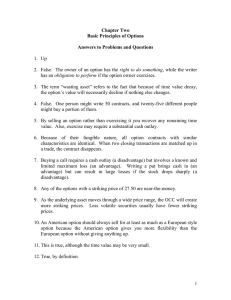

Hughes Optioneering Team Presents . . . How to Trade Options and Win! 1 Copyright 2018 by Legacy Publishing LLC. All Rights Reserved. Reproduction or translation of any part of this work beyond that permitted by Section 107 or 108 of the 1976 United States Copyright Act without the permission of the copyright owner is unlawful. Information within this publication contains "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21B of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, goals, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward looking statements." Forward looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Investing involves the risk of loss as well as the possibility of profit. All investments involve risk, and all investment decisions of an individual remain the responsibility of that individual. Option and stock investing involves risk and is not suitable for all investors. Past performance does not guarantee future results. No statement in this book should be construed as a recommendation to buy or sell a security. The author and publisher of this book cannot guarantee that the strategies outlined in this book will be profitable and will not be held liable for any possible trading losses related to these strategies. All information provided within this publication pertaining to investing, options, stocks and securities is educational information and not investment advice. Legacy Publishing is not an investment advisor and recommends all readers and subscribers to seek advice from a registered professional securities representative before deciding to invest in stocks and options featured within this publication. None of the material within this publication shall be construed as any kind of investment advice. Readers of this publication are cautioned not to place undue reliance on forward-looking statements, which are based on certain assumptions and expectations involving various risks and uncertainties that could cause results to differ materially from those set forth in the forward looking statements. Please be advised that nothing within this publication shall constitute a solicitation or an invitation to buy or sell any security mentioned herein. The author of this publication is neither a registered investment advisor nor affiliated with any broker or dealer. Although every precaution has been taken in the preparation of this publication, the publisher and author assume no liability for errors and omissions. This publication is published without warranty of any kind, either expressed or implied. Furthermore, neither the author nor the publisher shall be liable for any damages, either directly or indirectly arising from the use or misuse of the book. Users of this publication agree to indemnify, release and hold harmless Legacy Publishing, its members, employees, agents, representatives, affiliates, subsidiaries, successors and assigns (collectively, "The Companies") from and against any and all claims, liabilities, losses, causes of actions, costs, lost profits, lost opportunities, indirect, special, incident, consequential, punitive, or any other damages whatsoever and expenses (including, without limitation, court costs and attorneys' fees) ("Losses") asserted against, resulting from, imposed upon or incurred by any of The Companies as a result of, or arising out of this agreement and/or your use of this publication. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the author and publisher are not engaged in rendering legal, accounting, or other professional services. If legal advice or other expert assistance is required, the services of a competent professional person should be sought. Use of the material within this publication constitutes your acceptance of these terms. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS 2 How to Trade Options and Win! Welcome to the exciting world of Option Trading! In this Report the Optioneering® Team will explore one of the most important rules we use daily when trading options. We call this ‘The 1% Rule’. Using the 1% Rule has been a big part of our trading success over the past 30 years. The Team has been trading options successfully for many years in every type of market condition including the severe 2001 and 2008 bear markets when we profited from bearish option trades. $1.2 Million in Actual Profits with No Losing Trades Copies of our brokerage account Profit/Loss Reports for two of our retirement accounts at the end of this Report show we have $1,262,443.76 in open trade profits for our stock and option trades. There are 23 winning trades and no losing trades resulting in 100% accuracy. The average return for the two trading account portfolios is 120.5%. No Experience Needed The Optioneering® Team has taught thousands of people from all walks of life and backgrounds with no investing experience to trade the Optioneering® strategies. The Team has found that just about anybody can learn the Optioneering® trading strategies as long as they understand the basics of options trading. And if you don’t understand options, then no problem . . . We have the resources to teach you what you need to know. In this Report we will first look at option basics . . . teaching you only what you need to know about options and none of the complicated theories you don’t need. To trade options, you don’t need to know complicated math or formulas like you have probably been led to believe. Starting Small One of the big advantages of trading options is that you can start out small. Options control 100 shares of stock and can be purchased for as little as $300 to $500. A portfolio of options can be traded in a $3,000 - $5,000 account. I started trading options with a $4,600 trading account but within two years I had over $460,000 in profits which is more than I earned the previous six years as an airline pilot! Copies of my tax returns for that first two year period are included at the end of this Report. Let’s next look at option basics. 3 Option Basics There are two types of options: Puts give you the right to sell stock at a specified price And calls give you the right to buy stock at a specified price Just think “Put It Down” in a down market And “Call it Up” in an up market 4 Option Basics 5 Options Share the Following General Characteristics: • Options give you the right to buy or sell an underlying security or index • If you buy an option, you are not obligated to buy the underlying security. You simply have the right to exercise the option • Options are good for a specified period of time after which they expire and you lose the right to buy or sell the underlying security • When options are purchased the buyer incurs a debit • Options are available in various strike prices representing the price of the underlying security • The cost of an option is referred to as the option premium. The premium is comprised of time value and intrinsic value • There are two kinds of options: calls and puts. Calls give you the right to buy the underlying security and puts give you the right to sell the underlying security • Most options are never exercised and are closed out before option expiration • And one more thing… trading options is similar to trading stocks but it takes a lot less money to do! Below are examples of online orders to buy stocks and buy options. Stock Order Option Order 6 Once You Really Understand How Options Are Priced You Have a Winning Edge! (Unfortunately, very few traders do) Option premiums consist of two essential elements INTRINSIC value + TIME value The intrinsic value of an option is determined solely by the difference between the current stock price and the strike price and can be calculated exactly. Time value is the extra money you pay for the privilege of owning that option and will vary depending on several factors. 7 Intrinsic Value Intrinsic value is the difference between the current price and the strike price. Call options with a strike price at or above the current trading price of the underlying stock are ‘At the Money’ or ‘Out of the Money’ and have no intrinsic value. Their option premiums consist of Time Value only. Put options with a strike price at or below the current trading price of the underlying stock are ‘At the Money’ or ‘Out of the Money’ and have no intrinsic value. Their option premiums consist of Time Value only. 8 Leverage Each Option controls 100 shares of the underlying stock. Therefore, the Intrinsic value of your option increases $100 for every $1 the stock exceeds the strike price. 100 shares of Apple stock costs $21,240 at current prices. An ‘At the Money’ call option that controls 100 shares of Apple stock costs $680 at current prices giving the call option 31 to 1 leverage. You have less money at risk when trading options. In this example you have $680 at risk with the option versus $21,240 for the stock if Apple declines in price. 9 Time Value Time value is the extra money you pay for the privilege of owning an option. Although Volatility plays a role depending on market conditions… The two critical factors employed by every Optioneering® strategy are… The amount of Time before Option Expiration The Strike Price relative to the current price The less time there is before option expiration, the cheaper the option. The further the strike price is from the stock price, the cheaper the option… and this is true whether you’re going deeper into the money or further out of the money, (which most people don’t realize). As we just discussed, OTM options have no Intrinsic value… the entire premium is comprised of Time value. And since the premium gets less and less the further Out of the Money you go, the relationship between strike price and option cost is obvious. But, as you go deeper In-The-Money, the increased Intrinsic value pushes the option premium higher. So most people don’t realize the Time value is actually getting cheaper and cheaper the deeper In-The- Money you go. And, as you’ll soon see… therein lays the Optioneering® secret to winning! 10 Time Decay Each day before option expiration, the Time Value portion of an option decays . . . And the greatest amount of decay occurs in the last 30 days At option expiration call options lose all time value and consist of only intrinsic value if the underlying stock closes above the strike price of the call option 11 Choosing Your Option Once you select a stock for a call option purchase you must then select an option strike price. Depending on the stock, there could be hundreds or even thousands of strike prices available. With so many strike prices to choose from how do you determine which strike price to use? As noted previously, option premiums consist of time value and intrinsic value. - Options lose all time value at expiration and consist of only intrinsic value - So when you buy an option you are buying a decaying asset - Due to the time decay characteristics of options, when we buy an option we want to minimize time value and maximize intrinsic value Minimizing Time Value and Maximizing Intrinsic Value The best way to minimize Time Value and Maximize Intrinsic Value is to purchase in-themoney options. - In-the-money options have more Intrinsic Value and less Time Value than at-the-money or out-of-the-money options On the following page is an option price chain for the NASDAQ 100 ETF symbol QQQ. The option chain contains the current bid and ask prices for the QQQ ETF Jan options. The QQQ ETF is trading at 171.52 (circled). In- the-money options have strike prices below the current price of the stock/ETF. In this example the 171-Strike call and lower strike prices are in-the-money (circled). At-the-money options have a strike price that is closest to the current price of the stock/ETF. With the QQQ ETF trading at 171.52 the closest strike price would be the 172-Strike (circled). Out-of-the-money options have a strike price that is higher than the current price of the stock/ETF. In this example the 173-Strike call and higher strike prices are out-of-themoney (circled). 12 Minimizing Time Value In-The-Money At-The-Money Out-of-The-Money 13 Calculating Time Value and Intrinsic Value The table below focuses on the QQQ in-the-money January call options presented in the previous QQQ option chain. As noted previously, In-the-money options have more Intrinsic Value and less Time Value than at-the-money or out-of-the-money options. The first column in the table below lists the intrinsic value of the call option. The intrinsic value is calculated by subtracting the strike price from the current price of the stock/ETF. In the top row of the table we can see the 148-Strike call has an intrinsic value of 23.52 and was calculated by subtracting the strike price of 148 from the current stock/ETF price of 171.52. The second column in the table below lists the time value of the call option. The time value is calculated by subtracting the intrinsic value from the option premium. In the top row of the table we can see the 148-Strike call has a time value of 1.40 and was calculated by subtracting the intrinsic value of 23.52 from the 24.92 option premium which is the ask price for the 148-Strike call. 14 Minimizing Time Value and Maximizing Intrinsic Value The table below again lists the QQQ in-the-money January call options presented previously. Notice the Intrinsic Value increases and the Time value decreases as the strike price gets deeper in-the-money. The 160-Strike call has an Intrinsic Value of 11.52 which is less than the 21.52 Intrinsic Value of the deeper in-the-money 150-Strike call. And The 160-Strike call has a Time Value of 3.03 which is greater than the 1.60 Time Value of the deeper in-the-money 150-Strike call. 15 Use the ‘1% Rule’ for Selecting an Option Strike Price We developed a simple technique called the ‘1% Rule’ for selecting an in-the-money strike call option when purchasing options. The 1% Rule utilizes a Strike price that limits the Time Value portion of a call option premium to less than 1% of the stock price in order to minimize time value and maximize intrinsic value. Using our current example, with the QQQ ETF trading at 171.52, we would limit the time value portion of the call option to less than 1.71 points which is 1% of the current ETF price. We can see from our table below that the 150-Strike and lower strike prices have less than a 1.71 Time Value and would qualify using the 1% Rule. 16 A 1% Stock Move = Option Profit If you limit the Time Value portion of an option to less than 1% of the stock/ETF price, the stock/ETF price only needs to increase 1% in order for the option trade to profit! A 1% price increase to profit has a much higher probability of being profitable than an at-the-money or out-of-the-money strike price that can require up to a 5% to 10% or higher increase in price of the underlying stock/ETF at option expiration to profit. Many times the expected stock price move will not occur before option expiration. When you use the 1% Rule, the option value will increase $100 for each 1 point increase in the stock/ETF price. Remember, if you purchase an at-the-money or out-of-the-money strike call option and the stock is flat or down at option expiration, it will result a 100% loss for your option trade. Using the 1% Rule to select an option strike price will increase your percentage of winning trades compared to trading at-the-money or out-of-the-money strike calls and this higher accuracy will make you a more successful trader. 17 Let’s now look at an actual option trade example to demonstrate the profit/loss characteristics of an option purchase and illustrate the 1% Rule for selecting an option strike price. Our brokerage account transaction report below shows that on June 3rd we purchased the CIGNA 50-Strike call option for 17.00 points. CIGNA stock was trading at 66.71 at the time of the option purchase. Buy to Open CI 50-Strike Call @17.00 Determine the Profit/Loss Potential for Your Option Trade Before You Take the Trade The Optioneering® Team designed a series of calculators to calculate the profit potential for six different types of option strategies. These calculators allow us to know the profit/loss potential of an option trade before we take the trade. The calculators calculate the profit potential for an option trade based on the price change in the underlying stock/ETF at option expiration. The price movement of the underlying stock determines the profit for an option trade not using complicated mathematical formulas you may have been led to believe. The calculators allow us to know in advance the profit/loss potential for an option trade before you take the trade. The six option calculators are available to members of our Trading Service. 18 Let’s now take a look at the profit/loss potential for our CI 50-Strike call option purchase using the call option purchase calculator. The Call Option Purchase analysis below displays the profit/loss potential for purchasing the CI 50-Strike call at 17.00 points with CI stock trading at 66.71 at the time of purchase. The calculator displays the profit/loss potential for this trade assuming various price changes for CI stock at option expiration and does not include commissions. The first row of the table is labeled ‘% Change’ and assumes various percent changes in CI stock at option expiration from a 30% increase to a 5% decrease in price in this example. The second row is labeled ‘Stock Price’ and is the CI stock price that corresponds to the percentage change listed on the row above. The ‘Option Value’ row lists the value of the call option which corresponds to the price of CI stock. The rows labeled ‘Profit/Loss’ and ‘% Profit/Loss’ lists the point profit or loss and the % profit or loss for the option. There is no limit on the profit potential of a call option purchase. The Analysis below reveals that if CI stock increases 30% to 86.72 at option expiration then a $1,972 profit and a 116.0% return would be realized (circled). A 10% increase in CI price to 73.38 would result in a $638 profit and a 37.5% return. If CI stock increases 1% to 67.38 at option expiration then a 2.2% return would be realized verifying a profitable trade using the 1% Rule (circled). If CI stock price remains flat at 66.71 a 1.7% loss will be realized (circled) and a 5% decrease in CI to 63.37 would result in a 21.3% option loss (circled). CI stock is currently trading at 85.64 and we have an $1,864 open trade profit in this trade. 19 This CI In-the-Money Call Option Purchase analysis reveals: ● A 20% increase in stock price results in a 76% option profit ● A 30% increase in stock price results in a 116% option profit ● A 1% increase in stock price results in a profit ● A flat stock price results in a small 1.7% option loss ● Each 1 point increase in stock price results in a $100 increase in option value ● Risk is limited to cost of option ● Profit Potential is unlimited Calculating the Breakeven Price The breakeven price for a call option purchase can be manually calculated by adding the strike price to the option premium. Buy CI 50-Strike Call @17.00 Using this Cigna option trade example we would add the strike price of 50 to the option premium of 17.00 to calculate the breakeven price of 67.00. With a breakeven price of 67.00 and CI stock trading at 66.71 the stock only has to increase .29 points or 0.4 of 1% to breakeven. Any increase above .29 points becomes profit. Strike Price + Premium = Breakeven 50.00 17.00 67.00 stock price 20 1% Rule The Call Option Purchase Calculator will also calculate the time value and intrinsic value of an option. The Call Option Analysis for our CI 50-Strike call purchase below shows that the time value portion of this option is .29 and the intrinsic value is 16.71 (circled). The .29 points of time value is 0.4 of 1% of the Cigna stock price (.29/66.71 = .4%) and meets the criteria of limiting the time value portion of an option to less than 1% of the stock price. This allowed us to minimize time value and maximze intrinsic value. Cigna stock only has to increase .29 points in order for this trade to breakeven and start profiting. Time Value and Intrinsic Value of CI 50-Strike Call Option Purchase Let’s compare this CI in-the-money option purchase to an out-of-the-money option purchase. We do not own any out-of-the-money options so let’s take a look at an option quote table on the following page which has a partial list of Feb option quotes for Priceline.com symbol PCLN. Let’s focus on the PCLN Feb options which have about the same amount of time to option expiration as our CI 50-Strike in-the-money call purchase example. 21 Pricline.com Feb Out-of-the-Money Option Quotes Let’s analyze the PCLN Feb 1270-Strike call which is trading at an ask price of 12.60 (circled). With PCLN stock trading at 1162.40 the 1270-Strike call would be an out-ofthe-money call. Let’s now take a look at the profit/loss potential for the purchase of the PCLN 1270-Strike call using the call option purchase calculator. 22 The Call Option Purchase analysis on the previous page displays the profit/loss potential for purchasing the PCLN 1270-Strike call at 12.60 points with PCLN stock trading at 1162.40 at the time of purchase. The calculator displays the profit/loss potential for this trade assuming various price changes for PCLN stock at option expiration from a 10% increase to a 10% decrease in price and does not include commissions. The calculator also reveals that this option consists of only time value of 12.60 and has no intrinsic value. Adding the strike price of 1270 to the premium of 12.60 results in a breakeven price of 1282.60 for this call option purchase. This requires PCLN stock to increase 120.20 points or 10.3% in order for this trade to breakeven. Strike Price + Premium = Breakeven 1270.00 12.60 1282.60 stock price The maximum risk on this trade is $1,260 which is the cost of the option. The Analysis reveals that if there is any decline in PCLN stock price or if PCLN stock remains flat at 1162.40 (circled) a 100% option loss will be realized. A 5% increase in PCLN stock would also result in a 100% loss. A 10% increase in PCLN stock would result in a 31.4% option loss (circled). Remember when you invest in options you must be correct not only about the future price movement of the underlying stock but you must also be correct about the time frame during which this movement must occur (before option expiration). You must plan on the possibility that you are not correct about the price movement and/or time frame. If you are wrong about the price direction or time frame you could lose your whole investment with an out-of-the-money option. This is not an acceptable risk if you want to ‘stay in the game’ after unanticipated price declines in the underlying stock. The CI and PCLN trade examples clearly demonstrate that investing in in-the-money call options can reduce the overall risk of option investing. With a .4% breakeven price the in-the-money CI option has a much higher probability of being profitable than the PCLN out-of-the-money option with a 10.3% breakeven. The in-the-money call option purchase strikes a good balance between reward and risk compared to a high risk outof-the-money call option purchase. 23 100% Loss Versus 1.7% Loss We saw with the CI option purchase, that a flat stock price at option expiration resulted in a small 1.7% loss. A flat price at option expiration with the PCLN option purchase results in a 100% loss. If you purchase a 1 month out-of-the-money option that requires a 10% increase in the underlying stock price price to breakeven, you could easily lose 100% of your premium investment if the stock does not make the anticipated price move before expiration. Regardless of the accuracy of your trade selection process, a 10% monthly price increase does not occur that often. Out-of-the-money call option purchases incur considerably more risk than purchasing in-the-money options. Our CI in-the-money trade example does not require a large upward price move in the underlying stock to profit. Trading in-the-money options puts the odds of winning in your favor and greatly increases the probability of a winning trade. 24 The Secret to Becoming a More Successful Trader We hope you were able to gain some valuable insights into our technique for selecting option strike prices. We having been using this technique successfully for many years. Let’s review the advantages of using the 1% Rule for selecting option strike prices: - Underlying stock/ETF only needs to increase 1% at option expiration for option trade to profit - A 1% stock price increase to produce a profitable option trade has a much higher probability of success than an at-the-money or out-of-the-money strike price that can require up to a 5% to 10% or higher increase in the price of the underlying stock/ETF at option expiration to profit - Using the 1% Rule to select an option strike price will increase your percentage of winning trades compared to trading at-the-money or outof-the-money strike calls - This higher accuracy will make you a more successful trader Wishing you the best in investment success! The Optioneering Team 25 Real Time Profit Results The Optioneering Team has been trading options successfully for many years in every type of market condition. Let’s take a look at recent actual profit results. Copies of our online brokerage account Profit/Loss statements that follow contain a snap shot of open option trades. The stock/ETF symbol, entry price, number of contracts, current price and the dollar profit and percent return for each trade in the portfolio is listed. We can see from these profit results that our option trading strategies are performing well across a variety of stock and ETF options. $1.2 Million in Actual Profits With An Average Return of 120.5% Copies of our brokerage account Profit/Loss Reports for our two retirement trading accounts show that we have $1,262,443.76 in open trade profits for our stock and option trades. There are 23 winning trades and no losing trades resulting in 100% accuracy. The average return for the two trading account portfolios is 120.5%. 26 Trading Account #1 $356,934.87 $356,934.87 Profit 27 Profit Trading Account #2 $905,508.89 $905,508.89 Profit 28 Profit Trading Account #2 Continued . . . $905,508.89 Profit 29 $905,508.89 Profit First Two Years of Trading Chuck Hughes started investing in options more than 30 years ago. Chuck had a big mortgage payment and a young family at the time. He started investing in options with only a $4,600 trading account as that is all he could scrape together at the time. But within the first two years he made $460,164 in profits which is more than he made at his airline job over the previous six years. Copies of his tax returns that show the $460,164 profit follow. 30 Copies of Tax Returns from Chuck’s first two years of trading showing $460,164 in option profits 31 32