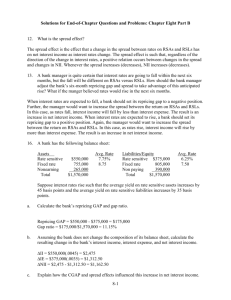

6. Which of the following is an appropriate change to make on a bank’s balance sheet when GAP is negative, spread is expected to remain unchanged and interest rates are expected to rise? According to the CGAP effect, when GAP, or CGAP, is positive the change in NII is positively related to the change in interest rates. Thus, an FI would want its GAP to be positive when interest rates are expected to rise. a. Replace fixed-rate loans with rate-sensitive loans Yes. This change will increase RSAs, which will increase GAP. b. Replace marketable securities with fixed-rate loans No. This change will decrease RSAs, which will decrease GAP. c. Replace fixed-rate CDs with rate-sensitive CDs No. This change will increase RSLs, which will decrease GAP. d. Replace equity with demand deposits No. This change will have no impact on either RSAs or RSLs. So, will have no impact on GAP. e. Replace vault cash with marketable securities Yes. This change will increase RSAs, which will increase GAP. 7. If a bank manager was quite certain that interest rates were going to rise within the next six months, how should the bank manager adjust the bank’s six-month repricing gap to take advantage of this anticipated rise? What if the manger believed rates would fall in the next six months. When interest rates are expected to rise, a bank should set its repricing gap to a positive position. In this case, as rates rise, interest income will rise by more than interest expense. The result is an increase in net interest income. When interest rates are expected to fall, a bank should set its repricing gap to a negative position. In this case, as rates fall, interest income will fall by less than interest expense. The result is an increase in net interest income. 8. Consider the following balance sheet positions for a financial institution: Rate-sensitive assets = $200 million. Rate-sensitive liabilities = $100 million Rate-sensitive assets = $100 million. Rate-sensitive liabilities = $150 million Rate-sensitive assets = $150 million. Rate-sensitive liabilities = $140 million a. Calculate the repricing gap and the impact on net interest income of a 1 percent increase in interest rates for each position. Rate-sensitive assets = $200 million. Rate-sensitive liabilities = $100 million. Repricing gap = RSA - RSL = $200 - $100 million = +$100 million. ΔNII = ($100 million)(0.01) = +$1.0 million, or $1,000,000. Rate-sensitive assets = $100 million. Rate-sensitive liabilities = $150 million. Repricing gap = RSA - RSL = $100 - $150 million = -$50 million. ΔNII = (-$50 million)(0.01) = -$0.5 million, or -$500,000. Rate-sensitive assets = $150 million. Rate-sensitive liabilities = $140 million. Repricing gap = RSA - RSL = $150 - $140 million = +$10 million. NII = ($10 million)(0.01) = +$0.1 million, or $100,000. b. Calculate the impact on net interest income on each of the above situations assuming a 1 percent decrease in interest rates. ΔNII = ($100 million)(-0.01) = -$1.0 million, or -$1,000,000. ΔNII = (-$50 million)(-0.01) = +$0.5 million, or $500,000. ΔNII = ($10 million)(-0.01) = -$0.1 million, or -$100,000. c. What conclusion can you draw about the repricing model from these results? The FIs in parts (1) and (3) are exposed to interest rate declines (positive repricing gap), while the FI in part (2) is exposed to interest rate increases. The FI in part (3) has the lowest interest rate risk exposure since the absolute value of the repricing gap is the lowest, while the opposite is true for the FI in part (1). 9. Consider the following balance sheet for MMC Bancorp (in millions of dollars): Assets Liabilities $ 6.25 1. Equity capital (fixed) $25.00 2. Short-term consumer loans 62.50 (one-year maturity) 2. Demand deposits 3. Long-term consumer loans 31.25 (two-year maturity) 3. Passbook savings 4. Three-month T-bills 37.50 4. Three-month CDs 5. Six-month T-notes 43.75 5. Three-month banker’s acceptances 25.00 6. Three-year T-bonds 75.00 6. Six-month commercial paper 7. One-year time deposits 25.00 8. 30-year, floating-rate 50.00 8. Two-year time deposits 50.00 6.25 $337.50 50.00 37.50 50.00 75.00 $337.50 a. Calculate the value of MMC’s rate-sensitive assets, rate sensitive liabilities, and repricing gap over the next year. Looking down the asset side of the balance sheet, we see the following one-year rate-sensitive assets (RSA): 1. Short-term consumer loans: $62.50 million, which are repriced at the end of the year and just make the one-year cutoff. 2. Three-month T-bills: $37.50 million, which are repriced on maturity (rollover) every three months. 3. Six-month T-notes: $43.75 million, which are repriced on maturity (rollover) every six months. 4. 30-year floating-rate mortgages: $50.00 million, which are repriced (i.e., the mortgage rate is reset) every nine months. Thus, these long-term assets are RSA in the context of the repricing model with a one-year repricing horizon. Summing these four items produces one-year RSA of $193.75 million. The remaining $143.75 million is not rate sensitive over the one-year repricing horizon. A change in the level of interest rates will not affect the interest revenue generated by these assets over the next year. The $6.25 million in the cash and due from category and the $6.25 million in premises are nonearning assets. Although the $131.25 million in long-term consumer loans, three-year Treasury bonds, and 10-year, fixed-rate mortgages generate interest revenue, the level of revenue generated will not change over the next year since the interest rates on these assets are not expected to change (i.e., they are fixed over the next year). Looking down the liability side of the balance sheet, we see that the following liability items clearly fit the one-year rate or repricing sensitivity test: 1. Three-month CDs: $50 million, which mature in three months and are repriced on rollover. 2. Three-month bankers acceptances: $25 million, which mature in three months and are repriced on rollover. 3. Six-month commercial paper: $75 million, which mature and are repriced every six months. 4. One-year time deposits: $25 million, which are repriced at the end of the one-year gap horizon. Summing these four items produces one-year rate-sensitive liabilities (RSL) of $175 million. The remaining $162.50 million is not rate sensitive over the one-year period. The $25 million in equity capital and $50 million in demand deposits do not pay interest and are therefore classified as nonpaying. The $37.50 million in passbook savings and $50 million in two-year time deposits generate interest expense over the next year, but the level of the interest generated will not change if the general level of interest rates change. Thus, we classify these items as fixed-rate liabilities. The four repriced liabilities ($50 + $25 + $75 + $25) sum to $175 million, and the four repriced assets of $62.50 + $37.50 + $43.75 + $50 sum to $193.75 million. Given this, the cumulative one-year repricing gap (CGAP) for the bank is: CGAP = (One-year RSA) - (One-year RSL) = RSA - RSL = $193.75 million - $175 million = $18.75 million b. Calculate the expected change in the net interest income for the bank if interest rates rise by 1 percent on both RSAs and RSLs. If interest rates fall by 1 percent on both RSAs and RSLs. The CGAP would project the expected annual change in net interest income (NII) of the bank is: NII = CGAP x R = ($18.75 million) x 0.01 = $187,500 Similarly, if interest rates fall equally for RSAs and RSLs, NII will fall by: = ($18.75 million) x (-0.01) = -$187,5000 c. Calculate the expected change in the net interest income for the bank if interest rates rise by 1.2 percent on RSAs and by 1 percent on RSLs. If interest rates fall by 1.2 percent on RSAs and by 1 percent on RSLs. The resulting change in NII is calculated as: NII = [RSA x R ] - [RSL x R ] = [$193.75 million x 1.2%] - [$175 million x 1.0%] = $2.325 million - $1.75 million = $575,000 RSA RSL 12. test? Which of the following assets or liabilities fit the one-year rate or repricing sensitivity 3-month U.S. Treasury bills Yes 1-year U.S. Treasury notes Yes 20-year U.S. Treasury bonds No 20-year floating-rate corporate bonds with annual repricing Yes 30-year floating-rate mortgages with repricing every two years 30-year floating-rate mortgages with repricing every six months Overnight fed funds Yes 9-month fixed-rate CDs Yes 1-year fixed-rate CDs Yes 5-year floating-rate CDs with annual repricing Yes Common stock No No Yes 14. A bank manager is quite certain that interest rates are going to fall within the next six months. How should the bank manager adjust the bank’s six-month repricing gap and spread to take advantage of this anticipated rise? What if the manager believes rates will rise in the next six months. When interest rates are expected to fall, a bank should set its repricing gap to a negative position. Further, the manager would want to increase the spread between the return on RSAs and RSLs. In this case, as rates fall, interest income will fall by less than interest expense. The result is an increase in net interest income. When interest rates are expected to rise, a bank should set its repricing gap to a positive position. Again, the manager would want to increase the spread between the return on RSAs and RSLs. In this case, as rates rise, interest income will rise by more than interest expense. The result is an increase in net interest income. 15. Consider the following balance sheet for WatchoverU Savings, Inc. (in millions): Assets Liabilities and Equity Floating-rate mortgages (currently 10% annually) 30-year fixed-rate loans (currently 7% annually) Equity $10 Total assets $100 a. 1-year time deposits $50 (currently 6% annually) 3-year time deposits $50 (currently 7% annually) Total liabilities & equity $70 $20 $100 What is WatchoverU’s expected net interest income at year-end? Current expected interest income: $50m(0.10) + $50m(0.07) = $8.5m. Expected interest expense: $70m(0.06) + $20m(0.07) = $5.6m. Expected net interest income: $8.5m - $5.6m = $2.9m. b. What will net interest income be at year-end if interest rates rise by 2 percent? After the 2 percent interest rate increase, net interest income declines to: 50(0.12) + 50(0.07) - 70(0.08) - 20(.07) = $9.5m - $7.0m = $2.5m, a decline of $0.4m. c. Using the cumulative repricing gap model, what is the expected net interest income for a 2 percent increase in interest rates? WatchoverU’s repricing or funding gap is $50m - $70m = -$20m. The change in net interest income using the funding gap model is (-$20m)(0.02) = -$0.4m. d. What will net interest income be at year-end if interest rates on RSAs increase by 2 percent but interest rates on RSLs increase by 1 percent? Is it reasonable for changes in interest rates on RSAs and RSLs to differ? Why? After the unequal rate increases, net interest income will be 50(0.12) + 50(0.07) - 70(0.07) 20(.07) = $9.5m - $6.3m = $3.2m, an increase of $0.3m. It is not uncommon for interest rates to adjust in an unequal manner on RSAs versus RSLs. Interest rates often do not adjust solely because of market pressures. In many cases, the changes are affected by decisions of management. Thus, you can see the difference between this answer and the answer for part a. 16. Use the following information about a hypothetical government security dealer named M. P. Jorgan. Market yields are in parenthesis, and amounts are in millions. Assets Liabilities and Equity Cash $10 Overnight repos $170 1-month T-bills (7.05%) 75 Subordinated debt 3-month T-bills (7.25%) 75 7-year fixed rate (8.55%) 2-year T-notes (7.50%) 50 8-year T-notes (8.96%) 100 5-year munis (floating rate) (8.20% reset every 6 months) 25 Equity 15 Total assets $335 Total liabilities & equity $335 150 a. What is the repricing gap if the planning period is 30 days? 3 months? 2 years? Recall that cash is a non-interest-earning asset. Repricing gap using a 30-day planning period = $75 - $170 = -$95 million. Repricing gap using a 3-month planning period = ($75 + $75) - $170 = -$20 million. Reprising gap using a 2-year planning period = ($75 + $75 + $50 + $25) - $170 = +$55 million. b. What is the impact over the next 30 days on net interest income if interest rates increase 50 basis points? Decrease 75 basis points? If interest rates increase 50 basis points, net interest income will decrease by $475,000. ΔNII = CGAP(ΔR) = -$95m.(0.005) = -$0.475m. If interest rates decrease by 75 basis points, net interest income will increase by $712,500. ΔNII = CGAP(ΔR) = -$95m.(-0.0075) = $0.7125m. c. The following one-year runoffs are expected: $10 million for two-year T-notes and $20 million for eight-year T-notes. What is the one-year repricing gap? The repricing gap over the 1-year planning period = ($75m. + $75m. + $10m. + $20m. + $25m.) - $170m. = +$35 million. d. If runoffs are considered, what is the effect on net interest income at year-end if interest rates increase 50 basis points? Decrease 75 basis points? If interest rates increase 50 basis points, net interest income will increase by $175,000. ΔNII = CGAP(ΔR) = $35m.(0.005) = $0.175m. If interest rates decrease 75 basis points, net interest income will decrease by $262,500. ΔNII = CGAP(ΔR) = $35m.(-0.0075) = -$0.2625m. 18. Assets Rate sensitive Fixed rate Nonearning Total $550,000 755,000 265,000 $1,570,000 Avg. Rate 7.75% 8.75 Liabilities/Equity Rate sensitive $575,000 Fixed rate 605,000 Nonpaying 390,000 Total $1,570,000 Avg. Rate 6.25% 7.50 Suppose interest rates fall such that the average yield on rate-sensitive assets decreases by 15 basis points and the average yield on rate-sensitive liabilities decreases by 5 basis points. a. Calculate the bank’s CGAP, gap to total asset ratio, and gap ratio. CGAP = $550,000 - $575,000 = -$25,000 Gap to total assets ratio = -$25,000/$1,570,000 = -1.59% Gap ratio = $550,000/$575,000 = 0.957 b. Assuming the bank does not change the composition of its balance sheet, calculate the resulting change in the bank’s interest income, interest expense, and net interest income. ΔII = $550,000(-0.0015) = -$825 ΔIE = $575,000(-0.0005) = -$287.50 ΔNII = -$825 – (-$287.50) = -$537.50 c. The bank’s CGAP is negative and interest rates decreased, yet net interest income decreased. Explain how the CGAP and spread effects influenced this decrease in net interest income. The CGAP affect worked to increase net interest income. That is, the CGAP was negative while interest rates decreased. Thus, interest income decreased by less than interest expense. The result is an increase in NII. The spread effect, on the other hand, worked to decrease net interest income. The spread decreased by 10 basis points. According to the spread affect, as spread decreases, so does net interest income. In this case, the increase in NII due to the CGAP effect was dominated by the decrease in NII due to the spread effect. 19. The balance sheet of A. G. Fredwards, a government security dealer, is listed below. Market yields are in parentheses, and amounts are in millions. Assets Liabilities and Equity Cash $20 Overnight repos $340 1-month T-bills (7.05%) 150 Subordinated debt 3-month T-bills (7.25%) 150 7-year fixed rate (8.55%) 2-year T-notes (7.50%) 100 8-year T-notes (8.96%) 200 5-year munis (floating rate) (8.20% reset every 6 months) 50 Equity 30 Total assets $670 Total liabilities and equity $670 a. 300 What is the repricing gap if the planning period is 30 days? 3 month days? 2 years? Repricing gap using a 30-day planning period = $150 - $340 = -$190 million. Repricing gap using a 3-month planning period = ($150 + $150) - $340 = -$40 million. Repricing gap using a 2-year planning period = ($150 + $150 + $100 + $50) - $340 = $110 million. b. What is the impact over the next three months on net interest income if interest rates on RSAs increase 50 basis points and on RSLs increase 60 basis points? ΔII = ($150m. + $150m.)(0.005) = $1.5m. ΔIE = $340m.(0.006) = $2.04m. ΔNII = $1.5m. – ($2.04m.) = -$0.54m. c. What is the impact over the next two years on net interest income if interest rates on RSAs increase 50 basis points and on RSLs increase 75 basis points? ΔII = ($150m. + $150m. + $100 + $50)(0.005) = $2.25m. ΔIE = $340m.(0.0075) = $2.04m. ΔNII = $2.25m. – ($2.04m.) = $0.21m. d. Explain the difference in your answers to parts (b) and (c). Why is one answer a negative change in NII, while the other is positive? For the 3-month analysis, the CGAP affect worked to decrease net interest income. That is, the CGAP was negative while interest rates increased. Thus, interest income increased by less than interest expense. The result is a decrease in NII. For the 3-year analysis, the CGAP affect worked to increase net interest income. That is, the CGAP was positive while interest rates increased. Thus, interest income increased by more than interest expense. The result is an increase in NII. 20. A bank has the following balance sheet: Assets Rate sensitive Fixed rate Nonearning Total $225,000 550,000 120,000 $895,000 Avg. Rate 6.35% 7.55 Liabilities/Equity Rate sensitive $300,000 Fixed rate 505,000 Nonpaying 90,000 Total $895,000 Avg. Rate 4.25% 6.15 Suppose interest rates rise such that the average yield on rate-sensitive assets increases by 45 basis points and the average yield on rate-sensitive liabilities increases by 35 basis points. Calculate the bank’s repricing GAP. a. Repricing GAP = $225,000 - $300,000 = -$75,000 b. Assuming the bank does not change the composition of its balance sheet, calculate the net interest income for the bank before and after the interest rate changes. What is the resulting change in net interest income? NII = ($225,000(0.0635) +$550,000(0.0755)) – ($300,000(0.0425) + $505,000(0.0615)) = $55,812.50 - $43,807.50 = $12,005 b NII = ($225,000(0.0635 + 0.0045) +$550,000(0.0755)) – ($300,000(0.0425 + 0.0035) + $505,000(0.0615)) = $56,825 - $44,857.50 = $11,967.50 a ΔNII = $11,967.50 - $12,005 = -$37.50 c. Explain how the CGAP and spread effects influenced this increase in net interest income. The CGAP affect worked to decrease net interest income. That is, the CGAP was negative while interest rates increased. Thus, interest income increased by less than interest expense. The result is a decrease in NII. In contrast, the spread effect worked to increase net interest income. The spread increased by 10 basis points. According to the spread affect, as spread increases, so does net interest income. However, in this case, the increase in NII due to the spread effect was dominated by the decrease in NII due to the CGAP effect.