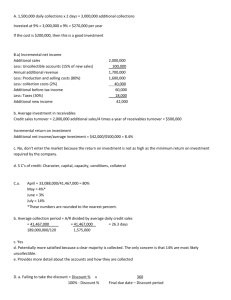

Capacity Management with Setups: Production/Inventory Models What are Set-Ups (Video27)? When multiple products (types) are processed through a bottleneck recourse, there is usually a setup involved. If the video clip does not play properly, please watch this through the link which I provide in the description of the page. https://www.youtube.com/watch?v=fHI8LN2F0hk What are Set-Ups (Video27)? When multiple products (types) are processed through a bottleneck recourse, there is usually a setup involved. A B C 7 min/unit 20 min/unit 8 min/unit 5 min/setup A B C 7 min/unit 20 min/unit 8 min/unit A B C 7 min/unit 20 min/unit 8 min/unit 5 min/setup A B C 7 min/unit 20 min/unit 8 min/unit 5 min/setup A B C 7 min/unit 20 min/unit 8 min/unit 20 min/unit → 25 min/unit What are Set-Ups? The term Set-up – Comes from manufacturing where machines needed to be prepared (set-up) to make a product. Set-Ups & Capacity Set-ups tend to require resources One product: Available time: 8hr/day. Two products: At least 1 changeover → 1 setup Available time: 8hr/day. Each setup time: 30mins. Results in a reduction of available resource time Could lead to a decrease in process capacity! How managers often minimize the impact of set-ups on capacity? Increase available time for a resource – but this leads to additional out-of pocket costs. A potential solution which does not require an increase in additional out-of-pocket cost is to process products in batches Batch A collection of flow units. Batches are produced in succession. Once the production of one batch is completed, the production of the next batch begins All batches contain the same number and type of flow unit. Computing Cycle Times Processing a fixed amount of work Example: Producing 50 cars. On average, production takes 5 hours per car. It takes 50 hours to set up the production line. Cycle Time = Set-up Time + (Batch size) x (Time per unit) Batch size = 50 + (50) x (5) 50 = 300 50 =6 Computing Cycle Times Processing a fixed amount of work Example: Producing 100 cars. On average, production takes 5 hours per car. It takes 50 hours to set up the production line. Cycle Time = Set-up Time + (Batch size) x (Time per unit) Batch size = 50 + (100) x (5) 100 = 550 100 = 5.5 The Impact of Set-ups on Capacity Production cycle Batch of 12 Production cycle Batch of 60 Batch of 120 Batch of 300 60 120 180 240 300 Produce steer supports (1 box corresponds to 12 units = 12 scooters) Set-up from Ribs to Steer support Produce ribs (1 box corresponds to 24 units = 12 scooters) Set-up from steer support to ribs Time [minutes] Larger Batch Leads to a Lot of Inventory Production with large batches Cycle Inventory Production with small batches Cycle Inventory Produce Sedan Produce Station wagon Beginning of Month End of Month Example: 2 car models. Average demand is 400 per day. Beginning of Month End of Month Capacity Management with Set-Ups Set-up times dominate Compute Capacity as function of batch size Compute cycle time (CT) of the rest of the process Compute set-up costs & inventory costs Use EOQ model or one of its variants Solve for batch size: Cap(B)=1/CT Analyze Set-up times & Set-up Costs Set-up costs dominate Reduce the need for batches • Set-up time reduction, SMED • Process lay-out •10-minute rule • Externalize internal set-ups Figure 7.11.: Summary of batching Batching Under Set-Up Costs Capacity Management with Set-Ups – Focused on Costs Set-up times dominate Compute Capacity as function of batch size Compute cycle time (CT) of the rest of the process Compute set-up costs & inventory costs Use EOQ model or one of its variants Solve for batch size: Cap(B)=1/CT Analyze Set-up times & Set-up Costs Set-up costs dominate Reduce the need for batches • Set-up time reduction, SMED • Process lay-out •10-minute rule • Externalize internal set-ups Figure 7.11.: Summary of batching Trade off between Holding cost and Set-up cost. Google image Set-up Cost Ordering cost or shipping cost… Holding Cost Notation we will use is h; carrying cost of inventory. expressed in terms of $ per unit per unit time. Fraction of unit cost, h = I x c, where I is expressed as a percent Example) Annual carrying costs are $3.6/unit Annual carrying costs are 12% of the purchase price (such as $30) Inventory Carrying Charge Category Housing costs (building rent or depreciation, operating costs, taxes, insurance) Material handling costs (equipment lease or depreciation, power, operating cost) Labor cost Cost (and range) as a Percent of Inventory Value 6% (3 - 10%) 3% (1 - 3.5%) 3% (3 - 5%) Investment costs (borrowing costs, taxes, and insurance on inventory) Pilferage, space, and obsolescence 11% (6 - 24%) Overall carrying cost 26% 3% (2 - 5%) Example (Noodle) Demand: 1200 per year, Order size: 100, Example (Noodle) Demand: 1200 per year, Order size: 100, Shipping cost: 10/order, Storage cost: 1 /unit/year Number of orders per year: Annual ordering cost Average inventory level Annual inventory 1200 = 12 100 1012 = 120 100 = 50 2 50 1 holding cost Total annual cost Length of order cycle 50 +120 = 170 1 12 months year × = 1 month 12 1 year Average Inventory = Order size / 2 100 100 90 90 80 80 70 70 60 60 50 50 40 40 30 30 20 20 10 10 0 0 1 2 3 … Capacity Management with setup cost: Economic Order Quantity Model Economic Order Quantity Model (EOQ) Assumptions (need to memorize this assumption): There is a fixed setup cost S independent of the order quantity. Demand is constant and not stochastic: D=annual demand Lead time is zero (or constant) → Replenishment occurs instantaneously. Full lot delivery No backorder or shortage is allowed, No quantity discounts. Related costs: Ordering cost: S $/order Inventory holding cost: H $/unit/year Questions When to order from the supplier How much to order Objective Minimize total annual cost The EOQ Model Annual setup cost = S D Q Q = Number of pieces per order D = Annual demand in units for the inventory item S = Setup or ordering cost for each order H = Holding or carrying cost per unit per year Annual setup cost = = Number of orders placed per year Annual demand Number of units in each order x Set-up or order cost Per order Setup or order cost per order = D Q (S) Annual setup cost = S The EOQ Model Annual holding cost = Q = Number of pieces per order D = Annual demand in units for the inventory item S = Setup or ordering cost for each order H = Holding or carrying cost per unit per year Annual holding cost = = Average Inventory Q 2 (H) x Holding cost per unit per year D Q Q H 2 Annual Cost Cost Minimization Goal TC = Q D H+ S 2 Q Ordering Costs QO Order Quantity (Q) ) (optimal order quantity) = EOQ TC curve reaches its minimum where the carrying & ordering costs are equal. Example (Noodle) Demand: 1200 per year, Order size: 100, Shipping cost: 10/order, Storage cost: 1 /unit/year Number of orders per year: Annual ordering cost Average inventory level Annual inventory 1200 = 12 100 1012 = 120 100 = 50 2 50 1 holding cost Total annual cost Length of order cycle 50 +120 = 170 1 12 months year × = 1 month 12 1 year How much to buy and performance measures If annual demand is D, ordering cost is S and holding cost is H, then for any order quantity Q, Number of orders per year: Annual ordering cost S Average inventory level Annual inventory holding cost Total annual cost Length of order cycle D Q D Q Q 2 Q Q H 2 Q D H + S 2 Q Q D Q/2 D Q Q Annual holding cost = H 2 Annual setup cost = S The EOQ Model Q = Number of pieces per order D = Annual demand in units for the inventory item S = Setup or ordering cost for each order H = Holding or carrying cost per unit per year Optimal order quantity is found when annual setup cost equals annual holding cost D S = Q Solving for Q* Where Q* = Optimal number of pieces per order (EOQ) 2DS = Q2H Q2 = 2DS/H Q*= EOQ = 2DS/H Q H 2 The Performance of “approximate” EOQ EOQ usually is an approximate quantity How good is it in terms of minimizing cost? It is fairly robust An EOQ Example Determine optimal number of needles to order D = 1,000 units S = $10 per order H = $.50 per unit per year Q* = 2DS H Q* = 2(1,000)(10) = 0.50 40,000 = 200 units An EOQ Example Determine optimal number of needles to order D = 1,000 units Q* = 200 units S = $10 per order H = $.50 per unit per year Expected number of = N = orders N= Demand Order quantity 1,000 200 = D Q* = 5 orders per year An EOQ Example Determine optimal number of needles to order D = 1,000 units Q*= 200 units S = $10 per order N= 5 orders per year H = $.50 per unit per year Expected time between =T= orders T= Number of working days per year N 250 5 = 50 days between orders An EOQ Example Determine optimal number of needles to order D = 1,000 units Q* S = $10 per order N = 200 units = 5 orders per year H = $.50 per unit per year T = 50 days Total annual cost = Setup cost + Holding cost TC = TC = D Q S + H Q 2 1,000 200 ($10) + ($.50) 200 2 TC = (5)($10) + (100)($.50) = $50 + $50 = $100 Sample Quiz Example Demand for a certain radial tires at a tire company is 800 units per month. Each tire costs the company $80. Ordering costs are $75, and the annual carrying costs are 20 percent of the purchase price. Assume that the lead time is zero and that the tire company operates 288 days a year D = 800 * 12 = 9600 /yr S = $75 /order H = $80 * 0.2 = $16 /unit · yr Match! D = 800 * 12 = 9600 /yr S = $75 /order H = $80 * 0.2 = $16 /unit · yr Solution to SQ 1. How many tires should the manager order in each lot? EOQ = 2 DS H = 2(9600)75 = 300 units. 16 2. What is the company's average inventory of this tire? EOQ 300 Averageinventory = = = 150 units. 2 2 Solution to SQ (Cont.) 3. How often will an order be placed (length of order cycle)? EOQ D 300 = = 0.03125 ( yr) 288 (days/yr) = 9 days. 9600 4. How many times per year will an order be placed? D EOQ 9600 = = 32 / y r. 300 Solution to SQ (Cont.) 5. How much does the company spend annually on ordering costs? D 9600 S= 75 = $2,400 EOQ 300 6. How much does the company spend annually on holding (carrying) costs? EOQ 300 H= 16 = $2,400 2 2 Solution to SQ (Cont.) 7. What is the total annual cost if the EOQ quantity is ordered? D EOQ TC = S+ H EOQ 2 = $2,400 + $2,400 = $ 4,800 The ordering and carrying costs are equal at the EOQ Capacity Management with setup cost: Economic Production Quantity Model Basic Economic Production Quantity Model (EPQ) Assumptions: 1. Produces in batch and production rate is constant. 2. Only one product is involved. 3. Constant demand rate. Demand is spread evenly throughout the year. 4. Constant lead time. Lead time does not vary much for a long enough time. 5. Usage occurs continually, but production occurs periodically. 6. Capacity to produce a part exceeds the part's usage rate. Economic Production Quantity (EPQ) EPQ Maximum Inventory Imax Slope= Production rate p Slope= Production rate p – usage rate u Slope = – usage rate u Usage rate u is demand rate D in terms of the time measure same as production rate p. e.g. (a) D = 200 units / week, p = 50 units / day ➔ u = 200/5 = 40 units / day (b) D = 5 units / hr, p = 8 units / hr ➔ u = 5 units / hr. EPQ p>0 We need to produce 100 units (=EPQ). P=10 Product rate = 10 units / day. Therefore, 1 D→u we need 10 days to produce 100 units without considering usages... EPQ At the same time, we spend 5 units / day = u EPQ/p = 10 days Production rate – usage rate = 10 units/day – 5 units/day = 5 units/day… EPQ/u = 20 days 2 DS EPQ = H p p −u Economical Production/Optimal Run quantity 2 DS EPQ = H p p−u Production cycle time EPQ = u Run time (time of producing in a cycle) I max p−u = EPQ p EPQ = p I max I average = 2 Economic Production Quantity (EPQ) EPQ Maximum Inventory Imax I av erag e Slope= Production rate p Production cycle time = Run time = EPQ p Slope= – usage rate u EPQ u Slope= Production rate p – usage rate u Economic Production Quantity (EPQ) I max Carrying cost = H 2 D Setup cost = S EPQ Sample Quiz Example A toy manufacturer uses 48,000 rubber wheels per year for its popular dump truck series. The firm makes its own wheels, which it can produce at a rate 800 per day. The toy trucks are assembled uniformly over entire year. Carrying cost is $1 per wheel a year. Setup costs for a production run of wheels is $45. The firm operates 240 days per year. D = 48,000 / yr S = $45, H = $1 / yr p = 800 / day 48,000 u= = 200 /day 240 Solution to Example 1. What is the optimal size of a production run? EPQ = 2 DS H p 2(48000)45 800 = = 2,400 wheels p−u 1 800 − 200 2. What is the length of each production run? EPQ 2400 Run time = = = 3 days p 800 3. What is cycle time for the optimal run size? EPQ 2400 Production cycle time = = = 12 days u 200 Solution to Example (Cont.) 4. What is the maximum inventory level? the average inventory level? EPQ 2400 I max = ( p − u) = (800 − 200) = 1,800 wheels p 800 I max 1800 I average = = = 900 wheels 2 2 5. What is the average annual cost for holding inventory? for setting up production? I max 1800 Carrying cost = H= 1 = $900 2 2 D 48,000 Setup cost = S= 45 = $900 EPQ 2400 TC = $1800 EPQ vs EOQ p=∞ P=10 1 D→u D EOQ EPQ EOQ/D EPQ = = 2 DS H p p −u 2 DS = EOQ H As p = ∞ EPQ/p = 10 days EPQ/u = 20 days 1 EPQ = 2 DS H p p −u Capacity Management with setup cost: Economies of Scale Quantity Discount Models ▪ Reduced prices are often available when larger quantities are purchased Total cost = Setup cost + Holding cost + Product cost Discount Number 1 2 Discount Quantity 0 to 999 1,000 to 1,999 Discount (%) no discount 4 Discount Price (P) $5.00 $4.80 3 2,000 and over 5 $4.75 Demand 2800 Order size = 700 Product cost = (700x5)x4 = 14,000 Order size = 1400 Product cost = (1400x4.80)x2 = 13,440 Order size = 2800 Product cost = (2800x4.75)x1 = 13,300 Quantity Discount Models ▪ Reduced prices are often available when larger quantities are purchased Total cost = Setup cost + Holding cost + Product cost TC = where P = unit price D Q S+ H + PD Q 2 EOQ = 2 DS H Quantity Discount Models ▪ Steps in analyzing a quantity discount • For each discount, calculate Q* • If Q* for a discount doesn't qualify, choose the smallest possible order size to get the discount • Compute the total cost for each Q* or adjusted value from Step 2 • Select the Q* that gives the lowest total cost Quantity Discount Example (H = $1 or H = 0.2P) Calculate Q* for every discount D = 5000, S = 49 Q* = 2DS H Total cost = Setup cost + Holding cost + Product cost TC = D S + Q H + PD Q 2 Quantity Discount Example (H = $1) Calculate Q* for every discount D = 5000, S = 49, H = 1 Q* = 2DS H Total cost = Setup cost + Holding cost + Product cost TC = D S + Q H + PD Q 2 Quantity Discount Example Calculate Q* for every discount Q* = 2DS H Q1* = 2(5,000)(49) = 700 cars/order (1) Q2* = 2(5,000)(49) = 700 cars/order (1) Q3* = 2(5,000)(49) = 700 cars/order (1) Example Calculate Q* for every discount D = 5000, S = 49, H = 0.2P Quantity Discount Example (H = 0.2 x p) Calculate Q* for every discount D = 5000, S = 49, H = 0.2P Q* = 2DS IP Total cost = Setup cost + Holding cost + Product cost TC = D S + Q H + PD Q 2 Quantity Discount Example Calculate Q* for every discount Q* = 2DS IP Q1* = 2(5,000)(49) = 700 cars/order (.2)(5.00) Q2* = 2(5,000)(49) = 714 cars/order (.2)(4.80) Q3* = 2(5,000)(49) = 718 cars/order (.2)(4.75) Quantity Discount Models Total cost $ Total cost curve for discount 1 1st price break 0 2nd price break 1,000 2,000 Order quantity Quantity Discount Models Total cost $ Total cost curve for discount 2 b a Q* for discount 2 is below the allowable range at point a and must be adjusted upward to 1,000 units at point b 1st price break 0 2nd price break 1,000 2,000 Order quantity Total cost $ Quantity Discount Models Total cost curve for discount 3 1st price break 0 2nd price break 1,000 2,000 Order quantity Quantity Discount Calculate Q* for every discount Q1* = 2(5,000)(49) = 700 cars/order (.2)(5.00) Q2* = 2(5,000)(49) = 714 cars/order (.2)(4.80) 1,000 — adjusted Q3* = 2(5,000)(49) = 718 cars/order (.2)(4.75) 2,000 — adjusted Quantity Discount Order Quantity Annual Product Cost Annual Ordering Cost Annual Holding Cost Discount Number Unit Price 1 $5.00 700 $25,000 $350 $350 $25,700 2 $4.80 1,000 $24,000 $245 $480 $24,725 3 $4.75 2,000 $23.750 $122.50 $950 $24,822.50 Total Table 12.3 Choose the price and quantity that gives the lowest total cost Buy 1,000 units at $4.80 per unit Extra Example The maintenance department of a large hospital uses about 816 cases of liquid cleanser annually. Ordering costs are $12, carrying costs are $4 per case a year, and the new price schedule indicates that orders of less than 50 case will cost $20 per case, 50 to 79 cases will cost $18 per case, 80 to 99 cases will cost $17 per case, and larger orders will cost $16 per case. Q: Determine the optimal order quantity and the total cost. Solution to Extra Example D = 816 cases/yr S = $12 H = $4/case yr Compute EOQ: EOQ = 2 DS = H Range 1 to 49 50 to 79 80 to 99 100 or more Price $20 $18 $17 $16 2(816)12 = 69.97 70 cases 4 Solution to Extra Example D = 816 cases/yr S = $12 H = $4/case yr Compute EOQ: EOQ = 2 DS = H Range 1 to 49 50 to 79 80 to 99 100 or more Price $20 $18 $17 $16 2(816)12 = 69.97 70 cases 4 The total cost to purchase at EOQ = 70 cases per order: TC70 = Carrying cost + Order cost + Purchase cost Q D = H+ S + PD 2 Qo 70 816 = 4+ 12 + 18(816) = $14,968 2 70 Solution to Extra Example(Cont.) 3. Check next two lower cost ranges: • Range 1 to 49 50 to 79 80 to 99 100 or more To buy at $17 per cases, order at least 80 cases: TC 80 = (80 / 2)4 + (816 / 80)12 + 17(816) = $14154 • To buy at $16 per cases, order at least 100 cases: TC100 = (100 / 2)4 + (816 / 100)12 + 16(816) = $13354 Finally, 100 cases yields the lowest cost, therefore, optimal order quantity is 100 cases. TC1 00 TC 8 0 TC 7 0 Q * = 100 cases Price $20 $18 $17 $16 Example Surge Electric uses 4,000 toggle switches a year. Switches are priced as follows: 1 to 499, 90 cents each; 500 to 999, 85 cents each ; and 1000 or more, 80 cent each. It costs approximately $30 to prepare an order and receive it, and carrying costs are 40 percentage of purchasing cost per unit on an annual basis. Determine the optimal order quantity and the total annual cost. Demand 4000 switches per year Ordering cost: S = $30 Carrying cost: H = 0.4 p Range Price H 1 to 499 $0.90 0.36 500 to 999 $0.85 0.34 1000 or more $0.80 0.32 12-72 Example D = 4000 /yr S = $30 H = 0.40P Range 1 to 499 500 to 999 1000 or more Price $0.90 $0.85 $0.80 1. First Compute EOQ with each price: EOQ 0.90 = 2 DS = H 0.90 2(4000)30 = 816.49 0.36 EOQ 0.85 = 2 DS = H 0.85 2(4000)30 = 840.16 0.34 EOQ 0.80 = 2 DS = H 0.80 2(4000)30 = 866 0.32 H = 0.4P 0.4(0.90) = 0.36 0.4(0.85) = 0.34 0.4(0.80) = 0.32 Example D = 4000 /yr S = $30 H = 0.40P Range 1 to 499 500 to 999 1000 or more Price $0.90 $0.85 $0.80 H = 0.4P 0.4(0.90) = 0.36 0.4(0.85) = 0.34 0.4(0.80) = 0.32 1. Total cost with each price: EOQ 0.90 = 499 TC499 EOQ 0.85 = 840.16 499 4000 = (0.36) + (30) + 0.90(4000) = $3930.30 2 499 840 4000 TC840 = (0.34) + (30) + 0.85(4000) = $3686 2 840 EOQ 0.80 = 1000 1000 4000 TC1000 = (0.32) + (30) + 0.80(4000) = $3480 2 1000 Capacity Management with setup cost: Backorder Planned Shortage Model When an item is out of stock, customers may: Go somewhere else (lost sales). Place their order and wait (backordering). In this model we consider the backordering case. All the other EOQ assumptions are in place. If backordered are considered This EOQ modification is based on the assumption that in some cases the magnitude of penalty costs could make it economical for the batching policy Relevant Costs and Decisions Relevant Costs Setup Costs(S) Holding Costs(H) Penalty Costs(p) Decisions: The batch size (Q) The number of units backordered (B) The EOQ Model with Backorders Inventory Q-B B Shipment arrives Order cycle = T Time EOQ Costs Structure with Backorders Now Total Annual Relevant Costs G(Q,B) which are a function of both batch size Q and the maximum backordered quantity B are as follows (detail omitted) G(Q,B) = total setup costs + total holding costs + total backorder costs H G(Q,B) = DS/Q + [(Q-B)2/2Q]H + [B2/2Q]p You won’t need to remember this but you will need to know the derived Q* and B* The Results Q* = B* = Q* 2DS(H +p) pH H H+p High penalty cost… Note: As p goes to infinity B* = 0 Q* = B* = Q* 0 2DS(H +p) pH H H+p = = 2DS 2DS + p H H ∞ =0 G(Q,B) = DS/Q + [(Q-B)2/2Q]H + [B2/2Q]p High penalty cost… Note: As p goes to infinity B* = 0 Q* = B* = Q* 2DS(H +p) pH H H+p = = 2DS 2DS + p H H ∞ =0 0 G(Q,B) = DS/Q + [(Q-0)2/2Q]H + [02/2Q]p [Q/2]H The EOQ Model with Backorders Inventory Q-B B Shipment arrives Order cycle = T Time The EOQ Model with Backorders Inventory Q Time Shipment arrives Order cycle = T