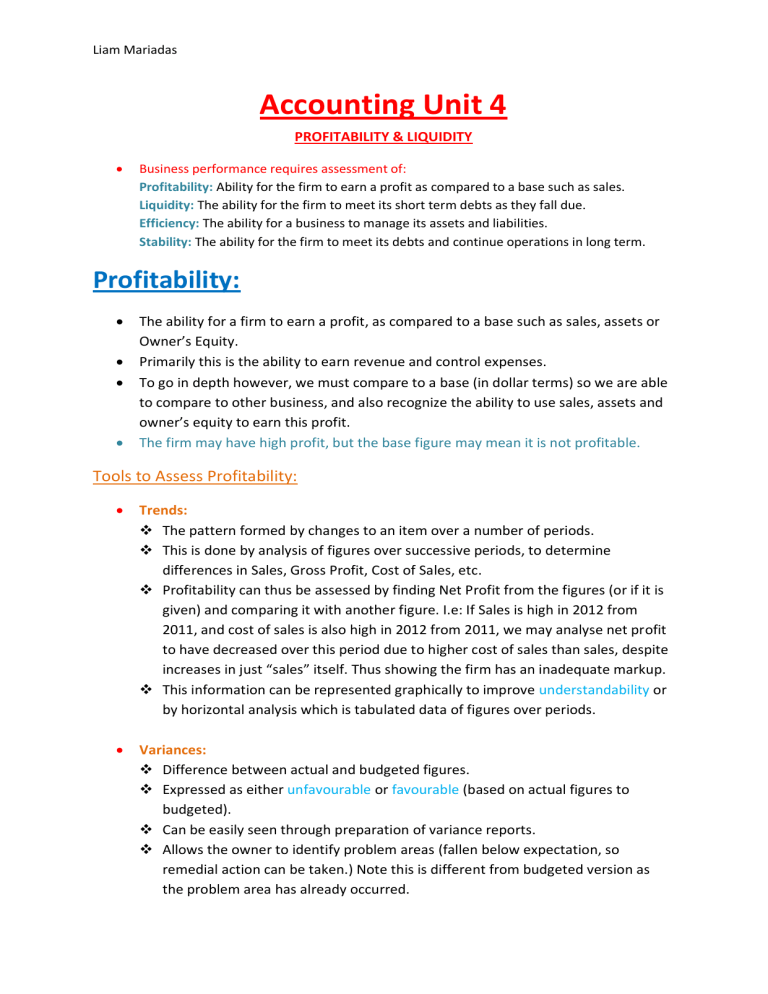

Liam Mariadas Accounting Unit 4 PROFITABILITY & LIQUIDITY Business performance requires assessment of: Profitability: Ability for the firm to earn a profit as compared to a base such as sales. Liquidity: The ability for the firm to meet its short term debts as they fall due. Efficiency: The ability for a business to manage its assets and liabilities. Stability: The ability for the firm to meet its debts and continue operations in long term. Profitability: The ability for a firm to earn a profit, as compared to a base such as sales, assets or Owner’s Equity. Primarily this is the ability to earn revenue and control expenses. To go in depth however, we must compare to a base (in dollar terms) so we are able to compare to other business, and also recognize the ability to use sales, assets and owner’s equity to earn this profit. The firm may have high profit, but the base figure may mean it is not profitable. Tools to Assess Profitability: Trends: The pattern formed by changes to an item over a number of periods. This is done by analysis of figures over successive periods, to determine differences in Sales, Gross Profit, Cost of Sales, etc. Profitability can thus be assessed by finding Net Profit from the figures (or if it is given) and comparing it with another figure. I.e: If Sales is high in 2012 from 2011, and cost of sales is also high in 2012 from 2011, we may analyse net profit to have decreased over this period due to higher cost of sales than sales, despite increases in just “sales” itself. Thus showing the firm has an inadequate markup. This information can be represented graphically to improve understandability or by horizontal analysis which is tabulated data of figures over periods. Variances: Difference between actual and budgeted figures. Expressed as either unfavourable or favourable (based on actual figures to budgeted). Can be easily seen through preparation of variance reports. Allows the owner to identify problem areas (fallen below expectation, so remedial action can be taken.) Note this is different from budgeted version as the problem area has already occurred. Liam Mariadas Benchmarks: A standard by which the firm’s performance can be assessed, to regard figures as “favourable” or “unfavourable”. Comparisons can be made between the firm’s actual performance and: Performance from previous periods. (Use of trends.) Budgeted Performance for the period. (Use of variance) Performance of other, similar firms- Industry averages or inter-firm comparisons. Profitability Indicators: Involve measurements that express an element of profit, in relation to some other aspect of business performance. Using the following, the results can be used to assess profitability between periods as well as between businesses as they use a common base: Return on Owner’s Investment (ROI) Return on Assets (ROA) Asset Turnover (ATO) Net Profit Margin (NPM) Gross Profit Margin (GPM) Don’t forget: RETURN ON OWNER’S INVESTMENT: Indicates how effectively the firm has used its owner’s investments (capital) to earn a net profit. Average is found by (Capital start + Capital end / 2) An ROI of 60% means that for every $1 of investment (capital) the firm earns $0.6 of profit. Can be assessed in trends, and benchmarked by previous period figures, budgeted figures and especially similar business. Owners will want this to be high so they know they are investing in the right place (rather than a term deposit or rent earned on land, or in another business.) If this figure is unsatisfactory, owners may invest elsewhere. Liam Mariadas RETURN ON ASSETS: Indication of how effectively a firm utilizes its assets to earn a net profit. If ROA is 40%, this means the firm earns $0.4 profit for every $1 assets. An unsatisfactory (as compared to usual benchmarks) figure could mean the firm must improve expense control, or earn more revenue via sales (go to a better location, advertise, lower sales price in hope that the greater frequency of sales earns more revenue, or increase sales price and hope the frequency of sales remains constant. ) ROA and ROI are linked- ROI will always be less than ROA for a firm due to the firm’s liabilities not being part of ROI (A=L+OE). A firm will usually have to look at both of these figures, and The Debt Ratio will account for the gap between them. The figure will also obviously depend on assets and net profit (as well as those revenues and expenses mentioned above). So if net profit increases more than assets, this is more profitable. Likewise, if assets increase more than net profit, this is less profitable. (A way to increase ROA is to donate stock for advertising, this will also attract more sales! Think of how this will improve it.) DEBT RATIO: (Gearing) Measures the percentage of the firm’s assets that are consumed by liabilities. The higher the debt ratio, the worse off the firm is as it means they rely more on external sources of finance to fund their assets. Assesses the firm’s long term stability, and level of risk associated with the firm. Should be used alongside ROI for the risk vs reward (of investment) factor. ROI might be high if debt ratio is high (less capital due to more external sources.) The firm should make Debt ratio as high as possible (for increased ROI) but keep it low enough to not make its debt burden unmanageable. Liam Mariadas ASSET TURNOVER: This is about earning revenue, not exactly profit- but will contribute to it. This indicator measures the firm’s effective use of assets to generate revenue. The ATO IS NOT A PERCENTAGE. If the ATO is 0.5, it means the firm has earned sales revenue 0.5 times the amount it has in assets. Benchmarked by previous periods, budgets, or similar business figures. ROA and ATO look similar but they are not. ROA refers to profit whilst ATO refers to revenue (Sales) with assets as the base. This means the discrepancy between the two could be from “other revenue” or the expense control of the firm. If the ROA is worse than the ATO, it means the firm has poor expense control. CONTROLLING EXPENSES: The firm’s ability to control expenses so that they either decrease, or increase less than the rate of sales revenue. (in the case of variable expenses.) For example, decrease wages altogether. Or, for the variable expense like Cost of Sales, to earn more sales revenue both will have to increase, the firm wants “cost of sales” to increase less than sales revenue though to be more profitable. These are indications of better expense control. As expense control improves, so too should profitability. Indicators to measure this are two that calculate the % $Sales retained as net profit: Net Profit Margin (NPM) Gross Profit Margin (GPM) NET PROFIT MARGIN: Measures the firm’s ability to earn net profit from their sales revenue, (revenue that ends up as profit) - and thus the expense control of the firm. A low NPM would mean high expenses, and thus poor expense control. If NPM is 30%, the firm earns $0.3 net profit per $1 sales. An increase in both sales revenue and profit may still mean poor expense control, it depends how much net profit increases in relation to sales. These can be compared to the usual benchmarks. 100 – NPM= $ expense consuming sales. ROA depends on ATO and NPM. Liam Mariadas GROSS PROFIT MARGIN: Indicates the amount of gross profit earned from the firms sales revenue, and thus how much of its sales is retained as gross profit- thus detailing the firm’s management of cost of goods sold (Expenses to do with trading activities). Assesses the adequacy of the firm’s mark up. If GPM is 40%, this means the firm retains $0.4 gross profit for every $1 sales. The lower the GPM is, the poorer the firm’s expense control is in relation to its trading activities. (cost of goods sold). If NPM is poor and GPM is satisfactory, it will support the fact that “other expenses” are the problem, not cost of goods sold. The mark up of a firm’s stock: A greater mark up may not always mean higher gross profit- as the firm’s stock may be of such poor quality it reduces sales. Ways in which firm can increase gross profit & mark up: Selling prices increasing but cost prices remaining constant. Cost prices decreasing and selling prices remaining constant. Both increasing but sales increasing by more. Both decreasing but costs decreasing by more. When answering these questions it is important to state the rate at which things will increase or decrease. If we lower the selling price for more sales, state that the frequency of sales must increase to increase the revenue earned from the drop in selling price. Likewise always state that the increase in sales should be more than that of the cost. Vertical Analysis: A report which details every item in the report (Income Statement) as a percentage of the base figure, which is usually sales revenue. Through this we can identify poor expense control (Net Profit as a percentage of Sales) and even how much % Cost of Goods sold consumed sales revenue (assessing the mark up.) We can also see any positive or negatives in expense control to do with “other expenses”, in which a lower % will be more satisfactory. Of course, all of this should be compared to a benchmark. Graphs: Improves Understandability, in that not all owners are knowledgeable of accounting so the presentation of financial information through graphs can make it easier for them to understand the firm’s financial performance. It is extremely likely to be examinable, graphs are usually straight forward if you understand the effect of the items included. Liam Mariadas DISADVANTAGES OF FINANCIAL INFORMATION: The reports use historical data: The firm’s use of historical data is based on past events so cannot be used to represent future events or one’s that will occur. Different businesses use different accounting methods: Hard to compare with industry averages, undermines comparability of reports and financial indicators. The use of averages can be misleading and even inaccurate: Averages are not always accurate, so indicators may not accurately represent the firm’s financial performance, concealing details about individual items. Reports themselves may contain limited information: There are many items of important information not reported in the Income Statement (or Cash Flow.) NON FINANCIAL INDICATORS: Any information that helps inform the owner of its financial performance or position, that is not based on a monetary unit or present in its financial reports. This includes: The firm’s relationship with its customers: Number of repeat sales, number of customer complaints, catalogue requests, brand recognition and primarily customer satisfaction surveys can go help the owner assess the firms relationship in retaining and attracting more customers. The suitability of stock: The number of sales returns and purchase returns can be assessed to identify the quality of the stock the firm sells, and the customer complaints monitored. A better stock mix means better financial performance (more sales and more satisfaction with these sales.) The firm’s relationship with employees: Employees are important for tasks such as increasing sales and customer service. It is thus important to maintain workplace harmony and employee satisfaction, through appraisals and also assessing the number of days sick leave, or duration of average length of employment. The state of the economy: A poor economy will affect the firm’s financial performance, so this must be taken into account also. End of Profitability Liam Mariadas LIQUIDITY Refers to the ability of the business to meet its short term debts as they fall due. Unlike profitability, cash is now a major factor. That is, the cash the business already has on hand as well as measuring the speed it will attain cash to pay off short term debts. We can identify a firm’s liquidity position by the same four methods: Trends (covered in profitability) Benchmarks (Previous periods, budgeted figures, industry averages.) Variances (covered in profitability) Liquidity Indicators. The following indicators can be used to assess the level of liquidity of the firm: Working Capital Ratio (WCR) Quick Asset Ratio (QAR) Cash Flow Cover (CFC) These indicators can be used to assess the speed of liquidity: Stock Turnover (STO) Debtors Turnover (DTO) Creditors Turnover (CTO) WORKING CAPITAL RATIO: The measure of the firm’s ability to cover its short term debts as they fall due (current liabilities) with their current assets (and measures the ratio between them.) A WCR of 2:1 means the firm has $2 assets for every $1 liability. Can be compared to the usual benchmarks. A WCR is said to be satisfactory is it is 1:1, as the firm can meet all its short term debts with its current assets. However, this ratio means there is no room for error. A WCR less than 1:1 is certainly unsatisfactory, it means the firm cannot meet its short term debts as they fall due with their current assets (within 12 months.) This means the firm may be unable to pay back creditors, and will have to sell assets to meet their debts. To correct this, the owner can contribute capital, withdraw less, extend overdraft or borrow out a loan (benefits in the short term.) A WCR greater than 1:1 is satisfactory, however if it is too big, the firm may be not utilizing its assets to pay off short term debts as they should- in which case there is Liam Mariadas margin to do so. It could also indicate idle assets, (debtors not paying back, stock not being sold, or more cash at bank than need be.) They can correct this by reminding debtors to pay back, or only ordering stock when levels have run down. Excess cash means the firm would benefit from using this money pay off any debts remaining, expand operations (buying noncurrent assets) or maybe invest in a term deposit or take out more drawings. QUICK ASSET RATIO: A liquidity indicator that measures the ratio of quick assets to quick liabilities, to assess the firm’s ability to meet its short term debts on a realistic basis. It is a realistic adjustment to WCR, excludes stock, prepaid expenses from assets, and bank overdraft from liabilities. Stock control has no guarantee of being turned to cash, prepaid expenses can’t realistically be refunded as we are contracted, and bank overdraft is unlikely to be called upon by the bank as long as it is under the limit. It is a ratio, and a QAR of 2:1 means the firm has $2 of quick assets to every $1 quick liabilities. It can be compared to benchmarks, but a 1:1 QAR is satisfactory. If WCR is satisfactory but QAR is not, it means the firm need to sell its stock quickly, or is dependable on prepaid expenses to meet it’s short term debts as they fall due. It can also reduce liabilities by paying/reducing creditors and accrued expenses. CASH FLOW COVER: Measures the firm’s ability to cover its short term debts with the net flows it makes to do with its daily transactions (operating activities.) Using WCR and QAR has the problem of using static items, however CFC uses operating cash flows generated and not just figures from the balance sheet. Note that this current liability figure is an average. A CFC of 3.2 would mean the firm can use its Net Operating Flows to cover its current liabilities 3.2 times. A poor CFC means the firm needs to seek external sources of finance or owner’s capital to meet its short term debts as they fall due. Compared to usual benchmarks (previous periods, budgets, industry averages.) Longer period the more times the firm expects for NCFO to cover short term debts. Liam Mariadas The Speed of Liquidity: Previously we have assessed the level of liquidity, the static aspect of how much current assets can cover current liabilities. However, the speed or liquidity is equally important, and firms with poor WCR can still survive if they can turnover Stock, Debtors and Creditors satisfactorily (usually quickly.) STOCK TURNOVER: Average number of days it takes the firm to convert its stock into sales. An STO of 48 means the firm takes 48 days to turn its stock into sales. A lower stock turnover is better (the firm makes cash quicker from sales of stock.) Round the value to the nearest day. If stock turnover is too slow: Increase sales by advertising, changing selling prices or changing (improving) the stock mix. The firm can also order less stock, so less stock on hand but reorder more frequently to keep customer demand, or remove slow moving stock lines. If stock turnover is too fast: the firm may be selling the stock for too low a price and thus losing potential revenue. It could also mean the firm has high delivery costs due to holding too little stock (so purchases more frequently.) Proper management of stock (as assisted by stock cards) may be appropriate also. Reviewing sales for better stock mix (faster lines in, slower lines out.) Promote the sales of complementary goods- to make more sales. Ensure stock is up to date and in demand, attracts and makes more sales. Rotate stock, so older units are sold first (especially perishables) so less chance of a stock loss or stock write down. Determine an appropriate level of stock on hand, not too high and not too low. Strong marketing such as advertising., attracts sales. DEBTORS TURNOVER: Measures the number of days it takes the firm to receive cash from debtors. Higher DTO, more unfavourable (means more days taken to receive cash.) Slow DTO means firm receives cash from debtors (one of its primary sources) too slow, and so may find it difficult to meet short term debts as they fall due. Liam Mariadas To increase DTO: Offer discounts, Send reminder notices, instigate removal of credit facilities, threaten to take legal action. Should be compared to credit terms or other benchmarks. CREDITORS TURNOVER: Measures the average number of days a firm takes to pay its creditors (meet one of its short term debts as they fall due.) Slow CTO may mean the firm is unable to meet short term debts as they fall due, but should be compared to credit terms and other benchmarks. If the firm’s CTO is too high (too slow) it may be disadvantageous as they may be exceeding credit terms (comparison) and may have credit facilities removed from them in the future. They may also be missing out on discounts. However is CTO is too low (too fast) this is disadvantageous as cash is leaving the firm too quickly to pay back creditors, instead of being used for other areas such as expansion (purchase of noncurrent assets), paying other expenses such as wages or advertising, or withdraws for the owner. Therefore the firm should try to have a stable CTO which is not too fast, but still allows them to either obtain discounts but primarily allows them to stay within the credit terms. Comparison to benchmarks is needed to assess as satisfactory. End of Liquidity