X Foreign Country Income tax paid to Y Foreign Country Philippine income tax paid, three quarters of the year P1,000,000 600,000 400,000 250,000 120,000 110,000 Tax credit for foreign income taxes paid? a. P540,000. b. P370,000. c. P312,000. d. P340,000. 217. In Question 216, the Philippine income tax still due, after credit for foreign income taxes paid is: a. P218,000. b. P356,000. c. P570,000. d. P0. 218. If in Question 216, the corporation chose to deduct the foreign income tax paid (instead of availing of a foreign income tax credit), how much would have been the income tax due? a. P521,600. b. P640,000. c. P411,600. d. Some other amount. 219. A revocable transfer, with a consideration received: Consideration received Fair market value of property at the time of transfer Fair market value of property at the time of death P200,000 300,000 250,000 Value to include in the gross estate: a. P300,000. b. P250,000. c. P100,000. d. P50,000. 220. A decedent was married at the time of death and under the system of conjugal partnership of gains. Among the properties in the gross estate were: Land, inherited before the marriage, fair market value Family home built by the spouses on the inherited land Deduction for family home: a. P900,000. b. P500,000. c. P400,000. d. P450,000. 30 P100,000 800,000 Multiple Choice Questions CPAReviewer inTaxation ANSWER KEYTO QUIZZERS 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “B’ is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. 31 Multiple Choice Questions 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80. 81. 82. 83. 84. 85. 86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. 101. 102. 103. 104. 105. 106. 107. 108. 109. 110. CPAReviewer inTaxation Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. 3 2 Multiple Choice Questions 111. 112. 113. 114. 115. 116. 117. 118. 119. 120. 121. 122. 123. 124. 125. 126. 127. 128. 129. 130. 131. 132. 133. 134. 135. 136. 137. 138. 139. 140. 141. 142. 143. 144. 145. 146. 147. 148. 149. 150. 151. 152. 153. 154. 155. 156. 157. 158. 159. 160. 161. 162. 163. 164. 165. 166. CPAReviewer inTaxation Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer (or “D”). Letter “A” is the correct answer (or “D”). Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “A” and “C” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. 33 Multiple Choice Questions 167. 168. 169. 170. 171. 172. 173. 174. 175. 176. 177. 178. 179. 180. 181. 182. 183. 184. 185. 186. 187. 188. 189. 190. 191. 192. 193. 194. 195. 196. 197. 198. 199. 200. 201. 202. 203. 204. 205. 206. 207. 208. 209. 210. 211. 212. 213. 214. 215. 216. 217. 218. 219. 220. CPAReviewer inTaxation Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. Letter “C” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “B” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “A” is the correct answer. Letter “C” is the correct answer. Letter “D” is the correct answer. Letter “B” is the correct answer. 34