Decision Analysis Assignment: Quantitative Methods for Business

advertisement

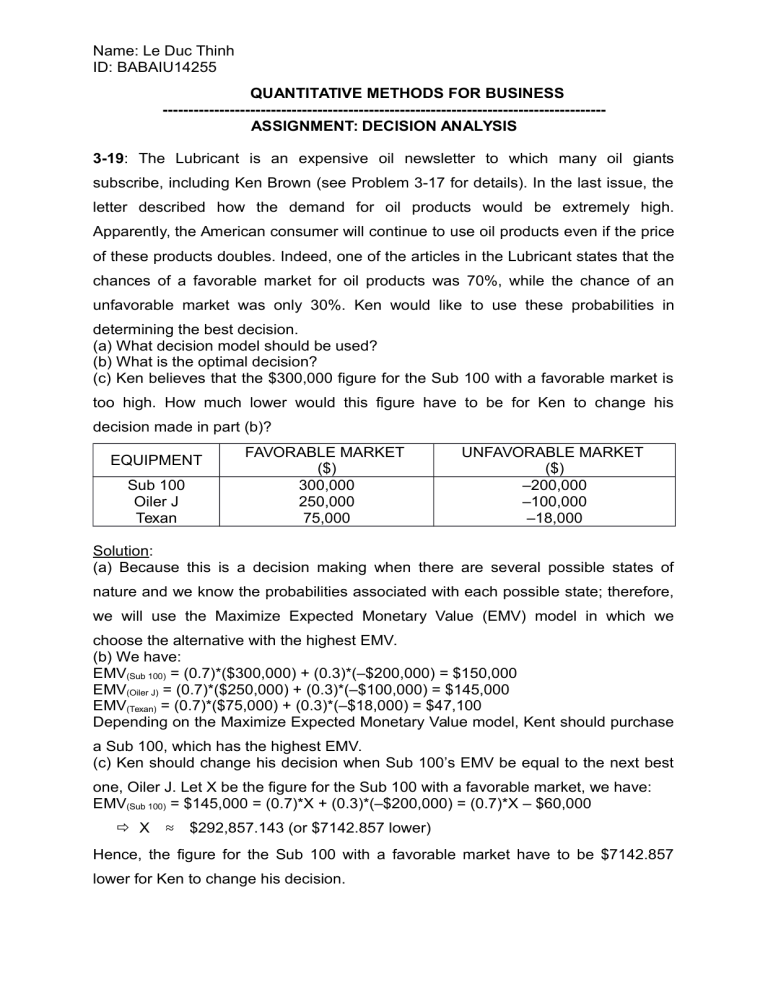

Name: Le Duc Thinh ID: BABAIU14255 QUANTITATIVE METHODS FOR BUSINESS -------------------------------------------------------------------------------------ASSIGNMENT: DECISION ANALYSIS 3-19: The Lubricant is an expensive oil newsletter to which many oil giants subscribe, including Ken Brown (see Problem 3-17 for details). In the last issue, the letter described how the demand for oil products would be extremely high. Apparently, the American consumer will continue to use oil products even if the price of these products doubles. Indeed, one of the articles in the Lubricant states that the chances of a favorable market for oil products was 70%, while the chance of an unfavorable market was only 30%. Ken would like to use these probabilities in determining the best decision. (a) What decision model should be used? (b) What is the optimal decision? (c) Ken believes that the $300,000 figure for the Sub 100 with a favorable market is too high. How much lower would this figure have to be for Ken to change his decision made in part (b)? EQUIPMENT Sub 100 Oiler J Texan FAVORABLE MARKET ($) 300,000 250,000 75,000 UNFAVORABLE MARKET ($) –200,000 –100,000 –18,000 Solution: (a) Because this is a decision making when there are several possible states of nature and we know the probabilities associated with each possible state; therefore, we will use the Maximize Expected Monetary Value (EMV) model in which we choose the alternative with the highest EMV. (b) We have: EMV(Sub 100) = (0.7)*($300,000) + (0.3)*(–$200,000) = $150,000 EMV(Oiler J) = (0.7)*($250,000) + (0.3)*(–$100,000) = $145,000 EMV(Texan) = (0.7)*($75,000) + (0.3)*(–$18,000) = $47,100 Depending on the Maximize Expected Monetary Value model, Kent should purchase a Sub 100, which has the highest EMV. (c) Ken should change his decision when Sub 100’s EMV be equal to the next best one, Oiler J. Let X be the figure for the Sub 100 with a favorable market, we have: EMV(Sub 100) = $145,000 = (0.7)*X + (0.3)*(–$200,000) = (0.7)*X – $60,000 X ≈ $292,857.143 (or $7142.857 lower) Hence, the figure for the Sub 100 with a favorable market have to be $7142.857 lower for Ken to change his decision. Name: Le Duc Thinh ID: BABAIU14255 3-20: Mickey Lawson is considering investing some money that he inherited. The following payoff table gives the profits that would be realized during the next year for each of three investment alternatives Mickey is considering: (a) What decision would maximize expected profits? (b) What is the maximum amount that should be paid for a perfect forecast of the economy? DECISION ALTERNATIVE Stock market Bonds CDs Probability STATE OF NATURE GOOD ECONOMY 80,000 30,000 23,000 0.5 POOR ECONOMY –20,000 20,000 23,000 0.5 Solution: (a) Using the possible profits and probabilities in the table, we have the expected profits for each decision are as follows: EMV(Stock market) = (0.5)*($80,000) + (0.5)*(–$20,000) = $30,000 EMV(Bonds) = (0.5)*($30,000) + (0.5)*($20,000) = $25,000 EMV(CDs) = (0.5)*($23,000) + (0.5)*($23,000) = $23,000 Depending on the Maximize Expected Monetary Value model, Mickey Lawson should invest in stock market, which has the highest EMV, to maximize expected profit. (b) Best alternative for favorable and unfavorable state of nature is invest in stock market with a payoff of $80,000 and invest in CDs with a payoff of $23,000, respectively. We have: EV(with prefect information) = (0.5)*($80,000) + (0.5)*($23,000) = $51,500 EVPI = EV(with prefect information) – Maximum EMV(without prefect information) = $51,500 – $30,000 = $21,500 So, the maximum Mickey Lawson should pay for a perfect forecast of the economy is $21,500. 3-21: Develop an opportunity loss table for the investment problem that Mickey Lawson faces in Problem 3-20. What decision would minimize the expected opportunity loss? What is the minimum EOL? Solution: Name: Le Duc Thinh ID: BABAIU14255 Best alternative for favorable and unfavorable state of nature is invest in stock market with a payoff of $80,000 and invest in CDs with a payoff of $23,000; respectively. We have the opportunity loss table for the investment problem that Mickey Lawson faces as following: DECISION ALTERNATIVE Stock market Bonds CDs Probability STATE OF NATURE GOOD POOR ECONOMY ECONOMY 80,000 – 80,000 = 0 23,000 – (–20,000) = 80,000 – 30,000 = 43,000 50,000 23,000 – 20,000 = 80,000 – 23,000 = 3,000 57,000 23,000 – 23,000 = 0 0.5 0.5 MAXIMUM IN A ROW ($) 43,000 50,000 57,000 – Depending on the table, we can see that investing in stock market has the lowest opportunity loss; therefore, Mickey Lawson should invest in stock market to minimize the expected opportunity loss. We have: EOL(Stock market) = (0.50)($0) + (0.50)($43,000) = $21,500 EOL(Bonds) = (0.50)($50,000) + (0.50)($3,000) = $26,500 EOL(CDs) = (0.50)($57,000) + (0.50)($0) = $28,500 So, the minimum EOL will happen when Mickey invests in stock market, which equals $21,500. Name: Le Duc Thinh ID: BABAIU14255 3-24: Today’s Electronics specializes in manufacturing modern electronic components. It also builds the equipment that produces the components. Phyllis Weinberger, who is responsible for advising the president of Today’s Electronics on electronic manufacturing equipment, has developed the following table concerning a proposed facility: (a) Develop an opportunity loss table. (b) What is the minimax regret decision? Large facility Medium-sized facility Small facility No facility STRONG MARKET PROFIT ($) FAIR MARKET POOR MARKET 550,000 300,000 200,000 0 110,000 129,000 100,000 0 –310,000 –100,000 –32,000 0 Solution: (a) Best alternative for strong, fair and poor market is having large facility with a payoff of $550,000; medium-sized facility with a payoff of $129,000 and no facility with a payoff of $0, respectively. We have the opportunity loss table as following: Large facility Mediumsized facility Small facility No facility STRONG MARKET 550,000 – 550,000 =0 550,000 – 300,000 = 250,000 PROFIT ($) FAIR MARKET 129,000 – 110,000 = 19,000 129,000 – 129,000 =0 550,000 – 200,000 = 350,000 129,000 – 100,000 = 29,000 550,000 – 0 = 550,000 129,000 – 0 = 129,000 POOR MARKET 0 – (– 310,000) = 310,000 0 – (– 100,000) = 100,000 MAXIMUM IN A ROW ($) 310,000 250,000 350,000 0 – (–32,000) = 32,000 550,000 0–0 =0 (b) Depending on the table, we can see that having medium-sized facility has the lowest opportunity loss; therefore, Today’s Electronics should have medium-sized facility. Name: Le Duc Thinh ID: BABAIU14255 3-25: Brilliant Color is a small supplier of chemicals and equipment that are used by some photographic stores to process 35mm film. One product that Brilliant Color supplies is BC-6. John Kubick, president of Brilliant Color, normally stocks 11, 12, or 13 cases of BC-6 each week. For each case that John sells, he receives a profit of $35. Like many photographic chemicals, BC-6 has a very short shelf life, so if a case is not sold by the end of the week, John must discard it. Since each case costs John $56, he loses $56 for every case that is not sold by the end of the week. There is a probability of 0.45 of selling 11 cases, a probability of 0.35 of selling 12 cases, and a probability of 0.2 of selling 13 cases. (a) Construct a decision table for this problem. Include all conditional values and probabilities in the table. (b) What is your recommended course of action? (c) If John is able to develop BC-6 with an ingredient that stabilizes it so that it no longer has to be discarded, how would this change your recommended course of action? Solution: (a) We have the following decision table : STOCK 11 cases 12 cases 13 cases Probability 11 cases 11*$35 = $385 11*$35 – 1*$56 = $329 11*$35 – 2*$56 = $273 0.45 STOCK SOLD 12 cases 11*$35 = $385 12*$35 = $420 12*$35 – 1*$56 = $364 0.35 13 cases 11*$35 = $385 12*$35 = $420 13*$35 = $455 0.2 (b) We have: EMV(11 cases) = (0.45)*($385) + (0.35)*($385) + (0.2)*($385) = $385 EMV(12 cases) = (0.45)*($329) + (0.35)*($420) + (0.2)*($420) = $379.05 EMV(13 cases) = (0.45)*($273) + (0.35)*($364) + (0.2)*($455) = $341.25 Depending on the Maximize Expected Monetary Value model, John should choose to sell 11 cases because it has the highest EMV. Name: Le Duc Thinh ID: BABAIU14255 (c) If John is able to develop BC-6 with an ingredient that stabilizes it so that it no longer has to be discarded, we have the decision table as following: STOCK 11 cases 12 cases 13 cases Probability 11 cases 11*$35 = $385 11*$35 = $385 11*$35 = $385 0.45 STOCK SOLD 12 cases 11*$35 = $385 12*$35 = $420 12*$35 = $420 0.35 13 cases 11*$35 = $385 12*$35 = $420 13*$35 = $455 0.2 We have: EMV(11 cases) = (0.45)*($385) + (0.35)*($385) + (0.2)*($385) = $385 EMV(12 cases) = (0.45)*($385) + (0.35)*($420) + (0.2)*($420) = $404.25 EMV(13 cases) = (0.45)*($385) + (0.35)*($420) + (0.2)*($455) = $411.25 In this situation, based on the Maximize Expected Monetary Value model, John should choose to sell 13 cases because of their highest EMV.