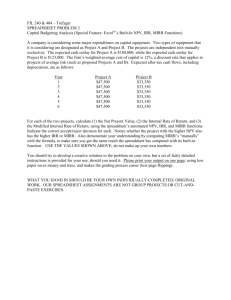

Question Discuss the notions of conventional and nonconventional cash flows in capital budgeting. Which investment evaluation criteria would you use for unconventional cash flows and why? Provide a fictitious example and apply the NPV, IRR, and MIRR methods to your example. Interpret the results. Notions of conventional and non-conventional cash flows in capital budgeting Capital Budgeting helps in the organization’s long-term investment planning and is a crucial decision-making tool to determine investment opportunities based on a positive return on investment (Stephen, Randolph, & Bradford, 2013). For example, Bhat-Bhateni's superstore plans to open its store in a new place would be an essential capital budgeting decision as this involves huge investment and the payback period is longer. Thus, capital budgeting decision is essential for making an investment decision for large scale projects. Such projects may have conventional or non-conventional cash flows. If cashflows have only one change in sign, either plus to minus or vice versa, then such cash flow is conventional cash flow and the project associated with it is called conventional project (Kastro & Kulakov, 206). If the project has multiple changes in sign (plus and minus) in cashflows then such a project can be called nonconventional project and cash flow associated with it can be called non-conventional cashflows. Projects that involve periodic repair, maintenance or replacement of tools show non-conventional cashflows. Example of conventional cash flow Year 0 1 2 4 5 6 Cash Inflows (+) in NPR Cash Outflows (-) in NPR -50,00,000 1,00,000 3,00,000 2,00,000 5,00,000 8,00,000 Example of Non-conventional cash flow Year 0 Cash Inflows (+) in NPR Cash Outflows (-) in NPR -50,00,000 1 2 4 5 6 1,00,000 -3,00,000 2,00,000 5,00,000 -8,00,000 Investment Evaluation Criteria for Non-conventional Cash Flows Internal Rate of Return (IRR) is the rate of return for projects having conventional cash flows and represents the highest rate of interest that can be bearded by an investor to pay all debts without losing money to the project such that all money to finance the project is borrowed (Kulakova & Kulakov, 2012). So, it can be said that if the project’s IRR is equal to the rate of return then such a project is conventional. So, IRR is not suitable for an investment of nonconventional cash flows. For non-conventional cash flows, the framework of Net Present Value (NPV) method, is not sufficient to determine the rate of return (Kulakova & Kulakov, 2012) For this Kulakova and Kulakov (2012), have proposed GNPV (Generalized Net Present Value) method for investment evaluation for Non-Conventional Project. GNPV method uses two different interest rate i.e. finance interest rate and re-investment interest rate are different instead of a single rate of interest and this enable to determine the rate of interest of non-conventional projects more accurately (Kastro & Kulakov, 206). Fictitious Example to demonstrate NPV, IRR, and MIRR method The NPV uses an actual value of money to measure the return on investment whereas the IRR calculates the earning in return on the investment (Kulakova & Kulakov, 2012). In general practice project investors prefer IRR over the NPV to determine whether money should be invested in the project or not (Kulakova & Kulakov, 2012). Moreover, investors prefer MIRR over IRR. MIRR stands for Modified Internal Rate of Return which considered that positive cash flows are reinvested at the company’s capital cost. MIRR is considered more accurate and precise than IRR. Mathematical formulae to calculate NPV is as follows NPV = Kt/(1+i)t – K0 ……… (i) (Jagerson, 2019) Here, Kt = Cash flows represent cash flows in each period of the time. i = Discount rate or interest rate t = time period K0 = Initial investment is the amount invested in the initial stage of the project. Mathematical formulae to calculate IRR is as follows If NPV of all cash flows is zero for the particular project then the discount rate becomes the internal rate of return. Thus from (i), we can say NPV = 0 = Kt /(1+IRR)t – K0 ………………. (ii) Mathematical formulae to calculate MIRR is as follows MIRR = √(n&TVCI/PVCO) – 1 Here, n = The number of year of investment TVCI = Terminal Value of Cash Inflows (i.e. Cash inflows in future is assumed to be re-invested as the rate of interest throughout investment.) PVCI = Present Value of Cash inflows (i.e. Cash outflows at present incurred during the investment period at the present rate of interest) Excel Formulae For Calculating NPV =NPV (rate,value1,[value2],….) For Calculating IRR =IRR(values,[guess]) For Calculating MIRR =MIRR(values,finance_rate,reinvest_rate) Suppose we have a project say Project Alfa. For ease of calculation, we consider cashflow is conventional. The discount rate or interest rate (i) is considered 9%. For calculation of MIRR let us consider re-invest rate is equivalent to the discount rate. It is also considered that interest rate and re-invest rate remain constant throughout the five-year period. I will be using MS excel for calculation and safe is attached along with this post. 9% 9% 0 Discount Rate (i) Re-Invest Rate Period (in Years) For Project Alfa $ 1 2 Cash Flows (in $) (10,000.00) 2000 4000 NPV IRR MIRR 3 4 5 1000 2000 2000 The calculation for Project Alfa ($1,201.40) 3.5% 6.0% As we can see NPV is negative so we can say that the project is not profitable so it is better not to do this project. We would select a project only if NPV is positive. For mutually exclusive projects, if we need to select among two projects then projects have high NPV value should be considered only if NPV is positive. If NPV is negative for both project then neither of the projects should be selected. Here, IRR is less than the discount rate or interest rate so this project won’t be able to pay interest in the debt invested in the project so this project is not feasible. Also, MIRR is less than interest rate so this project is not feasible from an investment point of view. References Jagerson, J. A. (2019, April 11). What Is the Formula for Calculating Net Present Value (NPV)? Retrieved from https://www.investopedia.com/ask/answers/032615/what-formula-calculating-netpresent-value-npv.asp Kastro, A. N., & Kulakov, N. Y. (206). Definition of the concepts of conventional and non-conventional projects. Information Systems and Technologies in Business, 36(2), 16-23. doi:10.17323/19980663.2016.2.16.23 Kulakova, A. N., & Kulakov, N. J. (2012). Capital Budgeting Technique for Non-Conventional Projects. IIE Annual Conference Proceedings, (pp. 1-8). Norcross. Stephen, R. A., Randolph, W. W., & Bradford, J. D. (2013). Fundamentals of Corporate Finance (10 ed.). New York: McGraw-Hill Education.