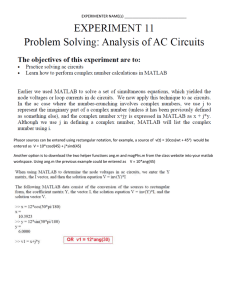

SCHOOL OF ACCOUNTANCY, BUSINESS and HOSPITALITY Accountancy Department LMS ACTIVITIES - SHORT TERM 2020 Week 2 – June 15-19, 2020 Course FMGT 1013 – Financial Management Code 031, 033, 034 032, 035, 037 036 Teacher Jerome D. Marquez Rovelle Concepcion S. Siazon Rommel Royce V. Cadapan FINANCIAL STATEMENT ANALYSIS, PART 1 Learning Objectives: At the end of this session, you should be able to: 1. Explain the basic objectives of analyzing financial statements. 2. Describe the general approach to financial statement analysis. 3. Enumerate the steps in financial statements analysis. 4. Apply the following techniques in financial statement analysis: Horizontal analysis of Comparative Statements (Increase-Decrease Method) Trend Analysis Vertical Analysis or Common Size Financial Statements Financial Ratios Analysis 5. Explain the limitations of financial statement analysis. DISCUSSION Motivation: Good day, guys! I have read several outputs of your activities (expectations, debate, and essay) and surprisingly, I was inspired. Inspired because I never expected that many of you have good written communication and research skills. Many of you are good in using the business language. It just shows that the passion to learn the rigors of business is already there. Keep it up! This is accounting. If you want to learn accounting effectively and efficiently, you must know how to relate it to other fields like finance. Learning accounting should go beyond the walls of accounting. And having a good grasp of finance is an edge in the accounting world. Some reminders before we proceed to the discussion proper: 1. We allow late submissions for a maximum of 3 days after the deadline. This is in compliance with the new policies on reporting student’s non-compliance and inactivity in flexible learning modality. However, we will monitor those students who habitually submit outputs after the deadline. Do not abuse this privilege because we want you to have a healthy pacing while learning. 2. Please be loyal in the power of learning. In today’s set-up, there are few possible means to complete your output. The most fulfilling among them is when you submit yourself to selfdirected learning. Hence, we should always remind ourselves that in order to grow, leave your comfort zones. Work independently without any guilt of cheating. Remember, as future accounting professionals, honesty is our core foundation in all business transactions. So, keep that young vibe. The vibe to improve and grow. Keep the passion to learn! 3. I believe that online learning should go beyond accumulation of knowledge. It is more than reading and comprehending all forms of discussion – whether in a written form or in an oral form. It should direct you to a higher form of learning, i.e., learning how to learn. Being proactive is a must in today’s highly competitive accounting arena. Knowledge-based learning is an oldschool concept. It is where spoon-feeding greatly resides. And as future accounting professionals, we do not want you to reside there. Instead, we want you to be accountants who can work with less supervision, who can work under pressure, who can work collaboratively with others, who can work with critical thinking and problem solving skills, and who can work with an end of self-improvement. Hence, for the weeks to come, expect for learning tasks that would challenge and excite you a lot. Your study hours should be devoted greatly doing learning tasks and not merely reading or watching video tutorials. You must apply that knowledge accumulated to reinforce a higher form of learning. No worries, we will provide you the best possible content discussion here. If you have concerns on the content or you cannot comprehend them, feel free to collaborate with your classmates, ates, kuyas, and to us – your mentors. Follow-Up and Recap: We have learned during week 1 that Financial Management or Corporate Finance aims ultimately to maximize the wealth of the owners or shareholders. Equally important concept was also introduced in the name of Corporate Social Responsibility (CSR). It has been a long-time debate among academicians and scholars on what should be the primary objective of financial management. One viewpoint (stockholders) emphasizes that FinMan should aim for wealth maximization. The other viewpoint (other stakeholders) emphasizes that FinMan should aim for CSR. All your arguments have strong basis. I appreciate all your arguments, however financial practitioners and academics now tend to believe that the manager’s responsibility should be to maximize shareholders’ wealth and give only secondary consideration to other stakeholders’ welfare. The strongest argument was that of Adam Smith, first and well-known proponent of this viewpoint. He argued that, in capitalism, an individual pursuing his interest tends also to promote the good of his community. He also pointed out that acting through competition and the free price system, only those activities most efficient and beneficial to society as a whole would survive in the long run. Thus, those same activities would also profit the individual most. Owners of the firm hire managers to work on their behalf, so the manager is morally, ethically, and legally required to act in the owners’ best interest. Any relationships between the manager and other firm stakeholders are necessarily secondary to the objective that shareholders give to their hired managers. Therefore, the overriding premise of financial management is that the firm should be managed to enhance owner(s) well-being. Remember the following grounds of wealth maximization: 1. it considers the risk and time value of money – we will elaborate the concept of risk in your Financial Market course and the time value of money at the later part of this course. 2. it considers all future cash flow, dividends and earnings per share- Cash flows analysis is part of this chapter. Dividends and earnings per share will be covered at the later part of this course. 3. it suggests the regular and consistent dividend payments to the shareholders - While dividend payment has disadvantages like giving less priority for future expansion and scalability, it is also viewed by the existing stockholders as a means of showing financial strength to potential shareholders’ hence inviting them to invest in the company. 4. the financial decisions are taken with a view to improve the capital appreciation of the share price - When a company has shown consistent growth of profitability (normally EPS), the company’s intrinsic value (the true value of the company) would definitely increase. An increase in intrinsic value would ultimately be reflected on the market price of the share. Since a share price is market-driven (remember the law of supply and demand), as the company looks promising (consistent growth of profitability), investors would come in. The demand from investors to have a share or part of the pie (company) would increase thereby pushing the price of the company’s shares to rise. 5. maximization of firm's value is reflected in the market price of share. - This is widely accepted quantitative measure of wealth maximization. This is supported by the Efficiency Market Hypothesis (EMH) Theory where when market or public becomes efficient (lahat nalang about sa company alam ng public) in obtaining information about the financial condition of the entity including all future plans of the company, the public will make decisions whether to invest or add more investments or to sell their current holdings in the company. Hence, all actions and decisions will ultimately be reflected in price of the share. With an end of maximizing the wealth of the shareholders, a financial manager has many tools of assessing the financial health of a company. One of them is Financial Statement Analysis: New Topic: Financial Statement Analysis -involves careful selection of data from financial statements for the primary purpose of forecasting the financial health of the company. Sample specific questions to be resolved in arriving at the BEST DECISION after careful analysis of the financial statements may include the following: 1. Will the e-commerce industry like Amazon, Lazada or Shoppee continue to make good results after this COVID 19 pandemic? How about the oil industry, can they still recover from massive losses after this COVID 19 pandemic? What could be the effects of the unending US-China trade war to emerging economies like the Philippines. (This is a macro environment scanning where a company may be greatly impacted by the current economic developments in the world or in the Philippines) 2. Can BPI extend more credit to potential short-term creditors despite the increase in credit defaults due to government-imposed regulation during this pandemic? 3. Do online sellers have sufficient stock of goods to meet promptly orders despite problems in logistics brought about by this pandemic? 4. Can ABS-CBN pay its huge long-term obligation amid suspension of franchise renewal? 5. Can GMA7 maintain its position as one of the publicly listed companies in the Philippines which gives high and consistent dividend payments to the shareholders amid this pandemic? 6. Can DITO Telecommunity, having a huge debt over equity, translate borrowings into earnings in 3 to 5 years? 7. Does Gilead Sciences Inc have competitive advantage in the discovery of vaccine against COVID 19 virus? 8. Despite Ramon Ang’s philanthropic activities (CSR) which entails substantial cost, could this greatly affect San Miguel Corporation’s profitability? How about its effect on the company’s stock price? In summary of the foregoing questions, we can have the following as general approach when analyzing financial statements: 1. Background study and evaluation of firm industry, economy and outlook. 2. Analysis of the short-term solvency (working capital analysis) 3. Analysis of the capital structure and long-term solvency (Equity and long term assets and liabilities analysis) 4. Analysis of operating efficiency and profitability (revenues and expenses analysis) 5. Other considerations: Quality of earnings – Baka naman one-time gain lang kaya mataas ang profit nila ngayong taon. A good quality of earnings are those that are result of recurring revenues (operating income). Quality of assets and relative amount of debt – Baka naman profitable yung business pero hindi naman makabayad ng utang on time ang company, or deteriorating na rin pala mga PPE nila. Transparent financial reporting – The more reliable the economic information provided by a company through the financial statements, the more confidence potential investors can place in that information. Ok, guys, hinga na muna! Take a break! Inom ng tubig! Kain ng Kitkat! Basta break muna tayo! Baka pagod na utak mo! Heavy ba? Hindi naman diba. Sige tuloy na natin a! After knowing the general considerations as mentioned above, we should also look into the procedures or steps in conducting FS analysis (Pagdadaanan mo ito later sa napakaganda at makatotohanang learning task na gagawin mo matapos maunawaan itong discussion natin) Steps in Financial Statement Analysis 1. Establish objectives of the analysis - May balak ka bang pautangan ulit si ABS CBN o si DITO? - Magiinvest kaba sa GMA7 o Meralco kasi mataas at consistent silang magbayad ng dividends? - Gusto mo bang mag-invest kay Jollibee despite huge downside ng stock price niya? - O baka naman bored ka lang kaya nagaaral ka ng financial ratios? Sanaol! 2. Study the industry in which firm operates and relate industry climate to current and projected economic development Siguro magandang mag-invest kay PUREGOLD or FRUITAS ngayong panahon ng pandemya. Kasi tumataas ang consumption ng basic goods ngayon. Siguro maganda rin mag-invest kay Netflix ngayon. Lahat ng tao nasa loob ng bahay at nanonood ng movies and series. Iiwas ba muna ako kila PETRON ay PHOENIX kasi bagsak presyo ang langis? Baka masunog pera ko.hahaha #relatemuch toinks 3. Develop knowledge of the firm and the quality of management Diba si DITO, siya yung 3rd Telco major player na inawardan ng franchise last year. Tapos ang may-ari si Dennis Uy, isa sa pinakabatang business tycoon sa Pilipinas, 45 yrs. Old ata, at crony ni PDUTS. Tas 40% ng shares outstanding at pag-aari ng China Telecom. Tas nagistart na sila ng roll-out sa Davao City. Sabi nila tatapatan daw nila ang bilis ng Singapore. Chismosa..haha 4. Evaluate financial statements using any of the techniques below: (This is the gist of the topic) A. Horizontal analysis of Comparative Statements (Increase-Decrease Method) B. Trend Analysis C. presents a comparative financial statements for the current and previous years. For every line item, the difference between the two years are computed and divided by the amount of the base year or previous year to determine the percentage of change. (Refer to Illustrative Case No. 1. Pasensiya, walang hyperlink tool 'tong LMS natin. Scroll down mo nalang. Andiyan lang naman sa baba :)) a modification of the vertical and horizontal analysis. The percentage changes are determined for several successive periods instead of the typical two-year period horizontal analysis. In here, items not seen in two-period analysis may surface in a longer-based study such as trend analysis. in computing the trend, the oldest year becomes the base year. The percentage relationship of each account in the statements is then computed by dividing each amount by the base year figure. A trend is then determined by comparing percentage relationships. Based on the trends, interpretations, conclusions and implications are derived. (Refer to Illustrative Case No. 2) Vertical Analysis or Common Size Financial Statements uses percentages/ratios that present the relationship of the different accounts/items in the financial statement relative to a base figure or amount. It presents the relative size of an account/item in proportion to the whole or the base amount. For the Statement of Financial Condition, the total asset is the base amount while the Statement of Income uses the net sales/revenue as the base amount. The outcome of the percentages is presented in the common-sized statement which management looks into to have a better understanding if the changes to total assets (SFP) or net sales/revenue (SI) that have transpired from one period to another. This also aids management to assess their financial position and performance by comparing their statements with other companies belonging to the same industry. (Refer to Illustrative Case No. 3) D. Financial Ratios Analysis A comparison in fraction, proportion, decimal or percentage form of two significant figures taken from financial statements. It expresses the direct relationship between two or more quantities in the statement of financial position and income statement of a business firm. Through ratio analysis, the financial statement user comes into possession of measures which provide insight into the profitability of operations, the soundness of the firm’s short-term and long-term financial condition and the efficiency with which management has utilized the resources entrusted to it. (Ito ‘yung medyo matrabaho kasi andaming available ways or ratios to measure profitability and efficiency, liquidity, or solvency. In practice, not all these available ratios are used. May mga common ratios lang na ginagamit. But for board exam sake, i-cover narin natin yung iba. This topic will be elaborated in a separate module) 5. Summarize findings based on analysis and reach conclusions about firm relevant to the established objectives. At the end of the day, you will go back to your objectives. Based on the figures which you obtained after applying the various techniques, we must make a decision. Ok, guys. Sana kinakaya pa. Pero wait, para mas maintidihan mo yung mga apat na techniques of financial statement analysis, kailangan natin ng illustrative cases. Ok ready ka na? Actually yung iba dito pinagaralan mo na sa Business Finance subject mo nung SHS ka. Kaya kung tutuusin, review mo na rin ‘to. Before we proceed to our illustrative cases, let’s have first a quick review of financial statements which you have learned in your FAR, CFAS and IA series especially in IA 3. The Financial Statements 1. Statement of Financial Position – it shows the financial condition or financial position of a company on a particular date. It is a summary of what the firm owns (assets) and what the firm owes to outsiders (liabilities) and to internal owners (stockholders equity) a. Assets CURRENT ASSETS: Cash and cash equivalents Marketable securities Accounts receivable Inventories Prepaid expenses NON-CURRENT ASSETS: Property, plant and equipment (Land, Buildings and Leasehold Improvements, and Equipment) Other non-current assets (Long-term investments, Intangible assets, Goodwill, Deferred tax assets) b. Liabilities CURRENT LIABILITIES Accounts payable Short-term Notes payable Current Maturities of Long-term debt Accrued liabilities NON-CURRENT LIABILITIES Long-term debt Deferred tax liabilities c. Equity Share capital Additional paid-in capital/Share Premium Retained earnings Other Equity accounts 2. Statement of Income – the performance of the firm for a period of time. a. b. c. d. Net sales Cost of goods sold Gross profit or gross margin Operating expenses Selling and administrative Marketing/Advertising Costs Lease payments Depreciation and amortization Repairs and Maintenance e. Operating income f. Other income/expense (dividend income, interest income, interest expense, gains (losses) from investments, and gains (losses) from sale of fixed assets) g. Income from continuing operations before income tax h. Provision for income taxes on continuing operations i. Income from continuing operations j. Gains (losses) on discontinued operations k. Net income Net Sales or service revenues − Cost of goods sold (COGS) = Gross profit − Selling, general, and administrative expenses = Operating income + Interest and dividend income − Interest expense +/− Non-operating gains/(losses) = Income from continuing operations before income tax − Provision for income taxes on continuing operations = Income from continuing operations +/− Gains/(losses) on discontinued operations (net of applicable taxes) = Net Income WARNING: There are income statement terms that are used in Financial Statement Analysis which cannot be seen from a pro-forma or standard income statement (for external use). Earnings Before Interest and Taxes (EBIT) is a term you will see frequently in financial statement analysis. EBIT is not the same as operating income, though in some cases they may be the same. A line titled “EBIT” does not appear on a standard income statement because EBIT is a calculated amount used in financial statement analysis and other types of analysis. Earnings Before Interest and Taxes is equivalent to net income adjusted to add back any deduction for interest expense and any deductions for taxes. EBIT can be calculated in more than one way. Beginning with operating income, it would be calculated as follows: Operating income + Interest and dividend income +/− Non-operating gains/(losses) +/− Gains/(losses) from discontinued operations (gross, not net of applicable taxes) = Earnings Before Interest and Taxes (EBIT) In other words, in contrast to operating income, EBIT includes non-operating gains and losses such as gains and/or losses on acquisitions or investments, interest and dividend income, pretax additions or deductions for discontinued operations. EBIT does not include any deductions for interest expense or for taxes. Therefore, if the company has gains and/or losses on acquisitions or investments, interest or dividend income, and income/losses from discontinued operations, its Earnings Before Interest and Taxes will not be the same as its operating income. All of those items constitute the difference between operating income and EBIT. If the company has none of those items, its operating income will be the same as its EBIT, but that will be true only because the items that would create the difference are zero. Earnings Before Taxes (EBT) is another term used in financial statement analysis that you will not see on a standard income statement. Earnings Before Taxes is Earnings Before Interest and Taxes minus Interest Expense. 3. Statement of Cash Flow – the sources and uses of funds during an accounting period Operating – generation of the principal revenue of the firm or ability to generate sufficient cash to meet maturing obligations, sustain the firms operating capability and pay dividends without recourse to external source of financing Financing – borrowings to support firm’s operation Investing – cash flow from sale or purchase transaction wherein non-operating assets are involved. (There will be a separate module for Cash Flow Analysis) After reviewing the basic financial statements, I will now present to you the illustrative cases for the first three techniques of financial statement analysis: Illustrative Case No. 1 - Horizontal analysis of Comparative Statements (Increase-Decrease Method) REQUIRED: Evaluate the company's financial position and results of operations using the Comparative Statements Analysis. SOLUTION: Financial Statements Analysis of Golden Garments, Inc. a. Short-term Solvency Analysis ( Habang tumataas ang current liabilities, sumasabay rin ba ang mga current assets sa pagtaas? Kung "Oo" ang sagot, maari ngang may pambayad sila ng current liabilities when they fall due at hindi mailalagay sa alanganing posisyon ang company. Minsan tinitignan din dito kung mabilis ba ang conversion ng A/R at Inventories into Cash because ultimately cash parin naman pambabayad mo ng utang ) As shown on the statement of financial position, the percentage of increase in total current assets (10.1%) was lower than the percentage of increase in total current liabilities (15%). It can be observed that accounts payable and bank loans increased significantly. Accounts receivable and inventory increased at a much higher percentage than the percentage of increase in Sales revenue (11%). (Segue ako dito, guys. If AR increased at a higher rate than sales revenue during the period, ibig sabihin nun, mabagal collection or nahihirapan silang makacollect ng cash from customers. If Inventory increased at a higher rate than Sales revenue, ibig sabihin nun marami silang production na hindi nabebenta.) This indicates slower conversion of inventory and receivables to cash. The changes mentioned resulted to the deterioration in the short-term solvency position of the company as of the end of year 2014 compared with year 2013. b. Long-term Financial Position Analysis (Tumataas ba ang non-current assets ng entity? Alam naman natin na malaki ang pakinabang ng long-term assets sa kakayahan ng company to generate revenues in the long-run. Mga "investments" ito like PPE, Intangibles or long-term investments na naglalayung palakasin ang posisyon ng company sa malayong hinaharap. Aside from long term asset, tinitignan din dito kung ano ang mas daks, este mas malaki - TOTAL LIABILITIES o EQUITY? Alam naman natin na ang equity represents the invested capital of the owners including accumulated earnings. Kung mas mabilis ang pagtaas ng porsyento sa liabilities kesa sa equity, medyo red flag yun. Parang sinasabi kasi nun na hindi kayang pondohan ng equity ang pangangailan ng company kaya nag-reresort sila sa utang. Otherwise, kung mas malaki ang porsyento ng pagtaas ng equity kesa sa liabilities, magandang senyales yun, may pondo ang company, kumikita sila.) The book value of property, plant and equipment declined because of the depreciation provision for the year. Total liabilities increased by only 1%, whereas shareholders' equity increased by 11.8%. Thus, the company's capital structure shifted slightly away from borrowing and toward capital provided by profitable operations. These changes can be viewed favorably because they indicate strengthening of the long-term financial position by end of year 2014. c. Operating Efficiency and Profitability Analysis (Ang mga tanong dito ganito: Nakatipid ba ang company (efficiency) o kumita ba sila (profitability)? Hindi lang bottom figure (net income) ang tinitignan dito. Binubusising mabuti talaga dito ang composition ng income items at expense items. Pinakacomplikadong part ng FS analysis ang aspetong ito, pero pinaka-exciting aralin. Minsan magtataka ka, mas malaki naman ang airtime revenues ni ABS kesa ni GMA, pero bakit mas malaki ang net income ni GMA kesa ABS nung 2018? Ibig ba sabihin nun mas efficient si GMA? Bakit si ABS nagreport ng operating loss, pero net income parin? Bakit si Shopify or si UBER net loss parin pero tumataas ang kanilang revenues yearly? Si Jollibbee, akala ko bida ang saya, pero bakit ang laki ng net loss niya sa 1st quarter ng 2020?) Sales revenues increased by 11% while cost of goods sold increased by 12.4%. This is unfavorable because this could indicate that the company was unable to adjust the selling price of the goods commensurate to the increase in cost of goods purchased or manufactured or it was unable to control the price factor of its cost of sales. These changes resulted to the reduction in the gross profit rate which is unfavorable. The 11% increase in sales was accompanied by a 7.8% and 2.8% increase in selling and administrative expenses, respectively. This is favorable because this could indicate management's efficiency in keeping expenses within control. On an overall basis, operating performance could be considered satisfactory or favorable because of the lower increase in operating costs of 10.5% as compared with the increase in revenue of which resulted to an 18.4% increase in operating income. Repayment of notes payable reduced interest expense by 4.7%. Reduced interest expense together with higher operating income increased income before taxes by 25.9%. Illustrative Case No. 2 - Trend Analysis REQUIRED: 1. Compute the trend percentages for the Statement of Financial Position and Income Statements from 2010 to 2014. 2. Evaluate the company’s short-term solvency, long-term financial position and profitability using the trend percentages obtained in No. 1. SOLUTION: Requirement 1 – Computation of trend percentages Requirement 2 – Analysis and Evaluation 1. Short-term Solvency - Current assets increased by 9% while current liabilities decreased by 27% by 2014. The current financial position of the Gilbert Company improved as reflected by the upward trend in total current assets accompanied by the downward trend in current liabilities. The improvement in the current financial position is also indicated by the fact that the current assets were 2.05 times the current liabilities as of December 31, 2010 and 3.05 times at the most recent date. - The trend data reveal that cash, receivables and inventory showed upward tendencies over the years. The increase in receivables and inventory is favorable because net sales increased at a faster rate. The favorable tendency indicates that more effective credit, collection and merchandising policies, could have been established and made effective. The relatively smaller amount of trade receivable reflects more rapid turnover of customer accounts and possibly a large increase in cash sales. - The decline in marketable securities and other current assets over the years also indicates lesser investment in not-so-productive assets. All these trends in different directions reflect an increasing efficiency of working capital management. 2. Long-term financial position - A comparison of the trends in total liabilities and equity reveals that the former declined and the latter increased. As a result of these variations, the creditors' margin of safety increased significantly. - The expansion in property, plant and equipment which substantially increased was financed by shareholders' capital through the issuance of share capital at a premium, long-term liabilities and working capital derived from operations. - A greater reliance on equity funds rather than on creditor funds increased the margin of safety of the creditors and therefore strengthened the financial position of the company. 3. Profitability - It will be observed that both sales and cost of sales showed upward trends with sales increasing at a faster rate. These data reflect a favorable situation from the point of view of managerial ability to control costs relative to change on sales volume. This more desirable percentage may have been the result of one or more factors such as favorable price-level changes, more effective markup policies or greater efficiency in purchasing. - An unfavorable tendency is reflected by the fact that trend percentages for selling, general and administrative expenses increased at a faster rate than the net sales. The company could have earned more profit if better and more effective control over operating expenses were instituted. Illustrative Case No. 3 - Vertical Analysis or Common Size Financial Statements The percentages here are computed based on the Illustrative Case No.2 Evaluation of the Financial Position 1. The Gilbert Company's statements of financial position showed that there had been substantial changes in the proportions of current and fixed assets and current and long-term liabilities during the period from December 31, 2010 to December 31, 2014. The percentages showed a declining liquidity in the company's assets accompanied by a consistent reduction in liabilities over the five-year period. 2. It can be observed that Cash balance and accounts receivable as a percentage of total assets had been increasing while investment in inventory in relation to total assets had been decreasing. Considering that the volume of sales was increasing, these changes can be viewed as beneficial to the company. 3. The increase in investment in fixed assets had been financed largely from owners' investment as indicated in the increasing percentage of equity to total assets. 4. The decreasing percentage of total liabilities to total assets further indicates lesser reliance of the company from creditors in raising additional capital. This, of course, is favorable as far as the long-term financial position of the company is concerned because a wider margin of safety is provided among the creditors. Evaluation of Profitability 1. Favorable changes could be observed in the gross margin percentage in relation to net sales. The increase in percentage over the years could be due to improvement in the company's markup policy or better procurement policy. 2. Selling expenses in relation to sales however, show increasing percentages from 2010 to 2014, while administrative expenses had more or less remained constant. Better control over the selling expenses should be instituted to further improve the profitability of the company. 3. Decrease in percentage of other expenses to net sales is traceable to the decreasing amount of notes payable and long-term debts. It can be concluded that the figures presented will have no meaning without interpreting it. Financial statement analysis does not end on computation. A good financial manager must be able to articulate in his financial statement analysis report the relevance and meaning of the figures computed. Hence, in order to maximize the objectives of this topic, we will not focus only on computations. The essay part could be challenging for you, but that is the essence of the topic - to summarize findings based on your analysis and reach conclusions about firm relevant to your established objectives. Outline of the Topic 1. Definition of Financial Statement Analysis 2. General Approach in the conducting FS analysis 3. Steps in FS Analysis 4. Review of Basic Financial Statements 5. Discussion of the four techniques of FS analysis: Horizontal analysis of Comparative Statements (Increase-Decrease Method) Trend Analysis Vertical Analysis or Common Size Financial Statements Financial Ratios Analysis 6. Illustrative Cases for: Horizontal analysis of Comparative Statements (Increase-Decrease Method) Trend Analysis Vertical Analysis or Common Size Financial Statements If you have realized, the computation part is essentially procedural. Tiyagaan lang talaga kasi buong financial statements ang subject ng FS analysis. The challenging part is really on the interpretation of the figures. But having a good grasp on the nature of the accounts or line item is a big help for you to have good and sound interpretation of the figures. Ang maganda sa interpretation part, may kalayaan ka to draw conclusions out of the computed figures, so long as na-cacapture ng interpretation mo yung important aspects - Short term solvency, long-term financial position, and profitability. O diba, napakadaming nakatagong kwento at hiwaga ang financial statements. Sana sa mga susunod na exercises, mahasa pa ang financial analyst instinct mo. Kaya yan! Kung may di kayo nagets, PM IS THE KEY! That ends the 1st part of Financial Statements Analysis. The 2nd part is exclusively reserved for Financial Ratios Analysis. But before you proceed to Financial Ratios Analysis, try to test your knowledge of the 1st part by answering the Exercises. Supplemental Readings: https://courses.lumenlearning.com/boundless-finance/chapter/asset-managementratios/ https://www.accountingverse.com/managerial-accounting/fs-analysis/financialratios.html https://www.thebalancesmb.com/how-do-you-do-financial-statement-analysis-393235 https://www.principlesofaccounting.com/chapter-16/statement-analysis/ https://www.bdc.ca/en/articles-tools/money-finance/manage-finances/pages/financialratios-4-ways-assess-business.aspx