Vietnamese Financial System: Markets, Securities, Intermediaries

advertisement

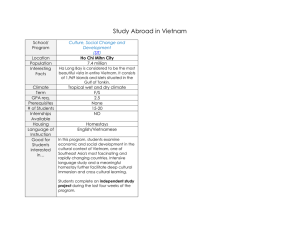

Course: Finance & Money Course code: TCHE301.1 Teacher: Ph.D. Tran Thi Minh Tram Group: 1 Group members: Vuong Nguyen Anh; Bui Thi Thanh Tam; Pham Huong Giang; Tran Tuyet Trang; Cu Thi Hong Nhung; Nguyen Thi Que Anh. GROUP ASSIGNMENT: VIETNAMESE FINANCIAL SYSTEM INTRODUCTION Over the past 30 years, Vietnam has had a remarkable development record. Economic and political reforms under Doi Moi, launched in 1986, have spurred rapid economic growth and development and transformed Vietnam from one of the world’s poorest nations to a lower middle-income country. This remarkable achievement was enabled by outward-oriented development strategies, dynamic human resources and, inevitably, a growing financial system. VIETNAMESE FINANCIAL MARKETS One of the central duties of a financial manager is to acquire capital—that is, to raise funds. Few companies are able to fund all their activities solely with funds from internal sources. Most find it necessary at times to seek funding from outside sources. For this reason, all business people need to know about financial markets. Financial market and its functions?1 A financial market is a market is a market in which financial assets (securities) such as stocks and bonds can be purchased or sold. The basic function of financial market is to transfer funds within the different units of the economy—from surplus units to deficit units for productive purposes. Financial markets facilitate the flow of funds: funds transferred when one party purchases financial assets which are previously held by another party, Financial markets in Vietnam Financial market plays a key role in economic growth and macroeconomic stabilization. The fact that capital circulates smoothly from financial sector to the real economy and capital is effectively allocated to preferential fields and industries is significant for the process of restructuring the economy and supporting private sector – the main growth motivation. Frederic S. Mishkin, The Economics of Money, Banking and Financial Markets (10th Edition), published by Pearson, 2013 1 Vietnam's financial system includes the following markets: (a) the bank credit market; (b) interbank money market and foreign exchange market (c) the equity market; and (d) the bond market.2 The bank credit market: The banking system is the most important, and also the most long-standing on in the national economy. Mobilization of funds for the economy has been mainly dependent on the banking system. The total outstanding loans in the banking system is around VND7,500 trillion (US$323.2 billion), equivalent to 130 percent of GDP, while the stock market capitalization is just VND3,000 trillion, as of December 2018. At the microstructure level, state-owned commercial banks (SOCBs) outweigh all other non-state banks, including both joint-stock commercial banks (JSCBs) and those with foreign capital, in terms of assets portfolio. The interbank market: The interbank market is the mechanics with which legallyregistered full-fledged commercial banks, both domestic and international banks can lend, onlend and do other types of commercial banking transaction. This market has been closely monitored by the State Bank of Vietnam (SBV). The equity market3. The bond market Quan Hoang Vuong, Financial Markets in Vietnam's Transition Economy—Facts, Insights, Implication, published by VDM Verlag Dr. Müller, 4 February 2010 3 Military Bank Securities, Vietnam Capital Market Report, published on March 2019 2 Note: HNX—Hanoi Stock Exchange; HSX—Ho Chi Minh City Stock Exchange; SBV—State Bank of Vietnam; SSC—State Securities Commission; VSD—Vietnam Securities Depository Vietnam bond market is still remarkably undeveloped, boosted mainly by the Government bond market which posted a 5.2% on-quarter and 14.7% yearly expansion to US$49 billion. Unlike other emerging East Asia bond markets, Vietnam’s debt market was not sensitive to the US monetary policy tightening as bonds were largely held by domestic investors, particularly commercial banks. However, it had been indirectly affected by the US dollar strengthening vis-à-vis most regional currencies. Short-term risks included general risk aversion toward emerging markets, faster-than-expected hikes in US interest rates, and escalating global trade tensions. Depreciation of regional currencies and capital outflows posed further risks to the region’s financial stability, according to the report. VIETNAMESE FINANCIAL SECURITIES Financial securities are documents that represent the right to receive funds in the future. For the holder, a security represents an investment as an owner, creditor or rights to ownership on which the person hopes to gain profit. Examples are stocks, bonds and options. There are many ways to categorize different types of securities, but one of the most common method is dividing them into long-term and short-term securities. Long-term securities A long-term investment is an account on the asset side of a company's balance sheet that represents the company's investments, including stocks, bonds, real estate and cash. Longterm investments are assets that a company intends to hold for more than a year.4 Being a long-term investor equates accepting a certain amount of risk in pursuit of potentially higher rewards and being able to afford to be patient for a longer period of time. It also suggests enough capital available to afford to tie up a set amount for a long period of time. Long-term securities in Vietnamese financial market include: bonds, stocks, mortgages and consumer and bank commercial loans. Of all four, bond is the least developed security in Vietnam as mentioned above. Meanwhile, although it is a long-term security, investment in stock market is mainly short-term, of which the underlying reasons are small stock market sizes and weaknesses of Vietnamese enterprises. The consumer lending industry in Vietnam has seen remarkable growth. According to a report by the National Financial Supervision Commission, which advises the prime minister on matters related to the financial markets, consumer lending in Vietnam has been growing fast since 2015, with a growth rate at 65% in 2017 compared to 50.2% in 2016, and with the percentage of consumer lending in total credit rising to 18% in 2017 from 12.3% in 2016. Short-term securities Short-term securities are investments (usually in equity and debt securities) that are expected to be sold and converted to cash within one year or within the company's operating cycle. These funds are included in a company's current assets, usually right after the disclosure of the cash. Companies will decide to invest excess cash in short-term investments to generate some return while still maintaining flexibility. If need be, they can sell the shortterm investments, to deploy the cash into something else. The commonly available money market instruments apart from time deposits and Certificates of Deposit (CDs) are: 4 Treasury Bills: Treasury bills are issued by the State Treasury at tenors less than 1 year (normally 13 weeks, 26 weeks, and 52 weeks). These are discounted securities with a face value of VND100,000. This instrument is issued to temporarily finance the state’s budget deficit or help the SBV in controlling monetary policy. These bills are issued in the form of book entry, currently kept in custody with the SBV, and are openmarket instruments. Viet Nam will have T-bills traded exclusively on HNX’s electronic bond system by May 2012. This plan is envisaged to create a secondary market for Tbills. State Bank of Vietnam Bills: Up to now, there is only one issuance of SBV bills sold on 17 March 2008. Banks were required to buy VND20.3 trillion worth of bills, and were https://efinancemanagement.com/investment-decisions/financial-securities not allowed to trade them with the central bank, aiming to withdraw cash from the economy and actively control liquidity. Repos of Government Bonds: Repos were introduced in 2003. Government bonds (including T-Bills and government bonds with maturities of more than 1 year) are accepted as collateral for repos between commercial banks and SBV. Such repos are conducted on the open-monetary market. Government bonds with maturities of more than 1 year are commonly used as collateral for repos between securities firms, commercial banks, and financial firms. Trading of these repos are done on HNX’s bond system, mainly via the put-through method. Municipal bonds are legally acceptable as collaterals for repos; but in reality, they are rarely used. FINANCIAL INTERMEDIARIES Financial intermediary is an organization or individual that stands between two or more parties involved in a transaction or financial context. Usually, one party is a supplier of a product/service and another is a customer or consumer. In Vietnam, as is common in many countries around the world, financial intermediaries are often an intermediary organization for the capital transfer channel between lenders and borrowers, between deficit and surplus sides, typically. And the most common is banks. Types of financial intermediaries in Vietnam In Vietnam, there are a full range of intermediary financial institutions including: Commercial Banks: Those who trade currency and provide the widest range of banking services, such as: take deposits, loan, and investments. Their operating goal is to optimize the profits. Top largest commercial banks in Vietnam includes Vietcombank, Techcombank, Vietinbank, etc. Financial companies: Those who raise capital by issuing bonds, stocks, short-term valuable papers and lending. Insurance companies: Those as financial intermediaries with regular activities and mainly premium income to form insurance funds, using fund to compensate it for the loss insured the risk and insured. Mutual Funds: They help pool savings of individual investors into financial markets. A fund manager oversees a mutual fund and allocates the funds to different investment products. Credit Union: It is also a type of bank, but works to serve its members and not public. They may or may not operate for profit purposes. Other financial intermediaries are pension funds, investment banks and more. Among all, the most important financial intermediaries in Vietnam are state-owned commercial banks. The super-weights of SOCBs come from the fact that they own large equity funded by the state. The best-performing SOCB is Vietcombank, making a pre-tax profit of more than VNĐ11 trillion (US$482.5 million) in 2017.5 INTERNALIZATION OF FINANCIAL MARKETS "As far as the financial markets are concerned, August 9 2007 has all the resonance of August 4 1914. It marks the cut-off point between 'an Edwardian summer' of prosperity and tranquility and the trench warfare of the credit crunch – the failed banks, the petrified markets, the property markets blown to pieces by a shortage of credit." —Larry Elliot The Credit Crisis in U.S. 2007 The period known as the Great Moderation came to an end when the decade-long expansion in US housing market activity peaked in 2006 and residential construction began declining. In 2007, losses on mortgage-related financial assets began to cause strains in global financial markets, and in December 2007 the US economy entered a recession. That year several large financial firms experienced financial distress, and many financial markets experienced significant turbulence. In response, the Federal Reserve provided liquidity and support through a range of programs motivated by a desire to improve the functioning of financial markets and institutions, and thereby limit the harm to the US economy.1 Nonetheless, in the fall of 2008, the economic contraction worsened, ultimately becoming deep enough and protracted enough to acquire the label “the Great Recession." While the US economy bottomed out in the middle of 2009, the recovery in the years immediately following was by some measures unusually slow. It causes rise and fall of the housing market, effects on the financial sector, effects on the broader economy, and effects on financial regulation. Its internalization effects on Vietnamese financial market Economic Growth Rate: The negative influence of the Global Financial Crisis has resulted in a slowdown in the Vietnamese economic growth rate. According to the plan of early 2008, GDP growth rate was expected to be from 8.5% to 9%. Although the National Assembly had adjusted the GDP growth rate to 7% in May 2008, the actual GDP growth was 6.52 % in October and 2008’s GDP growth was only 6.23%. Financial and Banking System: The connection between the Vietnamese financial and banking system and the international financial market met some difficulties; The ability of international banking and financial transaction has decreased which has affected the Viet Nam’s short term loans at banks and enterprises; many banks’ https://vietnamnews.vn/economy/421066/vietcombank-reports-record-pre-taxprofit.html#e5LXgAxf7j8eevqR.97 5 profits have decreased, even some small-sized banks may have loss; NPLs may increase; thus the impact on Vietnamese financial and banking system can remain in several years. Import – Export Operation: In the context of crisis situation, capital cost has become higher and export market can be narrowed down, so capital flow to Viet Nam may decrease. Moreover, most of investment projects in general and FDI in particular have utilized a great proportion of borrowed fund out of the total capital. Therefore, the difficulties of the credit institutions and banks will result in the failure for signing or disbursement of loan contracts. Stock Markets face difficulties, the investors meet disadvantages: Due to the influence of the global financial crisis, listed enterprises could not avoid the bad effects, especially the export enterprises, thus the stock price decreased. The influence of Global Financial Crisis has created a so-called psychological effect to Vietnamese stock investors, immediately affecting negatively the domestic stock market. Real estate market: At the end of 2007, real estate speculation had pushed the price of Vietnamese real estate to a too high level compared with the real value. Market became a virtual fever; virtual demand increased. Real estate enterprises fell into the difficulty and could not sell the products, incurring a high interest rate because of the tightening monetary policies Goods and services market: It can be said that the global financial crisis has impacted many fields of Vietnamese economy. The economic growth rate has been slowed down; consumer price index has increased many times compared with the previous years and it is still at a rather high level; the macroeconomic stability has not been solid and hidden many threats; people’s living standard is still low especially the people with low-income and people in remote areas. The general effect that international market has on Vietnam market The international market has close relationship with Vietnam market. Every change in international market has wide influence on all aspects of Vietnam market. The globalization process has increased the internalization effects on a multi-national scope, especially on a country with a globalization growth rate of more than 200% as Vietnam. CONCLUSION Frankly speaking, Vietnam’s financial system, though has been developing significantly since Doi Moi, is still weak compared to neighboring countries, especially on the funding aspect. The structure of the bond market is imbalanced and need further improvement to attract domestic and foreign investors. The availability of short-term funds is high, while that of longterm funds is low, resulting in a shortage of capital for sustainable long-term growth. The capital market is mainly dependent on the banking system. However, the growth of the credit market is not stable, capital flows are ineffective and the resource allocation to various sectors is imbalanced. The dearth of domestic funding also creates a dependence on foreign investment activities as shown by the Vinamilk and Sabeco deals. It is still a long way for Vietnam to come on develop a sustainably growing financial system. It is a goal of utmost importance in the upcoming future for the whole nation, for that is the underlying foundation of a dynamic and sustainable economy. Challenging as it might be, with the magical economic growth that we have managed to perform, we can believe in such promising future to come.

![vietnam[1].](http://s2.studylib.net/store/data/005329784_1-42b2e9fc4f7c73463c31fd4de82c4fa3-300x300.png)