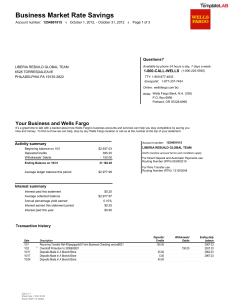

Business Market Rate Savings Account number: 1254691015 ■ October 1, 2012 - October 31, 2012 ■ Page 1 of 3 Questions? Available by phone 24 hours a day, 7 days a week: LIBERIA REBUILD GLOBAL TEAM 6528 TORRESDALE AVE PHILADELPHIA PA 19135-2822 1-800-CALL-WELLS (1-800-225-5935) TTY: 1-800-877-4833 En español: 1-877-337-7454 Online: wellsfargo.com/biz Write: Wells Fargo Bank, N.A. (338) P.O. Box 6995 Portland, OR 97228-6995 Your Business and Wells Fargo It's a great time to talk with a banker about how Wells Fargo's business accounts and services can help you stay competitive by saving you time and money. To find out how we can help, stop by any Wells Fargo location or call us at the number at the top of your statement. Account number: 1254691015 Activity summary Beginning balance on 10/1 Deposits/Credits Withdrawals/Debits Ending balance on 10/31 Average ledger balance this period $2,937.03 395.25 - 150.00 $3,182.28 $2,977.99 LIBERIA REBUILD GLOBAL TEAM North Carolina account terms and conditions apply For Direct Deposit and Automatic Payments use Routing Number (RTN): 053000219 For Wire Transfers use Routing Number (RTN): 121000248 Interest summary Interest paid this statement $0.25 Average collected balance $2,977.99 Annual percentage yield earned 0.10% Interest earned this statement period $0.25 Interest paid this year $0.96 Transaction history Date 10/1 10/2 10/11 10/17 10/24 Description Recurring Transfer Ref #Opeqqppd8G From Business Checking xxxxxx5821 ✳ Overdraft Protection to 3395605821 Deposit Made In A Branch/Store Deposit Made In A Branch/Store Deposit Made In A Branch/Store (338) Ins = 1 Sheet Seq = 0003595 Sheet 00001 of 00002 Deposits/ Credits 150.00 Withdrawals/ Debits 150.00 25.00 5.00 40.00 Ending daily balance 3,087.03 2,937.03 2,962.03 2,967.03 Account number: 1254691015 ■ October 1, 2012 - October 31, 2012 ■ Page 2 of 3 Transaction history (continued) Date 10/24 10/31 10/31 Description Deposit Made In A Branch/Store Recurring Transfer Ref #Ope88Pbz6B From Business Checking xxxxxx5821 Interest Payment Deposits/ Credits 25.00 150.00 0.25 Withdrawals/ Debits Ending daily balance 3,032.03 3,182.28 Ending balance on 10/31 3,182.28 Totals $395.25 $150.00 The Ending Daily Balance does not reflect any pending withdrawals or holds on deposited funds that may have been outstanding on your account when your transactions posted. If you had insufficient available funds when a transaction posted, fees may have been assessed. ✳ Indicates transactions that count toward Federal Reserve Board Regulation D limits. Please refer to your Account Agreement for complete details of the federally-mandated transaction limits for savings accounts. Account transaction fees summary Service charge description Deposited Items Total service charges Units used 4 Units included 20 Excess units 0 Service charge per excess units ($) 0.50 Total service charge ($) 0.00 $0.00 Account number: 1254691015 ■ October 1, 2012 - October 31, 2012 ■ Page 3 of 3 General statement policies for Wells Fargo Bank Notice: Wells Fargo Bank, N.A. may furnish information about accounts belonging to individuals, including sole proprietorships, to consumer reporting agencies. If this applies to you, you have the right to dispute the accuracy of information that we have reported by writing to us at: Overdraft Collections and Recovery, P.O. Box 5058, Portland, OR 97208-5058. ■ Account Balance Calculation Worksheet You must describe the specific information that is inaccurate or in dispute and the basis for any dispute with supporting documentation. In the case of information that relates to an identity theft, you will need to provide us with an identity theft report. Number Items Outstanding 1. Use the following worksheet to calculate your overall account balance. 2. Go through your register and mark each check, withdrawal, ATM transaction, payment, deposit or other credit listed on your statement. Be sure that your register shows any interest paid into your account and any service charges, automatic payments or ATM transactions withdrawn from your account during this statement period. 3. Use the chart to the right to list any deposits, transfers to your account, outstanding checks, ATM withdrawals, ATM payments or any other withdrawals (including any from previous months) which are listed in your register but not shown on your statement. ENTER A. The ending balance shown on your statement . . . . . . . . . . . . . . . . . . . . . .$. ADD B. Any deposits listed in your register or transfers into your account which are not shown on your statement. $ $ $ + $ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . TOTAL ......$ CALCULATE THE SUBTOTAL (Add Parts A and B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . TOTAL ......$ SUBTRACT C. The total outstanding checks and withdrawals from the chart above . . . . . . . . . . . . . - $ CALCULATE THE ENDING BALANCE (Part A + Part B - Part C) This amount should be the same as the current balance shown in your check register . . . . . . . . . . . . . . . . . . . . . . . . . . .$. . Total amount $ ©2010 Wells Fargo Bank, N.A. All rights reserved. Member FDIC. NMLSR ID 399801 Sheet Seq = 0003596 Sheet 00002 of 00002 Amount