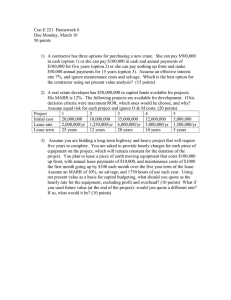

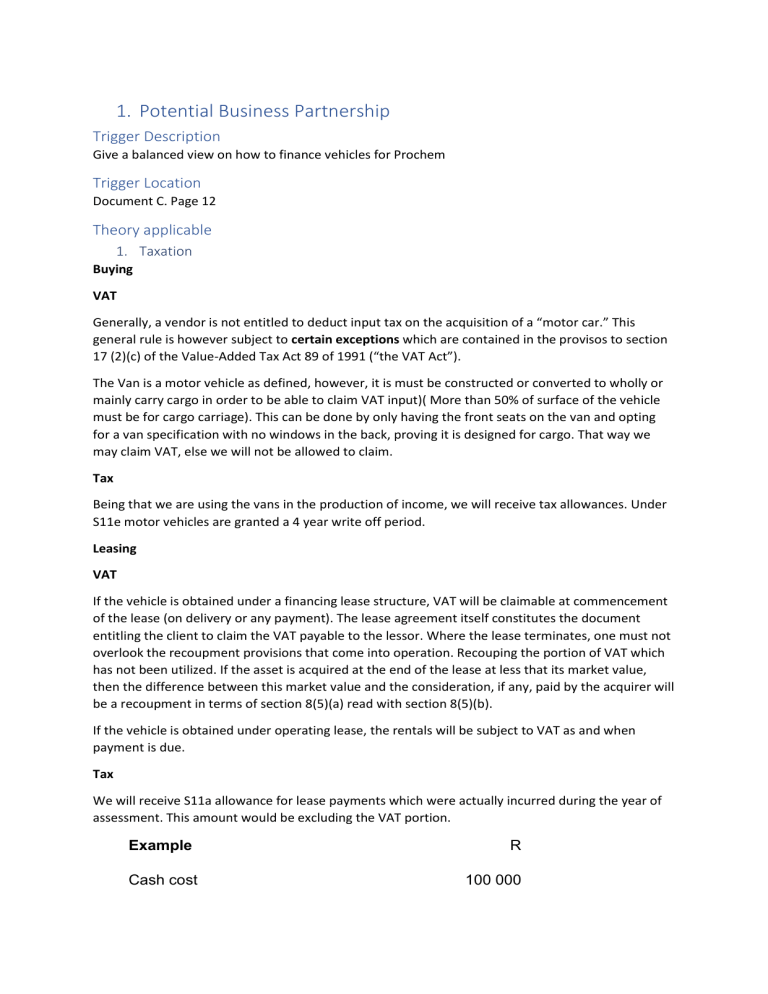

1. Potential Business Partnership Trigger Description Give a balanced view on how to finance vehicles for Prochem Trigger Location Document C. Page 12 Theory applicable 1. Taxation Buying VAT Generally, a vendor is not entitled to deduct input tax on the acquisition of a “motor car.” This general rule is however subject to certain exceptions which are contained in the provisos to section 17 (2)(c) of the Value-Added Tax Act 89 of 1991 (“the VAT Act”). The Van is a motor vehicle as defined, however, it is must be constructed or converted to wholly or mainly carry cargo in order to be able to claim VAT input)( More than 50% of surface of the vehicle must be for cargo carriage). This can be done by only having the front seats on the van and opting for a van specification with no windows in the back, proving it is designed for cargo. That way we may claim VAT, else we will not be allowed to claim. Tax Being that we are using the vans in the production of income, we will receive tax allowances. Under S11e motor vehicles are granted a 4 year write off period. Leasing VAT If the vehicle is obtained under a financing lease structure, VAT will be claimable at commencement of the lease (on delivery or any payment). The lease agreement itself constitutes the document entitling the client to claim the VAT payable to the lessor. Where the lease terminates, one must not overlook the recoupment provisions that come into operation. Recouping the portion of VAT which has not been utilized. If the asset is acquired at the end of the lease at less that its market value, then the difference between this market value and the consideration, if any, paid by the acquirer will be a recoupment in terms of section 8(5)(a) read with section 8(5)(b). If the vehicle is obtained under operating lease, the rentals will be subject to VAT as and when payment is due. Tax We will receive S11a allowance for lease payments which were actually incurred during the year of assessment. This amount would be excluding the VAT portion. Example Cash cost R 100 000 VAT 14000 Finance charges 92 340 Total lease liability 206 340 Term of lease 48 months Instalments (per month) 4 299 or (per annum) 51 588 Claim for tax purposes Lease payments made 51 588 Less: 12/48 x R14 000 - i.e. VAT adjustment 3 500 Lease payments claimable for tax 48 088 2. Cost and Financial Management An installment loan is a loan that is repaid over time with a set number of scheduled payments. normally at least two payments are made towards the loan. The term of loan may be as little as a few months and as long as 30 years. A mortgage, for example, is a type of installment loan. Generic comparison of a lease vs Buy decision: Ownership BUYING LEASING We own the vehicle and get to keep it as long as you want it. We don’t own the vehicle. We get to use it but must return it at the end of the lease unless we decide to buy it. Up-Front Costs They include the cash price or a down payment, taxes, registration, and other fees. They can include the first month’s payment, a refundable security deposit, an acquisition fee, a down payment, taxes, registration, and other fees. Monthly Payments Loan payments are usually higher than lease payments because you’re paying off the entire purchase price of the vehicle, plus interest and other finance charges, taxes, and fees. Lease payments are almost always lower than loan payments because you’re paying only for the vehicle’s depreciation during the lease term, plus interest charges (called rent charges), taxes, and fees. Early Termination We can sell or trade in the vehicle at any time. If necessary, money from the sale can be used to pay off any loan balance. If we end the lease early, charges can be as costly as sticking with the contract. On occasion a dealer may buy the van from the leasing company as a trade-in, letting you off the hook. Vehicle Return We will have to deal with selling or trading in the van when we decide to upgrade. We return the vehicle at leaseend, pay any end-of-lease costs, and walk away. Future Value The vehicle will depreciate, and the market will decide the residual value at the end of the useful life The future value doesn’t affect us financially. Mileage We are free to drive as many miles as you want. Which is critical, being in the logistics business. Considering though that higher mileage lowers the vehicle’s trade-in or resale value. Most leases limit the number of miles you may drive, often 12,000 to 15,000 per year. (You can negotiate a higher mileage limit.) You’ll have to pay charges for exceeding your limits. These costs may be significant. Excessive Wear and Tear Due to the nature of our business we expect to write down our vans in a short period. This will lower the vehicle’s tradein or resale value. Most leases hold you responsible. We will have to pay extra charges for exceeding what is considered normal wear and tear. End of Term At the end of the loan term, you have no further payments At the end of the lease (usually two to three years), you can finance the purchase of the car, or lease or buy another. Customizing The vehicle is yours to modify or customize as you like, although doing so may void your warranty. This is useful as we may want to brand our vans for marketing purposes. Because you must return the vehicle in saleable condition, any modifications or custom parts you add have to be removed. If there is any residual damage, we have to pay to have it fixed or we’ll need to file an insurance claim and pay a deductible. Accept or Reject Decision: Capital Budgeting Financial Consideration: In deciding whether the investment shall be accepted or rejected we shall consider the Net Present Value of all cashflows over the period. In making this assessment we require the following: 1. Initial cash flows Cost of acquiring the operating assets Staff employment costs/recruiting costs Proceeds from sale of existing assets Working Capital requirements (initial investment) Tax effects Excluding sunk costs Information in the scenario: Required initial investment: Vehicles (30 fleet) Staff recruitment costs Procurement Costs (R460k incl vat * 30)= R13 800m May be sunk if already incurred, howevr if incremental these would need to be included. These costs include market and interviewing cost. The month payroll costs will be included in the annual cashflows To obtain finance and corresponding assets Research costs 2. Annual operating cashflows After tax cashflows Incremental costs/ relevant costs Including opportunity costs Excluding allocated costs (fixed overhead costs) Excluding finance charges. This is due to the discount rate takes into account the financing element i.e. WACC = ke + kd Changes to working capital requirements 3. End of project cashflows Proceeds from resale of operating assets Recoupments, scrapping allowances Return of working capital (inflow)/ Disinvestment through the sale of remaining working capital Tax implications 4. Life of the project The project is over a 10 year period 5. Weighted Average cost of capital (Assumption being the project is internally funded) The discount rate used in determining the NPV is determined as the cost of capital. The formula applied is as follows: WACC = WeKe + WpKp + WdKd (1-t) In determining the cost of capital we shall adjusted the rates determined below for the corresponding weight of each source of finance. This can be based on the current capital structure or the targeted capital structure. Ke being the cost of equity. The cost of equity is determined using the following methods: Bond Yield: Bond yield + Risk premium Capital Asset Pricing Model: Rf + B (Rm-Rf) DDM: (D1/Po) + g Rf being the risk free rate. B being beta represent the spread/volatility of the companies share in a pool/bucket of shares Rm being the market premium Kp being cost of preference shares. This is determined using the DDM method Kd being the cost of debt. This is determined using the following method: Yield to maturity The interest on debt shall be adjusted for tax as it is deductible for tax purposes. Capital Structure As per the financial statement analysis the current D:E ratio is 0.75 thus meaning the Debt Ratio is 42% of debt and 58% equity. This represent the current capital structure in DS. See the financial statement analysis document (understanding DS) Qualitative Consideration: The decision of whether to accept or reject the project shall not be based solely on the financial impact but also qualitative factors and the entities overall strategy. It is therefore important to understanding Dynamic Supply’s overall strategy and see how the projects fits into the core business. The entity aims to be a leading logistics provider and be amongst the most profitable in the industry. They aim to achieve this through providing industry specific and innovative logistical supply chain solutions mainly to Pharma customers and E-Commerce businesses. The proposed contract is therefore in line with our overall strategy, and furthermore as we have been exposed to Pharma clients before we therefore have the knowledge and understanding of their logistical requirements. This will result in a lot of saving from our side as well as their client as we don’t have to spend much on research and designing these solutions as we can leverage off already existing products and tools. Furthermore given the current economic client more and more companies are looking to outsource their logistical function as to allow them to focus on their core business, however they are looking for business partners rather than mere service provider thus innovation and value add to the supply chain will further strength these relationships. It is noted that ProChem is considering an innovative 3PL service provider. We would be a perfect fit given the extensive investment in R&D and the already developed digital tools. These include warehouse management tools and inventory management solutions, including myDigital Supply , Predictive Analytics (possible used in inventory management), AI and the RPA tools being developed for warehousing facilities and the voice picking software of which will likely result in client saving on a lot of costs and improved efficiencies was the picking and warehousing processes will be significantly improved. The client will also benefit from project currently being developed of which will be deployed in the near future. Other qualitative factors to be considered include: Capability requirements: Knowledge, labour (additional employees to be employed) and warehousing facilities and transport network. We would have to train the new employees on our business and the partners business Understanding of clients requirements and staying to update on the for ever change needs. Financing Options Quantitative factors: Should the project yield a positive NPV and be considered to be in line with the entities overall strategy, they shall consider the most effective and efficient methods of finance. The entity may either buy the required operating assets or lease them. The decision of whether to buy or lease is evaluated through using two methods i.e. NPV or NPC NPV: The decision is incorporated in the overall DCF calculation for both the alternatives and which yields the highest NPV is the better decision. In relation to NPC, which ever yields the lowest NPC is the better alternative. It is important to note that these are solely based on the financial impact, the entity is still required to consider the qualitative impact such as the entities target capital structure, impact on financial statement and future growth opportunities. The discount rate and logic behind the cashflows is different from the normal DCF. The assumption is that the entity would have funded the assets through debt and thus the appropriate discount rate to be used is the after tax debt rate i.e. Kd (1-t). With regards to the cashflows we are focused on lease related cashflows as well as acquisition related cashflows. The assumption is that cost saving from any of the decisions are to be included in the other decision. See NPV illustration below: Lease option T0 Cost Savings Lease payments Tax on Cashflows After tax CF’s T1 Inflow (outflow) Net cashflow Net cashflow Buy Option: Machine Costs Machine residual value Cost Savings Tax on cashflows After tax CF T0 Outflow T1 Inflow Inflow Net cashflow Net cashflow The net cashflows from the above to be discounted using the debt rate, and which ever yield the highest NPV is the better decision. Note that the NPV method is only useful where there are cost savings. Where there are solely costs we consider using NPC method. With the net present cost we remove the cost saving and only use the cost incurred i.e. annual lease payment and acquisition costs to assess our decision. The decision that yield the lowest NPC is the better alternative. Qualitative Factors: Buy Consideration: The acquisition may be financed through the following (bearing in mind the entities capital structure): 1. Cash reserves (i.e. working capital) >Currently sitting with high receivables and low payables thus may be able to use funds from debtors to fund the acquisition of the required assets. However this may place significant pressure on the entities cashflows, given that debtors pay late i.e. roughly 60 days. The entity may use their creditors to indirectly fund the acquisition given that they normally settle them timeously i.e. 15 days, thus can afford to delay payment in order to improve cashflows. Re-working the working capital cycle to create cash flows. >However it is not always advisable to fund fixed assets through working capital as it is always best to match the cash inflow generated by the asset to the required repayments. Therefore the next best alternative would be using long term debt. 2. Debt financing >They have a lot of unleveraged assets i.e. R142 million in assets vs R68 million in debt. There is still sufficient headroom for further financing) 3. Reinvested retained earnings 4. Issue of preference shares 5. Issue of ordinary shares through right issue (given the recent buy back) 6. Issue of ordinary share capital (equity partner) >Concerns over dilution of control (given entity is owner managed) >May consider listing as to allow easy access to finance on the capital markets as to help fund growth >Meeting the listing requirements may not be difficult given we are already applying full IFRS furthermore we may be an attractive investment given we are still in our growth phase and are experiencing rapid exponential growth. > The entity is owner managed with a strong board in terms of industry knowledge > Possible looking at ALTX or ZARX > Issue maybe be from compliance requirements and restructure may be required in terms of the board. More non executives etc. 7. Crowding funding or purchase order funding should the investment be lucrative (the peoples fund and other platforms) Other considerations of alternative financing solutions - - Owner- drivers entering to a service agreement as independent contractor. By souring individual drivers with their own specified vans, we may avoid employing the 70-odd staff. However, we take on the risk of not controlling the whole process. This would have to be based on stringent service agreement and thorough procurement process. Outsourcing a reputable small logistics company to supply vans and/or personnel. This could be used to buy some time until the company can afford to buy its own vans. Buying cheaper second-hand panel vans. This will have to be supported by investment in maintenance plans which could add to the cost. However, we would save on the capital out lay and it is advantageous as we will be using the vans excessively and not have to worry about excess mileage cost from a lessor. The tax benefits from the above is that the entity may claim wear and tear allowance on the vehicles and corresponding interest charges (should debt funding be used). Lease Consideration: Acquire the fleet through DFR and subleased to DSS. This will prove to be advantageous given that DFR is in the business of fleet rental and already has a financing partner thus can negotiate favourable rates. Furthermore this will help in strengthen the asset base given that they current have one client (i.e. Malibuye Civils). The lease through DFR will also allow DSS to focus on their core operations and not having worry about asset maintenance and related costs. This may prove to be fruitful given the entity is still its growth phase, thus all its energy shall be focused on its core business. Furthermore this arrangement may allow the asset to be used for different client after the contract ends (i.e. leased to other clients) The lease decision will have tax benefits in the sense that the lease repayments will be deductible against taxable gains from the project. Other vehicle options VW Transporter Panel van: Starting price (VAT inclusive): R471,200 Ford Transporter Panel van: Starting price (VAT inclusive): R476,000 Toyota Transporter Panel van: Starting price (VAT inclusive): R488,000 Nissan NV2350 Panel van: Starting price (VAT inclusive): R418,000