Strategic Management

Brief History Of S.M.

Industrial Organization

Resource Based View of

the firm and its Model

Literature

Review

of

Competitive advantage

VRIO Frame of work.

Implications

Criticism and Suggestions

Overall Goal of Strategic Management

for an Organization

Deploy & allocate resources ==> competitive advantage

Process of Strategic Management

What is Strategic Management?

Analyze

competitive

situation

Develop strategic goals

Devise plan of action

Allocate resources

Implement plan

Evaluate results

Brief history of Strategic

Management

Early Period

o Study of general management

o Largely descriptive

o Not theory based { SWOT ANALYSIS}

Key Authors

o Andrews…

o Christiansen…

o Ansoff.

Brief history

of Strategic

Management

First Revolution

o Potter Frame work

o Structure conduct performance

o

model (SCP) & Social Welfare.

o

Apply the SCP logic to strategic

o

Management

o Five forces frame work for

o

industry analysis

o

Generic strategies

Brief history of Strategic

Management

Limits of potter frame work

o

Market power versus efficiency (Demsetz)

o

Industry versus firm works (Wal-Mart)

o

The cost of entering attractive industries.

Central Conclusion

It is not possible to evaluate the attractiveness of

industry independent of the resources a firm bring to

the industry.

Two Contrasting Approaches

Industrial Organization Model vs. ResourceBased View

o Research provides support for both positions

What drives strategy?

o I/O: External considerations

o RBV: Internal considerations

I/O: Strategy drives resource acquisition

RBV: Strategy determined by resources

Two Contrasting Approaches

I/O Economics

Industry Characteristics

Profitability

RBV

Firm Characteristics

Profitability

Industrial Organization (O/I)

Model

o External

environment

determinant

of

is

organizational

primary

strategy

rather than internal decisions of managers

o Environment

presents

threats

&

opportunities

o All competing organizations control or

have equal access to resources

o Resources are highly mobile between

firms

o Organizational success is achieved by

Offering goods & services at lower costs

than competitors

o Differentiating products to bring premium

prices

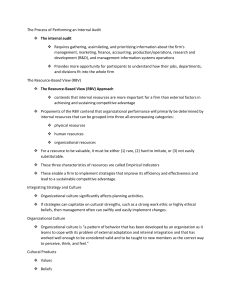

Resource-Based View (RBV)

Definition

An organization’s resources & capabilities, not external environmental

conditions, should be basis for strategic decisions

Competitive advantage is gained through acquisition & value of

organizational resources

Organizations can identify, locate & acquire key valuable resources

Resources are not highly mobile across organizations & once acquired

are retained

Valuable resources are costly to imitate & non-substitutable

Definition

Jay Barney

The resource-based view (RBV) argues that firms possess resources, a

subset of which enable them to achieve competitive advantage, and a

subset of those that lead to superior long-term performance. Resources that

are valuable and rare can lead to the creation of competitive advantage.

That advantage can be sustained over longer time periods to the extent that

the firm is able to protect against resource imitation, transfer, or substitution.

In general, empirical studies using the theory have strongly supported the

resource-based view.

Resources

Daft, 1983, Barney, J., 1991

Physical capital {Technology, plant, equipment, location, access to raw material}

Human capital {Training, expertise, judgment, intelligence, relationships and

insights of managers and workers}

Organizational capital {Organizational structure, planning, controlling and

coordinating systems, informal relations among groups within the firm and with

outside groups}

Wernerfelt, B., 1984, Hafeez, K., Malak, N. and Zhang,

Y., 2002

Resource = anything that could be thought as a strength or a

weakness for a firm. Tangible and intangible assets tied permanently

or semi-permanently to the firm.

Hofer and Schendel, 1978, Grant, R., 1991

Mahoney, J. and Pandian, R., 1992

Physical resources

Financial resources

Human Resources

Organizational resources

Technological resources

Legal resources

Experience

Intangible resources

Hafeez, K., Malak, N. and Zhang, Y., 2002

Physical assets

Intellectual assets

Cultural assets

R. B. V. Definitions

Competences

Selznick, 1957

Competence = things that an Organization does especially well in

comparison to its competitors

Hamel, G. and Prahalad, C., 1990

Competence = collective learning of the Organization, especially how to

coordinate diverse production skills and to integrate multiple streams of

technology

Penrose, 1959

Resource = stock. A resource can be defined independently from its use

Capability (competence) = flow. It implies function and activity and cannot be

defined independently from its use. Capabilities are created over time and

may depend on History and use of resources in an extremely complex (“pathdependent”) process

Hrebiniak, L. and Snow, C., 1980

Competence = aggregate of numerous specific activities that the organization

tends to perform better than other Organizations in a similar environment

Durand, T. 1996 & (Penrose, 1959)

Elementary assets and resources, tangible and intangible

Plant, equipment, products, software and brands

Cognitive competences, individual and collective, explicit and tacit

Knowledge, know-how, technologies, patents

Organizational processes and routines).

Coordination mechanisms in the organization to combine the action of individuals into

collective tasks and achievements

Organizational structure

Structure including its internal and external dimensions (links with suppliers and

customers)

Identity (Culture)

Corporate culture and behavior in the organization. Its shared values, its rites and

taboos are manifestations of the firm’s identity

Porter 1980-1985

Ghemawat 1986

Lieberman and

Montgomery

1988

Hamel and

Prahalad 1994

Competitive

Advantage

Cost OR

Differentiation

Future Position

Capabilities

Technology

Design

Production

Service

Distribution

Polanyi 1962

Rumelt 1984

Teece 1987

Itami 1987

Andrews 1971

Hofer and

Schendel 1978

Prahalad and

Hamel 1990

Ulrich and lake

1991

Resources

Tangible Resources

In-tangible Resources

Competiences

Wernerfelt 1984

Deiricks & Cool

1989

Reed and

Defillipi 1990

Barney 1991

Prahalad and Hamel (1990):

core competencies

Management’s ability to consolidate technology and production skills

into competencies so the business can adapt quickly to changing

opportunities/circumstances.

Core competencies = collective learning of the organisation about

prod/tech/markets. e.g. Sony’s miniaturisation skills.

Competencies have to be built over a long period.

They are difficult to identify precisely and hard to imitate.

Many firms fail to identify their own core competencies and so fail to

nurture them properly or exploit them fully.

Chandler (1990)

initial risky investments

Chandler (1990): successful giants such as IBM and Bayer derive

from the initial heavy and risky investments in building

organisational knowledge and capabilities which allowed them to

exploit the opportunities available to exploit scale and scope

economies.

Two Critical Assumptions of the RBV

Resource Heterogeneity

» different firms may have different resources

Resource Immobility

» it may be costly for firms without certain

resources to acquire or develop them

» some resources may not spread from firm

to firm easily

Resource Heterogeneity

Heterogeneity of resources typically occurs as the

result of ‘bundling’ several resources of a firm

Managers of a firm could take resources that seem

homogeneous and ‘bundle’ them to create

heterogeneous combinations

Resource Immobility

Resources may be immobile due to natural

and/or intentionally created barriers to imitation

Costs of imitation

o Imperfect imitability: the resource could be

imitated but the cost of doing so would

capitalize the full value of imitation

o Inimitability: the resource cannot be imitated

at any cost

The VRIO Framework

If a firm has resources that are:

• Valuable,

• Rare, and

• Costly to Imitate, and…

• The firm is Organized to exploit

these resources,

Then the firm can expect to

enjoy a sustained

competitive advantage.

First, the resource must be valuable in the sense that it

exploits opportunities and/or neutralizes threats in the firm’s

environment.

Second, it must be rare among the firm’s current and potential

competitors.

Third, the resource must be difficult for competitors to imitate.

Fourth, the resource must have no strategically equivalent

substitutes.

3-27

Competitive advantage

Competitively valuable resources (Collis and Montgomery, 1995)

Reduction of costs,

The exploitation of market opportunities, and/or

The neutralization of competitive threats.

Inimitability -- is the resource hard to copy?

Durability -- how quickly does the resource depreciate?

Approprability -- who captures the value the resource creates?

Substitutability -- can the resource be trumped by another

resource?

Competitive superiority -- whose resource is really better?

Stalk, Evans, and Shulman (1992): capabilities

Competitive advantage is based on the ability to respond to

evolving opportunities which depends on business processes or

capabilities. Business success involves choosing the right

capabilities to build, managing them carefully, and exploiting

them

e.g. Honda, Canon.

Collis and Montgomery (1995): competing

on resources

Competitive advantage derives ultimately from the ownership of a

valuable resource.

Superior performance derives from developing a ‘competitively

distinct’ set of resources and deploying them in a well conceived

strategy.

Resources can be physical, intangible, or organisational capabilities.

Example: Marks and Spencer (poor timing!)

Empirical implications

Henderson and Cockburn (1994) {Why pharmaceuticals innovate

then others.}

Rumelt (1991) { variance Decomposition}.

Mcghan and Potter {Industry effect size can but firm effects is

generally larger.

Barnett et al (1994)

{ why some banks compete out during

recession}.

Ray et al.(2004) {IT and Customer satisfaction in insurance firms}. {IT

and CS management has direct and interaction effects.

Hatch and Dyer (2004) firm specific human capital can create the

competitive advantage .because human capital is imitate.

Theoretical extension

Applied to additional phenomenon

Vertical integration and theory of firm (Corner ,1994 , Corner and

Prahalad ,2001, Barany 2002)..

Diversification (wireman and Robbins ).

Complementary extensions {heterogeneity}

HRM

Marketing

Enterpenuership

Operations management.

Practical Implications of RBT

Industry attractiveness cant be evaluated without the firm resources.

(South west and Wal-Mart.

Competitive advantage is every employee responsibility (Koch

industries of trading manufacturing investment).

Doing as well as just competition just shows the Mediocrity (Bench

marking).

Product features cant not be used for sustained the competitive

advantage as the ability to produce different features (Sony).

HP.. Mail Box Incorporation.. Xerox.

Criticisms on RBV and assessment

Criticisms

Assessment

1- The RBV has no managerial

implications.

1- Not all theories should have

direct

managerial

implications. Through its

wide dissemination, the

RBV has evident impact.

2- The RBV implies infinite

regress.

2- Applies only to abstract

mathematical theories. In an

applied theory such as the

RBV levels are qualitatively

different.

Criticisms on RBV and assessment

3. The RBV’s applicability is

too limited

3Generalizing

about

uniqueness is not impossible

by definition. The RBV

applies to small firms and

startups as well, as long as

they strive for an SCA. Path

dependency

is

not

problematic when not taken

to the extreme. The RBV only

applies to firms in predictable

environments.

Criticisms on RBV and assessment

4- SCA is not

achievable.

By including dynamic

capabilities, the RBV is

not

purely

static.

Though, it only explains

ex post, not ex ante

sources of SCA. While no

CA can last forever, a

focus on SCA remains

useful.

Criticisms on RBV and assessment

The VRIN/O criteria are not always

necessary and not always sufficient to

explain a firm’s SCA.

5- VRIN/O is neither necessary nor

sufficient for SCA.

The RBV does not sufficiently consider

the synergy within resource bundles as a

source of SCA. The RBV does not

sufficiently recognize the role that

judgment

and

mental

models

of

individuals play in value assessment and

creation.

Criticisms on RBV and assessment

7- The value of a

resource is too

indeterminate to provide

for useful theory.

The

current

conceptualization

of

value turns the RBV into

a trivial heuristic, an

incomplete theory, or a

tautology.

A

more

subjective and creative

notion of value is

needed.

Criticisms on RBV and assessment

Definitions of resources are allinclusive.

8- The definition of

resource is unworkable.

The RBV does not recognize

differences between resources as

inputs and resources that enable

the organization of such inputs.

There is no recognition of how

different types of resources may

contribute to SCA in a different

manner.

Suggestions for future research in RBV:

Demarcating and Defining Resources

o Theorize the distinctions between the building, versus the processes

of deploying that capacity.

o Conduct more process-based empirical research within the RBV

frame to probe how resource-based SCA and performance are

related.

o Identify types or characteristics of resources that help refine the

predictions of the RBV – that differ in the manner they contribute to a

firm’s SCA. Specifically:

Suggestions for future research in RBV:

o Explore the distinction between rivalries and non-rivalries resources

and the impact of this distinction on the predictions of the RBV.

o Expand on the distinction between resources and integrative

capabilities and on the hierarchical relationship between individual

and collective resources.

Suggestions for future research in RBV:

Towards a Subjective and Firm-Specific Notion of

Resource Value

o Investigate the value assessment processes by which new ways to

create and capture novel value are conceived.

o Study whether and how human ideas ignite revolutionary modes of

value creation.

o Study the social influence mechanisms through which entrepreneurs

create value by convincing others of the value of their products.

Suggestions for future research in RBV:

The RBV as a Theory of Sustained Competitive

Advantage

o Develop a resource-based explanation of SCA that focuses on the

differences in people’s capacities to identify or imagine and judge the

potential risks and benefits associated with the ownership of resources.

o Develop refined propositions on the relationship between specific

types of resources and a firm’s SCA.

o Study how new resources are selected and how they can be matched

with the existing resources in place in the organization.