Practical Guide to Crypto Investment 2018 - Helping the Early Adopters

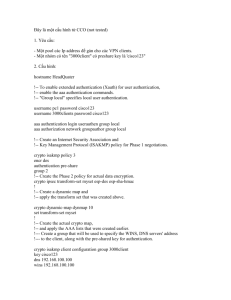

advertisement