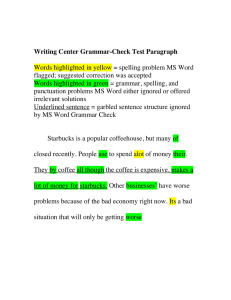

Running head: STRATEGIC AUDIT: THE CASE FOR STARBUCKS Strategic Audit: The Case for Starbucks Name Institutional Affiliation 1 STRATEGIC AUDIT: THE CASE FOR STARBUCKS 2 Strategic Analysis Starbucks has adopted a unique type of cost leadership. Cost leadership, as a business strategy, involves gaining a particular advantage over the competition by lowering economic costs that set it apart from competitors (Barney & Hesterly, 2019). The current business strategy of Starbucks is based on selling coffee of the highest quality. As such, Starbucks's business strategy focuses on product differentiation. A differentiation approach involves offering consumers a unique product or service (Barney and Hesterly, 2019). Thus, the coffee chain implements a differentiation strategy to increase their competitive advantage. Based on this understanding, the coffee retailer pays special attention to the quality of its product offerings. This explains why its consumers display a willingness to pay a premium or higher price for a coffee. Starbuck also uses superior customer service to sustain its competitive advantage. This has further contributed to the coffee chain giant's attractiveness. When it comes to corporate strategy, Starbucks involves establishing itself as the leading source of exceptional coffee globally while at the same time, remaining committed to the long-term growth of the company (Starbucks, 2020). Thus, the guiding values of Starbucks' concerns providing their customers with the guarantee of the highest product standards while maintaining a diverse product mix at the same time (Starbucks, 2020). This way, the company can appeal to a diverse consumer base. Consistent with Starbucks' corporate strategy, the coffeehouse strives to expand its business, especially in developing industries. Business penetration in emerging markets has been for years Starbuck's corporate strategy (Barney & Hesterly, 2019). Overall, this strategy has given the firm a unique competitive advantage as the world's coffee chain retailer. Performance Analysis Starbuck's tracks its performance using multiple matrices such as monthly status reports and other statistics. One of the most prominent measurements for the company is the financial performance measure. According to statistics, Starbuck's latest EBITDA margin over the last twelve months stands at 19.2 percent. When Starbuck's EBITDA margin is benchmarked against competitors in the same related industry, such as Yum! Brands and Wendy's, which have an EBITDA forecast margin of 32.7% and 23.5% respectively, it becomes clear that the two companies are more attractive to investors than Starbucks ("EBITDA Margin for Starbuck's Corporation," 2020). It also means that Yum! Brands and Wendy's Company have betteroperating efficiency compared to Starbucks. Another financial KPI that Starbuck uses is Revenue Growth. If you look at the last twelve months, Starbucks ' revenue growth slumped in 2019 at -7.7 percent. Benchmarking the results to its competitors, Starbucks displays a dismal run of results since Yum! Brands and Wendy's reported revenue growth increase by 0.6% and 6.0%, respectively ("Revenue Growth for Starbucks," 2020). Starbucks also traces service performance to the American Customer Satisfaction Index (ACSI) to benchmark every aspect of the customer experience with industry peers. ACSI is a national economic indicator of consumer's experiences with a company's quality of services and products. In 2019, Starbuck received an ACSI score of 79 in the Limited-Service Restaurant category, which was higher than that of its main competitors, like Wendy's, which received a score of 76 (ACSI, 2020). This ACSI rating emphasizes the relentless focus Starbuck's has on its customer base and its commitment to its brand promise to deliver on customer expectations. STRATEGIC AUDIT: THE CASE FOR STARBUCKS 3 Starbucks also uses an innovation strategy to boost its performance. Service innovation refers to the change in a specific business dimension that positively impacts other elements of service. Currently, as part of the service innovation of Starbucks, the coffee retailers launched their rewards programs and mobile app as a way of increasing the information they collect and use it to gain insights into their clientele base and retrieve data regarding their purchasing habits (Marr, 2018). This way, the company can respond to customer demands. In turn, this plays a pivotal role in helping the company direct marketing, sales, along with the business decision. External Analysis Starbucks operates in a perfect competition market characterized by four conditions: identical products, no entry or exit barriers, information shared consistently with all participants and the presence of many sellers and buyers. Because there are no barriers to entry and information is that homogenous businesses usually make reasonable profits. The American coffee shop industry is in a mature stage with medium level concentration and is continually changing as the high number of players continues to compete for market share. Starbucks and Dunkin Brands accounted for more than 65 percent of the market share (Brown, 2019). Porters 5 forces framework is a tool that businesses use to analyze competition in the industry (Barney and Hesterly, 2019). First, the coffeehouse experiences a moderate threat of new entries. The coffee landscape industry does not have many barriers, and the true cost of opening a coffee shop business is very high either. This means Starbucks can experience some competition from new entrants. There is a significant variety of substitutes for Starbuck products, including alcoholic and non-alcoholic drinks. Besides, some people prefer brewing coffee at home. This makes the threat of substitutes higher for the Starbucks brand. Next, the bargaining power of suppliers is low because Starbucks has partnered with suppliers around the world (Matthews, 2015). Accordingly, buyers' bargaining power is high due to the existence of tougher competition, which translates to a wide variety of choices for customers. Starbucks faces an intense competitive rivalry due to the presence of both large and small coffeehouses. Considering that switching is relatively low makes competition ever so high. Competitive rivalry and the threat of substitution demonstrates that external forces remain significant but limited issues in Starbuck's strategic management. Internal Analysis Some of the resources that form the basis for Starbuck's sustainable competitive advantage include innovation capacity, marketing, financial resources, human resources, and employees. At the same time, capabilities refer to what the organization can do with these resources. This way, resources, and capabilities usually provide a sustainable competitive advantage based on the four dimensions of (VRIO) Value, Rarity, Inimitability, and organizational support (Barney & Hesterly, 2019). According to the first dimension of VRIO, Starbucks has a strong brand image, which is the company's most pivotal strength. As a global leader in the retail coffee market, global consumers acknowledge the company as a valuable product and service provider. The brand image helps Starbucks to create a competitive advantage over other competitors like Dunkin and Wendy's. The supply chain also adds value to the company. Starbucks has adopted a vertically integrated supply chain, which implies that the firm STRATEGIC AUDIT: THE CASE FOR STARBUCKS 4 owns its entire supply chain and interacts closely with farmers. This way, the company is able to maintain the same quality and flavor standards of all its coffee beans (Matthews, 2015). Starbucks possesses rare resources that include secret menu items coupled with distinctive flavors and premium coffee (Hseih, Tullo & Uy, 2020). These rare features make Starbucks products and customer experience more superior compared to those of other competitors like Dunkin. At the same time, imitating the firm's rare resources is next to impossible, which gives Starbucks an edge from its competitors. While other companies can somehow replicate customer service, it would be costly to imitate. Starbucks also organizes its resources as a way of maintaining its leadership position in the coffee shop industry. Global presence in over 30,000 locations plays a significant role in helping the firms generate revenue. Based on this VRIO, it becomes apparent that Starbucks' strength lies in offering products of the highest quality and avoiding standardization of quality. The premium prices of coffee pose some threats for the company to succeed in emerging markets. Conclusion and Recommendations Undeniably, Starbucks continues to sustain a competitive advantage on account of quality, particularly compared with other competitors. Part of the reason for this growth and success has been due to the company's international business strategy. This way, Starbucks has been able to implement its objectives. However, a problem that continues to plague the company is the high number of stores in the U.S. that have led to Starbuck's market oversaturation. The chain's many branded coffee shops and coffee-focused restaurants across different American locations are cannibalizing sales. However, Starbucks can overcome this problem by investing more in emerging markets of India, Russia, Brazil, Mexico, and South Africa. Since these countries continue taking the lead in consumer market growth, they can provide significant entry opportunities. As per Starbuck's internationalization strategy, the management teams must consider transferring the company's core competencies and capabilities on a region-to-region basis to tap into the potential growth in these marketplaces. This shows there a need for Starbucks to develop unique strategies and approaches for each market as a way of making Starbucks experience part of their culture. It is also recommended that the company needs to focus on articulating an entry strategy through franchising in the market industry around the world. STRATEGIC AUDIT: THE CASE FOR STARBUCKS 5 References ACSI. (2020). Benchmarks by Industry. Retrieved from https://www.theacsi.org/index.php?option=com_content&view=article&id=149&catid=& Itemid=212&i=Limited-Service+Restaurants Barney, J.B., & Hesterly, W.S., (2019). Strategic Management and Competitive Advantage: Concepts and Cases (6th Ed). London, England: Pearson Brown, N. (2019, October 25). Nearly Four of Every Five U.S. Coffee Shops are Now Starbucks, Dunkin' or JAB Brands. Daily Coffee News. Retrieved from https://dailycoffeenews.com/2019/10/25/nearly-four-of-every-five-us-coffee-shops-arenow-starbucks-dunkin-or-jab-brands/ EBITDA Margin for Starbucks Corporation. (2020). Retrieved from https://finbox.com/NASDAQGS:SBUX/explorer/ebitda_margin Hsieh, C., Tullo, D., Uy, M. (2020, May 19). 36 Secret-Menu Starbucks Drinks You Can Order to Feel Fancy and Extra as Hell. Cosmopolitan. Retrieved from https://www.cosmopolitan.com/food-cocktails/news/a38276/20-things-you-didnt-knowyou-could-order-at-starbucks/ Marr, B. (2018, May 28). Starbucks: Using Big Data, Analytics and Artificial Intelligence To Boost Performance. Forbes. Retrieved from https://www.forbes.com/sites/bernardmarr/2018/05/28/starbucks-using-big-dataanalytics-and-artificial-intelligence-to-boost-performance/#1ece9b8065cd Matthews, C. (2016, March 5). What Can We Learn from Starbucks' Supply Chain Management? Retrieved from https://www.maistro.com/procurement/what-can-we-learnstarbucks-supply-chain-management/ Revenue Growth for Starbucks Corporation. (2020). Retrieved from https://finbox.com/NASDAQGS:SBUX/explorer/total_rev_growth Starbucks. (2020). The Best Coffee. Starbucks Coffee Finder. Retrieved from https://www.starbucks.com/coffee