Marketing & Business Overview: Strategies, Research, E-commerce

advertisement

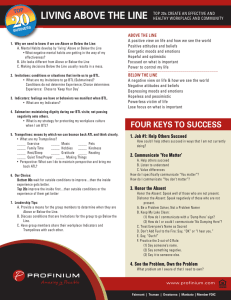

Guerilla Marketing: Guerrilla marketing is an advertisement strategy in which a company uses surprise and/or unconventional interactions in order to promote a product or service. Pricing Strategies: o Premium pricing: high price is used as a defining criterion. Such pricing strategies work in segments and industries where a strong competitive advantage exists for the company. Example: Porche in cars and Gillette in blades. o Penetration pricing: price is set artificially low to gain market share quickly. This is done when a new product is being launched. It is understood that prices will be raised once the promotion period is over and market share objectives are achieved. Example: Mobile phone rates in India; housing loans etc. o Economy pricing: no-frills price. Margins are wafer thin; overheads like marketing and advertising costs are very low. Targets the mass market and high market share. Example: Friendly wash detergents; Nirma; local tea producers. o Skimming strategy: high price is charged for a product till such time as competitors allow after which prices can be dropped. The idea is to recover maximum money before the product or segment attracts more competitors who will lower profits for all concerned. Example: the earliest prices for mobile phones, VCRs and other electronic items where a few players ruled attracted lower cost Asian players. Market Research: o Primary Market Research: Primary market research is a process, where organizations or businesses get in touch with the end consumers or employ a third party to carry out relevant studies to collect data. o Secondary Market Research: Secondary research uses information that is organized by outside source like government agencies, media, chambers of commerce etc. This information is published in newspaper, magazines, books, company website, free government and nongovernment agencies and so on. Secondary source makes use of the following: Public sources: Public sources like library are an awesome way of gathering free information. Government libraries usually offer services free of cost and a researcher can document available information. Commercial sources: Commercial source although reliable are expensive. Local newspapers, magazines, journal, television media are great commercial sources to collect information. Educational Institutions: Although not a very popular source of collecting information, most universities and educational institutions are a rich source of information as many research projects are carried out there than any business sector. Niche Market: Niche marketing is an advertising strategy that focuses on a unique target market. Instead of marketing to everyone who could benefit from a product or service, this strategy focuses exclusively on one group—a niche market—or demographic of potential customers who would most benefit from the offerings. Marketing Planning: Marketing Planning is what’s your strategies to be used to achieve your companies’ and your objectives. Factors of Production: Factors of production are the inputs available to supply goods and services in economy. Four factors which are capital, enterprise, land and labor. A company/organization needs to consider these factors in order to survive. Price Skimming: Price skimming is used for technology advanced and initiative products. For example, when company sell a new product, they set a price. Then, other companies products’ price decide to first companies’ price. Promotion: Promotion is the method of communication message to the market with the intension of selling firm’s product. The objectives of promotional strategies are; o Inform: Alert the market about the firm’s product. o Persuade: Encourage customers to make a persuasion. Above the Line (ATL): ATL Promotion is the form of paid for communication in the independent mass media. It’s a form of promotion to reach a mass market. o o TV, Internet, Newspaper, Radio. However, this form of promotion is for larger organization, because of the cost, as it very expensive. Below the Line (BTL): A form promotion that refers to use of non-mass media promotional activities, allowing to business to have direct control. o Telemarketing o E-Mail marketing Differences Between ATL and BTL: ATL marketing strategies uses traditional marketing mediums such as TV, Print Media, Radio BTL marketing strategies on the other hand uses off-beat mediums. Some of the branches of BTL marketing are telemarketing, internet marketing, visual merchandising, brand activation, exhibitions etc. ATL marketing strategies are targeted towards a large set of audience. It is an effective medium to reach out the masses. BTL advertising is the best option if you want to reach out to a specific set of audience. BTL marketing activities give you access to address and communicate to a specific target group. This ensures that your message is communicated to the right people at the right time. For example BTL activities for retail stores gives you direct access to your customers ATL marketing mediums are quite expensive. A slot at prime time will put a hole in your pockets. When compared to ATL marketing activities, BTL marketing is relatively budget-friendly. Explain the term intermediaries for Amazon in Turkey. o The channel of distribution refers to the means used to get a product to the consumer. Amazon is an online shopping company. And they don’t have any retailer store. They use distributors like shipping companies and then they reach their customers. Explain why culture is important for business looking to expand overseas? o Culture is an important factor for businesses that expands overseas because if you do not know the culture in that country you will probably fail because the people won’t get used to your product or treatment. Your product will be something unusual and no one will want it. Explain two benefits of aggregators (price comparison websites) to customers. o Customers can get information and save money. o Customers can catch some sale promotions and buy more product for same cost. Explain 2 features of E-Commerce. o It is accessible by everyone who has an access to internet. So its range is huge. o It has 3 types: B2B, B2C, and C2C. Explain one cost of E-Commerce. o Security problems o Site crash Explain the following: o B2B: B2B (Business-to-business) marketing is marketing of products from businesses to other organizations. It may be for use in production of goods or for selling to other consumers. For example Apple sells their products to MediaMarkt and then MediaMarkt sells their product to customers. o C2C: C2C (Customer-to-customer) marketing is marketing of products from customer to other customers. It can be second-hand products that someone doesn’t need it anymore and wants to sell it for less price than its first-hand price. For example a person sells her used iPhone to someone else. o B2C: B2C (Business-to-customer) marketing is marketing of products from business to customers. It can be directly selling from manufacturers to customers or may be from retail stores to customers. For example MediaMarkt sells a first-hand iPhone to a person. - CT= Course Theory CL= Case Link SW= So What 4.8.6 Online Banking Fraud a) One limitation of e-commerce is security problem, because there are so many fraudulent people who tries to steal customers’ personal banking details. And customers are not informed enough and they give their personal information to fraudulent people via e-mail but they do not know that if it is bank or not. And another limitation is that banks are cutting fees from e-commerce services. For example when you want to transfer your money, they are taking a part from it because you are using their servers and they want it as a cost of providing this service. But this is also effecting banks because they have to spend so much money to experts and all of the workers just for e-commerce. b) It saves so much time, it is free and 7/24 accessible. You do not have to go to a bank and spend money and also time there. 3.1 Sources of Finance Role of Finance: - Capital expenditure: Finance spent on fixed assets e.g land, machinery, equipment, buildings - Revenue expenditure: Payments for the daily running of the business e.g wages, raw materials, rent and electricity Internal Sources: - Owner’s capital (equity): Personal savings. Retained profit: Retained profit is the profit kept in the company rather than paid out to shareholders as a dividend. Sale of assets: Selling the assets that you own. Asset: Something that you own. For example; money in bank, school building, monetary physical. Internal finance: a) Personal savings would be an appropriate source of finance for a sole trader or partnership. The amount of finance that can be raised from this method is dependent on the personal savings of the owner. b) Retained profit would be available to all types of business so long as the business is profitable and has not recently started up. More often than not retained profit is insufficient on its own to allow a business to expand. c) Asset sales can be used by all businesses, so long as they are not a start-up business (since the business will have no assets). Students may question whether a business which is efficiently run will have any surplus assets to sell and whether asset sales will generate sufficient finance for the business to pursue its objectives. Why businesses need finance: - Startup capital - Working capital - Expansion - Emergency situations - Research and development Question 3.1.1 London Olympic Games a) Capital expenditure is finance spent on fixed assets. For example bullet trains is an example for capital expenditure. Revenue expenditure is payments for daily businesses. For example wages of the constructors of bullet train is an example for revenue expenditure. b) The employers of the UK Construction would benefit from being employed + earning an income. However, the construction company would have to source finance to pay all the workers. c) The customers would benefit from the new trains that will come to the stations. And also there will be more improvements of rail system. And an example for a disadvantage is that maybe price of transportation will increase because of these improvements. External Sources: - Short Term: o Overdraft o Trade credit o Bank loan o Factoring - Medium: o Leasing o Med term loan - Long Term: o Share issue o Long term loan o Venture cap o Business angel Question 3.1.3 Kellet School d) Examine two alternative sources of finance that Kellet School could have used to finance its capital expenditure. I will examine two alternative sources of finance that Kellet School could use to finance its capital expenditure. Retained profit is one way to finance their capital expenditures. This is an example of internal source. It means that the profit kept in the company rather than paid out to shareholders as a dividends. From this money, they can finance their capital expenditures. But it can cause some problems amongst the dividends because they can want their dividend payments fully. One other way is, selling assets. If they sell one of their assets, they can finance the other ones. For example if they sell their swimming pool to a swimming team, they will lose their monthly outgoings and also they will earn money when they sell there. With this money, they can finance other assets like auditorium or the library. But it can cause some problems amongst students which wants to use the swimming pool. Maybe they can rent the swimming pool after they sell it. Costs + Revenues Start-up Costs: - Marketing Purchase building Lease building Capital expenditure Running Costs: - - Fixed costs (Rent, wages) Variable costs (Raw materials, delivery, packaging) o Variable costs are costs of production that change in proportion to the level of output per unit. Semi-variable costs