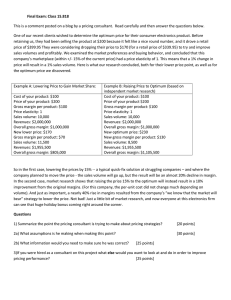

The PRICING ADVISOR 3535 Roswell Road, Suite 59 Marietta, GA 30062 770-509-9933 w w w.pri ci ngsociet y. com A Prof es s ional P r i c i n g S o c i e ty P u b l i c a ti o n Price Elasticity - Sensitivity: An Opportunity for Price Improvement There is ongoing debate as to the effectiveness of price sensitivity and elasticity analysis in forecasting the change in unit quantity with respect to a pricing action. In this article, the author uses a case history analysis to analyze how price elasticity and sensitivity can be integrated into a price setting process, with the outcome providing significant price improvement opportunities at an SKU or customer level. Dick Sobel is Managing Director of the Pricing Analytic Group, a member of the Professional Pricing Society and Director of Analytics at PricePoint Partners. He can be reached at richard.sobel@ pricing-analytic.com. T here is ongoing debate as to the effectiveness of price sensitivity and elasticity analysis in forecasting the change in unit quantity with respect to a pricing action. Keeping in mind the influences of markets, segmentation, competitive environment and product specific special situations, price sensitivity and elasticity analysis can be an effective tool in price optimization, forecasting and price setting. Price sensitivity analysis can help determine the amount of value created by a product or service by providing an indiDecember 2013 cation of your customer’s willingness to pay (WTP). It can also become a competitive advantage, when WTP is better understood. Buyers are less price sensitive when the product they are buying is unique or of high quality, prestige or exclusiveness or when substitute products are hard to find or cannot easily be compared. The converse is true for customers with high price sensitivity. Faithful customers tend to be less price sensitive, where price sensitive buyers are subject to customer churn. Sometimes the loss of unit volume due to a price increase is caused by the price sensitive customer looking for alternatives while the 2 loyal customers remain. the outcome providing significant price improvement opportunities at an SKU or customer level. Case History This case study will evaluate price sensitivity- elasticity with a large distributor having over 10,000 SKU’s and 1500 customers serving a large North American customer base. The company uses a cost plus approach to pricing as multiple vendors implement price increases on a periodic basis throughout the product portfolio. Prices are raised to compensate for vendor cost increases, however there is minimal visibility as to the effect of these price increases on subsequent unit volume and margin. There are times when methods for deter- The served markets are very competimining WTP such as Van Westendorp, tive with different distributors selling the conjoint analysis, qualitative & quantisame products within the same territories tative and to the same customers. The compaCasesurveys, History:next best alternative and won/loss data are not readily obtainable. ny wishes to maximize their price inHowever if a company’s comparative creases without jeopardizing overall unit We will evaluate price sensitivity- elasticity with a large distributor having over 10,000 SKU's and transactional data is available, price senvolume and or gross margin. 1500 customers serving a large North American customer base. sitivity and elasticity can be calculated and to price 1 shows four (4) scenarios Thecontribute company uses a costimprovement. plus approach to pricingFigure as multiple vendors implement price for increases on a periodic the product portfolio. Prices to compensate Combined with any ofbasis the throughout above WTP price actions andare theraised corresponding affor vendoritcost there visibility as tomargin the effect of theseChanges price methods, is aincreases, powerfulhowever addition to is minimal fect on gross dollars. in increases on arsenal. subsequent unit volume and margin.unit volume that occur without a price your pricing action are not included thisproducts discusThe served markets are very competitive with different distributors selling the in same Through case territories history we look at customers. sion. within theasame andwill to the same how price elasticity and sensitivity can company into wishes to maximize price increases without jeopardizing overall unit beThe integrated a price settingtheir process, Forecasting price realization andvolume profitand or gross margin. Figure 1 Price Change Scenarios Impact on Gross Margin Dollars Increased price with increased unit volume Maximum Increase in Gross Margin Dollars Increased price with decreased unit volume Gross Margin dollars may increase or decrease depending on unit volume Decreased price with increased unit volume Gross Margin dollars may increase or decrease depending on unit volume Decreased price with decreased unit volume Maximum Decrease in Gross Margin Dollars Table 1 5 The PRICING ADVISOR 3535 Roswell Road, Suite 59 Chart 1 (below) plots the required unit volume to maintain constant gross Marietta, GA 30062 margin when either increasing or decreasing price. 770-509-9933 w w w.pri ci ngsociet y. com A Prof es s ional P r i c i n g S o c i e ty P u b l i c a ti o n Figure 2: Plots the required unit volume to maintain constant gross margin when either increasing or decreasing price. ability is dependent on understanding price sensitivity and whether your price actions meet your strategy and profit goals. The change in gross margin dollars is affected by the current %GM of the SKU. The higher the gross margin of a product the less sensitive is the unit volume change needed to maintain constant margin dollars. 10,000 9656 35 9,000 8057 8,000 % Change in Price 25 6862 7,000 Units 30 20 5975 6,000 15 5262 4675 5,000 4185 4,000 10 3771 3415 5 3,000 0 2,000 -5 Units Percent change in price Product Gross Margin @85% In Figure 2 (above), a 5% 1,000 -10 reduction in price requires 0 -15 a 17% increase in unit volume to maintain constant gross margin dollars. Howrebates and volume-mix when comparFigure 3’s contribution margin bridge Chart 1 ever a 5% increase in price can maining year on year data. In this example, showing the result of a 6.4% year on tain constant gross margin dollars with a 6.4% price increase was implemented year price increase. In this example, price a 13% reduction of unit volume. These on a product with a low price sensitivity- realization ($15,748) exceeded the negaChart 1, a 5% reduction in price requires a 17% increase unitofvolume to maintain constant relationships are factored intoInthe overall elasticity. tive in effect a material cost increase of in price can maintain constant gross margin gross margin dollars. However a 5% increase price sensitivity discussion and provide ($5216) and the impact of a negative 4 pricing opportunities a user with above The impact of unit volume change rela-relationships rebate ofare ($78), and a unit volume-mix dollars with a 13% reduction of unit volume. These factored into the overall and beyond covering cost increases, as tive to a price and action is the basis forwith pricepricing reduction of ($568). price sensitivity discussion provides a user opportunities above and beyond we will see sensitivity and elasticity optimization. In gross Let'slater. look at a case history contribution bridge Chart (below) that illustrates covering cost margin increases asinwe will 2see later. this case an material aggressive price increase was A similar chart or data analysis can be margin dollar changes due to price realization, direct cost, rebates and volume-mix Let’s look at acomparing case history warranted the overall SKU price performed across the entire user prodwhen yearcontribution on year data. In this example,as a 6.4% price increase was senimplemented on margin bridge in with Figure 3 that sitivity-elasticity was very low. (Elasticity uct portfolio. Each SKU will fall into a product a low price illussensitivity-elasticity. trates gross margin dollar changes due of -1 to +1 is viewed as inelastic) one of the categories shown in Figure 1. impact ofdirect unit volume change andonly exception would be SKU’s with to price The realization, material cost,relative to a price action is the basis for price sensitivityThe elasticity optimization. In this case an aggressive price increase was warranted as the overall no price change during the Figure 3 SKU price sensitivity-elasticity was very low. (Elasticity of -1 to +1 is viewed as inelastic) comparative time frame. The Pricing Analytic Group SKU Gross Margin Dollars $105,000 $15,749 $100,000 $5,216 $90,000 $85,000 $80,000 $75,000 $92,744 $78 $95,000 $82,857 Year on Year Gross Margin Bridge $568 Prior Year Units: Current Year Units: Prior Year Sales: Current Year Sales: Elasticity = (.11) $70,000 %GM From 33.7% to 35.7% $65,000 $60,000 $55,000 $50,000 Gross Margin $ Volume/Mix Chart 2 Material Rebate Price Gross Margin $ 6 6862 6815 $246K $260K Anwww.pricing-analytic.com opportunity for Price Improvement Figure 4 on the next page is a cross section of price sensitivity data for a select number of SKUs. The same analysis is suitable to customers as well. It looks at both the percent change in quantity for a 1% change in price and the overall elasticity. Elasticities between -1 to +1 are generally considered inelastic. Figure 4 combined with a contribution margin analysis as shown in Figure 3 provided the user with the required visibility to make effective pricing deciDecember 2013 customer basis. The PRICING ADVISOR 3535 Roswell Road, Suite 59 Marietta, GA 30062 770-509-9933 w w w.pri ci ngsociet y. com A Prof es s ional P r i c i n g S o c i e ty P u b l i c a ti o n Figure 4: Price Sensitivity Bands - SKUs - Customers Price Sensitivity Bands – SKUs - Customers (1) 2012 SKU Description Units 10635 JUNIOR MINTS 501 10636 SUGAR BABIES 134 10640 CHUCKLES ASST 268 10644 NESTLE CRUNCH BAR 1005 10647 NESTLE 100 GRAND BAR by price 445 SKU's - Customers are sorted 10757 WET ONES ANTIBACTERIAL 2013 bands depending on the 10772 MCORMK RSTD GARchanges BRD SEA of1320 10784 with BIG MAMA SAUSAGE quantity respect to changes in 4047 10800 BABY RUTH 1504 price. 13460 HERSHEY CH CHP KIS DGH 30 13462 HERSHEY REESES PB DGH 38 10689 RICH'S PIZZA DOUGH 7IN 1397 17579 WRIGLY 5 RAIN 5801 20350 AL ICE SMOOTH LEMONADE 83 18360 HOT N RD CHEESBRGR 1346 (2) 1% price change = Percent x % of change qty in price $ Sales % GM $6,958 $1,884 $4,020 $20,741 $9,196 $4,277 $20,971 $37,520 $20,685 $1,452 $1,864 $65,272 $54,164 $4,273 $28,871 7.1% 8.2% 6.7% 7.7% 7.9% 19.2% 13.0% 16.4% 7.7% 13.9% 15.1% 12.3% 7.2% 28.9% 14.5% (3) Yr to Yr Change in Quantity (4) (5) Percent change in quantity Elasticity SKU - Customers 0.4% 1.4% 1.3% 0.4% 2.7% 1.1% 9.2% 0.3% 2.8% 3.9% 6.1% 3.8% 1.7% 1.6% 0.6 6.0% 5.0% 7.8% 4.6% 3.4% 3.2% 3.3% 8.9% 4.0% -6.3% -3.7% -5.2% -0.7% -5.6% -3.1% -11 -10 -30 -18 -44 69 307 109 151 6 7 227 -76 -8 -27 -2.1% -6.9% -10.1% -1.8% -9.0% 3.5% 30.3% 2.8% 11.2% 25.0% 22.6% 19.4% -1.3% -8.8% -2.0% -0.37 -1.48 -1.41 -0.40 -2.85 1.11 8.09 0.32 2.69 3.40 5.41 3.34 -1.73 -1.59 -0.64 A B C D • Column (1) calculates the impact in the change of quantity as a result of a 1% change in price for an SKU or customer. • Column (2) is the actual SKU or customer price realization percent on a year to year comparative sale. • Column (3) is the actual unit volume change for the SKU or customer. • Column (4) is the annual percent change in unit volume per 1% of price realization. • Column (5) are the elasticity values. Increased Price - Increased Volume Increased Price – Decreased Volume Decreased Price – Increased Volume Decreased Price – Decreased Volume © 2007 PricePoint Partners. All Rights Reserved. | Contact 330-342-0923 or info@pricepointpartners.com So how can we use price sensitivity data to help Figure 4 examines the effect of a change improve price setting and In Figure 4 we keep all of the changes in quantity for a given change in price price improvement? Column (1) calculates the impact in the change of quantity as a result of a 1% change in price for an SKU and sorts the results into four (4) pricing in price as a positive number. The corReferring to Figure 4, products in row or customer. responding elasticity calculation can be bands: “A” (Increased price with decreasing unit Column (2) is the actual SKU or customer price realization percent on a on year comparative sale. factors less than negative or positive depending theto yearvolume) with elasticity Column (3) is the actual unit volume change for the SKU or customer. • Increased price with increased unit direction of quantity change. one display low quantity change with Column (4) is the annual percent change in unit volume per 1% of price realization increased prices. Gross margins actuvolume Column (5) are the elasticity values § Best Outcome The comparative time frame, that is ally increase as the price realization more § Product Skimming Strategy whether the data comparison is monthly, than offsets for the loss of unit volume. quarterly or yearly plays an important This outcome works well if you are tryIncreased Price with decreased unit role in evaluating what price actions to www.pricing-analytic.com ing to prune a product or where loss of The•Pricing Analytic Group volume take and the magnitude of the actions. unit volume for a non strategic product § Outcome works if overall gross mar- Monthly data may be too frequent and is acceptable. gin dollars increase annual data too long. § Product Pruning Strategy As elasticity factors increase the loss of However, a timeframe helps establish an unit volume may result in lower gross • Decreased Price with increased SKU profile for price sensitivity. Quarmargin dollars and so more caution is unit volume terly works well as there is a time delay required in how much if any future price § Outcome works if overall gross mar- between when a price change is impleincreases are merited. gin dollars increase mented and the time it takes to flow § Penetration Strategy through your customer’s purchases and Row “B” is the best case scenario where be reflected in your transactional data. unit quantity is increasing with increased • Decreased Price with decreased price and supports a price skimming sions on a product or customer basis. December 2013 unit volume § Worst Outcome Chart 3 7 The PRICING ADVISOR A Prof es s ional P r i c i n g S o c i e ty P u b l i c a ti o n strategy. Here high positive elasticity is exhibited robust increases in quantity good as it demonstrates that the willing- and gross margin. When implementing ness to pay for these products are high. a penetration pricing strategy that is a Again, the marketing manager evaluates the significance of these changes The use of price sensitivitywithin their market and competitive environments elasticity analysis for forecasting when setting future prices. and implementing a price change These SKU’s enjoy high margin improvement opis an important tool in the price portunities. optimization tool box. In row “C” (decreasing price with increasing volume) SKU quantity outcomes need to be positive with a net improvement in gross margin dollars. The higher the SKU initial gross margin, the better the outcome will be when lowering prices. All of the examples shown 8 desire to increase market share, row “C” outcomes are desirable. Row “D” SKU’s perform the worst, where lowering the price resulted in low- 3535 Roswell Road, Suite 59 Marietta, GA 30062 770-509-9933 w w w.pri ci ngsociet y. com er unit quantity Product managers need to understand what external issues if any are affecting the pricing actions taken. Summary The use of price sensitivity-elasticity analysis for forecasting and implementing a price change is an important tool in the price optimization tool box. Combined with contribution margin analysis and an understanding of your customers, markets and competitors it can support proactive price setting and positive price realization. The distributor in this case history is achieving 1-2% price realization where price sensitivity-elasticity is included in their price improvement process. December 2013