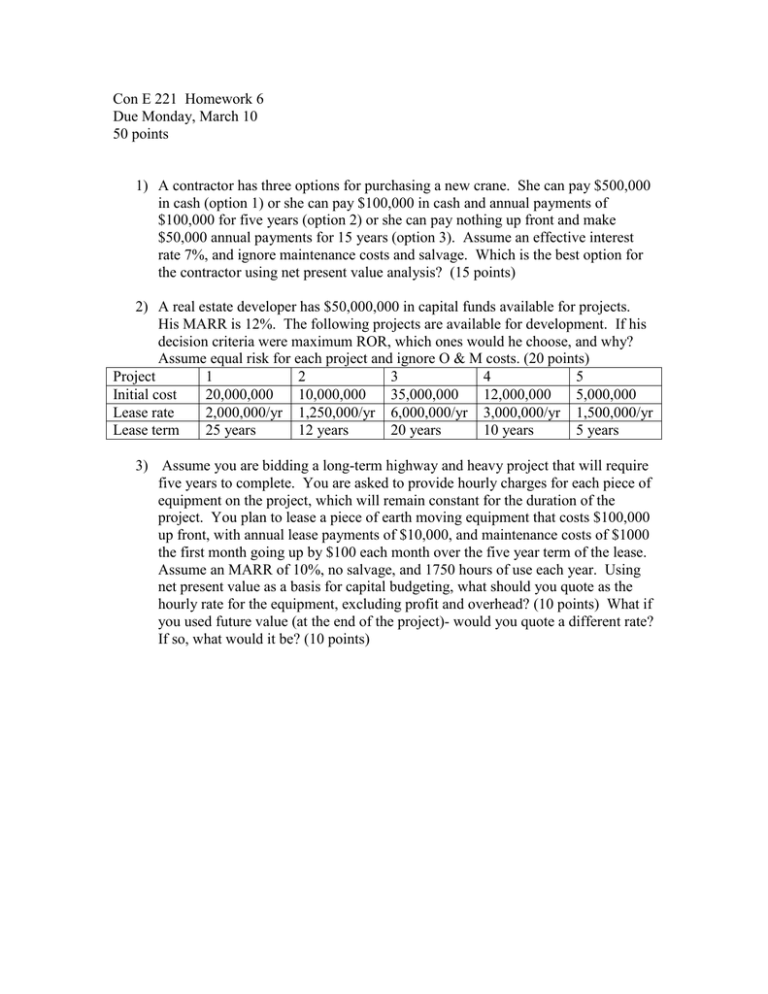

Con E 221 Homework 6 Due Monday, March 10 50 points

advertisement

Con E 221 Homework 6 Due Monday, March 10 50 points 1) A contractor has three options for purchasing a new crane. She can pay $500,000 in cash (option 1) or she can pay $100,000 in cash and annual payments of $100,000 for five years (option 2) or she can pay nothing up front and make $50,000 annual payments for 15 years (option 3). Assume an effective interest rate 7%, and ignore maintenance costs and salvage. Which is the best option for the contractor using net present value analysis? (15 points) 2) A real estate developer has $50,000,000 in capital funds available for projects. His MARR is 12%. The following projects are available for development. If his decision criteria were maximum ROR, which ones would he choose, and why? Assume equal risk for each project and ignore O & M costs. (20 points) Project 1 2 3 4 5 Initial cost 20,000,000 10,000,000 35,000,000 12,000,000 5,000,000 Lease rate 2,000,000/yr 1,250,000/yr 6,000,000/yr 3,000,000/yr 1,500,000/yr Lease term 25 years 12 years 20 years 10 years 5 years 3) Assume you are bidding a long-term highway and heavy project that will require five years to complete. You are asked to provide hourly charges for each piece of equipment on the project, which will remain constant for the duration of the project. You plan to lease a piece of earth moving equipment that costs $100,000 up front, with annual lease payments of $10,000, and maintenance costs of $1000 the first month going up by $100 each month over the five year term of the lease. Assume an MARR of 10%, no salvage, and 1750 hours of use each year. Using net present value as a basis for capital budgeting, what should you quote as the hourly rate for the equipment, excluding profit and overhead? (10 points) What if you used future value (at the end of the project)- would you quote a different rate? If so, what would it be? (10 points)