DATE: TO: FROM: April 5, 2013

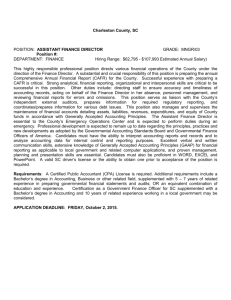

advertisement

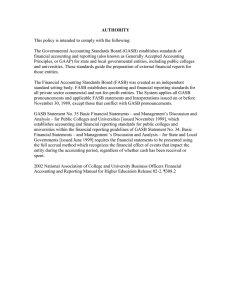

DATE: April 5, 2013 TO: Agency Addressed (No. 29, 2012-2013) FROM: Christina Smith, Director Division of Accounting and Auditing Department of Financial Services SUBJECT: GOVERNMENTAL ACCOUNTING STANDARDS BOARD STATEMENTS NUMBERS 60, 61, and 63 Section 216.102, Florida Statutes, requires the Chief Financial Officer to prepare the State’s Comprehensive Annual Financial Report (CAFR) using generally accepted accounting principles (GAAP). The Governmental Accounting Standards Board (GASB) issued statements of governmental accounting standards for Fiscal Year 2012-13. The following statements must be considered for implementation: Statement No. 60: Accounting and Financial Reporting for Service Concession Arrangements - This statement addresses accounting and reporting for Public-Private Partnership and Public-Public Partnership contracts. A questionnaire will be sent to each state agency to determine applicability of this statement. Statement No. 61: The Financial Reporting Entity - This statement changes the criteria for reporting component units as part of the State's reporting entity. Implementation of this statement may result in current component units no longer meeting the criteria for reporting or being classified differently. A questionnaire will be sent to affected agencies to review selected component units. Statement No. 63: Financial Reporting of Deferred Outflows of Resources, Deferred Inflows of Resources, and Net Position - This statement requires minimal formatting changes to the Statement of Net Assets. The impact to agencies depends on responses to the questionnaire for Statement No. 60 and will be communicated to those affected. Agency participation is imperative as the State implements these statements to ensure the CAFR is prepared in conformity with GAAP. Agency responses to the questionnaires will be reviewed for implementation and followed up as needed. Agency comments and questions related to GASB statements are welcomed and may be addressed to the Bureau of Financial Reporting at (850) 413-5511.