Simulation Exam Question: Profit Contribution Analysis

advertisement

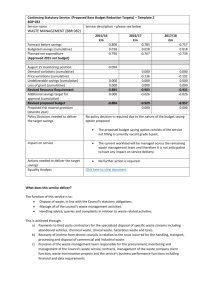

SIMULATION PAST EXAM QUESTION QUESTION TWO The managers of ABS Company are considering the question of introducing a new product. The estimated sales volume for the new product will be 4, 000 units. The factors are Uncertain - selling price and variable cost. The product will have a life of only one year. The Management has the data on these two factors as shown below. Selling price K 3 4 5 Probability 0.2 0.5 0.3 Variable cost K 1 2 3 Probability 0.3 0.6 0.1 Consider the following sequence of twenty random number: 81,32,60,04,46,31,67,25,24,10,40,02,39,68,08,59,66,90,12,64. Required: (a) Using the sequence (First 2 random numbers for the first trail, etc.), simulate the Average contribution to profit per year for the above project on the basis of 10 trials Total: 20 marks SOLUTION Step 1: Find the cumulative probabilities (in red) Selling price K 3 4 5 Probability 0.2 0.5 0.3 Cumulative Prob 0.2 0.7 1.0 Variable cost K 1 2 3 Probability 0.3 0.6 0.1 Cumulative prob 0.3 0.9 1.0 Step2: Add a column of Random numbers assigned (RNAS) to selling price and variable cost (in blue) Selling price K 3 4 5 Probability 0.2 0.5 0.3 Cumulative Prob 0.2 0.7 1.0 RNAS Variable cost K 1-19 1 20-69 2 70-99 3 Probability 0.3 0.6 0.1 Cumulative prob 0.3 0.9 1.0 RNAS 1-29 30-89 90-99 For cumulative probability of 0.2 which is the same as 20% or 20 as an absolute number we can assign random numbers ranging from 1 to 19 and for 0.7 which is 70% or 70 as an absolute number we can assign random numbers from 20 to 69. The same applies to variable costs cumulative probabilities. For 0.3 or 30 we can assign random numbers from 1-29 and so on Step 3: Simulate the selling price and variable cost 10 times using these random numbers. 81,32,60,04,46,31,67,25,24,10,40,02,39,68,08,59,66,90,12,64. Note that question (a) said (a) Using the sequence (First 2 random numbers for the first trail, etc.). This means that 81 is the random number for selling price and 32 for variable cost. 60 for selling price and 04 for variable cost and so on. No. of trials 1 2 3 4 5 6 7 8 9 10 Selling price Random #s 81 60 46 67 24 40 39 08 66 12 Variable cost Random #s 32 04 31 25 10 02 68 59 90 64 These are random numbers for selling price and variable costs Step 4: Simulate the selling price and the variable cost 10 times using these random numbers Selling price K 3 4 5 No. of trials 1 2 3 4 5 6 7 8 9 10 Probability 0.2 0.5 0.3 Selling price 5 5 4 4 4 4 4 3 4 3 Cumulative Prob 0.2 0.7 1.0 Random #s 81 60 46 67 24 40 39 08 66 12 RNAS Variable cost K 1-19 1 20-69 2 70-99 3 Variable cost 3 1 1 2 1 1 2 2 3 2 Probability 0.3 0.6 0.1 Cumulative prob 0.3 0.9 1.0 RNAS 1-29 30-89 90-99 Random #s 32 04 31 25 10 02 68 59 90 64 First trail: For selling price the random is 81 and this falls 70-99 above which corresponds to selling price K5. For variable cost the random number 32 falls between 30-89 above and corresponding to variable cost K3. Second trial: 60 falls between 70-99 and the selling price relating to this category is 5. For 04 its 1-29 category which relates to variable cost 1 and so on. Second part of the question is to find the simulated average contribution to profit per year for the Above project on the basis of 10 trials CONTRIBUTION = SELLING PRICE PER UNIT – VARIABLE COST PER UNIT The next step is to calculate the contribution per unit per trial No. of Selling trials price 1 5 2 5 3 4 4 4 5 4 6 4 7 4 8 3 9 4 10 3 TOTAL CONTRIBUTION Random #s 81 60 46 67 24 40 39 08 66 12 Variable cost 3 1 1 2 1 1 2 2 3 2 Random #s 32 04 31 25 10 02 68 59 90 64 Total Contribution = 22/10 trials = 2.2 average contribution to profit per year. Contribution per trial 5-3=2 5-1=4 4-=3 2 3 3 2 1 1 1 22