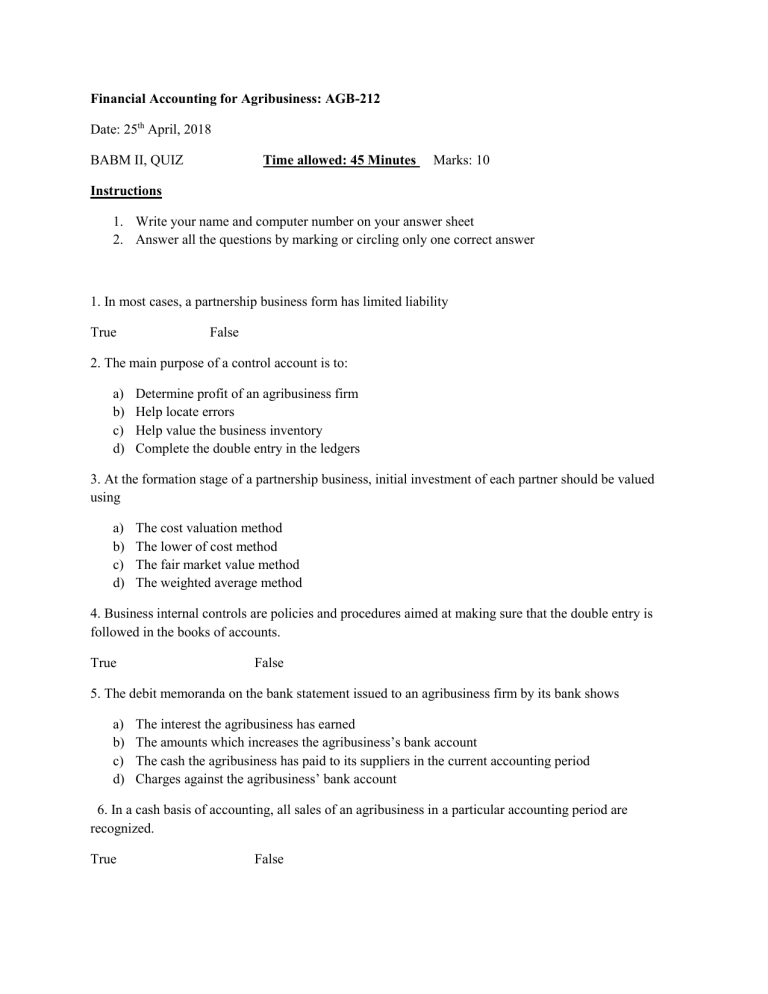

Financial Accounting for Agribusiness: AGB-212 Date: 25th April, 2018 BABM II, QUIZ Time allowed: 45 Minutes Marks: 10 Instructions 1. Write your name and computer number on your answer sheet 2. Answer all the questions by marking or circling only one correct answer 1. In most cases, a partnership business form has limited liability True False 2. The main purpose of a control account is to: a) b) c) d) Determine profit of an agribusiness firm Help locate errors Help value the business inventory Complete the double entry in the ledgers 3. At the formation stage of a partnership business, initial investment of each partner should be valued using a) b) c) d) The cost valuation method The lower of cost method The fair market value method The weighted average method 4. Business internal controls are policies and procedures aimed at making sure that the double entry is followed in the books of accounts. True False 5. The debit memoranda on the bank statement issued to an agribusiness firm by its bank shows a) b) c) d) The interest the agribusiness has earned The amounts which increases the agribusiness’s bank account The cash the agribusiness has paid to its suppliers in the current accounting period Charges against the agribusiness’ bank account 6. In a cash basis of accounting, all sales of an agribusiness in a particular accounting period are recognized. True False 7. To account for depreciation of a fixed asset (e.g. a tractor) of an agribusiness firm, the double entry required is to a) b) c) d) Credit profit and loss account and debit tractor account Debit trading account and credit profit and loss account Debit provision for depreciation account and credit profit and loss account Debit profit and loss account and credit provision for depreciation 8. At liquidation of a partnership business any losses on realization are allocated to the partners based on their income sharing ratios and then the remaining cash is distributed to partners based on their capital balances. True False 9. Adjustments to final accounts of an agribusiness firm are necessary before preparing financial statements at the end of the accounting period in order to a) b) c) d) Maintain the double entry system Meet the requirement of the accrual basis of accounting Reflect the correct profit made by the business in for that accounting period Reflect the correct balance sheet at the balance sheet date 10. When a business receives a prepayment from its customers for products to be supplied later, what sort of account relationship is created? a) b) c) d) Asset – capital account relationship Liability – expense relationship Liability – revenue relationship Asset – expense relationship 11. When a business receives a prepayment from its customers for products to be supplied later, the necessary double entry is to debit the cash account and credit the sales account. True False 12. Using the market basis of the tables provided in the quiz, the Debt – Equity Ratio, Working Capital and the Current Ratio are a) b) c) d) Debt – Equity Ratio Working Capital 3.27 1.90 0.99 0.12 $ 35,200 $ 26,700 $ 23,640 $ 23,450 13. If the Debt – Equity Ratio increases, the Debt – Asset Ratio will also increase True False Current Ratio 1.38:1 2.34:1 1.27:1 3.14:1