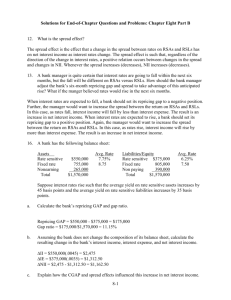

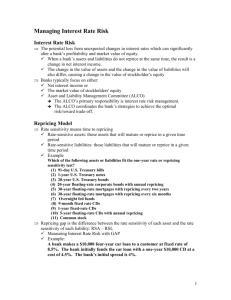

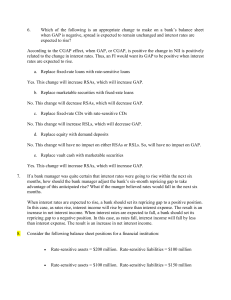

CH 8: net worth: The value of an FI to its owners; this is equal to the difference between the market value of assets and that of liabilities. M.V Asset – M.V liability - measure an FI’s interest rate risk The repricing model: The repricing, or funding gap, model concentrates on the impact of interest rate changes on an FI’s net interest income (NII), which is the difference between an FI’s interest income and interest expense the central bank’s monetary policy strategy that most directly underlies the level and movement of interest rates that, in turn, affect an FI’s cost of funds and return on assets. Through its daily open market operations, such as buying and selling Treasury bonds and Treasury bills, the Fed seeks to influence the money supply, inflation, and the level of interest rates (particularly short-term interest rates) In turn, changing interest rates impact economic decisions, such as whether to consume or save. When the Fed finds it necessary to slow down the economy, it tightens monetary policy by raising interest rates. The normal result is a decrease in business and household spending (especially that financed by credit or borrowing). Conversely, if business and household spending declines to the extent that the Fed finds it necessary to stimulate the economy, it allows interest rates to fall (an expansionary monetary policy). the increased level of financial market integration over the last decade has also affected interest rates. THE REPRICING MODEL Repricing gap: The difference between assets whose interest rates will be repriced or changed over some future period (rate-sensitive assets) and liabilities whose interest rates will be repriced or changed over some future period (rate sensitive liabilities). interest-rate sensitivity reports which show the repricing gaps for assets and liabilities with various maturities. Rate sensitivity the asset or liability is repriced at or near current market interest rates within a certain time horizon (or maturity bucket). rate-sensitive asset or liability: An asset or liability that is repriced at or near current market interest rates within a maturity bucket. Thus, a negative gap (RSA < RSL) exposes the FI to refinancing risk, in that a rise in these short-term rates would lower the FI’s net interest income since the FI has more rate-sensitive liabilities than assets in this bucket. In other words, assuming equal changes in interest rates on RSAs and RSLs, interest expense will increase by more than interest revenue. If the FI has a positive $20 million difference between its assets and liabilities being repriced in 6 months to 12 months, it has a positive gap (RSA > RSL) for this period and is exposed to reinvestment risk, in that a drop in rates over this period would lower the FI’s net interest income; that is, interest income will decrease by more than interest expense. Refinancing risk: The risk that the cost of rolling over or re-borrowing funds will rise above the returns being earned on asset investments. Reinvestment risk: The risk that the returns on funds to be reinvested will fall below the cost of the funds. In this first bucket, if the gap is negative $10 million and short-term interest rates (such as fed fund and/or repo rates) rise 1 percent, the annualized change in the FI’s future net interest income is: That is, the negative gap and associated refinancing risk results in a loss of 100,000 in net interest income for the FI. - Short-term consumer loans: These are repriced at the end of the year and just make the one-year cutoff. - Three-month T-bills: these are repriced on maturity (rollover) every three months. - Six-month T-notes: these are repriced on maturity (rollover) every six months. - 30-year floating-rate mortgages: These are repriced every nine months total one-year rate-sensitive assets (RSAs) = $155 (50+30+35+40) Rate-Sensitive Liabilities: 1- Three-month CDs: $40 million. These mature in three months and are repriced on rollover. 2. Three-month banker’s acceptances: $20 million. These also mature in three months and are repriced on rollover. 3. Six-month commercial paper: $60 million. These mature and are repriced every six months. 4. One-year time deposits: $20 million. These get repriced right at the end of the one-year gap horizon. core deposits Those deposits that act as an FI’s long-term sources of funds. The cumulative one-year repricing gap (CGAP) for the bank is: it tells us: (1) the direction of the interest rate risk exposure (positive or negative CGAP) (2) the scale of that exposure as indicated by dividing the gap by the asset size of the institution. In our example the FI has 5.6 percent more RSAs than RSLs in one-year-and less buckets as a percentage of total assets. FIs calculate a gap ratio defined as rate-sensitive assets divided by ratesensitive liabilities gap ratio = rate-sensitive assets ÷ rate sensitive liabilities - A gap ratio greater than 1 indicates that there are more rate sensitive assets than liabilities. - A gap ratio less than 1 indicates that there are more rate sensitive - liabilities than assets EX: from previous example calculate the gap ratio 𝑔𝑎𝑝 𝑟𝑒𝑡𝑖𝑜 = 𝑅𝑎𝑡𝑒 𝑠𝑒𝑛𝑠𝑖𝑡𝑖𝑣𝑒 𝐴𝑠𝑠𝑒𝑡 155 = = 1.107 𝑅𝑎𝑡𝑒 𝑠𝑒𝑛𝑠𝑖𝑡𝑒𝑣𝑒 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑒𝑠 140 meaning that in the one-year-and-less time bucket, the FI has $1.107 of RSAs for every $1 of RSLs. relation between CGAP and changes in NII when interest rate changes for RSAs are equal to interest rate changes for RSLs. For example, when CGAP is positive (or the FI has more RSAs than RSLs), NII will rise when interest rates rise It is evident from this equation that the larger the absolute value of CGAP, the larger the expected change in NII (i.e., the larger the increase or decrease in the FI’s interest income relative to interest expense when CGAP is positive, the change in NII is positively related to the change in interest rates. So FI would want its CGAP to be positive when interest rates are expected to rise. when CGAP is negative, if interest rates rise by equal amounts for RSAs and RSLs ( NII will fall (since the FI has more RSLs than RSAs). when CGAP is negative. If interest rates fall equally for RSAs and RSLs, NII will increase when CGAP is negative, the change in NII is negatively related to the change in interest rates, so FI would want its CGAP to be negative when interest rates are expected to fall. CGAP effects: The relations between changes in interest rates and changes in net interest income. Unequal Changes in Rates on RSAs and RSLs If the spread between the rate on RSAs and RSLs increases, when interest rates rise interest income increases by more than interest expense. The result is an increase in NII. if the spread between the rates on RSAs and RSLs decreases, when interest rates rise, interest income increases less than interest expense, and NII decreases. the direction of the change in interest rates, a positive relation exists between changes in the spread (between rates on RSAs and RSLs) and changes in NII. Whenever the spread increases (decreases), NII increases (decreases). positive relation exists between changes in the spread (between rates on RSAs and RSLs) and changes in NII. Whenever the spread increases (decreases), NII increases (decreases). spread effect: The effect that a change in the spread between rates on RSAs and RSLs has on net interest income as interest rates change. WEAKNESSES OF THE REPRICING MODEL 1- Market Value Effects: the present values of the cash flows on assets and liabilities change, in addition to the immediate interest received or paid on them, as interest rates change. So the repricing gap is only a partial measure of the true interest rate risk exposure of an FI. 2- over aggregative: The problem of defining buckets over a range of maturities ignores information regarding the distribution of assets and liabilities within those buckets. Clearly, the shorter the range over which bucket gaps are calculated, the smaller this problem is. 3- it fails to deal with the problem of rate-insensitive asset and liability runoffs and prepayments: Runoff: Periodic cash flow of interest and principal amortization payments on long-term assets, such as conventional mortgages, that can be reinvested at market rates. 4- it ignores cash flows from off-balance sheet activities: The RSAs and RSLs used in the repricing model generally include only the assets and liabilities listed on the balance sheet. Changes in interest rates will affect the cash flows on many off-balance-sheet instruments as well. For example, an FI might have hedged its interest rate risk with an interest rate futures contract as interest rates change, these futures contracts—as part of the marking-to-market process—produce a daily cash flow (either positive or negative) for the FI that may offset any on-balance-sheet gap exposure. These offsetting cash flows from futures contracts are ignored by the simple repricing model and should (and could) be included in the mode Q 1 Consider the following balance sheet positions for a financial institution: • Rate-sensitive assets = $200 million Rate-sensitive liabilities =$100 million • Rate-sensitive assets = $100 million Rate-sensitive liabilities = $150 million • Rate-sensitive assets = $150 million Rate-sensitive liabilities = $140 million a. Calculate the repricing gap and the impact on net interest income of a 1 percent increase in interest rates for each position. b. Calculate the impact on net interest income of each of the above situations, assuming a 1 percent decrease in interest rates. c. What conclusion can you draw about the repricing model from these results?