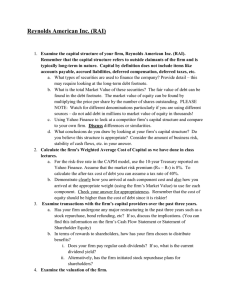

Cost of Capital and Valuation Basics Learning Objectives – coverage by question Multiple Choice Exercises Problems LO1 – Explain the basics of valuation, including intrinsic value, discounting, and payoffs. 1-6 1-2 1 LO2 – Explain and estimate the cost of equity capital. 7-8, 13-15, 26 3-4 2, 4-5 LO3 – Describe and estimate the cost of debt capital. 9, 16-17 & 27 5-7 2, 5 LO4 – Explain and estimate the weighted average cost of capital (WACC) 10-12 & 18-19 6-7 2, 4-5 LO5 – Describe and apply the dividend model with a constant perpetuity. 20-22 6-8 3,5 LO6 – Explain and apply the dividend discount model with an increasing perpetuity. 20-21 & 23-25 8-10 3 Answers available here http://bit.ly/2TD27Ni Test Bank, Module 12 ©Cambridge Business Publishers, 2013 12-1 Module 12: Cost of Capital and Valuation Basics Multiple Choice Topic: Basics of Valuation LO: 1 1. For stockholders one source of future cash flows is: A) Net income B) Dividends C) Cash flow from operations D) Free cash flow Answers available here http://bit.ly/2TD27Ni Topic: Basics of Valuation LO: 1 2. The first step in stock valuation requires: A) Estimating the cost of capital B) Applying a valuation model C) Analyzing the business D) Creating financial statements Topic: Basics of Valuation LO: 1 3. Estimating a company’s cost of capital requires: A) Applying a risk estimation model B) Applying a valuation model C) Adjustment for the time value of money and intrinsic value D) Adjustment for the time value of money and risk Answers available here http://bit.ly/2TD27Ni Topic: Basics of Valuation LO: 1 4. A company’s intrinsic value is its: A) Market value B) Economic value assuming actual payoffs are known C) Carrying value of debt D) Stock price Topic: Basics of Valuation LO: 1 5. Determine the present value of a 10 year annuity that pays $20,000 at the end of each year discounted at a rate of 5%. A) $154,435 B) $110,000 C) $137,842 D) $200,000 Topic: Basics of Valuation LO: 1 ©Cambridge Business Publishers, 2013 12-2 Financial Statement Analysis & Valuation, 3rd Edition 6. Determine the present value of a $50,000 to be received in 10 years when the discount rate is 5%. A) $25,000 B) $30,696 C) $45,000 D) $52,500 Answers available here http://bit.ly/2TD27Ni Topic: Cost of Capital LO: 2 7. Which of the following would be a non-diversifiable risk? A) A strike that shuts down production at a specific plant B) Inflation C) A disruption in a company’s supply chain D) The risk that a company may lose market share The following data pertains to Michalko Corp. Use this information to complete Questions 8 – 12. Michalko Corp. Total Assets Interest-Bearing Debt Average borrowing rate for debt Common Equity: Book Value Market Value Marginal Income Tax Rate Market Equity Beta $14,680 $8,124 11.5% $5,120 $25,700 37% 1.44 Topic: Cost of Equity Capital LO: 2 8. Using the information in the table and assuming that the risk-free rate is 4.2% and the market risk premium is 6.2% calculate Michalko's cost of equity capital, using the capital asset pricing model: A) 10.4% B) 8.9% C) 6.2% D) 13.1% Answers available here http://bit.ly/2TD27Ni Topic: Cost of Debt Capital LO: 3 9. Using the information in the table calculate Michalko's cost of debt capital, A) 11.5% B) 10.0% C) 7.2% D) 4.3% Topic: Weighted Average Cost of Capital Test Bank, Module 12 ©Cambridge Business Publishers, 2013 12-3 LO: 4 10. Determine the weight on debt capital that should be used to calculate Michalko's weighted-average cost of capital: A) 76.0% B) 24.0% C) 50% D) 61.3% Answers available here http://bit.ly/2TD27Ni Topic: Weighted Average Cost of Capital LO: 4 11. Determine the weight on equity capital that should be used to calculate Michalko's weighted-average cost of capital: A) 24.0% B) 50.0% C) 76.0% D) 38.7% Topic: Weighted Average Cost of Capital LO: 4 12. Using the above information, calculate Michalko’s weighted-average cost of capital: A) 15.9% B) 12.7% C) 11.7% D) 10.93% Topic: Cost of Equity Capital LO: 2 13. Market beta is a statistical coefficient that reflects a company’s historical stock price volatility relative to: A) All industry competitors in the world B) Risk free government bonds C) All securities in the market D) All firms of comparable market value Answers available here http://bit.ly/2TD27Ni Topic: Cost of Equity Capital LO: 2 14. The Capital Asset Pricing Model states that the expected return on a particular asset relates to all of the following components except: A) The risk-free rate B) The alpha risk C) The beta risk D) Stock specific risk Topic: Cost of Equity Capital LO: 2 15. Google has a market beta of 1.16, if the market increases by 1.2% on a given day we would expect that Google’s stock price would: A) Increase by 1.39% B) Increase by 2.36% C) Decrease by 1.86% ©Cambridge Business Publishers, 2013 12-4 Financial Statement Analysis & Valuation, 3rd Edition D) Increase by 1.16% Topic: Cost of Debt Capital LO: 3 16. The average borrowing rate for interest bearing debt is calculated as: A) Interest Expense divided by Average Liabilities B) Interest Paid divided by Average Liabilities C) Interest Expense divided by Average Interest-bearing debt D) Interest Expense divided by Average Long-term Debt Topic: Cost of Debt Capital LO: 3 17. When calculating the cost of debt capital you must multiply the average borrowing rate by: A) Marginal income tax rate B) 1 – Marginal income tax rate C) The effective tax rate D) 1 – Statutory corporate rate Answers available here http://bit.ly/2TD27Ni Topic: WACC LO: 4 18. The weighted average cost of capital is used when valuing the payoffs A) To equity holders B) To debt holders C) To both equity and debt holders D) To equity holders less the payoff to debt holders Topic: WACC LO: 4 19. If a company has preferred stock, the cost of preferred equity used in the company’s weighted average cost of capital calculation is A) Ignored B) Equal to the preferred dividend rate C) Equal to the preferred dividend rate multiplied by 1 – marginal income tax rate D) Equal to the cost of equity capital Topic Dividend Discount Model LO: 5, 6 20. The proper discount rate when using the dividend discount valuation model is the: A) Weighted average cost of capital B) Cost of equity capital C) Cost of debt capital D) Average borrowing rate Answers available here http://bit.ly/2TD27Ni Topic: Dividend Discount Model LO: 5, 6 21. The dividend discount valuation model equates the current stock price to: A) All future expected dividends B) All future expected dividends discounted by the weighted average cost of capital C) All future expected dividends discounted by the cost of equity capital D) The current dividend divided by current earnings per share Test Bank, Module 12 ©Cambridge Business Publishers, 2013 12-5 Topic: Dividend Discount Model LO: 5 22. Investment Company forecasts a $1.45 dividend for 2013, $1.56 dividend for 2014 and a $1.65 dividend for 2015 for Malibu Corporation. For all years after 2015, Investment Company forecasts that Malibu will pay a $1.75 dividend. Using the dividend discount valuation model determine the intrinsic value of Malibu Corporation, assuming the company’s cost of equity capital is 8%. A) $25.44 B) $21.88 C) $18.12 D) $21.36 Topic: Dividend Discount Model LO: 6 23. Investment Company forecasts a $1.45 dividend for 2013, $1.56 dividend for 2014 and a $1.65 dividend for 2015 for Malibu Corporation. For year 2016 Investment Company forecasts that Malibu will pay a $1.75 dividend and that dividend will continue to grow by 4% each year. Using the dividend discount valuation model determine the intrinsic value of Malibu Corporation, assuming the company’s cost of equity capital is 8%. A) $45.22 B) $38.72 C) $43.75 D) $55.12 Answers available here http://bit.ly/2TD27Ni Topic: Dividend Discount Model LO: 6 24. Wesley Corporation currently pays a $2.40 dividend and its current stock price is $42.80. Assuming the company’s cost of equity capital is 7% use the dividend discount valuation model to estimate the company’s growth rate. A) 1.4% B) 5.6% C) 2.3% D) 11.9% Topic: Dividend Discount Model LO: 6 25. Beatle Company currently pays a $0.60 dividend and its current stock price is $22.45. Assuming the company’s cost of equity capital is 10% use the dividend discount valuation model to estimate the company’s growth rate. A) 4.0% B) 1.7% C) 7.3% D) 10.0% Topic: Cost of Equity Capital LO: 2 26. Assume that a company has a beta of .88 and the risk-free rate is 5%. If the market risk premium is 6% calculate cost of equity capital, using the capital asset pricing model: A) 6.0% B) 5.3% C) 10.4% D) 10.3% Topic: Cost of Debt Capital ©Cambridge Business Publishers, 2013 12-6 Financial Statement Analysis & Valuation, 3rd Edition LO: 3 27. Gibson Corporation has $185 million dollars of interest-bearing debt outstanding at the end of fiscal 2012 year. In addition, the company incurred $26 million dollars of interest expense in 2012. If the company has a marginal tax rate of 30% calculate Gibson’s cost of debt capital. A) 14.1% B) 4.2% C) 9.8% D) 11.1% Exercises Topic: Valuation Basics LO: 1 1. The fourth step in the stock valuation is using information for valuation. This step involves estimating the cost of capital; describe the two adjustments that need to be made in this estimation. Topic: Valuation Basics LO: 1 2. Calculate the following present value amounts: a. An investor is expected to receive $2,000 5 years from today. What would its present value be today assuming a discount rate of 8%? b. An investor is expected to receive $1,000 each year for the next 7 years, What would its present value be today assuming a discount rate of 9%? Answers available here http://bit.ly/2TD27Ni Topic: Cost of Equity Capital LO: 2 3. At the end of 2012 Sommers Company had a market beta of 1.45. The risk free interest rate at that time was 3.75% and expected market premium was 6.5%. a. Given Sommers’ Company market beta, how did the company's stock returns compare to the market return? b. Estimate Sommers’ Company's cost of equity capital. Topic: Cost of Equity Capital LO: 2 4. Suppose a firm has a market beta of 1.34 and the risk free interest rate is 4.3%. In addition, the excess return over the risk-free rate is 5.9%. Calculate the firm's cost of equity capital using the CAPM model. Topic: Cost of Debt Capital LO: 3 5. An analyst has the following information available about Bears Corp. Use the information to compute the company’s cost of debt capital. Listed below is financial information for Bears Corp. Total Assets Average borrowing cost Marginal Income Tax Rate Market Equity Beta Test Bank, Module 12 $157,652 10.5% 34% 0.92 ©Cambridge Business Publishers, 2013 12-7 Risk-free Rate of interest Market Premium 4.5% 6.5% Answers available here http://bit.ly/2TD27Ni Topic: Weighted Average Cost of Capital LO: 3, 4, 5 6. Listed below is financial information for Bulls, Inc. Total Assets Book value of debt Average borrowing cost Common Equity: Book Value Market Value Marginal Income Tax Rate Market Equity Beta Risk-free Rate Market Premium $38,673 $11,258 10% $21,489 $42,698 37% 1.1 4.5% 6.5% An analyst wants to value the expected payoffs to both the debt and equity holders of Bulls, Inc. and is provided with the above information. Compute the relevant cost of capital that should be used to value the payoff to both debt and equity holders. Topic: Weighted Average Cost of Capital LO: 3, 4, 5 7. Use the following information to calculate Easton Corporation's weighted average cost of capital: The risk free interest rate is 4%. The expected return on the market is 12%. The proportion of debt in the capital structure is 45%. Easton Corporation’s beta is 1.2 Easton’s marginal income tax rate is 35%. The company's average borrowing rate is 10%. Answers available here http://bit.ly/2TD27Ni Topic: DDM LO: 5, 6 8. Zhang Corp. currently pays a dividend of $0.80 per share. In addition, Zhang’s market beta is 1.7 when the risk free rate is 5% and the expected market premium is 7%. Estimate the intrinsic value of Zhang Corp. using the dividend discount model under each of the following separate assumptions: a. The dividend is expected to last into perpetuity. b. The dividend will be $0.90 next year and then will grow at a rate of 5% per year. c. The dividend will be $0.80 for the next four years and then will grow at a rate of 5%. ©Cambridge Business Publishers, 2013 12-8 Financial Statement Analysis & Valuation, 3rd Edition Answers available here http://bit.ly/2TD27Ni Topic: DDM with Increasing Perpetuity LO: 6 9. Leah Inc. currently pays a dividend of $2.08, and the company’s dividend is expected to grow by 3% per year. The company’s has the following costs of capital: Cost of equity capital = 9%, Cost of debt capital = 6.5%, Weighted average cost of capital = 8.25%. Use the above information to calculate Leah’s stock price using the dividend discount model. Answers available here http://bit.ly/2TD27Ni Topic: DDM with Increasing Perpetuity LO: 6 10. Malibu Corporation currently pays a $2.20 dividend and its current stock price is $42.80. Assuming the company’s cost of equity capital is 7% use the dividend discount valuation model to estimate the company’s growth rate. Problems Topic: Basics of Valuation LO: 1 1. Assume that you are being interviewed for a job with an investment banking firm as a stock analyst. The interviewer is interested in how you would value a stock. In a concise manner describe the steps you would take in order to value a stock. Topic: Cost of Capital LO: 2, 3, 4 2. The following financial statement data pertains to Halsey, Inc.: Total Assets Interest-Bearing Debt Average borrowing cost Common Equity: Book Value Market Value Marginal Income Tax Rate Market Equity Beta Expected Market Premium Risk-free interest rate $195,245 $82,680 11.25% $42,154 $135,849 37% 0.9 7.0% 4.7% Required: a. Calculate the company's cost of equity capital. b. Calculate the weight on debt capital that should be used to determine Halsey’s weighted-average cost of capital. Test Bank, Module 12 ©Cambridge Business Publishers, 2013 12-9 Calculate the weight on equity capital that should be used to determine Halsey’s weightedaverage cost of capital. d. Calculate Halsey’s weighted-average cost of capital. c. Answers available here http://bit.ly/2TD27Ni c. Debt Market Value of Equity TOTAL $82,680 $135,849 $218,529 d. Halsey’s WACC = [0.378 x 0.1125 x (1 - 0.37)] + (0.622 x 0.11) = 0.02679 + 0.06842 = 0.09521, or 9.5% 37.8% 62.2% 100% Topic: DDM LO: 5, 6 3. Use the information below, along with the cash flow data, to compute the value per share of Nike. 1. Nike has 368,000,000 shares of common stock outstanding. 2. Nike's cost of equity capital is 10%. Required: a. Determine the value per share of Nike assuming that Nike will have no future growth and that 90% of all dividends go to common stockholders. b. Determine the value per share of Nike assuming that Nike has a constant growth rate and that the growth rate can be determined by computing the growth of cash provided by operations in the current period presented. Consolidated Statements of Cash Flows Year Ended May 31, (In millions) 2012 2011 2010 2,223 $ 2,133 $ 1,907 373 335 Cash provided by operations: Net income $ Income charges (credits) not affecting cash: Depreciation 324 Deferred income taxes (60 ) (76) Stock-based compensation (Note 11) 130 105 159 32 23 72 (Increase) decrease in accounts receivable (323 ) (273) 182 (Increase) decrease in inventories (805 ) (551) 285 (Increase) decrease in prepaid expenses and other current assets (141 ) (35) (70) 470 151 297 1,899 1,812 3,164 Purchases of short-term investments (2,705 ) (7,616) (3,724) Maturities of short-term investments 2,585 4,313 2,334 Sales of short-term investments 1,244 2,766 453 Amortization and other 8 Changes in certain working capital components and other assets and liabilities: Increase (decrease) in accounts payable, accrued liabilities and income taxes payable Cash provided by operations Cash provided (used) by investing activities: Additions to property, plant and equipment Disposals of property, plant and equipment ©Cambridge Business Publishers, 2013 12-10 (597 ) 2 (432) 1 (335) 10 Financial Statement Analysis & Valuation, 3rd Edition Increase in other assets, net of other liabilities (37 ) Settlement of net investment hedges Cash provided (used) by investing activities 22 514 (30) (11) (23) (1,021) 5 (1,268) (8) (32) Cash used by financing activities: Reductions in long-term debt, including current portion (203 ) (Decrease) increase in notes payable (65 ) 41 (205) Proceeds from exercise of stock options and other stock issuances 468 345 364 Excess tax benefits from share-based payment arrangements Repurchase of common stock 115 (1,814 ) 64 (1,859) 58 (741) (619 ) (555) (505) (2,118 ) (1,972) (1,061) Dividends — common and preferred Cash used by financing activities Effect of exchange rate changes 67 Net increase (decrease) in cash and equivalents 362 Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR $ 57 (1,124) (47) 788 1,955 3,079 2,291 2,317 $ 1,955 $ 3,079 Answers available here http://bit.ly/2TD27Ni Topic: Cost of Capital LO: 2, 4 4. At the end of its 2012 fiscal year-end McNally Corporation had 50,000 shares of preferred stock outstanding. The preferred stock has a book value of $20 per share. In addition, McNally paid $70,000 in dividends to preferred shareholders in 2012. McNally also has $2,500,000 of interest bearing debt outstanding and its after-tax cost of debt is 6.4%. The market value of McNally's common stock equity at year end is $5,200,000 and the company's cost of common equity is 9.4%. Required: a. What is the total book value of McNally’s preferred stock at the end of 2012? b. Estimate the cost of McNally’s preferred equity capital. c. Calculate McNally’s weighted average cost of capital Topic: Cost of Capital LO: 2, 3, 4, 5 5. A financial analyst determines that Podman Company has $40 million of interest bearing debt outstanding and 3,800,000 common shares outstanding at the end of 2012. She also estimates that Podman's after-tax cost of debt is 5.67% and that its cost of equity using the capital asset pricing model is 9.72%. The company pays a $1.82 dividend and has a current stock price $36 per share. The company has a marginal income tax rate of 37%. Required: a. Compute Podman's average borrowing rate. b. Compute the company's weighted average cost of capital. c. Assuming that Podman's dividend will last into perpetuity what cost of equity capital is inferred by the current stock price? d. Assuming that the financial analyst has properly calculated the cost of equity capital and that Podman will pay a dividend of $1.92 next year what growth rate is implied by the current stock price? Answers available here http://bit.ly/2TD27Ni Test Bank, Module 12 ©Cambridge Business Publishers, 2013 12-11 ©Cambridge Business Publishers, 2013 12-12 Financial Statement Analysis & Valuation, 3rd Edition