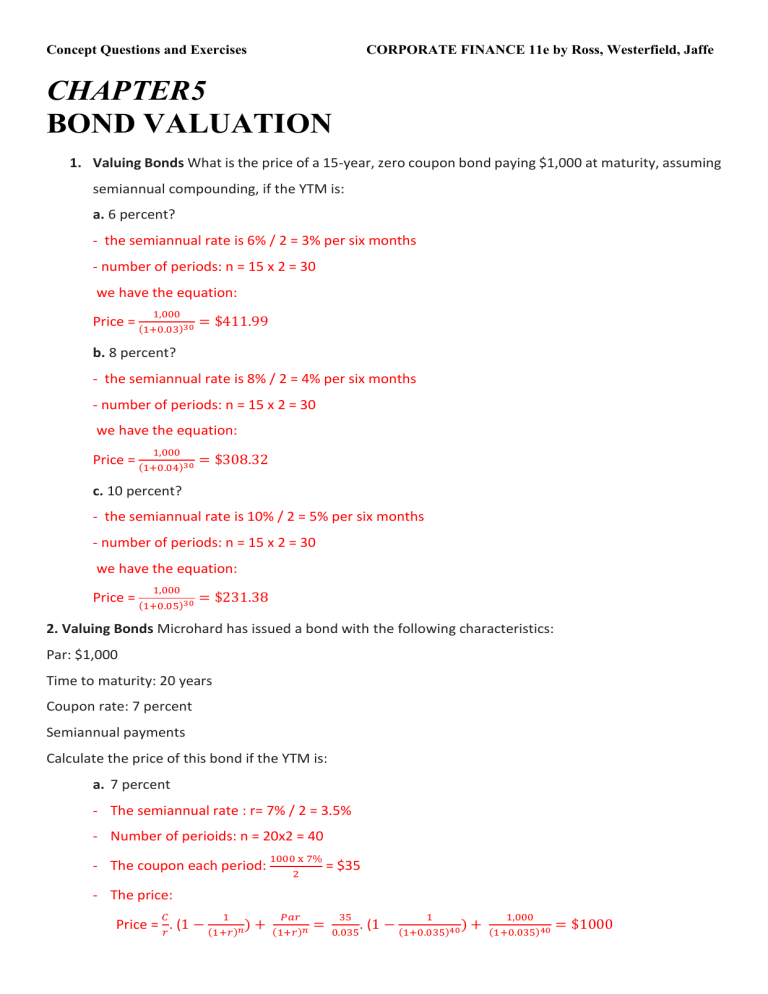

Concept Questions and Exercises CORPORATE FINANCE 11e by Ross, Westerfield, Jaffe CHAPTER5 BOND VALUATION 1. Valuing Bonds What is the price of a 15-year, zero coupon bond paying $1,000 at maturity, assuming semiannual compounding, if the YTM is: a. 6 percent? - the semiannual rate is 6% / 2 = 3% per six months - number of periods: n = 15 x 2 = 30 we have the equation: 1,000 Price = (1+0.03)30 = $411.99 b. 8 percent? - the semiannual rate is 8% / 2 = 4% per six months - number of periods: n = 15 x 2 = 30 we have the equation: 1,000 Price = (1+0.04)30 = $308.32 c. 10 percent? - the semiannual rate is 10% / 2 = 5% per six months - number of periods: n = 15 x 2 = 30 we have the equation: 1,000 Price = (1+0.05)30 = $231.38 2. Valuing Bonds Microhard has issued a bond with the following characteristics: Par: $1,000 Time to maturity: 20 years Coupon rate: 7 percent Semiannual payments Calculate the price of this bond if the YTM is: a. 7 percent - The semiannual rate : r= 7% / 2 = 3.5% - Number of perioids: n = 20x2 = 40 - The coupon each period: 1000 x 7% 2 = $35 - The price: 𝐶 1 Price = 𝑟 . (1 − (1+𝑟)𝑛 ) + 𝑃𝑎𝑟 (1+𝑟)𝑛 = 35 1 . (1 − (1+0.035)40 ) + 0.035 1,000 (1+0.035)40 = $1000 Concept Questions and Exercises CORPORATE FINANCE 11e by Ross, Westerfield, Jaffe ( cacsh 2: Since the Coupon rate = YTM => Price = par value = $1000 ) b. 9 percent The semiannual rate : r= 9% / 2 = 4.5% Number of perioids: n = 20x2 = 40 The coupon each period: 𝐶 1000 x 7% 2 1 Price = 𝑟 . (1 − (1+𝑟)𝑛 ) + = $35. Thus, The price: 𝑃𝑎𝑟 (1+𝑟)𝑛 35 1 1,000 (1+0.045)40 = $815.98 35 1 1,000 (1+0.025)40 = $1251.03 = = 0.045. (1 − (1+0.045)40 ) + c. 5 percent The semiannual rate : r= 5% / 2 = 2.5% Number of perioids: n = 20x2 = 40 The coupon each period: 1000 x 7% 2 = $35 The price: 𝐶 1 Price = 𝑟 . (1 − (1+𝑟)𝑛 ) + 𝑃𝑎𝑟 (1+𝑟)𝑛 = = 0.025. (1 − (1+0.025)40 ) + 3. Bond Yields Watters Umbrella Corp. issued 15-year bonds 2 years ago at a coupon rate of 5.9 percent. The bonds make semiannual payments. If these bonds currently sell for 105 percent of par value, what is the YTM? Assume the Par value is A => the current price: 1.05A => the coupon per period: 𝐴.5.9% 2 = 2.95% A Number of periods: n = 13x2 = 26. Assume the rate per period is r. We have the equation: 2.95% 𝐴 1 𝐴 .( 1 − )+ = 1.05 𝐴 26 (1 + 𝑟)26 𝑟 (1 + 𝑟) => r = 0.0268 = 2.68% => YTM = 5.36%. 4. Bond Yields A Japanese company has a bond outstanding that sells for 106 percent of its ¥100,000 par value. The bond has a coupon rate of 2.8 percent paid annually andmatures in 21 years. What is the yield to maturity of this bond? The sell price = 100,000 x 106% = $106,000. Coupon per period = 100,000 x 2.8% = $2,800 Number of period : n = 21 Equation: 2,800 1 100,000 .(1− ) + = 106,000 (1 + 𝑌𝑇𝑀)21 (1 + 𝑌𝑇𝑀)30 𝑌𝑇𝑀 Concept Questions and Exercises CORPORATE FINANCE 11e by Ross, Westerfield, Jaffe YTM = 2.43%. 5. Zero Coupon Bonds You find a zero coupon bond with a par value of $10,000 and 17 years to maturity. If the yield to maturity on this bond is 4.9 percent, what is the dollar-price of the bond?Assume semiannual compounding periods. Since the bond paid semiannualy, the rate in each period: r = 4.9% /2 = 2.45% Number of periods = n = 17x2 = 34 => Equation: 𝑃𝑟𝑖𝑐𝑒 = 10,000 = $4391.3 (1 + 0.0245)34 6. Valuing Bonds Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.9 percent paid semiannually and 13 years to maturity. The yield to maturity ofthe bond is 3.8 percent. What is the dollar price of the bond? Number of periods: n= 26 Coupon per period: C = 2,,000 𝑥 4.9% 2 = 49. YTM = 3.8% => rate per period : r = 3.8% / 2 = 1.9%.. The dollar price:; 𝑃𝑟𝑖𝑐𝑒 = 49 1 2,000 . (1 − )+ = $2224.04 26 (1 + 0.019) 0.019 (1 + 0.019)26 7. Valuing Bonds Union Local School District has bonds outstanding with a coupon rate of 3.7 percent paid semiannually and 16 years to maturity. The yield to maturityon these bonds is 3.9 percent, and the bonds have a par value of $5,000. What is the dollar price of the bond? Number of periods: n= 16x2 = 32 Coupon per period: C = 5,,000 𝑥 3.7% 2 = $92,5. YTM = 3.9% => rate per period : r = 3.9% / 2 = 1.95%. 𝑃𝑟𝑖𝑐𝑒 = 92.5 1 5,000 . (1 − )+ = $4881.8 32 (1 + 0.0195) 0.0195 (1 + 0.0195)32 8. Zero Coupon Bonds You buy a zero coupon bond at the beginning of the year that has a face value of $1,000, a YTM of 6.3 percent, and 25 years to maturity. If you hold the bond for the entire year, how much in interest income will you have to declare on your tax return? Assume semiannual compounding. Number of period: n = 25x2 = 50 YTM = 6.3% => rate per period = r = 3.15% Since there are 25 more years till maturity, the interest income this year will be 0. Concept Questions and Exercises CORPORATE FINANCE 11e by Ross, Westerfield, Jaffe 9. Bond Yields Hacker Software has 6.2 percent coupon bonds on the market with 9 years to maturity. The bonds make semiannual payments and currently sell for 104 percent of par. What is the current yield on the bonds? The YTM? The effectiveannual yield? Assume the par value is $1000. => The annual coupon: 1,000 x 6.2% = 62 => the coupon each period: 1,000 𝑥 6.2% 2 = 31.. The number of period: n= 9x2 = 18 The currently sell price: PV = 104% . 1000 = $1040 62 => The CURRENT YIELD = 1,040 = 5.96% We calculate the semiannual rate (r) : 31 1 1,000 . (1 − )+ = $1,040 18 (1 + 𝑟) (1 + 𝑟)18 𝑟 r= 2.81% YTM = 2r = 5.62% The effective annual rate = (1+ 2.81%)2 – 1 = 5.69% Concept Questions and Exercises CORPORATE FINANCE 11e by Ross, Westerfield, Jaffe 10. Bond Yields RAK Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.4 percent coupon bonds on the market that sell for $1,063, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Miss the Par??????????????????? 1000$>>>>>>> - First, calculate the YTM: Number of period: n = 20 x 2 = 40 Par value: PV = $1,000 Semiannual Coupon: C = $1,000 x 6.4% 2 = $32 32 1 1,000 . (1 − )+ = $1,063 40 (1 + 𝑟) (1 + 𝑟)40 𝑟 r = 2.93% YTM = 5.86%. - If the company want so sell at par,, the coupon rate should be equal to YTM. - => The coupon rate = 5.86% 11. Finding the Bond Maturity Erna Corp. has 9 percent coupon bonds making annual payments with a YTM of 7.81 percent. The current yield on these bonds is 8.42 percent.How many years do these bonds have left until they mature? Assume the par value is $1,000. The annual coupon: C = 1,000 x 9% = $90. The number of period: n YTM = 7.81% 𝐶 𝐶 Current yields = 8.42% = 𝑃𝑉 => 𝑃𝑉 = 8.42% = 90 8.42% = $1068.88 => Equation: 90 1 1,000 . (1 − )+ = $1068.88 𝑛 (1 + 7.81%) (1 + 7.81%)𝑛 7.81% N =8 So the bonds have 8 years left until they mature. 12. Finding the Maturity You’ve just found a 10 percent coupon bond on the market that sells for par value. What is the maturity on this bond? Assume the par value is A. The bond sells at par => YTM = coupon rate = 10% = 0.1 We have the equationasssss Concept Questions and Exercises CORPORATE FINANCE 11e by Ross, Westerfield, Jaffe 0.1𝐴 1 𝐴 . (1 − )+ = $𝐴 𝑛 (1 + 0.1) (1 + 0.1)𝑛 0.1 n= 8 So the maturity on this bond is 8 years. 13. Zero Coupon Bonds Suppose your company needs to raise $50 million and you want to issue 30-year bonds for this purpose. Assume the required return on your bond issue will be 6 percent, and you’re Concept Questions and Exercises CORPORATE FINANCE 11e by Ross, Westerfield, Jaffe evaluating two issue alternatives: A semiannual coupon bond with a 6 percent coupon rate and a zero coupon bond. Your company’s tax rate is 35 percent. a. How many of the coupon bonds would you need to issue to raise the $50 million? How many of the zeroes would you need to issue? Assume the par value of each bond is $1,000 * Semiannual coupon bond: Since the required return on bond equal to the coupon rate = 6%. => The price of the semiannual coupon = The par value = $1,000. => need to issue: $50,000,000 $1,000 = 50,000 𝑏𝑜𝑛𝑑𝑠. * zeroes: $1,000 The price of one bond: (1+0.06)30 = $174.11 Need to issue: $50,000,000 147.11 = 287,174.55 𝑏𝑜𝑛𝑑𝑠 b. In 30 years, what will your company’s repayment be if you issue the coupon bonds?What if you issue the zeroes? * Semiannual coupon bond: Repayment = 50,000 x 1,000 + 50,000 x 1,000 x 0.06 = $53,000,000 * Zeroes: Repayment = 287,174.55 x 1,000 = $287,147,550 c. Based on your answers in (a) and (b), why would you ever want to issue the zeroes?To answer, calculate the firm’s aftertax cash outflows for the first year under the two different scenarios. Assume the IRS amortization rules apply for the zero coupon bonds. * Semiannual Coupon Bond: The pretax cash outflows: $1,000 𝑥 6% 𝑥 50,000 = $3,000,000. Aftertax cash outflows: $3,000,000 x ( 1 – 35%) = $1,950,000. * Zeroes: If the IRS Amortization apply for the zero coupon bonds: $1,000 The price of each bond after year 1: (1+0.06)29 = $184.57 The aftertax cash outflows: (184.57 – 147.11) x 287,147.55 x ( 1 – 35%) = $7,551,693 => Only issue the zeroes if you need exactly ammount of money in very short time. 14. Valuing Bonds The Frush Corporation has two different bonds currently outstanding.Bond M has a face value of $30,000 and matures in 20 years. The bond makes no paymentsfor the first six years, then pays $800 Concept Questions and Exercises CORPORATE FINANCE 11e by Ross, Westerfield, Jaffe every six months over the subsequent eight years, andfinally pays $1,000 every six months over the last six years. Bond N also has a face value of$30,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond.If the required return on both these bonds is 6.4 percent compounded semiannually, what isthe current price of Bond M? Of Bond N? Semiannual rate = 6.4% / 2 = 3.2%. *Bond M: PV of the coupon from year 7 to year 14 at year 6 = 800 3.2% 1 . (1 − (1+3.2%)16 ) = $9896.94 9896.94 PV of the coupon from year 7 to year 14 at year 0 = (1+3.2%)12 = $6781.79 PV of the coupon from year 15 to year 20 at year 14 = 1,000 3.2% 1 . (1 − (1+3.2%)12 ) = $9836.2 9836.2 PV of the coupon from year 15 to year 20 at year 0 = (1+3.2%)28 = $4071.89 Price of the bond M = $6781.79 + $4071.89 + *Bond N : 30,000 Price = (1+3.2%)40 = $8,510.07 30,000 (1+3.2%)40 = $19,363.75