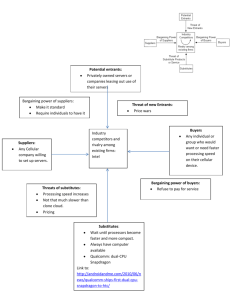

2/11/2020 ANALYZING THE EXTERNAL ENVIRONMENT OF THE FIRM BPL 5100 – Dr. Judith Ryba 1 THE IMPORTANCE OF EXTERNAL ENVIRONMENT • Consider. . . • The best CEOs are always aware of what’s going on outside their company. Their perceptual acuity allows them to sense what’s coming. Detecting early warning signals, keeping pace with changes in the external environment can sustain a competitive advantage. 2 1 2/11/2020 ENHANCING AWARENESS OF THE EXTERNAL ENVIRONMENT Exhibit 2.1 Inputs to Forecasting 3 ENVIRONMENTAL SCANNING & MONITORING • Environmental scanning involves surveillance of a firm’s external environment. • Predicts environmental changes to come • Detects changes already under way • Allows firm to be proactive • Environmental monitoring tracks evolution of environmental trends. • Sequences of measurable facts/events • Streams of activities or trends from outside the organization 4 2 2/11/2020 COMPETITIVE INTELLIGENCE • Competitive intelligence • Helps firms define & understand their industry • Identifies rivals’ strengths & weaknesses • Collect data on competitors • Interpret intelligence data • Helps firms avoid surprises • Anticipate competitors’ moves • Decrease response time • Potential for unethical behavior while gathering intelligence 5 ENVIRONMENTAL FOREC ASTING • Environmental forecasting predicts change. • Plausible projections about • Direction of environmental change? • Scope of environmental change? • Speed of environmental change? • Intensity of environmental change? • Scenario analysis involves detailed assessments of the ways trends may affect an issue & development of alternative futures based on these assessments. 6 3 2/11/2020 SWOT ANALYSIS • SWOT analysis is a basic technique for analyzing firm and industry conditions. • Firm or internal conditions = Strengths & Weaknesses • Where the firm excels or where it may be lacking • Environmental or external conditions = Opportunities & Threats • Developments that exist in the general environment • Activities among firms competing for the same customers • Must consider both internal & external factors simultaneously 7 THE GENERAL ENVIRONMENT • The general environment is composed of factors that are both hard to predict and difficult to control. • Demographic • Sociocultural • Political/Legal • Technological • Economic • Global 8 4 2/11/2020 THE DEMOGRAPHIC SEGMENT • Demographics are easily understandable & quantifiable. • Aging population • Rising affluence • Changes in ethnic composition • Geographic distribution of population • Greater disparities in income levels 9 THE SOCIOCULTURAL SEGMENT • Sociocultural forces influence the values, beliefs, and lifestyles of a society. • More women in the workforce • Increase in temporary workers • Greater concern for healthy diets & physical fitness (increasing levels of obesity) • Greater concern for the environment • Postponement of marriage & family formation, having children 10 5 2/11/2020 THE POLITICAL/LEGAL SEGMENT • Political/Legal processes & legislation influence environmental regulations with which industries must comply. • Tort reform • Americans with Disabilities Act (ADA) • Deregulation of utilities & other industries • Increases in minimum wages • Taxation • Legislation on corporate governance reforms • Affordable Health Care Act, Medicare reimbursements 11 THE TECHNOLOGIC AL SEGMENT • Technological developments lead to new products & services. They can create new industries & alter existing ones. • Genetic engineering • Three-dimensional (3D) printing • Computer-aided design/computer-aided manufacturing systems (CAD/CAM) • Research in synthetic & exotic materials • Pollution/global warming • Miniaturization of computing technologies • Wireless communications • Nanotechnology • Big data/data analysis 12 6 2/11/2020 THE ECONOMIC SEGMENT • Economic forces affect all industries. • Interest rates • Unemployment • Consumer Price Index • Trends in GDP & net disposable income • Changes in stock market valuations 13 THE GLOBAL SEGMENT • Global forces offer both opportunities & risks. • Increasing global trade • Currency exchange rates • Emergence of the Indian & Chinese economies • Trade agreements among regional blocs (NAFTA, EU, ASEAN) • Creation of the WTO (leading to decreasing tariffs/free trade in services) • Increased risks associated with terrorism 14 7 2/11/2020 GENERAL ENVIRONMENT: RELATIONSHIPS AMONG ELEMENTS • Elements of the general environment interact with each other. • Demographic trends have implications for economics. • Greater access to information technology affects both economics and global relationships. • Political/legal trends can have very different effects on different industries. • Digital technology has altered the way business is conducted in nearly every business domain. • Data analytics 15 THE COMPETITIVE ENVIRONMENT • The competitive environment consists of factors in the task or industry environment that are particularly relevant to a firm’s strategy. • Competitors (existing or potential) • Including those considering entry into an entirely new industry • Customers (or buyers) • Suppliers • Including those considering forward integration 16 8 2/11/2020 PORTER’S FIVE FORCES MODEL OF INDUSTRY COMPETITION Exhibit 2.4 Porter’s Five Forces Model of Industry Competition Source: From Michael E. Porter, “The Five Competitive Forces That Shape Strategy,” Special Issue on HBS Centennial.. Harvard Business Review 86, No. 1 (January 2008), 78-93. Reprinted with permission of Michael E. Porter. Jump to Appendix 1 for long description. 17 THE THREAT OF NEW ENTRANTS • The threat of new entrants – possibility that the profits of established firms in the industry may be eroded by new competitors. • Depends on existing barriers to entry: • Economies of scale • Product differentiation • Capital requirements • Switching costs • Access to distribution channels • Cost disadvantages independent of scale 18 9 2/11/2020 QUESTION (2 OF 2 ) • If you are considering opening a new pizza restaurant in your community, what would be the threat of new entrants? How would you evaluate Porter’s other forces for this industry? Explain. 19 THE BARGAINING POWER OF BUYERS • Buyers have bargaining power. • Buyers can force down prices, bargain for higher quality or more services, or play competitors against each other. • Buyer groups are powerful. • Purchasing standard products are in large volumes. • Profits are low & switching costs are few. • Backward integration is possible. • Buyer’s product quality is not affected by industry product. 20 10 2/11/2020 THE BARGAINING POWER OF SUPPLIERS • Suppliers can exert bargaining power by threatening to raise prices or reduce the quality of purchased goods and services. • Supplier groups are powerful. • Only a few firms dominate the industry. • There is no competition from substitute products. • Suppliers sell to several industries. • Buyer quality is affected by industry product. • Products are differentiated & have switching costs. • Forward integration is possible. 21 THE THREAT OF SUBSTITUTE PRODUCTS & SERVICES • Substitute products & services limit the potential returns of an industry. • Substitutes come from another industry. • Substitutes can perform the same function as the industry’s offerings. • Substitutes place a ceiling on prices that firms in an industry can profitably charge. • The more attractive the price/performance ratio, the more the substitute erodes industry profits. 22 11 2/11/2020 THE INTENSITY OF RIVALRY AMONG COMPETITORS IN AN INDUSTRY • Rivalry tactics include price competition, advertising battles, new product introductions, increased customer service or warranties. • Interacting factors lead to intense rivalry. • Numerous or equally balanced competitors • Slow industry growth • High fixed or shortage costs • Lack of differentiation or switching costs • Capacity augmented in large increments • High exit barriers 23 HOW TH E I N TE R NE T A N D D I GI TA L T E C HNO LO G I E S A F F E C T C OM PE T I T I V E F ORC E S Competitive Forces Benefits to Industry Threat of New Entrants Disadvantages to Industry • Lower barriers to entry increases number of new entrants. • Many Internet-based capabilities can be easily imitated. Bargaining Power of Buyers Reduces the power of buyer intermediaries in many distribution channels. • Switching costs decrease. • Information availability online empowers and users. Bargaining Power of Suppliers Online procurement methods can increase bargaining power over suppliers. • The Internet gives suppliers access to more customers and makes it easier to reach end users. • Online procurement practices deter competition and reduce differentiating features. Threat of Substitutes Internet-based increases in overall efficiency can expand industry sales. • Internet-based capabilities create more opportunities for substitution. Intensity of Rivalry • Since location is less important, the number of competitors increases. • Differences among competitors are harder to perceive online. • Rivalry tends to focus on price and differentiating features are minimized. Sources: Bodily, S., & Venkataraman, S. 2004. Not walls, windows: Capturing value in the digital age. Journal of Business Strategy. 25(3): 15-25; Lumpkin, G.T. Droege, S.B., & Dess, G.G. 2002. E-commerce strategies: Achieving sustainable competitive advantage and avoiding pitfalls. Organizational Dynamics, 30 (Spring): 1-17. 24 12 2/11/2020 USING INDUSTRY ANALYSIS: A FEW CAVEATS • Managers must not always avoid low profit industries; these can still yield high returns for players who pursue sound strategies. • Five forces analysis implicitly assumes a zero-sum game. Yet mutually beneficial relationships can still be established with buyers & suppliers. • Five forces analysis is essentially a static analysis, yet external forces can still change the structure of all industries. • See the value net extension of five forces analysis. • Vertical dimension = suppliers & customers • Horizontal dimension = substitutes & complements 25 THE VALUE NET Exhibit 2.6 The Value Net Source: Adapted from “The Right Game: Use Game Theory Shape Strategy,” by A. Brandenburger and B.J. Nalebuff, JulyAugust 1995 Harvard Business Review. Jump to Appendix 2 for long description. 26 13 2/11/2020 DOING A GOOD INDUSTRY ANALYSIS • Good industry analysis looks rigorously at the structural underpinnings & root causes of profitability. • Must choose the appropriate time frame • Consider the industry business life cycle • Average profitability over 3-5 years or longer • Must consider quantitative factors as well as qualitative • Get numbers to quantify five forces factors • Percentages of total cost or sales accounted for by the industry, actual switching costs 27 STRATEGIC GROUPS WITHIN INDUSTRIES • Two unassailable assumptions in industry analysis: • No two firms are totally different. • No two firms are exactly the same. • Strategic groups – clusters of firms that share similar strategies: • Breadth of product & geographic scope • Price/quality • Degree of vertical integration • Type of distribution 28 14 2/11/2020 STRATEGIC GROUPS AS AN ANALYTIC TOOL • Strategic groups can be analytical tools. • Helps identify barriers to mobility that protect a group from attacks by other groups • Helps identify groups whose competitive position may be marginal or tenuous • Helps chart the future direction of firms’ strategies • Helps to think through the implications of each industry trend for the strategic group as a whole 29 EXAMPLE: STRATEGIC GROUPS WITHIN INDUSTRIES Exhibit 2.7 The World Automobile Industry: Strategic Groups Note: Members of each strategic group are not exhaustive, only illustrative. Jump to Appendix 3 for long description. 30 15