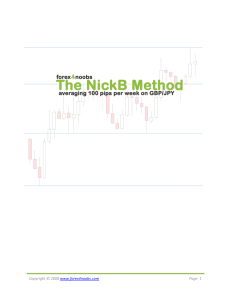

© copyright 2016 no reproduction or resale rights are granted Introduction You may be wondering who am I? And why should you listen to what I have to teach you? Well those are good questions, and I tell everyone that is new to forex to ask for a myfxbook portfolio link for any person that is trying to sell you something or teach you something in forex. So here is my link where you can view my trading stats for the past few months. http://bit.ly/NakedStrategy In the early 1990's a customer that visited my shop regularly started discussing what he did for a living. He traded forex, by phone. I was fascinated. Fast forward 25 years, and I decided to revisit this fascination, by computer! I cannot imagine forex trading by phone, without the internet, but exchanging forex has been around since man created currency. I've been trading for over a year and a half. I've lost 2 accounts in the amount of $1500, which is considered a right of passage in the trading world. I've tried a zillion different strategies and indicators, knowing that if I kept at it, I would find something consistently profitable. THIS IS IT! So I'm sharing it with you, so you can have success too. Enjoy. Practice. Modify to your liking. I recommend everyone try a new strategy on a 1-3k demo account until you can double that account. Then you know you are ready to go live! Personal Invitation: as promised, you are welcome to join my facebook group with over 1200 members. I do not tolerate spam and require anyone offering advice, mentorship, or selling a system to post there myfxbook link so I can verify their claims to success! The Strategy Ready to dedicate your midnight hour to Forex trading? This strategy can be your winner. Currency pairs: GBP/USD, GBP/JPY, GBP/CAD, GBP/CHF, GBP/AUD, GBP/NZD, USD/MXN (note:USDMXN has high spread but cheaper per pip and averages over 2,000 pip per day movement) Time frame: Daily Indicators: None Trading Theory: This system is based on the fact that most of the time you won't find same size candles for 2 consecutive days on a daily chart. What does this mean for us – only one thing: the price is moving steady either up or down with almost no price "noise" which is always present on smaller time frames. ENTRY: At 00:00 (your brokers time)according to the time set on your trading platform, with newly formed daily candle, find highest and lowest price of the day for the previous daily bar. The MT4 tool circled in pink here will show you the hi/lo for the candles as you mouse over them. If the price bar (including wicks) is less than 90 pips long we will not open new trades for this currency pair. If the previous day bar turns out to be an Inside bar, be cautious about entries the following day. While an Inside bar candle implies a good breakout opportunity the following day, it can also be a dual whipsaw breakout - a break in both directions - the most unwanted scenario for our trading system. If we've chosen to trade the next day, set a Buy Stop order at the top of the previous day candle at the highest price +5 pips, and Sell stop order at the bottom/lowest price -5 pips. Stop Losses: Candles size 100-150 pips: Put your stop loss order for a Long entry at the lowest price of the previous day. Put your stop for the Short order at the top of the highest price of the previous day. Candles size 151+ pips: Put your stop loss order at the middle of the candle for shorts and longs. These settings for entries and stops can be adjusted once you learn the behavior of a chosen currency pair over time. Exiting the Trades: When one of the orders is filled – stay in the trade for the whole day. At midnight with the new daily candle open, adjust your orders and stops according with the previous daily candle following the same routine; keep trading position open until you get +100 pips, then you may close current position to reward yourself. Rewarding is a very powerful tool, use it. You can also handle losses by checking the trade 12-14 hours into it, and closing trades that are in the negative. An alternative money management approach would be to enter with two trading positions, where the first one will be closed once we are +100 pips in profit, while the second one will be left to run, adjusting your stop to capture profits, until we get stopped out. This allows us to collect everything the market is willing to offer. Close you current open positions (with either profit or loss) if a daily candle becomes a Doji candle or is almost a Doji. What we mean by "almost" is that for the true Doji you need open price = close price, while "almost Doji" can have some distance between open and close (but no more than 10 pips). Also close your open trades if you've met a Shooting Star candlestick in an uptrend or a Hammer candlestick in a downtrend. Below is an example (no screen shot) to illustrate how we navigate in time: On May 1st at 00:05am broker time, we opened a daily chart and it was a downtrend. We set our orders (both Buy and Sell) according to the previous candle (April 30th). The same day our Sell order gets filled. The day has passed and the price made some further progress down. At 00:05am, May 2nd with a new daily candle appearing we change our stop loss for a current Short position according to the high of the previous bar (from May 1st), from that point we can either continue to stay in the trade or lock in profits. Also we reset our Buy order which is now going to be just above the highest high of the May 2nd candle. This system also gives an opportunity to be constantly in a trade and at the same time it requires very little observation and takes only 5 to 10 minutes a day to set all positions and forget about Forex till the next day! You will see losing trades with this system from time to time – it is a part of any trading, but the overall result will be very positive. Let’s look at a screen shot now and examine our trading in greater details: Next is a detailed candle-by-candle explanation of the trading on the chart above. Starting with the circled candle, #1, (high – low = over 90 pips) which allows entries the next day. We set entry orders.(buy stops and sell stops above and below candle with wick included) Candle #2 – the price triggered a sell and at the end of the day we had 11 pips profit. We leave the order open. Candle #3 – the market changes to bullish and our open trade gets stopped out. But our Buy Stop gets triggered and a day later, at candle close, we are up 71 pips. We leave the trade open and adjust our SL to the bottom of Candle #3 Candle #4 – We are up an additional 104 pips, for a total of 175 pips. We close out the trade, taking our profits. And set up trades for next day. You can also choose a profit target for the day, which becomes easier when you know a daily range average for a particular currency pair. For example: average daily pip range (aka-volatility) source:http://www.investing.com/tools/forex-volatilitycalculator GBP/USD GBP/AUD GBP/CAD GBPCHF GBPJPY GBPNZD 159.50 257.30 235.66 176.44 243.02 303.48 Taking about a half of the daily volatility can determine your daily profit targets. Candle #5 – once again our buy stop is triggered and we are up 77 pips in profit. We keep it open. Candle #6 – closes as an almost doji,with only an additional 11 pips. At this point we can move our SL tighter or close the trade since it's a doji. For this example we keep it open, as we have yet to get our 100 pips. Candle #7 – closes with an additional 140 pips added to our 88 pip position, for a total of 228 pips profit. We close the position and take our money to the bank Candle #8 – our new Buy Stop triggers, but it closes at a loss. We are negative 115 pips. We close the trade for a loss. We don't place a new trade, as this is a shooting star candle. Candle #9 – is over 90 pips, and is not a doji, hammer or shooting star, so when it closes, we set up our new trades Candle #10 – triggers our Sell Stop, but then it closes high for a loss of -115 pips. We close the trade at a loss. Candle #11 – no trading, since candle #10 is a hammer, but if we had traded it, the day would have ended with a 111 pip profit. As you can see if you had this strategy applied to multiple GBP pairs, you would be making a huge number of pips per day. Yes, you will have losses, too, but every trading system has losses. The advantages of this strategy is the simplicity, and that you don't have to stare at charts all day. Simply set it and forget it until 12-24 hours later. Note: personally, if my trade is negative 12-14 hours later, I close it out, as usually that means it will stay negative and keep going that direction. So I cut my losses sooner. However, it is imperative that you let your winners run until you have at least 100 pips. Cutting losses quick and letting winners run is a great trading mindset. One that will profit you. If you'd like to join my group and discuss this strategy, you may do so here: Http://facebook.com/groups/20PipsaDay Happy Trading! BONUS: If you don't feel comfortable setting up a trade and sleeping on it, you may like trading the GBP pairs and USD/MXN during US market hours. I have recently added this strategy to my list of 'go to' strats. You can view it here. I am not the seller of this strategy. http://www.simple4xsystem.net/winter2016.html Required Disclaimer: High Risk Investment Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.