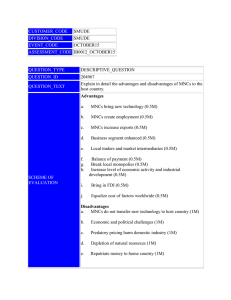

Chapter 28: Foreign Investment, Aid, Trade & Debt 28.1 The meaning of FDI and MNCs TERMS: ❏ Foreign Direct Investment (FDI): An investment made by a firm or individual of one country into business interests located in another country. ❏ Multinational Corporation (MNC): Large companies with trading, manufacturing, or service operations across several countries. ❏ Investment: The allocation of money to capital that will allow for the production of goods and services in hopes of it flourishing and making profit. Class Presentation Notes: Foreign direct investment → usually done by multinational corporations (MNC) by: - Expanding to those new countries Buying existing firms in those new countries What does FDI do? - Helps to acquire foreign exchange Adds to domestic savings Adds to technical skills, management skills, and new technology Why do MNCs expand? - To increase their sales, revenue, and profit To bypass trade barriers To lower production costs ● Cost of labour in LDCs is far lower than in MDCs To extract natural resources What would make a country attractive to a MNC? - Political stability Macroeconomic stability Freedom to repatriate No exchange controls Tax benefits Lax regulation Well established property rights - Privatization Liberal markets and trade policies Large markets Rapid growth and expectations that will continue Infrastructure Well educated labor force Possible advantages of FDI: - Balances a current account deficit Improve local skills Increase insufficient domestic savings Greater tax revenue Promote local industries and employment Higher economic growth Sources of Foreign Direct Investment (FDI): - Only these four sources produce government debt Foreign portfolio investment → Buying shares from companies abroad = Indirectly contributing to the development of the country Foreign direct investment → Buying assets that allow for the production of goods and services in both quantity and quality of them to improve in another country = Directly contributing to the development of the country ● Inward flows of FDI to a country → When foreign companies invest in the domestic market of the country ● Outward flows of FDI to a country → When domestic companies do the same in foreign markets of the country FDI occurs when → foreign companies purchase productive assets (factories, mines, land..) FDI can be classified as: 1) Greenfield investment ● When companies construct new facilities from scratch 2) Brownfield investment ● When investors purchase or lease existing facilities 28.2 Conditions that favour MNC investment MNCs and developing countries MNCs are also called trans-national corporations (TNCs) - Trade has increased four times more rapidly than GDP - FDI has increased even more quickly - Largest MNCs → come from developed countries ● 2010 → 50% of FDI flows went to developed countries and the other 50% to developing countries Why MNCs are attracted to developing countries Low-cost labour - MNCs relocate production to countries where the per-unit labour costs are much lower Natural resources - Access to natural resources Political stability - MNCs don’t invest in areas where political order is not clear Large domestic market - MNCs want LDC country products to ALSO be successful in their own domestic market Relaxed regulatory environment - Developing countries relax their market regulations to gain more FDI ● Profit repatriation ● Tax rules ● Property rights ● Health and safety regulations / pollution control Liberalized free market conditions - MNCs want developing countries to be relatively free in terms of trade ● Free trade ● Privatization ● Tradable foreign exchange 28.3 Evaluation of FDI TERMS: ❏ Transfer pricing: Firms show that they pay for resources from affiliates with prices higher than actually paid. Advantages of FDI ● Capital improvements - Capital injections = help break poverty cycle - Foreign purchase of domestic assets → money into capital account - Induces LDC governments to invest in infrastructure to support new firms Provides opportunities for enhanced research and development Stimulates the domestic industry when the MNC buys locally produced capital G/S Technology transfer improves the country’s capital stock - ● Income, employment, and training ➔ Employment is increased ◆ Foreign firms hire significantly from domestic workforce ◆ Firms improve the skills of workers ➔ Increased income is subject to taxation → + tax revenue → better development ● Market efficiency and choice - MNCs may compete with domestic industries → added competition = lower prices and increase in market efficiency - Arrival of foreign firms → more choice for domestic consumers Disadvantages of FDI ● Muted effects on employment - Foreign firms bring large amounts of management personnel = employment growth only goes to the low-skilled and low-wage labour force - Some FDI companies that earn large revenues → have few domestic workers ● Limited income benefits - Repatriation of a foreign firm’s profits = limits growth benefits of FDI - Foreign firms use accounting methods → to avoid taxes ● Limited capital injections - No guarantee the investment spending from FDI companies comes from outside the domestic economy - Many firms borrow from local financial markets ● MNC power - MNCs generally earn more in revenue than the GDP of many small LDCs - MNCs → highly skilled lawyers, accountants, political lobbyists ➔ Influence over regulatory environment ◆ ‘Race to the bottom’ process → companies seeking lowest possible costs → pressure governments of LDCs to relax their regulatory policies over taxes and other ➔ Taxes ◆ For investors → companies compete to reduce tax burdens for foreign firms ➔ Environment ◆ Countries allowing for more pollution and environmental liberties → more attractive to foreign investors ➔ Worker rights ◆ MNCs move production to low-wage countries where: ● Organizing unions is difficult ● Worker’s rights are not valued ➔ Overwhelming competition with local industry ◆ MNC firms have a great competitive advantage over domestic firms = kill local industry and eliminate the possibility of domestically owned firms 28.4 Foreign aid TERMS: ❏ Development aid: Name for long- or short-term loans, grants, and technical assistance for the purpose of increasing the living standard of another country. ❏ Bilateral aid: Occurs when one government directly transfers money or other assets to a recipient country. ❏ Tied aid: Money that a rich country lends to a poor country, on condition that the poor country spends the money on goods from the rich country Official aid ● Foreign aid: Financial, technical, and in kind assistance to other countries ○ Can be given by foreign governments when called official development assistance (ODA) ● ○ Can be given by non-governmental organizations (NGOs) ○ Aid flows tracked by OECD Development aid: ○ Long term focus ○ Consists of outright grants or concessional long term loans ○ Provides support for schools and hospitals Government aid ● Donor country governments can give directly to another country → bilateral aid ● Alternative: Donors can contribute to multilateral organizations (UN, IMF, World Bank…) Types of aid Foreign aid takes many forms but can be classified this way: - Debt relief grants to heavily indebted LDCs - Technical assistance to LDCs such as engineers, doctors… - Development assistance → sectors of education, health… - Humanitarian aid → emergency relief in disaster areas - Commodity assistance → purchase of seeds, fertilizer, equipment, building materials… Aid from NGOs ● ● Dedicated to poverty relief and advocacy of fair trade NGOs focus on areas that official aid may not reach Donor motivation for giving aid Political and strategic ● Sometimes previous colonial powers might provide aid to their former colonies ○ Due to political relationships Economic ● Countries may provide aid → to conduct good business in countries where business relationships are valued and natural resources are desired by the donor country Humanitarian ● Emergency assistance to disaster-stricken areas → short term humanitarian aid ● Growth policies towards development goals → long term humanitarian aid Trends in foreign aid Is giving going up or down? ● Rich-country giving to poor countries has grown ● Aid totals have increased steadily → not at rate that keeps pace with income growth Who gives foreign aid? ● OECD keeps track of countries donating foreign aid 28.5 Evaluation of foreign aid TERMS: ❏ Commitment to Development Index (CDI): Index that ranks the world's richest countries on their dedication to policies that benefit the five billion people living in poorer nations. Is foreign aid effective? Criticisms of aid ● ● Aid is inefficient - Aid money is set aside for large-scale showcase projects that embellish reputations of the project administrators and donors - Extravagant use of the money and not allocated efficiently Corruption misuses aid - ● Enormous amounts of money and resources → diverted by corrupt leaders - Stolen money, rerouted elsewhere Aid rarely gets to those who need it - Most aid money goes to relatively well-off countries - To more affluent urban areas rather than rural ones ● ● Aid displaces local investment and markets Foreign aid discourages governments to enforce the tax code and generate revenue for itself Some kinds of commodity aid may depress local markets and reduce incentives for domestic production Aid fosters dependency - For some of the poorest countries → aid accounts for majority of government revenue → chronic situation that fails to become temporary - Countries expect aid to fill the gap in government budgets Arguments for foreign aid ● Delivery of aid is the problem - Aid programmes are relatively new areas of social policy → attempt to solve very complex problems ● - Most believe aid provision will improve and become more productive in the future Aid addresses areas where growth alone will not - Many pro-growth policies can create significant negative externalities - Income inequality → area where aid can redress and support vulnerable populations ● Successes not celebrated because the need is still great - By advertising success in helping through aid → agencies risk reducing the sense of urgency that might motivate countries to give more Trade vs aid ● Rich world countries have agricultural commodities → just like LDCs which are their only comparative advantage goods to trade = World commodity prices decrease = Reduces income of LDCs that are dependent on these goods The case for trade ● Reducing or eliminating rich country subsidies and trade barriers = Expand market for poor-country agricultural goods Larger export markets → farming industry could grow and build up capital = agricultural sectors would earn more foreign exchange for the country = reduce dependency on staple goods Increased income = reverse the trend in poverty cycle = more savings and investment = REDUCE DEPENDENCE ON FOREIGN AID Limitations of trade ● Poor countries produce food → many import it ● If rich-country agricultural subsidies are eliminated = net food-importing LDCs could be hurt Major cut in subsidies: - Rise in food prices = instability Concern that rich countries would demand that LDCs further reduce the exceptions to free trade rules allowed by the WTO = swamping of LDC infant industries Most economists argue trade and aid are NOT mutually exclusive Some argue aid will go where trade does not reach Beyond aid? ● Commitment to Development Index (CDI) → Based on the premise that: ○ ○ Aid itself is insufficient Policies of rich countries in many different areas will influence development as well Ranking adds: - Trade policy - Immigration - Investment - Technology - Security - Environment - Technology contributions