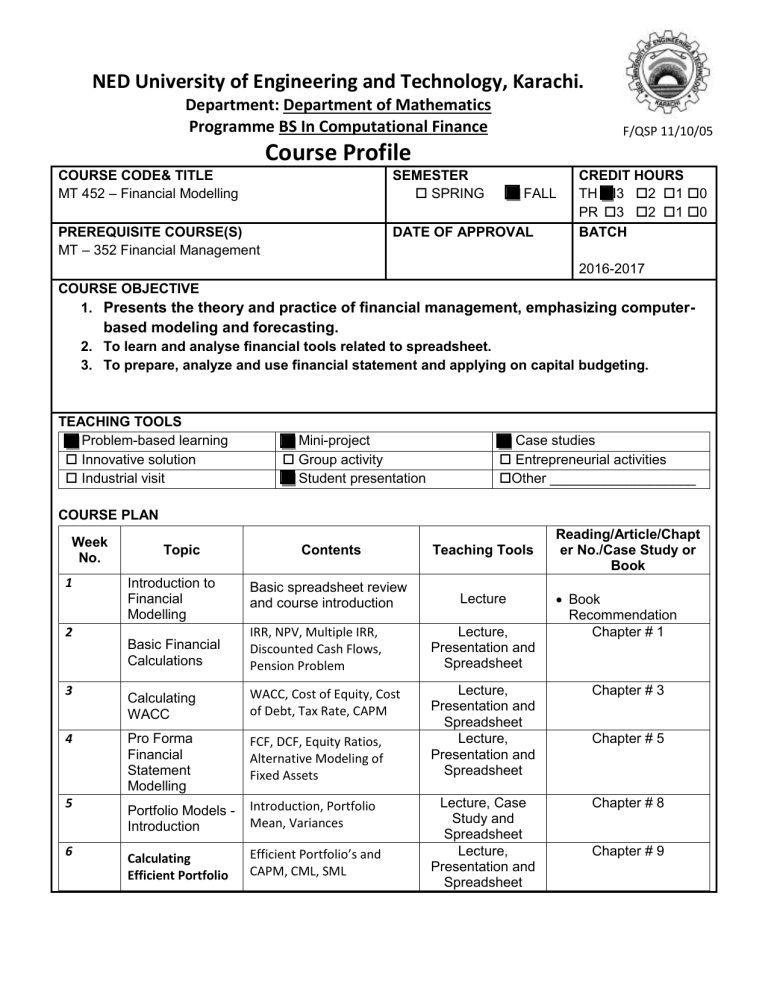

NED University of Engineering and Technology, Karachi. Department: Department of Mathematics Programme BS In Computational Finance F/QSP 11/10/05 Course Profile COURSE CODE& TITLE MT 452 – Financial Modelling SEMESTER SPRING PREREQUISITE COURSE(S) MT – 352 Financial Management DATE OF APPROVAL FALL CREDIT HOURS TH 3 2 1 0 PR 3 2 1 0 BATCH 2016-2017 COURSE OBJECTIVE 1. Presents the theory and practice of financial management, emphasizing computer- based modeling and forecasting. 2. To learn and analyse financial tools related to spreadsheet. 3. To prepare, analyze and use financial statement and applying on capital budgeting. TEACHING TOOLS Problem-based learning Innovative solution Industrial visit Mini-project Group activity Student presentation Case studies Entrepreneurial activities Other ___________________ COURSE PLAN Week No. 1 2 3 4 5 6 Topic Reading/Article/Chapt er No./Case Study or Book Contents Teaching Tools Introduction to Financial Modelling Basic spreadsheet review and course introduction Lecture Basic Financial Calculations IRR, NPV, Multiple IRR, Discounted Cash Flows, Pension Problem Lecture, Presentation and Spreadsheet Calculating WACC WACC, Cost of Equity, Cost of Debt, Tax Rate, CAPM Chapter # 3 Pro Forma Financial Statement Modelling FCF, DCF, Equity Ratios, Alternative Modeling of Fixed Assets Lecture, Presentation and Spreadsheet Lecture, Presentation and Spreadsheet Portfolio Models Introduction Introduction, Portfolio Mean, Variances Chapter # 8 Calculating Efficient Portfolio Efficient Portfolio’s and CAPM, CML, SML Lecture, Case Study and Spreadsheet Lecture, Presentation and Spreadsheet Book Recommendation Chapter # 1 Chapter # 5 Chapter # 9 NED University of Engineering and Technology, Karachi. Department: Department of Mathematics Programme BS In Computational Finance F/QSP 11/10/05 Course Profile 7 Calculating the VarianceCovariance Methods Sample covariance matrix, correlation matrix, Alternative of sample covariance Lecture, Presentation and Spreadsheet Chapter # 10 Lecture, Presentation and Spreadsheet Chapter # 28 Value at Risk ( VaR) Three Assets Problem, Quantiles in Excel, Bootstrapping 8 9 10 Introduction to Options 11 Midterm Examination Lecture, Basic Options, Presentation and Terminologies, Option Spreadsheet payout and Patterns Strategies Chapter # 15 The Black Scholes Model The Black Scholes Model, Volatility, Dividends Adjustment portfolio Lecture, Presentation and Spreadsheet Chapter # 17 Lecture, Presentation and Spreadsheet Chapter # 19 Real Options The Abandonment Model, Valuating the Abandonment Option, Valuating the Biotechnology project Lecture, Presentation and Spreadsheet Chapter # 20 Durations Valuating Bonds, Duration Patterns and Duration of Bonds 14 Immunization Strategies Basic Simple Immunization, Convexity Chapter # 21 15 Project Presentation Based on Excel Spreadsheet Course Review All Topics Lecture, Presentation and Spreadsheet Presentation and Spreadsheet Lecture and Feedback 12 13 16 Total No. of sessions TEXTBOOKS (Book Name, Authors, edition, Publisher, Year) 1. Simon Benninga, Financial Modeling, Fourth Edition, 2014 All Chapters NED University of Engineering and Technology, Karachi. Department: Department of Mathematics Programme BS In Computational Finance F/QSP 11/10/05 Course Profile COURSE LEARNING OUTCOME AND ITS MAPPING WITH PROGRAMME LEARNING OUTCOME Sr. No. CLOs Programme learning outcome (PLO) Taxonomy level Assessment Tool At the end of the course, the student will be able to: Quiz Assignment Financial Model Project Taught by: Muhammad Amin, Mathematics Department. REMARKS (if any): Prepared by: Muhammad Amin Reviewed & Approved by: Course Instructor Date Chairperson Date