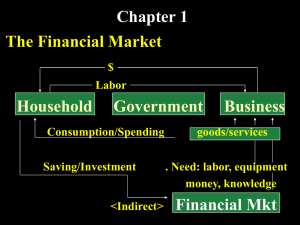

Course Name: Principles of Finance Chapter 1: Overview of Financial Management TABLE OF CONTENTS LEARNING OBJECTIVES ................................................................................... 2 ABSTRACT .......................................................................................................... 2 1.1 INTRODUCTION ............................................................................................ 3 1.2 THE EVOLUTION OF FINANCE .................................................................... 4 1.3 THE FINANCIAL MANAGER’S FUNCTIONS ................................................ 5 1.3.1 Forecasting and Planning ........................................................................................ 5 1.3.2 Investment and Financing Decisions ...................................................................... 5 1.3.3 Coordination and Control ....................................................................................... 5 1.3.4 Dealing with Financial Markets ............................................................................. 5 1.3.5. Risk Management ................................................................................................... 6 1.4 FORMS OF BUSINESS ORGANIZATION ..................................................... 7 1.5 THE GOALS OF THE CORPORATION ......................................................... 8 1.6 AGENCY RELATIONSHIP ............................................................................. 9 1.6.1 Primary Agency Relationship ................................................................................. 9 1.6.2 Mechanisms to Motivate Managers To Act in Shareholder’s Best Interests ... 10 ADDITIONAL MATERIALS ................................................................................ 11 QUESTIONS ....................................................................................................... 11 Page 1 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management LEARNING OBJECTIVES At the end of this chapter, you will be able to: Introduce the three interrelated areas of finance to students Describe the responsibilities of the financial manager Describe the advantages and disadvantages of alternative forms of business organization State the primary goal of a corporation, and agency relationship. ABSTRACT This chapter provides an overview of financial management. The three interrelated areas of finance will be discussed and so as the functions of financial manager. Besides, students are exposed to alternative forms of business organization. The concentration will be on corporation. The goal of a corporation and how financial managers can contribute to the attainment of these goals will be discussed in this chapter. Page 2 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management 1.1 INTRODUCTION The field of finance is broad and dynamic. It directly affects every person and every organization, financial or non-financial institution, private or public, large or small, profit seeking or not-for-profit. Finance can be defined as the art and science of managing money. Virtually all individuals and organizations raise money and spend or invest the money. Finance is more concern with the process, institutions, markets, and instruments involved in the transfer of money among and between individuals, businesses, and governments. Finance consists of three interrelated areas: Money and Capital markets Money markets are the financial markets in which funds are borrowed or loaned for short periods (less than one year). In other words, money market is where you put your cash if you have surplus funds. On the other hand, capital markets are the financial markets for stocks and for intermediate-or-long-term debt (one year or longer). In other words, capital market is where you sell or buy financial instruments. Investments Investment area focuses on the decisions made by both individual and institutional investors as they choose securities for their investment portfolio. The three main functions in the investments area are sales, analyzing individual securities, and determining the optimal mix of securities for a given investor. Financial Management Financial management is the broadest of the three areas and is important in all types of businesses including banks, financial institutions, industrial, retail firms as well as governmental operations. Financial management involves various decision-making ranging from how to finance the company operation, determine the most appropriate types of financing for the specific projects, and costs of each type of financing. It also involves management of current asset such as cash, account receivables, and inventories as well. Page 3 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management 1.2 THE EVOLUTION OF FINANCE Similar to other functional areas like accounting, marketing, and production, to name a few, finance has also undergone some kind of evolution. This is due to the fact that business itself has evolved from purely an entity with a single objective such as profit maximization into an entity, which has to accept multiple objectives. The evolution of finance can be divided into six eras, as explained below. 1900s Emphasis on the legal aspects of merger, formation of new firms, and the various types of securities the firm can issue as new capital. 1930s Legalistic and descriptive emphasizing on bankruptcy and reorganization, corporate liquidity, and the regulation of security markets. 1940s Descriptive, institutional subject viewed more from the standpoint of outsider rather than from internal management. 1950s Movement towards theoretical analysis focusing on the choice of assets to maximize the value of the firm. 1960s Important advances in the pricing of risky assets and in valuing contingent claims. 1990s Continuation of the valuation process expanded to include inflation, deregulation, computer analysis and electronic transfer of information and globalization. On the local fronts, introduction of Islamic Bank and Islamic counters in conventional banks and the uses of Islamic financial instruments as another alternative of financing captured most of the academic discussions. Page 4 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management 1.3 THE FINANCIAL MANAGER’S FUNCTIONS The financial managers are responsible to the financial activities in a company and help to employ resources so as to maximize the value of the firm. Activities performed by financial manager can be grouped into five categories: 1. 2. 3. 4. 5. Forecasting and Planning Investment and Financing Decisions Coordination and Control Dealing with Financial Markets Risk Management 1.3.1 Forecasting and Planning Financial data is analyzed and transformed into a form that can be used to monitor and forecast the firm's financial condition. The firm position in the market is evaluated and financial analysis is carried out to determine whether additional or reduced financing is required. The managers concerned must interact with people from other departments as they look ahead and lay the plans that will shape the firm's future. 1.3.2 Investment and Financing Decisions A successful firm normally has a high volume of sales shown in financial statements. An increase in sales requires additional investments in plant, equipment and inventory. In this case, the managers concerned need to determine the optimum sales growth rate, decide what specific assets to acquire, and then choose the best way to finance those assets according to the firm's financial position. 1.3.3 Coordination and Control The managers concerned must interact with other personnel to ensure that the firm is operated as efficiently as possible. Coordination of different activities in the firm is important to produce the required results, for example the preparation of financial statements. All business decisions have financial implications, and all managers need to take this into account. 1.3.4 Dealing with Financial Markets Financial managers deal with the money and capital markets for investments and raising capital expenditures. This is the result of the firm's activities and objectives that has to be satisfied. The financial markets where funds are raised affect the firm, securities are traded, and where investors either make or lose money. Page 5 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management 1.3.5. Risk Management All businesses face certain kind of risks such as natural disasters, uncertainties in commodity and security market, volatile interest rates, and fluctuating foreign exchange rates. Financial manager analyzes and evaluates the business activities and the risks associated with it. Page 6 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management 1.4 FORMS OF BUSINESS ORGANIZATION There are basically three forms of business organizations: sole proprietorship, partnership, and corporation. Sole proprietorship is a business legally owned by a person who operates it for his or her own profit. Generally, this type of business is the most common form of organization. A partnership consists of two or more owners, operating the business together for profit. Basically, partnership is typically larger than sole proprietorships. A corporation is an artificially being created by law. It is also known as 'legal entity'. It is separate and distinct from its owners and managers. The advantages and disadvantages of sole proprietorship, partnership and corporation shown in Figure 1. Figure 1: Advantages and Disadvantages of Sole Proprietorship, Partnership and Corporation Page 7 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management 1.5 THE GOALS OF THE CORPORATION Shareholders are the owners of a corporation and they elect directors, who then hire managers to run the corporation on a daily basis. Since managers are working on behalf of shareholders, they should pursue policies that enhance shareholder value. Consequently, the primary goal of a corporation is stockholder wealth maximization. This is the primary goal for a corporation. Stockholders own the corporation; elect the board of directors who then elect the management team. Management, in turn is supposed to operate in the best interest of the stockholders. Managers should consider the risk and timing associated with expected earnings per share in order to maximize the price of the firm's common stock. Besides stockholder wealth maximization, there are other objectives that a corporation would pursue such as personal satisfaction, employee welfare and good of community. It relates to the concept of social responsibility. Social responsibility is the concept that businesses should be actively concerned with the welfare of society at large. It raises the question whether businesses should operate strictly in their stockholders' best interests or also be responsible for the welfare of their employee, customer, and the communities in which they operate. The costs of socially responsible actions play the roles here. Corporations and government should cooperate in establishing the rules of corporate behavior, and the costs as well as the benefits of such actions must be estimated accurately and then taken into account. It is believed that if a corporation attempts to maximize its stock price, the same action will also benefit the society. To maximize stock price, a firm must provide a low-cost, high quality product to consumers. This, in itself, is a benefit to society. Page 8 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management 1.6 AGENCY RELATIONSHIP When the owners such as the shareholders appoint themselves as the member of the board and/or the management, there is no agency relationship. But when the shareholders such as the principals appoint another individuals, or agents on his behalf to run the company, then the agency-principals relationship exists. The managers are the agents of the company holding the management position on behalf of the shareholders. The graphic below shows the agency relationship. Figure 2: Agency Relationship 1.6.1 Primary Agency Relationship In financial management, the primary agency relationships are those between: Stockholders and managers Managers and creditor Stockholders and Managers A potential agency problem arises when the manager of a firm owns less than 100% of the firm's common stock. Conflict of interest arises when the owner-manager incorporates and then sells some of the stock to outsiders. In this situation, the owner-manager may not work as strenuously to maximize shareholder wealth, as less of this wealth will affect him or her. In addition, the fact that the owner-manager will neither gain all the benefits nor bear all the costs will increase the incentives to take actions that are not in the best interests of other shareholders. In order to encourage managers to maximize the firm's stock price, the shareholders have to bear all the costs incurred. This is also called agency costs. There are three major categories of agency costs, which are: Page 9 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management 1. Expenditure to monitor managerial actions such as audit costs. 2. Expenditures to structure the organization in a way that will limit undesirable managerial behavior. 3. Opportunity costs which are incurred when shareholders imposed restriction. Managers and Creditors Creditors have a claim on part of the firm's earnings stream for payment of interest and principal on the debt. Creditors also have the right to claim on the firm's assets in the event of bankruptcy. Conflicts arise if management acting for the stockholders takes on risky projects that are not anticipated by creditors or the firm increases debt to a level higher than was anticipated. Therefore, to best serve the shareholders in the long run, managers must play fairly with creditors. Managers as agents of both shareholders and creditors must act in a manner that is fairly balance between the interests of two classes of security holders. As managers do not own 100 percent of a corporation's common stock, sometimes they may not act in the best interest of shareholders. Managers can be encouraged to act in stockholders' best interests through incentives and rewards for their good performance. 1.6.2 Mechanisms to Motivate Managers To Act in Shareholder’s Best Interests Some specific mechanisms used to motivate managers to act in shareholders' best interests are: Managerial compensation The compensation package should be designed to cater these two objectives: 1. To attract and retain able managers 2. To align managers' actions as closely as possible with the interest of shareholders. Normally, different compensation package is different from one company to another. Direct intervention by shareholders Today, institutional investors such as mutual funds, insurance companies, and pension funds own majority of the stock. Therefore, the institutional money managers have the clout if they decide to exercise considerably influence over most of the firms' operations. They can propose to the management and institutional investors will acts as lobbyists for the body of shareholders. The threat of firing The probability of a large firm's management being dismissed by its stockholder was so remote that it posed little threat. This is because of the firm's shares are so widely distributed, and management's control over the voting mechanism was so strong. However, this situation is changing nowadays. The threat of takeover Hostile takeovers are most likely to occur when a firm's stock is undervalued relative to its potential because of poor management. Normally, the managers of the acquired firm are fired. Those who manage to stay on would lose their status and authority. Thus, managers have a strong incentive to take actions designed to maximize stock prices. Page 10 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management ADDITIONAL MATERIALS Hyperlinks Mutual Fund Basics http://www.investopedia.com/university/mutualfunds/default.asp The Encyclopedia About Corporate Governance http://www.investopedia.com/university/mutualfunds/default.asp QUESTIONS 1. The primary goal of a publicly-owned firm interested in serving its stockholders should be to _________________. a. b. c. d. 2. Which of the following factors tend to encourage management to pursue stock price maximization as a goal? a. b. c. d. 3. Maximize expected total corporate profit. Maximize expected earning per share. Maximize expected net income Maximize the stock price per share Shareholders link management’s compensation to company performance. Managers’ reaction to the threat of firing and hostile takeovers. Managers do not have goals other than stock price maximization. Statement a and b are correct. Which of the following actions are likely to reduce agency conflicts between stockholders a and managers? a. b. c. d. Paying managers a large fixed salary. Increasing the threat of corporate takeover. Placing restrictive covenants in debt agreements Statement b and c are correct. Page 11 of 12 Course Name: Principles of Finance Chapter 1: Overview of Financial Management Answer: 1. d 2.d 3.b Page 12 of 12