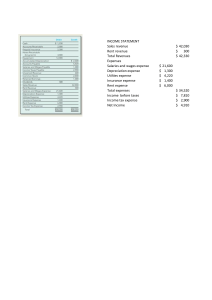

Chapter 01 - Financial Statements and Business Decisions Chapter 01 Financial Statements and Business Decisions ANSWERS TO QUESTIONS 1. Accounting is a system that collects and processes (analyzes, measures, and records) financial information about an organization and reports that information to decision makers. 2. Financial accounting involves preparation of the four basic financial statements and related disclosures for external decision makers. Managerial accounting involves the preparation of detailed plans, budgets, forecasts, and performance reports for internal decision makers. 3. Financial reports are used by both internal and external groups and individuals. The internal groups are comprised of the various managers of the entity. The external groups include the owners, investors, creditors, governmental agencies, other interested parties, and the public at large. 4. Investors purchase all or part of a business and hope to gain by receiving part of what the company earns and/or selling the company in the future at a higher price than they paid. Creditors lend money to a company for a specific length of time and hope to gain by charging interest on the loan. 5. In a society each organization can be defined as a separate accounting entity. An accounting entity is the organization for which financial data are to be collected. Typical accounting entities are a business, a church, a governmental unit, a university and other nonprofit organizations such as a hospital and a welfare organization. A business typically is defined and treated as a separate entity because the owners, creditors, investors, and other interested parties need to evaluate its performance and its potential separately from other entities and from its owners. 6. Name of Statement (a) Income Statement (b) Balance Sheet (c) Audit Report Alternative Title (a) Statement of Earnings; Statement of Income; Statement of Operations (b) Statement of Financial Position (c) Report of Independent Accountants 1-1 Chapter 01 - Financial Statements and Business Decisions 7. The heading of each of the four required financial statements should include the following: (a) Name of the entity (b) Name of the statement (c) Date of the statement, or the period of time (d) Unit of measure 8. (a) (b) (c) (d) The purpose of the income statement is to present information about the revenues, expenses, and the net income of the entity for a specified period of time. The purpose of the balance sheet is to report the financial position of an entity at a given date, that is, to report information about the assets, obligations and stockholders’ equity of the entity as of a specific date. The purpose of the statement of cash flows is to present information about the flow of cash into the entity (sources), the flow of cash out of the entity (uses), and the net increase or decrease in cash during the period. The statement of retained earnings reports the way that net income and distribution of dividends affected the retained earnings of the company during the accounting period. 9. The income statement and the statement of cash flows are dated “For the Year Ended December 31, 2010,” because they report the inflows and outflows of resources during a period of time. In contrast, the balance sheet is dated “At December 31, 2010,” because it represents the resources, obligations and stockholders’ equity at a specific date. 10. Assets are important to creditors and investors because assets provide a basis for judging whether sufficient resources are available to operate the company. Assets are also important because they could be sold for cash in the event the company goes out of business. Liabilities are important to creditors and investors because the company must be able to generate sufficient cash from operations or further borrowing to meet the payments required by debt agreements. If a business does not pay its creditors, the law may give the creditors the right to force the sale of assets sufficient to meet their claims. 11. Net income is the excess of total revenues over total expenses. Net loss is the excess of total expenses over total revenues. 12. The equation for the income statement is Revenues - Expenses = Net Income (or Net Loss if the amount is negative). Thus, the three major items reported on the income statement are (1) revenues, (2) expenses, and (3) net income. 1-2 Chapter 01 - Financial Statements and Business Decisions 13. The equation for the balance sheet (also known as the basic accounting equation) is: Assets = Liabilities + Stockholders’ Equity. Assets are the probable (expected) future economic benefits owned by the entity as a result of past transactions. They are the resources owned by the business at a given point in time such as cash, receivables, inventory, machinery, buildings, land, and patents. Liabilities are probable (expected) debts or obligations of the entity as a result of past transactions which will be paid with assets or services in the future. They are the obligations of the entity such as accounts payable, notes payable, and bonds payable. Stockholders’ equity is financing provided by owners of the business and operations. It is the claim of the owners to the assets of the business after the creditor claims have been satisfied. It may be thought of as the residual interest because it represents assets minus liabilities. 14. The equation for the statement of cash flows is: Cash flows from operating activities + Cash flows from investing activities + Cash flows from financing activities = Change in cash for the period. The net cash flows for the period represent the increase or decrease in cash that occurred during the period. Cash flows from operating activities are cash flows directly related to earning income (normal business activity including interest paid and income taxes paid). Cash flows from investing activities include cash flows that are related to the acquisition or sale of productive assets used by the company. Cash flows from financing activities are directly related to the financing of the enterprise itself. 15. The equation for the statement of retained earnings is: Beginning Retained Earnings + Net Income - Dividends = Ending Retained Earnings. It begins with beginning-of-the-year Retained Earnings which is the prior year’s ending retained earnings reported on the balance sheet. The current year's Net Income reported on the income statement is added and the current year's Dividends are subtracted from this amount. The ending Retained Earnings amount is reported on the end-ofperiod balance sheet. 16. Marketing managers and credit managers use customers' financial statements to decide whether to extend them credit for their purchases. Purchasing managers use potential suppliers' financial statements to judge whether the suppliers have the resources necessary to meet current and future demand. Human resource managers use financial statements as a basis for contract negotiations, to determine what pay rates the company can afford. The net income figure even serves as a basis to pay bonuses not only to management, but to other employees through profit sharing plans. 17. The Securities and Exchange Commission (SEC) is the U.S. government agency which determines the financial statements that public companies must provide to stockholders and the measurement rules used in producing those statements. The Financial Accounting Standards Board (FASB) is the private sector body given the primary responsibility to work out the detailed rules which become generally accepted accounting principles. 1-3 Chapter 01 - Financial Statements and Business Decisions 18. Management is responsible for preparing the financial statements and other information contained in the annual report and for the maintenance of a system of internal accounting policies, procedures and controls. These measures are intended to provide reasonable assurance, at appropriate cost, that transactions are processed in accordance with company authorization as well as properly recorded and reported in the financial statements, and that assets are adequately safeguarded. Independent auditors examine the financial reports (prepared by management) and the underlying records to assure that the reports represent what they claim and conform with generally accepted accounting principles (GAAP). 19. A sole proprietorship is an unincorporated business owned by one individual. A partnership is an unincorporated association of two or more individuals to carry on a business. A corporation is a business that is organized under the laws of a particular state whereby a charter is granted and the entity is authorized to issue shares of stock as evidence of ownership by the owners (i.e., stockholders). 20. A CPA firm normally renders three services: auditing, management advisory services, and tax services. Auditing involves examination of the records and financial reports to determine whether they “fairly present” the financial position and results of operations of the entity. Management advisory services involve management advice to the individual business enterprises and other entities. It is like a consulting firm. Tax services involve providing tax planning advice to clients (both individuals and businesses) and preparation of their tax returns. 1-4 Chapter 01 - Financial Statements and Business Decisions ANSWERS TO MULTIPLE CHOICE 1. b) 6. d) 2. d) 7. a) 3. d) 8. a) 1-5 4. c) 9. c) 5. a) 10. b) Chapter 01 - Financial Statements and Business Decisions Authors' Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 5 3 5 Exercises No. Time 1 12 2 12 3 12 4 20 5 25 6 20 7 15 8 25 9 25 10 25 11 30 12 15 13 12 14 30 Problems No. Time 1 45 2 45 3 45 4 45 Alternate Problems No. Time 1 45 2 45 3 45 Cases and Projects No. Time 1 20 2 30 3 30 4 60 5 30 6 20 7 * * Due to the nature of these cases and projects, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 1-6 Chapter 01 - Financial Statements and Business Decisions MINI-EXERCISES M1–1. B D A C* B D A D (1) (2) (3) (4) (5) (6) (7) (8) Element Expenses Cash flow from investing activities Assets Dividends Revenues Cash flow from operating activities Liabilities Cash flow from financing activities A. B. C. D. Financial Statement Balance sheet Income statement Statement of retained earnings Statement of cash flows *Dividends paid in cash are also subtracted in the Financing section of the Statement of Cash Flows M1–2. SE A R A E A E L A (1) Retained earnings (2) Accounts receivable (3) Sales revenue (4) Property, plant, and equipment (5) Cost of goods sold expense (6) Inventories (7) Interest expense (8) Accounts payable (9) Land M1–3. (1) (2) (3) (4) (5) Abbreviation CPA GAAP AICPA SEC FASB Full Designation Certified Public Accountant Generally Accepted Accounting Principles American Institute of Certified Public Accountants Securities and Exchange Commission Financial Accounting Standards Board 1-7 Chapter 01 - Financial Statements and Business Decisions EXERCISES E1–1. K G I E A D J F C L H B N M Term or Abbreviation (1) SEC (2) Audit (3) Sole proprietorship (4) Corporation (5) Accounting (6) Accounting entity (7) Audit report (8) Cost principle (9) Partnership (10) FASB (11) CPA (12) Unit of measure (13) GAAP (14) Publicly traded Definition A. A system that collects and processes financial information about an organization and reports that information to decision makers. B. Measurement of information about an entity in the monetary unit–dollars or other national currency. C. An unincorporated business owned by two or more persons. D. The organization for which financial data are to be collected (separate and distinct from its owners). E. An incorporated entity that issues shares of stock as evidence of ownership. F. Initial recording of financial statement elements at acquisition cost. G. An examination of the financial reports to ensure that they represent what they claim and conform with generally accepted accounting principles. H. Certified Public Accountant. I. An unincorporated business owned by one person. J. A report that describes the auditor’s opinion of the fairness of the financial statement presentations and the evidence gathered to support that opinion. K. Securities and Exchange Commission. L. Financial Accounting Standards Board. M. A company with stock that can be bought and sold by investors on established stock exchanges. N. Generally accepted accounting principles. 1-8 Chapter 01 - Financial Statements and Business Decisions E1–2. A A R L L SE E E E L A A L A E (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) Accounts receivable Cash and cash equivalents Net sales Notes payable Taxes payable Retained earnings Cost of products sold Marketing, administrative, and other operating expenses Income taxes Accounts payable Land Property, plant, and equipment Long-term debt Inventories Interest expense E1–3. L E L L SE A A E E (1) Notes payable to banks (2) General and administrative (3) Accounts payable (4) Dividends payable (5) Retained earnings (6) Cash and cash equivalents (7) Accounts receivable (8) Provision for income taxes* (9) Cost of goods sold A R A E A A L E A (10) Machinery and equipment (11) Net sales (12) Inventories (13) Marketing, selling, and advertising (14) Buildings (15) Land (16) Income taxes payable (17) Distribution and warehousing costs (18) Investments (in other companies) *Note that “Provision for income taxes” is a common synonym for “Income tax expense.” 1-9 Chapter 01 - Financial Statements and Business Decisions E1–4. Honda Motor Corporation Balance Sheet as of March 31, 2009 (in billions of Yen) Assets Cash and cash equivalents Trade accounts, notes, and other receivables Inventories Investments Net property, plant and equipment Other assets Total assets Liabilities Accounts payable and other current liabilities Long-term debt Other liabilities Total liabilities Stockholders’ Equity Contributed capital Retained earnings Total stockholders’ equity Total liabilities and stockholders’ equity 1-10 ¥ 690 854 1,244 639 2,148 6,244 ¥11,819 ¥ 4,237 1,933 1,519 7,689 259 3,871 4,130 ¥11,819 Chapter 01 - Financial Statements and Business Decisions E1–5. Req. 1 NEW WORLD BOOK STORE Balance Sheet At December 31, 2011 ASSETS Cash Accounts receivable Store and office equipment LIABILITIES $68,350 39,000 72,000 Accounts payable Note payable Interest payable Total liabilities $12,000 3,000 120 15,120 STOCKHOLDERS’ EQUITY Total assets $179,350 Contributed capital Retained earnings Total stockholders’ equity Total liabilities and stockholders' equity 140,000 24,230 164,230 $179,350 Req. 2 Net income for the year was $24,230. This is the first year of operations and no dividends were declared or paid to stockholders; therefore, the ending retained earnings of $24,230 represents income for one year. E1–6. COLLEGE CONNECTION Income Statement For the Month of January 2011 Revenues: Sales: Cash On credit Total sales revenue Expenses: Cost of goods sold Salaries, rent, supplies, and other expenses (paid in cash) Utilities Total expenses Net Income $110,000 3,000 $113,000 50,000 37,000 900 87,900 $25,100 1-11 Chapter 01 - Financial Statements and Business Decisions E1–7. WALGREEN CO. Income Statement For the Quarter ended May 31, 2009 (in millions) Revenues: Net sales Total revenues Expenses: Cost of sales Selling, occupancy and administration expense Interest Expense Total expenses Pretax income Income tax expense Net earnings $16,210 $16,210 11,751 3,613 25 15,389 821 299 $ 522 *Note that “Provision for income taxes” is a common synonym for “Income tax expense.” E1–8. NEIGHBORHOOD REALTY, INCORPORATED Income Statement For the Year Ended December 31, 2012 Revenues: Commissions earned ($150,900+$16,800) Rental service fees Total revenues Expenses: Salaries expense Commission expense Payroll tax expense Rent expense ($2,475+$225)* Utilities expense Promotion and advertising expense Miscellaneous expenses Total expenses (excluding income taxes) Pretax income Income tax expense Net Income $167,700 20,000 $187,700 62,740 35,330 2,500 2,700 1,600 7,750 500 113,120 74,580 24,400 $50,180 *$2,475 has been paid for 11 months ($225 per month) plus $225 owed for December. 1-12 Chapter 01 - Financial Statements and Business Decisions E1–9. Net Income (or Loss) = Revenues - Expenses Assets = Liabilities + Stockholders’ Equity A Net Income = $91,700 - $76,940 = $14,760; Stockholders’ Equity = $140,200 - $69,000 = $71,200. B Total Revenues = $74,240 + $14,740 = $88,980; Total Liabilities = $107,880 - $79,010 = $28,870. C Net Loss = $69,260 - $76,430 = ($7,170); Stockholders’ Equity = $97,850 - $69,850 = $28,000. D Total Expenses = $58,680 - $21,770 = $36,910; Total Assets = $17,890 + $78,680 = $96,570. E Net Income = $84,840 - $78,720 = $6,120; Total Assets = $25,520 + $79,580 = $105,100. E1–10. Net Income (or Loss) = Revenues - Expenses Assets = Liabilities + Stockholders’ Equity A Net Income = $231,820 - $196,700 = $35,120; Stockholders’ Equity = $294,300 - $75,000 = $219,300. B Total Revenues = $175,780 + $29,920 = $205,700; Total Liabilities = $590,000 - $348,400 = $241,600. C Net Loss = $72,990 - $91,890 = ($18,900); Stockholders’ Equity = $258,200 - $190,760 = $67,440. D Total Expenses = $36,590 - $9,840 = $26,750; Total Assets = $189,675 + $97,525 = $287,200. E Net Income = $224,130 - $210,630= $13,500; Total Assets = $173,850 + $361,240 = $535,090. 1-13 Chapter 01 - Financial Statements and Business Decisions E1–11. PAINTER CORPORATION Income Statement For the Month of January 2011 Total revenues Less: Total expenses (excluding income tax) Pretax income Less: Income tax expense Net income $299,000 189,000 110,000 34,500 $ 75,500 PAINTER CORPORATION Balance Sheet At January 31, 2011 Assets Cash Receivables from customers Merchandise inventory Total assets $ 65,150 34,500 96,600 $196,250 Liabilities Payables to suppliers Income taxes payable Total liabilities Stockholders' Equity Contributed capital (2,600 shares) Retained earnings (from income statement above) Total stockholders’ equity Total liabilities and stockholders' equity 1-14 $26,450 34,500 60,950 59,800 75,500 135,300 $196,250 Chapter 01 - Financial Statements and Business Decisions E1–12. CLINT’S STONEWORK CORPORATION Statement of Retained Earnings For the Year Ended December 31, 2012 Beginning retained earnings* Net income Dividends Ending retained earnings $16,800 42,000 18,700 $40,100 * Beginning retained earnings + Net income – Dividends = Ending retained earnings For 2011: $0 + 31,000 – 14,200 = $16,800; Ending retained earnings for 2011 becomes beginning retained earnings for 2012 E1–13. (I) O (F) (O) (O) (O) I (F) (1) (2) (3) (4) (5) (6) (7) (8) Purchases of property, plant, and equipment Cash received from customers Cash paid for dividends to stockholders Cash paid to suppliers Income taxes paid Cash paid to employees Cash proceeds received from sale of investment in another company Repayment of borrowings 1-15 Chapter 01 - Financial Statements and Business Decisions E1–14. LAH MANUFACTURING CORPORATION Statement of Cash Flows For the Year Ended December 31, 2011 Cash flow from operating activities Cash collections from sales $270,000 Cash paid for operating expenses (175,000) Net cash flow from operating activities $95,000 Cash flow from investing activities Sale of land 25,000 Purchase of new machines (48,000) Net cash flow from investing activities (23,000) Cash flow from financing activities Sale of capital stock 30,000 Payment on long-term notes (80,000) Payment of cash dividends (18,000) Net cash flow from financing activities (68,000) Net increase in cash 4,000 Cash at beginning of year 63,000 Cash at end of year $ 67,000 1-16 Chapter 01 - Financial Statements and Business Decisions PROBLEMS (Note to the instructor: Most students find the Problems in this chapter to be quite challenging.) P1–1. Req. 1 GASLIGHT COMPANY Income Statement For the Year Ended December 31, 2011 Total sales revenue (given) Total expenses (given) Pretax income Income tax expense ($45,800 x 30%) Net income $126,000 80,200 45,800 13,740 $ 32,060 Req. 2 GASLIGHT COMPANY Statement of Retained Earnings For the Year Ended December 31, 2011 Beginning retained earnings +Net income (from req. 1) –Dividends (given) Ending retained earnings $ 0 32,060 10,000 $ 22,060 Req. 3 GASLIGHT COMPANY Balance Sheet At December 31, 2011 Assets Cash (given) Receivables from customers (given) Inventory of merchandise (given) Equipment (given) Total assets Liabilities Accounts payable (given) Salary payable (given) Total liabilities Stockholders' Equity Contributed capital (given) Retained earnings (from req. 2) Total stockholders' equity Total liabilities and stockholders' equity $24,500 10,800 81,000 40,700 $157,000 $46,140 1,800 $ 47,940 $87,000 22,060 109,060 $157,000 1-17 Chapter 01 - Financial Statements and Business Decisions P1–2. Req. 1 BRIDGET'S LAWN SERVICE Income Statement For the Three Months Ended August 31, 2011 Revenues Lawn service–cash –credit Total revenues Expenses Gas, oil, and lubrication ($940+$180) Pickup repairs Repair of mowers Miscellaneous supplies used Helpers (wages) Payroll taxes Preparation of payroll tax forms Insurance Telephone Interest expense on note paid Equipment use cost (depreciation) Total expenses Net income $12,300 700 $13,000 1,120 250 110 80 5,400 190 25 125 110 65 600 8,075 $ 4,925 Req. 2 Because the above report reflects only revenues, expenses, and net income, it is reasonable to suppose that Bridget would need the following: (1) (2) (3) A balance sheet–that is, a statement that reports for the business, at the end of August 2011, each asset (name and amount, such as Cash, $XX), each liability (such as Wages Payable, $XX), and stockholders’ equity. A statement of retained earnings that shows how income and dividends (if any) affect retained earnings on the balance sheet. A statement of cash flows–that is, a statement of the inflows and outflows of cash during the period in three categories: operating, investing, and financing. 1-18 Chapter 01 - Financial Statements and Business Decisions P1–3. Req. 1 Transaction Income (a) +$66,000 Req. 2–Explanation Cash +$55,000 (b) –0– +45,000 (c) –0– –9,500 All services performed increase income; cash received during the period was, $66,000 – 11,000 = $55,000. Cash borrowed is not income. Purchase of the truck does not represent an expense until it is used (it is an asset); cash outflow was $9,500. (d) –21,000 –10,500 (e) –2,900 –3,800 Not all of the supplies were used; expense is the amount used, $3,800 – 900 = $2,900. Cash paid during the quarter was $3,800. (f) –39,000 –32,500 All expenses incurred reduce income; cash expended was, $39,000 – 6,500 = $32,500. All of the wages incurred reduce income, $21,000; cash paid during the quarter was, $21,000 x 1/2 = $10,500. The $10,500 owed will be paid on the next payroll date. Based only on the above: Income (loss) $3,100 Cash inflow (outflow) $ 43,700 1-19 Chapter 01 - Financial Statements and Business Decisions P1–4. Req. 1 The personal residences of the organizers are not resources of the business entity. Therefore, they should be excluded. Req. 2 It is not indicated whether the $57,000 listed for service trucks and equipment is their cost when acquired or the current market value on December 31, 2011. Req. 3 The list of company resources (i.e., assets) suggests the following areas of concern: Company resources: (1) Cash, inventories, and bills due from customers (i.e., accounts receivable)–these items tend to fluctuate; they may be significantly more or less at date of the loan and during the term of the loan. (2) Service trucks and equipment–as noted above, it is not indicated whether the $57,000 is cost when acquired or current market value on December 31, 2011. (3) Personal residences–as noted above, these items are not resources of the business entity and should be excluded. Company obligations: (4) Unpaid wages of $19,000, which are now due, pose a serious problem because only $12,000 cash currently is available. (5) Unpaid taxes and accounts payable to suppliers–it is not clear when these payments of $8,000 and $10,000, respectively, are due (cash needed to pay them is a problem). (6) The $45,000 owed on the service trucks probably is long term; however, shortterm installments may be required–these details are very important to the bank. (7) Loan from organizer–the expected payment date and interest rate are important issues for which details are not provided. This is a major cash demand. In general, the bank should request more details about the specific resources and debts. The personal residences are not a part of the resources of the business entity. The bank should request that the owners provide audited information about the entity's assets and debts. 1-20 Chapter 01 - Financial Statements and Business Decisions P1–4. (continued) Req. 4 The amount of stockholders’ equity (i.e., assets minus liabilities) for Northwest Company, assuming the amounts provided by the owners are acceptable, would be: Assets ($311,000–$190,000) Liabilities Stockholders’ equity $121,000 92,000 $29,000 1-21 Chapter 01 - Financial Statements and Business Decisions ALTERNATE PROBLEMS AP1–1. Req. 1 INFLUENCE CORPORATION Income Statement For the Year Ended June 30, 2011 Total sales revenue (given) Total expenses (given) Pretax income Income tax expense ($31,500 x 30%) Net income $100,000 68,500 31,500 9,450 $22,050 Req. 2 INFLUENCE CORPORATION Statement of Retained Earnings For the Year Ended June 30, 2011 Beginning retained earnings +Net income (from req. 1) –Dividends (given) Ending retained earnings $ 0 22,050 0 $ 22,050 Req. 3 INFLUENCE CORPORATION Balance Sheet At June 30, 2011 Assets Cash (given) Receivables from customers (given) Inventory of merchandise (given) Equipment (given) Total assets Liabilities Accounts payable (given) Salary payable (given) Total liabilities Stockholders' Equity Contributed capital (given) Retained earnings (from req. 2) Total stockholders' equity Total liabilities and stockholders' equity $13,150 10,900 27,000 66,000 $117,050 $31,500 1,500 $ 33,000 $62,000 22,050 84,050 $117,050 1-22 Chapter 01 - Financial Statements and Business Decisions AP1–2. Req. 1 LIST ELECTRIC REPAIR COMPANY, INC. Income Statement For the Three Months Ended December 31, 2011 Revenues: Electric repair services–cash –credit Total revenues Expenses: Electrician's assistant (wages) Payroll taxes Supplies used on jobs Oil, gas, and maintenance on truck Insurance Rent ($500+$250) Utilities and telephone Miscellaneous expenses Depreciation of truck and tools (use) Total expenses Pretax Income Income taxes Net Income $32,000 3,500 $35,500 7,500 175 9,500 1,200 700 750 825 600 1,200 22,450 13,050 3,930 $ 9,120 Req. 2 Because the above report reflects only revenues, expenses, and net income, it is reasonable to suppose that Sam would have need for the following: (1) (2) (3) A statement that reports for the business, at the end of 2011, each asset (name and amount such as Cash, $XX), and each liability (such as Income taxes payable, $XX), and stockholders' equity; that is, a balance sheet. A statement of the sources and uses of cash during the period; that is, a statement of cash flows. A statement of retained earnings that shows how net income and dividends affect retained earnings on the balance sheet. 1-23 Chapter 01 - Financial Statements and Business Decisions AP1–3. Req. 1 Transaction Income Cash (a) +$85,000 +$70,000 (b) –0– +25,000 (c) –0– –8,000 (d) –36,000 –30,000 (e) –3,000 –4,000 (f) –31,000 –15,500 Req. 2–Explanation All services performed increase income; cash received during the period was, $85,000 – 15,000 = $70,000. Cash borrowed is not income. Purchase of the truck does not represent an expense until it is used (it is an asset); cash outflow was $8,000. All of the wages incurred reduce income, $36,000; cash paid during the quarter was, $36,000 x 5/6 = $30,000. The $6,000 owed will be paid on the next payroll date. Not all of the supplies were used; expense is the amount used, $4,000 – 1,000 = $3,000. Cash paid during the quarter was $4,000. All expenses incurred reduce income; cash expended was, $31,000 – 15,500 = $15,500. Based only on the above: Income (loss) $15,000 Cash inflow (outflow) $ 37,500 1-24 Chapter 01 - Financial Statements and Business Decisions CASES AND PROJECTS ANNUAL REPORT CASES CP1–1. 1. It sells its own brand of high quality, on-trend clothing, accessories, and personal care products targeting 15 to 25 year-old customers. 2. The company’s most recent fiscal year ended on January 31, 2009. 3. a. Balance Sheets–2 years b. Income Statements–3 years c. Cash Flow Statements–3 years 4. Yes, it is audited by independent CPAs, as indicated by the ”Report of Independent Registered Public Accounting Firm” on page 68 of the annual report. 5. Its total assets increased from $1,867,680,000 to $1,963,676,000. The instructor should note that the reported numbers are in thousands. 6. As of January 31, 2009, the company had $294,928,000 in inventory. 7. Assets = Liabilities* $1,963,676,000 = $554,645,000 + Stockholders’ Equity + $1,409,031,000 *Liabilities are determined by either adding current ($401,763,000) and long term liabilities ($152,882,000) or by solving the accounting equation: Assets ($1,963,676,000) = Liabilities + Stockholders’ Equity ($1,409,031,000) 1-25 Chapter 01 - Financial Statements and Business Decisions CP1–2. 1. Net income was $199,364 thousand or $199,364,000 for the year ended January 31, 2009. This is disclosed on the income statement. The instructor should note that the reported numbers are in thousands. Some students will erroneously report income as $199,364. Students should also be warned that different companies often use different terminology—some companies may use the term “net earnings” to describe net income. 2. Net sales were $1,834,618,000. This is also disclosed on the income statement. 3. Inventory is $169,698,000. This is disclosed on the balance sheet. 4. Cash and cash equivalents increased by $210,764,000 during the year. This amount can be computed from the balance sheet or it can be found on the statement of cash flows. 5. The auditor is Deloitte & Touche LLP. This is found on the auditor’s report (in this case, called the “report of independent registered public accounting firm”). CP1–3. 1. American Eagle Outfitters had total assets of $1,963,676,000 at the end of the most recent year, whereas Urban Outfitters had total assets of $1,329,009,000. Clearly American Eagle Outfitters is the larger of the two companies in terms of total assets at the end of the most recent year. 2. Urban Outfitters had net sales of $1,834,618,000 in the most recent year, while American Eagle Outfitters had greater net sales in the amount of $2,988,866,000. Again, American Eagle Outfitters is the larger of the two companies in terms of net sales. 3. In the most recent year, Urban Outfitters had growth in total assets of ($1,329,009,000 - $1,142,791,000)/($1,142,791,000) = 16.3%, while American Eagle Outfitters had lower growth in total assets of ($1,963,676,000 $1,867,680,000)/($1,867,680,000) = 5.1%. Similarly, Urban Outfitters had growth in net sales of ($1,834,618,000 $1,507,724,000)/($1,507,724,000) = 21.7%, while American Eagle Outfitters had negative growth in net sales of ($2,988,866,000 - $3,055,419,000)/($3,055,419,000) = -2.2%. By both measures, Urban Outfitters is growing faster. 1-26 Chapter 01 - Financial Statements and Business Decisions FINANCIAL REPORTING AND ANALYSIS CASES CP1–4. Req. 1–Deficiencies: (1) (2) (3) (4) (5) (6) (7) (8) Heading: titles of the reports are missing and dates are not in proper form. Income statement should show revenues and expenses separately. “Profit earned in 2009” should be “Net income.” Balance sheet should separately report assets, liabilities, and stockholders' equity. Retained earnings, $30,000, should be reported under stockholders' equity. Due from customers, $13,000, should be reported under assets. Supplies on hand, $15,000, should be reported under assets. Accumulated depreciation, $10,000, should be subtracted from service vehicles. 1-27 Chapter 01 - Financial Statements and Business Decisions CP1–4. (continued) Req. 2–Financial Statements: PERFORMANCE CORPORATION Income Statement For the Year Ended December 31, 2009 Revenues: Sales $175,000 Services 52,000 Total revenues Expenses: Cost of goods sold $ 90,000 Selling expenses 25,000 Depreciation expense 10,000 Salaries and wages 62,000 Total expenses (excluding income tax) Pretax income Income tax expense (25% x $40,000) Net income $227,000 187,000 40,000 10,000 $30,000 PERFORMANCE CORPORATION Balance Sheet At December 31, 2009 Assets Cash Accounts receivable (from customers) Merchandise inventory (for resale) Supplies inventory (for use in rendering services) Service vehicles $50,000 Less accumulated depreciation (10,000) Total assets Liabilities Accounts payable (to suppliers) Note payable (to bank) Total liabilities Stockholders' equity Contributed capital, 6,500 shares $65,000 Retained earnings 30,000 Total stockholders' equity Total liabilities and stockholders' equity 1-28 $ 32,000 13,000 42,000 15,000 40,000 $142,000 $22,000 25,000 47,000 95,000 $142,000 Chapter 01 - Financial Statements and Business Decisions CRITICAL THINKING CASES CP1–5. Req. 1 You should forcefully assert the need for an independent audit of the financial statements each year because this is the best way to assure credibility– conformance with GAAP, completeness and absence of bias. You should firmly reject “Uncle Ray” as the auditor because there is no evidence about his competence as an accountant or auditor. Also, he is related to the partner who prepares the financial statements; there is a conflict of interest. Req. 2 You should strongly recommend the selection of an independent CPA in public practice because the financial statements should be audited by a competent and independent professional who must follow prescribed accounting and auditing standards on a strictly independent basis. An audit by “Uncle Ray” would not meet any of these requisites, particularly the important one in this case– independence (and absence of bias). 1-29 Chapter 01 - Financial Statements and Business Decisions CP1–6. The textbook does not explicitly cover the elements of independence. The case is designed to permit the students to develop their own values. We have found that it is useful to emphasize the difference between independence in fact and in appearance during these discussions. 1. Most students feel that there is no problem with independence if the stock held is immaterial in amount. When asked about a possible headline that might read “Auditor who was shareholder is accused of fraud,” most students see a problem with the appearance. In fact, the AICPA does not apply a materiality threshold where there is a direct financial interest. Any holding of stock is a problem. 2. This is an example of an indirect holding of stock. A materiality threshold is applied in these situations. There could be a question of independence if the auditor held a material interest in the mutual fund (relative to her net worth) and the mutual fund held a material interest in the company that she audited. 3. The AICPA Code of Professional Conduct applies only to audit professionals who are members (though most state laws incorporate similar rules). Bob's employers may want to assign him to a different company but there is no conflict with the Code. 4. Clearly there is an ethics violation in this case because she would audit statements that covered a period of time where she was responsible for the accounting operations of the company. This is a problem both in appearance and in fact. 5. The original Code indicated that a loan from a bank that was made under normal lending procedures, terms, and requirements was not an impairment of independence. This issue is currently under a review that will probably result in a modification of the rule. It is an excellent example of how ethics rules can change over time. The savings and loan debacle with the resulting lawsuits has caused the profession to reconsider the appearance of loans to auditors. FINANCIAL REPORTING AND ANALYSIS PROJECTS CP1–7. The solutions to this case will depend on the company and/or accounting period selected for analysis. 1-30 Chapter 02 - Investing and Financing Decisions and the Balance Sheet Chapter 02 Investing and Financing Decisions and the Balance Sheet ANSWERS TO QUESTIONS 1. The primary objective of financial reporting for external users is to provide useful economic information about a business to help external parties, primarily investors and creditors, make sound financial decisions. These users are expected to have a reasonable understanding of accounting concepts and procedures. Usually, they are interested in information to assist them in projecting future cash inflows and outflows of a business. 2. (a) An asset is a probable future economic benefit owned by the entity as a result of past transactions. (b) A current asset is an asset that will be used or turned into cash within one year; inventory is always considered a current asset regardless of how long it takes to produce and sell the inventory. (c) A liability is a probable debt or obligation of the entity as a result of a past transaction, which will be paid with assets or services. (d) A current liability is a liability that will be paid in cash (or other current assets) or satisfied by providing service within the coming year. (e) Contributed capital is the financing provided to the business by owners; usually owners provide cash and sometimes other assets such as equipment and buildings. (f) Retained earnings are the cumulative earnings of a company that are not distributed to the owners and are reinvested in the business. 2-1 Chapter 02 Investing and Financing Decisions and the Balance Sheet 3. (a) The separate-entity assumption requires that business transactions are separate from the transactions of the owners. For example, the purchase of a truck by the owner for personal use is not recorded as an asset of the business. (b) The unit-of-measure assumption requires information to be reported in the national monetary unit. That means that each business will account for and report its financial results primarily in terms of the national monetary unit, such as Yen in Japan and Australian dollars in Australia. (c) Under the continuity or going-concern assumption, businesses are assumed to operate into the foreseeable future. That is, they are not expected to liquidate. (d) The historical cost principle requires assets to be recorded at the cashequivalent cost on the date of the transaction. Cash-equivalent cost is the cash paid plus the dollar value of all noncash considerations. 4. Accounting assumptions are necessary because they reflect the scope of accounting and the expectations that set certain limits on the way accounting information is reported. 5. An account is a standardized format used by organizations to accumulate the dollar effects of transactions on each financial statement item. Accounts are necessary to keep track of all increases and decreases in the fundamental accounting model. 6. The fundamental accounting model is provided by the equation: Assets = Liabilities + Stockholders' Equity 7. A business transaction is (a) an exchange of resources (assets) and obligations (debts) between a business and one or more outside parties, and (b) certain events that directly affect the entity such as the use over time of rent that was paid prior to occupying space and the wearing out of equipment used to operate the business. An example of the first situation is (a) the sale of goods or services. An example of the second situation is (b) the use of insurance paid prior to coverage. 8. Debit is the left side of a T-account and credit is the right side of a T-account. A debit is an increase in assets and a decrease in liabilities and stockholders' equity. A credit is the opposite -- a decrease in assets and an increase in liabilities and stockholders' equity. 2-2 Chapter 02 - Investing and Financing Decisions and the Balance Sheet 9. Transaction analysis is the process of studying a transaction to determine its economic effect on the entity in terms of the accounting equation: Assets = Liabilities + Stockholders' Equity The two principles underlying the process are: * every transaction affects at least two accounts. * the accounting equation must remain in balance after each transaction. The two steps in transaction analysis are: (1) identify and classify accounts and the direction and amount of the effects. (2) determine that the accounting equation (A = L + SE) remains in balance. 10. The equalities in accounting are: (a) Assets = Liabilities + Stockholders' Equity (b) Debits = Credits 11. The journal entry is a method for expressing the effects of a transaction on accounts in a debits-equal-credits format. The title of the account(s) to be debited is (are) listed first and the title of the account(s) to be credited is (are) listed underneath the debited accounts. The debited amounts are placed in a left-hand column and the credited amounts are placed in a right-hand column. 12. The T-account is a tool for summarizing transaction effects for each account, determining balances, and drawing inferences about a company's activities. It is a simplified representation of a ledger account with a debit column on the left and a credit column on the right. 13. The current ratio is computed as current assets divided by current liabilities. It measures the ability of the company to pay its short-term obligations with current assets. A high ratio normally suggests good liquidity, but a ratio that is too high may indicate inefficient use of resources. The rule of thumb was a ratio between 1.0 and 2.0 (twice as many current assets as current liabilities), but sophisticated cash management systems allow many companies to minimize funds invested in current assets and have a current ratio below 1.0. 14. Investing activities on the statement of cash flows include the buying and selling of productive assets and investments. Financing activities include borrowing and repaying debt, issuing and repurchasing stock, and paying dividends. 2-3 Chapter 02 Investing and Financing Decisions and the Balance Sheet MULTIPLE CHOICE 1. 2. 3. 4. 5. b d b a d 6. 7. 8. 9. 10. c d d b a 2-4 Chapter 02 - Investing and Financing Decisions and the Balance Sheet Authors' Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 3 2 3 3 4 4 4 5 5 6 3 7 3 8 6 9 6 10 6 11 4 12 4 Exercises No. Time 1 8 2 15 3 8 4 10 5 10 6 10 7 10 8 15 9 20 10 20 11 15 12 20 13 20 14 20 15 20 16 15 17 10 18 10 19 15 20 10 Problems No. Time 1 20 2 25 3 40 4 15 5 40 6 20 Alternate Problems No. Time 1 20 2 25 3 40 4 15 Cases and Projects No. Time 1 15 2 15 3 15 4 20 5 15 6 20 7 30 8 20 9 * * Due to the nature of these cases and projects, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any openended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 2-5 Chapter 02 Investing and Financing Decisions and the Balance Sheet MINI-EXERCISES M2–1. C (1) Separate-entity assumption H (2) Historical cost principle G (3) Credits A (4) Assets I (5) Account M2–2. D (1) Journal entry C (2) A = L + SE, and Debits = Credits A (3) Assets = Liabilities + Stockholders’ Equity I (4) Liabilities B (5) Income statement, balance sheet, statement of retained earnings, and statement of cash flows M2–3. (1) Y (2) N (3) Y (4) N (5) Y (6) N 2-6 Chapter 02 - Investing and Financing Decisions and the Balance Sheet M2–4. CL (1) Accounts Payable CA (2) Accounts Receivable NCA (3) Buildings CA (4) Cash SE (5) Contributed Capital NCA (6) Land CA (7) Merchandise Inventory CL (8) Income Taxes Payable NCA (9) Long-Term Investments NCL (10) Notes Payable (due in three years) CA (11) Notes Receivable (due in six months) CA (12) Prepaid Rent SE (13) Retained Earnings CA (14) Supplies CL (15) Utilities Payable CL (16) Wages Payable M2–5. Assets = a. Cash +20,000 b. Cash Notes receivable –7,000 +7,000 c. Cash +1,000 d. Cash Equipment e. Cash –6,000 +15,000 + Stockholders’ Equity Liabilities Notes payable +20,000 Notes payable –2,000 2-7 Contributed capital +1,000 Retained earnings –2,000 +9,000 Chapter 02 Investing and Financing Decisions and the Balance Sheet M2–6. Debit Increases Decreases Decreases Credit Decreases Increases Increases Increase Decrease Assets Debit Credit Liabilities Credit Debit Stockholders’ equity Credit Debit Assets Liabilities Stockholders’ equity M2–7. M2–8. a. Cash (+A) ............................................................................ Notes Payable (+L) ........................................................ b. c. d. e. 20,000 20,000 Notes Receivable (+A)......................................................... Cash (A) ....................................................................... 7,000 Cash (+A) ............................................................................ Contributed Capital (+SE) .............................................. 1,000 Equipment (+A) ................................................................... Cash (A) ....................................................................... Notes Payable (+L) ........................................................ 15,000 Retained Earnings (SE) ..................................................... Cash (A) ....................................................................... 2,000 7,000 1,000 6,000 9,000 2,000 M2–9. Cash Beg. 800 (a) 20,000 7,000 (c) 1,000 6,000 2,000 6,800 (b) (d) (e) Notes Receivable Beg. 900 (b) 7,000 7,900 Equipment Beg. 15,000 (d) 15,000 30,000 2-8 Chapter 02 - Investing and Financing Decisions and the Balance Sheet Notes Payable 2,700 Beg. 20,000 (a) 9,000 (d) Contributed Capital 5,000 Beg. 1,000 (c) 31,700 Retained Earnings 9,000 Beg. (e) 2,000 6,000 7,000 M2–10. Pitt Inc. Balance Sheet At January 31, 2012 Assets Current assets: Cash Notes receivable Total current assets Equipment Total Assets $ 6,800 7,900 14,700 30,000 $44,700 Liabilities Current liabilities: Notes payable Total current liabilities Stockholders’ Equity Contributed capital Retained earnings Total stockholders’ equity Total Liabilities & Stockholders’ Equity $ 31,700 31,700 6,000 7,000 13,000 $44,700 M2–11. Current Ratio = 2007 2008 Current Assets 240,000 260,000 ÷ ÷ ÷ Current Liabilities 160,000 220,000 = = 1.50 1.18 This ratio indicates that Sal’s Pizza has sufficient current assets to settle current liabilities, but that the ratio has also decreased between 2007 and 2008 by .32 (21%). Sal’s Pizza’s ratio is higher than Papa John’s 2008 ratio (of .75), indicating that Sal’s Pizza appears to have stronger liquidity than Papa John’s. However, given its size, Papa John’s is likely to have a strong cash management system that can keep current asset levels low. 2-9 Chapter 02 Investing and Financing Decisions and the Balance Sheet M2–12. (a) F (b) I (c) F (d) I (e) F EXERCISES 2-10 Chapter 02 - Investing and Financing Decisions and the Balance Sheet E2–1. E (1) Transaction F (2) Continuity assumption B (3) Balance sheet P (4) Liabilities K (5) Assets = Liabilities + Stockholders’ Equity M (6) Note payable S (7) Conservatism H (8) Historical cost principle I (9) Account Q (10) Dual effects O (11) Retained earnings A (12) Current assets C (13) Separate-entity assumption W (14) Reliability D (15) Debits J (16) Accounts receivable N (17) Unit-of-measure assumption U (18) Materiality T (19) Relevance R (20) Stockholders’ Equity 2-11 Chapter 02 Investing and Financing Decisions and the Balance Sheet E2–2. Req. 1 Received Given (a) Cash (A) Contributed capital (SE) (b) Equipment (A) (c) No exchange transaction — (d) Equipment (A) Note payable (L) (e) Building (A) (f) Intangibles (A) (g) Retained earnings (SE) [Received a reduction Cash (A) in the amount available for payment to stockholders] (h) Land (A) (i) Intangibles (A) (j) No exchange transaction — (k) Investments (A) Cash (A) (l) Cash (A) Short-term note payable (L) (m) Note payable (L) promise to pay] [or Delivery truck] Cash (A) [or Computer equipment] [or Construction in progress] [or Copyright] Cash (A) Cash (A) Cash (A) [or Patents] Cash (A) and Note payable (L) [Received a reduction in its Cash (A) Req. 2 The truck in (b) would be recorded as an asset of $18,000. The land in (h) would be recorded as an asset of $50,000. These are applications of the historical cost principle. Req. 3 The agreement in (c) involves no exchange or receipt of cash, goods, or services and thus is not a transaction. Since transaction (j) occurs between the owner and others, there is no effect on the business because of the separate-entity assumption. 2-12 Chapter 02 - Investing and Financing Decisions and the Balance Sheet E2–3. Balance Sheet Categorization Debit or Credit Balance (1) Accounts Receivable CA Debit (2) Retained Earnings SE Credit (3) Taxes Payable CL Credit (4) Prepaid Expenses CA Debit (5) Contributed Capital SE Credit (6) Long-Term Investments NCA Debit (7) Plant, Property, and Equipment NCA Debit (8) Accounts Payable CL Credit (9) Short-Term Investments CA Debit NCL Credit Account (10) Long-Term Debt E2–4. Event a. b. Assets Cash = +34,000 Equipment +8,000 Cash –1,000 c. Cash +9,000 d. Note receivable +500 Cash –500 Land +15,000 Cash –4,000 e. + Stockholders’ Equity Liabilities Contributed capital Notes payable +7,000 Notes payable +9,000 Mortgage note payable +11,000 2-13 +34,000 Chapter 02 Investing and Financing Decisions and the Balance Sheet E2–5. Req. 1 Event Assets a. Buildings Equipment Cash b. Cash = +212.0 +30.4 – 43.2 Liabilities + Stockholders’ Equity Notes payable (long-term) +199.2 +186.6 c. Contributed capital Dividends payable d. Short-term Investments Cash e. No effects f. Cash Short-term Investments +121.4 Retained earnings +186.6 –121.4 +2,908.7 – 2,908.7 +2,390.0 – 2,390.0 Req. 2 The separate-entity assumption states that transactions of the business are separate from transactions of the owners. Since transaction (e) occurs between the owners and others in the stock market, there is no effect on the business. 2-14 Chapter 02 - Investing and Financing Decisions and the Balance Sheet E2–6. a. b. c. d. e. Cash (+A) ............................................................................ Contributed capital (+SE) ............................................... 34,000 Equipment (+A) ................................................................... Cash (A) ....................................................................... Notes payable (+L) ........................................................ 8,000 Cash (+A) ............................................................................ Notes payable (+L) ......................................................... 9,000 Notes receivable (+A) ......................................................... Cash (A) ...................................................................... 500 Land (+A)............................................................................. Cash (A) ....................................................................... Mortgage notes payable (+L) ........................................ 15,000 Buildings (+A) ...................................................................... Equipment (+A) .................................................................. Cash (A) ....................................................................... Note payable (+L) ......................................................... 212.0 30.4 Cash (+A) ............................................................................ Contributed capital (+SE) ............................................... 186.6 Retained earnings (SE) ..................................................... Dividends payable (+L) .................................................. 121.4 Short-term investments (+A)................................................ Cash (A) ....................................................................... 2,908.7 34,000 1,000 7,000 9,000 500 4,000 11,000 E2–7. Req. 1 a. b. c. d. e. No journal entry required. f. Cash (+A) ............................................................................ Short-term investments (A) .......................................... 2-15 43.2 199.2 186.6 121.4 2,908.7 2,390.0 2,390.0 Chapter 02 Investing and Financing Decisions and the Balance Sheet Req. 2 The separate-entity assumption states that transactions of the business are separate from transactions of the owners. Since transaction (e) occurs between the owners and others in the stock market, there is no effect on the business. E2–8. Req. 1 Cash Beg. 0 (a) 63,000 5,000 (b) (d) 4,000 2,500 (e) 59,500 Land Beg. 0 (d) 13,000 13,000 Note Receivable Beg. 0 (e) 2,500 2,500 Equipment Beg. 0 (b) 20,000 20,000 Note Payable 0 Beg. 15,000 (b) Contributed Capital 0 Beg. 63,000 (a) 17,000 (d) 15,000 80,000 Req. 2 Assets $ 95,000 = Liabilities $ 15,000 + Stockholders’ Equity $ 80,000 Req. 3 The agreement in (c) involves no exchange or receipt of cash, goods, or services and thus is not a transaction. Since transaction (f) occurs between the owner and others, there is no effect on the business due to the separate-entity assumption. 2-16 Chapter 02 - Investing and Financing Decisions and the Balance Sheet E2–9. Req. 1 Transaction 1 Brief Explanation Issued capital stock to shareholders for $15,000 cash. (FastTrack Sports Inc. is a corporation.) 2 Borrowed $75,000 cash and signed a short-term note for this amount. 3 Purchased land for $16,000; paid $5,000 cash and gave an $11,000 short-term note payable for the balance. 4 Loaned $4,000 cash; borrower signed a short-term note for this amount (Note Receivable). 5 Purchased store fixtures for $9,500 cash. 6 Purchased land for $4,000, paid for by signing a short-term note. Req. 2 FastTrack Sports Inc. Balance Sheet At January 7, 2011 Assets Current Assets Cash Note receivable Total Current Assets Store fixtures Land Total Assets $71,500 4,000 75,500 9,500 20,000 $105,000 2-17 Liabilities Current Liabilities Note payable Total Current Liabilities Stockholders’ Equity Contributed capital Total Stockholders’ Equity Total Liabilities & Stockholders’ Equity $90,000 90,000 15,000 15,000 $105,000 Chapter 02 Investing and Financing Decisions and the Balance Sheet E2–10. Req. 1 Transaction 1 Brief Explanation Issued capital stock to shareholders for $50,000 cash. 2 Purchased a delivery truck for $30,000; paid $6,000 cash and gave a $24,000 long-term note payable for the balance. 3 Loaned $4,000 cash; borrower signed a short-term note for this amount. 4 Purchased short-term investments for $7,000 cash. 5 Sold short-term investments at cost for $2,000 cash. 6 Issued capital stock to shareholders for $4,000 of computer equipment. Req. 2 Volz Cleaning, Inc. Balance Sheet At March 31, 2011 Assets Current Assets Cash Investments Note receivable Total Current Assets Computer equipment Delivery truck Total Assets $35,000 5,000 4,000 44,000 4,000 30,000 $78,000 2-18 Liabilities Notes payable Total Liabilities Stockholders’ Equity Contributed capital Total Stockholders’ Equity Total Liabilities & Stockholders’ Equity $24,000 24,000 54,000 54,000 $78,000 Chapter 02 - Investing and Financing Decisions and the Balance Sheet E2–11. a. Cash (+A) ............................................................................ Contributed capital (+SE) ............................................... 65,000 65,000 b. No transaction has occurred because there has been no exchange or receipt of cash, goods, or services. c. Cash (+A) ............................................................................ Notes payable (long-term) (+L) ...................................... 10,000 Equipment (+A) ................................................................... Cash (A) ....................................................................... Notes payable (short-term) (+L) ..................................... 13,000 Notes receivable (short-term) (+A) ...................................... Cash (A) ....................................................................... 1,000 Store fixtures (+A) ............................................................... Cash (A) ....................................................................... 20,000 d. e. f. 10,000 1,500 11,500 1,000 20,000 E2–12. a. Retained earnings (SE) ..................................................... Dividends payable (+L) .................................................. 197 197 b. No transaction has occurred because there has been no exchange or receipt of cash, goods, or services. c. Dividends payable (L) ........................................................ Cash (A) ....................................................................... 694 Cash (+A) ............................................................................ Notes payable (+L) ......................................................... 2,655 Cash (+A) ............................................................................ Equipment (A) .............................................................. 285 Equipment (+A) ................................................................... Cash (A) ....................................................................... Notes payable (+L) ........................................................ 1,255 Investments (+A) ................................................................. Cash (A) ....................................................................... 2,220 d. e. f. g. 2-19 694 2,655 285 970 285 2,220 Chapter 02 Investing and Financing Decisions and the Balance Sheet E2–13. Req. 1 Assets $ 8,500 = Liabilities $ + Stockholders’ Equity $ 2,500 6,000 Req. 2 Cash 4,000 3,000 1,000 1,250 300 (d) 8,950 Beg. (a) (b) (c) End. Short-Term Investments Beg. 2,000 1,000 (b) Property & Equipment Beg. 2,500 1,250 (c) End. End. 1,000 Short-Term Notes Payable 2,200 Beg. Long-Term Notes Payable 300 Beg. 3,000 (a) 2,200 End. 3,300 End. Contributed Capital 4,000 Beg. Retained Earnings 2,000 Beg. (d) 300 4,000 End. 1,700 End. Req. 3 Assets $ 11,200 = Liabilities $ 1,250 + Stockholders’ Equity $ 5,500 5,700 Req. 4 Current Ratio = Current Assets Current Liabilities = $8,950+$1,000 $2,200 = $9,950 = 4.52 $2,200 This ratio indicates that, for every $1 of current liabilities, Zeber maintains $4.52 of current assets. Zeber’s ratio is higher than the industry average of 1.50, indicating that Zeber maintains a lower level of short-term debt and has higher liquidity. However, maintaining such a high current ratio also suggests that the company may not be using its resources efficiently. Increasing short-term obligations would lower Zeber’s current ratio, but this strategy alone would not help its efficiency. Zeber should consider investing more of its cash in order to generate future returns. 2-20 Chapter 02 - Investing and Financing Decisions and the Balance Sheet E2–14. Zeber Company Balance Sheet At December 31, 2012 Assets Current Assets Cash Short-term investments Total Current Assets Property and equipment $ 8,950 1,000 9,950 1,250 $11,200 Total Assets Liabilities Current Liabilities Short-term notes payable Total Current Liabilities Long-term notes payable Total Liabilities Stockholders’ Equity Contributed capital Retained earnings Total Stockholders’ Equity Total Liabilities & Stockholders’ Equity $ 2,000 2,200 3,300 5,500 4,000 1,700 5,700 $11,200 E2–15. Req. 1 Cash Beg. 0 (a) 40,000 4,000 (c) 1,000 (d) 35,000 Equipment Beg. 0 (c) 20,000 (d) 1,000 21,000 Short-Term Notes Receivable Beg. 0 (e) 4,000 4,000 Land Beg. 0 (b) 16,000 4,000 (e) 12,000 Short-Term Notes Payable 0 Beg. 16,000 (b) 16,000 Contributed Capital 0 Beg. 40,000 (a) 40,000 2-21 Long-Term Notes Payable 0 Beg. 16,000 (c) 16,000 Chapter 02 Investing and Financing Decisions and the Balance Sheet E2–15. (continued) Req. 2 Strauderman Delivery Company, Inc. Balance Sheet At December 31, 2011 Assets Current Assets Cash Short-term note receivable Total Current Assets Land Equipment $35,000 4,000 39,000 12,000 21,000 $72,000 Total Assets Liabilities Current Liabilities Short-term notes payable Total Current Liabilities Long-term notes payable Total Liabilities Stockholders’ Equity Contributed capital Total Stockholders’ Equity Total Liabilities & Stockholders’ Equity $16,000 16,000 16,000 32,000 40,000 40,000 $72,000 Req. 3 2011: Current Ratio = Current Assets Current Liabilities = $39,000 $16,000 = 2.44 2012: Current Ratio = Current Assets Current Liabilities = $52,000 $23,000 = 2.26 2013: Current Ratio = Current Assets Current Liabilities = $47,000 $40,000 = 1.18 The current ratio has decreased over the years, suggesting that the company’s liquidity is decreasing. Although the company still maintains sufficient current assets to settle the short-term obligations, this steep decline in the ratio may be of concern – it may be indicative of more efficient use of resources or it may suggest the company is having cash flow problems. 2-22 Chapter 02 - Investing and Financing Decisions and the Balance Sheet Req. 4 The management of Strauderman Delivery Company has already been financing the company’s development through additional short-term debt, from $16,000 in 2011 to $40,000 in 2013. This suggests the company is taking on increasing risk. Additional lending, particularly short-term, to the company may be too much risk for the bank to absorb. Based solely on the current ratio, the bank’s vice president should consider not providing the loan to the company as it currently stands. Of course, additional analysis would provide better information for making a sound decision. E2–16. Transaction Brief Explanation (a) Issued capital stock to shareholders in exchange for $16,000 cash and $4,000 tools and equipment. (b) Loaned $1,500 cash; borrower signed a note receivable for this amount. (c) Purchased a building for $50,000; paid $10,000 cash and gave a $40,000 note payable for the balance. (d) Sold $800 of tools and equipment for their original cost. E2–17. Req. 1 Increases with… Decreases with… Equipment Purchases of equipment Sales of equipment Notes receivable Additional loans to others Collection of loans Notes payable Additional borrowings Payments of debt Req. 2 Equipment 1/1 500 250 12/31 100 Notes Receivable 1/1 650 150 245 12/31 Notes Payable 100 1/1 225 170 2-23 110 170 160 12/31 Chapter 02 Investing and Financing Decisions and the Balance Sheet Beginning balance $500 + “+” “” = + 250 ? ? = = Ending balance $100 650 Notes receivable 150 + ? 225 ? = = 170 245 Notes payable 100 + 170 ? ? = = 160 110 Equipment E2–18. Activity (a) (b) (c) (d) (e) Reduction of long-term debt Sale of short-term investments Issuance of common stock Capital expenditures (for property, plant, and equipment) Dividends paid on common stock. Type of Activity F I F I F E2–19. Starwood Hotels & Resorts Worldwide, Inc. Partial Statement of Cash Flows For the Year Ended December 31, 2012 (in millions) Investing Activities Purchase of investments Sale of assets and investments Purchase and renovation of properties Receipt of payment from note receivable Cash flow from investing activities $ (37) 359 (476) 172 18 Financing Activities Additional borrowing from banks Issuance of stock Payment of debt Cash flow from financing activities 986 120 (574) $ 532 2-24 Effect on Cash + + Chapter 02 - Investing and Financing Decisions and the Balance Sheet E2–20. 1. Current assets 2. Debt principal repaid 3. Significant accounting policies 4. Cash received on sale of noncurrent assets 5. Dividends paid 6. Short-term obligations 7. Date of the statement of financial position. In the asset section of a classified balance sheet. In the financing activities section of the statement of cash flows. Usually the first note after the financial statements. In the investing activities section of the statement of cash flows. In the financing activities section of the statement of cash flows. In the current liabilities section of a classified balance sheet. In the heading of the balance sheet. PROBLEMS P2–1. Balance Sheet Classification Debit or Credit Balance (1) Notes and Loans Payable (short-term) CL Credit (2) Materials and Supplies CA Debit (3) Contributed Capital SE Credit (4) Patents (an intangible asset) NCA Debit (5) Income Taxes Payable CL Credit (6) Long-Term Debt NCL Credit (7) Marketable Securities (short-term) CA Debit (8) Property, Plant, and Equipment NCA Debit (9) Retained Earnings SE Credit (10) Notes and Accounts Receivable (short-term) CA Debit (11) Investments (long-term) NCA Debit (12) Cash and Cash Equivalents CA Debit (13) Accounts Payable CL Credit (14) Crude Oil Products and Merchandise CA Debit 2-25 Chapter 02 Investing and Financing Decisions and the Balance Sheet P2–2. Req. 1 East Hill Home Healthcare Services was organized as a corporation. Only a corporation issues shares of capital stock to its owners in exchange for their investment, as in transaction (a). Req. 2 (On next page) Req. 3 The transaction between the two stockholders (Event e) was not included in the tabulation. Since the transaction in (e) occurs between the owners, there is no effect on the business due to the separate-entity assumption. Req. 4 (a) Total assets = $111,500 + $18,000 + $5,000 + $510,500 + $160,000 + $65,000 = $870,000 (b) Total liabilities = $100,000 + $180,000 = $280,000 (c) Total stockholders’ equity = Total assets – Total liabilities = $870,000 – $280,000 = $590,000 (d) Cash balance = $50,000 + $90,000 – $9,000 + $3,500 – $18,000 – $5,000 = $111,500 (e) Total current assets = Cash $111,500 + Short-Term Investments $18,000 + Notes Receivable $5,000 = $134,500 Req. 5 Current Ratio = Current Assets Current Liabilities = $111,500+$18,000+$5,000 = $134,500 = 1.35 $100,000 100,000 This suggests that for every $1 in current liabilities, East Hill maintains $1.35 in current assets. The ratio suggests that East Hill is likely maintaining adequate liquidity and using resources efficiently. 2-26 Chapter 02 - Investing and Financing Decisions and the Balance Sheet P2–2. (continued) Req. 2 Assets Beg. Short-Term Notes Cash Investments Receivable 50,000 = ST Notes LT Notes Land Buildings Equipment Payable Payable 500,000 100,000 50,000 = 100,000 100,000 (a) +90,000 (b) –9,000 +14,000 (c) +3,500 –3,500 (d) –18,000 (e) No effect (f) –5,000 +111,500 Liabilities = +60,000 Stockholders' Equity Contributed Retained Capital Earnings 100,000 400,000 +90,000 +15,000 = +80,000 = +18,000 = +5,000 +18,000 + = +5,000 +510,500 +160,000 +65,000 = +100,000 $870,000 +180,000 $280,000 2-27 +190,000 +400,000 $590,000 Chapter 02 Investing and Financing Decisions and the Balance Sheet P2–3. Req. 1 and 2 Beg. (e) (f) (i) Cash 19,000 12,000 9,000 (a) 12,000 7,000 (b) 1,000 6,000 (c) 3,000 (g) 9,000 (h) Investments (short-term) Beg. 2,000 (a) 9,000 Accounts Receivable Beg. 3,000 End. 11,000 End. Beg. Inventory 24,000 24,000 End. 10,000 End. Beg. (c) Equipment 48,000 18,000 1,000 (i) Beg. (h) End. 65,000 3,000 Notes Receivable (long-term) Beg. 1,000 (b) 7,000 End. 8,000 Beg. (g) Intangibles 3,000 3,000 End. 115,000 End. 6,000 Accounts Payable 15,000 Beg. Accrued Liabilities Payable 2,000 Beg. 15,000 End. 2,000 End. Notes Payable (short-term) 7,000 Beg. 12,000 (c) 12,000 (f) 31,000 End. Long-Term Notes Payable 46,000 Beg. 16,000 (h) Contributed Capital 90,000 Beg. 12,000 (e) Retained Earnings 30,000 Beg. 62,000 End. 102,000 End. 30,000 End. Factory Building 90,000 25,000 2-28 Chapter 02 - Investing and Financing Decisions and the Balance Sheet P2–3. (continued) Req. 3 No effect was recorded for (d). The agreement in (d) involves no exchange or receipt of cash, goods, or services and thus is not a transaction. Req. 4 Cougar Plastics Company Balance Sheet At December 31, 2012 Assets Current Assets Cash Investments Accounts receivable Inventory Total Current Assets $ 10,000 11,000 3,000 24,000 48,000 Notes receivable Equipment Factory building Intangibles 8,000 65,000 115,000 6,000 $242,000 Total Assets Liabilities Current Liabilities Accounts payable Accrued liabilities payable Notes payable Total Current Liabilities Long-term notes payable Total Liabilities Stockholders’ Equity Contributed capital Retained earnings Total Stockholders’ Equity Total Liabilities & Stockholders’ Equity Req. 5 Current Ratio = Current Assets Current Liabilities = $48,000 = 1.00 $48,000 This ratio indicates that Cougar Plastics has relatively low liquidity; for every $1 of current liabilities, Cougar Plastics maintains only $1 of current assets. 2-29 $ 15,000 2,000 31,000 48,000 62,000 110,000 102,000 30,000 132,000 $242,000 Chapter 02 Investing and Financing Decisions and the Balance Sheet P2–4. Transaction Type of Activity Effect on Cash (a) (b) (c) (d) (e) (f) (g) (h) (i) I I I NE F F I I I – – – NE + + – – + P2–5. Req. 1 a. b. c. d. e. f. g. Cash (+A) ............................................................................ Long-term liabilities (+L) ................................................. 30 Receivables and other assets (+A)...................................... Cash (A) ....................................................................... 250 Long-term investments (+A) ................................................ Short-term investments (+A) ............................................... Cash (A) ....................................................................... 2,600 10,400 Property, plant, and equipment (+A).................................... Cash (A) ....................................................................... Long-term liabilities (+L) ................................................. 2,285 Cash (+A) ............................................................................ Contributed capital (+SE) ............................................... 200 Cash (+A) ............................................................................ Short-term investments (A) .......................................... 10,000 Retained earnings (SE) ..................................................... Cash (A) ....................................................................... 52 2-30 30 250 13,000 875 1,410 200 10,000 52 Chapter 02 - Investing and Financing Decisions and the Balance Sheet P2–5. (continued) Req. 2 Beg. (a) (e) (f) Cash 8,352 30 250 200 13,000 10,000 875 52 (b) (c) (d) (g) Beg. (c) Beg. 4,405 Short-Term Investments 740 10,400 10,000 (f) 1,140 Inventories 867 Receivables and Other Assets Beg. 6,443 (b) 250 6,693 Other Current Assets Beg. 3,749 867 Property, Plant, and Equipment Beg. 2,277 (d) 2,285 4,562 Accounts Payable 8,309 Beg. Beg. (c) Long-Term Investments 454 2,600 3,054 11,389 Other Noncurrent Assets Beg. 3,618 3,618 Other Short-term Obligations 6,550 Beg. 8,309 Contributed Capital 11,189 200 (e) 3,749 Long-Term Liabilities 7,370 Beg. 30 (a) 1,410 (d) 8,810 6,550 Other Stockholders’ Equity Items Beg. 27,904 (g) 27,904 2-31 Retained Earnings 20,986 Beg. 52 20,934 Chapter 02 Investing and Financing Decisions and the Balance Sheet P2–5. (continued) Req. 3 Dell, Inc. Balance Sheet At January 29, 2010 (in millions) ASSETS Current Assets Cash Short-term investments Receivables and other assets Inventories Other current assets $ Noncurrent Assets Property, plant and equipment Long-term investments Other noncurrent assets Total assets 4,405 1,140 6,693 867 3,749 16,854 4,562 3,054 3,618 $28,088 LIABILITIES AND STOCKHOLDERS’ EQUITY Current Liabilities Accounts payable Other short-term obligations Long-term Liabilities Stockholders’ Equity Contributed capital Retained earnings Other stockholders’ equity items Total liabilities and stockholders’ equity $ 8,309 6,550 14,859 8,810 11,389 20,934 (27,904) $28,088 Req. 4 Current Ratio = Current Assets Current Liabilities = $16,854 $14,859 = 1.13 For every $1 of short-term liabilities, Dell has $1.13 of current assets. This low current ratio suggests that Dell is using its resources efficiently and has sufficient liquidity. 2-32 Chapter 02 - Investing and Financing Decisions and the Balance Sheet P2–6. Dell, Inc. Partial Statement of Cash Flows For the Year Ended January 29, 2010 (in millions of dollars) INVESTING ACTIVITIES Purchase of property, plant, and equipment Purchase of investments Loan of funds to affiliates Sale of investments Cash flow used in investing activities $ FINANCING ACTIVITIES Borrowings Issuance of stock Payment of dividends Cash flow provided by financing activities Net change in cash Beginning balance of cash Cash balance on January 29, 2010 2-33 (875) (13,000) (250) 10,000 (4,125) 30 200 (52) 178 $ (3,947) 8,352 4,405 Chapter 02 Investing and Financing Decisions and the Balance Sheet ALTERNATE PROBLEMS AP2–1. Balance Sheet Classification Debit or Credit Balance (1) Prepaid Expenses CA Debit (2) Inventories CA Debit (3) Accounts Receivable CA Debit (4) Long-Tterm Debt NCL Credit (5) Cash and Cash Equivalents CA Debit (6) Goodwill (an intangible asset) NCA Debit (7) Accounts Payable CL Credit (8) Income Taxes Payable CL Credit (9) Property, Plant, and Equipment NCA Debit (10) Retained Earnings SE Credit (11) Contributed Capital SE Credit (12) Short-Tterm Borrowings CL Credit (13) Accrued Liabilities CL Credit 2-34 Chapter 02 - Investing and Financing Decisions and the Balance Sheet AP2–2. Req. 1 Adamson Incorporated was organized as a corporation. Only a corporation issues shares of capital stock to its owners in exchange for their investment, as Adamson did in transaction (c). Req. 2 (On next page) Req. 3 Since the transaction in (i) occurs between the owners and others outside the company, there is no effect on the business due to the separate-entity assumption. Req. 4 (a) Total assets = $35,000 + $2,000 + $85,000 + $107,000 + $510,000 = $739,000 (b) Total liabilities = $169,000 + $170,000 = $339,000 (c) Total stockholders’ equity = Total assets – Total liabilities = $739,000 – $339,000 = $400,000 (d) Cash balance = $120,000 + $110,000 – $3,000 + $100,000 – $5,000 – $2,000 – $200,000 – $85,000 = $35,000 (e) Total current assets = $35,000 + $2,000 = $37,000 Req. 5 Current Ratio = Current Assets Current Liabilities = $35,000 + $2,000 $169,000 = $37,000 = 0.22 $169,000 This suggests that Adamson may not have sufficient liquidity to cover its current obligations. Adamson should consider increasing its current assets or seeking to convert some of its short-term debt to long-term debt. 2-35 Chapter 02 - Investing and Financing Decisions and the Balance Sheet AP2–2. (continued) Req. 2 Assets Beg. = Liabilities + Stockholders' Equity Short-Term Long-Term Notes Long-Term Notes Notes Contributed Retained Cash Receivable Investments Equipment Building Payable Payable Capital Earnings 120,000 70,000 310,000 = 140,000 60,000 220,000 80,000 (a) +110,000 (b) = –3,000 +30,000 = (c) +100,000 (d) –5,000 (e) –2,000 +10,000 = +2,000 +100,000 +5,000 = +200,000 = –85,000 +85,000 = –3,000 (h) = (i) No effect +35,000 +27,000 = (f) –200,000 (g) +110,000 –3,000 = +2,000 +85,000 +107,000 +510,000 = $739,000 +169,000 $339,000 2-37 +170,000 +320,000 $400,000 +80,000 Chapter 02 Investing and Financing Decisions and the Balance Sheet AP2–3. Req. 1 and 2 Cash and Cash Equivalents Beg. 74,376 (a) 1,020 3,400 (d) 4,020 2,980 (g) 310 1,830 300 (b) (e) (f) (h) Beg. (e) Short-Term Investments 0 2,980 2,980 36,865 Beg. Other Assets 4,540 12,672 Inventories Beg. 186,265 186,265 71,216 Prepaid Expenses and Other Current Assets Beg. 36,865 Beg. Accounts Receivable 12,672 Property, Plant, and Equipment Beg. 350,432 (f) 11,230 4,020 (d) 357,642 Accounts Payable 26,444 Beg. Intangibles Beg. 96,823 (b) 3,400 100,223 Accrued Expenses Payable 109,017 Beg. 310 (g) 4,230 Long-Term Debt* 203,029 Beg. 9,400 (f) 212,429 26,444 Other Long-Term Liabilities 47,710 Beg. 47,710 * Current portion is $41. 109,017 Contributed Capital 21,048 Beg. 1,020 (a) 22,068 Retained Earnings 354,725 Beg. (h) 300 354,425 Req. 3 No effect was recorded for (c). Ordering goods involves no exchange or receipt of cash, goods, or services and thus is not a transaction. 2-38 Chapter 02 - Investing and Financing Decisions and the Balance Sheet AP2–3. (continued) Req. 4 Ethan Allen Interiors, Inc. Balance Sheet At September 30, 2008 (in thousands of dollars) Assets Current assets Cash and cash equivalents Short-term investments Accounts receivable Inventories Prepaid expenses and other current assets Total current assets Property, plant, and equipment Intangibles Other assets Total Assets Liabilities Current liabilities Accounts payable Accrued expenses payable Current portion of long-term debt Total current liabilities Long-term debt Other long-term liabilities Total Liabilities Stockholders’ Equity Contributed capital Retained earnings Total Stockholders’ Equity Total Liabilities and Stockholders’ Equity $ 71,216 2,980 12,672 186,265 36,865 309,998 357,642 100,223 4,230 $772,093 $ 26,444 109,017 41 135,502 212,388 47,710 395,600 22,068 354,425 376,493 $772,093 Req. 5 Current Ratio = Total Current Assets = $309,998 = 2.29 Total Current Liabilities $135,502 Ethan Allen maintains a relatively high current ratio, indicating that they are highly liquid. Initially, this seems to suggest that they are not investing their resources efficiently. However, a closer look reveals that a significant portion of their current assets are invested in inventory, which often necessitates a higher current ratio. 2-39 Chapter 02 Investing and Financing Decisions and the Balance Sheet AP2–4. Transaction Type of Activity Effect on Cash (a) (b) F I + (c) (d) (e) NE I I (f) I (g) (h) I F NE + + 2-40 Chapter 02 - Investing and Financing Decisions and the Balance Sheet CASES AND PROJECTS ANNUAL REPORT CASES CP2–1. 1. The company is a corporation since it maintains share capital and its owners are referred to as “shareholders.” (Refer to the stockholders’ equity section of the balance sheet). 2. The amount listed on the balance sheet for inventories does not represent the expected selling price. It represents the historical cost of acquiring the inventory, as required by the cost principle. 3. The company’s current obligations include: accounts payable, notes payable, accrued compensation and payroll taxes, accrued rent, accrued income and other taxes, unredeemed stored value cards and gift certificates, current portion of deferred lease credits, and other liabilities and accrued expenses. 4 Current Ratio = Current Assets Current Liabilities = $925,359 = 2.30 $401,763 The current ratio measures the ability of the company to settle short-term obligations with current assets. American Eagle Outfitters’ current ratio of 2.30 suggests strong liquidity with $2.30 in current assets for every $1 in current liabilities. In the most recent year presented, the company had a significant amount of cash primarily from selling short-term investments. Given the poor economic environment beginning in 2008 with a downturn in the financial markets, maintaining a cash position may be an investing strategy. 5. The company spent $265,335,000 on purchasing property and equipment in the year ended 1/31/09; $250,407,000 in the year ended 2/2/08; and $225,939,000 in the year ended 2/3/07. This information is listed as Capital Expenditures on the Statement of Cash Flows in the investing activities section. 2-41 Chapter 02 Investing and Financing Decisions and the Balance Sheet CP2–2. 1. Assets $1,329,009,000 = = Liabilities $275,234,000 + + Shareholders’ Equity $1,053,775,000 2. No – shareholders’ equity is a residual balance, meaning that the shareholders will receive what remains in cash and assets after the creditors have been satisfied. It is likely that shareholders would receive less than $1,053,775,000. In addition, nearly all assets on the balance sheet are not stated at market value, only historical cost. 3. The company’s only noncurrent liability is Deferred Rent and Other Liabilities. 4. Current Ratio = Current Assets Current Liabilities = $624,402,000 =4.42 $141,150,000 5. The company had a net cash outflow from investing activities of $56,907,000, primarily because of capital expenditures (the purchase of property and equipment for $112,553,000). The company also purchased marketable securities (investments) for $809,039,000, nearly equivalent to the amount of marketable securities that were sold or matured during the year ($864,685,000). 2-42 Chapter 02 - Investing and Financing Decisions and the Balance Sheet CP2–3. 1. Current Ratio = Industry Average 2.55 American Eagle Outfitters 2.30 Urban Outfitters 4.42 American Eagle Outfitters’ current ratio of 2.30 is slightly lower than the industry average, but Urban Outfitters’ current ratio of 4.42 is significantly higher than the industry average of 2.55. For the year ended January 31, 2009, Urban Outfitters tripled its amount of cash from the prior year while maintaining similar balances in the remaining current assets. This suggests that Urban Outfitters chose to respond to the poor economic environment beginning in 2008 by maintaining a strong cash position. Many retailers, such as American Eagle Outfitters, choose to rent space rather than purchase buildings for stores. Acquiring buildings often requires borrowing longterm (mortgages). Thus, the choice of renting or purchasing buildings does not have an effect on the numerator or denominator of the current ratio. 2. As indicated in the financing activities section of each company’s statement of cash flows, during the most recent year, American Eagle Outfitters spent $3,432,000 repurchasing common stock from employees with no repurchases from investors. This was a dramatic shift from prior years. Urban Outfitters did not repurchase shares of common stock in the current or prior years. 3. As indicated the statement of cash flows, American Eagle Outfitters paid $82,394,000 in dividends. Urban Outfitters did not pay any dividends during the year. Refer to the financing activities section of the statement of cash flows. 4. American Eagle reports “Property and equipment, at cost, net of accumulated depreciation and amortization” and Urban Outfitters reports “Property and equipment, net.” Details of the amount of land, building, and equipment are reported by each in the notes to the financial statements. Other companies sometimes choose to report these assets separately on the balance sheet, for example in accounts such as: “Land,” “Buildings and building improvements,” Furniture, fixtures and equipment,” and “Rental property and equipment.” 2-43 Chapter 02 Investing and Financing Decisions and the Balance Sheet FINANCIAL REPORTING AND ANALYSIS CASES CP2–4. 1. (a) Papa John’s total assets reported at March 29, 2009 are $387,861,000. (b) Long-term debt including the current portion due decreased over three months from $130,654,000 ($123,579,000 long-term + $7,075,000 current portion) at December 28, 2008, to $111,525,000 ($103,075,000 long-term + $8,450,000 current portion) on March 29, 2009. (c) Current Ratio = Current Assets = $80,351,000 = .79 Current Liabilities $102,065,000 Papa John’s current ratio increased from the level of .75 as discussed in the chapter. This indicates that, between December 28, 2008, and March 29, 2009, Papa John’s increased its liquidity slightly. Current assets increased by approximately $5 million while current liabilities increased by only $2 million. Cash and cash equivalents increased the most (over $7 million). Given the difficult economic environment that continued through 2009, Papa John’s appeared to increase its cash balance as an added cushion. 2. (a) For the three months ended March 29, 2009, Papa John’s spent $5,064,000 on the purchase of property and equipment, its largest use of cash for investing activities. (b) The total cash flows used in financing activities was $17,447,000, mostly from the repayment of debt and the repurchase of its common stock. CP2–5. The major deficiency in this balance sheet is the inclusion of the owner’s personal residence as a business asset. Under the separate-entity assumption, each business must be accounted for as an individual organization, separate and apart from its owners. The improper inclusion of this asset as part of Frances Sabatier’s business: overstates total assets by $300,000; total assets should be $105,000 rather than $405,000, and Overstates stockholders’ equity that should be only $5,000, rather than $305,000. Since current assets and current liabilities were not affected, the current ratio remains the same. However, other ratios involving long-term assets and/or stockholders’ equity will be affected. 2-44 Chapter 02 - Investing and Financing Decisions and the Balance Sheet CP2–6. 1. The company is a corporation since its owners are referred to as “stockholders.” 2. Assets $26,500 3. Current Ratio = Liabilities = $22,229 = + Stockholders’ Equity (in millions) + $4,271 Current Assets Current Liabilities = $20,151 $14,859 = 1.36 (dollars in millions) For every $1 of current liabilities, Dell maintains $1.36 of current assets, suggesting that Dell has the ability to pay its short-term obligations with current assets in the upcoming year. The interpretation of this ratio would be more useful given information on the company’s current ratio over time and on the typical current ratio for the computer industry. 4. Accounts Payable (L) ........................................................ 8,309 million Cash (A) ...................................................................... 8,309 million 5. Over its years in business, it appears that Dell has been profitable, based on a positive amount in Retained Earnings of $20,677,000,000. The Retained Earnings account represents the cumulative earnings of the firm less any dividends paid to the shareholders since the business began. In addition, Dell appears profitable in the most recent year because Retained Earnings increased. It is possible to determine the amount of net income by using the following equation, assuming no dividends were declared: (in millions) Beg. For the Year End. Retained Earnings + Net Income – Dividends declared = Retained Earnings $18,199 + ? – $ 0 = $20,677 Thus, net income for the most recent year was $2,478,000,000. 2-45 Chapter 02 Investing and Financing Decisions and the Balance Sheet CRITICAL THINKING CASES CP2–7. Req. 1 Dewey, Cheetum, and Howe, Inc. Balance Sheet December 31, 2012 Assets Current Assets: Cash Accounts receivable Inventory Total current assets Furniture and fixtures Delivery truck (net) Buildings (net) Total assets $ 1,000 8,000 8,000 17,000 52,000 12,000 60,000 $141,000 Liabilities Current Liabilities: Accounts payable Payroll taxes payable Total current liabilities Notes payable (due in three years) Mortgage payable Total liabilities $ 16,000 13,000 29,000 15,000 50,000 94,000 Stockholders' Equity Contributed capital Accumulated deficit Total stockholders' equity Total liabilities and stockholders' equity 80,000 (33,000) 47,000 $141,000 2-46 Chapter 02 - Investing and Financing Decisions and the Balance Sheet CP2–7. (continued) Req. 2 Dear ___________, I corrected the balance sheet for Dewey, Cheetum, and Howe, Inc. Primarily, I reduced the amount reported for buildings to $60,000 which is the historical cost less any depreciation. Estimated market value is not a generally accepted accounting principle for recording property, plant, and equipment. The $38,000 difference ($98,000 – $60,000) reduces total assets and reduces retained earnings. In fact, retained earnings becomes negative suggesting that there may have been several years of operating losses. Before making a final decision on investing in this company, you should examine the past three years of audited income statements and the past two years of audited balance sheets to identify positive and negative trends for this company. You can also compare this company's current ratio to that of the industry to assess trends in liquidity, and compare how this company’s long-term debt as a proportion of stockholders’ equity has changed over time. You should also learn as much about the industry as you can by reviewing recent articles on economic and technological trends which may have an impact on this company. 2-47 Chapter 02 Investing and Financing Decisions and the Balance Sheet CP2–8. 1. The most obvious parties harmed by the fraud at Ahold’s U.S. Foodservice, Inc., were the stockholders and creditors. Stockholders were purchasing shares of stock that were inflated due to the fraud. Creditors were lending funds to the company based on inflated income statement and balance sheet information. When the fraud was discovered, the stock price dropped causing the stockholders to lose money on their investments. In addition, the creditors have a lower probability of receiving full payment on their loans. The vendors who assisted in verifying false promotional allowances were also investigated. Those who were helped by the fraud included the former executives who were able to receive substantial bonuses based on the inflated results of operations. The SEC also charged two individuals with insider trading for trading on a tip illegally. 2. U.S. Foodservice set certain financial goals and tied the former executives’ bonuses to meeting the goals. Adopting targets is a good tool for monitoring progress toward goals and identifying problem areas, such as rising costs or sagging sales. Better decision making can result by heading off potential problems before they grow too large. However, setting unrealistic financial targets, especially in poor economic times, can result in those responsible for meeting the targets circumventing appropriate procedures and policies for their own benefit. 3. In many cases of fraudulent activity, auditors are named in lawsuits along with the company. If the auditors are found to be negligent in performing their audit, then they are liable. However, in many frauds, the management at multiple levels of the organization are so involved in covering the fraud that it becomes nearly impossible for the auditors to detect the fraudulent activity. In this case, it appears that top executives concocted a scheme to induce vendors to confirm false promotional allowance income by signing audit letters agreeing to the false amounts. In audits, confirming balances or amounts with external parties usually provides evidence for the auditors on potential problem areas. The auditors appropriately relied on this external evidence in performing their audit, not knowing it to be tainted or fraudulent. FINANCIAL REPORTING AND ANALYSIS TEAM PROJECT CP2–9. The solution to this team project will depend on the companies and/or accounting period selected for analysis. 2-48 Chapter 03 - Operating Decisions and the Income Statement Chapter 03 Operating Decisions and the Income Statement ANSWERS TO QUESTIONS 1. A typical business operating cycle for a manufacturer would be as follows: inventory is purchased, cash is paid to suppliers, the product is manufactured and sold on credit, and the cash is collected from the customer. 2. The time period assumption means that the financial condition and performance of a business can be reported periodically, usually every month, quarter, or year, even though the life of the business is much longer. 3. Net Income = Revenues + Gains - Expenses - Losses. Each element is defined as follows: Revenues -- increases in assets or settlements of liabilities from ongoing operations. Gains -increases in assets or settlements of liabilities from peripheral transactions. Expenses -- decreases in assets or increases in liabilities from ongoing operations. Losses -decreases in assets or increases in liabilities from peripheral transactions. 4. Both revenues and gains are inflows of net assets. However, revenues occur in the normal course of operations, whereas gains occur from transactions peripheral to the central activities of the company. An example is selling land at a price above cost (at a gain) for companies not in the business of selling land. Both expenses and losses are outflows of net assets. However, expenses occur in the normal course of operations, whereas losses occur from transactions peripheral to the central activities of the company. An example is a loss suffered from fire damage. 5. Accrual accounting requires recording revenues when earned and recording expenses when incurred, regardless of the timing of cash receipts or payments. Cash basis accounting is recording revenues when cash is received and expenses when cash is paid. 3-1 Chapter 03 - Operating Decisions and the Income Statement 6. The four criteria that must be met for revenue to be recognized under the accrual basis of accounting are (1) delivery has occurred or services have been rendered, (2) there is persuasive evidence of an arrangement for customer payment, (3) the price is fixed or determinable, and (4) collection is reasonably assured. 7. The matching principle requires that expenses be recorded when incurred in earning revenue. For example, the cost of inventory sold during a period is recorded in the same period as the sale, not when the goods are produced and held for sale. 8. Net income equals revenues minus expenses. Thus revenues increase net income and expenses decrease net income. Because net income increases stockholders’ equity, revenues increase stockholders’ equity and expenses decrease it. 9. Revenues increase stockholders’ equity and expenses decrease stockholders’ equity. To increase stockholders’ equity, an account must be credited; to decrease stockholders’ equity, an account must be debited. Thus revenues are recorded as credits and expenses as debits. 10. Item Increase Decrease Credit Debit Credit Debit Debit Credit Debit Credit Debit Credit Decrease Increase Decrease Increase Increase Decrease Increase Decrease Operating, Investing, or Financing Direction of the Effect on Cash Operating None Operating Investing Operating Financing – None + – – + Revenues Losses Gains Expenses 11. Item Revenues Losses Gains Expenses 12. Transaction Cash paid to suppliers Sale of goods on account Cash received from customers Purchase of investments Cash paid for interest Issuance of stock for cash 3-2 Chapter 03 - Operating Decisions and the Income Statement Total asset turnover is calculated as Sales (or Operating revenues) Average total assets. The total asset turnover ratio measures the sales generated per dollar of assets. A high ratio suggests that the company is managing its assets (resources used to generate revenues) efficiently. 13. ANSWERS TO MULTIPLE CHOICE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. c a b b b c d b a b 3-3 Chapter 03 - Operating Decisions and the Income Statement Authors' Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 6 3 6 4 5 5 5 6 5 7 5 8 6 9 6 10 6 11 6 Exercises No. Time 1 10 2 15 3 20 4 20 5 20 6 20 7 18 8 20 9 20 10 20 11 20 12 15 13 20 14 20 15 20 16 20 17 20 18 10 19 10 Problems No. Time 1 20 2 20 3 25 4 40 5 20 6 40 7 30 Alternate Problems No. Time 1 30 2 30 3 35 4 40 5 20 6 40 Cases and Projects No. Time 1 20 2 30 3 30 4 20 5 30 6 30 7 60 8 30 9 * * Due to the nature of this project, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 3-4 Chapter 03 - Operating Decisions and the Income Statement MINI-EXERCISES M3–1. TERM G C F E B (1) Losses (2) Matching principle (3) Revenues (4) Time period assumption (5) Operating cycle M3–2. Cash Basis Income Statement Revenues: Cash sales Customer deposits Expenses: Inventory purchases Wages paid Net Income $10,000 3,000 1,000 750 $11,250 3-5 Accrual Basis Income Statement Revenues: Sales to customers $15,000 Expenses: Cost of sales Wages expense Utilities expense Net Income 9,000 750 200 $5,050 Chapter 03 - Operating Decisions and the Income Statement M3–3. Revenue Account Affected a. Games Revenue b. Sales Revenue Amount of Revenue Earned in July $13,000 $7,000 c. None No revenue earned in July; cash collections in July related to earnings in June. d. None No revenue earned in July; earnings process is not yet complete – Unearned Revenue is recorded upon receipt of cash. M3–4. Expense Account Affected e. Cost of Goods Sold f. None g. Wages Expense h. Insurance Expense i. Repairs Expense j. Utilities Expense Amount of Expense Incurred in July $3,890 No expense is incurred in July; payment related to June electricity usage. $4,700 $600 incurred and expensed in July and $1,200 not incurred until future months (recorded as Prepaid Expense (A)). $1,400 $2,600 incurred in July 3-6 Chapter 03 - Operating Decisions and the Income Statement M3–5. a. b. c. d. Cash (+A) ............................................................................ Games Revenue (+R, +SE) ........................................... 13,000 Cash (+A) ............................................................................ Accounts Receivable (+A) ................................................... Sales Revenue (+R, +SE) .............................................. 3,000 4,000 Cash (+A) ............................................................................ Accounts Receivable (A) .............................................. 2,500 Cash (+A) ............................................................................ Unearned Revenue (+L)................................................. 2,600 Cost of Goods Sold (+E, SE) ............................................. Inventory (A)................................................................. 3,890 Accounts Payable (–L) ........................................................ Cash (A) ....................................................................... 1,900 Wages Expense (+E, SE) .................................................. Cash (A) ....................................................................... 4,700 Insurance Expense (+E, SE) ............................................. Prepaid Expenses (+A)........................................................ Cash (A) ....................................................................... 600 1,200 Repairs Expense (+E, SE)................................................. Cash (A) ....................................................................... 1,400 Utilities Expense (+E, SE) ................................................. Accounts Payable (+L) ................................................... 2,600 13,000 7,000 2,500 2,600 M3–6. e. f. g. h. i. j. 3-7 3,890 1,900 4,700 1,800 1,400 2,600 Chapter 03 - Operating Decisions and the Income Statement M3–7. Assets Balance Sheet Income Statement Stockholders’ Net Liabilities Equity Revenues Expenses Income a. +13,000 NE +13,000 +13,000 NE +13,000 b. +7,000 NE +7,000 +7,000 NE +7,000 c. +2,500 –2,500 NE NE NE NE NE d. +2,600 +2,600 NE NE NE NE Transaction (c) results in an increase in an asset (cash) and a decrease in an asset (accounts receivable). Therefore, there is no net effect on assets. M3–8. Assets Balance Sheet Income Statement Stockholders’ Net Liabilities Equity Revenues Expenses Income e. –3,890 NE –3,890 NE +3,890 –3,890 f. –1,900 –1,900 NE NE NE NE g. –4,700 NE –4,700 NE +4,700 –4,700 h. –1,800/ +1,200 NE –600 NE +600 –600 i. –1,400 NE –1,400 NE +1,400 –1,400 j. NE +2,600 –2,600 NE +2,600 –2,600 Transaction (h) results in an increase in an asset (prepaid expenses) and a decrease in an asset (cash). Therefore, the net effect on assets is 600. 3-8 Chapter 03 - Operating Decisions and the Income Statement M3–9. Craig’s Bowling, Inc. Income Statement For the Month of July 2011 Revenues: Games revenue Sales revenue Total revenues $13,000 7,000 20,000 Expenses: Cost of goods sold Utilities expense Wages expense Insurance expense Repairs expense Total expenses 3,890 2,600 4,700 600 1,400 13,190 Net income $ 6,810 M3–10. Craig’s Bowling, Inc. Partial Statement of Cash Flows For the Month of July 2011 Cash Flows from Operating Activities: Cash received from customers (=$13,000+$3,000+$2,500+$2,600) $21,100 Cash paid to suppliers (=$1,900+$1,800+$1,400) (5,100) Cash paid to employees (4,700) Cash from operating activities $11,300 M3–11. 2012 Total Asset = Sales Turnover Average Total Assets $163,000 $56,500* 2011 = 2.89 $151,000 $47,000** = 3.21 * ($53,000 + $60,000) ÷ 2 ** ($41,000 + $53,000) ÷ 2 The decrease in the asset turnover ratio suggests that the company is managing its assets less efficiently, generating fewer sales per dollar of assets in 2012 than in 2011. 3-9 Chapter 03 - Operating Decisions and the Income Statement EXERCISES E3–1. TERM K E G I M C D F J L (1) (2) (3) (4) (5) (6) (7) (8) Expenses Gains Revenue principle Cash basis accounting Unearned revenue Operating cycle Accrual basis accounting Prepaid expenses (9) Revenues Expenses = Net Income (10) Ending Retained Earnings = Beginning Retained Earnings + Net Income Dividends Declared E3–2. Req. 1 Cash Basis Income Statement Revenues: Cash sales Customer deposits Expenses: Inventory purchases Wages paid Utilities paid Net Income $520,000 35,000 90,000 164,200 17,200 $283,600 Accrual Basis Income Statement Revenues: Sales to customers $630,000 Expenses: Cost of sales Wages expense Utilities expense 387,000 169,000 18,940 Net Income $55,060 Req. 2 Accrual basis financial statements provide more useful information to external users. Financial statements created under cash basis accounting normally postpone (e.g., $110,000 credit sales) or accelerate (e.g., $35,000 customer deposits) recognition of revenues and expenses long before or after goods and services are produced and delivered (until cash is received or paid). They also do not necessarily reflect all assets or liabilities of a company on a particular date. 3-10 Chapter 03 - Operating Decisions and the Income Statement E3–3. Activity Amount of Revenue Earned in September Revenue Account Affected a. None No revenue earned in September; earnings process is not yet complete. b. Interest revenue $12 (= $1,200 x 12% x 1month/12 months) c. Sales revenue $18,050 d. None No transaction has occurred; exchange of promises only. e. Sales revenue $15,000 (= 1,000 shirts x $15 per shirt); revenue earned when goods are delivered. f. None Payment related to revenue recorded previously in (e) above. g. None No revenue earned in September; earnings process is not yet complete. h. None No revenue is earned; the issuance of stock is a financing activity. i. None No revenue earned in September; earnings process is not yet complete. j. Ticket sales revenue $3,660,000 (= $18,300,000 ÷ 5 games) k. None No revenue earned in September; earnings process is not yet complete. l. Sales revenue $18,400 m. Sales revenue $100 3-11 Chapter 03 - Operating Decisions and the Income Statement E3–4. Activity Amount of Expense Incurred in January Expense Account Affected a. Utilities expense $2,754 b. Advertising expense $282(= $846 x 1 month/3 months) incurred in January. The remainder is a prepaid expense (A) that is not incurred until February and March. c. Salary expense $189,750 incurred in January. The remaining half was incurred in December. d. None Expense will be recorded when the related revenue has been earned. e. None Expense will be recorded in the future when the related revenue has been earned. f. Cost of goods sold $40,050 (= 450 books x $89 per book) g. None December expense paid in January. h. Commission expense $14,470 i. None Expense will be recorded as depreciation over the equipment’s useful life. j. Supplies expense $5,190 (= $4,000 + $2,600 - $1,410) k. Wages expense $104 (= 8 hours x $13 per hour) l. Insurance expense $300 (= $3,600 ÷ 12 months) m. Repairs expense $300 n. Utilities Expense $202 o. Consulting Expense $1,285 p. None December expense paid in January. q. Cost of goods sold $5,000 (= 500 shirts x $10 per shirt) 3-12 Chapter 03 - Operating Decisions and the Income Statement E3–5. Assets Balance Sheet Income Statement Stockholders’ Net Liabilities Equity Revenues Expenses Income a. + NE + NE NE NE b. + + NE NE NE NE c. - NE - NE NE NE d. + NE + + NE + e. NE + – NE + – f. + NE + + NE + g. – – NE NE NE NE h. – NE – NE + – i. + NE + + NE + j. + + NE NE NE NE k. +/– NE NE NE NE NE l. – NE – NE +* – m. – + – NE + – n. – NE – NE + – Transaction (k) results in an increase in an asset (cash) and a decrease in an asset (accounts receivable). Therefore, there is no net effect on assets. * A loss affects net income negatively, as do expenses. 3-13 Chapter 03 - Operating Decisions and the Income Statement E3–6. Assets Balance Sheet Income Statement Stockholders’ Net Liabilities Equity Revenues Expenses Income a. +7,047 NE +7,047 NE NE NE b. +765,472 +765,472 NE NE NE NE c. +59,500 +59,500 NE NE NE NE NE NE +1,220,568 –734,547 +1,220,568 NE NE +734,547 +1,220,568 –734,547 NE –20,758 NE NE NE NE NE NE NE NE d. +1,220,568 –734,547 –20,758 e. f. +/–24,126 g. –258,887 +86,296 –345,183 NE +345,183 –345,183 h. +1,757 NE +1,757 +1,757 NE +1,757 i. NE +2,850 –2,850 NE +2,850 –2,850 Transaction (f) results in an increase in an asset (property, plant, and equipment) and a decrease in an asset (cash). Therefore, there is no net effect on assets. E3–7. (in thousands) a. b. c. Plant and equipment (+A) ................................................... 515 Cash (A) ....................................................................... Debits equal credits. Assets increase and decrease by the same amount. 515 Cash (+A) ........................................................................... 758 Short-term notes payable (+L) ....................................... Debits equal credits. Assets and liabilities increase by the same amount. 758 Cash (+A) ........................................................................... 10,272 Accounts receivable (+A) .................................................... 27,250 Service revenue (+R, +SE) ............................................. 37,522 Debits equal credits. Revenue increases retained earnings (part of stockholders' equity). Stockholders' equity and assets increase by the same amount. 3-14 Chapter 03 - Operating Decisions and the Income Statement E3–7. (continued) d. 4,300 Accounts payable (L) ........................................................ 4,300 Cash (A) ....................................................................... Debits equal credits. Assets and liabilities decrease by the same amount. e. Inventory (+A) ..................................................................... 30,449 Accounts payable (+L) .................................................... 30,449 Debits equal credits. Assets and liabilities increase by the same amount. f. 3,500 Wages expense (+E, SE) ................................................. 3,500 Cash (A) ....................................................................... Debits equal credits. Expenses decrease retained earnings (part of stockholders' equity). Stockholders' equity and assets decrease by the same amount. g. Cash (+A) ........................................................................... 37,410 37,410 Accounts receivable (A) ............................................... Debits equal credits. Assets increase and decrease by the same amount. h. 750 Fuel expense (+E, SE) ..................................................... 750 Cash (A) ....................................................................... Debits equal credits. Expenses decrease retained earnings (part of stockholders' equity). Stockholders' equity and assets decrease by the same amount. i. 497 Retained earnings (SE) .................................................... 497 Cash (A) ....................................................................... Debits equal credits. Assets and stockholders’ equity decrease by the same amount. j. 68 Utilities expense (+E, SE) ................................................. 55 Cash (A) ....................................................................... 13 Accounts payable (+L) .................................................... Debits equal credits. Expenses decrease retained earnings (part of stockholders' equity). Together, stockholders' equity and liabilities decrease by the same amount as assets. 3-15 Chapter 03 - Operating Decisions and the Income Statement E3–8. Req. 1 a. Cash (+A) ................................................................... 2,500,000 Short-term note payable (+L) ........................... 2,500,000 Debits equal credits. Assets and liabilities increase by the same amount. b. Equipment (+A) .......................................................... 95,000 Cash (A)......................................................... 95,000 Debits equal credits. Assets increase and decrease by the same amount. c. Merchandise inventory (+A)........................................ 40,000 Accounts payable (+L) ..................................... 40,000 Debits equal credits. Assets and liabilities increase by the same amount. d. Repair and maintenance expense (+E, SE) ............. 62,000 Cash (A)......................................................... 62,000 Debits equal credits. Expenses decrease retained earnings (part of stockholders' equity). Stockholders' equity and assets decrease by the same amount. e. Cash (+A) ................................................................... 372,000 Unearned pass revenue (+L) ........................... 372,000 Debits equal credits. Since the season passes are sold before Vail Resorts provides service, revenue is deferred until it is earned. Assets and liabilities increase by the same amount. f. Two transactions occur: (1) Accounts receivable (+A) ...................................... 750 Ski shop sales revenue (+R, +SE) ................... 750 Debits equal credits. Revenue increases retained earnings (a part of stockholders' equity). Stockholders' equity and assets increase by the same amount. (2) Cost of goods sold (+E, SE) ................................ 450 Merchandise inventory (A) ............................. 450 Debits equal credits. Expenses decrease retained earnings (a part of stockholders' equity). Stockholders' equity and assets decrease by the same amount. 3-16 Chapter 03 - Operating Decisions and the Income Statement E3–8. (continued) g. Cash (+A) ................................................................... 270,000 Lift revenue (+R, +SE) ..................................... 270,000 Debits equal credits. Revenue increases retained earnings (a part of stockholders' equity). Stockholders' equity and assets increase by the same amount. h. Cash (+A) ................................................................... 3,200 Unearned rent revenue (+L) ............................ 3,200 Debits equal credits. Since the rent is received before the townhouse is used, revenue is deferred until it is earned. Assets and liabilities increase by the same amount. i. Accounts payable (L) ................................................ 20,000 Cash (A)......................................................... 20,000 Debits equal credits. Assets and liabilities decrease by the same amount. j. Cash (+A) ................................................................... 400 Accounts receivable (A) ................................. 400 Debits equal credits. Assets increase and decrease by the same amount. k. Wages expense (+E, SE) ......................................... 258,000 Cash (A)......................................................... 258,000 Debits equal credits. Expenses decrease retained earnings (a part of stockholders' equity). Stockholders' equity and assets decrease by the same amount. Req. 2 Accounts Receivable (j) Beg. bal. 1,200 400 (f) 750 End. bal. 1,550 3-17 Chapter 03 - Operating Decisions and the Income Statement E3–9. 2/1 Rent expense (+E, SE) ..................................................... Cash (A) ................................................................. 275 2/2 Fuel expense (+E, SE) ..................................................... Accounts payable (+L) .............................................. 490 2/4 Cash (+A) ........................................................................... Unearned revenue (+L) ............................................ 820 2/7 Cash (+A) ........................................................................... Transport revenue (+R, +SE) ................................... 910 2/10 Advertising expense (+E, SE) ........................................... Cash (A) ................................................................. 175 2/14 Wages payable (L) ........................................................... Cash (A) ................................................................. 2,300 2/18 Cash (+A) ........................................................................... Accounts receivable (+A) .................................................... Transport revenue (+R, +SE) ................................... 1,600 2,200 2/25 Parts supplies (+A) ............................................................. Accounts payable (+L) .............................................. 2,550 2/27 Retained earnings (SE) .................................................... Dividends payable (+L) ............................................. 200 3-18 275 490 820 910 175 2,300 3,800 2,550 200 Chapter 03 - Operating Decisions and the Income Statement E3–10. Req. 1 and 2 Cash Beg. 6,200 (a) 18,400 2,140 (b) 600 15,000 (c) 820 2,600 (d) 7,200 960 12,520 (g) (i) (j) (k) Equipment Beg. 9,600 (h) 920 10,520 Accounts Payable 9,600 Beg. (g) 2,140 520 (e) 7,980 Contributed Capital 8,600 Beg. 920 (h) 9,520 Rent Revenue 0 Beg. 820 (c) 820 Accounts Receivable Beg.30,000 7,200 (d) 22,800 Land Beg. 7,200 7,200 Unearned Fee Revenue 3,840 Beg. 600 (b) 4,440 Retained Earnings 10,800 Beg. (j) 2,600 8,200 Wages Expense Beg. 0 (i) 15,000 15,000 Item (f) is not a transaction; there has been no exchange. 3-19 Supplies Beg. 1,440 (k) 960 2,400 Building Beg. 26,400 26,400 Note Payable 48,000 Beg. 48,000 Rebuilding Fees Revenue 0 Beg. 18,400 (a) 18,400 Utilities Expense Beg. 0 (e) 520 520 Chapter 03 - Operating Decisions and the Income Statement E3–10. (continued) Req. 3 Net income using the accrual basis of accounting: Revenues $19,220 ($18,400 + $820) – Expenses 15,520 ($15,000 + $520) Net Income $ 3,700 (accrual basis) Assets $12,520 22,800 2,400 10,520 7,200 26,400 $81,840 = Liabilities $ 7,980 4,440 48,000 $60,420 + Stockholders’ Equity $ 9,520 8,200 3,700 net income $21,420 Req. 4 Net income using the cash basis of accounting: Cash receipts $27,020 (transactions a through d) – Cash disbursements 18,100 (transactions g, i, and k) Net Income $ 8,920 (cash basis) Cash basis net income ($8,920) is higher than accrual basis net income ($3,700) because of the differences in the timing of recording revenues versus receipts and expenses versus disbursements between the two methods. The $7,800 higher amount in cash receipts over revenues includes cash received prior to being earned (from (b), $600) and cash received after being earned (in (d), $7,200). The $2,580 higher amount in cash disbursements over expenses includes cash paid after being incurred in the prior period (in (g), $2,140), plus cash paid for supplies to be used and expensed in the future (in (k), $960), less an expense incurred in January to be paid in February (in (e), $520). 3-20 Chapter 03 - Operating Decisions and the Income Statement E3–11. Req. 1 STACEY’S PIANO REBUILDING COMPANY Income Statement (unadjusted) For the Month Ended January 31, 2011 Operating Revenues: Rebuilding fees revenue Total operating revenues $ 18,400 18,400 Operating Expenses: Wages expense Utilities expense Total operating expenses Operating Income 15,000 520 15,520 2,880 Other Item: Rent revenue 820 Net Income $ 3,700 Req. 2 STACEY’S PIANO REBUILDING COMPANY Statement of Stockholders’ Equity (unadjusted) For the Month Ended January 31, 2011 Balance, December 31, 2010 Additional contributions Net income Dividends Balance, January 31, 2011 Contributed Capital $ 8,600 920 $ 9,520 3-21 Retained Earnings $ 10,800 3,700 (2,600) $11,900 Total Stockholders’ Equity $19,400 920 3,700 (2,600) $21,420 Chapter 03 - Operating Decisions and the Income Statement E3–11. (continued) Req. 3 STACEY’S PIANO REBUILDING COMPANY Balance Sheet (unadjusted) At January 31, 2011 Assets Current assets: Cash Accounts receivable Supplies Total current assets Equipment Land Building Total Assets Liabilities and Stockholders’ Equity Current liabilities: Accounts payable Unearned fee revenue Total current liabilities Note payable Total Liabilities Stockholders’ Equity: Contributed Capital Retained Earnings Total Stockholders’ Equity Total Liabilities and Stockholders’ Equity 3-22 $ 12,520 22,800 2,400 37,720 10,520 7,200 26,400 $ 81,840 $ 7,980 4,440 12,420 48,000 60,420 9,520 11,900 21,420 $ 81,840 Chapter 03 - Operating Decisions and the Income Statement E3–12. STACEY’S PIANO REBUILDING COMPANY Statement of Cash Flows For the Month Ended January 31, 2011 Operating Activities Cash received from customers (=$18,400+$600+$820+$7,200) Cash paid to employees Cash paid to suppliers (=$2,140+$960) Total cash from operating activities Investing Activities None Total cash provided by investing activities Financing Activities Dividends paid Total cash used in financing activities Increase in cash Beginning cash balance Ending cash balance $27,020 (15,000) (3,100) 8,920 0 0 (2,600) (2,600) 6,320 6,200 $12,520 Transaction (h) is omitted from the statement of cash flows because the transaction did not involve a cash payment. However, as discussed in future chapters, this type of transaction is a noncash investing and financing activity that requires supplemental disclosure. 3-23 Chapter 03 - Operating Decisions and the Income Statement E3–13. Req. 1 and 2 Cash Beg. 0 72,000 (a)160,000 10,830 (c) 50,000 363 (e) 2,600 6,280 (f) 11,900 600 70,000 64,427 (b) (d) (h) (i) (j) (k) Equipment Beg. 0 (a) 18,300 (k) 50,000 68,300 (j) 3,600 Beg. Supplies Expense Beg. 0 (d) 10,830 10,830 Supplies Beg. 0 (a) 1,200 1,200 Building Beg. 0 (b)360,000 (k) 20,000 380,000 Note Payable 0 Beg. 50,000 (c) 50,000 Retained Earnings 0 600 600 Accounts Receivable Beg. 0 (a) 2,000 (e) 1,600 Accounts Payable 0 Beg. 420 (g) 420 Mortgage Payable 0 Beg. 288,000(b) 288,000 Contributed Capital 0 Beg. 181,500 (a) 181,500 Food Sales Revenue 0 Beg. 11,900 (f) 11,900 Catering Sales Revenue 0 Beg. 4,200 (e) 4,200 Utilities Expense Beg. 0 (g) 420 420 Fuel Expense Beg. 0 (h) 363 363 3-24 Wages Expense Beg. 0 (i) 6,280 6,280 Chapter 03 - Operating Decisions and the Income Statement E3–14. Req. 1 TRAVELING GOURMET, INC. Income Statement (unadjusted) For the Month Ended March 31, 2011 Revenues: Food sales revenue Catering sales revenue Total revenues Expenses: Supplies expense Utilities expense Wages expense Fuel expense Total costs and expenses Net Loss $ 11,900 4,200 16,100 $ 10,830 420 6,280 363 17,893 (1,793) Req. 2 TRAVELING GOURMET, INC. Statement of Stockholders’ Equity (unadjusted) For the Month Ended March 31, 2011 Beginning, March 1, 2011 Additional contributions Net loss Dividends Ending, March 31, 2011 Contributed Capital $ 0 181,500 $ 181,500 Retained Earnings $ 0 (1,793) (600) $ (2,393) Total Stockholders’ Equity $ 0 181,500 (1,793) (600) $179,107 Note: In many states, dividends could not have been declared legally due to the insufficient amount in retained earnings. 3-25 Chapter 03 - Operating Decisions and the Income Statement E3–14. (continued) Req. 3 TRAVELING GOURMET, INC. Balance Sheet (unadjusted) At March 31, 2011 Assets Current assets: Cash Accounts receivable Supplies Total current assets Equipment Building Total Assets Liabilities Current liabilities: Accounts payable Note payable Total current liabilities Mortgage payable Total Liabilities Stockholders’ Equity Contributed capital Retained earnings Total Stockholders’ Equity Total Liabilities and Stockholders’ Equity $ 64,427 3,600 1,200 69,227 68,300 380,000 $517,527 $ 420 50,000 50,420 288,000 338,420 181,500 (2,393) 179,107 $517,527 Req. 4 The company generated a small loss during its first month of operations, before making any adjusting entries. The adjusting entries for depreciation and interest expense will increase the loss. So far the company does not appear to be successful, but it is only in its first month of operating a retail store. If sales can be increased without inflating fixed costs (particularly salaries expense), the company may soon turn a profit. It is not unusual for small businesses to lose money as they start up operations. 3-26 Chapter 03 - Operating Decisions and the Income Statement E3–15. TRAVELING GOURMET, INC. Statement of Cash Flows For the Month Ended March 31, 2011 Operating Activities Cash received from customers (=$2,600+$11,900) Cash paid to employees Cash paid to suppliers (=$10,830+$363) Total cash used in operating activities $ 14,500 (6,280) (11,193) (2,973) Investing Activities Purchased building (=$72,000+$20,000) Purchased equipment Total cash used in investing activities (92,000) (50,000) (142,000) Financing Activities Borrowed on a note payable Issued stock Paid dividends Total cash from financing activities Increase in cash Beginning cash balance 50,000 160,000 (600) 209,400 64,427 0 Ending cash balance $ 64,427 Note that portions of transactions (a) and (b) are omitted from the statement of cash flows. However, as discussed in future chapters, these types of transactions are noncash investing and financing activities that require supplemental disclosure. 3-27 Chapter 03 - Operating Decisions and the Income Statement E3–16. Req. 1 Transaction Brief Explanation a Issued capital stock to shareholders for $63,300 cash. b Purchased store fixtures for $13,700 cash. c Purchased $24,800 of inventory, paying $6,200 cash and the balance on account. d Sold $12,400 of goods or services to customers, receiving $8,680 cash and the balance on account. The cost of the goods sold was $6,510. e Used $1,480 of utilities during the month, not yet paid. f Paid $1,240 in wages to employees. g Paid $2,480 in cash for rent, $620 related to the current month and $1,860 related to future months. h Received $3,720 cash from customers, $1,240 related to current sales and $2,480 related to goods or services to be provided in the future. Req. 2 Kate’s Kite Company Income Statement For the Month Ended April 30, 2011 Sales Revenue Expenses: Cost of sales Wages expense Rent expense Utilities expense Total expenses Net Income 3-28 $ 13,640 $ 6,510 1,240 620 1,480 9,850 3,790 Chapter 03 - Operating Decisions and the Income Statement E3–16. (continued) Kate’s Kite Company Balance Sheet At April 30, 2010 Assets Current Assets: Cash Accounts receivable Inventory Prepaid expenses Total current assets Store fixtures $52,080 3,720 18,290 1,860 75,950 13,700 Total Assets $89,650 Liabilities and Shareholders’ Equity Current Liabilities: Accounts payable $20,080 Unearned revenue 2,480 Total current liabilities 22,560 Shareholders’ Equity: Contributed capital 63,300 Retained earnings 3,790 Total shareholders’ equity 67,090 Total Liabilities & Shareholders’ Equity $89,650 E3–17. Req. 1 Assets $ 3,200 8,000 6,400 $17,600 = Liabilities $ 2,400 5,600 1,600 $9,600 3-29 + Stockholders’ Equity $ 4,800 3,200 $ 8,000 Chapter 03 - Operating Decisions and the Income Statement E3–17. (continued) Req. 2 Cash Beg. 3,200 57,200 (d) (a) 48,000 480 (g) (b) 5,600 (c) 400 (e) 1,600 1,120 Accounts Receivable Beg. 8,000 5,600 (a) 10,000 (b) 12,400 6,400 Accounts Payable (d) 1,600 2,400 Beg. 800 (f) 1,600 Unearned Revenue 5,600 Beg. 1,600 (e) 7,200 Contributed Capital 4,800 Beg. 4,800 Retained Earnings (g) 480 3,200 Beg. 2,720 Consulting Fee Revenue 0 Beg. 58,000 (a) 58,000 Investment Income 0 Beg. 400 (c) 400 Wages Expense Beg. 0 (d) 36,000 36,000 Long-Term Investments Beg. 6,400 Travel Expense Beg. 0 (d) 12,000 12,000 Rent Expense Beg. 0 (d) 7,600 7,600 3-30 Long-Term Notes Payable 1,600 Beg. 1,600 Utilities Expense Beg. 0 (f) 800 800 Chapter 03 - Operating Decisions and the Income Statement E3–17. (continued) Req. 3 Revenues – Expenses Net Income Assets $ 1,120 12,400 6,400 $19,920 $58,400 ($58,000 + $400) 56,400 ($36,000 + $12,000 + $800 + $7,600) $ 2,000 = Liabilities $ 1,600 7,200 1,600 $10,400 + Stockholders’ Equity $ 4,800 2,720 2,000 net income $ 9,520 Req. 4 Total Asset Turnover = Sales (Operating) Revenues Average Total Assets = $58,000* = 3.09 $18,760** * The $400 of investment income is not an operating revenue and is not included in the computation. ** ($17,600 beginning total assets + $19,920 ending total assets) ÷ 2 The increasing trend in the total asset turnover ratio from 1.80 in 2010 and 2.00 in 2011 to 3.09 in 2012 suggests that the company is managing its assets more efficiently over time. 3-31 Chapter 03 - Operating Decisions and the Income Statement E3–18. Req. 1 Accounts receivable increases with customer sales on account and decreases with cash payments received from customers. Prepaid expenses increase with cash payments of expenses related to future periods and decrease as these expenses are incurred over time. Unearned subscriptions increases with cash payments received from customers for goods or services to be provided in the future and decreases when those goods and services are provided. Req. 2 Accounts Receivable 1/1 438 2,949 12/31 Prepaid Expenses 1/1 90 313 2,983 404 Unearned Subscriptions 12/31 81 1/1 148 151 277 126 84 12/31 Computations: Beginning + “+” “” = Ending Accounts receivable 438 + 2,949 ? ? = = 404 2,983 Prepaid expenses 90 + 313 ? ? = = 126 277 Unearned subscriptions 81 + 151 ? ? = = 84 148 3-32 Chapter 03 - Operating Decisions and the Income Statement E3–19. ITEM LOCATION 1. Description of a company’s primary business(es). Letter to shareholders; Management’s Discussion and Analysis; Summary of significant accounting policies note 2. Income taxes paid. Notes; Statement of cash flows 3. Accounts receivable. Balance sheet 4. Cash flow from operating activities. Statement of cash flows 5. Description of a company’s revenue recognition policy. Summary of significant accounting policies note 6. The inventory sold during the year. Income statement (Cost of Goods Sold) 7. The data needed to compute the total asset turnover ratio. Balance sheet and income statement 3-33 Chapter 03 - Operating Decisions and the Income Statement PROBLEMS P3-1. Transactions Debit Credit 5 1, 8 Paid cash for salaries and wages earned by employees this period. 14 1 Paid cash on accounts payable for expenses incurred last period. 7 1 d. Purchased supplies to be used later; paid cash. 3 1 e. Performed services this period on credit. 2 13 f. Collected cash on accounts receivable for services performed last period. 1 2 g. Issued stock to new investors. 1 11 h. Paid operating expenses incurred this period. 14 1 i. Incurred operating expenses this period to be paid next period. 14 7 j. Purchased a patent (an intangible asset); paid cash. 6 1 k. Collected cash for services performed this period. 1 13 l. Used some of the supplies on hand for operations. 14 3 m. Paid three-fourths of the income tax expense for the year; the balance will be paid next year. 15 1, 10 8, 16 1 4 1 a. b. c. n. o. Example: Purchased equipment for use in the business; paid one-third cash and signed a note payable for the balance. Made a payment on the equipment note in (a); the payment was part principal and part interest expense. On the last day of the current period, paid cash for an insurance policy covering the next two years. 3-34 Chapter 03 - Operating Decisions and the Income Statement P3–2. a. b. c. d. e. f. g. h. i. j. Cash (+A) ............................................................................ Contributed capital (+SE) ............................................... 40,000 Cash (+A) ............................................................................ Note payable (long-term) (+L) ........................................ 60,000 Rent expense (+E, SE)...................................................... Prepaid rent (+A) ................................................................. Cash (A) ....................................................................... 1,500 1,500 Prepaid insurance (+A) ........................................................ Cash (A) ...................................................................... 2,400 Equipment (+A) ................................................................... Accounts payable (+L) .................................................. Cash (A) ...................................................................... 15,000 Inventory (+A) ...................................................................... Cash (A) ...................................................................... 2,800 Advertising expense (+E, SE)............................................ Cash (A) ...................................................................... 350 Cash (+A) ............................................................................ Accounts receivable (+A) .................................................... Sales revenue (+R, +SE) .............................................. 850 850 Cost of goods sold (+E, SE) .............................................. Inventory (A) ............................................................... 900 Accounts payable (L) ......................................................... Cash (A) ...................................................................... 12,000 Cash (+A) ............................................................................ Accounts receivable (A) .............................................. 210 3-35 40,000 60,000 3,000 2,400 12,000 3,000 2,800 350 1,700 900 12,000 210 Chapter 03 - Operating Decisions and the Income Statement P3–3. Req. 1 Req. 2 Assets Balance Sheet Income Statement Stockholders’ Net Liabilities Equity Revenues Expenses Income Stmt of Cash Flows a. +/– + NE NE NE NE O b. +/– NE NE NE NE NE I c. – + – NE + – O d. + NE + + NE + O e. – NE – NE + – NE* f. – NE – NE NE NE F g. + NE + + NE + O h. – NE – NE + – O * Cash is not affected in this transaction. 3-36 Chapter 03 - Operating Decisions and the Income Statement P3–4. Req. 1 and 2 Cash Beg. 0 5,640 (a) 27,600 1,430 (e) 11,000 11,000 (h) 2,675 500 (k) 155 550 (m) 2,400 1,500 130 23,080 (b) (d) (f) (g) (i) (j) (l) Inventory Beg. 0 1,200 (h) (c) 5,500 1,210 (m) 3,090 Accounts Receivable Beg. 0 155 (k) (h) 325 170 1,430 Prepaid Expenses Beg. 0 (b) 5,640 5,640 Furniture and Fixtures Beg. 0 (f) 8,250 8,250 Accounts Payable (i) 550 0 Beg. 5,500 (c) 4,950 Contributed Capital 0 Beg. 27,600 (a) Sales Revenue 0 Beg. 3,000 (h) 2,400 (m) 5,400 27,600 Advertising Expense Beg. 0 (g) 500 500 Supplies Beg. 0 (d) 1,430 Wage Expense Beg. 0 (j) 1,500 1,500 3-37 Equipment Beg. 0 (f) 2,750 2,750 Notes Payable 0 Beg. 11,000 (e) 11,000 Cost of Goods Sold Beg. 0 (h) 1,200 (m) 1,210 2,410 Repair Expense Beg. 0 (l) 130 130 Chapter 03 - Operating Decisions and the Income Statement P3–4. (continued) Req. 3 BRI’S SWEETS Income Statement (unadjusted) For the Month Ended February 28, 2011 Revenues: Sales revenue $ 5,400 Expenses: Cost of goods sold Advertising expense Wage expense Repair expense Total costs and expenses Net Income 2,410 500 1,500 130 4,540 $ 860 BRI’S SWEETS Statement of Stockholders’ Equity (unadjusted) For the Month Ended February 28, 2011 Beginning, February 1, 2011 Additional contributions Net income Dividends Ending, February 28, 2011 Contributed Capital $ 0 27,600 $27,600 3-38 Retained Earnings $ 0 $ 860 (0) 860 Total Stockholders’ Equity $ 0 27,600 860 (0) $28,460 Chapter 03 - Operating Decisions and the Income Statement P3–4. (continued) BRI’S SWEETS Balance Sheet (unadjusted) At February 28, 2011 Assets Current assets: Cash Accounts receivable Inventory Supplies Prepaid expenses Total current assets Furniture and fixtures Equipment Total Assets Liabilities and Stockholders’ Equity Current liabilities: Accounts payable Total current liabilities Notes payable Total Liabilities Stockholders’ Equity: Contributed capital Retained earnings Total Stockholders’ Equity Total Liabilities and Stockholders’ Equity $ 23,080 170 3,090 1,430 5,640 33,410 8,250 2,750 $ 44,410 $ 4,950 4,950 11,000 15,950 27,600 860 28,460 $ 44,410 Req. 4 Date: (today’s date) To: Brianna Webb From: (your name) After analyzing the effects of transactions for Bri’s Sweets for February, the company has realized a profit of $860. This is 16% of sales revenue. However, this is based on unadjusted amounts. There are several additional expenses that will decrease the net income amount, perhaps resulting in a net loss. These include rent, supplies, depreciation, interest, and wages. Therefore, the company does not appear to be profitable, which is common for small businesses at the beginning of operations. A focus on maintaining expenses while increasing revenues should result in profit in future periods. It would also be useful to prepare a budget of cash flows each month for the upcoming year to decide how potential cash shortages will be handled. 3-39 Chapter 03 - Operating Decisions and the Income Statement P3–4. (continued) Req. 5 Total Asset = Turnover Sales Average Total Assets 2012 2013 $82,500 =1.88 $44,000* $93,500 = 1.36 $68,750** * ($38,500 + $49,500) ÷ 2 ** ($49,500 + $88,000) ÷ 2 The ratio for 2013 is lower than it otherwise would have been given Brianna’s decision to open a second store. The loans and inventory purchases required have increased the average total assets used and therefore decreased the turnover ratio. With future sales expected to grow, the ratio should increase in coming years. Based on this rationale, the manager should be promoted. P3–5. BRI’S SWEETS Statement of Cash Flows For the Month Ended February 28, 2011 Operating Activities Cash received from customers (=$2,675+$155+$2,400) Cash paid to employees Cash paid to suppliers (=$5,640+$1,430+$500+$550+$130) Total cash used in operating activities Investing Activities Purchased equipment Total cash used in investing activities $ 5,230 (1,500) (8,250) (4,520) (11,000) (11,000) Financing Activities Issued stock Borrowed from bank Total cash from financing activities 27,600 11,000 38,600 Increase in cash Beginning cash balance 23,080 0 Ending cash balance $23,080 3-40 Chapter 03 - Operating Decisions and the Income Statement P3–6. Req. 1 and 2 Cash 4,598 Beg. 360 (a) 17,600 1,348 (e) 4,824 18 (g) 16 10,031 5,348 784 673 (c) (d) (f) (h) (i) (j) Prepaid Expenses Beg. 82 (c) 1,531 1,613 Other Noncurrent Assets Beg. 1,850 Receivables Beg. 1,162 4,824 (e) (a) 4,567 905 294 Other Current Assets Beg. 1,196 1,196 (j) Accounts Payable 784 835 Beg. 1,850 51 Other Current Liabilities 297 Beg. 297 Contributed Capital 492 Beg. 16 (g) 508 Delivery Service Revenue 0 Beg. 22,167 (a) 22,167 Wage Expense Beg. 0 (h) 10,031 10,031 Spare Parts, Supplies, and Fuel Beg. 294 Long-Term Notes Payable (f) 18 667 Beg. 1,345 (b) 1,994 Property and Equipment (net) Beg. 8,362 (b) 1,345 9,707 Accrued Expenses Payable 1,675 Beg. 1,675 Other Noncurrent Liabilities 3,513 Beg. 3,513 Retained Earnings 5,827 Beg. 5,827 Rental Expense Beg. 0 (c) 3,067 3,067 Fuel Expense Beg. 0 (i) 5,348 5,348 3-41 Repair Expense Beg. 0 (d) 1,348 1,348 Item k does not constitute a transaction. Chapter 03 - Operating Decisions and the Income Statement P3–6. (continued) Req. 3 FedEx Income Statement (unadjusted) For the Year Ended May 31, 2012 (in millions) Revenues: Delivery service revenue Expenses: Rental expense Wage expense Fuel expense Repair expense Total expenses Net Income $ 22,167 3,067 10,031 5,348 1,348 19,794 $ 2,373 FedEx Statement of Stockholders’ Equity (unadjusted) For the Year Ended May 31, 2012 (in millions) Beginning, May 31, 2011 Additional contributions Net income Dividends Ending, May 31, 2012 Contributed Capital $ 492 16 $ 508 3-42 Retained Earnings $5,827 2,373 (0) $8,200 Total Stockholders’ Equity $6,319 16 2,373 (0) $8,708 Chapter 03 - Operating Decisions and the Income Statement P3–6. Req. 3 (continued) FedEx Balance Sheet (unadjusted) At May 31, 2012 (in millions) Assets Current assets: Cash Receivables Prepaid expenses Spare parts, supplies, and fuel Other current assets Total current assets Property and equipment (net) Other noncurrent assets Total assets Liabilities and Stockholders’ Equity Current liabilities: Accounts payable Accrued expenses payable Other current liabilities Total current liabilities Long-term notes payable Other noncurrent liabilities Total liabilities Stockholders' Equity: Contributed capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 3-43 $ 673 905 1,613 294 1,196 4,681 9,707 1,850 $ 16,238 $ 51 1,675 297 2,023 1,994 3,513 7,530 508 8,200 8,708 $ 16,238 Chapter 03 - Operating Decisions and the Income Statement P3–6. Req. 3 (continued) FedEx Statement of Cash Flows For the Year Ended May 31, 2012 (in millions) Cash Flows from Operating Activities Cash received from customers (=$17,600+$4,824) Cash paid to employees Cash paid to suppliers (=$4,598+$1,348+$5,348+$784) Total cash provided by operating activities Cash Flows from Investing Activities None $ 22,424 (10,031) (12,078) 315 0 0 Cash Flows from Financing Activities Repayment of long-term debt Proceeds from share issuance Total cash used in financing activities (18) 16 (2) Increase in cash Beginning cash balance 313 360 Ending cash balance $ 673 Note that transaction (b) is omitted from the statement of cash flows. However, as discussed in future chapters, this type of transaction is a noncash investing and financing activity that requires supplemental disclosure. 3-44 Chapter 03 - Operating Decisions and the Income Statement P3–6. (continued) Req. 4 Total Asset Turnover = Sales (or Operating Revenues) Average Total Assets * (Beginning $13,306 + = $22,167 = 1.50 $14,772* Ending $16,238) ÷ 2 ($360 + $1,162 + $294 + $82 + $1,196 + $8,362 + $1,850) (computed in Req. 3) The asset turnover ratio suggests that the company obtained $1.50 in sales for the year for every $1 in assets. To analyze this result, we would need to calculate the ratio for the company over time to observe the trend in how efficiently assets are being utilized. We would also need the industry ratio for the current period to determine how the company is doing in comparison to others in the industry. P3–7. Req. 1 (in thousands) a. Cash (+A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Admissions revenue (+R, +SE). . . . . . . . . . . . . . . . b. c. d. e. f. 566,266 566,266 Operating expenses (+E, SE). . . . . . . . . . . . . . . . . . . Cash (A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Accounts payable (+L). . . . . . . . . . . . . . . . . . . . . . . . 450,967 Notes payable (L). . . . . . . . . . . . . . . . . . . . . . . . . . . . . Cash (A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58,962 Cash (+A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Food, merchandise, and games revenue (+R, + SE) 335,917 Cost of goods sold (+E, SE). . . . . . . . . . . . . . . . . . Food and merchandise inventory (A). . . . . . . . . . . . 90,626 Property and equipment (+A). . . . . . . . . . . . . . . . . . . . . Cash (A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 83,841 Cash (+A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Accounts receivable (+A). . . . . . . . . . . . . . . . . . . . . . . . Accommodations revenue (+R, +SE). . . . . . . . . . . . . 72,910 1,139 3-45 412,200 38,767 58,962 335,917 90,626 83,841 74,049 Chapter 03 - Operating Decisions and the Income Statement P3–7. (continued) g. h. i. j. Interest expense (+E, SE). . . . . . . . . . . . . . . . . . . Cash (A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 125,838 Food and merchandise inventory (+A). . . . . . . . . . . Cash (A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Accounts payable (+L). . . . . . . . . . . . . . . . . . . . . 146,100 Selling, general and admin. expenses (+E, SE) Cash (A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Accounts payable (+L). . . . . . . . . . . . . . . . . . . . . 131,882 Accounts payable (L). . . . . . . . . . . . . . . . . . . . . . . Cash (A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,600 125,838 118,000 28,100 125,500 6,382 9,600 Req. 2 Transaction Operating, Investing, or Financing Effect Direction and Amount of the Effect (in thousands) (a) O +566,266 (b) O –412,200 (c) F –58,962 (d) O +335,917 (e) I –83,841 (f) O +72,910 (g) O –125,838 (h) O –118,000 (i) O –125,500 (j) O –9,600 3-46 Chapter 03 - Operating Decisions and the Income Statement ALTERNATE PROBLEMS AP3-1. c. Transactions Example: Issued stock to new investors. Incurred and recorded operating expenses on credit to be paid next period. Purchased on credit but did not use supplies this period. d. Performed services for customers this period on credit. e. Prepaid a fire insurance policy this period to cover the next 12 months. Purchased a building this period by making a 20 percent cash down payment and signing a mortgage loan for the balance. Collected cash this year for services rendered and recorded in the prior year. Collected cash for services rendered this period. Paid cash this period for wages earned and recorded last period. Paid cash for operating expenses charged on accounts payable in the prior period. Paid cash for operating expenses incurred in the current period. Made a payment on the mortgage loan, which was part principal repayment and part interest. This period a shareholder sold some shares of her stock to another person for an amount above the original issuance price. Used supplies on hand to clean the offices. Recorded income taxes for this period to be paid at the beginning of the next period. Declared and paid a cash dividend this period. a. b. f. g. h. i. j. k. l. m. n. o. p. 3-47 Debit 1 Credit 11 14 7 3 7 2 13 4 1 5 1, 8 1 1 2 13 9 1 7 1 14 1 8, 14 1 None 14 None 3 15 12 10 1 Chapter 03 - Operating Decisions and the Income Statement AP3–2. a. b. c. d. e. f. g. h. i. j. k. Accounts receivable (+A) .................................................... Service revenue (+R, +SE) ........................................ 23,500 Accounts payable (L) ......................................................... Cash (A) .................................................................. 3,005 Office supplies (+A) ............................................................. Accounts payable (+L) ............................................... 2,600 Equipment (+A) ................................................................... Cash (A) .................................................................. 3,800 Advertising expense (+E, SE) ............................................ Cash (A) .................................................................. 1,400 Wages expense (+E, SE) .................................................. Wages payable (L) ............................................................ Cash (A) .................................................................. 8,100 3,800 Cash (+A) ............................................................................ Contributed capital (+SE) .......................................... 135,000 Cash (+A) ............................................................................ Accounts receivable (A) ........................................... 12,500 Accounts receivable (+A) .................................................... Service revenue (+R, +SE) ........................................ 14,500 Land (+A) ............................................................................ Cash (A) .................................................................. Note payable (+L) ...................................................... 10,000 Utilities expense (+E, SE) .................................................. Accounts payable (+L) ............................................... 1,950 3-48 23,500 3,005 2,600 3,800 1,400 11,900 135,000 12,500 14,500 3,000 7,000 1,950 Chapter 03 - Operating Decisions and the Income Statement AP3–3. Req. 1 Req. 2 Assets Balance Sheet Income Statement Stmt of Cash Flows Stockholders’ Net Liabilities Equity Revenues Expenses Income a. – + – NE + – O b. – NE – NE + – O c. + NE + + NE + NE – NE – NE + – NE NE + + NE + I (Net +) d. +/– (Net +) e. +/– NE NE NE NE NE O f. – NE – NE + – NE g. – – NE NE NE NE F h. + NE + + NE + O i. +/– + NE NE NE NE I (Net +) j. – – NE NE NE NE O k. + NE + NE NE NE F l. – NE – NE + – O 3-49 Chapter 03 - Operating Decisions and the Income Statement AP3–4. Req. 1 and 2 Cash Beg. 0 31,000 (b) (a) 60,000 1,240 (g) (d) 13,200 2,700 (h) (e) 2,400 6,000 (j) (i) 10,000 3,600 (k) 500 (m) 40,560 Accounts Receivable Beg. 0 10,000 (i) (c) 35,260 25,260 15,810 Prepaid Insurance Beg. 0 (k) 3,600 Land Beg. 0 (a) 90,000 Barns Beg. 0 (a)100,000 (b) 62,000 162,000 3,600 90,000 Accounts Payable (h) 2,700 0 Beg. 3,810 (f) 1,800 (l) 2,910 Unearned Revenue 0 Beg. 2,400 (e) Contributed Capital 0 Beg. 262,000(a) 262,000 Retained Earnings (m) 500 0 Beg. Animal Care Service Revenue 0 Beg. 35,260 (c) 35,260 Utilities Expense Beg. 0 (g) 1,240 (l) 1,800 3,040 2,400 500 Rental Revenue 0 Beg. 13,200 (d) 13,200 Wages Expense Beg. 0 (j) 6,000 6,000 3-50 Supplies Beg. 0 (a) 12,000 (f) 3,810 Long-term Note Payable 0 Beg. 31,000 (b) 31,000 Chapter 03 - Operating Decisions and the Income Statement AP3–4. (continued) Req. 3 ALPINE STABLES, INC. Income Statement (unadjusted) For the Month Ended April 30, 2011 Revenues: Animal care service revenue Rental revenue Total revenues $ 35,260 13,200 48,460 Expenses: Wages expense Utilities expense Total costs and expenses Net Income 6,000 3,040 9,040 $ 39,420 ALPINE STABLES, INC. Statement of Stockholders’ Equity (unadjusted) For the Month Ended April 30, 2011 Contributed Capital Beginning, April 1, 2011 $ 0 Additional contributions 262,000 Net income Dividends Ending, April 30, 2011 $262,000 3-51 Retained Earnings $ 0 39,420 (500) $ 38,920 Total Stockholders’ Equity $ 0 262,000 39,420 (500) $300,920 Chapter 03 - Operating Decisions and the Income Statement AP3–4. (continued) ALPINE STABLES, INC. Balance Sheet (unadjusted) At April 30, 2011 Assets Current assets: Cash Accounts receivable Supplies Prepaid insurance Total current assets $ 40,560 25,260 15,810 3,600 85,230 Barns Land Total Assets 162,000 90,000 $337,230 Liabilities Current liabilities: Accounts payable Unearned revenue Total current liabilities Note payable Total Liabilities Stockholders’ Equity Contributed Capital Retained Earnings Total Stockholders’ Equity Total Liabilities and Stockholders’ Equity $ 2,910 2,400 5,310 31,000 36,310 262,000 38,920 300,920 $337,230 Req. 4 Date: (today’s date) To: Shareholders of Alpine Stables, Inc. From: (your name) After analyzing the effects of transactions for Alpine Stables, Inc., for April, the company has realized a profit of $39,420. This is 81% of total revenues. However, this is based on unadjusted amounts. There are several additional expenses that will decrease the net income amount. These include depreciation of the barns, supplies, insurance, interest, and wages. Therefore, the company appears to have earned a small profit in its first month. It would be useful to prepare a budget of income and of cash flows each month for the upcoming year to decide whether the positive income and cash flows are likely to continue in the future. 3-52 Chapter 03 - Operating Decisions and the Income Statement AP3–4. (continued) Req. 5 2012: Total = Asset Turnover 2013: Sales (Operating) Revenue = $400,000 = $400,000 = 1.29 Average ($300,000+$320,000)÷2 $310,000 Total Assets Sales (Operating) Revenue Total = = $450,000 ($320,000+$480,000)÷2 Asset Average Turnover Total Assets = $450,000 = 1.13 $400,000 Under your management, the asset turnover ratio appears to be decreasing over time. The ratio for 2013 is lower than it otherwise would have been given the shareholders’ decision to build a riding arena. The loans and building have increased the average total assets used and therefore decreased the turnover ratio. In addition, with the new facilities, revenues should increase in the future. Based on this rationale, you should be promoted. AP3–5. ALPINE STABLES, INC. Statement of Cash Flows For the Month Ended April 30, 2011 Operating Activities Cash received from customers ($13,200 +$2,400 +$10,000) Cash paid to employees Cash paid to suppliers ($1,240+$2,700+$3,600) Total cash provided by operating activities $25,600 (6,000) (7,540) 12,060 Investing Activities Purchase of barns Total cash used in investing activities (31,000) (31,000) Financing Activities Proceeds from share issuance Dividends paid Total cash provided by financing activities 60,000 (500) 59,500 Increase in cash Beginning cash balance 40,560 0 Ending cash balance $40,560 3-53 Chapter 03 - Operating Decisions and the Income Statement AP3–6. Req. 1 and 2 (in millions) Cash 3 (c) Beg. 31,437 (b) 3,100 1,238 (e) 7,545 (f) 82 (h) 11 (i) 6 (j) 25,652 Inventories Beg. 9,331 5,984 (d) (g) 23 3,370 Investments Beg. 28,556 28,556 Accounts Payable 36,640 Beg. 1,610 (a) 23 (g) 38,273 Notes Payable (LT) 7,025 Beg. Marketable Securities Beg. 570 570 Retained Earnings 107,651 Beg. 107,651 Utilities Expense Beg. 0 (c) 3 3 61,382 Prepaid Expenses Beg. 2,315 (h) 82 2,397 Property & Equipment (net) Beg.121,346 (a) 1,610 122,956 Income Tax Payable (f) 7,545 10,060 Beg. 2,515 Other Long-Term Debt (i) 10 58,962 Beg. 7,025 58,952 Sales Revenue 0 Beg. 39,780 (d) 39,780 Interest Expense Beg. 0 (i) 1 1 3-54 Accounts Receivable 3,100 (b) Beg. 24,702 (d) 39,780 Other Current Assets Beg. 3,911 3,911 Other Assets and Intangibles (net) Beg. 5,884 (j) 6 5,890 Notes Payable (ST) 2,400 Beg. 2,400 Contributed Capital 5,314 Beg. 5,314 Cost of Sales Beg. 0 (d) 5,984 5,984 Wages Expense Beg. 0 (e) 1,238 1,238 Chapter 03 - Operating Decisions and the Income Statement AP3–6. (continued) Req. 3 Exxon Mobil Corporation Income Statement (unadjusted) For the Month Ended January 31, 2011 (in millions) Revenues: Sales revenue $39,780 Costs and expenses: Cost of sales Wage expense Utilities expense Total costs and expenses Operating income 5,984 1,238 3 7,225 32,555 Other revenues (expenses): Interest expense Net Income (pretax) 1 $32,554 Exxon Mobil Corporation Statement of Stockholders’ Equity (unadjusted) For the Month Ended January 31, 2011 (in millions) Beginning, December 31, 2010 Stock issuance Net income Dividends Ending, January 31, 2011 Contributed Capital $ 5,314 0 $ 5,314 3-55 Retained Earnings $107,651 32,554 (0) $140,205 Total Stockholders’ Equity $112,965 0 32,554 (0) $145,519 Chapter 03 - Operating Decisions and the Income Statement AP3–6. (continued) Exxon Mobil Corporation Balance Sheet (unadjusted) At January 31, 2011 (in millions) Assets Current assets: Cash Marketable securities Accounts receivable Inventories Prepaid expenses Other current assets Total current assets Investments Property & equipment (net) Other assets and intangibles (net) $ 25,652 570 61,382 3,370 2,397 3,911 97,282 28,556 122,956 5,890 Total assets $254,684 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable Income tax payable Notes payable Total current liabilities Notes payable Other long-term debt Total liabilities Shareholders' Equity: Contributed capital Retained earnings Total stockholders’ equity Total liabilities and shareholders' equity 3-56 $38,273 2,515 2,400 43,188 7,025 58,952 109,165 5,314 140,205 145,519 $254,684 Chapter 03 - Operating Decisions and the Income Statement AP3–6. (continued) Exxon Mobil Corporation Statement of Cash Flows For the Month Ended January 31, 2011 (in millions) Cash Flows from Operating Activities Cash received from customers Cash paid to employees Cash paid to suppliers (= $3 + $82) Cash paid to government for taxes Interest paid Total cash used in operating activities $ 3,100 (1,238) (85) (7,545) (1) (5,769) Cash Flows from Investing Activities Purchase of intangible assets Total cash used in investing activities (6) (6) Cash Flows from Financing Activities Repayment of debt Total cash used in financing activities (10) (10) Decrease in cash Beginning cash balance (5,785) 31,437 Ending cash balance $ 25,652 Req. 4 Total Asset Turnover = Sales = Average Total Assets $39,780 $241,368 = 0.165 * ($228,052 + $254,684) ÷ 2 The asset turnover ratio suggests that the company obtained $0.165 in sales for the month for every $1 in assets. Assuming that sales are spread equally throughout the year, the annual asset turnover would be 1.98 (0.165 x 12 months). Compared to other examples in the text, this suggests that Exxon Mobil is a higher capital intensive industry (requiring extremely high levels of assets). Exxon Mobil’s actual asset turnover for a recent year was 2.03. 3-57 Chapter 03 - Operating Decisions and the Income Statement CASES AND PROJECTS FINANCIAL REPORTING AND ANALYSIS CASES CP3–1. 1. The largest expense on the income statement for the year ended January 31, 2009, is the “cost of sales” for $1,814,765 (in thousands). As goods were sold throughout the year, cost of goods sold would be recorded and inventory would be reduced. 2. This question is intended to focus students on accounts receivable and the typical activities that increase and decrease the account. Assuming all net sales are on credit, American Eagle Outfitters collected $2,797,510,000 from customers. T-account numbers are in thousands. Accounts and Notes Receivable Beginning Sales Ending 31,920 2,988,866 2,979,315 Collections 41,471 Most retailers settle sales in cash at the register and would not have accounts receivable related to sales unless they had layaway or private credit. For American Eagle, the accounts receivable on the balance sheet primarily relates to amounts owed from landlords for their construction allowances for building new American Eagle stores in malls. 3. Over the life of the business, total earnings will equal total net cash flow. However, for any given year, the assumption that net earnings is equal to cash inflows is not valid. Accrual accounting requires recording revenues when earned and expenses when incurred, not necessarily when cash is received or paid. There may be revenues recorded as earnings that are not yet received in cash. In the same way, there may be cash outflows as prepayments of expenses that are not recorded as expenses until incurred, such as inventories, insurance, and rent. Or, there may be expenses that have been incurred for which payment will occur in the future. 4. An income statement reports the financial performance of a company over a period of time in terms of revenues, gains, expenses, and losses. A balance sheet or statement of financial position lists the economic resources owned by an entity and the claims to those resources from creditors and investors at a point in time. They are linked through retained earnings. 3-58 Chapter 03 - Operating Decisions and the Income Statement CP3–1. (continued) 5. Total Asset = Turnover (In thousands) $2,988,866 ($1,867,680 + $1,963,676)÷2 Sales = Average Total Assets = $2,988,866 $1,915,678 = 1.56 The total asset turnover ratio measures the sales generated per dollar of assets. American Eagle Outfitters generated $1.56 of sales per $1 of assets. CP3-2. 1. Urban Outfitters’ revenue recognition policy for retail store sales is to record revenues when customers purchase merchandise. Internet, catalog, and wholesale sales are recognized when the goods are shipped. Revenue is recognized for stored value cards and gift certificates when they are redeemed for merchandise. (See pages F-10 and F-11 of the notes to the financial statements). 2. Assuming that $50 million of cost of sales is due to distribution and occupancy costs, Urban Outfitters purchased $1,068,913 thousand worth of inventory. Inventory (in thousands) Beginning 171,925 Purchases 1,068,913 Ending 1,071,140 Cost of Sales* 169,698 * Total cost of sales reported $1,121,140 - an estimated $50,000 for noninventory purchase costs = $1,071,140. 3. Year ended 1/31/09 Year ended 1/31/08 Percentage Genl., Admin. & Selling Expenses Net Sales $414,043 $1,834,618 22.6% Percentage $351,827 $1,507,724 23.3% General, Administration, & Selling Expenses increased by 17.7% over the amount for the year ended 1/31/08. 3-59 Chapter 03 - Operating Decisions and the Income Statement 4. Total Asset = Turnover Sales = $1,834,618 = $1,834,618 = 1.48 Average ($1,329,009+$1,142,791)÷2 $1,235,900 Total Assets The total asset turnover ratio measures the sales generated per dollar of assets. Urban Outfitters generated $1.48 of sales per $1 of assets. CP3–3. 1. American Eagle Outfitters calls its income statement the “Consolidated Statements of Operations.” Urban Outfitters calls its income statement the “Consolidated Statements of Income.” “Consolidated” implies that the statements of two or more companies (usually the company and its majority-owned subsidiaries) have been combined into a single statement for presentation. 2. Urban Outfitters had the higher net income of $199,364 for the year ended January 31, 2009, compared to American Eagle Outfitters’ net income of $179,061 for the same year (all dollars in thousands). American Eagle reported a $22,889 impairment charge in the most recent year that reduced net income. Urban Outfitters did not report any impairment charge. If the charge were not included, American Eagle would have reported $201,950 in net income, higher than Urban Outfitters. 3. (in thousands) Total Asset = Sales Turnover Average Total Assets American Eagle Outfitters Urban Outfitters $2,988,866 =1.56 $1,915,678* $1,834,618 = 1.48 $1,235,900** * ($1,867,680 + $1,963,676)÷2 ** ($1,329,009+$1,142,791)÷2 American Eagle Outfitters has the higher asset turnover ratio, 1.56 compared to Urban Outfitters’ of 1.47, suggesting that Urban Outfitters is utilizing its assets less effectively to generate sales than is American Eagle Outfitters. However, the difference is not very large. 4. Asset Turnover = Industry Average 1.90 American Eagle Outfitters 1.56 3-60 Urban Outfitters 1.48 Chapter 03 - Operating Decisions and the Income Statement Both American Eagle Outfitters and Urban Outfitters are utilizing their assets to generate sales less effectively than the average company in their industry. Companies that are expanding will have higher asset values that may not as of yet have generated sales. 5. Operating cash flows 2009 2008 $302,193 $464,270 2009 Operating cash flows 2008 $251,570 $254,353 American Eagle Outfitters Percentage Change 2008 2007 (34.91%) $464,270 $749,268 Urban Outfitters Percentage Change 2008 (1.09%) 3-61 2007 $254,353 $187,117 Percentage Change (38.04%) Percentage Change 35.93% Chapter 03 - Operating Decisions and the Income Statement CP3–4. Req. 1 American Eagle Outfitters (dollars in thousands) Fiscal year ended: 2006: Total = Sales = $2,321,962 = $2,321,962 = 1.58 ($1,328,926+$1,605,649)÷2 Asset Average $1,467,287.5 Turnover Total Assets 2007: Total = Sales = $2,794,409 = $2,794,409 = 1.56 ($1,605,649+$1,979,558)÷2 Asset Average $1,792,603.5 Turnover Total Assets 2008: Total = Sales = $3,055,419 = $3,055,419 = 1.59 Asset Average ($1,979,558+$1,867,680) ÷2 $1,923,619 Turnover Total Assets 2009: Total = Sales = $2,988,866 = $2,988,866 = 1.56 Asset Average ($1,867,680+$1,963,676)÷2 $1,915,678 Turnover Total Assets Req. 2 Current Ratio = Current Assets Current Liabilities Reported in American Eagle Outfitters’ 10-K report (Item 6): 2006 3.06 2007 2.56 2008 2.71 2009 2.30 Req. 3 American Eagle Outfitters’total asset turnover ratio has remained relatively stable from 2006 to 2009. On the other hand, the current ratio has steadily declined from 3.06 in 2006 to 2.30 in 2009, although American Eagle Outfitters continues to have sufficient liquidity. Companies with strong cash management systems tend to have lower current ratios. In addition, American Eagle Outfitters receives most of its sales in cash and should have sufficient cash flows to pay current liabilities when they come due. 3-62 Chapter 03 - Operating Decisions and the Income Statement CP3–5. Req. 1 Accrual accounting is defined in the article as follows: “By accruing, or allotting, revenues to specific periods, they (accountants) aim to allocate income to the quarter or year in which it was effectively earned, though not necessarily received. Likewise, expenses are allocated to the period when sales were made, not necessarily when the money was spent.” (from Business Week, October 4, 2004, p. 78) Req. 2 The author of the article suggests that “fuzzy numbers” result from the judgments companies make to come up with revenues and expenses on an accrual basis. Companies are given wide discretion in determining estimates to use to compute net income under current accounting rules, and users of the financial statements need to read statements carefully to understand the impact of management judgments and accounting rules. Even then, the author suggests that financial statements are often unclear, incomplete, or too complex. Req. 3 Congress and the SEC have adopted reforms to attempt to address the rising concerns about financial reporting. The article suggests that many of the reforms will not help to make financial statements clearer and more consistent. Instead, many of the reforms are aimed at policing managers and auditors and not at clarifying estimates managers make. 3-63 Chapter 03 - Operating Decisions and the Income Statement CP3–6. Req. 1 a. Given as an example in the textbook. b. Cash decreased $5,000, Office Fixtures increased $22,000, and long-term Notes Payable increased $17,000. Therefore, transaction (b) was the purchase of office fixtures for $22,000, paid partly in cash of $5,000 and the rest by signing a long-term notes payable for $17,000. c. Cash increased $15,000, Accounts Receivable increased $12,000, and Paint Revenue increased $27,000. Therefore, transaction (c) was delivery of painting services for $27,000; $15,000 was received in cash and the rest was on account. d. Cash decreased $14,000, Land increased $18,000, and Note Payable increased $4,000. Therefore, transaction (d) was a purchase of land for $18,000; $14,000 was paid in cash and an interest-bearing note was signed for the remainder. e. Cash decreased $10,000, Accounts Payable increased $3,000, Supplies Expense increased $5,000, and Wages Expense increased $8,000. Therefore, transaction (e) was purchase and use of $5,000 of supplies and $8,000 of employee labor. $10,000 was paid in cash and $3,000 is owed. f. Cash increased $3,000, Accounts Receivable increased $14,000, and Paint Revenue increased $17,000. Therefore, transaction (f) was a sale of painting services made on account for $14,000 while $3,000 was received in cash. g. Cash decreased $4,000, and Retained Earnings decreased $4,000. Therefore, transaction (g) was declaration and payment of a dividend of $4,000. h. Cash decreased $11,000, Accounts Payable increased $7,000, Supplies Expense increased $3,000, and Wages Expense increased $15,000. Therefore, transaction (h) was purchase and use of supplies of $3,000 and employee labor of $15,000. $11,000 was paid in cash, and $7,000 is owed. i. Cash decreased by $5,000, and Accounts Payable decreased by $5,000. Therefore, transaction (i) is a payment made on account. j. Cash increased $16,000, Accounts Receivable decreased $16,000. Therefore, transaction (j) was the receipt of payments from customers. 3-64 Chapter 03 - Operating Decisions and the Income Statement CP3–6. (continued) Req. 2 PETE’S PAINTING SERVICE Income Statement For the Month Ended January 31, 2011 Revenues: Paint revenue $44,000 Expenses: Supplies expense Wages expense Total costs and expenses Net Income 8,000 23,000 31,000 $13,000 PETE’S PAINTING SERVICE Statement of Stockholders’ Equity For the Month Ended January 31, 2011 Beginning, January 20, 2011 Additional contributions Net income Dividends Ending, January 31, 2011 Contributed Capital $ 0 75,000 $75,000 3-65 Retained Earnings $ 0 13,000 (4,000) $ 9,000 Total Stockholders’ Equity $ 0 75,000 13,000 (4,000) $84,000 Chapter 03 - Operating Decisions and the Income Statement CP3–6. (continued) PETE’S PAINTING SERVICE Balance Sheet At January 31, 2011 Assets Current assets: Cash Accounts receivable Total current assets Office fixtures Land Total assets $ 60,000 10,000 70,000 22,000 18,000 $110,000 Liabilities and Shareholders’ Equity Current liabilities: Accounts payable Total current liabilities Notes payable Total liabilities $ 5,000 5,000 21,000 26,000 Shareholders' Equity: Contributed capital Retained earnings Total shareholders’ equity Total liabilities and shareholders' equity 75,000 9,000 84,000 $110,000 Req. 3 Transaction Operating, Investing, or Financing Effect (a) F +75,000 (b) I –5,000 (c) O +15,000 (d) I –14,000 (e) O –10,000 (f) O +3,000 (g) F –4,000 (h) O –11,000 (i) O –5,000 (j) O +16,000 3-66 Direction and Amount of the Effect Chapter 03 - Operating Decisions and the Income Statement CRITICAL THINKING CASES CP3–7. Req. 1 Estela used the cash basis of accounting. We can infer this from his references to income collected rather than earned, expenses paid rather than incurred, and supplies purchased rather than used. Accrual accounting should be used because it correctly assigns revenues and expenses to the accounting period in which they are earned or incurred. Req. 2 (a) (b) Building (+A) ........................................................................ Tools and equipment (+A) ................................................... Land (+A) ............................................................................ Cash (+A) ............................................................................ Contributed capital (+SE) ......................................... 21,000 17,000 20,000 1,000 Cash (+A) ............................................................................. Accounts receivable (+A) ..................................................... Unearned revenue (+L) ............................................. Service fees revenue (+R, +SE) ................................ 55,000 52,000 59,000 20,000 87,000 (c) No entry (d) Operating expenses (+E, SE) ............................................ Accounts payable (+L) ............................................... Cash (A) .................................................................. 61,000 Supplies expense (+E, SE)* .............................................. Supplies (+A) ....................................................................... Cash (A) .................................................................. 2,500 700 (e) Other (1) Loss from theft (+E, SE) .................................................... Cash (A) .................................................................. (2) Tools and equipment (+A) ................................................... Cash (A) .................................................................. 39,000 22,000 3,200 500 500 1,000 * Supplies purchased, $3,200 Supplies on hand at end of 2012, $700 = $2,500 supplies used 3-67 1,000 Chapter 03 - Operating Decisions and the Income Statement CP3–7. (continued) ASSETS: Cash Beg. 0 22,000 3,200 (a) 1,000 (b) 55,000 500 1,000 Accounts Receivable (d) Beg. 0 (e) (b) 52,000 (1) (2) 29,300 Building Beg. 0 (a) 21,000 21,000 LIABILITIES: Accounts Payable 0 Beg. 39,000 (d) 39,000 SHAREHOLDER’S EQUITY: Contributed Capital 0 Beg. 59,000 (a) 59,000 52,000 Beg. (e) Supplies 0 700 700 Land Beg. 0 (a) 20,000 Tools and Equipment Beg. 0 (a) 17,000 (2) 1,000 20,000 18,000 Unearned Revenue 0 Beg. 20,000 (b) 20,000 Retained Earnings 0 Beg. 0 REVENUES AND EXPENSES: Service Fees Revenue Operating Expenses 0 Beg. Beg. 0 87,000 (b) (d) 61,000 87,000 61,000 Loss from Theft Beg. 0 (1) 500 500 3-68 Supplies Expense Beg. 0 (e) 2,500 2,500 Chapter 03 - Operating Decisions and the Income Statement CP3–7. (continued) Req. 3 (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) ESTELA COMPANY Income Statement For the Year Ended December 31, 2012 Revenues: Service fees revenue [see note] Costs and expenses: Operating expenses Supplies expense Loss from theft Total costs and expenses Net Income $ 87,000 61,000 2,500 500 64,000 $ 23,000 Use the standard title. Date to indicate time period covered. Use appropriate title. Use accrual figure -- revenue earned, rather than cash collected. Exclude the dividends because the stock is owned by Julio and not the company -- apply the separate entity assumption. Use appropriate title. Use accrual figure -- expenses incurred, not cash paid. Expense is supplies used, $2,500; the $700 is still an asset until used. Stolen property should be recorded as a loss for the amount not covered by insurance. Use appropriate caption. Use standard terminology. 3-69 Chapter 03 - Operating Decisions and the Income Statement CP3–7. (continued) ESTELA COMPANY Balance Sheet At December 31, 2012 Assets Current assets: Cash Accounts receivable Supplies Total current assets Building Land Tools and equipment Total assets $ 29,300 52,000 700 82,000 21,000 20,000 18,000 $141,000 Liabilities Current liabilities: Accounts payable Unearned revenue Total current liabilities $ 39,000 20,000 59,000 Shareholders' Equity Contributed capital Retained earnings Total shareholders’ equity Total liabilities and shareholders' equity 59,000 23,000 82,000 $141,000 3-70 Chapter 03 - Operating Decisions and the Income Statement CP3–7. (continued) ESTELA COMPANY Statement of Cash Flows For the Year Ended December 31, 2012 Cash from Operating Activities Cash received from customers Cash paid to suppliers ($22,000 + $3,200) Cash stolen Total cash provided by operating activities Cash from Investing Activities Purchase of tools and equipment Total cash used in investing activities Cash from Financing Activities Proceeds from share issuance Total cash provided by financing activities Increase in cash Beginning cash balance $55,000 (25,200) (500) 29,300 (1,000) (1,000) 1,000 1,000 29,300 0 Ending cash balance $29,300 Req. 4 The above statements do not yet take into account most year-end adjustments, including depreciation and income taxes. The adjusting entry for income taxes is especially important because of the implication for future cash flows. The statements also record the building, land, and tools and equipment originally contributed in exchange for shares in the new company at their market value at that time. Their current market value at year-end is more relevant to a loan decision. Current market values for the building and land are provided ($32,000 and $30,000, respectively), but the current value of the tools and equipment is also needed. The stock in ABC Industrial is owned by Julio and not the company. However, it may be used as collateral if Julio is willing to sign an agreement pledging personal assets as collateral for the loan. This is a common requirement for small start-up businesses. Other of Julio’s personal assets could also be considered for collateral. Lastly, pro forma financial statements (or budgets) outlining the expected revenues, expenses, and cash flows from the expanded business would be helpful to gauge its viability. 3-71 Chapter 03 - Operating Decisions and the Income Statement CP3–7. (continued) Req. 5 (today’s date) Dear Mr. Estela: We regret to inform you that your request for a $100,000 loan has been denied. Your current business appears profitable and appears to generate sufficient cash to maintain operations, even once additional expenses, such as income taxes, are considered. However, pro forma financial statements (or budgets) outlining the expected revenues, expenses, and cash flows from the expanded business would be needed to gauge its future viability. We also require that there be sufficient collateral pledged against the loan before we can consider it. A loan of this size would increase your company’s size by over 70% of its current asset base. The current market value of the building and land held by the company are insufficient as collateral. The current value of the tools and equipment may provide additional collateral, if you provide us with this information. Your personal investments may also be considered viable collateral if you are willing to sign an agreement pledging these assets as collateral for the loan. This is a common requirement for small start-up businesses. If you would like us to reconsider your application, please provide us with the pro forma financial statements and with the current market values of any assets you would pledge as collateral. Regards, (your name) Loan Application Department, Your Bank 3-72 Chapter 03 - Operating Decisions and the Income Statement CP3–8. Req. 1 This type of ethical dilemma occurs quite frequently. The situation is difficult personally because of the possible repercussions to you by your boss, Mr. Lynch, if you do not meet his request. At the same time, the ethical and professional response is to follow the revenue recognition rule and account for the cash collection as deferred revenue (as was done). To record the collection as revenue overstates income in the current period. Req. 2 In the short run, Mr. Lynch would benefit by receiving a larger bonus. You also benefit in the short run because you would not experience any negative repercussions from your boss. However, there is the risk that sometime in the future, perhaps through an audit, the error will be found. At that point, both you and Mr. Lynch could be implicated in a fraud. In addition, this may be the first instance where you are being asked to account for a transaction in violation of accepted principles or company policies. There is a very strong possibility Mr. Lynch may ask you for additional favors in the future if you demonstrate your willingness at this point. Req. 3 In the larger picture, shareholders are harmed by the misleading income figures by relying on them to purchase stock at inflated prices. In addition, creditors may lend funds to the insurance company based on the misleading information. The negative impact of the discovery of misleading financial information will cause stock prices to fall, causing shareholders to lose on their investment. Creditors will be concerned about future debt repayment. You will also experience diminished self-respect because of the violation of your integrity. Req. 4 Managers are agents for shareholders. To act in ways to the benefit of the manager at the detriment of the shareholders is inappropriate. Therefore, the ethically correct response is to fail to comply with Mr. Lynch's request. Explaining your position to Mr. Lynch will not be easy. You may want to express that you understand the reason for his request, but cannot ethically or professionally comply. FINANCIAL REPORTING AND ANALYSIS TEAM PROJECT CP3–9. The solution to this project will depend on the companies and/or accounting periods selected for analysis. 3-73 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings Chapter 04 Adjustments, Financial Statements, and the Quality of Earnings ANSWERS TO QUESTIONS 1. A trial balance is a list of the individual accounts, usually in financial statement order, with their debit or credit balances. It is used to provide a check on the equality of the debits and credits. 2. Adjusting entries are made at the end of the accounting period to record all revenues and expenses that have not been recorded but belong in the current period. They update the balance sheet and income statement accounts at the end of the accounting period. 3. The four different types are adjustments for: (1) Deferred revenues -- previously recorded liabilities that need to be adjusted at the end of the period to reflect revenues that have been earned (e.g., Unearned Ticket Revenue must be adjusted for the portion of ticket revenues earned in the current period). (2) Accrued revenues -- revenues that have been earned by the end of the accounting period but which will be collected in a future accounting period (e.g., recording Interest Receivable for interest revenues not yet collected). (3) Deferred expenses -- previously recorded assets that need to be adjusted at the end of the period to reflect incurred expenses (e.g., Prepaid Insurance must be adjusted for the portion of insurance expense incurred in the current period). (4) Accrued expenses -- expenses that have been incurred by the end of the accounting period but which will be paid in a future accounting period (e.g., recording Utilities Payable for utilities expense incurred during the period that has not yet been paid). 4. A contra-asset is an account related to an asset that is an offset or reduction to the asset's balance. Accumulated Depreciation is a contra-account to the equipment and buildings accounts. 4-1 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings 5. The net income on the income statement is included in determining ending retained earnings on the statement of stockholders’ equity and the balance sheet. The change in the cash account on the balance sheet is analyzed and categorized on the statement of cash flows into cash from operating activities, investing activities, and financing activities. 6. (a) Income statement: Revenues (and gains) - Expenses (and losses) = Net Income (b) Balance sheet: Assets = Liabilities + Stockholders' Equity (c) Statement of cash flows: Changes in cash for the period = Cash from Operations + Cash from Investing Activities + Cash from Financing Activities (d) Statement of stockholders' equity: Ending Stockholders' Equity = (Beginning Contributed Capital + Stock Issuances - Stock Repurchases) + (Beginning Retained Earnings + Net Income - Dividends Declared) 7. Adjusting entries have no effect on cash. For deferred revenues and deferred expenses, cash was received or paid at some point in the past. For accruals, cash will be received or paid in a future accounting period. At the time of the adjusting entry, there is no cash being received or paid. 8. Earnings per share = Net income ÷ average number of shares of stock outstanding during the period. Earnings per share measures the average amount of net income for the year attributable to one share of common stock. 9. Net profit margin = Net income ÷ net sales The net profit margin measures how much of every sales dollar generated during the period is profit. 10. An unadjusted trial balance is prepared after all current transactions have been journalized and posted to the ledger. It does not include the effects of the adjusting entries. The basic purpose of an unadjusted trial balance is to check the equalities of the accounting model (particularly, Debits = Credits) and to provide the data in a form convenient for further processing in the accounting information processing cycle. In contrast, an adjusted trial balance is prepared after the effects of all of the adjusting entries have been applied to the corresponding (prior) unadjusted trial balance amounts. The basic purpose of an adjusted trial balance is to insure that accuracy has been attained in applying the effect of the adjusting entries. The adjusted trial balance provides a second check in the model equalities (primarily Debits = Credits). It also provides data in a form convenient for further processing. 4-2 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings 11. The closing entry is made at the end of the accounting period to (1) transfer the balances in the temporary income statement accounts to retained earnings and (2) reduce the revenue, gain, expense, and loss accounts to a zero balance so that they can be used for the accumulation process during the next period. A closing entry must be entered into the system through the journal and posted to the ledger accounts to state properly the temporary and permanent account balances (i.e., zero balances in the temporary accounts). 12. (a) Permanent accounts -- balance sheet accounts; that is, the asset, liability, and stockholders’ equity accounts (these are not closed at the end of each period). (b) Temporary accounts -- income statement accounts; that is, revenues, gains, expenses, and losses (these are closed at the end of each period). (c) Real accounts -- another name for permanent accounts. (d) Nominal accounts -- another name for temporary accounts. 13. The income statement accounts are closed at the end of the accounting period because, in effect, they are temporary subaccounts to retained earnings (i.e., a part of stockholders' equity). They are used only for accumulation during the accounting period. When the period ends, these accumulated accounts must be transferred (closed) to retained earnings. The closing process serves: (1) to correctly state retained earnings, and (2) to clear out the balances of the temporary accounts for the year just ended so that these subaccounts can be used again during the next period for accumulation and classification purposes. Balance sheet accounts are not closed at the end of the period because they reflect permanent accumulated balances of assets, liabilities, and stockholders' equity. Permanent accounts show the entity's financial position at the end of the period and are the beginning amounts for the next period. 14. A post-closing trial balance is a listing taken from the ledger after the adjusting and closing entries have been journalized and posted. It is not a necessary part of the accounting information processing cycle but it is useful because it demonstrates the equality of the debits and credits in the ledger after the closing entry has been journalized and posted and that all temporary accounts have zero balances. 4-3 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings ANSWERS TO MULTIPLE CHOICE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. c b b a b c c d c a 4-4 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings Authors' Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 5 3 3 4 5 5 5 6 5 7 5 8 5 9 5 10 5 11 5 12 3 Exercises No. Time 1 10 2 10 3 10 4 15 5 10 6 20 7 20 8 20 9 15 10 20 11 10 12 20 13 15 14 15 15 20 16 20 17 20 18 20 19 10 20 15 Problems No. Time 1 15 2 20 3 20 4 20 5 20 6 25 7 30 Alternate Comprehensive Problems Problems No. Time No. Time 1 15 1 60 2 20 2 60 3 20 4 20 5 20 6 25 7 30 Cases and Projects No. Time 1 25 2 25 3 25 4 20 5 25 6 40 7 45 8 35 9 50 10 25 11 * * Due to the nature of this project, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time to discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 4-5 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings MINI-EXERCISES M4–1. Hagadorn Company Adjusted Trial Balance At June 30, 2011 Debit Cash Accounts receivable Inventories Prepaid expenses Buildings and equipment Accumulated depreciation Land Accounts payable Accrued expenses payable Income taxes payable Unearned fees Long-term debt Contributed capital Retained earnings Sales revenue Interest income Cost of sales Salaries expense Rent expense Depreciation expense Interest expense Income taxes expense Totals $ Credit 175 420 710 30 1,400 $ 250 300 250 160 50 90 1,460 400 150 2,400 60 780 640 460 150 70 135 $ 5,270 M4–2. (1) D (2) C (3) A (4) D (5) A (6) B (7) B (8) C 4-6 $ 5,270 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings M4–3. (1) D (2) C (3) A (4) B M4–4. (a) 1. Rent revenue is now earned. 2. Cash was received in the past – a deferred revenue was recorded. 3. Amount: $1,000 4 months = $250 earned Adjusting entry – Unearned rent revenue (L)......................... Rent revenue (+R, +SE) ....................... 250 250 (b) 1. Depreciation Expense on the equipment is now incurred. 2. Cash was paid in the past when the equipment was purchased -- a deferred expense was recorded. The net book value of the equipment is overstated. Accumulated Depreciation (the contra-account) needs to be increased for the amount used during the period. 3. Amount: $3,000 given Adjusting entry – Depreciation expense (+E, SE) .................. 3,000 Accumulated depreciation (+XA, A) .... 3,000 (c) 1. Insurance expense was incurred in the period. 2. Cash was paid for the insurance in the past – a deferred expense was recorded. 3. Amount: $4,200 x 6/24 = $1,050 Adjusting entry – Insurance expense (+E, SE) ...................... Prepaid insurance (A) .......................... 4-7 1,050 1,050 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings M4–5. Balance Sheet Stockholders’ Liabilities Equity –250 +250 Income Statement Revenues Expenses +250 NE Net Income +250 Transaction a. Assets NE b. –3,000 NE –3,000 NE +3,000 –3,000 c. –1,050 NE –1,050 NE +1,050 –1,050 M4–6. (a) 1. Utilities Expense is incurred. 2. Cash will be paid in the future for utilities used in the current period – an accrued expense needs to be recorded. 3. Amount: $380 given Adjusting entry – Utilities expense (+E, SE) ........................... Utilities payable (+L) .............................. 380 380 (b) 1. Interest revenue is now earned on the note receivable. 2. Cash for the interest will be received in the future – an accrued revenue needs to be recorded. 3. Amount: $5,000 principal x .14 annual rate x 4/12 of a year = $233 Adjusting entry – Interest receivable (+A) ................................ Interest revenue (+R, +SE).................... 233 233 (c) 1. Wages expense was incurred in the period. 2. Cash will be paid in the future to the employees who worked in the current period – an accrued expense needs to be recorded. 3. Amount: 10 employees x 4 days x $150 per day = $6,000 Adjusting entry – Wages expense (+E, SE) ........................... Wages payable (+L) .............................. 4-8 6,000 6,000 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings M4–7. Balance Sheet Stockholders’ Liabilities Equity +380 –380 Income Statement Revenues Expenses NE +380 Net Income –380 Transaction a. Assets NE b. +233 NE +233 +233 NE +233 c. NE +6,000 –6,000 NE +6,000 –6,000 M4–8. ROMNEY’S MARKETING COMPANY Income Statement For the Year Ended December 31, 2012 Operating Revenues: Sales revenue Total operating revenues Operating Expenses: Wages expense Depreciation expense Utilities expense Insurance expense Rent expense Total operating expenses Operating Income Other Items: Interest revenue Rent revenue Pretax Income Income tax expense Net Income $ 37,650 37,650 19,000 1,800 320 700 9,000 30,820 6,830 $ 100 750 7,680 2,700 4,980 $9.05 Earnings per share* * calculated as $4,980 [(300 + 800) 2] = $4,980 550 = $9.05 Average number of shares 4-9 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings M4–9. ROMNEY’S MARKETING COMPANY Statement of Stockholders’ Equity For the Year Ended December 31, 2012 Balance, January 1, 2012 Share issuance Net income Dividends declared Balance, December 31, 2012 Contributed Capital $ 700 3,000 $ 3,700 Work backwards 4-10 Total Stockholders’ Equity $ 2,700 3,000 4,980 4,980 (0) (0) $ 6,980 $ 10,680 * From the trial balance. Retained Earnings $ 2,000* Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings M4–10. Req. 1 ROMNEY’S MARKETING COMPANY Balance Sheet At December 31, 2012 Assets Current Assets: Cash Accounts receivable Interest receivable Prepaid insurance Total current assets Notes receivable Equipment (net of accumulated depreciation, $3,000) Total Assets Liabilities Current Liabilities: Accounts payable Accrued expenses payable Income taxes payable Unearned rent revenue Total current liabilities Stockholders’ Equity Contributed capital Retained earnings Total Stockholders’ Equity Total Liabilities and Stockholders’ Equity $ 1,500 2,200 100 1,600 5,400 2,800 12,000 $ 20,200 $ 2,400 3,920 2,700 500 9,520 3,700 6,980 10,680 $ 20,200 Req. 2 The adjustments in M4–4 and M4–6 have no effect on the operating, investing, and financing activities on the statement of cash flows because no cash is paid or received at the time of the adjusting entries. 4-11 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings M4–11. Revenues: Sales revenue Interest revenue (not operating) Rent revenue (not operating) Total revenues Costs and expenses: Wages expense Depreciation expense Utilities expense Insurance expense Rent expense Income tax expense Total costs and expenses Net Income $ 37,650 100 750 38,500 19,000 1,800 320 700 9,000 2,700 33,520 $ 4,980 Net profit margin = Net income Operating revenues = $4,980 $37,650 = 13.23% The operating revenue source for this company is from sales. Interest revenue and rent revenue are not included in the denominator because they are other (nonoperating) revenue sources. M4–12. Sales revenue (R) ................................................ Interest revenue (R) ............................................. Rent revenue (R) .................................................. Retained earnings (+SE) .............................. Wages expense (E) ................................... Depreciation expense (E) .......................... Utilities expense (E) ................................... Insurance expense (E) .............................. Rent expense (E) ...................................... Income tax expense (E) ............................ 4-12 37,650 100 750 4,980 19,000 1,800 320 700 9,000 2,700 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings EXERCISES E4–1. Paige Consultants, Inc. Unadjusted Trial Balance At September 30, 2012 Debit Cash Accounts receivable Supplies Prepaid expenses Investments Buildings and equipment Accumulated depreciation Land Accounts payable Accrued expenses payable Unearned consulting fees Income taxes payable Notes payable Contributed capital Retained earnings * Consulting fees revenue Investment income Gain on sale of land Wages and benefits expense Utilities expense Travel expense Rent expense Professional development expense Other operating expenses General and administrative expenses Interest expense Totals Credit $ 153,000 225,400 12,200 10,200 145,000 323,040 $ 18,100 60,000 96,830 25,650 32,500 3,030 160,000 223,370 144,510 2,564,200 10,800 6,000 1,610,000 25,230 23,990 152,080 18,600 188,000 321,050 17,200 $3,284,990 $3,284,990 * Since debits are supposed to equal credits in a trial balance, the balance in Retained Earnings is determined as the amount in the credit column necessary to make debits equal credits (a “plugged” figure). 4-13 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–2. Req. 1 Types Deferred Revenues: Deferred Revenue may need to be adjusted for any revenue earned during the period Deferred Revenue (L) and Product Revenue and/or Service Revenue (R) Accrued Revenues: Interest may be earned on Short-term Investments Interest Receivable (A) and Interest Revenue (R) Any unrecorded sales or services provided will need to be recorded Deferred Expenses: Other Current Assets may include supplies, prepaid rent, prepaid insurance, or prepaid advertising Any additional use of Property, Plant, and Equipment during the period will need to be recorded Accrued Expenses: Interest incurred on Short-term Note Payable and Long-term Debt will need to be recorded Accounts to be Adjusted Accounts Receivable (A) and Product Revenue and/or Service Revenue (R) Other Current Assets (A) and Selling, General, and Administrative Expense (E) Accumulated Depreciation (XA) and Cost of Products and/or Cost of Services (E) Accrued Liabilities (L) and Interest Expense (E) There are likely many other accrued expenses to be recorded, including wages, warranties, and utilities Accrued Liabilities (L) and Selling, General, and Administrative Expenses (among other expenses) (E) Income taxes must be computed for the period and accrued Income Tax Payable (L) and Income Tax Expense (E) Req. 2 Temporary accounts that accumulate during the period are closed at the end of the year to the permanent account Retained Earnings. These include: Product revenue, service revenue, interest revenue, cost of products, cost of services, interest expense, research and development expense, selling, general, and administrative expense, other expenses, and income tax expense. 4-14 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–3. Req. 1 The annual reporting period for this company is January 1 through December 31, 2011. Req. 2 (Adjusting entries) Both transactions are accruals because revenue has been earned and expenses incurred but no cash has yet been received or paid. (a) 1. Wages expense is incurred. 2. Cash will be paid in the next period to employees who worked in the current period – an accrued expense needs to be recorded. 3. Amount: $7,000 given Adjusting entry – Wages expense (+E, SE) .......................... Wages payable (+L).............................. 7,000 7,000 (b) 1. Interest revenue is now earned. 2. Cash will be received in the future – an accrued revenue needs to be recorded. 3. Amount: $2,000 given Adjusting entry – Interest receivable (+A) ................................ 2,000 Interest revenue (+R, +SE).................... 2,000 Req. 3 Adjusting entries are necessary at the end of the accounting period to ensure that all revenues earned and expenses incurred and the related assets and liabilities are measured properly. The entries above are accruals; entry (a) is an accrued expense (incurred but not yet recorded) and entry (b) is an accrued revenue (earned but not yet recorded). In applying the accrual basis of accounting, revenues should be recognized when earned and measurable and expenses should be recognized when incurred in generating revenues. 4-15 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–4. Req. 1 Prepaid Insurance is a deferred expense that needs to be adjusted each period for the amount used during the period. The amount of expense is computed as follows: $3,600 x 3/24 = $450 used Adjusting entry: Insurance expense (+E, SE)..................................... Prepaid insurance (A) .................................... 450 450 Req. 2 Shipping Supplies is a deferred expense that needs to be adjusted at the end of the period for the amount of supplies used during the period. The amount is computed as follows: Beginning balance Supplies purchased Supplies on hand at end Supplies used Adjusting entry: Shipping supplies expense (+E, SE) ........................ Shipping supplies (A) ..................................... $11,000 60,000 (20,000) $51,000 51,000 51,000 Req. 3 Prepaid Insurance 10/1 3,600 AJE 450 End. 3,150 Insurance Expense AJE End. Shipping Supplies Beg. 11,000 Purch. 60,000 AJE 51,000 End. 20,000 450 450 Shipping Supplies Expense AJE 51,000 End. 51,000 2011 Income statement: Insurance expense $ 450 Shipping supplies expense $51,000 Req. 4 2011 Balance sheet: Prepaid insurance $ 3,150 Shipping supplies $20,000 4-16 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–5. Transaction Assets E4–3 (a) NE E4–3 (b) +2,000 E4–4 (a) –450 E4–4 (b) –51,000 Balance Sheet Stockholders’ Liabilities Equity +7,000 –7,000 NE +2,000 NE –450 NE –51,000 Income Statement Net Revenues Expenses Income NE +7,000 –7,000 +2,000 NE +2,000 NE +450 –450 NE +51,000 –51,000 E4–6. Req. 1 a. b. c. d. e. f. g. Accrued expense Deferred expense Accrued revenue Deferred expense Deferred expense Deferred revenue Accrued revenue Req. 2 a. 2,700 Wages expense (+E, SE) .......................................... Wages payable (+L) .......................................... 2,700 b. 675 Office supplies expense (+E, SE).............................. Office supplies (A) ........................................... 675 Computations Given $450 + $500 - $275 = $675 used c. Rent receivable (+A).................................................... 1,120 Rent revenue (+R, +SE) .................................... 1,120 $560 x 2 months = $1,120 earned d. 12,100 Depreciation expense (+E, SE) ................................. 12,100 Accumulated depreciation (+XA, A) Given e. 600 Insurance expense (+E, SE) ..................................... Prepaid insurance (A) ...................................... $2,400 x 6/24 = $600 used 600 f. 3,200 Unearned rent revenue (L) ........................................ Rent revenue (+R, +SE) .................................... 3,200 $9,600 x 2/6 = $3,200 earned g. Repair accounts receivable (+A) ................................. 800 Repair shop revenue (+R, +SE) ........................ Given 4-17 800 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–7. Req. 1 a. b. c. d. e. f. g. Accrued revenue Deferred expense Accrued expense Deferred revenue Deferred expense Deferred expense Accrued expense Req. 2 a. Accounts receivable (+A) ............................................ 2,700 Service revenue (+R, +SE)................................ 2,700 Computations Given 900 Advertising expense (+E, SE).................................... Prepaid advertising (A) .................................... $1,200 x 9/12 = $900 used b. 900 c. 5,000 Interest expense (+E, SE) ......................................... Interest payable (+L) ......................................... 5,000 $250,000 x .12 x 2/12 (since last payment) = $5,000 incurred d. 750 Unearned storage revenue (L) .................................. Storage revenue (+R, +SE) ............................... $4,500 x 1/6 = $750 earned 750 e. 22,000 Depreciation expense (+E, SE) ................................. 22,000 Accumulated depreciation (+XA, A) Given f. 50,100 Supplies expense (+E, SE) ....................................... Supplies (A) .....................................................50,100 $16,500 + $46,000 – $12,400 = $50,100 used g. 3,800 Wages expense (+E, SE) .......................................... Wages payable (+L) .......................................... 3,800 Given 4-18 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–8. Balance Sheet Stockholders’ Liabilities Equity Income Statement Revenues Expenses Net Income Transaction Assets (a) NE +2,700 –2,700 NE +2,700 –2,700 (b) –675 NE –675 NE +675 –675 (c) +1,120 NE +1,120 +1,120 NE +1,120 (d) –12,100 NE –12,100 NE +12,100 –12,100 (e) –600 NE –600 NE +600 –600 (f) NE –3,200 +3,200 +3,200 NE +3,200 (g) +800 NE +800 +800 NE +800 E4–9. Balance Sheet Stockholders’ Liabilities Equity Income Statement Transaction Assets (a) +2,700 NE +2,700 +2,700 NE +2,700 (b) –900 NE –900 NE +900 –900 (c) NE +5,000 –5,000 NE +5,000 –5,000 (d) NE –750 +750 +750 NE +750 (e) –22,000 NE –22,000 NE +22,000 –22,000 (f) –50,100 NE –50,100 NE +50,100 –50,100 (g) NE +3,800 –3,800 NE +3,800 –3,800 4-19 Revenues Expenses Net Income Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–10. a. Independent Situations Accrued wages, unrecorded and unpaid at year-end, $400 (example). Debit Code Amount N 400 Credit Code Amount G 400 b. Service revenue earned but not yet collected at year-end, $600. C 600 L 600 c. Dividends declared and paid during the year, $900. K 900 A 900 d. Office Supplies on hand during the year, $400; supplies on hand at year-end, $160. Q 240 B 240 e. Service revenue collected in advance, $800. A 800 I 800 f. Depreciation expense for the year, $1,000. O 1,000 E 1,000 g. At year-end, interest on note payable not yet recorded or paid, $220. P 220 H 220 h. Balance at year-end in Service Revenue account, $56,000. Give the closing entry at year-end. L 56,000 K 56,000 i. Balance at year-end in Interest Expense account, $460. Give the closing entry at year-end. K 460 P 460 E4–11. Selected Balance Sheet Amounts at December 31, 2012 Assets: Equipment (recorded at cost per cost principle) Accumulated depreciation (for one year, as given) Net book value of equipment (difference) $12,000 (1,200) 10,800 Office supplies (on hand, as given) 400 Prepaid insurance (remaining coverage, $600 x 18/24 months) 450 Selected Income Statement Amounts for the Year Ended December 31, 2012 Expenses: Depreciation expense (for one year, as given) $ 1,200 Office supplies expense (used, $1,600 - $400 on hand) 1,200 Insurance expense (for 6 months, $600 x 6/24 months) 150 4-20 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–12. Date Note 1: April 1, 2011 December 31, 2011a March 31, 2012b Note 2: August 1, 2011 December 31, 2011c January 31, 2012d Balance Sheet Income Statement Stockholders’ Net Assets Liabilities Equity Revenues Expenses Income +30,000/ –30,000 + 2,250 +33,000/ –32,250 NE NE NE NE NE NE + 2,250 + 2,250 NE + 2,250 NE + 750 +750 NE + 750 NE NE NE NE + 30,000 + 30,000 NE + 1,500 - 1,500 NE + 1,500 - 1,500 - 31,800 - 31,500 - 300 NE + 300 - 300 (a) $30,000 principal x .10 annual interest rate x 9/12 of a year = $2,250 (b) Additional interest revenue in 2012: $30,000 x .10 x 3/12 = $750. Cash received was $33,000 ($30,000 principal + $3,000 interest for 12 months); receivables decreased by the $30,000 note receivable and $2,250 interest receivable accrued in 2011. (c) $30,000 principal x .12 annual interest rate x 5/12 of a year = $1,500 (d) Additional interest expense in 2012: $30,000 x .12 x 1/12 = $300. Cash paid was $31,800 ($30,000 principal + $1,800 interest for 6 months); payables decreased by the $30,000 note payable and $1,500 interest payable accrued in 2011. 4-21 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–13. Req. 1 (a) Cash paid on accrued income taxes payable. (b) Accrual of additional income tax expense. (c) Cash paid on dividends payable. (d) Amount of dividends declared for the period. (e) Cash paid on accrued interest payable. (f) Accrual of additional interest expense. Req. 2 Computations: (a) Beg. Bal. + accrued income taxes $135 + 656 - cash paid ? ? = = = (c) Beg. Bal. $110 dividends declared 456 - cash paid ? ? = = = End. bal. $118 $448 paid accrued interest expense ? ? - cash paid 1,127 = = = End. bal. $150 $1,137 accrued + + (f) Beg. Bal. + $140 + 4-22 End. bal. $79 $712 paid Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–14. Req. 1 Adjusting entries that were or should have been made at December 31: (a) No entry was made. Entry that should have been made: Rent receivable (+A) ................................................... Rent revenue (+R, +SE) .................................. 1,400 1,400 (b) No entry was made. Entry that should have been made: Depreciation expense (+E, SE) ................................ 15,000 Accumulated depreciation (+XA, A) ………… (c) No entry was made. Entry that should have been made: Unearned fee revenue (L) ........................................ Fee revenue (+R, +SE) .................................... 15,000 1,500 1,500 (d) Entry that was already made: Interest expense (+E, SE) ....................................... Interest payable (+L) ....................................... ($17,000 x .09 x 12/12 months) 1,530 1,530 Entry that should have been made: Interest expense (+E, SE) ........................................ Interest payable (+L) ........................................ ($17,000 x .09 x 2/12 months) 255 255 (e) No entry was made. Entry that should have been made: Insurance expense (+E, SE)..................................... Prepaid insurance (A) .................................... 650 650 Req. 2 Balance Sheet Stockholders’ Liabilities Equity Income Statement Assets (a) U 1,400 NE U 1,400 U 1,400 NE U 1,400 (b) O 15,000 NE O 15,000 NE U 15,000 O 15,000 (c) NE O 1,500 U 1,500 U 1,500 NE U 1,500 (d) NE O 1,275 U 1,275 NE O 1,275 U 1,275 (e) O 650 NE O 650 NE U 650 O 650 4-23 Revenues Expenses Net Income Transaction Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–15. Items Balances reported Additional adjustments: a. Wages b. Depreciation c. Rent revenue Adjusted balances d. Income taxes Correct balances Net Income $60,000 (39,000) (17,000) 3,200 7,200 (2,160) $ 5,040 Total Assets $170,000 Total Liabilities $80,000 Stockholders’ Equity $90,000 39,000 (39,000) (17,000) 3,200 37,200 (2,160) $35,040 (17,000) 153,000 $153,000 (3,200) 115,800 2,160 $117,960 Computations: a. Given, $39,000 accrued and unpaid. b. Given, $17,000 depreciation expense. c. $9,600 x 1/3 = $3,200 rent revenue earned. The remaining $6,400 in unearned revenue is a liability for two months of occupancy "owed'' to the renter. d. $7,200 income before taxes x 30% = $2,160. 4-24 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–16. Req. 1 a. b. c. Rent receivable (+A) ................................... Revenues (rent) (+R, +SE) .................. 2,500 Expenses (depreciation) (+E, SE) ............ Accumulated depreciation (+XA, A)... 4,500 Income tax expense (+E, SE) ................... Income taxes payable (+L) .................. 5,100 2,500 4,500 5,100 Req. 2 Effects of Adjusting Entries As Prepared Income statement: Revenues Expenses Income tax expense Net income Balance Sheet: Assets Cash Accounts receivable Rent receivable Equipment Accumulated depreciation Liabilities Accounts payable Income taxes payable Stockholders' Equity Contributed capital Retained earnings $97,000 (73,000) a b c $24,000 $2,500 (4,500) (5,100) (7,100) $20,000 22,000 50,000 (10,000) $82,000 4-25 $99,500 (77,500) (5,100) $16,900 a 2,500 b (4,500) (2,000) $20,000 22,000 2,500 50,000 (14,500) $80,000 c 5,100 $10,000 5,100 (7,100) (2,000) 40,000 24,900 $80,000 $10,000 40,000 32,000 $82,000 Corrected Amounts Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–17. Req. 1 a. b. c. d. e. Salaries and wages expense (+E, SE) ................ Salaries and wages payable (+L) ................... 730 Utilities expense (+E, SE).................................... Utilities payable (+L) ....................................... 440 Depreciation expense (+E, SE) ........................... Accumulated depreciation (+XA, A) ............. 24,000 Interest expense (+E, SE) ................................... Interest payable (+L) ...................................... ($15,000 x .08 x 3/12) 300 Maintenance expense (+E, SE)........................... Maintenance supplies (A) ............................. 1,100 f. No adjustment is needed because the revenue will not be earned until January (next year). g. Income tax expense (+E, SE).............................. Income tax payable (+L) ................................. 4-26 730 440 24,000 300 1,100 5,800 5,800 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–17. (continued) Req. 2 TYSON, INC. Income Statement For the Year Ended December 31, 2011 Operating Revenue: Rental revenue Operating Expenses: Salaries and wages ($26,500 + $730) Maintenance expense ($12,000 + $1,100) Rent expense Utilities expense ($4,300 + $440) Gas and oil expense Depreciation expense Miscellaneous expenses Total expenses Operating Income Other Item: Interest expense ($15,000 x .08 x 3/12) Pretax income Income tax expense Net income $109,000 $27,230 13,100 8,800 4,740 3,000 24,000 1,000 81,870 27,130 300 26,830 5,800 $ 21,030 Earnings per share: $21,030 ÷ 7,000 shares $3.00 Req. 3 Net profit margin = Net Income Net Sales (or Operating Revenue) = $21,030 $109,000 = 19.3% The net profit margin indicates that, for every $1 of rental revenues, Tyson earns $0.193 (19.3%) in net income. This ratio is higher than the industry average net profit margin of 18%, implying that Tyson is more profitable and better able to manage its business (in terms of sales price or costs) than the average company in the industry. 4-27 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–18. Req. 1 (a) (b) (c) (d) Insurance expense (+E, SE) .................................... Prepaid insurance (A) .................................... 4 Wages expense (+E, SE) ......................................... Wages payable (+L) ........................................ 5 Depreciation expense (+E, SE) ................................ Accumulated depreciation (+XA, A) ............... 8 Income tax expense (+E, SE) ................................... Income tax payable (+L) .................................. 9 4 5 8 9 Req. 2 RED RIVER COMPANY Trial Balance December 31, 2011 (in thousands of dollars) Account Titles Cash Accounts receivable Prepaid insurance Machinery Accumulated depreciation Accounts payable Wages payable Income taxes payable Contributed capital Retained earnings Revenues (not detailed) Expenses (not detailed) Totals Unadjusted Debit Credit 35 9 6 80 Adjustments Debit Credit a 4 c 8 9 b 5 d 9 73 4 84 32 166 a c b d 166 4-28 4 8 5 9 26 26 Adjusted Debit Credit 35 9 2 80 8 9 5 9 73 4 84 58 188 188 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–19. RED RIVER COMPANY Income Statement For the Year Ended December 31, 2011 (in thousands of dollars) Revenues (not detailed) Expenses ($32 + $4 + $8 + $5) Pretax income Income tax expense Net income $84 49 35 9 $26 EPS ($26,000 ÷ 4,000 shares) $6.50 RED RIVER COMPANY Statement of Stockholders' Equity For the Year Ended December 31, 2011 (in thousands of dollars) Beginning balances, 1/1/2011 Stock issuance Net income Dividends declared Ending balances, 12/31/2011 Contributed Capital $ 0 73 $ 73 Retained Earnings $ 0 26 (4) * $ 22 Total Stockholders' Equity $ 0 73 26 (4) $ 95 * The amount of dividends declared can be inferred because the unadjusted trial balance amount for retained earnings is a negative $4. Since this is the first year of operations, we can assume the entire amount is due to a dividend declaration. RED RIVER COMPANY Balance Sheet At December 31, 2011 (in thousands of dollars) Assets Current Assets: Cash Accounts receivable Prepaid insurance ($6 - $4) Total current assets Machinery Accumulated depreciation Total assets $ 35 9 2 46 80 (8) $118 Liabilities and Stockholders’ Equity Current Liabilities: Accounts payable $ 9 Wages payable 5 Income taxes payable 9 Total current liabilities 23 Stockholders' Equity: Contributed capital 73 Retained earnings 22 Total liabilities and stockholders' equity $118 4-29 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings E4–20. Req. 1 The purposes of “closing the books” at the end of the accounting period are to: Transfer the balance in the temporary accounts to a permanent account (Retained Earnings). Create a zero balance in each of the temporary accounts for accumulation of activities in the next accounting period. Req. 2 Revenues (R) ........................................................... Expenses ($32 + $4 + $8 + $5 + $9) (E)........ Retained earnings (+SE) ................................. 4-30 84 58 26 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings PROBLEMS P4–1. Req. 1 Dell Inc. Adjusted Trial Balance At January 31, 2012 (in millions of dollars) Debit Cash Marketable securities Accounts receivable Inventories Property, plant, and equipment Accumulated depreciation Other assets Accounts payable Accrued expenses payable Long-term debt Other liabilities Contributed capital Retained earnings (deficit) Sales revenue Other income Cost of sales Selling, general, and administrative expenses Research and development expense Income tax expense Totals Credit $ 8,352 740 6,443 867 4,510 $ 2,233 7,821 8,309 3,788 1,898 8,234 11,189 9,396 61,101 134 50,144 7,102 665 846 $ 96,886 $ 96,886 Req. 2 Since debits are supposed to equal credits in a trial balance, the balance in Retained Earnings is determined as the amount in the debit column necessary to make debits equal credits (a “plugged” figure). 4-31 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings P4–2. Req. 1 a. Deferred revenue e. Deferred expense b. Accrued expense f. Accrued revenue c. Deferred expense g. Accrued expense d. Deferred revenue h. Accrued expense Req. 2 a. b. c. d. e. f. g. h. Unearned rent revenue (L) ......................................... Rent revenue (+R, +SE)..................................... ($8,400 ÷ 6 months = $1,400 per month x 4 months) 5,600 Interest expense (+E, SE) .......................................... Interest payable (+L) ............................................ ($18,000 x .12 x 3/12) 540 Depreciation expense (+E, SE) .................................. Accumulated depreciation (+XA, A) .................. 2,500 Unearned service revenue (L) .................................... Service revenue (+R, +SE) ................................. ($3,000 x 2/12) 500 5,600 540 2,500 500 1,500 Insurance expense (+E, SE) ...................................... Prepaid insurance (A) ..................................... ($9,000 ÷ 12 months = $750 per month x 2 months of coverage) Accounts receivable (+A) ............................................. Service revenue (+R, +SE) ................................ 4,000 Wage expense (+E, SE) ............................................ Wages payable (+L) ........................................... 14,000 Property tax expense (+E, SE)................................... Property tax payable (+L) ..................................... 500 4-32 1,500 4,000 14,000 500 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings P4–3. Req. 1 a. Deferred expense e. Accrued revenue b. Deferred expense f. Deferred expense c. Accrued expense g. Accrued expense d. Accrued expense h. Accrued expense Req. 2 a. b. c. d. e. f. g. h. Depreciation expense (+E, SE) .................................. Accumulated depreciation (+XA, A) .................. 4,000 4,000 1,150 Supplies expense (+E, SE) ........................................ Supplies (A) ..................................................... (Beg. Inventory of $400 + Purchases $1,000 – Ending Inventory $250) Repairs expense (+E, SE).......................................... Accounts payable (+L) ....................................... 1,200 Property tax expense (+E, SE)................................... Property tax payable (+L) ..................................... 1,500 Accounts receivable (+A) ............................................. Service revenue (+R, +SE) ................................ 6,000 Insurance expense (+E, SE) ...................................... Prepaid insurance (A) ..................................... ($1,200 ÷ 36 months x 6 months of coverage) 200 Interest expense (+E, SE) .......................................... Interest payable (+L) ............................................ ($11,000 x .14 x 3/12) 385 1,150 1,200 1,500 6,000 200 385 8,270 Income tax expense (+E, SE) .................................... Income tax payable (+L) ...................................... 8,270 To accrue income tax expense incurred but not paid: Income before adjustments (given) $30,000 Effect of adjustments (a) through (g) (2,435) (–$4,000–$1,150–$1,200 Income before income taxes 27,565 –$1,500+$6,000–$200–$385) Income tax rate x 30% Income tax expense $ 8,270 (rounded) 4-33 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings P4–4. Req. 1 a. Deferred revenue e. Deferred expense b. Accrued expense f. Accrued revenue c. Deferred expense g. Accrued expense d. Deferred revenue h. Accrued expense Req. 2 Transaction Assets Balance Sheet Stockholders’ Liabilities Equity Income Statement Revenues Expenses Net Income a. NE –5,600 +5,600 +5,600 NE +5,600 b. NE +540 –540 NE +540 –540 c. –2,500 NE –2,500 NE +2,500 –2,500 d. NE –500 +500 +500 NE +500 e. –1,500 NE –1,500 NE +1,500 –1,500 f. +4,000 NE +4,000 +4,000 NE +4,000 g. NE +14,000 –14,000 NE +14,000 –14,000 NE +500 –500 NE +500 –500 h. Computations: a. $8,400 ÷ 6 months = $1,400 per month x 4 months = $5,600 earned b. $18,000 principal x .12 x 3/12 = $540 interest incurred c. Amount is given. d. $3,000 unearned x 2/12 = $500 earned e. $9,000 ÷ 12 months = $750 per month x 2 months of coverage = $1,500 incurred f. Amount is given. g. Amount is given. h. Amount is given. 4-34 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings P4–5. Req. 1 a. Deferred expense e. Accrued revenue b. Deferred expense f. Deferred expense c. Accrued expense g. Accrued expense d. Accrued expense h. Accrued expense Req. 2 Balance Sheet Stockholders’ Liabilities Equity Income Statement Revenues Expenses Net Income Transaction Assets a. 4,000 NE 4,000 NE + 4,000 4,000 b. 1,150 NE 1,150 NE + 1,150 – 1,150 c. NE + 1,200 1,200 NE + 1,200 1,200 d. NE + 1,500 1,500 NE + 1,500 1,500 e. + 6,000 NE + 6,000 + 6,000 NE + 6,000 f. 200 NE 200 NE + 200 200 g. NE + 385 385 NE + 385 385 h. NE +8,270 8,270 NE + 8,270 8,270 Computations: a. Amount is given. b. Beg. inventory, $400 + Purchases, $1,000 - Ending inventory, $250 = $1,150 used c. Amount is given. d. Amount is given. e. Amount is given. f. $1,200 x 6/36 = $200 used g. $11,000 x 14% x 3/12 = $385 interest expense for the period h. Adjusted income = $30,000 - $4,000 - $1,150 - $1,200 - $1,500 + $6,000 - $200 $385 = $27,565 x 30% tax rate = $8,270 income tax expense. 4-35 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings P4–6. Req. 1 (1) (2) (3) (4) December 31, 2012, Adjusting Entries Accounts receivable (+A) ......................................... 560 Service revenue (+R, +SE) ........................... To record service revenue earned, but not collected. Insurance expense (+E, SE) ................................. Prepaid insurance (A) ................................. To record insurance expired as an expense. Depreciation expense (+E, SE).............................. Accumulated depreciation, equipment (+XA, A) To record depreciation expense. Income tax expense (+E, SE) ............................... Income taxes payable (+L) ........................... To record income taxes for 2012. 560 (b) (i) 280 (l) (c) 11,900 (k) (e) 6,580 (m) (f) 280 11,900 6,580 Req. 2 Amounts before Adjusting Entries Revenues: Service revenue Expenses: Salary expense Depreciation expense Insurance expense Income tax expense Total expense Net income (loss) Amounts after Adjusting Entries $64,400 $64,960 56,380 56,380 11,900 280 6,580 75,140 $(10,180) 56,380 $ 8,020 Net loss is $10,180 because this amount includes all revenues and all expenses (after the adjusting entries). This amount is correct because it incorporates the effects of the revenue and matching principles applied to all transactions whose effects extend beyond the period in which the transactions occurred. Net income of $8,020 was not correct because expenses of $18,760 and revenues of $560 were excluded that should have been recorded in 2012. Req. 3 Earnings (loss) per share = $(10,180) net loss 3,000 shares = $(3.39) per share 4-36 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings P4–6. (continued) Req. 4 Net profit margin = Net Income Net Sales = $(10,180) net loss $64,960 = (15.7)% The net profit margin indicates that, for every $1 of service revenues, Ramirez actually lost $0.157 of net income. This ratio implies that Ramirez destroys shareholder value in generating its sales and suggests that better management of its business (in terms of sales price or costs) is required. Req. 5 Service revenue (R) ............................................... Retained earnings (SE) ......................................... Salary expense (E)......................................... Depreciation expense (E)............................... Insurance expense (E) ................................... Income tax expense (E) ................................. 4-37 64,960 10,180 56,380 11,900 280 6,580 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings P4–7. Req. 1 December 31, 2011, Adjusting Entries: (a) (b) (c) (d) (e) Supplies expense (+E, SE) ...................................... Supplies (A) .................................................. 400 Insurance expense (+E, SE) .................................... Prepaid insurance (A) ................................... 400 Depreciation expense (+E, SE) ............................... Accumulated depreciation (+XA, A) .............. 4,200 Wages expense (+E, SE) ......................................... Wages payable (+L) ....................................... 720 Income tax expense (+E, SE) .................................. Income taxes payable (+L) ............................. 5,880 400 400 4,200 720 5,880 Req. 2 ELLIS, INC. Income Statement For the Year Ended December 31, 2011 Operating Revenue: Service revenue $61,600 Operating Expenses: Supplies expense ($640 - $240) Insurance expense Depreciation expense Wages expense Remaining expenses (not detailed) Total expenses Operating Income Income tax expense Net Income 400 400 4,200 720 33,360 39,080 22,520 5,880 $16,640 Earnings per share ($16,640 ÷ 5,000 shares) 4-38 $3.33 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings P4–7. (continued) Req. 2 (continued) ELLIS, INC. Balance Sheet At December 31, 2011 Assets Current Assets: Cash Accounts receivable Supplies Prepaid insurance Total current assets Service trucks Accumulated depreciation Other assets (not detailed) Total assets Liabilities and Stockholders’ Equity Current Liabilities: Accounts payable $ 2,400 Wages payable 720 Income taxes payable 5,880 Total current liabilities 9,000 Note payable, long term 16,000 Total liabilities 25,000 $46,000 10,400 240 400 57,040 16,000 (13,800) Stockholders' Equity Contributed capital Retained earnings* Total stockholders' equity Total liabilities and stockholders' equity 8,960 $68,200 20,560 22,640 43,200 $68,200 *Unadjusted balance, $6,000 + Net income, $16,640 = Ending balance, $22,640. Req. 3 December 31, 2011, Closing Entry: Service revenue (R) .................................................. Retained earnings (+SE) ................................ Supplies expense (E) .................................... Insurance expense (E) .................................. Depreciation expense (E) ............................. Wages expense (E) ...................................... Remaining expenses (not detailed) (E).......... Income tax expense (E) ................................ 4-39 61,600 16,640 400 400 4,200 720 33,360 5,880 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings ALTERNATE PROBLEMS AP4–1. Req. 1 Starbucks Corporation Adjusted Trial Balance At September 30, 2012 (in millions) Debit Cash Short-term investments Accounts receivable Inventories Prepaid expenses Other current assets Long-term investments Property, plant, and equipment Accumulated depreciation Other long-lived assets Accounts payable Accrued liabilities Short-term bank debt Long-term liabilities Contributed capital Retained earnings Net revenues Interest income Cost of sales Store operating expenses Other operating expenses Depreciation expense General and administrative expenses Interest expense Income tax expense Totals $ Credit 270 43 330 693 169 234 374 5,717 $ 2,761 594 325 1,152 713 992 40 2,124 10,497 9 $ 4,645 3,745 330 549 723 53 144 18,613 $ 18,613 Req. 2 Since debits are supposed to equal credits in a trial balance, the balance in Retained Earnings is determined as the amount in the credit column necessary to make debits equal credits (a “plugged” figure). 4-40 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings AP4–2. Req. 1 a. Deferred expense e. Deferred revenue b. Deferred revenue f. Accrued expense c. Accrued expense g. Accrued expense d. Deferred expense h. Accrued revenue Req. 2 a. b. c. d. e. f. g. h. Insurance expense (+E, SE) ...................................... Prepaid insurance (A) ..................................... ($3,200 ÷ 6 months x 3 months of coverage) 1,600 Unearned maintenance revenue (L) .......................... Maintenance revenue (+R, +SE) ....................... ($450 ÷ 2 months x 1 month) 225 Wage expense (+E, SE) ............................................ Wages payable (+L) .......................................... 900 Depreciation expense (+E, SE) ................................. Accumulated depreciation (+XA, A) .................. 3,000 Unearned service revenue (L) ................................... Service revenue (+R, +SE) ................................. ($4,200 ÷ 12 months x 2 months) 700 Interest expense (+E, SE).......................................... Interest payable (+L) ............................................ ($18,000 x .09 x 5/12) 675 Property tax expense (+E, SE) .................................. Property tax payable (+L) .................................... 500 Accounts receivable (+A) ............................................. Service revenue (+R, +SE) ................................ 2,000 4-41 1,600 225 900 3,000 700 675 500 2,000 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings AP4–3. Req. 1 a. Deferred expense e. Deferred expense b. Accrued revenue f. Deferred expense c. Deferred expense g. Accrued revenue d. Accrued expense h. Accrued expense Req. 2 a. 1,250 Supplies expense (+E, SE) ........................................ 1,250 Supplies (A) ..................................................... (Beg. Inventory of $450 + Purchases $1,200 – Ending Inventory $400) b. Accounts receivable (+A) ............................................. Catering revenue (+R, +SE) ............................... 7,500 Insurance expense (+E, SE) ...................................... Prepaid insurance (A) ..................................... ($1,200 x 2/12 months of coverage) 200 Repairs expense (+E, SE).......................................... Accounts payable (+L) ....................................... 600 Rent expense (+E, SE) .............................................. Prepaid rent (A) .................................................. ($2,100 x 1/3 months of rent used) 700 Depreciation expense (+E, SE) .................................. Accumulated depreciation (+XA, A) .................. 2,600 Interest receivable (+A) ................................................ Interest income (+R, +SE).................................... ($4,000 x .12 x 2/12) 80 Income tax expense (+E, SE) .................................... Income tax payable (+L) ...................................... 7,389 c. d. e. f. g. h. 4-42 7,500 200 600 700 2,600 80 7,389 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings To accrue income tax expense incurred but not paid: Income before adjustments (given) $22,400 Effect of adjustments (a) through (g) + 2,230 (-$1,250+$7,500 Income before income taxes 24,630 -$200-$600-$700 Income tax rate x 30% -$2,600+$80) Income tax expense $ 7,389 AP4–4. Req. 1 a. Deferred expense e. Deferred revenue b. Deferred revenue f. Accrued expense c. Accrued expense g. Accrued expense d. Deferred expense h. Accrued revenue Req. 2 Balance Sheet Stockholders’ Liabilities Equity Income Statement Transaction Assets a. –1,600 NE –1,600 NE +1,600 –1,600 b. NE –225 +225 +225 NE +225 c. NE +900 –900 NE +900 –900 d. –3,000 NE –3,000 NE e. NE –700 +700 +700 f. NE +675 –675 NE +675 –675 g. NE +500 –500 NE +500 –500 h. +2,000 NE +2,000 +2,000 4-43 Revenues Expenses Net Income +3,000 NE NE –3,000 +700 +2,000 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings Computations: a. $3,200 prepaid insurance x 3/6 months of coverage = $1,600 used b. $450 unearned revenue x 1/2 months = $225 earned c. Amount is given. d. Amount is given. e. $4,200 unearned revenue x 2/12 months = $700 earned f. $18,000 principal x .09 x 5/12 months = $675 interest expense g. Amount is given. h. Amount is given. AP4–5. Req. 1 a. Deferred expense e. Deferred expense b. Accrued revenue f. Deferred expense c. Deferred expense g. Accrued revenue d. Accrued expense h. Accrued expense Req. 2 Balance Sheet Stockholders’ Liabilities Equity Income Statement Revenues Expenses Net Income Transaction Assets a. –1,250 NE –1,250 NE +1,250 –1,250 b. +7,500 NE +7,500 +7,500 NE +7,500 c. –200 NE –200 NE +200 –200 d. NE +600 –600 NE +600 –600 e. –700 NE –700 NE +700 –700 f. –2,600 NE –2,600 NE +2,600 –2,600 g. +80 NE +80 +80 NE +80 h. NE +7,389 –7,389 NE +7,389 –7,389 4-44 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings Computations: a. Beg. Inventory of $450 + Purchases $1,200 – Ending Inventory $400 = $1,250 used for the period. b. Amount is given. c. $1,200 prepaid expense x 2/12 = $200 insurance used d. Amount is given. e. $2,100 x 1/3 = $700 rent used f. Amount is given. g. $4,000 principal x .12 x 2/12 months = $80 interest earned h. Adjusted income = $22,400 - $1,250 + $7,500 - $200 - $600 - $700 - $2,600 + $80 = $24,630 x 30% tax rate = $7,389 income tax expense 4-45 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings AP4–6. Req. 1 (1) (2) (3) (4) (5) December 31, 2011, Adjusting Entries Accounts receivable (+A) ........................................ 1,500 Service revenue (+R, +SE) ........................... To record service revenues earned, but not collected. Rent expense (+E, SE) ......................................... Prepaid rent (A)............................................ To record rent expired as an expense. 400 Depreciation expense (+E, SE) ............................. Accumulated depreciation (+XA, A) To record depreciation expense. 17,500 Unearned revenue (L) ........................................... Service revenue (+R, +SE) ........................... To record service revenue earned. 8,000 Income tax expense (+E, SE) ............................... Income taxes payable (+L) ........................... To record income taxes for 2011. 6,500 1,500 (b) (j) 400 (m) (c) 17,500 (l) (e) 8,000 (g) (j) 6,500 (n) (f) Req. 2 Amounts before Adjusting Entries Revenues: Service revenue Expenses: Salary expense Depreciation expense Rent expense Income tax expense Total expense Net income Amounts after Adjusting Entries $83,000 $92,500 56,000 56,000 17,500 400 6,500 80,400 $ 12,100 56,000 $ 27,000 Net income is $12,100 because this amount includes all revenues and all expenses (after the adjusting entries). This amount is correct because it incorporates the effects of the revenue and matching principles applied to all transactions whose effects extend beyond the period in which the transactions occurred. Net income of $27,000 was not correct because expenses of $24,400 and revenues of $9,500 were excluded that should have been recorded in 2011. 4-46 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings AP4–6. (continued) Req. 3 Earnings per share = $12,100 net income 5,000 shares = $2.42 per share Req. 4 Net profit margin = Net income Net Sales (or Operating Revenue) = $12,100 $92,500 = 13.1% The net profit margin indicates that, for every $1 of service revenues, Taos made $0.131 (13.1%) of net income. This ratio suggests that Taos is generally profitable. Req. 5 Service revenue (R) ............................................... Retained earnings (+SE) .................................. Salary expense (E)......................................... Depreciation expense (E)............................... Rent expense (E) ........................................... Income tax expense (E) ................................. 4-47 92,500 12,100 56,000 17,500 400 6,500 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings AP4–7. Req. 1 December 31, 2011, Adjusting Entries: (a) (b) (c) (d) (e) Depreciation expense (+E, SE) ............................... Accumulated depreciation (+XA, A) .............. 3,000 Insurance expense (+E, SE) .................................... Prepaid insurance (A) ................................... 450 Wages expense (+E, SE) ......................................... Wages payable (+L) ....................................... 2,100 Supplies expense (+E, SE) ...................................... Supplies (A) .................................................. 500 Income tax expense (+E, SE) .................................. Income tax payable (+L) ................................. 3,150 3,000 450 2,100 500 3,150 Req. 2 SOUTH BEND REPAIR SERVICE CO. Income Statement For the Year Ended December 31, 2011 Operating Revenue: Service revenue $48,000 Operating Expenses: Depreciation expense Insurance expense Wages expense Supplies expense ($1,300 balance - $800 on hand) Remaining expenses (not detailed) Total expenses Operating Income Income tax expense Net Income Earnings per share ($5,900 ÷ 3,000 shares) 4-48 3,000 450 2,100 500 32,900 38,950 9,050 3,150 $5,900 $1.97 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings AP4–7. (continued) SOUTH BEND REPAIR SERVICE CO. Balance Sheet At December 31, 2011 Assets Current Assets: Cash Accounts receivable Supplies Prepaid insurance Total current assets Equipment Accumulated depreciation Other assets (not detailed) $19,600 7,000 800 450 27,850 27,000 (15,000) 5,100 Total assets $44,950 Liabilities and Stockholders’ Equity Current Liabilities: Accounts payable $ 2,500 Wages payable 2,100 Income tax payable 3,150 Total current liabilities 7,750 Note payable, long term 5,000 Total liabilities 12,750 Stockholders' Equity Contributed capital 16,000 Retained earnings* 16,200 Total stockholders' equity 32,200 Total liabilities and stockholders' equity $44,950 *Unadjusted balance, $10,300 + Net income, $5,900 = Ending balance, $16,200. Req. 3 December 31, 2011, Closing Entry: Service revenue (R) .................................................. Retained earnings (+SE) ................................ Depreciation expense (E) ............................. Insurance expense (E) .................................. Wages expense (E) ...................................... Supplies expense (E) .................................... Remaining expenses (not detailed) (E).......... Income tax expense (E) ................................ 4-49 48,000 5,900 3,000 450 2,100 500 32,900 3,150 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMPREHENSIVE PROBLEMS COMP4–1. Req. 1, 2, 3, and 5 T-accounts (in thousands) Cash Bal. 4 b a 12 e c 156 g d 4 h f 34 k Bal. 53 Bal. b Bal. 12 91 13 19 22 Accounts Receivable Bal. 7 c 52 f 34 Bal. Land 0 12 12 25 Bal. i Bal. Other Assets Bal. 5 g 13 21 18 Accumulated Depreciation Bal. 8 m 8 Bal. 16 Equipment Bal. 78 Bal. Supplies 16 23 l 78 Accounts Payable Bal. 0 h 19 e 20 i 23 Bal. 24 Income Tax Payable Bal. 0 p 10 Wages Payable Bal. 0 o 16 Bal. 16 Interest Payable Bal. 0 n 1 Bal. 1 LT Notes Payable Bal. 0 a 12 Bal. 12 Contributed Capital Bal. 85 d 4 Retained Earnings Bal. 22 CE Bal. Bal. 18 Bal. Depreciation Expense Bal. 0 m 8 CE Bal. 0 89 8 k 17 41 36 Income Tax Expense Bal. 0 p 10 CE 10 Bal. 0 4-50 Bal. CE 10 Service Revenue Bal. 0 c 208 208 Bal. 0 Interest Expense Bal. 0 n 1 CE Bal. 0 1 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings Supplies Expense Bal. 0 l 21 CE Bal. 0 21 Wages Expense Bal. 0 o 16 CE Bal. 0 16 Remaining Expenses Bal. 0 e 111 CE 111 Bal. 0 COMP4–1. (continued) Req. 2 a. Cash (+A) .......................................................... Notes payable (+L) .................................. b. c. d. e. f. g. h. i. 12,000 12,000 Land (+A)........................................................... Cash (A) ................................................ 12,000 Cash (+A) .......................................................... Accounts receivable (+A)................................... Service revenue (+R, +SE) ...................... 156,000 52,000 Cash (+A) .......................................................... Contributed capital (+SE) ........................ 4,000 Remaining expenses (+E, SE) ........................ Accounts payable (+L) ............................. Cash (A) ................................................ 111,000 Cash (+A) .......................................................... Accounts receivable (A)......................... 34,000 Other assets (+A) .............................................. Cash (A) ................................................ 13,000 Accounts payable (L) ....................................... Cash (A) ................................................ 19,000 Supplies (+A) ..................................................... Accounts payable (+L) ............................. 23,000 j. No entry required; no revenue earned in 2012. k. Retained earnings (SE) ................................... Cash (A) ................................................ 4-51 12,000 208,000 4,000 20,000 91,000 34,000 13,000 19,000 23,000 22,000 22,000 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMP4–1. (continued) Req. 3 l. m. n. o. p. Supplies expense (+E, SE).............................. Supplies (A) ............................................ ($39,000 in account – $18,000 at year end) 21,000 Depreciation expense (+E, SE) ....................... Accumulated depreciation (+XA, A)........ 8,000 Interest expense (+E, SE) ............................... Interest payable (+L) ................................ ($12,000 x .10 x 10/12) 1,000 Wages expense (+E, SE) ................................ Wages payable (+L) ................................. 16,000 Income tax expense (+E, SE) .......................... Income taxes payable (+L) ....................... 10,000 21,000 8,000 1,000 16,000 10,000 Req. 4 H & H TOOL, INC. Income Statement For the Year Ended December 31, 2012 Operating Revenues: Service revenue Operating Expenses: Depreciation expense Supplies expense Wages expenses Remaining expenses Total operating expenses Operating Income Other Item: Interest expense Pretax income Income tax expense Net Income Earnings per share [$41,000 ÷ 89,000 shares all year] 4-52 $208,000 8,000 21,000 16,000 111,000 156,000 52,000 1,000 51,000 10,000 $41,000 $0.46 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMP4–1. (continued) H & H TOOL, INC. Statement of Stockholders' Equity For the Year Ended December 31, 2012 Balance, January 1, 2012 Additional stock issuance Net income Dividends declared Balance, December 31, 2012 Contributed Capital $85,000 4,000 $89,000 Retained Earnings $ 17,000 41,000 (22,000) $36,000 Total Stockholders' Equity $102,000 4,000 41,000 (22,000) $125,000 H & H TOOL, INC. Balance Sheet At December 31, 2012 Assets Current Assets: Cash Accounts receivable Supplies Total current assets Land Equipment Less: Accumulated deprec. Other assets $ 53,000 25,000 18,000 96,000 12,000 78,000 (16,000) 18,000 Total assets $188,000 Liabilities and Stockholders’ Equity Current Liabilities: Accounts payable $ 24,000 Interest payable 1,000 Wages payable 16,000 Income taxes payable 10,000 Total current liabilities 51,000 Notes payable 12,000 Total liabilities 63,000 Stockholders' Equity: Contributed capital 89,000 Retained earnings 36,000 Total stockholders' equity 125,000 Total liabilities and stockholders' equity $188,000 4-53 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMP4–1. (continued) H & H TOOL, INC. Statement of Cash Flows For the Year Ended December 31, 2012 Cash from Operating Activities: Cash collected from customers (c + f) Cash paid to suppliers and employees (e +h) Cash provided by operations $190,000 (110,000) 80,000 Cash from Investing Activities: Purchase of land (b) Purchase of other assets (g) Cash used for investing activities (12,000) (13,000) (25,000) Cash from Financing Activities: Borrowing from bank (a) Issuance of stock (d) Payment of dividends (k) Cash used for financing activities Change in cash Beginning cash balance, January 1, 2012 Ending cash balance, December 31, 2012 12,000 4,000 (22,000) (6,000) 49,000 4,000 $ 53,000 Req. 5 December 31, 2012, Closing Entry Service revenue (R) ......................................... Retained earnings (+SE) ......................... Depreciation expense (E) ...................... Interest expense (E) .............................. Supplies expense (E) ............................ Wages expense (E) ............................... Remaining expenses (E) ....................... Income tax expense (E) ......................... 4-54 208,000 41,000 8,000 1,000 21,000 16,000 111,000 10,000 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMP4–1. (continued) Req. 6 (a) Current ratio = Current assets Current liabilities = $96,000 $51,000 = 1.88 This suggests that H & H Tool, Inc., has sufficient current assets to pay current liabilities. (b) Total asset turnover = Sales Average total assets = $208,000 [($102,000 + $188,000) 2] = $208,000 $145,000 = 1.43 This suggests that H & H Tool, Inc., generated $1.43 for every dollar of assets. (c) Net profit margin = Net income Sales = $41,000 $208,000 = 0.197 or 19.7% This suggests that H & H Tool, Inc., earns $0.197 for every dollar in sales that it generates. For all of the ratios, a comparison across time and a comparison against an industry average or competitors will need to be analyzed to determine how liquid (current ratio) the company is and how efficient (total asset turnover) and how effective (net profit margin) H & H Tool’s management is. COMP4-2. Req. 1, 2, 3, and 5 Bal. a c d g j Bal. Cash 5 20 b 5 e 56 f 8 h 3 k 27 18 28 3 11 10 T-accounts (in thousands) Accounts Receivable Bal. 4 d 14 g 8 Bal. 10 Supplies Bal. 2 i 10 l Bal. 4-55 4 8 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings Small Tools Bal. 6 f 3 l 1 Bal. 8 Equipment Bal. 0 b 18 Bal. 18 Other Assets Bal. 9 Accounts Payable Bal. 7 h 11 e 7 i 10 Bal. 13 Bal. 9 Wages Payable Bal. 0 o 3 Bal. 3 Unearned Revenue Bal. j Bal. Notes Payable Bal. 0 a 20 Bal. 0 3 3 Service Revenue Bal. 0 d 70 CE 70 Bal. 0 Income Tax Expense Bal. 0 p 4 CE 4 Bal. 0 Wages Expense Bal. 0 o 3 CE 3 Bal. 0 4-56 20 Income Taxes Payable Bal. 0 p 4 Bal. 4 Interest Payable Bal. 0 n 1 Bal. 1 Contributed Capital Bal. 15 c 5 Bal. 20 Depreciation Expense Bal. 0 m 2 CE 2 Bal. 0 Accumulated Depreciation Bal. 0 m 2 Bal. 2 k Retained Earnings 10 Bal. CE Bal. 4 16 10 Interest Expense Bal. 0 n 1 CE 1 Bal. 0 Remaining Expenses Bal. 0 e 35 l 9 CE 44 Bal. 0 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMP4-2. (continued) Req. 2 a. b. c. d. e. f. g. h. i. j. k. Cash (+A) .......................................................... Notes payable (+L) .................................. 20,000 Equipment (+A) ................................................. Cash (A) ................................................ 18,000 Cash (+A) .......................................................... Contributed capital (+SE) ........................ 5,000 Cash (+A) .......................................................... Accounts receivable (+A)................................... Service revenue (+R, +SE) ...................... 56,000 14,000 Remaining expenses (+E, SE) ........................ Accounts payable (+L) ............................. Cash (A) ................................................ 35,000 Small tools (+A) ................................................. Cash (A) ................................................ 3,000 Cash (+A) .......................................................... Accounts receivable (A)......................... 8,000 Accounts payable (L) ....................................... Cash (A) ............................................... 11,000 Supplies (+A) ..................................................... Accounts payable (+L) ............................. 10,000 Cash (+A) .......................................................... Unearned revenue (+L) .......................... 3,000 Retained earnings (SE) ................................... Cash (A) ................................................ 10,000 4-57 20,000 18,000 5,000 70,000 7,000 28,000 3,000 8,000 11,000 10,000 3,000 10,000 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMP4-2. (continued) Req. 3 l. m. n. o. p. Remaining expenses (+E, SE) ........................ Supplies (A) ............................................ Small tools (A) ........................................ [Supplies used ($12 – 4) and small tools used ($9 – 8)] 9,000 Depreciation expense (+E, SE) ....................... Accumulated depreciation (+XA, A)........ 2,000 Interest expense (+E, SE) ............................... Interest payable (+L) ................................ ($20,000 principal x .10 x 6/12) 1,000 Wages expense (+E, SE) ................................ Wages payable (+L) ................................. 3,000 Income tax expense (+E, SE) .......................... Income taxes payable (+L) ....................... 4,000 8,000 1,000 2,000 1,000 3,000 4,000 Req. 4 FURNITURE REFINISHERS, INC. Income Statement For the Year Ended December 31, 2013 Operating Revenues: Service revenue Operating Expenses: Depreciation expense Wages expense Remaining expenses Total operating expenses Operating Income Other Item: Interest expense Pretax income Income tax expense Net Income Earnings per share ($16,000 ÷ 20,000] $70 000 2,000 3,000 44,000 49,000 21,000 1,000 20,000 4,000 $16,000 $0.80 4-58 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMP4-2. (continued) FURNITURE REFINISHERS, INC. Statement of Stockholders' Equity For the Year Ended December 31, 2013 Balance, January 1, 2013 Additional stock issuance Net income Dividends declared Balance, December 31, 2013 Contributed Capital $15,000 5,000 $20,000 Retained Earnings $ 4,000 16,000 (10,000) $ 10,000 Total Stockholders' Equity $19,000 5,000 16,000 (10,000) $30,000 FURNITURE REFINISHERS, INC. Balance Sheet At December 31, 2013 Assets Current Assets: Cash Accounts receivable Supplies Small tools Total current assets Equipment Less: Accum. deprec. Other assets $27,000 10,000 4,000 8,000 49,000 18,000 (2,000) 9,000 Total assets $74,000 Liabilities and Stockholders’ Equity Current Liabilities: Accounts payable $13,000 Notes payable 20,000 Wages payable 3,000 Interest payable 1,000 Income taxes payable 4,000 Unearned revenue 3,000 Total current liabilities 44,000 Stockholders' Equity: Contributed capital 20,000 Retained earnings 10,000 Total stockholders' equity 30,000 Total liabilities and stockholders' equity $74,000 4-59 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMP4-2. (continued) FURNITURE REFINISHERS, INC. Statement of Cash Flows For the Period Ended December 31, 2013 Cash from Operating Activities: Cash collected from customers (d + g + j) Cash paid to suppliers and employees (e + h) Cash provided by operations $ 67,000 (39,000) 28,000 Cash from Investing Activities: Purchase of equipment (b) Purchase of small tools (f) Cash used in investing activities (18,000) (3,000) (21,000) Cash from Financing Activities: Borrowing from bank (a) Issuance of stock (c) Payment of dividends (k) Cash provided by financing activities Change in cash Beginning cash balance, January 1, 2013 Ending cash balance, December 31, 2013 20,000 5,000 (10,000) 15,000 22,000 5,000 $ 27,000 Req. 5 December 31, 2013, Closing Entry Service revenue (R) ......................................... Retained earnings (+SE) ......................... Depreciation expense (E) ...................... Interest expense (E) .............................. Wages expense (E) ............................... Remaining expenses (E) ....................... Income tax expense (E) ......................... 4-60 70,000 16,000 2,000 1,000 3,000 44,000 4,000 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings COMP4-2. (continued) Req. 6 (a) Current ratio = Current assets Current liabilities = $49,000 $44,000 = 1.11 This result suggests that Furniture Refinishers, Inc., has sufficient current assets to pay current liabilities in the coming period. (b) Total asset turnover = Sales Average total assets = $70,000 [($26,000 + $74,000) 2] = $70,000 $50,000 = 1.40 This suggests that Furniture Refinishers, Inc., generates $1.40 for every dollar of assets. (c) Net profit margin = Net income Sales = $16,000 $70,000 = 0.23 or 23% This suggests that Furniture Refinishers, Inc., earns $0.23 for every dollar in sales that it generates. For all of the ratios, a comparison across time and a comparison against an industry average or competitors will need to be analyzed to determine how liquid (current ratio) the company is and how efficient (total asset turnover) and how effective (net profit margin) Furniture Refinishers, Inc.’s management is. 4-61 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CASES AND PROJECTS FINANCIAL REPORTING AND ANALYSIS CASES CP4–1. 1. American Eagle paid $132,234 thousand in income taxes in its 2008 fiscal year, as disclosed in note 2 under “Supplemental Disclosures of Cash Flow Information.” 2. The quarter ended January 31, 2009, was its best quarter in terms of sales at $905,713,000 (this quarter covered the holiday shopping season, the biggest part of the year for retailers). The worst quarter ended May 3, 2008 (the quarter following the holiday season). This is a common pattern for retailers. Note 13 discloses quarterly information. 3. Other income (net) is an aggregate of many accounts, but a summary entry for them all would be: Other income (net) ................... 17,790,000 Retained Earnings .......... 17,790,000 4. As disclosed in Note 5, Accounts and Note Receivable consists of (in thousands): Construction allowances 11,139 Merchandise sell-offs 17,057 Interest income 1,355 Marketing cost reimbursements 2,363 Credit card receivable 5,175 Merchandise vendor receivables 2,899 Other 1,483 Total $41,471 5. Fiscal year (dollars are in thousands) 2008: Net Profit Margin = Net Income = $179,061 = 0.060 Sales $2,988,866 2007: Net Profit Margin = Net Income = $400,019 = 0.131 Sales $3,055,419 2006: Net Profit Margin = Net Income = $387,359 = 0.139 Sales $2,794,409 Over the past three years, the company’s net profit margin has declined each year. Likely due to the deteriorating global economy over this time period, the company was less effective over time at controlling costs, generating greater sales, or both. 4-62 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–2 1. At the end of the most recent year, Prepaid Expenses and Other Current Assets was $46,412 thousand. This information is disclosed on the balance sheet. 2. The company reported $134,084 thousand in deferred rent. This information is disclosed on the balance sheet. 3. Prepaid rent (an asset) represents rent that a company has paid in advance to its landlords. If a company also rents property to tenants, deferred rent (a liability) represents rent that it has collected in advance for which the company has an obligation to allow a tenant to use the property. Urban Outfitters reported deferred rent of $134,084,000 on January 31, 2009. However, the related note under Summary of Significant Accounting Policies indicates that Urban Outfitters has significant leases and records certain related liabilities in that account. This issue is covered in a more advanced course. 4. Accrued Liabilities would consist of costs that have been incurred by the end of the accounting period but which have not yet been paid. 5. Interest Income is related to the company’s short-term and long-term marketable securities (investments). 6. The company’s income statement accounts (revenues, expenses, gains, and losses) would not have balances on a post-closing trial balance. These accounts are temporary accounts that have been closed to Retained Earnings. 7. Prepaid Expenses is an asset account. As such, it is a permanent account that carries its ending balance into the next accounting period. It is not closed at the end of the period. 8. The company reported basic earnings per share of $1.20 for the year ended January 31, 2009, $0.97 for the year ended January 31, 2008, and $0.71 for the year ended January 31, 2007. 4-63 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings 9. Year Ended (dollars in thousands) 1/31/09: Net Profit Margin = Net Income = $199,364 = 0.109 Sales $1,834,618 1/31/08: Net Profit Margin = Net Income = $160,231 = 0.106 Sales $1,507,724 1/31/07: Net Profit Margin = Net Income = $116,206 = 0.095 Sales $1,224,717 Over the past three years, the company’s net profit margin has increased. For the year ended January 31, 2009, management appears to be more effective at controlling costs, generating greater sales, or both. CP4–3. 1. American Eagle Outfitters reported an advertising expense of $79.7 million for the most recent year (Note 2 under Advertising Costs). Urban Outfitters reported $45.6 million of advertising costs for the year. (See Note 2 under Advertising). 2. Year Ended 2009 2008 2007 American Eagle Outfitters Advertising Expense / Net Sales 79,700 / 2,988,866 2.7% 74,900 / 3,055,419 2.5% 64,300 / 2,794,409 2.3% Urban Outfitters Advertising Expense / Net Sales 45,561 / 1,834,618 2.5% 40,828 / 1,507,724 2.7% 35,882 / 1,224,717 2.9% Urban Outfitters incurred the higher percentage in 2007 and 2008, but American Eagle incurred the higher percentage in 2009. While both firms increased advertising expense each year, American Eagle’s has increased as a percentage of sales while Urban Outfitters’ has decreased as a percentage of sales. 3. Advertising/Sales = Industry Average 2.39% American Eagle Outfitters 2.7% Urban Outfitters 2.5% Both American Eagle and Urban Outfitters are spending more on advertising as a percentage of sales than the average company in the industry. This might imply that they are less effective, as they are generating less sales per dollar spent on advertising. Another interpretation is that they are better supporting their brand, and sales will eventually increase as their brands gain value. 4-64 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings 4. Both accounting policies are similar indicating that advertising costs are expensed when the marketing campaigns become publicly available. American Eagle allocates advertising costs for television campaigns over the life of the campaign. Urban Outfitters capitalizes expenses associated with direct-to-consumer advertising (catalogs) and amortizes these expenses over the expected period of future benefits. (The policies are disclosed in note 2 in both annual reports). CP4–3. (continued) American Eagle Outfitters Urban Outfitters 2009: Net Profit = Net Income Margin Sales $179,061 = 0.060 $2,988,866 6.0% $199,364 = 0.109 $1,834,618 10.9% 2008: Net Profit = Net Income Margin Sales $400,019 = 0.131 $3,055,419 13.1% $160,231 = 0.106 $1,507,724 10.6% 2007: Net Profit = Net Income Margin Sales $387,359 = 0.139 $2,794,409 13.9% $116,206 = 0.095 $1,224,717 9.5% 5. Year Ended American Eagle Outfitters shows decreasing profit margins each year, whereas Urban Outfitters shows a steady increase in its profit margin over time. In 2007 and 2008, American Eagle was able to attain a greater profit margin than that for Urban Outfitters, suggesting a better overall performance. However, despite the decline in the world economy, Urban Outfitters was able to maintain, and even increase, its net profit margin, whereas American Eagle failed to do so. 6. Net Profit Margin = Industry Average 3.77% American Eagle Outfitters 6.0% Urban Outfitters 10.9% Both companies, American Eagle Outfitters and Urban Outfitters have higher Net Profit Margins than the average company in their industry. This is likely due to the strategy that these two companies have pursued, which is to differentiate their clothing in terms of style and quality and appeal to a particular niche market, therefore being able to charge a higher price. 4-65 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–4. 2011 Balance $508,000 Financial Statement Income statement 71,000 Income statement 68,000 9,150 Income statement No effect 16,000 Balance sheet No effect 5. Receivables from employees 1,500 Balance sheet 1,500 6. Maintenance supplies 1,850 Balance sheet 8,000 12,000 Balance sheet +12,000 3,000 Balance sheet 4,000 Account 1. Rent revenue 2. Salary expense 3. Maintenance supplies expense 4. Rent receivable 7. Unearned rent revenue 8. Salaries payable (1) Rent Revenue 492,000 (a) 16,000 (b) 508,000 (4) Rent Receivable (b) 16,000 (2) Salary Expense (e) 68,000 (f) 3,000 71,000 (3) Maintenance Supplies Expense Used 9,150 9,150 (5) Receivables from Employees (g) 1,500 16,000 (6) Maintenance Supplies (h) 3,000 (i) 8,000 9,150 used (j) 1,850 1,500 (7) Unearned Rent Revenue 12,000 (c) 12,000 (8) Salaries Payable (d) 4,000 4,000 Bal. 3,000 (f) 3,000 (a) from renters (c) from renters Cash 492,000 4,000 12,000 68,000 1,500 8,000 4-66 Effect on Cash Flows + $492,000 Inferred (d) to employees (e) to employees (g) to employees (i) to suppliers Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–5. Req. 1 Account Cash Maintenance supplies Service equipment Accumulated depreciation, service equipment Remaining assets Note payable, 8% Interest payable Income taxes payable Wages payable Unearned revenue Contributed capital Retained earnings Service revenue Expenses Unadjusted Trial Balance Debit Credit 20,000 500 90,000 Adjusted Trial Balance Debit Credit 20,000 200 90,000 18,000 42,500 27,000 42,500 10,000 12,000 50,000 9,000 214,000 160,000 313,000 313,000 Post-Closing Trial Balance Debit Credit 20,000 200 90,000 27,000 42,500 10,000 800 13,020 500 10,000 800 13,020 500 6,000 50,000 45,380 0 6,000 56,000 9,000 220,000 183,620 336,320 336,320 0 152,700 152,700 Ending Retained Earnings = Beg., $9,000 + Net income, ($220,000 - $183,620) Req. 2 (a) To record the amount of supplies used during 2011, $300, and to reduce the supplies account to the amount remaining on hand at the end of 2011. (b) To accrue interest expense for 2011 (the interest is payable in 2012, computed as $10,000 x .08 = $800) and to record interest payable. (c) To reduce unearned revenue for the amount of revenue earned during 2011 $6,000. (d) To record depreciation expense for 2011, $9,000. (e) To record 2011 wages of $500 that will be paid in 2012. (f) To record 2011 income tax and the related liability, $13,020. 4-67 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–5. (continued) Req. 3 Closing Entry on December 31, 2011: Service revenue (from the adjusted trial balance) (R) ......... 220,000 Retained earnings (+SE) ............................................ 36,380 Expenses (from the adjusted trial balance) (E) ........ 183,620 Req. 4 Pretax income x ($220,000 - 170,600) x $49,400 x Average income tax rate = Income tax expense ? = $13,020 ? = $13,020 ? = 26.4% Req. 5 Number of shares issued x 10,000 x Average issue price = Total issue amount ? = $50,000 ? = $5.00 per share 4-68 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–6. Transaction (a): 1. This transaction will affect Carey’s financial statements for 14 years (from 2011 to 2024) in conformity with the matching principle. [$14,000 ÷ $1,000 per year = 14 years] 2. Income statement: Depreciation expense, as given $1,000 each year 3. Balance sheet at December 31, 2013: Assets: Office equipment Less: Accumulated depreciation* Net book (carrying) value *$1,000 x 3 years = $3,000. $14,000 3,000 $11,000 4. An adjusting entry each year over the life of the asset would be recorded to reflect the allocation of the cost of the asset when used to generate revenues: 1,000 Depreciation expense (+E, SE) . . . . . . . . 1,000 Accumulated depreciation (+XA, A) . Transaction (b): 1. This transaction will affect Carey’s financial statements for 2 years--2013 and 2014-because four month’s rent revenue was earned in 2013, and two months' rent revenue will be earned in 2014. 2. The 2013 income statement should report rent revenue earned of $20,000 ($30,000 x 4/6). Occupancy was provided for only 4 months in 2013. This is in conformity with the revenue principle. 3. This transaction created a $10,000 liability ($30,000 - $20,000 = $10,000) as of December 31, 2013, because at that date Carey "owes'' the renter two more months' occupancy for which it has already collected the cash. 4. Yes, an adjusting entry must be made to (a) increase the Rent Revenue account by $10,000 for two months’ rent earned in 2014 and (b) to decrease the liability to $0 representing no future occupancy owed (in conformity with the revenue principle). December 31, 2014--Adjusting entry: Unearned Rent Revenue (L) ......................... 10,000 Rent Revenue (+R, +SE) ....................... 10,000 4-69 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–6. (continued) Transaction (c): 1. This transaction will directly affect Carey’s financial statements for two years, with the expense incurred in 2013 and the cash payment in 2014. 2. The $7,500 should be reported as wage expense in the 2013 income statement and as a liability on the 2013 balance sheet. On January 5, 2014, the liability will be paid. Therefore, the 2014 balance sheet will reflect a reduced cash balance and reduced liability balance. The transaction will not directly affect the 2014 income statement (unless the adjusting entry was not made). 3. Yes, an adjusting entry must be made to (a) record the $7,500 as an expense in 2013 (matching principle) and (b) to record the liability which will be paid in 2014. December 31, 2013--Adjusting entry: Wage expense (+E, SE) ............................... 7,500 Wages payable (+L) ............................. 7,500 Note: On January 5, 2014, the liability, Wages Payable, of $7,500 will be paid. Wage expense for 2014 will not include this $7,500. The 2014 related entry will debit (decrease) Wages Payable, and credit (decrease) Cash, $7,500. Transaction (d): 1. Yes, service revenue of $45,000 (i.e., $60,000 x 3/4) should be recorded as earned by Carey in conformity with the revenue principle. Service revenue is recognized as the service is performed. 2. Recognition of revenue earned but not collected by the end of 2013 requires an adjusting entry. This adjusting entry is necessary to (a) record the revenue earned (to be reported on the 2013 income statement) and (b) record the related account receivable (an asset to be reported on the 2013 balance sheet). The adjusting entry on December 31, 2013 is: Accounts receivable (+A)............................................ 45,000 Service revenue (+R, +SE) .............................. 45,000 ($60,000 total price x 3/4 completed) 3. February 15, 2014--Completion of the last phase of the service contract and cash collected in full: Cash (+A) .................................................................. 60,000 Accounts receivable (A) ................................. 45,000 Service revenue (+R, +SE) .............................. 15,000 4-70 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–7. Req. 1 Adjusting entries: (a) Expenses (insurance) (+E, SE) ....................................... Prepaid insurance (A) ........................................... To adjust for expired insurance. (b) (c) (d) (e) (f) 1 1 Rent receivable (+A) ......................................................... Revenues (rent) (+R, +SE) ...................................... To adjust for rent revenue earned but not yet collected. 2 Expenses (depreciation) (+E, SE) ................................... Accumulated depreciation (+XA, A) ....................... To adjust for annual depreciation. 11 Expenses (wages) (+E, SE) ............................................ Wages payable (+L) ................................................ To adjust for wages earned but not recorded or paid. 3 Income tax expense (+E, SE) ......................................... Income taxes payable (+L) ..................................... To adjust for income tax expense. 5 Unearned rent revenue (L)............................................... Revenues (rent) (+R, +SE) ...................................... To adjust for rent revenue collected but unearned. 3 2 11 3 5 3 Req. 2 Closing entry (from the adjusted trial balance): Revenues (R) ................................................................... Retained earnings (+SE) .............................................. Expenses (E)............................................................... Income tax expense (E) .............................................. To close the temporary accounts to Retained Earnings for 2011. 4-71 103 15 83 5 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–7. (continued) Req. 3 (a) Shares outstanding: 1,000 shares (given) – no change all year. (b) Interest expense: $20 thousand x .10 = $2 thousand. (c) Ending balance in retained earnings: Unadjusted balance, $(3,000) + Net income, $15,000 = $12,000. (d) Average income tax rate: $5,000 income tax expense ÷ ($103,000 revenues $83,000 total expenses) = 25%. (e) Rent Receivable -- report on the balance sheet as an asset (probably current). Unearned Rent Revenue -- report on the balance sheet as a liability probably (current) for future occupancy "owed''. (f) Net income of $15,000 was computed on the basis of accrual accounting concepts. Revenue is recognized when earned and expenses recorded when incurred regardless of the timing of the respective cash flows. Cash inflows, in addition to certain revenues, were from numerous sources such as the issuance of capital stock, borrowing, and revenue collected in advance. Similarly, cash outflows were, in addition to certain expenses, due to numerous transactions such as the purchase of operational and other assets, prepaid insurance, and dividends to stockholders. (g) EPS: $15,000 ÷ 1,000 shares (per (a) above) =$15.00 per share. (h) Selling price per share: $30,000 contributed capital ÷ 1,000 shares = $30 per share. (i) The prepaid insurance account reflected a $2,000 balance before the adjustment (decrease) of $1,000. Therefore, it appears that the policy premium was paid on January 1, 2011, and it was prepaid for two years (2011 and 2012). Other possibilities might be (a) a 12-month policy purchased on July 1, 2011, or (b) a 2month policy purchased on December 1, 2011. In any case, one-half of the premium has expired. (j) Net profit margin: $15,000 net income ÷ $103,000 revenues = 0.146 (14.6%). 4-72 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–8. Req. 1 CRYSTAL’S DAY SPA AND SALON, INC. Income Statement For the Year Ended December 31, 2012 Items Revenues: Spa fees Expenses: Office rent Utilities Telephone Salaries Supplies Miscellaneous Depreciation Total expenses Net income * ** Cash Basis Per Crystal’s Statement Explanation of Changes Corrected Basis $1,215,000 See * below. $1,102,000 130,000 43,600 12,200 562,000 31,900 12,400 0 792,100 $ 422,900 120,000 43,600 11,800 563,500 29,825 12,400 20,500 801,625 $ 300,375 Exclude rent for Jan. 2013 ($130,000 ÷ 13) (g) No change See ** below. Add December 2012 salary ($18,000 ÷ 12) (e) See *** below. No change Given for 2012 (c) Cash collected for spa fees Fees earned in prior years (a) Fees earned in 2012 but not yet collected (b) Fees earned in 2012 $1,215,000 -142,000 + 29,000 $1,102,000 $12,200 telephone paid + $1,400 December 2012 telephone bill - $1,800 December 2011 bill paid in 2012 = $11,800 *** Beg. Purchases End. Supplies (d) 3,125 31,900 29,825 5,200 Used 4-73 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–8. (continued) Req. 2 Memo to Crystal Mullinex should include the following: (1) Net income was overstated by $122,525 because of inappropriate recognition of revenue (overstated by $113,000) and expenses (understated by $9,525). Revenue should be recognized when earned, not when the cash is collected. Similarly, expenses should be matched against revenue in the period when the services or materials were used (including depreciation expense). (2) Some other items the parties should consider in the pricing decision: (a) A correct balance sheet at December 31, 2012. (b) Collectability of any receivables (if they are to be sold with the business). (c) Any liabilities of the spa to be assumed by the purchaser. (d) Current employees -- how will they be affected? (e) Adequacy of the rented space -- is there a long-term noncancellable lease? (f) Characteristics of Crystal’s spa practices. (g) Expected future cash flows of the business. What is the present value of those expectations? 4-74 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CRITICAL THINKING CASES CP4–9. Req. 1 2012 12/31 (a) (b) (c) (d) (e) (f) Adjusting Entries Debit Supplies expense (+E, SE)………………… Supplies (A)………………………………. ($4,000 - $1,800 = $2,200) 2,200 Insurance expense (+E, SE)……………………. Prepaid insurance (A)…………………… ($6,000 ÷ 2 years) 3,000 Depreciation expense (+E, SE)………………… Accumulated depreciation (+XA, A)……. 8,000 Salaries expense (+E, SE)………………………… Salaries payable (+L)……………………… 3,200 Transportation revenue (R, SE) ……… Unearned transportation revenue (+L)…… Transportation revenue is too high and needs to be reduced and an Unearned Revenue account created for the appropriate amount. 7,000 Income tax expense (+E, SE)…………………... Income tax payable (+L)…………………… To record 2011 income tax computation: Transportation revenue: $85,000 $7,000 = $78,000 Expenses: $47,000 + $2,200 + $3,000 + $8,000 + $3,200 = 63,400 Pretax income $14,600 Income tax expense: $14,600 x 35% = $ 5,110 5,110 4-75 Credit 2,200 3,000 8,000 3,200 7,000 5,110 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–9. (continued) Req. 2 STOSCHECK MOVING CORPORATION Corrections to 2012 Financial Statements Amounts Reported 2012 Income Statement: Revenue: Transportation revenue Expenses: Salaries expense Supplies expense Other expenses Insurance expense Depreciation expense Income tax expense Total expenses Net income December 31, 2012, Balance Sheet Assets: Current Assets: Cash Receivables Supplies Prepaid insurance Total current assets Equipment Less: Accumulated deprec. Remaining assets Total assets Liabilities: Current Liabilities: Accounts payable Salaries payable Unearned transportation revenue Income tax payable Total current liabilities Changes Debit Credit Corrected Amounts $ 85,000 e 7,000 $ 78,000 17,000 12,000 18,000 0 0 0 47,000 $ 38,000 d a 3,200 2,200 b c f 3,000 8,000 5,110 20,200 14,200 18,000 3,000 8,000 5,110 68,510 $ 9,490 $ 2,000 3,000 4,000 6,000 15,000 40,000 0 27,000 $82,000 $ 9,000 0 0 0 9,000 4-76 a b 2,200 3,000 c 8,000 d e f 3,200 7,000 5,110 $ 2,000 3,000 1,800 3,000 9,800 40,000 (8,000) 27,000 $68,800 $ 9,000 3,200 7,000 5,110 24,310 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings Stockholders' Equity Contributed capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity CP4–9. (continued) 35,000 38,000 73,000 $82,000 35,000 9,490 44,490 $68,800 Req. 3 Omission of the adjusting entries caused: (a) Net income to be overstated by $28,510. (b) Total assets to be overstated by $13,200. (c) Total liabilities to be understated by $15,310. Req. 4 (a) Earnings per share: Unadjusted -- $38,000 net income 10,000 shares = $3.80 per share Adjusted -- $ 9,490 net income 10,000 shares = $0.95 per share (b) Net profit margin: Unadjusted -- $38,000 net income $85,000 sales = 44.7% Adjusted -- $ 9,490 net income $78,000 sales = 12.2% Each of the ratios was affected by inclusion of the adjustments with revenues decreasing and expenses increasing resulting in a lower net income. For earnings per share, the numerator net income decreased while the denominator did not, resulting in a significantly lower figure. For the net profit margin, the denominator sales was lower but did not decrease more than the reduction in the numerator net income causing a significantly lower percentage. 4-77 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–9. (continued) Req. 5 To the Stockholders of Stoscheck Moving Corporation: We regret to inform you that your request for a $30,000 loan has been denied. Our review showed that various adjustments were required to the original set of financial statements provided to us. The original (unadjusted) financial statements overstated net income for 2012 by $28,510 (i.e., $38,000 - $9,490). This overstatement was caused by incorrectly including $7,000 of revenue collected in advance that had not been earned in 2012. Further, all of the expenses were understated and income tax expense had been incorrectly excluded. Total assets were overstated by $13,200 (i.e., $82,000 - $68,800). Supplies was overstated by $2,200, prepaid insurance was overstated by $3,000, and the net book value of the equipment was overstated by $8,000 because annual depreciation was not properly recognized. Further, total liabilities were understated by $15,310. A review of key financial ratios indicates that the adjustments caused earnings per share and net profit margin to decline. Net profit margin declined from 44.7% to 12.2%. The adjusted ratios, however, would be compared to those of other start-up companies in the same industry. We require that there be sufficient collateral pledged against the loan before we can consider it. The current market value of the equipment may be able to provide additional collateral against which the loan could be secured. Your personal investments may also be considered viable collateral if you are willing to sign an agreement pledging these assets as collateral for the loan. This is a common requirement for small start-up businesses. If you would like us to reconsider your application, please provide us the current market values of any assets you would pledge as collateral. Regards, (your name) Loan Application Department, Your Bank CP4–10. Req. 1 Cash from Operations: $24,000 Req. 2 Subscriptions Revenue for fiscal year ended March 31, 2013 ($24,000 x 7/36): $4,667 Req. 3 March 31, 2013, Unearned Subscriptions Revenue ($24,000 x 29/36) = $19,333 or $24,000 - $4,667 = $19,333. 4-78 Chapter 04 - Adjustments, Financial Statements, and the Quality of Earnings CP4–10. (continued) Req. 4 Adjusting entry (cash receipt credited to Unearned Subscriptions Revenue): Unearned Subscriptions Revenue (L) 9/1 24,000 AJE 4,667 End. 19,333 Subscriptions Revenue (R) Unearned subscriptions revenue (L) ........................ Subscriptions revenue (+R, +SE) .................... AJE 4,667 End. 4,667 4,667 4,667 Req. 5 a. $6,000 revenue target based on cash sales: This target is not clearly defined. Does management mean any cash subscriptions received during the period? Your region generated $24,000 in cash subscriptions. By this assumption, your region far exceeded the company’s target. You may be entitled to a generous bonus due to your strong performance. On the other hand, management may mean any sales revenue earned that has also been received in cash during the period. Under this assumption, sales revenue earned and received in cash is $4,667 (the accrual accounting basis amount). If this is the company’s intention of its target, then your region did not meet the goal, only generating 77.8% of the target. You may need to provide an analysis to management regarding this below par performance. This example demonstrates the need for clear communication of expectations by management. b. $6,000 revenue target based on accrual accounting: This situation is the same as the second assumption under a. Your region earned $1,333 less than expected by the company. FINANCIAL REPORTING AND ANLYSIS PROJECT CP4–11. The solutions to this project will depend on the company and/or accounting period selected for analysis. 4-79 Chapter 05 - Communicating and Interpreting Accounting Information Chapter 05 Communicating and Interpreting Accounting Information ANSWERS TO QUESTIONS 1. The primary responsibility for the accuracy of the financial records and conformance with Generally Accepted Accounting Principles (GAAP) of the information in the financial statements rests with management, normally the CEO and CFO. Independent auditors or CPAs are responsible for conducting an examination of the statements in accordance with Generally Accepted Auditing Standards (for private companies) and PCAOB Auditing Standards (for public companies), and based on that examination, attesting to the fairness of the financial presentations in accordance with GAAP. Both management and the auditors assume a financial responsibility to users of the statements. 2. Financial analysts, who normally work for brokerage and investment banking houses, mutual funds, and investment advisory services, gather extensive financial and nonfinancial information about a company, on which they base forecasts and stock purchase and sale recommendations. Private investors include individuals who purchase shares in companies, often on the basis of recommendations from financial analysts. Institutional investors are managers of pension, mutual, endowment, and other funds that invest on behalf of others. 3. Information services provide a wide variety of financial and nonfinancial information to analysts and investors, often on-line or on CD-ROM. These services are normally the first source where important financial information such as quarterly earnings announcements are available. 4. To be useful, information must be relevant; that is, it must be timely and have predictive and/or feedback value. However, if the information is not reliable (accurate, unbiased, and verifiable) it will not be relied upon, and thus will not be useful. 5. a. Income statement--Accrual basis required by GAAP. b. Balance sheet--Accrual basis required by GAAP. c. Statement of cash flows--Cash basis required by GAAP. 5-1 Chapter 05 - Communicating and Interpreting Accounting Information 6. Private companies normally issue quarterly and annual reports, both of which are normally simple photocopied reports. The quarterly reports normally present unaudited summary income statement and balance sheet information. The annual reports include the four basic financial statements, related notes, and the auditor’s opinion if the statements are audited. 7. Public companies issue quarterly press releases, quarterly reports, and annual reports to shareholders and Forms 10-Q (quarterly reports), 10-K (annual reports), and 8-K (special events) reports to the SEC. Press releases include a summary of the quarterly report information and are the first announcement of quarterly financial information. The quarterly reports normally present unaudited summary income statement and balance sheet information along with an abbreviated management discussion and analysis. Annual reports are often elaborate reports including extensive discussions and color photos. The financial section includes: (1) summarized financial data for a 5- or 10-year period; (2) management’s discussion and analysis of financial condition and results of operations and disclosures about market risk; (3) the four basic financial statements; (4) notes (footnotes); (5) report of independent registered public accounting firm (auditor’s opinion) and the management certification; (6) recent stock price information; (7) summaries of the unaudited quarterly financial data; and (8) listings of directors and officers of the company and relevant addresses. The Form 10-Q and 10-K provide more detailed information than the quarterly and annual reports including additional disclosures not included in those reports. The 8-K is issued irregularly when special events, such as a change in auditors, occur. 8. The four major subtotals or totals on the income statement are: (a) gross profit, (b) income from operations, (c) income before income taxes, and (d) net income. 9. Extraordinary items are reported on the income statement separately. They are items that are both unusual and infrequent. They are set out separately to aid the user in evaluating the profit performance of the business. Inclusion of extraordinary items in the regularly occurring revenue and expense categories would lead the user to believe that they are normal and will recur often in the future, which would be misleading. 10. The six major classifications on the balance sheet are: (a) current assets, (b) noncurrent assets, (c) current liabilities, (d) long-term liabilities, (e) contributed capital and (f) retained earnings. 5-2 Chapter 05 - Communicating and Interpreting Accounting Information 11. Property, plant, and equipment are reported on the balance sheet. Property, plant, and equipment are those assets held by the business not for resale but for use in operating the business, such as a delivery truck. (a) Property, plant, and equipment are reported at their acquisition cost which represents the amount of resources expended in acquiring them. (b) Over their period of use, they are "depreciated" because of being worn out (used up) or becoming obsolete in carrying out the function for which they were acquired. A portion of the cost of this effect is known as depreciation expense. A certain amount of depreciation is reported each period as an expense on the income statement and the total amount of depreciation on the asset from the date it was acquired up to the date of the financial statement is known as accumulated depreciation. (c) Cost minus accumulated depreciation equals net book value, as reported on the balance sheet. Net book value (sometimes also called book value or carrying value) does not represent the current market value of the asset but rather the original cost of it less the amount of that cost that has been measured as depreciation expense for all of the periods since the asset was acquired. 12. The major classifications of stockholders’ equity are: (1) contributed capital, which represents the stockholders' investments and (2) retained earnings, which represent the earnings of the company to date less any dividends paid to the owners. Contributed capital is often split between the account common stock (which consists of a nominal legal amount called par value) and additional paid-in capital. 13. The three major classifications on the Statement of Cash Flows are (a) cash from operating activities, (b) cash from investing activities, and (c) cash from financing activities. 14. The three major categories of footnotes are: (1) descriptions of accounting rules applied to the company’s statements, often called significant accounting policies (e.g., the depreciation method applied to property, plant, and equipment), (2) additional details about financial statement numbers (e.g., sales by geographic region), and (3) relevant financial information not listed on the statements (e.g., the existence of a bank line of credit). 15. Return on assets (ROA) is a ratio measure defined as net income divided by average assets. It measures how much the firm earned for each dollar of assets available to management, regardless of the source of financing. A return on assets analysis provides an overall framework for evaluating company performance by breaking down ROA into its two determinants: net profit margin and total asset turnover. Together, these indicate why ROA differs from prior levels or that of competitors, and provide insights into strategies to improve ROA in future periods. ANSWERS TO MULTIPLE CHOICE 1. b) 6. d) 2. b) 7. b) 3. d) 8. c) 5-3 4. a) 9. d) 5. b) 10. b) Chapter 05 - Communicating and Interpreting Accounting Information Authors' Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 5 3 5 4 10 5 10 6 10 7 10 Exercises No. Time 1 10 2 10 3 15 4 10 5 20 6 30 7 10 8 15 9 12 10 25 11 25 12 20 13 20 14 15 15 15 16 20 17 25 18 20 Problems No. Time 1 30 2 20 3 40 4 20 5 20 6 40 7 35 8 20 Alternate Problems No. Time 1 40 2 20 3 40 4 35 Cases and Projects No. Time 1 30 2 30 3 40 4 30 5 30 6 30 7 40 8 * * Due to the nature of these cases and projects, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 5-4 Chapter 05 - Communicating and Interpreting Accounting Information MINI-EXERCISES M5-1. Players ____D____ (1) ____C____ (2) ____B____ (3) ____A____ (4) Definitions Independent auditor CEO and CFO Users Financial analyst A. Adviser who analyzes financial and other economic information to form forecasts and stock recommendations. B. Institutional and private investors and creditors (among others). C. Chief executive officer and chief financial officer who have primary responsibility for the information presented in financial statements. D. Independent CPA who examines financial statements and attests to their fairness. M5-2. No. Title ____3_____ ____1_____ ____2_____ Form 10-K Earnings press release Annual report Note: Many companies now issue the annual report and the 10-K at the same time. M5-3. Elements of Financial Statements A C A B A C A B B D (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Financial Statements Expenses Cash from operating activities Losses Assets Revenues Cash from financing activities Gains Owners' equity Liabilities Assets personally owned by stockholder 5-5 A. Income statement B. Balance sheet C. Cash flow statement D. None of the above Chapter 05 - Communicating and Interpreting Accounting Information M5-4. Transaction Current Assets + NE a. b. Gross Profit + NE Current Liabilities NE + The effects of the transactions can be seen by making the related journal entries and using CA, CL, R, and E to denote current asset, current liability, revenue, and expense, respectively. a. Accounts receivable (+CA) ........................................ Sales revenue (+R) ........................................... Cost of goods sold (+E) ............................................... Inventory (–CA) ............................................... 120 120 80 80 Note that Gross Profit increases (by $40) since it is defined as Sales (increased by $120) less Cost of Goods Sold (increased by only $80). b. Advertising expense (+E) .......................................... Accounts payable (+CL) ................................. 10 10 Note that Advertising Expense is not included in Cost of Goods Sold and, hence, has no effect on Gross Profit. M5-5. Assets Liabilities a.) Accounts Receivable +800 Inventory b.) Cash Stockholders’ Equity Sales Revenue -350 +800 Cost of Goods Sold -350 +80,000 *Common stock +5,000 **Additional paid-in capital +75,000 *$1 par value 5,000 shares **$80,000 cash - $5,000 common stock 5-6 Chapter 05 - Communicating and Interpreting Accounting Information M5-6. a. b. Accounts receivable (+A) ........................................................ Sales revenue (+R, +SE) ............................................. Cost of goods sold (+E, –SE) ................................................. Inventory (–A) .............................................................. 800 800 350 Cash (+A) ................................................................................ 80,000 Common stock ($1 par value 5,000 shares) (+SE) .... Additional paid-in capital (+SE) ..................................... ($80,000 cash - $5,000 common stock) 350 5,000 75,000 M5-7. Return on assets (ROA) = Net income = $80 = $80 = 0.084 (8.4%) Avg total assets ($1,000+$900)/2 $950 Return on assets (ROA) measures how much the firm earned for each dollar of investment. 5-7 Chapter 05 - Communicating and Interpreting Accounting Information EXERCISES E5-1. Players F (1) Financial analyst A (2) Creditor H (3) Independent auditor G (4) Private investor D (5) SEC E (6) Information service C (7) Institutional investor B (8) CEO and CFO Definitions A. Financial institution or supplier that lends money to the company. B. Chief Executive Officer and Chief Financial Officer who have primary responsibility for the information presented in financial statements. C. Manager of pension, mutual, and endowment funds that invest on the behalf of others. D. Securities and Exchange Commission which regulates financial disclosure requirements. E. A company that gathers, combines, and transmits (paper and electronic) financial and related information from various sources. F. Adviser who analyzes financial and other economic information to form forecasts and stock recommendations. G. Individual who purchases shares in companies. H. Independent CPA who examines financial statements and attests to their fairness. E5-2. Information Release C (1) Form 10-Q B (2) Quarterly report D (3) Press release F (4) Annual report E (5) Form 10-K A (6) Form 8-K A. B. C. D. E. F. Definitions Report of special events (e.g., auditor changes, mergers) filed by public companies with the SEC. Brief unaudited report for quarter normally containing summary income statement and balance sheet (unaudited). Quarterly report filed by public companies with the SEC that contains additional unaudited financial information. Written public news announcement that is normally distributed to major news services. Annual report filed by public companies with the SEC that contains additional detailed financial information. Report containing the four basic financial statements for the year, related notes, and often statements by management and auditors. 5-8 Chapter 05 - Communicating and Interpreting Accounting Information E5-3. Information Item B,F B,F B,F E Report (1) (2) (3) (4) Summarized financial data for 5- or 10-year period. Notes to financial statements. The four basic financial statements for the year. Summarized income statement information for the quarter. F (5) Detailed discussion of the company’s competition. D (6) Initial announcement of hiring of new vice president for sales. D (7) Initial announcement of quarterly earnings. B,F (8) A description of those responsible for the financial statements. A (9) Complete quarterly income statement, balance sheet and cash flow statement. C (10) Announcement of a change in auditors. E5-4. No. 7 6 2 4 8 1 9 3 5 Title Long-term liabilities Current liabilities Long-term investments Intangible assets Contributed capital Current assets Retained earnings Property, plant, and equipment Other noncurrent assets 5-9 A. B. C. D. E. F. G. Form 10-Q Annual report Form 8-K Press release Quarterly report Form 10-K None of the above Chapter 05 - Communicating and Interpreting Accounting Information E5-5. Campbell Soup Company Consolidated Balance Sheet August 2, Current Year (in millions) Assets Current Assets Cash and cash equivalents Accounts receivable Inventories Other current assets Total current assets Noncurrent Assets Property, plant, and equipment, net Intangible assets Other assets Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued expenses Other current debt Total current liabilities Long-term liabilities Other noncurrent liabilities Total liabilities Stockholders' Equity Common stock, $0.0375 par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 5-10 $ 51 528 824 148 1,551 1,977 2,423 105 $6,056 $ 569 579 480 1,628 3,700 5,328 352 376 728 $6,056 Chapter 05 - Communicating and Interpreting Accounting Information E5-6. Req. 1. Lance, Inc. Consolidated Balance Sheet December 31, Current Year (in millions) Assets CURRENT ASSETS Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other Other current assets Total current assets Property, plant and equipment, net Goodwill Other intangible assets, net Other assets TOTAL ASSETS Liabilities and Stockholders’ Equity CURRENT LIABILITIES Accounts payable Accrued compensation Other payables and accrued liabilities Short-term debt Total current liabilities NONCURRENT LIABILITIES Long-term debt Other long-term liabilities Total noncurrent liabilities STOCKHOLDERS' EQUITY Common stock, 28,947,222 shares outstanding Additional paid-in capital Retained earnings Total stockholders' equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 5-11 $ 807 74,406 43,112 12,933 9,778 141,036 216,085 80,110 23,966 4,949 $466,146 $ 25,939 26,312 32,318 7,000 91,569 91,000 48,070 139,070 26,268 49,138 160,101 235,507 $466,146 Chapter 05 - Communicating and Interpreting Accounting Information E5-6. (continued) Req. 2. In each case, the term “net” means that the account is reported after the balance in the related contra account has been subtracted. Accounts receivable, net means that the allowance for doubtful accounts contra account has been subtracted. Other intangible assets, net means that the accumulated amortization contra account has been subtracted. Property, plant and equipment, net means that the accumulated depreciation contra account has been subtracted. E5-7. Cash (+A) ................................................................... 43,000 Common stock ($.01 10,200 shares) (+SE) ... Additional paid-in capital ($43,000 – $102) (+SE) 102 42,898 E5-8. Req. 1. Beginning RE + Net income - Dividends = Ending RE Dividends = Beginning RE + Net income - Ending RE Dividends = $6,480 M + $1,249 M - $7,489 M = $240 M Kroger declared dividends of $240,000,000 during the year. Req. 2. Cash (+A) ....................................................... 243,000,000 Common stock ($955 M – $947 M) (+SE) Additional paid-in capital ($3,266 M – $3,031 M) (+SE) 5-12 8,000,000 235,000,000 Chapter 05 - Communicating and Interpreting Accounting Information E5-9. Terms A B K E F C J H D G Definitions (1) Net income (2) Income tax expense on operations (3) Income before extraordinary items (4) Cost of goods sold (5) Operating expenses (6) Gross margin on sales (7) EPS (8) Interest expense (9) Service revenue (10) Pretax income from operations A. Revenues + Gains - Expenses - Losses including effects of discontinued operations and extraordinary items (if any). B. Income tax on revenues minus operating expenses. C. Sales revenue minus cost of goods sold. D. Sales of services for cash or on credit. E. Amount of resources used to purchase or produce the goods that were sold during the reporting period. F. Total expenses directly related to operations. G. Income before all income tax and before discontinued operations and extraordinary items (if any). H. Cost of money (borrowing) over time. I. Item that is both unusual and infrequent. J. Net income divided by average shares outstanding. K. Income before unusual and infrequent items and the related income tax. L. None of the above. E5-10. Case A $900 525* 375 Sales revenue Cost of goods sold Gross margin Operating expenses: Selling expense 50* Administrative expense 125 Total expenses 175* Pretax income 200 Income tax expense 80* Net income $120 *Amounts not given in the exercise. Case B $750 300 450* 100 150* 250* 200 30 $170* 5-13 Case C $420 190* 230* 80 70 150* 80* 20 $60 Case D $1,200* 500 700* Case E $750* 320 430 390 120 510* 190 50 $140* 240 90 330* 100* 20 $80 Chapter 05 - Communicating and Interpreting Accounting Information E5-11. Case A $770 300* 470* Sales revenue Cost of goods sold Gross margin Operating expenses: Selling expense 90 Administrative expense 200 Total expenses 290* Pretax income 180* Income tax expense 65 Net income $115 *Amounts not given in the exercise. Case B $1,200* 320 880 275 120 395* 485* 210 $275 Case C $400* 125 275* Case D $600 250 350* 45 80 125* 150 60 $90* 70 150* 220* 130 45 $85* Case E $1,050 420* 630 85* 175 260* 370 130* $240 E5-12. TOWNSHIP CORPORATION Income Statement For the Year Ended December 31, 2012 Sales revenue ................................ Cost of goods sold.......................... (a) Gross profit..................................... Operating expenses: Selling expense ............................ Administrative expense ................ (c) Total operating expenses ............... (b) Pretax income ................................ Income tax expense ................... (d) Net income ..................................... (e) Computations in Order Given $79,000 - $28,000 Given $79,000 51,000 28,000 Given $7,000 $15,000 – $7,000 8,000 $28,000 – $13,000 Given $13,000 x 35%* $13,000 – $4,550 15,000 13,000 4,550 $ 8,450 Earnings per share ($8,450 3,500 shares*) $2.41 *Given 5-14 Chapter 05 - Communicating and Interpreting Accounting Information E5-13. COFELT APPLIANCES, INCORPORATED Income Statement For the Year Ended December 31, 2011 Sales revenue ................................ Cost of goods sold.......................... (a) Gross profit..................................... Operating expenses: Administrative expense ............... Selling expense ........................... Total operating expenses ......... (b) Income before income taxes .......... (c) Income tax expense ................... (d) Net income ..................................... (e) Computations in Order Given $130,000 - $60,000 (given) Given $130,000 70,000 60,000 Given $17,000 Given 19,000 $17,000 + $19,000 $60,000 - $36,000 30%* x $24,000 $24,000 - $7,200 36,000 24,000 7,200 $16,800 Earnings per share ($16,800 2,500 shares*) = $6.72 *Given 5-15 Chapter 05 - Communicating and Interpreting Accounting Information E5-14. Transaction a. b. c. Current Assets +$472.7 +$425.0 –$43.5 Gross Profit +$472.7 NE NE Current Liabilities NE +$425.0 NE The effects of the transactions can be seen by making the related journal entries and using CA, CL, R, and E to denote current asset, current liability, revenue, and expense, respectively. a. Accounts receivable (+CA) ........................................ 792.2 Sales revenue (+R) ........................................... 792.2 Cost of goods sold (+E) ............................................... 319.5 Inventory (–CA) ............................................... 319.5 Note that Gross Profit increases (by $472.7) since it is defined as Sales (increased by $792.2) less Cost of Goods Sold (increased by only $319.5). b. Cash (+CA) ................................................................ Notes payable (+CL) ....................................... c. 425.0 425.0 Research and development expense (+E) ................ 43.5 Cash (–CA) ..................................................... 43.5 Note that Research and Development Expense is not included in Cost of Goods Sold and, hence, has no effect on Gross Profit. E5-15. Transaction a. b. Current Assets NE – 3.1 Gross Profit NE NE Current Liabilities NE – 3.1 Cash Flow from Operating Activities + 35.2 NE The effects of the transactions can be seen by making the related journal entries and using CA and CL to denote current asset and current liability, respectively. a. b. Cash (+CA).................................................................. Accounts receivable (–CA) ............................... 35.2 Notes payable (–CL).................................................... Cash (–CA) ....................................................... 3.1 Note that repayment of debt is a financing activity. 5-16 35.2 3.1 Chapter 05 - Communicating and Interpreting Accounting Information E5-16. AVALOS CORPORATION Statement of Cash Flows For the Year Ended December 31, 2011 From Operating Activities Net income ................................................................. Increase in accounts receivable ................................. Decrease in inventory ................................................ Decrease in accounts payable ................................... Cash flows from operating activities ....................... $25,000 (9,000) 1,000 (3,000) From Investing Activities Purchased a new delivery truck .................................. Purchased land ........................................................... Cash flows from investing activities ........................ (7,000) (36,000) From Financing Activities Borrowed cash on three-year note .............................. Issued stock for cash .................................................. Cash flows from financing activities ........................ Net cash inflows for the year .............................. Beginning cash balance .................................................... Ending cash balance ......................................................... 5-17 $ 14,000 (43,000) 30,000 24,000 54,000 25,000 25,000 $ 50,000 Chapter 05 - Communicating and Interpreting Accounting Information E5-17. Req. 1. Net Income (given) Average Total Assets (given) Current Year $220,022 = 0.072 $3,051,594 Prior Year $323,478 = 0.112 $2,883,833 The decrease in ROA from 0.112 in the prior year to 0.072 in the current year means that the firm earned $0.04 less for each $1 of investment. Req. 2. ROA Analysis Net Income Net Sales x Net Sales Average Total Assets Current Year $220,022 = 0.077 $2,859,997 Prior Year $323,478 = 0.110 $2,938,771 $2,859,997 = 0.937 $3,051,594 $2,938,771 = 1.019 $2,883,833 Return on Assets 0.072 0.112 The decrease in ROA is caused by decreases in both net profit margin and asset turnover (from 0.110 to 0.077, and from 1.019 to 0.937, respectively). The company’s profit margin and efficiency appear to have declined with the world economy. 5-18 Chapter 05 - Communicating and Interpreting Accounting Information E5-18. Req. 1. Net Income (given) Average Total Assets (given) Current Prior Year Year $36,796 = 0.093 $32,735 = 0.084 $394,143 $390,728 The increase in ROA from 0.084 in the prior year to 0.093 in the current year means that the firm earned $0.009 more for each $1 of investment. Req. 2. Security analysts would be more likely to increase their estimates of share value on the basis of this change. The company increased its earnings by $0.009 for each $1 of investment and, hence, increased the corresponding value of that investment. 5-19 Chapter 05 - Communicating and Interpreting Accounting Information PROBLEMS P5-1. (1) E; (2) L; (3) D; (4) I; (5) M; (6) W; (7) B; (8) Q; (9) A; (10) H; (11) U; (12) J; (13) C; (14) G; (15) V; (16) R; (17) K; (18) N; (19) T; (20) S; (21) O; (22) P; (23) F. P5-2. P E M O J I D A Q G (1) Capital in excess of par (2) Assets (3) Retained earnings (4) Book value (5) Other assets (6) Shares outstanding (7) Shareholders’ equity (8) Liquidity (9) Normal operating cycle (10) Current assets B C N F L K H (11) Current liabilities (12) Long-term liabilities (13) Fixed assets (14) Liabilities (15) Contra-asset account (16) Accumulated depreciation (17) Intangible assets 5-20 Chapter 05 - Communicating and Interpreting Accounting Information P5-3. Req. 1 EXQUISITE JEWELERS Balance Sheet December 31, 2012 Assets Current Assets Cash ........................................................................... Accounts receivable .................................................... Prepaid insurance ....................................................... Merchandise inventory ................................................ Total current assets ............................................ Long-Term Investments Stock of Z Corporation ................................................ Fixed Assets Store equipment ......................................................... Less accumulated depreciation .............................. Total fixed assets ............................................... Other Assets Used store equipment held for disposal ...................... Total assets ........................................................ $ 58,000 71,000 1,500 154,000 $284,500 36,000 67,000 19,000 48,000 9,000 $377,500 Liabilities Current Liabilities Accounts payable ....................................................... Income taxes payable ................................................. Total current liabilities......................................... Long-Term Liabilities Note payable .............................................................. Total liabilities ..................................................... Stockholders' Equity Contributed Capital Common stock, par $1 per share, 100,000 shares ..... Additional paid-in capital ............................................. Total contributed capital ..................................... Retained Earnings ............................................................. Total stockholders' equity ................................... Total liabilities and stockholders' equity ............. 5-21 $ 52,500 9,000 $ 61,500 42,000 103,500 100,000 10,000 110,000 164,000 274,000 $377,500 Chapter 05 - Communicating and Interpreting Accounting Information P5-3. (continued) Req. 2 Store equipment $67,000 - $19,000 = $48,000 Acquisition cost less sum of all depreciation expense to date. Net book value (sometimes called book value or carrying value) is the amount of cost less any contra accounts (offsets). P5-4. Req. 1 BARNARD CORPORATION Balance Sheet (Partial) December 31, 2012 Stockholders' Equity Contributed capital: Common stock par $15 per share, 7,000 shares outstanding (7,000 x $15) ............................................................... $105,000 Paid-in capital [$13,000 + (1,000 shares x $10 = $10,000)] ................. 23,000 Total contributed capital .............................................. 128,000 Retained earnings: Ending balance [$44,000 + $43,000 - (6,000 shares x $3 = $18,000)] .. Total stockholders' equity ........................................... 69,000 $197,000 Req. 2 Cash (1,000 shares x $25) (+A) .................................. Common stock, par $15 (1,000 shares) (+SE).. Paid-in capital, common stock [1,000 shares x ($25 - $15)] (+SE)................ 5-22 25,000 15,000 10,000 Chapter 05 - Communicating and Interpreting Accounting Information P5-5. AEROPOSTALE, Inc. Consolidated Statement of Income For Year Ended March 31, Current Year (In Thousands Except Per Share Amounts) Net revenue Cost of goods sold Gross profit Other selling, general and administrative expenses Total operating expenses Operating income Interest income Income before income taxes Provision for income taxes Net income Earnings per share: Basic earnings per share Weighted average shares outstanding 5-23 $1,885,531 1,231,349 654,182 405,883 405,883 248,299 510 248,809 99,387 $149,422 $2.24 66,832 Chapter 05 - Communicating and Interpreting Accounting Information P5-6. (a) JORDAN SALES COMPANY Income Statement For the Year Ended March 31, 2013 Sales revenue ................................................................... Cost of goods sold ...................................................... Gross profit........................................................................ Operating expenses: Operating expenses .................................................... Depreciation expense ................................................. Total operating expenses ....................................... Income from operations..................................................... Interest expense ......................................................... Income before income taxes ............................................ Income tax expense ($38,000 x 25%) ........................ Net income ........................................................................ Earnings per share ($28,500 33,000 shares) ................. 5-24 $99,000 33,000 66,000 $19,000 8,000 27,000 39,000 1,000 38,000 9,500 $28,500 $ .86 Chapter 05 - Communicating and Interpreting Accounting Information P5-6. (continued) (b) JORDAN SALES COMPANY Balance Sheet March 31, 2013 Assets Current Assets: Cash ........................................................................... Accounts receivable .................................................... Office supplies inventory ............................................. Total current assets ................................................ Noncurrent Assets: Automobiles ................................................. $34,000 Less accumulated depreciation ................ 14,000 Office equipment .......................................... 3,000 Less accumulated depreciation ................ 1,000 Total noncurrent assets .......................................... Total assets ............................................................ Liabilities Current Liabilities: Accounts payable ....................................................... Income taxes payable ................................................. Salaries and commissions payable ............................. Total current liabilities ............................................. Long-Term Liabilities: Note payable............................................................... Total liabilities ......................................................... $58,000 49,000 1,000 $108,000 20,000 2,000 22,000 $130,000 $22,000 9,500 2,000 $33,500 33,000 66,500 Stockholders' Equity Contributed capital: Capital stock (33,000 shares, par $1) ......................... Paid-in capital ............................................................. Total contributed capital ......................................... Retained earnings (beginning balance, $7,500 + net income, $28,500 - dividends declared and paid, $10,500) ........... Total stockholders' equity ........................................... Total liabilities and stockholders' equity .................. 5-25 33,000 5,000 38,000 25,500 63,500 $130,000 Chapter 05 - Communicating and Interpreting Accounting Information P5-7. Req. 1. Transaction a. b. c. d. Gross Profit + NE NE NE Operating Income (Loss) + – NE NE Return on Assets + – – + The effects of the transactions can be seen by making the related journal entries and using A, L, SE, R, and E to denote asset, liability, shareholders’ equity, revenue, and expense, respectively. a.* Accounts receivable (+A) ......................................................... 500 Sales revenue (+R) ....................................................... 500 Cost of goods sold (+E) ........................................................... 475 Inventory (–A) ............................................................... 475 *Note that net income goes up by $25 as does ending assets. As a consequence, average assets ((beginning + ending)/2) increases by only one-half of that amount or $12.5. b. c. d. Research and development expense (+E) .............................. Cash (–CA) ................................................................... 100 Cash (+CA) .............................................................................. Common stock and additional paid-in capital (+SE) ....... 200 Retained earnings (–SE) ......................................................... Cash (–CA) ................................................................... 90 5-26 100 200 90 Chapter 05 - Communicating and Interpreting Accounting Information P5-8. NEWELL RUBBERMAID Consolidated Statement of Operations For the Year Ended December 31, 2008 (dollars in thousands) Net Sales .......................................................................... Cost of Products Sold .............................................. Gross Profit ....................................................................... Operating Expenses: Selling, General, and Administrative Expenses ........ Other Expense ......................................................... Total Operating Expenses ................................... Operating Income (loss) ................................................... Interest and Other Non-Operating Expense ............. Income before Income Taxes ........................................... Income Tax Expense .............................................. Net (Loss) Income from Continuing Operations ................ Loss on Sale of Discontinued Operations, Net of Income Taxes ........................................................ Net (Loss) Income ........................................................... 5-27 $ 6,470.6 4,347.4 2,123.2 $1,502.7 419.7 1,922.4 200.8 199.0 1.8 53.6 (51.8) (0.5) $ (52.3) Chapter 05 - Communicating and Interpreting Accounting Information ALTERNATE PROBLEMS AP5-1. Req. 1 TANGOCO Balance Sheet December 31, 2012 Assets Current Assets Cash ........................................................................... Accounts receivable .................................................... Prepaid rent ................................................................ Inventory ..................................................................... Total current assets ............................................ Long-Term Investments Stock of PIL Corporation ............................................. Fixed Assets Store equipment ......................................................... Less accumulated depreciation .............................. Total fixed assets ............................................... Other Assets Used store equipment held for disposal ...................... Total assets ........................................................ Liabilities Current Liabilities Accounts payable ....................................................... Income taxes payable ................................................. Total current liabilities......................................... Long-Term Liabilities Note payable .............................................................. Total liabilities ..................................................... Stockholders' Equity Contributed Capital Common stock, par $1 per share, 100,000 shares ..... Additional paid-in capital ............................................. Total contributed capital ..................................... Retained Earnings ............................................................. Total stockholders' equity ................................... Total liabilities and stockholders' equity ............. 5-28 $ 48,800 71,820 1,120 154,000 $275,740 36,400 67,200 13,440 53,760 9,800 $375,700 $ 58,800 9,800 $ 68,600 32,000 100,600 100,000 10,000 110,000 165,100 275,100 $375,700 Chapter 05 - Communicating and Interpreting Accounting Information AP5-1. (continued) Req. 2 Store equipment $67,200 - $13,440 = $53,760 Acquisition cost less sum of all depreciation expense to date. Net book value (sometimes called book value or carrying value) is the amount of cost less any contra accounts (offsets). AP5-2. Req. 1 MESA INDUSTRIES Balance Sheet December 31, 2012 Stockholders' Equity Common stock (par $15, 8,500 shares outstanding) (8,500 x $15) ............................................................... Additional paid-in capital [$9,000 + (1,500 shares x $11 = $16,500)] ................... Retained earnings [$48,000 + $46,000 - (7,000 shares x $1 = $7,000)] .... Total stockholders' equity ........................................... $127,500 25,500 87,000 $240,000 Req. 2 Cash (1,500 shares x $26) (+A) .................................. Common stock (1,500 shares x $15) (+SE) ...... Additional paid-in capital [1,500 shares x ($26 - $15)] (+SE)................ 5-29 39,000 22,500 16,500 Chapter 05 - Communicating and Interpreting Accounting Information AP5-3. (a) DYNAMITE SALES Income Statement For the Year Ended August 31, 2012 Sales revenue ................................................................... Cost of goods sold ...................................................... Gross profit........................................................................ Expenses: Operating expenses .................................................... Depreciation expense ................................................. Total operating expenses ....................................... Income from operations .................................................... Interest expense ......................................................... Income before income taxes ............................................ Income tax expense ($30,600 x 30%) ........................ Net income ........................................................................ Earnings per share ($21,420 29,000 shares) ................. 5-30 $81,000 27,000 54,000 $16,200 4,950 21,150 32,850 2,250 30,600 9,180 $21,420 $ .74 Chapter 05 - Communicating and Interpreting Accounting Information AP5-3. (continued) (b) DYNAMITE SALES Balance Sheet August 31, 2012 Assets Current Assets: Cash ........................................................................... Accounts receivable .................................................... Office supplies ............................................................ Total current assets ................................................ Noncurrent Assets: Company vehicles ....................................... $27,000 Less accumulated depreciation .................. 9,000 Equipment........................................................ 2,700 Less accumulated depreciation ....................... 900 Total noncurrent assets .......................................... Total assets ............................................................ Liabilities Current Liabilities: Accounts payable ....................................................... Income taxes payable ................................................. Salaries payable ......................................................... Total current liabilities ............................................. Long-Term Liabilities: Long-term debt ........................................................... Total liabilities ......................................................... $47,700 38,320 270 $86,290 18,000 1,800 19,800 $106,090 $16,225 9,180 1,350 $26,755 25,000 51,755 Stockholders' Equity Contributed capital: Capital stock (29,000 shares, par $1) ......................... Paid-in capital ............................................................. Total contributed capital ......................................... Retained earnings (beginning balance, $6,615 + net income, $21,420 - dividends declared and paid, $7,200) ............. Total stockholders' equity ........................................... Total liabilities and stockholders' equity .................. 5-31 29,000 4,500 33,500 20,835 54,335 $106,090 Chapter 05 - Communicating and Interpreting Accounting Information AP5-4. Req. 1. Transaction a. b. c. d. Operating Income (Loss) NE NE – NE Net Income Return on Assets + NE – NE + – – – The effects of the transactions can be seen by making the related journal entries and using A, L, SE, R, and E to denote asset, liability, shareholders’ equity, revenue, and expense, respectively. a. b. c. d. Cash (+A) .................................................................................. Interest income (+R) ..................................................... 7 Inventory (+A) .......................................................................... Accounts payable (+L) .................................................. 80 Advertising expense (+E) ........................................................ Cash (–A) ...................................................................... 16 Cash (+A) ................................................................................ Common stock and additional paid-in capital (+SE) ....... 40 7 80 16 40 Req. 2. Assuming that next period Avon’s total assets increase by 5%, but Avon earns 20% more income as during the current period, Avon’s ROA will increase over that earned in the current period. Both the denominator and the numerator increase. In this case, net income is increasing at a faster rate than average total assets, causing ROA to be higher in the next period. (Students are encouraged to calculate ROA to verify this assertion.) Net Income Average Total Assets Current Next Year Year $875 = 0.15 $1,050 = 0.17 ($5,716+$6,074)/2 ($6,074+$6,378) 5-32 Chapter 05 - Communicating and Interpreting Accounting Information CASES AND PROJECTS ANNUAL REPORT CASES CP5-1. 1. The Balance Sheet lists “Property and equipment”, “Goodwill”, “Long-term investments”, Non-current deferred income taxes and “Other assets, net” as non-current assets. 2. The company owned $6,364,000 in land at the end of the year. This is disclosed in note 6, “Property and Equipment”. 3. Unredeemed stored value cards and gift certificates were $ 42,299,000, or 10.5% of current liabilities for the year. This is disclosed on the Balance Sheet. 4. Website sales are recorded “upon the estimated customer receipt date of the merchandise” (see note 2 under Revenue Recognition). 5. Although the company had negative cash from financing and continued to make considerable capital expenditures, the company also realized significant proceeds from the sale of available-for-sale securities. This resulted in a net inflow of $69,878,000 from financing and investing activities. The effect of exchange rates on cash was ($14,790,000), making up the difference between the $302,193,000 cash provided by operations and the overall change in cash of 357,281,000. 6. The highest stock price was $23.45, in the 1st quarter of fiscal 2008. This information is in Item 5 of the 10-K disclosed with the annual report. 7. ROA decreased from fiscal 2007 to 2008. This seems to be reflected in the share price decreasing from a high of $23.94 in the 4th quarter of 2007 to a low of $7.11 in the 4th quarter of 2008. Fiscal 2008 Fiscal 2007 Net Income _ $179,061 _ Average $(1,867,680+1,963,676)/2 = 0.093 Total Assets 5-33 $400,019 _ $(1,979,558+1,867,680)/2 = 0.21 Chapter 05 - Communicating and Interpreting Accounting Information CP5-2. 1. The company presents the subtotals “gross profit,” “income from operations,” and “income before income taxes”. 2. The cash flow statement indicates that operating activities provided $251,570,000 in cash, while financing activities provided only $ 22,325,000 in cash. Thus, the investing activities were financed primarily by operating activities. 3. The company’s largest asset (net) is “Property and Equipment, net” of $505,407,000 reported on the balance sheet. 4. The company “capitalizes applicable costs incurred during the application and infrastructure development stage and expenses costs incurred during the planning and operating stage”. This is disclosed in note 2. 5. Buildings are depreciated over useful lives of 39 years. This is disclosed in note 2. 6. Buildings are $96,205,000, which is 11% of the total balance of gross property and equipment. This is disclosed in note 5. 5-34 Chapter 05 - Communicating and Interpreting Accounting Information CP5-3. Req. 1. American Eagle Outfitters Urban Outfitters Net Income _ $179,061 _ Average $(1,867,680 +1,963,676)/2 = 0.093 Total Assets $199,364 = 0.161 $(1,142,791 +1,329,009)/2 Urban Outfitters had a higher return on assets during the current year. Req. 2. ROA Analysis Net Income Net Sales Net Sales Average Total Assets American Eagle Outfitters 179,061 2,988,866 = 0.06 2,988,866 1,915,678 = 1.56 Return on Assets 0.09 Urban Outfitters 199,364_ 1,834,618 1,834,618 1,235,900 = 0.11 = 1.48 0.16 Urban Outfitters has a higher ROA than American Eagle because it has a higher profit margin which more than compensates for its lower total asset turnover ratio. Ownership of property, plant, and equipment decreases the total asset turnover ratio relative to rentals. The owned assets would be included in “average total assets” while rented assets would not be included—thus, for the same level of sales, asset turnover would be lower. 5-35 Chapter 05 - Communicating and Interpreting Accounting Information CP5-3. (continued) Req. 3. Industry Return on Assets (ROA) profit driver analysis: ROA = Net Profit Margin Total Asset Turnover Industry Average American Eagle Outfitters Urban Outfitters Net Profit Margin .038 .060 .109 Total Asset Turnover 1.90 1.56 1.48 Return on Assets 0.07 0.09 0.16 ROA Analysis Both firms have a higher ROA than the industry average. This is being driven solely by their higher net profit margins. This is expected, given that the companies compete by differentiating their product rather than competing only on price. Both firms have asset turnover lower than the industry average. 5-36 Chapter 05 - Communicating and Interpreting Accounting Information FINANCIAL REPORTING AND ANALYSIS CASES CP5-4. 1. Gross margin on sales, $105,000. Computation: Sales revenue......................................................... Less: Cost of goods sold ........................................ Gross margin on sales ............................................ $275,000 170,000 $105,000 2. EPS, $1.00. Computation: Net income, $10,000 ($100,000 $10 = 10,000 shares) = $1.00 per share. 3. Pretax income, $13,333. Computation (and proof): Pretax income [$10,000 (100% - 25% = 75%)] ........ Proof: Income tax ($13,333 x 25%) ................................... Net income ($13,333 x 75%) (given) ...................... $13,333 3,333 $10,000 4. Average sales price per share of stock, $11.60. Computation: ($100,000 + $16,000 = $116,000) ($100,000 $10 = 10,000 shares) = $11.60 per share. 5. Beginning balance, $70,000. Computation: (work backwards) Beginning balance (?) ($80,000 - $10,000) ............ Add: 2012 net income (given) ................................. Deduct: 2012 dividends (given) .............................. Ending balance (given) ........................................... 5-37 $70,000 10,000 (None) $80,000 Chapter 05 - Communicating and Interpreting Accounting Information CRITICAL THINKING CASES CP5-5. Strategy Change a. Current Period ROA + – b. Future Periods’ ROA Explanation – The decrease in R&D investments would lead to lower expense in the current year, increasing current period’s income and ROA. However, when fewer products are brought to market in future periods, income and ROA will decrease. + The advertising expense would decrease income and ROA in the current year. Assuming that the movie earns a greater income in future periods because of the advertising, net income will increase, increasing ROA in future periods. CP5-6. Error (1) (2) (3) (4) (5) (6) (7) Net Income 2010 2011 O NE $950 O U 500 $500 U O 600 600 U O 200 200 O U 900 900 U NE 300 NE NE Assets 2010 2011 O O $950 $950 NE NE Liabilities 2010 2011 NE NE U 600 U 200 NE NE U $500 NE NE NE NE NE NE U 300 U 8,000 U 300 NE U 900 NE U 8,000 NE 5-38 NE NE NE Chapter 05 - Communicating and Interpreting Accounting Information CP5-6. (continued) Explanation of analysis if not corrected: (1) Given in problem (example). (2) Wage expense should be increased (debited) by $500 in 2010 because the wages were incurred in that year. This increase in expense was not recorded; therefore, income for 2010 was overstated by $500. The wages were not paid when earned in 2010. Therefore, there is a 2010 liability of $500; thus, liabilities were understated at the end of 2010. In 2011 when the wages are recorded, wage expense will be overstated and income will be understated. (3) Revenues were understated by $600 in 2010, which caused 2010 income to be understated by $600. Also accounts receivable was understated because the amount of $600 will be collected in 2011; thus, assets were understated by $600 at the end of 2010. Also, if not corrected, the $600 of revenue would be recorded in 2011, which would cause 2011 revenues, and hence income, to be overstated. (4) The $200 expense should be recorded as 2011 expense. It was recorded in 2010; therefore, 2010 expense was overstated which would cause 2010 income to be understated. If not corrected, 2011 expense would be understated, which would cause 2011 income to be overstated by $200. Assets at the end of 2010 would be understated by $200 because prepaid expense (an asset) should be debited at the end of 2010 for this expenditure, because it was paid in advance. (5) The $900 revenue should be recorded as revenue in 2011 because it was earned in 2011. Therefore, if not corrected, 2010 revenue and income would be overstated by $900. Also, 2011 revenue and income would be understated by $900 because that is the year that the $900 revenue was earned but was not recorded. At the end of 2010 liabilities would be understated by $900 because revenue collected in advance (a liability to render future performance to earn the revenue) should be credited for $900 at the end of 2010. (6) This transaction should have been recorded as a credit to revenue of $300 instead of a credit to accounts receivable. Therefore, revenue, and hence income, was understated by $300. The credit to accounts receivable caused assets to be understated by $300 for each year. Accounts receivable will continue to be understated until a correction is made. (7) This transaction should have been recorded in 2010 as a debit to Land (an asset) and a credit to a liability, $8,000. Therefore, at the end of 2010 both assets and liabilities were understated by $8,000. The entry in 2011 corrected the accounts. 5-39 Chapter 05 - Communicating and Interpreting Accounting Information CP5-7. 1. At the time this solution was prepared, three former top managers had pleaded guilty to fraud charges and the chief marketing officer pleaded not guilty and was found guilty at trial. He received an 84 month prison sentence. Dutch authorities fined two Dutch executives at Ahold but imposed no prison terms. Ahold settled shareholder suits against it for $1.1 billion dollars and, in May of 2007, sold its U.S. Foodservice unit to two private-equity firms. 2. In October 2004, the SEC chose not to impose a monetary fine on the company because of its extensive cooperation with the investigation. The company promptly attended to SEC requests for information, granted access to current employees, waived attorney-client privilege in its internal investigations, revised its internal control procedures to prevent further frauds, and fired employees found responsible for the frauds. This move sends a strong signal to other companies that there is a benefit to cooperating with SEC investigations. 3. Bonuses tied to performance measures such as accounting earnings tend to align the managers' interests with those of the shareholders. However, when companies face a significant downturn, and bonuses will not be awarded, some dishonest managers attempt to meet performance goals by falsifying accounting numbers. FINANCIAL REPORTING AND ANALYSIS PROJECT CP5-8. The solutions to this case will depend on the company and/or accounting period selected for analysis. 5-40 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash Chapter 06 Reporting and Interpreting Sales Revenue, Receivables, and Cash ANSWERS TO QUESTIONS 1. The difference between sales revenue and net sales is the amount of goods returned by customers because the goods were either unsatisfactory or not desired and also includes sales allowances given to customers (also refer to the answers given below to questions 3, 4 and 5). 2. Gross profit or gross margin on sales is the difference between net sales and cost of goods sold. It represents the average gross markup realized on the goods sold during the period. The gross profit ratio is computed by dividing the amount of gross profit by the amount of net sales. For example, assuming sales of $100,000, and cost of goods sold of $60,000, the gross profit on sales would be $40,000. The gross profit ratio would be $40,000/$100,000 =.40. This ratio may be interpreted to mean that out of each $100 of sales, $40 was realized above the amount expended to purchase the goods that were sold. 3. A credit card discount is the fee charged by the credit card company for services. When a company deposits its credit card receipts in the bank, it only receives credit for the sales amount less the discount. The credit card discount account either decreases net sales (it is a contra revenue) or increases selling expense. 4. A sales discount is a discount given to customers for payment of accounts within a specified short period of time. Sales discounts arise only when goods are sold on credit and the seller extends credit terms that provide for a cash discount. For example, the credit terms may be 1/10, n/30. These terms mean that if the customer pays within 10 days, 1% can be deducted from the invoice price of the goods. Alternatively, if payment is not made within the 10-day period, no discount is permitted and the total invoice amount is due within 30 days from the purchase, after which the debt is past due. To illustrate, assume a $1,000 sale with these terms. If the customer paid within 10 days, $990 would have been paid. Thus, a sales discount of $10 was granted for early payment. 6-1 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash 5. A sales allowance is an amount allowed to a customer for unsatisfactory merchandise or for an overcharge in the sales price. A sales allowance reduces the amount the customer must pay, or if already paid, a cash refund is required. Sales allowances may occur whether the sale was for cash or credit. In contrast, a sales discount is a cash discount given to a customer who has bought on credit, with payment made within the specified period of time. (Refer to explanation of sales discount in Question 4, above.) 6. An account receivable is an amount owed to the business on open account by a trade customer for merchandise or services purchased. In contrast, a note receivable is a short-term obligation owed to the company based on a formal written document. 7. In conformity with the matching principle, the allowance method records bad debt expense in the same period in which the credit was granted and the sale was made. 8. Using the allowance method, bad debt expense is recognized in the period in which the sale related to the uncollectible account was recorded. 9. The write-off of bad debts using the allowance method decreases the asset accounts receivable and the contra-asset allowance for doubtful accounts by the same amount. As a consequence, (a) net income is unaffected and (b) accounts receivable, net, is unaffected. 10. An increase in the receivables turnover ratio generally indicates faster collection of receivables. A higher receivables turnover ratio reflects an increase in the number of times average trade receivables were recorded and collected during the period. 11. Cash includes money and any instrument, such as a check, money order, or bank draft, which banks normally will accept for deposit and immediate credit to the depositor’s account. Cash equivalents are short-term investments with original maturities of three months or less that are readily convertible to cash, and whose value is unlikely to change (e.g., bank certificates of deposit and treasury bills). 12. The primary characteristics of an internal control system for cash are: (a) separation of the functions of cash receiving from cash payments, (b) separation of accounting for cash receiving and cash paying, (c) separation of the physical handling of cash from the accounting function, (d) deposit all cash receipts daily and make all cash payments by check, (e) require separate approval of all checks and electronic funds transfers, and (f) require monthly reconciliation of bank accounts. 6-2 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash 13. Cash-handling and cash-recording activities should be separated to remove the opportunity for theft of cash and a cover-up by altering the records. This separation is accomplished best by assigning the responsibility for cash handling to individuals other than those who have the responsibility for record-keeping. In fact, it usually is desirable that these two functions be performed in different departments of the business. 14. The purposes of a bank reconciliation are (a) to determine the “true” cash balance and (b) to provide data to adjust the Cash account to that balance. A bank reconciliation involves reconciling the balance in the Cash account at the end of the period with the balance shown on the bank statement (which is not the “true” cash balance) at the end of that same period. Seldom will these two balances be identical because of such items as deposits in transit; that is, deposits that have been made by the company but not yet entered on the bank statement. Another cause of the difference is outstanding checks, that is, checks that have been written and recorded in the accounts of the company that have not cleared the bank (and thus have not been deducted from the bank's balance). Usually the reconciliation of the two balances, per books against per bank, requires recording of one or more items that are reflected on the bank statement but have not been recorded in the accounting records of the company. An example is the usual bank service charge. 15. The total amount of cash that should be reported on the balance sheet is the sum of (a) the true cash balances in all checking accounts (verified by a bank reconciliation of each checking account), (b) cash held in all “cash on hand” (or “petty cash”) funds, and (c) any cash physically on hand (any cash not transferred to a bank for deposit—usually cash held for change purposes). 16. (Based on Supplement A) Under the gross method of recording sales discounts, the amount of sales discount taken is recorded at the time the collection of the account is recorded. ANSWERS TO MULTIPLE CHOICE 1. b) 6. c) 2. b) 7. d) 3. b) 8. b) 6-3 4. d) 9. d) 5. c) 10. c) Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash Authors' Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 5 3 10 4 10 5 10 6 10 7 10 8 5 9 10 Exercises No. Time 1 15 2 15 3 15 4 20 5 20 6 30 7 30 8 15 9 15 10 15 11 15 12 15 13 20 14 20 15 20 16 20 17 30 18 30 19 15 20 15 21 20 22 20 23 20 24 30 25 30 Problems No. Time 1 25 2 35 3 20 4 35 5 50 6 40 7 45 8 45 9 45 Alternate Problems No. Time 1 35 2 35 3 50 4 40 5 45 Cases and Projects No. Time 1 25 2 30 3 35 4 20 5 35 6 45 7 * * Due to the nature of these cases and projects, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time to discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 6-4 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash MINI-EXERCISES M6–1. Transaction (a) Sale of inventory to a business x customer on open account (b) Computer sold by mail order x company on a credit card (c) Airline tickets sold by an airline on a credit card Point A Point B Shipment Collection of account Shipment Delivery Point of sale x Completion of flight M6–2. If the buyer pays within the discount period, the income statement will report $8,415 as net sales ($8,500 x 0.99). M6–3. Credit card sales (R) Less: Credit card discount (XR) Net credit card sales $9,400 282 $9,118 Sales on account (R) Less: Sales returns (XR) Less: Sales discounts (1/2 x $10,000 x 2%) (XR) Net sales on account Net sales (reported on income statement) $10,500 500 10,000 100 9,900 $19,018 M6–4. Gross Profit Percentage = Gross Profit = $45,000 – $28,000 = $17,000 = 0.378 Net Sales $45,000 $45,000 The gross profit percentage is 37.8%. This ratio measures the excess of sales prices over the costs to purchase or produce the goods or services sold as a percentage. It indicates a company’s ability to charge premium prices and produce goods and services at lower cost. 6-5 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash M6–5. (a) (b) Allowance for doubtful accounts (–XA, +A) .............. 19,000 Accounts receivable (–A) .................................. To write off specific bad debts. 19,000 Bad debt expense (+E, –SE)..................................... 13,000 Allowance for doubtful accounts (+XA, –A) ....... To record estimated bad debt expense. 13,000 M6–6. Assets Bad debt expense –17,000 (a) Allowance for doubtful accounts –17,000 (b) Allowance for doubtful accounts Accounts receivable Stockholders’ Equity Liabilities +8,000 –8,000 M6–7. + + – (a) Granted credit with shorter payment deadlines. (b) Increased effectiveness of collection methods. (c) Granted credit to less creditworthy customers. M6–8. Reconciling Item (a) Outstanding checks (b) Bank service charge (c) Deposit in transit Company’s Bank Books Statement – – + M6–9. (Based on Supplement A) An $8,000 credit sale with terms, 2/10, n/30, should be recorded as follows: Accounts receivable (+A)............................................. 8,000 Sales revenue (+R, +SE) ................................. 8,000 This entry records the sale at the gross amount. If the customer does pay within the discount period, only $7,840 must be paid, in which case the entry for payment would be as follows: Cash (+A) ................................................................... 7,840 Sales discounts (+XR, –R, –SE) ................................. 160 Accounts receivable (–A) ................................. 8,000 6-6 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash EXERCISES E6–1. Sales revenue ($850 + $700 + $450) ........................................ Less: Sales discount ($850 collected from S. Green x 2%) ...... Net sales ................................................................................... $2,000 17 $1,983 Sales revenue ($3,000 + $9,000 +$4,000) ................................ Less: Sales discounts ($9,000 collected from S x 3%) ............. Less: Credit card discounts ($3,000 from R x 2%) ................... Net sales ................................................................................... $16,000 270 60 $15,670 Sales revenue ($5,500 + $400 + $9,000) .................................. Less: Sales returns and allowances (1/10 x $9,000 from D) ....... Less: Sales discounts (9/10 x $9,000 from D x 3%) .................... Less: Credit card discounts ($400 from C x 2%) ....................... Net sales ......................................................................... $14,900 900 243 8 $13,749 E6–2. E6–3. E6–4. Transaction July 12 July 15 July 20 July 21 Net Sales + 297 + 5,000 – 150 – 1,000 Cost of Goods Sold + 175 + 2,500 NE – 600 Gross Profit + 122 + 2,500 – 150 – 400 E6–5. Req. 1 (Amount saved ÷ Amount paid) = Interest rate for 40 days. (3% ÷ 97%) = 3.09% for 40 days. Interest rate for 40 days x (365 days ÷ 40 days) = Annual interest rate 3.09% x (365 ÷ 40 days) = 28.22% Req. 2 Yes, because the 15% rate charged by the bank is less than the 28.22% rate implicit in the discount. The company will earn 13.22% by doing so (28.22% – 15%). 6-7 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–6. Req. 1 WOLVERINE WORLD WIDE INC. Income Statement For the Year Ended (dollars in thousands) Sales of merchandise Cost of products sold Gross profit Selling and administrative expense Income from operations Other income (expense) Interest expense Other income Pretax income Income taxes Net Income $1,220,568 734,547 486,021 345,183 140,838 (2,850) 839 138,827 44,763 $ 94,064 Earnings per share ($94,064 ÷ 48,888 shares) $1.92 Req. 2 Gross profit margin: $1,220,568 – $734,547 = $486,021. Gross profit percentage ratio: $486,021 ÷ $1,220,568 = .398 (or 39.8%). Gross margin or gross profit in dollars is the difference between the sales prices and the costs of purchasing or manufacturing all goods that were sold during the period (sometimes called the markup); that is, net revenue minus only one of the expenses-cost of goods sold. The gross profit ratio is the amount of each net sales dollar that was gross profit during the period. For this company, the rate was 39.8%, which means that $.398 of each net sales dollar was gross profit (alternatively, 39.8% of each sales dollar was gross profit for the period). Wolverine World Wide's gross profit percentage was below Deckers’s current (2008) percentage of 44.3%. Deckers’s shoes have a reputation as a rugged product as well as a premium "high fashion" product. This has allowed it to maintain higher prices and higher gross margins. In marketing this is called the value of brand equity. 6-8 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–7. Req. 1 SLATE, INCORPORATED Income Statement For the Year Ended December 31, 2012 Amount Gross sales ($233,000 + $40,000) .................... Less sales returns and allowances ................... Net sales revenue ............................................. Cost of goods sold............................................. Gross profit ....................................................... Operating expenses: Administrative expense ................................... Selling expense ............................................... Bad debt expense ($40,000 x 3%) .................. Income from operations..................................... Income tax expense ($50,600 x 30%) ............. Net income ........................................................ $273,000 8,000 265,000 146,000 119,000 $20,000 47,200 1,200 Earnings per share ($35,420 ÷ 4,500 shares) 68,400 50,600 15,180 $ 35,420 $7.87 Req. 2 Gross profit margin: $265,000 – $146,000 = $119,000. Gross profit percentage ratio: $119,000 ÷ $265,000 = .45 (or 45%). Gross margin or gross profit in dollars is the difference between the sales prices and the costs of purchasing or manufacturing all goods that were sold during the period (sometimes called the markup); that is, net revenue minus only one of the expenses-cost of goods sold. The gross profit ratio is the amount of each net sales dollar that was gross profit during the period. For this company, the rate was 45%, which means that $.45 of each net sales dollar was gross profit (alternatively, 45% of each sales dollar was gross profit for the period). 6-9 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–8. (a) (b) E6–9. (a) (b) Bad debt expense (+E, –SE) ($800,000 x 0.01) ........ 8,000 Allowance for doubtful accounts (+XA, –A) ....... To record estimated bad debt expense. 8,000 Allowance for doubtful accounts (–XA, +A) .............. 2,500 Accounts receivable (–A) .................................. To write off a specific bad debt. 2,500 Bad debt expense (+E, –SE) ($790,000 x 0.02) ........ 15,800 Allowance for doubtful accounts (+XA, –A) ....... To record estimated bad debt expense. 15,800 Allowance for doubtful accounts (–XA, +A) .............. Accounts receivable (–A) .................................. To write off a specific bad debt. 360 360 E6–10. Assets Liabilities Bad debt expense –15,800 (a) Allowance for doubtful accounts –15,800 (b) Allowance for doubtful accounts Accounts receivable E6–11. Req. 1 (a) (b) Stockholders’ Equity +360 –360 Bad debt expense (+E, –SE) ($680,000 x 0.035) ...... 23,800 Allowance for doubtful accounts (+XA, –A) ....... To record estimated bad debt expense. 23,800 Allowance for doubtful accounts (–XA, +A) .............. 2,800 Accounts receivable (–A) .................................. To write off a specific bad debt. 2,800 Req. 2 Transaction a. b. Net Sales NE NE Gross Profit NE NE 6-10 Income from Operations – 23,800 NE Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–12. Estimated Estimated percentage amount Aged accounts receivable uncollectible uncollectible Not yet due $16,000 x 2% = $ 320 Up to 120 days past due 5,500 x 14% = 770 Over 120 days past due 2,500 x 35% = 875 Estimated balance in Allowance for Doubtful Accounts 1,965 Current balance in Allowance for Doubtful Accounts 900 Bad Debt Expense for the year $1,065 E6–13. Req. 1 December 31, 2011-Adjusting entry: Bad debt expense (+E, –SE) ....................................... 4,180 Allowance for doubtful accounts (+XA, –A)....... 4,180 To adjust for estimated bad debt expense for 2011 computed as follows: Estimated Estimated percentage amount Aged accounts receivable uncollectible uncollectible Not yet due $50,000 x 3% = $ 1,500 Up to 180 days past due 14,000 x 12% = 1,680 Over 180 days past due 4,000 x 30% = 1,200 Estimated balance in Allowance for Doubtful Accounts 4,380 Current balance in Allowance for Doubtful Accounts 200 Bad Debt Expense for the year $4,180 Req. 2 Balance sheet: Accounts receivable ($50,000 + $14,000 + $4,000) Less allowance for doubtful accounts ..................... Accounts receivable, net of allowance for doubtful accounts ......................................... 6-11 $68,000 4,380 $63,620 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–14. Req. 1 December 31, 2012-Adjusting entry: Bad debt expense (+E, –SE) ....................................... 20,225 Allowance for doubtful accounts (+XA, –A)....... 20,225 To adjust for estimated bad debt expense for 2012 computed as follows: Estimated Estimated percentage amount Aged accounts receivable uncollectible uncollectible Not yet due $275,000 x 3.5% = $9,625 Up to 120 days past due 50,000 x 10% = 5,000 Over 120 days past due 20,000 x 30% = 6,000 Estimated balance in Allowance for Doubtful Accounts 20,625 Current balance in Allowance for Doubtful Accounts 400 Bad Debt Expense for the year $20,225 Req. 2 Balance sheet: Accounts receivable ($275,000 + $50,000 + $20,000) Less allowance for doubtful accounts ..................... Accounts receivable, net of allowance for doubtful accounts ......................................... $345,000 20,625 $324,375 E6–15. 1. 2. Bad debt expense (+E, –SE) ................................................. 271 Allowance for doubtful accounts (+XA, –A).................. To record estimated bad debt expense. 271 Allowance for doubtful accounts (–XA, +A) ............................ 153 Accounts receivable (–A) ............................................. To write off specific bad debts. 153 It would have no effect because the asset “Accounts receivable” and contraasset “Allowance for doubtful accounts” would both decline by Euro 10 million. Neither “Receivables, net” nor “Net income” would be affected. 6-12 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–16. Req. 1 Allowance for Doubtful Accounts Write-offs 52 117 88 Beg. balance Bad debt exp. 153 End. balance Beg. Balance + Bad debt exp. – Write-offs = End. Balance Beg. Balance + Bad debt exp. – End. Balance = Write-offs 117 + 88 – 153 = 52 Bad debt expense increases (is credited to) the allowance. Since we are given the beginning and ending balances in the allowance, we can solve for write-offs, which decrease (are debited to) the allowance. Req. 2 Accounts Receivable (Gross) Beg. balance* Net sales 11,455 60,420 End. balance ** 13,742 52 58,081 Write-offs Cash collections * 11,338 + 117 ** 13,589 + 153 Beg. balance + Net sales – Write-offs – Cash collections = End. Balance Beg. balance + Net sales – Write-offs – End. Balance = Cash collections 11,455 + 60,420 – 52 – 13,742 = 58,081 Accounts receivable gross is increased by recording credit sales and decreased by recording cash collections and write-offs of bad debts. Thus, we can solve for cash collections as the missing value. 6-13 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–17. Req. 1 The allowance for doubtful accounts is increased (credited) when bad debt expense is recorded and decreased (debited) when uncollectible accounts are written off. This case gives the beginning and ending balances of the allowance account and the amount of uncollectible accounts that were written off. Therefore, the amount of bad debt expense (in thousands) can be computed as follows: Allowance for Doubtful Accounts Write-offs 811,000 570,000 1,251,000 Beg. balance Bad debt exp. 1,010,000 End. balance Beg. Balance + Bad debt exp. – Write-offs = End. Balance End. Balance – Beg. Balance + Write-offs = Bad debt exp. 1,010,000 – 570,000 + 811,000 = 1,251,000 Req. 2 Working capital is unaffected by the write-off of an uncollectible account when the allowance method is used. The asset account (accounts receivable) and the contraasset account (allowance for doubtful accounts) are both reduced by the same amount; therefore, the book value of net accounts receivable is unchanged. Working capital is decreased when bad debt expense is recorded because the contraasset account (allowance for doubtful accounts) is increased. From requirement (1), we know that net accounts receivable was reduced by $1,251,000 when bad debt expense was recorded in year 2, reducing working capital by $1,251,000. Note that income before taxes was reduced by the amount of bad debt expense that was recorded, therefore tax expense and tax payable will decrease. The decrease in tax payable caused working capital to increase; therefore, the net decrease was $1,251,000 – ($1,251,000 x 30%) = $875,700. Req. 3 The entry to record the write-off of an uncollectible account did not affect any income statement accounts; therefore, net income is unaffected by the $811,000 write-off in year 2. The recording of bad debt expense reduced income before taxes in year 2 by $1,251,000 and reduced tax expense by $375,300 (i.e., $1,251,000 x 30%). Therefore, year 2 net income was reduced by $875,700 (as computed in Req. 2). 6-14 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–18. Req. 1 Dec. 31, 2012 Allowance for doubtful accounts (–XA, +A) ............... Accounts receivable (J. Doe) (–A) .................. To write off an account receivable determined to be uncollectible. Dec. 31, 2012 Bad debt expense (+E, –SE) .................................... Allowance for doubtful accounts (+XA, –A)..... Adjusting entry--estimated loss on uncollectible accounts; based on credit sales ($75,000 x 1.5% = $1,125). 1,700 1,700 1,125 1,125 Req. 2 Income statement: Operating expenses: Bad debt expense ........................................................ Balance sheet: Current assets Accounts receivable ($16,000 + $75,000 - $60,000 - $1,700) ..................................... Less: Allowance for doubtful accounts ($900 - $1,700 + $1,125) ............................ $1,125 $29,300 325 $28,975 Req. 3 The 1.5% rate on credit sales may be too low because it resulted in bad debt expense only two-thirds the amount of receivables written off ($1,700) during the year. However, if the uncollectible account receivable written off during 2012 is not indicative of average uncollectibles written off over a period of time, the 1.5% rate may be appropriate. There is not sufficient historical data to make a definitive decision. 6-15 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–19. Req. 1 Dec. 31, 2011 Allowance for doubtful accounts (–XA, +A) ............... Accounts receivable (Toby’s Gift Shop) (–A) .. To write off an account receivable determined to be uncollectible. Dec. 31, 2011 Bad debt expense (+E, –SE) .................................... Allowance for doubtful accounts (+XA, –A)..... Adjusting entry--estimated loss on uncollectible accounts; based on credit sales ($25,000 x 2.5% = $625). 700 700 625 625 Req. 2 Income statement: Operating expenses: Bad debt expense ........................................................ Balance sheet: Current assets Accounts receivable ($4,000 + $25,000 - $19,000 - $700) ........................................ Less: Allowance for doubtful accounts ($300 - $700 + $625) .................................. $625 $9,300 225 $9,075 Req. 3 The 2.5% rate on credit sales appears reasonable because it approximates the amount of receivables written off ($700) during the year. However, if the uncollectible account receivable written off during 2011 is not indicative of average uncollectibles written off over a period of time, the 2.5% rate may not be appropriate. There is not sufficient historical data to make a definitive decision. 6-16 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–20. Req. 1 Receivables turnover = Net Sales = $35,497,000 = 9.16 times Average Net Trade $3,875,000* Accounts Receivable Average days sales in receivables 365 = 365 = 39.8 days Receivables Turnover 9.16 = * ($4,359,000 + $3,391,000) ÷ 2 Req. 2 The receivables turnover ratio reflects how many times average trade receivables were recorded and collected during the period. The average days sales in receivables indicates the average time it takes a customer to pay its account. E6–21. Req. 1 Receivables turnover = Net Sales = $61,101,000 = 11.43 times Average Net Trade $5,346,000* Accounts Receivable Average days sales in receivables 365 = 365 = 31.9 days Receivables Turnover 11.43 = * ($5,961,000 + $4,731,000) ÷ 2 Req. 2 The receivables turnover ratio reflects how many times average trade receivables were recorded and collected during the period. The average days sales in receivables indicates the average time it takes a customer to pay its account. 6-17 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–22. Req. 1 The change in the accounts receivable balance ($48,066 – 63,403 = –$15,337) would increase cash flow from operations by $15,337 thousand. This happens because the Company is collecting cash faster than it is recording credit sales revenue. Req. 2 (a) Declining sales revenue leads to lower accounts receivable because fewer new credit sales are available to replace the receivables that are being collected. (b) Cash collections from the prior period's higher credit sales are greater than the new credit sales revenue. Note that in the next period, cash collections will also decline. E6–23. Req. 1 JACKSON COMPANY Bank Reconciliation, June 30, 2011 Company's Books Ending balance per Cash account……………………… Additions: None Deductions: Bank service charge…… Correct cash balance……… Bank Statement Ending balance per bank statement……………… Additions: Deposit in transit………… $6,000 $6,060 1,900* 7,960 Deductions: Outstanding checks… Correct cash balance…… 40 $5,960 2,000 $5,960 *$18,100 – $16,200 = $1,900. Req. 2 Bank service charge expense (+E, –SE) ................................... Cash (–A)........................................................................ To record deduction from bank account for service charges. 40 40 Req. 3 The correct cash balance per the bank reconciliation ($6,000 – $40), $5,960 Req. 4 Balance sheet (June 30, 2011): Current assets: Cash ................................................................................... 6-18 $5,960 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–24. Req. 1 BENNETT COMPANY Bank Reconciliation, September 30, 2011 Company's Books Ending balance per Cash account........................... Bank Statement Ending balance per bank statement ........................ $5,700 Additions: None Additions: Deposit in transit* ......... Deductions: Bank service charges ... NSF check – Betty Brown ............. Deductions: $5,770 1,200* 6,970 $ 60 170 Correct cash balance ....... 230 Outstanding checks ($28,900 – $27,400) .... 1,500 $5,470 Correct cash balance ....... $5,470 *$28,100 - $26,900 = $1,200. Req. 2 (1) (2) Bank service charge expense (+E, –SE) ................................ Cash (–A)..................................................................... To record bank service charges deducted from bank balance. 60 Accounts receivable (Betty Brown) (+A) ................................. Cash (–A)..................................................................... To record customer check returned due to insufficient funds. 170 60 170 Req. 3 Same as the correct balance on the reconciliation, $5,470. Req. 4 Balance Sheet (September 30, 2011): Current Assets: Cash .......................................................................................... $5,470 6-19 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash E6–25 (Based on Supplement A) November 20, 2010 Cash (+A) .................................................................... Credit card discount (+XR, –R, –SE) ........................... Sales revenue (+R, +SE) .................................. To record credit card sale. November 25, 2010: Accounts receivable (Customer C) (+A) ...................... Sales revenue (+R, +SE) .................................. To record a credit sale. November 28, 2010: Accounts receivable (Customer D) (+A) ...................... Sales revenue (+R, +SE) .................................. To record a credit sale. 441 9 450 2,800 2,800 7,200 7,200 November 30, 2010: Sales returns and allowances (+XR, –R, –SE) ............ 600 Accounts receivable (Customer D) (–A)............ To record return of defective goods, $7,200 x 1/12 = $600. December 6, 2010: Cash (+A) .................................................................... Sales discounts (+XR, –R, –SE) .................................. Accounts receivable (Customer D) (–A)............ To record collection within the discount period, 98% × ($7,200 – $600) = $6,468 December 30, 2010: Cash (+A) .................................................................... Accounts receivable (Customer C) (–A)............ To record collection after the discount period. 6,468 132 6,600 2,800 Sales revenue ($450 + $2,800 + $7,200) .................................. Less: Sales returns and allowances ($7,200 x 1/12) ................. Less: Sales discounts (2% × ($7,200 – $600)) .......................... Less: Credit card discounts ($450 x 2%) ................................... Net sales ................................................................................... 6-20 600 2,800 $10,450 600 132 9 $9,709 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash PROBLEMS P6–1. Case A Because Wendy's collects cash when the coupon books are sold, cash collection is not an issue in this case. In order to determine if the revenue has been earned, the student must be careful in analyzing what Wendy's actually sold. Students who focus on the sale of the coupon book often conclude that the earning process is complete with the delivery of the book to the customer. In reality, Wendy's has a significant additional service to perform; it has to serve a meal. The correct point for revenue recognition in this case is when the customer uses the coupon or when the coupon expires and Wendy's has no further obligation. Case B In this case there is an extremely low down payment and some reason to believe that Uptown Builders may default on the contract because of prior actions. If students believe that Russell Land Development could sue and collect on the contract, they will probably argue for revenue recognition. Given the risk of cash collection, most students will argue that revenue should be recognized as cash is collected. The text does not discuss FASB #66 (ASC 360-20-40), but the instructor may want to mention during the discussion that there is authoritative guidance concerning minimum down payments before revenue can be recorded on a land sale. Case C While warranty work on refrigerators can involve significant amounts of effort and money, companies are permitted to record revenue at the point of sale. The text does not discuss this specific issue but the matching concept is mentioned in the context of revenue recognition. This is an excellent opportunity to mention the need to accrue estimated warranty expense at the time that sales revenue is recorded. Some students are surprised to see that costs that will be incurred in the future can be recorded as an expense in the current accounting period. 6-21 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash P6–2. Req. 1 (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) Total Sales Revenue +234,000 +11,500 +25,000 NE +26,000 NE NE NE +17,500 NE NE NE NE +$314,000 Sales Discounts (taken) NE NE NE NE NE +220 +2,000* +500 NE –70 NE NE NE +$2,650 Sales Returns and Allowances NE NE NE +500 NE NE NE NE NE +3,500 NE NE NE +$4,000 Bad Debt Expense NE NE NE NE NE NE NE NE NE NE NE NE +1,140** +$1,140 *$98,000 ÷ (1 ─ .02) = $100,000 gross sales; $100,000 x .02 = $2,000 **Credit sales ($11,500 + $25,000 + $26,000 + $17,500) . $80,000 Less: Sales returns ($500 + $3,500) ............................. 4,000 Net sales revenue........................................................... 76,000 Estimated bad debt rate ................................................. x 1.5% Bad debt expense ........................................................... $1,140 Req. 2 Income statement: Sales revenue ........................................................... $314,000 Less: Sales returns and allowances .............. 4,000 Sales discounts.................................... 2,650 Net sales revenue ..................................................... Operating expenses Bad debt expense ................................................... 6-22 $307,350 1,140 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash P6–3. Income Statement Items Gross sales revenue Sales returns and allowances Net sales revenue Cost of goods sold Gross profit Operating expenses Pretax income Income tax expense (20%) Income before extraordinary items Extraordinary gain (loss) Less: Income tax (20%) Net income EPS (10,000 shares) Case A a. c. b. d. e. f. g. h. i. Note = Computations in order a. b. c. d. e. f. g. h. i. CASE A $259,000 – $20,000 = $239,000 $239,000 x .30 = $71,700 $239,000 – $71,700 = $167,300 $71,700 – $22,000 = $49,700 $22,000 x .20 = $4,400 $22,000 – $4,400 = $17,600 $2,000 x .20 = $400 $17,600 - $2,000 + $400 = $16,000 $16,000 ÷ 10,000 = $1.60 a. b. c. d. e. f. g. h. i. CASE B $2.54 x 10,000 shares = $25,400 $10,000 x .20 = $2,000 $25,400 - $10,000 + $2,000 = $17,400 $17,400 ÷ .80 = $21,750 $21,750 - $17,400 = $4,350 $21,750 + $15,600 = $37,350 $37,350 ÷ (1 - .70) = $124,500 $124,500 - $37,350 = $87,150 $165,000 - $124,500 = $40,500 6-23 $259,000 20,000 239,000 167,300 (30%) 71,700 49,700 22,000 4,400 17,600 (2,000) 400 $16,000 $1.60 Case B i. g. h. f. d. e. c. b. a. $165,000 40,500 124,500 (70%) 87,150 37,350 15,600 21,750 4,350 17,400 10,000 (2,000) $25,400 $2.54 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash P6–4. 1. 2. Bad debt expense (+E, –SE) ..................................................... Allowance for doubtful accounts (+XA, –A)..................... End-of-period bad debt expense estimate. 7 Allowance for doubtful accounts (–XA, +A) ............................... Accounts receivable (–A) ................................................ Write-off of bad debts. 2 Year 2 ........................................ $145 Year 1 ........................................ $89 + $0 + $57 Allowance for DA Year 2 Write-offs 78 145 0 67 Beg. bal. Bad debt exp. 7 2 – $78 = $67 – $1 = $145 Allowance for DA Year 1 Write-offs 1 End. bal. 89 57 145 Beg. bal Bad debt exp. Ending Bal. The solution involves solving for the missing value in the T-account. 6-24 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash P6–5. Req. 1 Customer B. Brown………….. D. Donalds……….. N. Napier…………. S. Strothers……… T. Thomas………... Totals…………… Aging Analysis of Accounts Receivable (b) Up to One (c) More Than Total (a) Not Yet Year Past One Year Receivables Due Due Past Due $ 5,200 $5,200 8,000 $ 8,000 7,000 $ 7,000 22,500 2,000 20,500 4,000 4,000 $46,700 $13,000 $28,500 $5,200 Req. 2 a. b. c. Aging Schedule--Estimated Amounts Uncollectible Amount of Estimated Estimated Age Receivables Uncollectible Amount Percentage Uncollectible Not yet due…………………… $13,000 2% $ 260 Up to one year past due……. 28,500 7% 1,995 Over one year past due…….. 5,200 30% 1,560 Estimated ending balance in 3,815 Allowance for Doubtful Accounts Balance before adjustment 920 Bad Debt Expense for the year $2,895 Req. 3 Bad debt expense (+E, –SE) .......................................... Allowance for doubtful accounts (+XA, –A) ........... 2,895 2,895 Req. 4 Income statement: Operating expenses Bad debt expense .......................................................... Balance sheet: Current Assets: Accounts receivable ....................................................... Less: Allowance for doubtful accounts .......................... Accounts receivable (net) .............................................. 6-25 $2,895 $46,700 3,815 $42,885 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash P6–6. Req. 1 TUNGSTEN COMPANY, INC. Income Statement For the Year Ended December 31, 2011 Net sales revenue ($147,100 $5,600 $6,400) ................ Cost of goods sold................................................................ Gross profit on sales ............................................................ Operating expenses: Selling expense ............................................................ $14,100 Administrative expense ................................................ 15,400 Bad debt expense ........................................................ 1,600 Income from operations........................................................ Income tax expense ..................................................... Net income ........................................................................ $135,100 78,400 56,700 31,100 25,600 7,680 $ 17,920 Earnings per share on capital stock outstanding ($17,920 ÷ 10,000 shares) ................................................................ $1.79 Req. 2 Gross Profit Percentage = Gross Profit Net Sales = $56,700 = 0.420 (42.0%) $135,100 The gross profit percentage measures the excess of sales prices over the costs to purchase or produce the goods or services sold as a percentage. Receivables = Turnover Net Sales Average Net Trade Accounts Receivable = $135,100 = 8.89 $15,200* * ($16,000 + $14,400) ÷ 2 The receivables turnover ratio measures the effectiveness of credit-granting and collection activities. 6-26 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash P6–7. Req. 1 WOOD COMPANY Bank Reconciliation, April 30, 2011 Company's Books Bank Statement Ending balance per Cash account ......................... $23,900 Additions: Interest collected ............... Deductions: NSF—A.B. Wright .............. Bank charges .................... Correct cash balance ......... 1,180 25,080 160 50 210 $24,870 Ending balance per bank statement ..................... Additions: Deposits in transit* ............. $23,570 5,400 28,970 Deductions: Outstanding checks ............ 4,100 Correct cash balance ......... $24,870 *$41,500 - $36,100 = $5,400. Req. 2 (1) Cash (+A) .......................................................................... 1,180 Interest revenue (+R, +SE) ..................................... Interest collected. (2) (3) Accounts receivable (A. B. Wright) (+A) ............................ Cash (–A)................................................................ Customer's check returned, insufficient funds. 160 Bank service charge expense (+E, –SE) ........................... Cash (–A)................................................................ Bank service charges deducted from bank statement. 50 1,180 160 50 These entries are necessary because of the changes to the regular Cash account that have not yet been recorded by the company. The bank already has recorded them in its accounts. The Cash account (and the other accounts in the entries) must be brought up to date for financial statement purposes. Req. 3 Balance in regular Cash account ...................................................... $24,870 Req. 4 Balance Sheet (April 30, 2011): Current Assets: Cash ............................................................................ $24,870 6-27 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash P6–8. Req. 1 Comparison of deposits listed in the Cash account with deposits listed on the bank statement reveals a $5,200 deposit in transit on August 31. Req. 2 Comparison of the checks cleared on the bank statement with (a) outstanding checks from July, and (b) checks written in August reveals two outstanding checks at the end of August ($280 + $510 = $790). Req. 3 ALLISON COMPANY Bank Reconciliation, August 31, 2011 Company's Books Ending balance per Cash account ......................... Additions: Interest collected ............... Deductions: Bank service charges ........................... Correct cash balance ........................... $20,370 2,350 22,720 120 $22,600 Bank Statement Ending balance per bank statement ..................... Additions: Deposits in transit .............. Deductions: Outstanding checks ............ Correct cash balance ......... Req. 4 (1) Cash (+A) .......................................................................... 2,350 Interest revenue (+R, +SE) ..................................... Interest collected. (2) Bank service charge expense (+E, –SE) .......................... Cash (–A)................................................................ Service charges deducted from bank balance. $18,190 5,200 23,390 790 $22,600 2,350 120 120 These entries are necessary because of the changes in the regular Cash account that have not yet been recorded by the company. The bank already has recorded them in its accounts. The Cash account (and the other accounts in the entries) must be brought up to date for financial statement purposes. Req. 5 Current Assets: Cash ............................................................................................ 6-28 $22,600 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash P6–9. (Based on Supplement A) Req. 1 (a) (b) (c) (d) (e) (f) (g) (h) (i) Cash (+A) .................................................................. Sales revenue (+R, +SE) ................................ Cash sales for 2011. 234,000 Accounts receivable (R. Smith) (+A).......................... Sales revenue (+R, +SE) ................................ Credit sale, $11,500. 11,500 Accounts receivable (K. Miller) (+A) .......................... Sales revenue (+R, +SE) ................................ Credit sale, $25,000. 25,000 Sales returns and allowances (+XR, –R, –SE) .......... Accounts receivable (R. Smith) (–A) ............... Sale return, 1 unit @ $500. 500 Accounts receivable (B. Sears) (+A) ......................... Sales revenue (+R, +SE) ................................ Credit sale, $26,000. 26,000 Cash (+A) .................................................................. Sales discounts (+XR, –R, –SE) ................................ Accounts receivable (R. Smith) (–A) ............... Paid account in full within discount period, ($11,500 - $500) x (1 - .02) = $10,780. 10,780 220 Cash (+A) .................................................................. Sales discounts (+XR, –R, –SE) ................................ Accounts receivable (prior year) (–A) ............. Collected receivables of prior year, all within discount periods $98,000 ÷ .98 = $100,000. 98,000 2,000 Cash (+A) .................................................................. Sales discounts (+XR, –R, –SE) ................................ Accounts receivable (K. Miller) (–A) ................ Collected receivable within the discount period $25,000 x .98 = $24,500. 24,500 500 Accounts receivable (R. Roy) (+A) ............................ Sales revenue (+R, +SE) ................................ Credit sale. 17,500 6-29 234,000 11,500 25,000 500 26,000 11,000 100,000 25,000 17,500 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash P6–9. (continued) (j) (k) (l) Sales returns and allowances (+XR, –R, –SE) .......... Cash (–A)........................................................ Sales discounts (–XR, +R, +SE) ..................... Sales return, 7 units @ $500 less sales discounts taken = $3,500 x .98. 3,500 Cash (+A) .................................................................. Accounts receivable (–A) ................................ Collected receivable of prior year, after the discount period. 6,000 Allowance for doubtful accounts (–XA, +A) ............... Accounts receivable (2010 account) (–A) ....... Wrote off uncollectible account from 2010. 3,000 3,430 70 6,000 Bad debt expense (+E, –SE) ..................................... 1,140 Allowance for doubtful accounts (+XA, –A)..... To adjust for estimated bad debt expense Credit sales ($11,500 + $25,000 + $26,000 + $17,500) .. $80,000 Less: Sales returns ($500 + $3,500) ............................. 4,000 Net sales revenue........................................................... 76,000 Estimated bad debt rate ................................................. x 1.5% Bad debt expense................................................... $1,140 . 3,000 (m) 1,140 Req. 2 Income statement: Sales revenue ($234,000 + $11,500 + $25,000 + $26,000 + $17,500) ..................................... $314,000 Less: Sales returns and allowances ($3,500 + $500) ............... 4,000 Sales discounts ($220 + $2,000 + $500 – $70) .................................... 2,650 Net sales revenue ............................................................. Operating expenses Bad debt expense ........................................................... 6-30 $307,350 1,140 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash ALTERNATE PROBLEMS AP6–1. Req. 1 (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) Total Sales Revenue +227,000 +12,000 +23,500 NE +26,000 NE NE NE NE +18,500 NE NE NE +$307,000 Sales Discounts (taken) NE NE NE +240 NE -10 +1,800* NE +400 NE NE NE NE +$2,430 Sales Returns and Allowances NE NE NE NE NE +500 NE +3,500 NE NE NE NE NE +$4,000 Bad Debt Expense NE NE NE NE NE NE NE NE NE NE NE NE +3,040** +$3,040 * [($88,200/.98) x .02] = $1,800 **Credit sales ($12,000 + $23,500 + $26,000 + $18,500) . Less: Sales returns ($500 + $3,500) ............................. Net sales revenue........................................................... Estimated bad debt rate ................................................. Bad debt expense ........................................................... $80,000 4,000 $76,000 x 4% $3,040 Req. 2 Income statement: Sales revenue ........................................................... $307,000 Less: Sales returns and allowances .............. 4,000 Sales discounts .................................... 2,430 Net sales revenue ..................................................... Operating expenses Bad debt expense ................................................... 6-31 $300,570 $3,040 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash AP6–2. 1. Bad debt expense (+E, –SE) ..................................................... 6,014 Allowance for doubtful accounts (+XA, –A)..................... 6,014 End of period bad debt expense estimate. Allowance for doubtful accounts (–XA, +A) ............................... 5,941 Accounts receivable (–A) ................................................ 5,941 Write-off of bad debts. 2. Allowances for Doubtful Accounts Year 3 Balance at Beginning of Year $1,108 Additions Charged to Costs and Expenses $6,014 Deductions from Reserve $5,941 Balance at End of Year $1,181 Year 2 2,406 4,453 5,751 1,108 Year 1 2,457 4,752 4,803 2,406 Year 3 Allowance for Doubtful Accounts 1,108 Beg. bal. Write-offs Year 2 6,014 Bad debt exp. 1,181 End. bal. Allowance for Doubtful Accounts 2,406 Beg. bal. Write-offs Year 1 5,941 5,751 4,453 Bad debt exp. 1,108 End. bal. Allowance for Doubtful Accounts 2,457 Beg. bal Write-offs 4,803 4,752 Bad debt exp. 2,406 Ending bal. The solution involves solving for the missing value in the T-account. 6-32 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash AP6–3. Req. 1 Aging Analysis of Accounts Receivable (a) (b) (c) Not Yet Up to 6 to Total Due 6 Mo. 12 Mo. Customer Receivable Past Due Past Due R. Devens ……….. $ 2,000 $2,000 C. Howard ……….. 6,000 D. McClain .………. 4,000 $ 4,000 T. Skibinski ……… 14,500 $ 4,500 10,000 H. Wu ………..…... 13,000 13,000 Totals…………… $39,500 $17,500 $14,000 $2,000 (d) More Than 12 Mo. Past Due $6,000 $6,000 Req. 2 a. b. c. d. Estimated Amounts Uncollectible Amount of Estimated Age Receivable Loss Rate Not yet due…………………… $17,500 1% Up to 6 months past due...…. 14,000 5% 6 to 12 months past due.…. 2,000 20% Over 12 months past due…... 6,000 50% Estimated ending balance in Allowance for Doubtful Accounts Balance before adjustment Bad Debt Expense for the year Req. 3 Bad debt expense (+E, –SE) ......................................... Allowance for doubtful accounts (+XA, –A) .......... 6-33 1,550 $2,725 2,725 2,725 Req. 4 Income statement: Operating expenses Bad debt expense .......................................................... Balance sheet: Current Assets: Accounts receivable ....................................................... Less: Allowance for doubtful accounts .......................... Accounts receivable, net ....................................... Estimated Uncollectible $ 175 700 400 3,000 4,275 $2,725 $39,500 4,275 $35,225 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash AP6–4. Req. 1 PERRY CORPORATION Income Statement For the Year Ended December 31, 2012 Net sales revenue ($184,000 - $9,000- $8,000) ................. Cost of goods sold.............................................................. Gross profit......................................................................... Operating expenses: Selling expense .......................................................... $17,000 Administrative and general expense .......................... 18,000 Bad debt expense ...................................................... 2,000 Total operating expenses ................................... Income from operations...................................................... Income tax expense ................................................... Net income ......................................................................... $167,000 98,000 69,000 37,000 32,000 10,900 $ 21,100 Earnings per share on common stock outstanding ($21,100 ÷ 10,000 shares) ................................................................ $2.11 Req. 2 Gross Profit Percentage = Gross Profit Net Sales = $69,000 = 0.413 (41.3%) $167,000 The gross profit percentage measures the excess of sales prices over the costs to purchase or produce the goods or services sold as a percentage. Receivables = Turnover Net Sales Average Net Trade Accounts Receivable = $167,000 = 9.82 $17,000* * ($16,000 + $18,000) ÷ 2 The receivables turnover ratio measures the effectiveness of credit-granting and collection activities. 6-34 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash AP6–5. Req. 1 Comparison of (a) the unrecorded deposit carried over from November and (b) the deposits listed on the bank statement reveals that the $13,000 deposit for December 31 is in transit. Req. 2 Comparison of the checks cleared on the bank statement with (a) outstanding checks from November and (b) checks written in December reveals that the outstanding checks at the end of December are $5,000 + $3,500 + 500 = $9,000. Req. 3 RIVAS COMPANY Bank Reconciliation, December 31, 2011 Company's Books Ending balance per Cash account ......................... $61,060 Additions: Interest collected ............... Deductions: NSF check—J. Left ............ Bank service charges ......... Correct cash balance ......... Bank Statement 5,250 66,310 Ending balance per bank statement ..................... Additions: Deposits in transit .............. $61,860 13,000 74,860 Deductions: $300 150 450 $65,860 6-35 Outstanding checks ............ Correct cash balance ......... 9,000 $65,860 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash AP6–5. (continued) Req. 4 (1) (2) (3) Accounts receivable (J. Left) (+A) .................................. Cash (–A)............................................................. To record NSF check. 300 Cash (+A) ....................................................................... Interest revenue (+R, +SE) .................................. Interest collected. 5,250 Bank service charge expense (+E, –SE) ........................ Cash (–A)............................................................. Service charges deducted from bank balance. 150 300 5,250 150 These entries are necessary because of the changes in the regular Cash account that have not yet been recorded by the company. The bank already has recorded them in its accounts. The Cash account (and the other accounts in the entries) must be brought up to date for financial statement purposes. Req. 5 Balance Sheet (2011): Current Assets: Cash ................................................................................ 6-36 $65,860 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash CASES AND PROJECTS ANNUAL REPORT CASES CP6–1. 1. The company includes liquid financial instruments with original maturities of three months or less to be cash and cash equivalents. This information is from note 2 of the financial statements. The amount disclosed is likely to be close to the fair market value of the securities, given the short maturity date of the securities. 2. In addition to Cost of Goods Sold, American Eagle Outfitters subtracts buying, occupancy and warehousing costs from Net Sales in its computation of Gross Profit. This follows standard practice among retailers. No such additional expenses are subtracted in Deckers’s (a footwear manufacturer) computation of Gross Profit. This makes the interpretation of gross profit percentages across different industries difficult. 3. Receivables turnover = Net Sales = $2,988,866 = 81.4 times Average Net Trade $36,696* Accounts Receivable * ($31,920 + 41,471) ÷ 2 This question is designed to focus student attention on the mechanics of the computation of the receivables turnover ratio and the effect of industry differences. The receivables turnover is so high because of the nature of the company’s business. Retail sales are likely to be made with cash or credit card. As a consequence, most retailers would not have accounts receivable related to sales unless they had private store credit card accounts. The accounts receivable on American Eagle’s balance sheet relate primarily to amounts owed from landlords for construction allowances for building new stores in malls. 4. No, the company does not report an allowance for doubtful accounts on the balance sheet or in the notes. As a retailer, its trade receivables from customers are immaterial—the company’s receivables consist of non-trade receivables and notes receivable. 6-37 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash CP6–2. 1. The company held $316,035 thousand of cash and cash equivalents at the end of the current year. This is disclosed on the balance sheet and the statement of cash flows. 2. Accounts receivable increased by $10,025 thousand, decreasing Net Cash Provided by Operating Activities for the current year. This is included in the operating section of the statement of cash flows in the line item relating to changes in receivables. You may wish to note to students that this amount does not agree with the amount on the statement of cash flows which indicates a $10,726 increase. This difference is the result of the translation of foreign currency receivables. 3. 2009 Gross Profit = Percentage Gross Profit Net Sales $713,478 = 0.389 1,834,618 2008 $576,772 = 0.383 1,507,724 The gross profit percentage increased slightly from 2008 to 2009. The increase implies that the company has increased its ability to charge premium prices or to purchase goods for resale at lower cost. 4. It discloses its revenue recognition policies in note 2 which summarizes significant accounting policies. The company recognizes revenue from selling gift cards when customers redeem a gift card for merchandise rather than when the gift card is sold. When gift cards are sold, a current liability (deferred revenue) is recorded. 6-38 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash CP6–3. 1. Current year Gross Profit = Percentage American Eagle Outfitters Gross Profit Net Sales Prior year Gross Profit = Percentage $1,174,101 = 0.393 2,988,866 American Eagle Outfitters Gross Profit Net Sales $1,423,138 = 0.466 3,055,419 Urban Outfitters $713,478 = 0.389 1,834,618 Urban Outfitters $576,772 = 0.383 1,507,724 The improved gross profit percentage for Urban Outfitters suggests higher sales prices and/or lower costs of merchandise. Because other costs (occupancy, etc.) are included along with cost of goods sold, the improved ratios may also result from improved comparable store sales and better cost controls. The declining gross profit percentage for American Eagle suggests the opposite scenarios. 2. Companies with unique items for sale or valuable brand images often produce higher gross profit margins. Because American Eagle Outfitters and Urban Outfitters have unique items for sale as well as valuable brand images in certain markets, their margins are predicted to be in the mid to upper range of their industry. 3. Gross Profit Percentage = Industry Average 39.0% American Eagle Outfitters 39.3% Urban Outfitters 38.9% Urban Outfitters’ gross profit percentage is just below and American Eagle Outfitters’ is above the industry average. The higher gross profit percentage for American Eagle Outfitters was anticipated in Requirement 2, but Urban Outfitters is not above the industry average (although it is close). 6-39 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash FINANCIAL REPORTING AND ANALYSIS CASES CP6–4. 1. Yes. Given that only one three-year project is worked on at a time, the completed contract method would result in no revenue being recognized for two out of every three years, and all of the revenue from each project being recognized during the third. If the same amount of work was completed each year, the percentage of completion method would result in an approximately equal amount of revenue each period. 2. If the company regularly started and completed a larger constant number of equal sized projects each reporting period, the size of any difference between revenues reported under the two methods would decline. 3. Under generally accepted accounting principles, the appropriate method would be determined by whether the costs to complete can be accurately assessed. If they can be accurately estimated, the percentage of completion method is appropriate. If not, the completed contract method should be used. However, managers generally prefer to report the smoother earnings pattern conveyed by the percentage of completion method because smoother earnings are generally thought to convey lower risk to investors. CRITICAL THINKING CASES CP6–5. 1. Recording sales for goods or services that had not been delivered as of year-end violates the revenue principle. Recording revenue for sales that were subject to cancellation, without estimating returns properly, is also a violation. 2. It should establish a sales returns and allowances account (a contra revenue) for potential cancellations. An estimate of future cancellations should be made and the amount should reduce net sales in the period the revenue is recognized. 3. Profiting from sales of stock they owned at an inflated stock price and perhaps receiving bonuses determined on the basis of growth in net income probably motivated management. Management was very focused on reporting increased growth because the growth fueled the run-up in the stock price. 6-40 Chapter 06 - Reporting and Interpreting Sales Revenue, Receivables, and Cash CP6–5. (continued) 4. The other investors who paid inflated amounts for the stock, customers who were poorly served during the period, and employees of the company who were drawn into the fraud and suffered damage to their reputations were all hurt by management’s conduct. 5. Sales transactions booked near the end of the quarter and sales with special terms, e.g. right of return or cancellation, should receive special attention from auditors. Channel stuffing often lowers the receivables turnover ratio. To cover up this change, management improperly reclassified some accounts receivable as notes receivable. CP6–6. Req. 1 (a) $50 x 12 months (b) $12 x (52 weeks x 5 days per week) (c,d) Accounts receivable collections ($300 + $800) Total approximate amount stolen = = = $ 600 3,120 1,100 $4,820 Req. 2 Basic recommendations: (1) Install a tight system of internal control, including the following: a. Separate cash handling from recordkeeping. b. Deposit all cash daily. c. Make all payments by check. Consider a separate cash on hand system for small expense payments. d. Reconcile bank statement monthly. e. Institute a system of spot checks. f. Establish cash and paperwork flows. (2) a. Arrange for an annual independent audit on a continuing basis. b. Carefully plan and assign definite responsibilities for all employees. Focus on attaining internal control. Isolate the once trusted employee from all cash handling and accounting activities and consider dismissing and bringing charges against the employee. FINANCIAL REPORTING AND ANALYSIS PROJECTS CP6–7. The solutions to this case will depend on the company and/or accounting period selected for analysis. 6-41 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory Chapter 07 Reporting and Interpreting Cost of Goods Sold and Inventory ANSWERS TO QUESTIONS 1. Inventory often is one of the largest amounts listed under assets on the balance sheet which means that it represents a significant amount of the resources available to the business. The inventory may be excessive in amount, which is a needless waste of resources; alternatively it may be too low, which may result in lost sales. Therefore, for internal users inventory control is very important. On the income statement, inventory exerts a direct impact on the amount of income. Therefore, statement users are interested particularly in the amount of this effect and the way in which inventory is measured. Because of its impact on both the balance sheet and the income statement, it is of particular interest to all statement users. 2. Fundamentally, inventory should include those items, and only those items, legally owned by the business. That is, inventory should include all goods that the company owns, regardless of their particular location at the time. 3. The cost principle governs the measurement of the ending inventory amount. The ending inventory is determined in units and the cost of each unit is applied to that number. Under the cost principle, the unit cost is the sum of all costs incurred in obtaining one unit of the inventory item in its present state. 4. Goods available for sale is the sum of the beginning inventory and the amount of goods purchased during the period. Cost of goods sold is the amount of goods available for sale less the ending inventory. 5. Beginning inventory is the stock of goods on hand (in inventory) at the start of the accounting period. Ending inventory is the stock of goods on hand (in inventory) at the end of the accounting period. The ending inventory of one period automatically becomes the beginning inventory of the next period. 7-1 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory 6. 7. (a) Average cost–This inventory costing method in a periodic inventory system is based on a weighted-average cost for the entire period. At the end of the accounting period the average cost is computed by dividing the goods available for sale in units into the cost of goods available for sale in dollars. The computed unit cost then is used to determine the cost of goods sold for the period by multiplying the units sold by this average unit cost. Similarly, the ending inventory for the period is determined by multiplying this average unit cost by the number of units on hand. (b) FIFO–This inventory costing method views the first units purchased as the first units sold. Under this method cost of goods sold is costed at the oldest unit costs, and the ending inventory is costed at the newest unit costs. (c) LIFO–This inventory costing method assumes that the last units purchased are the first units sold. Under this method cost of goods sold is costed at the newest unit costs and the ending inventory is costed at the oldest unit costs. (d) Specific identification–This inventory costing method requires that each item in the beginning inventory and each item purchased during the period be identified specifically so that its unit cost can be determined by identifying the specific item sold. This method usually requires that each item be marked, often with a code that indicates its cost. When it is sold, that unit cost is the cost of goods sold amount. It often is characterized as a pick-and-choose method. When the ending inventory is taken, the specific items on hand, valued at the cost indicated on each of them, is the ending inventory amount. The specific identification method of inventory costing is subject to manipulation. Manipulation is possible because one can, at the time of each sale, select (pick and choose) from the shelf the item that has the highest or the lowest (or some other) unit cost with no particular rationale for the choice. The rationale may be that it is desired to influence, by arbitrary choice, both the amount of income and the amount of ending inventory to be reported on the financial statements. To illustrate, assume item A is stocked and three are on the shelf. One cost $100; the second one cost $115; and the third cost $125. Now assume that one unit is sold for $200. If it is assumed arbitrarily that the first unit is sold, the gross profit will be $100; if the second unit is selected, the gross profit will be $85; or alternatively, if the third unit is selected, the gross profit will be $75. Thus, the amount of gross profit (and income) will vary significantly depending upon which one of the three is selected arbitrarily from the shelf for this particular sale. This assumes that all three items are identical in every respect except for their unit costs. Of course, the selection of a different unit cost, in this case, also will influence the ending inventory for the two remaining items. 7-2 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory 8. LIFO and FIFO have opposite effects on the inventory amount reported under assets on the balance sheet. The ending inventory is based upon either the oldest unit cost or the newest unit cost, depending upon which method is used. Under FIFO, the ending inventory is costed at the newest unit costs, and under LIFO, the ending inventory is costed at the oldest unit costs. Therefore, when prices are rising, the ending inventory reported on the balance sheet will be higher under FIFO than under LIFO. Conversely, when prices are falling the ending inventory on the balance sheet will be higher under LIFO than under FIFO. 9. LIFO versus FIFO will affect the income statement in two ways: (1) the amount of cost of goods sold and (2) income. When the prices are rising, FIFO will give a lower cost of goods sold amount and hence a higher income amount than will LIFO. In contrast, when prices are falling, FIFO will give a higher cost of goods sold amount and, as a result, a lower income amount. 10. When prices are rising, LIFO causes a lower taxable income than does FIFO. Therefore, when prices are rising, income tax is less under LIFO than FIFO. A lower tax bill saves cash (reduces cash outflow for income tax). The total amount of cash saved is the difference between LIFO and FIFO inventory amounts multiplied by the income tax rate. 11. LCM is applied when market (defined as current replacement cost) is lower than the cost of units on hand. The ending inventory is valued at market (lower), which (a) reduces net income and (b) reduces the inventory amount reported on the balance sheet. The effect of applying LCM is to include the holding loss on the income statement (as a part of CGS) in the period in which the replacement cost drops below cost rather than in the period of actual sale. 12. When a perpetual inventory system is used, the unit cost must be known for each item sold at the date of each sale because at that time two things happen: (a) the units sold and their costs are removed from the perpetual inventory record and the new inventory balance is determined; (b) the cost of goods sold is determined from the perpetual inventory record and an entry in the accounts is made as a debit to Cost of Goods Sold and a credit to Inventory. In contrast, when a periodic inventory system is used the unit cost need not be known at the date of each sale. In fact, the periodic system is designed so that cost of goods sold for each sale is not known at the time of sale. At the end of the period, under the periodic inventory system, cost of goods sold is determined by adding the beginning inventory to the total goods purchased for the period and subtracting from that total the ending inventory amount. The ending inventory amount is determined by means of a physical inventory count of the goods remaining on hand and with the units valued on a unit cost basis in accordance with the cost principle (by applying an appropriate inventory costing method). 7-3 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory ANSWERS TO MULTIPLE CHOICE 1. a) 6. c) 2. d) 7. a) 3. a) 8. c) 4. b) 9. c) 5. c) 10. a) Authors' Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 5 3 5 4 10 5 5 6 5 7 5 8 5 9 10 Exercises No. Time 1 15 2 20 3 20 4 10 5 15 6 15 7 30 8 30 9 30 10 30 11 15 12 20 13 15 14 20 15 15 16 20 17 20 18 20 19 25 20 20 21 25 22 25 Problems No. Time 1 30 2 30 3 40 4 40 5 45 6 50 7 40 8 40 9 35 10 20 Alternate Problems No. Time 1 30 2 40 3 35 4 40 Cases and Projects No. Time 1 20 2 20 3 20 4 20 5 40 6 20 7 30 8 * * Due to the nature of these cases and projects, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time to discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 7-4 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory MINI-EXERCISES M7–1. Type of Inventory Type of Business Merchandising Manufacturing Work in process Finished goods Merchandise Raw materials X X X X M7–2. To record the purchase of 90 new shirts in accordance with the cost principle (perpetual inventory system): Inventory (+A) .............................................................. Cash (A).......................................................... 2,600 2,600 Cost: $2,250 + $185 + $165 = $2,600. The $135 interest expense is not a proper cost of the merchandise; it is recorded as prepaid interest expense and later as interest expense. M7–3. (1) Part of inventory a. Wages of factory workers X b. Costs of raw materials purchased X c. Sales salaries d. Heat, light, and power for the factory building e. Heat, light, and power for the headquarters office building (2) Expense as incurred X 7-5 X X Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory M7–4. Computation: Simply rearrange the basic inventory model (BI + P – EI = CGS): Cost of goods sold ................................................. + Ending inventory .................................................... – Beginning inventory ............................................... Purchases .............................................................. $11,571 million 3,259 million (3,641) million $11,189 million M7–5. (a) (b) Declining costs Highest net income Highest inventory Rising costs Highest net income Highest inventory LIFO LIFO FIFO FIFO M7–6. LIFO is often selected when costs are rising because it reduces the company’s tax liability which increases cash and benefits shareholders. However, it also reduces reported net income. M7–7. Quantity Item A Item B Total 70 30 Cost per Item $ 85 60 Replacement Lower of Cost Reported on Cost per Item or Market Balance Sheet $100 $85 70 x $85 = $5,950 55 55 30 x $55 = $1,650 $7,600 M7–8. + (a) Parts inventory delivered daily by suppliers instead of weekly. NE (b) Extend payments for inventory purchases from 15 days to 30 days. + (c) Shorten production process from 10 days to 8 days. 7-6 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory M7–9. Understatement of the 2011 ending inventory by $100,000 caused 2011 pretax income to be understated and 2012 pretax income to be overstated by the same amount. Overstatement of the 2011 ending inventory would have the opposite effect; that is, 2011 pretax income would be overstated by $100,000 and 2012 pretax income understated by $100,000. Total pretax income for the two years combined would be correct. 7-7 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory EXERCISES E7–1 Item Amount Explanation Ending inventory (physical count on December 31, 2011) $34,500 Per physical inventory. a. Goods purchased and in transit + Goods purchased and in transit, F.O.B. shipping point, are owned by the purchaser. b. Samples out on trial to customer + 1,800 c. Goods in transit to customer d. Goods sold and in transit 700 Samples held by a customer on trial are still owned by the vendor; no sale or transfer of ownership has occurred. Goods shipped to customers, F.O.B. shipping point, are owned by the customer because ownership passed when they were delivered to the transportation company. The inventory correctly excluded these items. + 1,500 Correct inventory, December 31, 2011 Goods sold and in transit, F.O.B. destination, are owned by the seller until they reach destination. $38,500 E7–2. (Italics for missing amounts only.) Case A Net sales revenue .......... Beginning inventory ........ Purchases .................. Goods available for sale . Ending inventory ............ Cost of goods sold.......... Gross profit .................. Expenses .................. Pretax income ................ Case B $7,500 $11,200 5,000 16,200 10,200 $5,500 $ 6,500 8,550 15,050 11,050 6,000 1,500 400 $ 1,100 7-8 Case C $6,000 $ 4,000 9,500 13,500 9,000 4,000 1,500 1,900 $ (400) 4,500 1,500 700 $ 800 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–3. (Italics for missing amounts only.) Beg. Sales InvenPurCase Revenue tory chases A B C D E $ 650 1,100 600 800 1,000 $100 200 150 150 200 $700 900 350 550 900 Total Available $800 1,100 500 700 1,100 Ending Inventory $500 300 300 300 600 Cost of Goods Sold Gross Profit Expenses $300 800 200 400 500 $350 300 400 400 500 $200 150 100 200 550 Pretax Income or (Loss) $150 150 300 200 (50) E7–4. Computations: Simply rearrange the cost of goods sold equation BI + P – EI = CGS P = CGS – BI + EI Cost of goods sold ................................... $1,178,584,000 – Beginning inventory .................................. (333,153,000) + Ending inventory ...................................... 372,422,000 Purchases ................................................ $1,217,853,000 E7-5 Units Cost of goods sold: Beginning inventory ($5) ............. 2,000 Purchases (March 21) ($7) ......... 5,000 (August 1) ($8) .......... 3,000 Goods available for sale .. 10,000 Ending inventory* ....................... 4,000 Cost of goods sold ........... 6,000 FIFO LIFO 10,000 35,000 24,000 69,000 31,000 38,000 10,000 35,000 24,000 69,000 24,000 45,000 Average Cost 10,000 35,000 24,000 69,000 27,600 41,400 *Ending inventory computations: FIFO: (3,000 units @ $8) + (1,000 units @ $7) = $31,000. LIFO: (2,000 units @ $5) + (2,000 units @ $7) = $24,000. Average: [(2,000 units @ $5) + (5,000 units @ $7) + (3,000 units @ $8)] = $69,000 ÷ 10,000 units = $6.90 per unit. 4,000 units @ $6.90 = $27,600. 7-9 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–6 Units Cost of goods sold: Beginning inventory ($5) ............. 2,000 Purchases (March 21) ($4) ......... 6,000 (August 1) ($2) .......... 4,000 Goods available for sale .. 12,000 Ending inventory* ....................... 3,000 Cost of goods sold ........... 9,000 FIFO LIFO Average Cost $10,000 24,000 8,000 42,000 6,000 $36,000 $10,000 24,000 8,000 42,000 14,000 $28,000 $10,000 24,000 8,000 42,000 10,500 $31,500 *Ending inventory computations: FIFO: (3,000 units @ $2) = $6,000. LIFO: (2,000 units @ $5) + (1,000 units @ $4) = $14,000. Average: [(2,000 units @ $5) + (6,000 units @ $4) + (4,000 units @ $2)] = $42,000 ÷ 12,000 units = $3.50 per unit. 3,000 units @ $3.50 = $10,500. E7–7. Req. 1 ELEMENT COMPANY Income Statement For the Year Ended December 31, 2012 Case A FIFO Sales revenue1 .............................. Cost of goods sold: Beginning inventory ................ Purchases .............................. Goods available for sale2 Ending inventory3 .................. Cost of goods sold ........... Gross profit .................................. Expenses .................................. Pretax income ................................ $550,000 $ 36,000 210,000 246,000 130,000 Sales: (11,000 units @ $50) = $550,000 7-10 $550,000 $ 36,000 210,000 246,000 96,000 116,000 434,000 195,000 $239,000 Computations: (1) Case B LIFO 150,000 400,000 195,000 $205,000 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–7. (continued) (2) Goods available for sale (for both cases): Beginning inventory Purchase, April 11, 2012 Purchase, June 1, 2012 Goods available for sale Units Unit Cost Total Cost 3,000 9,000 8,000 20,000 $12 10 15 $ 36,000 90,000 120,000 $246,000 Ending inventory (20,000 available – 11,000 units sold = 9,000 units): (3) Case A FIFO: (8,000 units @ $15 = $120,000) + (1,000 units @ $10 = $10,000) = $130,000. Case B LIFO: (3,000 units @ $12 = $36,000)+ (6,000 units @ $10 = $60,000) = $96,000. Req. 2 Comparison of Amounts Pretax Income Difference Ending Inventory Difference Case A FIFO Case B LIFO $239,000 $205,000 $34,000 130,000 96,000 34,000 The above tabulation demonstrates that the pretax income difference between the two cases is exactly the same as the inventory difference. Differences in inventory have a dollar-for-dollar effect on pretax income. Req. 3 LIFO may be preferred for income tax purposes because it reports less taxable income (when prices are rising) and hence (a) reduces income tax and (b) as a result reduces cash outflows for the period. 7-11 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–8. Req. 1 BECK INC. Income Statement For the Year Ended December 31, 2012 Case A FIFO Sales revenue1 .............................. Cost of goods sold: Beginning inventory ................ Purchases .............................. Goods available for sale2 Ending inventory3 .................. Cost of goods sold ........... Gross profit .................................. Expenses .................................. Pretax income ................................ Case B LIFO $704,000 $704,000 $ 35,000 281,000 316,000 128,000 $ 35,000 281,000 316,000 80,000 188,000 516,000 500,000 $16,000 236,000 468,000 500,000 $(32,000) Computations: (1) (2) Sales: (8,000 units @ $28) + (16,000 units @ $30) = $704,000 Goods available for sale (for both cases): Beginning inventory Purchase, March 5, 2012 Purchase, September 19, 2012 Goods available for sale (3) Units Unit Cost Total Cost 7,000 19,000 10,000 36,000 $5 9 11 $ 35,000 171,000 110,000 $316,000 Ending inventory (36,000 available – 24,000 units sold = 12,000 units): Case A FIFO: (10,000 units @ $11 = $110,000) + (2,000 units @ $9 = $18,000) = $128,000. Case B LIFO: (7,000 units @ $5 = $35,000)+ (5,000 units @ $9 = $45,000) = $80,000. 7-12 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–8. (continued) Req. 2 Comparison of Amounts Case A FIFO Case B LIFO Pretax Income Difference $16,000 $(32,000) Ending Inventory 128,000 Difference $48,000 80,000 48,000 The above tabulation demonstrates that the pretax income difference between the two cases is exactly the same as the inventory difference. Differences in inventory have a dollar-for-dollar effect on pretax income. Req. 3 LIFO may be preferred for income tax purposes because it reports less taxable income (when prices are rising) and hence (a) reduces income tax and (b) as a result reduces cash outflows for the period. 7-13 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–9. Req. 1 LIFO Average Cost $ 76,000 320,000 396,000 68,400 $327,600 $ 76,000 320,000 396,000 71,280 $324,720 FIFO LIFO Average Cost $615,000 324,000 291,000 194,500 96,500 28,950 $ 67,550 $615,000 327,600 287,400 194,500 92,900 27,870 $ 65,030 $615,000 324,720 290,280 194,500 95,780 28,734 $ 67,046 Units FIFO Cost of goods sold: Beginning inventory .................... 2,000 $ 76,000 Purchases................................... 8,000 320,000 Goods available for sale .. 10,000 396,000 Ending inventory* ....................... 1,800 72,000 Cost of goods sold ........... 8,200 $324,000 Income statement Sales revenue ....................................... Cost of goods sold................................. Gross profit ......................................... Expenses ......................................... Pretax income ....................................... Income tax expense (30%) ......... Net income ......................................... *Ending inventory computations: FIFO: 1,800 units @ $40 = $72,000. LIFO: 1,800 units @ $38 = $68,400. Average: [(2,000 units @ $38) + (8,000 units @ $40)] ÷ 10,000 units = $396,000 ÷ 10,000 units = $39.60 per unit. $39.60 x 1,800 units = $71,280. Req. 2 FIFO produces a more favorable (higher) net income because when prices are rising it gives a lower cost of goods sold amount. FIFO allocates the old (lower) unit costs to cost of goods sold. LIFO produces a more favorable cash flow than FIFO because, when prices are rising, it produces a higher cost of goods sold amount and lower taxable income and, therefore, lower income tax expense for the period. Cash outflow is less under LIFO by the amount of income tax reduction. LIFO causes these comparative effects because it allocates the new (higher) unit costs to cost of goods sold. Req. 3 When prices are falling, the opposite effect occurs–LIFO produces higher net income and less favorable cash flow than does FIFO. 7-14 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–10. Req. 1 FIFO Cost of goods sold: Beginning inventory (400 units @ $28)... Purchases (475 units @ $36) ................. Goods available for sale ......................... Ending inventory (545 units)*.................. Cost of goods sold (330 units) ................ $11,200 17,100 28,300 19,060 $ 9,240 LIFO $11,200 17,100 28,300 16,420 $11,880 Average Cost $11,200 17,100 28,300 17,625 $ 10,675 *Computation of ending inventory: FIFO: (475 units x $36) + (70 units x $28) = $19,060 LIFO: (400 units x $28) + (145 units x $36) = $16,420 Weighted Average: Units 400 475 875 Cost $11,200 17,100 $28,300 = weighted-average unit cost of $32.34. 545 units x $32.34 = $17,625 Req. 2 FIFO Sales revenue ($50 x 330) ............................... Cost of goods sold............................................. Gross profit ..................................................... Expenses ..................................................... Pretax income ................................................... 7-15 $16,500 9,240 7,260 1,700 $ 5,560 LIFO $16,500 11,880 4,620 1,700 $ 2,920 Average Cost $16,500 10,675 5,825 1,700 $ 4,125 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–10. (continued) Req. 3 Ranking in order of favorable cash flow: The higher rankings are given to the methods that produce the lower income tax expense because the lower the income tax expense the higher the cash savings. (1) LIFO–produces the lowest pretax income, hence the lowest amount of cash to be paid for income tax. (2) Weighted average–produces next lower pretax income. (3) FIFO–produces the highest pretax income and as a result the highest income tax. This result causes the lowest cash savings on income tax. The above comparative effects occurred because prices were rising. If prices were falling the three methods would have produced the opposite ranking. 7-16 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–11. Item Quantity A B C D E 50 80 10 70 350 Total Total Cost x x x x x $15 30 48 25 10 = = = = = Total Market $ 750 2,400 480 1,750 3,500 $8,880 x x x x x $12 40 52 30 5 = = = = = $600 3,200 520 2,100 1,750 $8,170 Inventory valuation that should be used (LCM) LCM Valuation $600 2,400 480 1,750 1,750 $6,980 $6,980 E7–12. Req. 1 Item Quantity Total Cost Total Market LCM Valuation A B 20 55 x x $10 40 = = $ 200 2,200 x x $15 = 44 = $300 2,420 $200 2,200 C D 35 10 Total x x 57 27 = = 1,995 270 $4,665 x x 55 = 32 = 1,925 320 $4,965 1,925 270 $4,595 Inventory valuation that should be used (LCM) $4,595 Req. 2 The write-down to lower of cost or market will increase cost of goods sold expense by the amount of the write-down, $70: Total Cost LCM Valuation = Write-down $4,665 $4,595 = $70 Write-down 7-17 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–13. Req. 1 Inventory turnover = Cost of Goods Sold Average Inventory = $50,144 ($1,180+$867)/2 = 48.99 Average days to sell inventory = 365 / inventory turnover = 365 / 48.99 = 7.5 days Req. 2 The inventory turnover ratio reflects how many times average inventory was produced and sold during the period. Thus, Dell produced and sold its average inventory nearly 49 times during the year. The average days to sell inventory indicates the average time it takes the company to produce and deliver inventory to customers. Thus, Dell takes an average of about 7.5 days to produce and deliver its computer inventory to its customers. 7-18 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–14. CASE A – FIFO: Goods available for sale for FIFO: Units (19 + 25 + 50) ..................................................... Amount ($304 + 350 + 950) ......................................... 94 $1,604 Ending inventory: 94 units – 68 units = 26. Ending inventory (26 units x $19) ................................ Cost of goods sold ($1,604 – $494)............................. Inventory turnover = Cost of Goods Sold = Average Inventory $1,110 ($304+$494)/2 $ 494 $1,110 = 2.78 CASE B – LIFO: Goods available for sale for LIFO: Units (19 + 25 + 50) ..................................................... Amount ($228 + 350 + 950) ......................................... 94 $1,528 Ending inventory: 94 units – 68 units = 26. Ending inventory (19 units x $12) + (7 units x $14) ..... Cost of goods sold ($1,528 – $326)............................. Inventory turnover = Cost of Goods Sold = Average Inventory $1,202 ($228+$326)/2 $ 326 $1,202 = 4.34 The FIFO inventory turnover ratio is normally thought to be a more accurate indicator when prices are changing because LIFO can include very old inventory prices in ending inventory balances. 7-19 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–15. Inventory A/P Current Year Previous Year 22,813,850 – 20,838,171 9,462,883 – 9,015,376 = = Change 1,975,679 447,507 Increases in inventory cause cash flow from operations to decrease by $1,975,679. This amount is subtracted in the computation of cash flow from operations. First Team Sports was able to offset some of this by increasing its A/P by $447,507, which increases cash flow from operations. This amount is added in the computation of cash flow from operations. Effectively, the Company is letting its suppliers finance a portion of its growing inventories. E7–16. Req. 1 The reported ending inventory for Ford was $8,618 million. If FIFO were used exclusively, the ending inventory would have been $891 million higher than reported, or $9,509 million. Req. 2 The restated cost of goods sold amount must reflect the restatement of both beginning and ending inventory: Beginning inventory ............................................... Less: Ending inventory .......................................... Impact on COGS ................................................... $1,100 million 891 million $ 209 million If FIFO had been used exclusively, cost of goods sold would have been $127,103 + $209 = $127,312 million. In this case, FIFO cost of goods sold is greater than LIFO cost of goods sold. This is likely the result of falling prices and/or a reduction in inventory quantities. Req. 3 When costs are rising, LIFO normally produces lower net income before taxes and lower current tax payments. 7-20 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–17. Req. 1 Net Income for 2011 will be Overstated. An understatement of purchases produces an understatement of cost of goods sold which produces an overstatement of the current period’s income. BI + P - EI Understate = CGS Understate Req. 2 Net Income for 2012 will be Understated. An overstatement of purchases produces an overstatement of cost of goods sold which produces an understatement of the current period’s income. BI + P - EI Overstate = CGS Overstate Req. 3 Retained Earnings for December 31, 2011, will be Overstated because of the overstatement of Net Income for 2011. Req. 4 Retained Earnings for December 31, 2012, will be Correct because the overstatement of Net Income for 2011 and understatement of Net Income for 2012 will offset one another. 7-21 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–18. Req. 1 When the ending inventory is overstated, cost of goods sold is understated which in turn results in an overstatement of net income. Gibson’s income from operations should be reduced by $8,806,000 and tax expense should be reduced by $3,460,758 (i.e., $8,806,000 x 0.393). Therefore, net income should be: As reported:........................................................ Increase in cost of good sold .............................. Reduction in tax expense ................................... Corrected income ............................................... $25,852,000 (8,806,000) 3,460,758 $20,506,758 Req. 2 The incorrect accounts can be summarized as follows: Account (a) Year of Error Beginning inventory Cost of goods sold Ending inventory Income tax expense Net income Retained earnings Taxes payable* correct understated overstated overstated overstated overstated overstated (b) Subsequent Year overstated overstated correct understated understated correct understated *The income tax payable for each year is incorrect by the same amount; therefore the total income tax paid was correct. 7-22 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–19. Req. 1 The $600 understatement of ending inventory produced pretax income amounts that were incorrect by the amount of $600 for each quarter. However, the effect on pretax income for each quarter was opposite (i.e., the first quarter pretax income was understated by $600, and in the second quarter it was overstated by $600). This selfcorrecting produces a correct combined income for the two quarters. Req. 2 The error caused the pretax income for each quarter to be incorrect [see (1) above]; therefore, it produced incorrect EPS amounts for each quarter. Req. 3 First Quarter Sales revenue ........................................ Cost of goods sold: Beginning inventory ..................... $4,000 Purchases.................................... 3,000 Goods available for sale ... 7,000 Ending inventory .......................... 4,400 Cost of goods sold ............ Gross profit .......................................... Expenses .......................................... Pretax income ........................................ Second Quarter $11,000 $18,000 $ 4,400 13,000 17,400 9,000 2,600 8,400 5,000 $3,400 8,400 9,600 6,000 $3,600 Req. 4 1st Quarter Incorrect Beginning inventory Correct 2nd Quarter Error Incorrect Correct Error $4,000 $4,000 No error $3,800 $4,400 $600 under Ending inventory 3,800 4,400 $600 under 9,000 9,000 No error Cost of goods sold 3,200 2,600 600 over 7,800 8,400 600 under Gross profit 7,800 8,400 600 under 10,200 9,600 600 over Pretax income 2,800 3,400 600 under 4,200 3,600 600 over 7-23 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–20. (Supplement A) Req. 1 This actual footnote from ConocoPhillips illustrates the impact of “dipping into a LIFO layer.'' Under LIFO, the cost of recently purchased items is assigned to cost of goods sold. When prices are rising, cost of goods sold, under LIFO, will include unit costs that are much higher than the unit costs assigned to ending inventory. This process will continue year after year so that the unit costs assigned to the ending inventory often will be significantly less than unit costs assigned to cost of goods sold. When a business permits inventory quantity to decline, old (and often very low) costs are allocated to cost of goods sold and are matched with revenues that usually are based on the current (higher) costs. As a result, a decline in LIFO inventory quantity often will produce a dramatic increase in net income for the company. Req. 2 When FIFO is used, a decline in inventory quantity will not result in the dramatic increase in net income that was discussed in requirement (1) because FIFO inventory costs are represented by the most recent purchases. E7–21. (Supplement B) Req. 1 Req. 2 Req. 3 Req. 4 Req. 5 Req. 6 Accounts receivable (+A) ...................................................900 Sales (+R, +SE) ............................................................ 900 Cost of goods sold (+E, SE) .............................................600 Inventory (A) ................................................................ 600 Cash (+A) ($900 x 0.98) .....................................................882 Sales discounts (+XR, R, SE) ($900 x 0.02) .................. 18 Accounts receivable (A) .............................................. 900 Cash (+A) ...........................................................................900 Accounts receivable (A) .............................................. 900 Inventory (+A) ..................................................................... 8,400 Accounts payable (+L)................................................... 8,400 8,400 Accounts payable (L) ........................................................ Inventory (A) ($8,400 x 0.03) ...................................... Cash (A) ($8,400 x 0.97)............................................. 252 8,148 8,400 Accounts payable (L) ........................................................ Cash (A) ..................................................................... 8,400 7-24 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory E7–22. (Supplement C) CASE A: Perpetual inventory system: January 14 Accounts receivable (+A) ....................................................950 Sales (+R, +SE) (20 units at $47.50)............................. 950 Cost of goods sold (+E, SE) .............................................400 Inventory (A) (20 units at $20) ..................................... 400 Inventory (+A) (15 units at $20) ..........................................300 Accounts payable (+L)................................................... 300 September 2 Accounts receivable (+A) .................................................... 2,250 Sales (+R, +SE) (45 units at $50).................................. 2,250 Cost of goods sold (+E, SE) .............................................900 Inventory (A) (45 units at $20) ..................................... 900 April 9 End of year No year-end adjusting entry needed. CASE B: Periodic inventory system: January 14 Accounts receivable (+A) ....................................................950 Sales (+R, +SE) (20 units at $47.50)............................. 950 Purchases (+A) (15 units at $20) ........................................300 Accounts payable (+L)................................................... 300 September 2 Accounts receivable (+A) .................................................... 2,250 Sales (+R, +SE) (45 units at $50).................................. 2,250 2,300 Cost of goods sold (+E, SE) (goods avail. for sale) .......... Purchases (A) ............................................................. Inventory (A) (Beginning: 100 units at $20) ................ 300 2,000 Inventory (+A) (Ending: 50 units at $20) ............................ 1,000 Cost of goods sold (E, +SE) ........................................ 1,000 April 9 End of year Calculation of cost of goods sold: Beginning inventory (100 units at $20) Add purchases Goods available for sale Ending inventory (physical count—50 units at $20) Cost of goods sold 7-25 $2,000 300 2,300 1,000 $1,300 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory PROBLEMS P7–1. Item Amount Explanation Ending inventory (physical count on December 31, 2011) $65,000 Per physical inventory. a. Goods out on trial to customer + b. Goods in transit from supplier Goods shipped by a supplier, F.O.B. destination, are owned by the supplier until delivery at destination. c. Goods in transit to customer Goods shipped to customers, F.O.B. shipping point, are owned by the customer because ownership passed when they were delivered to the transportation company. The inventory correctly excluded these items. d. Goods held for customer pickup – 1,590 The goods sold, but held for customer pickup, are owned by the customer. Ownership has passed. e. Goods purchased and in transit + 3,550 Goods purchased and in transit, F.O.B. shipping point, are owned by the purchaser. f. Goods sold and in transit + g. Goods held on consignment – 5,700 Goods held on consignment are owned by the consignor (the manufacturer), not by the consignee. $62,860 Correct inventory, December 31, 2011 750 Goods held by a customer on trial are still owned by the vendor; no sale or transfer of ownership has occurred. 850 7-26 Goods sold and in transit, F.O.B. destination, are owned by the seller until they reach destination. Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory P7–2. a) Goods available for sale for all methods: Units January 1, 2012–Beginning inventory January 30, 2012–Purchase May 1, 2012–Purchase Goods available for sale 400 600 460 1,460 Unit Cost $3.00 3.20 3.50 Total Cost $ 1,200 1,920 1,610 $4,730 Ending inventory: 1,460 units – (160 + 700) = 600 units b) and c) 1. 2. Average cost: Average unit cost Ending inventory Cost of goods sold First-in, first-out: Ending inventory Cost of goods sold 3. Last-in, first-out: Ending inventory Cost of goods sold 4. Specific identification: Ending inventory Cost of goods sold $4,730 ÷ 1,460 = $3.24 (600 units x $3.24) ($4,730 – $1,944) $1,944 $2,786 (460 units x $3.50) + (140 units x $3.20) $2,058 ($4,730 – $2,058) $2,672 (400 units x $3.00) + (200 units x $3.20) $1,840 ($4,730 – $1,840) $2,890 ( 0 units x $3.00) + ( 504 units x $3.20) + ( 96 units x $3.50) $1,949 ($4,730 – $1,949) $2,781 7-27 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory P7–3. Req. 1 DONNER COMPANY Partial Income Statement For the Month Ended January 31, 2011 (a) Average Cost Sales revenue* Cost of goods sold** Gross profit $9,920 3,630 $ 6,290 (b) (c) FIFO LIFO $9,920 3,220 $ 6,700 $9,920 4,040 $ 5,880 (d) Specific Identification $9,920 3,350 $ 6,570 Computations: *620 units @ $16 = $9,920. **Cost of goods sold: Units Beginning inventory Purchases (net)*** Goods available for sale Ending inventory**** Cost of goods sold ***Purchases: January 12 January 26 Totals 600 160 760 500 760 1,260 640 620 Average Cost $2,500 4,880 7,380 3,750 $3,630 units @ $6 units @ $8 ****Ending inventory: a. Average cost: Beginning inventory Purchases (per above) FIFO LIFO $2,500 4,880 7,380 4,160 $3,220 $2,500 4,880 7,380 3,340 $4,040 = $3,600 = 1,280 $4,880 Units 500 760 1,260 Amount $2,500 4,880 $7,380 Average cost: $7,380 ÷ 1,260 units = $5.86 Ending inventory: 640 units x $5.86 = $3,750 7-28 Specific Identification $2,500 4,880 7,380 4,030 $3,350 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory P7–3. (continued) Req. 1 (continued) b. FIFO: 160 480 640 units @ $8 = units @ $6 = $1,280 2,880 $4,160 c. LIFO: 500 140 640 units @ $5 = units @ $6 = $2,500 840 $3,340 d. Specific identification: 130 units @ $5 = 350 units @ $6 = 160 units @ $8 = 640 $ 650 2,100 1,280 $4,030 Req. 2 FIFO reports a higher pretax income than LIFO because (1) prices are rising and (2) FIFO allocates the old (lower) unit costs to cost of goods sold. For the same reason, FIFO will report a higher EPS amount because it produces a higher pretax income than LIFO. Req. 3 Because LIFO reports a lower pretax income than FIFO for the reasons given in Requirement (2), the former will derive less income tax by ($6,700 – $5,880) x 30% = $246. Req. 4 LIFO will provide a more favorable cash flow than FIFO of $246 because less cash will be paid for income tax in the current year than would be paid under FIFO (for the reasons given in Requirements 2 and 3). 7-29 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory P7–4. Req. 1 Sales revenue Cost of goods sold* (42 @ $10,000) + (5 @ $11,500) Gross profit Expenses Pretax income $1,151,500 477,500 674,000 300,000 $ 374,000 *Ending inventory (15 @ $11,500) $ 172,500 Req. 2 Sales revenue Cost of goods sold** (20 @ $9,500) + (27 @ $10,000) Gross profit Expenses Pretax income $1,151,500 460,000 691,500 300,000 $ 391,500 **Ending inventory (20 @ $11,500) + (15 @ $10,000) $ 380,000 Req. 3 Pretax income increased by $17,500 because of the decision to purchase the additional units at the end of the year. This decision provided lower cost units to allocate to cost of goods sold, which increased pretax income. There is evidence of deliberate income manipulation. Although no information is provided as to expected future sales, nor the time to order and receive units, the timing of the purchase of the additional units is suspect because the cost of the equipment will be decreased again during the first quarter of next year. (Instructional Note–This problem illustrates the way that income can be manipulated under LIFO by buying, or not buying, at year-end. This opportunity to manipulate income is not available under weighted average or FIFO.) 7-30 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory P7–5. Req. 1 Sales revenue (500 units) Cost of goods sold: Beginning inventory (300 units) Purchases (400 units) Goods available for sale Ending inventory (200 units)* Cost of goods sold (500 units) Gross profit Expenses Pretax income Income tax expense (30%) Net income Prices Rising A B FIFO LIFO $15,000 $15,000 3,300 4,800 8,100 2,400 (a) 5,700 9,300 4,000 5,300 1,590 $3,710 3,300 4,800 8,100 2,200 (b) 5,900 9,100 4,000 5,100 1,530 $3,570 *Inventory computations: (a) FIFO: 200 units @ $12.00 = (b) LIFO: 200 units @ $11.00 = (c) FIFO: 200 units @ $11.00 = (d) LIFO: 200 units @ $12.00 = Prices Falling C D FIFO LIFO $15,000 $15,000 3,600 4,400 8,000 2,200 (c) 5,800 9,200 4,000 5,200 1,560 $3,640 3,600 4,400 8,000 2,400 (d) 5,600 9,400 4,000 5,400 1,620 $3,780 $2,400 2,200 2,200 2,400 Req. 2 The above tabulation demonstrates that when prices are rising, FIFO gives a higher net income than LIFO. When prices are falling, the opposite effect results. The difference in pretax income (as between FIFO and LIFO) is the same as the difference in cost of goods sold but in the opposite direction. The difference in net income (i.e., after tax) is equal to the difference in cost of goods sold multiplied by one minus the income tax rate. Req. 3 When prices are rising, LIFO derives a more favorable cash position (than FIFO) equal to the difference in income tax. In contrast, when prices are falling, FIFO derives a more favorable cash position equal to the difference in income tax. 7-31 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory P7–5. (continued) Req. 4 Either method can be defended reasonably. If one focuses on current income and EPS, FIFO derives a more favorable result (higher than LIFO when prices are rising). Alternatively, if one focuses on income tax expense and cash position, when prices are rising, LIFO derives more favorable results (lower taxes, better cash position). However, these comparative results will reverse if prices fall. FIFO provides a better balance sheet valuation (higher current asset value) but on the income statement does not match current expense (cost of goods sold) with current revenues. Alternatively, LIFO better matches expenses with revenues but produces a less relevant inventory valuation on the balance sheet. P7–6. Req. 1 HARVEY COMPANY Income Statement (LCM basis) For the Year Ended December 31, 2011 Sales revenue Cost of goods sold: Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold Gross profit Operating expenses Pretax income Income tax expense ($38,850 x 30%) Net income *Computation of ending inventory on LCM basis: 7-32 $280,000 $ 33,000 184,000 217,000 37,850* 179,150 100,850 62,000 38,850 11,655 $ 27,195 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory Item Quantity A B C D 3,050 1,500 7,100 3,200 Total Replacement Cost (Market) Original Cost x $3 x 5 x1.5 x 6 = $ 9,150 = 7,500 = 10,650 = 19,200 $46,500 x $4 x3.5 x3.5 x 4 = = = = $12,200 5,250 24,850 12,800 $55,100 LCM inventory valuation LCM Valuation $ 9,150 5,250 10,650 12,800 $37,850 Req. 2 Item Changed Ending inventory Cost of goods sold Gross profit Pretax income Income tax expense Net income P7–6. (continued) FIFO Cost Basis LCM Basis Amount of Change (Decrease) $ 46,500 170,500 109,500 47,500 14,250 33,250 $ 37,850 179,150 100,850 38,850 11,655 27,195 ($8,650) 8,650 ( 8,650) ( 8,650) ( 2,595) ( 6,055) Req. 2 (continued) Analysis Ending inventory, cost of goods sold, gross profit, and pretax income each changed by the change in the valuation of the ending inventory. Income tax expense decreased because the increase in expense reduced pretax income. Net income was reduced by $8,650 (increased expense of $8,650) less the income tax savings of $2,595 = $6,055. Req. 3 The inventory costing methods (average cost, FIFO, LIFO, and specific identification) apply the cost and matching principles. Cost of goods sold, under these principles, is the actual cost incurred for the merchandise sold during the period; this cost is matched with sales revenue of the period. 7-33 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory LCM is an exception to the cost principle. Conceptually, LCM is based on the view that when replacement is less than the cost incurred for the merchandise, any such goods on hand should be valued at the lower replacement (market) price. The effect is to include the holding loss (i.e., the drop from cost to market) in the cost of goods sold amount for the period in which the replacement cost dropped. LCM recognizes holding losses in this manner; however, it does not recognize holding gains. Req. 4 LCM reduced pretax income and income tax expense. There was a cash savings of $2,595 for 2011 (assuming the LCM results are included on the income tax return). In subsequent periods pretax income will be greater by the $8,650 and hence, income tax and cash outflow will be more. The only real gain to the company would be the time value of money between 2011 and the subsequent periods when increased income taxes must be paid (of course, a change in tax rates would affect this analysis). P7–7. Req. 1 Inventory Turnover = Cost of Goods Sold Average Inventory Projected change No change from beginning of year $7,008,984 = 14.2 $495,005* $7,008,984 = 11.8 $595,700** * ($595,700 + $394,310) ÷ 2 ** ($595,700 + $595,700) ÷ 2 Req. 2 Projected decrease in inventory = $595,700 – $394,310 = $201,390 A $201,390 increase in cash flow from operating activities, because a decrease in inventory would increase cash, all other items held constant. Req. 3 An increase in the inventory turnover ratio indicates an increase in the number of times average inventory was produced and sold during the period. A higher ratio indicates that inventory moves more quickly through the production process to the ultimate customer. As a consequence, the company can maintain less inventory on hand, all other things being equal. This can benefit the company because less money is tied up in inventory and as a result, cash flow from operations will be higher. The excess cash can be invested, earning interest income, or used to reduce borrowings, reducing interest expense. 7-34 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory P7–8. Req. 1 A change that increases beginning inventory will decrease net income while a change that increases ending inventory will increase net income. Impact on GM net income (in millions) Change in ending inventory Change in beginning inventory Increase in pretax income Increase in taxes (30%) Increase in net income $2,077.1 (1,784.5) 292.6 (87.8) $ 204.8 Use of FIFO would result in an increase of $204.8 million in GM reported net income. The change would result in an increase in income taxes because the LIFO conformity rule precludes use of LIFO for tax purposes if a method other than LIFO were used for financial reporting. Reported net income Increase FIFO net income $320.5 204.8 $525.3 Req. 2 If FIFO had been used, the ending inventory would have been $2,077.1 million higher. Instead LIFO was used and the $2,077.1 million was allocated to cost of goods sold in earlier accounting periods (including the current year). Thus, the cumulative difference between LIFO pretax income and FIFO pretax income was $2,077.1 million, or a difference of $1,454 million after taxes ($2,077.1 x .7). Therefore, retained earnings on a FIFO basis would have been $16,794 million (i.e., $15,340 + $1,454). Req. 3 The reduction in taxes (compared to FIFO) was $87.8 million (calculated in Req. 1). 7-35 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory P7–9. Req. 1 2011 Sales revenue Cost of goods sold Gross profit Expenses Pretax income Income tax expense (30%) Net income $2,025,000 1,505,000 520,000 490,000 30,000 9,000 $ 21,000 2012 2013 $2,450,000 $2,700,000 1,645,000* 1,764,000* 805,000 936,000 513,000 538,000 292,000 398,000 87,600 119,400 $ 204,400 $ 278,600 2014 $2,975,000 2,113,000 862,000 542,000 320,000 96,000 $ 224,000 *There was an overstatement of the ending inventory in 2012 by $18,000; this caused cost of goods sold for 2012 to be understated and 2012 net income to be overstated. Similarly, because this error was carried over automatically to 2013 as the beginning inventory, cost of goods sold for 2013 was overstated and 2013 net income understated. The amounts for 2011 and 2014 were not affected. This is called a selfcorrecting or counterbalancing error. Cumulative net income for the four-year period was not affected. Req. 2 2011 2012 Gross profit ratio (gross profit ÷ sales): Before correction: $520,000 ÷ $2,025,000 = .26 $823,000 ÷ $2,450,000 = $918,000 ÷ $2,700,000 = $862,000 ÷ $2,975,000 = After correction: No change $805,000 ÷ $2,450,000 = $936,000 ÷ $2,700,000 = No change 2013 2014 .34 .34 .29 .26 .33 .35 .29 Req. 3 The effect of the error on income tax expense was: Income tax expense reported Correct income tax expense Income tax expense overstatement (understatement) 7-36 2012 $93,000 87,600 $ 5,400 2013 $114,000 119,400 $(5,400) Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory P7–10. (Supplement A) Req. 1 Pretax operating profit (loss) for the current year had FIFO accounting been employed instead of LIFO. Difference in beginning inventory* (LIFO to FIFO) Less: Difference in ending inventory* (LIFO to FIFO) Difference in cost of goods sold (LIFO to FIFO) $2,076 2,226 $ (150) Difference in Pretax Net Income = $150 increase (*The differences are the beginning and ending LIFO Reserve.) Req. 2 Since prices are rising, LIFO liquidations increase net income before taxes. The change in pretax operating profit during the current year is given in the footnote as $23 million. As a consequence, net income before taxes would be $23 million lower had there been no inventory quantity reduction. 7-37 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory ALTERNATE PROBLEMS AP71. a) Goods available for sale for all methods: Units January 1, 2011–Beginning inventory February 20, 2011–Purchase June 30, 2011–Purchase Goods available for sale 390 700 460 1,550 Unit Cost $32 34 37 Total Cost $12,480 23,800 17,020 $53,300 Ending inventory: 1,550 units – (70 + 750) = 730 units b) and c) 1. 2. Average cost: Average unit cost Ending inventory Cost of goods sold First-in, first-out: Ending inventory Cost of goods sold 3. Last-in, first-out: Ending inventory Cost of goods sold 4. Specific identification: Ending inventory Cost of goods sold $53,300 ÷ 1,550=$34.39. (730 units x $34.39) ($53,300 – $25,105) $25,105 $28,195 (460 units x $37) + (270 units x $34) $26,200 ($53,300 – $26,200) $27,100 (390 units x $32) + (340 units x $34) $24,040 ($53,300 – $24,040) $29,260 (658 units x $34) + (72 units x $37) $25,036 ($53,300 – $25,036) $28,264 7-38 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory AP7–2. Req. 1 NEWRIDGE COMPANY Partial Income Statement For the Month Ended January 31, 2012 Sales revenue* Cost of goods sold** Gross profit (a) Average Cost (b) (c) FIFO LIFO (d) Specific Identification $3,840 2,256 $1,584 $3,840 2,040 $1,800 $3,840 2,560 $1,280 $3,840 2,060 $1,780 Computations: *Sales revenue = 240 units @ $16 = $3,840. **Cost of Goods Sold Amounts: a) Average Cost Number of Units 120 380 200 x x x x Total Cost $ 960 3,420 2,200 = $8 = 9 = 11 = Available for Sale 700 = Cost of Goods Sold Unit Cost $6,580 $6,580 700 units = $9.40 per unit = $9.40 x 240 units = $2,256 Cost of Goods Sold b) FIFO First Units in (Beginning Inventory) Next Units in (January 12) Total Cost of Goods Sold (FIFO) c) LIFO Last Units in (January 26) Next Units in (January 12) Total Cost of Goods Sold (LIFO) 7-39 Unit Units Cost 120 $8 120 9 240 200 40 240 $11 9 Total Cost $ 960 1,080 $2,040 $2,200 360 $2,560 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory AP7–2. (continued) Cost of Goods Sold d) Specific First sale Identification Second sale Total Cost of Goods Sold Unit Cost $ 8 9 Units 100 140 240 Total Cost $ 800 1,260 $2,060 Cost of Ending Inventory Amounts: a) Average Cost Ending Inventory b) c) = = $9.40 x 460 units $4,324 Ending Inventory FIFO Last Units in (January 26) Next Units in (January 12) Total Ending Inventory FIFO Units 200 260 460 LIFO First Units in (Beginning Inventory) Next Units in (January 12) Total Ending Inventory LIFO Unit Cost Total Cost $11 $2,200 9 2,340 $4,540 $8 9 120 340 460 Ending Inventory d) Specific Beginning Identification January 12 January 26 Total Ending Inventory (Spec.) Units 20 240 200 460 Unit Cost $ 8 9 11 $ 960 3,060 $4,020 Total Cost $ 160 2,160 2,200 $4,520 Req. 2 FIFO reports a higher pretax income than LIFO because (1) prices are rising and (2) FIFO allocates the old (lower) unit costs to cost of goods sold. For the same reason, FIFO will report a higher EPS amount because it produces a higher pretax income than LIFO. 7-40 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory AP7–2. (continued) Req. 3 Because LIFO reports a lower pretax income than FIFO for the reasons given in Requirement (2), LIFO will result in lower income tax by ($1,800 – $1,280) x 30% = $156. Req. 4 LIFO will provide a more favorable cash flow than FIFO of $156 because less cash will be paid for income tax than would be paid under FIFO (for the reasons given in Requirements 2 and 3). 7-41 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory AP7–3. Req. 1 Sales revenue (510 units) Cost of goods sold: Beginning inventory (340 units) Purchases (410 units) Goods available for sale Ending inventory (240 units)* Cost of goods sold (510 units) Gross profit Expenses Pretax income Income tax expense (30%) Net income Prices Rising A B FIFO LIFO $13,260 $13,260 3,060 4,100 7,160 2,400 (a) 4,760 8,500 5,000 3,500 1,050 $2,450 3,060 4,100 7,160 2,160 (b) 5,000 8,260 5,000 3,260 978 $2,282 *Inventory computations: (a) FIFO: 240 units @ $10.00 = (b) LIFO: 240 units @ $9.00 = (c) FIFO: 240 units @ $9.00 = (d) LIFO: 240 units @ $10.00 = Prices Falling C D FIFO LIFO $13,260 $13,260 3,400 3,690 7,090 2,160 (c) 4,930 8,330 5,000 3,330 999 $2,331 3,400 3,690 7,090 2,400 (d) 4,690 8,570 5,000 3,570 1,071 $2,499 $2,400 2,160 2,160 2,400 Req. 2 The above tabulation demonstrates that when prices are rising, FIFO gives a higher net income than LIFO. When prices are falling, the opposite effect results. The difference in pretax income (as between FIFO and LIFO) is the same as the difference in cost of goods sold but in the opposite direction. The difference in net income (i.e., after tax) is equal to the difference in cost of goods sold multiplied by one minus the income tax rate. Req. 3 When prices are rising, LIFO derives a more favorable cash position (than FIFO) equal to the difference in income tax. In contrast, when prices are falling, FIFO derives a more favorable cash position equal to the difference in income tax. 7-42 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory AP7–3. (continued) Req. 4 Either method can be defended reasonably. If one focuses on current income and EPS, FIFO derives a more favorable result (higher than LIFO when prices are rising). Alternatively, if one focuses on income tax expense and cash position, when prices are rising, LIFO derives more favorable results (lower taxes, better cash position). However, these comparative results will reverse if prices fall. FIFO provides a better balance sheet valuation (higher current asset value) but on the income statement does not match current expense (cost of goods sold) with current revenues. Alternatively, LIFO better matches expenses with revenues but produces a less relevant inventory valuation on the balance sheet. AP7–4. Req. 1 COLCA COMPANY Income Statements Corrected 2011 Sales revenue Cost of goods sold Gross profit Expenses Pretax income 2012 $60,000 39,000 21,000 16,000 $ 5,000 $63,000 41,000* 22,000 17,000 $ 5,000 2013 $65,000 46,000* 19,000 17,000 $ 2,000 2014 $68,000 46,000 22,000 19,000 $ 3,000 * Increase in the ending inventory in 2012 by $2,000 causes a decrease in cost of goods sold by the same amount. Therefore, cost of goods sold for 2012 is $43,000 – $2,000 = $41,000. Because the 2012 ending inventory is carried over as the 2013 beginning inventory, cost of goods sold for 2013 was understated by $2,000. Thus, the correct cost of goods sold amount for 2013 is $44,000 + $2,000 = $46,000. 7-43 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory AP7–4. (continued) Req. 2 2011 2012 Gross profit ratio (gross profit ÷ sales): Before correction: $21,000 ÷ $60,000 = .35 $20,000 ÷ $63,000 = $21,000 ÷ $65,000 = $22,000 ÷ $68,000 = After correction: No change $22,000 ÷ $63,000 = $19,000 ÷ $65,000 = No change 2013 2014 .32 .32 .32 .35 .35 .29 .32 Req. 3 The error would have the following effect on income tax expense: 2012 Before correction: 2012: $3,000 x 30% = 2013: $4,000 x 30% = After correction: 2012: $5,000 x 30% = 2013: $2,000 x 30% = Difference 2013 $900 $1,200 1,500 600 $ 600 $ (600) The income tax expense would have been understated by $600 in 2012 and overstated by $600 in 2013. 7-44 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory CASES AND PROJECTS ANNUAL REPORT CASES CP7–1 Req. 1 The company held $294,928 thousand of merchandise inventory at the end of the current year. This is disclosed on the balance sheet. Req. 2 The company purchased $1,823,208 thousand during the current year. The beginning and ending inventory balances are disclosed on the balance sheet and cost of goods sold is disclosed on the income statement. Purchases during the year can be computed by rearranging the basic inventory equation (BI + P – EI = CGS) or using a T-account: Cost of goods sold ............................................. $1,814,765 thousand + Ending inventory ............................................... 294,928 thousand – Beginning inventory .......................................... (286,485) thousand Purchases ........................................................ $1,823,208 thousand Inventory Beg. Balance Purchases 286,485 1,814,765 1,823,208 End. Balance Cost of goods sold 294,928 Req. 3 The company uses the average cost method to determine the cost of its inventory. This is disclosed in Note 2 under “Merchandise Inventory.” It indicates that inventory is valued at the lower of average cost or market. Req. 4 American Eagle Outfitters Inventory = Turnover Cost of Goods Sold Average Inventory $1,814,765 = 6.24 290,706.5* *(286,485 + $294,928) / 2 It indicates how many times the average inventory was purchased and sold during the year. 7-45 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory CP7–2. Req. 1 Given the general trend of little or no inflation every year, it would be unlikely that the replacement cost of Urban Outfitters’ inventory would be lower than its current book value. And, unless a severe market downturn (or extreme change in fashion) took place, it would be unlikely that the net realizable value of the company’s current season inventory would drop below its original cost. Since the end of the year coincides with the end of the selling season for winter clothes, only these remaining goods are likely to have a net realizable value below original cost. Therefore, it is likely that only these items would require a writedown at the end of the year, because the company’s book value for other inventory items will be lower than both replacement cost and net realizable value. Req. 2 The company uses the first-in, first-out method to determine the cost of its inventory. This is disclosed in Note 2 under “Inventories.” Req. 3 If the company had overstated its ending inventory by $10 million, its income before income taxes would be overstated by $10 million. Recall that ending inventory reduces cost of goods sold, which is an expense. Therefore, cost of goods sold would be $10 million lower and income before income taxes would be $10 million higher (i.e., $309,490,000 reported instead of the correct amount of $299,490,). Req. 4 Urban Outfitters Inventory = Turnover Cost of Goods Sold Average Inventory $1,121,140 = 6.56 170,811.5* * (171,925 + $169,698) / 2 It indicates how many times the average inventory was purchased and sold during the year. 7-46 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory CP7–3 Req. 1 American Eagle Outfitters Inventory = Turnover Cost of Goods Sold Average Inventory Urban Outfitters $1,814,765 = 6.24 290,706.5* $1,121,140 = 6.56 170,811.5** * ($286,485 + $294,928) / 2 ** ($171,925 + $169,698) / 2 Urban Outfitters has a higher inventory turnover ratio than American Eagle Outfitters. This higher ratio implies that Urban Outfitters was more successful than American Eagle in moving inventory quickly through the purchasing and sales processes to the ultimate customer. Req. 2 Industry Average 5.92 American Eagle Outfitters 6.24 Urban Outfitters 6.56 Both American Eagle Outfitters and Urban Outfitters have a higher inventory turnover than the industry average. That means that they are doing a better job at managing inventory levels, and moving inventory quickly through the purchasing and sales processes to the ultimate customer. 7-47 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory FINANCIAL REPORTING AND ANALYSIS CASES CP7–4. Req. 1 Production costs included in inventory become cost of goods sold expense on the income statement in the period the goods are sold. Req. 2 Since some of the current year’s production is still not sold, some of these production-related costs that were added to work-in-process inventory during the production process are still in work-in-process inventory or in finished goods. This increases total inventory. Since the items have not been sold, the amounts have not been included in cost of goods sold expense. Thus total expenses are lower which in turn increases net income. CP7–5. Req. 1 Caterpillar Inventories - LIFO Plus: LIFO Reserve Inventories - FIFO 2008 $8,781 3,183 $11,964 2007 $7,204 2,617 $9,821 Cost of goods sold: LIFO + Beginning LIFO Reserve - Ending LIFO Reserve Cost of goods sold: FIFO $38,415 2,617 3,183 $37,849 $32,626 2,403 2,617 $32,412 7-48 2006 $6,351 2,403 $8,754 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory 2008 LIFO Inventory turnover = $38,415 = ($7,204 + $8,781) ÷ 2 4.8 $37,849 = ($9,821 + $11,964) ÷ 2 3.5 $32,626 = ($6,351 + $7,204) ÷ 2 4.8 $32,412 = ($8,754 + $9,821) ÷ 2 3.5 2008 FIFO Inventory turnover = 2007 LIFO Inventory turnover = 2007 FIFO Inventory turnover = CP7–5. (continued) DEERE (as provided) 2008 LIFO 7.3 2008 FIFO 4.9 Req. 2 In all three cases, the ratio is higher under LIFO than FIFO. The LIFO beginning and ending inventory numbers (the denominator) are artificially small because they reflect old lower costs. LIFO cost of goods sold (the numerator) reflects the new higher costs. Thus, the numerator in the LIFO calculation does not relate in a meaningful way to the denominator. 7-49 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory Req. 3 The FIFO inventory turnover ratio is normally thought to be a more accurate indicator when prices are changing because LIFO can include very old inventory prices in ending inventory balances. According to the FIFO ratios, Caterpillar has used inventory no more efficiently during the current period than the prior period. However, it is less efficient than John Deere. Such comparisons should also consider any changes in inventory mix between periods or companies, which may also affect the ratio. 7-50 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory CRITICAL THINKING CASES CP7–6. 1. The press release states that management believes LIFO is more appropriate because it better matches current costs with current revenues, and also mentions that there are tax benefits to adopting LIFO for tax purposes. 2. The decrease in pre-tax income was $28,165,000. Thus, ending inventory was decreased by $28,165,000 and cost of goods sold was increased by $28,165,000. Since the company is in the 35% tax bracket, this resulted in a decrease in tax expense of .35 x $28,165,000 = $9,858,000 (rounded to the nearest thousand) and a decrease in net income of $ 18,307,000. 3. This $9,858,000 tax postponement is significant and is likely to be the main reason that management adopted LIFO. A decrease in net income is normally a negative sign to analysts, since it normally implies a decline in future cash flows. In this case, however, the change had a positive cash flow effect. Most analysts would look favorably on a change, the only effect of which is to provide the company with an additional $9,858,000 in cash. 7-51 Chapter 07 - Reporting and Interpreting Cost of Goods Sold and Inventory CP7–7. To: The Files From: The New Staff Member Re: Effect of restatement 1. The Company understated purchases by $47.3 million. This causes cost of goods sold to be understated and pre-tax income to be overstated by $47.3 million. Net income is overstated by that amount times 1 – tax rate: $47.3 x (1 – .404) = $28.2 million overstatement 2. The restatement of the purchases caused the board to rescind management’s bonuses. Accordingly, pre-tax income will increase by $2.2 million, and net income will increase by that amount times 1 – tax rate. $2.2 x (1 – .404) = $1.3 million increase 3. If it is assumed that bonuses are a fixed portion of net income, the bonus rate can be roughly estimated using the amounts computed in parts 1 and 2. Change in bonus = Bonus rate per dollar of net income = $.078 per dollar of net income (or 7.8%) Change in net income $2.2 million $28.2 million 4. The Board likely tied management compensation to net income to align the interests of management with that of shareholders. Typically, increases in net income will fuel a rise in the stock price. This type of compensation scheme does create the possibility that unethical management may alter the financial results to receive higher bonuses. FINANCIAL REPORTING AND ANALYSIS PROJECTS CP7–8. The solution to this case will depend on the company and/or accounting period selected for analysis. 7-52 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Chapter 08 Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles ANSWERS TO QUESTIONS 1. Long-lived assets are noncurrent assets, which a business retains beyond one year, not for sale, but for use in the course of normal operations. Long-lived assets include land in use, plant and equipment, natural resources, and certain intangibles such as a patent used in operating the business. Long-lived assets are acquired because of the future use that is expected of them. Thus, they may be thought of as a bundle of future services to be used over a period of time to earn revenue. As those services are used, as in the case of a machine, the cost of the asset is allocated as a periodic expense (i.e., matched with revenue). 2. The fixed asset turnover ratio = Net sales [(Beginning net fixed asset balance + Ending net fixed asset balance) 2] This ratio measures how efficiently a company utilizes its investment in property, plant, and equipment over time. The ratio can also be compared to the ratio for the company’s competitors. 3. Long-lived assets are classified as follows: (1) Tangible long-lived assets—assets that are tangible (i.e., have physical substance) and long-lived (i.e., beyond one year); they are acquired for use in the operation of a business and are not intended for resale. They are comprised of three different kinds of assets: (a) Land—not subject to depreciation. (b) Plant and equipment—subject to depreciation. (c) Natural resources—mines, gravel pits, and timber tracts. Natural resources are subject to depletion. (2) Intangible long-lived assets—assets held by the business because of the special valuable rights that they confer; they have no physical substance. Examples are patents, copyrights, franchises, licenses, trademarks, technology, and goodwill. Intangible assets with definite lives are subject to amortization. 8-1 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles 4. When a long-lived asset is acquired, it is recorded in the accounts in conformity with the cost principle. That is, the acquisition cost of a long-lived asset is the cash equivalent price paid for it plus all incidental costs expended to obtain it, to place it in the location in which it is to be used, and to prepare it for use. 5. In measuring and reporting long-lived assets, the matching principle is applied. As a long-lived asset is used, revenues are earned over a period of time. Over that same period of time, the long-lived asset tends to be used up or worn out. As a consequence, under the matching principle, the acquisition cost of the asset must be allocated to the periods in which it is used to earn revenue. In this way the cost of the asset is matched, as expense, with the revenues as they are earned from period to period through the use of the asset. 6. a. Capital expenditures—expenditures of resources (i.e., assets given up or debt incurred) for a service or asset that will help earn revenue for periods beyond the current accounting period. Capital expenditures should be debited to appropriate asset accounts and then allocated to those future periods in which revenues will be earned and against which the expenditures will be matched. Revenue expenditures—expenditures that help earn revenue only for the current period. Revenue expenditures are debited to appropriate expense accounts in the period in which incurred. b. Ordinary repairs—expenditures for the normal maintenance and upkeep of machinery and other tangible long-lived assets that are necessary to keep the assets in their usual operating conditions. Generally, ordinary repairs are recurring in nature, involve relatively small amounts at each occurrence and do not extend the useful estimated life of the asset. Ordinary repairs are debited to expense in the period in which incurred. Improvements—unusual, nonrecurring, major renovations that are necessary because of unusual conditions. Generally, they are large in amount, not recurring, and tend to either make the asset more efficient or to extend its useful life. Extraordinary repairs are debited to the appropriate asset accounts (or alternatively to the accumulated depreciation accounts) and in that way affect the amount of depreciation expense for the remaining estimated life of the asset. 7. Depreciation—allocation of the cost of a tangible long-lived asset over its useful life. Depreciation refers to allocation of the costs of such items as plant and equipment, buildings, and furniture. Depletion—allocation of the cost of a natural resource over its useful life. It is identical in concept to depreciation except that it relates to a different kind of asset, depletable natural resources. Amortization—allocation of the cost of an intangible asset over its estimated useful life. Conceptually, it is the same as depreciation and depletion except it relates to an intangible asset. 8-2 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles 8. To compute depreciation, the three values that must be known or estimated are: Cost—the actual total expenditures incurred in acquiring the asset in conformity with the cost principle. Estimated useful life—the estimated length of time that the asset will be used by the present owner for the purposes for which it was acquired. Residual value—the estimated amount of cash that is expected to be recovered at the end of the estimated useful life of the asset. The residual value is the estimated cash recovery amount minus the estimated cost of removing and disposing of the asset at the end of its estimated useful life. Notice that, on the acquisition date, the first of these values is an actual known amount, while the latter two are estimates. 9. The estimated useful life and estimated residual value of a long-lived asset when used for depreciation purposes relate to the current owner-user and not to all potential users of the asset because the asset’s cost must be allocated to the revenue that it generates during the period in which it is to be used by the current owner. The fact that the current owner may dispose of the asset and others may use it to earn revenues for a number of periods after that is of no consequence to the measurement of the asset and income for the current owner (other than for the effect of estimated residual value). 10. a. The straight-line method of depreciation causes an equal amount of depreciation expense to be apportioned to, or matched with, the revenues of each period. It is especially appropriate for tangible long-lived assets that are used at an approximately uniform level from period to period. b. The units-of-production method of depreciation causes a depreciation expense pattern that varies in amount with the rate at which the asset is used productively each year. For example, if in the current year the asset is used twice as much as in the prior year, twice as much depreciation expense would be matched with the revenue of the current year as compared with the previous year. Usually use is measured in terms of productive output. The units-ofproduction method of depreciation is particularly appropriate for those assets that tend to earn revenue with use rather than with the passage of time. Thus, it normally would apply to assets that are not used at a uniform rate from period to period. c. The double-declining-balance method of depreciation is a form of accelerated depreciation, causing a higher amount of depreciation expense to be matched with revenue in early periods of the estimated useful life of the asset. The double-declining-balance method is particularly appropriate when the long-lived assets perform more efficiently and therefore produce more revenue in the early years of their useful life than in the later years. 8-3 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles 11. The cost of an addition to an existing long-lived asset should be depreciated over the shorter of the estimated life of the addition or the remaining life of the existing asset to which it relates. This rule is necessary because an addition to an existing long-lived asset has no use after the useful life of the existing asset has expired. 12. Asset impairment—when events or changes in circumstances cause the book value of long-lived assets to be higher than their related estimated future cash flows. It is accounted for by writing down the asset to the asset’s fair value and recording a loss. 13. When equipment is sold, the Equipment account is credited for the asset’s historical cost. Its related Accumulated Depreciation account is debited for the amount representing prior usage. The Cash account is debited for the sales price. If the cash received exceeds the cost less accumulated depreciation (net book value), a Gain on Sale of Equipment is recorded for the difference. If the cash received is lower than the net book value, a Loss on Sale of Equipment is recorded for the difference. Net book value is the asset’s historical cost less accumulated depreciation on the asset. 14. An intangible asset is acquired and held by the business for use in operations and not for sale. Intangible assets are acquired because of the special rights they confer on ownership. They have no physical substance but represent valuable rights that will be used up in the future. Examples are patents, copyrights, trademarks, technology, franchises, goodwill, and licenses. When an intangible asset is purchased, managers determine if it has a definite or indefinite life. If it has a definite life, the intangible asset’s cost is amortized on a straight-line basis over its expected useful life. However, an intangible asset with an indefinite life is not amortized, but is tested annually for probable impairment. 15. Goodwill represents an intangible asset that exists because of the good reputation, customer appeal, and general acceptance of a business. Goodwill has value because other parties often are willing to pay a substantial amount for it when they buy a business. Goodwill should be recorded in the accounts and reported in the financial statements only when it has been purchased at a measurable cost. The cost of goodwill is measured in conformity with the cost principle. Because it is considered to have an indefinite life, goodwill is not amortized, but it is reviewed annually for impairment of value. 16. Depreciation expense is a noncash expense. That is, each period when depreciation is recorded, no cash payment is made. (The cash outflow associated with depreciation occurs when the related asset is first acquired.) Since no cash payment is made for depreciation, the effect of the depreciation expense on net income needs to be reversed in the reconciliation to cash flows. Depreciation expense was originally subtracted to arrive at net income; thus, to reverse its effect, depreciation expense needs to be added back to net income on the statement of cash flows (indirect method). 8-4 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles ANSWERS TO MULTIPLE CHOICE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. a c b b a d a d d c 8-5 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Authors' Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 5 3 3 4 4 5 5 6 4 7 4 8 5 9 5 10 5 Exercises No. Time 1 10 2 15 3 15 4 20 5 15 6 15 7 20 8 20 9 10 10 10 11 20 12 20 13 15 14 15 15 10 16 15 17 20 18 20 19 15 20 15 21 15 22 20 23 15 Problems No. Time 1 20 2 30 3 25 4 20 5 25 6 20 7 20 8 30 9 15 10 25 11 20 Alternate Comprehensive Problems Problem No. Time No. Time 1 20 1 60 2 30 3 25 4 20 5 20 6 30 7 25 Cases and Projects No. Time 1 20 2 20 3 20 4 15 5 10 6 15 7 15 8 15 9 15 10 20 11 * * Due to the nature of this project, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time to discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 8-6 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles MINI-EXERCISES M8–1. Asset (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Tractors Land in use Timber tract Warehouse New engine for old machine Operating license Production plant Trademark Silver mine Land held for sale Nature E L NR B E I B I NR O (investment) Cost Allocation Concept DR NO DP DR DR A DR A DP NO M8–2. Kramer’s fixed asset turnover ratio is = Net sales [(Beginning net fixed asset balance + Ending net fixed asset balance) 2] = $3,300,000 [($1,900,000 + $2,300,000) 2] = 1.57 Kramer’s ratio is over 1½ times as high as Southwest’s 2008 ratio of 1.01, indicating that Kramer may be much more efficient in its use of fixed assets. M8–3. (1) C (2) R (3) N (4) C (5) N (6) R (7) R (8) C (9) C 8-7 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles M8–4. Machinery (original cost) Accumulated depreciation at end of third year Depreciation expense = ($31,000 cost – $1,000 residual value) x 1/5 = $6,000 $31,000 Accumulated depreciation = $6,000 annual depreciation expense x 3 yrs = 18,000 Net book value at the end of the third year $13,000 M8–5. Machinery (original cost) $45,000 Accumulated depreciation at end of first year: Depreciation expense = ($45,000 – $0 acc. depr.) x 2 / 4 = $22,500 22,500 Net book value at end of first year $22,500 Machinery (original cost) $45,000 Accumulated depreciation at end of second year: Depreciation expense = ($45,000 - $22,500 acc. depr.) x 2 / 4 = $11,250 Accumulated depreciation = Year 1, $22,500 + Year 2, $11,250 = 33,750 Net book value at end of second year $11,250 Machinery (original cost) Accumulated depreciation at end of third year: Depreciation expense = ($45,000 - $33,750 acc. depr.) x 2 / 4 = $5,625 Accumulated depreciation = (Year 2, $33,750 + Year 3, $5,625) = Net book value at end of third year $45,000 39,375 $5,625 M8–6. Machinery (original cost) Accumulated depreciation at end of third year Depreciation expense per machine hour = ($21,000 cost – $1,000 residual value) = $0.50 per machine hour 40,000 machine hours Accumulated depreciation = $0.50 depreciation expense per machine hr x (3,200+7,050+7,500) hrs = Net book value at end of third year 8-8 $21,000 8,875 $12,125 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles M8–7. a. Machine Impairment Y Loss $6,000 Cost - Fair Value $15,500 -$ 9,500 b. Copyright N — Estimated cash flows exceed book value c. Factory building Y $31,000 $58,000 - $27,000 d. Building N — Estimated cash flows equal book value M8–8. Store fixtures (original cost) Accumulated depreciation at end of tenth year Depreciation expense = ($6,000 cost – $800 residual value) x 1/13 = $400 Accumulated depreciation = $400 annual depreciation expense x 10 yrs = Net book value at end of tenth year (i.e., NBV immediately prior to sale) Journal entry to record the disposal is as follows. Cash (+A) .................................................................... Accumulated depreciation, store fixtures (XA, +A) .... Loss on sale of store fixtures (+Loss, SE) ................ Store fixtures (A) ............................................ $6,000 4,000 $2,000 1,800 4,000 200 6,000 M8–9. Elizabeth Pie Company’s management may choose to accept the offer of $5,000,000 as this amount is more than the $4,800,000 market value of separately identifiable assets and liabilities ($4,500,000 market value of recorded assets and liabilities and $300,000 for the patent). If so, Giant Bakery would record $200,000 of goodwill on the date of purchase (i.e., the excess of the $5,000,000 purchase price over the $4,800,000 fair value of identifiable assets and liabilities). The $110,000 difference in goodwill (Elizabeth’s $310,000 estimated value of goodwill less actual goodwill of $200,000) provides potential for Elizabeth’s management to negotiate a higher purchase price. 8-9 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles M8–10. Wexler Company Excerpts from Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities: Net income Add back: Depreciation expense Cash provided by (used in) operating activities $ 13,000 5,500 18,500 Cash flows from investing activities: Purchase of equipment Sale of land Cash provided by (used in) investing activities (156,000) 18,000 (138,000) 8-10 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles EXERCISES E8–1. Hasbro, Inc. Excerpts from Balance Sheet (in millions) ASSETS Current Assets Cash and cash equivalents Accounts receivable (net of allowance for doubtful accounts, $32) Inventories Prepaid expenses and other current assets Total current assets Property, Plant, and Equipment Machinery and equipment Buildings and improvements Land and improvements Property, plant, and equipment (at cost) Less: Accumulated depreciation Total property, plant, and equipment (net) Other Assets Goodwill Other intangibles (net of accumulated amortization, $800) Other noncurrent assets Total other assets Total Assets 8-11 $ 630 612 300 171 1,713 413 196 7 616 403 213 474 568 200 1,242 $3,168 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–2. Req. 1 Fixed asset turnover ratio: (in millions) Sales [(beginning net fixed assets + ending net fixed assets) 2] 2007 2008 2009 $24,006 $1,556.5 $32,479 $2,393.0 $36,537 $2,704.5 15.42 13.57 13.51 Computation of denominator: 2007 ($1,281 + $1,832) 2 2008 ($1,832 + $2,954) 2 2009 ($2,954 + $2,455) 2 = $1,556.5 = $2,393.0 = $2,704.5 Req. 2 Apple’s fixed asset turnover ratio fell each year from 2007 to 2009. This suggests that Apple’s management became less efficient at utilizing its long-lived assets over time. The decrease in 2008 was due primarily to a large increase in fixed assets that year. Although the turnover has declined, it is possible that the build-up of fixed assets may lead to increased sales in the future, thus increasing the fixed asset turnover ratio to prior levels. An analyst can use this longitudinal analysis to observe possible trends over time. In addition, the analyst may compare Apple’s ratios to those of competitors in the industry. 8-12 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–3 Req. 1 Building (+A) ......................................................................... 97,000 Land (+A) ............................................................................. 113,000 Cash (A) .................................................................... Building $71,000 23,000 3,000 $97,000 Cash paid + renovations to prepare for use + share of transfer costs 210,000 Land $107,000 6,000 $113,000 Req. 2 Straight-line depreciation computation: ($97,000 cost - $15,000 residual value) x 1/10 = $8,200 depreciation expense per year Note: Land is not depreciated. Req. 3 Computation of the book value of the property at the end of year 2: Building Less: Accumulated depreciation ($8,200 x 2 years) Land Net book value 8-13 $ 97,000 (16,400) $ 80,600 113,000 $193,600 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–4. Req. 1 Date Assets Liabilities January No effect 1 January Cash 2 Equipment January Cash 3 Equipment January Cash 5 Equipment July 1 Cash No effect Stockholders’ Equity No effect –6,000 Short term +15,000 +21,000 note payable –1,000 +1,000 –2,500 +2,500 –15,750 Short term –15,000 Interest note payable expense* –750 * $15,000 principal x .10 interest rate x 6/12 of a year = $750 interest Req. 2 Acquisition cost of the machine: Cash paid Note payable with supplier Freight costs Installation costs Acquisition cost $ 6,000 15,000 1,000 2,500 $24,500 Req. 3 Depreciation for 2012: ($24,500 cost - $4,000 residual value) x 1/10 $ 2,050 Req. 4 On July 1, 2012, $750 ($15,000 x 10% x 6/12) is paid and is recorded as interest expense. The amount is not capitalized (added to the cost of the asset) because interest is capitalized only on constructed assets. This machine was purchased. Req. 5 Equipment (cost) ...................................................................................... Less: Accumulated depreciation ($2,050 x 2 years) .............................. Net book value at end of 2013 ................................................................. 8-14 $24,500 4,100 $20,400 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–5. Req. 1 Adjusting entry for 2010: Depreciation expense (+E, SE) ....................................... Accumulated depreciation, equipment (+XA, A) ........ ($100,000 – $10,000) x 1/15 = $6,000 6,000 6,000 Req. 2 ( beginning of 2011) Estimated life Less: Used life $54,000 accumulated depreciation $6,000 annual expense = Remaining life 15 years 9 years 6 years Req. 3 (during 2011): Repair and maintenance expense (+E, SE) .................... Cash (A)..................................................................... (Ordinary repairs incurred.) 1,000 Equipment (+A) ................................................................. Cash (A)..................................................................... Extraordinary repairs incurred and capitalized. 12,000 1,000 12,000 E8–6. Date Assets Liabilities Stockholders’ Equity 1. 2010* Accumulated depreciation –6,000 Depreciation expense –6,000 2a. 2011 Cash –1,000 Repair and maintenance expense –1,000 2b. 2011 Cash –12,000 Equipment +12,000 * Adjusting entry for 2010: ($100,000 cost – $10,000 residual value) x 1/15 = $6,000. 8-15 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–7. Req. 1 a. Straight-line: Year Computation At acquisition 1 ($10,000 - $1,000) x 1/4 2 ($10,000 - $1,000) x 1/4 3 ($10,000 - $1,000) x 1/4 4 ($10,000 - $1,000) x 1/4 Depreciation Expense Accumulated Depreciation $2,250 2,250 2,250 2,250 $2,250 4,500 6,750 9,000 Net Book Value $10,000 7,750 5,500 3,250 1,000 b. Units-of-production: ($10,000 – $1,000) 9,000 = $1.00 per hour of output Depreciation Accumulated Net Year Computation Expense Depreciation Book Value At acquisition $10,000 1 $1.00 x 3,600 hours $3,600 $3,600 6,400 2 $1.00 x 2,700 hours 2,700 6,300 3,700 3 $1.00 x 1,800 hours 1,800 8,100 1,900 4 $1.00 x 900 hours 900 9,000 1,000 c. Double-declining-balance: Year Computation At acquisition 1 ($10,000 - $0) x 2/4 2 ($10,000 - $5,000) x 2/4 3 ($10,000 - $7,500) x 2/4 4 ($10,000 - $8,750) x 2/4 Depreciation Expense Accumulated Depreciation $5,000 2,500 1,250 625 250 $5,000 7,500 8,750 9,375 9,000 Net Book Value $10,000 5,000 2,500 1,250 625 1,000 Too large. Net book value cannot be below residual value. Req. 2 If the machine is used evenly throughout its life and its efficiency (economic value in use) is expected to decline steadily each period over its life, then straight-line depreciation would be preferable. If the machine is used at a consistent rate but the efficiency is expected to decline faster in the earlier years of its useful life, then an accelerated method would be appropriate [such as, double-declining-balance]. If the machine is used at different rates over its useful life and its efficiency declines with output, then the units-of-production method would be preferable because it would result in a better matching of depreciation expense with revenue earned. 8-16 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–8. Req. 1 a. Straight-line: Year Computation At acquisition 1 ($580,000 - $60,000) x 1/5 2 ($580,000 - $60,000) x 1/5 3 ($580,000 - $60,000) x 1/5 4 ($580,000 - $60,000) x 1/5 5 ($580,000 - $60,000) x 1/5 Depreciation Expense Accumulated Depreciation $104,000 104,000 104,000 104,000 104,000 $104,000 208,000 312,000 416,000 520,000 Net Book Value $580,000 476,000 372,000 268,000 164,000 60,000 b. Units-of-production: ($580,000 – $60,000) 260,000 = $2.00 per unit of output Depreciation Accumulated Net Year Computation Expense Depreciation Book Value At acquisition $580,000 1 $2.00 x 73,000 units $146,000 $146,000 434,000 2 $2.00 x 62,000 units 124,000 270,000 310,000 3 $2.00 x 30,000 units 60,000 330,000 250,000 4 $2.00 x 53,000 units 106,000 436,000 144,000 5 $2.00 x 42,000 units 84,000 520,000 60,000 c. Double-declining-balance: Year Computation At acquisition 1 ($580,000 - 0) x 2/5 2 ($580,000 - $232,000) x 2/5 3 ($580,000 - $371,200) x 2/5 4 ($580,000 - $454,720) x 2/5 5 ($580,000 - $504,832) x 2/5 Depreciation Expense Accumulated Depreciation $232,000 139,200 83,520 50,112 30,067 15,168 $232,000 371,200 454,720 504,832 534,899 520,000 Net Book Value $580,000 348,000 208,800 125,280 75,168 45,101 60,000 Too large. Net book value cannot be below residual value. 8-17 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–8. (continued) Req. 2 If the machine is used evenly throughout its life and its efficiency (economic value in use) is expected to decline steadily each period over its life, then straight-line depreciation would be preferable. If the machine is used at a consistent rate but the efficiency is expected to decline faster in the earlier years of its useful life, then an accelerated method would be appropriate [such as, double-declining-balance]. If the machine is used at different rates over its useful life and its efficiency declines with output, then the units-of-production method would be preferable because it would result in a better matching of depreciation expense with revenue earned. E8–9. Management of General Motors Corporation probably anticipated that the pre-2001 property and equipment would be more productive or efficient in the earlier part of their lives than in the later. Thus, the accelerated method would provide the best matching of expenses with revenues in the same period. In 2001, however, General Motors’ management may have recognized a change in the revenue-generating capacity of the property and equipment such that a better matching would occur using the straight-line method in which equal amounts of depreciation expense would be computed each period. E8–10. Straight-line depreciation (SL) is a simple method to use and understand. Managers often prefer SL because it results in lower depreciation expense and higher net income in the earlier years of an asset’s life when compared with the accelerated methods. Because SL depreciation results in higher income in earlier years, it is not desirable to use it for tax reporting purposes with the objective of lowering tax liabilities. By using SL depreciation instead of an accelerated method in the earlier years for tax purposes, a company would have to pay higher taxes. In any case, the tax code specifies that MACRS, an accelerated method, may be used for most tangible depreciable property placed in service after December 31, 1986. It is important to note, however, that, over the entire useful life of an asset, total depreciation expense is the same regardless of the method. 8-18 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–11. Req. 1 Method of Depreciation Straight-line .......................... Units-of-production ............... Double-declining-balance ..... Depreciation Expense Year 1 Year 2 $22,500 $22,500 32,250 33,750 48,000 24,000 Book Value at End of Year 1 Year 2 $73,500 $51,000 63,750 30,000 48,000 24,000 Computations: Amount to be depreciated: $96,000 – $6,000 = $90,000: Straight-line: $90,000 4 years = $22,500 per year Units-of-production: $90,000 120,000 units = $.75 per unit Year 1: 43,000 x $.75 = $32,250 Year 2: 45,000 x $.75 = $33,750 Double-declining-balance (Rate: 2 x the straight line rate of 25% (2/4) = 50%): Year 1: $96,000 x 50% = $48,000 Year 2: ($96,000 – $48,000) x 50% = $24,000 Req. 2 The double-declining-balance method would result in the lowest EPS for Year 1 because it produced the highest depreciation expense and therefore the lowest income (from Requirement 1). In Year 2, the units-of-production method would result in the lowest EPS because it produced the highest depreciation expense and therefore the lowest income in that year. Req. 3 Depreciation is a noncash expense; that is, no cash is paid when depreciation is recognized. Ignoring income tax implications, all methods have the same impact on cash flows in year 1. Assuming a method is applied for tax determination, the straightline method will result in the lowest expense, highest net income, highest tax liability, and therefore the highest amount of cash outflows in year 1. Companies will select methods for tax purposes that reduce tax obligations. Req. 4 The machine acquisition would decrease cash provided by investing activities by the purchase cost of $96,000. As a noncash expense, the annual depreciation should have no overall effect on cash provided by operating activities—however, because it is originally subtracted to arrive at net income, an adjustment needs to be made to reverse this effect for cash flows. Hence, $22,500 (the annual straight-line depreciation) must be added back to net income in the operating section of the statement of cash flows. 8-19 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–12. Req. 1 Property, Plant, and Equipment Beg. Bal Capital expenditures 33,611 2,636 End. Bal. 35,098 1,040 109 Property sold Write-offs Accumulated Depreciation Property sold 929 15,948 1,814 Beg. Bal. Depreciation expense 16,833 End. Bal. Disposal of property and equipment: Cash (+A) ......................................................................... Accumulated depreciation (XA, +A) ................................ Property and equipment (A) ....................................... Gain on sale of property and equipment (+Gain, +SE) 147 929 Req. 2 Amount of property and equipment written off as impaired during the year: Beginning balance $33,611 + Capital expenditures during year 2,636 - Cost of property sold during year (1,040) - Impairment loss during year (?) Ending balance $35,098 Impairment loss = $109 8-20 1,040 36 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–13. Req. 1a Cash (+A) .............................................................................. Accumulated depreciation (XA, +A) .................................... Delivery truck (A) ............................................................. Sale of an asset at book value; the result is no loss or gain. Req. 1b Cash (+A) ............................................................................ Accumulated depreciation (XA, +A) .................................. Gain on sale of long-lived asset (+Gain, +SE) ................. Delivery truck (A) ........................................................... Sale of an asset above book value; the result is a gain. Req. 1c Cash (+A) .............................................................................. Accumulated depreciation (XA, +A) .................................... Loss on sale of long-lived asset (+Loss, SE) ...................... Delivery truck (A) ............................................................. Sale of an asset below book value; the result is a loss. 15,000 23,000 38,000 15,600 23,000 600 38,000 14,600 23,000 400 38,000 Req. 2 Summarization of the effects of the disposal: 1. The loss or gain on disposal of a long-lived asset is the difference between the disposal price and the book value at date of disposal. 2. When the disposal price is the same as the book value there is no loss or gain; when the price is above book value there is a gain; and when the price is below book value, there is a loss on disposal. 3. The book value does not purport to be market value, so a loss or gain on disposal of a long-lived asset normally would occur. 8-21 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–14. Req. 1a Cash (+A) .............................................................................. 500,000 Accumulated depreciation (XA, +A) .................................... 5,500,000 Furniture (A) .................................................................... Sale of an asset at book value; the result is no loss or gain. Req. 1b Cash (+A) ............................................................................ Accumulated depreciation (XA, +A) .................................. Gain on sale of long-lived asset (+Gain, +SE) ................. Furniture (A) .................................................................. Sale of an asset above book value; the result is a gain. 6,000,000 1,600,000 5,500,000 Req. 1c Cash (+A) .............................................................................. 400,000 5,500,000 Accumulated depreciation (XA, +A) .................................... 100,000 Loss on sale of long-lived asset (+Loss, SE) ...................... Furniture (A) .................................................................... Sale of an asset below book value; the result is a loss. 1,100,000 6,000,000 6,000,000 Req. 2 Summarization of the effects of the disposal: 1. The loss or gain on disposal of a long-lived asset is the difference between the disposal price and the book value at date of disposal. 2. When the disposal price is the same as the book value there is no loss or gain; when the price is above book value there is a gain; and when the price is below book value, there is a loss on disposal. 3. The book value does not purport to be market value, so a loss or gain on disposal of a long-lived asset normally would occur. 8-22 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–15. Req. 1 Depreciation expense per year: $6,000 accumulated depreciation 3 years of usage = $2,000 per year Estimated useful life: ($18,000 – $8,000) x 1/? useful life = $2,000 per year $10,000 / $2,000 = 5 year useful life Req. 2 December 31, 2012: 2,000 Depreciation expense (+E, SE) .................................... 2,000 Accumulated depreciation (+XA, A) .......................... To bring accumulated depreciation up to the date of the accidental loss ($18,000 – $8,000) x 1/5 = $2,000. Accumulated depreciation ($6,000 + $2,000) (XA, +A ) Loss on disposal of truck (+Loss, SE) .......................... Truck (A) ................................................................... To record disposal of wrecked truck. 8,000 10,000 18,000 E8–16. Req. 1 Computation of acquisition cost of the deposit in 2012: February 2012: Purchase of mineral deposit March 2012: Preparation costs Total acquisition cost in 2012 $ 700,000 74,000 $ 774,000 Req. 2 Computation of depletion for 2012: $774,000 cost 900,000 cubic yards = $.86 per cubic yard depletion rate 60,000 cubic yards in 2012 x $.86 = $51,600 Req. 3 Computation of net book value of the deposit after the developmental work: Total acquisition cost in 2012 $ 774,000 Less: 2012 depletion (51,600) January 2013 developmental costs 6,000 Net book value $ 728,400 8-23 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–17. Req. 1 Acquisition cost: Technology Patent Trademark $70,000 6,000 13,000 Req. 2 Amortization on December 31, 2012 (straight-line method with no residual value): Technology: $70,000 x 1/4 = $17,500 amortization expense Patent: $6,000 x 1/15 remaining = $400 amortization expense Trademark: The trademark is not amortized due to its indefinite life. Req. 3 Income statement for 2012: Operating expenses: Amortization expense ($17,500 + $400) $17,900 Balance sheet at December 31, 2012: (under noncurrent assets) Intangibles: Technology ($70,000 - $35,000*) .................................... $35,000 Patent ($6,000 - $800) .................................................... 5,200 Trademark ...................................................................... 13,000 ** $53,200 * $17,500 amortization expense x 2 years ** Although trademarks are valuable assets, they are rarely seen on balance sheets. 8-24 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–18. Req. 1 Acquisition cost: Copyright Goodwill Patent $12,300 65,000 39,200 Req. 2 Amortization on December 31, 2011 (straight-line method with no residual value): Copyright: $12,300 x 1/10 = $1,230 amortization expense Goodwill: The goodwill is not amortized due to its indefinite life. Patent: $39,200 x 1/16 remaining at time of purchase = $2,450 amortization exp. Req. 3 Income statement for 2011: Operating expenses: Amortization expense ($1,230 + $2,450) Balance sheet at December 31, 2011: (under noncurrent assets) Intangibles: Copyright ($12,300 - $1,230) .......................................... $11,070 Goodwill ......................................................................... 65,000 Patent ($39,200 - $4,900*) .............................................. 34,300 * $2,450 amortization expense x 2 years 8-25 $3,680 $110,370 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–19. Req. 1 (January 1, 2012): Leasehold improvements (+A) .............................................. 375,000 Cash (A) .......................................................................... 375,000 Req. 2 (Adjusting entry on December 31, 2012): Amortization expense* (+E, SE).......................................... Leasehold improvements (A) ........................................... ($375,000 x 1/10 year lease = $37,500) 37,500 37,500 * Some accountants prefer to label this Rent Expense or Depreciation of Leasehold Improvements. The cost of the improvement should be allocated over the shorter of the life of the improvement or the lease term. 8-26 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–20. Item Location 1. Depreciation expense. (a) (b) (c) Income statement, or Statement of cash flows, or Notes to the financial statements 2. The detail on major classifications (a) of long-lived assets. (b) Balance sheet, or Notes to the financial statements 3. Prior year’s accumulated depreciation. (a) (b) Balance sheet, or Notes to the financial statements 4. The accounting method(s) used for financial reporting purposes. Notes to the financial statements 5. Net amount of property, plant, and equipment. (a) (b) Balance sheet, or Notes to the financial statements 6. Whether the company has had any capital expenditures for the year. (a) (b) (c) Statement of cash flows Increase in assets on the balance sheet Notes to the financial statements 7. Policies on amortizing intangibles. Notes to the financial statements 8. Any significant gains or losses on disposals of fixed assets. (a) (b) (c) 9. The amount of assets written off as (a) impaired during the year. (b) (c) 8-27 Income statement, or Statement of cash flows, or Note to the financial statements Income statement, or Statement of cash flows, or Notes to the financial statements Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–21. December 31, 2011: Adjusting entry for 2011 depreciation: Depreciation expense (+E, SE) ........ ………………. Accumulated depreciation, equipment (+XA, A) 8,000 8,000 Computation: ($58,000 net book value - $10,000 residual value) x 1/6 = $8,000 Net book value computation: $100,000 original cost (54,000) accumulated depreciation through 2010 12,000 capitalized overhaul on January 2, 2011 $ 58,000 net book value on January 2, 2011 Remaining life computation: 15 years estimated life ($54,000 accumulated depreciation $6,000 expense) – 9 years used 6 years remaining ($100,000 original cost - $10,000 residual value) x 1/15 = $6,000 per year through 2010 8-28 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–22. Req. 1 Equipment (+A) ................................................................ Cash (A).................................................................... 15,500 15,500 Req. 2 Age of Machine A at December 31, 2012: ($30,000 cost – $4,500 residual value) x 1/5 years = $5,100 depreciation per year. $10,200 accumulated depreciation $5,100 = 2 years old at December 31, 2012. Req. 3 Depreciation expense (for 2013) (+E, SE)...................... Accumulated depreciation, machinery (+XA, A) ....... 4,800 4,800 Computations: Cost when acquired .............................................................................. $30,000 Less: Accumulated depreciation (2 years) ........................................... 10,200 Undepreciated balance ......................................................................... 19,800 Add: Major renovation cost ................................................................... 15,500 Total .................................................................................................. $35,300 Annual depreciation: ($35,300 net book value - $6,500 new residual value) x 1/6 years of remaining useful life (8 years total useful life – 2 years used) = $4,800 Req. 4 Requirement (1) assumed that the major renovation and improvement cost was a capital expenditure rather than a revenue expenditure. Because capital expenditures benefit future periods, the expenditure is added to the net book value of the asset and then is depreciated over the remaining life of the asset. Requirement (3) recognized an accounting change due to a change in estimate (both estimated life and residual value). A change in estimate is not an error correction; consequently it is treated prospectively. That is, the effect is spread over the current year and the future remaining life of the asset. This approach means that the undepreciated balance at the date of the change in estimate is depreciated over the remaining life using the revised estimates. 8-29 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles E8–23. Req. 1 Depreciation expense prior to the change in estimates: ($330,000 cost – $30,000 residual value) x 1/50 = $6,000 annual depreciation Req. 2 Depreciation expense after the change in estimates: Step 1 – Age of the asset: $78,000 accumulated depreciation $6,000 annual expense = 13 years of depreciation to date. The building has been depreciated over 13 years as of the beginning of the year. Step 2 – Net book value: $330,000 cost $78,000 accum. deprec. = $252,000 Step 3 – Computation: (Net book value new residual value) x 1/remaining life = Deprec. expense ($252,000 $22,500) x 1/17 = $13,500 depreciation expense per year This was an accounting change due to a change in estimate (both remaining useful life and residual value). A change in estimate is not an error correction; the remaining book value is depreciated over the remaining useful life using the revised estimates. Req. 3 The depreciation expense increases by $7,500 each year for the next 17 years. Therefore, net income will be lower by $7,500 (ignoring taxes) each year; this in turn will lower Retained Earnings on the balance sheet. Also on the balance sheet, the asset’s net book value will be lowered by an additional $7,500 each year for 17 years. However, since depreciation is a noncash expense, there are no cash flow implications (again ignoring income tax considerations). 8-30 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles PROBLEMS P8–1. Req. 1 Long-lived assets are tangible and intangible resources owned by a business and used in its operations over several years. Tangible assets (such as property, plant, and equipment or natural resources) are assets that have physical substance. Intangible assets (such as goodwill or patents) are assets that have special rights but not physical substance. Req. 2 January 2 purchase: Equipment (1) (+A) ............................................................ Accounts payable(2) (+L) ............................................. Note payable (+L) ....................................................... Common stock(3) (+SE) .............................................. Additional paid-in capital(4) (+SE) .............................. Cash (A).................................................................... January 15 payment: Accounts payable (L)...................................................... Financing expense (+E, SE) ......................................... Cash (A) ................................................................... Computations: (1) Equipment: 86,410 32,010 45,000 2,000 5,000 2,400 32,010 990 33,000 $85,000 invoice – $990 (3% of $33,000 cash to be paid*) + $2,400 installation * Assets are recorded at the cash equivalent price (2) Balance payable: $85,000 invoice – $45,000 note payable – $7,000 common stock and additional paid-in capital – $990 (3% of $33,000 cash to be paid) (3) Common stock: $1 par value x 2,000 shares (4) Additional paid-in capital: ($3.50 market value - $1 par value) x 2,000 shares 8-31 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–1. (continued) Req. 3 Date Jan 2 Assets Equipment Liabilities +86,410 Note payable Cash -2,400 Accounts payable Jan 15 Cash -33,000 Accounts payable Stockholders’ Equity +45,000 Common stock +2,000 +32,010 Additional paid-in capital +5,000 -32,010 Financing expense -990 Req. 4 Cost of the machinery includes installation costs. Freight was excluded because it was an expense paid by the vendor. No discount was taken because Cruz Company paid the cash balance due after the discount period ended. The lost discount is treated as a financing expense. Common stock is valued at $3.50 per share—for accounting purposes, this amount is allocated between the Common Stock account for the par value ($1 per share) and the Additional Paid-In Capital account for the remaining value ($2.50 per share in excess of par value). 8-32 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–2. Req. 1 Balance 1/1/11 Depreciation for 2011 Balance prior to expenditures a. b. c. Balance 12/31/11 Building $820,000 820,000 NE +122,000 +230,000 $1,172,000 Accum. Deprec. $410,000 Deprec. Expense 41,000 $41,000* 451,000 NE NE NE $451,000 41,000 NE NE NE $41,000 Repairs Expense Cash NE +$7,000 NE NE $7,000 $7,000 122,000 230,000 * ($820,000 cost - $0) x 1/20 years = $41,000 depreciation expense per year. Req. 2 Book Value of Building on December 31, 2011: Building ($820,000 + $122,000 + $230,000) ......................... $1,172,000 Less: Accumulated depreciation ($410,000 + $41,000) ........ 451,000 Net book (or carrying) value ............................................. $721,000 Req. 3 Depreciation is a noncash expense. Unlike most expenses, no cash payment is made when the expense is recognized. The cash outflow occurred when the related asset was acquired. For companies selecting the indirect method of preparing a statement of cash flows (reconciling net income on the accrual basis to cash from operations), depreciation expense is added back to net income because the expense reduces net income, yet is not a cash outlay. 8-33 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–3. Req. 1 Cost of each machine: A Purchase price .................................... Installation costs .................................. Renovation costs ................................. Total cost ......................................... $11,000 500 2,500 $14,000 Machine B $30,000 1,000 1,000 $32,000 C $8,000 500 1,500 $10,000 Total $49,000 2,000 5,000 $56,000 Req. 2 Computation of depreciation at the end of year 1 for each machine: Machine Method Computation A Straight-line ($14,000 $1,000) x 1/5 = $2,600 B Units-of-production ($32,000 $2,000) 60,000 hours = $0.50 $0.50 x 4,800 hours = $2,400 C Double-declining-balance ($10,000 $0) x 2/4 = $5,000 Adjusting entry: Depreciation expense ($2,600 + $2,400 + $5,000) (+E, SE) Accumulated depreciation, Machine A (+XA, A) Accumulated depreciation, Machine B (+XA, A) Accumulated depreciation, Machine C (+XA, A) 8-34 10,000 2,600 2,400 5,000 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–4. Req. 1 Depreciation expense of $464 recorded in the current year is inferred from the activities affecting the Accumulated Depreciation account: Accumulated Depreciation 2,302 Beg. bal. Asset sales 0 464 Deprec. Exp. 2,766 End. bal. Req. 2 Recording depreciation at the end of the period increases expenses (and thus decreases net income and stockholders’ equity) and decreases the net book value of the property and equipment accounts. Failing to record depreciation creates the opposite effects. Effect on Ratio of Failing to Record Depreciation Expense Ratio Computation Earnings per share Net income Number of shares of stock outstanding Net income will be overstated with no change in the denominator Overstated Fixed asset turnover Sales Average net fixed asset balance Numerator does not change; however, the denominator is overstated Understated Current ratio Current assets Current liabilities Neither the numerator nor the denominator are affected by depreciation expense, since accumulated depreciation affects only long-lived assets on the balance sheet No effect Return on assets Net income Average total assets Net income is overstated and so is average total assets although at a lower amount due to averaging Overstated 8-35 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–5. Req. 1 a. Straight-line: Year Computation At acquisition 1 ($106,000 - $2,000) x 1/13 2 ($106,000 - $2,000) x 1/13 Depreciation Expense Accumulated Depreciation $8,000 $8,000 $ 8,000 16,000 Net Book Value $106,000 98,000 90,000 b. Units-of-production: ($106,000 – $2,000) 200,000 = $0.52 per unit of output Depreciation Accumulated Net Year Computation Expense Depreciation Book Value At acquisition $106,000 1 $0.52 x 20,000 units $10,400 $10,400 95,600 2 $0.52 x 16,000 units 8,320 18,720 87,280 c. Double-declining-balance: Year Computation At acquisition 1 ($106,000 - $0) x 2/13 2 ($106,000 - $16,308) x 2/13 Depreciation Expense* Accumulated Depreciation Net Book Value $106,000 $16,308 $16,308 89,692 13,799 30,107 75,893 *Rounded to the nearest dollar. Req. 2 Cash flow—For tax purposes, the declining-balance (DB) method usually is viewed as preferable because an early tax deduction is preferable to a later tax deduction. DB depreciation expense is highest; therefore, it yields lower taxable income and therefore lower income tax payable (and lower cash outflow) in the early years. In later years, this effect would reverse. Other than cash outflows for taxes, cash flows are unaffected by the method chosen by management for financial reporting purposes. Companies may select different methods for tax and financial reporting. Fixed asset turnover—The DB method would be most favorable for fixed asset turnover. Because this depreciation method yields the highest amount of depreciation expense, it yields the lowest level of net fixed assets and thus the highest fixed asset turnover during the early years. In later years, this effect would reverse. EPS—In terms of EPS, straight-line (SL) depreciation would be favorable. This depreciation method yields the lowest amount of depreciation expense, the highest net income, and therefore the highest EPS during the early years when compared with the accelerated methods. In later years, this comparative effect would reverse. 8-36 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–5. (continued) Recommendation to Ford Motor Company’s management—Companies may choose a different method for tax purposes than for financial reporting purposes. The goal of reducing taxes in year 1 is best accomplished by using the double-declining-balance method. The ease of use of the straight-line depreciation method for financial reporting would result in the highest EPS for year 1 (assuming no other method better reflects matching expenses with revenues). As time goes on (in years 2 and later), the relative advantages of one method over another will reverse. However, accounting methods should be used consistently over time. Changing methods in the future would require reasonable justification. 8-37 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–6. Req. 1 a. Machine A - Sold on Jan. 1, 2012: (1) Depreciation expense in 2012 - none recorded because disposal date was Jan. 1, 2012. (2) To record disposal: Cash (+A) .......................................................................... Accumulated depreciation, Machine A (XA, +A).............. Loss on disposal of machine (+Loss, SE) ....................... Equipment (Machine A) (A)....................................... 7,200 13,500 300 b. Machine B – Sold on December 31, 2012: (1) To record depreciation expense for 2012: Depreciation expense (+E, SE) ....................................... Accumulated depreciation, Machine B (+XA, A) ....... ($41,000 – $4,000) 10 years = $3,700. 3,700 (2) To record disposal: Cash (+A) .......................................................................... Note receivable (+A).......................................................... Accumulated depreciation, Machine B ($29,600 + $3,700) (XA, +A) .......................................................................... Gain on disposal of machine (+Gain, +SE) ................ Equipment (Machine B) (A)....................................... 21,000 3,700 2,500 6,000 33,300 800 41,000 c. Machine C – Disposal on January 1, 2012: (1) Depreciation expense in 2012 - none recorded because disposal date was Jan. 1, 2012. (2) To record disposal: Accumulated depreciation, Machine C (XA, +A) ............ Loss on disposal of machine (+Loss, SE) ....................... Equipment (Machine C) (A) ...................................... 56,000 19,000 75,000 Req. 2 Machine A: Disposal of a long-lived asset with the price below net book value results in a loss. Machine B: Disposal of a long-lived asset with the price above net book value results in a gain. Machine C: Disposal of a long-lived asset due to damage results in a loss equal to remaining book value. 8-38 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–7. Req. 1 Fixed Assets Beg. balance Acquisitions 24,839.2 4,418.0 End. balance 25,127.9 4,129.3 Disposals/transfers Accumulated Depreciation Disposals/transfers 8,365.1 1,812.3 1,083.3 41.4 9,135.5 Beg. balance Depreciation expense Impairment loss End. balance Req. 2 Net book value of the disposals and transfers: $4,129.3 cost $1,083.3 accumulated depreciation Add: Surplus on sale of fixed assets (on statement of cash flows) Cash proceeds from disposals and transfers $3,046.0 62.7 $3,108.7 Req. 3 Percentage depreciation expense to cash flows from operations = ($1,812.3 / $1,445.4) x 100% = 125.4% Depreciation expense is 1.25 times greater than cash generated from operations. This suggests that the result of adding back the noncash expense (depreciation) contributed significantly to the positive operating cash flows. This indicates the high level of capital assets needed for the airline’s operations. 8-39 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–8. Req. 1 a. b. c. d. Date Assets Jan. 1 Patent Cash Jan. 1 Assets (not detailed) Goodwill Cash Dec. 31 Leasehold improvements Cash 2011 Cash e. Dec. 31 Accumulated depreciation, machine A(1) Cash Machine A Accumulated depreciation, Machine A(2) f. Dec. 31 Cash Machine B Liabilities +28,000 –28,000 +154,000 +10,000 –164,000 +15,600 –15,600 – 5,500 – 4,000 +6,000 –25,000 +20,000 Stockholders’ Equity Repair and -5,500 maintenance expense Depreciation –4,000 expense Gain on +1,000 disposal of long-lived asset(3) –5,000 +5,000 (1) ($25,000 - $5,000) x 1/5 = 4,000 (2) Accumulated depreciation to Jan. 1, 2011 ................... Add: Depreciation expense for 2011 ............................ Total accumulated depreciation ............................... $16,000 4,000 $20,000 (3) Cash proceeds of disposition....................................... Net book value of Machine A ($25,000 – $20,000)...... Gain on disposal of long-lived asset ........................ $6,000 5,000 $1,000 Req. 2 December 31, 2011 depreciation and amortization: a. Patent: $28,000 7 years = $4,000 amortization expense. b. Goodwill: No amortization due to indefinite life. c. Leasehold improvements: No amortization since constructed on December 31. d. This transactions involved a revenue expenditure and not an intangible or capitalized asset. e. Machine A: Machine A was sold on December 31, 2011. Depreciation expense was recorded prior to the sale. No additional depreciation is necessary. f. Machine B: ($31,000 - $7,000) x 1/15 = $1,600 depreciation expense. 8-40 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–9. Req. 1 January 5, 2010: Cash purchase price ............................................................. Less market value of identifiable assets: Accounts receivable……………………………………. $ 41,000 Inventory…………………………………………………. 200,000 Fixed assets .............................................................. 50,000 Other assets .............................................................. 10,000 Difference (Goodwill) ............................................................. $500,000 301,000 $199,000 Req. 2 December 31, 2010: a. Depreciation expense on fixed assets acquired: ($50,000 - $0) x 1/10 years = $5,000. Depreciation expense (+E, -SE) . . . . . . . . . . . . 5,000 Accumulated depreciation (+XA, -A) . . . . 5,000 b. Goodwill has an indefinite life and is not amortized. 8-41 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–10. Req. 1 a. Patent amortization for one year, $55,900 13 years = $4,300. b. Copyright amortization for one year, $22,500 10 years = $2,250. c. Franchise amortization for one year, $14,400 10 years = $1,440. d. License amortization for one year, $14,000 5 years = $2,800. e. Goodwill has an indefinite life and is not amortized. Req. 2 Net Book Value on December 31, 2012: a. b. c. d. e. Item Date Acquired Patent .......................... Jan. 1, 2011 Copyright ..................... Jan. 1, 2011 Franchise ..................... Jan. 1, 2011 License ........................ Jan. 1, 2010 Goodwill ....................... Jan. 1, 2008 Total book value........... Book Value Computations $55,900 – ($4,300 x 2) $22,500 – ($2,250 x 2) $14,400 – ($1,440 x 2) $14,000 – ($2,800 x 3) $40,000 (not amortized) Book Value Dec. 31, 2012 $ 47,300 18,000 11,520 5,600 40,000 $122,420 Req. 3 The book value of the copyright on January 1, 2013 ($18,000) exceeds the expected future cash flows ($17,000). Therefore, the asset is impaired. Book value of copyright .......................................................................... Fair value of copyright ............................................................................ Impairment loss to be recorded, January 2, 2013 .................................. 8-42 $18,000 16,000 $ 2,000 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles P8–11. Req. 1 (a) Cost of press .......................................................................................... Residual value ........................................................................................ Amount to depreciate over 20 years....................................................... $400,000 50,000 $350,000 Annual depreciation expense recorded in 2010 ($350,000 20 years) . $17,500 (b) Cost of press .......................................................................................... Less: Accumulated depreciation for 6 years ($17,500 x 6 years) ........... Net book (carrying) value at end of 2010 ............................................... $400,000 105,000 $295,000 Req. 2 Cost of press ................................................................................................ $400,000 Accumulated depreciation at end of 2010 (from Req. 1) .............................. 105,000 Net book value (undepreciated amount at the beginning of 2011) ........... 295,000 Less: Revised residual value ........................................................................ 73,000 Remaining balance to depreciate ................................................................. $222,000 Annual depreciation for 2011 [$222,000 (25 years – 6 years = 19 years)] * $11,684 *Rounded to the nearest dollar Remaining life Req. 3 December 31, 2011—Adjusting entry: Depreciation expense (+E, SE) .............................................. Accumulated depreciation (+XA, A) .................................... 8-43 11,684 11,684 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles ALTERNATE PROBLEMS AP8–1. Req. 1 Long-lived assets are tangible and intangible resources owned by a business and used in its operations over several years. Tangible assets (such as property, plant, and equipment or natural resources) are assets that have physical substance. Intangible assets (such as goodwill or patents) are assets that have special rights but not physical substance. Req. 2 On June 1, 2012: Equipment (+A) .................................................................... (1) (1)61,500 Cash (A) ......................................................................... Common stock (+SE) ........................................................ (2) Additional paid-in capital (+SE) ......................................... (3) Note payable (+L) ............................................................. (4) 1,500 4,000 8,000 48,000 On September 2, 2012: Note payable (L) ................................................................. 48,000 (5) 1,440 Interest expense (+E, SE) .................................................. Cash (A) .......................................................................... 49,440 Computations: (1) Equipment: $60,000 invoice + $1,500 installation (2) Common stock: $2 par value x 2,000 shares (3) Additional paid-in capital: ($6 market value - $2 par value) x 2,000 shares (4) Balance payable: $60,000 invoice – $12,000 common stock and additional paid-in capital (5) Interest expense: $48,000 x 12% x 3/12 8-44 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles AP8–1. (continued) Req. 3 Date Assets June 1 Equipment Cash Sept 2 Cash Liabilities +61,500 Note payable -1,500 Stockholders’ Equity +48,000 Common stock +4,000 Additional paid-in +8,000 capital -49,440 Note payable -48,000 Interest expense -1,440 Req. 4 Cost of the machinery includes installation costs. Freight should not be included because it was paid by the vendor. The $1,440 interest is not a part of the cost of the machinery—it must be recorded as interest expense because it is a cost of financing. Common stock is valued at $6 per share—for accounting purposes, this amount is allocated between the common stock account for the par value ($2 per share) and the additional paid-in capital account for the remaining value ($4 per share in excess of par value). 8-45 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles AP8–2. Req. 1 Balance 1/1/2013 Depreciation for 2013 Balance prior to expenditures a. b. c. Balance 12/31/2013 Building $330,000 330,000 NE + 17,000 + 70,000 $417,000 Accum. Deprec. $82,500 Deprec. Expense 16,500 (1)$16,500 99,000 NE NE NE $99,000 16,500 NE NE NE $16,500 Repairs Expense Cash NE +$5,000 NE NE $5,000 $5,000 17,000 70,000 (1) $330,000 cost 20 years = $16,500 per year Req. 2 Book Value of Building on Dec. 31, 2013: Building ($330,000 + $17,000 + $70,000) ............................. Less: Accumulated depreciation ($82,500 + $16,500) .......... Net book (carrying) value ................................................... $417,000 99,000 $318,000 Req. 3 Depreciation is a noncash expense. Unlike most expenses, no cash payment is made when the expense is recognized. The cash outflow occurred when the related asset was acquired. For companies selecting the indirect method of preparing a statement of cash flows (reconciling net income on the accrual basis to cash from operations), depreciation expense is added back to net income because the expense reduces net income, yet is not a cash outlay. 8-46 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles AP8–3. Req. 1 Cost of each machine: A Purchase price .................................... Installation costs .................................. Renovation costs ................................. Total cost ......................................... $12,200 800 600 $13,600 Machine B $32,500 1,100 1,400 $35,000 C $21,700 1,100 1,600 $24,400 Total $66,400 3,000 3,600 $73,000 Req. 2 Computation of year 1 depreciation expense for each machine: Machine Method Computation A Straight-line ($13,600 $1,000) x 1/8 = $1,575 B Units-of-production ($35,000 $2,000) 33,000 hours = $1.00 $1.00 x 7,000 hours = $7,000 C Double-declining-balance ($24,400 $0) x 2/5 = $9,760 Depreciation expense ($1,575 + $7,000 + $9,760) (+E, SE)…. 18,335 Accumulated depreciation, Machine A (+XA, A)……… Accumulated depreciation, Machine B (+XA, A)……… Accumulated depreciation, Machine C (+XA, A)……… 8-47 1,575 7,000 9,760 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles AP8–4. Req. 1 Depreciation expense of $643 million recorded in the current year is inferred from the activities affecting the Accumulated Depreciation account: Accumulated Depreciation (in millions) Impairments 0 4,053 Beg. bal. Asset sales 384 643 Deprec. Exp. 4,312 End. bal. Req. 2 Recording depreciation at the end of the period increases expenses (and thus decreases net income and stockholders’ equity) and decreases the net book value of the property and equipment accounts. Failing to record depreciation creates the opposite effects. Effect on Ratio of Failing to Record Depreciation Expense Ratio Computation Earnings per share Net income Number of shares of stock outstanding Net income will be overstated with no change in the denominator Overstated Fixed asset turnover Sales Average net fixed asset balance Numerator does not change; however, the denominator is overstated Understated Current ratio Current assets Current liabilities Neither the numerator nor the denominator are affected by depreciation expense, since accumulated depreciation affects only long-lived assets on the balance sheet No effect Return on assets Net income Average total assets Net income is overstated and so is average total assets, although at a lower amount due to averaging Overstated 8-48 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles AP8–5. Req. 1 a. Machine A – Sold on Jan. 1, 2011: (1) Depreciation expense in 2011 - none recorded because disposal date was Jan. 1, 2011. (2) To record disposal: Cash (+A) .......................................................................... Accumulated depreciation, Machine A (XA, +A).............. Gain on disposal of machine (+Gain, +SE) ................ Machine A (A) ........................................................... b. Machine B – Sold on December 31, 2011: (1) To record depreciation expense for 2011: Depreciation expense (+E, SE) ....................................... Accumulated depreciation, Machine B (+XA, A) ....... ($16,500 – $5,000) x 1/10 years = $1,150. (2) To record disposal: Cash (+A) .......................................................................... Note receivable (+A).......................................................... Accumulated depreciation, Machine B ($8,050 + $1,150) (XA, +A) .......................................................................... Loss on disposal of machine (+Loss, SE) ....................... Machine B (A) ........................................................... 6,750 17,600 350 24,000 1,150 1,150 2,000 5,000 9,200 300 16,500 c. Machine C – Disposal on January 1, 2011: (1) Depreciation expense in 2011 - none recorded because disposal date was Jan. 1, 2011. (2) To record disposal: Accumulated depreciation, Machine C (XA, +A) ............ Loss on disposal of machine (+Loss, SE) ....................... Machine C (A) .......................................................... 48,000 11,200 59,200 Req. 2 Machine A - January 1, 2011: Disposal of a long-lived asset with the price above net book value, resulting in a gain. Machine B – December 31, 2011: Disposal of a long-lived asset with the price below net book value, resulting in a loss. Machine C - January 1, 2011: Disposal of a long-lived asset due to damage, resulting in a loss. 8-49 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles AP8–6. Req. 1 Assets Liabilities Jan. 1 (a) License +7,200 Cash –7,200 Jan. 1 (b) Leasehold +17,800 improvements Cash –17,800 (1) July 1 (c) Assets +115,000 Liabilities (not detailed) Goodwill Cash Dec. 31 (d1) Accumulated depreciation, Machine A (2) Dec. 31 (d2) Cash Equipment Accumulated depreciation, Machine A(3) 2012 (e) Cash Stockholders’ Equity +24,000 (not detailed) +29,000 –120,000 –4,500 +6,000 –21,500 +18,000 –6,700 Dec. 31 (f) Cash Equipment Depreciation expense –4,500 Gain on disposal of long-lived asset(4) +2,500 Repair and maintenance expense –6,700 –8,000 +8,000 Computations for Acquisition: (1) Purchase price ............................................................. $120,000 Less: Market value of net assets ($115,000 - $24,000) 91,000 Goodwill ....................................................................... $ 29,000 Computations for Machine A: (2) Depreciation expense for 2012: ($21,500 - $3,500) x 1/4 $4,500 (3) Accumulated depreciation to Jan. 1, 2012 ................... Add: Depreciation expense for 2012 (above) ............... Total accumulated depreciation ............................... $13,500 4,500 $18,000 (4) Cash proceeds from disposition ................................... Net book value of Machine A ($21,500 – $18,000)....... Gain on disposal of long-lived asset ......................... $6,000 3,500 2,500 8-50 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles AP8–6. (continued) Req. 2 December 31, 2012 depreciation and amortization expense: a. License: $7,200 4 years = $1,800 b. Leasehold improvements: Amortize over shorter of: (a) remaining lease term = 10 years or (b) life of the asset = 5 years Amortization for 2012: $17,800 x 1/5 = $3,560 c. Goodwill: No amortization since it has an indefinite life. d. Machine A: Machine A was sold on December 31, 2012. Depreciation expense was computed up to the date of disposal. No additional depreciation is necessary. e. This transaction involved a revenue expenditure and not an intangible or capitalized asset. f. Machine B: ($18,000 - $2,000) x 1/4 = $4,000 depreciation expense for 2012 The $8,000 capital expenditure was made on December 31, 2012; no depreciation expense is recorded in 2012 since the reconditioned machine has not yet been used. 8-51 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles AP8–7. Req. 1 a. Patent amortization for one year, $18,600 10 years = $1,860. b. Copyright amortization for one year, $24,750 30 years = $825. c. Franchise amortization for one year, $19,200 12 years = $1,600. d. License amortization for one year, $21,700 7 years = $3,100. e. Goodwill is not amortized since it has an indefinite life. Req. 2 Net book value on January 1, 2015: a. b. c. d. e. Item Date Acquired Patent ..........................Jan. 1, 2012 Copyright .....................Jan. 1, 2012 Franchise .....................Jan. 1, 2012 License ........................Jan. 1, 2011 Goodwill .......................Jan. 1, 2013 Total net book value..... Book Value Computations $18,600 – ($1,860 x 3) $24,750 – ($825 x 3) $19,200 – ($1,600 x 3) $21,700 – ($3,100 x 4) $75,000 (not amortized) Net Book Value Jan. 1, 2015 $ 13,020 22,275 14,400 9,300 75,000 $133,995 Req. 3 The net book value of the franchise on January 2, 2015 ($14,400) is greater than the expected future cash flows ($13,500). The asset is impaired. The loss due to impairment is computed as the difference between net book value ($14,400) and its fair value ($12,000). The impairment loss to be recorded is $2,400. 8-52 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles COMPREHENSIVE PROBLEM (Chapters 6, 7, and 8) COMP8-1. Case A Req. 1 (in millions) Allowance for uncollectible accounts (XA, +A) 1 ............. Accounts receivable (A)............................................ 12 12 Req. 2 Cash collections for 2008 2 were $5,711 million. Accounts Receivable Beg. 558 Sales 5,710 ? Collections ? Write-offs End. 545 - Allowance for Uncollectible Accounts 20 Beg. 5 Bad debt Write-offs ? expense 13 End. = Net Realizable Value 538 532 1 Beg. allowance $20 + Bad debt expense $5 – Write-offs ? = End. Allowance $13 Write-offs = $12 2 Beg. accounts receivable $558 + Sales $5,710 – Write-offs $12 – Collections ? = End. accounts receivable $532 Collections = $5,711 Req. 3 Net Income ÷ Net Sales = Net Profit Margin 2006 510 4,700 10.85% 2007 497 5,695 8.73% 2008 $(312) $5,710 (5.46)% The company’s net profit margin has fallen each year while net sales have risen, with a net loss reported in 2008. This suggests that, although Dr Pepper Snapple’s management has generated increasing sales revenue over time, it is having greater difficulty each year controlling costs and expenses. 8-53 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles COMP8-1. (continued) Case B Req. 1 The company should record bad debt expense of $13,900 for 2011. Req. 2 Under current assets on the 2011 balance sheet: Accounts receivable, net of the allowance for doubtful accounts of $12,400 Accounts Receivable - End. 620,000 Allowance for Uncollectible Accounts 1,500 Unadj. bal. Bad debt 13,900 expense 12,400 End. $607,600 Net = Realizable Value 607,600 Unadj. allowance bal. $(1,500) + Bad debt expense ? = End. bal. $12,400 Bad debt expense = $13,900 Case C Req. 1 The company should record bad debt expense of $481,350 for 2012. Req. 2 Under current assets on the 2012 balance sheet: Accounts receivable, net of the allowance for doubtful accounts of $490,550 Accounts Receivable End. 5,840,000 - Allowance for Uncollectible Accounts 9,200 Unadj. bal. Bad debt 481,350 expense 490,550 End. $5,349,450 Net = Realizable Value 5,349,450 Sales revenue $160,450,000 x Bad debt rate x .003 Bad debt expense $ 481,350 Unadj. allowance bal. $9,200 + Bad debt expense $481,350 = End. bal. $490,550 8-54 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles COMP8-1. (continued) Case D Req. 1 11/13 Purch 11/4 Purch Beg. 500 300 100 @ $21 = $10,500 @ $19 = $ 5,700 @ $18 = $ 1,800 Units 100 800 900 (700) 200 Beginning Purchases Available for sale Less: Sales Ending Cost $ 1,800 16,200 $18,000 a. FIFO Cost of ending inventory: Layer 200 units x $21 = $4,200 Cost of goods sold: Layers (100 x $18) + (300 x $19) + (300 x $21) = $1,800 + $5,700 + $6,300 = $13,800 OR Cost of goods available for sale Less: Cost of ending inventory Cost of goods sold $18,000 ($1,800 beg. + $16,200 purch.) 4,200 $13,800 b. LIFO Cost of ending inventory: Layers (100 units x $18) + (100 units x $19) $1,800 + $1,900 = $3,700 Cost of goods sold: Layers (500 x $21) + (200 x $19) = $10,500 + $3,800 = $14,300 OR Cost of goods available for sale Less: Cost of ending inventory Cost of goods sold 8-55 $18,000 ($1,800 beg. + $16,200 purch.) 3,700 $14,300 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles COMP8-1. (continued) Case D (continued) c. Weighted average Cost of ending inventory: Cost of goods available for sale ÷ Number of goods available Cost per unit $18,000 ($1,800 beg. + $16,200 purch.) ÷ 900 units $20 per unit 200 units ending inventory x $20 per unit cost = $4,000 ending inventory cost Cost of goods sold: 700 units sold x $20 per unit cost = $14,000 cost of goods sold OR Cost of goods available for sale Less: Cost of ending inventory Cost of goods sold $18,000 ($1,800 beg. + $16,200 purch.) 4,000 $14,000 Req. 2 a. Gross profit under FIFO method Sales revenue (700 units sold x $50) Less: Cost of goods sold Gross profit $35,000 13,800 $21,200 Gross profit percentage = $21,200 gross profit ÷ $35,000 sales = .6057 or 60.57% b. Net income under LIFO method Sales revenue Less: Cost of goods sold Gross profit Operating expenses Pretax income Income tax expense Net income $35,000 14,300 20,700 16,000 4,700 1,410 $3,290 c. The LIFO method should be recommended to Stewart for tax and financial reporting purposes. Prices of inventory are rising. When prices rise, LIFO yields the highest cost of goods sold, lowest net income, and, for tax purposes, the lowest tax amount. When a company chooses LIFO to save taxes (reduce cash outflows), the LIFO Conformity Rule indicates a company must also use LIFO for financial reporting purposes, even though it reports the lowest net income. 8-56 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles COMP8-1. (continued) Case D (continued) Req. 2 For valuation purposes, ending inventory is to be reported at the lower of cost or market, a conservative approach so that assets are not overstated, thus reducing net income. When Stewart applied the LCM method, the following comparisons were made: FIFO cost as calculated $4,200 Replacement cost (200 units x $19.50) 3,900 Since replacement cost (market) is lower than FIFO cost, Stewart should report the $3,900 on the balance sheet at the end of the month. The $300 difference will increase cost of goods sold, which will reduce net income for the month. Case E Req. 1 Partial depreciation schedules: a. Office equipment using double-declining-balance method Year Computation 2011 ($50,000 - $0) x 2/3 33,333 33,333 16,667 2012 ($50,000 - $33,333) x 2/3 11,111 44,444 5,556 1,667 35,000 15,000 residual value 0 35,000 15,000 2013 Depreciation Accumulated Expense Depreciation Fully depreciated Net Book Value b. Factory equipment using units-of-production method (Cost – Residual Value) / Total estimated production =Depreciation rate ($840,000 - $0) / 100,000 hours = $8.40 per hour Year Computation Depreciation Accumulated Expense Depreciation 2011 $8.40/hour x 8,000 hours 67,200 67,200 772,800 2012 $8.40/hour x 9,200 hours 77,280 144,480 695,520 2013 $8.40/hour x 8,900 hours 74,760 219,240 620,760 8-57 Net Book Value Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles COMP8-1. (continued) Case E Req. 2 Cash (+A).............................................................................. Accumulated depreciation, factory equipment(XA, +A) ....... Factory equipment (A) .............................................. Gain on sale of equipment (+Gain, +SE) ................... 700,000 219,240 840,000 79,240 Req. 3 Net book value of patent = $300,000 cost – ($20,000 annual expense x 3 years) = $240,000 $300,000 cost x 1/15 = $20,000 amortization expense per year Test for possible asset impairment: Net book value of patent $240,000 Future cash flows $210,000 Impaired Since the net book value of the patent exceeds its future cash flows, the patent is impaired and must be reduced to its fair value. Computation of impairment loss: Net book value of patent $240,000 Fair value $190,000 Impairment loss $ 50,000 reported on the income statement 8-58 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CASES AND PROJECTS ANNUAL REPORT CASES CP8–1. 1. The company spent $265,335,000 on property and equipment in the 2008 year (this information is disclosed on the Statement of Cash Flows). 2. The estimated useful life of leasehold improvements is the lesser of 5 to 10 years or the term of the lease (disclosed in Note 2 Summary of Significant Accounting Policies under the heading Property and Equipment). 3. The original cost of furniture, fixtures, and equipment held by the company at the end of the most recent reporting year was $536,009,000 (disclosed in Note 6). 4. Current depreciation and amortization expense is $133,141,000 (disclosed on the Statement of Cash Flows; note that the amount reported on the Income Statement is $131,219,000 because part of the $133,141,000 is included in cost of sales), but accumulated depreciation and amortization increased by only $92,647,000 ($558,389,000 – $465,742,000, disclosed in Note 6). The difference of $92,647,000 may be due to write-offs of capital assets (impairment losses) of $6,713,000 reported on the Statement of Cash Flows. 5. Fixed asset turnover = (in thousands) Net Sales = $2,988,866 = 4.38 Average Net Fixed Assets ($625,568 + $740,240)/2 Net sales is found on the Income Statement, and net fixed assets are found under “Property and Equipment” on the Balance Sheet. 8-59 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CP8–2. 1. The company uses the straight-line method of depreciation. This is disclosed in Note 2 Summary of Significant Accounting Policies, under the heading “Property and Equipment.” 2. Accumulated depreciation and amortization was $355,957,000. This is disclosed in Note 5. 3. Furniture and fixtures have estimated useful lives of 5 years. This is disclosed in Note 2 Summary of Significant Accounting Policies, under the heading “Property and Equipment.” 4. The original cost of the leasehold improvements was $486,959,000. This is disclosed in Note 5. 5. Depreciation and amortization expense was $81,949,000. This is disclosed on the Statement of Cash Flows. 6. (in thousands) Fixed asset = Net Sales = $1,834,618 = 3.69 turnover Average Net Fixed ($488,889 + $505,407)/2 Assets This ratio measures how efficiently Urban Outfitters utilizes its investment in property, plant, and equipment over time. Net Sales is disclosed on the Income Statement, and net fixed assets are disclosed on the Balance Sheet under “Property and Equipment”. CP8–3. 1. Fixed assets as a % of total assets American Eagle Outfitters Urban Outfitters 37.7% 38.0% ($740,240 / $1,963,676) ($505,407 / $1,329,009) If one examines the balance sheets for the two firms, American Eagle and Urban Outfitters have nearly the same percentage of current assets to total assets as well as nearly the same percentage of fixed assets to total assets. 8-60 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CP8–3. (continued) 2. American Eagle Outfitters Urban Outfitters 43.0% 41.3% ($558,339 accum. depr. / $1,298,629 cost.) ($355,957 accum. depr. / $861,364 cost) Percent of gross fixed assets that have been depreciated These percentages are somewhat similar. Differences are potentially due to Urban Outfitters having slightly newer fixed assets and also depreciating buildings over 39 years rather than 25 years as American Eagle does. 3. Fixed Asset Turnover American Eagle Outfitters Urban Outfitters 4.38 3.69 $2,988,866 / ($625,568 + $740,240)/2 $1,834,618/ ($488,889 + $505,407)/2 American Eagle appears to have the higher efficiency level for fixed assets. The company generates more than one and one-half times as much in net sales as Urban Outfitters, but has only one and one-third times more in net fixed assets. 4. Fixed Asset Turnover Industry Average American Eagle Outfitters Urban Outfitters 5.76 4.38 3.69 Both American Eagle Outfitters and Urban Outfitters have a fixed asset turnover ratio that is below the industry average, with Urban Outfitters having the lower fixed asset turnover ratio. This suggests that both companies are less efficient in generating sales with fixed assets than the average company in the industry. This could be due to both companies continuing growth strategies of investing in new stores which have yet to reach their potential to generate sales. 8-61 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles FINANCIAL REPORTING AND ANALYSIS CASES CP8–4. More than three competitors are listed in each of the following industries. Examples include: Industry Company name (Symbol, if available) 1. Airline Delta Air Lines,Inc. (DAL) AMR Corporation (AMR) Continental Airlines Inc. (CAL) 2. Hotels & Motels Wyndham Worldwide (WYN) Starwood Hotels and Resorts (HOT) Marriott International Inc. (MAR) 3. Footwear Brown Shoe Company, Inc. (BWS) Skechers USA, Inc. (SKX) The Timberland Company (TBL) 4. Computer Hardware Hewlett-Packard (HPQ) Western Digital Corp. (WDC) EMC Corporation (EMC) CP8–5. Req. 1 Depreciable assets: Buildings and improvements .... $ 2,818,300 Fleet and equipment ................ 2,072,116 Computer hardware and software 569,669 Total ..................................... $5,460,085 Depreciation expense .......... 361,062 Estimated useful life 15.12 years Req. 2 Accumulated depreciation ........ Depreciation expense .............. Average age $ 2,788,213 361,062 7.72 years At best, these are very rough estimates but they are probably the best that can be made as an analyst. Some prefer to use an average of several years which is an acceptable alternative. Likewise, dividing Accumulated Depreciation (used cost) by the total cost of the fixed assets yields the percentage of the assets’ cost that have been allocated ($2,788,213 ÷ $5,460,085 = 51% used). 8-62 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CP8–6. Req. 1 The cost of the property, plant, and equipment at the end of the current year is $3,911 million computed as follows: Cost – accumulated depreciation = Net book value ? – $1,178 million (from the notes) = $2,733 million (from the balance sheet) Cost = $3,911 million Req. 2 The approximate age of the property on that date was 4 years, computed as follows: $1,178 accumulated depreciation $289 depreciation expense = 4.076 years Req. 3 Current year fixed asset turnover ratio: Sales [(Beginning net fixed assets + Ending net fixed assets) 2)] $9,714 [($2,559 + $2,733) 2] = 3.7 times This ratio is a measure of a company’s efficiency in utilizing fixed assets to generate revenues. To evaluate Cain’s ratio, it should be compared to ratios in previous years and also to other companies in the industry. Req. 4 Cain reported $3,076 million as goodwill that represents the amount Cain paid above fair market value for the net assets of other companies Cain purchased. Req. 5 The amortization and depreciation amounts, totaling $497 million, are added to income from continuing operations because these are noncash expenses. No cash is paid when these amounts are recognized. To determine cash provided by continuing operations, all noncash expenses, losses, revenues, and gains need to be adjusted out of income accounted for on the accrual basis. Since noncash expenses reduce accrualbased income, they need to be added to income to determine cash-based income. 8-63 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CP8–7. Consider the kinds of transactions that make Property, Plant, and Equipment and Accumulated Depreciation change during a period: (in millions) Property, Plant, and Equipment Beg. bal. 7,327 Acquire 254 ? Disposal End. bal. 6,805 Accumulated Depreciation 5,516 Beg. bal. Disposal ? 420 Depr. Exp. 5,254 End. bal. Property, Plant, and Equipment (at cost): Beg. bal., $7,327 + Acquisitions, $254 Disposals, ? = $6,805 Disposals = $ 776 Accumulated Depreciation (used): Beg. bal., $5,516 + Depreciation expense, $420 Disposals, ? = $5,254 Disposals = $ 682 Net book value of disposals ($776 cost – $682 accumulated depreciation) Gain on disposal of property Cash proceeds when property was sold $ 94 14 $ 108 CRITICAL THINKING CASES CP8–8. Req. 1 The interest coverage ratio is a measure of the ability of a company to meet its obligatory interest payments from current operations. A company with a large coverage ratio has a greater ability to meet its interest obligations than a company with a small ratio (other things being equal). Req. 2 Hess did not include the capitalized interest in its reported interest expense. Instead this amount was included in an asset account and will be included in depreciation expense over the life of the asset. Most analysts include interest expense and capitalized interest when calculating the coverage ratio. Interest must be paid to the creditor whether it is listed as an expense or capitalized. This case is a good example of why users of financial statements must understand accounting and where to find information in the statements. 8-64 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CP8–9. Req. 1 Amounts in millions of US dollars Property and equipment, net Q1 Year 1 (March 31) With Without the the entries entries $ 38,614 $37,843 Q2 Year 1 (June 30) With Without the the entries entries $ 35,982 Q3 Year 1 (September 30) With Without the the entries entries $34,651 $ 38,151 Q4 Year 1 (December 31) With Without the the entries entries $36,077 $ 38,809 Q1 Year 2 (March 31) With Without the the entries entries $35,794 $ 39,155 $35,322 Sales revenues 8,825 8,825 8,910 8,910 8,966 8,966 8,478 8,478 8,120 8,120 Operating expenses 7,628 8,399 8,526 9,086 7,786 8,529 7,725 8,666 7,277 8,095 Operating income 1,197 426 384 (176) 1,180 437 753 (188) 843 25 The above table shows that the “special journal entries” had the effect of reducing operating expenses and increasing property and equipment in each quarter. The reduction in operating expenses directly increased operating income, in some instances allowing the company to report positive earnings rather than losses (see Q2 and Q4 of Year 1). Note: Because Property and Equipment is a balance sheet account that carries its balance forward from one period to the next, the computation of its book value “without the entries” must take into consideration the cumulative effects of the entries, calculated as: Q1: $37,843 = $38,614 - $771 (Q1) Q2: $34,651 = $35,982 - $771 (Q1) - $560 (Q2) Q3: $36,077 = $38,151 - $771 (Q1) - $560 (Q2) - $743 (Q3) Q4: $35,794 = $38,809 - $771 (Q1) - $560 (Q2) - $743 (Q3) - $941 (Q4) Q1Y2: $35,322 = $39,155 - $771 (Q1) - $560 (Q2) - $743 (Q3) - $941 (Q4) - $818 8-65 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CP8-9. (continued) Req. 2 Fixed Asset Turnover Ratio = Net Sales Average Net Fixed Assets Q2 Yr 1 Q3 Yr 1 Q4 Yr 1 Q1 Yr 2 = $8,910 $37,298* $8,966 $37,067+ $8,478 $38,480^ $8,120 $38,982† = 0.24 0.24 0.22 0.21 37,298* = (38,614 + 35,982)/2 37,067+ = (35,982 + 38,151)/2 38,480^ = (38,151 + 38,809)/2 38,982† = (38,809 + 39,155)/2 The trend across the four quarters shows a gradual and steady decline, suggesting the company is becoming less efficient in the use of its assets. This decline is somewhat consistent with the drop in operating income between Q3 and Q4 of Year 1. However, the trends between operating income and fixed asset turnover are not entirely consistent because operating income shows a big increase from Q2 to Q3 in Year 1 and a small increase between Q4 of Year 1 and Q1 of Year 2 at a time when the fixed asset turnover ratio shows decreases in operating efficiency. This inconsistency is puzzling. 8-66 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CP8-9. (continued) Req. 3 Looking back, there are a number of questions that might have been raised: Why you? It’s unusual that the CFO chose someone who doesn’t have experience with transactions of that magnitude. Why a new account? It’s unusual that a new account has been created for these special advance payments, when an “equipment deposit” account already existed for transactions supposedly of a similar nature. Why process the transactions through the operating division? The CFO didn’t offer a clear reason why the transactions were posted in an abnormal manner, requiring an unusual end-of-period adjustment. (Adjustments like this made at the request of management are sometimes called “top-side adjustments.”) Why no support for the amounts? If these truly represented contractual prepayments for equipment, they would be supported by a copy of the contract or a cashed check. Why were the sources of information untraceable? Anonymous Post-it notes and easily deleted voicemail messages might lead you to wonder if someone is being careful to cover their tracks. Why were the amounts so big in comparison to the existing property and equipment balances and other equipment purchases that period? Why weren’t the prepayments ever reduced? The length of time to complete the prepaid equipment deals had exceeded a year, when a normal prepayment was outstanding for only a few weeks at a time. Why did the CFO always compliment you and promise big promotion opportunities for what you must have thought was merely doing your job? 8-67 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CP8-9. (continued) Req. 4 As a staff person, you can’t doubt or mistrust every assignment you are given. If you did, you’d likely find yourself out of a job. So, instead, you need to be able to tell the difference between routine/ordinary requests and unusual requests. When you are confronted with unusual requests, attempt to understand and evaluate the reasons for those requests. Consider who is benefited and who is harmed by the actions you are asked to take. If you are concerned about the ethical or legal implications of your actions, consult with colleagues independent of the person asking you to take those actions. Finally, be sure to read and follow your company’s code of ethical conduct. Many companies make it easy for you to bring ethical concerns to the attention of an oversight committee. Req. 5 Clearly, the investors in WorldCom (or World-Con, as it was being called) were devastated by the news. In the days following the announcement that the company would restate its 2001 and 2002 financial results, WorldCom’s stock price lost about 90% of its value. Ultimately, stockholders would lose all that they had invested, when the company entered into and emerged from bankruptcy. This meant that millions of working people and retirees no longer had the investment income for which they had saved and on which they had made their retirement plans. It also meant that money invested in kids’ college funds was gone—more than likely, you or one of your classmates has to work a part-time job this term to pay for tuition that could have been funded by your parents’ investments had it not been for the WorldCom fraud. WorldCom’s creditors also were severely harmed. Soon after the company’s true financial condition became known, WorldCom filed for bankruptcy protection. This legal maneuver gave the company time to restructure its operations and propose new financing arrangements that would keep the company alive. Existing creditors eventually resigned themselves to the fact that they would have to forgive $36 billion of the company’s debt if the company was to survive. This meant that the average creditor was repaid only 42% of what was owed by WorldCom. The company’s external auditors also were severely hurt because they had failed to detect the fraud. Undetected fraud is always bad news for external auditors, but this situation was even worse because WorldCom’s external auditors had been Arthur Andersen—the same firm that had failed to detect and report the Enron fraud just one year earlier. Just as Andersen was bracing for a whirlwind of Enron-related lawsuits, WorldCom’s problems were discovered and that was the end of Arthur Andersen. These are just three of the groups directly affected by WorldCom’s fraud. Countless others were adversely affected as well, as the effects of WorldCom’s fraud and business failure spread through the economy like the ripple of a stone dropped in a pond. Employees were laid off, other companies lost WorldCom as one of their primary customers, the confidence of investors in other companies was shaken (causing other losses in investment value), and the government held numerous meetings to discuss how to protect the American economy from shocks like this in the future. 8-68 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles CP8–10. Req. 1 a. Cash flows: Because cash was paid for interest, cash decreases (-). However, the amount of interest expense that was capitalized caused expenses to be lower and net income to be higher. b. Fixed asset turnover ratio is lower (-) because the denominator is higher due to interest capitalization. Req. 2 Because the fixed asset turnover ratio has decreased due to the additional interest capitalization, all other things equal, one would infer that Marriott management’s effectiveness in utilizing fixed assets has also decreased. Req. 3 Although the fixed asset turnover ratio decreased due to the interest capitalization, this does not indicate a real change in asset efficiency. The same asset is used to generate the same level of net sales, regardless of whether the interest is capitalized or expensed. This highlights the need to adjust for the effects of differences in accounting policies when evaluating a company and making comparisons across time or across different companies. FINANCIAL REPORTING AND ANALYSIS TEAM PROJECT CP8–11. Due to the nature of this project, responses will vary. 8-69 Chapter 09 - Reporting and Interpreting Liabilities Chapter 09 Reporting and Interpreting Liabilities ANSWERS TO QUESTIONS 1. Liabilities are obligations that result from past transactions that require future payment of assets or the future performance of services, that are definite in amount or are subject to reasonable estimation. A liability usually has a definite payment date known as the maturity or due date. A current liability is a short-term liability; that is, one that will be paid during the coming year or the current operating cycle of the business, whichever is longer. It is assumed that the current liability will be paid out of current assets. All other liabilities are defined as long-term liabilities. 2. External parties have difficulty determining the amount of liabilities of a business in the absence of a balance sheet. Therefore, about the only sources available to external parties for determining the number, type, and amounts of liabilities of a business are the published financial statements. These statements have more credibility when they have been audited by an independent CPA. 3. A liability is measured at acquisition at its current cash equivalent amount. Conceptually, this amount is the present value of all of the future payments of principal and interest. For a short-term liability the current cash equivalent usually is the same as the maturity amount. The current cash equivalent amount for an interest-bearing liability at the going rate of interest is the same as the maturity value. For a long-term liability, the current cash equivalent amount will be less than the maturity amount: (1) if there is no stated rate of interest, or (2) if the stated rate of interest is less than the going rate of interest. 4. Most debts specify a definite amount that is due at a specified date in the future. However, there are situations where it is known that an obligation or liability exists although the exact amount is unknown. Liabilities that are known to exist but the exact amount is not yet known must be recorded in the accounts and reported in the financial statements at an estimated amount. Examples of a known obligation of an estimated amount are estimated income tax at the end of the year, property taxes at the end of the year, and obligations under warranty contracts for merchandise sold. 9-1 Chapter 09 - Reporting and Interpreting Liabilities 5. Working capital is computed as total current assets minus total current liabilities. It is the amount of current assets that would remain if all current liabilities were paid, assuming no loss or gain on liquidation of those assets. 6. The quick ratio is the percentage relationship of quick assets (cash, marketable securities, and accounts receivable) to current liabilities. It is computed by dividing quick assets by current liabilities. For example, assuming quick assets of $50,000 and current liabilities of $100,000, the quick ratio would be $50,000/$100,000 = 0.5 (for each dollar of current liabilities there is $0.50 of quick assets). The quick ratio is influenced by the amount of current liabilities. Therefore, it is particularly important that liabilities be considered carefully before classifying them as current versus long term. The shifting of a liability from one of these categories to the other often may affect the quick ratio significantly. This ratio is used by creditors because it is an important index of ability to meet short-term obligations. Thus, the proper classification of liabilities is particularly significant. 7. An accrued liability is an expense that was incurred before the end of the current period but has not been paid or recorded. Therefore, an accrued liability is recognized when such a transaction is recorded. A typical example is wages incurred during the last few days of the accounting period but not recorded because no payroll was prepared and paid that included these wages. Assuming wages of $2,000 were incurred, the adjusting entry to record the accrued liability and the wage expense would be as follows: December 31: Wage expense (+E, -SE)…………………………………… Wages payable (+L) ...... ………………………………….. 9-2 2,000 2,000 Chapter 09 - Reporting and Interpreting Liabilities 8. A deferred revenue (usually called unearned revenue or revenue collected in advance) is a revenue that has been collected in advance of being earned and recorded in the accounts by the entity. Because the amount already has been collected and the goods or services have not been provided, there is a liability to provide goods or services to the party who made the payment in advance. A typical example is the collection of rent on December 15 for one full month to January 15 when the accounting period ends on December 31. At the date of the collection of the rent the following entry usually is made: December 15: Cash (+A) ................................................................... Rent revenue (+R, +SE) ........................................ 4,000 4,000 On the last day of the period, the following adjusting entry should be made to recognize the deferred revenue as a liability: December 31: Rent revenue (-R, -SE) ............................................... Deferred rent revenue (or Rent revenue collected in advance) (+L) ...................................................... 2,000 2,000 The deferred rent revenue (credit) is reported as a liability on the balance sheet because two weeks’ occupancy is owed in the next period for which the lessee already has made payment. 9. A note payable is a written promise to pay a stated sum at one or more specified dates in the future. A secured note payable is one that has attached to it (or coupled with it) a mortgage document which commits specified assets as collateral to guarantee payment of the note when due. An unsecured note is one that does not have specific assets pledged, or committed, to its payment at maturity. A secured note carries less risk for the note holder (creditor). 10. A contingent liability is not an effective liability; rather it is a potential future liability. A contingent liability arises because of some transaction or event that has already occurred which may, depending upon one or more future events, cause the creation of a true liability. A typical example is a lawsuit for damages. Whether the defendant has a liability depends upon the ultimate decision of the court. Pending that decision there is a contingent liability (and a contingent loss). This contingency must be recorded and reported (debit, loss; credit, liability) if it is “probable” that the decision will require the payment of damages that can be reasonably estimated. If it is only “reasonably possible” that a loss will be incurred, only footnote disclosure is required. 9-3 Chapter 09 - Reporting and Interpreting Liabilities 11. $4,000 x 12% x 9/12 = $360. 12. The time value of money is another way to describe interest. Time value of money refers to the fact that a dollar received today is worth more than a dollar to be received at any later date because of interest. 13. Future value—The future value of a number of dollars is the amount that it will increase to in the future at i interest rate for n periods. The future value is the principal plus accumulated interest compounded each period. Present value—The present value of a number of dollars, to be received at some specified date in the future, is that amount discounted to the present at i interest rate for n periods. It is the inverse of future value. In compound discounting, the interest is subtracted rather than added as in compounding. 14. $8,000 x .3855 = $3,084. 15. An annuity is a term that refers to equal periodic cash payments or receipts of an equal amount each period for two or more periods. In contrast to a future value of $1 or a present value of $1 (which involve a single contribution or amount), an annuity involves a series of equal contributions for a series of equal periods. An annuity may refer to a future value or a present value. 9-4 Chapter 09 - Reporting and Interpreting Liabilities 16. Concept PV of $1 PV of annuity of $1 i = 5%; n =4 .8227 3.5460 Table Values i = 10%; n =7 .5132 4.8684 i = 14%; n = 10 .2697 5.2161 17. $18,000 – $3,000 = $15,000 ÷ 4.9173 = $3,050. ANSWERS TO MULTIPLE CHOICE 1. c) 6. a) 2. e) 7. c) 3. d) 8. b) 9-5 4. c) 9. b) 5. c) 10. d) Chapter 09 - Reporting and Interpreting Liabilities Authors’ Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 5 3 5 4 5 5 5 6 5 7 5 8 5 9 10 10 10 11 5 Exercises No. Time 1 30 2 30 3 30 4 30 5 20 6 20 7 20 8 20 9 30 10 20 11 20 12 15 13 20 14 20 15 10 16 20 17 20 18 20 19 20 20 15 21 20 22 20 23 15 24 20 25 20 26 20 Problems No. Time 1 35 2 45 3 30 4 25 5 45 6 30 7 30 8 40 9 40 10 25 11 40 12 30 13 35 14 30 Alternate Problems No. Time 1 45 2 40 3 40 4 30 5 30 6 35 7 35 8 45 Cases and Projects No. Time 1 30 2 30 3 30 4 20 5 45 6 20 7 30 8 * * Due to the nature of this project, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time to discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 9-6 Chapter 09 - Reporting and Interpreting Liabilities MINI-EXERCISES M9–1. 1st Year $600,000 .11 1/12 = $5,500 2nd Year $600,000 .11 2/12 = $11,000 M9–2. October 1 Cash (+A) ....................................................................... Note payable (+L) ....................................................... 290,000 December 31 Interest expense (+E, -SE) ............................................. Interest payable (+L)................................................... 7,250 9-7 290,000 7,250 Chapter 09 - Reporting and Interpreting Liabilities M9–3. 1. Computed from balance sheet data 2. Balance sheet 3. Notes to the statements 4. Not reported but can be computed from balance sheet and income statement data. 5. Statement of cash flows M9–4. Quick Ratio: $20,000 / $90,000 = 0.22 Working Capital: $ 120,000 - $ 90,000 = $ 30,000 M9–5. Quick Ratio Working Capital a. Decrease Remain the same b. Decrease Decrease c. Increase Remain the same d. Decrease Remain the same M9–6. 2011 Buzz does not have to record or disclose the liability because the chance of the liability occurring is remote. 2012 Buzz must disclose the liability in a note because the liability is reasonably possible. 2013 Buzz must disclose the liability in a note since the existence of a liability is reasonably possible. If the lawyers believe that the case will be lost on appeal, a liability should be recorded. 2014 Buzz must record the loss and the liability because the out of court settlement made the $150,000 loss probable. 9-8 Chapter 09 - Reporting and Interpreting Liabilities M9–7. $500,000 0.4632 = $231,600 $15,000 6.1446 = $92,169 = $118,000 + $129,000 0.9524 = 122,860 + $ 27,500 5.0757 = 139,582 Total = $380,442 $27,500 5.9847 = $164,579 $16,250 15.1929 = $246,885 M9–8. M9–9. $118,000 M9–10. It is much better to save $16,250 for 10 years. M9–11. $125,000 $17,039 = X (7.3359) = X EXERCISES 9-9 Chapter 09 - Reporting and Interpreting Liabilities E9–1. Req. 1 (a) Current assets ............................................................... Current liabilities: Accounts payable ....................................................... Income taxes payable ................................................ Liability for withholding taxes ...................................... Rent revenue collected in advance ............................ Wages payable .......................................................... Property taxes payable............................................... Note payable, 10% (due in 6 months) ........................ Interest payable .......................................................... Working capital .............................................................. $168,000 $56,000 14,000 3,000 7,000 7,000 3,000 12,000 400 (102,400) $ 65,600 (b) Quick ratio: ($70,000 $102,400) = 0.68. Working capital is critical for the efficient operation of a business. Current assets include cash and assets that will be collected in cash within one year or the normal operating cycle of the company. A business with insufficient working capital may not be able to pay its short term creditors on a timely basis. The quick ratio is a measure of liquidity. It helps analysts assess a company’s ability to meet its obligations. Req. 2 No, contingent liabilities are reported in the notes, not on the balance sheet. Therefore, they are not included in the required computations. 9-10 Chapter 09 - Reporting and Interpreting Liabilities E9–2. Req. 1 March 31 Salary and wage expense (+E, -SE) ...................................... Liability for income taxes withheld-employees (+L) ............ Liability for insurance premiums withheld-employees (+L) . FICA taxes payable-employees (+L) .................................. Cash (-A) ............................................................................ Payroll for March including employee deductions. 200,000 40,000 1,000 15,000 144,000 Req. 2 March 31 Payroll tax expense (+E, -SE) ................................................ FICA taxes payable-employer (+L) ..................................... Employer payroll taxes on March payroll. Req. 3 Liability for income taxes withheld-employees (-L) ................. Liability for insurance premiums withheld-employees (-L) ...... FICA taxes payable-employees (-L) ....................................... FICA taxes payable-employer (-L) ......................................... Cash (-A) ............................................................................ Remittance of payroll taxes and deductions for March payroll. 9-11 15,000 15,000 40,000 1,000 15,000 15,000 71,000 Chapter 09 - Reporting and Interpreting Liabilities E9–3. Req. 1 The additional labor expense was $6,000, which is the total of payroll taxes that must be paid by the employer. The $10,000 income taxes and the $6,000 FICA taxes paid by the employees did not add to the labor cost of the employer. The total labor cost to the company was $86,000 + $6,000 = $92,000. The employees’ take-home pay was $70,000; that is, the total of salaries and wages less the deductions paid by the employees (i.e., $86,000 – $10,000 – $6,000). Req. 2 Balance sheet liabilities: Liability for income taxes withheld .......................................................... $ 10,000 FICA taxes payable ($6,000 + $6,000)................................................... 12,000 Total ................................................................................................... $22,000 Req. 3 Both managers and analysts would understand that a 10% increase in salaries is more expensive than a 10% increase in the employer’s share of FICA (or any other benefit). The reason is that many benefits are stated as a percentage of salary. As a result, the cost of a 10% increase in salaries is an increase in both salaries and fringe benefits. 9-12 Chapter 09 - Reporting and Interpreting Liabilities E9–4. Req. 1 November 1 Cash (+A) ....................................................................... 4,800,000 Note payable (+L) ....................................................... Borrowed on 6-month, 8%, note payable. 4,800,000 Req. 2 December 31 (end of the accounting period): Interest expense (+E, -SE) ............................................. Interest payable (+L)................................................... Adjusting entry for 2 months’ accrued interest ($4,800,000 x 8% x 2/12 = $64,000). 64,000 64,000 Req. 3 April 30 (maturity date): Note payable (-L) ........................................................... 4,800,000 Interest payable (per above) (-L) .................................... 64,000 Interest expense ($4,800,000 x 8% x 4/12) (+E, -SE) .... 128,000 Cash (-A) .................................................................... Paid note plus interest at maturity. 4,992,000 Req. 4 It is doubtful that long-term borrowing would be appropriate in this situation. After the Christmas season, Neiman Marcus will collect cash from its credit sales. At this point, it does not need borrowed funds. It would be costly to pay interest on a loan that was not needed. It might be possible to borrow for a longer term at a lower interest rate and invest idle cash to offset the interest charges. Neiman Marcus should explore this possibility with its bank but in most cases it would be better to borrow on a short-term basis to meet short-term needs. 9-13 Chapter 09 - Reporting and Interpreting Liabilities E9–5. Req.1 Assets Liabilities Stockholders’ Equity November 1 Cash + Note Payable + Not Affected December 31 Not Affected Interest Payable + Interest Expense – April 30 Cash – Note Payable – Interest Expense – Date Interest Payable – Req. 2 It is doubtful that long-term borrowing would be appropriate in this situation. After the Christmas season, Neiman Marcus will collect cash from its credit sales. At this point, it does not need borrowed funds. It would be costly to pay interest on a loan that was not needed. It might be possible to borrow for a longer term at a lower interest rate and invest idle cash to offset the interest charges. Neiman Marcus should explore this possibility with its bank but in most cases it would be better to borrow on a short-term basis to meet short-term needs. E9–6. Analysts want to evaluate the short-term obligations of a business in order to assess liquidity or the ability to satisfy a liability that must be paid in the near future. If PepsiCo had to pay the $3.6 billion immediately, the analysts would want to know the source of the needed cash. Because PepsiCo plans to refinance the debt, it will not have to pay it immediately. Therefore, an analyst would be less concerned about this type of debt. The key condition that must be satisfied for a short-term borrowing to be classified as long term is the assurance that the debt can be refinanced. A desire or a plan is not sufficient. There must be evidence that the company has the capability to do so. 9-14 Chapter 09 - Reporting and Interpreting Liabilities E9-7 Quick ratio = 0.6 = $120,000 / X X = $120,000 / 0.6 X = $200,000 E9–8. Req. 1 Date Assets Liabilities Stockholders’ Equity January 10 Inventory + Accounts Payable + Not Affected March 1 Cash + Note Payable + Not Affected Req. 2 August 31 Cash Paid: $47,250 (Principal plus interest) Req. 3 Transaction (a) has no impact on cash flows because there is neither an inflow nor an outflow of cash. Transaction (b) results in an inflow of cash from financing activities. The August 31 payment is an outflow of cash. (Note to instructor: If you have emphasized the Statement of Cash Flows, you should discuss the specific nature of these cash flows. The repayment of principal is a cash flow from financing activities and the payment of interest expense is a component of cash flows from operating activities.) 9-15 Chapter 09 - Reporting and Interpreting Liabilities E9–9. The note does not give us sufficient information to reach a definitive conclusion but there a several factors that should be discussed. No obligation for future payments is recorded if the lease is short term, but the note indicates that the leases are long term and are designed to provide long-term occupancy rights. The critical issue is whether the leases meet one of the criteria to be classified as a capital lease in which case the present value of the lease payments would be recorded as a liability. We find that students enjoy talking about why McDonald’s buys some properties but leases others and how the accounting treatments differ. E9–10. The question of whether a lease will be recorded as a liability depends on the specific facts and circumstances associated with the lease. In the most simple terms, a short-term lease probably would not have to be recorded as a liability but a long-term lease would probably be recorded as a liability. The assistant is correct in the sense that assets could be acquired under a lease and, if the transaction is structured in the proper manner, no liability would be recorded. In class, we like to use this question to explore two issues: (1) Should managers structure transactions to meet the business needs of the company or to comply with rules associated with a preferred accounting treatment, and (2) Do users of financial statements react to the manner in which a transaction is reported or to the underlying economic reality of the transaction? 9-16 Chapter 09 - Reporting and Interpreting Liabilities E9–11. A liability is “a probable future sacrifice of economic benefits that arises from past transactions.” To be recorded, the amount of a liability must be subject to a reasonable estimate. The employees of American Airlines earn their retirement benefits by performing work for the company. These benefits are a form of deferred compensation and are directly related to a past transaction (exchanging work for compensation). Clearly, American Airlines has an economic obligation to pay for health care and life insurance in the future. It is difficult, however, to determine the exact amount of the liability for these benefits. To do so, American Airlines would have to know the number of employees who will actually retire, the number of years that they will live during retirement, and the cost of health care and life insurance during those retirement years. Under GAAP, it is not necessary to know the “exact” amount of a liability in order to record it. The liability must be one that can be reasonably estimated. The FASB requires companies to record liabilities for these benefits because, in their judgment, reasonable estimates can be developed. Many managers disagree with this view but, nevertheless, American Airlines reported this obligation as a liability on its balance sheet. 9-17 Chapter 09 - Reporting and Interpreting Liabilities E9–12. Req. 1 Income taxes payable Year 2011 Year 2012 $250,000 $290,000 54,000 58,000 $304,000 $348,000 Increase in deferred tax liability Income tax expense Req. 2. Tax expense is based on income reported on the income statement while tax liability is based on income reported on the tax return. Because different rules govern the preparation of the two statements, the tax expense and taxes currently payable are usually different. E9–13. Req. 1 Income tax payable: Income tax expense Less: increase in deferred taxes Income taxes payable $580,000 108,000 $472,000 Req. 2 There are separate rules governing the determination of tax expense (GAAP) and the amount of taxes currently payable (IRS regulations). Companies are required to keep separate records. Fortunately, most companies are able to reduce the amount of taxes currently payable by maintaining two sets of books. This savings justifies the additional bookkeeping costs. 9-18 Chapter 09 - Reporting and Interpreting Liabilities E9–14. Req. 1 For each year, income tax expense is less than income taxes currently payable. It is important for students to recognize that deferred taxes do not always result in lower taxes payable when compared to tax expense. Req. 2 This note explains the difference between taxes currently payable and tax expense for each year. It is not the amount of deferred taxes reported on the balance sheet. E9–15. Req. 1 $50,000 x 0.7513 = $37,565 $10,000 x 2.4869 = $24,869 Req. 2 It is better to pay in three installments because the economic cost is less. Req. 3 $40,000 x 0.5132 = $20,528 $15,000 x 6.1446 = $92,169 Req. 4 9-19 Chapter 09 - Reporting and Interpreting Liabilities E9–16. Present value of annuity: $10,100 x 4.8684 = $49,171 Because the present value of the annuity is less than the immediate cash payment, the winner should select the cash payment. E9–17. Present value of future amount: $900,000 x 0.5019 = $451,710 Because the client already has $200,000 in the account, she needs to deposit an additional $251,710. E9–18. Present value of annuity: $13,000 x 3.2397 = $42,116 E9–19. Present value of unequal payments: $11,000 x 0.9091 = $10,000 30,000 x 0.8264 = 24,792 50,000 x 0.7513 = 37,565 $72,357 E9–20. Present value of cash payments: $15,000 x 5.9713 = $89,570 120,000 x 0.5820 = 69,840 $159,410 E9–21. Present value of annuity: $55,000 x 6.8017 = $374,094 9-20 Chapter 09 - Reporting and Interpreting Liabilities E9–22. $25,000 x 5.0330 = $125,825 (purchase price) E9–23. Req. 1 $6,000 x 2.5937 = $15,562 Req. 2 $15,562 – $6,000 = $9,562 (time value of money, or interest) Req. 3 1st year: $6,000 x 10% = $600 (interest) 2nd year: ($6,000 + $600) x 10% = $660 (interest) E9–24. Req. 1 $58,800 x 1.3605 = $79,997 Req. 2 Savings account (+A) ..................................................... 58,800 Cash (-A) .................................................................... 58,800 Req. 3 $79,997 – $58,800 = $21,197 (time value of money or interest) Req. 4 December 31 2011 2012 Savings account (+A) ............................. 4,704 5,080 Interest revenue (+R, +SE) ................. 4,704 5,080 Computations: 2011: $58,800 x 8% = $4,704. 2012: ($58,800 + $4,704) x 8% = $5,080. 9-21 Chapter 09 - Reporting and Interpreting Liabilities E9–25. Req. 1 December 31 Savings account (+A) ..................................................... Cash (-A) .................................................................... 2,000 2,000 Req. 2 $2,000 x 15.1929 = $30,386 (balance) Req. 3 $30,386 - ($2,000 x 10) = $10,386 (time value of money or interest) Req. 4 1st year: $2,000 x 9% = $180 2nd year: ($2,000 + $2,000 + $180) x 9% = $376 Req. 5 Savings account (+A) ............................. Cash (-A) ............................................ Interest revenue (+R, +SE) ................ December 31 2012 2013 2,180 2,376 2,000 2,000 180 376 E9–26. Req. 1 $3,500 x 4.3746 = $15,311 (balance in the fund) Req. 2 $15,311 – ($3,500 x 4) = $1,311 (time value of money or interest) Req. 3 1st year: No interest because the deposit was at year-end. 2nd year: $3,500 x 6% = $210 (interest) 3rd year: ($3,500 + $3,500 + $210) x 6% = $433 4th year: ($3,500 + $3,500 + $3,500 + $210 + $433) x 6% = $669 9-22 Chapter 09 - Reporting and Interpreting Liabilities PROBLEMS P9–1. Req. 1 January 15: Purchases (+A) .............................................................. Cash (-A) .................................................................... 14,200 April 1: Cash (+A) ....................................................................... Note payable, short term (+L) ..................................... 700,000 June 14: Cash (+A) ....................................................................... Unearned revenue (+L) .............................................. 15,000 July 15: Unearned revenue (-L) ................................................... Service revenue (+R, +SE) ......................................... 3,750 December 12: Electric expense (+E, -SE) ............................................. Electric payable (+L) ................................................... 27,860 December 31: Wage expense (+E, -SE). .............................................. Wages payable (+L) ................................................... 15,000 9-23 14,200 700,000 15,000 3,750 27,860 15,000 Chapter 09 - Reporting and Interpreting Liabilities Req. 2 December 31: Interest expense (+E, -SE). ............................................ Interest payable (+L)................................................... 42,000 42,000 ($700,000 x 8% x 9/12 = $42,000). P9–2. Req. 1 January 8: Purchases (+A) .............................................................. Accounts payable (+L) ................................................ 14,860 January 17: Accounts payable (-L) .................................................... Cash (-A) .................................................................... 14,860 April 1: Cash (+A) ....................................................................... Note payable, short term (+L) ..................................... 35,000 June 3: Purchases (+A) .............................................................. Accounts payable (+L) ................................................ 17,420 9-24 14,860 14,860 35,000 17,420 Chapter 09 - Reporting and Interpreting Liabilities July 5: Accounts payable (-L) .................................................... Cash (-A) .................................................................... August 1: Cash (+A) ....................................................................... Rent revenue ($6,000 x 5/6) (+R, +SE) ...................... Deferred rent revenue ($6,000 x 1/6) (+L) .................. 17,420 17,420 6,000 5,000 1,000 December 20: Cash (+A) ....................................................................... Liability-deposit on trailer (+L) .................................... 100 December 31: Wage expense (+E, -SE). .............................................. Wages payable (+L) ................................................... 9,500 9-25 100 9,500 Chapter 09 - Reporting and Interpreting Liabilities P9–2. (continued) Req. 2 December 31: Interest expense (+E, -SE). ............................................ Interest payable (+L)................................................... 3,150 3,150 ($35,000 x 12% x 9/12 = $3,150). Req. 3 Balance Sheet, December 31 Current Liabilities Note payable, short term ............................................ Deposit on trailer ........................................................ Wages payable ........................................................... Interest payable .......................................................... Deferred rent revenue ............................................... Total ........................................................................ Req. 4 Transaction Effect January 8 No effect January 17 Decrease April 1 Financing activity (no effect on operating activities) June 3 No effect July 5 Decrease August 1 Increase December 20 Increase December 31 No effects for either entry 9-26 $35,000 100 9,500 3,150 1,000 $48,750 Chapter 09 - Reporting and Interpreting Liabilities P9–3. Req. 1 Date Assets Liabilities Stockholders’ Equity January 8 Purchases + Accounts Payable + No effect January 17 Cash – Accounts Payable – No effect April 1 Cash + Note Payable + No effect June 3 Purchases + Accounts Payable + No effect July 5 Cash – Accounts Payable – No effect August 1 Cash + Deferred Revenue + Revenue + December 20 Cash + Deposit + No effect December 31 No effect Wages Payable + Wage Expense - December 31 No effect Interest Payable + Interest Expense - 9-27 Chapter 09 - Reporting and Interpreting Liabilities Req. 2 Transaction Effect January 8 No effect January 17 Decrease April 1 Financing activity (no effect on operating activities) June 3 No effect July 5 Decrease August 1 Increase December 20 Increase December 31 No effects for either entry 9-28 Chapter 09 - Reporting and Interpreting Liabilities P9–4. Req. 1 (a) December 31 Wage expense (+E, -SE) ............................................... Wages payable (+L) ................................................... 4,000 (b) January 6 Wages payable (-L) ........................................................ Cash (-A) .................................................................... 4,000 4,000 4,000 Req. 2 (a) December 10 Cash (+A) ....................................................................... Rent revenue (+R, +SE) ............................................. Collection of rent revenue for one month. (b) December 31 Rent revenue (-R, -SE) .................................................. Rent revenue collected in advance (or Deferred rent revenue) (+L) .......................................................... Unearned rent (10/30 x $2,400 = $800). 2,400 2,400 800 800 Alternatively, the collection could have been originally recorded as follows, which would not require an adjusting entry: Cash (+A) ....................................................................... Rent revenue (+R, +SE) ............................................. Rent revenue collected in advance(+L) ...................... 2,400 1,600 800 Req. 3 Balance sheet at December 31 Current Liabilities: Wages payable ........................................................... Rent revenue collected in advance ............................ 9-29 4,000 800 Chapter 09 - Reporting and Interpreting Liabilities Req. 4 Accrual-based accounting is more beneficial to financial analysts because it records revenues when they are earned and expenses when they are incurred, regardless of when the related cash is received or paid. A financial analyst is looking towards the future of the company, so it is helpful to know how much cash will be coming into and out of the company at later dates. P9–5. Req. 1 Date Assets Liabilities Stockholders’ Equity (a) December 31 No impact Wages Payable + Wages Expense - (b) January 6 Cash - Wages Payable - No impact (c) December 10 Cash + No impact Rent Revenue + (d) December 31 No impact Deferred Rent + Rent Revenue - Req. 2 Accrual-based accounting is more beneficial to financial analysts because it records revenues when they are earned and expenses when they are incurred, regardless of when the related cash is received or paid. A financial analyst is looking towards the future of the company, so it is helpful to know how much cash will be coming into and out of the company at later dates. 9-30 Chapter 09 - Reporting and Interpreting Liabilities P9–6. 1. 2. December 31 Warranty expense (+E, -SE) .......................................... Warranty payable (+L) ................................................ 500,000,000 Total effect of various transactions during 2012: Warranty payable (-L) .................................................... Cash (-A) .................................................................... 500,000,000 Total effect of various transactions during 2011: Cash (+A) ....................................................................... Unearned revenue (+L) .............................................. 90,000,000 For 2012: Unearned revenue (-L) ................................................... Revenue (+R, +SE) .................................................... 54,000,000 500,000,000 500,000,000 90,000,000 54,000,000 3. The company should report litigation expense and the related liability after the jury awarded damages. If lawyers for Brunswick are confident of their grounds for appeal, the company might simply report a contingent liability. 4. The quick ratio for Disney is 0.35. To properly interpret the ratio, analysts would look at much more information. For example, Disney was able to generate over $6 billion in cash from its operations. Analysts would also compare the ratio to similar companies. For example, the quick ratios for many similar companies are close to the ratio for Disney. This brief exercise is intended to open a discussion concerning the need to avoid placing too much emphasis on a specific accounting number or ratio. 5. As an oil and gas company, Halliburton can be expected to have some adverse impact on our environment. In many cases, federal law requires these companies to rectify these negative effects. Halliburton records the cost of future environmental cleanup efforts in the year that the damage is done instead of the year that the work is performed. This policy is consistent with the matching principle. Environmental damage can be thought of as a necessary cost of producing oil and gas. The cost should be matched with the revenue generated by the sale of gas and oil instead of being recorded as an expense in the period in which the cleanup work actually takes place. 9-31 Chapter 09 - Reporting and Interpreting Liabilities P9–7. Req. 1 Not reported---Amount not subject to estimate Req. 2 Not reported---No reason to believe that loss is probable Req. 3 Report liability---Amount can be estimated and loss seems probable Req. 4 Judgment call depending on circumstances. A footnote disclosure might be sufficient, but some auditors would insist on a liability. Req. 5 Report liability--- Amount is known and loss is probable P9–8. a. Remain the same b. Decrease c. Remain the same d. Remain the same (because it is a financing activity) e. Remain the same f. Decrease g. Remain the same h. Remain the same i. Increase 9-32 Chapter 09 - Reporting and Interpreting Liabilities P9–9. The current liability classification is based on the expectation that the company will pay the liabilities during the subsequent year. Analysts are interested in this classification because it provides important information to use when predicting future cash flows. If management has the intent and the ability to refinance a short-term liability, then it will not result in a cash outflow. In this circumstance, it is appropriate to reclassify the debt as long term. The quick ratio for PepsiCo should be compared over time and to other companies before the analyst makes a determination. In the case of PepsiCo, the company is not experiencing a liquidity problem. It generates large cash flows from operations and has a significant line of credit available if it needs additional funds. Furthermore, the industry traditionally operates with a relatively low quick ratio. It is therefore unlikely that P9–9. (continued) management made the reclassification simply to increase its quick ratio. Instead the company was probably trying to get a better balance between short-term and long-term borrowings. Because management has the ability and intent to refinance the borrowings on a longterm basis, the quick ratio should be based on the reclassification. The analyst might want to use the ratio before reclassification if he or she thought that the reclassification was only intended to manipulate the ratio (which does not appear to be the case). The analyst should use caution when comparing the ratio for the current year (after reclassification) with the ratio for the previous year (before reclassification). P9–10. Req. 1 GAAP Depreciation: $1,000,000 ÷ 20 years = $50,000 Tax Depreciation: $1,000 000 × 10% = $100,000 Book Value: 2011 GAAP Cost Acc. Dep Book Value 2012 Tax GAAP Tax $1,000,000 $1,000,000 $1,000,000 $1,000,000 50,000 100,000 $ 950,000 $ 900,000 9-33 100,000 $ 900,000 200,000 $ 800,000 Chapter 09 - Reporting and Interpreting Liabilities Deferred tax liability 2011: ($950,000 - $900,000) × 34% = $17,000 Deferred tax liability 2012: ($900,000 - $800,000) × 34% = $34,000 The difference is a liability because additional income taxes must be paid in the future. This is a result of lower depreciation deductions in the tax return for the future; that is, lower tax deductions means more income tax in the future on other taxable amounts. P9–10. (continued) Req. 2: Income tax expense 2011: Taxes payable $400,000 Deferred taxes 17,000 Income tax expense $417,000 Income tax expense 2012: Taxes payable $625,000 Deferred taxes 17,000 Income tax expense $642,000 9-34 Chapter 09 - Reporting and Interpreting Liabilities P9–11. Req. 1 Present value of debt: $115,000 x 0.6227 = $71,611 $8,050 x 5.3893 = 43,384 $114,995 Req. 2 Single sum to deposit: $490,000 x .5820 = $285,180 Interest revenue: $490,000 - $285,180 = $204,820 Req. 3 Present value of payments: $75,000 x 0.9346 = $70,095 $112,500 x 0.8734 = 98,258 $150,000 x 0.8163 = 122,445 $290,798 P9–11. (continued) Req. 4 Equal annual payments on note payable: $130,000 4.1002 = $31,706 Interest expense: ($31,706 x 5) - $130,000 = $28,530 9-35 Chapter 09 - Reporting and Interpreting Liabilities P9–12. Option 1: $1,250,000 6.1446 = $7,680,750 = $10,000,000 = $8,144,600 Option 2: $10,000,000 Option 3: $2,000,000 + ($1,000,000 6.1446) Option 2 is the best option because it provides the greatest present value when all options are discounted. P9–13. Req. 1 $120,000 4.4399 = $27,028 (annual deposits) Req. 2 $120,000 - ($27,028 x 4) = $11,888 (time value of money or interest) Req. 3 1st year: None because the first deposit was at the end of the year. 2nd year: $27,028 x 7% ........................................................................ 3rd year: ($27,028 + $1,892 + $27,028) x 7% ...................................... 4th year: ($27,028 + $1,892 + $27,028 + $3,916 + $27,028) x 7% ...... Total interest revenue (differs from above because of rounding) ...... 9-36 $ 1,892 3,916 6,082 $11,890 Chapter 09 - Reporting and Interpreting Liabilities P9–14. Req. 1 Future Value of Deposit: $50,000 1.2653 = $63,265 Interest Earned: $63,265 - $50,000 = $13,265 Req. 2 Future Value of Deposits: $130,000 7.3359 = $953,667 Interest Earned: $953,667 - $780,000 = $173,667 Req. 3 Future Value of Deposit: $250,000 1.5869 = $396,725 Interest Earned: $396,725 - $250,000 = $146,725 9-37 Chapter 09 - Reporting and Interpreting Liabilities ALTERNATE PROBLEMS AP9–1. Req. 1 January 15 Tax expense (+E, -SE) ................................................... Taxes payable (+L) ..................................................... Deferred tax liability (+L) ............................................. 125,000 93,000 32,000 January 31 Interest payable (-L) ....................................................... Cash (-A) .................................................................... 52,000 April 30 Cash (+A) ....................................................................... Note payable (+L) ....................................................... 550,000 June 3 Inventory (+A) ................................................................ Accounts payable (+L) ................................................ 75,820 July 5 Accounts payable (-L) .................................................... Cash (-A) .................................................................... 75,820 August 31 Cash (+A) ....................................................................... Revenue (+R, +SE) .................................................... Deferred revenue (+L) ................................................ 9-38 52,000 550,000 75,820 75,820 12,000 8,000 4,000 Chapter 09 - Reporting and Interpreting Liabilities Req. 2 December 31 Interest expense (+E, -SE) ............................................. Interest payable (+L)................................................... 44,000 44,000 Long-term liability (-L) .................................................... Current liability (+L) .................................................... 100,000 Wage expense (+E, -SE) ............................................... Wages payable (+L) ................................................... 85,000 100,000 85,000 AP9–1. (continued) Req. 3 Balance Sheet: CURRENT LIABILITIES Wages Payable $85,000 Taxes Payable 93,000 Deferred Tax Liability 32,000 Interest Payable 44,000 Deferred Revenue Note Payable 4,000 550,000 Current Portion of Longterm Debt 100,000 TOTAL CURRENT LIABILITIES $908,000 9-39 Chapter 09 - Reporting and Interpreting Liabilities Req. 4 Cash from Operating Activities: January 15 No effect January 31 Decreased April 30 No effect June 3 No effect July 5 Decreased August 31 Increased All December 31 transactions No effect 9-40 Chapter 09 - Reporting and Interpreting Liabilities AP9–2. Req. 1 Date Assets Liabilities Stockholders’ Equity January 15 No effect Deferred Tax Liability + Taxes Payable + Expense – January 31 Cash – Interest Payable – No effect April 30 Cash + Note Payable + No effect June 3 Inventory + Accounts Payable + No effect July 5 Cash – Accounts Payable – No effect August 31 Cash + Deferred Revenue + Revenue + December 31 No effect Interest Payable + Interest Expense – December 31 No effect Long-term Liability – No effect Current Liability + December 31 No effect Wages Payable + Req. 2 Cash from Operating Activities: January 15 No effect January 31 Decreased April 30 No effect June 3 No effect July 5 Decreased August 31 Increased All December 31 transactions No effect 9-41 Wage Expense – Chapter 09 - Reporting and Interpreting Liabilities AP9–3. Req.1 Warranty Expense +$3.9 billion Warranty Liability +($3.9 billion –$4 billion) Cash - $4 billion Req. 2 In year 2011, no revenue has been earned. The liability is $23 million. Using an estimated life of 39 months, Bally may report $589,744 in revenue each month ($23 million ÷ 39) or $7,076,923 for the year. The balance sheet in 2012 would report Unearned revenue in the amount of $15,923,077. Req. 3 While the trend for the quick ratio is downward, it is doubtful that ExxonMobil is experiencing financial difficulty. The company has a reputation for aggressive cash management. It would be useful to study the Statement of Cash Flows to determine if ExxonMobil is generating significant cash resources from operating activities. Req. 4 The company estimates future costs and records them as a current expense. The matching concept dictates that all costs related to earning revenue should be reported in the same accounting period as the revenue. 9-42 Chapter 09 - Reporting and Interpreting Liabilities AP9–4. a. Decrease b. Decrease c. Decrease d. Remain the same e. Decrease f. Remain the same g. Decrease h. Decrease i. Remain the same AP9–5. The contractual agreement that General Mills entered into allows them to reclassify the current borrowings as noncurrent debt. Management would want to do this in order to improve measures of liquidity. A financial analyst’s answer would not be different. A financial analyst would not be concerned because the company has the ability to extend the maturity dates of the debt beyond the current year. 9-43 Chapter 09 - Reporting and Interpreting Liabilities AP9–6. Req. 1 $2,000,000 X 0.6806 = $1,361,200 $150,000 X 3.9927 = 598,905 $1,960,105 Req. 2 $1,000,000 .4632 = $463,200 The total amount of interest earned = $536,800 Req. 3 $350,000 3.3121 = $105,673 $422,692 - $350,000 = $72,692 The total amount of interest AP9–7. Option 1: $750,000 = $750,000 = $688,194 $50,000 7.3601 = $368,005 + 80,000 7.3601 0.5584 = 328,790 Total = $696,795 Option 2: $60,000 11.4699 Option 3: Option one is the best because it gives you the highest return. The time value of money makes a dollar received today worth more than a dollar received one year from now. 9-44 Chapter 09 - Reporting and Interpreting Liabilities AP9–8. Req. 1 $320,000 x 3.2781 = $1,048,992 Req. 2 Fund Accumulation Schedule Date 12/31/2011 12/31/2012 12/31/2013 Total Cash Payment (cr) $320,000 320,000 320,000 $960,000 Interest Revenue (prior balance x 9%) (cr) Fund Fund Balance Increase (dr) $ 320,000 $ 320,000 $320,000 x 9% = $28,800 348,800 668,800 668,800 x 9% = 60,192 380,192 1,048,992 $88,992 $1,048,992 9-45 Chapter 09 - Reporting and Interpreting Liabilities CASES AND PROJECTS FINANCIAL REPORTING AND ANALYSIS CASES CP9–1. Req. 1 Accrued compensation and payroll taxes are $29,417,000. Req. 2 Accounts payable decreased by $5,860,000. This change decreased operating cash flows. Req. 3 Long-term liabilities (called non-current in this report) are $152,882,000. Req. 4 The note under the caption Gift Cards states that the company determines an estimated gift card breakage (the amount customers will never use). This amount is included in revenue. The Company recorded $12.2 million of revenue related to gift card breakage during fiscal 2008. CP9–2. Req. 1 The amount of accrued compensation is $11,975,000. Req. 2 Accounts payable decreased by $11,065,000. This change decreased operating cash flows. Req. 3 Long-term liabilities are $134,084,000. Req. 4 The amount of gift cards and store merchandise credits that customers have not redeemed is $22,307,000 as of January 31, 2009. This information is found in note 6. 9-46 Chapter 09 - Reporting and Interpreting Liabilities CP9–3. Req. 1 Urban Outfitters Quick Ratio = Quick Assets Current Liabilities $402,373 = 2.9 $141,150 American Eagle $525,324 = 1.3 $401,763 Req. 2 Quick Ratio = Industry Average 1.4 Urban Outfitters American Eagle 2.9 1.3 The quick ratio for American Eagle is near the industry average but the one for Urban Outfitters is substantially higher than the average. While liquidity for both companies is good, further analysis is needed to determine if Urban Outfitters is effectively utilizing its liquid assets. Req. 3 Urban Outfitters Accounts Cost of Payable Goods Sold = Turnover Avg. Accts Ratio Payable $1,121,140 = 16.4 $68,488* *$(62,955 + 74,020)/2 = $68,488 **$(152,068 + 157,928)/2 = $154,998 9-47 American Eagle $1,814,765 = 11.7 $154,998** Chapter 09 - Reporting and Interpreting Liabilities CP9–3. (continued) Req. 4 Payable Turnover = Industry Average 6.4 Urban Outfitters American Eagle 16.4 11.7 Both companies’ payable turnover ratios are above the industry average. Based on the payable turnover ratio, both of these companies are doing better than the average company in their industry at paying trade creditors. Req. 5 Both companies have strong quick ratios and good payable turnover ratios. They generate significant cash flow from operating activities. Both are expending significant resources for capital expenditures, but they have sufficient resources available to continue to invest in marketable securities. On balance, liquidity looks strong for both. CP9–4. Req. 1 In business transactions, it usually is unreasonable to assume that one party will lend money to an unrelated party without charging interest. It is likely that the advertised selling price of the home included the true cash selling price plus an amount equal to the time value of money (interest) for the four-year period. Therefore, to evaluate the offer, the required payments must be analyzed (as in 2 below). Req. 2 If the monthly payments actually include principal and interest, the cash selling price can be found by calculating the present value of the monthly payments: $3,125 x 37.9740 = $118,669 9-48 Chapter 09 - Reporting and Interpreting Liabilities CRITICAL THINKING CASES CP9–5. Quick Ratio Working Capital Liquidity a. Decrease No Change Short-term improvement b. Increase Increase Improvement c. Increase Increase Improvement d. Increase No Change No Change e. No Change No Change Improvement 9-49 Chapter 09 - Reporting and Interpreting Liabilities CP9–6. While the question focuses on ethics, we believe that students should analyze the proposed strategy. Refusing to accept merchandise would result in a higher quick ratio. By not purchasing inventory, management avoids increasing liabilities without any change in the amount of quick assets. Management could actually improve the quick ratio by shipping merchandise to customers because accounts receivable (a quick asset) would increase along with the reduction in inventory (which is not a quick asset). There are legitimate ethical issues raised when management alters the operations of a business to achieve an accounting result. Students should understand, however, that management in many organizations engages in behaviors designed to affect accounting reports. In class discussions, we have included strategies for affecting ratios as well as reported profits. We have found some students believe some strategies are ethical but others are not. In such situations, we have been able to have very meaningful discussions concerning situational ethics. 9-50 Chapter 09 - Reporting and Interpreting Liabilities CP9–7. The jackpot does not have a present value of $3 million. The payments include interest earned by the state while it makes payments over the 20-year period. We believe that this form of advertising is misleading. We think that lottery jackpots should be advertised at their cash value today (i.e., present value) not the total of future payments. FINANCIAL REPORTING AND ANALYSIS PROJECT CP9–8. The response to this case will depend on the companies selected by the students. 9-51 Chapter 10 - Reporting and Interpreting Bonds Chapter 10 Reporting and Interpreting Bonds ANSWERS TO QUESTIONS 1. A bond is a liability that may or may not be secured by a mortgage on specified assets. Bonds usually are in denominations of $1,000 or $10,000, are transferable by endorsement, and may be bought and sold daily by investors. A bond specifies a maturity date and rate of interest that will be paid on the principal amount. Bonds usually are issued to obtain cash for long-term asset acquisitions (operational assets) and expansion of the entity. 2. A bond indenture is an agreement drawn up by a company planning to sell a bond issue. The indenture specifies the legal provisions of the bond issue such as maturity date, rate of interest, date of interest payments, and any conversion privileges. When a bond is sold, an investor receives a bond certificate (i.e., a bond). All of the bond certificates for a single bond issue are identical in most respects. That is, each certificate states the same maturity date, interest rate, interest dates, and other provisions of the bond issue. 3. Secured bonds are supported by a mortgage or pledge of specific assets as a guarantee of payment. Secured bonds are designated on the basis of the type of asset pledged, such as real estate mortgage bonds and equipment trust bonds. Unsecured bonds are not supported by a mortgage or pledge of specific assets as a guarantee of payment at maturity date. Unsecured bonds usually are called debentures. 10-1 Chapter 10 - Reporting and Interpreting Bonds 4. Callable bonds—bonds that may be called for early retirement at the option of the issuer. Convertible bonds—bonds that may be converted to other securities of the issuer (usually common stock) after a specified future date at the option of the bondholder. 5. Several important advantages of bonds compared with capital stock benefit the issuer. The issuance of bonds establishes a fixed amount of liability and a fixed rate of interest on the bond, and interest payments to the bondholders are deductible on the income tax return of the issuer. This deduction for tax purposes reduces the net cost of borrowing. For example, a corporation with a 40% average tax rate and bonds payable with a 10% interest rate would incur a net interest rate of 10% x 60% = 6%. 6. The higher the tax rate is, the lower the net cost of borrowing money because the interest paid on borrowed money is deductible on the income tax return of the borrower. The higher the income tax rate the less the net cost of interest for the borrower. For example, a corporation with an average tax rate of 40% and debt with 10% interest per annum incurs a net interest rate of 10% x 60% = 6%. In contrast, the same corporation with a 20% average tax rate incurs a net interest rate of 10% x 80% = 8%. 7. At the date of issuance, bonds are recorded at their current cash equivalent amount; that is, the amount of cash received for the bonds when issued. The recording is in conformity with the cost principle. 8. When a bond is issued (sold) at its face amount, it is issued at par. In contrast, when a bond is sold at an amount lower than the par amount, it is issued at a discount, and conversely, when it is sold at a price above par, it is issued at a premium. A bond will sell at a discount when the market, or effective, rate of interest is higher than the stated rate of interest on the bond. In contrast, when the market or effective rate of interest is lower than the stated rate, the bond will sell at a premium. Discounts or premiums on bonds payable are adjustments to the effective interest rate on the bonds. Therefore, the discount or premium is amortized over the life of the bonds as an increase or decrease in the amount of interest expense for each period. 9. The stated rate of interest is the rate specified on a bond, whereas the effective rate of interest is the market rate at which the bonds are selling currently. 10. When a bond is sold at par, the stated interest rate and the effective or market interest rate are identical. When a bond is sold at a discount, the stated rate of interest is lower than the effective rate of interest on the bond. In contrast, when a bond is sold at a premium, the stated rate of interest is higher than the effective rate of interest. 10-2 Chapter 10 - Reporting and Interpreting Bonds 11. A bond issued at par will have a book or carrying value, or net liability, equal to the par or principal of the bond. This amount should be reported as the carrying value on each balance sheet date. When a bond is sold at a premium or discount, the premium or discount must be amortized over the outstanding life of the bond. When there is bond discount or premium, the par amount of the bond less the unamortized discount, or plus the unamortized premium, must be reported on the balance sheet as the net liability as follows: Bonds payable ...................................... $100,000 Less: Unamortized discount .................. 12,000 Plus: Unamortized premium .................. Book value (net liability) ........................ $ 88,000 $100,000 12,000 $112,000 12. The basic difference between straight-line amortization and effective-interest amortization of bond discount and premium is that, under straight-line amortization, an equal amount of premium or discount is amortized to interest expense each period. Straight-line amortization per interest period is computed by dividing the total amount of the premium or discount by the number of periods the bonds will be outstanding. Under effective-interest amortization, the amount of premium or discount amortized is different each period. Effective-interest amortization of bond premium and discount correctly measures the current cash equivalent amount of the bonds and the interest expense reported on the income statement based on the issuance entry. It measures the amount of amortization by relating the market (yield) rate to the net liability at the beginning of each period. For this reason interest expense and the bond carrying value are measured on a present value basis. The straight-line method can be used only when the results are not materially different from the results of the effective-interest method. ANSWERS TO MULTIPLE CHOICE 1. c) 6. b) 2. c) 7. c) 3. b) 8. c) 10-3 4. d) 9. a) 5. c) 10. c) Chapter 10 - Reporting and Interpreting Bonds Authors’ Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 5 3 5 4 5 5 5 6 5 7 5 8 5 9 5 10 5 11 5 12 5 Exercises No. Time 1 10 2 10 3 10 4 15 5 15 6 15 7 10 8 20 9 20 10 20 11 15 12 15 13 20 14 25 15 30 16 20 17 20 18 20 19 25 20 30 21 25 22 10 23 10 24 10 Problems No. Time 1 40 2 30 3 30 4 40 5 50 6 45 7 45 8 50 9 35 10 40 11 40 12 25 13 35 14 30 15 20 Alternate Problems No. Time 1 20 2 30 3 35 4 40 5 40 6 35 7 25 Cases and Projects No. Time 1 25 2 20 3 20 4 30 5 30 6 25 7 * * Due to the nature of this project, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time to discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 10-4 Chapter 10 - Reporting and Interpreting Bonds MINI-EXERCISES M10–1. 1. Balance Sheet 2. Income Statement 3. Statement of Cash Flows 4. May be in notes 5. Not at all 6. May be in notes M10–2. Principal $600,000 0.4564 = $273,840 Interest $ 24,000 13.5903 = 326,167 Issue Price = $600,007* *Issue price should be exactly $600,000. The $7 difference is the result of rounding the present value factors at four digits. M10–3. Principal $900,000 0.4350 = $391,500 Interest $ 27,000 13.2944 = 358,949 Issue Price = $750,449 M10–4. January 1, 2011: Cash (+A) .............................................................................. Discount on Bonds Payable (+XL, -L) ................................... Bonds Payable (+L) .......................................................... June 30, 2011: Interest Expense (+E, -SE) ($940,000 11% 1/2) ............ Discount on Bonds Payable (-XL, +L) ............................... Cash (-A) ($1,000,000 10% 1/2) ................................. 10-5 940,000 60,000 1,000,000 51,700 1,700 50,000 Chapter 10 - Reporting and Interpreting Bonds M10–5. January 1, 2011: Cash (+A) .............................................................................. Discount on Bonds Payable (+XL, -L) ................................... Bonds Payable (+L) ........................................................... June 30, 2011: Interest Expense (+E, -SE) ................................................... Discount on Bonds Payable (-XL, +L) ............................... Cash (-A) ........................................................................... 580,000 20,000 600,000 31,000 1,000 30,000 M10–6. Principal $500,000 0.4564 = $228,200 Interest $ 25,000 13.5903 = 339,758 Issue Price = $567,958 M10–7. January 1, 2011: Cash (+A) .............................................................................. Premium on Bonds Payable (+L) ...................................... Bonds Payable (+L) .......................................................... December 31, 2011: Interest Expense (+E, -SE) ................................................... Premium on Bonds Payable (-L) ........................................... Cash (-A) ........................................................................... 620,000 20,000 600,000 52,000 2,000 54,000 M10–8 January 1, 2011: Cash (+A) .............................................................................. Premium on Bonds Payable (+L) ...................................... Bonds Payable (+L) .......................................................... December 31, 2011: Interest Expense (+E, -SE) ($910,000 7%) ........................ Premium on Bonds Payable (-L) ........................................... Cash (-A) ($850,000 8%) ................................................ 10-6 910,000 60,000 850,000 63,700 5,700 68,000 Chapter 10 - Reporting and Interpreting Bonds M10–9. The debt-to-equity ratio and times interest earned ratio are both measures of the risk associated with using debt in the capital structure of a company. A company could have a high debt-to-equity ratio with relatively little risk if it generated a high level of stable earnings. On the other hand, a company with a low debt-to-equity ratio might be risky if it was unable to earn any profits. For this reason, most analysts look to the times interest earned ratio as a measure of a company’s ability to meet its required interest payments. M10–10. If the interest rates fall after the issuance of a bond, the bond’s price will increase. The company will report a loss on the debt retirement. On the balance sheet, cash and bonds payable will decrease. On the income statement, a loss would be recorded. M10–11. When a company issues a bond at a discount, the interest expense each period will be more than the cash payment for the interest. When a company issues a bond at a premium, the interest expense will be less than the cash payment for the interest. Neither is affected by the method used to amortize the discount or premium. M10–12. Cash paid to retire a bond would be reported in the financing activities section of the Statement of Cash Flows while cash paid for interest payments would be reported in the operating activities section. 10-7 Chapter 10 - Reporting and Interpreting Bonds EXERCISES E10–1. 1. 2. 3. 4. 5. 6. 7. Bond principal, par value, or face value Par value or face value Face value or par value Stated rate, coupon rate, or contract rate Debenture Callable bonds Convertible bonds E10–2. The AT&T bonds have a coupon interest rate of 6.5%. If bonds with a $10,000 face value were purchased, the issue price would be $8,950 and they would provide a cash yield of 7.3%. A decline in value after issuance would have no impact on AT&T’s financial statements. E10–3. When a bond offers a conversion feature, its value will be affected by the value of the common stock. As the price of the stock goes up, the bond becomes more valuable. In the case of the Wynn bond, each $1,000 face value bond can be converted into 43.4782 shares of stock. Given that the stock now sells for $90 per share, each bond is worth at least $3,913 based on this conversion feature. A bondholder who needs cash can simply sell the bond rather than converting it to stock and then selling the stock. In many cases, it is better to hold a company’s bond than its stock. Such is the case with Wynn. The company’s stock does not pay dividends but the bonds do pay periodic interest. Therefore, holders of bonds can participate in the appreciation of the stock while earning interest on their investment. 10-8 Chapter 10 - Reporting and Interpreting Bonds E10–4. CASE A: $100,000 x 0.5835 ........................................................ $ 58,350 $8,000 x 5.2064 ............................................................ 41,651 Issue price (market and stated rate same) ................... $100,001 (at par; $1 rounding error) CASE B: $100,000 x 0.6651 ........................................................ $ 66,510 $8,000 x 5.5824 ............................................................ 44,659 Issue price (market rate less than stated rate).............. $111,169 (at a premium) CASE C: $100,000 x 0.5132 ........................................................ $ 51,320 $8,000 x 4.8684 ............................................................ 38,947 Issue price (market rate more than stated rate) ............ $ 90,267 (at a discount) E10–5. CASE A: $500,000 x 0.6730 ........................................................ $ 336,500 $15,000 x 16.3514 ........................................................ 245,271 Issue price (market rate less than stated rate).............. $581,771 (at a premium) CASE B: $500,000 x 0.5537 ........................................................ $15,000 x 14.8775 ........................................................ Issue price (market rate and stated rate same) ............ CASE C: $500,000 x 0.4564 ........................................................ $15,000 x 13.5903 ........................................................ Issue price (market rate more than stated rate) ............ $ 276,850 223,163 $500,013 (at par, $13 rounding error) $ 228,200 203,855 $ 432,055 (at a discount) E10–6. Applied Technologies’ ratios look better than Innovative Solutions’ ratios. Applied Technologies has a lower debt-to-equity ratio than Innovative Solutions. This means that they have less debt in their capital structure, and therefore, are a less leveraged company and have less risk than Innovative Solutions. Applied Technologies’ times interest earned ratio is higher than the ratio for Innovative Solutions. This also makes Applied Technologies a less risky company than Innovative Solutions because Applied Technologies generates a larger amount of income compared to its obligatory payments to creditors than Innovative Solutions. 10-9 Chapter 10 - Reporting and Interpreting Bonds E10–7. Computations: Interest: $100,000 x 6% x 1/2 = Present value: $100,000 x 0.6756 $ 3,000 x 8.1109 Issue price = = = $3,000 67,560 24,333 $91,893 E10–8. Computations: Interest: $750,000 x 8% = $ 60,000 Present value: $750,000 x 0.4224 $ 60,000 x 6.4177 Issue price = 316,800 = 385,062 = $701,862 Req. 1 January 1: Cash (+A) .............................................................................. Discount on Bonds Payable (+XL, -L) ................................... Bonds Payable (+L) ........................................................... 701,862 48,138 750,000 Req. 2 December 31: Interest Expense (+E, -SE) ................................................... Discount on Bonds Payable (-XL, +L) ............................... Cash (-A) ........................................................................... 10-10 64,814 4,814 60,000 Chapter 10 - Reporting and Interpreting Bonds Req. 3 December 31, 2011: Income statement: Interest expense $ 64,814 Balance sheet: Long-term Liabilities Bonds payable Less: Unamortized discount ($48,138 - $4,814) $750,000 43,324 $706,676 E10–9. Computations: Interest: $600,000 x 7.5% x 1/2 = $ 22,500 Present value: $600,000 x 0.7168 $ 22,500 x 6.6638 Issue price = 430,080 = 149,936 = $580,016 Req. 1 January 1: Cash (+A) .............................................................................. Discount on Bonds Payable (+XL, -L) ................................... Bonds Payable (+L) ........................................................... 580,016 19,984 600,000 Req. 2 June 30: Interest Expense* (+E, -SE) ................................................. Discount on Bonds Payable (-XL, +L) ............................... Cash (-A) ........................................................................... *($580,016 x 8.5% x ½) 10-11 24,651 2,151 22,500 Chapter 10 - Reporting and Interpreting Bonds Req. 3 June 30, 2011: Income statement: Interest expense $ 24,651 Balance sheet: Long-term Liabilities Bonds payable Less: Unamortized discount ($19,984 – $2,151) $600,000 17,833 $582,167 E10–10. Computations: Interest: $600,000 x 7.5% x 1/2 = $ 22,500 Present value: $600,000 x 0.7168 $ 22,500 x 6.6638 Issue price = 430,080 = 149,936 = $580,016 Req. 1 January 1: Cash (+A) .............................................................................. Bonds Payable (+L) ........................................................... 580,016 580,016 Req. 2 June 30: Interest Expense* (+E, -SE) ................................................. Bonds Payable (+L)........................................................... Cash (-A) ........................................................................... 10-12 24,651 2,151 22,500 Chapter 10 - Reporting and Interpreting Bonds *($580,016 x 8.5% x ½) Req. 3 June 30, 2011: Income statement: Interest expense $ 24,651 Balance sheet: Long-term Liabilities Bonds payable $582,167 E10–11. Req. 1 Issue price: 1. Par, $300,000 – Carrying value at end of 1 year, $281,100 = $18,900 (unamortized discount for 9 remaining years). 2. $18,900 9 years = $2,100 discount amortization per year (straight line). 3. $281,100 – $2,100 = $279,000 issue price (discount $21,000). Issuance entry: Cash (+A) .............................................................................. Discount on bonds payable (+XL, -L) .................................... Bonds payable (+L) ........................................................... 279,000 21,000 300,000 Req. 2 Coupon (stated interest) rate: 1. Reported interest expense, $23,100 – Discount amortized, $2,100 = $21,000 (cash interest). 2. $21,000 ÷ $300,000 = 7% coupon (stated interest) rate. Interest expense: Interest expense (+E, -SE) .................................................... 23,100 Discount on bonds payable ($21,000 ÷ 10 years) (-XL, +L) Cash ($300,000 x 7%) (-A) ................................................ 10-13 2,100 21,000 Chapter 10 - Reporting and Interpreting Bonds E10–12. 1. Issue price: $948. Stated rate, 6%; effective or yield rate, 8% (both were given). 2. Discount: $1,000 – $948 = $52. 3. $1,000 x 6% = $60. 4. 2011, $76; 2012, $77; 2013, $79. 5. Balance sheet: 2011 $ 964 2012 $ 981 2013 $1,000 6. (immediately before retirement) Effective-interest amortization was used. E10–12. (continued) 7. (a) $1,000 x 6% = $60. (b) $964 x 8% = $77 (rounded). (c) $77 – $60 = $17. (d) $964 + $17 = $981. 8. Effective-interest amortization measures the amount of interest expense and net liability for each period on a present value basis. The interest expense and related amortization are based on the actual unpaid balance of the debt and the effective interest rate. Straight-line amortization is an approximation that does not take these factors into consideration. The effective-interest method is conceptually preferable but the straight-line method is used widely in practice because of computational simplicity and the materiality concept. E10–13. The effective interest rate for a bond is determined by market forces and not the company. American was able to specify the coupon rate for the bonds which determines the periodic interest payments. It appears that American intended to sell the bonds close to par value which would be achieved by having a coupon rate that was the same as the market rate. The market rate of interest continually changes as the result of such factors as inflation expectations and the level of business activity. It is virtually impossible to issue a bond at a point when the coupon rate and the market rate are exactly the same. 10-14 Chapter 10 - Reporting and Interpreting Bonds E10–14. Students will typically offer one of two explanations: Normally, bonds that offer less than the market rate sell at a discount that results in a bond yield equal to the market rate of interest. While this is generally true, we do not think it explains the low interest rate for the Disney bond. The Disney bond includes a feature not seen in most bonds. It provides investors with the opportunity to participate in stock price appreciation while holding a more conservative investment. The conversion feature permits bond holders to convert their bonds into stock at a price of $29.46 per share. When this problem was written, Disney stock was selling for $33 per share. This conversion feature enhances the potential return for investors and permits the issuer to pay a lower rate of interest. E10–15. Assuming that both companies offer the same business risk, many people might prefer the bond that had the slightly higher yield which is Walt Disney at 9.5%. If interest rates were to fall significantly, companies might decide to call their bonds and issue new ones at a lower interest rate. In this case, a zero coupon bond offers an extra margin of protection. A zero is sold at a deep discount (say 60% of par). It would be very unusual to see a company call such a bond if it were callable at par. In this case, the PepsiCo bond would be preferred. Many people who are retired desire to have a steady income without engaging in time-consuming transactions. These people would probably not want to buy a zero coupon bond which paid interest only at maturity. E10–16. Computations: Interest: $1,400,000 x 8% x 1/2 = $ 56,000 Present value: $1,400,000 x 0.7894 $ 56,000 x 7.0197 1,105,160 393,103 = = 10-15 Chapter 10 - Reporting and Interpreting Bonds Issue price = $1,498,263 Req. 1 January 1: Cash (+A) .............................................................................. 1,498,263 Premium on Bonds Payable (+L) ...................................... Bonds Payable (+L) .......................................................... 98,263 1,400,000 Req. 2 June 30: Interest Expense (+E, -SE) ................................................... Premium on Bonds Payable (-L) ........................................... Cash (-A) ........................................................................... 43,717 12,283 56,000 E10–16. (continued) Req. 3 June 30, 2011: Income statement: Interest expense $ 43,717 Balance sheet: Long-term Liabilities Bonds payable Plus: Unamortized premium ($98,263 – $12,283) E10–17. Computations: Interest: $2,000,000 x 5% = $ 100,000 Present value: $2,000,000 x 0.4350 $ 100,000 x 13.2944 Issue price = 870,000 = 1,329,440 = $2,199,440 Req. 1 10-16 $1,400,000 85,980 $1,485,980 Chapter 10 - Reporting and Interpreting Bonds January 1: Cash (+A) .............................................................................. 2,199,440 Premium on Bonds Payable (+L) ...................................... Bonds Payable (+L) .......................................................... 199,440 2,000,000 Req. 2 June 30: Interest Expense (+E, -SE) ($2,199,440 x 4.25%) ............... Premium on Bonds Payable (-L) ........................................... Cash (-A) ........................................................................... 93,476 6,524 100,000 Req. 3 June 30, 2011: Income statement: Interest expense $ 93,476 Balance sheet: Long-term Liabilities Bonds payable Plus: Unamortized premium ($199,440 – $6,524) $2,000,000 192,916 $2,192,916 E10–18. Computations: Interest: $2,000,000 x 5% = $ 100,000 Present value: $2,000,000 x 0.4350 $ 100,000 x 13.2944 Issue price = 870,000 = 1,329,440 = $2,199,440 Req. 1 January 1: Cash (+A) .............................................................................. 2,199,440 Bonds Payable (+L)........................................................... Req. 2 June 30: Interest Expense (+E, -SE) ($2,199,440 x 4.25%) ............... Bonds Payable (-L) ............................................................... 10-17 93,476 6,524 2,199,440 Chapter 10 - Reporting and Interpreting Bonds Cash (-A) ........................................................................... 100,000 Req. 3 June 30, 2011: Income statement: Interest expense $ 93,476 Balance sheet: Long-term Liabilities Bonds payable $2,192,916 E10–19. Req. 1 Date 1/1/2011 12/31/2011 12/31/2012 12/31/2013 Cash Interest Interest Expense Premium Amortization $500 500 500 $10,278 x 4% = $411 $10,189 x 4% = $408 $10,097 x 4% = $404 $89 92 96 Net Liability Balance $10,278 10,189 10,097 10,001* * $1 rounding error Present value computation: Principal: $10,000 x .8890 Interest: 500 x 2.7751 Issue price $ 8,890 1,388 $10,278 Req. 2 December 31: Interest expense................... Bond liability…………………. 2011 2012 2013 $411 $10,189 $408 $10,097 $404 $10,000* *Immediately before repayment of principal 10-18 Chapter 10 - Reporting and Interpreting Bonds E10–20. Req. 1 Cash is increased on the balance sheet. The statement of cash flows shows an inflow from financing activities. Bonds payable and premium on bonds payable are increased on the balance sheet. The debt-to-equity ratio will be higher. January 1: Cash (+A) .............................................................................. Premium on bonds payable (+L) ....................................... Bonds payable (+L) ........................................................... 376,774 76,774 300,000 Principal: $300,000 x .7441 .................................................. Interest: $18,000 x 8.5302 .................................................... Issue (sale) price ...................................................... $223,230 153,544 $376,774 E10–20. (continued) Req. 2 The interest expense will be increased on the income statement and the cash will be decreased on the balance sheet. The premium on bonds payable will be decreased on the balance sheet. The debt-to-equity ratio will be decreased and the times interest earned ratio will be lower. December 31: Interest expense (+E, -SE) .................................................... Premium on bonds payable ($76,774 10 periods) (-L) ........ Cash ($300,000 x 6%) (-A) ................................................ Req. 3 December 31, 2011: Income Statement: 10-19 10,323 7,677 18,000 Chapter 10 - Reporting and Interpreting Bonds Interest Expense $10,323 Balance Sheet: Long-term Liabilities Bonds Payable $300,000 Add: Unamortized premium ($76,774 - $7,677) 69,097 $369,097 E10–21. Req. 1 Computations: Interest: $1,000,000 x 10% = $100,000 ÷ 2 = $50,000 Present value $ 1,000,000 x .4564 $ 50,000 x 13.5903 = = 456,400 679,515 $ 1,135,915 June 30: Cash (+A) .............................................................................. 1,135,915 Bonds payable (+L) ........................................................... Premium on bonds payable(+L) ....................................... 10-20 1,000,000 135,915 Chapter 10 - Reporting and Interpreting Bonds Req. 2 The amortization of bond premium does not affect cash flows directly but does result in cash payments for interest that are higher than reported interest expense for the period. E10–22. Bonds payable (-L) ................................................................ Loss on bond call (+Loss, -SE) ............................................. Cash (-A) ........................................................................... 600,000 30,000 630,000 E10–23. Bonds payable (-L) ................................................................ Loss on bond call (+Loss, -SE) ............................................. Discount on bonds payable (-XL,+ L) ................................ Cash (-A) ........................................................................... E10–24. 10-21 500,000 60,000 25,000 535,000 Chapter 10 - Reporting and Interpreting Bonds 1. Impacts Statement of Cash Flows (SCF) : report $960,000 inflow in financing section 2. Does not impact SCF 3. Impacts SCF : report $54,000 payment in operating activities section 4. Impacts SCF : report $940,000 payment in financing section 10-22 Chapter 10 - Reporting and Interpreting Bonds PROBLEMS P10–1. Req. 1—Comparison of results: Actual Results for 2011 Item (a) (b) (c) (d) (e) (f) (g) Total debt ................................................. Total assets ............................................. Total stockholders’ equity ........................ Interest expense (total at 10%) ................ Net income............................................... Return on total assets .............................. Earnings available to stockholders: (1) Amount ............................................... (2) Per share ............................................ (3) Return on stockholders’ equity ........... Results with an Increase in Debt and a Decrease in Stockholders’ Equity $ 40,000 360,000 320,000 4,000 60,000 17.3% $90,000 360,000 270,000 9,000 57,000 17.3% $ 60,000 2.61 18.75% $ 57,000 3.17 21.11% Computations: (a) Given (b) Given (c) Given (d) $90,000 x 10% = $9,000. (e) ($100,000 + $4,000 – $9,000) = $95,000, pretax; $95,000 x (100% – 40%) = $57,000. (f) $60,000 + [$4,000 x (100% – 40%) = $2,400] = $62,400; $62,400 ÷ $360,000 = 17.3%. $57,000 + [$9,000 x (100% – 40%) = $5,400] = $62,400; $62,400 ÷ $360,000 = 17.3%. (g–1) From Item (e) (g–2) $60,000 23,000 shares = $2.61 EPS. $57,000 18,000 shares = $3.17 EPS. (g–3) $60,000 $320,000 = 18.75%. $57,000 $270,000 = 21.11%. 10-23 Chapter 10 - Reporting and Interpreting Bonds P10–1. (continued) Req. 2 Interpretation: The recommendation provided higher financial leverage compared with actual financial leverage. This increase in positive financial leverage was because the company had a net of tax interest rate on debt that was lower than the return on total assets. This increase is favorable to the stockholders because their potential dividends (based on retained earnings) and total owners’ equity are much higher. The disadvantage of higher debt is the cash required to pay interest and principal. This company appears to have the potential for future success. Therefore, the higher debt leverage seems advisable. P10–2. Req. 1 Interest: $300,000 x 8% Present value $ 300,000 x .6756 $ 12,000 x 8.1109 Issue price = = = $ 24,000 ÷ 2 = $12,000 202,680 97,331 $300,011 The exact present value is $300,000. The $11 difference is due to rounding the present value factors at four digits. Req. 2 June 30 2011 $12,000 Dec. 31 2011 $12,000 June 30 2011 $12,000 Dec. 31 2011 $12,000 2011 Bonds payable ....................................... $300,000 2012 $300,000 Interest expense..................................... Req. 3 Cash paid ............................................... Req. 4 10-24 Chapter 10 - Reporting and Interpreting Bonds P10–3. Case A a. Cash received at issue .......................................... $500,000 b. Bond interest expense (pretax) .............................. $ 35,000 Case B Case C $475,000 $515,000 $ 37,500 $ 33,500 c. d. e. f. Bonds payable, 7% ................................................ $500,000 $500,000 $500,000 Unamortized discount (deduct) ** .......................... 22,500 Unamortized premium (add) ** .............................. 13,500 Net liability ............................................................. $500,000 $477,500 $513,500 **Balance in discount or premium account (January 1, 2011) ............................................... $ 25,000 $ 15,000 Amortization during 2011 ...................................... (2,500)) (1,500) Unamortized balance on December 31, 2011 .... $ 22,500 $ 13,500 g. Stated rate of interest (given)................................. 7% 7% 7% P10–4. Req. 1 December 31, 2011—Financial statements: a. b. c. d. e. f. Interest expense ..................................... Bonds payable ........................................ Unamortized premium or discount .......... Net liability .............................................. Stated rate of interest ............................. Cash interest paid ................................... Case A At Par, 100 Case B Case C At 99 At 104 $ 10,000 $100,000 $ 10,100 $100,000 (900) $ 99,100 10% $ 10,000 $ 9,600 $100,000 3,600 $103,600 10% $ 10,000 $100,000 10% $ 10,000 10-25 Chapter 10 - Reporting and Interpreting Bonds P10–4. (continued) Req. 2—Explanation of differences: Item a, interest expense, is different (in this situation) from Item f, cash interest paid, by the amount of any bond discount or premium amortized for the period. This divergence reflects the fact that discount and premium are adjustments of interest expense because of a difference between the market and stated interest rates at date of issuance of bonds. Req. 3 The letter should explain that most bonds pay a fixed rate of interest by contract. As market interest rates change over time, the price of the bond changes. When the market interest rates increase, the price of the bond will fall. When rates decrease, the bond price will increase. A discount simply means that the bond is selling for less than par; a premium occurs when the bond sells for more than par. There is no advantage to purchasing a bond at a discount because all bonds will adjust in price to yield the market rate of interest. 10-26 Chapter 10 - Reporting and Interpreting Bonds P10–5. 1. Computation of the amount of the bond liability when issued: $200,000 x .4632 = $92,640 $ 12,000 x 6.7101 = 80,521 Issue Price $173,161 2. Computation of interest expense recorded on December 31, 2011: $173,161 x 8% = $13,853 3. Managers are normally relatively indifferent between the straight-line and effectiveinterest methods. The two methods typically produce very similar financial results. In such cases, most managers would select the method that is simpler to use, which would be the straight-line method. 4. Date Debt-to-Equity Times Interest Earned Issue date Increase No effect Interest payment date Increase Decrease 10-27 Chapter 10 - Reporting and Interpreting Bonds P10–6. Req. 1 Computations: Interest: $700,000 x 8% x 1/2 Present value $ 700,000 x 0.3769 $ 28,000 x 12.4622 Issue Price = $ = = 28,000 263,830 348,942 $612,772 Req. 2 June 30 Interest expense..................................... $32,361* December 31 $32,361* *$700,000 - $612,772 = $87,228 20 periods = $4,361 + $28,000 = $32,361 Req. 3 June 30 Cash paid ............................................... $28,000 December 31 $28,000 Req. 4 June 30 Bonds payable ....................................... $617,133* *$612,772 + $4,361 = $617,133 **$617,133 + $4,361 = $621,494 10-28 December 31 $621,494** Chapter 10 - Reporting and Interpreting Bonds P10–7. Req. 1 Computations: Interest: $1,000,000 x 10% x 1/2 = Present value $ 1,000,000 x 0.3118 $ 50,000 x 11.4699 Issue Price Req. 2 = = $ 50,000 311,800 573,495 $885,295 June 30 Interest expense..................................... $53,118* December 31 $53,305** $885,295 x 12% x ½ = $53,118 **[$885,295 + ($53,118 - $50,000)] x 12% x ½= $53,305 Req. 3 June 30 December 31 Cash paid ............................................... $50,000 $50,000 Req. 4 June 30 Bonds payable ....................................... $888,413* *$885,295 + $3,118 = $888,413 **$888,413+ $3,305 = $891,718 10-29 December 31 $891,718** Chapter 10 - Reporting and Interpreting Bonds P10–8. Req. 1 Principal: Interest: $800,000 x 0.5674 ............................................................... $ 64,000 x 3.6048 ................................................................ Bond issue price ............................................................... $453,920 230,707 $684,627 The stated rate of interest is used only to compute the periodic cash interest payments of $64,000. This amount is necessary because it is discounted to PV using the effective interest rate. The effective-interest rate is used to discount the two future cash flows: principal and cash interest. The discounting must be based on the effective-interest rate because the selling (issue) price is the PV of the future cash flows. Req. 2—Straight-line amortization: 2011 a. Cash interest payment ($800,000 x 8%) ................... b. Amortization of discount ($115,373 5 years) ............ c. Bond interest expense ............. 2012 2013 2014 2015 $64,000 $64,000 $64,000 $64,000 $64,000 23,075 $87,075 23,075 23,075 23,075 23,075 $87,075 $87,075 $87,075 $87,075 Req. 3 —Effective-interest amortization: Bond Amortization Schedule Date 1/1/2011 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2015 $115,373 *Rounded Cash Payment $64,000 64,000 64,000 64,000 64,000 Interest Expense $684,627 x 702,782 x 723,116 x 745,890 x 771,397 x 12% 12% 12% 12% 12% Amortization of Discount = $82,155 $18,155 = 84,334 20,334 = 86,774 22,774 = 89,507 25,507 = 92,603 * 28,603 Net Liability $684,627 702,782 723,116 745,890 771,397 800,000 A constant interest rate can be demonstrated each year by dividing interest expense by the net liability – the answer on all lines will be the effective rate (12%). Req. 4 Effective-interest amortization is preferable to straight-line because it better measures interest expense (on the income statement) and the net liability (on the balance sheet). The effective-interest approach is conceptually sound because interest expense is based on the unpaid balance of the liability. In this case, interest expense as a percent of the net liability is 12% each period (the effective or true rate) only if the effective- 10-30 Chapter 10 - Reporting and Interpreting Bonds interest approach is used. If the straight-line approach is used, the interest percent changes each year and ranges from 11.21% to 12.72%. P10–9. Req. 1 Computations: Interest: $2,000,000 x 10% x 1/2 = Present value $ 2,000,000 x 0.4564 $ 100,000 x 13.5903 Issue price = = $ 100,000 912,800 1,359,030 $2,271,830 Req. 2 June 30 Interest expense..................................... $86,408* December 31 $86,408* *$2,271,830 - $2,000,000= $271,830 20 periods = $13,592 $100,000 - $13,592 = $86,408 Req. 3 June 30 Cash paid ............................................... $100,000 December 31 $100,000 Req. 4 June 30 Bonds payable ....................................... $2,258,238* *$2,271,830- $13,592 = $2,258,238 **$2,258,238- $13,592 = $2,244,646 10-31 December 31 $2,244,646** Chapter 10 - Reporting and Interpreting Bonds P10–10. Req. 1 Computations: Interest: $700,000 x 13% x 1/2 Present value $ 700,000 x 0.5584 $ 45,500 x 7.3601 Issue Price = = = $ 45,500 390,880 334,885 $725,765 Req. 2 June 30 Interest expense..................................... $43,546* December 31 $43,429** $725,765 x 12% x ½ = $43,546 **[$725,765 - ($45,500- $43,546)] x 12% x ½= $43,429 Req. 3 June 30 Cash paid ............................................... $45,500 December 31 $45,500 Req. 4 June 30 Bonds payable ....................................... $723,811* *$725,765 – ($45,500 – $43,546) = $723,811 **$723,811 – ($45,500 - $43,429) = $721,740 10-32 December 31 $721,740** Chapter 10 - Reporting and Interpreting Bonds P10–11. Req. 1 Principal: Interest: $300,000 x 0.6209 ............................................................. $33,000 x 3.7908 ............................................................... Issue (sale) price ................................................................ $186,270 125,096 $311,366 Req. 2 January 1, 2011: Cash (+A) .............................................................................. Premium on bonds payable (+L) ....................................... Bonds payable (+L) ........................................................... Sale of bonds at a premium. 311,366 11,366 300,000 Req. 3 December 31, 2011: Bond interest expense (+E, -SE) ........................................... Premium on bonds payable (-L) ............................................ Cash (-A) ........................................................................... Interest payment plus premium amortization. 30,727 2,273 33,000 Req. 4 Income Statement for 2011: Interest expense: $30,727 Balance Sheet at December 31, 2011: Long-term Liabilities: Bonds payable ................................................................... $300,000 Add: Unamortized premium ($11,366 – $2,273) ......................................................... 9,093 10-33 $309,093 Chapter 10 - Reporting and Interpreting Bonds P10–12. 1. Missing amounts are underlined: Date Cash Jan. 1, 2011 ............................. End of Year 2011 ..................... $3,600 End of Year 2012 ..................... 3,600 End of Year 2013 ..................... 3,600 End of Year 2014 ..................... 3,600 Interest Amortization $3,417 3,404 3,390 3,381 $183 196 210 219* Balance $48,808 48,625 48,429 48,219 48,000 Calculations: Effective interest rate: $3,417 $48,808 = 7% Interest: 7% x Previous balance Amortization: Cash payment – Interest Balance: Previous balance – Amortization *$6 rounding error 2. Maturity (par) amount: $48,000 from last column at end of the last year. 3. Cash received: $48,808 from last column at January 1, 2011. 4. Premium: $48,808 – $48,000 = $808. 5. Cash disbursed for interest: $3,600 per period x 4 years = $14,400 total. 6. Effective-interest amortization: Evident from the computations in the schedule. The amortization amount is different each year. 7. Stated rate of interest: $3,600 $48,000 = 7.5%. 8. Yield or effective rate of interest: $3,417 $48,808 = 7%. 9. Interest expense: 2011, $3,417; 2012, $3,404; 2013, $3,390; 2014, $3,381. 10. Balance sheet: 2011 Long-Term Liabilities Bonds payable, 7.5% Maturity amount $48,000, plus unamortized premium ......................................................... $48,625 2012 2013 $48,429 $48,219* $48,000* * At the end of 2013 and during the last year of the term of the bonds before retirement they would be reported as a current liability on the balance sheet. 10-34 2014 Chapter 10 - Reporting and Interpreting Bonds P10–13. When a bond is sold for a premium, the amount of cash collected is greater than the maturity value. This extra amount is called a bond premium. The recorded value for this liability is the maturity value plus the unamortized amount of the premium. Bond premiums are amortized over the life of a bond, using either the straight-line or effective-interest method. When bond premium amortization is recorded, the amount of bond premium is reduced. The reduction reported in the note is the result of the required amortization of the bond premium. P10–14. Req. 1 The company used cash on hand to retire their bonds prior to their maturity date. Req. 2 Most likely, the bonds were callable with a $49 million premium. The payment of the premium on retirement is reported as an expense. P10–15. 1. Financing, inflow 2. It is reported as an operating activity. 3. Financing, outflow 4. It is reported as an operating activity. 5. Financing, outflow 6. No effect 10-35 Chapter 10 - Reporting and Interpreting Bonds ALTERNATE PROBLEMS AP10–1. Req. 1 Interest: $2,000,000 x 10% Present value $ 2,000,000 x .6139 $ 100,000 x 7.7217 Issue price = $ 200,000 ÷ 2 = $100,000 = = 1,227,800 772,170 $1,999,970 The exact present value is $2,000,000. The $30 difference is due to rounding the present value factors at four digits. Req. 2 June 30 2011 Interest expense..................................... $100,000 Dec. 31 2011 $100,000 Req. 3 June 30 2011 Cash paid ............................................... $100,000 Dec. 31 2011 $100,000 Req. 4 2011 Bonds payable ....................................... $2,000,000 10-36 2012 $2,000,000 Chapter 10 - Reporting and Interpreting Bonds AP10–2. (000’s): At At At At End End End End of 2011 of 2012 of 2013 of 2014 Case A: Sold at Par Interest expense on the income statement 10 10 10 10 100 100 100 100 Case B: Sold at a discount Interest expense on the income statement 11 11 11 11 Net liability on balance sheet 96 97 98 99 Case C: Sold at a premium Interest expense on the income statement 8 8 8 8 108 106 104 102 Net liability on balance sheet Net liability on balance sheet 10-37 Chapter 10 - Reporting and Interpreting Bonds AP10–3. Req. 1 Computations: Interest: $1,000,000 x 7% = $ Present value $ 1,000,000 x 0.6499 = 70,000 x 3.8897 = Issue Price 70,000 649,900 272,279 $922,179 Req. 2 Interest expense..................................... 2011 $85,564* 2012 $85,564* *$1,000,000 - $922,179 = $77,821 5 years = $15,564 + $70,000 = $85,564 Req. 3 Cash paid ............................................... 2011 $70,000 2012 $70,000 Req. 4 2011 Bonds payable ....................................... $937,743* *$922,179 + $15,564 = $937,743 **$937,743+ $15,564 = $953,307 10-38 2012 $953,307** Chapter 10 - Reporting and Interpreting Bonds AP10–4. Req. 1 Computations: Interest: $2,000,000 x 6% Present value $ 2,000,000 x 0.7130 $ 120,000 x 4.1002 Issue Price = $ = = 120,000 1,426,000 492,024 $1,918,024 Req. 2 2011 Interest expense..................................... $134,262* 2012 $135,260** $1,918,024 x 7% = $134,262 **[$1,918,024 + ($134,262- $120,000)] x 7% = $135,260 Req. 3 2011 Cash paid ............................................... $120,000 2012 $120,000 Req. 4 2011 Bonds payable ....................................... $1,932,286* *$1,918,024 + $14,262 = $1,932,286 **$1,932,286 + $15,260 = $1,947,546 10-39 2012 $1,947,546** Chapter 10 - Reporting and Interpreting Bonds AP10–5. Req. 1 Computations: Interest: $900,000 x 10% = Present value $ 900,000 x 0.6499 $ 90,000 x 3.8897 = = $ 90,000 584,910 350,073 $934,983 Req. 2 Interest expense..................................... 2011 $83,003* 2012 $83,003* *$934,983 - $900,000= $34,983 5 years = $6,997 $90,000 - $6,997 = $83,003 Req. 3 Cash paid ............................................... 2011 $90,000 2012 $90,000 Req. 4 2011 Bonds payable ....................................... $927,986* *$934,983 - $6,997 = $927,986 **$927,986 - $6,997 = $920,989 10-40 2012 $920,989** Chapter 10 - Reporting and Interpreting Bonds AP10–6. Req. 1 Computations: Interest: $4,000,000 x 9% Present value $ 4,000,000 x 0.7473 $ 360,000 x 4.2124 Issue Price = $ = = 360,000 2,989,200 1,516,464 $4,505,664 Req. 2 2011 Interest expense..................................... $270,340* 2012 $264,960** $4,505,664 x 6% = $270,340 **[$4,505,664 - ($360,000 - $270,340)] x 6% = $264,960 Req. 3 2011 Cash paid ............................................... $360,000 2012 $360,000 Req. 4 2011 Bonds payable ....................................... $4,416,004 *$4,505,664 - $89,660 = $4,416,004 **$4,416,004 - $95,040 = $4,320,964 10-41 2012 $4,320,964** Chapter 10 - Reporting and Interpreting Bonds AP10–7. Req. 1 Cash (+A) .............................................................................. 52,720,000 Bonds payable (11 7/8%) (+L) ........................................... Bonds payable (13.6%) (-L) .................................................. 50,000,000 Loss on bond retirement (+Loss, -SE)................................... 2,720,000 Cash (-A) ........................................................................... 52,720,000 52,720,000 Req. 2 The loss on this transaction would be reported on the income statement as a loss. Req. 3 There are a number of reasons why a bond may be retired early. For example, the bond may include a restrictive covenant that can only be overcome by retirement. The present case does not mention any reasons of this nature. The most likely explanation is cash flow. The old bonds required interest payments of $6,800,000 per year (13.6% x $50,000,000). The new bonds (assuming they were issued at an amount close to par) require $6,260,500 (11 7/8% x $52,720,000) for a savings of $539,500 per year over the life of the bonds. 10-42 Chapter 10 - Reporting and Interpreting Bonds CASES AND PROJECTS FINANCIAL REPORTING AND ANALYSIS CASES CP10–1. Req. 1 The company paid $1,947,000 for interest. See “Supplemental Disclosures of Cash Flow Information” in the notes for the answer to this question. . Req. 2 Bonds must be reported unless the company has not issued any. Therefore, the company must not have issued bonds. Req. 3 Note 7 describes the company’s credit arrangements. The company has borrowing arrangements with two separate financial institutions under which it may borrow an aggregate of $350.0 million. CP10–2. Req. 1 Companies are not required to report immaterial amounts. Most likely, the amount of cash interest paid by Urban Outfitters was immaterial. This question is related to the next one. Req. 2 Bonds must be reported unless the company has not issued any. Therefore, the company must not have issued bonds. Req. 3 The notes disclose that the company has established an unsecured line of credit. 10-43 Chapter 10 - Reporting and Interpreting Bonds CP10–3. Req. 1 The primary source of cash flow for both companies is from their operating activities. From examining the financing activities section of the statement of cash flows, it is apparent that neither company relies on borrowed funds to a significant degree. Req. 2 Accounting ratios are useful in most circumstances but not all. The capital structures for these two companies are unusual and have relatively little debt. As a result, they have minimal related interest costs. The debt/equity ratios reflect these low debt levels. Because of the correspondingly low interest costs, a times interest earned ratio cannot be computed. CP10–4. Req. 1 Most bond indentures specify two types of cash outflows during the life of a bond issue: (1) periodic interest payments, and (2) payment of par value at maturity. When the stated interest rate is less than the effective-interest rate, bonds will sell at a discount. This means that when the bond matures, the investor will receive more cash than was paid for the bond when it was purchased. The discount on the bond compensates the investor for the difference between a stated interest rate that is less than the effective rate of interest. The JCPenney bonds sold at a “deep discount” because the stated rate of interest was zero. If investors want 15% effective interest, they would be willing to pay only $326.90 for a $1,000 JCPenney bond; the present value of the bond is computed as follows: Principal: $1,000 x.3269 = $326.90 Req. 2 Principal: $400,000,000 x 0.3269 = $130,760,000 The bonds would sell for 32.69% of par value, which is $130,760,000 for bonds with a $400,000,000 face value. 10-44 Chapter 10 - Reporting and Interpreting Bonds CRITICAL THINKING CASES CP10–5. People invest in different securities for a variety of reasons. Bondholders are interested in fixed income and low risk. They are willing to give up higher returns for lower risk. While the president of the company may be confident of a high return on the investment, in reality there is always risk. It is not unethical to offer an investor a lower-risk, lower-return investment. CP10–6. Obviously, there is no right answer to this question. We have found that some students approach this question from the perspective that people’s jobs are more important than people’s money. We try to point out that both the current workers and the retired investors are dependent on income from the corporation in order to survive. Nevertheless, some students will not budge from the belief that workers have a higher priority than suppliers of capital. Once this part of the discussion winds down, we like to shift to the issues of fiduciary responsibility. Even if students believe that the needs of the workers should take priority, a question remains concerning the portfolio manager’s professional obligation. Given that he has been hired to protect the interests of the investors, how high a priority can be placed on another group that will be affected by a potential bankruptcy? FINANCIAL REPORTING AND ANALYSIS PROJECTS CP10–7. The response to this case will depend on the companies selected by the students. 10-45 Chapter 11 - Reporting and Interpreting Owners’ Equity Chapter 11 Reporting and Interpreting Owners’ Equity ANSWERS TO QUESTIONS 1. A corporation is a separate legal entity (authorized by law to operate as an individual). It is owned by a number of persons and/or entities whose ownership is evidenced by shares of capital stock. Its primary advantages are: (a) transferability of ownership, (b) limited liability to the owners, and (c) the ability to accumulate large amounts of resources. 2. The charter of a corporation is a legal document from the state that authorizes its creation as a separate legal entity. The charter specifies the name of the entity, its purpose, and the kinds and number of shares of capital stock it can issue. 3. (a) Authorized capital stock—the maximum number of shares of stock that can be sold and issued as specified in the charter of the corporation. (b) Issued capital stock—the total number of shares of capital stock that have been issued by the corporation at a particular date. (c) Outstanding capital stock—the number of shares currently owned by the stockholders. 4. Common stock—the usual or normal stock of the corporation. It is the voting stock and generally ranks after the preferred stock for dividends and assets distributed upon dissolution. Often it is called the residual equity. Common stock may be either par value or no-par value. Preferred stock—when one or more additional classes of stock are issued, the additional classes are called preferred stock. Preferred stock has modifications that make it different from common stock. Generally, preferred stock has both favorable and unfavorable features in comparison with common stock. Preferred stock usually is par value stock and usually specifies a dividend rate such as “6% preferred stock.” 11-1 Chapter 11 - Reporting and Interpreting Owners’ Equity 5. Par value is a nominal per share amount established for the common stock and/or preferred stock in the charter of the corporation, and is printed on the face of each stock certificate. The stock that is sold by a corporation to investors above par value is said to have sold at a premium, while stock that is sold below par is said to have sold at a discount. The laws of practically all states forbid the initial sale of stock by a corporation to investors below par value. No-par value stock does not have an amount per share specified in the charter. As a consequence, it may be issued at any price without involving a discount or a premium. It avoids giving the impression of a value that is not present. 6. The usual characteristics of preferred stock are: (1) dividend preferences, (2) conversion privileges, (3) asset preferences, and (4) nonvoting specifications. 7. The two basic sources of stockholders’ equity are: Contributed capital—the amount invested by stockholders by purchase from the corporation of shares of stock. It is comprised of two separate elements: (1) the par or stated amount derived from the sale of capital stock (common or preferred) and (2) the amount received in excess of par or stated value. Retained earnings—the accumulated amount of all net income since the organization of the corporation, less losses and less the accumulated amount of dividends paid by the corporation since organization. 8. Stockholders’ equity is accounted for in terms of source. This means that several accounts are maintained for the various sources of stockholders’ equity, such as common stock, preferred stock, contributed capital in excess of par, and retained earnings. 9. Treasury stock is a corporation’s own capital stock that was sold (issued) and subsequently reacquired by the corporation. Corporations frequently purchase shares of their own capital stock for sound business reasons, such as to obtain shares needed for employees’ bonus plans, to influence the market price of the stock, to increase earnings per share amounts, and to have shares on hand for use in the acquisition of other companies. Treasury stock, while held by the issuing corporation, confers no voting, dividend, or other stockholder rights. 10. Treasury stock is reported on the balance sheet under stockholders’ equity as a deduction; that is, as contra stockholders’ equity. Any “gain or loss” on treasury stock that has been sold is reported on the financial statements as an addition to contributed capital if a gain; if a loss, it is deducted from any previous contributed capital, or otherwise from retained earnings. 11-2 Chapter 11 - Reporting and Interpreting Owners’ Equity 11. The two basic requirements to support a cash dividend are: (1) cash on hand or the ability to obtain cash sufficient to pay the dividend and (2) a sufficient balance in retained earnings, because the dividend represents a return of earnings to the stockholders. A cash dividend reduces both the assets of a corporation and stockholders’ equity by the amount of the dividend. 12. Cumulative preferred stock has a dividend preference such that, should the dividends on the preferred stock for any year, or series of years, not be paid, dividends cannot be paid to the common stockholders until all such dividends in arrears are paid to the preferred stockholders. Noncumulative preferred stock does not have this preference; therefore, dividends not paid in past periods will never be paid to the preferred stockholders. 13. A stock dividend involves the issuance to the stockholders of a dividend in the corporation’s own stock (rather than cash). A stock dividend is significantly different from a cash dividend in that the corporation does not disburse any assets, while in the case of a cash dividend, cash is decreased by the amount of the dividend. A cash dividend also reduces total stockholders’ equity by the amount of the dividend. In contrast, a stock dividend does not change total stockholders’ equity. 14. The primary purposes for issuing a stock dividend are: (1) to maintain dividend consistency; that is, to pay dividends each year either in cash or in capital stock, and (2) to capitalize retained earnings; that is, a stock dividend requires a transfer from the Retained Earnings account to the permanent contributed capital accounts for the amount of the dividend. Although this transfer does not change stockholders’ equity in total, it does cause a shift from retained earnings to contributed capital. 15. When a dividend is declared and paid, the three important dates are: Declaration date—the date on which the board of directors votes the dividend. In the case of a cash dividend, a dividend liability comes into existence on this date and must be recorded as a debit to Retained Earnings and as a credit to Dividends Payable. Date of record—this date usually is about one month after the date of declaration. It is the date on which the corporation extracts from its stockholders’ records the list of individuals owning shares. The dividend is paid only to those names listed on the record date. No entry in the accounts is made on this date. Date of payment—the date on which the cash is disbursed to pay the dividend. It follows the date of record as specified in the dividend announcement. The entry to record the cash disbursement for the dividend is a debit to Dividends Payable and a credit to Cash. 11-3 Chapter 11 - Reporting and Interpreting Owners’ Equity 16. Retained earnings is the accumulated amount of all net income of the corporation less all losses and less the accumulated amount of all dividends declared to date. The primary components of retained earnings are: beginning balance, plus net income, less net losses, minus dividends declared, equals the ending balance. ANSWERS TO MULTIPLE CHOICE 1. c) 6. b) 2. d) 7. c) 3. b) 8. c) 11-4 4. a) 9. d) 5. c) 10. a) Chapter 11 - Reporting and Interpreting Owners’ Equity Authors’ Recommended Solution Time (Time in minutes) Alternate Problems No. Time 1 45 2 30 3 30 4 20 5 50 Mini exercises No. Time 1 5 2 5 3 5 4 5 5 5 6 5 7 5 8 5 9 5 10 5 Cases and Projects No. Time 1 30 2 30 3 20 4 20 5 20 6 30 7 * Exercises Problems No. Time No. Time 1 15 1 45 2 15 2 45 3 30 3 45 4 30 4 60 5 20 5 30 6 20 6 30 7 45 7 30 8 15 8 30 9 30 9 45 10 15 10 20 11 20 11 30 12 20 12 30 13 20 13 45 14 30 15 30 16 30 17 20 18 30 19 20 20 15 21 15 22 20 23 20 24 15 25 15 26 15 27 20 28 20 * Due to the nature of this project, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time to discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 11-5 Chapter 11 - Reporting and Interpreting Owners’ Equity MINI- EXERCISES M11–1. Stockholders may: a) Vote in the stockholders’ meeting (or by proxy) on major issues concerning management of the corporation. b) Participate proportionately with other stockholders in the distribution of the corporation’s profits. c) Share proportionately with other stockholders in the distribution of corporate assets upon liquidation. Being able to vote is the most important of the rights because this ensures that the owners have an input at the stockholders’ meeting and some control of the management of the corporation, thus enabling them to protect their rights as stockholders. M11–2. Unissued shares = 90,000 (268,000 – 178,000) M11–3. 3,570,000 Cash (170,000 $21) (+A) .................................................... Common Stock (170,000 $1) (+SE) ............................... Capital in Excess of Par (+SE) .......................................... 170,000 3,400,000 The journal entry would be different if the par value were $2: 3,570,000 Cash (170,000 $21) (+A) .................................................... Common Stock (100,000 $2) (+SE) ............................... Capital in Excess of Par (+SE) .......................................... 11-6 340,000 3,230,000 Chapter 11 - Reporting and Interpreting Owners’ Equity M11–4. Common stock is the basic voting stock issued by a corporation. It ranks after preferred stock for dividends and assets distributed upon liquidation of the corporation. The dividend rate for common stock is determined by the board of directors, and is based on the company’s profitability. The dividend rate for preferred stock is fixed by a contract. Common stock has more potential for growth than preferred stock if the company is profitable. On the other hand, the investor may lose more money with common stock than with preferred stock if the company is not profitable. It is advisable to invest in the common stock. If the company is profitable, common stock will receive a higher return on the $100,000 than preferred stock would. M11–5. Assets Liabilities Stockholders’ Equity Net Income Purchased 20,000 shares of treasury stock Decrease by $900,000 No change Decrease by $900,000 No change Sold 5,000 shares Increase by $250,000 No change Increase by $250,000 No change Sold 10,000 shares Increase by $370,000 No change Increase by $370,000 No change M11–6. 200,000 X $0.65 = 11-7 $130,000 Chapter 11 - Reporting and Interpreting Owners’ Equity M11–7. April 15: Retained Earnings (-SE) .......................................................65,000 Dividends Payable (+L) ..................................................... 65,000 June 14: Dividends Payable (-L) ..........................................................65,000 Cash (-A) ........................................................................... 65,000 M11–8. Past Year 200,000 shares $2 = $400,000 Current Year 200,000 shares $2 = $400,000 Total to Preferred Stockholders $800,000 M11–9. Stock Dividend Stock Split No change in assets No change in assets No change in liabilities No change in liabilities Increase in common stock No change in common stock No change in stockholders’ equity: decrease retained earnings and increase contributed capital by the same amount. No change in stockholders’ equity Decreases market value Decrease in market value M11–10. Retained Earnings (-SE) ....................................................... 800,000 Common Stock (+SE) ....................................................... 11-8 800,000 Chapter 11 - Reporting and Interpreting Owners’ Equity EXERCISES E11–1. Computation of End of Year Balance for Treasury Stock: Beginning balance 380,474,028 Net decrease ( 5,047,286) Ending balance 375,426,742 Computation of Shares Outstanding: Issued shares 2,805,961,317 Treasury stock ( 375,426,742) Shares Outstanding 2,430,534,575 E11–2. Req. 1 The number of authorized shares is specified in the corporate charter: 200,000. Req. 2 Issued shares are the shares sold to the public: 160,000 Req. 3 Issued shares 160,000 Treasury stock (20,000) Outstanding shares 140,000 11-9 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–3. Req. 1 Stockholders’ Equity Contributed capital: Preferred stock, authorized 4,000 shares, issued and outstanding, 3,000 shares ...................................................... Common stock, authorized 103,000 shares, issued and outstanding, 20,000 shares .................................................... Capital in excess of par, preferred .............................................................. Capital in excess of stated value, no-par common ..................................... Total contributed capital .......................................................................... Retained earnings .......................................................................................... Total Stockholders’ Equity....................................................................... $ 24,000 200,000 36,000 120,000 380,000 40,000 $420,000 Req. 2 The answer would depend on the profitability of the company and the stability of its earnings. The preferred stock has a 9% dividend rate. If the company earns more than 9%, the additional earnings would accrue to the current stockholders. If the company earns less than 9%, it would pay a higher rate to the preferred stockholders. E11–4. Req. 1 ($20 x 90,000 shares) - $1,600,000 = $200,000 Req. 2 $900,000 - $1,000,000 + $800,000 = $700,000 Req. 3 90,000 shares – 80,000 shares = 10,000 shares Req. 4 EPS = $1,000,000 80,000 = $12.50 11-10 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–5. Req. 1 a. Cash (5,600 shares x $20) (+A) ............................................ Common stock (5,600 shares x $10) (+SE) ...................... Capital in excess of par, common stock (+SE) .................. Sold common stock at a premium. b. Cash (1,000 shares x $25) (+A) ............................................ Common stock (1,000 shares x $10) (+SE) ...................... Capital in excess of par, common stock (+SE) .................. Sold common stock at a premium. 112,000 56,000 56,000 25,000 10,000 15,000 Req. 2 Stockholders’ Equity Contributed capital: Common stock, par $10, authorized 11,500 shares, outstanding 6,600 shares .................................................................... Contributed capital in excess of par ........................................................ Total contributed capital .......................................................................... Retained earnings (deficit) ......................................................................... Stockholders’ equity ................................................................................... $ 66,000 71,000 137,000 (6,000) $131,000 Req. 3 The company has a negative balance in retained earnings, which, in most cases, would preclude the payment of dividends. Dividends are a distribution of earnings to the owners. In the absence of retained earnings, dividends should not be paid. 11-11 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–6. Req. 1 Common stock, class A at par value: 116,560,308 X $0.01 = $1,166 (thousand) Req. 2 Number of shares outstanding 2009: 116,560,308 shares issued minus 47,116,748 shares held as treasury stock = 69,443,560. Number of shares outstanding 2008: 116,445,495 shares issued minus 45,290,148 shares held as treasury stock = 71,155,347. Req. 3 (In thousands) Retained earnings for 2008: $2,427,727 plus net loss for 2009 $241,065 plus dividends for 2009 $11,898 = $2,680,690 Req. 4 As of 2009, treasury stock had decreased corporate resources by $942,001 (thousand). Req. 5 For 2009, treasury stock transactions decreased stockholders’ equity by $17,441 (thousand) ($942,001 - $924,560). Req. 6 For 2009, treasury stock cost per share: $942,001,000 ÷ 47,116,748 shares = $19.99. 11-12 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–7. Req. 1 a. Cash (50,000 shares x $50) (+A) .......................................... Common stock (50,000 shares x $2) (+SE) ...................... Capital in excess of par, common stock (+SE) .................. Sold common stock at a premium. 2,500,000 b. Treasury stock (1,000 shares x $52) (+XSE, -SE) ................ Cash (-A) ........................................................................... Bought treasury stock. 100,000 2,400,000 52,000 52,000 Req. 2 Stockholders’ Equity Contributed capital: Common stock, par $2, authorized 80,000 shares, issued 50,000 shares .......................................................................... $ 100,000 Contributed capital in excess of par ........................................................ 2,400,000 Total contributed capital .......................................................................... 2,500,000 Treasury stock............................................................................................ (52,000) Stockholders’ equity ................................................................................... $2,448,000 E11–8. Shareholders’ equity (deficit) in thousands: Common stock, par value $.01 per share; 100,000,000 shares authorized, 23,215,356 shares issued and outstanding at December 31, 2007, 23,337,986 shares issued and outstanding at December 31, 2008 Additional paid-in capital Accumulated deficit Total shareholders’ equity 2007 233 233 168,431 171,389 (80,597) (134,480) 88,067 11-13 2008 37,142 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–9. Stockholders’ Equity Contributed capital: Preferred stock, 8%, par $50, authorized 59,000 shares, issued and outstanding, 20,000 shares ............................................... Common stock, par $10, authorized 98,000 shares, issued, 78,000 shares ......................................................................... Capital in excess of par, preferred stock ................................................. Capital in excess of par, common stock .................................................. Treasury stock ..................................................................................... Retained earnings*......................................................................................... Total stockholders’ equity........................................................................ $1,000,000 780,000 600,000 780,000 (80,000) 60,000 $3,140,000 *($90,000 – $30,000 = $60,000.) E11–10. Req. 1 a. Cash (20,000 shares x $20) (+A) .......................................... Common stock, no-par (+SE) ............................................ . 400,000 400,000 b. Cash (6,000 shares x $40) (+A) ............................................ Common stock, no-par (+SE) ........................................... 240,000 c. Cash (7,000 shares x $30) (+A) ............................................ Preferred stock (7,000 shares x $10) (+SE) ...................... Capital in excess of par, preferred (+SE) .......................... 210,000 240,000 70,000 140,000 Req. 2 Yes, it is ethical as long as there is a full disclosure of relevant information. In any arm’s length transaction, an informed buyer will pay the market value of the stock. 11-14 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–11. Req. 1 Number of preferred shares issued: $100,000 $20 = 5,000 Req. 2 Number of preferred shares outstanding: 5,000 shares issued minus 500 shares held as treasury stock = 4,500. Req. 3 Average sales price per share of preferred stock when issued: ($100,000 + $15,000) ÷ 5,000 shares = $23.00. Req. 4 Decreased corporate resources by $9,500 - $1,500 = $8,000. Req. 5 Treasury stock transactions decreased stockholders’ equity by $8,000 (same as the decrease in corporate resources in 4 above). Req. 6 Treasury stock cost per share: $9,500 ÷ 500 shares = $19.00. Req. 7 Total stockholders’ equity: $741,000. Req. 8 Issue price of common stock $600,000 ÷ 8,000 shares = $75.00. 11-15 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–12. Req. 1 The number of shares that have been issued is computed by dividing the common stock account ($4,002 million) by the par value of the shares ($1 per share) or approximately 4,002,000,000 shares. Req. 2 Retained earnings end of 2007 ............ Net income for 2008 ............................ Dividends for 2008 ............................... Retained earnings end of 2008 ............ $41,797,000,000 12,075,000,000 (5,802,900,000) $48,069,100,000 The amount of retained earnings is an estimate because we do not know the exact number of shares outstanding (because we do not know the number of shares in treasury stock. This number is needed to determine the amount of dividends paid during 2008. We based the dividends on the estimate calculated in the previous requirement. E11–13. Req. 1 Assets - $133,750,000 Stockholders’ Equity - $133,750,000 The treasury stock account is a contra equity account, meaning that it subtracts from the total stockholders’ equity. Cash also decreases on the balance sheet by the same amount. Req. 2 Many companies repurchase common stock in order to develop an employee bonus plan that provides workers with shares of the company’s stock as part of their compensation. Because of SEC regulations concerning newly issued shares, companies find it cheaper to give their employees shares of stock that were purchased from stockholders than to issue new shares. In this case, the company mentions the goal of enhancing shareholders’ value. If the company maintains its current level of income, earnings per share will increase with fewer shares outstanding. The management expects that the increase in EPS will be reflected in an increase in stock price. Req. 3 11-16 Chapter 11 - Reporting and Interpreting Owners’ Equity Shares that are held in treasury stock do not participate in dividend payments. As a result, the purchase of treasury stock will reduce the amount of dividends that the company must pay in future years. E11–14. Req. 1 Stockholders’ Equity Contributed capital: Common stock, authorized 100,000 shares, issued 34,000 shares, of which 2,000 shares are held as treasury stock .................................. Capital in excess of par ........................................................................ Total contributed capital .................................................................... Retained earnings ................................................................................... Total .................................................................................................. Less: Cost of treasury stock ................................................................. Total Stockholders’ Equity ............................................................. $680,000 163,000 843,000 89,000 932,000 25,000 $907,000 Req. 2 The dividend yield ratio is 2.24% ([$16,000 32,000 shares] $22.29). While this yield seems small, it is a typical return on common stock. Investors receive a return from both dividends and stock price appreciation. Treasury stock does not receive dividends. As a result, dividends should be paid on 32,000 shares. E11–15. Req. 1 a. Treasury stock (200 shares x $20) (+XSE, -SE) ................... Cash (-A) ........................................................................... Bought treasury stock. 4,000 4,000 b. Cash (40 shares x $25) (+A) ................................................. Treasury stock (40 shares x $20) (-XSE, +SE) ................. Capital in excess of par (+SE) ........................................... Sold treasury stock. 1,000 c. Cash (30 shares x $15) (+A) ................................................. 450 Capital in excess of par (-SE) ............................................... Treasury stock (30 shares x $20) (-XSE, +SE) ................ Sold treasury stock. 150 Req. 2 11-17 800 200 600 Chapter 11 - Reporting and Interpreting Owners’ Equity It is not possible to make a “profit” or “loss” on treasury stock transactions. Therefore, these transactions do not affect the income statement. E11–16. Req. 1 Feb. 1: Treasury stock, common (160 shares x $20) (+XSE, -SE) Cash (-A)........................................................................ July 15: Cash (80 shares x $21) (+A) ............................................. Treasury stock, common (-XSE, +SE) ........................... Capital in excess of par (+SE) ....................................... Sept. 1: Cash (50 shares x $19) (+A) ............................................. Capital in excess of par (-SE) ............................................ Treasury stock, common (50 shares x $20) (-XSE, +SE) . 3,200 3,200 1,680 1,600 80 950 50 1,000 Req. 2 Dividends are not paid on treasury stock. Therefore, the amount of total cash dividends paid is reduced when treasury stock is purchased. Req. 3 The sale of treasury stock for more or less than its original purchase price does not have an impact on net income. The transaction affects only balance sheet accounts. The cash received from the sale of treasury stock is a cash inflow which would affect the Statement of Cash Flows in the financing activities section. 11-18 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–17. Req. 1 Case 1: When companies unexpectedly announce increases in dividends, stock prices typically increase. Depending on course objective, the instructor may want to discuss research in finance concerning dividend policy. Case 2: Stock price is based on expectations. If the increase in operating performance was not expected, the stock price should increase. It is not necessary to increase dividends to have a favorable stock price reaction. Case 3: Stock dividends do not provide any economic value but they may have a signal effect and are often associated with increases in cash dividends. As a result, stock dividends do not appear to directly cause an increase in stock price but are often associated with factors that do impact favorably on price. Req. 2 Stock prices react to underlying economic events and not changes in reporting methods, per se. Markets are relatively effective in recognizing the difference between profits generated by operations and profits generated by the use of liberal accounting policies. 11-19 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–18. Req. 1 a) Noncumulative: Preferred ($50,000 x 10%) ...................................... Balance to common ($65,000 – $5,000) ................. Per share ................................................................ Preferred Common (5,000 Shares) (30,000 Shares) $ 5,000 $60,000 $ 5,000 $60,000 $1.00 $2.00 b) Cumulative: Preferred, arrears ($50,000 x 10% x 2 years) ......... $ 10,000 Preferred, current year ($50,000 x 10%) ................. 5,000 Balance to common ($65,000 – $10,000 – $5,000) $50,000 $15,000 $50,000 Per share ................................................................ $3.00 $1.67 Total $ 5,000 60,000 $65,000 $ 10,000 5,000 50,000 $65,000 Req. 2 The total dividend amount and dividends per share of common stock were less under the second assumption because the preferred stock preferences increased while at the same time the total dividend amount remained stable. Req. 3 Larger total dividend distributions are more favorable for the common stockholders. 11-20 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–19. Item Assets Liabilities Stockholders’ equity Effect of Cash Dividend (Preferred) Effect of Stock Dividend (Common) –No effect on declaration date. –Decreased by the amount of the dividend ($7,200) on payment date. –Increased on declaration date ($7,200). –Decreased on payment date ($7,200). Decreased by the amount of the dividend (retained earnings decreased by $7,200). No effect because no assets are disbursed. No effect—no entry on declaration date because no contractual liability is created (no assets are disbursed). –Total stockholders’ equity not changed. –Retained earnings reduced and contributed capital increased by same amount ($120,000). E11–20. July 15 Retained earnings (-SE) ........................................................ 119,900,000 Cash (-A) ........................................................................... Declaration and payment of preferred dividends. Retained earnings (-SE) ........................................................ 691,688,600 Cash (-A) ........................................................................... Declaration and payment of common dividends. Computation of shares outstanding: Shares issued ...................... 387,514,300 Treasury stock...................... 41,670,000 Shares outstanding .............. 345,844,300 Dividends paid: 345,844,300 x $2 = $691,688,600 E11–21. 11-21 119,900,000 691,688,600 Chapter 11 - Reporting and Interpreting Owners’ Equity Req. 1 Duke Energy is a utility company that is very established. They have very little opportunity for growth and they have stable business operations. Therefore, they have the ability to have a high dividend yield. On the other hand, Starbucks is a fairly new company with a high opportunity for growth. Due to the fact that they are retaining all of their earnings to invest into their growth, they have a 0.0% dividend yield. Req. 2 The companies will attract two different types of investors. Duke Energy will attract investors who want and/or need current income, such as someone who is retired. Starbucks will attract investors who want appreciation on their stock price, such as those who are planning for their retirement in 25 years. 11-22 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–22. Req. 1 Stockholders’ Equity Before Stock After Stock Dividend Dividend Contributed capital: Common stock, authorized 65,000 shares Outstanding: 30,000 shares, par $12 ............. Outstanding: 48,000 shares, par $12 ............. Capital in excess of par value ............................ Retained earnings ................ Total stockholders’ equity............................... $360,000 120,000 736,000 $1,216,000 $576,000 120,000 520,000 $1,216,000 Req. 2 Item Assets Liabilities Stockholders’ equity Effects of Stock Dividend No change because no assets were disbursed. No change because no liability was created (no assets were to be disbursed). –Total stockholders’ equity not changed. –Retained earnings was reduced by the amount of the dividend. –The common stock account was increased by the same amount. E11–23. July 13, 2009 Retained earnings (-SE)........................................................ 1,320,000,000 Dividends payable (+L) ..................................................... 1,320,000,000 3,000 (million) shares x $0.44= $1,320,000,000 July 24, 2009 No journal entry required. August 17, 2009 Dividends payable (-L) .......................................................... 1,320,000,000 Cash (-A)........................................................................... 11-23 1,320,000,000 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–24. Comparative results: Items Common stock account Par per share Shares outstanding Capital in excess of par Retained earnings Total stockholders’ equity Before Dividend and Split $600,000 $3 200,000 $ 900,000 $ 700,000 $2,200,000 After Stock Dividend $900,000 $3 300,000 $900,000 $ 400,000 $2,200,000 After Stock Split $600,000 $2.50 240,000 $ 900,000 $ 700,000 $2,200,000 Comments: Neither the stock dividend nor stock split changed total stockholders’ equity because neither involved the disbursement of assets. The stock dividend capitalized retained earnings and increased the common stock account by the same amount; it increased shares outstanding but did not change par value per share. The stock split did not change any account balances; its only effects were to (1) increase shares outstanding and (2) decrease par value per share. E11–25. Req. 1 February 12, 2007---No entry February 20, 2007---No entry March 16, 2007 Retained earnings (-SE)........................................................ 760,000 Common stock (+SE) ........................................................ 760,000 Req. 2 Without additional information, one cannot determine the impact on future cash dividends. In some cases, the company will maintain its dividend per share payout, in which case total dividends will increase. In other cases, the company may reduce the dividends per share and maintain the same total payout. In the case of GameStock, the company is not currently paying cash dividends, so there is no immediate effect. 11-24 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–26. Comparative results: Items Common stock account Par per share Shares outstanding Capital in excess of par Retained earnings Total stockholders’ equity Before Dividend and Split $640,000 $8 80,000 $ 280,000 $ 1,300,000 $2,220,000 After Stock Dividend $896,000 $8 112,000 $ 280,000 $ 1,044,000 $2,220,000 After Stock Split $640,000 $ 4.80 133,333 $ 280,000 $ 1,300,000 $2,220,000 Comments: Neither the stock dividend nor stock split changed total stockholders’ equity because neither involved the disbursement of assets. The stock dividend reduced retained earnings and increased the common stock account by the same amount; it increased shares outstanding but did not change par value per share. The stock split did not change any account balances; its only effects were to (1) increase shares outstanding and (2) decrease par value per share. E11–27. Req. 1 A corporation does not need to earn net income in a given year in order to declare and pay dividends. There are two requirements 1) the balance of retained earnings should be sufficient to pay dividends, and 2) there must be sufficient cash on hand. Req. 2 Clearly the board determined that the balances in retained earnings and cash were sufficient to pay dividends. The board probably analyzed cash flow for the current year and the future to determine whether the payment of dividends would create any problems in subsequent years. The board also probably took into consideration the impact of skipping a dividend. If the company did not pay a dividend, many investors might assume that the board concluded that the company might lose money for several years. This lack of confidence could have a significant impact on the price of the company’s stock. By paying a dividend, the company sent a signal to the market that the board had confidence in the long-term health of the company. 11-25 Chapter 11 - Reporting and Interpreting Owners’ Equity E11–28. The fact that dividends are in arrears indicates that the company has been experiencing some financial difficulty. Most companies do not want to suspend dividend payments because it will erode investor confidence. Typically, companies are experiencing severe cash flow problems when they take this type of drastic action. The investor assumed that he would get a large cash payment “when Archon started paying dividends again.” The student should have realized that he was making a large assumption; a financially troubled company may never pay dividends again. 11-26 Chapter 11 - Reporting and Interpreting Owners’ Equity PROBLEMS P11–1. 1. Shares authorized (given) ......................................................................... Shares issued ($2,125,000 $17) ............................................................ Shares outstanding (125,000 – 3,000) ...................................................... 200,000 125,000 122,000 2. Capital in excess of par: $2,125,000 – (125,000 shares issued x $10 par) = $875,000. 3. Earnings per share: $118,000 122,000 shares = $.97 (rounded). 4. Dividend per share: $73,200 122,000 shares = $0.60. 5. Treasury stock: Stockholders’ equity, as a deduction in the amount of 3,000 shares x $20 cost = $60,000. 6. Stock split, 100%: Par value per share after the split, $10 2 = $5. Outstanding shares before split (per 1 above), 122,000 x 2 = 244,000 shares outstanding after the split. 7. Entry for the stock split—None, because the total par value amount before and after the split is the same; retained earnings are not capitalized in a stock split. 8. Entry for stock dividend (capitalize retained earnings for market value of $21 per share): Retained earnings (122,000 shares x 10% x $21) (-SE) ....... Common stock (122,000 shares x 10% x $10) (+SE)........ Capital in excess of par (122,000 shares x 10%) x ($21 – $10)(+SE) ................... 11-27 256,200 122,000 134,200 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–2. Stockholders’ Equity Contributed capital: Preferred stock authorized 21,000 shares; issued and outstanding, 6,500 shares ...................................................................................... Common stock authorized 50,000 shares; issued and outstanding, 43,000 shares .................................................................................... Capital in excess of par, preferred ........................................................ Capital in excess of par, common......................................................... Total contributed capital .................................................................... Retained earnings .................................................................................... Total stockholders’ equity ..................................................................... $ 65,000 344,000 49,000 181,000 639,000 51,000 $690,000 P11–3. (a) Cash (66,000 shares x $9)(+A) ............................................. Common stock (66,000 shares x $5) (+SE) ..................... Contributed capital in excess of par, common (66,000 x $4) (+SE) ........................................................................ . 594,000 (b) Cash (9,000 shares x $20) (+A) ............................................ Preferred stock (9,000 shares x $10) (+SE) ...................... Contributed capital in excess of par, preferred (+SE) ........ . 180,000 (c) Cash (1,000 shares x $20) + (1,500 shares x $10) (+A) ...... Preferred stock (1,000 shares x $10) (+SE) ...................... Common stock (1,500 shares x $5) (+SE) ........................ Contributed capital in excess of par, preferred (+SE) ........ Contributed capital in excess of par, common (+SE) ........ 35,000 11-28 330,000 264,000 90,000 90,000 10,000 7,500 10,000 7,500 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–4. Req. 1 (in millions) (a) Cash (+A) .............................................................................. Common stock (+SE) ....................................................... . 136.5 136.5 . Req. 2 (in millions) (a) Cash (+A) .............................................................................. Common stock (+SE) ......................................................... Capital in excess of par (+SE)………………………………. 136.5 2.1 134.4 Req. 3 In most cases, stockholders should not care whether stock is issued as par or no-par value stock. The various types of stock do not offer any real economic advantages to investors. 11-29 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–5. Stockholders’ Equity Contributed capital: Common stock, par $1, authorized 200,000 shares; issued 100,000 shares, of which 15,000 shares are held as treasury stock ...................... $ 100,000 Capital in excess of par .............................................................................. 1,115,000 Total contributed capital .......................................................................... 1,215,000 Retained earnings .......................................................................................... 475,000 Less: Treasury stock held (15,000 shares x $15) ....................................... (225,000) Total stockholders’ equity ........................................................................... $1,465,000 P11–6. (a) Treasury Stock (+XSE, -SE) ................................................. 165,258 Cash (-A) ........................................................................... (b) Retained Earnings (-SE) .......................................................66,086 Dividends Payable (+L) ..................................................... Dividends Payable (-L) ..........................................................66,086 Cash (-A) ........................................................................... (c) Cash (+A) .............................................................................. 903,825 Common Stock (+SE) ....................................................... Capital in Excess of Par (+SE) .......................................... 11-30 165,258 66,086 66,086 50,000 853,825 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–7. Req. 1 A stock dividend is a dividend paid in additional stock of the issuing company while a cash dividend is paid in cash. Req. 2 Stock dividends are classified as either large or small. A large stock dividend involves the distribution of additional shares that are more than 20–25% of the currently outstanding shares. A small stock dividend involves additional shares that are less than 20–25% of the outstanding shares. Req. 3 The sale of treasury stock for more than cost has no impact on the reported income for a company. The sale does affect the Statement of Cash Flows because it is an inflow of cash from financing activities. Req. 4 There are a number of strategic reasons why a corporation may want to purchase its own stock from existing stockholders. A common reason is the existence of an employee bonus plan that provides workers with shares of the company’s stock as part of their compensation. Because of Securities and Exchange Commission regulations concerning newly issued shares, most companies find that it is less costly to give their employees shares of stock that were purchased from stockholders than to issue new shares. P11–8. Req. 1 Treasury Stock (+XSE, -SE) ................................................. 625.8 Cash (-A) ........................................................................... 625.8 Req. 2 Cash (+A) .............................................................................. 10.5 Treasury Stock (-XSE, +SE) ............................................. Capital in Excess of Par (+SE) .......................................... 9.0 1.5 Req. 3 While there would be an economic loss on this transaction, an accounting loss would not be recorded. Instead, Capital in Excess of Par would be reduced. 11-31 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–9. Req. 1 Case A—Preferred is noncumulative (total amount to distribute, $31,000): Preferred Common (8,000 (35,000 shares) shares) Preferred ($120,000 x 10%) ......................................... $ 12,000 Balance to common ($31,000 – $12,000) .................... $19,000 $ 12,000 $19,000 Per share ..................................................................... $1.50 Case B—Preferred is cumulative (total amount to distribute, $25,000): Preferred: Arrears ($120,000 x 10% x 2 years) ......................... $ 24,000 Current year ($120,000 x 10%) ................................ 1,000 $25,000 Per share ..................................................................... $3.13 Case C—Preferred is cumulative (total amount to distribute, $67,000): Preferred: Arrears ($120,000 x 10% x 2 years) ......................... $ 24,000 Current year ($120,000 x 10%) ................................ 12,000 Balance to common ($67,000 – $36,000) $36,000 Per share ..................................................................... 11-32 $4.50 Total $ 12,000 19,000 $31,000 $0.54 –0– –0– $ 24,000 1,000 $25,000 $ –0– $31,000 $31,000 $0.89 $ 24,000 12,000 31,000 $67,000 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–9. (continued) Req. 2 Item Assets Liabilities Stockholders’ equity Schedule of Comparative Differences (with comments) Amount of Dollar Increase (Decrease) Cash Dividend – Case C Stock Dividend $67,000 decrease to cash No assets were disbursed. Current liabilities increased No effect – no contractual liability $67,000 on declaration date and was created. decreased $67,000 on payment date. The net effect is zero. $67,000 decrease (debit to No effect on total stockholders’ retained earnings). equity. Decreased retained earnings and increased common stock by same amount ($84,000). Summary comment: (1) A cash dividend decreases assets and stockholders’ equity by the amount of the dividend because resources were disbursed. (2) A stock dividend does not change total assets or total stockholders’ equity because no resources are disbursed; only the internal content of stockholders’ equity is changed. P11–10. Req. 1 Heather feels some concern about whether Scott is looking in the right place on the Statement of Cash Flows (SCF) for dividends. She shouldn’t be concerned; dividends paid are reported in the financing activities section of the SCF. While cash flows from operating activities have declined for the current year, the reduction has to do with the fact that cash flows were positively affected in the previous year by the one time $2 billion reduction in inventory and accounts receivable. Heather is wrong when she implies that the company’s cash flows will not support the payment of dividends. Req. 2 Dell has a very aggressive program to repurchase stock from investors. Some companies elect to pay out extra cash in dividends while others use the cash to repurchase their stock. Because fewer shares are outstanding, reported earnings per share will be higher which may be reflected in a higher stock price. 11-33 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–11. Item Comparative Effects Explained Cash Dividend on Preferred Stock Dividend on Common a) Through December 31, 2011: Assets None—No cash yet disbursed. None—No entry (no assets to be disbursed). Liabilities Increased current liabilities by None—No entry made on the amount of the dividend declaration date. Stockholders’ Decreased by the amount of None—No entry. equity the dividend. b) On February 15, 2012: Assets Decreased by the amount of None—No assets are the dividend (credit cash disbursed. $40,000). Liabilities Decreased by the amount of None—No liability was the dividend (debit dividends created. payable $40,000). Stockholders’ No change since Dec. 31. The (1) Total stockholders’ equity equity effect was recorded in the not changed. previous year. (2) Retained earnings reduced by the amount of the dividend (i.e., par value of the stock issued, $156,000). (3) Common stock is increased by the amount of the dividend. c) Overall Effects From December 1 through February 15: Assets Decreased $40,000. No effect. Liabilities No effect. No effect. Stockholders’ Decreased $40,000. No effect on total. equity 11-34 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–12. Req. 1 March 9 No journal entry is required for the declaration of a stock dividend. May 21 No journal entry is required. June 18 (millions) Retained earnings* (-SE) .................................................. Common stock (+SE) ..................................................... Capital in excess of par (+SE) ....................................... 12,500 250 12,250 * 2,500 million shares x 10% x $50 = $12,500 million. Req. 2 This simple question can give the instructor an excellent opportunity to discuss the relevancy of dividend policy. There is a strong theoretical argument to be made that dividend policy is irrelevant. There are several real world factors that make the question more difficult to answer (e.g., the impact of taxes, information content of dividends, and the clientele effect). The level of the discussion of this issue will depend on the amount of finance that has been introduced during the instructor’s lectures. Req. 3 The board must consider the impact of the stock dividend and the increase in cash dividends on the price of the stock. They made the decision with the expectation that it would have a favorable impact on the long-term value of the stock. 11-35 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–13. Req. 1 Case A: Sole Proprietorship, closing entries: A, Capital ........................................................................... Individual revenue and expense accounts ..................... A, Capital ........................................................................... A, Drawings .................................................................... 20,000 20,000 9,000 9,000 Case B: Partnership, closing entries: A, Capital ........................................................................... B, Capital ........................................................................... Individual revenue and expense accounts ..................... A, Capital ........................................................................... B, Capital ........................................................................... A, Drawings .................................................................... B, Drawings .................................................................... 10,000 10,000 20,000 5,000 7,000 5,000 7,000 Case C: Corporation, closing entry: Retained earnings ............................................................. Individual revenue and expense accounts ..................... 11-36 20,000 20,000 Chapter 11 - Reporting and Interpreting Owners’ Equity P11–13. (continued) Req. 2 Case A: Sole Proprietorship Statement of Owner’s Equity A, Capital, January 1 ............................................................. Less: Net loss........................................................................ Total .................................................................................. Less: Withdrawals ................................................................. A, Capital, December 31 ....................................................... $52,000 20,000 32,000 9,000 $23,000 Case B: Partnership Partners’ Equity A, Capital .............................................................................. B, Capital .............................................................................. Total Partners’ Equity ........................................................ Statement of Partners’ Equity A Partners’ equity, January 1 ............................... $43,000 Deduct: Net loss ................................................ 10,000 Total .............................................................. 33,000 Deduct: Withdrawals ......................................... 5,000 Partners’ Equity, December 31 ......................... $28,000 $28,000 26,000 $54,000 B $43,000 10,000 33,000 7,000 $26,000 Total $86,000 20,000 66,000 12,000 $54,000 Case C: Corporation Stockholders’ Equity Contributed capital: Common stock, par $10, authorized 30,000 shares, outstanding 14,000 shares .............................................. Capital in excess of par ..................................................... Total contributed capital ................................................. Retained earnings ................................................................. Total Stockholders’ Equity .......................................... $140,000 9,000 149,000 42,000 Statement of Retained Earnings Retained earnings, balance Jan. 1 ........................................................... Less: Net loss .......................................................................................... Retained earnings, balance Dec. 31 ........................................................ 11-37 $191,000 $62,000 20,000 $42,000 Chapter 11 - Reporting and Interpreting Owners’ Equity ALTERNATE PROBLEMS AP11–1. Req. 1 Common Stock $1,500,000 / $1 = Issued Shares 1,500,000 Treasury Stock (100,000) Shares Outstanding 1,400,000 1,500,000 shares Req. 2 The balance in the Capital in Excess of Par Account appears to be $118,500,000. [($80-$1) x 1,500,000 shares] Req. 3 EPS on net income is $3.43 (rounded) $4,800,000 / 1,400,000 shares = $3.43 Req. 4 Total dividends paid on common stock during the year is $2,800,000. 1,400,000 shares $2.00 per share = $2,800,000 Req. 5 Treasury stock should be reported on the balance sheet under the major caption Stockholders’ Equity, as a deduction in the amount of $6,000,000. 100,000 shares $60 per share = $6,000,000 11-38 Chapter 11 - Reporting and Interpreting Owners’ Equity AP11–2. (a) Cash (30,000 shares x $40) + (5,000 shares x $26) (+A) ..... Common stock, (30,000 shares x $40) (+SE) ................... Preferred stock (5,000 shares x $5) (+SE) ........................ Capital in excess of par, preferred (5,000 shares x $21) (+SE) ............................................. Sold stock. 1,330,000 (b) Cash (2,000 shares x $32) (+A) ............................................ 64,000 1,200,000 25,000 105,000 Preferred stock (2,000 shares x $5) (+SE) ........................ Contributed capital in excess of par, preferred ($64,000 - $10,000) (+SE) ................................................ Sold preferred stock. (c) Treasury stock, common (3,000 shares x $38) (+XSE, -SE) Cash (-A) ........................................................................... Purchased treasury stock, common, at $38 per share. 10,000 54,000 114,000 114,000 AP11–3. Stockholders’ Equity Contributed capital: Common stock, par $5, authorized 1,000,000 shares; issued 700,000 shares, of which 25,000 shares are held as treasury stock ...................... Capital in excess of par, common............................................................... Total contributed capital .......................................................................... Retained earnings .......................................................................................... Total ........................................................................................................ Less: Treasury stock held (25,000 shares x $50) ....................................... Total stockholders’ equity ........................................................................... 11-39 $ 3,500,000 34,300,000 37,800,000 429,000 38,229,000 (1,250,000) $36,979,000 Chapter 11 - Reporting and Interpreting Owners’ Equity AP11–4. a. Cash (+A) .............................................................................272,900 Common stock (+SE) ....................................................... 272,900 b. Treasury stock (+XSE, -SE) .................................................. 99,964 Cash (-A) ........................................................................... 99,964 c. Retained earnings (-SE) .......................................................340,867 Dividend payable (+L) ....................................................... Dividend payable (-L) ............................................................340,867 Cash (- A) .......................................................................... 340,867 340,867 AP11–5. Req. 1 Case A—Preferred is noncumulative (total amount to distribute, $25,000): Preferred Common (21,000 (500,000 shares) shares) Preferred ($210,000 x 8%) ............................................ Balance to common ($25,000 – $16,800) ..................... Per share ...................................................................... $16,800 $16,800 $8,200 $8,200 $.80 $.016 Case B—Preferred is cumulative (total amount to distribute, $25,000): Preferred: Arrears ($210,000 x 8% x 2 years = $33,600) ........... $25,000 Current year ($210,000 x 8%) ................................... $25,000 –0– Per share ...................................................................... $1.19 11-40 $2.40 $16,800 8,200 $25,000 $25,000 $25,000 $ –0– Case C—Preferred is cumulative (total amount to distribute, $75,000): Preferred: Arrears ($210,000 x 8% x 2 years) ............................ $33,600 Current year ($210,000 x 8%) ................................... 16,800 Balance to common ($75,000 – $50,400) ..................... $24,600 $50,400 $24,600 Per share ...................................................................... Total $.049 $33,600 16,800 24,600 $75,000 Chapter 11 - Reporting and Interpreting Owners’ Equity AP11–5. (continued) Req. 2 Item Assets Liabilities Stockholders equity Schedule of Comparative Differences (with comments) Amount of Dollar Increase (Decrease) Cash Dividend – Case C Stock Dividend $75,000 decrease No assets were disbursed. Current liabilities increased No effect – no contractual liability $75,000 on declaration date and was created. decreased $75,000 on payment date. The net effect is zero. $75,000 decrease (debit to No effect on total stockholders’ retained earnings). equity. Decreased retained earnings and increased common stock by same amount. Summary comment: (1) A cash dividend decreases assets and stockholders’ equity by the amount of the dividend because resources were disbursed. (2) A stock dividend does not change total assets or total stockholders’ equity because no resources are disbursed; only the internal content of stockholders’ equity is changed. 11-41 Chapter 11 - Reporting and Interpreting Owners’ Equity Comprehensive Review Problem (Chapter 9, 10, 11) Case A Req. 1 Preferred stock dividend --- $2,160 = 3,000 shares x $8 x 9% Common stock dividend---$7,840 = $10,000 - $2,160 Req. 2 35,000 shares (40,000 shares issued – 5,000 shares treasury stock) Req. 3 The sale of treasury stock does not affect the income statement. Rogers would record an increase in cash from the sale. In stockholders’ equity, the treasury stock account would be reduced by the cost of the shares sold with the difference between the cash collected and the cost of the shares recorded as an increase in capital in excess of par. Req. 4 A journal entry is not required to record a stock split. Instead, the par value of the stock is adjusted. After a 2-for-1 stock split, the par value for Rogers stock would be $5 per share. Case B Quick Ratio Working Capital a. Decrease Remain the same b. Decrease Decrease c. Remain the same Remain the same d. Decrease Remain the same Case C Req. 1 $1,000,000 x 0.6139 ..................................................... $ 613,900 $50,000 x 7.7217 .......................................................... 386,085 Issue price .................................................................... $999,985 (at par)* 11-42 Chapter 11 - Reporting and Interpreting Owners’ Equity *$15 rounding error---issue price is par value, or $1,000,000 Comprehensive Review Problem (continued) Req. 2 $1,000,000 x 0.6756 ..................................................... $ 675,600 $50,000 x 8.1109 .......................................................... 405,545 Issue price .................................................................... $1,081,145 Req. 3 $1,000,000 x 0.5584 ..................................................... $ 558,400 $50,000 x 7.3601 .......................................................... 368,005 Issue price .................................................................... $ 926,405 Case D Req. 1 Computations: Interest: $1,000,000 x 5% = Present value: $1,000,000 x 0.4564 $ 50,000 x 13.5903 Issue price = 456,400 = 679,515 = $1,135,915 $ 50,000 Cash (+A) .............................................................................. 1,135,915 Premium on Bonds Payable (+L) ...................................... Bonds Payable (+L) .......................................................... Req. 2 Cash (+A) .............................................................................. 1,125,000 Common stock (+SE) ....................................................... Capital in excess of par, common stock (+SE) .................. 11-43 135,915 1,000,000 45,000 1,080,000 Chapter 11 - Reporting and Interpreting Owners’ Equity CASES AND PROJECTS FINANCIAL REPORTING AND ANALYSIS CASES CP11–1. Req. 1 There are 43,248 (thousand) shares in treasury stock. Req. 2 The dividend per share for the current year was $0.40. Req. 3 The Company both bought and sold treasury stock during the current year. Req. 4 Par value is $.01 per share CP11–2. Req. 1 200,000,000 shares authorized; 167,712,088 shares issued and outstanding. Req. 2 The company does not pay dividends. Req. 3 The company does not have any treasury stock. Req. 4 No, the company has not issued a stock dividend or stock split over the reporting period. Req. 5 Par value is $0.0001. 11-44 Chapter 11 - Reporting and Interpreting Owners’ Equity CP11–3. Req.1 The stock price of a company will immediately adjust downward. Each share is worth less after a split because there are more shares outstanding. Some companies believe that higher stock prices might make the stock less attractive to some investors. By splitting the stock, the stock price is lowered making the stock potentially more attractive to some investors. Req. 2 Urban Outfitters Dividends per share Market price per share 0 American Eagle 0% 0.40 $28 2.7% $15 Req. 3 Many investors are interested in the appreciation of stock rather than the amount of dividends. Note that although American Eagle paid dividends, its dividend yield ratio is low; thus, investors would still be relying on American Eagle’s stock appreciating in value. Req. 4 Dividend Yield Example Company Retail Apparel Pharmaceuticals Electric Utilities 1.1% 2.6% The GAP Eli Lilly 3.8% American Electric Power The dividend yield ratio increases across the three industry groups. An investor that wants regular dividend payments would be more interested in investing in an electric utility company than a retail store. Often these investors are retirees that use the income stream from dividends to supplement their income after they stop working. 11-45 Chapter 11 - Reporting and Interpreting Owners’ Equity CP11–4. Number of common shares outstanding. Total par value = $298.3 million = 119.32 million shares Par per share 2.50 Less treasury stock (12.8 million) shares 106.52 million 106.52 million shares x $1 per share = $106.52 million CRITICAL THINKING CASES CP11–5. The payment of a stock dividend is a cosmetic solution with no cash flow effects. If the stock is valued by the market for its steady dividends, a stock dividend will not prevent a negative response. Unfortunately, there is no easy way to solve this problem. We find that most students think the priority should be on maintaining the long-term health of the company. CP11–6. We do not have an easy answer to this question. We use this case to discuss corporate governance and responsibilities. FINANCIAL REPORTING AND ANALYSIS PROJECTS CP11–7. Student response depends on the company selected. 11-46 Chapter 13 - Statement of Cash Flows Chapter 13 Statement of Cash Flows ANSWERS TO QUESTIONS 1. The income statement reports revenues earned and expenses incurred during a period of time. It is prepared on an accrual basis. The balance sheet reports the assets, liabilities, and equity of a business at a point in time. The statement of cash flows reports cash receipts and cash payments of a business, from three broad categories of business activities: operating, investing, and financing. 2. The statement of cash flows reports cash receipts and cash payments from three broad categories of business activities: operating, investing, and financing. While the income statement reports operating activities, it reports them on the accrual basis: revenues when earned, and expenses when incurred, regardless of the timing of the cash received or paid. The statement of cash flows reports the cash flows arising from operating activities. The balance sheet reports assets, liabilities, and equity at a point in time. The statement of cash flows and related schedules indirectly report changes in the balance sheet by reporting operating, investing, and financing activities during a period of time, which caused changes in the balance sheet from one period to the next. In this way, the statement of cash flows reports information to link together the financial statements from one period to the next, by explaining the changes in cash and other balance sheet accounts, while summarizing the information into operating, investing, and financing activities. 3. Cash equivalents are short-term, highly liquid investments that are purchased within three months of the maturity date. The statement of cash flows does not separately report the details of purchases and sales of cash equivalents because these transactions affect only the composition of total cash and cash equivalents. The statement of cash flows reports the change in total cash and cash equivalents from one period to the next. 4. The major categories of business activities reported on the statement of cash flows are operating, investing, and financing activities. Operating activities of a business arise from the production and sale of goods and/or services. Investing activities arise from acquiring and disposing of property, plant, and equipment and investments. Financing activities arise from transactions with investors and creditors. 13-1 Chapter 13 - Statement of Cash Flows 5. Cash inflows from operating activities include cash sales, collections on accounts, and notes receivable arising from sales, dividends on investments, and interest on loans to others and investments. Cash outflows from operating activities include payments to suppliers and employees, and payments for operating expenses, taxes, and interest. 6. Depreciation expense is added to net income to adjust for the effects of a noncash expense that was deducted in determining net income. It does not involve an inflow of cash. 7. Cash expenditures for purchases and salaries are not reported on the statement of cash flows, indirect method, because that method does not report cash inflows and outflows for each operating activity. Rather, it reports only net income, changes in accounts payable and wages payable, and net cash flow from operating activities. 8. The $50,000 increase in inventory must be used in the statement of cash flows calculations because it increases the outflow of cash all other things equal. It is used as follows: Direct method—added to cost of goods sold, accrual basis (the other adjustment would involve accounts payable) to compute cost of goods sold, cash basis. Indirect method—subtracted from net income as a reconciling item to obtain cash flows from operating activities. 9. The two methods of reporting cash flows from operating activities are the direct method and the indirect method. The direct method reports the gross amounts of cash receipts and cash payments arising from the revenues and expenses reported on the income statement. The indirect method reports the net amount of cash provided or used by operating activities, by reporting the adjustments to net income for the net effects of noncash revenues and expenses, and changes in accruals and deferrals. The two approaches differ in the way they report cash flows from operating activities, but net cash provided by operating activities is the same amount. 10. Cash inflows from investing activities include cash received from sale of operational assets, sale of investments, maturity value of bond investments, and principal collections on notes receivable. Cash outflows from investing activities include cash payments to purchase property, plant, and equipment and investments, and to make loans. 11. Cash inflows from financing activities include cash received from issuing stock, the sale of treasury stock, and borrowings. Cash outflows from financing activities include cash payments for dividends, the purchase of treasury stock, and principal payments on borrowing. 13-2 Chapter 13 - Statement of Cash Flows 12. Noncash investing and financing activities are activities that would normally be classified as investing or financing activities, except no cash was received or paid. Examples of noncash investing and financing include the purchase of assets by issuing stock or bonds, the repayment of loans using noncash assets, and the conversion of bonds into stock. Noncash investing and financing activities are not reported in the statement of cash flows, because there was no cash received or cash paid; however, the activities are disclosed in a separate schedule. 13. When equipment is sold, it is considered an investing activity, and any cash received is reported as a cash inflow from investing activities. When using the indirect method, the gain on sale of equipment must be reported as a deduction from net income, because the gain was included in net income, but did not provide any cash from operating activities. When using the indirect method, the loss on sale of equipment is added to net income because the loss was included in net income but did not require an operating cash outflow. ANSWERS TO MULTIPLE CHOICE 1. d) 6. b) 2. d) 7. d) 3. a) 8. a) 13-3 4. a) 9. d) 5. a) 10. c) Chapter 13 - Statement of Cash Flows Authors' Recommended Solution Time (Time in minutes) Mini-exercises No. Time 1 5 2 5 3 5 4 5 5 5 6 5 7 5 Exercises No. Time 1 10 2 10 3 15 4 15 5 15 6 15 7 20 8 20 9 20 10 10 11 15 12 10 13 20 14 25 15 20 16 25 17 25 18 15 19 15 20 20 21 35 22 35 Problems No. Time 1 35 2 35 3 35 4 40 5 40 6 45 Alternate Problems No. Time 1 35 2 35 3 35 Cases and Projects No. Time 1 20 2 15 3 25 4 45 5 35 6 35 7 * * Due to the nature of these cases and projects, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries. 13-4 Chapter 13 - Statement of Cash Flows MINI–EXERCISES M13–1. F F I O O O 1. 2. 3. 4. 5. 6. Purchase of stock. (This involves repurchase of its own stock.) Principal payment on long-term debt. Proceeds from sale of properties. Inventories (decrease). Accounts payable (decrease). Depreciation, depletion, and amortization. + – + – + 1. 2. 3. 4. 5. Accrued expenses (increase). Inventories (increase). Accounts receivable (decrease). Accounts payable (decrease). Depreciation, depletion, and amortization. O F F I F O 1. 2. 3. 4. 5. 6. Receipts from customers. Dividends paid. Payment for share buy-back. Proceeds from sale of property, plant and equipment. Repayments of borrowings (bank debt). Net interest paid. M13–2. M13–3. M13–4. Quality of income ratio = Cash flow from operations = $52,500 Net income $86,000 = 0.61 (61%) The quality of income ratio measures the portion of income that was generated in cash. A low ratio indicates a likely need for external financing. M13–5. Investing Activities Sale of used equipment Purchase of short-term investments Cash used in investing activities $ 250 (285) $ (35) Financing Activities Additional short-term borrowing from bank Dividends paid Cash provided by financing activities $950 (900) $ 50 M13–6. 13-5 Chapter 13 - Statement of Cash Flows M13–7. Yes No No Yes Purchase of building with mortgage payable Additional short-term borrowing from bank Dividends paid in cash Purchase of equipment with short-term investments EXERCISES E13–1. F F O F O NA F O I O 1. Dividends paid 2. Repayments of long-term debt 3. Depreciation and amortization 4. Proceeds from issuance of common stock to employees 5. [Change in] Accounts payable and accrued expenses 6. Cash collections from customers 7. Net repayments of notes payable to banks 8. Net income 9. Payments to acquire property and equipment 10. [Change in] Inventory E13–2. I O F O F F O O I NA 1. Proceeds from sale of property, plant and equipment 2. Interest received 3. Repayments of loans 4. Income taxes paid 5. Proceeds from ordinary share [stock] issues 6. Dividends paid 7. Payments in the course of operations 8. Receipts from customers 9. Payments for property, plant and equipment 10. Net income 13-6 Chapter 13 - Statement of Cash Flows E13–3. 1. NE Salaries expense Accrued salaries payable 2. – NCFI Plant and equipment Cash 3. + NCFO Cash Accounts receivable 4. – NCFO Interest expense Cash 5. – NCFF Retained earnings Cash 6. + NCFI Cash Accumulated depreciation Plant and equipment 7. – NCFO Prepaid expenses (rent) Cash 8. – NCFF Short-term debt Cash 9. NE 10. – NCFO Inventory Accounts payable Accounts payable Cash 13-7 Chapter 13 - Statement of Cash Flows E13–4. 1. NE Inventory Accounts payable 2. – NCFO Prepaid expenses (rent) Cash 3. NE Plant and equipment Note payable 4. NE Expense Prepaid expense NCFO Income tax expense Cash 5. – 6. – NCFI Investment securities Cash 7. + NCFF Cash Common stock Additional paid-in capital 8. + NCFO Cash Accounts receivable 9. + NCFI Cash Plant and equipment (net) 10. + NCFF Cash Long-term debt 13-8 Chapter 13 - Statement of Cash Flows E13–5. Comparison of Statement of Cash Flows--direct and indirect reporting 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Cash Flows (and related changes) Accounts payable increase or decrease Payments to employees Cash collections from customers Accounts receivable increase or decrease Payments to suppliers Inventory increase or decrease Wages payable, increase or decrease Depreciation expense Net income Cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net increase or decrease in cash during the period Statement of Cash Flows Method Direct Indirect X X X X X X X X X X X X X X X X X The direct method reports cash flows from operating activities individually for each major revenue and expense. In contrast, the indirect method reports a reconciliation of net income to cash flow from operating activities. The two methods report the investing and financing activities in exactly the same way. 13-9 Chapter 13 - Statement of Cash Flows E13–6. Cash flows from operating activities—indirect method Net income............................................................................................... Depreciation expense .............................................................................. Accounts receivable decrease ($10,500 – $12,000) ............................... Inventory increase ($14,000 – $8,000) ................................................... Salaries payable increase ($1,750 – $800) ............................................. Net cash provided by operating activities ........................................... $12,625 8,500 1,500 (6,000) 950 $17,575 E13–7. Req. 1 Cash flows from operating activities—indirect method Net loss .................................................................................................... Depreciation expense .............................................................................. Amortization of copyrights........................................................................ Accounts receivable decrease ($8,000 – $15,000) ................................. Salaries payable increase ($15,000 – $1,000) ........................................ Other accrued liabilities decrease ($1,000 – $5,100)............................... Net cash provided by operating activities ........................................... ($4,900) 7,000 200 7,000 14,000 (4,100) $19,200 Req. 2 The first reason for the net loss was the depreciation expense. This is a non-cash expense. Depreciation expense, along with decreased working capital requirements (current assets - current liabilities), turned the net loss into positive operating cash flow from operations. The reasons for the difference between net income and cash flow are important because they help the financial analyst determine if the trends are sustainable or whether they represent one-time events. E13–8. Cash flows from operating activities—indirect method Net income............................................................................................... Depreciation expense .............................................................................. Loss on sale of equipment ...................................................................... Accounts receivable decrease ................................................................ Salaries payable increase ........................................................................ Other accrued liabilities decrease ............................................................ Net cash provided by operating activities ........................................... 13-10 $ 8,000 7,300 1,700 12,000 9,000 (4,000) $34,000 Chapter 13 - Statement of Cash Flows E13–9. Req. 1 Cash flows from operating activities—indirect method Net loss ................................................................................................... Depreciation, amortization, and impairments .......................................... Decrease in receivables.......................................................................... Increase in inventories ............................................................................ Decrease in accounts payable ................................................................ Cash flows from operating activities .................................................. ($13,402) 34,790 1,245 (5,766) (445) $16,422 Note: The additions to equipment do not affect cash flows from operating activities. Req. 2 The primary reason for the net loss was the depreciation, amortization, and impairments expense. These represent non-cash expenses. Large depreciation, amortization, and impairments expense, offset partially by increased working capital requirements, turned Time Warner’s net loss into positive operating cash flow. The reasons for the difference between net income and cash flow from operations are important because they help the financial analyst determine if the trends are sustainable or whether they represent onetime events. 13-11 Chapter 13 - Statement of Cash Flows E13–10. Account Receivables Inventories Other current assets Payables Change Increase Increase Increase Increase E13–11. Account Accounts receivable Inventories Other current assets Accounts payable Deferred revenue Other current liabilities Change Increase Decrease Increase Increase Increase Decrease E13–12. Req. 1 Cash flows from investing activities Year 1 Year 2 Proceeds from sale of equipment ........ $17,864 $12,163 The amount reported in the cash flow from investing activities section of the statement of cash flows is the total cash proceeds from the sale of the equipment, regardless of the amount of any gain or loss. Req. 2 Any gain on the sale of the equipment is subtracted from net income to avoid double counting of the gain. Any loss on the sale of the equipment is added to avoid double counting of the loss. Cash flows from operating activities Year 1 Year 2 Loss (Gain) on sale of equipment ........ $16,751 $(2,436) Computations: Plant and equipment (at cost) Accumulated depreciation Net book value Cash Proceeds – Net book value = Gain (Loss) on sale 13-12 Year 1 $75,000 40,385 34,615 (16,751) Year 2 $13,500 3,773 9,727 2,436 Chapter 13 - Statement of Cash Flows E13–13. Req. 1 Beg. Bal. End. Bal. Equipment 19,000 6,900* 12,100 Sold Sold Accumulated Depreciation 1,800 Beg. Bal. 720* 820 Dep. Exp. 1,900 End. Bal. *plug figures Cost of equipment sold = $6,900 Accumulated depreciation on sold equipment = $720 Book value of sold equipment ............... Less: Loss on sale (given) .................... Cash received from sale ...................... $6,180 (4,400) $1,780 Req. 2 Any gain on the sale of the equipment is subtracted from net income to avoid double counting of the gain. Any loss on the sale of the equipment is added to avoid double counting of the loss. The loss of $4,400 would be added. Req. 3 The amount of cash received is added in the computation of Net Cash Flow from Investing Activities, regardless of whether the sale results in a gain or loss. The cash inflow if $1,780 would be added. 13-13 Chapter 13 - Statement of Cash Flows E13–14. Req. 1 Cash flows from operating activities—indirect method Net income............................................................................................... Depreciation and amortization ................................................................. Increase in accounts receivable ............................................................... Increase in inventory ................................................................................ Increase in prepaid expense .................................................................... Increase in accounts payable .................................................................. Decrease in taxes payable....................................................................... Increase in other current liabilities ........................................................... Cash flows from operating activities .................................................. $5,142 1,543 (549) (345) (68) 718 (180) 738 $6,999 Note: The cash dividends paid and treasury stock purchased are not related to operating activities and do not affect cash flows from operating activities. Req. 2 Quality of income ratio = Cash flow from operations = Net income $6,999 $5,142 = 1.36 Req. 3 The reason the quality of income ratio was greater than one was primarily because of large non-cash depreciation charges. E13–15. The investing and financing sections of the statement of cash flows for Oering’s Furniture: Cash flows from investing activities: Purchase of property, plant & equipment ........................... Sale of marketable securities ............................................... Proceeds from sale of property, plant & equipment ......... Net cash flows from investing activities ........................ $(1,071) 219 6,894 Cash flows from financing activities: Borrowings under line of credit ............................................ Proceeds from issuance of stock ......................................... Payments on long-term debt ................................................ Payment of dividends ............................................................ Purchase of treasury stock ................................................... Net cash flows from financing activities ........................ 1,117 11 (46) (277) (2,583) 13-14 $6,042 (1,778) Chapter 13 - Statement of Cash Flows E13–16. DEEP WATERS COMPANY Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities: Net income...................................................................... Adjustments to reconcile net income to net cash provided by operating activities: Increase in accounts receivable ..................................... Increase in prepaid expenses ....................................... Decrease in wages payable ........................................... Net cash provided by (used for) operating activities .. Cash flows from investing activities: Cash paid for equipment Net cash provided by (used for) investing activities .. Cash flows from financing activities: Cash proceeds from issuing stock .................................. Net cash provided by financing activities .................... Net increase (decrease) in cash during the year ................... Cash balance, January 1, 2012............................................. Cash balance, December 31, 2012 ....................................... 13-15 $ 300 (100) (50) (650) (500) (400) (400) 600 600 (300) 4,000 $3,700 Chapter 13 - Statement of Cash Flows E13–17. Req. 1 The investing and financing sections of the statement of cash flows for Gibraltar Industries: Cash flows from investing activities: Acquisitions (investments in other companies) (8,724) Proceeds from sale of other equity investments 34,701 Purchases of property, plant and equipment (21,595) Net proceeds from sale of property and equipment 2,692 Net cash provided by (used in) investing activities 7,074 Cash flows from financing activities: Long-term debt reduction Proceeds from long-term debt Net proceeds from issuance of common stock Payment of dividends Net cash provided by (used in) financing activities (185,567) 53,439 250 (5,985) (137,863) Req. 2 Capital acquisitions ratio = Cash flow from operations = Cash paid for plant & equipment $107,874 = 5.00 $21,595 The capital acquisitions ratio measures the company's ability to finance plant and equipment purchases from operations. Since this amount was more than 1 (5.00), the company has generated more than enough to finance plant and equipment purchases from operations. Req. 3 Gibraltar’s management is using the cash proceeds from the sale of other equity investments, along with the excess cash generated by operations (see Req. 2) mainly to pay down long-term debt. Note that most of the new long-term debt issuances are also being used to pay off existing long-term debt. 13-16 Chapter 13 - Statement of Cash Flows E13–18. Req. 1 Both of these transactions are considered noncash investing and financing activities, and are not reported on the statement of cash flows. The transactions must be disclosed in a separate schedule or in the footnotes. The information disclosed in the separate schedule would state: a. Equipment valued at $36,000 was acquired by giving a $15,000, 12%, two-year note, and common stock with a market value of $21,000. b. A machine valued at $12,700 was acquired by exchanging land with a book value of $12,700. Req. 2 The capital acquisitions ratio measures the company's ability to finance plant and equipment purchases from operations. Since neither of these transactions enters the numerator or denominator of the ratio, they would have no effect. Many analysts believe that these transactions represent important capital acquisitions, and thus should be included in the denominator of the ratio to indicate what portion of all (not just cash) acquisitions are being financed from operations. 13-17 Chapter 13 - Statement of Cash Flows E13–19. Cash flows from operating activities—direct method Cash collected from customers1 Cash payments to suppliers of inventory2 Cash payments to employees 3 Net cash provided by operating activities ........................................... $86,500 (57,875) (11,050) $17,575 1. Cash collected from customers = Sales revenue + Decrease in Accounts receivable $85,000 + $1,500 = $86,500 2. Cash payments to suppliers of inventory = Cost of goods sold + Increase in Inventory $51,875 + $6,000 = $57,875 3. Cash payments to employees = Salaries expense – Increase in Salaries payable $12,000 – $950= $11,050 E13–20. Req. 1 Cash flows from operating activities—direct method Cash collected from customers1 Cash payments to employees2 Cash paid for other expenses3 Net cash provided by operating activities ........................................... $60,000 (27,000) (13,800) $19,200 1. Cash collected from customers = Sales revenue + Decrease in Accounts receivable $53,000 + $7,000 = $60,000 2. Cash payments to employees = Salaries expense – Increase in Salaries payable $41,000 – $14,000 = $27,000 3. Cash paid for other expenses = Other expenses + Decrease in Other accrued liabilities $9,700 + $4,100 = $13,800 Req. 2 The first reason for the net loss was the depreciation expense. This is a non-cash expense. Depreciation expense, along with decreased working capital requirements (current assets - current liabilities), turned the net loss into positive operating cash flow. The reasons for the difference between net income and cash flow are important because they help the financial analyst determine if the trends are sustainable or whether they represent one-time events. 13-18 Chapter 13 - Statement of Cash Flows E13–21. Req. 1 Cash flows from operating activities—direct method Cash collected from customers1 Cash payments to employees Cash payments to suppliers2 Cash payments for other expenses3 Cash payments for income tax4 Net cash provided by operating activities $146,670 (56,835) (52,575) (9,164) (700) $27,396 1. Cash collected from customers = Revenues + Decrease in Accounts receivable $146,500 + $170 = $146,670 2. Cash payments to suppliers: Cost of sales – Decrease in Inventories – Increase in Accounts payable $55,500 – $643 – $2,282 = $52,575 3. Cash payments for other expenses = Other expense + Increase in Prepaid expenses + Decrease in Accrued liabilities $7,781 + $664 + $719 = $9,164 4. Cash payments for income tax = Income tax expense – Increase in income taxes payable $2,561 – $1,861 = $700 Req. 2 The primary reason for the net loss was the depreciation and amortization expense. These represent non-cash expenses. Large depreciation and amortization expense, along with decreased working capital requirements, turned Huanca’s net loss into positive operating cash flow. The reasons for the difference between net income and cash flow from operations are important because they help the financial analyst to determine if the trends are sustainable or whether they represent one-time events. 13-19 Chapter 13 - Statement of Cash Flows E13–22. Item Cash Noncash accounts: Accounts receivable (net) ............ Merchandise inventory ................ Investments, long-term ................ Equipment ................................... Total ........................................... Accumulated depreciation ........... Accounts payable ........................ Wages payable ........................... Income taxes payable ................. Bonds payable ............................ Balances 12/31/2012 20,500 Debit 22,000 68,000 h d 114,500 b 225,000 32,000 i 17,000 e 2,500 f 3,000 54,000 Common stock, no par ................ 100,000 Retained earnings ....................... Total ........................................... 16,500 k 225,000 Statement of Cash Flows Conversion of net income to cash flow from operating activities: Net income Depreciation expense Accounts payable decrease Wages payable decrease Income taxes payable increase Inventory increase Analysis Credit l 1,700 7,000 15,000 19,000 15,000 3,000 1,000 10,000 i 21,000 c 5,000 g 1,500 j b 3,600 19,000 a 18,200 Inflows a c g Cash flows from investing activities: Long-term investment purchased Sale of equipment Cash flows from financing activities: Sale of capital stock Dividends paid Net increase (decrease) in cash Totals 122,600 24,700 243,300 Outflows e f 3,000 1,000 h 7,000 d 15,000 1,500 6,000 j 3,600 1,700 106,000 13,700 (9,000) k 13-20 22,000 75,000 15,000 112,500 243,300 22,000 14,000 1,500 4,500 54,000 18,200 5,000 i l Balances 12/31/2013 18,800 10,000 (6,400) 106,000 (1,700) Chapter 13 - Statement of Cash Flows PROBLEMS P13–1. Req.1 Related Cash Flow Section Δ in Cash O O I O Balance sheet at December 31 2012 Cash $68,250 Accounts receivable 15,250 Merchandise inventory 22,250 Property and equipment 209,250 Less: Accumulated (59,000) depreciation $256,000 2011 $63,500 22,250 18,000 150,000 Change +4,750 -7,000 +4,250 +59,250 (45,750) -13,250 2 Add to NI because depreciation expense does not affect cash Subtract from net income the decrease in Accounts Payable Add to net income the increase in Wages payable Cash used for repayment of note principal Issuance of stock for cash Increased for net income amount of $46,750 Decreased for dividends declared & paid $12,650 10 3 4 7 $208,000 O Accounts payable $9,000 $19,000 -10,000 5 O Wages payable Note payable, long-term Contributed capital 4,000 59,500 98,500 1,200 71,000 65,900 +2,800 -11,500 +32,600 6 Retained earnings 85,000 50,900 +34,100 1 F F O,F Net increase in cash Add to net income the decrease in A/R Subtract from net income the increase in Inventory Payment in cash for equipment $256,000 $208,000 Income statement for 2012 Sales $195,000 Cost of goods sold 92,000 Depreciation expense 13,250 Other expenses 43,000 Net Income $46,750 13-21 8 9 Chapter 13 - Statement of Cash Flows P13-1 (continued) HiDef Films, Inc. Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Decrease in accounts receivable $13,250 7,000 Increase in merchandise inventory Decrease in accounts payable Increase in wages payable (4,250) (10,000) 2,800 Net cash provided by operating activities Cash flows from investing activities: Cash payments to purchase fixed assets Cash flows from financing activities: Cash payments on long-term note Cash payments for dividends Cash receipts from issuing stock Net cash provided by financing activities Net increase in cash during the year Cash balance, January 1, 2012 Cash balance, December 31, 2012 $46,750 1 2 3 4 5 6 8,800 55,550 (59,250) (11,500) (12,650) 32,600 7 8 1 9 8,450 4,750 10 63,500 $68,250 Req. 2 An overall increase in cash of $4,750 came from inflows of $55,550 from operating activities and a stock issuance of $32,600. A large percentage of the cash inflows were invested in equipment ($59,250), with $11,500 used to pay down long-term financing and $12,650 for dividends. 13-22 Chapter 13 - Statement of Cash Flows P13–2. Req. 1 Related Cash Flow Section Δ in Cash O O I O O Balance sheet at December 31 Cash Accounts receivable Merchandise inventory Property and equipment Less: Accumulated depreciation Accounts payable 2013 $37,000 32,000 41,000 132,000 2012 $29,000 28,000 38,000 111,000 Change +8,000 +4,000 +3,000 +21,000 (41,000) (36,000) -5,000 2 $201,000 $170,000 $36,000 $27,000 +9,000 5 10 3 4 7 O Accrued wage expense 1,200 1,400 -200 6 F F O,F Note payable, long-term Contributed capital Retained earnings 38,000 88,600 37,200 $201,000 44,000 72,600 25,000 $170,000 -6,000 +16,000 +12,200 8 Income statement for 2013 Sales Cost of goods sold Other expenses Net Income $120,000 70,000 37,800 $12,200 13-23 9 1 Net increase in cash Subtract from net income the increase in A/R Subtract from net income the increase in Inventory Payment in cash for equipment Add back to NI because depreciation expense does not affect cash Add to net income the increase in Accounts Payable Subtract from net income the decrease in accrued wage expense Cash used for repayment of note principal Issuance of stock for cash Increased for net income amount Chapter 13 - Statement of Cash Flows P13–2. (continued) BG Wholesalers Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Increase in accounts receivable Increase in merchandise inventory Increase in accounts payable Decrease in accrued expenses Net cash provided by operating activities Cash flows from investing activities: Cash payments to purchase fixed assets Cash flows from financing activities: Cash payments on long-term note Cash receipts from issuing stock Net cash provided by financing activities Net increase in cash during the year Cash balance, January 1, 2013 Cash balance, December 31, 2013 $12,200 $ 5,000 (4,000) 2 (3,000) 9,000 (200) 4 1 3 5 6 6,800 19,000 (21,000) (6,000) 16,000 7 8 9 10,000 8,000 29,000 $37,000 10 Req. 2 There was an increase in cash for BG Wholesalers this year of $8,000. Operating activities provided a positive cash flow of $19,000. This inflow of cash from operating activities, combined with the stock issuance for $16,000 cash, allowed the company to invest $21,000 in fixed assets and pay down a long-term note by $6,000. 13-26 Chapter 13 - Statement of Cash Flows P13–3. Req.1 O Balance sheet at December 31 2012 Cash $68,250 Accounts receivable 15,250 Merchandise inventory 22,250 Property and equipment 209,250 Less: Accumulated (59,000) depreciation $256,000 Accounts payable $9,000 O Wages payable F F Note payable, long-term Contributed capital 59,500 98,500 71,000 65,900 -11,500 +32,600 8 Retained earnings 85,000 50,900 +34,100 1 Related Cash Flow Section Δ in Cash O O I O O,F 2011 $63,500 22,250 18,000 150,000 Change +4,750 -7,000 +4,250 +59,250 (45,750) -13,250 2 Depreciation expense does not affect cash $208,000 $19,000 -10,000 5 4,000 1,200 +2,800 6 Add to CGS to compute payments to suppliers Subtract from Other expenses to compute payments for wages Cash used for repayment of note principal Issuance of stock for cash Increased for net income amount of $46,750 Decreased for dividends declared & paid $12,650 $256,000 $208,000 Income statement for 2012 Sales $195,000 Cost of goods sold 92,000 Depreciation expense 13,250 Other expenses 43,000 Net Income $46,750 13-25 10 3 4 7 9 Net increase in cash Add to sales to compute collections from customers Add to CGS to compute payments to suppliers Payment in cash for equipment Chapter 13 - Statement of Cash Flows P13-3. (continued) HiDef Films Inc. Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities: Collections from customers ($195,000 + $7,000) Payments to suppliers ($92,000 + $4,250 + $10,000) Payments for wages ($43,000 – $2,800) Net cash provided by operating activities Cash flows from investing activities: Cash payments to purchase fixed assets Cash flows from financing activities: Cash payments on long-term note Cash payments for dividends Cash receipts from issuing stock $202,000 3 (106,250) 4, 5 (40,200) 6 55,550 (59,250) (11,500) (12,650) 32,600 Net cash provided by financing activities Net increase in cash during the year Cash balance, January 1, 2012 Cash balance, December 31, 2012 7 8 1 9 8,450 4,75010 63,500 $68,250 13 26 Chapter 13 - Statement of Cash Flows Req. 2 An overall increase in cash of $4,750 came from an inflow of $55,550 from operating activities and a stock issuance of $32,600. A large percentage of the cash inflow was invested in equipment ($59,250), with $11,500 used to pay down long-term financing and $12,650 for dividends. P13–4. Req. 1 ALPHA COMPANY Cash Flows from Operating Activities Direct Method Cash flows from operating activities: Cash receipts from customers ................................................................ Cash payments to suppliers ................................................................... Cash payments for salaries .................................................................... Cash payments for rent .......................................................................... Cash payments for insurance ................................................................. Cash payments for utilities ..................................................................... Cash payments for bond interest ............................................................ Net cash provided by operating activities ......................................... 13-27 $20,890 (9,016) (4,062) (2,801) (910) (720) (600) $2,781 Chapter 13 - Statement of Cash Flows Req. 2 ALPHA COMPANY Cash Flows from Operating Activities Indirect Method Cash flows from operating activities: Net loss .......................................................................... Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation expense .................................................... Loss on sale of investments .......................................... Decrease in accounts receivable ................................... Increase in merchandise inventory ................................ Increase in accounts payable ........................................ Increase in salaries payable .......................................... Decrease in rent payable ............................................... Decrease in prepaid rent ............................................... Increase in prepaid insurance ....................................... Total adjustments ......................................................... Net cash provided by operating activities .................. 13 28 $ (870) $2,900 650 90 (19) 33 8 (4) 3 (10) 3,651 $2,781 Chapter 13 - Statement of Cash Flows P13–5. Req. 1 Related Cash Flow Section Δ in Cash O O Balance sheet at December 31 Cash Accounts receivable Merchandise inventory 2011 $ 34,000 35,000 41,000 2010 $ 29,000 28,000 38,000 Change +5,000 +7,000 +3,000 10 3 4 I Property and equipment 121,000 100,000 +21,000 7 O Less: Accumulated depreciation (30,000) (25,000) -5,000 2 $201,000 $ 36,000 $170,000 $ 27,000 +9,000 5 O O F F O, F Accounts payable Wages payable Note payable, long-term Contributed capital Retained earnings Income statement for 2011 Sales Gain on sale of equipment Cost of goods sold Other expenses Net Income 1,200 1,400 -200 6 38,000 88,600 37,200 $201,000 44,000 72,600 25,000 $170,000 -6,000 +16,000 +12,200 8 $120,000 10 1,000 70,000 38,800 $ 12,200 13-29 9 1 Net increase in cash Subtract from net income the increase in A/R Subtract from net income the increase in Inventory Payment in cash for equipment $31,000 Original cost of equipment sold ($10,000) Accumulated depreciation on equipment sold $7,000 Add back $12,000 to NI because depreciation expense does not affect cash Add to net income the increase in Accounts payable Subtract from net income the decrease in Wages payable Cash used for repayment of note principal Issuance of stock for cash Increased for net income amount Chapter 13 - Statement of Cash Flows P13–5. (continued) XS Supply Company Statement of Cash Flows For the Year Ended December 31, 2011 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Gain on sale of equipment $12,200 $ 12,000 (1,000) 2 10 Increase in accounts receivable (7,000) 3 Increase in merchandise inventory Increase in accounts payable Decrease in wages payable (3,000) 9,000 (200) 4 Net cash provided by operating activities Cash flows from investing activities: Cash payments to purchase equipment Cash received from sale of equipment Net cash used by investing activities Cash flows from financing activities: Cash payments on long-term note Cash receipts from issuing stock 1 5 6 9,800 22,000 (31,000) 4,000 7 (27,000) (6,000) 16,000 Net cash provided by financing activities Net increase in cash during the year Cash balance, January 1, 2011 Cash balance, December 31, 2011 8 9 10,000 5,000 29,000 $34,000 10 Req. 2 There was an increase in cash for XS Supply Company this year of $5,000. Operating activities provided a positive cash flow of $22,000. This inflow of cash from operating activities, combined with the $4,000 proceeds from sale of equipment and the stock issuance for $16,000 cash, allowed the company to invest $31,000 in new equipment and pay down a long-term note by $6,000. 13 30 Chapter 13 - Statement of Cash Flows P13–6. Req.1 Statement of Cash Flows Spreadsheet Forrest Company For the Year Ended December 31, 2013 12-31-2012 BALANCE SHEET Cash Accounts receivable Merchandise inventory Fixed assets-net Total Accounts payable Wages payable Note payable, long-term Common stock-no par Retained earnings Total 18,000 29,000 36,000 72,000 155,000 22,000 1,000 48,000 60,000 24,000 155,000 DR CR 26,000 (k) 10,000 (g) 3,000 (b) 6,000 (c) 6,000 (e) 3,000 (d) 200 (f) 10,000 (h) 3,800 (j) 20,000 (i) 12,000 (a) 12-31-2013 44,000 26,000 30,000 76,000 176,000 25,000 800 38,000 80,000 32,200 176,000 STATEMENT OF CASH FLOWS-INDIRECT METHOD Inflow Cash flows from operating activities: Net income Adjustments to net income Decrease in accounts receivable Decrease in merchandise inventory Increase in accounts payable Depreciation expense Decrease in wages payable Outflow 12,000 (a) 3,000 6,000 3,000 6,000 (b) (c) (d) (e) Cash flows from investing activities: Cash payment to purchase fixed assets Cash flows from financing activities: Cash payments on long-term note Cash receipts from issuing stock Cash payments for dividends 200 (f) 29,800 10,000 (g) (10,000) 10,000 (h) 20,000 (i) Increase (decrease) in cash during the year Totals Cash balance, Jan. 1 Cash balance, Dec. 31 100,000 3,800 (j) 6,200 26,000 (k) 100,000 26,000 18,000 44,000 13-31 Chapter 13 - Statement of Cash Flows P13–6. (continued) Req. 2 FORREST COMPANY Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities: Net income...................................................................... Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense .................................................... Decrease in accounts receivable ................................... Decrease in merchandise inventory ............................... Increase in accounts payable ........................................ Decrease in wages payable ........................................... Total adjustments ........................................................... Net cash provided by operating activities .................. Cash flows from investing activities: Cash payments to purchase fixed assets ....................... Cash flows from financing activities: Cash payments on long-term note .................................. Cash receipts from issuing stock .................................... Cash payments for dividends.......................................... Net cash provided by financing activities ................... Net increase in cash during the year ..................................... Cash balance, January 1, 2013............................................. Cash balance, December 31, 2013 ....................................... $12,000 $ 6,000 3,000 6,000 3,000 (200) 17,800 29,800 (10,000) (10,000) 20,000 (3,800) Req. 3 There were no noncash investing and financing activities during 2013. 13 32 6,200 26,000 18,000 $44,000 Chapter 13 - Statement of Cash Flows ALTERNATE PROBLEMS AP13–1. Req. 1 Related Cash Flow Section Δ in Cash O O I O O O F F O,F Balance sheet at December 31 Cash Accounts receivable Merchandise inventory Property and equipment Less: Accumulated depreciation Accounts payable Wages payable Note payable, long-term Contributed capital Retained earnings 2012 $34,000 45,000 32,000 121,000 2011 $29,000 28,000 38,000 100,000 (30,000) (25,000) $202,000 $170,000 $36,000 $27,000 2,200 1,400 40,000 46,000 86,600 70,600 37,200 25,000 $202,000 $170,000 Income statement for 2012 Sales $135,000 Cost of goods sold 70,000 Other expenses 37,800 Net Income $ 27,200 13-33 Change +5,000 +17,000 –6,000 +21,000 10 3 4 7 Net increase in cash Subtract from net income the increase in A/R Add to net income the decrease in Inventory Payment in cash for equipment –5,000 2 Add back to NI because depreciation expense does not affect cash +9,000 +800 –6,000 +16,000 5 +12,200 1 Add to net income the increase in Accounts payable Add to net income the increase in Wages payable Cash used for repayment of note principal Issuance of stock for cash Increased for net income of $27,200 and decreased for dividends declared and paid of $15,000 6 8 9 Chapter 13 - Statement of Cash Flows AP13–1. (continued) Ingersol Construction Supply Company Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Increase in accounts receivable Decrease in merchandise inventory Increase in accounts payable Increase in wages payable Net cash provided by operating activities Cash flows from investing activities: Cash payments to purchase fixed assets Cash flows from financing activities: Cash payments for dividends Cash payments on long-term note Cash receipts from issuing stock Net cash provided by financing activities Net increase in cash during the year Cash balance, January 1, 2012 Cash balance, December 31, 2012 $27,200 $ 5,000 (17,000) 6,000 9,000 800 1 2 3 4 5 6 3,800 31,000 (21,000) 7 (15,000) (6,000) 16,000 1 8 9 (5,000) 5,00010 29,000 $34,000 Req. 2 There was an increase in cash for Ingersol Construction Supply Company this year of $5,000. Operating activities provided a positive cash flow of $31,000. This inflow of cash from operating activities, combined with the stock issuance for $16,000 cash, allowed the company to invest $21,000 in fixed assets, pay down a long-term note by $6,000, and pay dividends of $15,000. 13 34 Chapter 13 - Statement of Cash Flows AP13–2. Req.1 Related Cash Flow Section Δ in Cash O O I O Balance sheet at December 31 Cash Accounts receivable Inventory Property and equipment Less: Accumulated depreciation O Accounts payable O Taxes payable F F Note payable, long-term Contributed capital O,F Retained earnings 2013 $64,000 15,000 22,000 210,000 2012 $65,000 20,000 20,000 150,000 Change -1,000 -5,000 +2,000 +60,000 (60,000) (45,000) -15,000 2 $251,000 $210,000 $8,000 $19,000 -11,000 5 2,000 1,000 +1,000 6 86,000 75,000 75,000 70,000 +11,000 +5,000 8 80,000 $251,000 45,000 $210,000 +35,000 1 Income statement for 2013 Sales $190,000 Cost of goods sold 90,000 Other expenses 60,000 Net Income $40,000 13-35 10 3 4 7 9 Net decrease in cash Add to net income the decrease in A/R Subtract from net income the increase in Inventory Payment in cash for equipment Add to NI because depreciation expense does not affect cash Subtract from net income the decrease in Accounts payable Add to net income the increase in Taxes payable Borrow additional note principal Issuance of stock for cash Increased for net income ($40,000) / decreased for dividends ($5,000) Chapter 13 - Statement of Cash Flows AP13–2. (continued) Audio House Inc. Statement of Cash Flows For the Year Ended December 31, 2013 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Decrease in accounts receivable Increase in inventory Decrease in accounts payable Increase in taxes payable Net cash provided by operating activities Cash flows from investing activities: Cash payments to purchase fixed assets Cash flows from financing activities: Cash receipts from borrowing on long-term note Cash receipts from issuing stock Cash dividends paid $40,000 $15,000 5,000 2 (2,000) (11,000) 1,000 4 3 5 6 8,000 48,000 (60,000) 11,000 8 5,000 9 ( 5,000) Net cash provided by financing activities Net decrease in cash during the year Cash balance, January 1, 2013 Cash balance, December 31, 2013 7 1 11,000 ( 1,000) 65,000 $64,000 13 36 1 10 Chapter 13 - Statement of Cash Flows Req. 2 There was an overall decrease in cash of $1,000. This resulted from an inflow of $48,000 from operating activities, borrowing on a long-term note of $11,000, and a stock issuance of $5,000. A large percentage of the cash inflow was invested in equipment ($60,000) and $5,000 was paid as dividends. 13-37 Chapter 13 - Statement of Cash Flows AP13–3. Req. 1 Related Cash Flow Section Δ in Cash Balance sheet at December 31 Cash O Accounts receivable O I Merchandise inventory Property and equipment Less: Accumulated depreciation O O Accounts payable O Wages payable F F O,F 2012 $34,000 2011 Change $29,000 +5,000 10 Net increase in cash Subtract from sales to compute collections from customers Subtract from CGS to compute payments to suppliers Payment in cash for equipment 45,000 28,000 +17,000 3 32,000 121,000 38,000 100,000 -6,000 +21,000 4 (30,000) (25,000) -5,000 2 Depreciation expense does not affect cash $202,000 $170,000 $36,000 $27,000 +9,000 5 Subtract from CGS to compute payments to suppliers Subtract from Wage expense to compute payments for wages Cash used for repayment of note principal Issuance of stock for cash Increased for net income of $27,200 and decreased for dividends declared and paid of $15,000 7 2,200 1,400 +800 6 Note payable, long-term Contributed capital 38,000 88,600 44,000 72,600 -6,000 +16,000 8 Retained earnings 37,200 25,000 +12,200 1 $202,000 $170,000 Income statement for 2012 Sales $135,000 Cost of goods sold 70,000 Other expenses 37,800 Net Income $27,200 13 38 9 Chapter 13 - Statement of Cash Flows AP13–3. (continued) Ingersol Construction Supply Company Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities: Collections from customers ($135,000 – $17,000) Payments to suppliers ($70,000 – $6,000 – $9,000) Payments for wages ($20,000 – $800) Payments for other expenses Payments for taxes $118,000 3 (55,000) 4,5 (19,200) 6 (6,800) (6,000) Net cash provided by operating activities Cash flows from investing activities: Cash payments to purchase fixed assets Cash flows from financing activities: Cash payments for dividends Cash payments on long-term note Cash receipts from issuing stock Net cash provided by financing activities Net increase in cash during the year Cash balance, January 1, 2012 Cash balance, December 31, 2012 31,000 (21,000) 7 (15,000) (6,000) 16,000 1 8 9 (5,000) 5,00010 29,000 $34,000 Req. 2 There was an increase in cash for Ingersol Construction Supply Company this year of $5,000. Operating activities provided a positive cash flow of $31,000. This inflow of cash from operating activities, combined with the stock issuance for $16,000 cash, allowed the company to invest $21,000 in fixed assets, pay down a long-term note by $6,000, and pay dividends of $15,000. 13-39 Chapter 13 - Statement of Cash Flows CASES AND PROJECTS ANNUAL REPORT CASES CP13–1. Req. 1: Depreciation and amortization was the largest item. The $133,141 expense was added to net income in the reconciliation because it is a noncurrent deferred expense which does not cause a cash outflow when it is recorded. The increase in prepaid expenses and other was the largest change in operating assets or liabilities. The increase of $24,781 was subtracted from net income in the reconciliation because the cash payments for the prepaid expenses were more than the amount recorded for expenses resulting from the expiration of prepaid expenses. Req. 2: American Eagle Outfitters’ three largest investing and financing uses of cash over the past three years have been purchasing investments, purchases of property and equipment (capital expenditures), and repurchases of common stock. The two major sources of cash for these activities has been cash flow provided by operating activities and sales of investments. Req. 3: Free Cash Flow was negative $45,536 thousand, calculated as (in thousands): Cash Flows from Operating Activities less Dividends less Capital Expenditures (purchase of PPE) Free Cash Flow $302,193 (82,394) (265,335) $(45,536) This implies that the company lacks the financial flexibility to consider additional capital expenditures or other means of expansion without increasing its debt. 13-40 Chapter 13 - Statement of Cash Flows CP13–2. Req. 1 The company uses the indirect method. Req. 2 Tax payments of $115,040 thousand were made (located near the bottom of the Statement of Cash Flows). Req. 3 “Share-based compensation” is an expense paid with common stock rather than cash. Since it does not use cash, it is added back to net income to determine cash flows from operations. Depreciation and amortization are also expenses that do not involve a cash outflow as they are incurred. Thus, both of these expenses are added back to net income to determine the cash flow from operations. Req. 4 The company has not paid cash dividends during the last three years, or in any year since its initial public offering. (Any dividends paid would be a financing cash outflow.) This information can be found under the “Dividend Policy” heading in the section of the annual report entitled “Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities”. Req. 5 Free Cash Flow was $139,017 thousand, calculated as (in thousands): Cash Flows from Operating Activities less Dividends less Capital Expenditures Free Cash Flow 13-41 $251,570 0 112,553 $139,017 Chapter 13 - Statement of Cash Flows CP13–3. Req. 1 American Eagle Outfitters Urban Outfitters Quality of = Cash flow from operations income ratio Net income $302,193 = 1.69 $179,061 $251,570 = 1.26 $199,364 American Eagle Outfitters has a higher, and therefore better, quality of income ratio than does Urban Outfitters. Req. 2 Quality of Income = Industry Average 0.72 American Eagle Outfitters 1.69 Urban Outfitters 1.26 Both Urban Outfitters and American Eagle have a higher than average (and therefore better) quality of income ratio. Req. 3 American Eagle Outfitters Urban Outfitters Capital = Cash flow from operations acquisitions Cash paid for plant & ratio equipment $302,193 = 1.14 $265,335 $251,570 = 2.24 $112,553 Urban Outfitters has a higher capital acquisitions ratio than does American Eagle Outfitters. This implies that Urban Outfitters has a greater ability to fund additional capital expenditures from the cash flow provided by its operating activities. Req. 4 Capital Acquisitions = Industry Average 1.93 American Eagle Outfitters 1.14 Urban Outfitters 2.24 Urban Outfitters’ capital acquisitions ratio is higher and American Eagle Outfitters’ is lower than the industry average. This implies their relative ability to fund additional capital expenditures from the cash flow provided by their operating activities compared to the average company in the industry. 13-42 Chapter 13 - Statement of Cash Flows FINANCIAL REPORTING AND ANALYSIS CASES CP13–4. ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. Statement of Cash Flows For the Quarter Ended May 31 Cash flows from operating activities: Net income....................................................................... Add (deduct) to reconcile net income to net cash flow: Depreciation expense ........................................................... Amortization expense ........................................................... Accounts receivable increase ............................................. Inventories increase.............................................................. Other current assets increase ............................................. Accounts payable increase.................................................. Accrued liabilities increase .................................................. Income taxes payable decrease ......................................... Long-term accounts receivable decrease ......................... Net cash inflow from operating activities .................... $ 163,837 276,304 5,901 (138,681) (243,880) (357,507) 280,935 164,087 (43,031) 11,382 $ 119,347 Cash flows from investing activities: Fixed assets purchased ................................................. (1,081,121) Other assets decrease ......................................................... 50,055 Net cash outflow from investing activities (1,031,066) Cash flows from financing activities: Repayment of short-term debt ....................................... (1,000,000) Repayment of long-term debt.............................................. (2,355,029) Issuance of long-term debt............................................. 4,659,466 Net cash inflow from financing activities ..................... Net increase in cash during the quarter ................................ Cash, February 29 ................................................................ Cash, May 31 ........................................................................ 1,304,437 392,718 528,787 $ 921,505 13-43 Chapter 13 - Statement of Cash Flows CP13–5. Date: To: From: Re: (today’s date) Supervising Analyst (your name) Evaluation of Carlyle Golf, Inc.’s Planned Expansion While many companies experience losses and negative cash flows during the early years of their operations, the cash situation for Carlyle Golf is a major concern. The company has announced plans to increase inventory by $2.2 million but there is no obvious source to finance the acquisition of this inventory. The statement of cash flows shows that the company has to make cash deposits with its suppliers. It is unlikely that these suppliers will be a major source of financing for Carlyle's inventory. The company obviously does not have enough cash on hand to finance its expansion of inventory. The planned expansion of inventory has additional implications. The company must have plans to expand its sales volume. There is no information in the company's report concerning whether this expansion will require additional expenditures, such as increased advertising or hiring new sales people. In any case, the expansion will most likely require an increase in accounts receivable. Most companies underestimate the amount of resources that must be tied up in inventory and accounts receivable when they expand sales volume. Carlyle should seek additional capital to support an increased level of operations. Without this extra capital, it is unlikely that Carlyle can continue in business. Instructor's note: Subsequent to this date, Carlyle sought new financing through an initial public offering. However, the company was unable to develop a niche in this very competitive market and was subsequently liquidated. 13-44 Chapter 13 - Statement of Cash Flows CRITICAL THINKING CASES CP13–6. Req. 1 The payment from Merrill Lynch to Enron does not automatically make the Nigerian barge transaction a sale. When a loan is established between a lender and borrower, a similar cash payment is made between the two parties. Two other features of the Nigerian barge transaction resemble a loan. First, the requirement that Enron arrange for Merrill Lynch to be paid only six months after the “sale” is similar to a possible requirement that a borrower repay a lender six months after a borrower receives cash in conjunction with signing a promissory note. Second, the “hefty fee” paid by Enron for temporarily obtaining the use of Merrill Lynch’s funds is similar to interest that is paid by a borrower for temporarily obtaining the use of a lender’s funds. The four revenue recognition criteria discussed in Chapter 3 are: 1) delivery has occurred or services have been rendered, 2) there is persuasive evidence of an arrangement for customer payment, 3) the price is fixed or determinable, and 4) collection is reasonably assured. Without knowing about the secret side deal, it’s not obvious which of the four criteria have not been fulfilled. Knowing about the side deal, however, makes it clear that the first criterion has not been fulfilled. At the time of the initial transaction (and receipt of cash from Merrill Lynch) Enron had a continuing obligation to ensure that Merrill Lynch was repaid six months later. In other words, Enron had not performed all of the acts promised to Merrill Lynch. Req. 2 By recording the transaction as a regular sale, Enron reports the cash received as a cash inflow from an operating activity. Had the transaction been recorded as a loan, Enron would have reported the cash received as a cash inflow from a financing activity. 13-45 Chapter 13 - Statement of Cash Flows Req. 3 Most financial statement users view cash flows from operating activities as recurring sources of cash into the future. If $100,000 of cash is generated from operations this year, it’s often reasonable to expect that a similar amount will be generated next year and the year after that and the year after that. Financing activities, on the other hand, are not as readily recurring in the future, particularly as a company takes on more and more debt. Eventually, lenders will stop lending if a company’s liabilities grow too large. Given these different perceptions, financial statement users attach more value to cash generated from operating activities than from financing activities. Thus, when the transaction is recorded as a sale, financial statement users will perceive the company’s value as greater than when the transaction is recorded as a loan. FINANCIAL REPORTING AND ANALYSIS PROJECTS CP13–7. The solutions to this case will depend on the company and/or accounting period selected for analysis. 13-46