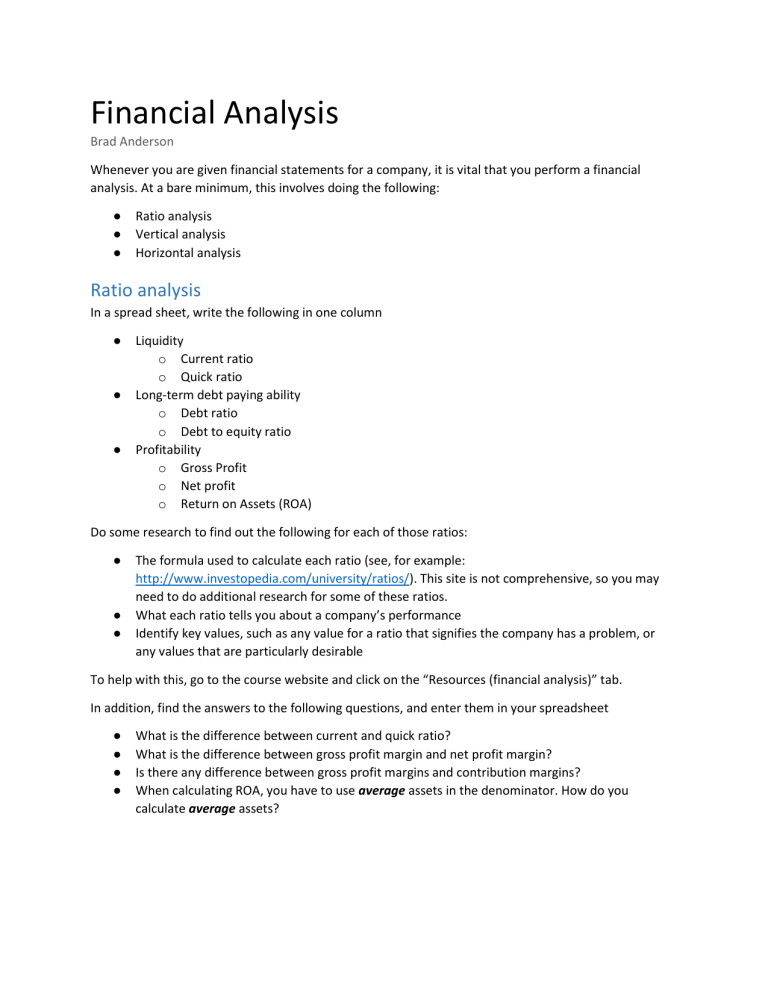

Financial Analysis Brad Anderson Whenever you are given financial statements for a company, it is vital that you perform a financial analysis. At a bare minimum, this involves doing the following: ● ● ● Ratio analysis Vertical analysis Horizontal analysis Ratio analysis In a spread sheet, write the following in one column ● ● ● Liquidity o Current ratio o Quick ratio Long-term debt paying ability o Debt ratio o Debt to equity ratio Profitability o Gross Profit o Net profit o Return on Assets (ROA) Do some research to find out the following for each of those ratios: ● ● ● The formula used to calculate each ratio (see, for example: http://www.investopedia.com/university/ratios/). This site is not comprehensive, so you may need to do additional research for some of these ratios. What each ratio tells you about a company’s performance Identify key values, such as any value for a ratio that signifies the company has a problem, or any values that are particularly desirable To help with this, go to the course website and click on the “Resources (financial analysis)” tab. In addition, find the answers to the following questions, and enter them in your spreadsheet ● ● ● ● What is the difference between current and quick ratio? What is the difference between gross profit margin and net profit margin? Is there any difference between gross profit margins and contribution margins? When calculating ROA, you have to use average assets in the denominator. How do you calculate average assets? Vertical & Horizontal Analysis In your spreadsheet, enter in the definition of vertical and horizontal analysis. What does each analysis tell you about the company? If you’re not sure of the answer, go to the course website and click on the “Resources (financial analysis)” tab for assistance. Let’s see if you can do these analyses correctly In your spreadsheet, enter in the following income statement for Company A Then, enter in the following balance sheet information for Company A Now calculate the ratios you defined above, as well as perform a vertical and horizontal analysis. The answers to this analysis are presented below so you can compare your answers. Make sure you can calculate each parameter correctly. If you get a wrong answer, check with a fellow student to see if they did it correctly. Otherwise, bring it in during our class discussion of Financial Analysis, and we’ll discuss as a class. Hey, you just made yourself a very useful tool This spreadsheet you just made is a powerful tool you can use again throughout this course and many other courses. On this spreadsheet, you now have formulas and definitions for important financial ratios. In addition, you have a template to calculate these ratios and perform vertical/horizontal analyses. Now, whenever you are given financial statements for a company, you can enter in the income statement and balance sheet data into the spreadsheet, and your analysis will be done automatically for you. (You’re welcome!) Answers Ratio analysis Vertical Analysis (income statement) Horizontal Analysis (income statement) as percent of year 2000