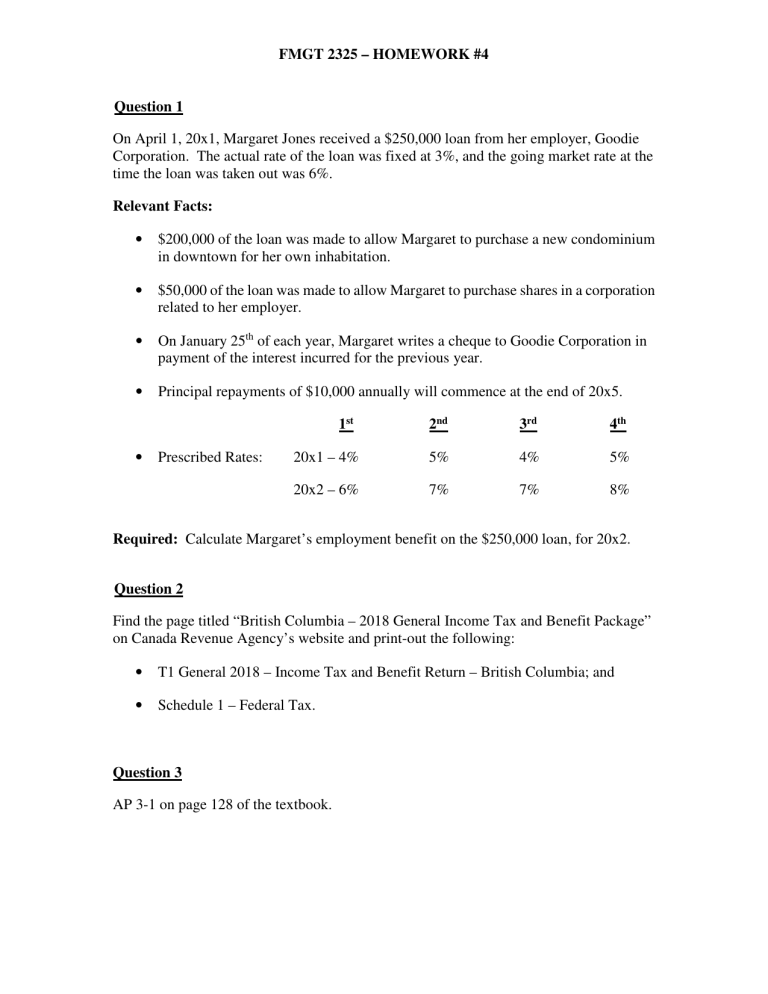

FMGT 2325 – HOMEWORK #4 Question 1 On April 1, 20x1, Margaret Jones received a $250,000 loan from her employer, Goodie Corporation. The actual rate of the loan was fixed at 3%, and the going market rate at the time the loan was taken out was 6%. Relevant Facts: • $200,000 of the loan was made to allow Margaret to purchase a new condominium in downtown for her own inhabitation. • $50,000 of the loan was made to allow Margaret to purchase shares in a corporation related to her employer. • On January 25th of each year, Margaret writes a cheque to Goodie Corporation in payment of the interest incurred for the previous year. • Principal repayments of $10,000 annually will commence at the end of 20x5. 1st • Prescribed Rates: 2nd 3rd 4th 20x1 – 4% 5% 4% 5% 20x2 – 6% 7% 7% 8% Required: Calculate Margaret’s employment benefit on the $250,000 loan, for 20x2. Question 2 Find the page titled “British Columbia – 2018 General Income Tax and Benefit Package” on Canada Revenue Agency’s website and print-out the following: • T1 General 2018 – Income Tax and Benefit Return – British Columbia; and • Schedule 1 – Federal Tax. Question 3 AP 3-1 on page 128 of the textbook.