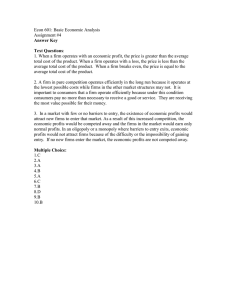

ECON 211 ELEMENTS OF ECONOMICS I Session 5– Profit Maximization (Part 1) Lecturer: Dr. (Mrs.) Nkechi S. Owoo, Department of Economics Contact Information: nowoo@ug.edu.gh College of Education School of Continuing and Distance Education 2014/2015 – 2016/2017 Session Overview • Session 5 explains how a firm sets its price and output level in the short run under the assumption that the firm’s goal is to maximize its economic profit. • There are two approaches to finding a firm’s short-run profitmaximizing level of output. – In the total revenue and total cost approach, the firm calculates profit as the difference between total revenue and total cost, and produces the quantity of output where profit is greatest. – In the marginal revenue and marginal cost approach, the firm maximizes profit when it sets marginal revenue equal to marginal cost. These two approaches are demonstrated with tables and graphs. • The first session deals with the introduction to a number of concepts while the second session deals with the TR/TC and MR/MC approach. Slide 2 Session Outline The key topics to be covered in the session are as follows: • The Goal of Profit Maximization • Understanding Profit • The Firm’s Constraint – Demand Constraint – Cost Constraint Slide 3 Reading List • Hall and Lieberman – Chapter 7, pp:196-202 Slide 4 Topic One THE GOAL OF PROFIT MAXIMIZATION Slide 5 The Goal Of Profit Maximization • In order to analyze firms’ decision-making process, we need to know what the firm is trying to maximize • In this analysis, we assume that firms are single economic decision-makers whose main goal is to maximize profits. • This assumption helps us to understand how firms decide – – – – What prices to charge How much to produce Whether to temporarily shut down the firm or keep operating Whether to enter a new market or exit an existing one 6 Understanding Profit • Profit is defined as the difference between a firms sales revenue and its costs of production • There are two ways of expressing profits: – Accounting profit • Total revenue minus accounting costs • This is mostly used by accountants and takes into account only explicit costs – Economic profit • Total revenue minus all costs of production • Recognizes all the opportunity costs of production - both explicit costs and implicit costs 7 Understanding Profits • Which of the two types of profits is the correct one? • It depends – For tax purposes, the government is interested in profits as measured by accountants • The government is only interested in money earned, and not money that could have been earned had a firm done something else with its time or resources – For the purposes of understanding the behaviour of firms, economic profits is better Slide 8 Why are there Profits? • When we observe households income, we note that there are a variety of payments that accrue – Those who provide firms with land receive rent; the payment for land – Those who provide labour receive a wage or a salary – Those who lend firms money so they can purchase capital equipment receive interest – A firms profits go to its owners • But what do the owners of these firms provide that earns them this payment? Slide 9 Why Are there Profits? • Economists view profits as payment for two contributions of entrepreneurs – Risk-taking – Innovation • Risk-taking – Sometimes, in taking the risk of starting a business, the consequences of failure are so severe that the reward for success must be large enough to induce an entrepreneur to establish a business • Innovation – Profits are also a reward for innovation – Innovation makes a substantial contribution to production and therefore, profit is a reward for those who innovate Slide 10 Topic One THE FIRMS CONSTRAINTS Slide 11 The Firm’s Constraint • If firms were free to earn whatever level of profit they wanted, they would earn virtually infinite profit – This would make owners very happy • However, firms are not free to earn unlimited profits • Firms face constraints on both: – Revenue – Cost Slide 12 The Demand Constraint • The constraint on firms revenue arises from the demand curve • This curve tells us the different quantities that consumers are willing and able to buy at different prices • We are, for the purposes of this session, more interested in the demand curve facing the firm • The demand curve facing the firm refers to the quantity of output that customers will choose to purchase from that firm, at different prices – we are interested in one firm and all buyers who are potential customers of that firm Slide 13 The Demand Constraint • Let us consider a hypothetical firm- Ned’s Beds, a manufacturer of bed frames • The table on the next slide lists the different prices that Ned could charge for each bed frame and the number of these that he can sell at each price • Like other types of demand curves, the demand facing Neds Beds is downward sloping – This indicates that in order to sell more beds, Ned must lower his price • Therefore, once Neds Beds decides on an output level, it has also determined the maximum price it can charge Slide 14 Demand and Total Revenue The Demand Curve Facing the Firm 15 Demand and Total Revenue • Each time a firm chooses its level of output, it also determines its total revenue – Why? – Because once we know the level of output, we also know the highest price the firm can charge – Total Revenue= Price x Output • Because Ned’s demand curve slopes downwards, he must lower his price each time his output increases, or else he will not be able to sell all he produces • With more units of output but with each selling at a lower price, total revenue could increase or decrease Slide 16 Demand and Total Revenue Figure 1 The Demand Curve Facing the Firm Price Per Bed $600 450 Demand Curve Facing Ned’s Beds 2 5 Number of Bed 17 Frames per Day The Cost Constraint • Every firm struggles to reduce costs – But there is a limit on how low costs can go – These impose a second constraint on the firm • Where do these limits come from? – The Production function • This is determined by firms technology • In the long run, the firm can use any method in its production function • In the short run however, some inputs are fixed – The firm must pay the prices of each of the inputs that it uses • Greater output implies greater costs, and greater costs imply lower profits, all else remaining constant Slide 18 The Profit-Maximizing Output Level • In the next session, using information on firms’ demand and cost constraints, we examine how firms arrive at their profit-maximizing level of production Slide 19 References • Economics: Principles and Applications: Hall R.E. and Lieberman M. (2008), Thomson/ South Western (4th Edition) Slide 20