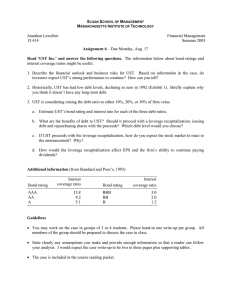

Compute the interest coverage ratioAnswer:By using the 5% annual growth rate in sales, the sales of 1999 is:1,423,200,000 * (1+5%) = 1,494,360,000By using the EBIT/Sales ratio of 53%, the EBIT of 1999 is:1,494,360,000 * 53% = 792,010,000Interest expense of each year by using 20 years “A” Investment Grade Corporate Bond:1,000,000,000 * 7.05% = 70,500,000Assume that all other interest expense is zero:Interest coverage ratio = 792.01/70.5 = 11.2Does this ratio support an “A” rating?Answer:The interest coverage ratio is 11.2, which exceed the requirement of “A” Investment Grade Corporate Bond (7.2), and UST even meets the requirement for “AA” Investment Grade Corporate Bond (9.2), thus the rating of the bond is well supported by the ratio.What if UST’s debt is rated ‘BBB’?Answer:If the bond is rated to “BBB”, the interest rate for the bond will be 7.82%, with annual interest payment of 78,200,000.The new interest coverage ratio is:792,010,000/78,200,000 = 10.1What is you assessment of UST’s risk of experience financial distress?Answer:It is unlikely for UST to experience financial distress due to strong cash flow that generated by the operation. From the above calculation, we can see that even with lower the investment grade; it has little effect on UST’s credit rating What are the market value of equity and the share price at the end of 1998?Answer:The market value of equity is $6,470.8 million and the share price at the end of the year is$34.88 (Exhibit 5)Further in this assignment we assume that the market price of the shares will remain at $34.88. How much is the present value of the debt tax shield?Answer:PV (interest tax shield) = $1,000million * 0.38 = $380millionHow will the market value of equity and the share price change when UST makes the announcement?Answer:VL = $6,470.8 + $380= $6,850.8 (increase)E= $6,850.8 – $1,000 = $5,850.8 (decrease)When the UST makes the announcement, the market value of equity will decrease, but the total firm value increases (due to tax interest shield).How many shares will be bought back?Answer:The UST Inc are able to buy back ($1,000 million / $34.88) =286,697 million shares to a market price of $34.88 each. In total, stockholders has ($6,470.8 / $34.88) million = 185.5160 million shares before the repurchase of shares. After the repurchase, the stockholders have (185.5160 – 28.6697) million= 156.8463 million shares outstanding. The new price of the share will increase to (5,850.8 / 156.8463) = $37.3All over, the shareholders who kept their shares will benefit from a capital gain of ($37.3 new price – $34.88 old price) = $2.42 per share. This adds up to a total gain of ($2.42 * 156. 8463million) = $380 million which equals the interest tax shield. What is the present value of the tax shield with personal taxations?Answer:To calculate the tax shield with personal taxations we have to calculate the ‘Effective TaxAdvantage on Debt’. We can do this by : Where tc = corporate tax, te = tax on dividens, ti = tax on interest income1- ( (1-0.38)(1-0.15)/(10.4) ) = 0.1217 This means that from every 1 $ gain to the shareholders, effectively they only gain (10.1217) = $0.87VL = $6,470.8 + (12.17 % * $1,000) = $6,592.5 million$6,592.5 / 185.5160 = $35.54 per share before repurchase $35.54 - $34.88 = $0.66 increase per share$0.66 * 156.8463 = $103.5 million in interest tax shield with personal taxation. Conclusion: We can conclude that this transaction is a win-win situation as the interest tax shield amounts to 103.5 million and because the share repurchases increases earnings per share and tends to elevate the market value of the remaining shares. In addition, the fact that UST will benefit from this debt-to-equity recapitalization is supported by UST’s high interest coverage ratio and the low risk of experiencing financial distress.In addition, UST shouldn’t worry so much about the risks that would come in gaining more debt for the reason that the company seems to face little risk of bankruptcy. While itwas noted that the company is facing a lot of competition, and that people fear it is underperforming, UST should still be able to take advantage and benefit greatly from thisnew debt structure. One must not forget that UST is still a market leader, able to control the largest share and use brand recognition. What’s more, despite the rise of competition, UST maintains its edge especially given therestrictions for advertising tobacco. The conditions of the UST’s industry also prove that there will be economical stability, at least in the foreseeable future. Given the increasing popularity of smokeless tobacco, as well as the fewer cases that smokeless tobacco companies receive compared to regular ones, (as mentioned) UST shows an optimistic future in its performance. All of these instances prove that there shouldn’t be much worry about the riskiness of the firm. With this, the firm, when using taxes, will only be able to improve its profits even more through tax shields, and the investors themselves can also receive similar benefits