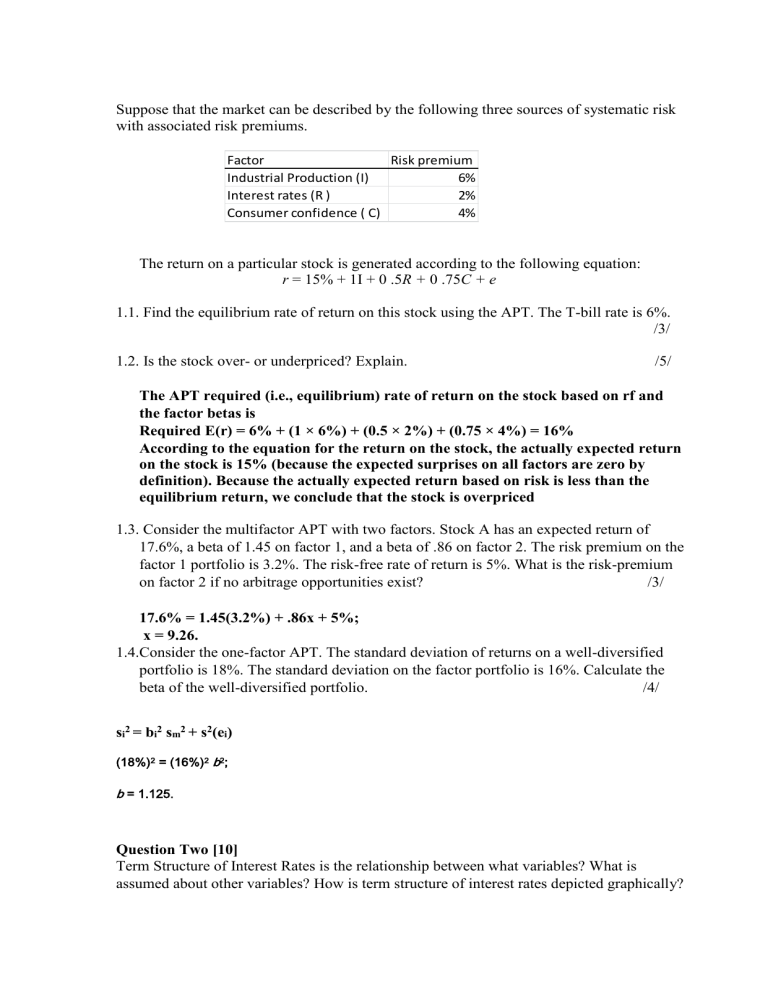

Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums. Factor Risk premium Industrial Production (I) 6% Interest rates (R ) 2% Consumer confidence ( C) 4% The return on a particular stock is generated according to the following equation: r = 15% + 1I + 0 .5R + 0 .75C + e 1.1. Find the equilibrium rate of return on this stock using the APT. The T-bill rate is 6%. /3/ 1.2. Is the stock over- or underpriced? Explain. /5/ The APT required (i.e., equilibrium) rate of return on the stock based on rf and the factor betas is Required E(r) = 6% + (1 × 6%) + (0.5 × 2%) + (0.75 × 4%) = 16% According to the equation for the return on the stock, the actually expected return on the stock is 15% (because the expected surprises on all factors are zero by definition). Because the actually expected return based on risk is less than the equilibrium return, we conclude that the stock is overpriced 1.3. Consider the multifactor APT with two factors. Stock A has an expected return of 17.6%, a beta of 1.45 on factor 1, and a beta of .86 on factor 2. The risk premium on the factor 1 portfolio is 3.2%. The risk-free rate of return is 5%. What is the risk-premium on factor 2 if no arbitrage opportunities exist? /3/ 17.6% = 1.45(3.2%) + .86x + 5%; x = 9.26. 1.4.Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 18%. The standard deviation on the factor portfolio is 16%. Calculate the beta of the well-diversified portfolio. /4/ si2 = bi2 sm2 + s2(ei) (18%)2 = (16%)2 b2; b = 1.125. Question Two [10] Term Structure of Interest Rates is the relationship between what variables? What is assumed about other variables? How is term structure of interest rates depicted graphically? Term Structure of Interest Rates is the relationship between yield to maturity and term to maturity, all else equal. The "all else equal" refers to risk class. Term Structure of Interest Rates is depicted graphically by the yield curve, which is usually a graph of Treasuries of different yields and different terms to maturity. The use of Treasuries allows one to examine the relationship between yield and maturity, holding risk constant. The yield curve depicts this relationship at one point in time only. Question Three [15] 3.1 A par value bond has a coupon rate of 8.7% and the remaining time to maturity is 6 years. If interest rates changes by 50 basis points, what will be the percentage change in price? If the convexity is 405, calculate the percentage change in price according to the duration with convexity rule. /10/ (5 marks) According to the duration rule %price change = - (4.92/1+8.7%) * 0.005= -0.02263109 or accept if they multiply this answer with the price of the bond Therefore the bond value will decrease by 2.26% (5 marks) According to the duration with duration with convexity rule ∆P/P = -D × ∆y + (1/2) × Convexity × (∆y)2; = - 4.526 × 0.005 + (1/2) × 405× (.005)2 = 0.0277 = 2.77% (5 marks) 3.2 Discuss duration. Include in your discussion what duration measures, how duration relates to maturity, what variables affect duration, and how duration is used as a portfolio management tool. /5/ Duration is a measure of the time it takes to recoup one's investment in a bond, assuming that one purchased the bond for R1,000. Duration is shorter than term to maturity on coupon bonds as cash flows are received prior to maturity. Duration equals term to maturity for zero-coupon bonds, as no cash flows are received prior to maturity. Duration measures the price sensitivity of a bond with respect to interestrate changes. The longer the maturity of the bond, the lower the coupon rate of the bond, and the lower the yield to maturity of the bond, the greater the duration. Interest-rate risk consists of two components: price risk and reinvestment risk. END