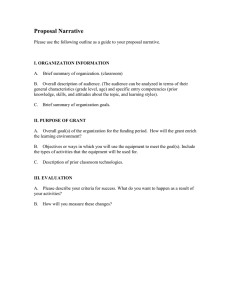

Case Study 2 (Impact Investing) Board Meetings #1 to 6 MEETING FORMAT: PART A: In the first part of each board meeting, each team will present a succinct and yet comprehensive discussion (10 minutes maximum per team) addressing just one question from the question bank each week. You are free to choose any question, but pick at least one from each category. Please note that your presentation should be strictly limited to well-argued opinions. It should contain mostly HOTS and a NARRATIVE. PART B: Intra-team discussions will be facilitated in the second part of each board meeting. QUESTION BANK PLEASE FEEL FREE TO RESTATE EACH QUESTION YOU PICK SO THAT IT BECOMES A HOT ONE. A: ANALYTICAL AND CRITICAL THINKING (AOL 2.1) (1) What would Milton Friedman have said about your investment idea in terms of being a legitimate business activity, and why? (2) What are some of the major challenges that makes it hard to solve your choice of social problem (and where others have failed)? (3) How would you know whether your investment has had the intended social impact (is there a good impact measurement available)? (4) How would you estimate the scalable of your investment idea? (5) How do the risk and return of your investment idea differ from what you would find in the conventional market? (6) What are the social risks of your investment idea? B: CREATIVE THINKING (AOL 2.2) (1) What is your investment idea and why do you belief it is a valid strategy to solve the social problem? (2) What are achievable alternatives to solving your choice of social problem? (3) What stops you from being creative in solving the case? How do you intend to overcome these challenges? (4) How will your investment idea move the dial in terms of social impact? (5) How would you go about optimising both financial returns and social impact? C: ETHICAL THINKING (AOL 5.2) (1) How do CEOs/shareholders view the aim of the firm and why? Give real examples, if possible. (2) What role do you believe institutional investors could play in impact investing? (3) In your opinion, is the singular view of shareholder value maximization reconcilable with impact investing? (4) How does impact investing relate to ethics? Give examples, where possible. D: COMMUNICATION SKILLS (AOL 3.1) (1) What is meant by a narrative? How would you go about creating a narrative, such that the information is easy to digest and conveys your main points? Give examples where possible of a good/bad narrative. (2) How would you convince your investor audience about the merits of your investment idea? What are (not) convincing arguments? Give examples where possible. (3) How would you convey strategy in your communication? (4) How would you convince your audience that you are fully committed to (believing of) the investment idea? The End