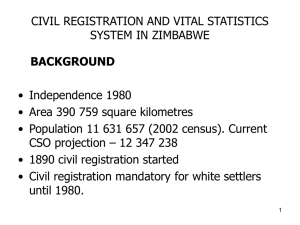

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/314154884 Zimbabwe Post Independence Economic Policies: A Critical Review Book · February 2017 CITATIONS READS 2 75,287 2 authors: Vusumuzi Sibanda Ranganayi Makwata National University of Science and Technology, Bulawayo National University of Science and Technology, Bulawayo 9 PUBLICATIONS 5 CITATIONS 1 PUBLICATION 2 CITATIONS SEE PROFILE SEE PROFILE Some of the authors of this publication are also working on these related projects: The Impact of Multi-Currency System on the Viability of the Zimbabwean Hospitality System View project Customer Relationship Management as a Customer Retention Tool View project All content following this page was uploaded by Vusumuzi Sibanda on 22 December 2017. The user has requested enhancement of the downloaded file. ! ! ! " ! # # " " $ % $& '()*+& , -. () /0 1 &) 2 - & 3 ) /4 ! ! ! ""# $ % ! " # $ !% ! & $ ' ' ($ ' # % % ) % * % ' $ ' + " % & ' !# $, ( $ - . ! "- ( % . % % % % $ $ $ - - - - // $$$ 0 1"1"#23." 4& )*5/ +) 678%99:::& % 2 ; ) - * & /- <0 & %3 -# $ /- <7=:>4& )*5/ +) "3 " & 7=:> Zimbabwe Post Independence Economic Policies: A Critical Review. 1. Vusumuzi Sibanda – Lecturer Graduate School of Business: NUST, Zimbabwe. 2. Ranganayi Makwata – Financial Analyst with Zfn Capital, Zimbabwe. Abstract In its 36 years of existence as an independent state since 1980, Zimbabwe has come up with several economic blueprints aimed at promoting sustainable economic growth and poverty alleviation. Early years of independence were marked by policies aimed at redressing colonial era imbalances by assimilating previously marginalized people into the mainstream economy. These people did not have the means and capacity to participate in the economic programmes and government had to assist them through providing free education and health, job creation and land resettlement. Later on the thrust was to wean off the citizens from too much dependence on government for survival with the economy moving from being tightly controlled to liberalisation. This conceptual paper seeks to evaluate the country’s post independence economic policies and the impacts thereof. It will take note of success stories from the different economic policies but will argue that in general they have not been very successful because of poor implementation and excessive political expediency by national leaders. Current economic problems cannot be solved by more blueprints but require policy makers to change their paradigms towards prudent economic management and eradicate social ills such as corruption while reengaging the world as opposed to narrowly focusing on one side under the Look East Policy. Key words: post independence, economic policies, economic liberalisation Contents 1.0 Introduction and Background ..................................................................................................... 2 2.0 Economic Policies Since Independence ...................................................................................... 3 3.0 Review of economic policies ....................................................................................................... 4 3.1 Growth with Equity (GWE) 1981 ................................................................................................... 4 3.1.1 Growth with Equity Success Stories ....................................................................................... 5 3.1.2 Problems with Growth with Equity ........................................................................................ 6 3.2 Transitional National Development Plan (TNDP) (1982-90) ................................................... 7 3.3 The First Five Year National Development Plan (FFYNDP) 1986-1990.................................. 8 3.4 The Economic Structural Adjustment Programme (ESAP) (1991-1995) ............................... 11 3.4.1 3.5 Outcomes of ESAP ......................................................................................................... 12 Zimbabwe Programme for Economic and Social Transformation (ZIMPREST)..................... 14 3.5.1 ZIMPREST Outcomes ............................................................................................................ 17 3.6 Vision 2020 and Long Term Development Strategies ........................................................... 18 3.7 Zimbabwe Millennium Economic Recovery Programme (MERP) (2000-2001) .................... 19 3.8 The National Economic Revival Programme (NERP) ............................................................. 20 3.9 Macro- Economic Policy Framework (MEPF) (2005-2006) ................................................... 21 3.10 National Economic Development Priority Programme (NEDPP) (2006-2008) ..................... 22 3.11 Zimbabwe Economic Development Strategy (ZEDS) (2007-2011)........................................ 22 3.12 Short Term Emergency Recovery Programme (STERP) (2009) ............................................. 24 3.13 STERP II: The Three Year Macro-Economic Policy and Budget Framework for the years (2010 – 2012) .................................................................................................................................... 25 3.13.1 Challenges to STERP ........................................................................................................... 26 3.14 Medium Term Plan (MTP) (2010-2015) ................................................................................ 28 3.15 Zimbabwe Agenda for Sustainable Socio-Economic Transformation (ZIMASSET) ............... 29 3.15.1 Challenges to ZIMASSET ..................................................................................................... 32 4.0 4.1 4.2 Economic Performance since 1980 ........................................................................................... 34 Current Economic Situation .................................................................................................. 39 Notable policy announcements which upset the economy ................................................. 40 5.0 Recommendations .................................................................................................................... 42 6.0 Conclusion ................................................................................................................................ 45 References ............................................................................................................................................ 46 1 1.0 Introduction and Background Since independence in 1980, policy makers in Zimbabwe have come up with quite impressive economic policies some of which if pursued and implemented judiciously would have resulted in notable prosperity for the country and its people. Sichone (2003) notes that soon after independence, the country embarked on a programme of post-war reconstruction with the support of some foreign donors. In general terms, he argues, the reconstruction was successful as the economy was re-capitalised and reintegrated into the world economy. The new Government faced the pressing challenge of reconstituting and realigning the inherited national policy making structures in line with the new socio-politico-economic dispensation that had set in. Inherited national policy making systems and processes needed to be transformed from minority-focused to majority-focused institutions. The inherited economy was also fraught with embedded inequalities in income and wealth distribution, with the agricultural, education, industrial and banking sectors among the most visibly affected. Against this background, the need to address inequalities and injustices wrought by yesteryear policies underpinned policy making during the first decade. It also underlined the state-centric nature of policy making in parastatal, agricultural, health, education, labour and social welfare sectors. The new Government viewed itself first and foremost as the central instrument through which yester-imbalances were redressed (Zhou & Zvoushe, 2012). The government hosted the Zimbabwe Conference on Reconstruction and Development (ZIMCORD) in Harare on 23-27 March 1981 and the conference sought financial assistance from the international community for reconstruction of the country and to lay groundwork for sustainable development in future. Subsequent to that conference the government embarked on rebuilding and for the past 36 years it has been coming up with several economic reform programmes. From 1980 to date, Zimbabwe’s economic performance has been mixed, the instability has been influenced by policy lapses, adverse weather conditions that affected agricultural output, high levels of foreign capital inflows at independence in 1980, redistributive fiscal policies that focused on increased Government spending on health, education etc. and other social welfare programmes within the framework of the economy. The country recorded its strongest post-independence growth performance during the period 1980-90 with gross domestic product (GDP) growing by an average of around 5.5 percent and a record low performance of -17.70 percent in 2008. The government has over the years put in place different economic policies. 2 2.0 Economic Policies Since Independence Table 1 below shows a timeline of some of the most notable programmes in date order. Table 1: Economic policies timeline (1980-2018) DATE 1-Feb-81 18-Jan-91 20-Feb-98 29-Mar-00 1-Aug-01 1-Feb-03 1-Nov-04 1-Apr-06 30-Sep-07 19-Mar-09 23-Dec-09 1-Jul-11 1-Oct-13 POLICY Growth with Equity (GWE) Transitional National Development Plan (TNDP) First Five Year National Dev Plan (FFYNDP) Economic Structural Development Programme (ESAP) Zimbabwe Programme for Economic and Social Transformation (ZIMPREST) Vision 2020 & Long Term Development Strategy Millenium Economic Recovery Programme (MERP) National Economic Revival Programme (NERP) Macro Economic Policy Framework (MEPF) National Economic Development Priority Programme (NEDPP) Zimbabwe Economic Development Strategy (ZEDS) Short Term Emergency Recovery programme (STERP I) Short Term Emergency Recovery programme (STERP II) Medium Term Plan (MTP) Zimbabwe Agenda for Sustainable Socio-Economic Transformation (ZIMASSET) PERIOD COVERED 1981 1982-1985 1985-1990 1991-1995 1996-2000 1997-2020 2001-2002 2003-2004 2005-2006 2006-2008 2007-2011 2009 2010-2012 2011-2015 2013-2018 According to Gibbon (1995: in Sichone, 2003), “Zimbabwe’s social and economic policies can be grouped into four main phases in post-colonial era.” “The first, from independence to 1982 was accompanied by an economic boom and characterized by twin phenomena of the adoption of redistributive policies and a high level of mutual suspicion between government and capital. A second phase, from 1982 to around 1986, contained two major economic recessions, a check on redistributive policies and continuing cool relations between government and capital. The third, dating from 1986 to 1990 involved the resumption of a degree of economic growth and the downplaying of redistribution. The fourth, that of structural adjustment began in 1990 and has been marked by a very severe drought and economic contraction, an implicit rejection of redistributivism and liberal economic policies.” From 1995 many more phases were also observed and in particular, 1995-2000 was the beginning of economic decline marked by economic shocks induced by the 1997 unplanned payouts to Veterans of the Liberation War and the cost of engaging in the civil war in the Democratic Republic of Congo (DRC). A sixth phase can be added and this covers 20002008 which was highlighted by the chaotic fast track land redistribution programme, 3 emergence of vibrant opposition politics which sent the ruling party into panic mode and the unprecedented hyperinflation period which culminated into the discontinuation of the Zimbabwe dollar. Between 2009 and 2012 the country recorded tremendous economic growth of 5.4%, 9.6%, 10.6% and 4.4% in that order which was a big relief after a decline of 17.7% in 2008 and that coincided with the Inclusive Government which saw ZANU PF and MDC formations working together. Unfortunately since 2013 to date when the Inclusive government was replaced by a wholly ZANU PF government the country has been slowly reversing those gains as highlighted by slow growth rates of 4.5%, 3.5% and 1.5% for 2013, 2014 and 2015 respectively, company closures, rising unemployment and rampant street vending as people struggle to survive punctuated with the recent wave of demonstrations in 2016 as people vent their frustrations with the Government. In 2016 the economy contracted by 0.3% according to the International Monetary Fund (government in its 2016 Fiscal policy review announced a more optimistic 0.6% growth). The forecast for 2017 is higher negative growth rate of 2.5%, a return to inflation of 4.6% (inflation rate has been negative in the past few years). 3.0 Review of economic policies 3.1 Growth with Equity (GWE) 1981 According to Zhou and Masunungure (2006) the new government in 1980 inherited a dual economy of white large-scale farms and a stagnant impoverished communal sector. The new black government only had one option, to prioritize socio-economic policies and adopt stateled development strategies so as to address the colonial imbalances that were in existence. Anything short of this could have amounted to the state reneging on its liberation promises. To this end the black government adopted the Growth with Equity policy in 1981 as the first post-independence economic policy statement. Growth with Equity sought to: "Achieve a sustained high rate of economic growth and speedy development in order to raise incomes and standards of living of all our people and expand productive employment of rural peasants and urban workers, especially the former.” This policy was meant to address social economic disparities inherited from the colonial era and was used predominantly in 1982. It also formed the backbone of the 1982-85 Plan. The government wanted to vest control of economic activities in the hands of majority black 4 people. It allowed politically marginal large-scale white farming, industry and mining to continue their economic dominance. The policy mainly focused on redistribution of wealth, expansion of rural infrastructure and redressing social and economic inequality including land reform. The economy recovered significantly in the early years of independence averaging 10 percent growth during 1980-82. This was mainly because the country had inherited one of the most structurally developed economies and effective state systems in Africa. At the time there were favourable domestic and external conditions, including the lifting of economic sanctions, motivation of overall demand in the economy with redistributive economic policies as well as the opening up of external markets. The Growth with Equity policy was also characterized by land resettlement on a willing buyer willing seller basis. The blacks did not have resources to purchase land and as such the policy did not effectively address the land question. There were massive subsidies for services such as education and health. The new government promoted socialism and partially relied on international aid which as such was not sustainable. This also negatively affected growth in the private sector as there was no promotion of foreign investment resulting in inflation. 3.1.1 Growth with Equity Success Stories According to Zhou and Masunungure (2006), the first decade of redistributive policies witnessed marked improvements in access to health and education by the previously marginalised black majority as well as marked improvement in resource allocation. Health indicators such as life expectancy and infant mortality improved. The free for all basic education policy saw a rapid growth in schools and enrolment, in both primary and secondary schools by 1990. Primary schooling was made tuition free, and this resulted in gross admission rates that exceeded 100%. By the end of the first decade of independence, Zimbabwe had achieved universal primary education for all (Shizha & Kariwo, 2011). Zhou and Masunungure (2006) further note that the government’s expansionary income policies of the first decade of independence also promoted security of employment as well as raising living standards through the setting of minimum wages. The economy experienced very high growth rates of 10.7% and 9.7% in 1980 and 1981 respectively engineered by external factors on growth, fiscal driven redistributive programmes and the return of access to external markets 5 (Mzumara, 2012). The Government as observed by Zhou and Zvoushe (2012), viewed itself first and foremost as a benevolent father with a historical mandate to decide what it thought was good for its people in the long term pursuit of the aspirations of the liberation struggle. The new government was led by a political party that had waged the armed struggle that yielded political independence. In summary the positives from the growth with equity policy were mainly on the social front where access to education, access to health and employment creation greatly improved from 1980 to 1990. This led to an improvement of the general social being of the black majority. Therefore, it can be said that on the social front the policy was a significant success. 3.1.2 Problems with Growth with Equity One explicit assumption of Growth-With-Equity was that the economy would grow at a fast rate enough to generate sufficient revenue to fund national projects. This optimism was a result of the boom that was experienced from 1980 to 1982 as due to excellent weather, lifting of sanctions, easy access to foreign aid and a decrease in defence outlays. The economy experienced an 11% growth in 1980 (Zhou & Masunungure, 2006). Mzumara (2012) however, observes that during the period from 1980 to 1990 the growth in social sectors was not matched with the growth in productive sectors, reduced demand of Zimbabwean exports due to an overvalued currency, a decline in investment and capital formation as well as severe shortages of foreign currency combined to bring in recession towards the end of the decade. The arguments above show that the main assumption, on which Growth-With-Equity was based, was not well researched and somewhat too optimistic. The policies adopted were not sustainable as they drained the fiscus. According to Zhou and Masunungure (2006), the socio-economic development goals could only be achieved through a subsidy policy that enabled parastatals to undertake and provide affordable services to the public. This removed the motivation to perform as poorly performing parastatals could be bailed out from treasury creating a government dependency culture in public enterprises. The government also controlled the price of goods and services often setting them below the market levels and in the process making it difficult for public enterprises to cover their operating costs. This led to these public enterprises to be loss making entities all in the name of focusing on social issues even if they were not economical viable. Barett (2005) observes 6 that by the late 1980s, the control regime was inhibiting the dynamism of the domestic economy and generating structural problems that were systematically undermining its economic and political sustainability. The rapid growth in civil service employment and spending on social services, drought relief, and parastatals generated a chronic budget deficit, a high tax regime, and a rapid increase in public debt. In summary, the policies taken up by the government in 1980 were necessary so as to address the imbalances but the way they were implemented was not sustainable. Socially the policies were a success but economically they were not sustainable. 3.2 Transitional National Development Plan (TNDP) (1982-90) This plan focused on achieving social justice and equity. It called for a greater role by the state through creation of state enterprises (SEs) to implement government programmes, worker participation and social cooperation. At the core of this plan was the desire to accelerate economic growth through promotion of productive sectors. Government had a leading role to provide services and redistribution of resources to redress inherited inequities and imbalances and access to basic needs. Black people had limited capacity to meet these needs themselves. Employment and business opportunities were restricted, few people could develop the skills needed to prosper through own enterprise hence the state felt compelled to actively assist in the allocation of resources. Major successes of this era were on social services where primary education for instance was provided for free while secondary schooling was heavily subsidised with many schools being constructed. Table 2: Selected Economic Indicators during TNDP Year 1980 1981 1982 1983 1984 1985 Real GDP Inflation Budget Money Supply External Debt Current A/t Growth Rate rate (%) Deficit (% of Growth (%) Service Ratio (%) Deficit as % of (%) GDP) GDP 10.8 7.3 -9 21.5 9 -4.9 13.5 13.5 -7 13.1 10 -10.9 3.3 14.6 -9 13.6 16 -11.6 1.3 19.6 -10 11.7 25 -8.9 -2.2 16.3 -11 10.5 27 -1.8 10.5 9.2 -8 17.7 29 -1.9 Source: Central Statistical Office During this period of the TNDP, economic growth rates remained subdued, falling short of the target of 8%, largely due to; low investment levels in the productive sectors, world 7 recession and severe drought in the 1983 to 1984 agricultural seasons. The plan failed to address issues like; equitable land redistribution, indigenisation and empowerment, product beneficiation, fiscal restraint among other measures. The TNDP was largely a failure but to its credit it created over 150 000 jobs and enhanced agricultural production of small scale communal land farmers (Mapuva, 2015). Due to the failure of the TNDP the government embarked on another policy to try and remedy the TNDP failures. 3.3 The First Five Year National Development Plan (FFYNDP) 1986-1990 The First Five Year National Development Plan (FFYNDP) was formulated after comprehensive and detailed review of economic performance during the first five years of independence. During the period 1980 to 1985, the economy registered an average growth rate of around 5% compared to the target of 8% largely due to low levels of investment in the productive sectors. Inflation remained high during the period, averaging 13%, coupled with rising budget deficits. The overall domestic and external debt positions escalated concomitantly with budget deficits. It is against this background that Government unveiled the First Five Year National Development Plan targeting an average GDP growth of 5.1% per annum during the life span of the plan and it sought to achieve the following objectives: x Control and transformation of the economy as well as economic expansion; x Land reform and efficient utilisation of land; x Raising the standards of living of the entire population, in particular, the peasant population; x Enlargement of employment opportunities and manpower development; x Development of science and technology; x Maintenance of a correct balance between the environment and development. To achieve the above objectives, the following key policies were announced under NDP: x Establishment of new enterprises in strategic industries by the state; x State participation in existing strategic enterprises with the role of state gradually increasing until majority or full ownership is attained by the state; x Joint ventures between state and private capital on terms which allow for eventual ownership or control by state; 8 x Establishment of cooperative ventures in industry, commerce, trade and agriculture as well as participation of local authorities in the economy; x Workers education in management, technical skills and ideology in order to increase their efficiency and ability to manage enterprises; x Encouragement and acceptance of private local investment and foreign investment on terms consistent with social transformation; x Improvement of marketing facilities and the infrastructure in communal areas; x Irrigation schemes in rural areas were introduced ; x Prioritised the development of industries that were involved in production of agricultural inputs; x Increased the number of state farms; x Government intensified education of communal farmers in modern agricultural practice. The government experienced another severe drought during the 1986/1987 agricultural season that adversely reduced output for both rural and commercial farmers. Erratic economic performance coupled with the channeling of substantial amounts of resources in redressing social inequalities, which were characteristics of the Plan period, resulted in limited resources being available for productive public investment. Public investment expenditure as a proportion of GDP stagnated at less than 1% and was thus largely recurrent, with salaries and wages, interest on debt and transfer payments accounting for over 90% of total government expenditure. During the same period capital expenditure only accounted for 5% of total government expenditure. The manufacturing sector was the chief economic growth driver, followed by agriculture and the retail and hotel industry as shown in Figure 1 below: 9 Figure 1: Sectoral Contribution to GDP during 1985-1990 era During the preriod1986 to1990, the country’s budget deficit remained high against a backdrop of substantial foreign financing. The economy was faced by internal and external imbalances reflected in relatively high inflation, high unemployment levels (around 30%) and high budget deficits. The first three economic policies that Zimbabwe embarked on the first decade after independence are as summarised on the table below: Table 3: Economic development for the first decade (1980 to 1990) Plan Orientation Performance Growth with Equity -Social rhetoric combined -High growth of 11% and with conservative policy on 10% in 1980 and 1981 the ground -Welfarism and limited redistribution Transitional National Development Year National Plan -Economic growth of 8% -Low inflation rates of around 15% -critical issues of land redistribution were not addressed -growth rate target was not achieved First Five Year National - Emphasis on economic growth, employment 10 -economic decline of Development Plan creation and poverty reduction growth rate by about 3% -subdued average productive sector growth of 1.7% Adapted from Kanyenze (2007) In order to address the challenges of the first decade the government sought to stabilize the economy in the second decade. 3.4 The Economic Structural Adjustment Programme (ESAP) (19911995) In 1990, ten years after independence Government felt that the economy was not growing adequate income and employment while population was increasing at a faster pace. According to the ZIMPREST document, formal sector was creating only 18,000 jobs and this was only10% of the required level. It was imperative for the Government to develop policies aimed at encouraging and assisting people to use own initiatives and enterprise to meet their aspirations. In January 18th 1991 the government launched the Economic Structural Adjustment Programme (ESAP) which covered the 1991-1995 periods. The main theme of the programme was to transform the economy from being heavily regulated to liberalisation. ESAP’s objectives included the following: x Reducing deficit from 10% of GDP to 5% by 1994/5. x Reforming public enterprise to eliminate large budgetary burden caused by subsidies. x Civil service reform to reduce number of civil servants in noncritical areas. The plan was to cut the wage bill while properly paying those retained workers. x Labour law reforms through amending the labour act to streamline hiring and firing, facilitate quick retrenchments and to replace direct intervention in wage setting by collective bargain. x Monetary and fiscal reforms- It was necessary to strengthen monetary management, slow credit creation to reduce inflationary pressures, and liberalise the financial sector to encourage savings and improve intermediation efficiency. x Trade and exchange market liberalization to create market based foreign exchange systems and shift to a tariff based systems of protection. This was meant to encourage exports and allow competition for local industries. 11 x Liberalise investment and deregulate prices and agricultural marketing. x Implementation of a social dimension of adjustment programme to protect the poor and vulnerable groups from the negative transitional effects. 3.4.1 Outcomes of ESAP The programme had some success but was largely hampered by lack of compliance to government policy by both ministries and SEs management. This was to be expected since senior civil servants in Zimbabwe are not usually appointed on merit but through political patronage. SEs continued to make losses which drained the fiscus while profitable SEs were not paying dividends to government and were misusing the profits. In an interview with Zfn published in the Banks and Banking Survey, former permanent secretary in the Ministry of Finance during the ESAP era Elisha Mushayakarara had this to say: “not everyone in government was supportive of ESAP as some harboured serious suspicions against foreign institutions especially the IMF and the sceptics called it the Economic Suffering of Africa People” (Makwata, 2013). He argued that ESAP despite causing some pain to the people it helped to put the economy right on track. “.. before ESAP shelves were empty but through reform measures shops restocked again. The dual carriageway from Harare to Chitungwiza was constructed during that time while bigger commuter vehicles were introduced after transport liberalisation to compete with ZUPCO to ease urban transport problems.” The suspicion on the IMF is still present within government and as recent as in September 2015, the then War Veterans Minister Chris Mutsvangwa hit out at “some of ministers in the cabinet who still think the white man is superior” adding that the IMF wants to remove President Robert Mugabe and replace him with opposition leader Morgan Tsvangirai (New Zimbabwe, 2015). This was probably aimed at Finance Minister Patrick Chinamasa who has been working hard to normalise relations with the IMF and other multilateral institutions in a desperate bid to secure debt relief, new financial support and to improve the country’s battered image in the West, the report inferred. During ESAP commercialisation was successful on SEs like Dairy Marketing Board, Cotton Marketing Board and Cold Storage Commission which went on to become prosperous commercial entities before some like CSC and Cottco encountered problems later. On civil service reform the ZIMPREST document indicates that 94% of target posts were abolished 12 and the wage bill was reduced from 16.5% GDP in 1990/1 to 10.4% in 1994/94. Removal of barriers of entry resulted in more new merchant banks, discount houses and commercial banks which were started by black Zimbabweans. On trade and exchange market liberalisation, ESAP resulted in the deregulation of exchange control regimes. For instance it allowed individuals and companies to operate foreign currency accounts; it ushered in bureau de change to handle currency exchange and also resulted in the unification of official and interbank exchange rates. By 1995 all price and distribution controls had been removed while transport deregulations ushered in more players to compete with ZUPCO. ESAP reforms also allowed for remittance of profits and dividends by foreign investors. In Makwata (2013) Mushayakarara identified two mistakes or omissions at implementation which negatively affected the ESAP Programme. The first one was lack of full commitment by some people in government suspicious of the IMF. These were the same people who should have worked hard to make the programme a success but somehow their suspicions ‘sabotaged’ the reforms and acted as self-fulfilling prophecies of doom. The second mistake, he added, was the failure by the work stream task force to bring on board tariffs to protect the local manufacturing sector from import competition. The programme was of course also affected by exogenous factors, in particular the devastating 1991/2 drought. By the end of ESAP in 1995 the deficit had worsened to 13% of GDP and government funded this gap through domestic borrowing in the process crowding out indigenous business people of resources. Inflation also got worse and it eroded people’s purchasing power (ZIMPREST document, 1998). The table below summarises some of the key performance indicators during the ESAP period. Table 4: Selected Economic Indicators during ESAP Year Real End Period 90 – Day Commercial Budget GDP Inflation NCD Rate Bank Lending Deficit (% Growth Rate (%) (%) rate (%) of GDP) Rate (%) 1991 5.0 30.2 22.5 14.6 -7.6 1992 -4.8 46.4 37.0 34.6 -8.9 1993 2.9 18.6 29.0 37.9 -5.4 1994 4.2 21.1 30.3 36.4 -9.7 1995 -0.2 25.8 31.0 35.1 -12.6 Source: Reserve Bank of Zimbabwe and Central Statistical Office 13 Broad Money Growth (%) 20.4 22.1 43.8 33.8 30.0 External Debt Service Ratio (%) 24.0 30.0 30.0 25.0 20.0 Current A/C deficit as % of GDP -5.3 -8.9 -2.1 -2.0 -5.0 The performance of the economy under ESAP was largely unimpressive such that significant decline in real incomes were noted. Real GDP fell from about 4% in 1990 to about 1.4% during the reform period well below the expected 5% growth rate and this was mainly due to: x Poor programme support: There was a delay in donor funds release such that funds were diverted from old projects to new projects. Donor support started to be negotiated eight months into the programme. x Initial conditions failure: ESAP was designed to shift resources from non-tradable and protected import competing to tradable and unprotected import competing sectors. There was no fiscal stabilization in the beginning. x Lack of consultation: Mumvuma et al. (2006) noted that the failure to consult with stakeholders was a mistake since there was no awareness about the policy reforms hence resulted in ignorance and lack of ownership on the part of many relevant interest groups. x Exogenous factors: Poor policy advice from the World Bank and the global economic recession during 1991/2 also led to the failure of ESAP for example cutting capital spending while it’s the key enabler of growth. The 1992 drought also saw resources being channeled to food shortages. x Lack of implementation of key reforms: During the ESAP era there was slow progress in civil service reforms and privatisation. The civil service was downsized without adequate compensation. Due to this reduction there was failure to sustain macroeconomic stability due to government inability to substantially reduce money supply, government expenditure, inflation levels etc. Realising that the public was not satisfied with ESAP due to its failure to meet its objectives the government then decided to focus on fiscal discipline on its part. It launched the ESAP successor in the mould of Zimbabwe Programme for Economic and Social Transformation (ZIMPREST). 3.5 Zimbabwe Programme for Economic and Social Transformation (ZIMPREST) ZIMPREST was expected to run from 1996 to 2000 but was only unveiled belatedly in 1998. It was to continue the unfinished business of ESAP i.e. parastatal reforms, financial sector reform, civil service reform etc. and aimed at overcoming the constraints to economic growth, employment creation and poverty alleviation as well as facilitating public and private 14 savings and investment. President Mugabe in the foreword to the ZIMPREST document described it as a second phase of the social and economic reform initiated by government in 1991. It was meant to "…provide a firm basis for sustainable growth, greater employment and equitable distribution of incomes. Thus ZIMPREST sought: “to prop up private sector role in production and distribution of goods and services with government to act as enabler while private sector was to lead in growing the economy and employment creation.” The immediate objective of the plan was to mobilize savings and investment and use them to generate growth, create employment, encourage entrepreneurial development and foster economic empowerment in a way that guaranteed sustainable poverty alleviation. The key targets of ZIMPREST were: x Grow the economy by 8-10% in non-drought years. x Urgent restoration of macroeconomic stability through low inflation and interest rates, stable exchange rate. x Reduce deficit from 10% to 5% and inflation from 20% to single digit by 2000. x Promote the public and private savings and investment needed to attain growth. x Pursuing economic empowerment and poverty alleviation by generating opportunities for employment and encouraging entrepreneurial initiatives. x Investing in human resources development x Providing safety nets for the disadvantaged. The targets of ZIMPREST are as summarised on the table below: Table 5: ZIMPREST targets Economic Indicators Annual Growth Rate Employment Creation Budget Deficit Inflation Rate Savings and Investment Levels Export Growth Target 6% 42 000 jobs per annum Decrease from 10% to less than 5% of GDP Decrease from 20% to single digit 23% of GDP 9% per annum Source: Central Statistical Office ZIMPREST was supposed to build on the moderate achievements of ESAP but this plan fared poorly and the economy got worse. During the same period of 1996-2000 government embarked on programmes which worked against the objectives of the envisaged reforms of ZIMPREST. The Zimbabwean government in 1997 decided to provide once-off payments of 15 Z$50 000 dollar (then worth $1 315) and long-term pensions to 60,000 veterans of the nation’s liberation war. Notwithstanding the noble intentions the fact is that this was not budgeted for, and dramatically increased government expenditures, costs that could not be met through increased income or reductions to other programmes (Wharton, 2014). At about the same time the government chose to participate in what the BBC termed an ‘expensive’ civil war in the Democratic Republic of Congo to prop up the Laurent Kabila regime. Those massive off budget expenditures undermined confidence in Zimbabwe’s fiscal policy. On November 14, 1997, a day subsequently referred to as “Black Friday”, the Zimbabwe dollar lost 71.5% of its value against the United States dollar while the stock market subsequently crashed by 46% as investors scrambled out of the Zimbabwe dollar (Marawanyika, 2007). Even the government controlled newspaper, The Herald attributed the Black Friday to ‘fiscal imprudence’ adding that the “government shot itself on the foot by awarding unbudgeted massive packages to war veterans.” Then, in the wake of political setbacks in 1998, the government announced the seizure of white-owned farms even in violation of bilateral investment promotion and protection agreement (BIPPA), which exacerbated the instability (Madise, 2009). According to statistics by Kingdom Financial Holdings, foreign currency reserves fell from $760-million in January 1997 to a then all-time low of $255-million by November (Marawanyika, 2007). In response to worsening macro-economic fundamentals, the government reintroduced regulations and controls that it had abandoned earlier in the decade. The exchange rate was fixed, but inflation reached 70%, interest rates doubled to 80%, business activity slumped, unemployment increased and government’s unpopularity increased (Robertson, 2009).The rejection of the draft constitution which had provisions considered necessary to speed up land acquisition procedures in a referendum in February 2000 was Zanu (PF)’s first failure at the polls in 20 years (Robertson, 2009): “With the parliamentary elections due within months and the possibility that the new opposition party, the Movement for Democratic Change, might win the election the party used State resources to start the widespread occupation of white-owned farms. The police were instructed not to respond to calls for protection from the invaders as they were engaged in a political demonstration, not in criminal activities.” The fast track land reform resulted in massive displacement of white commercial farmers, violence and general lawlessness which drew wide condemnation from other countries with Western countries imposing sanctions on the country’s political leadership. From then on it was a rollercoaster ride as the economy descended deeper into depression. Many economic 16 interventions were put in place to address the problems which came as a result of that. These included rising inflation and interest rates, foreign currency shortages and growing national debt. Nevertheless, some of the positive outcomes specifically attributable to ZIMPREST are as summarised below. 3.5.1 ZIMPREST Outcomes x The highest growth rate was achieved in the first three years at about 7% in 1997 and deteriorated in the following years. x Reduction in budget deficit from 12% in 1994 to 7% in 1997/8 x Weak performance in the consequent years due to: o a sharp depreciation of the Zimbabwean dollar in 1998 caused by low prices of the country’s major minerals on the international market. o a slowdown in global economic performance in 1998 which reduced demand for exports o a sporadic rainfall pattern during the 1997/98 season which reduced agricultural output o unstable macro-economic environment, characterized by high inflation rates, high interest rates and weak currency which negatively affected performance in most sectors of the economy especially the manufacturing sector. x GDP growth rates slumped during this reform period as shown in the graph below Figure 2: Real GDP Growth 1991-1998 Source: World Bank Database 17 Policies under this period lacked local ownership. They were viewed as IMF and World Bank imposed measures as access to balance of payment was on condition of compliance with these measures (Zhou, 2009).They also carried high political and social costs for society and political leadership. There was also absence of enabling legal and institutional frameworks hence policy implementation under protest. Largely, ZIMPREST suffered from lack of international financial support to fund programme implementation. It was also too ambitious, encompassing a host of goals to be achieved: poverty reduction, land reform, employment creation, institutional reforms, decentralization, and others, without clearly spelling out the budgetary implications of each one of these policy objectives. 3.6 Vision 2020 and Long Term Development Strategies Launched on 29th March 2000 this policy document covers 23 years from 1997-2020. Under the vision 2020 programme, government sought economic revival which was to be spearheaded by good governance and political stability, sustainable macro-economic growth, regional and provincial management of human and natural resources. The government sought to work towards the provision of adequate, affordable and accessible social services as well as promoting culture, sport and family. It was to be the basis for any upcoming short and medium term policy announcements and its specific targets are: a) Doubling current GDP per capita in 23 years b) stabilize inflation to single digit c) achieve and maintain positive real interest rates d) reduction of budget deficit to manageable levels e) substantial decrease in unemployment rate f) increase investment and national savings to at least 30% To meet these targets, the following actions were to be pursued: (i) Efficient public sector resources management in which government lived within its means, reduce deficit, SEs reforms, enhance revenue generation. (ii) Industrialisation – promoting value addition to local raw materials, further processing of manufactured outputs. (iii)Agriculture - target full commercialisation and expand output ahead of inflation. 18 3.7 Zimbabwe Millennium Economic Recovery Programme (MERP) (2000-2001) This was a continuation of the commitments and targets of ZIMPREST and was supposed to run concurrently with the Millennium Budget announced in October 1999. This policy framework covered 30 months from July 2000 up to December 2002 and its aim was to “fight spiralling inflation" which was cited as a major cause of macroeconomic instability. The prime objective was to rebuild mutual trust and confidence among citizens and also reducing budget deficit to 3.8% of GDP through mobilisation of all stakeholders i.e. government, private sector, labour, civil society to implement measures that would restore macroeconomic stability. It further aimed to restore vibrant economic growth by removing causes of inflation, achieve sustainable investment capacities, stable real incomes and improve living standards. It also sought to restore normal cooperative relations with the international community. Some more specific objects of MERP were to consolidate fiscal adjustment policies, accelerate and complete the Public Enterprise Reforms, stabilize prices at lower levels, lower interest rates, stabilize the local currency and resolve the foreign currency crisis, stimulate rate of growth and deepen the financial sector reforms, establishment and implementation of accountability and monitoring institution. The action plans for the Millennium Economic Recovery Programme (MERP) included: x Consolidating the fiscus –embarking on cash budget to avoid spending overruns, reforming Public Enterprises to stem losses, restructure public debt and enhance revenue collection capacity; x Monetary policy was aimed at reducing inflation, lowering interest rates and reducing RBZ lending to government and financial institutions; x It also marked the beginning of concessional financing of major sectors of the economy; manufacturing, agricultural and mining. Other measures included reducing duty on inputs, input schemes to beneficiaries of the fast track land reform as well as reducing duties and tariffs for the mining sector. The MERP objectives were to be achieved under its principles of: x Government committing itself to use market forces in the allocation of resources and pricing of goods and services with the possibility of limited government intervention in some cases 19 x Equitably sharing costs of adjustments among the social groups x Use of balanced and flexible strategies to resolve macro-economic imbalances x Direct market interventions would be of limited duration and confined to resolving the market distortions. Market institutions would be developed to efficiently allocate resources x Government and stakeholders to have the prime responsibility if implementing the programme. However, MERP failed to revive the economy mainly as a result of non-implementation of recommended policies and loss of macroeconomic balance due to the size of the budget. It was later succeeded by the National Economic Recovery Plan (NERP). 3.8 The National Economic Revival Programme (NERP) This policy document was released in February 2003 and was meant to respond to ‘hostile’ external and domestic environment; ‘sanctions’ and “vibrant opposition politics’. Inflation then had climbed to more than 200% and the country was facing unprecedented foreign currency shortages. By the end of 2003, inflation had reached 600% and GDP declined by 7.4%.The economy was characterised by cash shortages, parallel market activities and decline in capacity utilisation. In view of the foregoing the Government introduced NERP to address these inherent economic challenges. NERP focused on macroeconomic stability; reduce inflation and increase aggregate supply; improve foreign currency supply and reverse de industrialization. It also focused intensely on land reforms; through giving input support to farmers and announcing attractive producer prices. NERP was underpinned by a desire to embark on sectoral led economic revival and enunciated sectoral policies with recommendations to revive as summarised below: Table 6: Sectoral Reforms SECTORIAL POLICY Agriculture RECOMMENDATION x Secure land tenure through land reform x Producer pricing to ensure viability and stimulate production x Encourage contract farming x Development programmes in dairy, livestock and irrigation to boost dairy products ,national herd and 20 winter cropping respectively Manufacturing x Increased value addition x Promote diversification of exports x Attract foreign investments x Promote technological linkages x Set up productivity centre to come up with benchmarks and standard to enhance productivity Mining Tourism x Increased old production x Increased value addition x Setting up of Mining Industry Loan Fund x Amendment of Mining Fiscal Regime x Intensify marketing activities and broaden tourist x Boost public relations campaigns to improve country image x Invest in tourism infrastructure Since the prior broad based macroeconomic policies were not successful it was difficult for the sectoral policies to be successful and there was no agricultural output reaped from the land redistribution. 3.9 Macro- Economic Policy Framework (MEPF) (2005-2006) In November 2004 the Zimbabwean government embarked on another policy called the Macro-economic Policy Framework to cover the period 2005-2006. Again this document aimed at reducing inflation and increase capacity utilisation with concessional funding becoming even more available as the RBZ just printed currency for it. It also focused on sectoral objectives crafted to take into account the realisation of Zimbabwe Millennium Development Goals targeted at reducing poverty and improving education and health services. During this period the policy succeeded in enhancing the provision of financial support to agriculture and other key sectors though most of the objectives were not met prompting the formulation of a new short term policy. 21 3.10 National Economic Development Priority Programme (NEDPP) (2006-2008) This was launched to restore economic stability through the implementation of quick –win strategies during the last half of 2006. This came as a result of Public Private Sector Partnership under the auspices of the National Economic Consultative Forum. Its architects opined that Zimbabwe had to forget the sad memories of a myriad of other past failed programmes as NEDPP was a panacea meant to reverse the severe effects of ten years of recession within nine months (Chikukwa, 2013). The specific objectives of NEDPP were to reduce inflation and stabilise the local currency, mobilisation and stabilization of foreign currency, food security, grow output and productivity, generate foreign exchange, enhance expenditure and revenue management, remove price distortions and effective policy coordination and implementation, reduction of both internal and external debt to sustainable levels maintaining infrastructure, improving delivery of public services and building business confidence and lastly, restoration of a positive image of the country hence economic empowerment (Macro-economic Convergence Report, 2006). However, NEDPP died a natural death as it was rolled out in place at a time when the Government was working on a new five year development strategy. Thus before NEDPP could be implemented, the government came up with yet another programme, the Zimbabwe Economic Development Strategy (ZEDS) which was billed to run from 2007 to 2011. 3.11 Zimbabwe Economic Development Strategy (ZEDS) (2007-2011) The Zimbabwe Economic Development Strategy (ZEDS) contained nothing new but a repackaging of policies contained in the previous policy announcements. Its primary objective was to achieve sustainable, balanced and robust economic growth and development that was oriented towards poverty reduction. It came into effect when the country’s woes were at their worst. During the crisis era real GDP further declined significantly by an average of 6.2% as shown on the graph below. By the end of NERP annual average inflation had reached 365% up from 5.8% in 1999. However, in 2004 through the implementation of a combination of policies contained in the National Budget of that year and Central Bank monetary policies prices temporarily stabilized with inflation dropping from 622.8% in 2004 January to 251.5% by September 2004 (Government of Zimbabwe, 2005). 22 Figure 3: GDP Growth at 1990 Prices, 1996-2007 Source: Central Statistical Office The third decade post independence was generally characterized by turmoil and uncertainty (Cousins, 2003; Phimister, 2004; Raftopoulos, 2009; Kanyenze, et al., 2011). For the first time since independence in 1980, the ruling party ZANU PF felt politically threatened in elections at the local, parliamentary and presidential levels. This prompted it to adopt a somewhat violent approach to fend off opposition. The government endorsed the fast track land reform, a process that received mixed reviews within and outside the country with most extreme reviews describing them as processes driven by political motives of expediency and survival (Zhou & Zvoushe, 2012). A lot of questionable and controversial policies and activities were bankrolled by the Government such as the unpopular Murambatswina programme aimed at demolishing all unregistered residential settlements in urban areas. This tense and emotional political climate produced regressive policies and the accompanying restrictive legislation the nation has to date under the Public Order and Security Act (POSA) and Access to Information and Protection of Privacy Act (AIPPA). This political mood was also manifest in most major policy decisions and actions of the decade. On the economic front, the country experienced an unparalleled hyperinflation year after year, with a rate of 7982 percent in September 2007(MDGs Report, 2009:3). There was also an acute shortage of basic commodities which included maize meal, drugs, fuel, electricity and foreign currency. Unfortunately at the end of September 2007, the government indefinitely postponed the launch of ZEDS. 23 3.12 Short Term Emergency Recovery Programme (STERP) (2009) This was a nine months programme from March to December 2009 focusing on political and governance issues, social protection programmes, supply side reforms and macro-economic reforms. This policy came after the formation of an Inclusive Government by ZANU PF and MDC formations. Economic ministries were headed by MDC ministers and had the task to reverse the ills of the hyperinflation era. It had the following specific objectives: x Political and governance issues: i.e. constitution and the constitution making process, media and media reforms, legislation reforms intended at strengthening governance and accountability, promoting governance and rule of law; x Gender equality: promoting equality and fairness; x Social protection programmes: i.e. food and humanitarian assistance, education, health and strategically targeting vulnerable sectors; x Stabilisation: i.e. involve implementation of a growth oriented recovery programme, restoring value of local currency, increase capacity utilisation in all sectors; x Labour Market and National Employment Policy: i.e. people centred, nurture the basis of people driven development agenda; x Economic stabilization; revive industry capacity utilization from below 10% in 2008; ensure availability of fuel, food and electricity. STERP had significant positive benefits as summarised on the table below: Table 7: Sectoral STERP Achievements ECONOMIC SECTOR ACHIEVEMENTS Economic growth x inflation reduced due to the adoption of multicurrency which helped ease inflationary pressures i.e. form 230 million percent in July 2008 to -7% by December 2009 x price distortions in goods and foreign exchange markets x introduction of cash budget for Government to operate were removed within available resources restrained expenditure overruns Agriculture x Liberalisation measures led to stimulus and empowerment for small scale farmers e.g. in the tobacco 24 sector Manufacturing x Utilisation levels of over 70% were realised by October 2009 x Food industry capacity utilisation increased to around 30% due to a backdrop of increased domestic demand and stable macro-economic environment Social Sector x Health and education sector benefited immensely from donor funding arranged by cooperative partners x There was smooth administration of the schooling activities though education fees increased and reduced the ‘O’ and ‘A ‘level sitting The short term nature of STERP meant that some programmes and projects would not be fully implemented within the time frame of nine months and little support on donor funds to implement the programmes, hence the launch of STERP II to consolidate gains from the initial recovery efforts under STERP. 3.13 STERP II: The Three Year Macro-Economic Policy and Budget Framework for the years (2010 – 2012) This was launched on 23 December 2009 with a three year macroeconomic policy and budget framework by the Ministry of Finance. After STERP successfully stabilised the macroeconomy, STERP II was to facilitate sustainable rapid growth and further development of the economy. More broadly, STERPII sought to put a price tag on the ‘critical financial investment needed to restore the economy to 1997 levels, emerging with a grand total of US45 billion of which $20 to $30 billion of this amount was needed over the three years to 2012 (Chikukwa, 2013). According to Zimbabwe Government (2009c:22-382) the objectives of STERP II were: x Sustaining macro-economic stabilisation and consolidating STERP; x Support for rapid growth and employment creation; x Ensuring food security; x Restoring basic services; x Encouraging public and private investment; x Promoting regional integration; 25 x Restoring basic freedoms; x Restoring of international relations; x Turn around agricultural sector: this was to be done through land audit to solve the problem of security tenure, prevent new farm disruptions, attain growth rates in agriculture of up to 20%; x Increase capacity utilisation in manufacturing: from 10% to above 60%; x Improve the mining sector: through removal of surrender requirements, beneficiation added value, exploration, new regulations, reform in pricing of minerals; x Rehabilitation of both urban and rural network: in the transport sector. The impact of political will in fostering economic growth is well demonstrated in STERP because its first 3 years were very successful as politicians worked together coherently to operationalise it. After embracing STERP II, inflation dramatically fell to single digit levels and stabilized at below 5% by the end of the year of 2010. Capacity utilisation in the manufacturing sector increased from about 10% to 40% and GDP per capita increased from US$403.1 in 2007 to USD$499 in 2010.There was improved macroeconomic stabilisation and improved socio political system. Professor Tony Hawkins from the Graduate School of Management at the University of Zimbabwe also weighed in arguing that STERPII was more realistic than previous programmes that were based on the printing of money to drive the economy. Unfortunately, this was short lived as politics started to interfere with economics again as parties in the government tried to outshine each for political gain in the process somewhat sabotaging each other. It was not helped by the fact that elections were beckoning in 2013. Inter-party fights which had subsided between 2009 and 2011 emerged in 2012 and became vicious and disruptive towards the 2013 polls. Although the economic sector improved a bit, international donors unfortunately, shunned the policy hence the introduction of the Medium Term Plan (MTP). 3.13.1 Challenges to STERP In spite of the gains discussed above, STERP faced a number of challenges as discussed hereunder. At the time of its implementation electricity generation by the power utility Zimbabwe Electricity Supply Authority (ZESA) could not power the local industry whilst the National Railways of Zimbabwe (NRZ) could not move inputs and goods. Local authorities could not supply adequate treated water to industry. The coal miner, Hwange Colliery Company (HCC) had no capacity to provide enough coal to power ZESA’s thermal power 26 stations or to the agricultural entities and heavy industries. Sable Chemical Industries and Zimphos Limited could not supply fertilizer for the agricultural sector and SeedCo, Pannar and other seed breeders had no capacity to meet the seed needs of the local farming sector. The assumption made by policymakers, was that there existed international lines of credit ready to finance the local productive sector if an arrangement is made (Financial Gazette, 2009). To the contrary, the global financial crisis had left many international banks struggling to deal with toxic assets stemming from the sub-prime crisis which happed in 2008. The few who had the financial capacity did not consider Zimbabwe a credible borrower given its huge debt arrears with international funders. The absence of an overarching developmental vision to anchor STERP was one of its major limiting factors. The development strategy should have provided a guiding and allencompassing framework of where the country was going. Kadenge (2009) argues that STERP was only a short-term economic revival document and it did not address the structural development challenges inherent in the economy. STERP contained no specific measures to deal with the structural distortions and rigidities arising out of the dual and enclave economic structure. The demise of the formal sector coupled with the likely adverse impacts of the global financial crisis and anti-inflation measures, implies the decent work deficits that characterize the economy and entrenches poverty and its feminization will abound. More importantly, STERP failed to provide stimuli for a new paradigm that is pro-poor and inclusive, failed to promote the integrability of marginalized groups (women, youths, people with disabilities and people living with HIV/AIDS) and sectors, especially the informal and rural economy, and unleash a more employment-intensive pathway out of poverty (Kadenge, 2009). Some of the major reasons that resulted in the failure by the government to achieve the goal of STERP are: political disagreements or lack of progress in constitutional reform leading to policy reversals within the inclusive government (African Development Bank, 2009). Revenue or budget shortfalls had an immediate impact on expenditure, thus aggravating social and humanitarian problems for the government. The inclusive government also received inadequate support from the international community, and lack of visible improvement in day to day conditions for most Zimbabweans, called into question the rigor 27 needed for effective change and reform. The government also did not make meaningful progress on property rights and the rule of law, and the rehabilitation of physical infrastructure and the related systems. Private sector confidence could not return. In short STERP did not succeed in turning around the country, had the factors discussed above been implemented it would have succeeded. 3.14 Medium Term Plan (MTP) (2010-2015) This was launched in July 2011 by the Ministry of Economic Planning and Investment Promotion with a view to guide all Government plans and programmes beyond short term stabilization and build foreign exchange reserves sufficient to cover at least three months imports by 2015. Its theme was restoration and transformation of capacities for sustainable economic growth and development. Its objectives (Government of Zimbabwe, 2010) were among other things; infrastructure development with emphasis on rehabilitation and completion of outstanding projects, employment creation, human centered development, entrepreneurship development, macroeconomic stability, ICT and science & technology development, good governance, investment regulation, coordination and promotion, resource utilization and poverty reduction, gender mainstreaming into economic activities all focusing on promotion of programs that endure gender parity in access to education, health and other social services. MTP specific targets: x Average annual GDP growth rate of 7.1%; x Single-digit annual inflation; x Interest rates that promotes savings and investment; x Current Account Deficit of ≤ 5 percent of GDP by 2015; x Average annual jobs creation rate of 6 %; x Sustained Poverty Reduction in line with MDGs targets; x Foreign Exchange Reserves of at least 3 months import cover by 2015; x Double-digit savings and investment ratios of around 20 percent of GDP by 2015; x Budget deficit of less than 5 percent of GDP by 2015; x Reduce sovereign debt to at least 60 percent of GDP by 2015. 28 MTP required approximately $9.3 billion for full implementation which was a very big resource constraint to the country. It lacked consistency and donor support on which the blue print was underpinned hence it failed to meet its target between 2011 and 2012. This was hastily abandoned when ZANU PF won the 2013 elections paving the way for the ZIMASSET Programme. 3.15 Zimbabwe Agenda for Sustainable Socio-Economic Transformation (ZIMASSET) Following the end of the Government of National Unity (GNU), the Government launched the Zimbabwe Agenda for Sustainable Socio-Economic Transformation (ZIMASSET). According to Government of Zimbabwe (2013) this economic blue print was developed through a consultative process involving political leadership in government, private sector and other stakeholders. The ZIMASSET blue print was crafted whilst recognizing the continued existence of the ‘illegal’ economic sanctions, subversive activities and internal interferences from hostile countries. This therefore, called for the need to come up with sanctions busting strategies, hence ZIMASSET’s focus being on the full exploitation and value addition to the country’s own abundant human and natural resources (Government of Zimbabwe, 2013). The policy was developed to guide national development for the next five years up to 2018.The vision of ZIMASSET is ‘Towards an Empowered Society and a Growing Economy’ a well thought and crafted statement whose dream is assumed to be easily shared by any patriotic Zimbabwean. ZIMASSET is built on four strategic clusters envisaged to enable the country to achieve economic growth and reposition itself as one of the strongest economies in Africa. Based on the President of Zimbabwe’s speech, there is hope for economic modification: “In pursuit of a new trajectory of accelerated economic growth and wealth creation, my Government has formulated a new plan known as the Zimbabwe Agenda for Socio-Economic Transformation (ZIMASSET): October 2013-December 2018. ZIMASSET was crafted to achieve sustainable development and social equity anchored on indigenisation, empowerment and employment creation which will be largely propelled by the judicious exploitation of the country’s abundant natural and human resources.” 29 The document describes ZIMASSET as a Results Based Agenda built around four strategic clusters namely: Food Security and Nutrition; Social Services and Poverty Eradication; Infrastructure and Utilities; and Value Addition and Beneficiation. This will assist the government to prioritise its programmes for implementation with a view of realising broad results to address the socio economic challenges. With ZIMASSET the economy is expected to grow by an average of 7.3% and continue a trajectory growth to 9.6% by 2018 as shown in Figure 4 below. The success of ZIMASSET depends on the stability of its assumptions which may change either side. They need a lot of commitment and consistency on all activities to be transacted. The assumptions are: • Improved liquidity and access to credit by key sectors of the economy such as agriculture; - this is only possible if we increase exports and value addition to our products; • Establishment of a Sovereign Wealth Fund; - no turn back is required in this case; Figure 4: Projected GDP Growth Targets for ZIMASSET Projected GDP Growth Targets:2013-2018 12 PERCENTAGE 10 8 6 4 2 0 2013 2014 2015 YEAR 2016 2017 2018 Source: Ministry Of Finance and Economic Development • Improved revenue collection from key sectors of the economy such as mining; • Increased investment in infrastructure such as energy and power development, roads, rail, aviation, telecommunication, water and sanitation, through acceleration in the 30 implementation of Public Private Partnerships (PPPs) and other private sector driven initiatives; • Increased Foreign Direct Investment (FDI) into Zimbabwe; • Establishment of Special Economic Zones; • Continued use of the multi-currency system; • Effective implementation of Value Addition policies and strategies • Improved electricity and water supply ZIMASSET is a socialist policy where everyone in the country is considered to benefit from the policy hence its broad based. It also acknowledges its broadness and highlights that it will implement initiatives that can yield rapid results. It also takes into account the shrinking tax base against recurrent expenditure, hence appropriate care will be taken to utilize the little in the country. Abundance of minerals in the country has been identified and the mining sector is aimed to grow and provide the much needed revenue. Other key drivers of the economy to create employment have also been identified as: agricultural sector; infrastructural sectors primarily focusing on power generation; transport; tourism; ICT and enhanced support for the SMEs and cooperative sectors. The implementation of the policy will rely on the following key success factors: x Strong collaborative partnerships among Government agencies, the private sector, citizens and other stakeholders; x Total commitment and the strong desire to meet the people’s development expectations; x Undertake human resource capacity development programmes to enhance the acquisition of requisite Skills; x Continued use of the multi-currency regime to consolidate macroeconomic stabilization; x Introduction of Special Economic Zones; x Creation of special funding vehicles such as, acceleration of the implementation of PPPs; x The establishment of the Sovereign Wealth Fund; x Institutionalization of RBM across the public sector (civil service, parastatals, state enterprises and local authorities); 31 x Value addition and beneficiation in productive sectors like as mining, agriculture and manufacturing x Rehabilitation, upgrading and development of key infrastructure and utilities comprising power generation, roads, rail, aviation and water; x Deliberate implementation of supportive policies in key productive economic sectors such as agriculture, mining, manufacturing and tourism in order to quickly grow the economy. The key success factors of the policy are not rigid and certain because it rests on the ability of the government to set them. Actual facts and attributes of the economy must be used to draft policies. This cluster approach was meant to enable government to prioritise its programmes and projects for implementation given the resource constraints. 3.15.1 Challenges to ZIMASSET ZIMASSET being the current socio economic development plan does not in any way provide reference to Vision 2020 nor link its development aspirations to the country’s’ vision (Matutu, 2014). During the inclusive government there were attempts to develop Vision 2040.There is no doubt that the country’s vision has been abandoned therefore, reducing the country’s development to short term myopic plans divorced from the long term vision more so considering that publicity has been more on the economic blue prints than its implementation. A shared national vision can be a powerful force and rallying point for uniting citizens. It is the contention of the analysis that ZIMASSETs’ capacity to turnaround the economy is highly impaired due to its short sightedness and unclear link to the country’s vision. The Government has since independence, reduced development to five year blocks defined by various economic blue prints at different epochs explained above. Five years is too short to transform even the smallest economy or community in the world. Just like any other policy, ZIMASSET development plans will always be diluted by elections which are carried every five years, wherein political survival and electoral victory becomes the prime goal for most politicians. In the second and third year the momentum gathers for preparations for the next elections (Matutu, 2014). The continuous election mood coupled with development frameworks whose cycle is attached to the election cycle is inimical to development in a country. ZIMASSET remains trapped in the development planning shortcomings of the country, thus limiting its capacity to attain its defined goals. 32 ZIMASSET lands itself in a country with serious challenges on transparency, accountability and corruption which are one of the country’s challenges. The prevalence of corruption in Zimbabwe has increased over the last decade. According to the Transparency International Corruption Perception Index (CPI), Zimbabwe’s score declined from 3.0 out of 10 in 2000 to 2.2 in 2011(Matutu, 2014). Over the same period, Zimbabwe’s CPI ranking has fallen from 65th out of 90 countries to 154th out of 183 countries. Similarly, the World Bank’s Control of Corruption Index ranks Zimbabwe in the 5.2 percentile, down from 15.1 in 2000 (Matutu, 2014).While the CPI is a contested indicator due to the fact that it’s a perception based indicator which is also value laden. However, what cannot be disputed in Zimbabwe is the fact that corruption is at its worst levels in both the public and private sectors. Weak public accountability systems sustained low civic engagements have added to governance challenges facing the country. In addition, institutions for public service delivery are weak with serious capacity challenges thus a weak engine for ZIMASSET. The government cannot deliver the public goods which are the base for total economic and social development. The current governance crisis prevailing in the country whose redress requires a time period which is beyond the ZIMASSET implementation time frame, the capacity of the government to deliver the ZIMASSET goals remains blurred. A new value system is required to address the current governance crisis and this is a mammoth task which is beyond frameworks and policies. The performance of the public sector which is at its worst at the moment remains critical to the turnaround of the country. The quality and performance of the public sector combined with its effects and impact are pervasive to both the public and private sectors thus ultimately determining the country socio -economic development (Matutu, 2014). The public sector determines the country’s capacity to meet its goals with respect to poverty reduction, economic growth and unemployment. The success of ZIMASSET is also determined by the quality and performance of the public sector. The current efforts to institutionalize Result Based Management (RBM) in the public sector is going to have little impact due to limited resources to fully fund the public sector and more so the same efforts are not being duplicated in the private sector. Efforts by the Government to institutionalize RBM and the corporate governance framework shall only provide a framework for good governance and performance management with little positive change during the life span of ZIMASSET. As argued above, the implementation time frame for ZIMASSET despite its well-intended cause remains too short to transform the economy due to complexity of the challenges bedeviling the country. 33 In order for ZIMASSET to succeed it would require resources and the major one is funding to its development plan. According to Government of Zimbabwe (2013), the country requires about USD 27 billion to fully operationalise ZIMASSET. The country is struggling to fund a USD 4 billion budget whose bigger share is going towards recurrent expenditure. Zimbabwe has been isolated from the international community over the past decade thus denying the nation international financial support. While the rationale of sanctions upon Zimbabwe as well as the qualification and conceptualization of these sanctions have remained a contested terrain but what cannot be contested is the fact that the country has not been able to access funding from international financial institutions due to these measures and sanctions. ZIMASSET risk being reduced to a mere piece of paper waiting to be retired in the dust bins of history due to challenges of funding its complete implementation. Kanyenze (2014) further argues that the ZIMASSET blueprint would not succeed due to the fact that its position is more of a party manifesto and not necessarily a consultative and all-inclusive framework. From the above analysis, we can conclude that ZIMASSET remains far away from being a reality in the lived realities of Zimbabwe due to key issues noted above which are related to its successful implementation. The blue print is projected to have little positive impact on the lives of Zimbabweans though it will record a significant economic growth whose dividends shall remain marginal to the poor people of the country. ZIMASSET will, however, remain a framework which shall guide various socioeconomic efforts by the government and non- state actors who believe in it. 4.0 Economic Performance since 1980 The economic performance of Zimbabwe since independence is as summarised below. 34 Figure 4: Annual GDP Growth Rate in Zimbabwe (1980 - 2017) Source: Zfn, Zimstats, Ministry of Finance Figure 2 above shows that the country has experienced an almost fair share of ups and downs from 1980 to 2016. It is also clear that 15 years between 1980 and 1995 have generally been characterised by positive growth except for years which suffered from severe droughts as marked on the graph. This period coincides with the Growth with Equity, Transitional National Development Plan, and ESAP as shown in the time line in Figure 1. It can therefore be argued that these early policies despite some evident shortcomings were moderately successful in as far as they delivered positive economic growth rates. Using the same analysis, it can be said that policies from ZIMPREST in 1996 to NEDPP which ran up to 2008 were dismal failures. From 2000 to 2008 the Zimbabwe government took a number of decisions that resulted in hyper inflation, the near total collapse of the economy, a massive humanitarian crisis with 7 million people on food aid and a third of the population migrating to other countries – especially South Africa. This resulted in the intervention of the South African government and eventually a GNU with the MDC following the hotly contested elections in 2008. The GNU stabilized the economy and both GDP and revenues to the State rebounded dramatically. This is shown in the following table: 35 Table 8: Economic Performance during GNU Year 2008 2009 2010 2011 2012 2013 Revenue $b 0,28 0,98 1,6 2,8 3,8 4,3 GDP $b 1,28 3,92 6,40 11,20 15,20 17,2 Growth % 0 +306% +163% +175% +136% +113% Source: ZimStats, 2014 The table above shows that revenue to the State grew by a factor of 14 over 5 years. In each of these years a small budget surplus was generated and inflation fell to almost zero. Total expenditure on employment costs was maintained at about 60 per cent of revenue. In 2013 the country went through another election in which Zanu PF party assumed a two thirds majority in Parliament and President Robert Mugabe was given another 5 year term. This resulted in an immediate increase in State expenditure to $4,8 billion a year and employment costs to nearly 80 per cent of total revenue. At the same time business confidence declined and the stock market fell by one third, a billion dollars left the banks followed by the failure of 9 commercial banks and the loss of a billion dollars in depositor’s funds (Cross, 2016). In the following years, revenues to the State declined and this has continued into 2016. The following table shows what has happened: Table 9: Performance of Economy after the Collapse of GNU Year 2013 2013 2014 2015 2016 Revenue $b 4,30 4,30 3,80 3,60 3,20 Expenditure $b 4,20 4,80 4,80 4,60 4,60 Deficit $million +100 -500 -1,000 -1,000 -1,400 Percentage +0,24% -10,4% -20,83% -21,73% -30,43% Source: ZimStats, 2016 The impact of the fiscal changes in 2013 can be seen from the above table – the first year was the budget under the GNU team and then the final outturn after the changes to staff costs. The subsequent changes show an accumulative 37 per cent decline in revenues and GDP and the fiscal deficit rising from 10 per cent in 2013 to 30 per cent in 2016. The cumulative deficit of $2,5 billion between 2013 and 2015 was funded mainly by treasury bills which pushed domestic debt to nearly $6 billion. This is on top of $11 billion in foreign debt under discussion with the IMF and this continues to grow rapidly. 36 What should be clearly understood is that when the State issues a Treasury Bill, it is exchanging real cash with a paper IOU with no intrinsic value other than the trust the people have on the government of the day. This exercise therefore, withdrew from the local market $2,5 billion in cash assets and replaced this with TBs or paper “money”. This means that essentially the State was printing money. STERP I and II were associated with positive and steadily improving gross domestic product growth rates implying some success of some sort while three years into ZIMASSET have been marked by rapidly deteriorating growth rates. In fact the Ministry of Finance (MoF) has had to revise downwards growth rates for 2015 from 3.2% to 1.5% while ZIMASSET was predicting at least 6% in the same year. The economy is expected to register at best 1.5% growth in 2016 (MoF) with less optimistic forecasts below 1% to even negative growth as government continues to introduce unfavourable policies. One of them was the announcement to introduce bond notes which has caused serious panic withdrawal of cash from the bank and was widely condemned by citizens (Nyavaya & Mtomba, 2016). During the same time the RBZ directed exporters to remit 50% of their export proceeds to the central bank (RBZ Directive, 2016) depriving the economy of those foreign currency earnings with debilitating consequences. In June 2016 the Ministry of Industry and Commerce gazetted Statutory Instrument 64 of 2016 which effectively banned importation of several products with only few licensed entities allowed to import them. The ban was also condemned by citizens, caused massive protests by cross border traders at Beitbridge Border Post and has seen businesses in neighbouring countries urging their governments to retaliate (Daily News, 2016). In addition to mopping up local cash through TB issuance, the RBZ also took and used up foreign currency held by local banks in foreign nostro accounts. It took advantage of the fact that though owned by individual banks, it still controlled and managed all foreign currency in the country. As the nostro accounts continued to be depleted it became increasingly difficult to make foreign payments and banks also could not order US dollars cash from foreign banks resulting in a serious cash shortage. Another monetary system at the central bank’s mercy is the real time gross settlement (RTGS) account which contains funds in transit to and from local banks for the purpose of the transfer of funds electronically. In 2015 this account handled $45 billion or $170 million a 37 day and the average delay on transfers was three days. Therefore, at any one point in time this account held $500 million in cash – real money in transit to and from private bank accounts. In the first six months of 2016 the State withdrew an undisclosed amount from this account. Given the size of the fiscal deficit this must have involved at least $800 million. These withdrawals are illegal and in violation of IMF rules and have crippled the transfer system. Currently external payments are being held up for months and are being prioritized against a list of 4 categories of imports. Shortages are emerging and many firms are under severe and growing pressures. When it became apparent that they could no longer continue to draw funds from this system, the State began to expropriate foreign earnings from exports. This now involves 100 per cent of gold and diamond exports and 80 per cent of tobacco earnings and 50 per cent of all other mineral exports – over 70 per cent of export earnings or $2 billion a year. What they are doing is to retain the hard currency earnings in the Reserve Bank accounts and then send an electronic credit for the same sum to the exporter’s private bank accounts. This is in effect “virtual” money and is not convertible. The hard currency from these export earnings is now being used by the Reserve Bank to fund essential payments externally. Overall this means that the liquid cash reserves of the banks are now virtually depleted and banks are no longer able to pay out their depositors in cash. So called “plastic money” is the main means of exchange but this does not meet the needs of the majority. This situation is being exacerbated by the payment of civil service salaries in virtual currency and trying to get the banks to convert these funds into hard currency through their ATM’s or from tellers. In August it became more evident that this was not going to be possible and cash shortages began to reach critical levels with salary delays becoming the order of the day. The “Bond Note” proposal was intended to fill this gap and despite assurances about convertibility, no such arrangements are in place, the line of credit from the Afrexim Bank has not been concluded and a sizeable quantity (just under $80million) of these notes have been printed and introduced into the economy triggering a series of legal battles. Clearly the failures of several economic policies cannot be blamed on the policy documents because all have been well structured and consistent on issues that needed to be addressed since 1980. As shown in the section evaluating ESAP and ZIMPREST, the failures are largely because of poor implementation and detours from the policies caused by the political 38 pressure which has been forcing national leadership into knee jerk reactions to perceived threats to political power. Robertson (2009) argued that many of government’s policy choices in the past years reflected anxiety about possible voter responses at the elections. 4.1 Current Economic Situation The period 2009 to date saw the introduction of the multiple currency system and the following economic changes occurred; Table 10: Current Economic Situation Sector Situation Economic growth GDP The economy grew at an average rate of 11% x Decelerated sharply from 10.6% in 2012 to 4.5% in 2013 x estimated growth of 6% in 2015 backed by planned and 3.1% in 2014. investments in agriculture, mining, communications, power generations etc did not materialize. Instead it was 1.5%. Manufacturing x Declining industrial capacity estimated at 36.3% due to underproduction and lack of competitiveness Inflation x Relatively low due to the appreciation of the US dollar against the South African Rand Trade Overvaluation of the South African Rand has caused loss in external competitiveness making imports cheaper and locally produced goods expensive hence there has been an increased demand of imports and dwindling exports causing an estimated current account deficit of around 25% Unemployment x This has been on an increase due to the closure of companies with at least 4610companies having closed between 2011 and 2014 causing 55 443 people to lose jobs (2015 Budget Statement) x At least 80% of the employment population is engaged in informal employment. External debt The country is at high risk of debt distress with an unsustainable external debt estimated at USD8.4 billion at the 39 end of 2014 though it has engaged in a debt resolution strategy with African Development Bank Mining Has replaced the role of agriculture and became the leading export sector due to high mineral prices of platinum, gold and diamonds growing from an average of 10.2% of GDP in 2009 to 16.9% in 2011 Foreign Direct This has declined due to the political situation and to a large Investment extent the Indigenization Act regulations which has killed investor confidence in the country and caused capital flight The table below also gives a summary of a few economic indicators since the dissolution of the Government of National Unity (GNU) in 2013. Table 10: Selected Macroeconomic Indicators Macroeconomic indicator 2013 2014(e) 2015(p) 2016(p) Real GDP growth 4.5 3.1 1.5 -0.3 Real GDP per capita growth 1.4 0 0.2 0.5 CPI Inflation 1.6 -0.1 0.6 1.5 Budget Balance %GDP -2.4 -2.4 -1.3 -1.1 Current Account Balance % GDP -25.4 -23.1 -17.8 -17.2 Source: Data from domestic authorities; estimates (e) and projections (p) 4.2 Notable policy announcements which upset the economy In addition to war veteran gratuity payments, participation in DRC civil war and the fast track land reforms, the 2007 price reduction directive and the indigenisation laws have been often cited as having caused some damage to the economy. On the 27th June 2007 the government ordered all companies to roll back their prices to the levels of June 18, a reduction of roughly 50% which was dubbed ‘the closing sale of the year’. This was done to control rampant inflation but it resulted in acute shortages of basically everything as merchants who had lost stock at ridiculously low prices were unable to restock. The government promised to seize the assets of industries and businesses that evaded controls and several business people were arrested for failing to heed the directive. This was largely viewed as bad advertisement to investors who were considering investing in the country. During the same hyperinflation period a number of companies had their foreign currencies raided from their accounts by the central bank and were given worthless Zimbabwe dollars. Some of the affected companies have not fully recovered from those losses even up to now. 40 The theme of privatising SOEs has been going on for too long and even after the collapse of such businesses as ZISCO there has been little urgency to resuscitate them. When a $750 million deal where ESSAR was to acquire ZISCO was announced in 2011 it was regarded as one giant step forward but five years after the announcement ZISCO remains closed amid speculation the transaction could be off the table because the government dillydallied. This failure to fully commercialise SOEs continues to drain the fiscus since these entities are perennial loss makers who are relying on government funding for existence. The Indigenisation Law has also caused jitters among investors especially the requirement that 51% be ‘ceded’ to black Zimbabweans. Many deals have stalled after that announcement as no investor is interested in putting money into an operation where 51% ownership can be taken without proper sale arrangements. In a 2012 article in the Zimbabwe Independent South African business people that had come for trade and investment mission expressed apprehension over the country’s Indigenisation Act, saying it was inconsistent and open to abuse since it gave the responsible minister too much discretion on important areas. In the same report then acting chief executive officer of the Zimbabwe Stock Exchange Martin Matanda attributed the poor stock market performance then to among other issues, uncertainty over the Indigenisation Act further showing the negative impact of the policy on investment. In addition to these, events such as the recent (2015) one where government unilaterally cancelled the license of mobile operator Telecel for reasons linked to its shareholding and license fees have also been counterproductive. The cancellation was only set aside by the High Court but already damage had been done as subscribers had moved to other network operators fearing a blackout. Such events are not good for the economy as they send a message that Zimbabwe is not friendly to business hence its low ease of doing business rankings of 171 out of 185 according to the 2015 World Bank Report. Another area that has been cited as hampering investment in the country is the stringent labour laws especially the inflexibility in hiring and firing workers. While the recent Supreme Court ruling was used to terminate several thousands in a painful fashion given the already high unemployment rate, it actually found support from some economic agents because it gave businesses flexibility. By hastily amending the law without considering employers’ 41 input the government may have missed an opportunity to improve its ‘Ease of Doing Business’ rankings. Another problem the country has to deal with is corruption which is also turning away investors. In an article in the Herald by Maodza (2012) President Mugabe revealed that he was told by his then counterparty President of South Africa Thabo Mbeki that business people in South Africa had been asked as much as $10million to facilitate meetings for them with him by some cabinet ministers. 5.0 Recommendations What needs to be done to address the current Zimbabwean economic situation? Instead of blaming sanctions or external parties the government has to change the way it manages the economy to more progressive methods. As Wharton (2014) argued Zimbabwe’s sovereign policy decisions are the most powerful factors in the nation’s economic performance. Below are some of the things that need to be done to address the current difficult economic situation: Land reform: Everyone probably including the evicted farmers acknowledges the irreversibility of the land reforms but there is a need to expeditiously carry out land audit to flush out multiple owners. The government can adopt the use-it-or-lose-it policy to encourage utilisation of the land. Robertson (2009) argued that after land reform land in Zimbabwe now has no market value and no collateral value, and the people to whom it has been allocated have no ownership rights, no security of tenure and neither the means nor the incentive to invest in production. This has to be addressed through giving qualifying farmers title to their land so that they can use it as security to borrow from banks to fund farming operations. If land is optimally utilised the impact on the economy will be huge as agriculture is the backbone of this country. Indigenisation Law: Investors are not disputing the indigenisation laws but they want more clarity and consistency for them to plan their investment without concerns about losing them to empowerment partners for anything other than arm’s length ownership sale. This has to be addressed to assure owners of capital that their investment is safe. Corruption: There is a lot of talk about zero tolerance to corruption but the government has to do more than talking by actually stamping hard on offenders notwithstanding their standing in society or politics. Merely stating that some ministers or senior government 42 officials have been found demanding bribes without prosecuting them is unhelpful. The country has an anti-corruption commission but unfortunately it is probably being undermined by those in power and tends to only prosecute less important people while high profile offenders go scot-free. The Government should also lead by example and give the Zimbabwe Anti-Corruption (ZACC) complete independence and autonomy to execute its mandate. Government role in business: Government should stop interfering with private business and actively protect private property rights. As noted in earlier sections of this paper, government must play the role of an enabler to private businesses. It is the attack (perceived or real) on property rights that has done most to bring private sector investment virtually to a stop throughout the economy. Investors are prepared to invest even in the most unstable environments with high security threats as long as their investment is not under threat. Zimbabwe has fewer to no security threats but is perceived to be lacking on protecting private property rights and hence attracting very low investment. The country wants investment (foreign and local) to resuscitate the ailing economy and the government must create that enabling environment. Partnerships: Reengagement with the multilateral financial institutions like the IMF, World bank and African Development Bank as well as every possible country as opposed to the Look East policy which has so far failed to bring notable investment. This is good for attracting investment but also could be used to access technical assistance. Lenders across the world take a cue from these institutions to lend to sovereigns in emerging and frontier markets. If these institutions are lending to a country it will be easier to get others to lend to it. Finance minister Chinamasa has been actively reengaging these institutions and this should continue. Recurring deficits: The IMF is encouraging the country to reduce primary deficit and achieve balance by 2016. This can be achieved by reducing public sector employment cost to free up funds for capital spending to raise growth and social spending to protect the poor. Right now the deficit is being funded by domestic borrowing through issuance of treasury bills but this is unsustainable because the market’s capacity to absorb this paper is shrinking daily due to tight liquidity in the economy. Restoring Investor Confidence: Restoring confidence in the financial sector will enable it to attract savings and foreign lines of credit which it can lend to productive sectors to boost economic activity. This can be done through reducing non-performing loans in the market to give the banks some capacity to lend more. Furthermore, investment climate may be improved through putting in place business friendly policies such as tax exemptions on new 43 investment for a set period say 5 years. Also the country has to make it easier for business seeking to establish operations in the country. Foreign Debts: Make plans to clear arrears with multilateral institutions so that the country becomes able to access grants and loans from these lenders.Zimbabwe’s debt situation remains an albatross to medium-term fiscal and external sustainability. This has been making Zimbabwe’s financial risk profile high and financiers would be unwilling to give loans to Zimbabwean entities and the few who do so would be charging a risk premium. In order to address this scenario a debt-resolution strategy is therefore critical to resolving external payment arrears and re-engaging the international community to unlock international credit lines. This would require a comprehensive arrears clearance framework underpinned by a strong macro policy framework. Infrastructural development and massive retooling: An urgent rehabilitation and expansion of power stations and construction of road networks, and upgrades to water and sewer infrastructure is needed to usher massive investment and economic growth. At the moment the cost of doing being is very high as a result of the infrastructural development which is lagging behind. For example, industry incurs huge costs to transport coal from say Hwange to Harare to fire the factories as this is done by road as opposed to rail which is cheaper but cannot be done using the later because the system is dilapidated. So if the policy makers are to address this it would make Zimbabwe a favourable investment destination. A combination of these policies would be able to address most of the current economic problems. Social contract: Engaging in social contract and implementation of agreed position would help in containing some social and labour problems bedevilling the country. In view of the trade-offs in policies (e.g. containment and reduction of the share of revenues taken up by employment costs), there is need for Zimbabwe to negotiate and implement a Social Contract. A Social Contract helps restore good faith (trust) amongst the social partners; make them accountable to each other; help parties subordinate sectoral interests to national interests; develop and share a common vision; and inculcate a smart-partnership win-win mind-set (Kanyenze, 2014). Other recommendations include: • A competent and politically independent judiciary, particularly in the area of commercial law. • An autonomous Central Bank charged with the conduct of monetary policy. 44 • Independent regulatory agencies charged with the supervision and prudential oversight of key sectors, such as financial institutions, insurance companies, public utilities, health. • Agencies that guard against anti-competitive practices in private industry, banking and trade. • A parliament that has access to all the information needed to exercise oversight and control over the executive branch and the resources necessary to do so effectively. 6.0 Conclusion The Zimbabwean economy still remains fragile and most of its economic policies have failed due to lack of proper implementation and resource constraints. Current recovery programmes may not be sustainable without meaningful and deeper reforms being undertaken to sustain GDP growth and other crucial indicators. There is also need for necessary institutional framework for the success of Zimbabwean policies. Institutions of government must have clearly defined responsibilities and competencies as well as the required human and financial resources.The implementation of these suggestions among other things would improve the economy and promote domestic and foreign investments. The success of this would require cooperation and involvement of all stakeholders in the economy as some of the suggestions would involve taking radical steps such as job cuts especially in the public sector in order to create fiscal space for other things like infrastructural development. The current scenario where recurrent expenditure takes up to 95 % of the budget is not sustainable and spells doom for the future of Zimbabwe. Total commitment is also necessary especially from the business and political leadership of the country in order for this to succeed. 45 References African Development Bank (2004). Zimbabwean, African Economic Outlook. African Development Bank, 2009. Zimbabwe Short-Term Strategy: Concept Note, Harare: ADB. Brett, T. (2005). Crisis States Programme From Corporatism To Liberalisation In Zimbabwe: Economic Policy Regimes And Political Crisis 1980-1997, London: Development Destiny Studies Institute. BBC NEWS (2000). Mugabe’s costly Congo War. [Online] Available from: http://news.bbc.co.uk/2/hi/africa/611898.stm[Accessed: 15 September 2015] Chikukwa, J. W. (2013). Zimbabwe: The end of the first republic. Author-House, Uk Ltd. Cousins, B. (2003). “The Zimbabwean Crisis in its Wider Context: The Politics of Land, Democracy and Development in Southern Africa”, in Hammar, A, Raftopoulos, B and S. Jansen (eds), Zimbabwe’s Unfinished Business: Rethinking Land, State and Nation in the Context of Crisis, Harare: Weaver Press, 2003, pp: 263 – 316. DAILY NEWS (2016). Zambia bosses call for retaliation to Zimbabwe exports. [Online] Available from: https://www.dailynews.co.zw/articles/2016/07/19/zambia-challengeszim-imports-ban Dixit, A. (1989). Intersectoral Capital reallocation under price uncertainty. Journal of International Economics, 26, 309-325. Hoogenveen, H., & Mumvuma, T. (2002). Manufacturing Export Performance, Macroeconomic Adjustment and the Role of Networks. In J. W. Gunning & R. H. Oostendorp, Industrial Chnage in Africa: Micro Evidence on Zimbabwean Firms under Structural Adjustment. Basingstoke: Palgrave Macmillan. Hoogenveen, H., & Mumvuma, T. (2002). Manufacturing Export Performance, Macroeconomic Adjustment and the Role of Networks. In J. W. Gunning, & R. H. Oostendorp, Industrial Chnage in Africa: Micro Evidence on Zimbabwean Firms Under Structural Adjustment. Basingstoke: Palgrave Macmillan. Jenkins, C. (1997). Economic Objectives, Public Sector Deficits and Macroeconomic Stability in Zimbabwe. Oxford: The Centre for the Study of African Economies (CSAE). Kanyeze, G. (2014). The Zimbabwean Economy. Ledriz Crisis Coalition, Harare, Zimbabwe. Kanyenze, G., Kondo, T., Chitambara P., and Martens J. (2011). (Eds), Beyond the Enclave: Towards a Pro-Poor and Inclusive Development Strategy for Zimbabwe, Harare: Weaver Press. Macro-economic Convergence Report: 2006, Ministry of Finance, Harare, 2007. Madise, K. M. (2009). An Appraisal of Zimbabwe’s economic performance: Issues, problems and prospects.[Online] Available from: http://marshalmadise.blogspot.com/2009/11/appraisal-of-zimbabwes-economic.html Makina, D. (2009). Recovery of the Financial Sector and Building Financial Inclusiveness, Working Paper 5, Comprehensive Economic Recovery in Zimbabwe Working Paper Series, United Nations Development Programme. Makwata, R. (2013). From bureaucrat to banker: Mushayakarara’s five decades in finance and banking. Banks & Banking Survey 2013. Zimbabwe Independent. Maodza, T. (2012). Corrupt Ministers face axe: President. Herald. [Online] Available from: http://www.herald.co.zw/corrupt-ministers-face-axe-president [Accessed: 20 September 2015] 46 Marawanyika, G. (2007). Zimbabwe marks 10 years since black Friday. Mail and Guardian [Online] Available from: http://mg.co.za/article/2007-11-11-zim-marks-10-yearssince-black-friday[Accessed: 20 September 2015] Mashakada, T. J. (2013). Macroeconomic Consequences of Fiscal Deficits in Developing Countries: A comperative Study of Zimbabwe and Selected African Countries (19802008). University of Stelenbosch, Department of Economics. Capetown: University of Stelenbosch. Matutu, V. (2014). Zimbabwe Agenda For Sustainable Socio-Economic Transformation (ZIMASSET 2013-2018) A Pipeline Dream Or Reality. A Reflective Analysis of The Prospects of The Economic Blue Print. Research Journal of Public Policy, 1(1), pp. 1-10. Mehlum, H. (2002). Zimbabwe: Investments credibility and dynamics following trade liberalisation. Oslo: Frisch Centre, Department of Economics, University of Oslo. Ministry of Finance (2011). The 2011 Mid Year Fiscal Policy Review: Riding the Storm: Economics in Time of Challenges. Harare: Government of Zimbabwe. Mumbengegwi, C., & Mabugu, R. (2002). Macroeconomic and Adjustment Policies in Zimbabwe (1980-2000): an Introduction and Overview. In C. Mumbengwgwi, Macroeconomic and Structural Adjustment Policies in Zinmbabwe (pp. 3-20). Basingstoke: Palgrave. Mumvuma, T., Mujajati, C., & Mufute, B. (2006). Understanding Economic Reforms: the Case of Zimbabwe. In J. Mensah, Understanding Economic Reforms in Africa: A tale of seven Nations (pp. 237-268). Basingstoke : Palgrave Macmillan. Nyavaya, K., Mtomba,V. (2016). Cash crisis bond notes trigger panic withdrawals. The Standard [Online] Available from: http://www.thestandard.co.zw/2016/05/11/cashcrisis-bond-notes-trigger-panic-withdrawals/[Accessed: 29July 2016] Phimister, I. (2009). “South African Diplomacy and the Crisis in Zimbabwe: Liberation Solidarity in the 21st Century”, In Raftopoulos, B. and Savage, T., Zimbabwe: Injustice and Political Reconciliation, Harare: Institute for Justice and Reconciliation, Pp: 271 – 291. Raftopoulos, B., Hammar, A., and Jansen, A. (2003). (Eds), Zimbabwe’s Unfinished Business: Rethinking Land, State and Nation in the Context of Crisis, Harare: Weaver Press, pp: 263 – 316. Reserve Bank of Zimbabwe Annual Reports, (1998; 2003; 2005). Reserve Bank of Zimbabwe, Bank Licensing, Supervision & Surveillance Annual Reports. Reserve Bank of Zimbabwe (2016). Exchange control directive RR:101/2016. RBZ. [Online] Available from: http://www.rbz.co.zw/assets/directive-rr101.pdf Robertson, J. (2009). Zimbabwe-An economy on the edge, since 1980 [Online] Available from:http://www.economic.co.zw/index.php?option=com_content&view=article&id= 1185:zimbabwe--an-economy-on-the-edge-since-1980&catid=111:zimbabwe-history &Itemid=557[Accessed: 15th September 2015] Robinson, P. (2002). Macroeconomic Performance under the Economic Structural Adjustment Program: an Essay on Iatrogenic Effects. In C. Mumbengegwi, Macroeconomic and Structural Adjustment Policies in Zimbabwe (pp. 23-52). Basingstoke: Palgrave. Sydney, E., M. (2001). Monetary Policy Framework in Zimbabwe. The Economist Intelligence Unit (1998), Zimbabwe 1998-1999. UNDP. (2009). Comprehensive Economic Recovery in Zimbabwe: Restructuring Public Enterprises and Rehabilitation of Infrastructure in Zimbabwe Working Paper Series No. 8. Harare: UNDP. 47 Wharton, B. (2014). Remarks on US policy on post-election Zimbabwe. [Online] Available from: http://harare.usembassy.gov/about-us/ambassador-bruce-wharton/speechesand-statements/remarks-on-u.s.-policy-in-post-election-zimbabwe [Accessed: 23rd September 2015] WORLD BANK. (2014). Doing Business 2015: Economy profile of Zimbabwe. 12th Ed. [Online] Available from: http://www.doingbusiness.org/data/exploreeconomies/zimbabwe/~/media/giawb/doing%20bu siness/documents/profiles/country/ZWE.pdf [Accessed: 20 September 2015] Zhou, G. (2006). From Interventionism to Market based Management Sytles: The Case of Zimbabwe, ZAMBEZIA Volume XXVIII (ii) Harare: SAPSN, ZIMCODD and AIDC. Zhou, G. and Zvoushe, H. (2012). Public Policy Making in Zimbabwe: A Three Decade Perspective. International Journal of Humanities and Social Science Vol. 2 No. 8 [Special Issue – April 2012] Pp. 212-222 Zimbabwe Democracy and Economic Recovery Act of 2001, 107th Congress, Senate and House of Representatives of the United States of America Congress. Zimbabwe Millennium Development Goals, (2009). Midterm Progress Report (2000-2007), Harare UNDP/Government Publications. Government of Zimbabwe Documents (i) Government of Zimbabwe, (1980). Budget Statement, Harare, Print flow. (ii) Government of Zimbabwe, (1981). Budget Statement, Harare, Print flow. (iii)Government of Zimbabwe, (1981). Growth with Equity. An Economic Policy Statement. Harare: Ministry of Finance, Economic Planning and Development. (iv) Government of Zimbabwe, (1982). Transitional National Development Plan 1982-85, Harare, Government Printers. (v) Government of Zimbabwe, (1983). Budget Statement, Harare, Print flow. (vi) Government of Zimbabwe, (1985). Budget Statement, Harare, Print flow. (vii) Government of Zimbabwe, (1990). Budget Statement, Harare, Print flow. (viii) Government of Zimbabwe, (1991). Budget Statement, Harare, Print flow. (ix) Government of Zimbabwe, (1995). Budget Statement, Harare, Print flow. (x) Government of Zimbabwe, Zimbabwe, (1996). Programme For Economic and Social Transformation (ZIMPREST), 1996-2000, Harare Jongwe Printers. (xi) Government of Zimbabwe, (1982). Transitional National Development Plan, Volume 1, 1982/83, Harare. (xii) Government of Zimbabwe, (1986). First National Five Year Plan1986-1990, Volume 1 Harare: Government Printers. (xiii) Government of Zimbabwe, (1991). A Framework for Economic Reform (19911995), Government Printers, Harare. (xiv) Government of Zimbabwe (1991). Zimbabwe A framework for Economic Reform (1991-95) Government Printers. (xv) Government of Zimbabwe, (1998). Budget Statement, Harare, Print flow. (xvi) Government of Zimbabwe, (2000). Budget Statement, Harare, Print flow. (xvii) Government of Zimbabwe, (2004). Budget Statement, Harare, Print flow. (xviii) Government of Zimbabwe, (2005). Budget Statement, Harare, Print flow. (xix) Government of Zimbabwe, (2005). Budget Statement, Harare, Print flow. (xx) Government of Zimbabwe, (2008). Government Political Agreement, Harare, Print flow. (xxi) Government of Zimbabwe, (2008). Budget Statement, Harare, Print flow. 48 (xxii) Government of Zimbabwe, (2009). Budget Statement, Harare, Print flow. (xxiii) Government of Zimbabwe (2009). Short Term Emergency Recovery Programme. Government Printer. (xxiv) Government of Zimbabwe, (2011). Medium Term Plan, 2011-2015, Harare, Print flow. (xxv) Government of Zimbabwe, (2011). Budget Statement, Harare, Print flow. (xxvi) Government of Zimbabwe, (2012). Budget Statement, Harare, Print flow. (xxvii) Government of Zimbabwe (2013). Zimbabwe Agenda for Sustainable SocioEconomic Transformation (ZIMASSET). Government Printer. (xxviii) Government of Zimbabwe, (2013). Zimbabwe Agenda for Sustainable SocioEconomic Transformation October 2013-December 2018, Harare: Government Printers. 49 View publication stats