ffirapt*r

INTRODUCTION

Finance is the lifehload of business coneefl1 because it is interlinked with all activities

performed by the business corisern. In a human body if blood circulation is not proper,

body function will stop. Similarly, if the finanw r,at being properly arranged, the business

system will stop. Arrangement of the required finance to each department of business

concern is highly a complex one and it needs carefu1 decision. Quantum of filanee rnay be

depending upon the nature and sitnation of the business concerrr. But, the requirement of

the finance maybe broadly classified iri.to two parts:

Long-term Financial Requirements or Fixed Capital Requirement

Financial requirement of the business differs from firm to firm and the nat*re of the

requirements on the basis of terms or period of financial requirement, it may be long ter:a

and short-term financial requirements.

Long-term financial requirement m€ans the finance needed to acquire land andbuilding

for business cafrcerrl, purchase of plant and machinety and other fixed ezpenditure. Longterm financ.ial requirement is also called as fixed capital requirements- Fixed capital is the

capital, which is used to purchase the fixed assets of the firms such as land and truilding,

furniture ald fittings, plant and macHrcery, etc. llence, it is also called a capital expenditure.

Short-term Financial Requirements or Working Capital Requirement

Apart from the caprtaT expenditure of the firus, the firms should need certain expenditure

like procurement of raw materials, pa;rment of wages, day-to-day expenditures, etc. Ttris

kind of expenditure is to rreet with the help of short-term financial requirements which

will meet the opetational expenditure of the firms. Short-term financial requirements are

popularly known as working capitai.

Financial Managemefit

SOURCES OF FINANCE

Sources of finance mean the ways for mobilizing various terms of finance to the industrial

concern. Sources of fi.nance state that, how the €ompanies are msbilizing finance for their

requirements. The companies belong to the existing or the new which need sum amount

of finance to meet the long-term and short-term requirements such as purchasing of fixed

assets, construcdon of office building purchase of raw materials aad day-to-day expelrses.

Sources of finance may be classified under various categories according to the

following important heads:

1. Based on the Period

Sources of Finance ruaybe classified under various categories based on the period.

Long-term sourscs: Finance ru,aybe mobilized by loug-term or short-term. When

the filance mobilized with large amouat and the repayable oyer the period will

be more tJlan five yeats, it may be cansidered as long-tefin sou{ces- Share capital,

issue of debenture, long-term loars frcm financial ir:stitutions aad ccmmercial

banks come under this kind of source of finance. Long-term source of finalce

needs to meet ti.e capital expenfiture of the firms xrch as purchase of fixed assets,

land and buildings, etc.

Loa$-ter:m soilrses of finance include:

r Equity Shares

r

o

o

.

Preference Shares

Debenture

Lon$-term Loans

Fixed Deposits

Skort-teru sorrrses: Apart from the long-term aource of fi.nance, firms can

generate finance with the help of short-term sollrces like loans and advarces from

cornmercial banks, raoneylenders, etc. Short-term aource of firance neeils to meet

the operational expenditure of the business concern.

Short-ter:n source of fitance indrrde:

e Bank Credit

r Customer Advances

o Ttade Credit

. Factoring

r Public Deposits

. Money Market Instruments

2.

Based on Owaership

Sources of Finance nraybe classifred under various categories based on the period:

Sources of

Financing

27

An owrrership source of financ€ include

.

.

o

Shares capital, earnings

Retained earnings

r

r

r

Bonds

Surplus and Profits

Borrowed calrital include

r Debenture

3.

4.

Ptrblic deposits

toans from Bank and Fiaancial Tnstitutions.

Based on Sources of Generatiou

Sources of Finance rr.ay be classified into various categories based on the period.

Internal source of fraance ineludes

r Retained earnilgs

. Depreciation funds

r Surplus

Exterral sourc,es of firrance may be iaclude

r .Share capital

r Debenture

r Public deposits

. Loans from Banks and Financial institutions

Based iu Mode of Finance

Security finance may be include

o

o

Shares capital

Debenture

Retaired earnings may include

. Retained earnings

r I)epreciation funds

Loan finance may inslude

. Long-term loans from Financial Institutions

. Short-term loals frorn Commercial banks.

The above classificatiofls are based on ttre nature and how tle firance is mobilized

from various sources. But the above sources of finar.ce cartbe divided into three major

classifications:

r Securify Fiaance

r Internal Fiaance

r Loans Finance

28

SECURITY FINANCE

If the fi.nance is mobilized tlrough issue of securities suc,h as shares and debenture, it is

ca11ed as sectrity frnance. It is also calied as corporate securities. This type of finance

plays a major role in the fie1d of deciding the capital structure of the comparry.

Characters of Securitlr Finance

Security finance consists of the following important characters:

1. Long-term sollrces of finance.

2. lt lE also called as corporate securities.

3. Secudty finance includes both shares and debentures.

4. It plays a anajot role in deciding the capitai structure of the company.

5. Repayment of finance is very limited.

6, It is a major parl of the company's total capitalization.

Types of Security Finance

Security finance mayhe diviiled into two major

t5ryes:

1. Ownership securities or capital stoek.

2. Creditorship sesurities or debt capital.

Ownership Securities

The owrrership securities also called as capital stock, is commoaly called as shares. Shares

are the most Universal mettrod of raising finance for the business concern. Ownership

capital consists of the foliowing ffies of securities.

o

.

.

e

Equity

Shares

Preference Shares

No par stock

Deferred Shares

EQUITY SHARES

Equity Shares also known as ordiaary shares, which mearls, other than prefereace shares.

Equity shareholders are the real owners of the coflpary. Ttey have a cortrol over the

ft*rLagemer,;tof the eompany- Equity shareholders are eligible to get dividend if the company

earns profit. Equrty share capital canaot be redeemed during the lifetiae of the company.

The liability of the equity shareholders is the value of unpaid value of skares.

Features of Equity Shares

Equity shares consist of the following imporlant features:

1. Maturity of the shares: Equity shares have permaaent

has no maturity period.

nature of capital, which

It cannot be redeemed. duriag the lifetime of the company.

Z" Residual claim on ineome: Equity shareholders have the right to giet income

left after paytrrg ftxed, rate of dividead. to preference

3.

4.

5.

6.

7.

sh.areholder. The earnings

or the income availahle to the shareholders is equal tc tle profit after tax misus

preference dividend.

Residual claims orr assets: ff the company wound up, the ardinary or equity

shareholders have the right to get the claims ou assets. These rights are only

available to the equity shareholders.

Right to control: Equity shareholders are the real owners of the company.

Hence, they have power to control th€ management of the company and-they

have power to take any decision regarding the business operation.

Voting rigfuts: Equity shareholders have voting rights in the meeting of tke

company with the help of votiag right power; they can clnarrge or remorre any

decision of the business corrcerfl. Equity shareholders only have voting rights

in the colupany meetiag and also they can nominate proxy to participate and vote

in the meeting instead of the shareholder

Pre-emptive right Equity shareholder pre-emptive rights. The pre-ercptive right

is the legal right of tle existing shareholders. It is attested by the company in the

first opportunity to purchase additioaal equity shares in proporbion to their

current holding capacily.

Liinited liability: Equity shareholders are hardxg caiy limited liability to fhe

value of shares they have purchased. If the shareholders are having fu1ly paid

up shares, they have no 1iabi1i4z. For example: If the shareholder purchased 100

shares with the face value of Rs. 10 each. He paid only Rs. 900. His liability is

only Rs. 100.

Total number of shares 100

Face value of shares Rs. 10

Total value of shares 100 x 10 : 1,000

Paid up value of shares

900

Unpaid valueAiability

100

Liabilify of the shareholders is only ,rrpl-idorlrre of the share [that is Rs. 100).

Advantages of Equity Shares

Equity shares ate tlre most common and universally used shares to mobilize finance for

the company. It consists of the followiag advaatages.

1. Perrranent sources of fin*rcc: Equity share capital is belonging to longi-term

permanent nature of sources of fi:rance, hence, it car. be used for long-term or

fixed capital requirement of the business coflcefll2. Voting rigfits: Equity shareholders are the real owners of the compalry who have

voting rights. This lype of advantage is available only ta the equity shareholders.

3. No ftxed diyidend: Equity shares do not create any obligation to pay a fixed

rate of dividend. If the campany earns profiq equity shareholders are eligible for

F in a nci al

30

4.

5.

lL4 a

n a ge m e nt

profit, they arc eligible to get dividend otherwisg ard tkey eannot claim arry

dividend from the eompany.

Less ccst of capital: Cost of capital is the major factor, r,rhich affects the value

of the sompany. If the cafrpany warlts to inctease the value of the caryany,

they lrave to use more share capltai because, it eonsists of less cost sf capital (K")

while corrpared to other sources of finance.

Retained earnings: When the company have roore share capital, it will be

suitable for retained earnings which is the less cost sources of fiaance while

campared. to other sources of finarrca

Disadvantages of Equity Shares

1.

Irredeemable: Equity shares cannot he redeemed during the lifetime of the

It is the most dangierous thing of oyer capital:u:atian.

Obstacles in managieuerrt: Equrty shareholder calr put obstacles in management

business concertl.

2.

by manipulation and crrganizing themselves. Becaus€, they have posrer to contrast

any decision which are agair:st the wealth of the shareholders.

3.

4.

5.

Leads to speculation: Equity shares dealiugs in share market lead to secularism

during prosperolls periods.

rirrrited income to investor: The Investors who desire to invest in safe securities

with a fixed income have no attraction for egnity shares.

No trading on equity:When the company raises capital or:ly with the heip of

equlty, the compaay cannot take the advantage of trading on equity.

PREFERENCE SHARES

Tlee parts of corporate securities are called as preference shares. It is the shates, which

have preferential right to get dividend and get back the initial investment at the time of

winding up of the company. Prefereoce shareholders are eligible to get fixed rate of dividend

and they do not have votingirights.

Preference shares may tre classified into the following major t5rpes:

1.

2.

Cumulative preference shar,es: Cumulative preference shares have rig;ht to claim

fividends for those years which have no profits. If the company is unable to ear"n

profit in alry orle or mors years, C.P Shares are unable to get any dividend but

they have right to get the comparative dividend for the previous years if fhe

cofrt)any earned profit.

Non-cumulative preference sLares: Non-cumulative prefersrce shares have no

right to enjoy the above benefits. They are eligible to get only dividend if the

coupany earns profit during the years. Otherwise, they cannot claim any dividend.

Sources of Financing

3.

Redeenalole prefereree shares; When, the preference shares have a fixed

maturity period it becomes redeemable preference shares. It can be rcdeem&le

during the lifetime of the comparly. The Comparry Act has provided certain restrictioas

on the return of tke redeemable preference

shares.

lrredeemable Preference Shares

Irredeemabl e preferer,ce shares can be redeemed orly when the company gaes for liquidator.

There is no fixed maturity period for such kind of preference shares.

Participating Preference Shares

Participating preference sharesholders have rigfirt to participate extra profrts after distributing

the equity shareholders.

Non-Participating Preference Shares

Non-participating preference sharesholders are not ba,irg aay right ta partidpate extra

profits after distributing to the equity shareholders. Fixed rate of dividend is payable to

the type of shareholders.

Convertible Preference Shares

Convertible preference sharesholders have right to conrrert their holding into equity shares

after a specific period. The articles of association must authorize the right of conversion.

Non-convertible Preference Shares

There shares, cannot be converted into equity shares from preference shares.

Features of Preference Shares

The following are the important features of the preference shares:

1. Maturity period: Norrnal11, preference shares have no fixed maturity period

except in the case of redeemable preference shares. Prefetence shares can be

redeemable on11, 21 the time

of

tl-re cornpaflv liquidation.

2. Residual claims on income: Preferential

sharesholders have a residual claim

ot.r

income. Fixecl rate of dir.idend is payable to the preference shareholdets.

3. Residual claims on assets: The first preference is given to the pleference

shareholders at the time of liquiclation. If any extra Assets are available tjrat

should he distributed to equity shareholder.

4. Control of Management: Preference shareholcler does not have any voting

rights. Helrce, they cannot have control over the mana$ement of the company.

Advantages of Preference Shares

Preference shares have the follorving important advantages.

1. Fixed dividend: The dividend rate is fixed in the case of preference shares.

It is cal1ec1 as fixed income securitv because it provides a constant rate of income

to the investors.

32

Financial hlanagement

2. Cumulative dividends:

3.

Preference shares have ansther advanta€e rn,hic} is

called cumulative dividends. If the company cloes not earn any profit in any

previotrs years, it can be cumulative with future period dividend.

Redemption: Preference Shares can he redeemable afLer a specific period except

in the case of irredeemable pref'erence shares- There is a fixed maiurity period

for repayment of the initial investrnent.

4. Partieipation:

Participative preference sharesholders can participate in ihe surplus

profit atter distribution to rhe equiq' shareholders.

5. Convertibility: Convertibilitv prefer-ence shares can be conrzerted into equity

shares rvhen the articles of assoc,iation provide such convelsion.

Disadvantages of Preference Shares

1. Expensive sources of finance:

Preference shares have high experrsive source

of finance nhile compared to equirv shares.

Z. No voting right: Generaliy preference sharesholders do not have any vcting

3.

4.

5.

rights. Hence they cannot have the control over the managemeflt of the company.

Fixed dividend only: Preference shares can get only fixed rate of ciir,.idend. The-v

may not enjoSz uore profits of the c.ompany

Permanent burden: Cumulatir,'e pref'erence shares become a pexmalrent burden

so far as the payment of dividend is concerned. Because the companv must pay

the dividend for ttrre unprofitable periods a1so.

Taxation: In the taxation point of viern, preference shares diviclend is not a

deductible expense while calculatrrig tax. But, intelest is a deductible exper:se.

Hence, it has disadvantage orr the tax deduction poir:rt of vieqr

DEFERRED SHARES

Deferred shares also ca11ed as founder shares because these shares were normally issued to

founders. Tte shareholders have a preferential right to get dividend befare the preference

shares and equity shares. According to Companies Act 1956 no public limited coilpany or

which is a subsidiary of a public company can issue deferred shares.

T'hese shares were issued to the founder at sma1l deaomination

management by the virlue of their voting rights.

to control over the

NO PAR SHARES

it is said to be no par shares. The company

issues this kind of sharss which is divided iato a number of specific shares witlout any

specific denomination. The value of shares can be measured by dividing the real net worth

lMhen the shares are haviag no face valug

of the company with the total rumber of shares.

\hlue of no- per share-

:

IJreleal networth

Toklno.of shares

Sorrrces of Financing

CREDITORSHIP SECURITIES

Creditorship Securities also lcnown as debt finance which means the finaace is mobilized

from the creditors. Debenture and Bonds are the two major parts of the Creditorship

Securities.

Debentures

A Debenture is a document issued by the company. It is a certificate issued by fhe company

under its seal acknowledging a debl.

According to the Companies Act 1956, "debentare includes debenture stock, bonds

and any other securities of a company whether constituting a charge of the assets of tke

company or not."

Types of Debentures

Debentures may be divided into the foliowing major

1.

t5ryes:

IJnsecured debetfures: {Jnsecured debentures are not given any securilr on

assets of the company. It is also called simple or naked debentures. This type

of debentures are treaded as unsecured sreditors at the time of winding up of the

compafly.

2.

3.

4.

5.

6.

Secured debentures: Sefilred debentures are given security ou assets of the

cofrparty. It is also called as mofrgaged debentures because these debentures are

given agailrst any mortgage of the assets of the company.

Redeemahle debentures: These debentures are to be redeemed on the expiry

of a certain period. The interest is paid periodically and the initial investment is

returned after the fixed maturity period.

Irredeemable debentures: These kind of debentures caanot be redeematrle

during the life time of the business corcerfl.

Convertible deberrtures; Convertible debeatnres ate the debentrrres whose holders

have the option to get them converted wholly or partly into shares. These

debeatures are usually converted into equity shares. Conversion of the debentures

may be:

Noa-coavsrtible debentures

Fully canvertible debentures

Par$y convertible debenfirres

Other t5ryes: Debeahres can also be classified into the following t;ryes. Some

of the commcll tygres of tlle debeafirres are as follows:

1. Collateral Debenture

2. GuaranteedDeberture

3. First Debenture

4. Zeto Coupon Bond

5. Zera hterest Bond/Debenture

Financial Management

34

Features of Debentures

1. Maturity period: Debentures consist of long-term fixed maturity period" Normally,

del:entures consist of 10-20 years matrrity period and are repayable with the

principle investrnent at the end of the maturity period.

2. Residual claims in income: Debenture holders are eligible to get frxsd rate af

interest at every end of the accoullting! period. Debenture holders bave pn<trily

of claim in income of the company over equit;r and preference shareholders.

3. Residual clafurs or asset: Debenfiffe holders have priority of claims on Assets

of the company over equity and prefera:ce shareholders. Ttre Debenture holders

way tnve either specific change on the Assets or floating change of the assets

of the company. Specific change of Debenture holders are treated as secured

creditors and floating change of Debenture holders are treated, as unsecured

creditors.

4. No voting rigft.ts: Debenture holders are considered as creditors of the compairyHence they have no voting rights. Debenture holders cannot have the control

over the pertotmance of the business concern.

5. Fixed rate of irterest: Debentures vield fixed rate of interest ti11 the maturitv

period. Hence the business will not affect the yield of the debenture.

Advantages of Debenture

Debenture is one of the major parts of the long-term sources of finance which of consists

the following important advantages:

1. Lon$-teru solrrces: Debenture is one of the loag-term sources of filance to the

company- Normally the maturity period is longer than the othgr sources of finance.

Fixed

2rate of interest Fixed rate of interest is payable to debenture holders,

hence it is most suitable of tle companies earn higfter profrt. Generally, the rate

of interest is lower than the other sources of lor:g-term, fttatce.

3. Trade on equity; A company can trade on equity by mixing debentures in its

capital stmcture and theretry increase its earning per share. When the company

appiy the trade on eqJLty concept, cost of capital will reduce and value of the

coapany will increase

4. Ineome tax deduetion: Interest payable to debentures can tre deducted from the

total profit of tke compa11y. SCI it hehs to reduce the tax trurden of the company.

5. Protection: Various provisions of the debenture trust deed and the guidelines

issued by the SEB1 protect the interest of debenture holders.

Disadvantages of Debenture

Debenture finance consists of the following major disadvantages;

1. Fixed rate of interest: Debenture

coasists of fixed rate of iuterest payable to

securities. Even though the company is unable to earn profit, they have to pay

the fixed rate of interest to debenture holders, hence, it is not suitable to those

coffipany earnings which fluctuate considerably.

Sources of

Financing

35

2. No voting rigftts: Debenture h,:lders

3.

do not have any voting rights. Hence, they

caflnot have the control over the managetnellt of the compal1y.

Creditors of the eompany: Debenture holders are *rerely creditors and nr:t the

owners of the company. The-v do not have any claim in the surplus profits of

the company.

4. HigL risk: Every additional issue of debentures becomes more risky and costly

ol account of higher expectation of debenture holders. This enhanced financial

risk increases the cost of equity capital and the cost of raising finance through

debentures which is also high because of high starrp du(y.

5. Restrictions of further issues: T'he company canilot raise further finarce

through debentures as the debentures are undet the part of securitv of the assets

already mortgaged to debenture holders.

INTERNAL FINANCE

A company can mobilize finance throu$h external and internal sources. A neu, coxlpany

rnay not rajse inter:ra1 soutces of flnance and the3. can raise finance only external sources

such as shares, debentures and loans but an existing company can raise both internal ancl

external sources of finance for their financial requir-ements. trnternal finance is also one of

the important sources of finance and it consists of cost of capital rnhile compared to other

sources of finance.

Internai source of finance may he

A. Dcpreciation Funds

B.

broadlSz classified

into nvo categories:

Reraiticd earnings

Depreciation Funds

Depreciation funds are the major part of internal sources of finance, r,vhich is used to meet

the working capital requirements of the business conce n. Deprec ation means decrease in

the value of asset due to wear and tear, lapse of time, obsolescence, exhaustion and accident.

Generally depreciation is changed against fixed assets of the compally at fixed rate for

eyery year. The purpose of depreciation is rep'lacement of the asse[s after the expited

period. It is one kind of provision of fund. u'hich is needed to reduce the tax burderr and

overall profitabili6, of the company.

Retained Earnings

Retained earnings are another method of internal sources of finance. Actually is not a

method of raising finance, J:ut it is cal1ed as accumulatir:n of profits by a company fbr its

expansion and diversification activities.

Retained earnings are called under different names such as; self finance, inter finance,

plugging

ancl

back of profits. Accorcling tr:r the Companies ,tct 1956 certain percentage, as

prescribed by the central governnent (not exceeding 10926J of the net profits after tax of a

35

Fiiancial Management

fiaancial yearhave to be compulsorily traasferred to reserveby a comFanybefore declaring

dividends for the year.

Under the retained earrrings sources of frnancg a part of the total profits is transferred

to various reserves such as $eneral reserve, replacement fund, reserve for repairs and

renewals, reserve funds and seerete reserves, eta

Advantages of Retained Earnings

Retained earnings consist of the following important advantagies:

1. Useful for e4lmr.sien aad diversification: Retained earaiags are mcst usefi:l

to expansion and diversification of *re business activities.

2. Economical sources of ffnans€: Retained earnings are one of the least costly

sources of finance since it does not involye any floatatton cost as in the case of

raising of funds by issuing different types of securities.

3. No fixed obligation: If the companies use equity finance lhey have to pay

dividend and if the ccmpanies use debt finance, they have to pay interest. But

if the compatly uses retained earni:rgs as solrces of finance, they need not pay

any fixed obligation regarding the payment of dividend or interesl

4. Flexible sources; Retained earnings a1low the financial structure to remain

completely flexible. The company need not raise loals for further requirements,

if it has retained earningg.

5. krsrease the share value: When the company uses tle retained earnings as the

sources of finnngs for their financial requiremerrts, the cost of capital is very cheaper

than tha other sources of finance; Hence the value of the share will iacrease.

g. Avoid excessive tax: Retained earnings provide oppottunities for evasion of

excessive tax in a €ompany when it has small number of shareholders.

7. Irrcrease earrirrg capacity: Retained earnings consist of least cost of capital and

also it is most suitable to those companies which go for diversification arrd expansionDisadvantages of Retained Earnings

Retained earnings also have certain disadvantages:

1.

2.

3.

Misuses: The management by manipulating the value of the shares in the stock

market can misuse the retailed earnings.

Leads to monopolies: Excessive use of retained earrings leads to monopolistic

attitude of the caffipany.

Over capitelizs{6113 Retained earnings lead to over capitalization,because if the

company uses more and more rctained, earnings, it leads to insufficient source

of fi.nance.

4.

Tax evasioru Retained earnings lead to tax evasion" Since, the company reduces

tax burden fhrough the retaiaed earnings.

Sources of Fhancina

5.

37

Dissatisfaction: If the catrLparly uses retaiaed earnings as sources of finaace, the

shareholder can't get raore dividends. So, the shareholder does rot like to use

the retained earnings as sourcs of finance in all situations.

LOAN FINANCING

Loan financing is the importaat mode of finance raised. by the comparly. Loan finance may

be divided into two !ryes:

(uJ Long-Term

(b)

'

Sources

Short-Term Sources

Loan finance can be raised through the following itrFortant institutiores.

Specialist Institutions

Commercial Banks

Domestic

Frnance

Currency

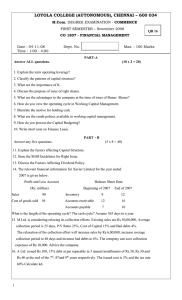

Fig. 3.1 Loan Financing

Financial lnstitutions

'With the effect of the industrial revaluation,

the government established nation wide and

state wise financial industries to provide long-term financial assistaace to industrial concerns

in the country. Financial institutions play a key role in the fie1d of irdustriai development

and they are meeting the financial requirements of the trusirless concern. IFCI, ICICI, IDBI,

SFC, EXIM Bark, ECGC are the famous financial institutio::s irr the country.

Commercial Banks

Commercial Banks normally provide short-tetm finance which is repayable within a year.

The major finance of commercial banks is as follows:

Shart-term advance: Commercial banks provide adva*ce to their customers with or

without securities. It is one of the most corrmoll a1ld -id"1y used short-tern sources of

financg which are needed to meet the working capital requirement of the company.

It is a cheap so.$rce af {tta*ce, which is in the form of pledge, mortgagg hypothecation

and trills discounted and rediscounted.

38

Financial Management

Short-term Loans

Commercial banks also provide loans to the business carrcerr, to meet the short-term

financial requirements. When abartkmakes ,n advaoce in lu:np sum against soae securit;r

it is termed as 1oan. Loan may be irr the following form:

(")

(b)

Cash credit: A cash credit is an arrangement by which a bank allcws his customer

to borrow molley up to certain limit against the security of the commodity.

Overdraft: Overdraft is an arrangement with a bank try which a srrrent account

holder is allowed to withdraw more than tle bala:rce to his credit up to a certain

limit without any securities.

Development Banks

Developmentbanks were established mairrly for the purpose of prouotion and development

the industrial sector iu tke coar;rtry. Presently, large number of development banks are

functioningwithmultidimensional actiyities. Developmentbanks are also called as financial

institutions or statutory firancial institutiors or statutory non-baaking institutions.

Development baaks provide two imporlant types of finance:

(u) Direct Finance

(b) Indirect Finance/Refinance

Some of the important development banks are discussed

in Chapter

11.

PresentJy the commercial banks are providing all kinds of financia1 seryices including

development-banking services. And also nowadays developmeat banks and specialisted

firraneial institutioas are providing all kinds of firralcial services including commercial

banking services. Diversified and $obal finaacial seryices are unavoidable to the preseat

day econorrics. Heacg we can classify the finaucial iastitutions only by the strucfl:re and

set up and not by t}le services provided try them-

MODEL SUESTIONS

1.

2.

3.

4.

5.

6.

7.

8.

Explain tie various souices of financing.

What is meant by seanrity financinf

lVhat is debt finaucing?

Critically exansiae &e advantages and disadvaotages of equiSr

Discuss the features of equify shares.

What are the merits of tke &eterced shares?

E4pdin the merits and demerits of preference shares?

List out tke t5ryes of debentures.

shares.