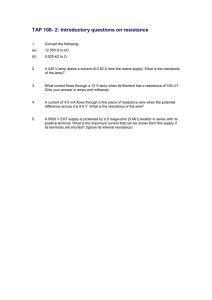

26) Macaulay Company has three product lines—D, E, and F. The following information is available: Sales Variable costs Contribution margin Fixed expenses Operating income (loss) Macaulay Company is thinking of dropping product line F because it is reporting an operating loss. Assume that $15,000 of total fixed costs could be eliminated by dropping F. What effect would this decision have on operating income? A) Operating income will increase by $25,000. B) Operating income will increase by $20,000. C) Operating income will decrease by $5,000. D) Operating income will decrease by $15,000. 27) Macaulay Company has three product lines—D, E, and F. The following information is available: Sales Variable costs Contribution margin Fixed expenses Operating income (loss) Macaulay Company is thinking of dropping product line F because it is reporting an operating loss. Assume that $25,000 of total fixed costs could be eliminated by dropping F. What effect would this decision have on operating income? A) Operating income will increase by $25,000. B) Operating income will increase by $5,000. C) Operating income will decrease by $25,000. D) Operating income will decrease by $5,000. 28) The income statement for Sweet Dreams Company is divided by its two product lines, blankets and pillows, as follows: Sales revenue Variable expenses Contribution margin Fixed expenses Operating income (loss) Sweet Dreams is considering eliminating the pillows product line. If they do so, they will be able to eliminate $76,000 of total fixed costs. How would that business decision impact operating income? A) increase $76,000 in operating income B) decrease $60,000 in operating income C) increase $42,000 in operating income D) increase of $16,000 in operating income 29) Which of the following statements describes a scenario when management should consider dropping a business division? A) The division has been reporting an operating loss consistently. B) The division's avoidable fixed costs are less than its contribution margin. C) The division's avoidable fixed costs are greater than its contribution margin. D) The division's unavoidable fixed costs are greater than its operating loss. 30) Clay Corporation manufactures two styles of lamps—a Bedford Lamp and a Lowell Lamp. The following per unit data are available: Sale price Variable costs Machine hours required for 1 lamp Total fixed costs are $30,000, and Clay can sell a maximum of 10,000 units of each style of lamp annually. Machine hour capacity is 25,000 hours per year. What is the contribution margin per machine hour for the Bedford lamp? A) $4 per machine hour B) $2 per machine hour C) $6 per machine hour D) $8 per machine hour 31) Clay Corporation manufactures two styles of lamps—a Bedford Lamp and a Lowell Lamp. The following per unit data are available: Sale price Variable costs Machine hours required for 1 lamp Total fixed costs are $30,000, and Clay can sell a maximum of 10,000 units of each style of lamp annually. Machine hour capacity is 25,000 hours per year. What is the contribution margin per machine hour for the Lowell lamp? A) $4 per machine hour B) $2 per machine hour C) $3 per machine hour D) $12 per machine hour 32) Clay Corporation manufactures two styles of lamps—a Bedford Lamp and a Lowell Lamp. The following per unit data are available: Sale price Variable costs Machine hours required for 1 lamp Total fixed costs are $30,000. Machine hour capacity is 25,000 hours per year. Assuming that the company can sell as many products as it can make, which product mix would deliver the highest operating income? A) 10,000 Bedford lamps, 1,250 Lowell lamps B) Zero Bedford lamps, 6,250 Lowell lamps C) 12,500 Bedford lamps, zero Lowell lamps D) 12,500 Bedford lamps, 12,500 Lowell lamps 33) Clay Corporation manufactures two styles of lamps—a Bedford Lamp and a Lowell Lamp. The following per unit data are available: Sale price Variable costs Machine hours required for 1 lamp Total fixed costs are $30,000. Marketing data indicate that the company can sell up to 8,000 units of the Bedford lamp and up to 4,000 units of the Lowell lamp. Machine hour capacity is 25,000 hours per year. What product mix will deliver the optimum operating income? A) 4,500 Bedford lamps, 4,000 Lowell lamps B) 12,500 Bedford lamps, zero Lowell lamps C) 8,000 Bedford lamps, 2,250 Lowell lamps D) 7,500 Bedford lamps, 3,000 Lowell lamps 34) Todd Corporation produces two products, P and Q. P sells for $5 per unit; Q sells for $6.50 per unit. Variable costs for P and Q are respectively, $3 and $4.50. There are 4,300 direct labor hours per month available for producing the two products. Product P requires 4 direct labor hours per unit and Product Q requires 5 direct labor hours per unit. The company can sell as many of either product as it can produce. What is the maximum monthly contribution margin that Todd can generate under the circumstances? Round to nearest whole dollar. A) $2,150 B) $1,505 C) $1,500 D) $2,250 35) Todd Corporation produces two products, P and Q. P sells for $5 per unit; Q sells for $6.50 per unit. Variable costs for P and Q are respectively, $3 and $4.50. There are 4,300 direct labor hours per month available for producing the two products. Product P requires 4 direct labor hours per unit and Product Q requires 5 direct labor hours per unit. The company can sell up to 900 units of each kind per month. What is the maximum monthly contribution margin that Todd can generate under the circumstances? Round to nearest whole dollar. A) $2,150 B) $1,505 C) $2,080 D D $70,000 E F $40,000 $30,000 -40,000 -20,000 -10,000 30,000 20,000 20,000 -15,000 -15,000 -25,000 $15,000 $5,000 ($5,000) D $70,000 E F $40,000 $30,000 -40,000 -20,000 -10,000 30,000 20,000 20,000 -15,000 -15,000 -25,000 $15,000 $5,000 ($5,000) Blankets $620,000 -465,000 Pillows $300,000 -240,000 $155,000 Total $920,000 -705,000 $60,000 $215,000 -76,000 -76,000 -152,000 $79,000 $(16,000) $63,000 20000 12000 15000 Bedford Lamp $25 $17 Lowell Lamp $35 $23 2 Bedford Lamp $25 $17 4 Lowell Lamp $35 $23 2 Bedford Lamp $25 $17 4 Lowell Lamp $35 $23 2 Bedford Lamp $25 4 Lowell Lamp $35 $17 $23 2 4 Remaining machine hours = 700(4,300 less 3,600) Number of units which can be made multiply by Contribution Margin per unit Total Contribution Margin Answer 26 C) Operating income will decrease by $5,000. Fixed Costs of $ 15,000 will be saved but Contribution Margin of $ 20,000 of Product F will be forgone. Overall decrease in Operating Income $ 5,000($ 15,000 less $ 20,000) Answer 27 B) Operating income will increase by $5,000. Fixed Costs of $ 25,000 will be saved but Contribution Margin of $ 20,000 of Product F will be forgone. Overall increase in Operating Income $ 5,000($ 25,000 less $ 20,000) Answer 28 D) increase of $16,000 in operating income Fixed Costs of $ 76,000 will be saved but Contribution Margin of $ 60,000 of Product F will be forgone. Overall increase in Operating Income $ 16,000($ 76,000 less $ 60,000) Answer 29 C) The division's avoidable fixed costs are greater than its contribution margin. Dropping a business division will result in avoidance of fixed costs of the division and also loss of the contribution margin. So, a product should be product only if the avoidable fixed cost is greater than the contribution margin as only in this situation, there will be overall saving. Answer 30 A) $4 per machine hour Sale price less: Variable costs Contribution Margin divide by machine hours used Contribution Margin per machine hour Answer 31 C) $3 per machine hour Sale price less: Variable costs Contribution Margin divide by machine hours used Contribution Margin per machine hour Answer 32 C) 12,500 Bedford lamps, zero Lowell lamps Contribution Margin per machine hour Ranking on the basis of contribution per machine hour As bedford lamp is having the higher contribution per machine hour and the company can sell as many products as it can make, it is beneficial to make only bedford lamp and no lowell lamp as it will highest operating income. Available machine hours divide by machine hours per lamp Product Mix Answer 33 C) 8,000 Bedford lamps, 2,250 Lowell lamps Contribution Margin per machine hour Ranking on the basis of contribution per machine hour First, 8000 units of Bedford lamp will be made as it has the highest contribution per machine hour. Production of 8000 units of Bedford lamp will consume 16000 machine hours(8000 units * 2 machine hour per unit). Remaining machine hours = 9,000(25,000 less 16,000) 2,250 units of lowell lamp will be made in remaining 9000 machine hours(9,000 hours /4 machine hour per lamp) Answer 34 A) $2,150 Selling price Variable costs Contribution Margin divide by direct labor hour per unit Contribution Margin per direct labor hour Ranking on the basis of Contribution margin per direct labor hour As Product P is having the higher contribution per direct labor hour and the company can sell as many products as it can make, it is beneficial to make only Product P and no Product Q as it will highest operating income. Direct labor hours available divide by direct labor hour per unit Number of units which can be made Number of units which can be made multiply by Contribution Margin per unit Total Contribution Margin Answer 35 C) $2,080 Contribution Margin per direct labor hour Ranking on the basis of Contribution margin per direct labor hour First, 900 units of Product P will be made as it has the highest contribution per direct labor hour. Production of 900 units of Product P will consume 3600 direct labor hours(900 units * 4 direct labor hour per unit). Remaining machine hours = 700(4,300 less 3,600) 140 units of Product Q will be made in remaining 700 Direct labor hours(700 hours /5 direct labor hour per unit) Number of units which can be made multiply by Contribution Margin per unit Total Contribution Margin 70000 -40000 30000 -15000 15000 40000 -20000 20000 -15000 5000 30000 -10000 20000 -25000 -5000 Total 140000 -70000 70000 -55000 15000 70000 -40000 30000 -15000 15000 $ $ 25 17 $ $ 8 2 4 $ $ 35 23 $ 12 4 3 $ Bedford Lamp Lowell Lamp $ 4 $ 3 1st 2nd 25000 2 12500 Bedford Lamp Lowell Lamp $ 4 $ 3 1st 2nd P $ Q 5.00 $ $ $ 3.00 $ 2.00 $ 4 0.5 2nd 1st 6.50 4.50 2.00 5 0.4 4300 4 1075 $ $ 1075 2.00 2,150.00 P Q 0.5 1st 0.4 2nd P Q $ $ 900 2.00 $ 1,800.00 $ Total 140 2.00 280.00 $ 2,080.00 40000 -20000 20000 20000 Total 110000 -60000 50000 40000 10000