Uploaded by

Diana Munyaradzi

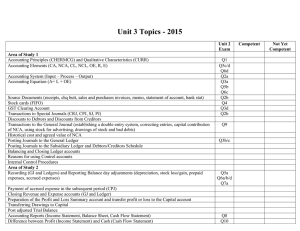

Bank, Debtors, Creditors Reconciliation: Grade 11 Revision

advertisement

Bank, Debtors and Creditors reconciliations This section looks at bank, debtors & creditors reconciliations. You must be able to correct, analyse and interpret these reconciliations as well as debtors and creditors control accounts. Bank Reconciliations. At the end of the month, the CRJ and CPJ are totaled, and the bank column is posted to the bank account in the General Ledger. At the same time a bank statement drawn up by the bank is sent to the business. The Bank Account: (the business’ books/ our view) The Bank Statement: (the bank’s book/ bank’s view) Is an asset Debit receipts/ deposits (when the bank increases) Credit payments (when the bank decreases) The bank owes us the money we pay in According to the bank, deposits are credits Payments/ withdrawals are debits (The bank statement is opposite to the bank account) We must compare the statement (the banks records) with the journals (the business’ records). If there is a difference between the Bank Account balance and the Bank Statement we must reconcile the books and the statement so that they balance. The Process! 1. Compare the CPJ with the DEBIT entries in the bank statement. Check () the ones that match. Entries that were not checked in the DEBIT column of the bank statement, must be recorded in the CPJ. Entries that were not checked in the CPJ must be recorded in a BANK RECONCILIATION STATEMENT. 2. Compare the CRJ with the CREDIT entries in the bank statement. Check () the ones that match. Entries that were not checked in the CREDIT column of the bank statement, must be recorded in the CRJ. Entries that were not checked in the CRJ must be recorded in a BANK RECONCILIATION STATEMENT. 3. Compare the previous month’s BANK RECONCILIATION STATEMENT with the current BANK STATEMENT. Check () the ones that match. Entries that still do not appear in this month’s statement must be recorded in the BANK RECONCILIATION STATEMENT. J Cansfield Grade 11 Revision 4. Correct any errors. Errors made by us - correct in the journals. - entry incorrectly too big, then enter in opposite journal. - entry incorrectly too small, then enter in same journal. Errors made by the bank - notify the bank - correct in the reconciliation statement. 5. Re-total the journals (once extra entries have been recorded). Post to the Bank Account. Balance the bank account. 6. Balance the bank reconciliation statement. To do this: (1) Add up the column which has the largest amount. (2) Put this total in the total blocks in both columns. (3) Subtract the smaller column from this total. (4) That gives you balance, enter this in the smaller column as your Balance per Bank Account (end off from the business’ point of view). Some Common Differences! LEARN THESE: 1. To be entered in the CRJ: Interest received on our current account. Stopped/ cancelled cheque. Direct deposit into our bank account (often Rent). Errors (amount originally recorded was too little; or amount originally recorded in CPJ was too much.) 2. To be entered in the CPJ: Interest on overdraft. Bank Charges (cash deposit fee, cheque book levy, credit card levy, etc.) Stop/ debit orders made directly by the bank (Insurance, Water & Electricity etc.) Replaced cheque [old cheque was stopped (CRJ) and a new cheque is issued (CPJ)]. Dishonoured/ unpaid cheque of debtor (cheque returned marked R/D or I/F) Unpaid cheques (any cheques that were received and recorded but are dishonoured by the bank; this could be due to mistakes or errors on the cheque or the cheque is postdated) Errors (amount originally recorded was too little, or amount originally recorded in CRJ was too much). 3. To be entered on the Bank Reconciliation Statement: Credit outstanding deposits (not yet credited by the bank) Credit cheque incorrectly debited by bank (bank’s mistake). Debit cheques not yet presented for payment. This includes: 1. cheques that have not been presented by payee yet (if after 6 months, cheque becomes stale and must be cancelled) 2. cheques that were replaced now at end of month 3. post-dated cheques issued (as payee can’t redeem payment until date falls due). Debit deposit incorrectly credited by bank (bank’s mistake). J Cansfield Grade 11 Revision Try this question taken from the DOE 2007 SG March examination. The information below appears in the books of Hanif Traders. Required: 1 Complete the Cash Receipts Journal and the Cash Payments Journal for May 2006. Total only the bank columns in the Cash Journals. 2 Post to the Bank Account in the general ledger. Balance the account on 31 May 2006. 3 Prepare a Bank Reconciliation Statement on 31 May 2006. 4 Provide TWO examples of bank charges that will appear on the Bank Statement. Note: It is the policy of the business to correct errors in the Cash Journals, whenever possible. Information: 1. Provisional totals in the Cash Journals for May 2006: CRJ CPJ Bank 42 424 36 363 Sundry Accounts 42 424 36 363 2. The Bank Reconciliation Statement prepared on 30 April 2006 reflects the following information: R Favourable balance per Bank Statement 3 489 Outstanding deposit 2 247 Outstanding cheques: 301 1 521 302 315 304 876 Favourable balance per Bank Account in the Ledger 3 024 3. A comparison of the Bank Reconciliation Statement for April 2006 with the Bank Statement of Cats Bank for May 2006 reflects the following: 3.1 The outstanding deposit of R2 247 appears on the Bank Statement for May 2006. 3.2 Cheque No. 301 for R1 521 appears on the Bank Statement for May 2006. 3.3 Cheque No. 302 for R315 was issued to Fralize Stores for trading stock purchased. This cheque has been lost and payment has been stopped. It was replaced with cheque No. 335 on 31 May 2006. This cheque is in the post. No entry has been made for the cancellation of the old cheque or the issuing of the new cheque. 3.4 Cheque No. 304 for R876, dated 15 June 2006 is still outstanding. 4. A comparison of the Bank Statement for May 2006 with the Cash Journals reflects the following differences: 4.1 A tenant, S. Stefne, paid R950 for rent. This appears only on the Bank Statement. 4.2 A dishonoured cheque for R342, received from a debtor L. Bryden, appears on the Bank Statement. 4.3 4.4 J Cansfield A stop order to Naidoo Insurers appears on the Bank Statement for the following: • R680 for business insurance • R220 for household insurance of the owner paid on his behalf by the business. Bank charges according to the Bank Statement amount to R134. Grade 11 Revision 4.5 A credit of R44 being interest on current bank account was reflected on the Bank Statement of Cats Bank. A deposit of R3 211 appears in the CRJ but not on the Bank Statement. 4.6 5. The Salaries Journal for May 2006 reflects the following: Employees Cheque number Net salaries J. Meslo 347 R4 275 B. Roos 348 R5 437 J. Ramsamy 349 R3 954 Only cheques 348 and 349 appeared on the Bank Statement for May 2006. 6. The Bank Statement on 31 May reflects a credit balance of R10 958. Answer this question in the space provided below: CASH RECEIPTS JOURNAL OF HANIF TRADERS FOR MAY 2006 CRJ 6 DOC No. DAY 30 DETAILS Total BANK 42 424 SUNDRY ACCOUNTS FOL DETAILS 42 424 CASH PAYMENTS JOURNAL OF HANIF TRADERS FOR MAY 2006 CPJ 6 DOC No. DAY 30 J Cansfield DETAILS Total BANK 36 363 SUNDRY ACCOUNTS FOL DETAILS 36 363 Grade 11 Revision GENERAL LEDGER OF HANIF TRADERS BANK BANK RECONCILIATION STATEMENT OF HANIF TRADERS AS AT 31 MAY 2006 DEBIT CREDIT Debtors & Creditors Reconciliations and Control Accounts. DEBTORS: Debtors OWE the business money. A debtor is a current asset. If they owe MORE we DEBIT the Debtors control account. If they owe LESS we CREDIT the debtors control account. Learn this framework of a Debtors Control Account: DR 2001 Aug 2001 Sept DEBTORS CONTROL 1 10 Balance Petty Cash b/d PCJ 31 Sales 1 2001 Aug CR Bank and Discount Allowed Debtors Allowances CRJ DAJ DJ Journal Credits GJ Bank (R/D) CPJ Balance c/d Journal Debits GJ Balance b/d J Cansfield 31 Grade 11 Revision CREDITORS: The business OWES money to Creditors. Creditors are a current liability. If we owe them MORE we CREDIT the Creditors control account. If we owe them LESS we DEBIT the Creditors control account. Learn this framework of a Creditor’s Control Account: DR CREDITORS CONTROL 2001 Bank and Discount Aug 31 Received Creditors Allowances 2001 Aug CPJ CAJ Journal Debits GJ Balance c/d 2001 Sept CR 1 Balance 31 Sundry Purchases b/d CJ Journal Credits GJ Balance b/d 1 ERRORS AND OMISSIONS When correcting errors, make use of T accounts. Show in these T accounts: 1. What has been recorded. 2. What should have been recorded. 3. Record the correction Errors are unexpected. There are no rules as many different errors occur. However keep the accounting process in mind – once you have identified where the error took place, the process will help you discover what will be affected. If an entry was omitted or an error was made in (1.) Source document or (2.) Journal then it would affect both the (4.) Debtors Control account in the General Ledger AND the (3.) Debtors Ledger. If the error was made when posting to the account of a debtor, then ONLY the Debtors Ledger would be affected. If the error was made when totaling the journal or in posting a total, then ONLY the General Ledger is affected. The same applies to Creditors. J Cansfield 1. source document 2. Journals post single entry 3. Debtors /Creditors Ledger post totals to 4. General Ledger Grade 11 Revision Try this question taken from the DOE 2004 SG November examination. LEDGER ACCOUNTS (29 marks; 18 minutes) The following information relates to Mandela Traders. The financial year-end is 29 February 2004. The business uses a control account system and the perpetual (continuous) inventory system. INSTRUCTION: Use the given information to complete the following accounts in the General Ledger of Mandela Traders. Folio references must be shown. Balance/Close off the accounts on 29 February 2004. 1 Creditors Control (17) 2 Sales (12) INFORMATION: The following balances appeared in the General Ledger of Mandela Traders on 1 February 2004: GENERAL LEDGER Creditors Control Trading Stock Sales Debtors Allowances R 40 000 48 000 160 000 20 000 The following information was taken from the subsidiary journals of Mandela Traders on 29 February 2004: CREDITORS JOURNAL R Invoices received from suppliers 51 000 DEBTORS JOURNAL Invoices issued to customers Cost of sales on invoices issued R 75 000 50 000 CASH PAYMENTS JOURNAL Bank Trading stock Creditors control : Paid : Discount Sundry accounts R 88 100 36 000 42 000 420 10 100 CREDITORS ALLOWANCES JOURNAL Duplicate debit notes issued to suppliers for goods returned R 750 DEBTORS ALLOWANCES JOURNAL Duplicate credit notes issued to customers Cost of sales on duplicate credit notes issued to customers R 2 400 1 600 CASH RECEIPTS JOURNAL Total of cash register roll for cash sales Cost of sales on cash sales Receipts issued to creditors for refunds received R 3000 2000 1000 GENERAL JOURNAL Debtors control columns Creditors control columns J Cansfield Debit R 410 340 Credit R 250 280 Grade 11 Revision Hint: Draw up the frameworks of the accounts first, and then post the relevant information. GENERAL LEDGER OF MANDELA TRADERS CREDITORS CONTROL ACCOUNT SALES ACCOUNT J Cansfield Grade 11 Revision Try this question taken from the DOE 2005 SG March examination LEDGER ACCOUNTS (40 marks; 24 minutes) The two accounts below appeared in the General Ledger of Afro Jewellers. Certain details, folios and amounts have been omitted. REQUIRED: Study the accounts and answer the questions that follow. INFORMATION: GENERAL LEDGER OF AFRO JEWELLERS Debtors control Trading stock QUESTIONS ON DEBTORS CONTROL ACCOUNT: 1. Provide the folio for the amount of R32 500 on the debit side of the Debtors Control Account. (2) 2. Provide the details for the R500 on the debit side of the Debtors Control Account. (2) 3. Give TWO reasons that could have led to the Debtors Control Account being credited with the R2 500. 4. How much did the debtors owe on 30 September 2004? J Cansfield (4) (2) Grade 11 Revision 5. The business allowed debtors R700 discount for prompt payment of their accounts. What is the actual amount received from them? (2) 6. The R300 on the debit side of the Debtors Control Account was posted from the Cash Payments Journal. Provide ONE example of a transaction to suit this entry. (2) 7. Name the source document for the entry of R40 000 on the credit side of the Debtors Control Account. (2) 8. At the end of the financial year, the Debtors Allowances Account will be closed and transferred to which account? (2) 9. What is the cost of goods sold on credit for the month of September 2004 if the business maintains a mark-up of 30% on cost of sales? (4) QUESTIONS ON TRADING STOCK ACCOUNT: 10. Provide the folio for the R22 000 on the credit side of the Trading Stock Account. (2) 11. Does this business buy most of its stock for cash or on credit? Give a reason for your answer. (3) 12. Name the contra account for the R30 000 on the debit side of the Trading Stock Account. (2) 13. Why is the Trading Stock Account debited with R1 000? (2) 14. The business uses a mark-up of 30% on cost. Calculate the goods sold for cash. (4) 15. When preparing the financial statements, under which note to the Balance Sheet will you reflect trading stock? (2) 16. Does this business use the periodic or the perpetual (continuous) inventory system? Provide a reason for your answer. (3) Remember: keep your answers short and to the point. If calculations are required, then show your workings – this will earn you part marks! J Cansfield Grade 11 Revision Complete the answers to the above questions the spaces provided: 1 Folio for R32 500 Marks 2 2 Details for R500 Marks 2 3 TWO reasons for credit entry of R2 500 Marks 4 4 Amount owed by debtors on 30 September 2004 Marks 2 5 Amount received from debtors Marks 2 6 ONE example of a transaction for R300 from CPJ Marks 2 7 Source document for R40 000 Marks 2 8 Account to which Debtors Allowances will be transferred Marks 2 9 Calculation of cost of sales Marks 4 10 Folio reference for R22 000 Marks 2 11 Cash or credit? Reason. Marks 3 12 Contra account for R30 000 Marks 2 13 Reason for debit of R1 000 in Trading Stock Account Marks 2 14 Calculation of goods sold for cash Marks 4 15 Note in financial statements for trading stock Marks 2 16 Periodic or perpetual inventory? Reason. Marks 3 J Cansfield Grade 11 Revision