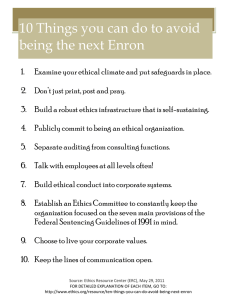

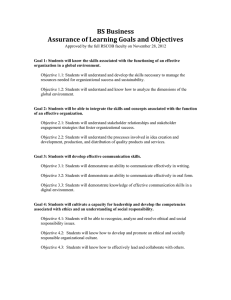

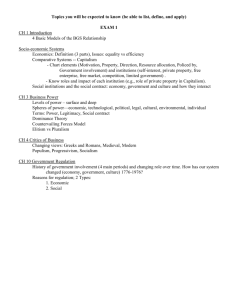

Corporate Performance, Governance, and Business Ethics SYNOPSIS OF CHAPTER Chapter 11 introduces concepts related to strategy implementation. The first section addresses the causes of poor performance, which occurs in some firms in every industry. Causes of poor performance include poor management, high costs, inadequate differentiation, overexpansion, shifts in demand, and organizational inertia. The chapter then suggests ways that firms can improve poor performance, such as changing leadership, changing strategy, or changing the organization. The chapter then describes the ways in which various stakeholder groups make contributions to, and receive benefits from, the organization, and how stakeholder support leads to high organizational performance. Managers and to suggest ways to overcome it. Next, corporate governance is presented, including boards of directors, compensation for principals, independently audited financial statements, the threat of corporate takeover, strategic control systems, and incentive systems. Each of these governance mechanisms is described in detail, and the costs and benefits of each are provided. The final topic of the chapter is ethics. Business ethics are defined and described. Then, suggestions are given to TEACHING OBJECTIVES 1. Introduce concepts about strategy implementation. 2. Describe reasons for poor performance and suggest ways to improve poor performance. 3. Identify important stakeholder groups, show how they contribute to and benefit from the firm, and describe how stakeholders affect corporate profitability. 4. Familiarize students with agency theory, and use it to explain why a misalignment of interests exists at every level of the organization. 5. Present information about various corporate governance mechanisms. 6. Define and describe business ethics, and show ho OPENING CASE: THE FALL OF ENRON because it held $27 billion in hidden debt, true financial position. The partnerships were set up in compliance with regulations, but they were a way of ecutives. These top managers reaped millions from the sale of their Enron stock, then abruptly left the firm. It seems clear that a few managers were suspicion for its role in the debacle and has also declared bankruptcy. More than one employee attempted to of lost jobs, billions of dollars in lost shareholder wealth.