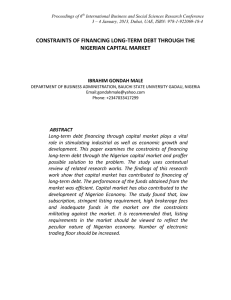

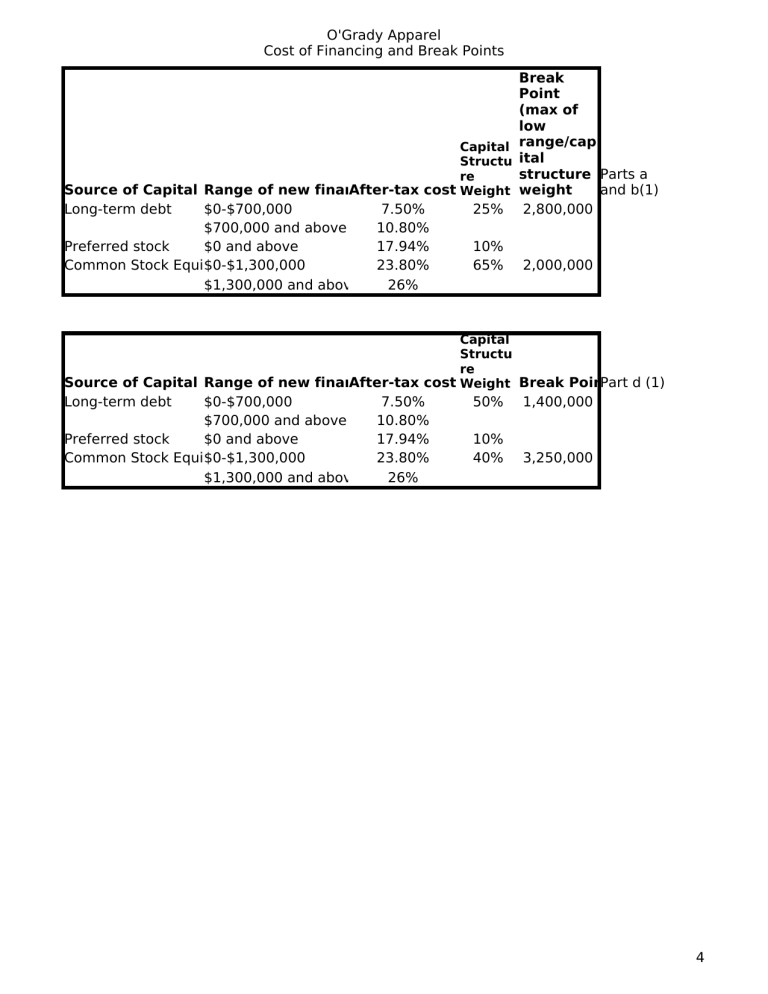

O'Grady Apparel Cost of Financing and Break Points Break Point (max of low Capital range/cap Structu ital structure Parts a re Source of Capital Range of new financing After-tax cost Weight (%) weight and b(1) Long-term debt $0-$700,000 7.50% 25% 2,800,000 $700,000 and above 10.80% Preferred stock $0 and above 17.94% 10% Common Stock Equity $0-$1,300,000 23.80% 65% 2,000,000 $1,300,000 and above 26% Capital Structu re Source of Capital Range of new financing After-tax cost Weight (%) Break Point Part d (1) Long-term debt $0-$700,000 $700,000 and above Preferred stock $0 and above Common Stock Equity $0-$1,300,000 $1,300,000 and above 7.50% 10.80% 17.94% 23.80% 26% 50% 1,400,000 10% 40% 3,250,000 4 O'Grady Apparel Cost of Financing and Break Points b (2) and (3). Weighted Average Cost of Capital for Ranges of Total New Financing for O'Grady Apparel Company Weighted Cost Range of total new Source of Weight Cost [(2)x(3)] 4 financing Capital (2) (3) Debt 0.25 7.50% 1.88% 0.1 17.89% 1.79% $0 to $2,000,000 Preferred Common 0.65 23.80% 15.47% Weighted Average Cost of Capital 19.13% Debt 0.25 7.50% 1.88% $2,000,001 to Preferred 0.1 17.89% 1.79% $2,800,000 Common 0.65 26.00% 16.90% Weighted Average Cost of Capital 20.56% Debt 0.25 10.80% 2.70% Preferred 0.1 17.89% 1.79% $2,800,000 and above Common 0.65 26% 16.90% Weighted Average Cost of Capital 21.39% (1). Weighted Average Cost of Capital for Ranges of Total New Financing for O'Grady Apparel Comp Weighted Cost Range of total new Source of Weight Cost [(2)x(3)] financing Capital (2) (3) 4 Debt 0.5 7.50% 3.75% 0.1 17.89% 1.79% $0 to $1,400,000 Preferred Common 0.4 23.80% 9.52% Weighted Average Cost of Capital 15.06% Debt 0.5 10.80% 5.40% $1,400,001 to Preferred 0.1 17.89% 1.79% $3,250,000 Common 0.4 23.80% 9.52% Weighted Average Cost of Capital 16.71% Debt 0.5 10.80% 5.40% 0.1 17.89% 1.79% $3,250,000 and abovePreferred Common 0.4 26% 10.40% Weighted Average Cost of Capital 17.59% d. (2) The capital structure in d. is preferred. It allows the firm to finance investment opportunities at cost and 25% LTD in the capital structure seems low. e. (1) O'Grady Apparel Compay appears to employ the Constant-Payout-Ration Dividend Policy. It doe seem appropriate given the firms current investment opportunities. Further it could jeopardize their f stock prices if their earnings decrease and therefore dividends decrease and shareholders are worried stability of the firm. e. (2) Low-Regular-and-Extra Dividend Policy is recommended. This would allow the firm to have more control of equity available for financing as well as protect the stability of the stock price. It would affect thebecause they would have more financing ability. investments in part c(2) 4 l New Financing O'Grady Apparel Cost of Financing and Break Points r O'Grady Apparel Company vestment opportunities at a lower on Dividend Policy. It does not it could jeopardize their future d shareholders are worried about llow the firm to bility of the stock 4 O'Grady Apparel Cost of Financing and Break Points After tax cost of debt: 0-$700,000 Used calculator for rd: N=10 PV=970 PMT=-120 (.12*1000) FV=-1000 Compute for I=12.5428 ri=rd*(1-T) .125*(1-.40) 7.50% After tax cost of debt: above $700,000 .18*(1-.40)= Preferred stock preferred diviend/preferred price pg 511 $60*17%=$10.20 $10.20/57= Common stock equity D1/Nn+g 10.80% $0 and above 17.94% $0-1,300,000 $1.76/20+.15= 23.80% D1= per share diviend expect at end of year 1 Nn=net proceeds from the sale of new common stock g=constant growth in dividends $1,300,000 and above 1.76/16+.15= 26% 4