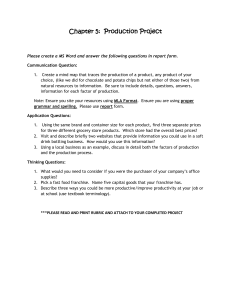

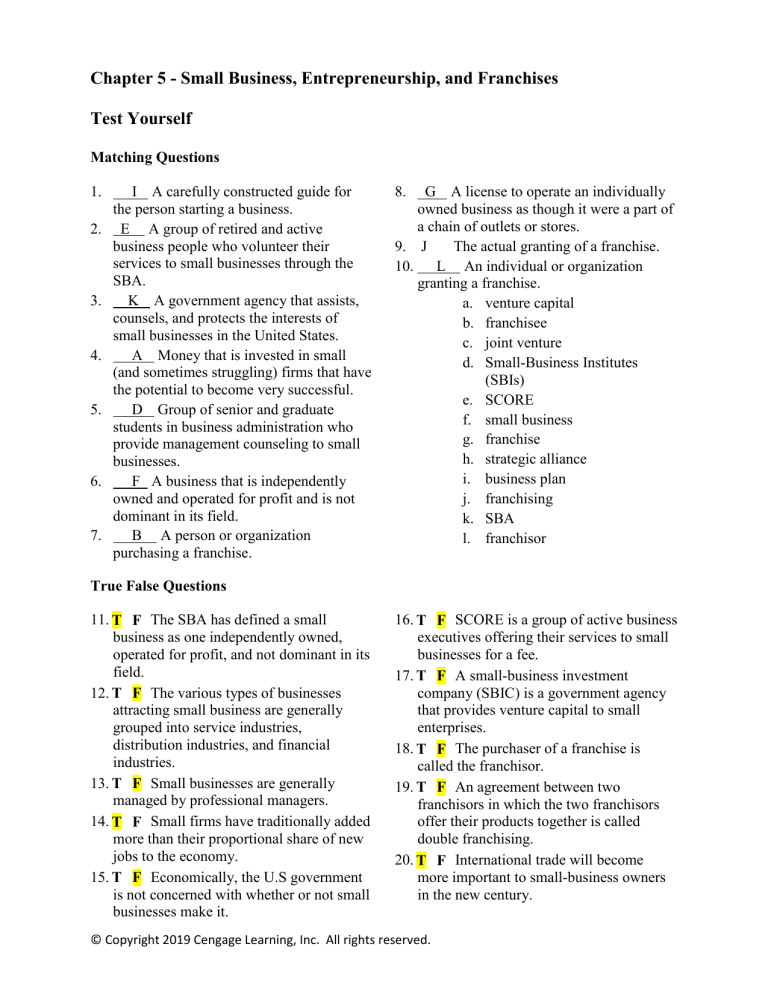

Chapter 5 - Small Business, Entrepreneurship, and Franchises Test Yourself Matching Questions 1. 2. 3. 4. 5. 6. 7. I A carefully constructed guide for the person starting a business. E A group of retired and active business people who volunteer their services to small businesses through the SBA. K A government agency that assists, counsels, and protects the interests of small businesses in the United States. A Money that is invested in small (and sometimes struggling) firms that have the potential to become very successful. D Group of senior and graduate students in business administration who provide management counseling to small businesses. F A business that is independently owned and operated for profit and is not dominant in its field. B A person or organization purchasing a franchise. 8. G A license to operate an individually owned business as though it were a part of a chain of outlets or stores. 9. J The actual granting of a franchise. 10. L An individual or organization granting a franchise. a. venture capital b. franchisee c. joint venture d. Small-Business Institutes (SBIs) e. SCORE f. small business g. franchise h. strategic alliance i. business plan j. franchising k. SBA l. franchisor True False Questions 11. T F The SBA has defined a small business as one independently owned, operated for profit, and not dominant in its field. 12. T F The various types of businesses attracting small business are generally grouped into service industries, distribution industries, and financial industries. 13. T F Small businesses are generally managed by professional managers. 14. T F Small firms have traditionally added more than their proportional share of new jobs to the economy. 15. T F Economically, the U.S government is not concerned with whether or not small businesses make it. 16. T F SCORE is a group of active business executives offering their services to small businesses for a fee. 17. T F A small-business investment company (SBIC) is a government agency that provides venture capital to small enterprises. 18. T F The purchaser of a franchise is called the franchisor. 19. T F An agreement between two franchisors in which the two franchisors offer their products together is called double franchising. 20. T F International trade will become more important to small-business owners in the new century. © Copyright 2019 Cengage Learning, Inc. All rights reserved. Multiple-Choice Questions 21. What is the primary reason that so many new businesses fail? a. Owner does not work hard enough b. Mismanagement resulting from lack of business know-how c. Low employee quality for new businesses d. Lack of brand-name recognition e. Inability to compete with wellestablished brand names 22. Businesses such as flower shops, restaurants, bed and breakfasts, and automobile repair are good candidates for entrepreneurs because they a. do not require any skills. b. are the most likely to succeed. c. can obtain financing easily. d. require no special equipment. e. have a relatively low initial investment. 23. An individual’s desire to create a new business is referred to as a. the entrepreneurial spirit. b. the desire for ownership. c. self-determination. d. self-evaluation. e. the laissez-faire spirit. 24. What is a common mistake that small-business owners make when their businesses begin growing? a. They sell more goods and services. b. They put too much money in advertising. c. They move beyond their local area. d. They over-expand without proper planning. e. They invest too much of their own money. 25. The fact that insulin and power steering both originated with individual inventors and small companies is testimony to the power of small businesses as providers of a. employment. b. competition. c. technical innovation. d. capital. e. quality products. 26. In her small retail shop, Jocelyn knows most of her best customers by name and knows their preferences in clothing and shoes. This demonstrates which advantage of a small business? a. Ability to adapt to change b. Independence from customer’s desires c. Simplified record keeping d. Personal relationships with customers e. Small customer base 27. Shonta started a graphic design firm a year ago. The business has done well, but it needs a lot more equipment, computers, and employees to continue expanding. Shonta thinks she can get all the money she will need from her bank. What advice might you give to her? a. She is right—the bank is likely to lend her as much as she needs because banks primarily focus on supporting small businesses. b. She is crazy—banks do not lend money to small businesses but only to well-known, wellestablished organizations. c. She should sell her business immediately before it fails because most small businesses fail during the first five years. © Copyright 2019 Cengage Learning, Inc. All rights reserved. d. She should not accept any new clients so that she can end the need to add additional equipment and employees. e. She should consider alternative sources of financing because banks provide only a portion of the total capital to small businesses. 28. Volunteers for SCORE are a. mostly university business professors. b. active executives from large corporations. c. generally either lawyers or accountants. d. graduate business students working on projects. e. retired and active businesspeople from different industries. 29. An individual or organization granting a license to operate an individually owned business as though it were part of a chain of outlets or stores is a(n) a. franchise. b. franchisor. c. franchisee. d. venture capitalist. e. entrepreneur. 30. Manju asks for your advice in opening a new business. She plans to provide tax-related services to individuals and small-business owners in her community. Of course, she wants an attractive means of starting and operating her business with a reasonable hope of succeeding in it. What will be your advice? a. Start your own independent business b. Form a partnership with a CPA c. Consider purchasing a franchise d. Forget about opening the business because it is too risky e. First secure a loan from the Small Business Administration © Copyright 2019 Cengage Learning, Inc. All rights reserved.